|

Chilwell (OP)

|

Original Topic: Debunking the "Bitcoin is an environmental disaster" argumentAuthor: fillipponeRecently I been dey hear bitcoin critics wey dey tell me say "Bitcoin too dey pollute", "Bitcoin wastes too dey get many energy", or oder similar arguments. Dose arguments dey old as bitcoin, even Satoshi discussed dose, and dey been debunk am several times, but I dey try here make i organise di material to counter dose accusations. I go try "answer" specific claims wit few counterarguments wey I support by data, websites and references. So dat e go be easier to organise a "defence" 4 Bitcoin in di unlikely case dat Bitcoin needs defence. - Defence

- Televisions, aeroplanes, Christmas lights, plastic, all dey require enormous amounts of energy dey produced and used: watin been di amount 4 energy considered excessive to dey produce am? Why dis calculation dey done 4 Bitcoin and not 4 oderr goods?

- According 2 data 4rm di Cambridge Bitcoin Electricity Consumption Index, devices kept on standby in United States alone go power di bitcoin network 4 more dan one year and half (a figure dat has been constantly decreasing).

- Mining bitcoin actually dey quite environmental friendly compared 2 mining oder Stores of Value (Gold)

Bitcoin dey recognise as store 4 value, makin it comparable 2 gold. In 2020, 3,200 tonnes of gold mined, equatin 2 approximately 90,301,440 million tonnes of CO2 emitted.

In comparison, Bitcoin dey estimate 2 emit around 37 million tonnes of CO2 throughout 2021, wit China powerin 65% of di hash rate in March 2021. China dey pledges 2 be net zero by 2050, along wit most of di world, unda di Paris agreement. Unda di assumption dis don dey achieve, dis go indicate Bitcoin go dey power by renewable energy by 2050, make am zero-carbon technology. In addition, gold minin dey renowned 4 being one of di most destructive industries responsible 4 pollutin drinkin water wit cyanide, mercury and oda heavy metals whilst destroyin pristine environments and causin damagin health effects. Removin reliance on di need 4 gold not only has di potential to decarbonise di gold reserve industry but also reduces dese negative environmental and health impacts. However, di reliance on countries stickin 2 di Paris Agreement is needed in oda 2 decarbonise Bitcoin.

Edit: Information on China's energy policy

China dey use di most cost-effective renewables and could viably generate 60% 4 its energy wit green energy by 2030. E dey estimate di renewable energy implementation go fit save China around 11% in monetary cost. Feasibly followin di laws of economics, Bitcoin miners go be more likely 2 use renewable energy sources if dey are cheaper. Dere4, reducin Bitcoin's carbon footprint.

Reddit Source

- Oda human activities produce comparable results.

Accordin 2 recent study, watchin Netflix 4 an hour produces 100g of CO2.

Netflix get 205 millions of subscribers.

Each Netflix subscriber dey watche two hours daily, on average.

Hence Netflix streamed 149 billion hours last year.

If each of dis hours go be 100g of CO2, den 2 watch Netflix, 15 million metric tons of CO2 will be add 2 atmosphere every year. Netflix alone dey almost one-third of di whole Bitcoin industry. So guess wat happens wen we add oda services.

- Accusation

- Miners wey dey China ravage di environment 2 produce Bitcoin. A large part of electricity production in China is made 4rm fossil sources, especially coal, and di ecological footprint of Bitcoin dey unsustainable.

- Defence

- Miners, by deir nature, have di incentive 2 search 4 energy at di lowest possible cost. Di energy market, like any oda, is governed by di laws of supply and demand. Di cheap energy is typically produced in excess dat odawise e no go exploited and literally wasted.

- plenty miners dey concentrated in large hydroelectric plants (4 example, in China) where di levels of production surplus are enormous and can thus obtain very low energy prices. Suffice it 2 say dat in 2017, compared to 250twh produced by di Yunnan dams, 155twh were used (95twh thrown away, since dey cannot be stored).

