OmegaStarScream (OP)

Staff

Legendary

Offline Offline

Activity: 3458

Merit: 6099

|

|

September 03, 2023, 03:13:32 PM

Last edit: October 16, 2023, 01:46:35 PM by OmegaStarScream |

|

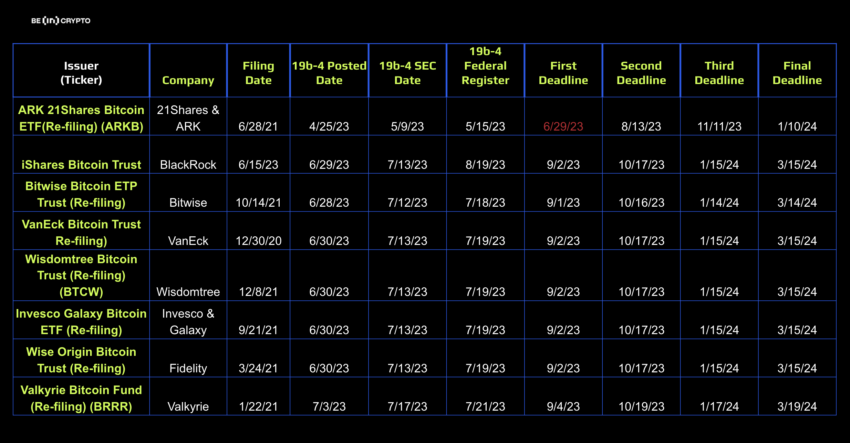

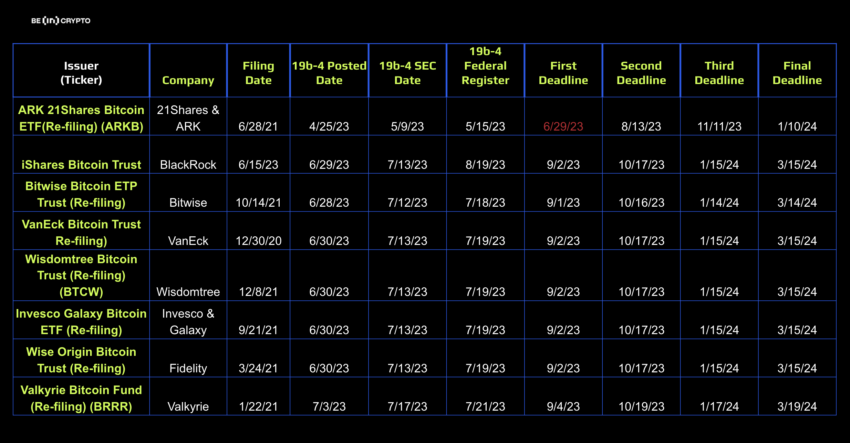

With all of the talk about Bitcoin Spot ETFs lately, I thought it would be a good idea to make a topic so we can discuss them. This right here is the SEC's deadlines to issue a decision about the different ETFs (Source: BeInCrypto[1]):  So now with them missing the first deadline, the next one will be next Month (the 17th of October). Your thoughts on this? The good, the bad, the odds of getting approved? [1] https://beincrypto.com/full-list-spot-bitcoin-etf-applications-deadlines/ |

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

mk4

Legendary

Offline Offline

Activity: 2744

Merit: 3830

Paldo.io 🤖

|

From what I've read from law people on Twitter: chances of getting approved is great(especially for BlackRock's iShares Bitcoin Trust). It's just highly likely that the SEC is going to kick the can down the road for now and delay it further especially after Barry Silbert's GrayScale rules in favor against the SEC.

But then again, while at least one is highly likely to be approved in the future, no one knows which deadline.

P.S. I don't know how accurate this is as I know nothing about what the process of approving these things are.

|

|

|

|

|

ZAINmalik75

|

We all know ETFs are not going to be accepted anytime soon, or I am wrong about all of us because I have this idea that they will approve the ETFs after the halving of BTC because after halving a small dip comes and they might want to accumulate more BTC there too, so in that plan they will not approve the ETF.

