alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 13, 2024, 10:00:26 PM |

|

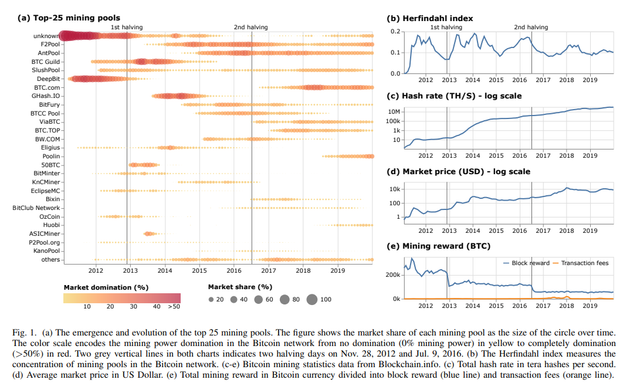

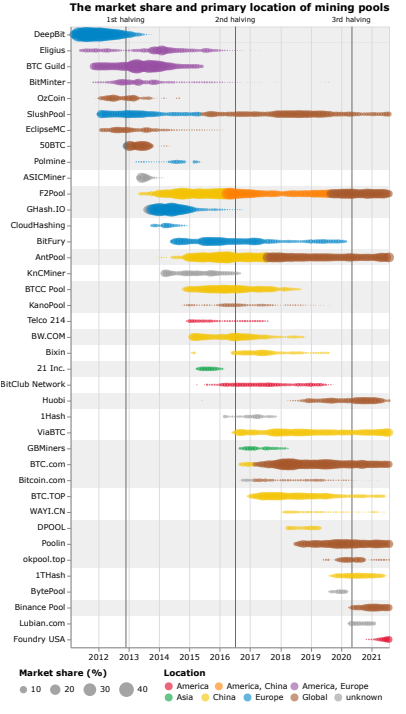

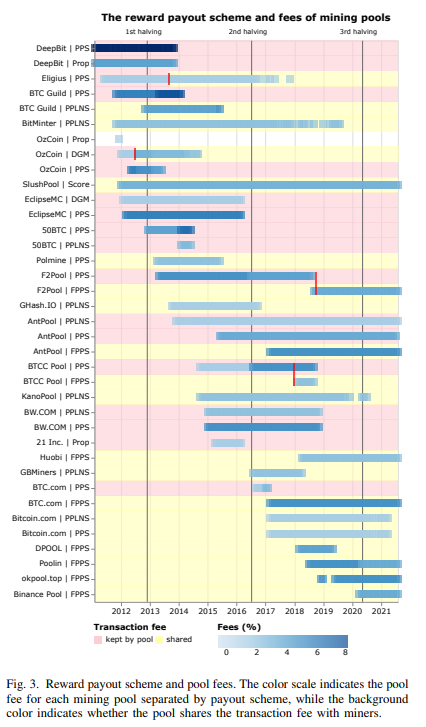

Hello, I am researching the different types of blockchains both PoS and PoW. In general, I can find important data for the former that is apparently not available for the latter. Specifically, I am looking for a dashboard that shows the distribution of hash rate sorted by miner, by country, by ISP and so on, the total number of miners, how many miners control 51% of the hash rate. Something similar to this data from Ethereum https://beaconcha.in/ and https://etherscan.io/dashboards/beacon-depositors. I found the following resources, some contain hash rates by country and the network map, but I did not find a complete dashboard like other PoS projects. This data is very important in the light of the following research that shows the high centralisation of mining and thus of control of PoW consensus. A Deep Dive into Bitcoin Mining Pools https://github.com/MatteoRomiti/Deep_Dive_BTC_Mining_Poolswe conduct the first in-depth analysis of mining reward distribution within three of the four largest Bitcoin mining pools and examine their cross-pool economic relationships. Our results suggest that individual miners are simultaneously operating across all three pools and that in each analyzed pool a small number of actors (≤ 20) receives over 50% of all BTC payouts.Blockchain Analysis of the Bitcoin Market https://mitsloan.mit.edu/sites/default/files/2022-06/Bitcoin-blockchain%20-%20AER.pdfWe show that the Bitcoin mining capacity is highly concentrated and has been for the last five years. The top 10% of miners control 90% and just 0.1% (about 50 miners) control close to 50% of mining capacity. Furthermore, this concentration of mining capacity is counter cyclical and varies with the Bitcoin price. It decreases following sharp increases in the Bitcoin price and increases in periods when the price drops or when there are halving events. Thus, the risk of a 51% attack increases in these times as well.Thank you |

