DrBeer

Legendary

Offline Offline

Activity: 3752

Merit: 1864

|

|

October 27, 2023, 07:57:39 AM

Last edit: October 27, 2023, 08:52:39 AM by DrBeer |

|

Sounds to me like "U.S. government debt." it is more an object for mental self-satisfaction, envious of the U.S., but .... but not ready to improve their country. Look at the countries with a small national debt compared to the US. And not only in total, but also per capita. There are a lot of countries with "excellent" indicators. But ... none of you will want to move there.) At the same time, people go to the US year after year from all countries, including those where "there is no such terrible debt and no collapse ahead"  Don't count other people's debts - make life better in your own country ! |

| ...AoBT... | | ▄▄█████████████████▄▄

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████████ | | The Alliance

of Bitcointalk

Translators | | | | │ | | ▄▄▄███████▄▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀▀███████▀▀▀ | .

..JOIN US.. | | │ | |

▄███████████████████████▄

█████████████████████████

█████▀▀██████▀▀██▀▀▀▀████

██████████▀██████████████

█████▄▄███████▄▄▀████████

█████████▄▀▄██▀▀█████████

█████████████████████████

█████████████████████████

████████████▀████████████

▀███████████████████████▀

█████

██████████

| .

..HIRE US.. | | │ |

|

|

|

|

|

|

|

|

You get merit points when someone likes your post enough to give you some. And for every 2 merit points you receive, you can send 1 merit point to someone else!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

blckhawk

Sr. Member

Offline Offline

Activity: 1484

Merit: 326

★Bitvest.io★ Play Plinko or Invest!

|

|

October 27, 2023, 08:15:19 AM |

|

The U.S. is still the world's leading debtor; should the US be happy that they are the world's most indebted country? The question is, can the US pay off such a huge debt of 33 trillion dollars?

The US is borrowing money from their own banks so they really aren't that quick to paying those debts plus if you are a country that has loaned to US, I am sure that paying the debt isn't the best thing you can do, favors go far more than just a lump sum payment of the debts they've incurred. What I mean by the favors is that the US will be on your good side or you can ask for a different kind of payment, you know like a military hardware to upgrade your own military. To answer your question about them paying that back, I don't think so, they're probably just going to raise the debt ceiling so they can justify printing more dollars to circulate on the global market. |

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6281

Blackjack.fun

|

|

October 27, 2023, 01:51:59 PM |

|

Gold demand is the most shocking one to me, there are some rich nations that doesn't really demand gold apparently, I wonder what other method they prefer? I mean if you are a rich nation like for example lets say Norway, and you are not in the gold demand but you are in the list and have a high GDP as well, then what is it that you are requiring in that situation? They could demand a lot more gold than many other nations in that list but they are not, which means that they must have figured out something else that they could request, what is it?

Gold demand for reserves is just 1/8 of the total gold demand, at 22 million ounces is just 40 billion globally for all CB, Norway made $50.2bn just in 2022 from oil and gas, and Apple sold $205.49 billion of iPhones. Even for countries that buy a lot of gold compared to others, the numbers are just tiny compared to their whole economy. What you see in India and China is just domestic demand, people like gold, people like jewelry, just as in some parts of the Middle East, in Japan gold jewelry for example has no traction whatsoever, nor does it in Northern Europe. As for what they use the cash for is mostly direct savings in savings accounts, treasury bonds and pension funds. Saving money via rare metals is a pretty scarce method in Europe, and if they do they do it in the form of jewelry, not bars! With a >135% public debt ratio, should I start thinking on moving from Spain? (definitely not to Portugal, with an even higher ratio...).

Or you could move to Nigeria, it has only 21% debt to GDP ratio, but somehow I think this might be misleading. Just to make sure, go to Congo, it has only 16%, I think you will have a way better life there than in Spain... This sort of debt clock is a bit of a joke really, but it makes good entertainment for some people it seems.