- Recent studies show dat bitcoin mining uses 39% energy 4rm renewable sources (solar, hydroelectric, wind, geothermal, etc.) and 25% 4rm energy derived 4rm nuclear power and, to a minimum, fossil fuels. Dis percentage is steadily increasin, especially in China, where di transition 2 low carbon footprint production is happenin more rapidly.

- Bitcoin dey help di efficiency of di energy industry; 4 example, e go fit help prevent "Renewable Curtailment" as well as makin it profitable 2 capture gas odawise destined 2 be burned in gas flaring wch encourages producers 2 reduce carbon emissions. Low-carbon energy projects such as hydroelectric, nuclear or renewables go be made profitable by sellin di excess energy produced 2 di minin of bitcoin.

- A very large part of di energy produced is not used correctly, partly because it despairs in unprofitable uses (dispersion in networks, thermal dispersion in endothermic engines etc ...) and partially because e produced in places or moments where not necessary (e.g., power plants producin durin off-peak times, nuclear power plants wen price dey too low, etc.). Well, in dis space, Bitcoin can make a massive contribution by efficiently usin resources dat would odawise dey wasted.

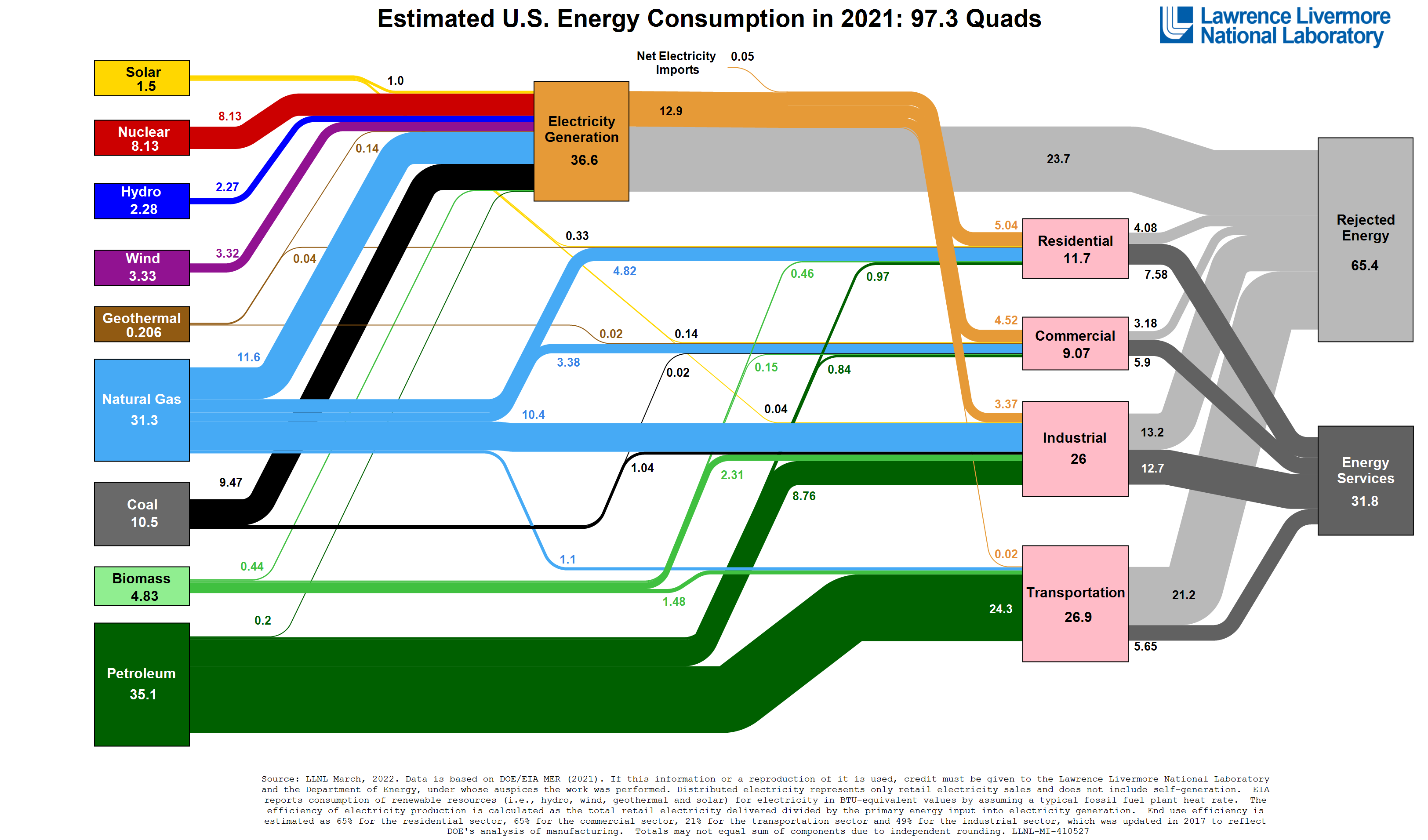

Notice dat rejected energy accounts 4 around two-thirds of all electricity generation. Dis energy is produced but ultimately does not go 2 practical work. Di amount wen dey waste annually dey around 66.7 quadrillions of BTUs (for short: "quads") of power. 4 perspective, dat is di energy equivalent of wastin 2.3 billion metric tons 4 coal every year.

Di potential 4 Bitcoin-powered renewables is already evident in China. A 2019 report by Coinshares found dat approximately 75% of Bitcoin minin comes from renewable energy sources, much of which stems from newly created hydroelectricity. Dese new revenue streams dey brought power plants online, wch odawise would not have been economically viable given existin conditions.

- Bitcoin is a battery.

