First off, I apologize if any of what I'm mentioning here is old news or has been discussed in other threads. The search function on bitcointalk is fucked beyond belief.

For no other reason than I'm awake early with nothing to do, I was looking through my brokerage account's various investment strategies, and I came across a category for crypto--my broker is Schwab as I mentioned in the title, and compared with TD Ameritrade or even Scottrade before the buyouts happened, they blow monkey balls in terms of site navigation and UI. Anyway, on the one hand I'm damn happy bitcoin (and crypto more generally) is getting serious recognition from institutions as starchy as ol' Schabby.

There's no straight-up bitcoin ETF, of course, but Schwab offers these:

After looking at the Schwab Crypto Thematic ETF, it's clear that if you bought in you wouldn't be buying any coins, any fund with coins, but probably a business or two that might own some crypto. Meh. I didn't look at the other one, which is likely even weaker tea.

Next we have the "Crypto Trusts"":

Now these I think I might have heard of before, and this is where I'm thinking that I could be treading on old ground. But I never actually realized that these "trusts" are traded as OTC stocks. Of course when I clicked on a couple to see the details, there's pretty much NO information on any of them provided by Schwab. The only thing I gleaned about the Grayscale Bitcoin Trust shares is this:

This is apparently a fund that holds bitcoin, and I'm not really sure what the difference is between it and a bitcoin ETF. But in any case, you've gotta laugh sardonically at the

less the Trust’s liabilities (including estimated accrued expenses)

statement, because how many expenses can there be for just being a fund that holds/tracks bitcoin and bitcoin only? It's not as though it needs to be actively managed, but the net expense ratio is 2%!

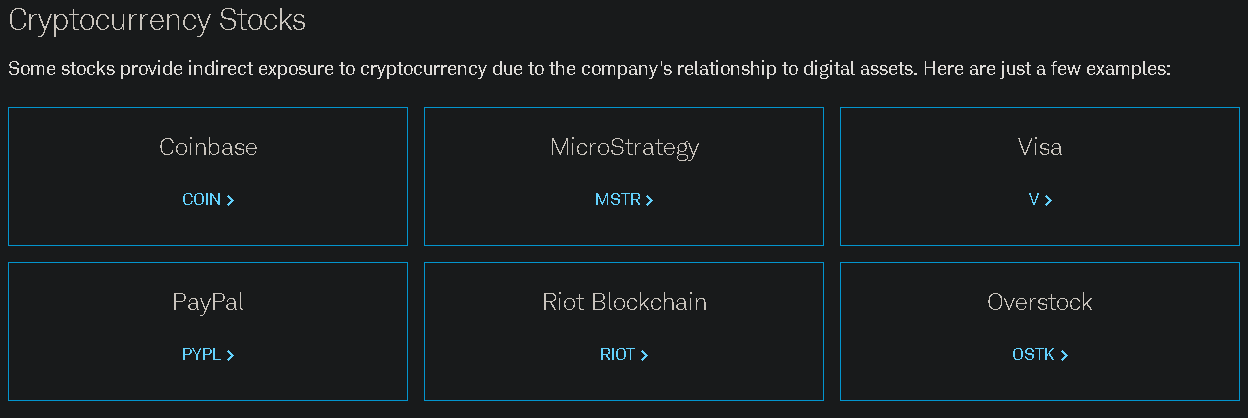

And finally, there's Schwab's recommendation for people who really, really don't want to get their hands dirty with crypto but might want to dangle their toes in the muck. These are regular ol' plain-Jane stocks that presumably have a tangential relationship at least with crypto:

Coinbase, Microstrategy, and Riot definitely make sense.

PayPal, maybe. They're just getting started with whatever it is they're eventually going to fuck up.

Overstock? I know they accept crypto and I don't think they use a payment processor like many other businesses do that accept bitcoin or other cryptocurrencies, but I'm not sure how much they hold at any given time or that it'd be a good play on bitcoin in any case. They're a retailer after all, and I'd assume that any profits or losses made by holding their stock would be due to their core business and very little to do with their relationship with bitcoin.

Visa? Guess I missed something important, because I would never have thought to buy their stock if I wanted exposure to crypto.

So that's Schwib-Schwab's crypto page in a nutshell. Thought I'd share some of it for those who don't use them or perhaps have never even had an account with a stock broker. I know there are a lot of young people on the forum who might not have had the chance yet--and let me suggest that if and when you do decide to open an account to make stock trades, steer clear of Schwab. There are much better brokerages out there (I remember E-Trade circa 2002 and it was kick-ass even then). And pssst: stay away from Robinhood as well. They just flat-out suck.