If you do it, then I could give you numbers for December, January and February.. so I am not sure how easy it will be to update, but if you already have something in mind then we can see how it turns out.

I was thikning about something simple. Like, selling always the first day of the month (as we cannot know which day will be the best or the worse day to sell).

Then, the stash would be recalculated based in the value to sell each first day of the month.

For anyone trying to follow this part of the conversation, in regards to the tool.. there may well be a need for a reference...

https://bitcoindata.science/withdrawal-strategy and we also talk about aspects of the tool in bitmover's thread..

https://bitcointalk.org/index.php?topic=5479482.0Of course, there is a difference between manually entering your withdrawals (BTC sales), and doing it based on an algorithm, and this kind of historical illustration that you are considering would largely be intended to show how the system would play out if the withdrawals were based on the then applicable formula were to be followed in a kind of strict and formulaic way.

If you enter that kind of system, then it is no longer going to look like my column C, and that is o.k... but the idea could be retained, and I would recommend starting out with similar kinds of parameters that I had used.. or perhaps starting out with an earlier date in order to show how it would play out with a longer history.

Regarding the parameters to input and to start out with:

Day of the month: Personally, I wouldn't want to pick the first day of the month, but maybe a date in the middle of the month or towards the end of the month. but if you want it to be consistent then maybe pick something like the 22th or some other date that would not be quite as common.... and I am a bit bothered about the idea of locking in sales all on one date, even though that is easier for an algorithm. I agree with your assertion that we cannot really know when the dips and the raises are gong to be, but with an actual real world manual application, we might have a bit of an idea, and picking dates can help us to play the little gambling streak that so many folks have.. yeah of course, there may well be personalities (and maybe time constraints) in which they just want to get it done with and then to have that money in cash for the month.. but there also can be desires to spread it out during the month.. and to see what happens.. maybe take half out in the beginning of the month and then see how the other have of the month plays out.

In my own rendition, I had put the date towards the end of the month because I was considering that various sales/withdrawals would be done at various points in the month in order to reach the maximum allowance for the month at some point towards the end of the month .. and so in my own hypothetical, if the maximum allowance for the month might be 0.064 BTC and then at some point of the month 0.02 BTC might get spent and then another point another 0.02 BTC and then at another point the remaining 0.02 BTC, and with an attempt to stay a little bit below the maximum authorization. Yet, once all the spending for the month had been accomplished the next month would come and have an additional authorization for 0.063 BTC or some quantity of BTC that would be slightly reduced in terms of total withdrawal authorization amount, so part of the problem if the whole wadd were to be spent at one shot in the beginning of the month would mean a need to wait all the way until the next month before having another authorization.. even though I agree that for an algorithmic rendition, it is going to be easier to pick one day of the month... rather than overly complicating matters or alternatively to be even more realistic in the incrementalism kind of approach, there could be a couple of dates chosen.. the 8th and the 22nd, for example.

How far to go back: You see that my hypothetical goes back to October 2022, but if you were to get the algorithm to punch in the dates, we might want to go back a bit further to show how the tool would have had worked over a longer period of time, maybe even a whole cycle.... .. so then once it is set up, then I suppose it would just update every month, like you mentioned.

