|

larry_vw_1955 (OP)

|

|

November 14, 2023, 12:36:35 AM |

|

https://www.coindesk.com/consensus-magazine/2023/11/13/the-irs-is-making-crypto-compliance-impossible/The IRS states, “A specific identification of the units of a digital asset sold, disposed of, or transferred is made if, no later than the date and time of the sale, disposition, or transfer, the taxpayer identifies on its books and records the particular units to be sold…”

If a taxpayer uses a broker they must instruct the broker which digital assets they intend to sell before-the-trade. In the case of a broker taxpayers must:

Identify and document digital assets in their own records

Tell the broker to sell the assets they’ve identified

The IRS states, “…the taxpayer specifies to the broker having custody of the digital assets the particular units of the digital asset to be sold…”

Now, if you don’t meet the spec id requirements, your basis defaults to FIFO and you could incur a gigantic tax liability. Your spec ID gets recalculated under a FIFO basis.

you guys better hope this little rule doesn't pass because if it does then you are screwed if you live in the usa.

|

|

|

|

|

|

|

|

You get merit points when someone likes your post enough to give you some. And for every 2 merit points you receive, you can send 1 merit point to someone else!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

November 14, 2023, 01:07:29 AM |

|

https://www.coindesk.com/consensus-magazine/2023/11/13/the-irs-is-making-crypto-compliance-impossible/The IRS states, “A specific identification of the units of a digital asset sold, disposed of, or transferred is made if, no later than the date and time of the sale, disposition, or transfer, the taxpayer identifies on its books and records the particular units to be sold…”

If a taxpayer uses a broker they must instruct the broker which digital assets they intend to sell before-the-trade. In the case of a broker taxpayers must:

Identify and document digital assets in their own records

Tell the broker to sell the assets they’ve identified

The IRS states, “…the taxpayer specifies to the broker having custody of the digital assets the particular units of the digital asset to be sold…”

Now, if you don’t meet the spec id requirements, your basis defaults to FIFO and you could incur a gigantic tax liability. Your spec ID gets recalculated under a FIFO basis.

you guys better hope this little rule doesn't pass because if it does then you are screwed if you live in the usa. I already do fifo you planner it. and don't trade much. but if you trade it sucks bigly. |

|

|

|

|

Yamane_Keto

|

|

November 14, 2023, 03:47:09 AM |

|

1099-DA cost basis complicates the tax record, and even if a program is created that makes everything unified, complications will exist, and failure to do so may return you to FIFO, which may make a difference in calculating taxes if you use another method.

Tracking and calculating gains separately for each address is a never-ending headache and may lead many to stop trading, so imposing taxes based on returns will solve many of this headaches.

|

|

|

|

|

larry_vw_1955 (OP)

|

|

November 14, 2023, 03:49:48 AM |

|

1099-DA cost basis complicates the tax record, and even if a program is created that makes everything unified, complications will exist, and failure to do so may return you to FIFO, which may make a difference in calculating taxes if you use another method.

more from the story! If the exchange doesn’t support specific identification, they will default to FIFO reporting for all their customers. Meanwhile, taxpayers who previously used HIFO (highest in, first out), CCFO (closest cost, first out) or some other cost-basis method in prior years end up with a perpetual cost-basis mismatch. The exchange issues a 1099-DA on a FIFO basis and taxpayer A calculates a totally different gain or loss using their own cost-basis method. You should start to see where the extra work is creeping in.get ready for a new IRS tax form guys. it's called 1099-DA. Double trouble that's what the D stands for.  all you can do is hope they don't come out with it. Tracking and calculating gains separately for each address is a never-ending headache and may lead many to stop trading, so imposing taxes based on returns will solve many of this headaches.

who would want anything to do with anything that made them have to do something like that? i would have to be guaranteed 100% returns to even go through something like that. |

|

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

November 14, 2023, 04:55:45 AM |

|

The thing is that the Bitcoin was not intended for that, to be calculating the equivalence with the fucking fiat every time you spend something and then calculate the difference with the acquisition price to calculate the potential tax. Another thing is how things have developed. But in El Salvador they don't have that problem, for example.