|

|

|

|

|

|

|

|

|

|

|

|

|

It is a common myth that Bitcoin is ruled by a majority of miners. This is not true. Bitcoin miners "vote" on the ordering of transactions, but that's all they do. They can't vote to change the network rules.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

logfiles

Copper Member

Legendary

Online Online

Activity: 1960

Merit: 1639

Top Crypto Casino

|

I am researching the different types of blockchains both PoS and PoW. In general, I can find important data for the former that is apparently not available for the latter. Specifically, I am looking for a dashboard that shows the distribution of hash rate sorted by miner, by country, by ISP and so on, the total number of miners, how many miners control 51% of the hash rate.

You can't find such data because a lot of miners join mining pools, so for example the readily available data is that the Hash rate is sorted according to the pools rather than individual miners. The same applies to location of miner. A miner from Russia can use the same pool as a miner from the US. How are you going to group them if the pool won't reveal that information to the public. Remember the crack-down of miners in China? I am pretty sure some solo miners definitely use VPN. So again the information is going to be unreliable |

|

|

|

DannyHamilton

Legendary

Offline Offline

Activity: 3374

Merit: 4610

|

Not only don't we know who is running mining equipment, where they are located, or how much equipment any of them are running.

Believe it or not, we also have no way of even knowing how much total hashpower is actually running during any timeframe.

All we know is what the current difficulty target is, and how much time it takes for a block to show up. From there we can calculate an ESTIMATED total hash rate.

Some of the mining pools may publish their hash rate, but you have to decide if you trust them to tell the truth or not. They easily could lie about it. Some pools add data into their blocks to indicate that they mined that block, but there is nothing forcing them to do so, and they certainly could leave the data out of some blocks or even lie and put some other pools data into their own blocks if they wanted to.

Some mining businesses may publish information about how much hashpower they are running. Again, you have to decide if you trust them to be honest about it or not.

Am I running any minging equipment? How would you know? If I told you I was (or wasn't) how would you know if you could trust what I said?

|

|

|

|

|

BlackBoss_

Sr. Member

Offline Offline

Activity: 616

Merit: 393

Rollbit - the casino for you. Take $RLB token!

|

|

January 14, 2024, 03:16:10 AM |

|

You can use this one https://www.blockchain.com/explorer/charts/pools-timeseriesData from third party sites about mining pools are not accurate if you consider it by countries, geolocations because miners can connect their ASICs to mining pools through VPNs and IP addresses are not reflecting their real geolocations. This weakness of data is mentioned by Cambridge Bitcoin Electricity Consumption Index's methodology. https://ccaf.io/cbnsi/cbeci/mining_map/methodologyData collection We have partnered with several Bitcoin mining pools to collect geolocational mining facility data in a non-obtrusive and privacy-preserving manner. This geolocational data is based on IP addresses of mining facility operators (‘hashers’) that connect to the servers of mining pools. Assumption 1: IP addresses of mining facility operators are an accurate indicator of hashrate location.

Each participating mining pool aggregates IP addresses on their end to create an average geographic distribution of total pool hashpower by country and region. Pools then periodically push their individual distribution to our database via a dedicated API endpoint, connecting with a unique, pseudonymous access token that obfuscates the identity of the pool. The corresponding name table is encrypted and stored locally for security purposes. Please note that CCAF has at no point access to the underlying IP addresses or any other sensitive pool data. Extra information about Bitcoin Mining History |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3430

Merit: 10505

|

|

January 14, 2024, 03:49:23 AM |

|

This kind of data is not possible to acquire in Bitcoin with its PoW algorithm because of its decentralized nature. However, since there is some degree of centralization involved in Bitcoin mining in the form of mining pools, the data exists in their hands.

If you are serious about your research, your only option is to directly contact bitcoin mining pools one by one and ask them whether they are willing to publish this information. They don't have to publish it in details, all they have to do is to announce: their total hashrate, the IP distribution of the miners that connect to their servers and their individual or average hashrate and general information like that.

Then you can aggregate the data and get a better picture.