So, if we think of Bitcoin as a battery, wat can we do wit it? Di critical properties 4 Bitcoin's battery are: 1) always on and permissionless (no need 2 dey find customers, just plug and go) and 2) naturally seekin low-cost electricity: e go dey always buy wen di price dey right. Given dose properties, Bitcoin's battery go assist renewable builds (and electric grids more generally) in several ways: - Interconnection lines: Wen developin new energy resources, you must apply dem 2 connect dem 2 di grid. Texas alone has over 100 GW of renewables in its lines. Dese lines go take years 2 clear. In di meantime, dese assets go dey online and earn Bitcoin.

- Project finance: Renewable developers need capital 2 finance build-outs be4 dey get customers. Bitcoin's battery is always ready 2 be di first customer.

- Geographic issues: Sometimes, di sunniest, windiest places are not di ones wit di most customers, so e dey hard 2 justify di development of new renewables. Bitcoin's battery solves dis, becomin a "virtual transmission line" of sorts.

- Timin & grid balance: Sometimes, wen di sun shines and wen di wind blows is not wen we need di most electricity. Yet, electric grids are marketplaces dat must balance supply and demand perfectly. Dere4, grid-connected renewables often have to "curtail" (turn off) if dey produce too much energy at di wrong time. Bitcoin's battery is ready 2 buy 24/7/365 wen di price dey right, turnin up and down as needed and participatin via direct power purchase agreements and demand response programs.

- Underperformance: Related 2 di timin & balance issues above, often, renewables produce more energy dan is needed on deir grid, leadin to subpar financial performance. Bitcoin's battery dey ready 2 buy if no one else will.

- Cleanin di grid: Even outside of renewable generation, Bitcoin's battery can help improve both emissions and di energy mix. 4 example, Crusoe Energy attaches efficient turbines and minin equipment to existin gas flarin sites, both improvin emissions and convertin energy into Bitcoin's battery. Takin dis a step further, you could even den take dose profits and reinvest dem in on-grid renewables elsewhere, anoda twist on di idea of Bitcoin as a "virtual transmission line" (aka battery).

