|

virginorange (OP)

|

|

March 28, 2024, 02:03:12 PM

Last edit: April 26, 2024, 06:12:30 PM by virginorange Merited by hugeblack (25), Turbartuluk (15), d5000 (10), mk4 (5), bitcoincidence (4), Wexnident (2), fachant (2), o48o (1), slaman29 (1), Solosanz (1), Pandorak (1), SilverCryptoBullet (1) |

|

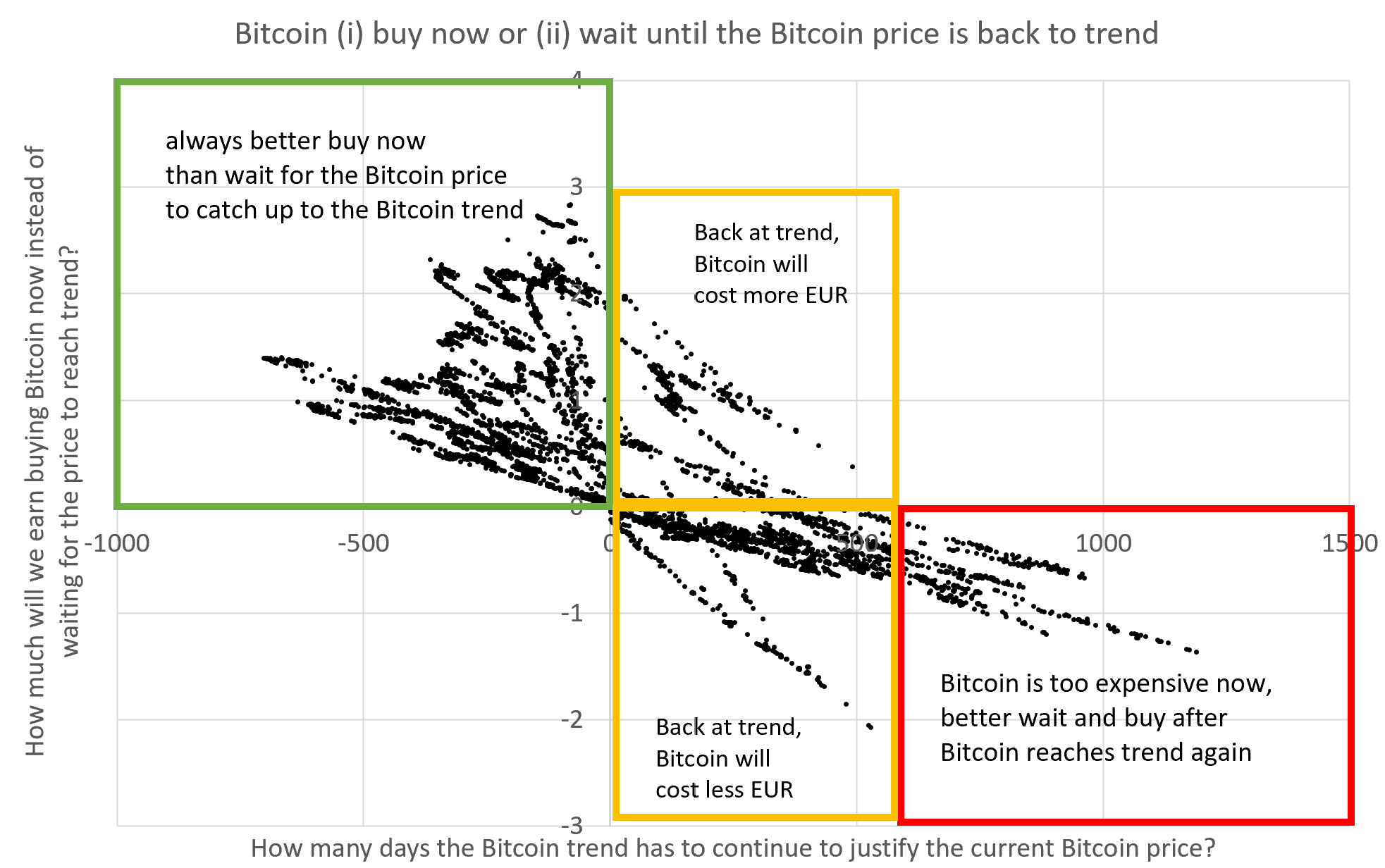

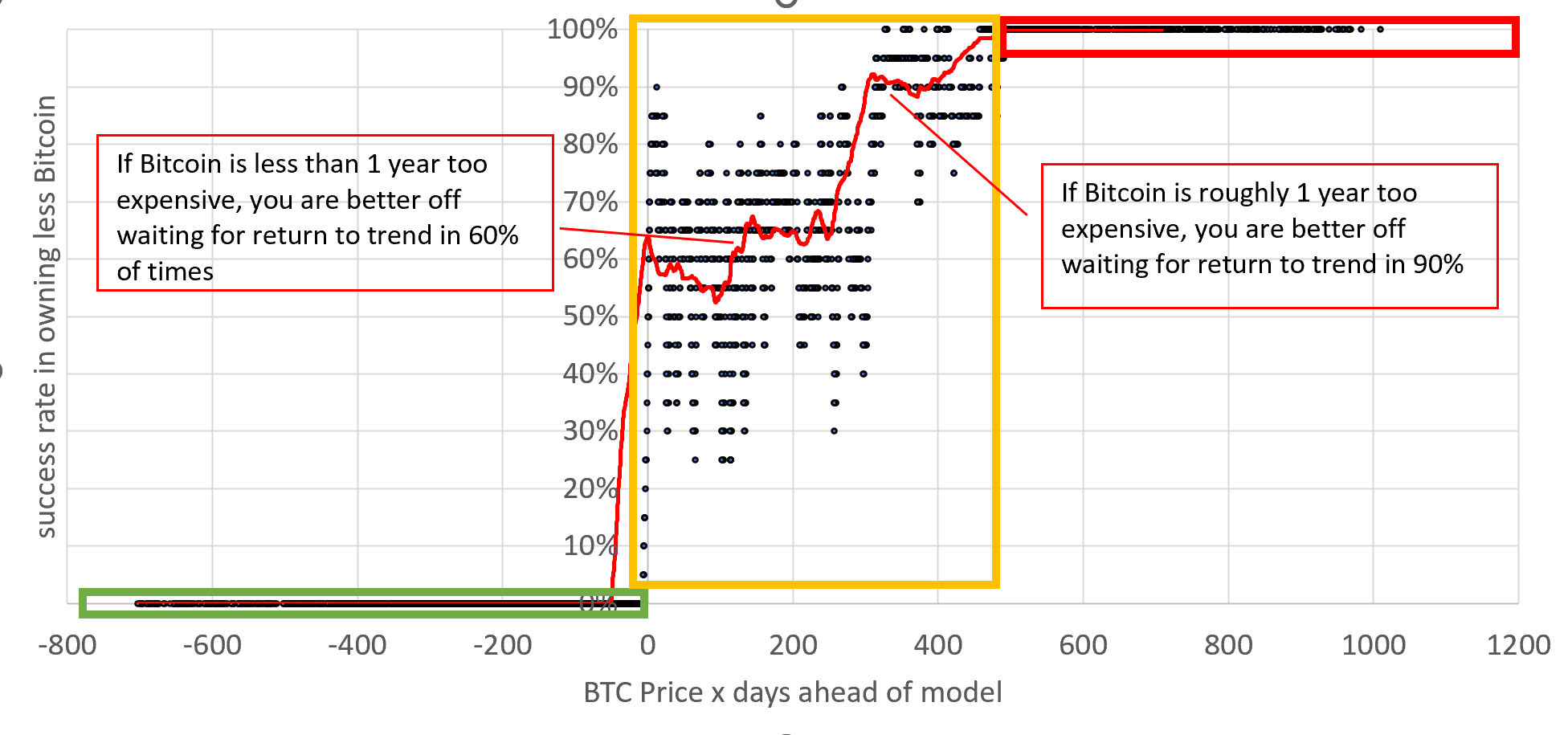

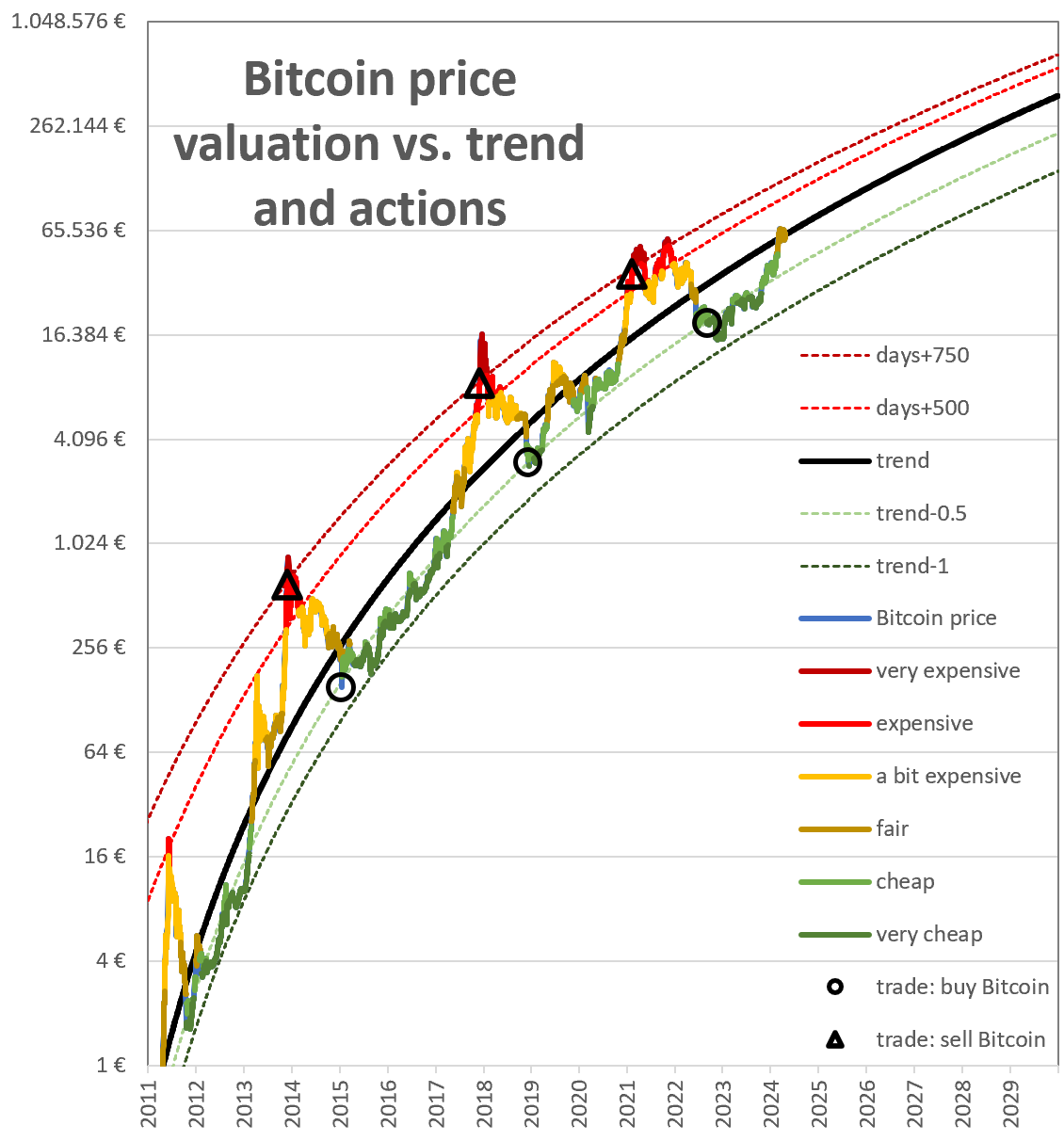

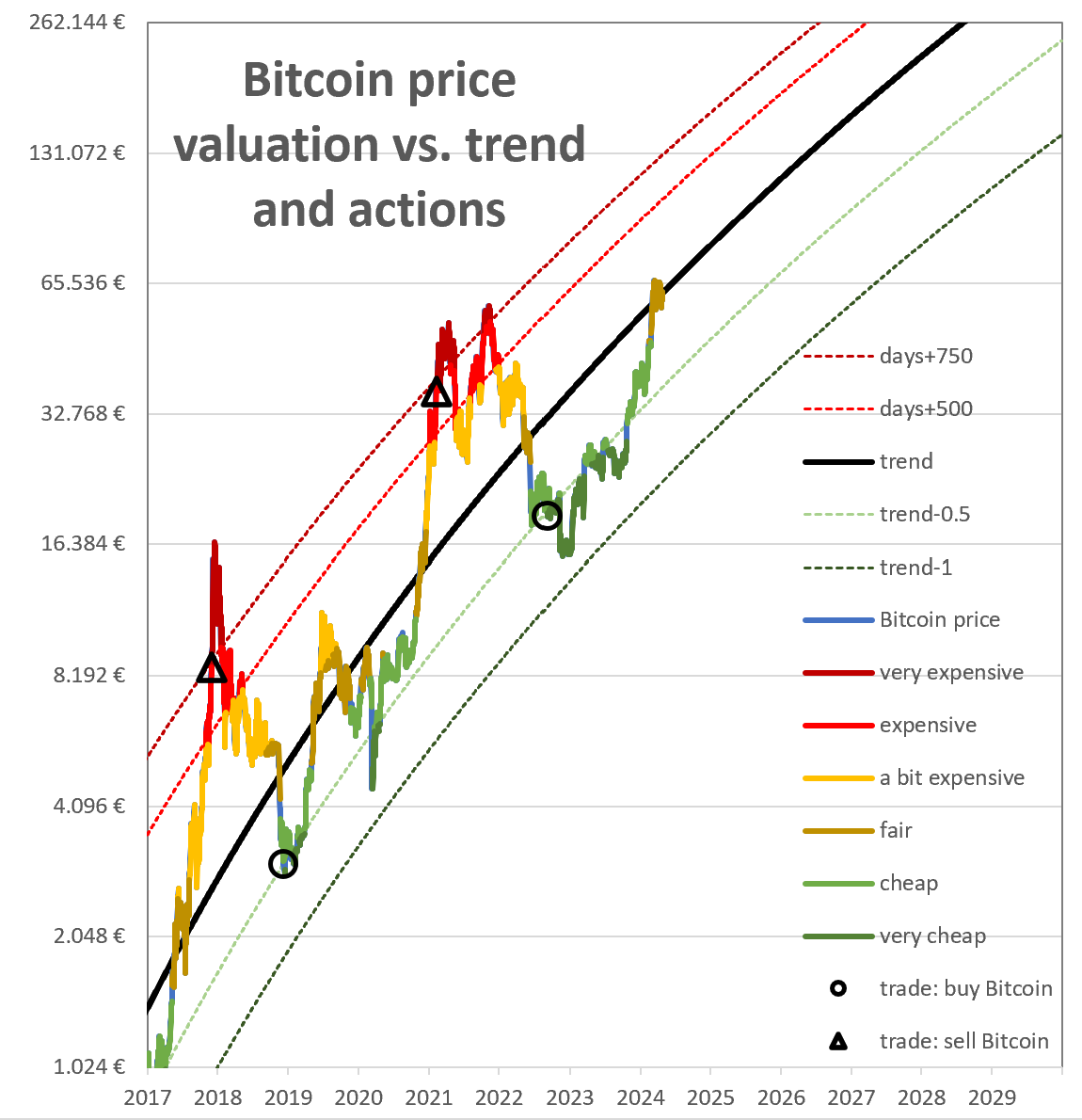

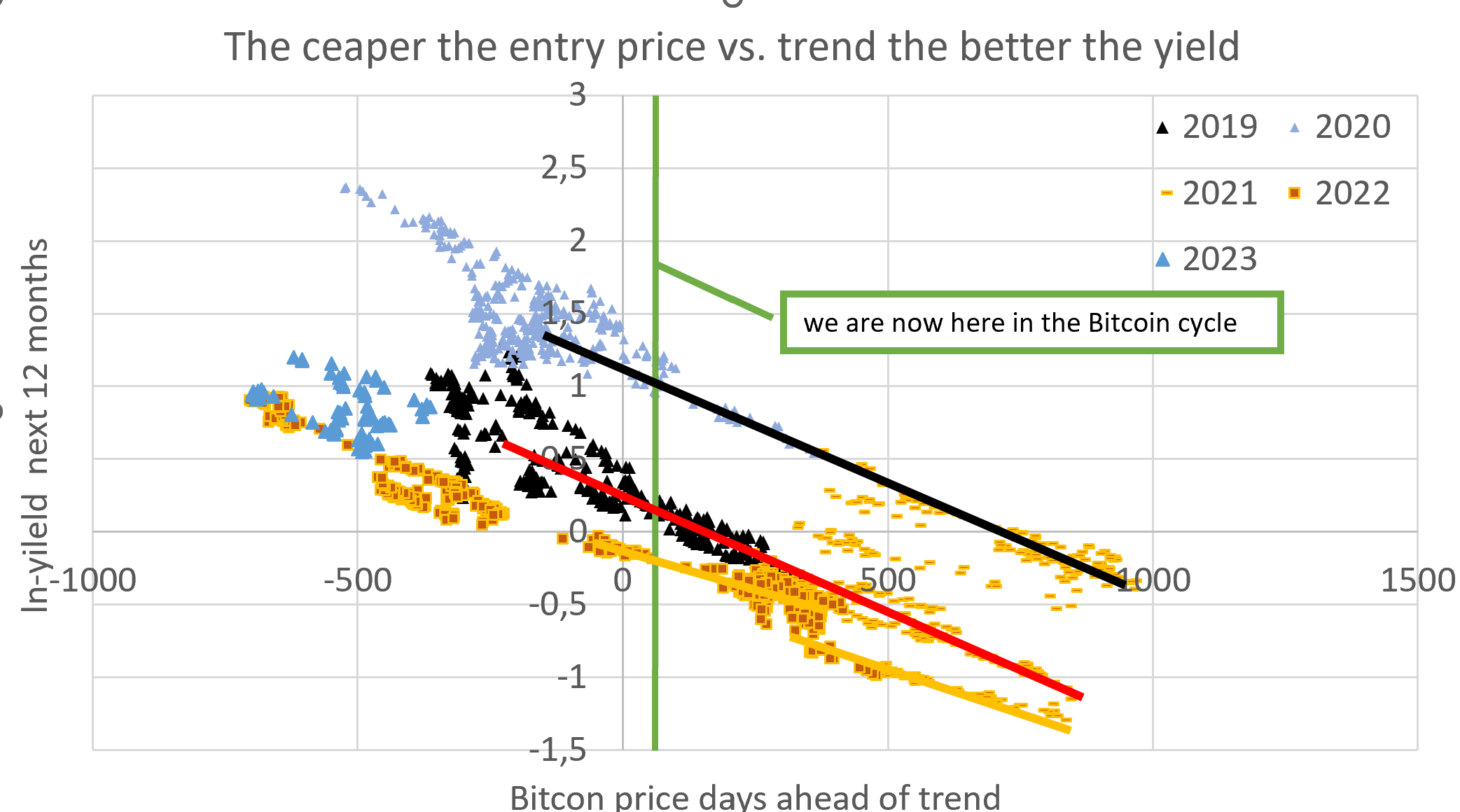

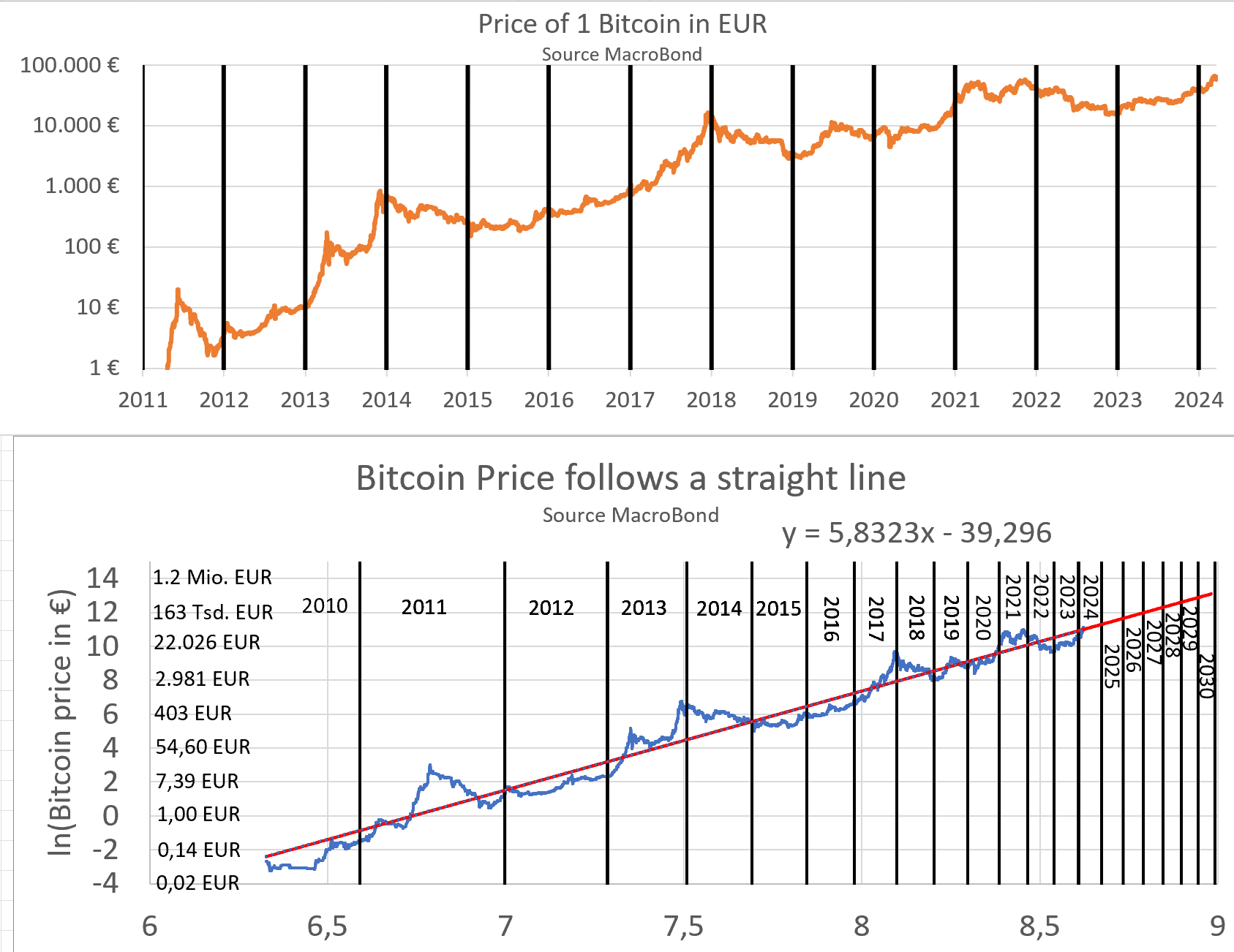

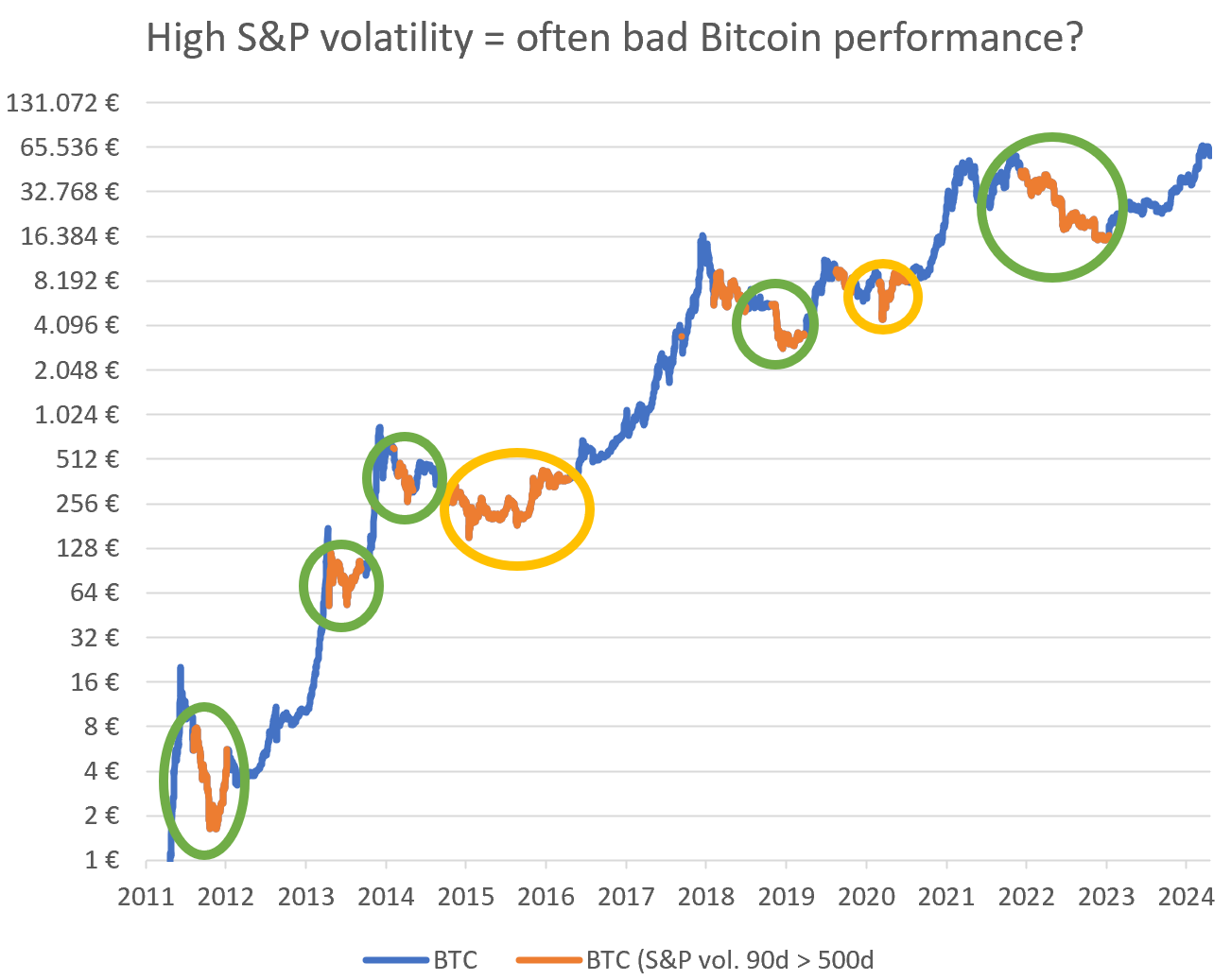

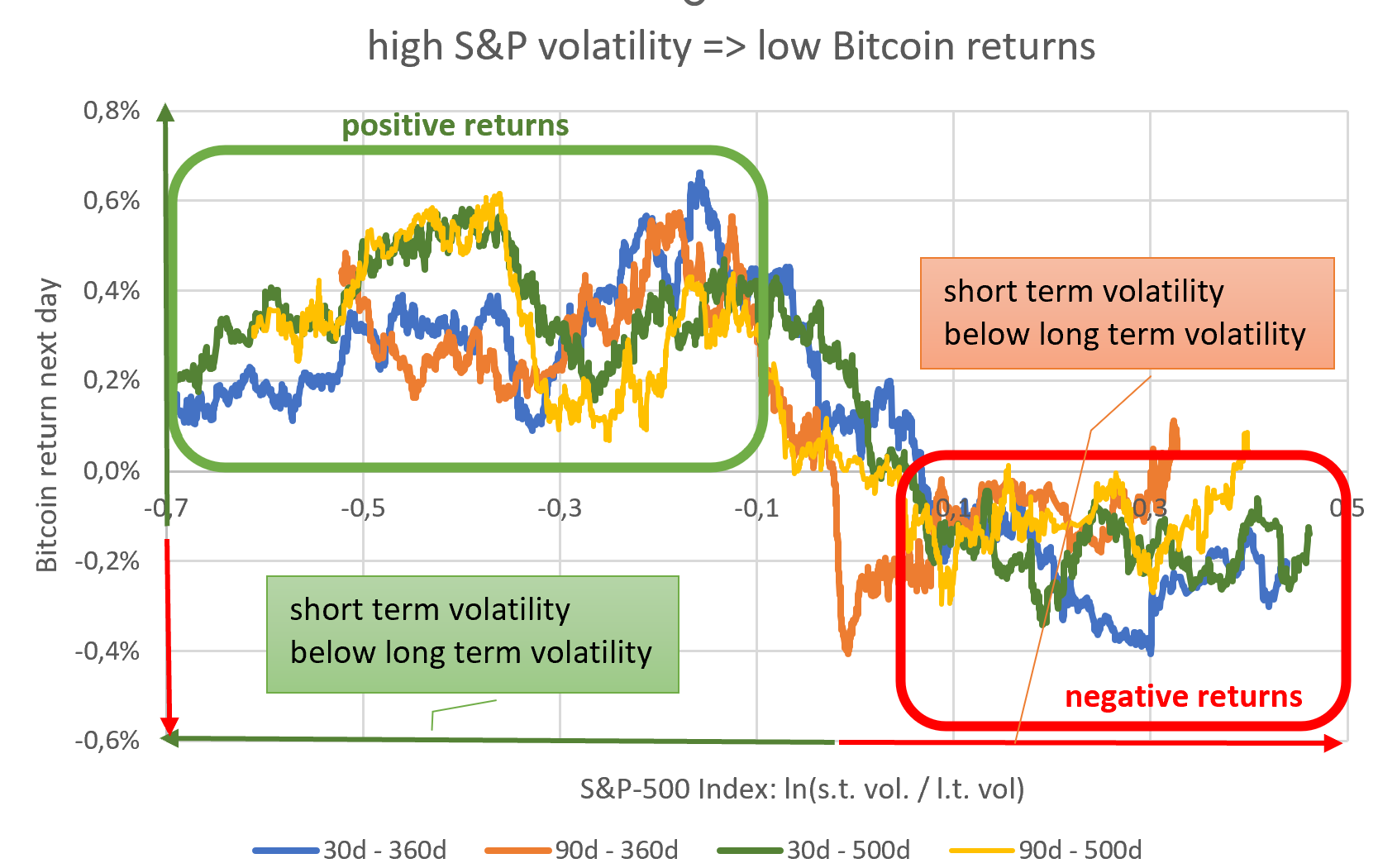

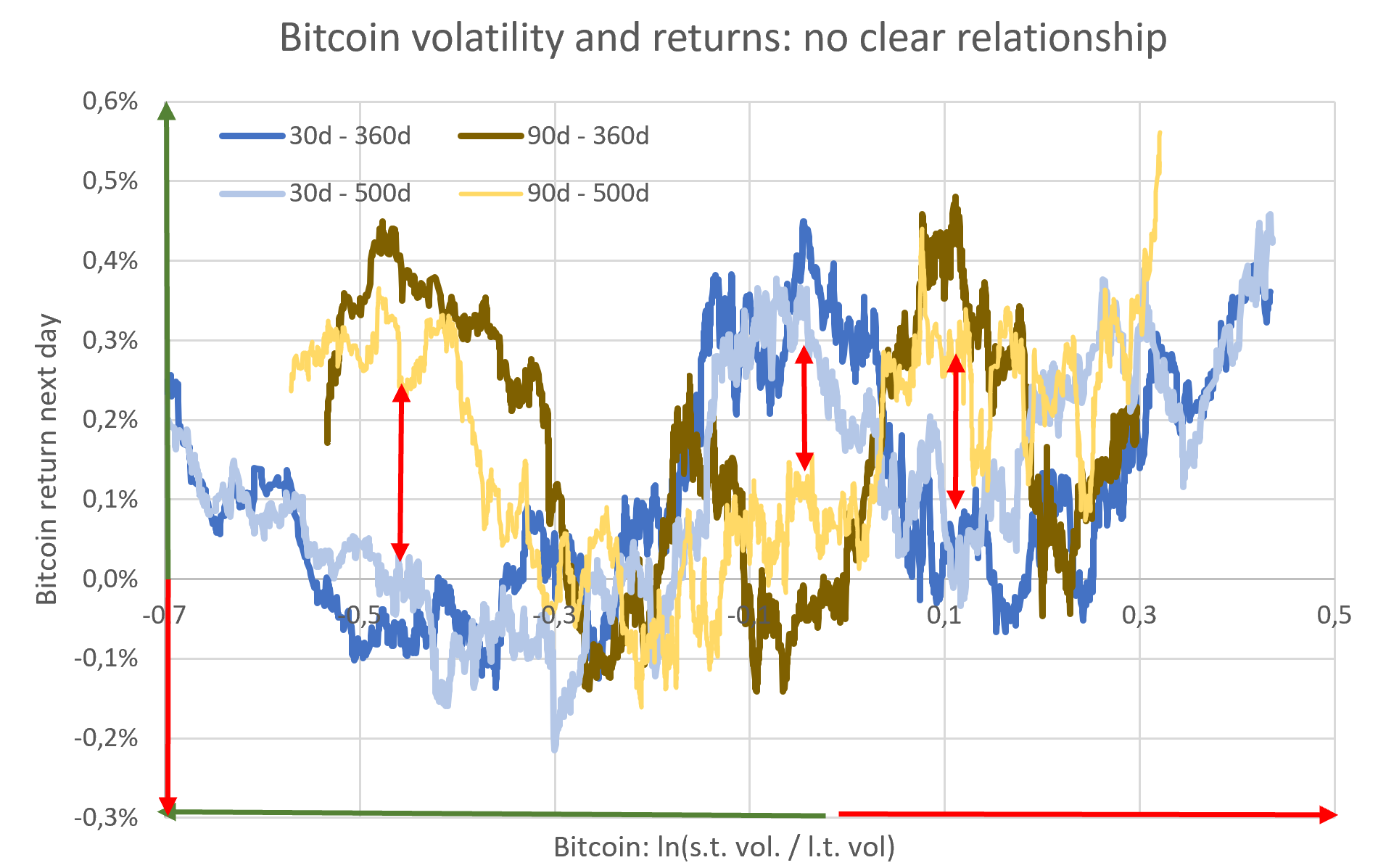

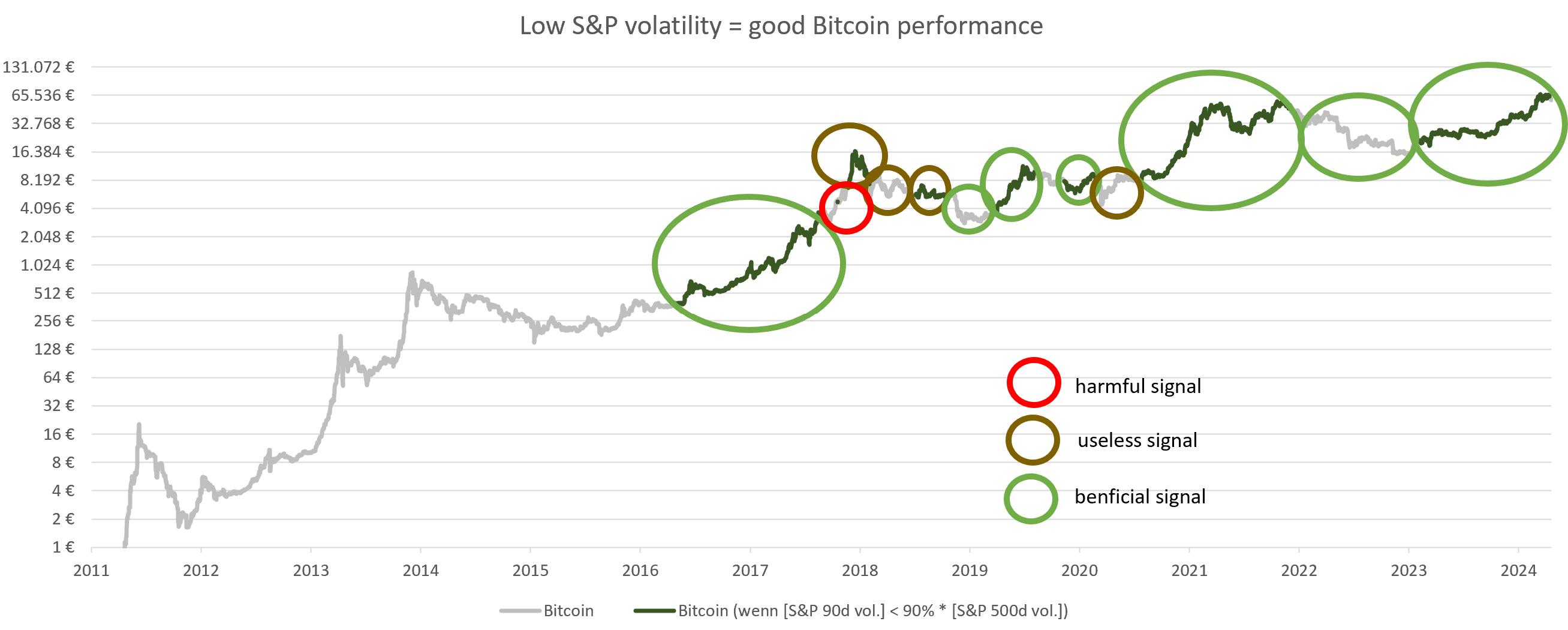

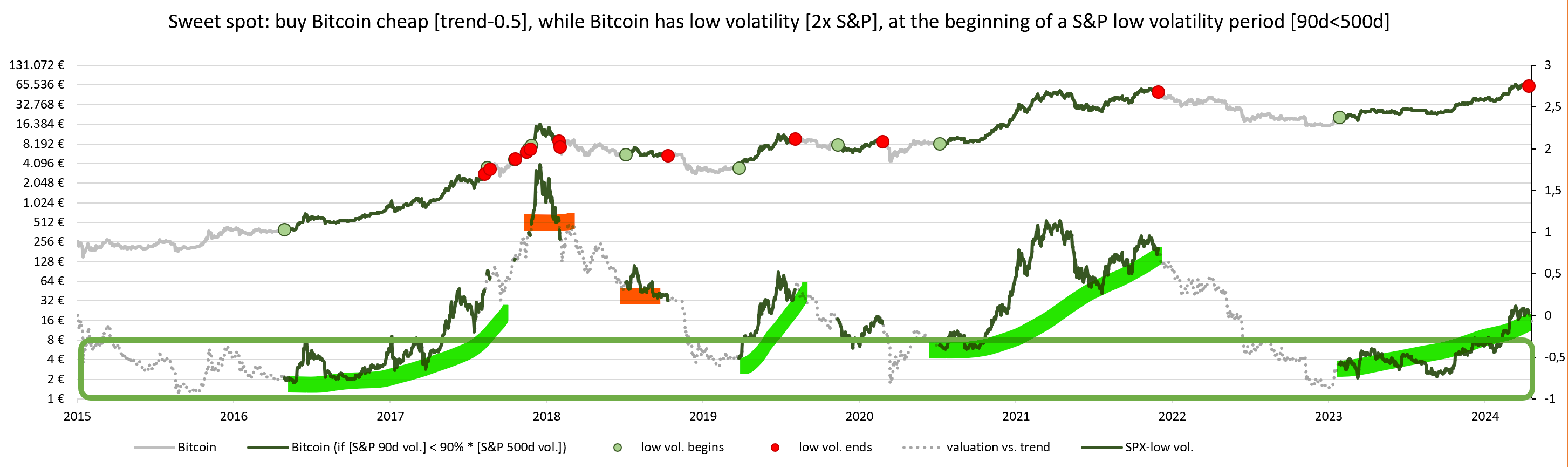

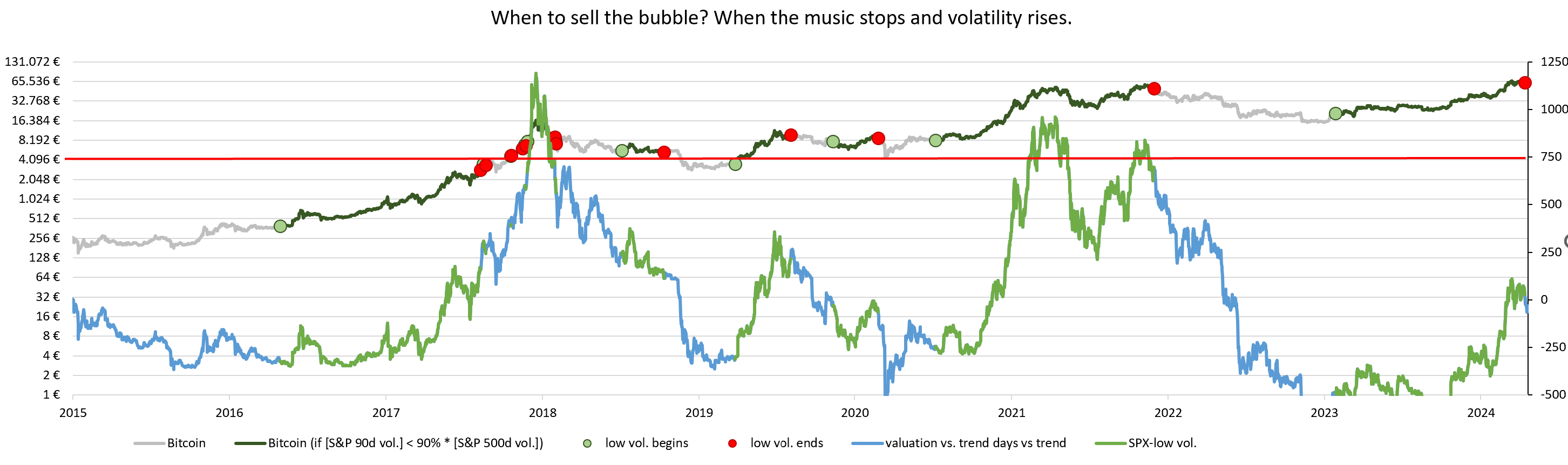

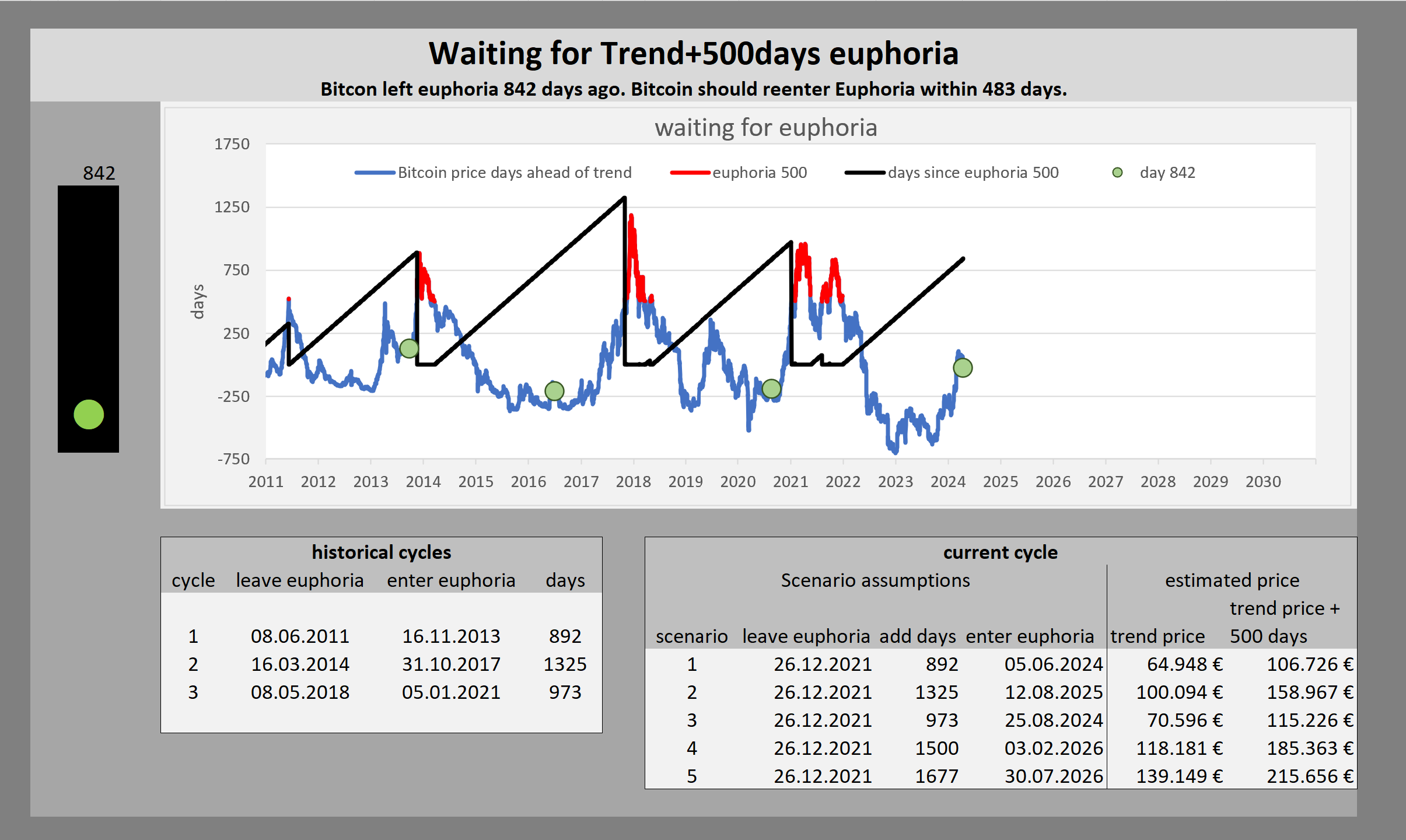

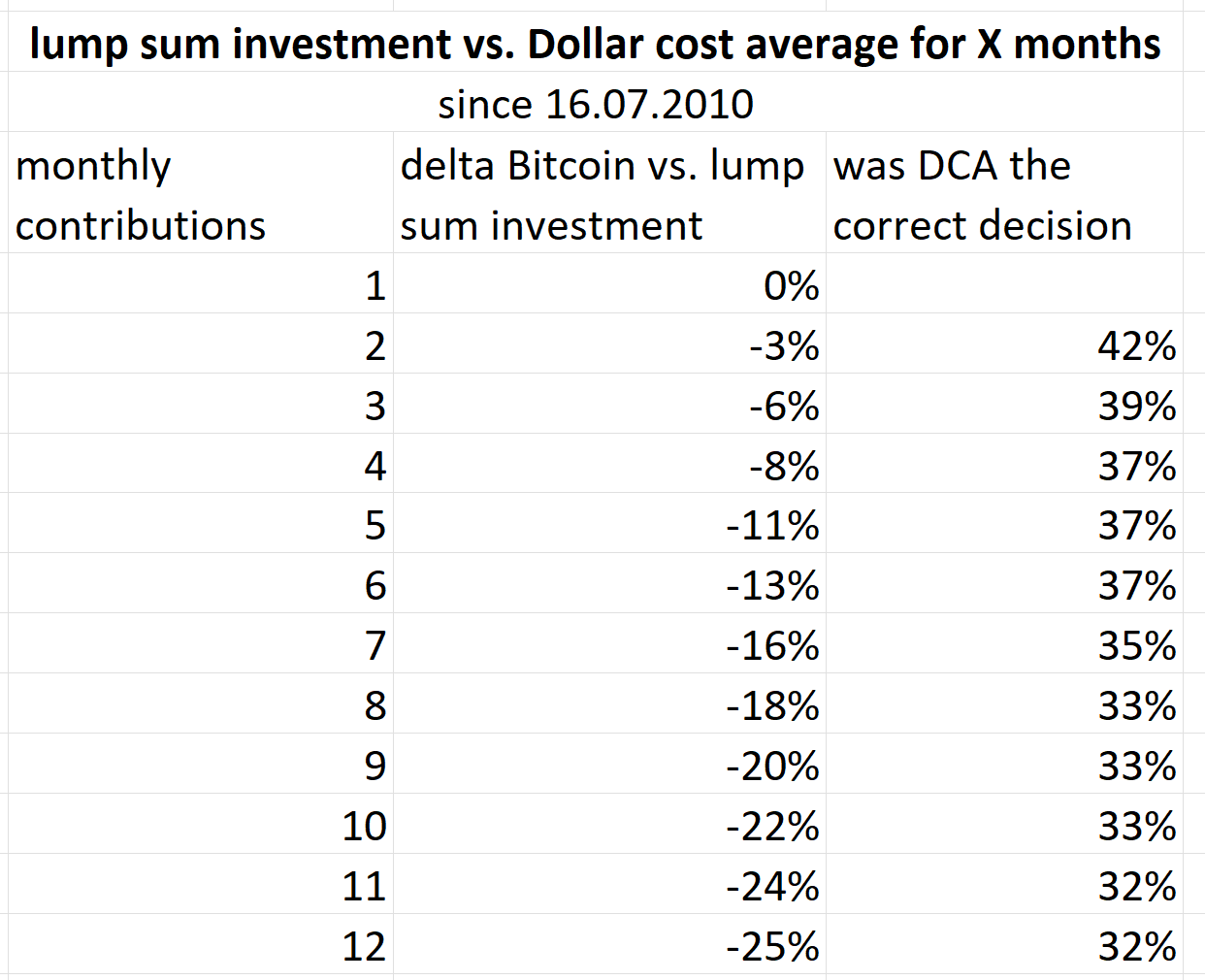

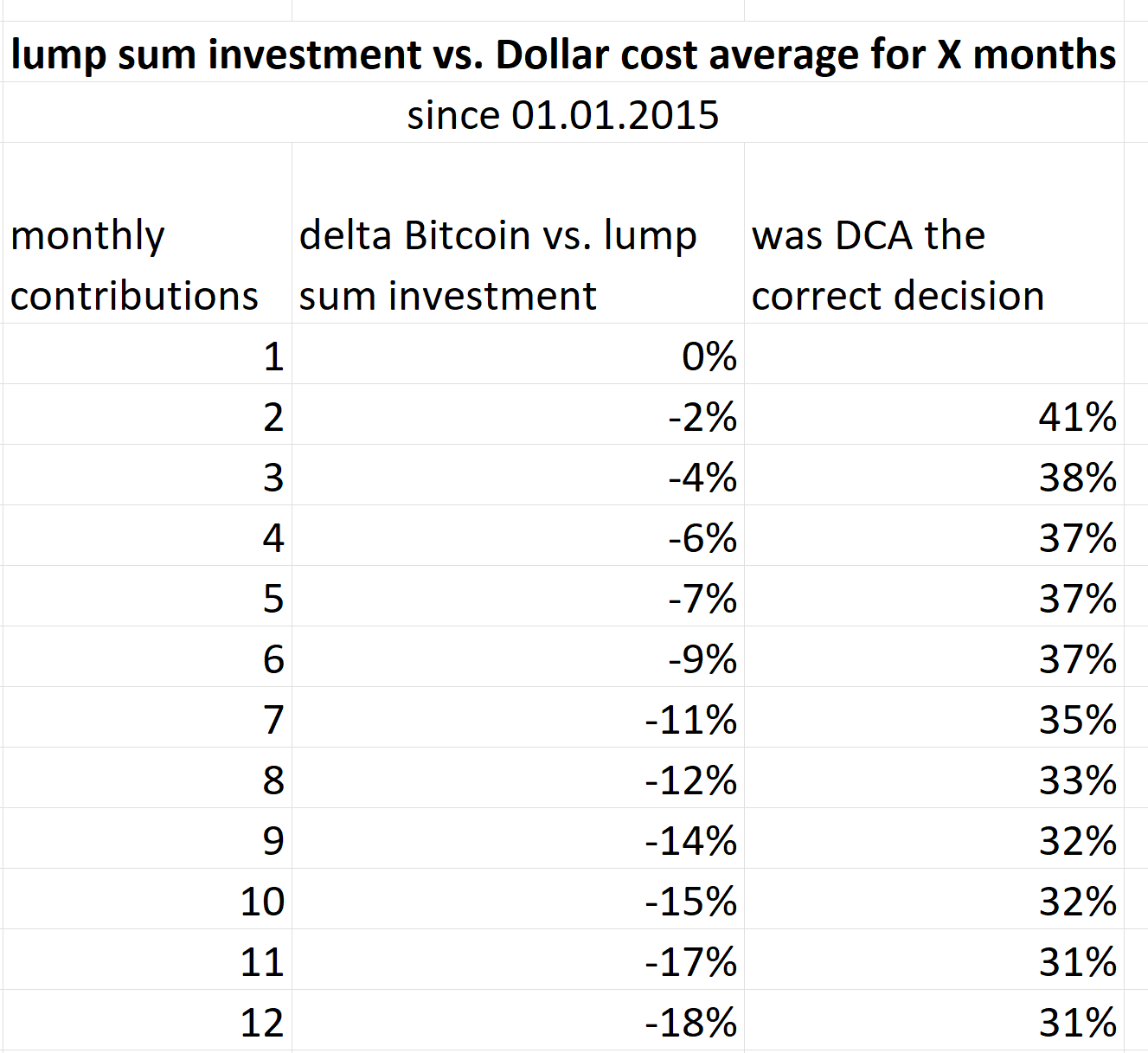

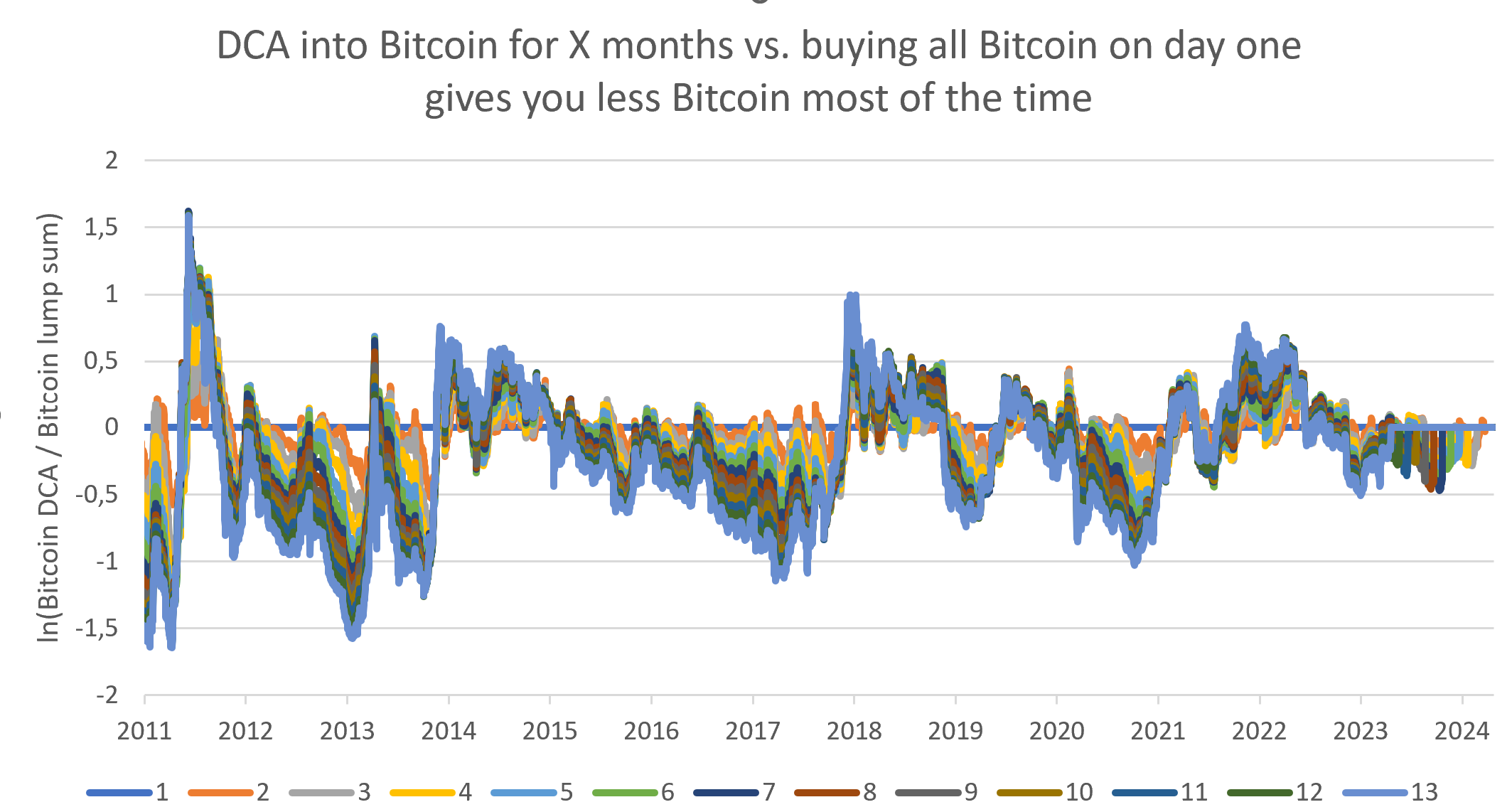

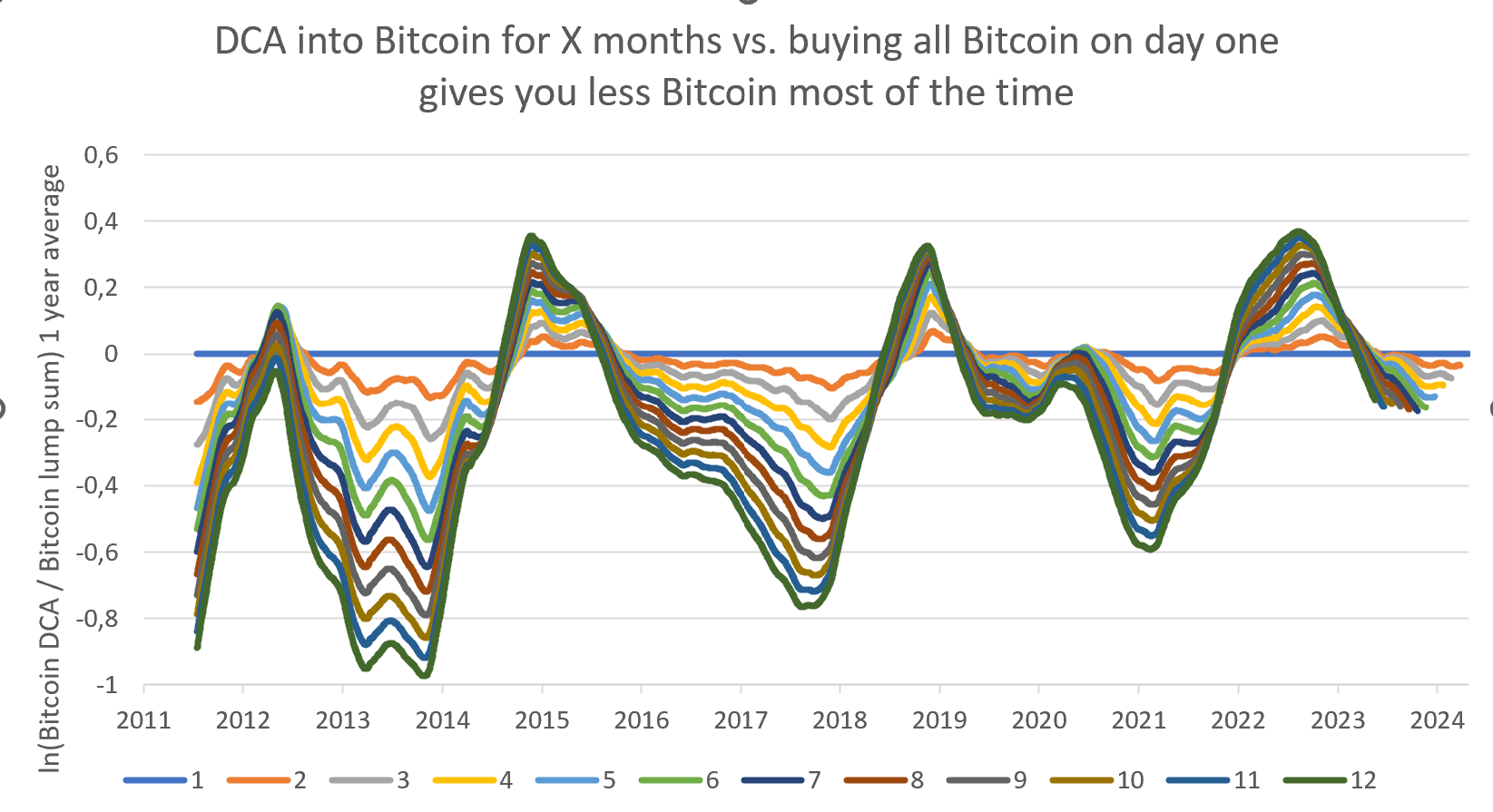

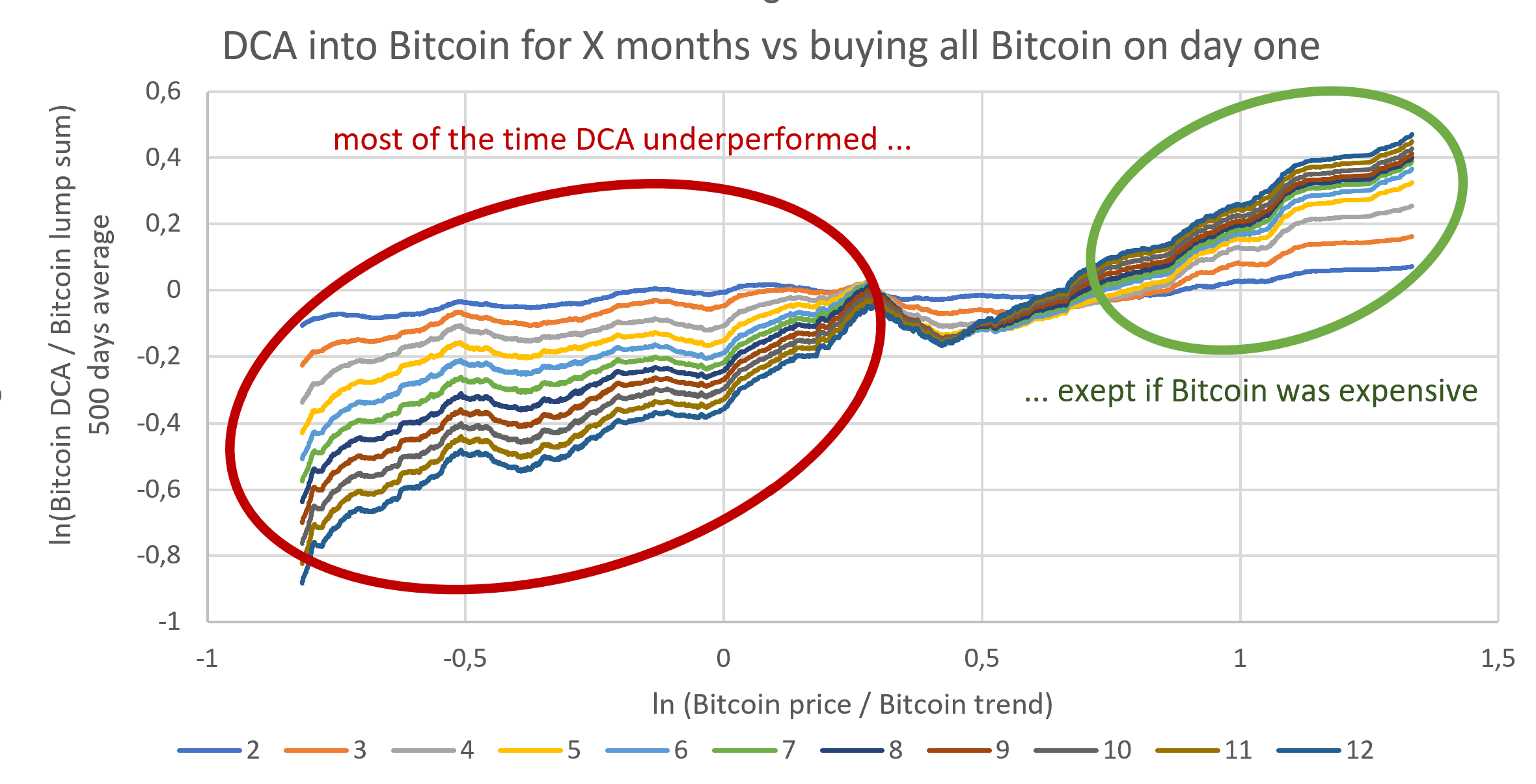

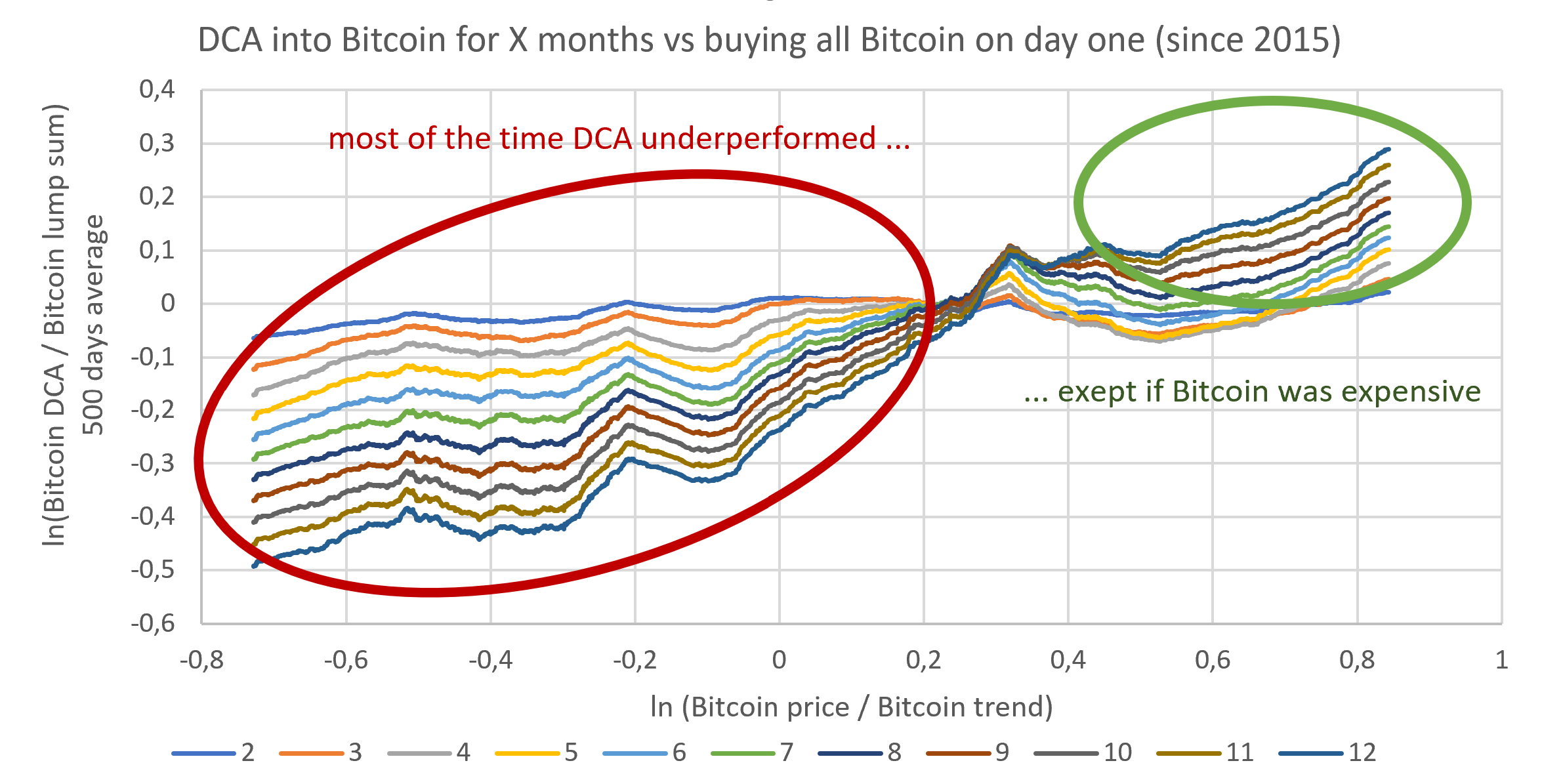

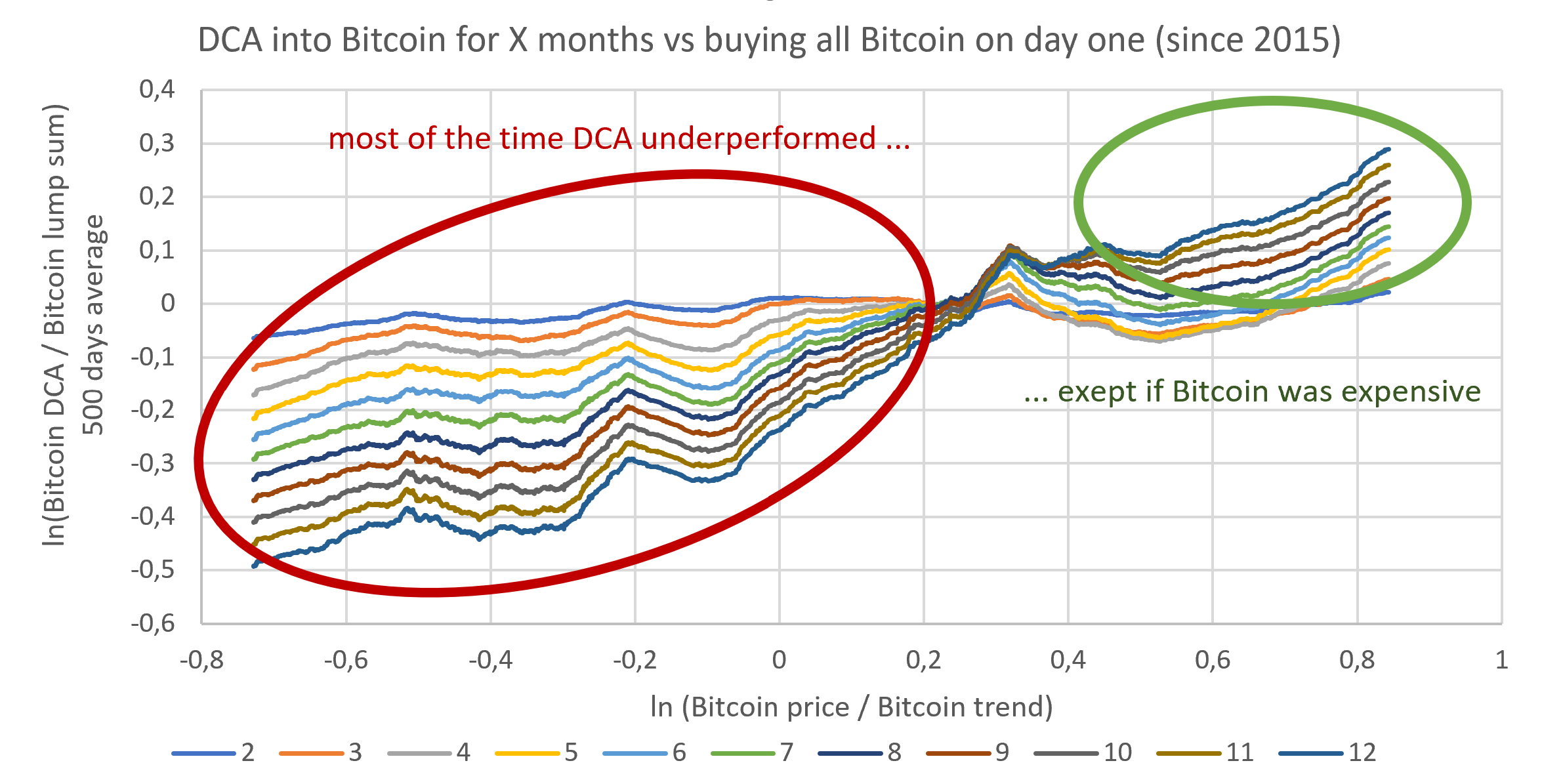

Can we time the Bitcoin cycle?The case for Dollar Cost Averaging (DCA)Most people discover Bitcoin during a bull market, invest money, get discouraged during the bear market and sell. As a result, they can lose in USD terms even though they have invested in an asset with a huge average trend growth. Investing the same amount in Bitcoin every month is an easy rule to follow. It saves you the mental load of thinking about when and how much to invest and prevents you from buying at the euphoric top and selling at the depressed bottom. The case for countercyclical buyingHowever, if we could be reasonably sure that Bitcoin were near the top or near the bottom, we could invest accordingly. For example, we could stop DCA during the euphoria and double DCA during the bear market. Or we could sell some of our bitcoin close to the top and buy back close to the bottom. This would be a simple DCA strategy. In this article, I attempt to develop a reasonable strategy for the timing of bitcoin cycles.TL;DR: A smart and disciplined investor can outperform a simple dollar cost average strategy, by buying Bitcoin depending to its price cycle. If Bitcoin is cheap (40% below trend), I would take a full position. If Bitcoin's price is expensive (more than 750 days ahead of trend), I would not add to my position and possibly even trim my position. If Bitcoin is neither cheap nor expensive I would dollar cost average into Bitcoin.