The problem is that not all of them are willing to publish this type of statistic and as it was mentioned it is not possible to verify this information. But I'd say if you put enough effort into it and if they actually publish something, the result could be close to reality with small error.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

January 14, 2024, 04:56:07 AM |

|

Hello, I am researching the different types of blockchains both PoS and PoW. In general, I can find important data for the former that is apparently not available for the latter. Specifically, I am looking for a dashboard that shows the distribution of hash rate sorted by miner, by country, by ISP and so on, the total number of miners, how many miners control 51% of the hash rate. Something similar to this data from Ethereum https://beaconcha.in/ and https://etherscan.io/dashboards/beacon-depositors. I found the following resources, some contain hash rates by country and the network map, but I did not find a complete dashboard like other PoS projects. This data is very important in the light of the following research that shows the high centralisation of mining and thus of control of PoW consensus. A Deep Dive into Bitcoin Mining Pools https://github.com/MatteoRomiti/Deep_Dive_BTC_Mining_Poolswe conduct the first in-depth analysis of mining reward distribution within three of the four largest Bitcoin mining pools and examine their cross-pool economic relationships. Our results suggest that individual miners are simultaneously operating across all three pools and that in each analyzed pool a small number of actors (≤ 20) receives over 50% of all BTC payouts.Blockchain Analysis of the Bitcoin Market https://mitsloan.mit.edu/sites/default/files/2022-06/Bitcoin-blockchain%20-%20AER.pdfWe show that the Bitcoin mining capacity is highly concentrated and has been for the last five years. The top 10% of miners control 90% and just 0.1% (about 50 miners) control close to 50% of mining capacity. Furthermore, this concentration of mining capacity is counter cyclical and varies with the Bitcoin price. It decreases following sharp increases in the Bitcoin price and increases in periods when the price drops or when there are halving events. Thus, the risk of a 51% attack increases in these times as well.Thank you A 51% attack is the least of btc worries. Why is this because it would lose a shit ton of money for the top players. If you want to worry about btc worry about fee manipulation which will get easier with every ½ ing Why is that? Simple underclock your gear for ½ of the two week diff period of 2016 blocks. this makes the mempool crowd. then over clock your gear to grab blocks fill with fees in the second half of the 2016 block period. Ie do the first 1008 blocks in 8 days. do the second 1008 blocks in 6 days. the diff stays the same. you lose emptier blocks the first half you make crowded blocks the second half. a pool like foundry with ⅓ the hash should do 48 blocks a day. so they do 38 a day for 8 days in the hole 80 blocks they make 62 a day for 6 days up 84 blocks. the diff drifts up just a tiny bit. the pool makes just over 48 blocks a day for the 14 days. the diff moves just a bit up and the pool gets a lot of high fee blocks 6 x 62 = 372 high fee blocks plus they do not raise the diff much. they also get 304 low fee blocks but they slow the diff growth which does not help them since they are near 33% and this will get far worse after the ½ as they lose less coins. Pretty sure foundry does this. |

|

|

|

alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 14, 2024, 06:49:26 AM |

|

Hello, thank you all for the detailed replies. So I understand that it is not possible to know such important details and to know how really decentralised the bitcoin PoW consensus is. This is a major drawback that undermines the trustless principle of the network, as the do not trust, verify principle cannot be put into practice. As suggested by some of you, I will try to contact at least the first 5 mining pools to see if I can get some useful information. Thanks A 51% attack is the least of btc worries. Why is this because it would lose a shit ton of money for the top players. If you want to worry about btc worry about fee manipulation which will get easier with every ½ ing

Why is that? Simple underclock your gear for ½ of the two week diff period of 2016 blocks.

this makes the mempool crowd.

then over clock your gear to grab blocks fill with fees in the second half of the 2016 block period.

Ie do the first 1008 blocks in 8 days.

do the second 1008 blocks in 6 days.

the diff stays the same.

you lose emptier blocks the first half

you make crowded blocks the second half.

a pool like foundry with ⅓ the hash should do 48 blocks a day.

so they do 38 a day for 8 days in the hole 80 blocks

they make 62 a day for 6 days up 84 blocks. the diff drifts up just a tiny bit.

the pool makes just over 48 blocks a day for the 14 days.

the diff moves just a bit up

and the pool gets a lot of high fee blocks

6 x 62 = 372 high fee blocks

plus they do not raise the diff much.

they also get 304 low fee blocks

but they slow the diff growth which does not help them since they are near 33%

and this will get far worse after the ½ as they lose less coins.

Pretty sure foundry does this.