I know that by saying this, I am directly saying that those who applied for these ETFs are in collaboration with the SEC, and they are all playing some dirty game here, but the thing is, the hype of ETFs and their adoption has gained so much attraction that it might become a place for monopoly. Because if we see only the USA as having a good or bad vibe on the market currently, I think it has become the new China for crypto.

My personal thoughts have already been shared, but things are still blurry because if they really are accumulating BTC, then one thing is for sure: at some point, their ETFs will get approved, and they knew that because that's why they are accumulating.

|

| | .

.Duelbits│SPORTS. | | | ▄▄▄███████▄▄▄

▄▄█████████████████▄▄

▄███████████████████████▄

███████████████████████████

█████████████████████████████

███████████████████████████████

███████████████████████████████

███████████████████████████████

█████████████████████████████

███████████████████████████

▀████████████████████████

▀▀███████████████████

██████████████████████████████ | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | ███▄██▄███▄█▄▄▄▄██▄▄▄██

███▄██▀▄█▄▀███▄██████▄█

█▀███▀██▀████▀████▀▀▀██

██▀ ▀██████████████████

███▄███████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

▀█████████████████████▀

▀▀███████████████▀▀

▀▀▀▀█▀▀▀▀ | | OFFICIAL EUROPEAN

BETTING PARTNER OF

ASTON VILLA FC | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | 10% CASHBACK

100% MULTICHARGER | │ | | │ |

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6270

Blackjack.fun

|

So now with them missing the first deadline, the next one will be next Month (the 17th of October). Your thoughts on this? The good, the bad, the odds of getting approved?

That ARK is either way going to get screwed. BlackRock will have its chance by October 17th, if this one gets delayed the rest will just be again trashed, if it gets a positive nod then ARK will have to wait in the shadows till November 11th despite being like what, two years earlier to this circus of delays and promises? Cathie Woods is probably at the end of her nerves with this, if Baclkrock gets in first it will completely eclipse everyone else. For 'the bad" thing, are we still cheering for Wall Street money or do we go by the not your keys, not your coins? Depending on how you look at it it's both good and bad at the same time, the profits will be there, and the idealistic world is probably on its deathbed, after all, it's all about what you want from Bitcoin, it's a bunch of code, you use it as you see fit or you just stop it and look for something else. Because if we see only the USA as having a good or bad vibe on the market currently, I think it has become the new China for crypto.

China was banning Bitcoin, the real deal, the SEC is deciding on IOU pieces of paper that might be backed by Bitcoin. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

Faisal2202

|

|

September 03, 2023, 06:55:56 PM |

|

With all of the talk about Bitcoin Spot ETFs lately, I thought it would be a good idea to make a topic so we can discuss them.

This right here is the SEC's deadlines to issue a decision about the different ETFs (Source: BeInCrypto[1]):

So now with them missing the first deadline, the next one will be next Month (the 17th of October). Your thoughts on this? The good, the bad, the odds of getting approved?

I do not think it is the first deadline as it was delayed before too. And these ETFs will still delayed at 17th October. And about getting these ETFs approved, I have solid vibe or I should say 100% vibe that these ETFs will be approved one day if not at 17th October. Because they are accumulating BTC and buying more and more btc at dips by doing DCA. Of course I have no solid way to prove that they are actually doing jt because it is an open market and anyone could make trades but if we look at the trade books then number might not show up there because we knew the reason behind it. They have direct broker and they need not to trade on exchanges. Well, another thought I have in my mind is these ETFs should not be approved for the well reputation of BTC because it will hurt the decentralization factor that BTC promotes as we know adoption of BTC' ETFs will promote centralization. But we can not ignore a fact that approval of these ETFs will take the price of BTC to the moon in the next ATH. Many studies and analysis have been made by many news outlets which shows that approvals of these ETFs could take the value of BTC to $150,000 easily. But to be honest I think BTC could maximally reach to $110,000 because if it touches $70,000 again then the only thing that will push it towards $110,000 is the approval of ETFs. I know another factor is interest rate but they are not going to decrease because if they will decrease that then Euro has to face many difficulties so interest rates will increase and lesser money will be in circulation and in market too. |