It has always been like that. If I'm indebted to you $100 000 , I have a wage of $100 000 a year but I have $600 000 in savings, am I in trouble? I'm pretty sure Japan is taking notes about managing its debt from Afghanistan which has only a 7% debt-to-GDP ratio, I heard they are moving their entire Gundam production line there! |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Peanutswar

Legendary

Offline Offline

Activity: 1526

Merit: 1028

Top Crypto Casino

|

|

October 27, 2023, 03:53:14 PM |

|

Country expenses is too high so the leaders of the country need to seek assistance from other so they can build the things they need for the community to sustain their current living and give a lot of opportunities to their people, we cannot avoid having this debt reason why there's a lot of country seeking it and giving those because they have some rights to have a percentage of the income if the country does not have the capability, one of those listed is my country too even the child not yet old enough they have a debt need to pay. Additionally with it is inflation that increases the price of the things you can see in the market, there's an inflation but theres no increase in the salary to get a balance reason towards the country gets more lower GDP.

|

|

|

|

|

3kpk3

|

|

October 27, 2023, 04:11:48 PM |

|

This is like the n'th thread about world debt in recent times which is weird since global debt has, will and shall always be a thing which the world has gotten used to. This isn't some doomsday scenario or something.

The US will simply keep raising the debt ceiling again and again and they will be fine as we have observed time and time again.

|

|

|

|

|

lixer

|

|

October 28, 2023, 05:35:05 AM |

|

The World is owing the World!

These debts are still in the hands of the world. When I hear countries like America being in debt, I'm forced to ask, what is a country with liberty to print as much as they want to, to finance whatever they deem fit, doing with debt clock on themselves. I can understand the debt of the then days America, when they had to borrow $100m from J.P.Morgan but for today's America, I'm still left in awe.

The one that owns the world are the humans. We already dealt a lot of damage to it. The debts are on our own hands, not in the world. But the whole country or the whole world is now experiencing it because the life now is getting tougher and tougher. Solving the debt via printing numerous amounts of cash is not the perfect solution to it, but it will only worsen the problem. If you already understand the debt of the old America then that is not different from the new America or any other country right now. No need to confuse yourself anymore. |

|

|

|

|

wallet4bitcoin

|

|

October 28, 2023, 07:03:22 AM |

|

If you already understand the debt of the old America then that is not different from the new America or any other country right now. No need to confuse yourself anymore.

Exactly my point, the debt of the old is quite considerate and how it came up was crystal clear. My wonder is, with the luxury of printing as much USD as America wants, how is their debt rising to heights never seen before and they still print more. One will expect their debts to reduce as they print USD. |

|

|

|

|

Mauser

|

|

October 28, 2023, 01:55:03 PM |

|

Central Government Debt Map in 2022 from International Monetary Fund (IMF).

It is shared by jasonjm.

Thank you for posting the overview, it's a very interesting and also alarming website and map. How can the whole world be so much in debt? Even a country like Switzerland is almost at 50% debt levels. I can understand from an economic point of view that running some public debt is good to increase growth by funding infrastructure projects, but seeing debt levels of close to 100% feels wrong to me. How can a country ever pay back so much debt? Even trying to grow out of it and repay in the future seems very unrealistic and I wonder why the interest rates on public debt aren't higher. A big surprise from the list is Turkey, I always thought that they are struggling a lot and their high inflation rates makes a big problem for the economy. But seeing that their public debt is only at 48%, doesn't this give them a lot of room to increase debt to grow out of the inflation trap? I think that economist recommend a public debt level around 60%, which puts most countries so far above that level. Why isn't there more pressure on politicians to fix their budgets and not run deficits every year? |

|

|

|

|

|

so98nn

|

|

October 28, 2023, 03:28:27 PM |

|

That's the sophisticated clock for sure and I am wondering from where the data is getting fetched. Is it the US government that is injecting this live feed? (How?) Those are remarkable figures but I am still confused about how they can not recover their debts in time considering they also have strong exponential ongoing GDP growth. That should be taking care of that but somehow I feel that's not how it works when returning the money. Moreover, since every country has a GDP to Debt ratio of almost 100% it seems that nullifies the entire competition in the economic circle with good breathing space to return the debts. It's strange how these things work but whats amusing is, if any of the countries started going towards lower debts then does it mean it will become a powerful nation and put down the US just like that? If you already understand the debt of the old America then that is not different from the new America or any other country right now. No need to confuse yourself anymore.