There are programs that automatically track all transactions, such as CoinLedger or Cointracking, so technically there is no problem.

|

|

|

|

|

larry_vw_1955 (OP)

|

|

November 15, 2023, 12:15:03 AM |

|

The thing is that the Bitcoin was not intended for that, to be calculating the equivalence with the fucking fiat every time you spend something

and then calculate the difference with the acquisition price to calculate the potential tax.

welcome to the USA where they don't want you to be in involving in anything. they want to treat cryptocurrencies like they do trading in the stock market which is a centralized exchange  Another thing is how things have developed. But in El Salvador they don't have that problem, for example.

El Salvador doesn't have an IRS? a money hungry orginazation trying to take back as much money from people as they can while at the same time limiting their freedoms? There are programs that automatically track all transactions, such as CoinLedger or Cointracking, so technically there is no problem.

i don't know. they'll need to probably update their softwares so they can handle more than 1 form 1099-DA. that article gave a crazy example where someone had like 36 different form 1099s.  but it's hard to imagine this new thing passing because if it does, it pretty much means buy and hold is the only way to avoid becoming a tax evader. |

|

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

November 15, 2023, 04:34:18 AM |

|

welcome to the USA where they don't want you to be in involving in anything. they want to treat cryptocurrencies like they do trading in the stock market which is a centralized exchange  The same happens in Europe, in fact let me quote: Everything I've seen come out of the EU in relation to bitcoin has been just as bad/stupid/misguided/idiotic as what our government in the US spits out. This kind of mass surveillance of bitcoin will only spread if we don't fight to put a stop to it.

El Salvador doesn't have an IRS? a money hungry orginazation trying to take back as much money from people as they can while at the same time limiting their freedoms?

They have a body equivalent to the IRS but people don't pay taxes for using Bitcoin as it is legal tender, or do you have to pay taxes for using dollars, calculating on every payment you make whether it has gone up or down? but it's hard to imagine this new thing passing because if it does, it pretty much means buy and hold is the only way to avoid becoming a tax evader.

Not really. The solution is to use software, as I said, although I suppose that the reliable one for the administration will be centralized, or that they put a tax exempt minimum for payments/transactions below a threshold, but I see it unlikely given how things are developing. |

|

|

|

o_e_l_e_o

In memoriam

Legendary

Offline Offline

Activity: 2268

Merit: 18507

|

|

November 15, 2023, 11:35:42 AM |

|

Exchanges simply won't support this. You think Coinbase is going to set up a process by which every time anyone makes any trade, they notify Coinbase in advance exactly which coins they are intending to trade with. And Coinbase keep a record of not just the balance on everybody's account, but exactly which coins were bought when, which coins were sold when, and which coins were traded when? This effectively means Coinbase would have to trace every single individual satoshi in their custody at all times. Logistical nightmare. And so when exchanges simply refuse to support this, everyone will default to FIFO and get hit with outrageous tax bills.

Yet another reason not to use centralized exchanges. You can easily avoid this by trading exclusively peer to peer, since whenever you sell any bitcoin you will be choosing which outputs to use and should know where those outputs came from, or you can use software to track it all for you as mentioned above.

|

|

|

|

|

zasad@

Legendary

Offline Offline

Activity: 1736

Merit: 4270

|

|

November 15, 2023, 03:13:15 PM |

|

And in the USA there are only 2 modes: FIFO and LIFO?

In Russia there is still a regime based on the average value.

I really sympathize with you. I have never read such tax nonsense. This is a clear attack on crypto traders and the remaining crypto exchanges in the US.

|

|

|

|

odolvlobo

Legendary

Offline Offline

Activity: 4298

Merit: 3209

|

|

November 17, 2023, 01:30:46 AM Merited by vapourminer (1) |

|

Exchanges simply won't support this. You think Coinbase is going to set up a process by which every time anyone makes any trade, they notify Coinbase in advance exactly which coins they are intending to trade with. ...

So, this rule has applied to stock brokers for a long time now, and it is not as bad as you describe. Typically, if you don't want FIFO, you go into your account settings and change it. I don't see why Coinbase couldn't do the same thing. The setting would apply to all the sales that follow so you don't have to notify Coinbase before every sale. Furthermore, it wouldn't take much to add a feature to the sales process that lets the seller specify which lots they are selling from. Now, of course the exchange has to add this capability, and if they don't then I don't know what happens. It might be a good idea to avoid exchanges that don't let you specify. OTOH, it might not even matter because if they don't do that, they probably aren't going to file the 1099, either. |

Join an anti-signature campaign: Click ignore on the members of signature campaigns.