I'm not sure, but it looks to me like a self mining attack that allows the network to be attacked with only 1/3 of the hash power. Majority is not Enough: Bitcoin Mining is Vulnerable https://arxiv.org/abs/1311.0243. |

|

|

|

|

|

Cricktor

|

|

January 14, 2024, 03:54:01 PM |

|

... I'm not sure, but it looks to me like a self mining attack that allows the network to be attacked with only 1/3 of the hash power. How is this an attack to the network? Exploiting the fee market is not quite an attack or is it? I'm not entirely convinced of the benefit of this controlled hashrate limitting that philipma1957 describes, but there're some transaction market variables which are to some extend beyond the control of mining pools, e.g. transaction volume of bitcoiners induces by external factors like Bitcoin market value development. In situations where bitcoiners demand a spike of transactions for whatever reasons such hashrate control might exaggerate the fee market to a mining pool's benefit. As far as I remember the last time we didn't have mempool congestion was around midth of April 2023 and before that at the beginning of 2023. Since then mempool never got emptied enough that there wasn't an excess of transactions waiting to be confirmed in new blocks. When mempool has more unconfirmed transactions than fit in a (few) block(s) there's natural fee rate competition, a natural fee rate market for bitcoiners. To maximize profit mining pools should choose transactions solely based on the max. fee rate they offer, unless the pools have some special paid services, like paid transaction accelerators, that can compensate choice of lower fee rates. Anything beyond the beneficial choice of transactions based on their top fee rate is likely intransparent, trust based, manipulated and hardly verifiable for participating miners of pools. Concentration of hashpower in large pools is a problem of concentration of choice of which transactions go into blocks of those pools. Usually the pool decides about the block template that participating miners work on and miners don't have a word on the block template. Miners only choice is at which pool(s) they mine. Most likely this will be a pool which maximizes their profit. Mining gear and energy have to be paid... |

|

|

|

alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 15, 2024, 06:01:52 AM |

|

... I'm not sure, but it looks to me like a self mining attack that allows the network to be attacked with only 1/3 of the hash power. How is this an attack to the network? I was referring to the fact that a mining pool like foundry is close to 33% or 1/3 of the total hash rate, which allows a selfish mining attack. Majority is not Enough: Bitcoin Mining is Vulnerable https://arxiv.org/abs/1311.0243. Thanks for the explanation. |

|

|

|

|

DaveF

Legendary

Online Online

Activity: 3458

Merit: 6235

Crypto Swap Exchange

|

|

January 20, 2024, 03:46:45 PM |

|

... I'm not sure, but it looks to me like a self mining attack that allows the network to be attacked with only 1/3 of the hash power. How is this an attack to the network? I was referring to the fact that a mining pool like foundry is close to 33% or 1/3 of the total hash rate, which allows a selfish mining attack. Majority is not Enough: Bitcoin Mining is Vulnerable https://arxiv.org/abs/1311.0243. Thanks for the explanation. Keep in mind foundry is mostly for institutional investors. Who are not stupid, if it looks like foundry is going to do something that may hurt the price of BTC they are going to leave and go elsewhere. Or sue them for violating fiduciary trust. Or both. Due to the nature of investing in mining it's a long term ROI having your pool tank the value of BTC is going to make you react. -Dave |

|

|

|

alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 20, 2024, 05:02:53 PM |

|

... I'm not sure, but it looks to me like a self mining attack that allows the network to be attacked with only 1/3 of the hash power. How is this an attack to the network? I was referring to the fact that a mining pool like foundry is close to 33% or 1/3 of the total hash rate, which allows a selfish mining attack. Majority is not Enough: Bitcoin Mining is Vulnerable https://arxiv.org/abs/1311.0243. Thanks for the explanation. Keep in mind foundry is mostly for institutional investors. Who are not stupid, if it looks like foundry is going to do something that may hurt the price of BTC they are going to leave and go elsewhere. Or sue them for violating fiduciary trust. Or both. Due to the nature of investing in mining it's a long term ROI having your pool tank the value of BTC is going to make you react. -Dave This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC? In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research. To achieve such a high hash rate, it is necessary to have a mining farm and an economy of scale. |

|

|

|

|

DannyHamilton

Legendary

Offline Offline

Activity: 3374

Merit: 4610

|

|

January 20, 2024, 07:24:30 PM |

|

- snip -

This confirms that mining is very centralised and controlled by a few institutional investors

- snip -

In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research.