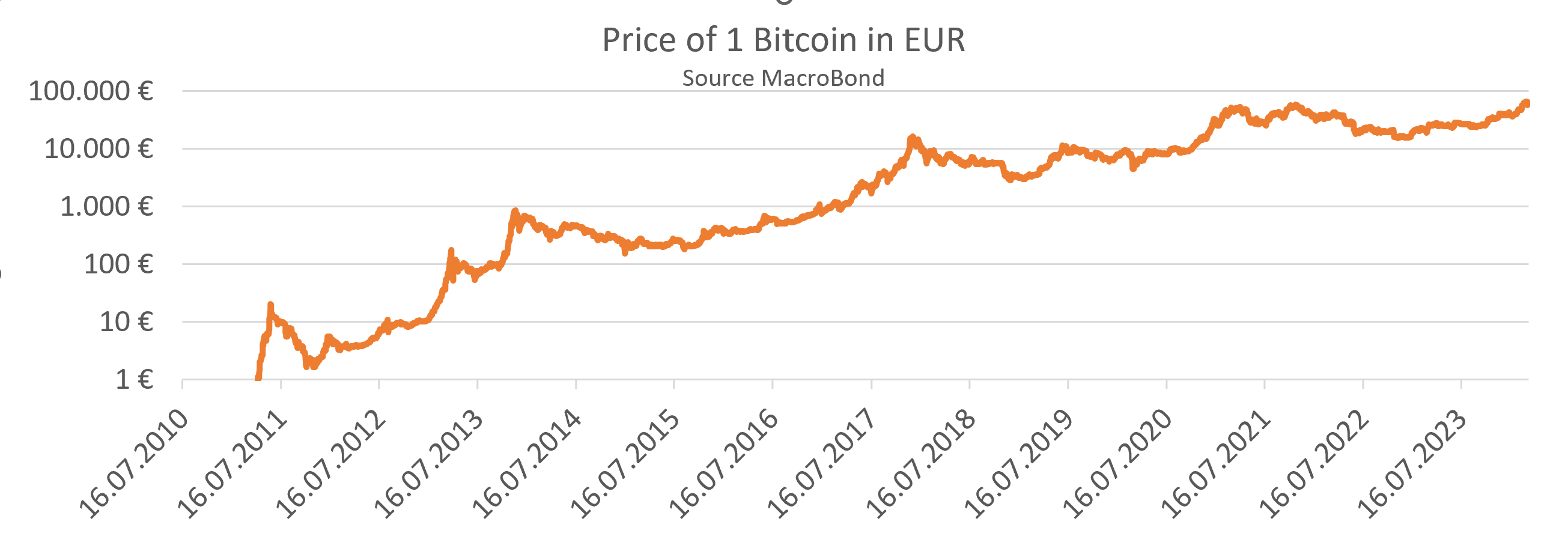

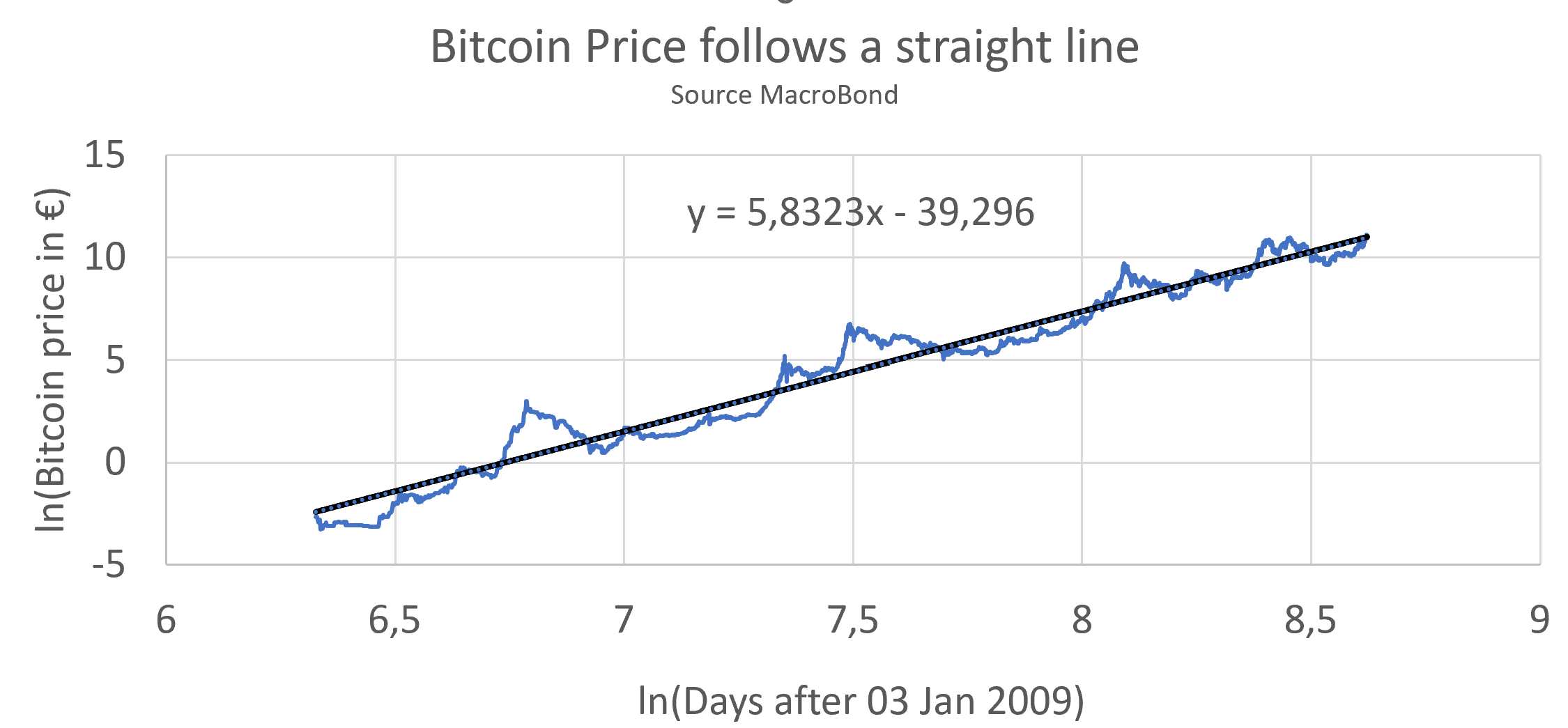

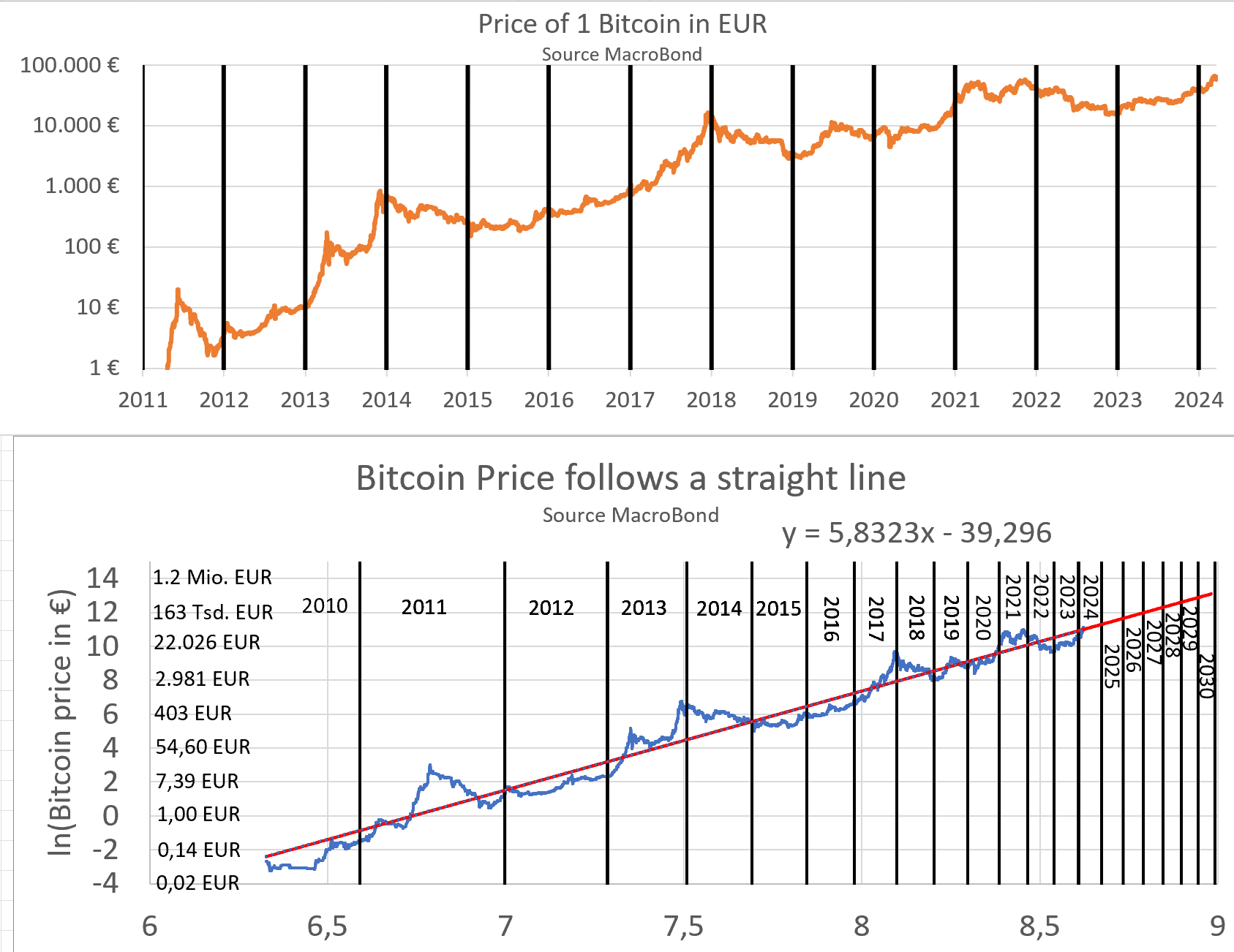

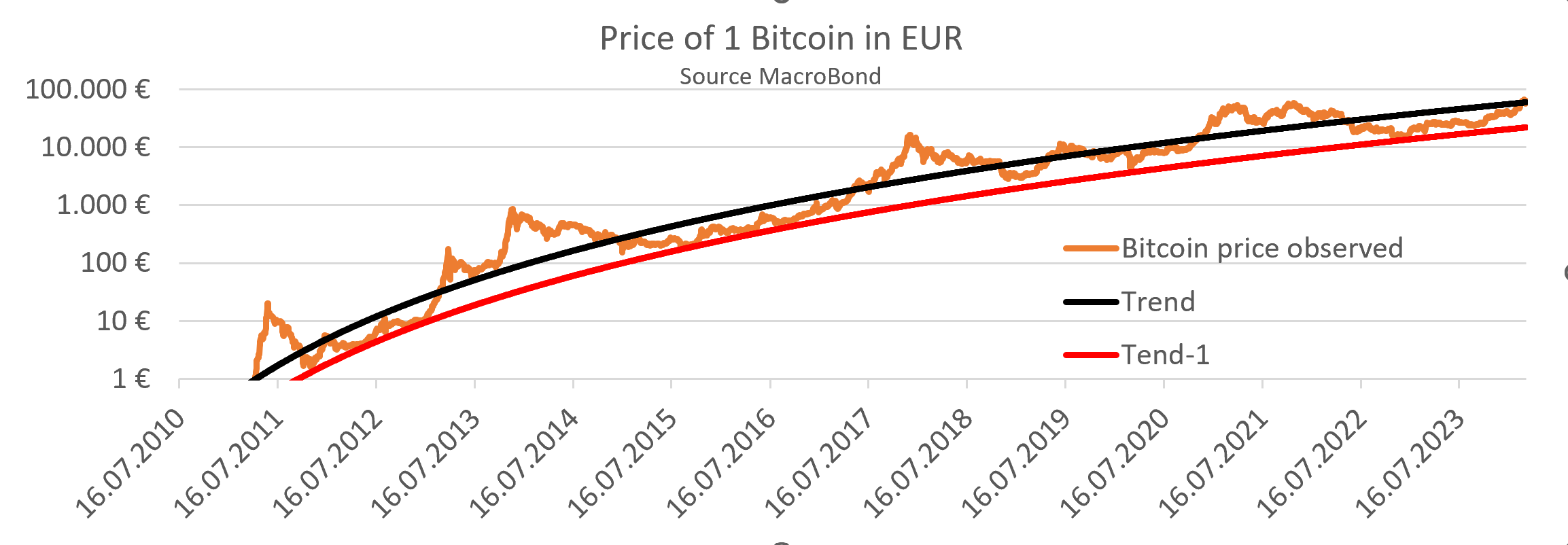

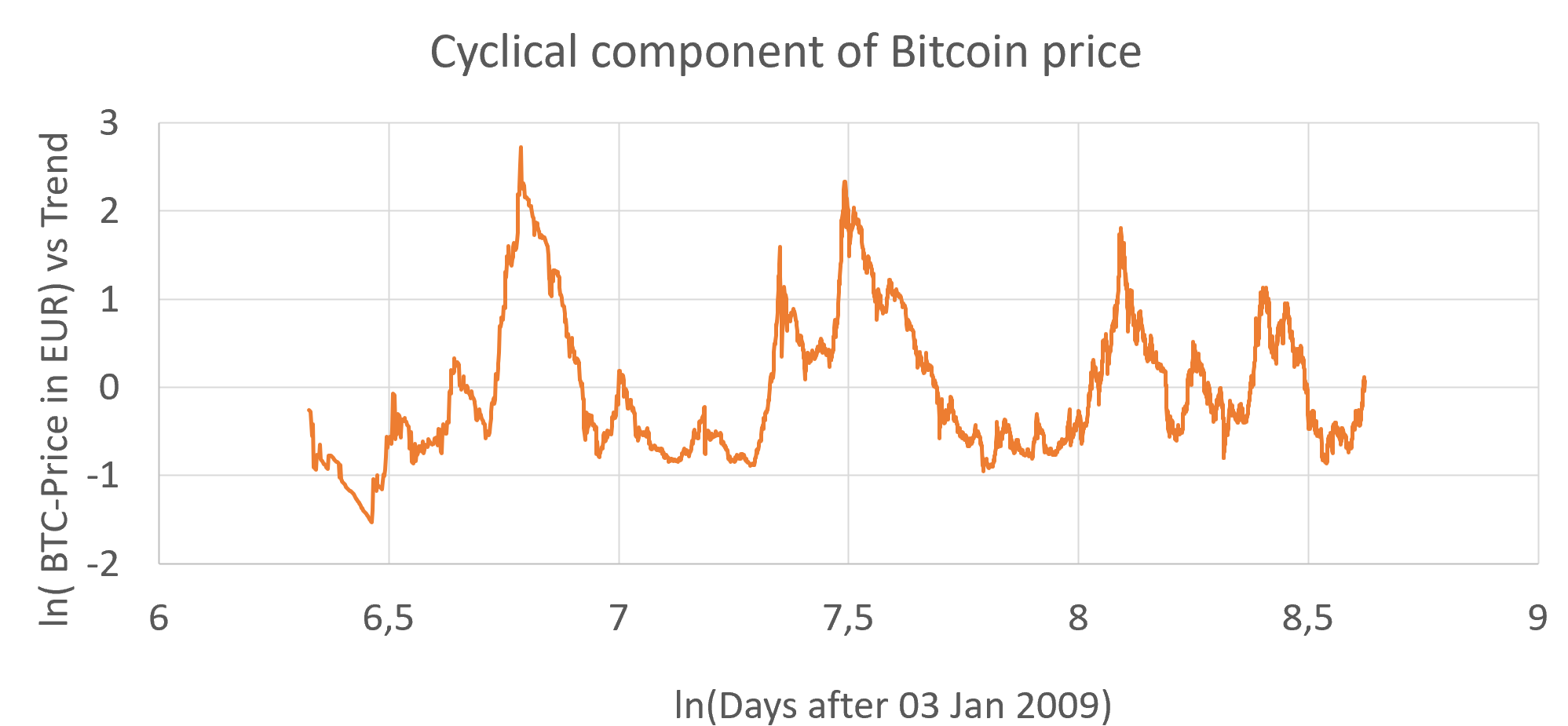

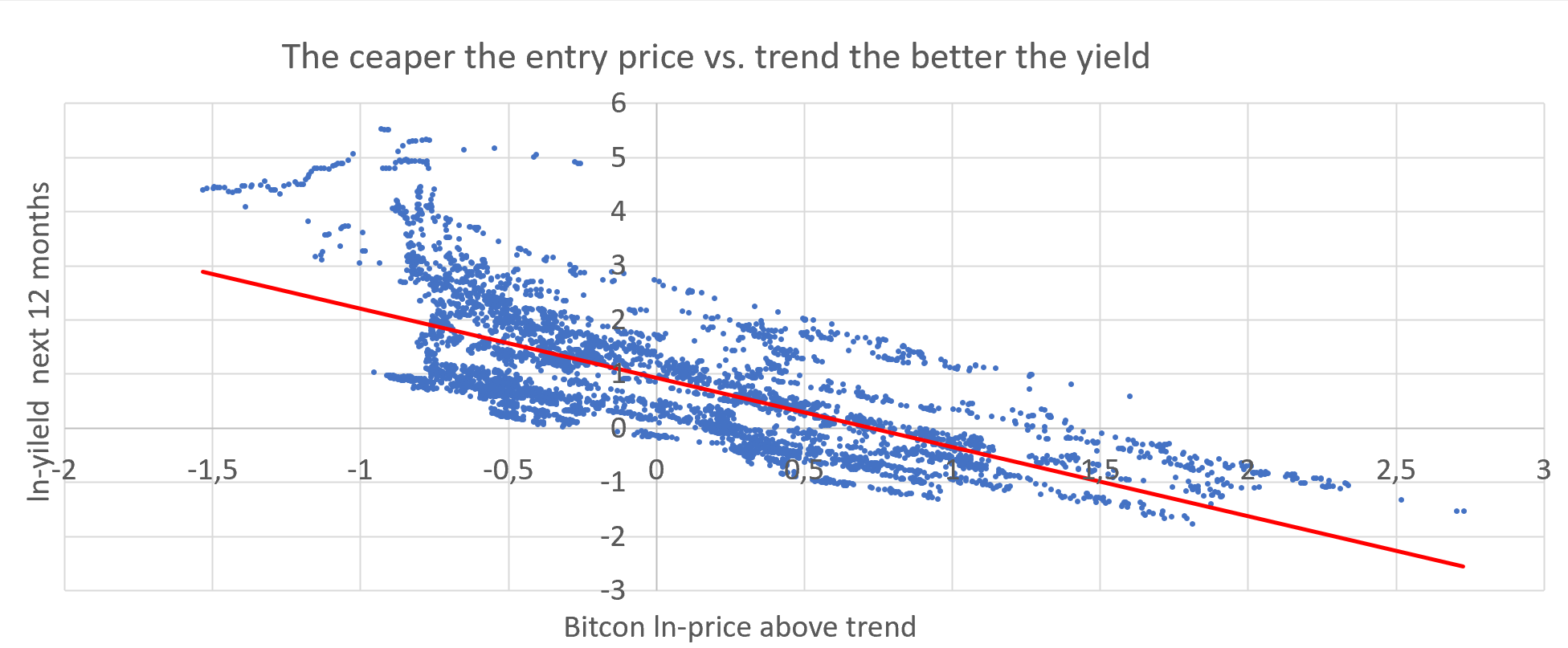

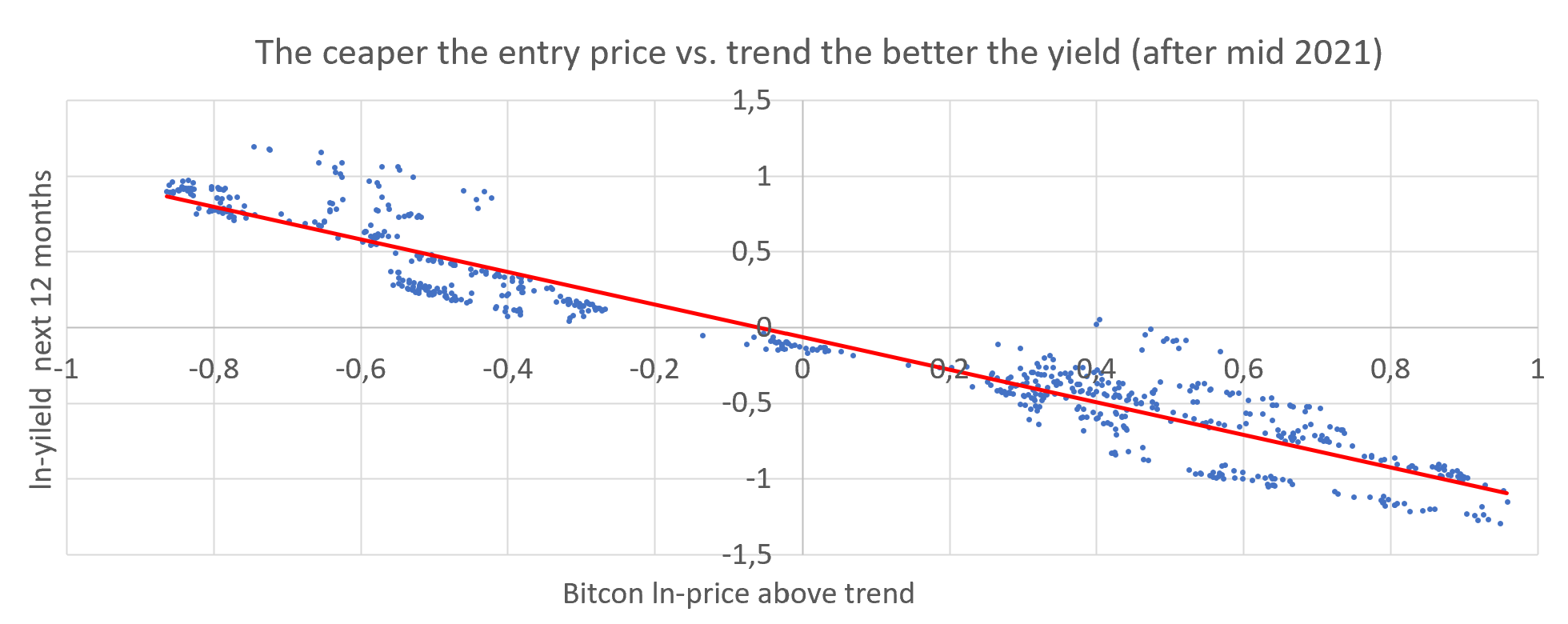

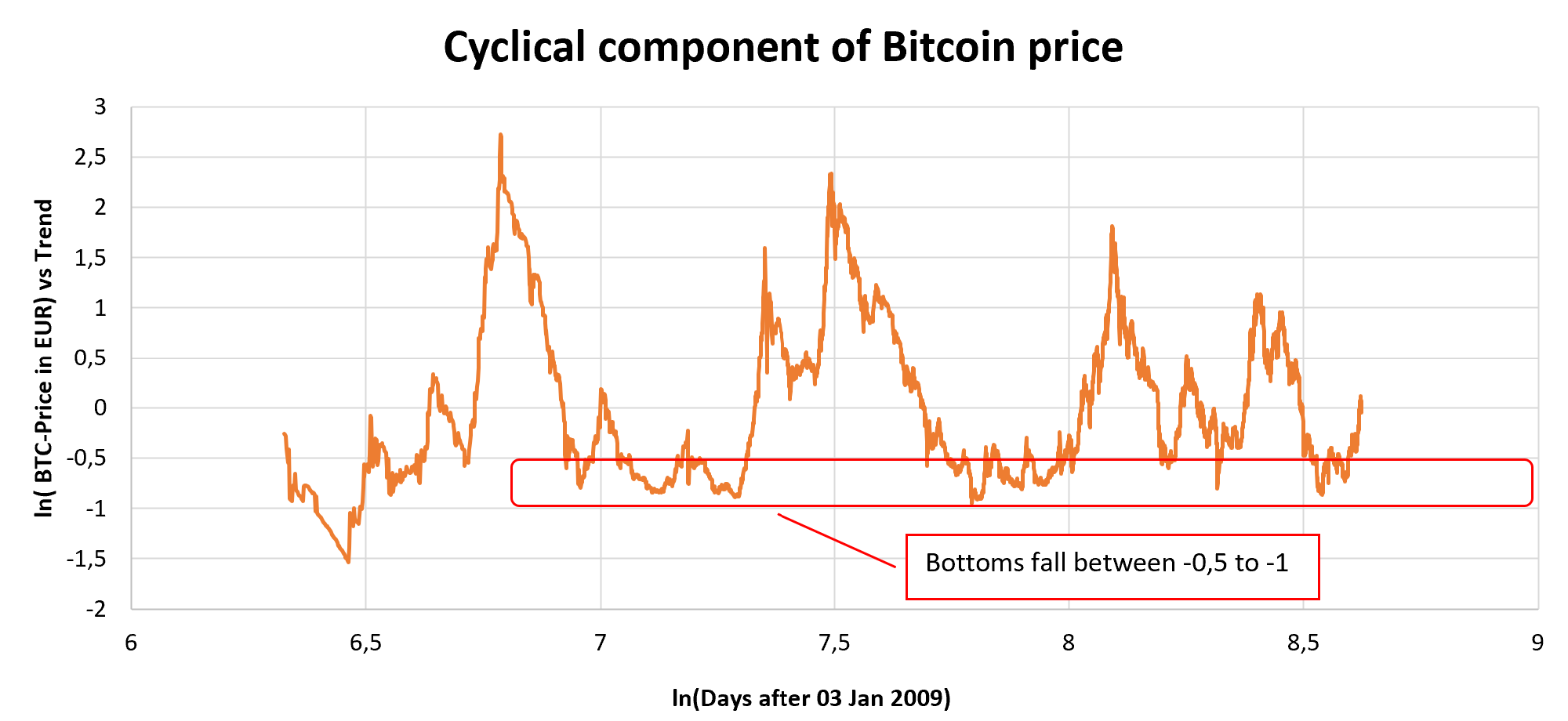

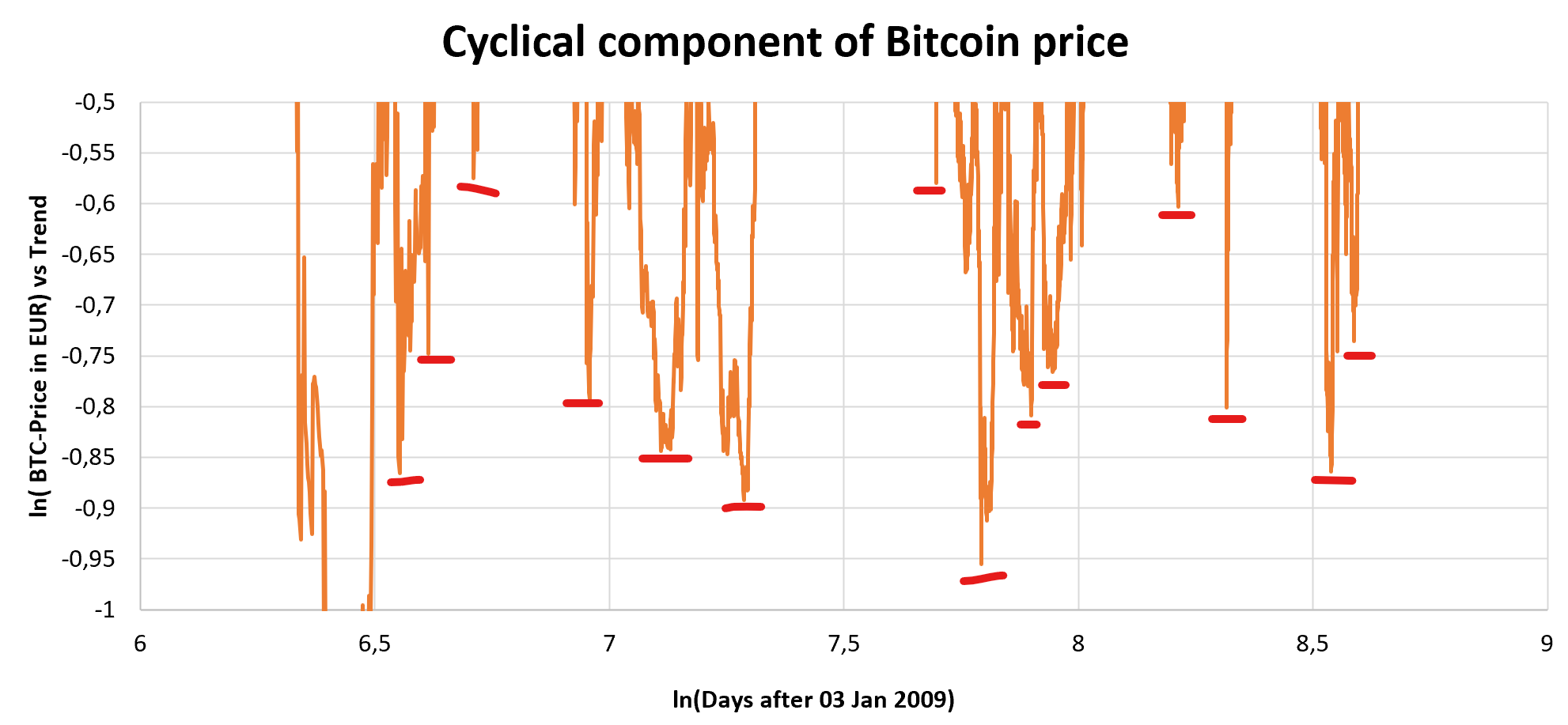

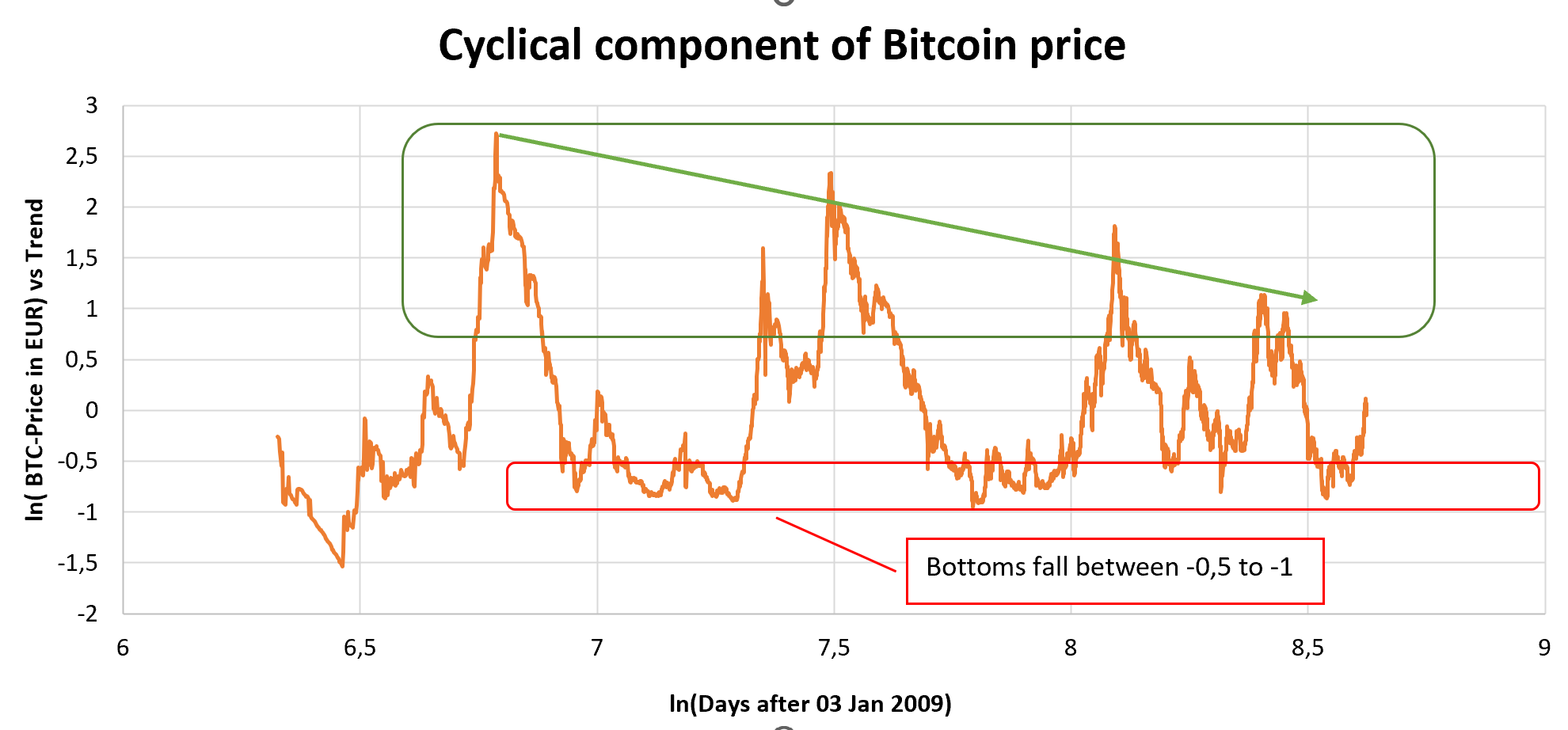

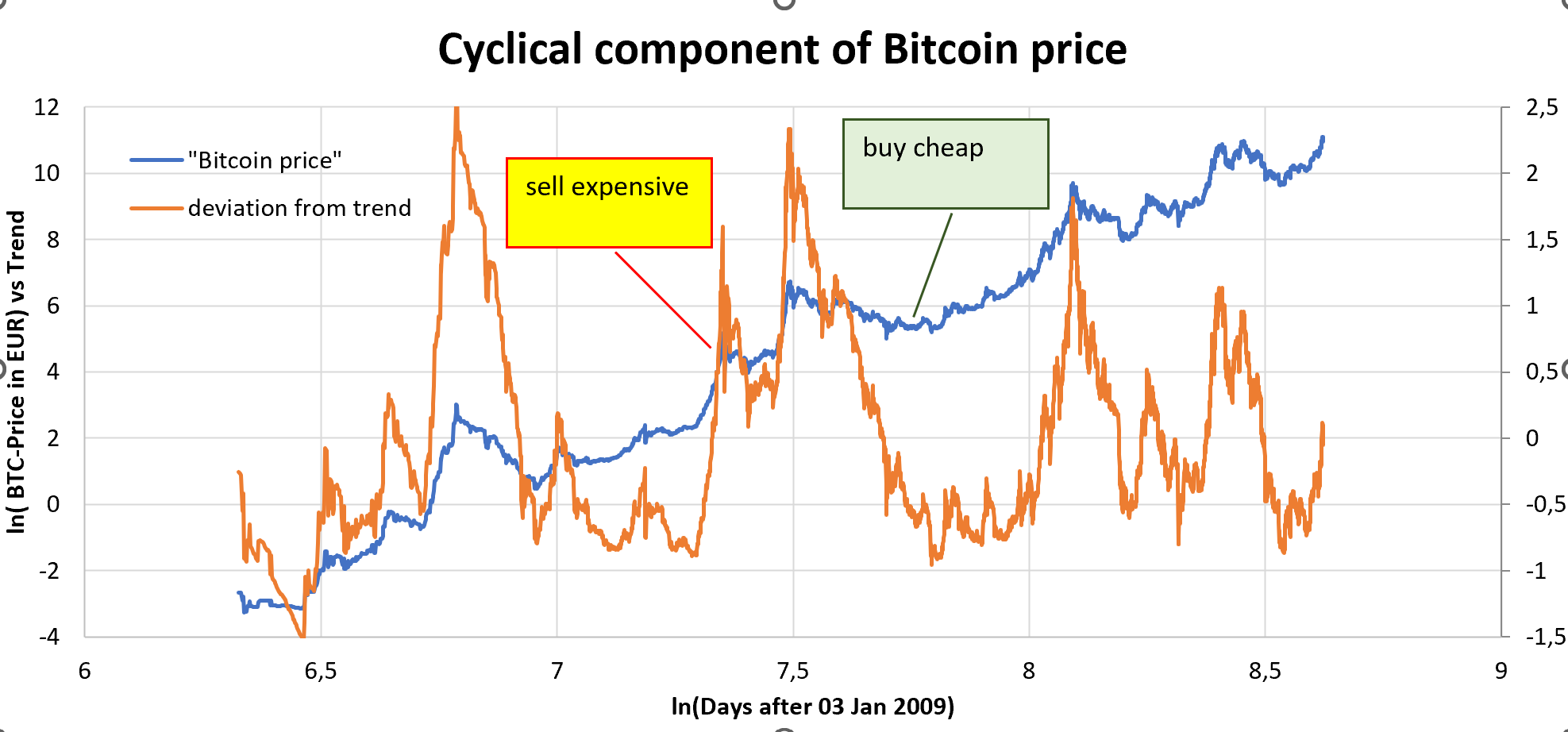

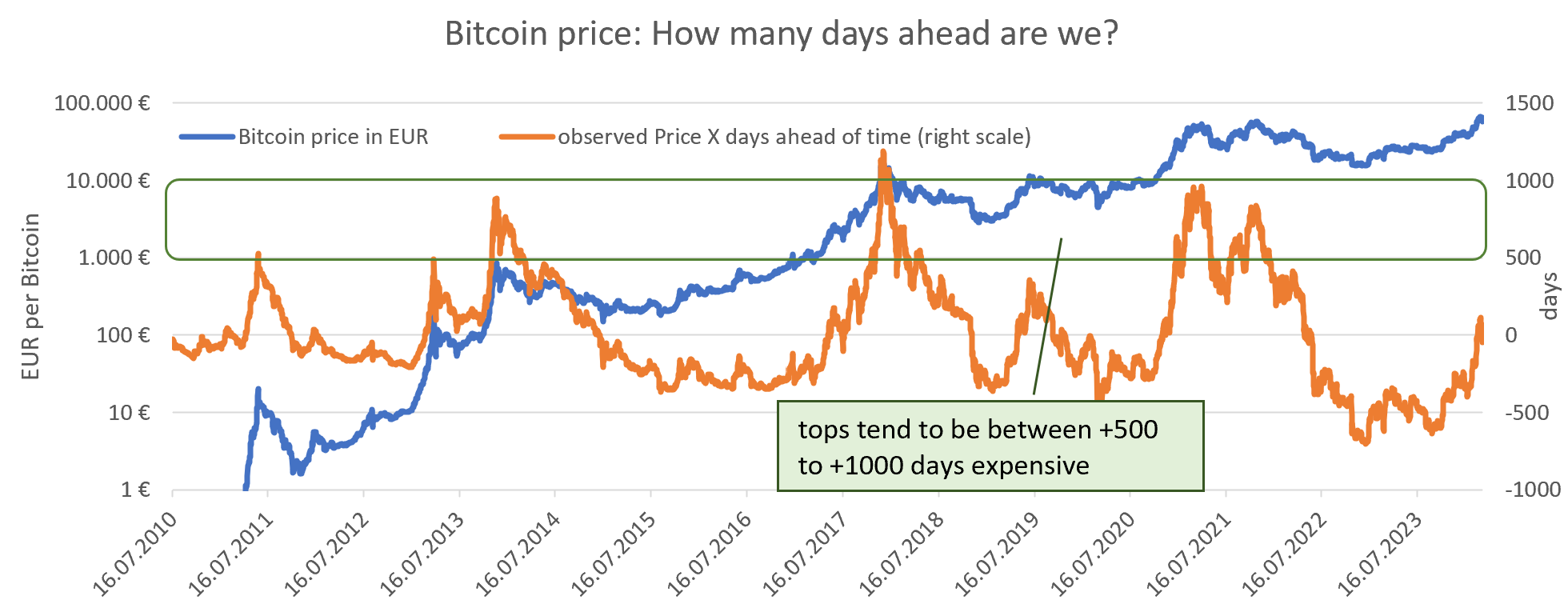

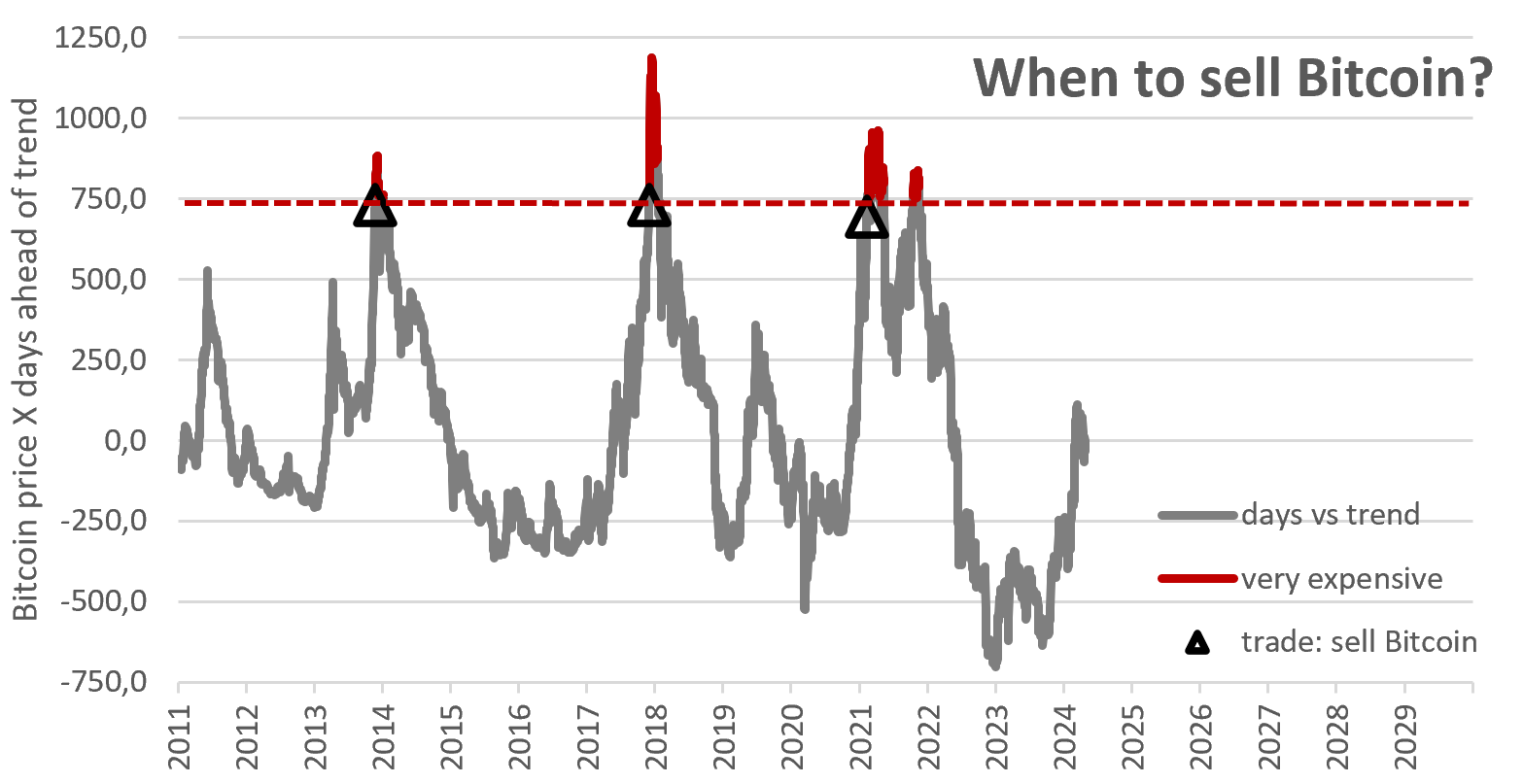

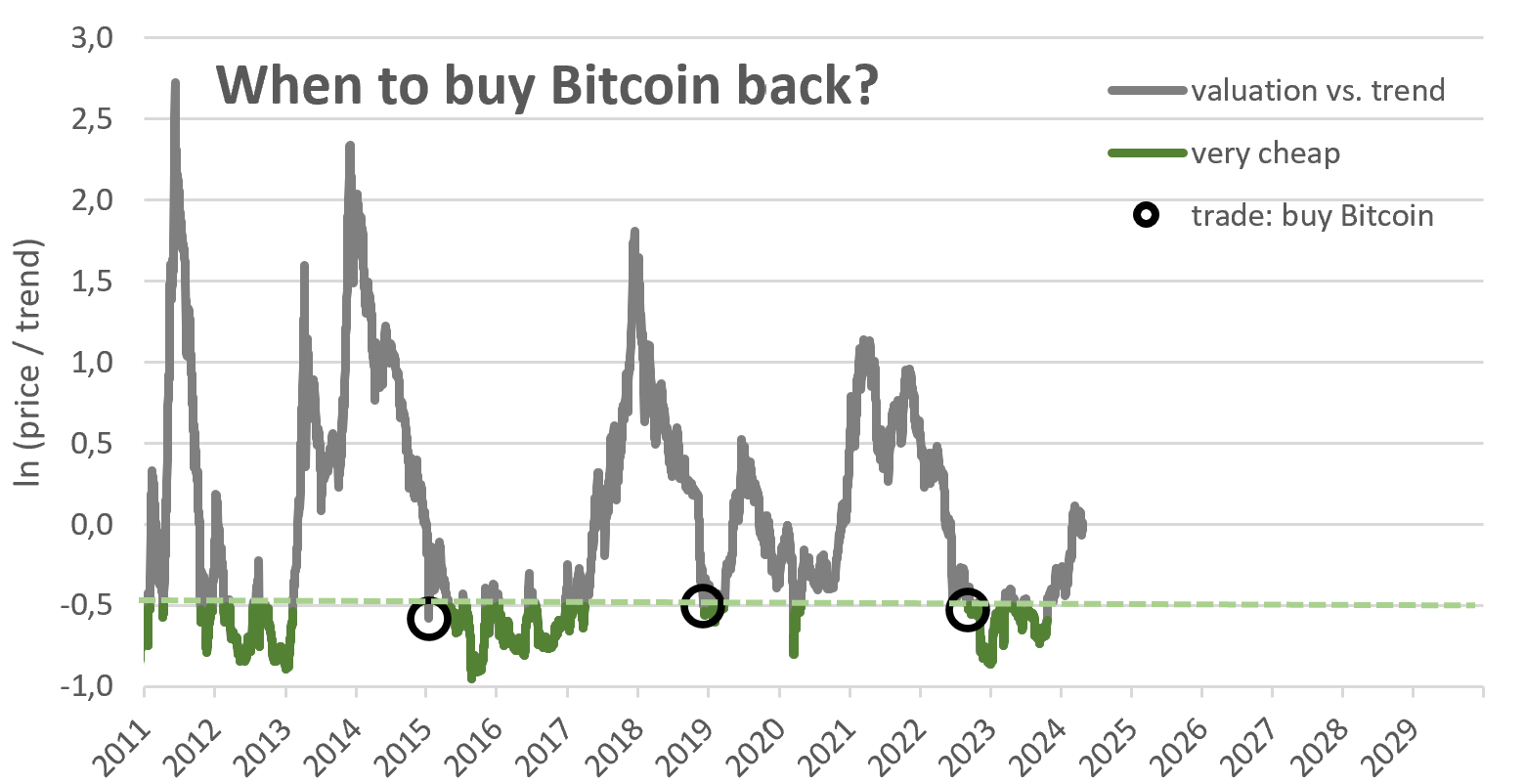

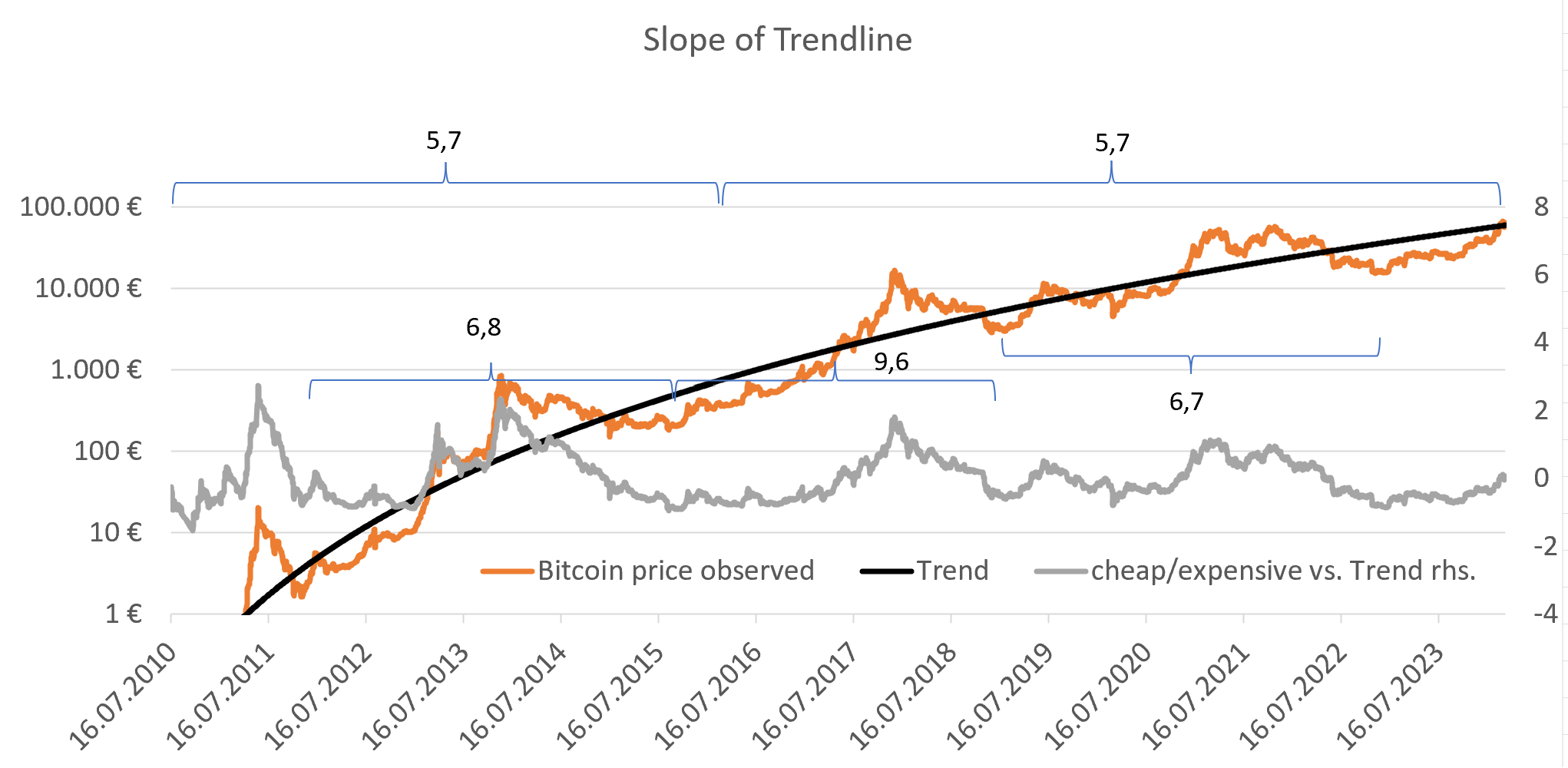

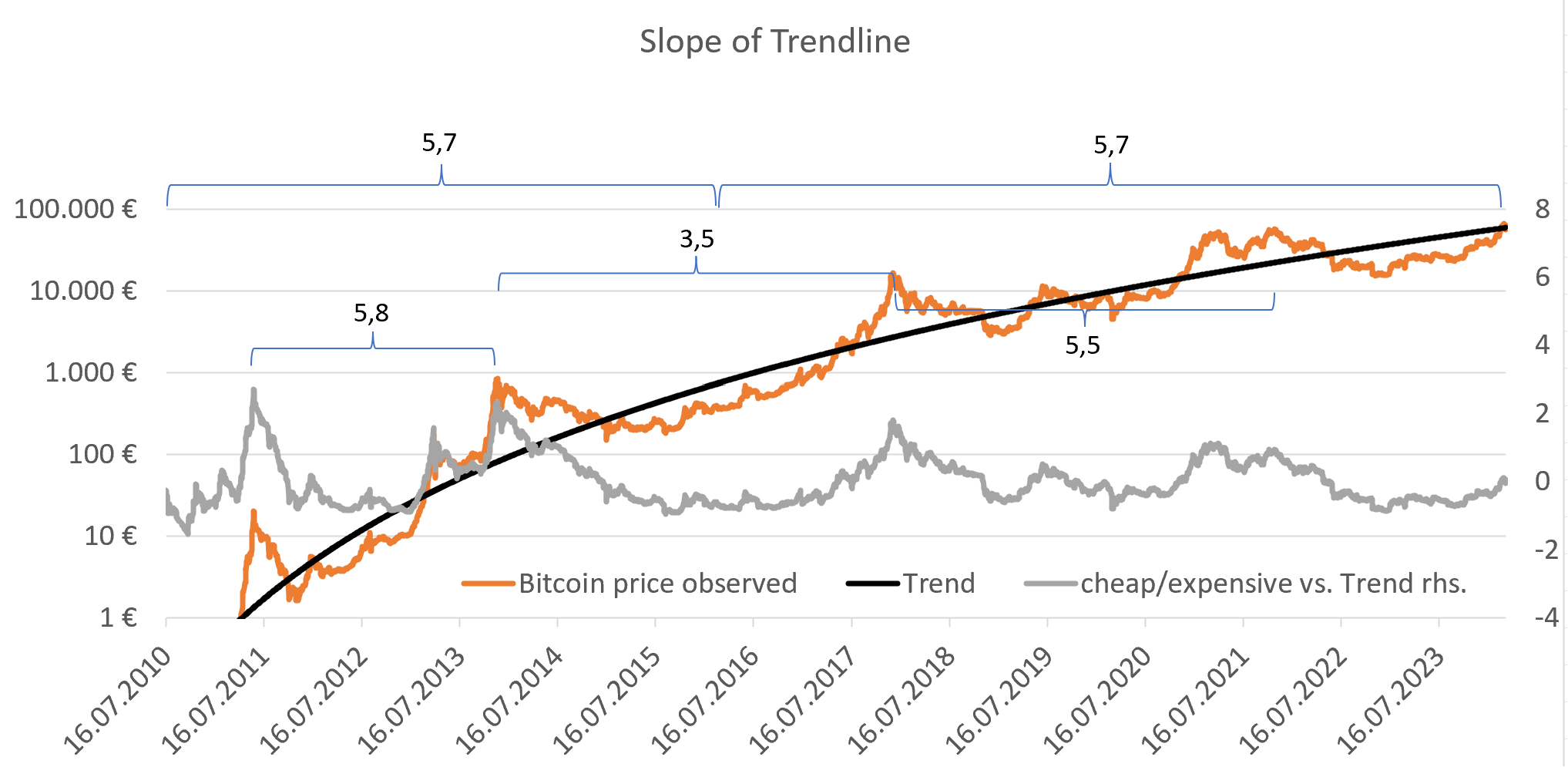

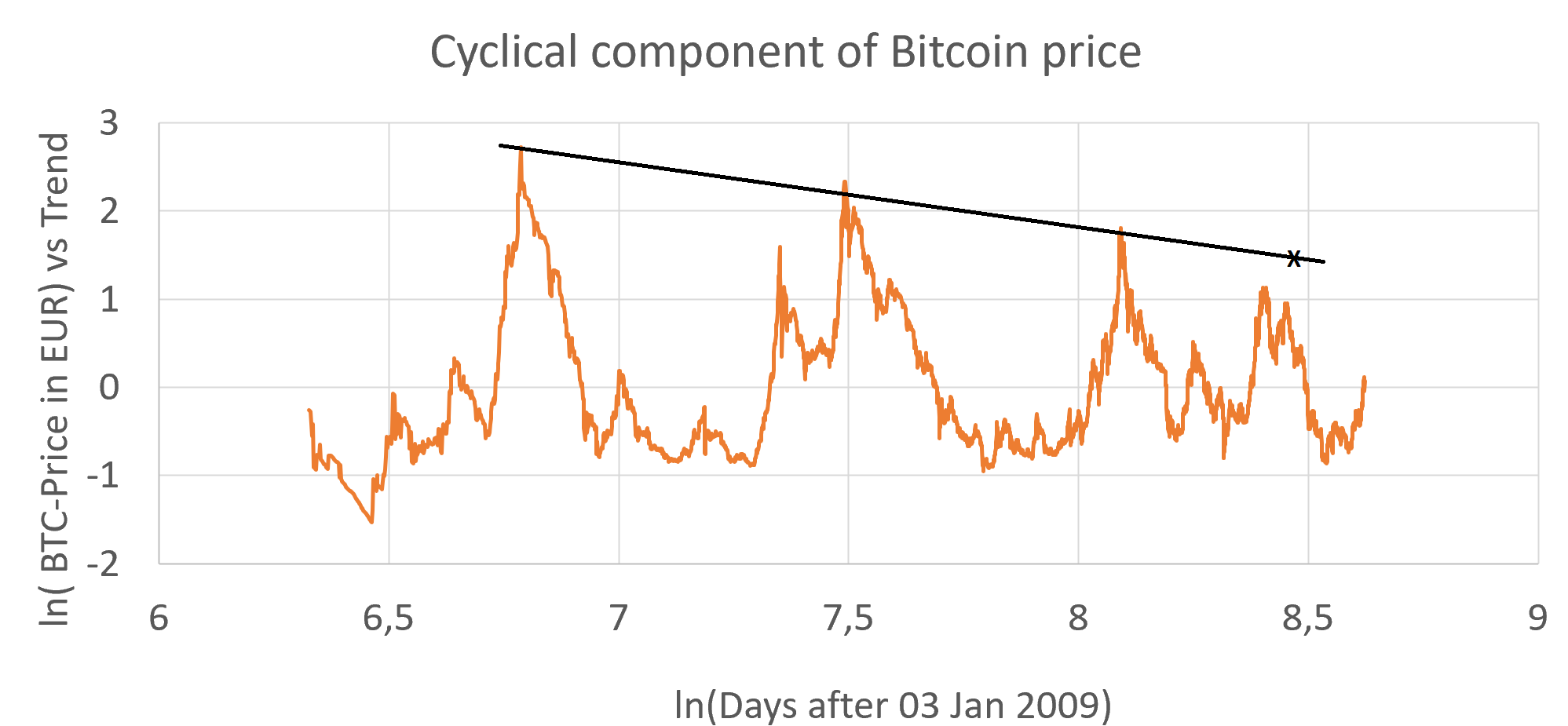

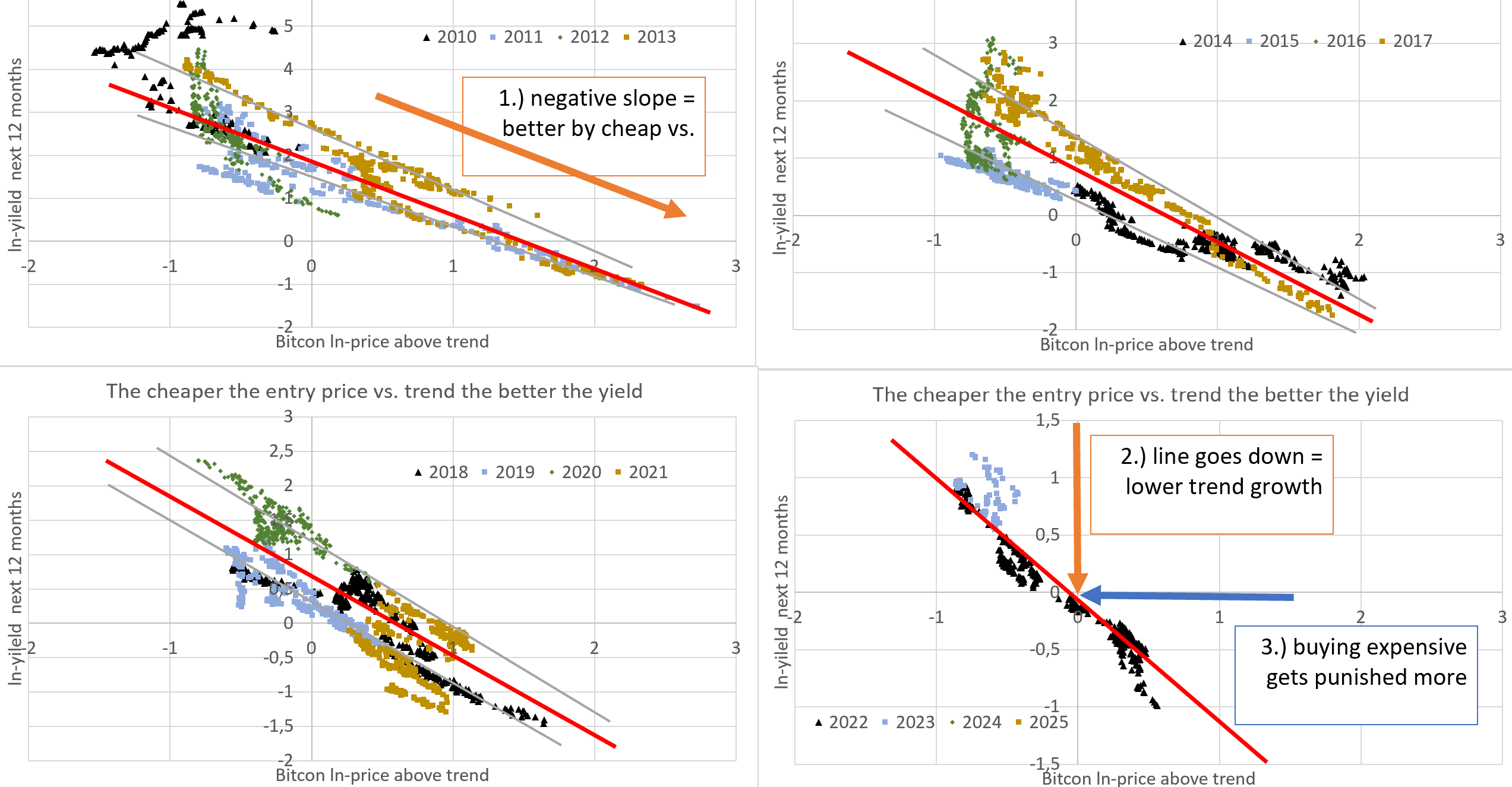

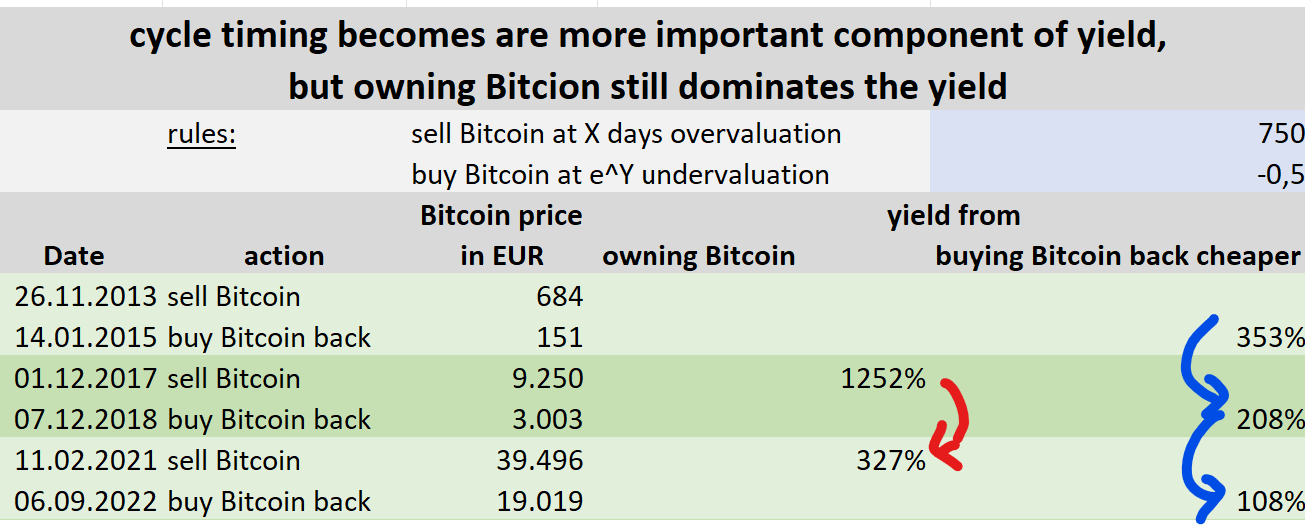

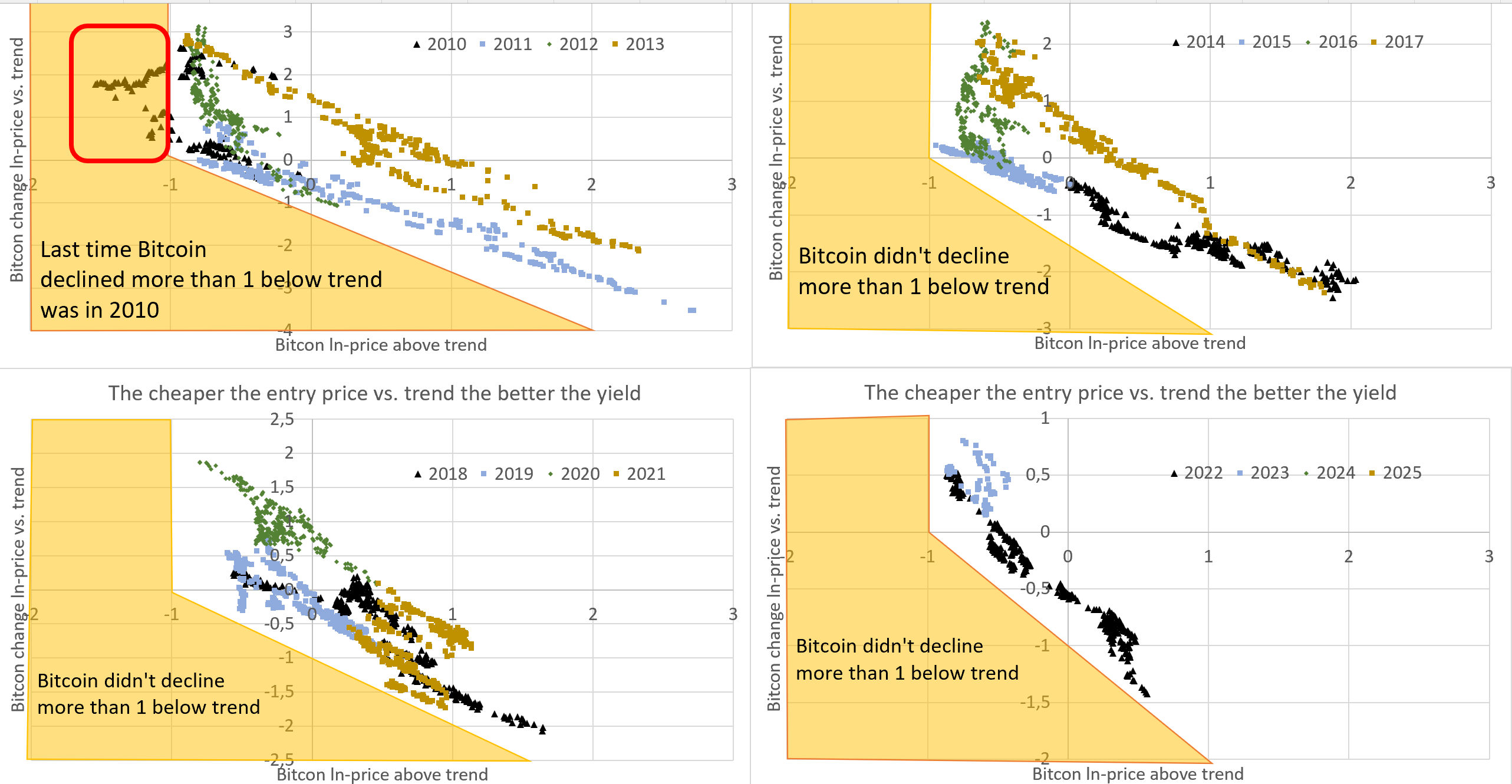

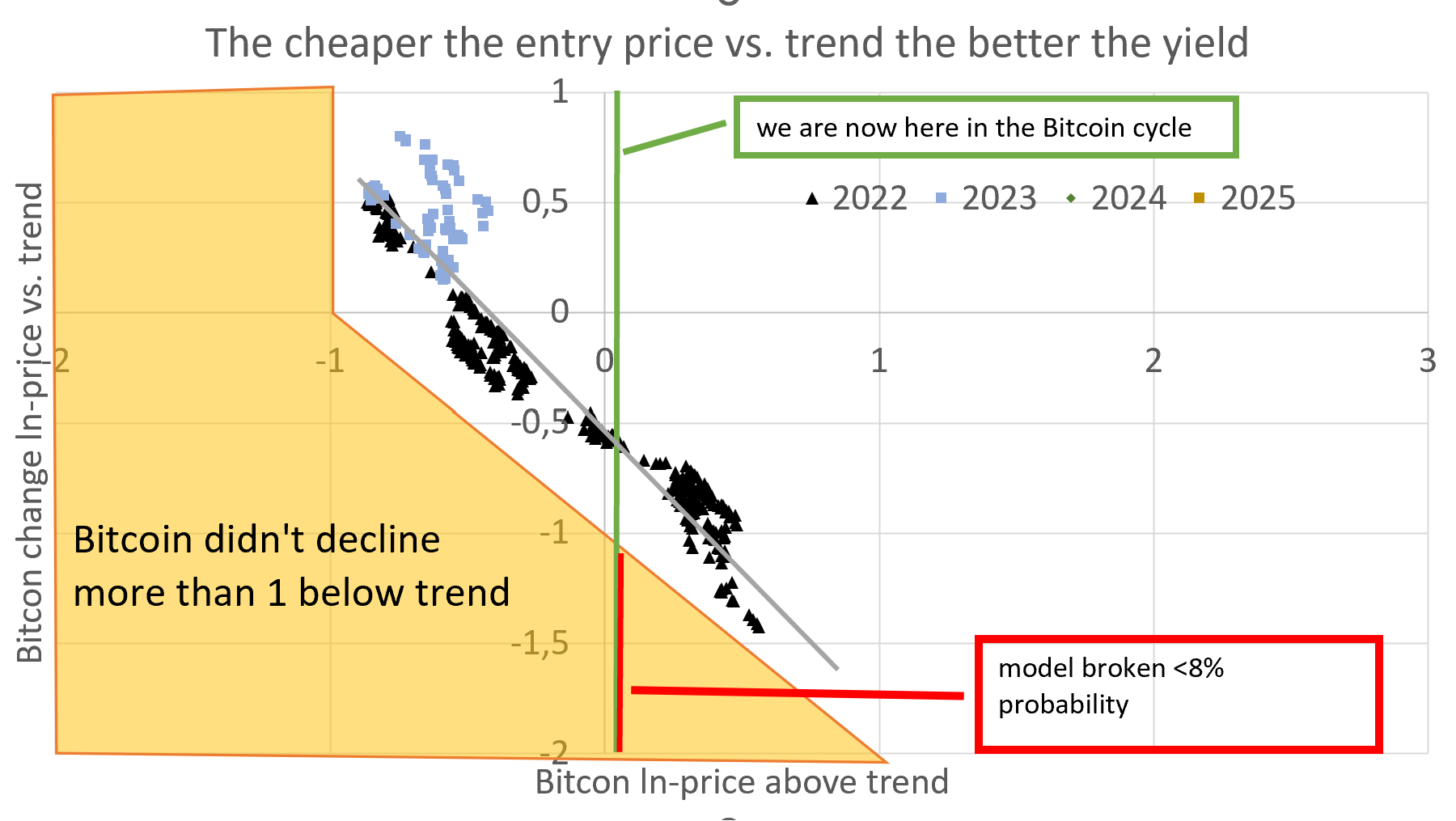

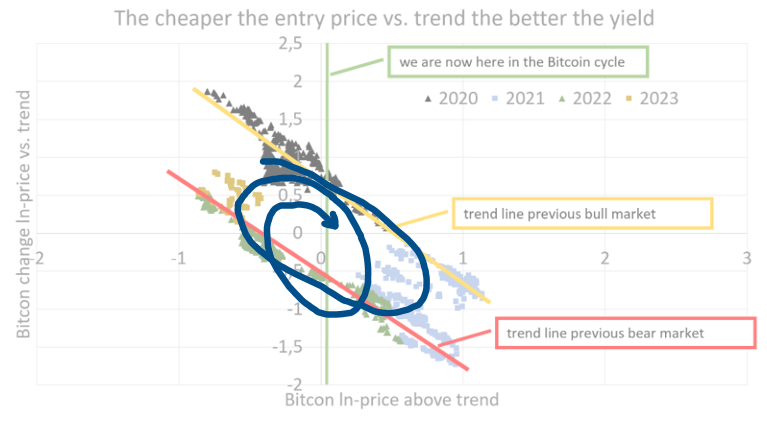

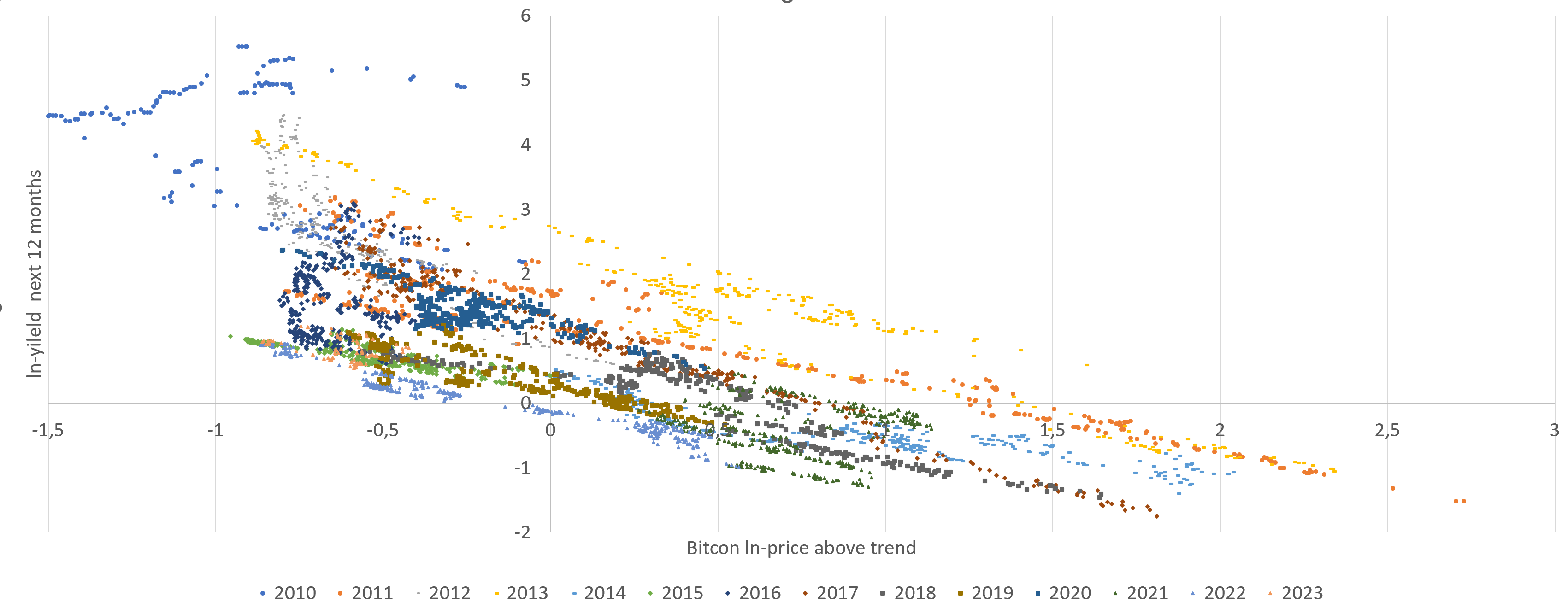

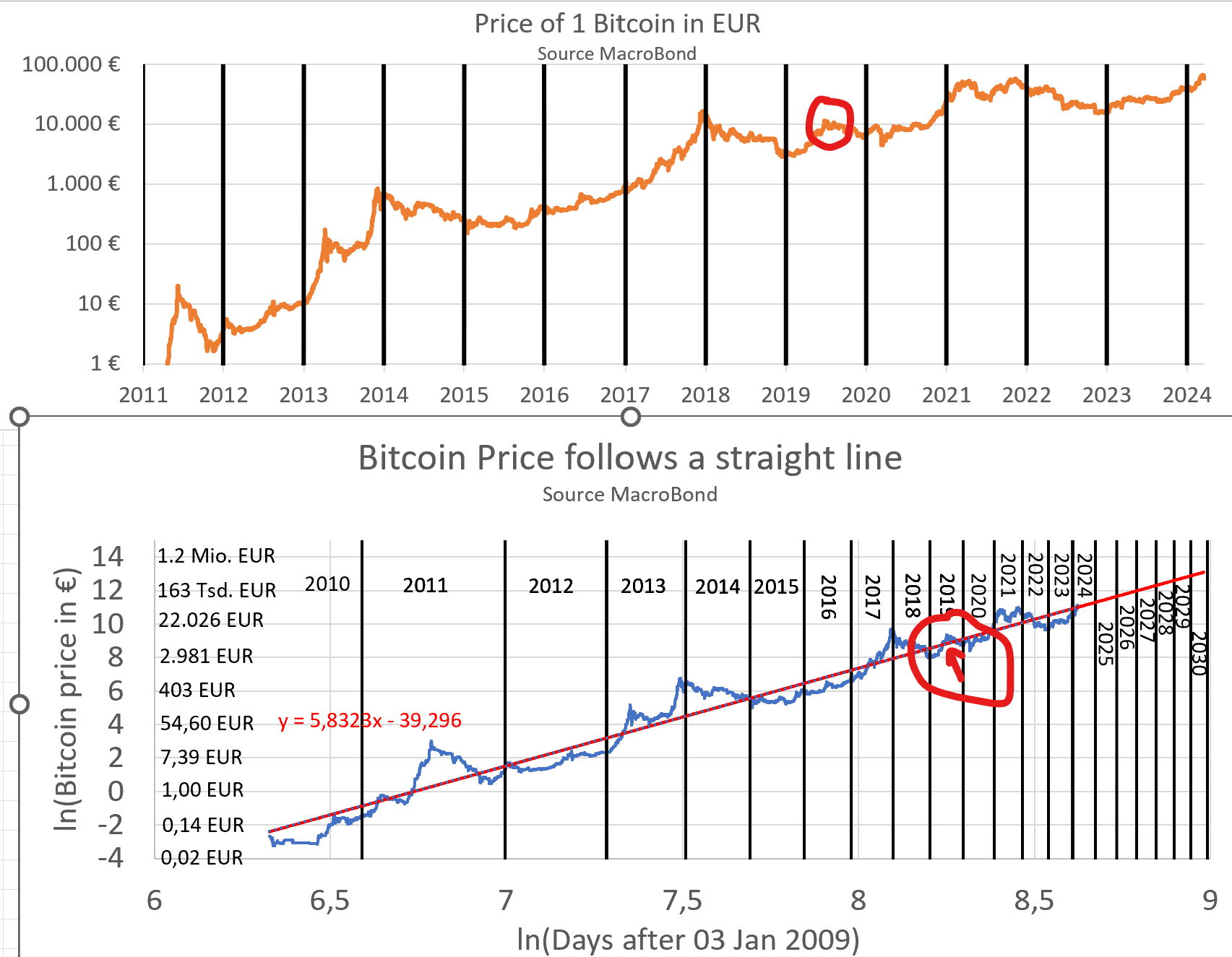

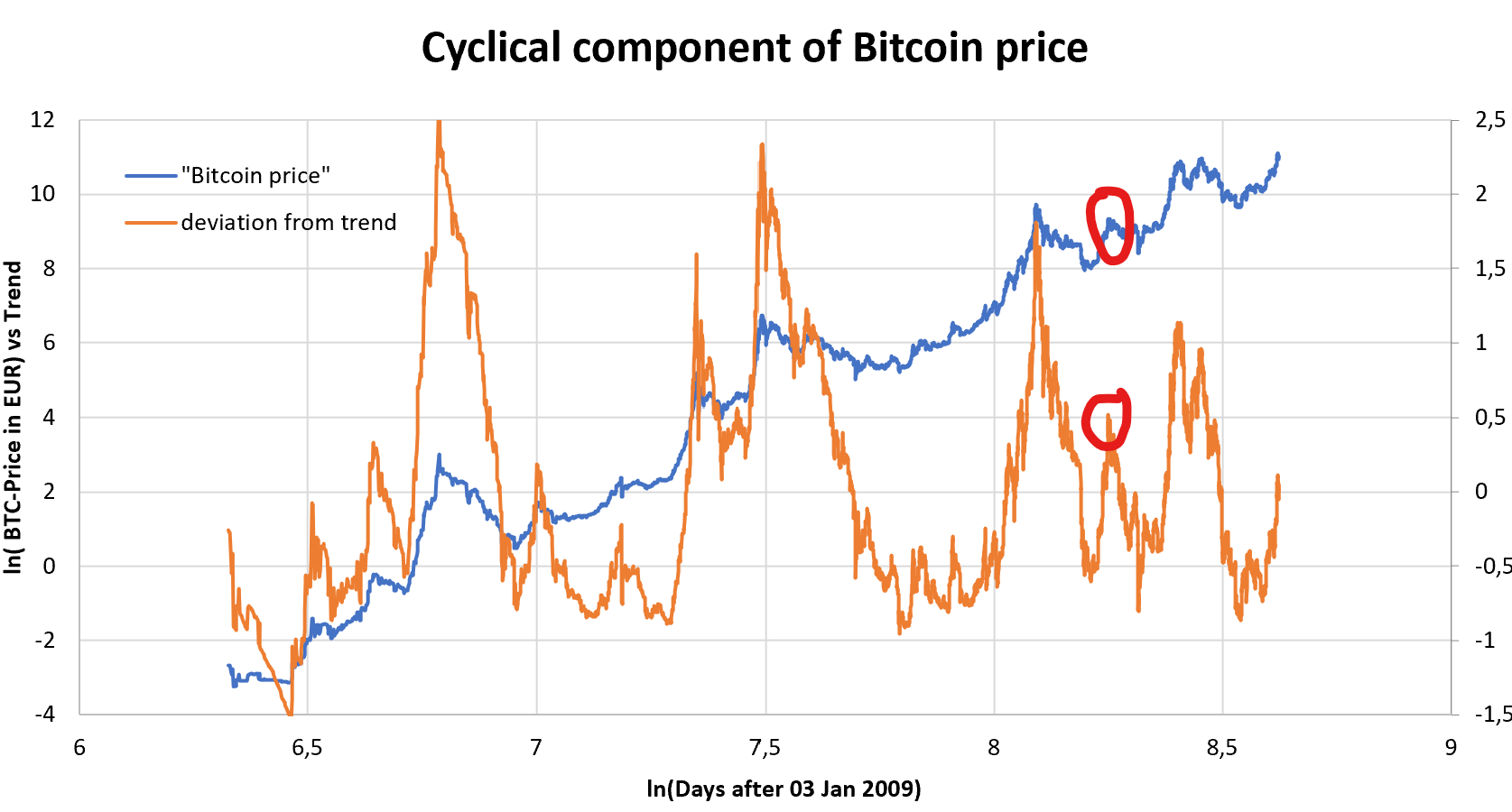

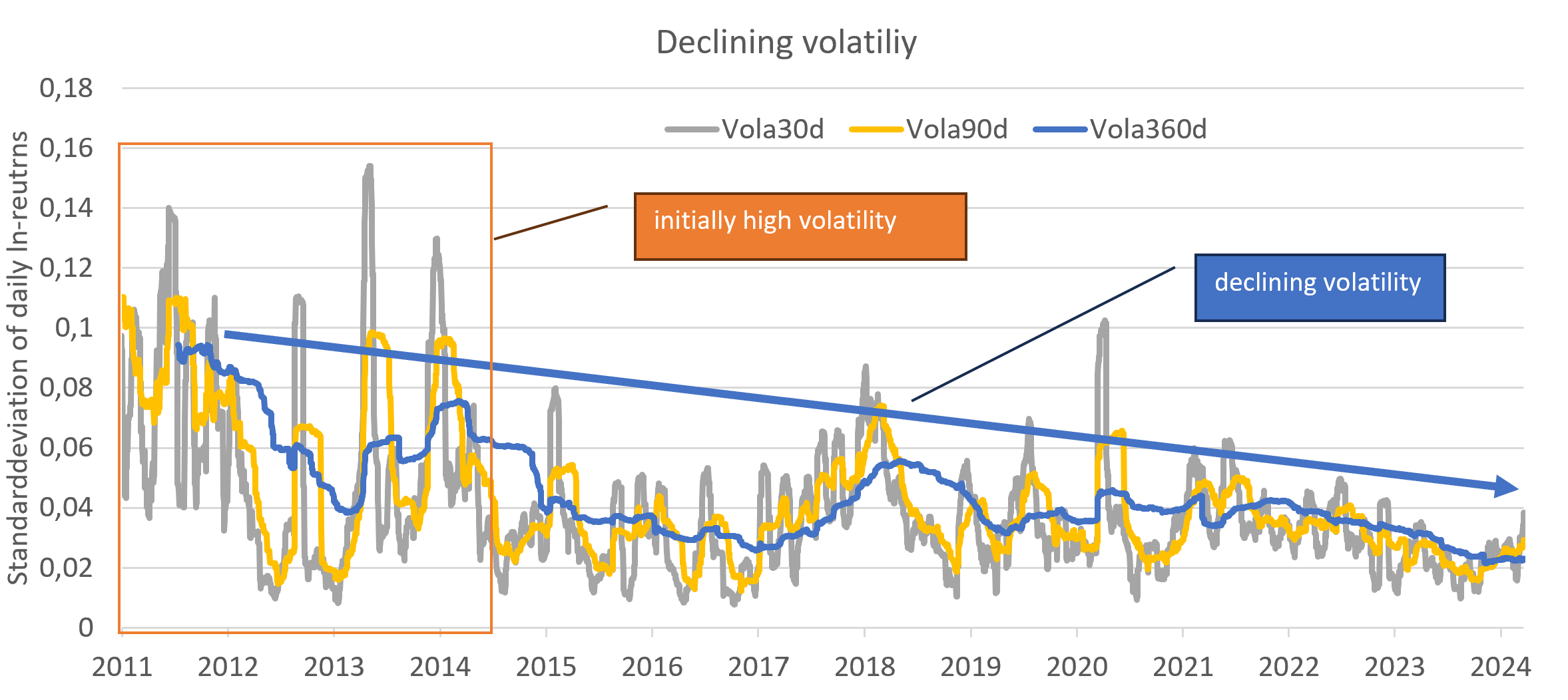

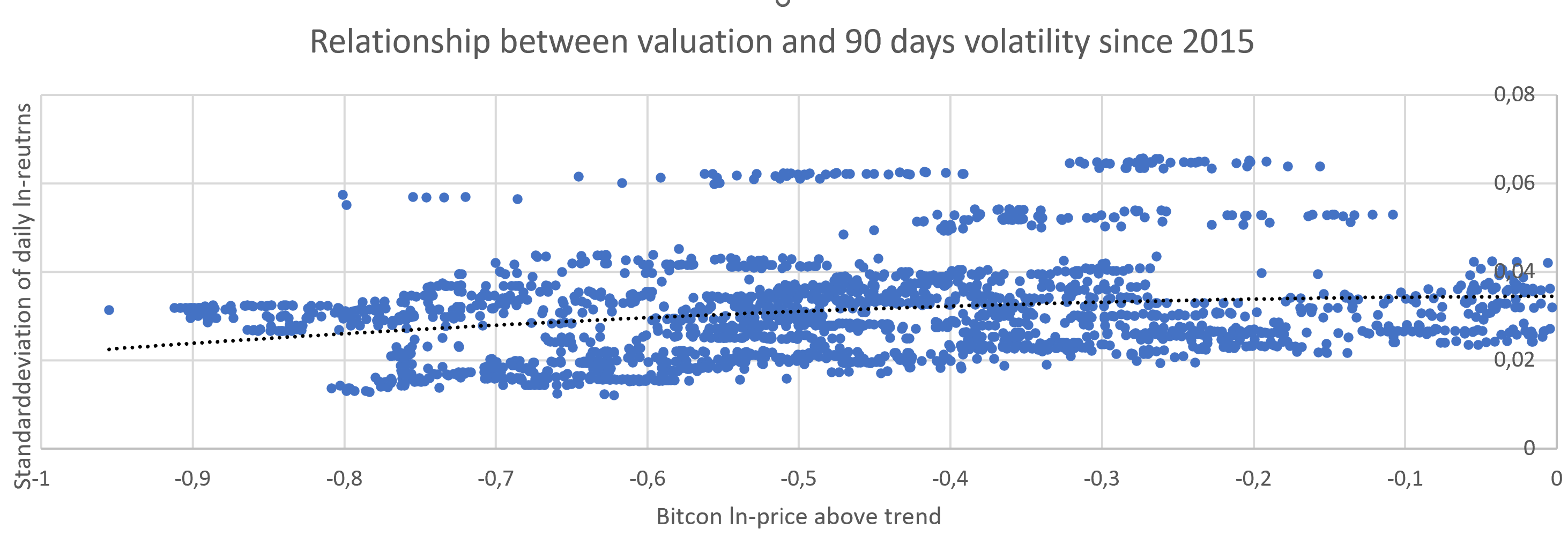

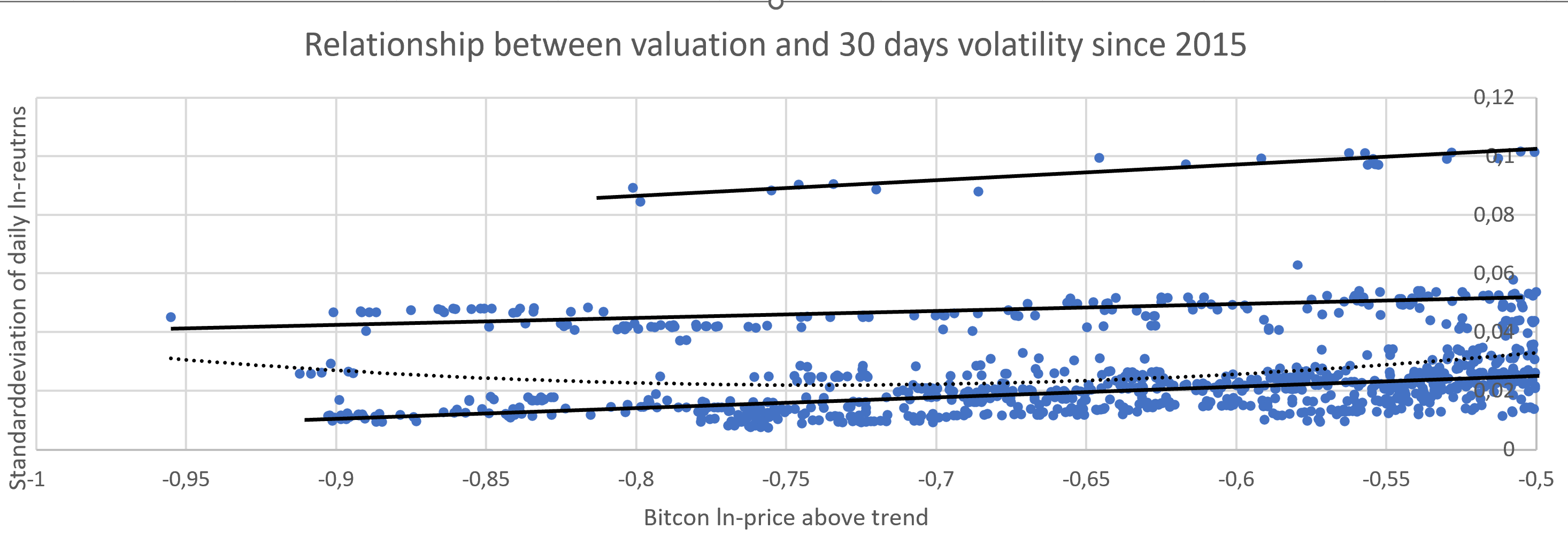

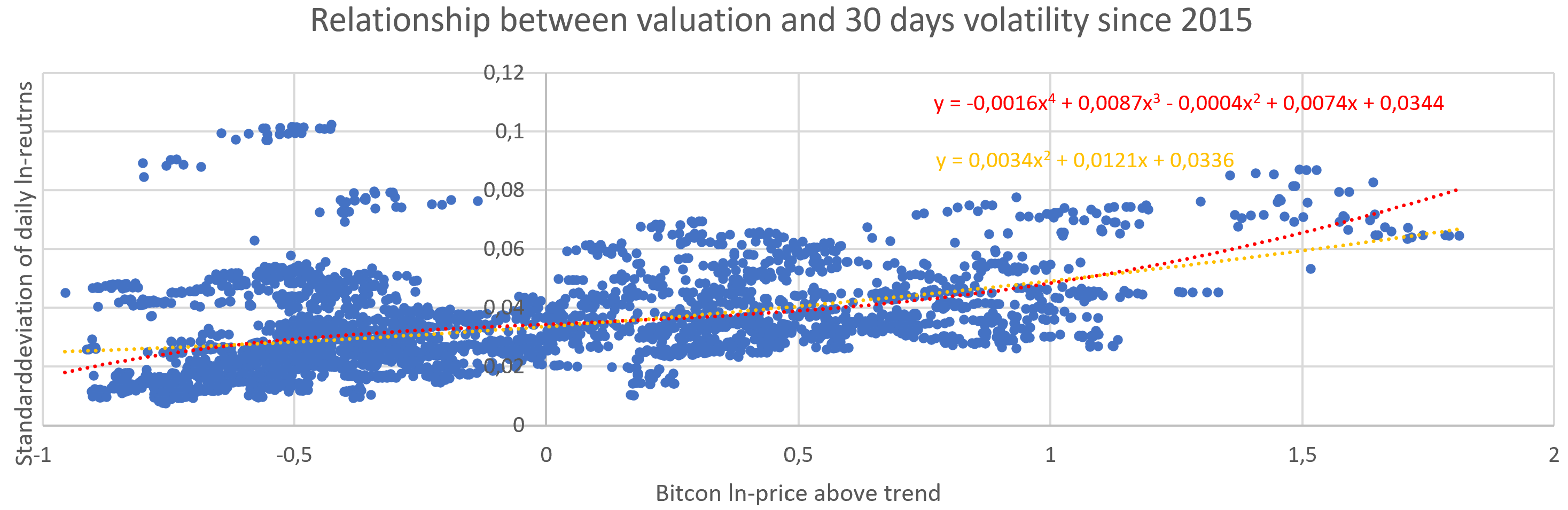

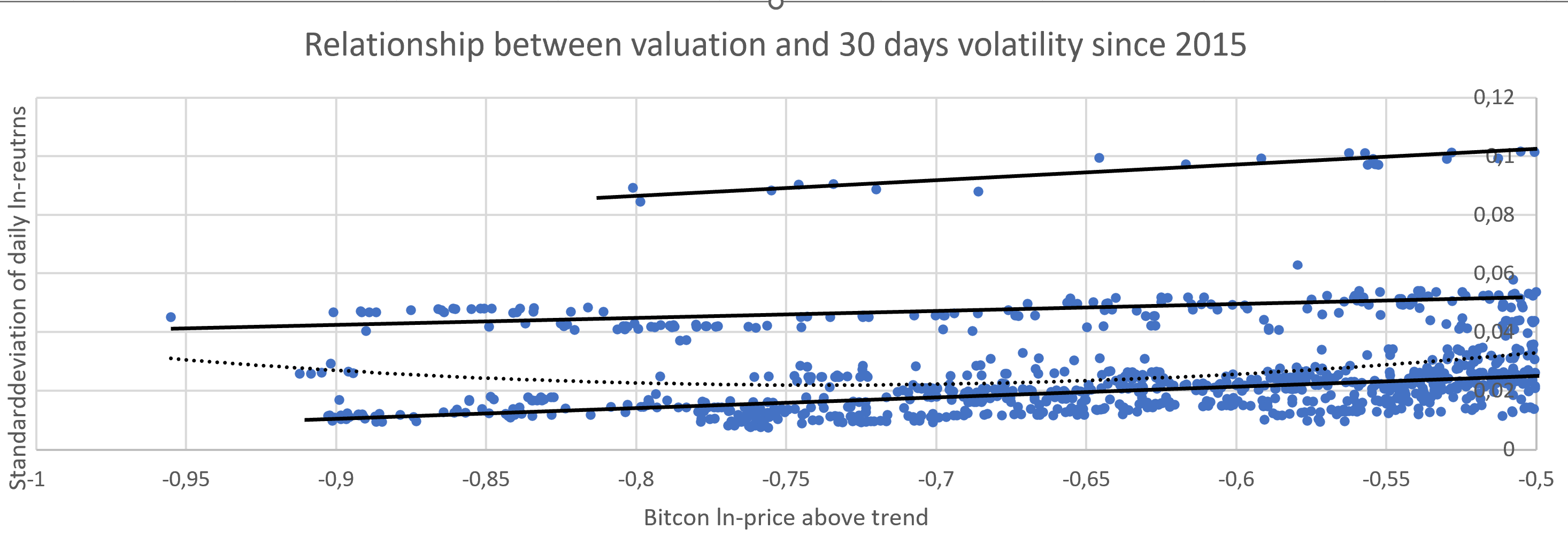

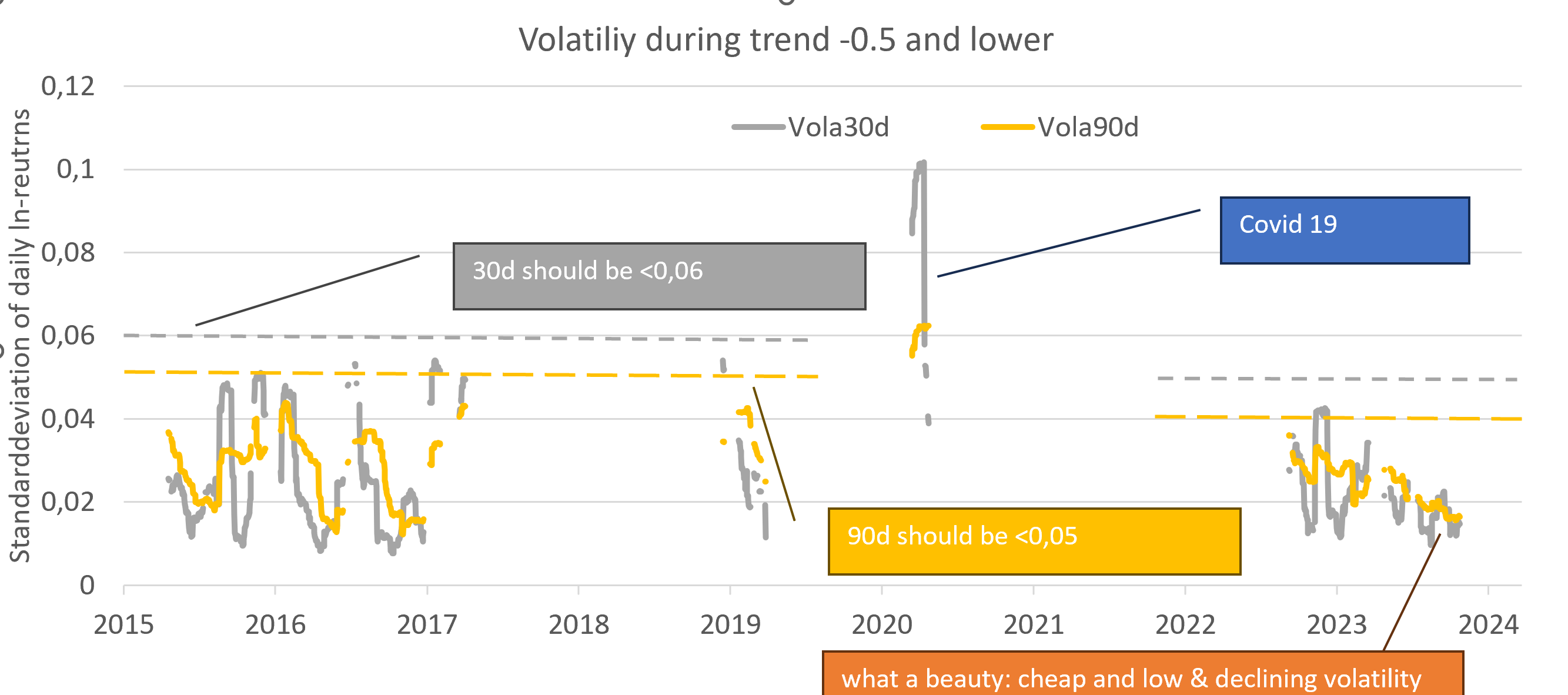

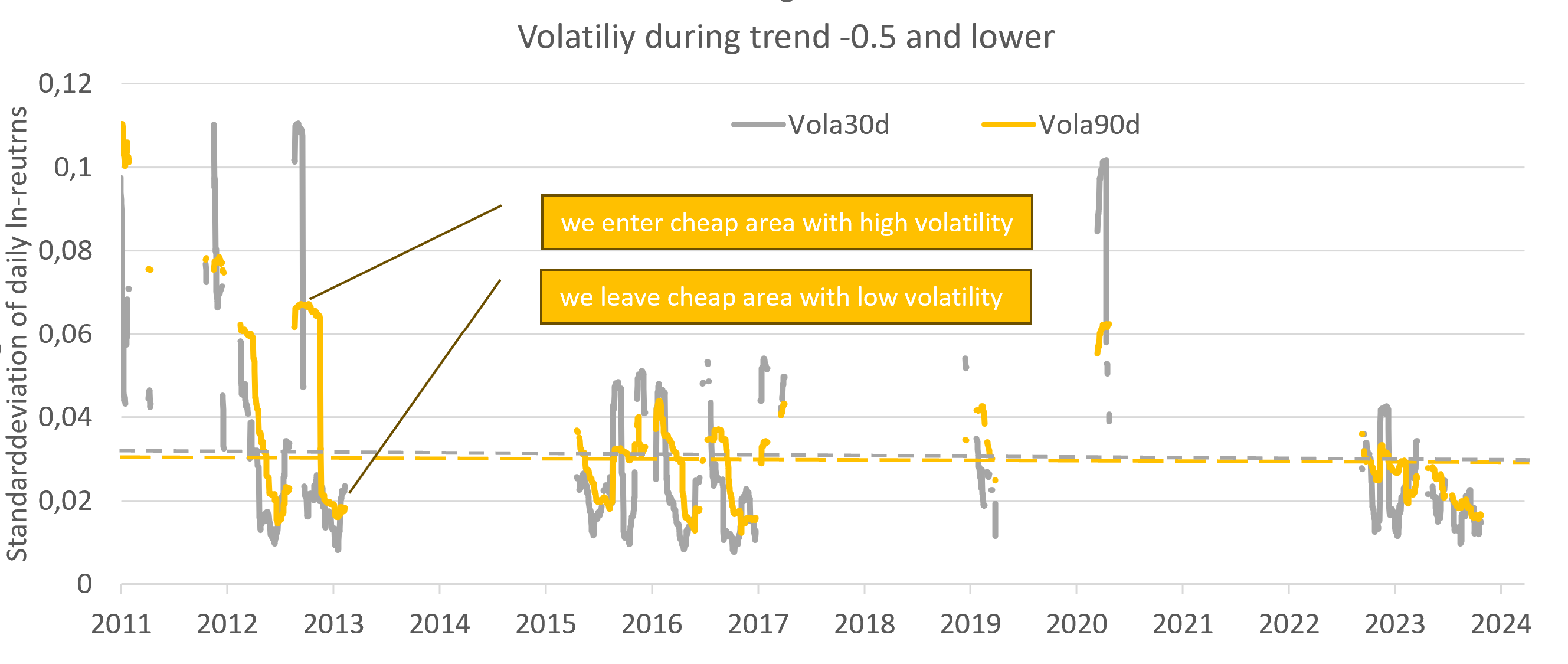

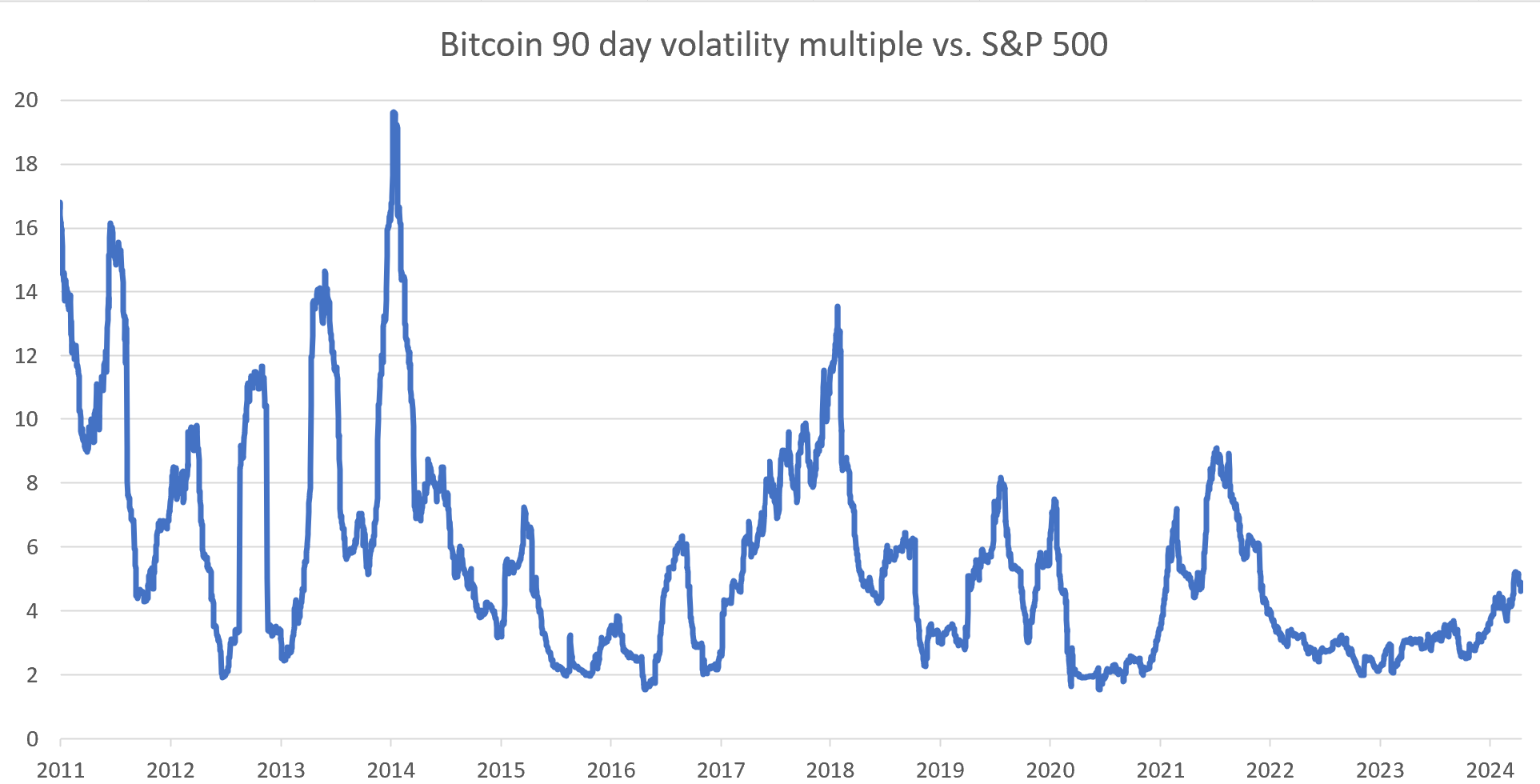

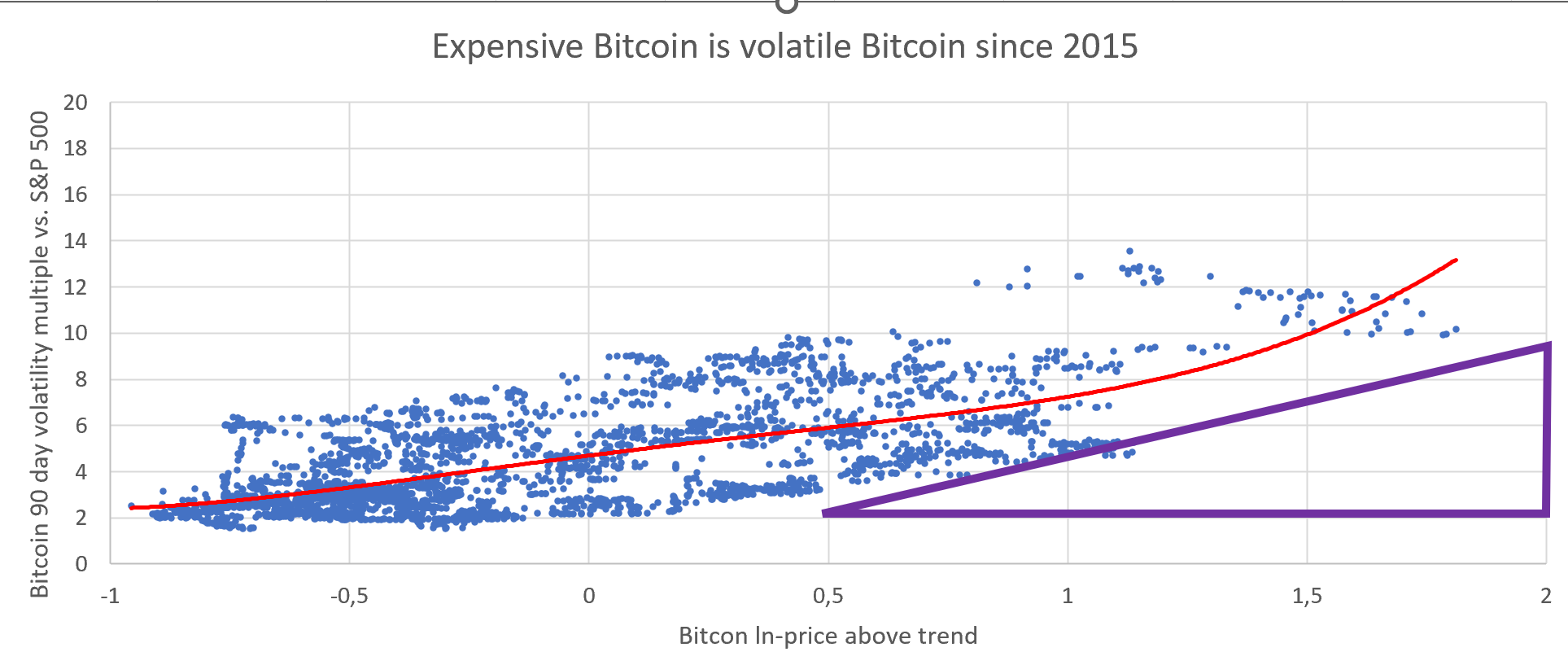

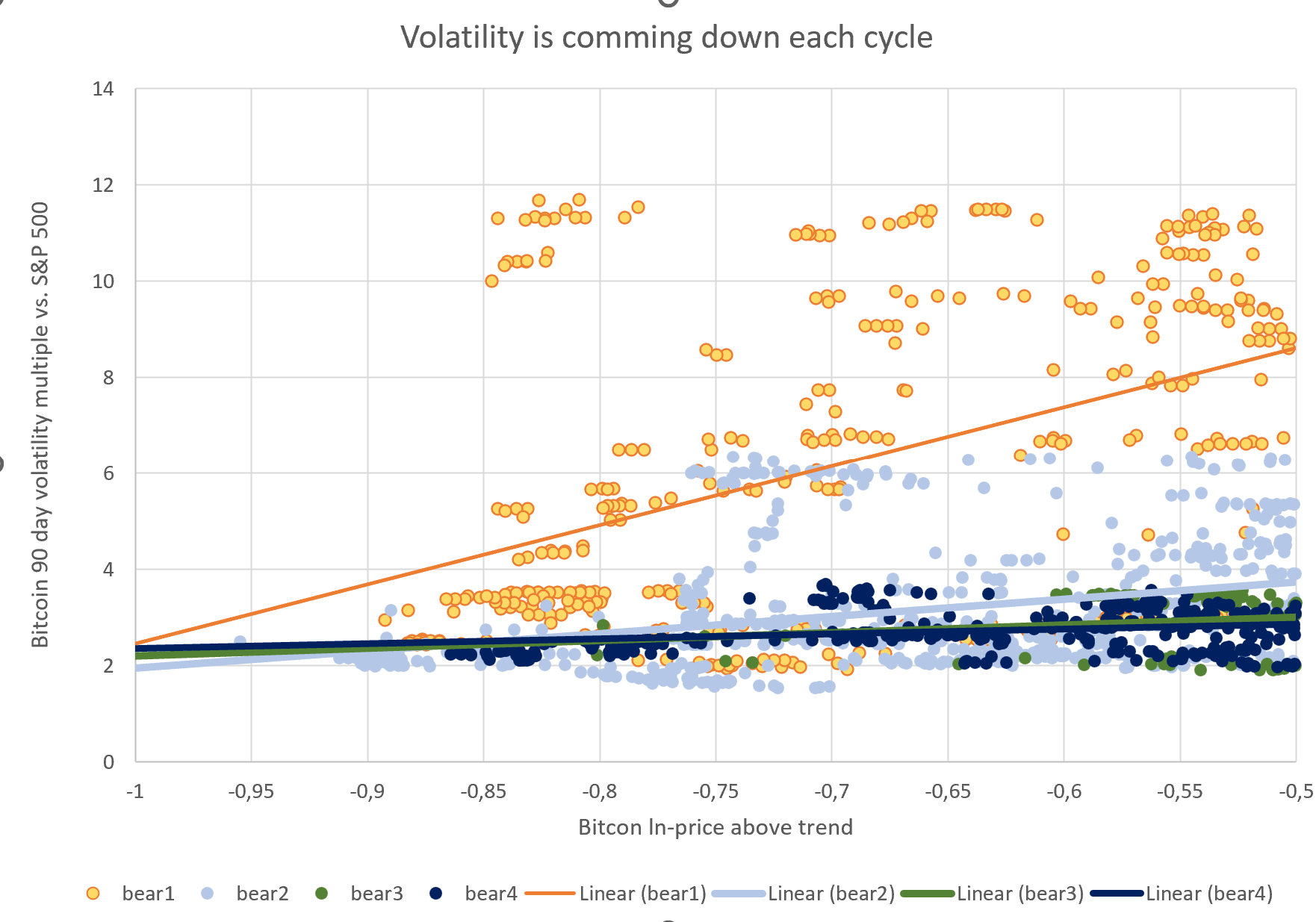

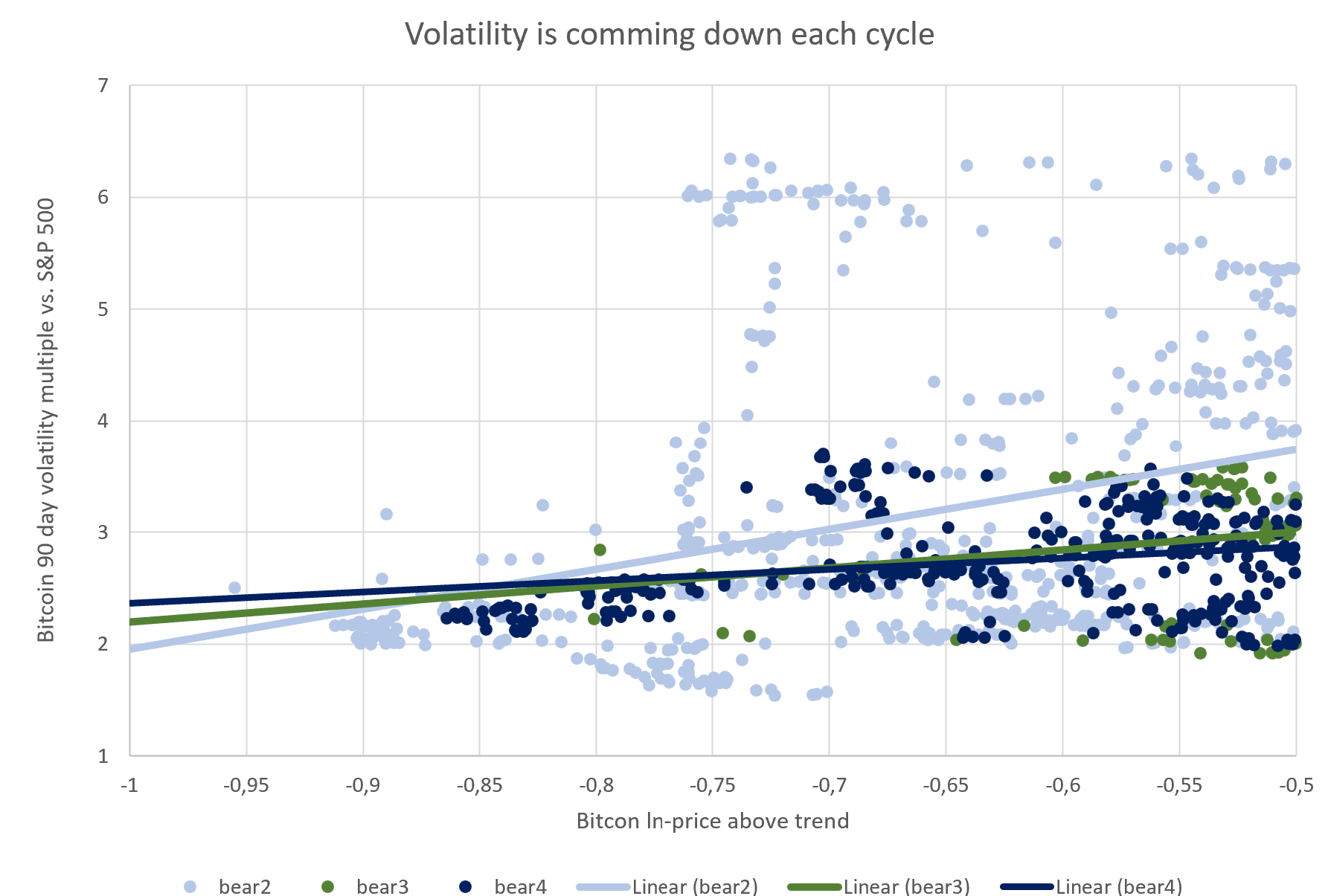

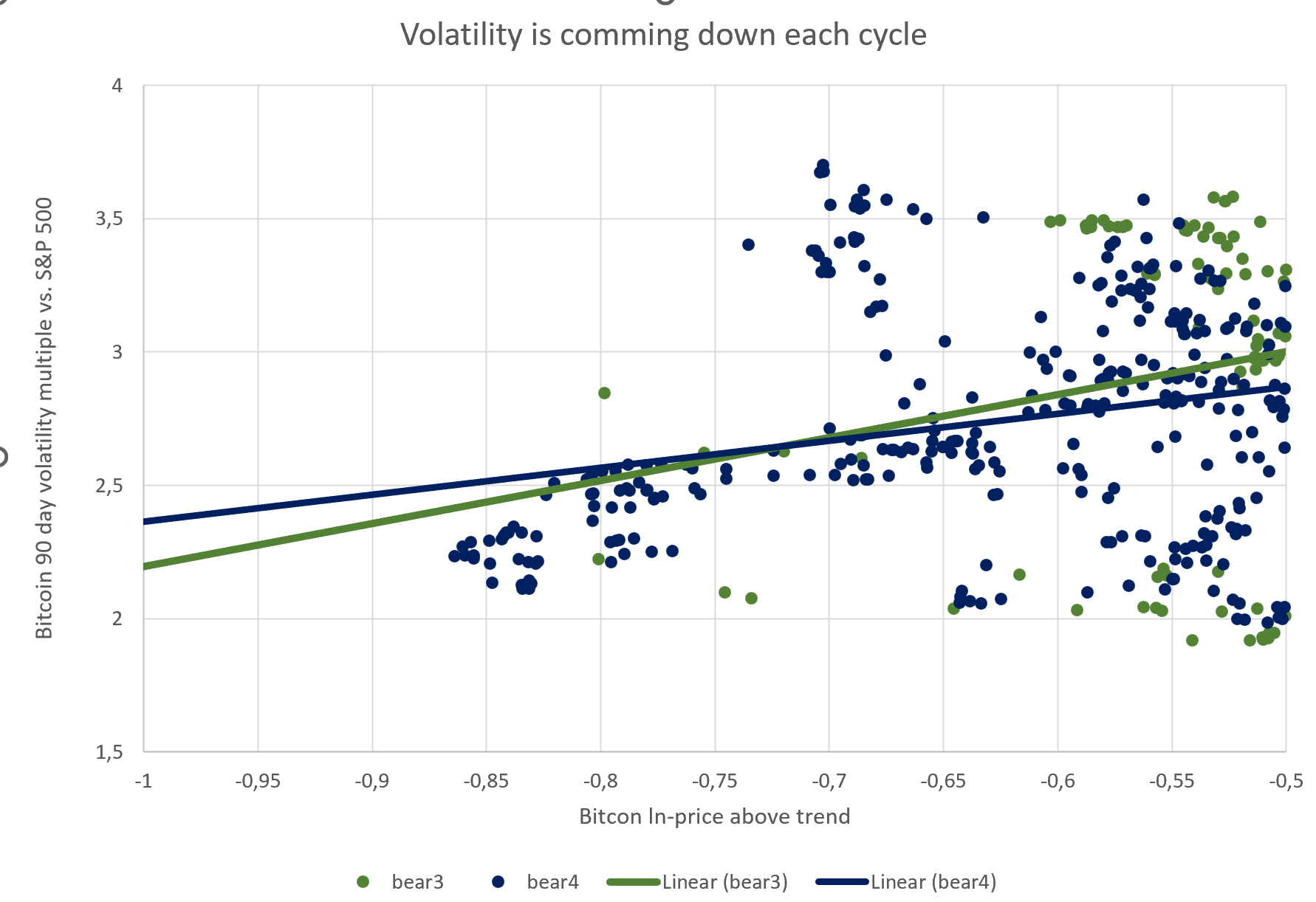

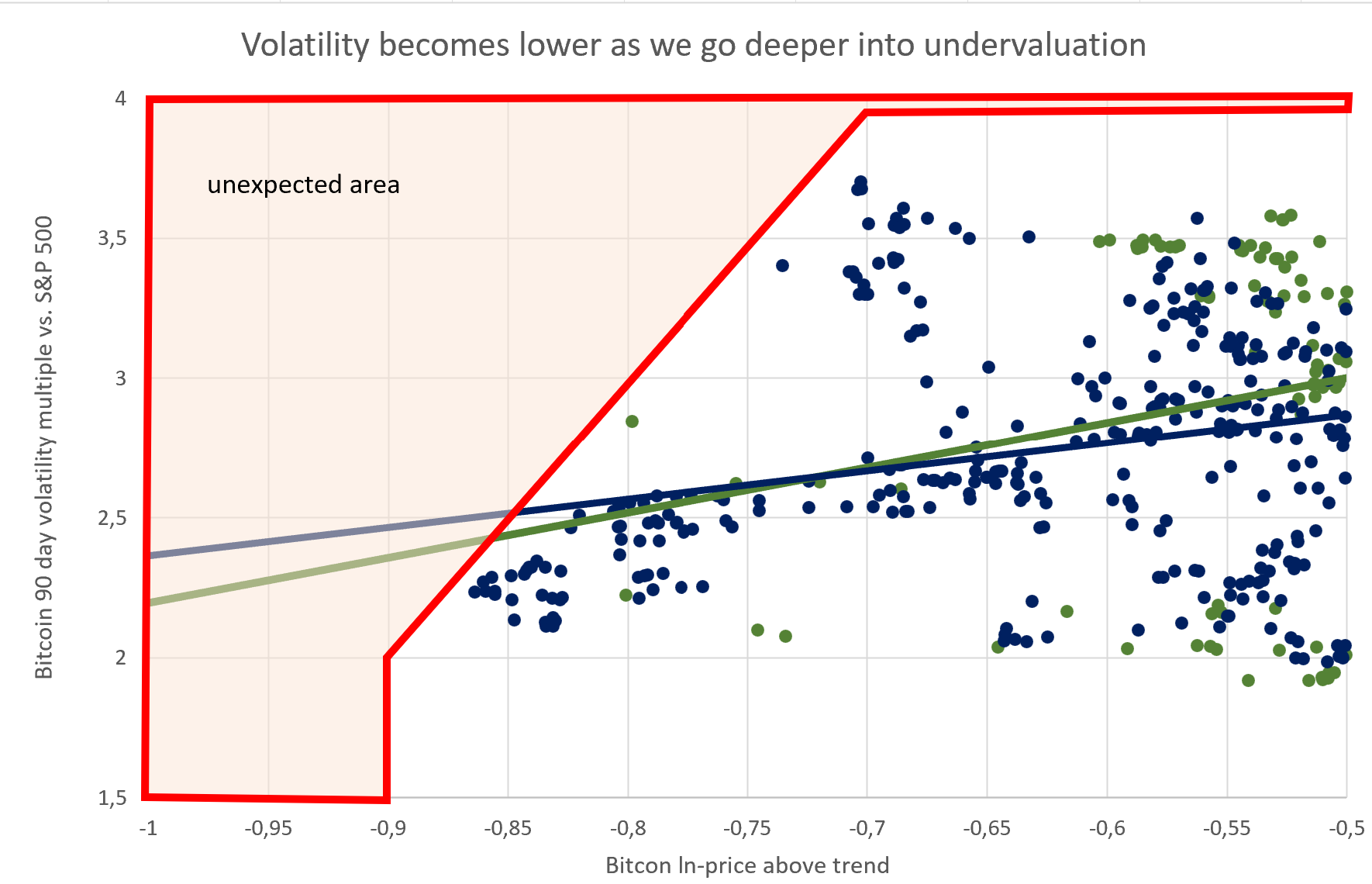

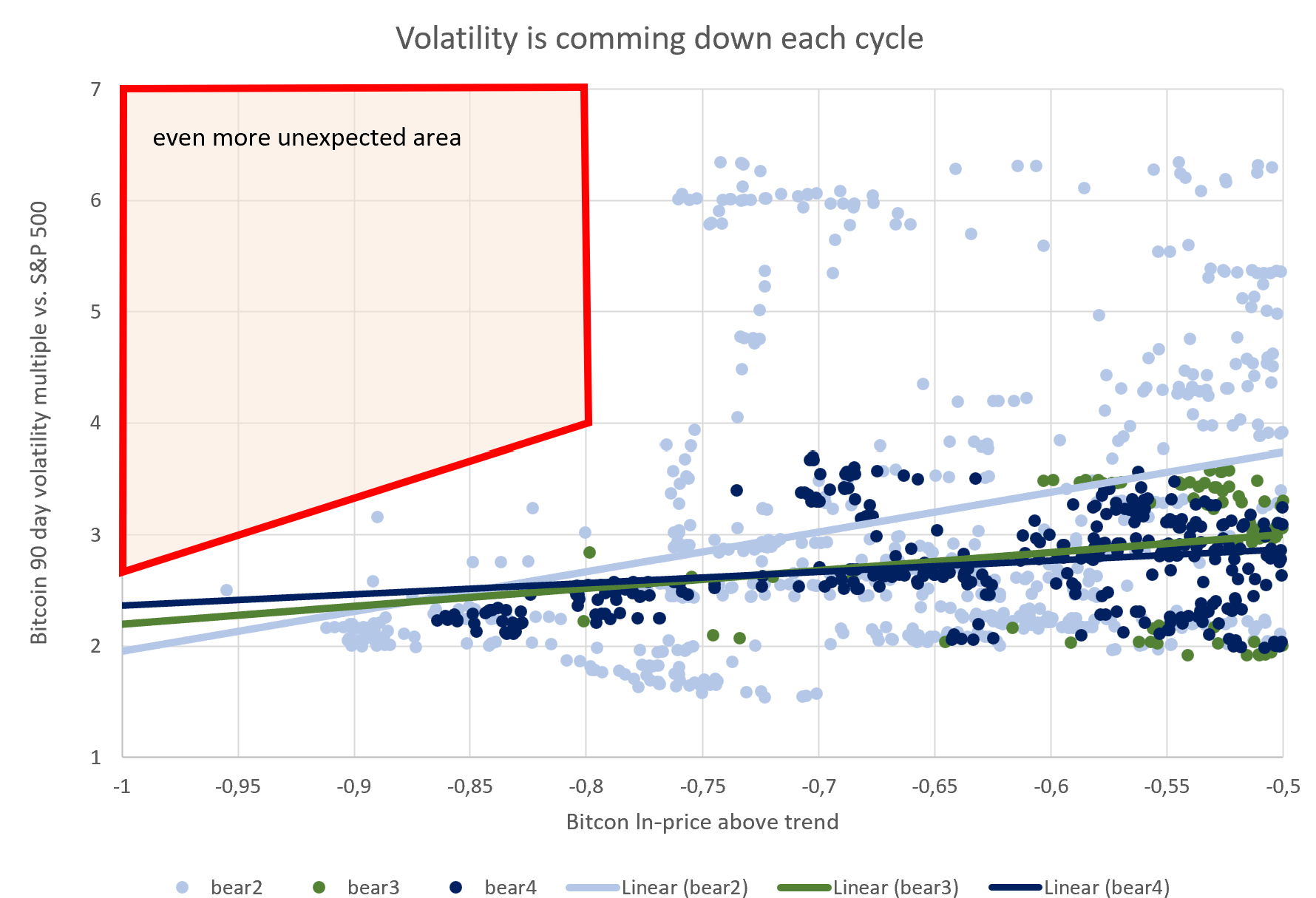

