zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

January 10, 2024, 03:06:05 PM |

|

"Couple pts here: $15b in flows for a new category is massively high, even bond ETFs didn't do anything like that in their first year(s). Also if we go out 5-10yrs we think it will be in the gold ETF range at $100b aum. Trust me tho $100b in FLOWS is crazy, would be big shocker" https://twitter.com/EricBalchunas/status/1744793794803839456 |

|

|

|

|

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

aoluain

Legendary

Offline Offline

Activity: 2254

Merit: 1256

|

|

January 10, 2024, 11:42:33 PM |

|

but Bitcoin isnt anything like a bond or Gold, they have realised its potential thats why

all the big asset managers want SPOT ETF, they know there is a demand from their

clients, they want to take custody of it because if they dont do it now their rivals will.

|

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

|

|

pakhitheboss

|

|

January 11, 2024, 10:51:41 AM |

|

I now suspect the SEC, yesterday their x.com handle got hacked due to lack of third party security. A lot of investors lost their money because of the hack and today they approved all ETFs and announced it.

Everyone thought that as soon as the ETFs would get approved there would be a massive rally. That has not happened because those funds would take time to get into Bitcoin ecosystem. Overall a massive news for Bitcoin and hopefully a bullish year.

|

|

|

|

zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

January 12, 2024, 02:23:08 PM |

|

I now suspect the SEC, yesterday their x.com handle got hacked due to lack of third party security. A lot of investors lost their money because of the hack and today they approved all ETFs and announced it.

Everyone thought that as soon as the ETFs would get approved there would be a massive rally. That has not happened because those funds would take time to get into Bitcoin ecosystem. Overall a massive news for Bitcoin and hopefully a bullish year.

I think that soon, on the contrary, the price of Bitcoin will begin to decline. The big players knew about the approval of the spot ETF so they bought bitcoins in advance, and now they need to sell their ETFs to the hamsters on the stock exchanges. But there are few hamsters on stock exchanges, so ETFs are even offered to pension funds. As soon as the big players sell their ETFs, the bearish game will begin. |

|

|

|

avikz

Legendary

Offline Offline

Activity: 3080

Merit: 1499

|

|

January 16, 2024, 05:31:35 PM |

|

Buy allowing BlackRock into the cryptocurrency market, SEC puts us in a grave situation. While majority of the people thought that Bitcoin price will increase, in reality it is decreasing. This allows blackrock to become the largest institutional holder of Bitcoin. They will have absolute power to manipulate the market as per there wish.

That is exactly what I feared and it seems it is now a reality. Welcome to the world of Wall Street manipulation.

|

|

|

|

zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

January 17, 2024, 02:50:40 PM |

|

Buy allowing BlackRock into the cryptocurrency market, SEC puts us in a grave situation. While majority of the people thought that Bitcoin price will increase, in reality it is decreasing. This allows blackrock to become the largest institutional holder of Bitcoin. They will have absolute power to manipulate the market as per there wish.

That is exactly what I feared and it seems it is now a reality. Welcome to the world of Wall Street manipulation.

"Sell on the news"(C) https://www.coindesk.com/business/2024/01/11/ubs-will-let-some-customers-trade-bitcoin-etfs-contrary-to-rumors-source/"UBS and Citi Will Let Some Customers Trade Bitcoin ETFs, Contrary to Rumors The banking giants' decisions contrast with Vanguard's decision to bar customers from buying bitcoin ETFs." It seems that banks are tired of being fools and prohibiting clients from legal investments  |

|

|

|

avikz

Legendary

Offline Offline

Activity: 3080

Merit: 1499

|

|

January 17, 2024, 04:58:47 PM |

|

Buy allowing BlackRock into the cryptocurrency market, SEC puts us in a grave situation. While majority of the people thought that Bitcoin price will increase, in reality it is decreasing. This allows blackrock to become the largest institutional holder of Bitcoin. They will have absolute power to manipulate the market as per there wish.

That is exactly what I feared and it seems it is now a reality. Welcome to the world of Wall Street manipulation.

"Sell on the news"(C) https://www.coindesk.com/business/2024/01/11/ubs-will-let-some-customers-trade-bitcoin-etfs-contrary-to-rumors-source/"UBS and Citi Will Let Some Customers Trade Bitcoin ETFs, Contrary to Rumors The banking giants' decisions contrast with Vanguard's decision to bar customers from buying bitcoin ETFs." It seems that banks are tired of being fools and prohibiting clients from legal investments  Lol! That is a news to cheer on. My concern is not on the news. Manipulation is real and someone with a very deep pocket like Blackrock, poses a real threat to the decentralized bitcoin ecosystem. They have so much power that they can make all major newspapers around the world to publish negative news on Bitcoin at the same day so that the market can crash. Then when they are done buying Bitcoins at the lower rate, publish all previous news as FUD and encourage people to invest in it. Black rock is the biggest investment company in the world. The amount of manipulation they can play with any market, is un imaginable. |

|

|

|

zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

January 17, 2024, 06:10:15 PM |

|

Buy allowing BlackRock into the cryptocurrency market, SEC puts us in a grave situation. While majority of the people thought that Bitcoin price will increase, in reality it is decreasing. This allows blackrock to become the largest institutional holder of Bitcoin. They will have absolute power to manipulate the market as per there wish.

That is exactly what I feared and it seems it is now a reality. Welcome to the world of Wall Street manipulation.