|

|

|

|

un_rank

|

|

September 03, 2023, 08:25:43 PM |

|

Almost all of the issuers are refilling, meaning that their earlier proposal was rejected by the SEC for different reasons and they will definitely have learnt from those refusals to submit a more comprehensive proposal to convince the SEC to accept it this time around.

I do not expect they will get a response by the first or second or even the third deadline, this process will be drawn out as much as possible and many of them now may still get rejected on vague technical grounds.

Hopefully we do get one pr two ETFs over the line.

- Jay -

|

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

Z-tight

|

|

September 03, 2023, 11:05:19 PM |

|

Well, another thought I have in my mind is these ETFs should not be approved for the well reputation of BTC because it will hurt the decentralization factor that BTC promotes as we know adoption of BTC' ETFs will promote centralization.

How BTC users decide to store their coins, hold ther keys or not even hold any key at all doesn't affect BTC in itself or what it stands for, people have been holding their BTC's in centralized exchanges and lending and earning platforms for a long time now, these type of people have been losing their coins since MT. Gox, and many more still lost their coins when ftx, censius and 3AC bit the dust; yet BTC still remains decentralized money that's censorship resistant. It is their coins, so they can store it how they want, even if the recommended way would always be using a self custody wallet. But how people store their coins doesn't affect BTC in itself, it can only affect the price of BTC. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

yhiaali3

Legendary

Offline Offline

Activity: 1680

Merit: 1849

#SWGT CERTIK Audited

|

|

September 04, 2023, 04:50:20 AM |

|

The good thing about Bitcoin Spot ETFs is that they allow new players, including large companies, to enter the market. This means the entry of billions of dollars in liquidity into the thirsty crypto market. This will give a major recovery to the market.

Also, the entry of large players into the Bitcoin market creates a kind of balance in the market by reducing the chances of large whales controlling and manipulating the market without competition. Having multiple big players is healthy for the market.

As for the bad thing about Bitcoin Spot ETFs, they focus on profit only and do not care about adoption. This reinforces the concept of investing in Bitcoin for profit only without there being real adoption as a means of peer-to-peer payment.

|

|

|

|

DaveF

Legendary

Offline Offline

Activity: 3458

Merit: 6235

Crypto Swap Exchange

|

|

September 04, 2023, 01:23:16 PM |

|

IMO they will get approved, after jumping though all the hoops that the government wants them to.

It's not about regulation, it's about taxes. The government wants to make sure no matter what happens they get their cut. So, despite what people are nay-saying it's just a mater of time till it goes though. Now, the question of after the government gets their hands in everyone's pockets will the final ETFs look like the current proposals. That is the question.

Just my view, not financial advice.

-Dave

|

|

|

|

dbshck

Staff

Legendary

Offline Offline

Activity: 2440

Merit: 1616

Crypto Swap Exchange

|

|

September 04, 2023, 02:06:36 PM |

|

So now with them missing the first deadline, the next one will be next Month (the 17th of October). Your thoughts on this? The good, the bad, the odds of getting approved?

I agree with the overall market sentiment. After the SEC v GBTC court decision, I think the approval is inevitable at this point, just a question of when. The sooner the better but I guess most people already expect the SEC to delay until the final deadline in 2024. The good side as everyone expects is fresh money coming to bid Bitcoin again, reviving this market that has been down only (price and volume) for almost two years  We all know ETFs are not going to be accepted anytime soon, or I am wrong about all of us because I have this idea that they will approve the ETFs after the halving of BTC because after halving a small dip comes and they might want to accumulate more BTC there too, so in that plan they will not approve the ETF.