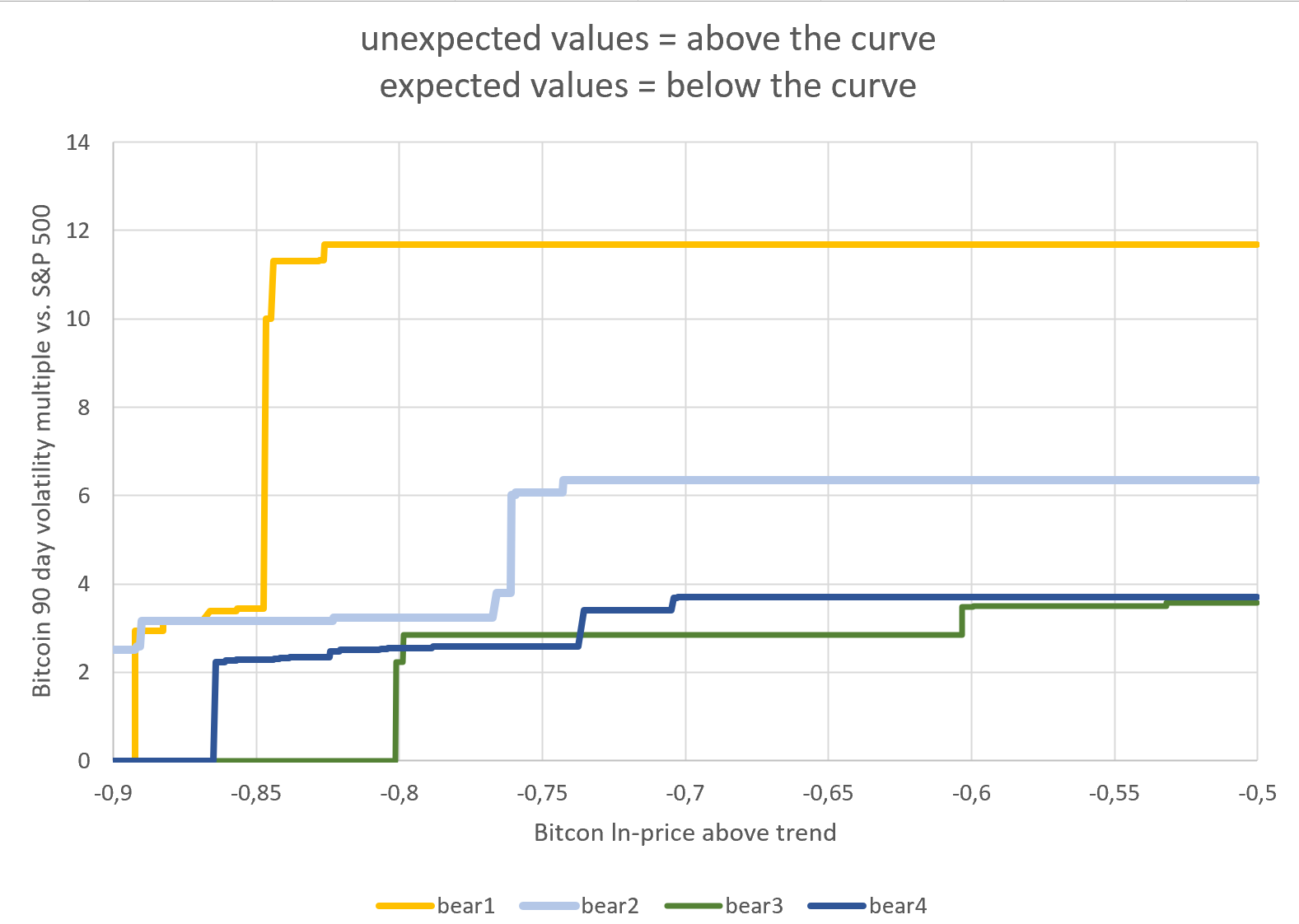

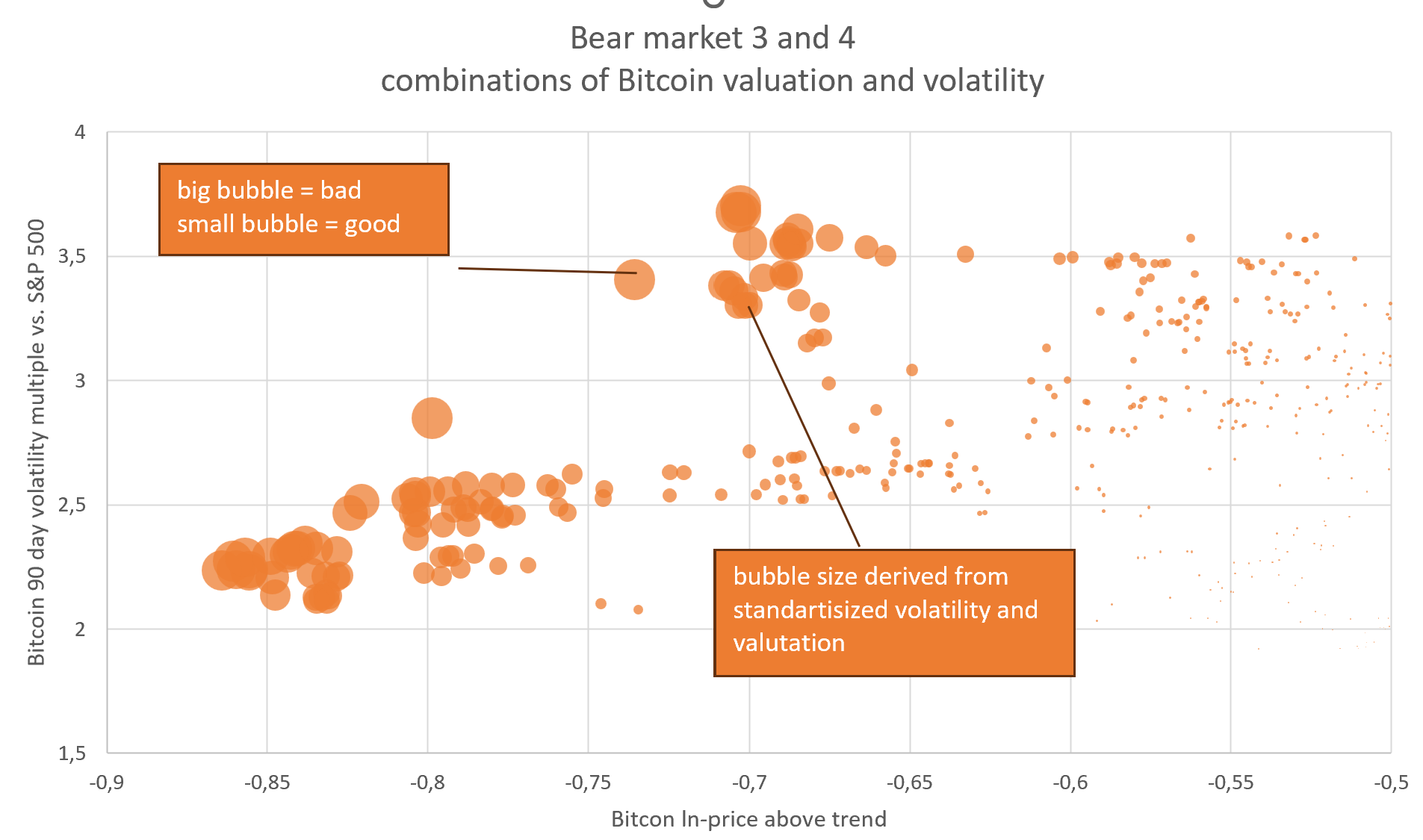

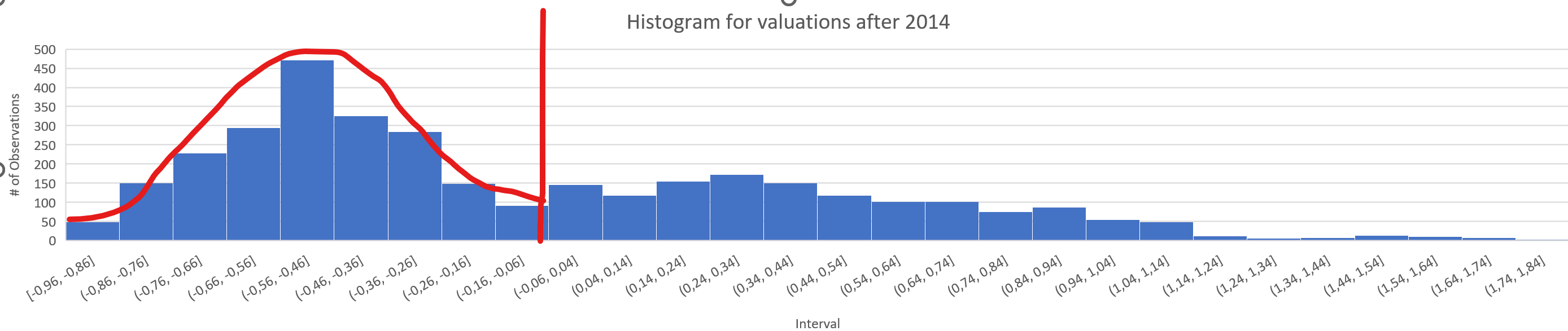

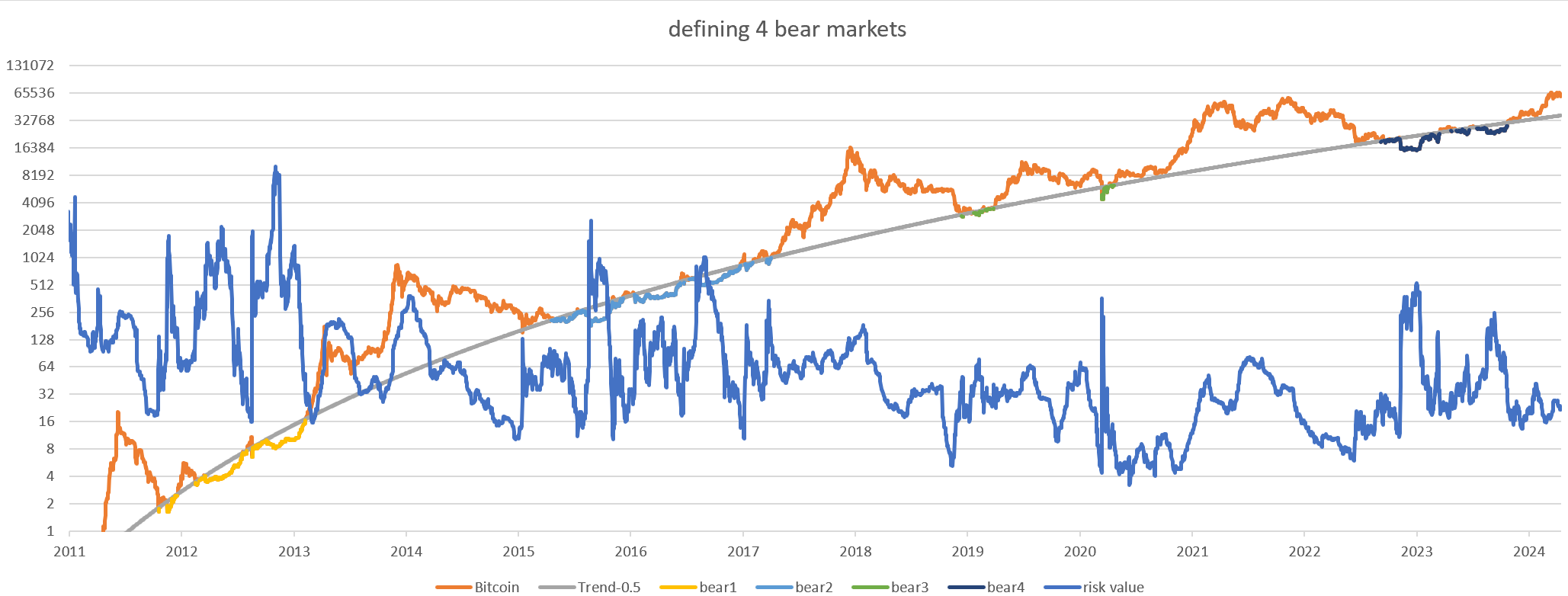

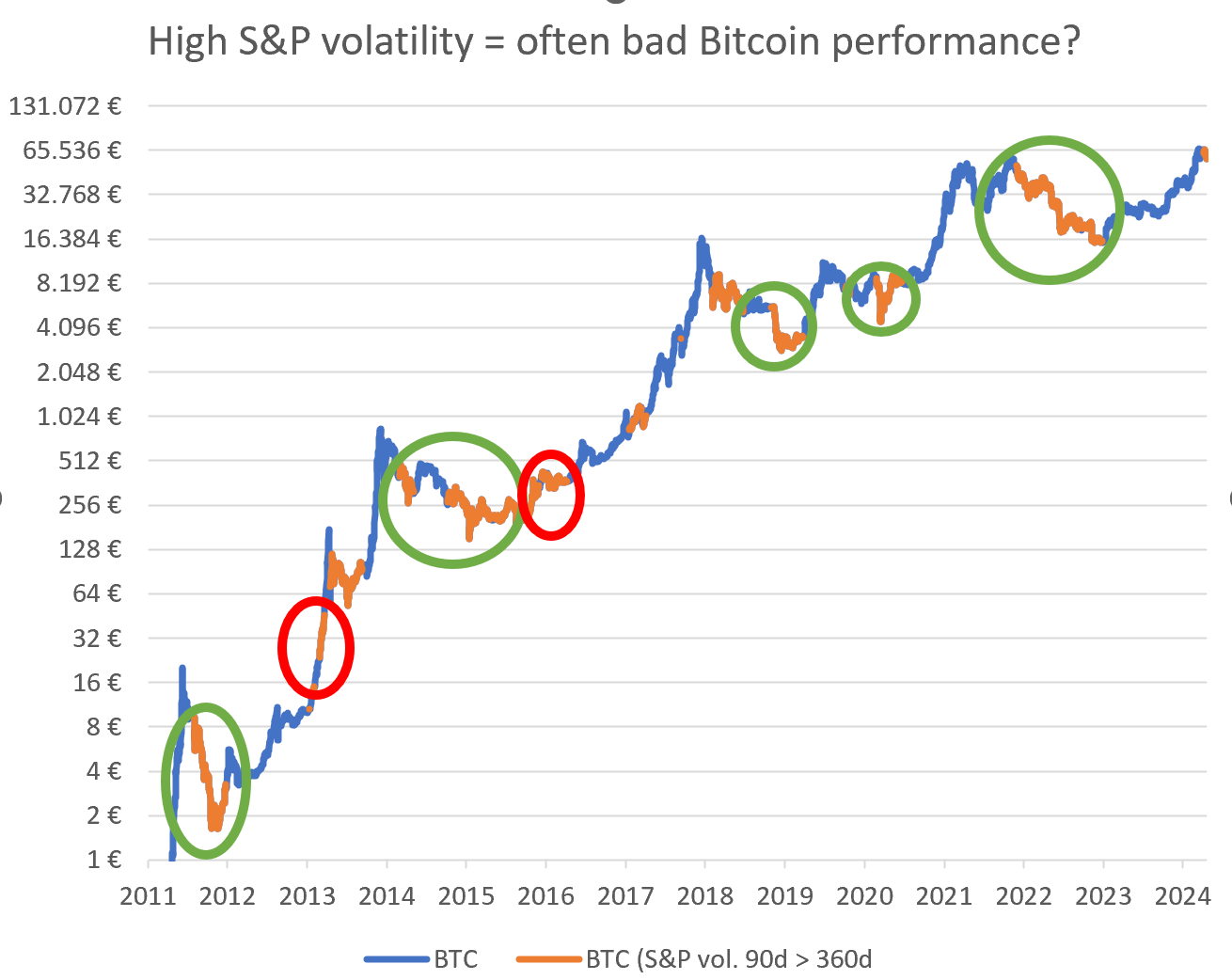

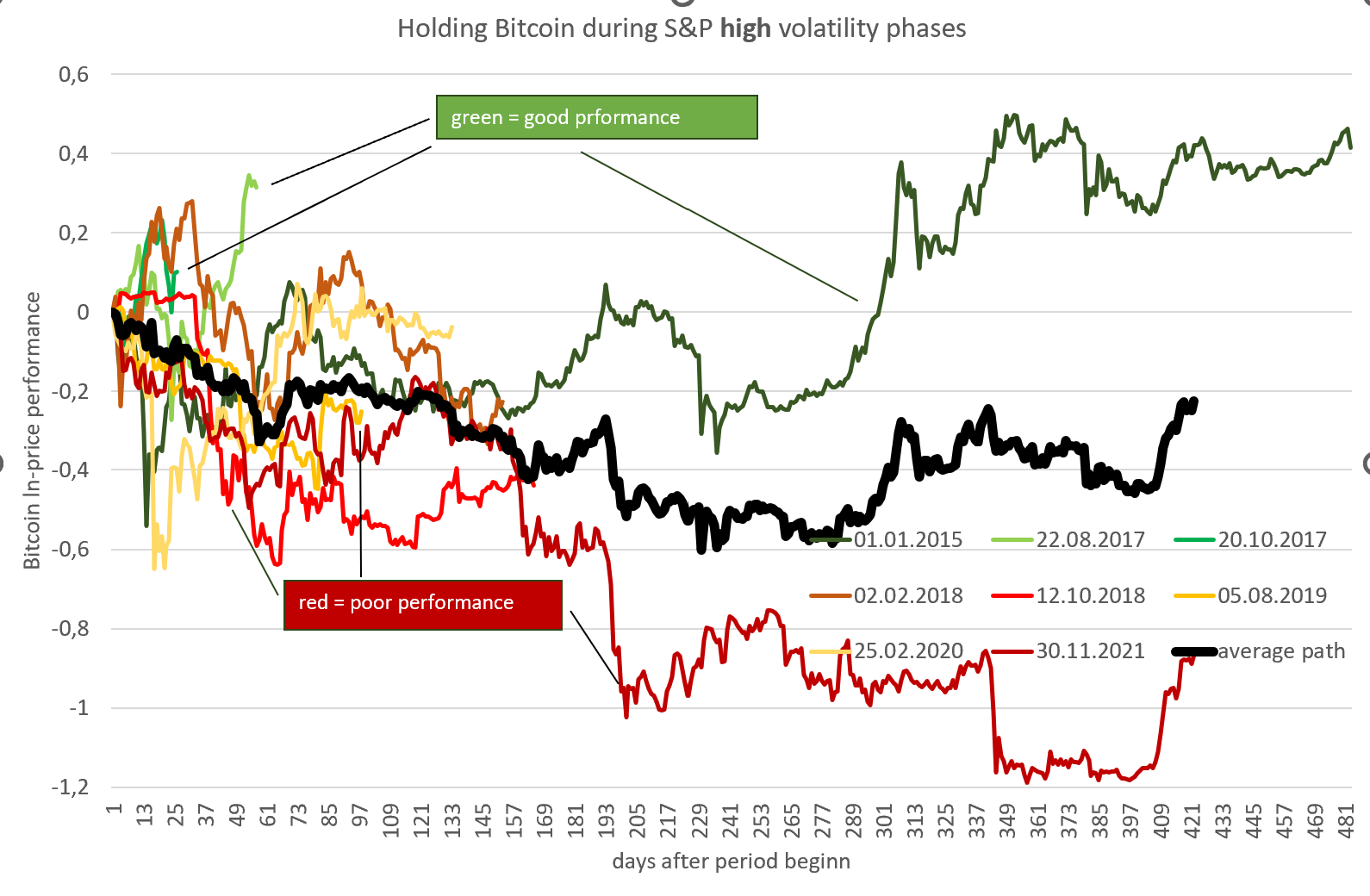

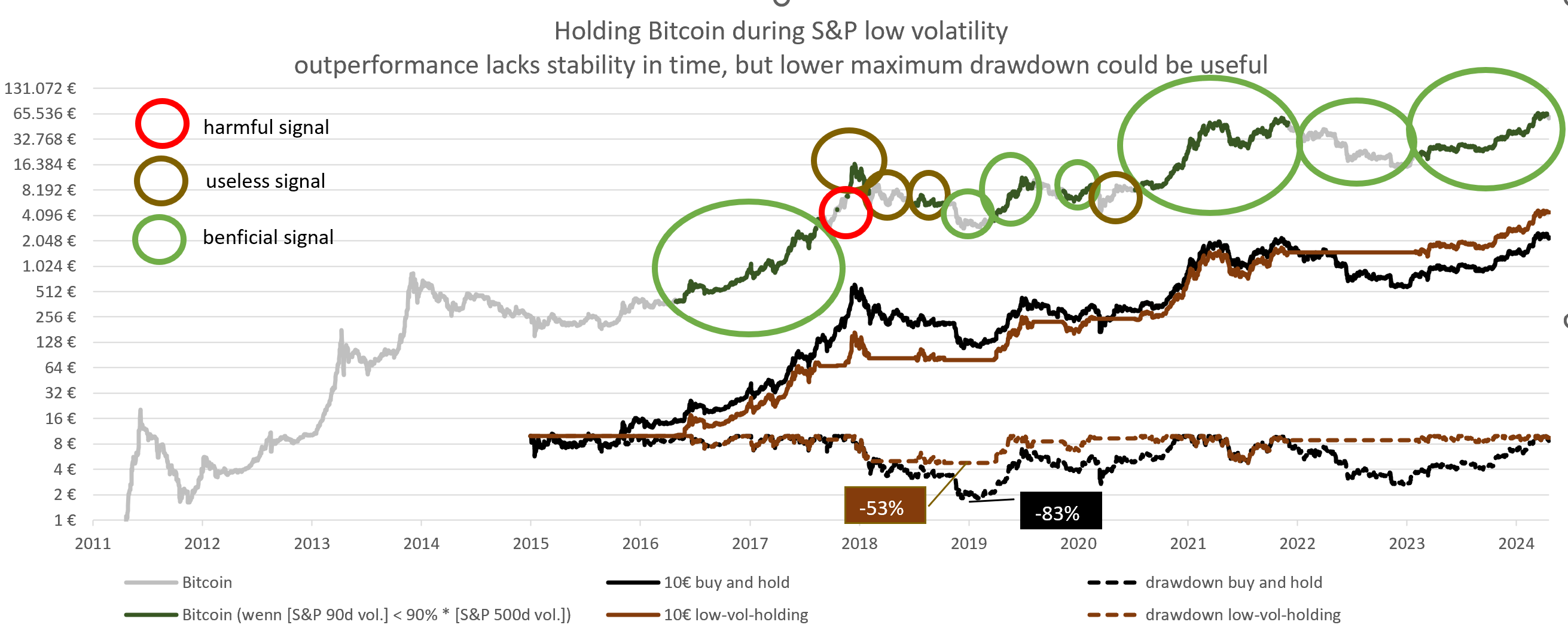

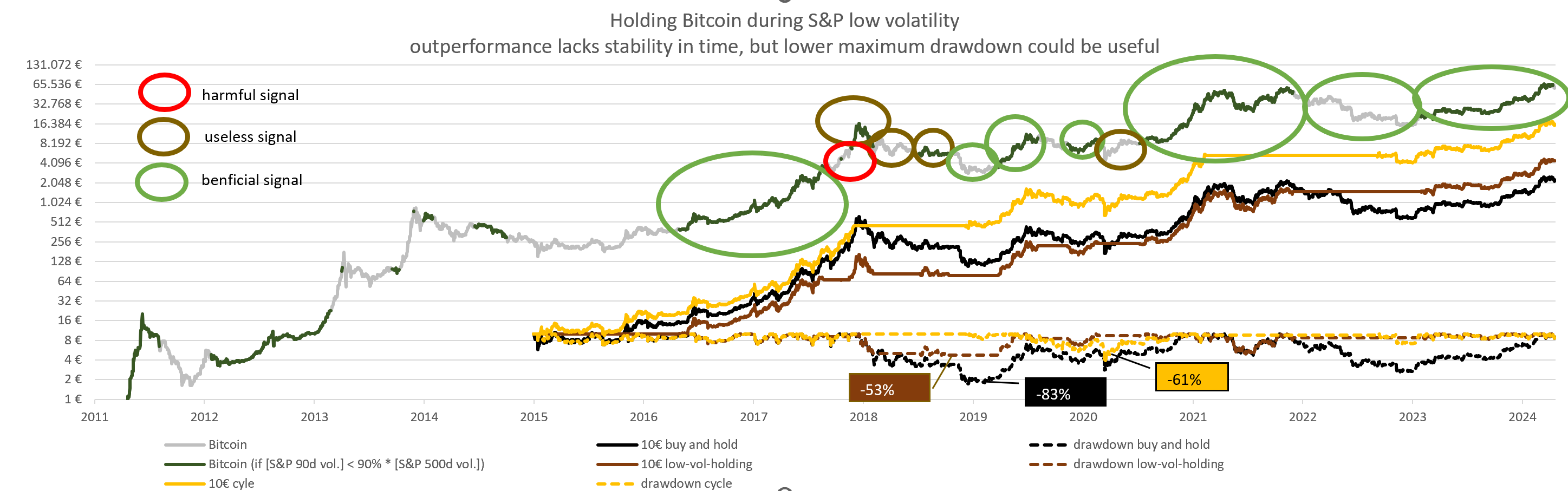

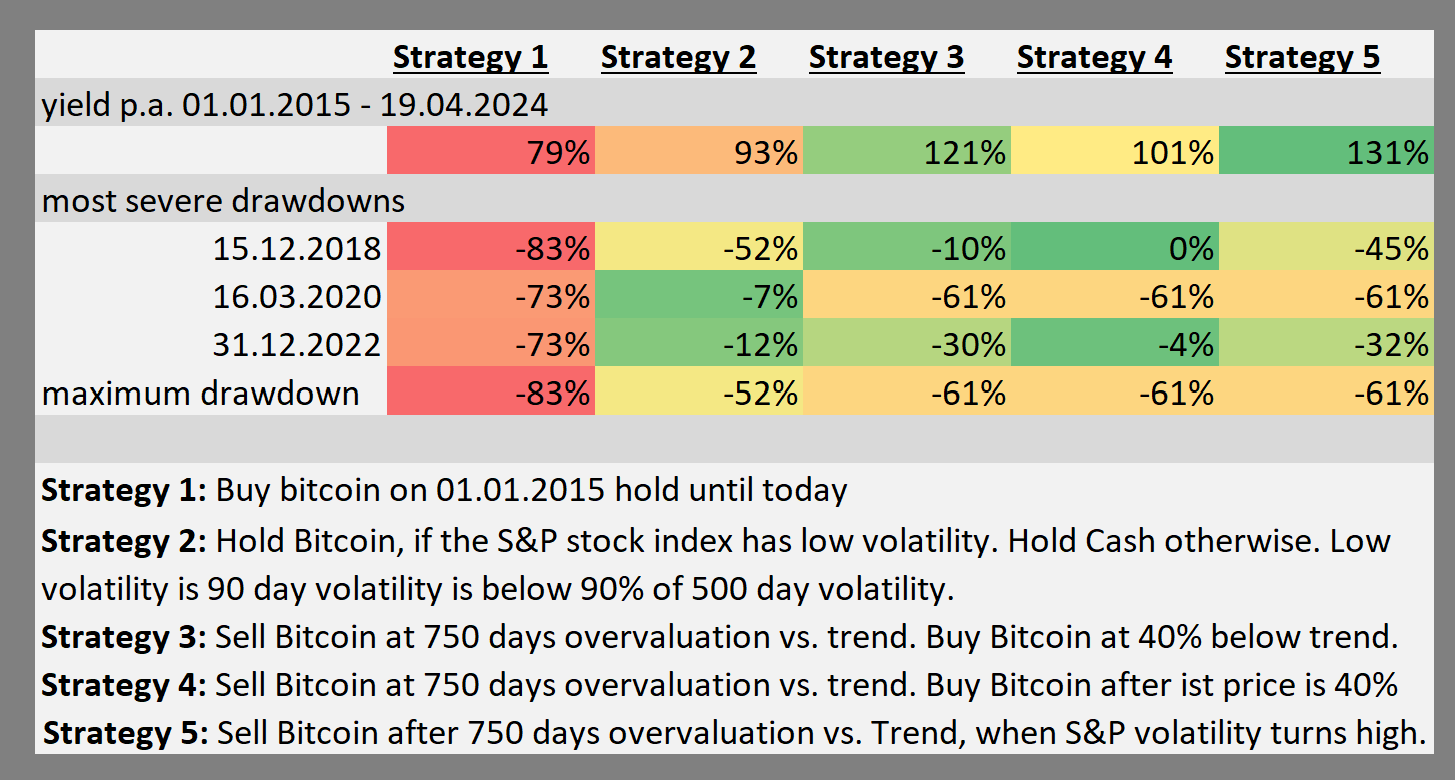

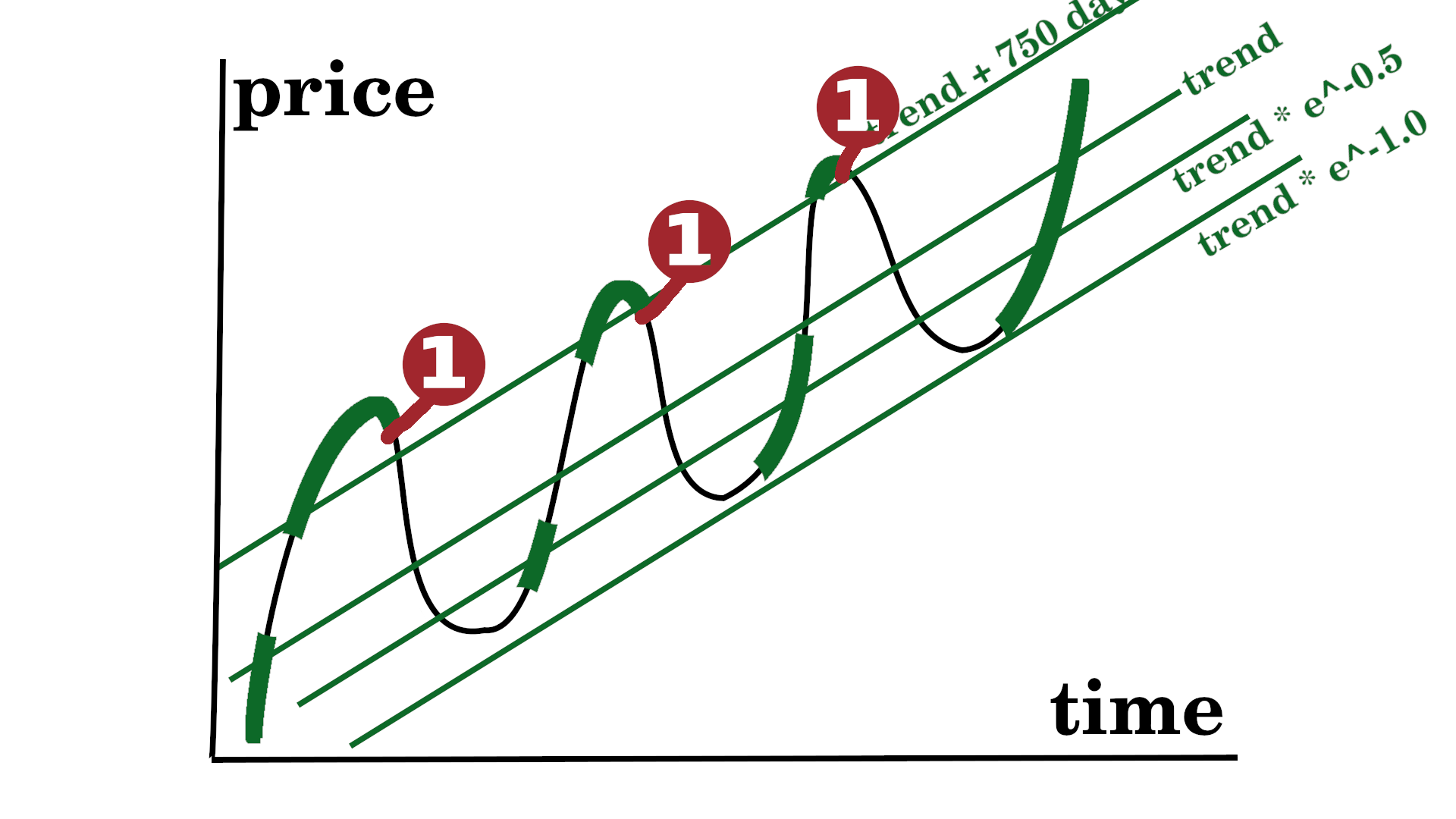

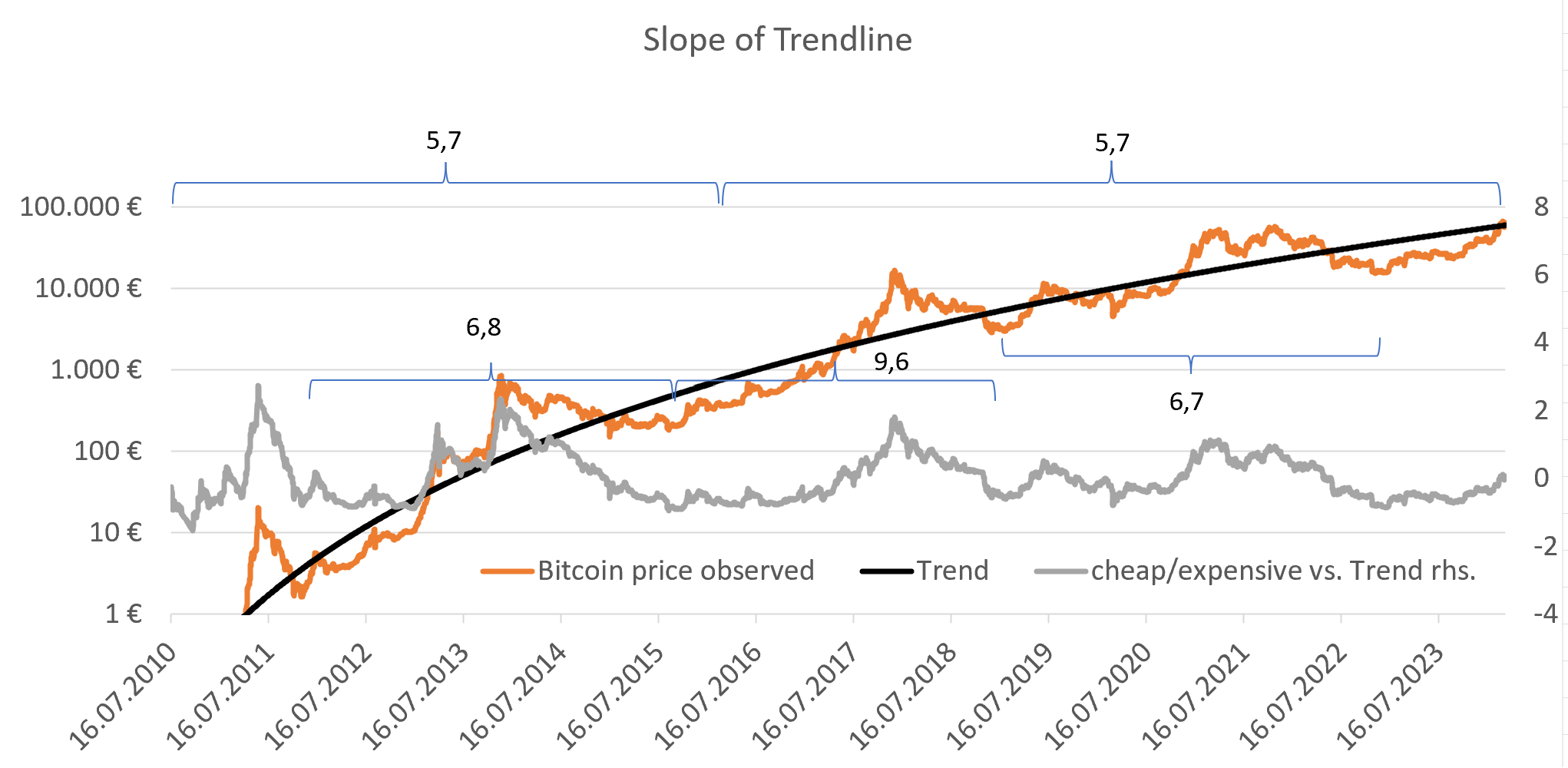

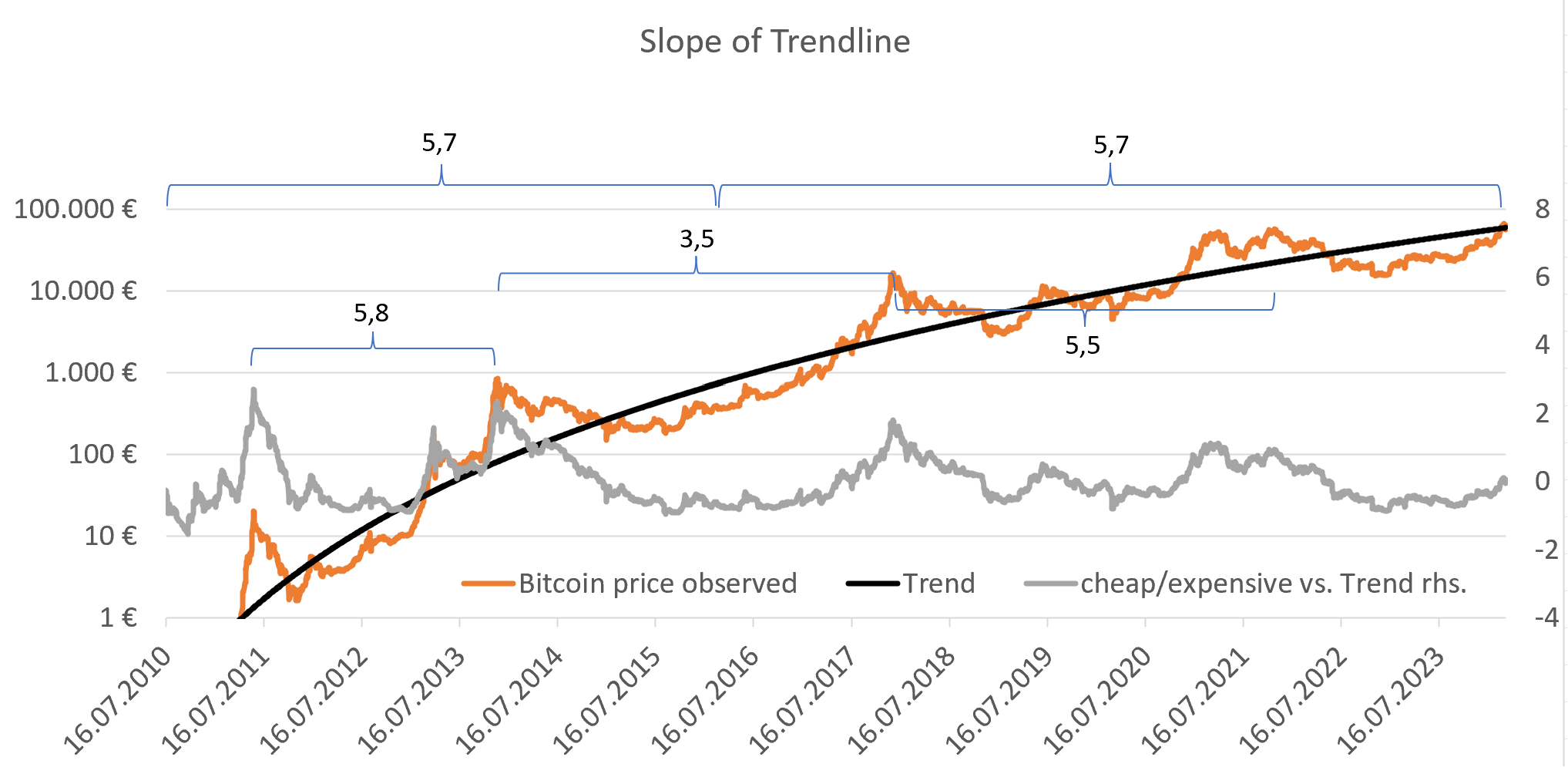

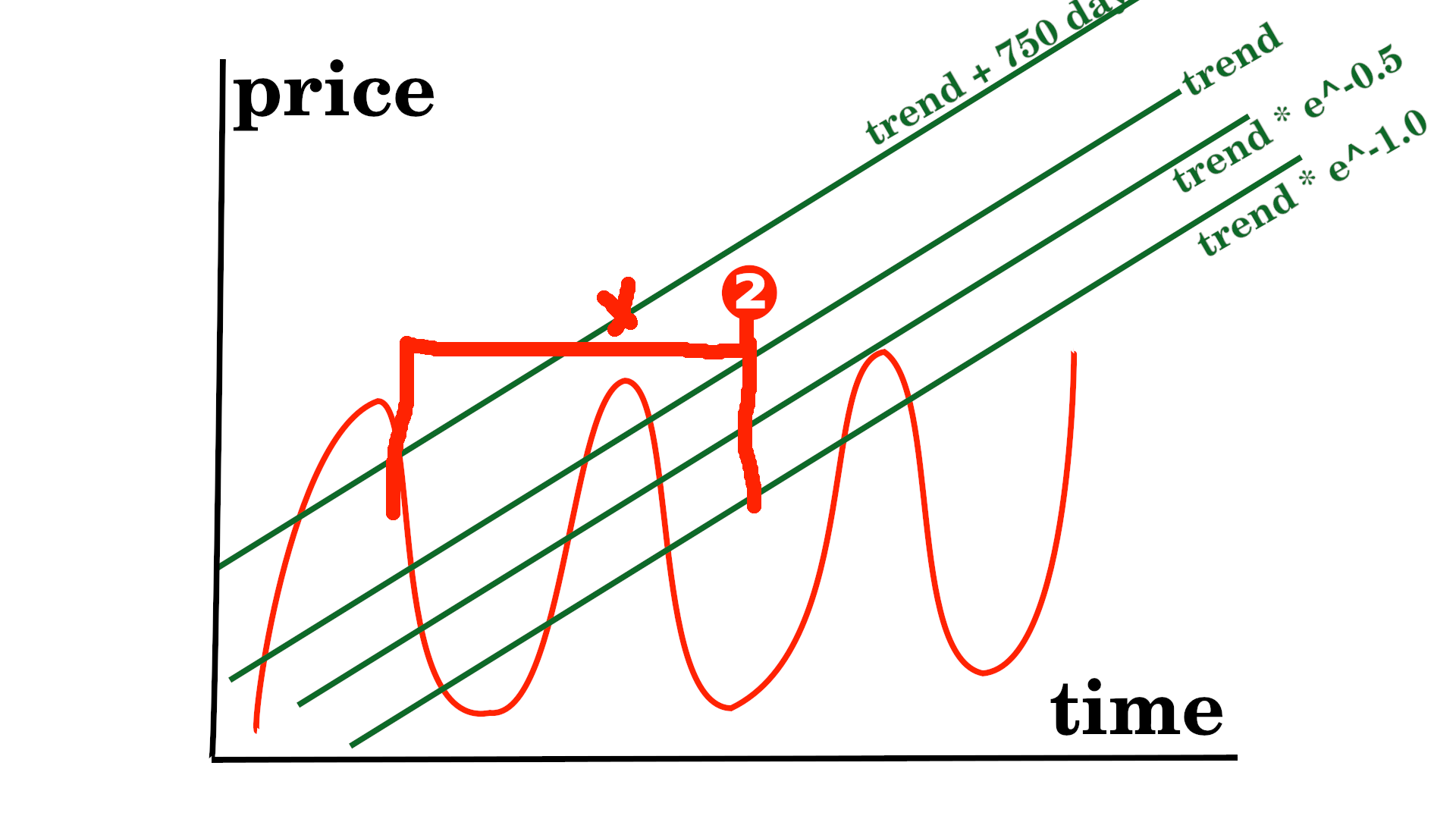

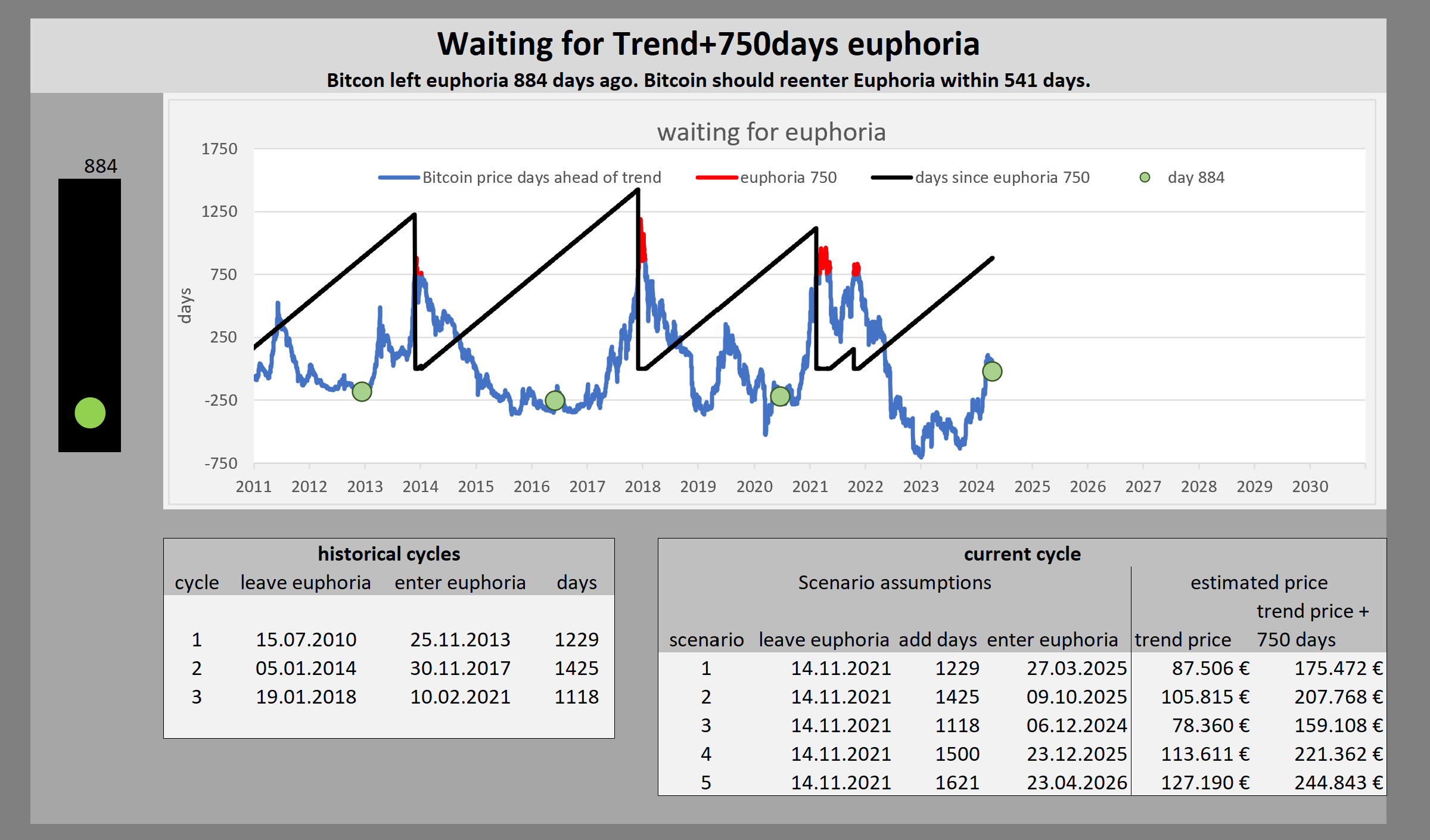

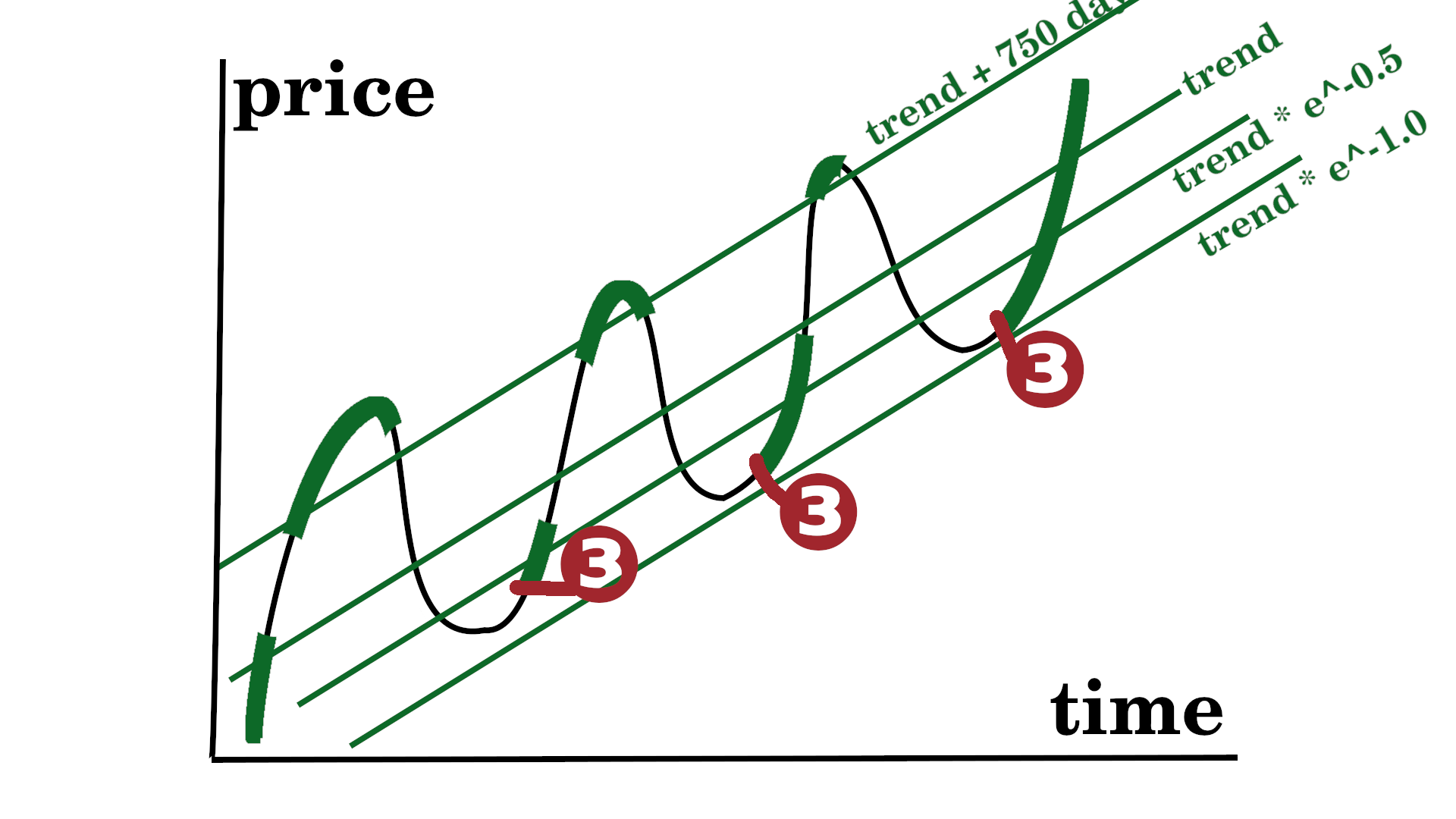

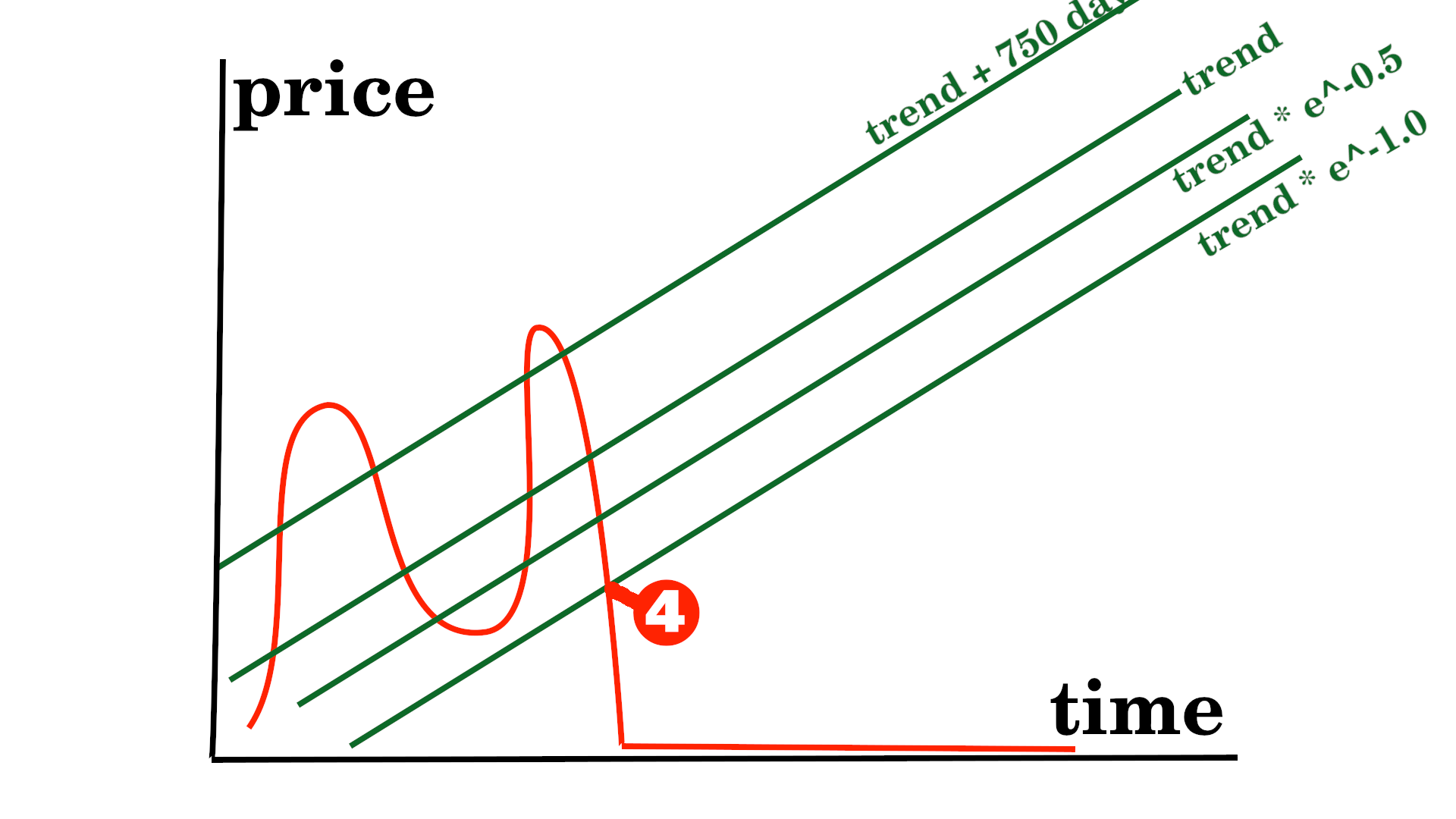

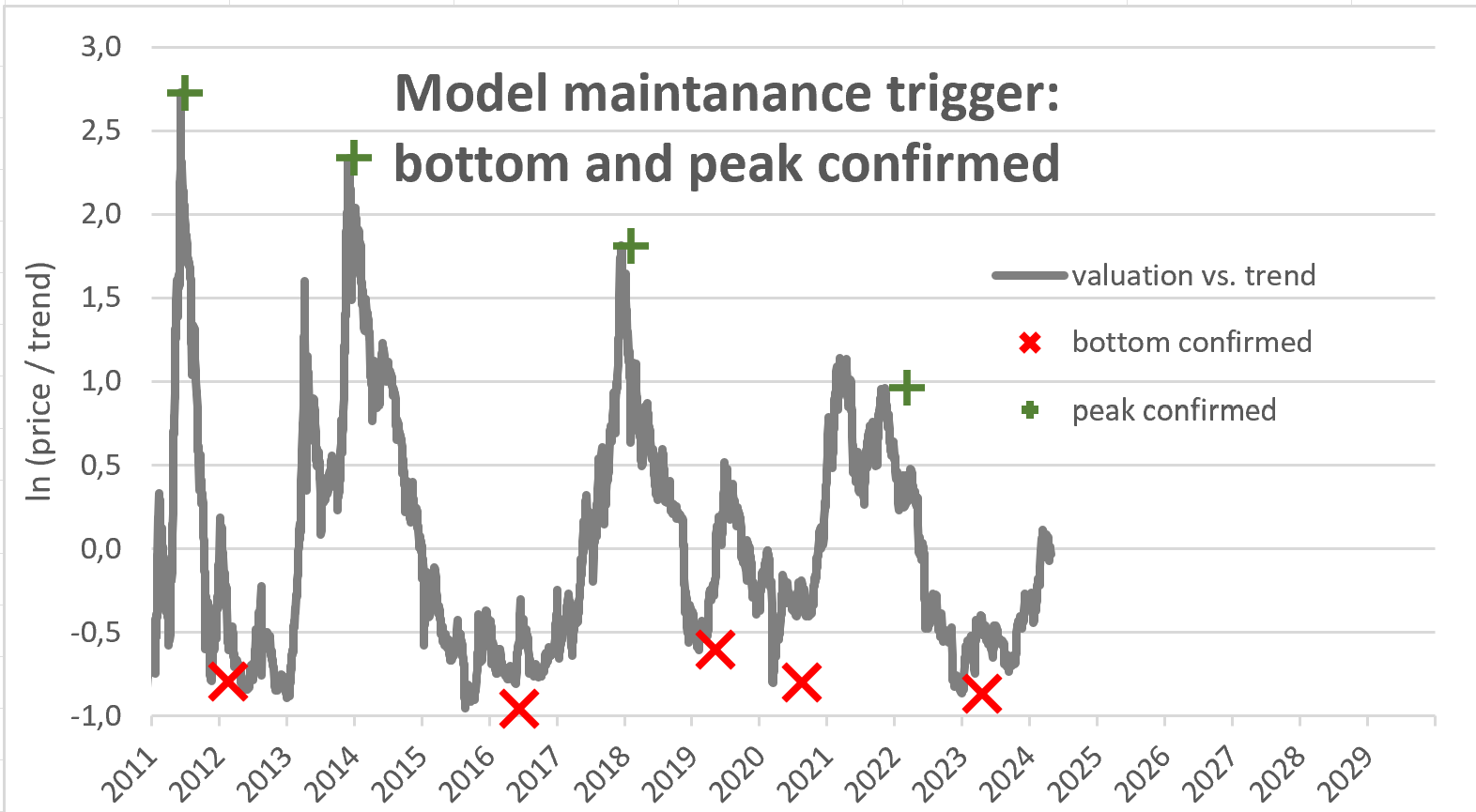

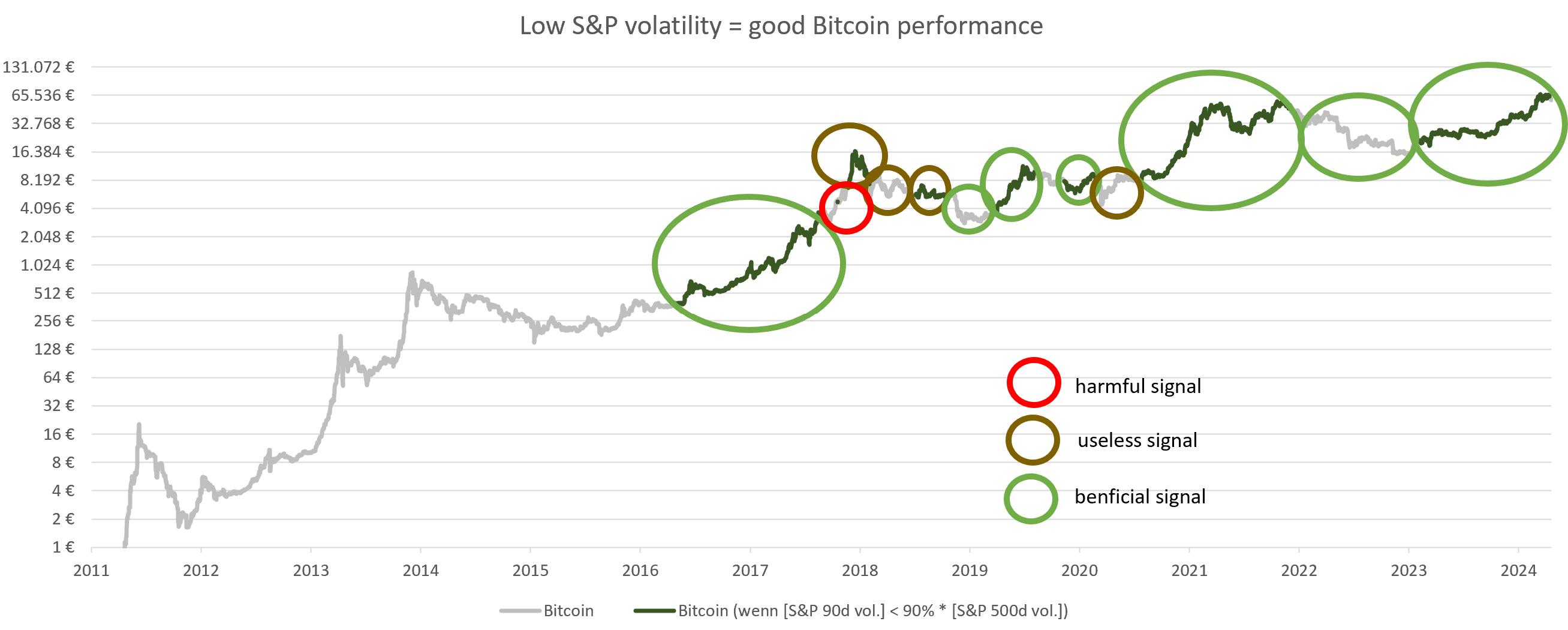

Seperating Trend and cycleMy Bitcoin price history dates from 16.07.2010 (0,07€) to now 20.03.2024 (64.000€) and price increase of six orders of magnitude 10^6. There seems to be an uptrand of higher highs and higer lows.  There seems to be an upward trend with some movement around the trend. Which function could describe this trend? I perform a logarithmic transformation on both axes of my chart. The new y-axis is ln(Bitcoinprice_in_EUR) and the x-axis is the ln number of days since the Bitcoin genesis block ln(Date - 03 Jan 2009).  The in ln-space the Bitcoin price follows the trend: y = 5,8323x - 39,296This translates into (= black line): Bitcoin_price_in_EUR = e^[ 5,8323 * ln(Date - 03.Jan.2009) - 39,296 ]Making the graphs easier to followA Bitcoin price in ln(EUR) and a Bitcoin age in ln(days) is easy to draw, but difficult to understand. Therefore I added the Bitcoin price in EUR and the calendar year.  