PGP Fingerprint: 6B6BC26599EC24EF7E29A405EAF050539D0B2925 Signing address: 13GAVJo8YaAuenj6keiEykwxWUZ7jMoSLt

|

|

|

|

larry_vw_1955 (OP)

|

|

November 18, 2023, 05:17:28 AM |

|

And so when exchanges simply refuse to support this, everyone will default to FIFO and get hit with outrageous tax bills.

yep. that's the only logical conclusion. when you are trading on an exchange with simulated bitcoin...where you can't see the utxos or anything. just a balance on your screen. yeah you're gonna be at the mercy of whatever. Yet another reason not to use centralized exchanges. You can easily avoid this by trading exclusively peer to peer, since whenever you sell any bitcoin you will be choosing which outputs to use and should know where those outputs came from, or you can use software to track it all for you as mentioned above.

thanks for the 4 merit  |

|

|

|

|

nutildah

Legendary

Offline Offline

Activity: 2968

Merit: 7948

|

|

November 18, 2023, 09:28:37 AM |

|

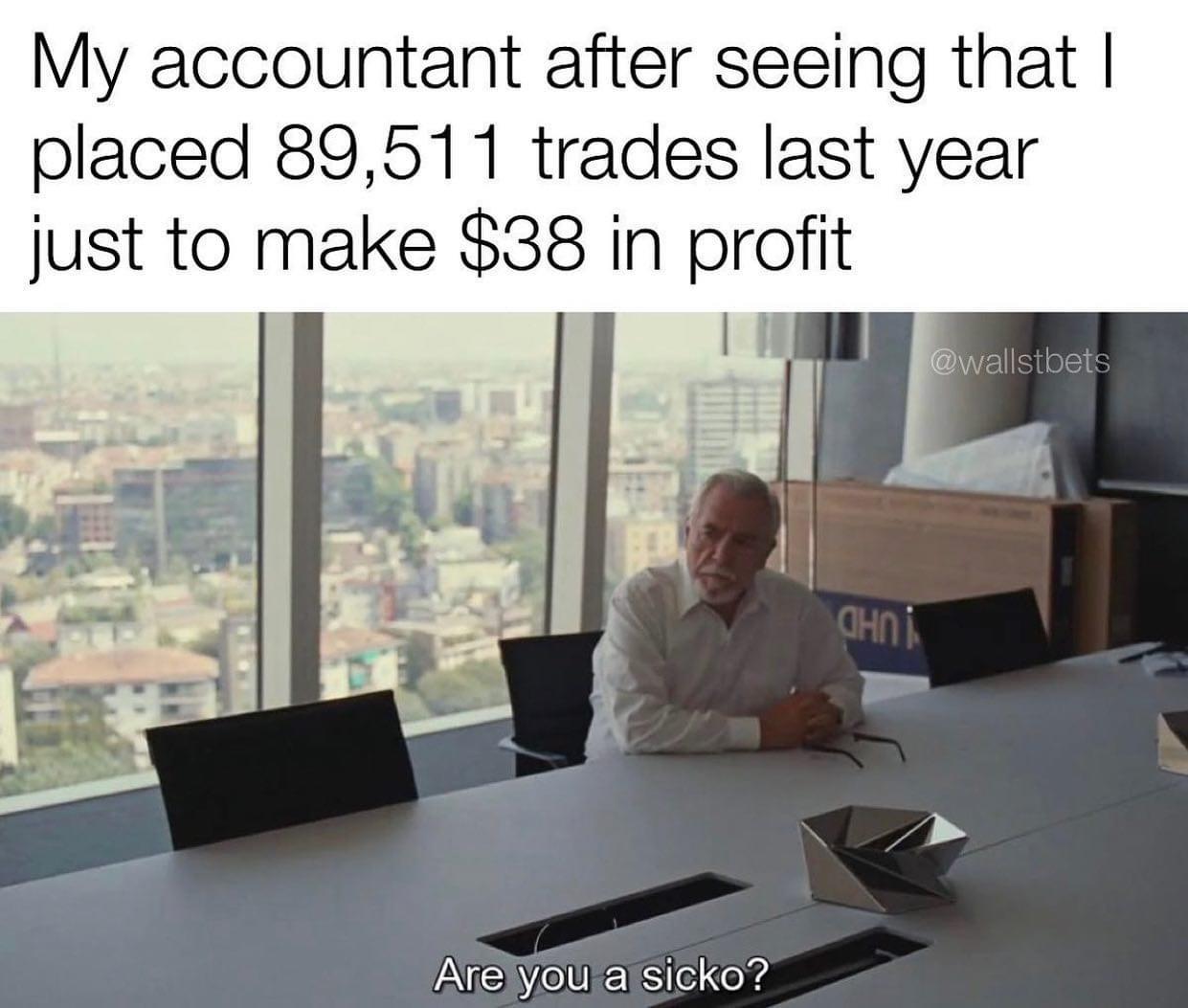

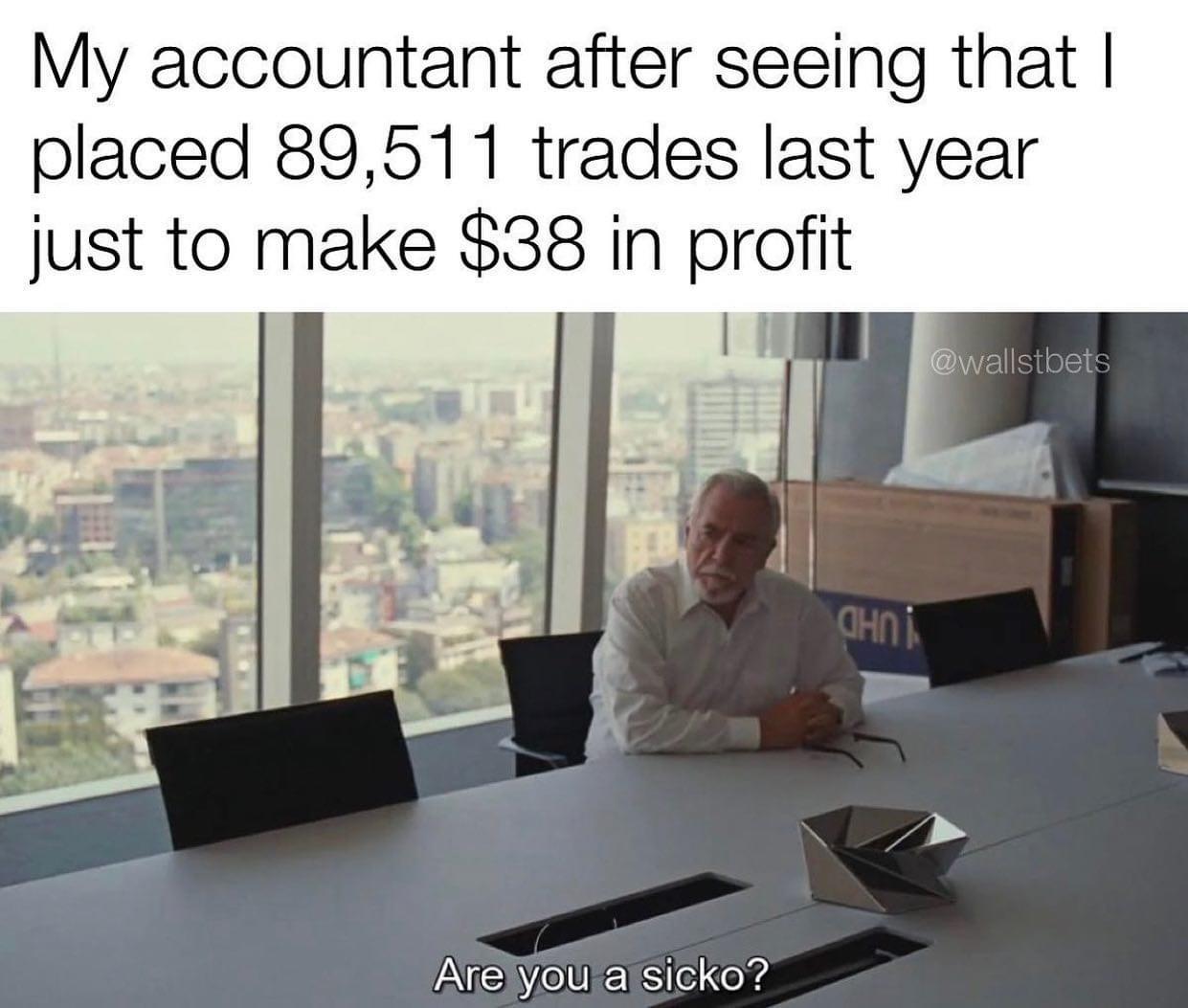

I was reminded of this meme:  Several years back my state passed a ludicrous law that forbids any USA-based crypto exchange from servicing me as a customer (because the law's demands on exchanges are ridiculous), so what is being proposed is literally impossible for me to follow. I imagine there's at least hundreds of thousands (if not millions) of Americans in a similar situation. As we discussed in the other thread, there's no way the IRS will have the manpower & resources to track us all down, and they will only go after the worst offenders (according to tax data they receive from complying exchanges). thanks for the 4 merit  You ask some good questions larry, and seem to be interested in cutting-edge bitcoin tech & policy on your own accord, so you deserve every merit you get, even if it turns out you were a government mole all along  |