"Sell on the news"(C) https://www.coindesk.com/business/2024/01/11/ubs-will-let-some-customers-trade-bitcoin-etfs-contrary-to-rumors-source/"UBS and Citi Will Let Some Customers Trade Bitcoin ETFs, Contrary to Rumors The banking giants' decisions contrast with Vanguard's decision to bar customers from buying bitcoin ETFs." It seems that banks are tired of being fools and prohibiting clients from legal investments  Lol! That is a news to cheer on. My concern is not on the news. Manipulation is real and someone with a very deep pocket like Blackrock, poses a real threat to the decentralized bitcoin ecosystem. They have so much power that they can make all major newspapers around the world to publish negative news on Bitcoin at the same day so that the market can crash. Then when they are done buying Bitcoins at the lower rate, publish all previous news as FUD and encourage people to invest in it. Black rock is the biggest investment company in the world. The amount of manipulation they can play with any market, is un imaginable. For such manipulations, you need to control a very large part of bitcoins. Not all users will follow the recommendations in newspapers and it is more profitable for manipulators to cut hamsters who use large trading leverage. We must not forget that this crypto market is still very small. |

|

|

|

avikz

Legendary

Offline Offline

Activity: 3080

Merit: 1499

|

|

January 18, 2024, 03:22:55 PM |

|

That's true! As per the news, BlackRock owns around 11,500 bitcoins as a part of their ETF offering. https://www.thestreet.com/crypto/markets/blackrock-becoming-largest-bitcoin-holder-in-worldThis is a significant amount of Bitcoins they are holding. I think they will keep on buying more as and when the market dips. That's a significant risk for a decentralized ecosystem like Bitcoin. I never preferred institutional investors in this space to be honest. They just ruin the game of the retail investors like you and I. |

|

|

|

zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

January 18, 2024, 04:25:01 PM |

|

I have seen a lot of such news, and large funds have profitably sold Bitcoin on exchanges at over $46,000. https://cryptoslate.com/grayscale-transfers-200m-bitcoin-to-coinbase-prime-hinting-at-possible-etf-redemption-activity/"Grayscale transfers $200M Bitcoin to Coinbase Prime hinting at possible ETF redemption activity Grayscale has begun moving Bitcoin out of its trust and sending it to Coinbase as of 2 p.m. GMT, Jan. 12. A total of 4,000 BTC (roughly $200M) has been sent as of press time, with all Bitcoin going to Coinbase Prime, one of the key participants in the series of Bitcoin ETFs launched yesterday. Coinbase acts as the broker and trading counterparty for almost all ETF issuers, including Grayscale. Thus, it is likely that this transfer indicates outflows from the trust from sales yesterday. The last outflows before today were around 2 weeks again, where there were multiple transactions in and out of the Grayscale Bitcoin wallets." |

|

|

|

zasad@ (OP)

Legendary

Offline Offline

Activity: 1750

Merit: 4271

|

|

February 28, 2024, 09:21:07 AM |

|

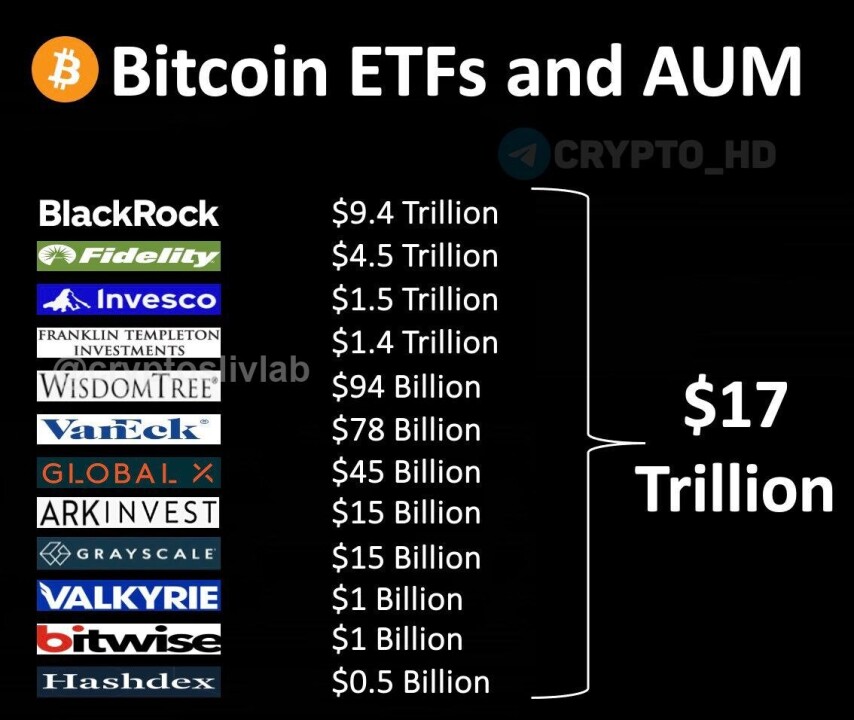

https://www.theblock.co/post/279302/new-spot-bitcoin-etfs-300000-btc-total-net-inflow-6-billion"The newborn nine U.S. spot bitcoin ETFs have now amassed more than 300,000 BTC in assets under management. Daily net inflows exceeded $500 million on Monday as total net inflows reached $6 billion and bitcoin’s price surged. According to K33 Research, the nine new ETFs had amassed 303,002 BTC ($17 billion) as of yesterday’s close. Launching on Jan. 11, these ETFs are BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB), Ark Invest 21Shares (ARKB), Invesco (BTCO), VanEck (HODL), Valkyrie (BRRR), Franklin Templeton (EZBC), and WisdomTree (BTCW)."

|

|

|

|

|