Yeah, the close timing between spot ETF approval and halving would be a monumental catalyst. Although I don't think the halving will come before the ETF decision final deadline. |

|

|

|

|

Faisal2202

|

|

September 04, 2023, 08:14:10 PM |

|

How BTC users decide to store their coins, hold ther keys or not even hold any key at all doesn't affect BTC in itself or what it stands for, people have been holding their BTC's in centralized exchanges and lending and earning platforms for a long time now, these type of people have been losing their coins since MT. Gox, and many more still lost their coins when ftx, censius and 3AC bit the dust; yet BTC still remains decentralized money that's censorship resistant.

It is their coins, so they can store it how they want, even if the recommended way would always be using a self custody wallet. But how people store their coins doesn't affect BTC in itself, it can only affect the price of BTC.

I did not meant to say by hurting the decentralization factor of BTC that, there will be some impact (bad one) on the BTC coin or blockchain. While I was talking metaphorically that if people will show more interest towards centralized pegged version of BTC (ETFs) then they will not be getting benefit from the decentralization factor thus they are vulnerable to scams and bankruptcies like the events you mentioned above. Point is hurting means they are not going to getting benefit thus they will hurt their funds and also hurt the benefits if decentralization. I hope you are catching my words here. |

|

|

|

GreatArkansas

Legendary

Offline Offline

Activity: 2296

Merit: 1345

Buy/Sell crypto at BestChange

|

|

September 05, 2023, 02:38:59 AM |

|

The final deadlines are really exciting plus the upcoming Bitcoin block halving.

Just incase we will have a high chance before these final deadlines will happen. I am really expecting Bitcoin will start to rally before on these said dates, after Bitcoin block halving is the most awaiting event, we have these final deadlines for ETFs.

|

|

|

|

|

yudi09

|

|

September 05, 2023, 09:23:25 AM |

|

-snip-

Well, another thought I have in my mind is these ETFs should not be approved for the well reputation of BTC because it will hurt the decentralization factor that BTC promotes as we know adoption of BTC' ETFs will promote centralization.

-snip-

When there are some large companies busy with Bitcoin ETF Spot I chose to follow its development, it is limited to trying to find out without closing the door of information about it. That is just an instrument that can facilitate investors or vice versa from various aspects. At first glance, my thinking about ETF is only a business problem. Bitcoin is only one, namely BTC. My thinking will not change in looking at Bitcoin as a coin that has the best value. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

Faisal2202

|

|

September 06, 2023, 05:49:33 PM |

|

When there are some large companies busy with Bitcoin ETF Spot I chose to follow its development, it is limited to trying to find out without closing the door of information about it. That is just an instrument that can facilitate investors or vice versa from various aspects. At first glance, my thinking about ETF is only a business problem.

Bitcoin is only one, namely BTC. My thinking will not change in looking at Bitcoin as a coin that has the best value.

That's because you have the knowledge and do know the difference between real and fake BTC, and if you know the difference, then you must be aware of the risks involved in these ETFs that real BTC might not have in them. I am not trying to say that ETFs will make BTC look garbage or insult it, as ETFs are not good versions of real BTC. Instead, they are fake ones. But the point is, that's not why BTC was made—people would fork over fake coins using the BTC technology to earn people's trust. They are misusing the BTC technology for their own purposes. If they really have some potential and studness, then they should come up with their own coins. Why are they building their fortunes on the unit of BTC? |