Interestingly, the Bitcoin price does not seem to fall more than 1 below the trend (= red line). Bitcoin_price_in_EUR_low = e^[ 5,8323 * ln(Date - 03.Jan.2009) - 39,296 -1] This chart is similar to the bitcoin rainbow charts produced by others*. We can now subtract the observed price from the trend to separate the cyclical component of the bitcoin price from the trend component. *https://www.blockchaincenter.net/en/bitcoin-rainbow-chart/  A graph of -1 on the y-axis means the Bitcoinprice was 63% below trend. If the trend was 10.000€, then the Price at -1 would be at 3679, since exp(-1) = 0.36 . Can we use the cycle information to buy at a low price and sell at a high price?A quick back-of-the-envelope chart shows us that there may be value in knowing whether bitcoin is currently cheap or expensive. If we buy bitcoin when it is expensive, we can expect a worse return than if we buy it when it is cheap.  Even in recent history, the rule remains that "the cheaper you buy your bitcoin, the better":  Can we find some trading rules when to buy Bitcoin and when to sell Bitcoin to outperform DCA? Finding the bottoms of the cycleWe can see that all the bottoms (except the first one on 04 Feb 2011) are between 0.5 and 1.0 below the trend:  To see the exact bottoms, I have zoomed into this chart at 0.5 to 1.0 below trend. Especially between -0.7 and -1.0 there are many bottoms. Only one bottom is lower than -1.0.  