|

|

|

|

larry_vw_1955 (OP)

|

|

November 19, 2023, 01:43:21 AM |

|

I was reminded of this meme:  Several years back my state passed a ludicrous law that forbids any USA-based crypto exchange from servicing me as a customer that's REALLY crazy. it's almost like they're forcing you to go underground trading p2p or use some dex or offshore exchange that is grudgingly willing to accept Americans as customers ( few and far between these days I would imagine!). not that coinbase or gemini or bittrex would be places i would reccommend to anyone but i guess they're better than having to go "offshore". but none of them is ideal. and they will only go after the worst offenders (according to tax data they receive from complying exchanges).

only go after the worst offenders but probably still send out payments due to anyone they can get data on that they think owes some money. they just pop out a letter in the mail and assume their bill is valid unless you dispute it by a certain date. there was someone once that didn't know how to compute cost basis in the stocks they bought and the IRS assumed they had no cost basis: zero cost basis the entire sale was assumed to be profit. Guess how big that bill was?  You ask some good questions larry, and seem to be interested in cutting-edge bitcoin tech & policy on your own accord, so you deserve every merit you get, even if it turns out you were a government mole all along  appreciate the kind words. bitcointalk is a pretty cool place and i have had alot of fun getting to be here. with regard to this story i found an update: https://www.coindesk.com/policy/2023/11/16/us-lawmakers-urge-treasury-to-revise-proposed-crypto-tax-rules/A group of bipartisan U.S. lawmakers have urged the Treasury to revise its proposed digital-assets taxation regime. The group is backing crypto representatives and lawyers who have called the proposed taxation scheme “dangerous and improper overreach.”