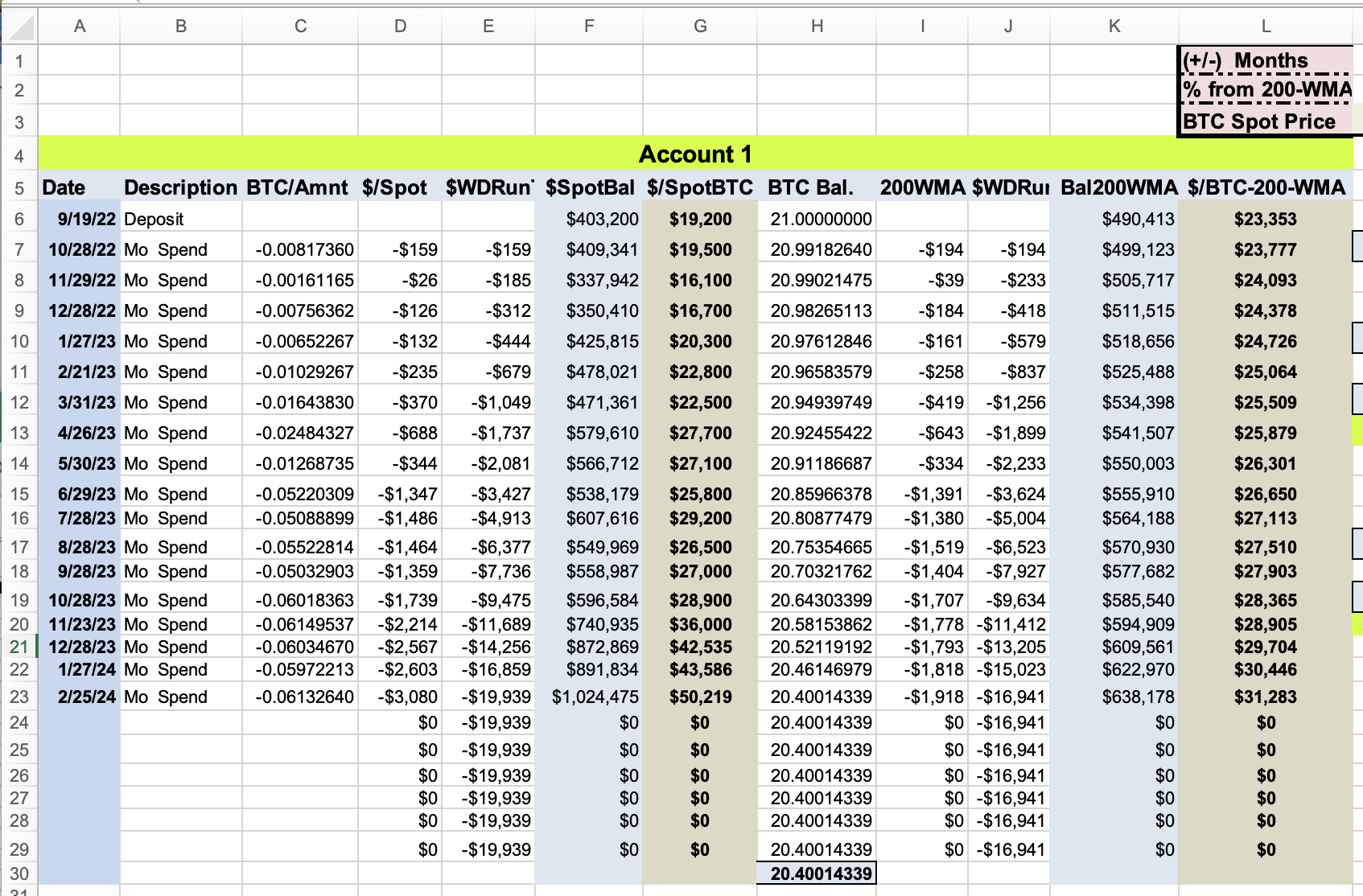

How much BTC and/or value to use: Of course, I am very much into the idea of using fuck you status and suggesting that default entry-level fuck you status could be considered as $2 million in western location. However, with this particular tool, I started out with 21 coins in a bit of a random way, and if we use the tool, and we look back to September/October 2022, we see that 21 BTC were then worth $490k-ish in terms of the 200-WMA, but the spot price was then below the 200-WMA at $403k-ish, so at that time with the use of the tool (or the formula), the withdrawal authorization amounts were quite extensively reduced (even if we were to have had used this tool back then), and even in my own hypothetical presentation, the withdrawal amounts were even way below the limits, so I had a lot of reluctance to be selling and/or withdrawing BTC during that time (in terms of the hypothetical example that I used).

O.k. Here is my updated chart:

I added running total columns (E and J) that show the spot price amount withdrawn and the 200-WMA amount reduced.

We could start out with the same value of $500k in October 2022 or we could go back a whole 4-year cycle, and then the amount of starting out BTC would be different, but I am pretty sure that it will hold its value in terms of measuring the value from the 200-WMA, and we see that my limited chart, the 200-WMA value continues to go up, but I was using a 4% withdrawal rate and even quite below the authorized withdrawal rate. I think that for any kind of algorithmic application of the formulas (and back testing it), it would be fair and reasonable to use a 6% withdrawal rate and then see how it plays out.