Exactly my point, the debt of the old is quite considerate and how it came up was crystal clear. My wonder is, with the luxury of printing as much USD as America wants, how is their debt rising to heights never seen before and they still print more. One will expect their debts to reduce as they print USD. Huh? Print the money how? That will create more debts because they cant print out of thin air. If they started printing money just like that then inflation is the bitch that will make it's beautiful entry mate. |

|

|

|

|

tygeade

Legendary

Offline Offline

Activity: 2086

Merit: 1058

|

|

October 28, 2023, 07:22:03 PM |

|

That's the sophisticated clock for sure and I am wondering from where the data is getting fetched. Is it the US government that is injecting this live feed? (How?) Those are remarkable figures but I am still confused about how they can not recover their debts in time considering they also have strong exponential ongoing GDP growth. That should be taking care of that but somehow I feel that's not how it works when returning the money. Moreover, since every country has a GDP to Debt ratio of almost 100% it seems that nullifies the entire competition in the economic circle with good breathing space to return the debts. It's strange how these things work but whats amusing is, if any of the countries started going towards lower debts then does it mean it will become a powerful nation and put down the US just like that?

The more you gain, the more you create debt to get richer. So lets assume you have 1 billion income, you can get as much as 3 billion in debt, so you grow and because of that debt you start to use it for making more and now you make 2 billion, now they give you 6 billion in debt, so you use that loan to grow and now you are making 4 billion income, and they give you 12 billion in debt. See how that works? They are growing for sure but because they are making more money that means they have the credit to get more debt as well and they keep growing their debt to grow their income as well. This is what companies do as well, they do not really wish to pay all their debt, they want to make more and more debt to increase their revenue. |

|

|

|

|

BitcoinTurk

|

|

October 28, 2023, 07:54:21 PM |

|

Unfortunately, in today's conditions many countries are under a serious debt burden that we cannot predict or even imagine and when we carefully examine the macro data a much more serious crisis awaits us compared to the 2008 crisis. Due to the ever-increasing debts of many governments, unfortunately, every newborn baby starts their life with debt and the debts of every individual who continues his daily life (debt per capita) increases day by day. Especially considering the past years, we often saw that citizens of developing countries had concerns about the their future. Unfortunately, this has become a problem for all citizens of the world in today's conditions and unfortunately it is getting worse every day.

Economic conditions, which are getting worse day by day, unfortunately, cause many individuals to spend money on debt in order to continue their lives and we see that the debt amounts of individuals are increasing day by day instead of decreasing.

|

|

|

|

|

|

Catenaccio (OP)

|

|

October 29, 2023, 07:39:06 AM |

|

A video on the US. government debt that goes up to $32T from $16T within only 10 years. A snapshot from the video. Watch there.  |

|

|

|

|

Negotiation

|

|

October 29, 2023, 09:17:04 AM |

|

If a country's debt crisis is severe enough it can result in a sharp economic recession in the country that inhibits economic growth elsewhere in the world. Inflation is the rising cost of food and other goods and services as the government prints money to finance its spending. Austerity measures need to be imposed to help countries become debt free in order to sustain people's livelihoods. The measures taken by the leaders became very unpopular, but eventually the crisis was dealt with financial stability in the area and how to prevent another crisis. Debt burden has become a poverty trap for many countries current borrowing means increasing the future tax burden on taxpayers. Therefore developing countries have the opportunity to spend more of their annual revenue to accelerate economic development.

|

|

|

|

|

Catenaccio (OP)

|

|

October 29, 2023, 10:14:40 AM |

|

The measures taken by the leaders became very unpopular, but eventually the crisis was dealt with financial stability in the area and how to prevent another crisis.

It is very popular and the world has many countries with government debt. It is very popular, not unpopular. Governments take action and policies that only create a crisis after another, endless. Debt becomes bigger with time and crisis becomes bigger with time too. |

|

|

|

|

South Park

|

|

October 30, 2023, 08:29:45 PM |

|

If a country's debt crisis is severe enough it can result in a sharp economic recession in the country that inhibits economic growth elsewhere in the world. Inflation is the rising cost of food and other goods and services as the government prints money to finance its spending. Austerity measures need to be imposed to help countries become debt free in order to sustain people's livelihoods. The measures taken by the leaders became very unpopular, but eventually the crisis was dealt with financial stability in the area and how to prevent another crisis. Debt burden has become a poverty trap for many countries current borrowing means increasing the future tax burden on taxpayers. Therefore developing countries have the opportunity to spend more of their annual revenue to accelerate economic development.