Chairman of the House Financial Services Committee, Patrick McHenry (R-NC) and Congressman Ritchie Torres (D-N.Y) led a group of nine lawmakers in the effort calling the tax reporting requirement “unworkable.”so it's not like they're taking this lying down. it's being protested against so if this thing really passes i would REALLY be suprised. But if the IRS ignores all of these efforts and comments from the 124,000 people that submitted comments (you have to assume they were all against it!) then that just shows the government doesn't listen to the people. |

|

|

|

|

o_e_l_e_o

In memoriam

Legendary

Offline Offline

Activity: 2268

Merit: 18507

|

I was reminded of this meme: Would love to see the IRS inundated with tax returns each consisting of a few thousand pages of trades, which ultimately end up with no tax owed but which they have to spend many man hours trawling through. You want to set ridiculous rules? You enforce them. only go after the worst offenders but probably still send out payments due to anyone they can get data on that they think owes some money. they just pop out a letter in the mail and assume their bill is valid unless you dispute it by a certain date. That's it exactly. Guilty until proven innocent. They will assume you owe them thousands based on erroneous or entirely absent data, and it is up to you to prove otherwise. then that just shows the government doesn't listen to the people. I mean, this has been blatantly obvious for quite some time. |

|

|

|

|

|

larry_vw_1955 (OP)

|

|

November 20, 2023, 05:40:20 AM |

|

Would love to see the IRS inundated with tax returns each consisting of a few thousand pages of trades, which ultimately end up with no tax owed but which they have to spend many man hours trawling through. You want to set ridiculous rules? You enforce them.