We now have a pretty good understanding of where the bottoms are. However, this assumes that the shape of the function and the parameters are stable going forward. Later I will show that the parameters are quite stable. When we are between 0.5 and 1.0 below the trend, it has always been a good time to invest in bitcoin, because bitcoin has managed to come back to the trend every time until today. Your return has been quite nice as you have received bitcoin trend growth + catching up to the trend line.Overvaluation alone is not enough to find cycle topsFinding the top of the cycle is a bit more complicated for three reasons. 1. Bitcoin tops fall into a wider range than bottoms, as can be seen in the green box. While the bottoms range from -0.5 to -1, the tops range from 0.88 to 2.7. If you think you bought the bottom at -0.5 and the price goes to -1, you lose 39%. If you think you bought the top at +0.88 and the price goes to 2.7, you miss out on a return of 517%. 2. Bitcoin's tops are getting smaller and smaller, which means you might miss the next top.For the bottoms we don't see a trend, the bottoms fall randomly between -0.5 and -1, so we could expect the next bottom to fall between -0.5 and -1 again. For the tops, we can see a declining trend. This means that the next top could be even lower than 0.88. Maybe only 0.5. 3. Selling expensive bitcoin to buy cheap bitcoin could backfire in fiat termsSelling expensive bitcoin to buy cheap bitcoin later seems like a good idea. However, waiting in cash or gold for bitcoin to become cheap again takes time. The longer you wait, the higher the trend will be. If Bitcoin does not become cheap soon enough, the trend growth will exceed the cycle contraction. So you sell expensive bitcoin at a low USD price only to buy cheap bitcoin at a much higher USD price later. I