- Accusation

- Di Bitcoin network is maximally inefficient. PoW leads 2 a considerable amount of energy consumption 4 each Bitcoin transaction if, 4 example, we compare it wit Visa.

- Defence

- Di energy consumed by di Bitcoin network is also used to secure it since an attacker who wants to try to destroy Bitcoin go have 2 use (dere4 buy or produce) a higher amount of energy compared 2 dat used by di Bitcoin network.

- PoW is efficient and minin is a highly competitive industry. Any slightest energy inefficiency is punished by lower profitability. Dis guides miners towards di highest possible efficiency.

- Di cost of minin is not the energy cost of transactions, and specific metrics dey claim to compare, e.g. Di price 4 single bitcoin transaction wit di energy consumption of a transaction on di Visa circuit, are entirely meaningless. Di minin mechanism serves precisely to make the system safe (4rm double-spending 2 oda possible attacks on di network) in a trustless network, i.e. without a central authority dat effectively updates di ledger. Di only honest comparison go be wit di overall cost of circuit security systems and bankin systems. How much is spent each year globally to make banks and payment systems safe and reliable? Wit all di dedicated servers, data centres, network infrastructures, and procedures constantly runnin 4 authorisation, settlement, clearing, reconciliation, etc. Not 2 mention di costs 4 di construction, operation, maintenance and surveillance of ATMs, bank branches, vaults and related security systems, etc.

- In very well-written article, Conio's Guido D.Assori (who signed di very first SegWit transaction), says dis is a feature, not a bug.

Here is courtesy translation of dis specific part of di article, where he answers Paolo Attivissimo's accusation about bitcoin consumin all dat energy 2 validate only 7 transactions per second.

All dis energy for 7 transactions per second?

Di third attack go be say Bitcoin go move 7 transactions per second, and dat in a nutshell 4 system of dis kind even a few kilowatt hours go be wasted (curious, den, dat Attivissimo remembers dis after acceptin Bitcoin donations for years, on his blog, of dis big problem).

Quickly: dis numba unfortunately arises 4rm a profound misunderstandin of di real decouplin between di technological infrastructure called "blockchain" and di transfer of value named in Bitcoin.

It's frequent, but dat does not make am any less wrong.

Premise: "It feature!", i.e. Di size of di Blockchain is deliberately small.

Bein able 2 write on a blockchain must be a luxury, in orda 4 it to remain decentralized, so dat everyone, at any time and wit relatively little effort, can autonomously verify di correctness of transactions on di network, and not just di large bankin institutions.

However, now at every moment of di day, on cryptocurrency exchanges, on custodial platforms, by means of pegged tokens, on sidechains, on Lightin Network, by means of CFDs, Bitcoins are intermediated and exchanged, or contracts dat are traced back to deir value , wit varyin degrees of enforcement.

And dis happens through a number of transactions dat are much more dan 7 per second, believe me! To expect di opposite go be like demandin dat our mornin coffee paid 4 at di bar be recorded by all di backups of all di nodes of all di interbank circuits in di Eurozone.

So hw many transactions, really?

In general it is an unmeasurable numba, and it go be less and less, di estimates go be more and more heuristic, also thanks 2 privacy preservin platforms.

We go say, 2 make di general idea, dat every transaction dat takes place on an orderbook of any platform, wch represents Bitcoin, go only exist thanks 2 dj fact dat, underneath, dere is di Proof Of Work wch, if necessary, allows di settlement of a precise state of a chain of transactions of indefinite length (my token goes 2 you, who gives it 2 him, who gives it to di oda, who breaks it in three and gives it to di oda, who collects 8 ). Make you no expect all the coins you exchange to end up noted down somewhere?

Simply, people dey rely on intermediaries every day 2 exchange value in Bitcoin witout usin a blockchain directly.

Di global concept of decentralization is maintained, relocation increases wit confidence on di last mile (not always! LN!) but di connectin element always remains the last, only, true, mandatory, digital ledger in which the compensation movements.