I doubt austerity measures are going to be taken, government spending is a great part of the economy so any reduction there will immediately lead to a recession, and this is a scenario governments dread to face so we can forget about any decrease on the government spending, so what could be done to try to reduce the debt of governments? Nothing, the system will continue on its current inertia and changes will only come once the system becomes too unstable to work out, but no one knows when this could happen. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

Catenaccio (OP)

|

|

October 31, 2023, 12:08:39 AM |

|

I doubt austerity measures are going to be taken, government spending is a great part of the economy so any reduction there will immediately lead to a recession, and this is a scenario governments dread to face so we can forget about any decrease on the government spending, so what could be done to try to reduce the debt of governments? Nothing, the system will continue on its current inertia and changes will only come once the system becomes too unstable to work out, but no one knows when this could happen.

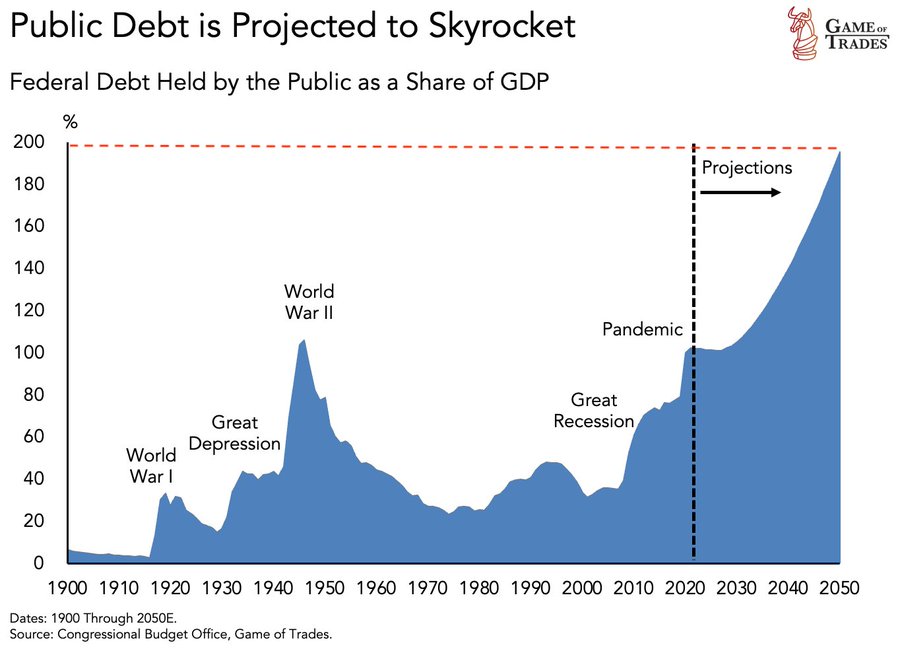

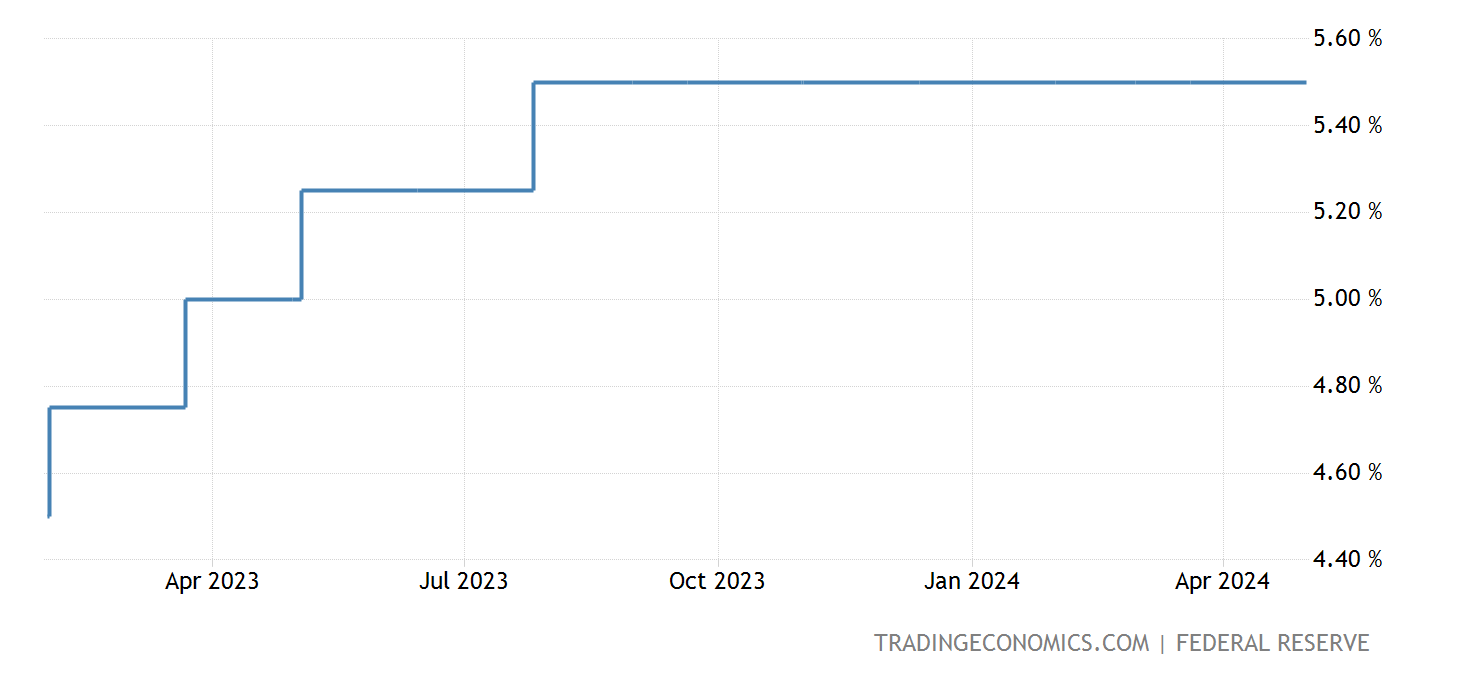

Do governments and central banks fix anything? They do not and you need examples, I can give you the USA. and FED. They printed a lot of money and they tried to fix it by increasing interest rate that does not fix anything but trigger the collapse of banks as consequences for increasing interest rate and inverted bond yield curve.  United States FED fund rateWorld government bonds, yield and inverted yield curves. United States FED fund rateWorld government bonds, yield and inverted yield curves. |

|

|

|

|

Catenaccio (OP)

|

|

November 01, 2023, 01:16:23 AM |

|

Two big countries, the USA. and the UK. have very high Inflation Rate Aggregated (last 3 years). The USA: 23.67% The UK: 32.08% source from truflation.comThe world is covered by abundant fiat currencies from central banks but we are living in a high inflationary time. |

|

|

|

|

Youngkhngdiddy

|

|

November 01, 2023, 12:58:18 PM |

|

If a country's debt crisis is severe enough it can result in a sharp economic recession in the country that inhibits economic growth elsewhere in the world. Inflation is the rising cost of food and other goods and services as the government prints money to finance its spending. Austerity measures need to be imposed to help countries become debt free in order to sustain people's livelihoods. The measures taken by the leaders became very unpopular, but eventually the crisis was dealt with financial stability in the area and how to prevent another crisis. Debt burden has become a poverty trap for many countries current borrowing means increasing the future tax burden on taxpayers. Therefore developing countries have the opportunity to spend more of their annual revenue to, accelerate economic development.