- snip -

I repeat myself: - snip -

Am I running any minging equipment? How would you know? If I told you I was (or wasn't) how would you know if you could trust what I said?

|

|

|

|

|

DaveF

Legendary

Online Online

Activity: 3458

Merit: 6235

Crypto Swap Exchange

|

|

January 20, 2024, 08:56:53 PM |

|

This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research. To achieve such a high hash rate, it is necessary to have a mining farm and an economy of scale.

Not at all. Learn how mining and pools work. Just the people on this board who mine are more then the "0.1%" that you claim. Anyone can point their miners at Ant or F2 or Via or Kano or another pool. Just because you don't have a bunch of S19 sitting in your garage does not mean that other people don't. https://explorer.btc.com/btc/insights-pools-Dave |

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

January 20, 2024, 10:36:34 PM |

|

foundry has a 20ph minimum level.

that is 150 s19xp's burning 500kwatts an hour.

so you need 3000 x 150 = $450,000 in miners

a mining box maybe 75,000

a transformer that can go to 600kwatts = $25,000

hard pressed to be ready for under 575K usd.

and power cost per month need to be under 6 cents. which is 262,800 for power.

add in labor.

I put it at 1 million dollars to be able to mine with foundry

|

|

|

|

ranochigo

Legendary

Offline Offline

Activity: 2954

Merit: 4165

|

|

January 21, 2024, 04:19:36 AM |

|

This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

Investors != Miners. If they are investors, they may not necessary be the ones mining at the pool either. The thing about these pools is that they are NOT exclusively tailored for a small number of miners, but they are tailored to accommodate for a large number of miners with their own farms. That alone should tell you how decentralized Bitcoin mining is. The FUD that is put forth in this thread is largely unwarranted. The key factor that you're ignoring is with the game theory that the miners are involved in when they invest their resources into mining. The key question would lie with whether they gain more when they act maliciously, or honestly. It would be obvious that the answer is to be honest. Selfish mining is largely only a concern among pools, because they are able to gain an unfair advantage than the rest of the pools. It poses much less of a security threat than you think. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 21, 2024, 06:07:27 AM |

|

This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research. To achieve such a high hash rate, it is necessary to have a mining farm and an economy of scale.

Not at all. Learn how mining and pools work. Just the people on this board who mine are more then the "0.1%" that you claim. Anyone can point their miners at Ant or F2 or Via or Kano or another pool. Just because you don't have a bunch of S19 sitting in your garage does not mean that other people don't. https://explorer.btc.com/btc/insights-pools-Dave According to the research reported in my first post: Blockchain Analysis of the Bitcoin Market https://mitsloan.mit.edu/sites/default/files/2022-06/Bitcoin-blockchain%20-%20AER.pdfWe show that the Bitcoin mining capacity is highly concentrated and has been for the last five years. The top 10% of miners control 90% and just 0.1% (about 50 miners) control close to 50% of mining capacity. Furthermore, this concentration of mining capacity is counter cyclical and varies with the Bitcoin price. It decreases following sharp increases in the Bitcoin price and increases in periods when the price drops or when there are halving events. Thus, the risk of a 51% attack increases in these times as well.Also, according to this research from August 2022 page 13 when the hash rate was about 207.2 EH/s https://kraken.docsend.com/view/2gwc64da9h5ccmhm, to get 51% hash rate were necessary 2.16 M S19 antminers, $8.6 B hardware cost and $19.8 M electricity cost/day. So, in theory, everyone can participate, but in practice to be in the 51% hash rate, i.e. 0.1% of the miners, about 50, several hundred million dollars are needed. These are the reasons for the questions in my first post. |

|

|

|

|

|

Cricktor

|

|

January 21, 2024, 01:58:31 PM

Last edit: January 21, 2024, 02:12:37 PM by Cricktor |

|

I've glimpsed over your cited paper and their methodology to try to identify individual miners who point their hashpower to pools looks quite legit (to me). It's not fool-proof but to my understanding they tried to apply reasonable efford to make a good miner attribution (in the sense to identify pool payout to individual miners and thus those miner's hashpower contribution). It's not too surprising that in Bitcoin mining bigger is better as you gain advantage with size because certain cost factors don't scale linearly with size. A very simple example is an individual miner with 10 ASICs. This individual could likely handle also 20 ASICSs alone, so no additional expenses for labour. Maybe this miner also has the space for the additional 10 ASICs, so almost no additional cost for storage of his mining rig. On the other hand he has doubled costs for energy and likely cooling. I'm very much simplifying here…This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

How do you come to that conclusion regarding your institutional investors? Hashpower concentrates into pools. According to your cited paper there are not many miners with a great percentage of hashpower that point their hashpower to large mining pools. Agreed on that and this development isn't actually too surprising and I personally don't see much of an issue here. It's economy in a very competetive playground. In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research.