imagine how much it would cost you to mail a few thousand pages of trades? better look into e-filing  but then you would be playing right into their hands. they WANT you to file electronically so it means less work for them. at some point i expect the IRS to refuse to accept paper returns in the mail just like banks refuse to accept coins. That's it exactly. Guilty until proven innocent. They will assume you owe them thousands based on erroneous or entirely absent data, and it is up to you to prove otherwise.

check mark. i should give you a merit for that statement because it's the truth. I mean, this has been blatantly obvious for quite some time.

yeah but if they don't do anything to mitigate this situation, i would be really surprised. this thing has been a long time coming it appears. no one seemed to see it coming though. https://coinledger.io/blog/form-1099-da

Why is the IRS creating Form 1099-DA?

In November 2021, the American infrastructure bill was signed into law by President Biden. The bill stated that cryptocurrency exchanges would be required to report their customer’s capital gains and losses to the IRS through 1099 forms starting in the 2023 tax year.

This law drew criticism from prominent voices in the cryptocurrency ecosystem. Cryptocurrency’s unique properties make it difficult for exchanges to accurately report their customers’ capital gains and losses.

It’s likely that the IRS is creating Form 1099-DA to tackle this issue and make it easier for cryptocurrency exchanges to report their customers’ activity.

they snuck it into the American infrastructure bill, whatever that bill was for. they just snuck it in no one knew about it until after it happened probably! thanks biden. |

|

|

|

|

o_e_l_e_o

In memoriam

Legendary

Offline Offline

Activity: 2268

Merit: 18507

|

|

November 20, 2023, 09:27:24 AM |

|

they snuck it into the American infrastructure bill, whatever that bill was for. they just snuck it in no one knew about it until after it happened probably! thanks biden. Haha. Welcome to our broken government: The only reason these cryptocurrency provisions are still in this bill is because one Senator - Richard Shelby - continually blocked amendments to fix the bill unless everyone agree to another $50 billion for the military. I mean, we only spend $800 billion a year on the military already. I'm sure that extra $50 billion will make all the difference to Afghanistan, and definitely won't just line the pockets of the companies which pay for his campaigns.  Senators attach completely unrelated pieces of legislation and completely unrelated amendments to bills all the time, as a way to sneak them through. Other senators will turn a blind eye to these unpopular pieces of legislation in return for their original legislation being passed without being vetoed. Which is why we end up with nonsense crypto legislation unless we agree to spend more and more of our tax money on bombing other countries.  |

|

|

|

|

|

larry_vw_1955 (OP)

|

|

November 21, 2023, 02:25:32 AM |

|

Other senators will turn a blind eye to these unpopular pieces of legislation in return for their original legislation being passed without being vetoed. Which is why we end up with nonsense crypto legislation unless we agree to spend more and more of our tax money on bombing other countries.  so i guess 2 wrongs really do make a right when it comes to uncle sam. he can do anything he wants to. including running up a huge debt that he'll never repay. the higher bitcoin goes in price the more they'll try and make life miserable for crypto users i would imagine.  bitcoin users in particular. Migrant crisis has US taxpayers on the hook for up to $451B, House GOP report says Americans could pay up to $451 billion to care for migrants who entered the US illegally, but have been released into the country or escaped from custody, according to a new report due out Monday from House Republicans and obtained exclusively by The Post.

The bill for government care and housing could total as much as $451 billion per year nationwide for apprehended migrants and known “gotaways” who have entered the US since 2021, according to figures the House panel cites from the Center for Immigration Studies.

https://nypost.com/2023/11/13/news/house-gop-report-cites-historic-451-billion-cost-of-migrant-crisis/that's not just a one-off cost. it's per year.