think Bitcoin bubbles (How much new retail will join?) are less predictable than bitcoin bear markets (The stable core of bitcoiners keeps buying bitcoin). Bubbles are also more difficult to trade, because you are trading against the trend, whereas in bear markets you have the trend on your side. Selling in bubbles gives you a short window before the trend catches up. Buying in bear markets has the trend on your side. Because one of the main risks of selling bitcoin during a bubble is running out of time, therefore I ask: "How much time do we have before the trend catches up with us?". So instead of saying "the current bitcoin price is e^1 too expensive", we could say "The current bitcoin price will only be justified in 500 days.". Also, bitcoin bubbles are not dominated by growing bitcoin network effects, but by human behavior. So we work with simple days (e.g. 500 days) and not the growth of days relative to the bitcoin genesis block ln(Date - 03 Jan 2009).  During peaks, the price of bitcoin is 500-1200 ahead of its trend. This means that the trend would have to continue for 500-1200 days to catch up with the current price. I like this chart because the peaks fall into a narrower band and since the peaks don't show a trend, you have to worry less about the next peak being outside of this band. How many days ahead are too many?Since we have found our peak indicator "days ahead of price", we can now think about a cut-off point. If the current bitcoin price is 1000 or 1500 days ahead, we will probably be able to buy bitcoin cheaper if we wait a bit. However, if the current price of bitcoin is only 10 days ahead, we are unlikely to get a cheaper price until the trend catches up with the current price.  