This is nonsense or paints an oversimplified picture. In practice anybody can join a mining pool and point his hashpower to it. You're probably excluded from certain larger pools that have a lower limit of required minimum hashpower, but that doesn't prevent you from finding some other pool that will accept your hashpower. If there're 50-60 miners who provide a majority of hashpower to pools, then those big miners gain most of the coin rewards from pool payouts. That doesn't mean that all other participating miners don't get anything, see below for explanation. Are you sure, you understand PoW mining? There's no such thing as PoW consensus (51%). Bitcoin mining PoW forces you do execute hashwork to find a blockheader hash that satisfies the required mining difficulty (your to be found blockheader hash needs to be lower than a certain hash value dictated by current difficulty). Finding such a blockheader hash is due to the used hash algorithm a completely random process. You can hit a valid blockheader hash within a few thousands or millions hashes (statistically very … very unlikely) or you need a ridiculously high number of hashes to hit it for which you need longer than some other miner who was luckier than you. Again: it's a random process and with higher hashpower you gain statistical advantage. Mining pools mitigate the risk of solo-mining. With "fair" pools you're paid statistically according to your provided hashpower compared to global hashpower within the granularity of the pool's payout scheme. Choose your mining pool wisely! I didn't want to go into pool payout schemes as it's probably not relevant to go into such details here and now. |

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6270

Blackjack.fun

|

|

January 21, 2024, 02:47:37 PM |

|

This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

Investors != Miners. If they are investors, they may not necessary be the ones mining at the pool either. Hihi, yeah but also Investors != Miners. hmmm but also != Poll owners != Investors in a mining company != CEOs out of touch with reality != Drunk technician coming high at work! The FUD that is put forth in this thread is largely unwarranted. The key factor that you're ignoring is with the game theory that the miners are involved in when they invest their resources into mining. The key question would lie with whether they gain more when they act maliciously, or honestly. It would be obvious that the answer is to be honest. Selfish mining is largely only a concern among pools, because they are able to gain an unfair advantage than the rest of the pools. It poses much less of a security threat than you think.

The only way a 51% would unfold right now (not counting area 52 having a replica of Omnius in the basement) would be a wave of bankruptcies due to losing profits and someone being able to take over those mining farms at a fraction of the costs or even for free and with deep enough pockets and grudge to actually mount such a thing, but by the time this happen we would already be in a lot of deep *** since it would come with a ridiculous drop in price. So basically nobody is going to kill the golden goose, but someone might want to throw a few rocks at it when you leave it out of the yard unguarded! I've glimpsed over your cited paper and their methodology to try to identify individual miners who point their hashpower to pools looks quite legit (to me). It's outdated since it doesn't have Foundry and it's before the great migration, the second the payment tracing is a bit ridiculous, how do you deal with guys that have mining farms in 3 countries and how do you deal with the ones that don't sell their coins! If riot or core decides to make a purchase in BTC from Bitmain and send 1000 BTC to Okex you suddenly move 30 Exahash from the US back to China!  Genuinely curious how would separate with this method Canada and the United States! |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

alfredaino (OP)

Newbie

Offline Offline

Activity: 16

Merit: 2

|

|

January 22, 2024, 06:26:17 AM |

|

I've glimpsed over your cited paper and their methodology to try to identify individual miners who point their hashpower to pools looks quite legit (to me). It's not fool-proof but to my understanding they tried to apply reasonable efford to make a good miner attribution (in the sense to identify pool payout to individual miners and thus those miner's hashpower contribution). It's not too surprising that in Bitcoin mining bigger is better as you gain advantage with size because certain cost factors don't scale linearly with size. A very simple example is an individual miner with 10 ASICs. This individual could likely handle also 20 ASICSs alone, so no additional expenses for labour. Maybe this miner also has the space for the additional 10 ASICs, so almost no additional cost for storage of his mining rig. On the other hand he has doubled costs for energy and likely cooling. I'm very much simplifying here…My first paper in my first post confirms the results: A Deep Dive into Bitcoin Mining Pools https://github.com/MatteoRomiti/Deep_Dive_BTC_Mining_Poolswe conduct the first in-depth analysis of mining reward distribution within three of the four largest Bitcoin mining pools and examine their cross-pool economic relationships. Our results suggest that individual miners are simultaneously operating across all three pools and that in each analyzed pool a small number of actors (≤ 20) receives over 50% of all BTC payouts.However, if you have a more updated and better version, I will read it. This confirms that mining is very centralised and controlled by a few institutional investors acting in their own interests and not those of the other participants. Is there a chance to know who are the investors of Foundry, AntPool, F2Pool and ViaBTC?