Quote from: o_e_l_e_o on September 28, 2021, 09:48:19 AM

The only reason these cryptocurrency provisions are still in this bill is because one Senator - Richard Shelby - continually blocked amendments to fix the bill unless everyone agree to another $50 billion for the military. I mean, we only spend $800 billion a year on the military already. I'm sure that extra $50 billion will make all the difference to Afghanistan, and definitely won't just line the pockets of the companies which pay for his campaigns. Roll Eyes

not go get into any type of argument with you but you've always kind of been dismissive of budget expenditures saying how the the migrant situation is so tiny in comparison to the other things in the federal budget but not anymore. if the NYT story is true, then it's right up there with medicaid, medicare and a little less than half of the entire social security budget. is that big enough for you? https://www.cbo.gov/publication/58888 |

|

|

|

|

o_e_l_e_o

In memoriam

Legendary

Offline Offline

Activity: 2268

Merit: 18507

|

|

November 21, 2023, 08:56:10 AM |

|

Migrant crisis has US taxpayers on the hook for up to $451B, House GOP report says We've been over this before. The media are experts at taking numbers out of context and selectively reporting the things they want you to be angry about. National Health Expenditure was $4.3 trillion for 2021. We spend significantly more money than any other developed country and yet have significantly worse health in return, because our healthcare system is uniquely filled with unnecessary middle men who only care about making profits for themselves: About 25% of U.S. healthcare costs relate to administrative costs (e.g., billing and payment, as opposed to direct provision of services, supplies and medicine) versus 10-15% in other countries. For example, Duke University Hospital had 900 hospital beds but 1,300 billing clerks during 2013. Tell me why a hospital needs more billing clerks than actual beds? Cut that 15% excess compared to other countries from the $4.3 trillion budget and you are saving $645 billion a year, every year. Why is that not reported on? Because every time anyone even suggests fixing the broken system, it's sOcIaLiSm!  not go get into any type of argument with you but you've always kind of been dismissive of budget expenditures saying how the the migrant situation is so tiny in comparison to the other things in the federal budget but not anymore. if the NYT story is true, then it's right up there with medicaid, medicare and a little less than half of the entire social security budget. is that big enough for you? As I've explained above, $451 billion is still several hundred billion less than the completely unnecessary amount we throw away in unnecessary healthcare administrative costs every year. I'm also highly skeptical of this number. The article you linked says it takes the number from this report: https://homeland.house.gov/wp-content/uploads/2023/11/Phase4Report.pdfThat report takes the number from this article, published by an anti-immigration think tank which is widely discredited: https://cis.org/Arthur/Bidens-Border-Fiasco-Costing-Local-Taxpayers-BillionsThat article reaches that number by multiplying the estimated cost of an immigrant in NYC by the estimated number of immigrants in the country. It's estimated cost of an immigrant in NYC comes from this article: https://www.realclearinvestigations.com/articles/2023/04/20/where_did_all_the_biden_illegal_immigrants_go_hard-up_sanctuary_cities_like_new_york_are_only_part_of_the_answer_894505.htmlThat article reaches its estimate by saying that NYC pays $150,000 per immigrant, but it also says that 40,000 immigrants have cost $2 billion, which works out at $50,000 per immigrant, so the numbers are simply wrong. So incorrect numbers, multiplied by guesswork, based on one of the most expensive states in the country. The final number is nowhere near accurate. |

|

|

|

|

bbc.reporter

Legendary

Offline Offline

Activity: 2912

Merit: 1440

|

|

November 22, 2023, 04:26:01 AM |

|

However, might this little IRS rule also encourage the holders not to sell their coins hehehee? We can also use them as currency, particularly bitcoin. Does the rule say something about taxes and using your cryptocoins as currency? Also, what about coin to coin trades?

|

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

o_e_l_e_o

In memoriam

Legendary

Offline Offline

Activity: 2268

Merit: 18507

|

|

November 22, 2023, 12:27:53 PM |

|

However, might this little IRS rule also encourage the holders not to sell their coins hehehee? We can also use them as currency, particularly bitcoin. Does the rule say something about taxes and using your cryptocoins as currency? Also, what about coin to coin trades? The IRS are already very clear on this matter and have been for some time. Spending bitcoin on goods or services or trading it for an altcoin is the same as selling it for fiat as far as they are concerned. |

|

|

|

|

|