We have seen inflation rise in some of the above countries mentioned by the OP, the united state with all their money still complains about inflation. Money is created against the debt for the purpose of paying back the debt. (Insane? Yes, but this is how the system was designed.) The population then works for the money, to pay their bills AND to pay taxes to pay back the debt. The amount of money created is in direct proportion to the amount of debt created.All governments on earth sold labor forward. Example: Government promises to pay $100,000 in 30 years. Bank prints $100,000 and government spends it today. Government taxes the population to pay back the $100,000. Yes, it is insane. It is a slavery system. And it was designed to be a slavery system. The reason any independent country ends up in debt is almost entirely through the ignorance, corruption and/or stupidity of the people who get to control the legislative body of the nation. That applies to both the people who get elected and the people who are responsible for electing them. The vast majority of “money” in today’s world is created, completely unnecessarily, as interest-bearing debt. This has happened because the private banking cartels have, over the past couple of centuries, managed to corrupt and control governments around the world. It has reached the stage when no politician has the guts to challenge the system because the central banking system is so powerful that they will impose sanctions on any nation that tries to buck the system. |

|

|

|

|

DrBeer

Legendary

Offline Offline

Activity: 3752

Merit: 1864

|

|

November 01, 2023, 06:21:49 PM |

|

Two big countries, the USA. and the UK. have very high Inflation Rate Aggregated (last 3 years). The USA: 23.67% The UK: 32.08% source from truflation.comThe world is covered by abundant fiat currencies from central banks but we are living in a high inflationary time. This is largely a consequence of covid and post-covid stagnation, where the state was forced to "print money" to support the population. Read how much money was given to the population in the US in the form of monthly guaranteed financial aid.... And here is the full "ranking" of countries by inflation rate (2020-2023 +/-). Over the last year. I've chosen countries with inflation rates above 15%. LIST OF COUNTRIES BY INFLATION RATE FOR THE YEAR Country / Period / Value / Unit / Previous value Venezuela Sep. 2023 318 % 395 Lebanon Aug. 2023 230 % 252 Syria Aug. 2020 139 % 134 Argentina Aug. 2023 124 % 113 Sudan Feb. 2023 63.3 % 83.6 Turkey Sep. 2023 61.53 % 58.94 North Korea Jul. 2013 55 % 70 Suriname Aug. 2023 53.8 % 56.6 Sierra Leone Aug. 2023 50.94 % 44.98 Cuba 2023 41.77 % 44.98 Haiti Jul. 2023 39.8 % 43.9 Iran Sep. 2023 39.5 % 39.8 Ghana Sep. 2023 38.1 % 40.1 Egypt Sep. 2023 38 % 37.4 Pakistan Sep. 2023 31.4 % 27.38 Burundi Aug. 2023 28.74 % 24.76 Malawi Aug. 2023 28.6 % 28.4 Ethiopia Aug. 2023 28.2 % 28.8 Nigeria Aug. 2023 25.8 % 24.08 Laos Sep. 2023 25.69 % 25.88 Sao Tome and Principe Jun. 2023 25.4 % 23.2 Comoros 2023 20.2 % 19.9 Gambia Aug. 2023 18.41 % 18.36 Zimbabwe Sep. 2023 18.4 % 17.7 Rwanda Sep. 2023 18.4 % 17.4 |

| ...AoBT... | | ▄▄█████████████████▄▄

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████████ | | The Alliance

of Bitcointalk

Translators | | | | │ | | ▄▄▄███████▄▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀▀███████▀▀▀ | .

..JOIN US.. | | │ | |

▄███████████████████████▄

█████████████████████████

█████▀▀██████▀▀██▀▀▀▀████

██████████▀██████████████

█████▄▄███████▄▄▀████████

█████████▄▀▄██▀▀█████████

█████████████████████████

█████████████████████████

████████████▀████████████

▀███████████████████████▀

█████

██████████

| .

..HIRE US.. | | │ |

|

|

|

|

Catenaccio (OP)

|

|

November 02, 2023, 01:38:25 AM |

|

This is largely a consequence of covid and post-covid stagnation, where the state was forced to "print money" to support the population. Read how much money was given to the population in the US in the form of monthly guaranteed financial aid....

They made things worse exponentially since the pandemic Covid-19 but they did not make good things before the pandemic. History shows governments and central banks always make their bad management to harm Purchasing power of their fiat currencies. It happens many decades, not only started since the pandemic. How quickly is the US national debt increasing?

In 1986, it took 1642 days to go from the 1st trillion in debt added to the 2nd trillion ~ 4.5 years.

In 2023, it took 92 days ~ 0.25 years. 🤯

That means debt is increasing 18x faster.

The money is broken. Go with Bitcoin

|

|

|

|

|