If we were to go back 4-years from now, of course, we would get into the whole calamity of the large correction that was in March 2020, so maybe we could either start from January 2020 or alternatively start from July 2020.

If we were to start from January 1, 2020, the 200-WMA would then have had a value of $5,084.. So a 200 WMA portfolio valued at $500k would be starting with 98.35 BTC. On the other hand, if we start with July 1, 2020 the 200-WMA would then have had a value of $6,114.. So a 200 WMA portfolio valued at $500k would be starting with 81.78 BTC.

Hopefully all of this is not too crazy-sounding... but I am having quite a bit of confidence in the tool and the various formulas that we have chosen to provide guidance in terms of ways in which to withdraw BTC consistently, persistently and ongoingly while being able to retain dollar value in terms of measuring in terms of the 200-WMA, even if we were to use a 6% withdrawal rate.

Another thing that seems to worry people is a potential need for the value of their overall BTC portfolio to continue to grow in terms of dollar value so that they will be able to withdraw more value in the future in order to keep up with the inevitable ongoing debasement of the dollar and the value of the dollar... and surely there could be needs to make adjustments to the withdrawal rate, yet I remain confident that currently, even with a 6 % withdrawal rate, the BTC holdings will hold their value and even sufficiently increase in value in regards to valuing holdings in light of the 200-WMA sufficiently enough in order to keep up with inflation (and/or the ongoing persistent and inevitable debasement of the dollar).