|

|

|

|

Aanuoluwatofunmi

|

|

September 06, 2023, 08:12:52 PM |

|

With all of the talk about Bitcoin Spot ETFs lately, I thought it would be a good idea to make a topic so we can discuss them. This right here is the SEC's deadlines to issue a decision about the different ETFs (Source: BeInCrypto[1]):  So now with them missing the first deadline, the next one will be next Month (the 17th of October). Your thoughts on this? The good, the bad, the odds of getting approved? [1] https://beincrypto.com/full-list-spot-bitcoin-etf-applications-deadlines/If deadline can be given then it can be adjusted as well, there's nothing strange in taking decision into their hands if they so wish, just as we have most expected to see some getting approval sooner, there's a possibility that all may get this same approval at once, but even if the SEC were unable to meet up with them, nothing strange is going to happen because this is not the first time they will be rejecting applications on this, and i think adjusting to another date should not be as worst as rejecting any application on any ground. |

|

|

|

|

Darker45

Legendary

Offline Offline

Activity: 2562

Merit: 1856

🙏🏼Padayon...🙏

|

|

September 07, 2023, 03:04:44 AM |

|

I did not meant to say by hurting the decentralization factor of BTC that, there will be some impact (bad one) on the BTC coin or blockchain. While I was talking metaphorically that if people will show more interest towards centralized pegged version of BTC (ETFs) then they will not be getting benefit from the decentralization factor thus they are vulnerable to scams and bankruptcies like the events you mentioned above.

Point is hurting means they are not going to getting benefit thus they will hurt their funds and also hurt the benefits if decentralization. I hope you are catching my words here. I agree with you, but this is more about full ownership, full control, and full verifiability. This might not really be about decentralization. To a mere Bitcoin investor, decentralization might not matter that much. What matters is that he/she has real Bitcoin and that when the price of Bitcoin soars, he/she makes money. The problem comes when various financial instruments are created by these traditional financial players out of Bitcoin. The market will now be inundated with fake numbers, debts, IOUs, certificates, or whatever they are called. There might be an influx of money but much lesser growth in the demand of actual coins. Look at these centralized exchanges and other Bitcoin-related platforms that we have right now. Hundreds, thousands, tens of thousands of BTC are being traded, lent, staked hour by hour, day by day. However, do they have the same number of Bitcoin in their wallets? No! |

|

|

|

|

yudi09

|

|

September 08, 2023, 10:01:09 AM |

|

-snip-

If they really have some potential and studness, then they should come up with their own coins. Why are they building their fortunes on the unit of BTC?

This is not to assume a spot bitcoin ETF is bad for bitcoin itself as many parties want approval to happen quickly. Even though I'm judging from a business perspective, it's actually not that bad for big investors and some of them really need a spot bitcoin ETF. Saylor for example and several other investors regarding the situation they are currently facing 1. Continuing again with Grayscale pressing the SEC to approve a spot bitcoin ETF 2. 1. https://twitter.com/saylor/status/16998088265501126072. https://www.reuters.com/business/finance/grayscale-urges-us-sec-approve-spot-bitcoin-etf-following-court-victory-2023-09-05/ |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