How do you come to that conclusion regarding your institutional investors? Hashpower concentrates into pools. According to your cited paper there are not many miners with a great percentage of hashpower that point their hashpower to large mining pools. Agreed on that and this development isn't actually too surprising and I personally don't see much of an issue here. It's economy in a very competetive playground. According to both articles, some miners, about 50-60 or <=20 per pool, control more than 50% of the network hashing power, thus controlling the PoW consensus. Who do you think own these miners? They need hundreds of millions of dollars of investment. In theory everyone can join the network, but in practice those who actually participate in the PoW consensus (51%) and produce blocks are less than 0.1% of the miners, i.e. those 50-60 miners reported in the research.

This is nonsense or paints an oversimplified picture. In practice anybody can join a mining pool and point his hashpower to it. You're probably excluded from certain larger pools that have a lower limit of required minimum hashpower, but that doesn't prevent you from finding some other pool that will accept your hashpower. If there're 50-60 miners who provide a majority of hashpower to pools, then those big miners gain most of the coin rewards from pool payouts. That doesn't mean that all other participating miners don't get anything, see below for explanation. Are you sure, you understand PoW mining? There's no such thing as PoW consensus (51%). Bitcoin mining PoW forces you do execute hashwork to find a blockheader hash that satisfies the required mining difficulty (your to be found blockheader hash needs to be lower than a certain hash value dictated by current difficulty). Finding such a blockheader hash is due to the used hash algorithm a completely random process. You can hit a valid blockheader hash within a few thousands or millions hashes (statistically very … very unlikely) or you need a ridiculously high number of hashes to hit it for which you need longer than some other miner who was luckier than you. Again: it's a random process and with higher hashpower you gain statistical advantage. Mining pools mitigate the risk of solo-mining. With "fair" pools you're paid statistically according to your provided hashpower compared to global hashpower within the granularity of the pool's payout scheme. Choose your mining pool wisely! I didn't want to go into pool payout schemes as it's probably not relevant to go into such details here and now. Thanks for the explanation. As you pointed out, mining is a random process and the probability of being the first to mine a block is proportional to the hash power, i.e. if you have x% of the total hash power, in the long run you will mine x% of the blocks on average. Thus, miners who have at least 51% of the hash power on average control the PoW consensus and are rewarded by the network. Again, in theory everyone can participate, but in practice the chances of influencing the 51% decision and being rewarded are only statistically significant for those with a high hash rate and an investment of hundreds of millions of dollars. I've glimpsed over your cited paper and their methodology to try to identify individual miners who point their hashpower to pools looks quite legit (to me). It's outdated since it doesn't have Foundry and it's before the great migration, the second the payment tracing is a bit ridiculous, how do you deal with guys that have mining farms in 3 countries and how do you deal with the ones that don't sell their coins! If riot or core decides to make a purchase in BTC from Bitmain and send 1000 BTC to Okex you suddenly move 30 Exahash from the US back to China!  Genuinely curious how would separate with this method Canada and the United States! If you have better sources I will gladly read them. They may be out of date, however the data collected shows the history of bitcoin mining has been. |

|

|

|

|

BlackBoss_

Sr. Member

Offline Offline

Activity: 616

Merit: 393

Rollbit - the casino for you. Take $RLB token!

|

|

January 23, 2024, 02:11:32 AM |

|

If you have better sources I will gladly read them. They may be out of date, however the data collected shows the history of bitcoin mining has been.

I shared but you did not read. There are some researches and reports that show in the past, there are some dominating mining pools, which can have combined hash rate big enough to attack Bitcoin network. Unfortunately, they did not do that and I believe they see no good benefit by attacking the network. Visual Analytics of Bitcoin Mining Pool Evolution: On the Road Toward Stability? The evolution of mining pools and miners’ behaviors inthe Bitcoin blockchain The evolution of mining pools and miners’ behaviors inthe Bitcoin blockchain  |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|