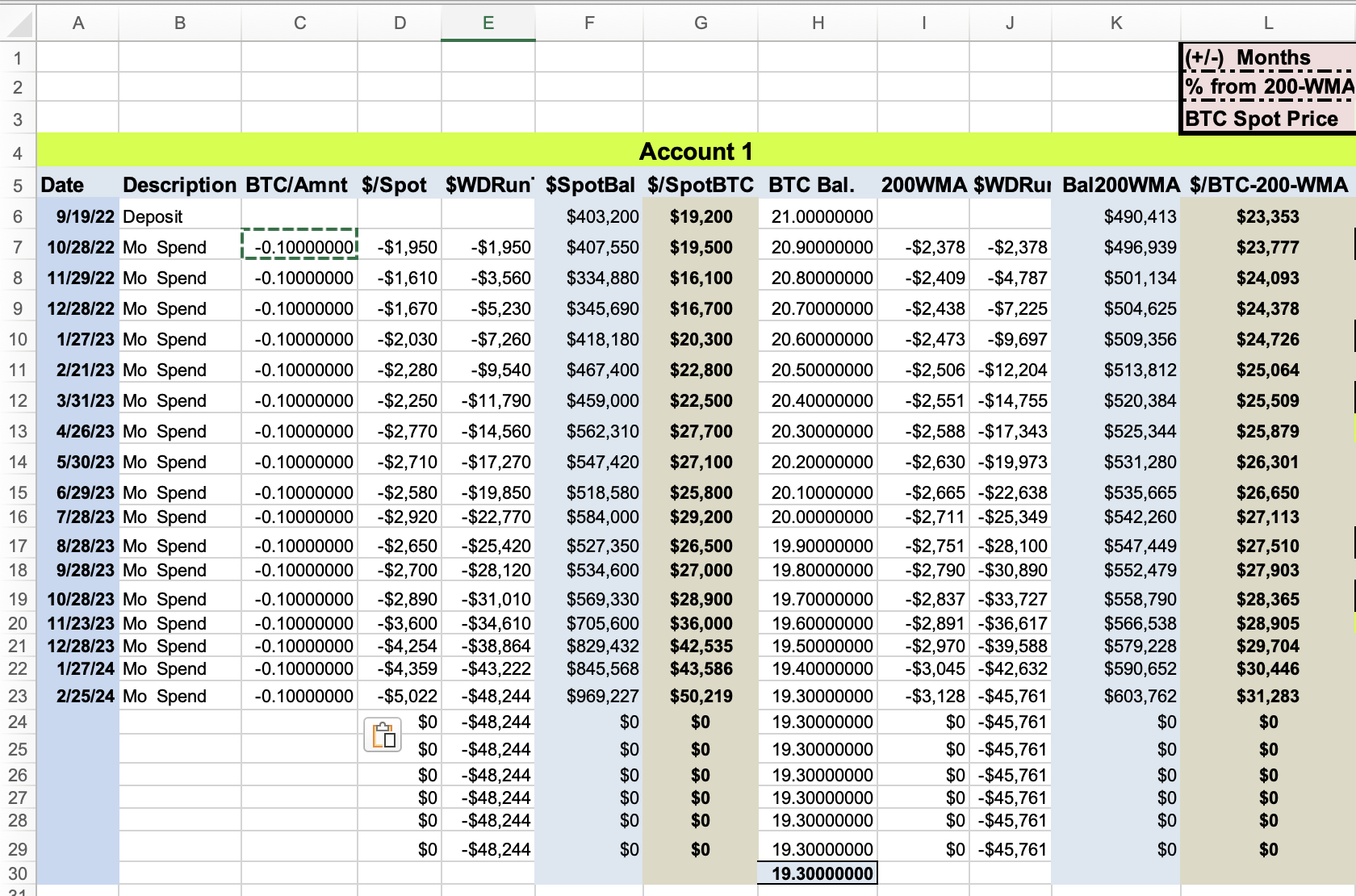

I just went back and did a quick calculation that even starting from October 2022 and with 21 BTC, even if we would have withdrawn at a 6% per year rate, and just do a quickie calculation of 0.1 BTC per month (even though the tool recommends to reduce the rate of withdrawal once the BTC price is less than 25% above the 200-WMA, but even if we withdrew 0.1 BTC for the last 17 months, we would end up with a reduction of our BTC holdings from 21 BTC to 19.3 BTC, and the 200-WMA value of the BTC holdings would have gone from $490k in October 2022 to $605k today.. of course BTC spot price is even greater, but this tool is attempting to help us to emphasize value based on the 200-WMA so that we are less likely to get caught up in the rash exuberance of BTC spot price changes, even though at the same time, we are advantaged to be able to sell BTC and to receive spot price which is usually (but not always) 25% or more higher than the 200-WMA.

See that experimental chart of 0.1 BTC withdrawal per month here:

Even though the flat rate is simpler to follow, it does not take advantage of either reductions or the advance months that the tool attempts to guide.. and of course, if we start with 0.1 BTC, in order to stick with 6%, we should be reducing the amount each month otherwise we are going to be withdrawing way more than 6%, but it still goes with my argument that it is my tentative conclusion that anywhere between 6% and 10% fit within levels of moderate sustainability.. and the more that you would use the guidelines of the tool, then the more likely you could gravitate more and more towards more aggressive levels of withdrawal while at the same time likely being able to retain the dollar value of your BTC holdings in light of its 200-WMA valuations.

I keep looking for the brush and/or for the highs and lows for the day to get in there

I was implementing the high/lows for the day. But it will work only for today's date. I don't think there is data available with that precision for so many days back. (to get high and lows for the day, I need basically data for every minute, or at least every hour, which now i have only 1 data per day/12h , not sure exactly)

Do you that working only with today's date will be good? I can implement it soon.

It would be nice to be able to go back, but if we are not able to find any kind of reliable data source for that, then at least having the current date would be better than nothing.

Part of the reason for the highs and lows was to maybe sometimes to go back and compare the various actual prices of any particular day to the 200-WMA.. so sometimes the answer in the tool might not show all of the possibilities for the day, since sometimes authorizations for how many months in advance to withdraw or even if the amount of withdrawal might be reduced if the BTC price is below certain thresholds that we chose to use in the tool.

or did I mention the abilit to save input numbers and to share.. so like copy link that some of the other tools have.

Well, I can do this, it is easy. The point is that there are so few inputs (2 fields). But this is easy task. You will get an unique shareable URL.

I see that in the saved inputs there seem to ONLY be 2, but wouldn't 3-4 inputs be possible? or is it not possible to save or share 3 & 4?

1) withdrawal rate (percentage)

2) size of BTC stash

3) date

4) whether date is selected or not

Maybe 3 and 4 are just one field.