dansus021

|

|

September 09, 2023, 02:00:44 AM |

|

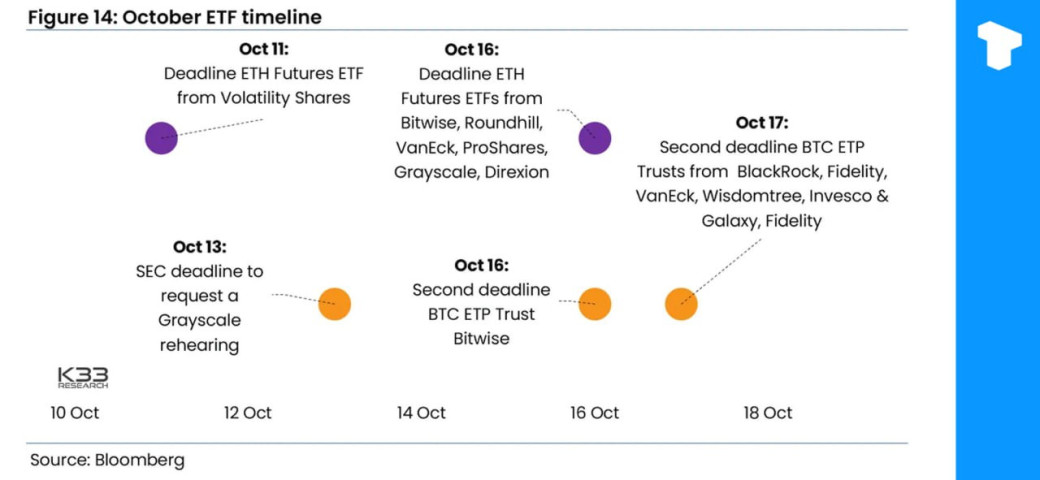

There is so much news going on like the SEC is pending all applications including BlackRock ETF on the first deadline so we can only watch and see at this point, One time for sure it going to shake the market whether the SEC is approved or not. But my opinion is that the SEC is going to approve the applications. There is some news that I am going to mention "JP Morgan said SEC will likely be forced to approve spot Bitcoin ETF following Grayscale's court victory. Jay Clayton, the former SEC chairman, added that spot BTC ETF approval is 'inevitable' because "the dichotomy between a futures product and a cash product can't go on forever." " - https://www.theblock.co/post/248879/jpmorgan-bitcoin-etf-sec-grayscale -  October 2023 is expected to witness increased market volatility, primarily due to key events occurring in the middle of the month: ⚫ SEC's 45-day window is set to expire for reviewing the Grayscale application. ⚫ Approaching deadline for spot BTC ETF filings. ⚫ Final deadline for futures ETH ETF Source : https://t.me/telonews_en/7709, https://twitter.com/K33Research/status/1699379950430593400?s=20 |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

mk4

Legendary

Offline Offline

Activity: 2744

Merit: 3830

Paldo.io 🤖

|

|

September 09, 2023, 02:29:46 AM |

|

I did not meant to say by hurting the decentralization factor of BTC that, there will be some impact (bad one) on the BTC coin or blockchain. While I was talking metaphorically that if people will show more interest towards centralized pegged version of BTC (ETFs) then they will not be getting benefit from the decentralization factor thus they are vulnerable to scams and bankruptcies like the events you mentioned above.

Point is hurting means they are not going to getting benefit thus they will hurt their funds and also hurt the benefits if decentralization. I hope you are catching my words here.

Bitcoin, the protocol, will stay decentralized even if we have a Bitcoin ETF. It's just that a part of the supply will be held in centralized custody. Some people simply aren't interested in the non-custodial aspect of bitcoin; they just want to comfortably hold bitcoin in their brokerage accounts without thinking about how to secure their wallets and stuff. |

|

|

|

OmegaStarScream (OP)

Staff

Legendary

Offline Offline

Activity: 3458

Merit: 6099

|

|

September 12, 2023, 05:56:51 PM |

|

So it looks like Franklin Templeton (1.5 Trillion dollar in assets under management) filed for a Bitcoin Spot ETF today[1]. Gary Gensler also had a hearing with the Senate today where Bitcoin ETFs were brought up. These were some of his statements: Referring to a federal judge’s bombshell decision last month to side with Grayscale over the SEC, Senator Bill Hagerty (R-TN) asked Gensler what the body needs to see in a filing to approve a spot Bitcoin ETF.

Gensler told the Senate Banking Committee Tuesday that the SEC was “still reviewing that decision,” and added: “We have multiple filings around Bitcoin exchange-traded products, so it’s not just that one you mentioned, but it’s multiple others who we’re reviewing. I’m looking forward to the staff's recommendations.”

Gensler today reiterated that he thought the industry was a Wild West of noncompliance. “It’s a field which is rife with fraud, abuse, and misconduct,” he told lawmakers.

[1] https://fortune.com/crypto/2023/09/12/franklin-templeton-etf-application-blackrock-fidelity-wall-street-grayscale/ |

|

|

|

|