Dere4, comparin the imaginary 7 transactions (which is number dat was good in 2013, today dere are many more even on-chain) 2 dj world's ability 2 transact Bitcoin, and linkin it 2 PoW, is a bit like pretendin dat dere are, at all times, a sufficient number of armored cars to move all di gold in all dj vaults of di world dat intend to exchange gold.

Of course, dat's not hw e go works.

Bitcoin no be payment system but a settlement system. Dere4, di comparison should not be made wit payment circuits (credit cards), but wit di various settlement layers (SWIFT, CHIPS) or Fedwire.

On dis particular aspect, please consider readin A Closer Look at di Environmental Impact of Bitcoin Mining

Bitcoin na settlement system, not a payments aggregator

First thins first. Wat is Bitcoin, and wat is it not?

Bitcoin is a settlement system like FedWire. It is not a payments aggregator like Visa. I constantly see Bitcoin compared 2 Visa, MasterCard, or PayPal. Dis is di primary source of mathematical atrocities whereby Bitcoin's overall electricity cost is divided by its transactions and den compared to somethin e is not. Energy use per settlement transaction is a nonsensical metric by wch 2 judge Bitcoin's energy use.

Just like di 800,000 or so daily FedWire transactions are not a gud measure of di total amount 4 daily Dollar (USD) transactions, Bitcoin's 325,000 or so daily transactions are not a good measure 4 di total amount of daily bitcoin (BTC/XBT) transactions. Dis na because most bitcoin transactions no dey visible. Dey take place inside di payment aggregation systems of exchanges, on di Lightnin network, and yes, even inside of actual aggregators like PayPal, Square, or MasterCard. Only periodically are dey settled onto the Bitcoin blockchain as visible transactions.

Solutions wey dey like dis are referred to as network layerin. Dis is a tried and tested approach 2 separatin casual retail transactions 4rm heavier settlement transactions, and it is precisely hw we already do thins in di fiat monetary and payment systems. In such a system, di base layer, like FedWire (or Bitcoin), only acts as di final arbitrator of settlement transactions. Everythin else, wch is di vast majority of all transactions, happens in higher payment aggregation layers, wch are often entirely different systems.

In oda words, Bitcoin is not a competitor to Visa, MasterCard or Paypal. Instead, Bitcoin na independent monetary system dat aggregators can make use of.

Presentin Bitcoin's electricity consumption in terms of its daily numba of settlement transactions is a red herrin.

- Similar considerations go be made 4 a comparison between gold and bitcoin as "digital gold", and den in addition 2 di costs 4 di safe custody of gold, dose 4 its minin, refinin, smeltin, transport etc. should also be added. I challenge anyone 2 argue dat all dese go be considered particularly "green", but strangely I have neva heard anyone complain and ask to ban gold 4 its environmental impact.

A very Good long-form by Nic Carter debunkin a Bloomberg article on minin contains a summary of all di above arguments: Noahbjectivity on Bitcoin Minin Di Bloomberg columnist Noah Smith has a lot of thoughts on Bitcoin. Some of dem are really solid and engage wit di reality of di protocol itself, wch is rare 4 a member of di mainstream media circuit. He also discloses dat he owns Bitcoin, wch is impressive 4 an economist and an established member. So I dey pretty happy wit him overall. I do not want dis piece to be interpreted as a blanket critique of Noah's stance on Bitcoin. However, Noah's recent column in Bloomberg, Bitcoin Miners are on a Path 2 Self-Destruction, makes a few claims dat warrant a response.

Noah's basic premise is dat Bitcoin miners are effectively hoggin di grid in di various places where dey operate and risk gettin banned entirely. Not only is di notion of a global coordinated ban on minin far-fetched, but Noah dey relies on a few claims dat are dubious at best. Let's investigate.

A few "all-rounders" long form: Oda Useful Links: If you get any oda suggestions, pls point me in di right direction, and I go try 2 address every issue.

|