Green box: Green box: Since the bitcoin price has always returned to the trend, it was always good to buy bitcoin below the trend, as you got the increase in the trend price of bitcoin plus the cyclical price increase to return to the trend. Red box: If bitcoin has become so expensive that the trend would have to continue for more than 700 days to justify the current price, then it was always better to wait to buy bitcoin until the current price is supported by the trend again. Yellow box: When bitcoin was moderately expensive (0 - 700 days ahead of the trend), the picture is not clear. Sometimes waiting gave you cheaper prices in the future, sometimes not. If you decided to wait until you could buy bitcoin without a premium to the trend, you would have been able to get cheaper bitcoin in more than half of the cases:  Does this mean that we should never buy expensive bitcoin and instead always wait until we can buy bitcoin at the trend price? No! First of all, when bitcoin is moderately expensive (e.g. trend + 10 days), in most cases you can successfully wait for the trend to return and buy bitcoin slightly cheaper (e.g. for 5% less EUR). However, sometimes you will have to wait a long time to buy bitcoin back at fair value, which will cost you much more in fiat terms (e.g. for 200% more EUR). Second, if bitcoin is cyclically expensive, we could always wait for bitcoin to become even more expensive before selling.

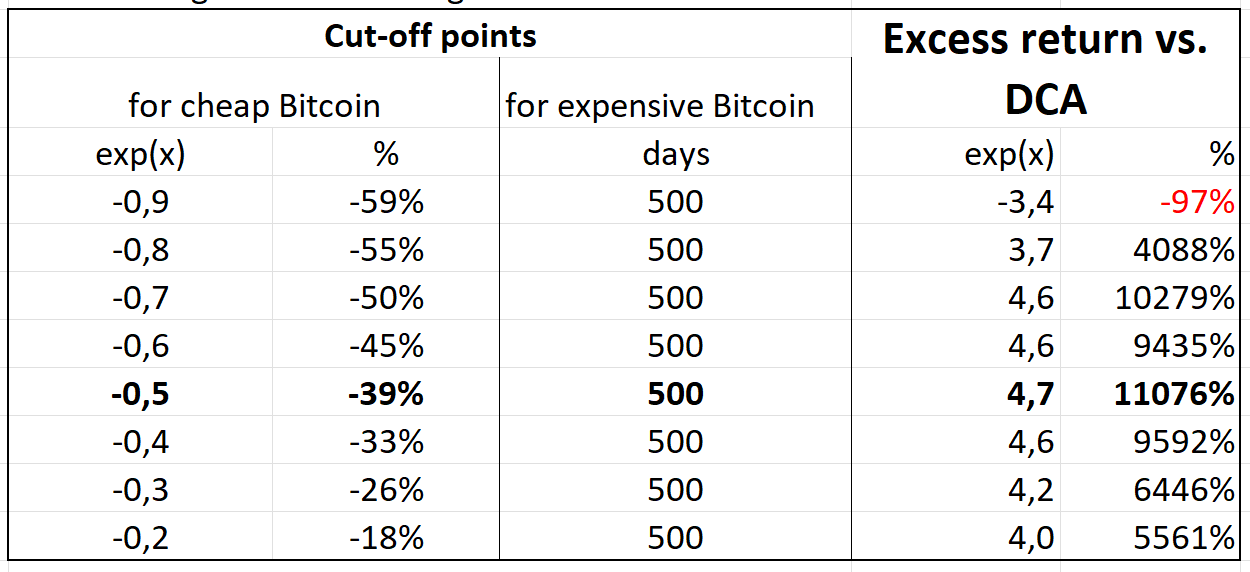

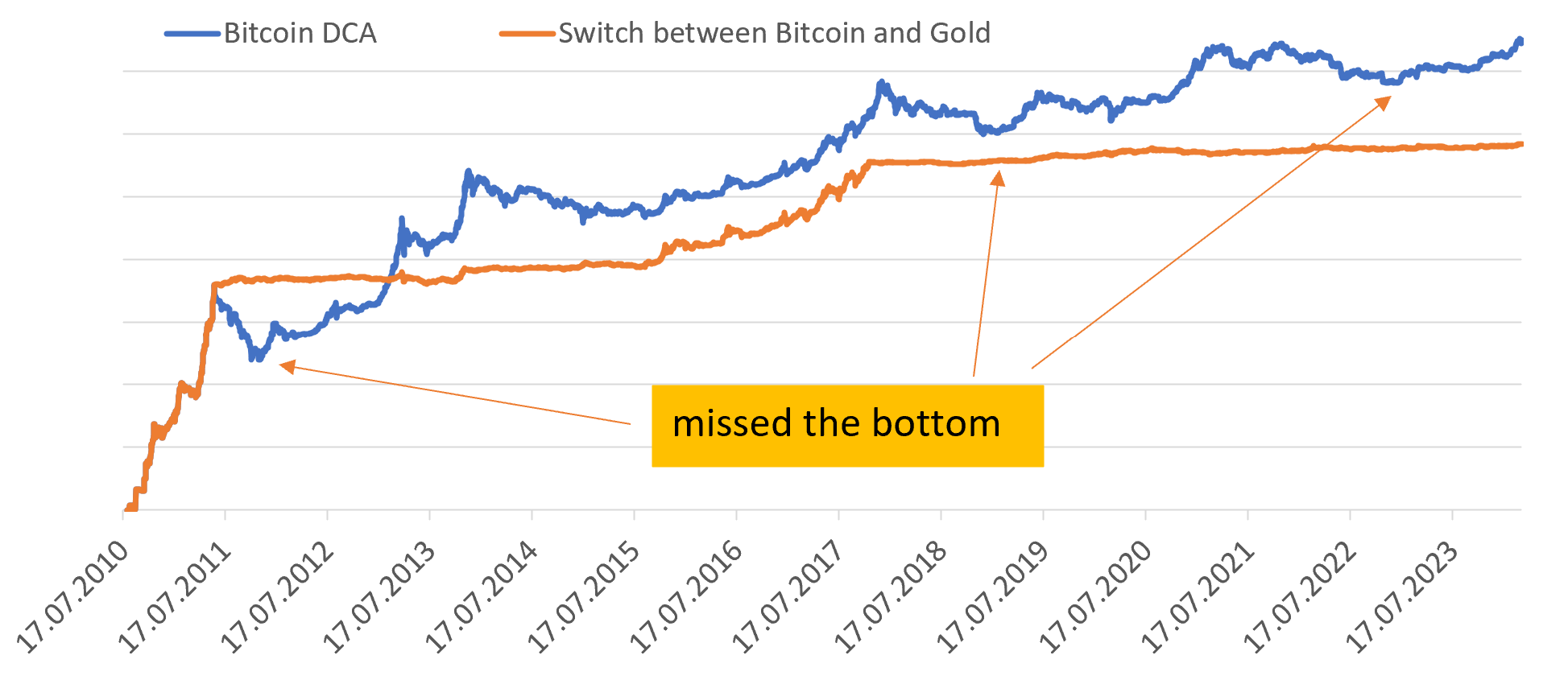

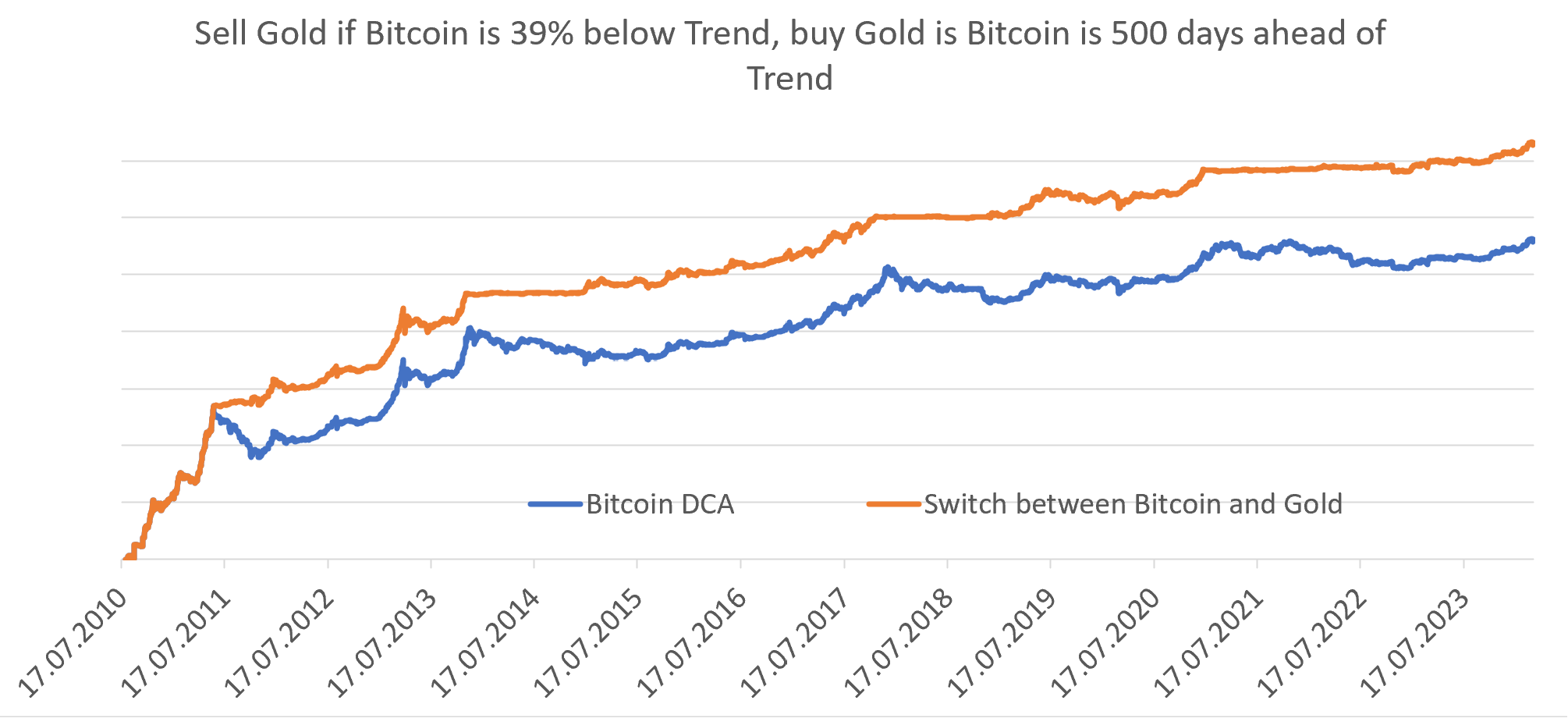

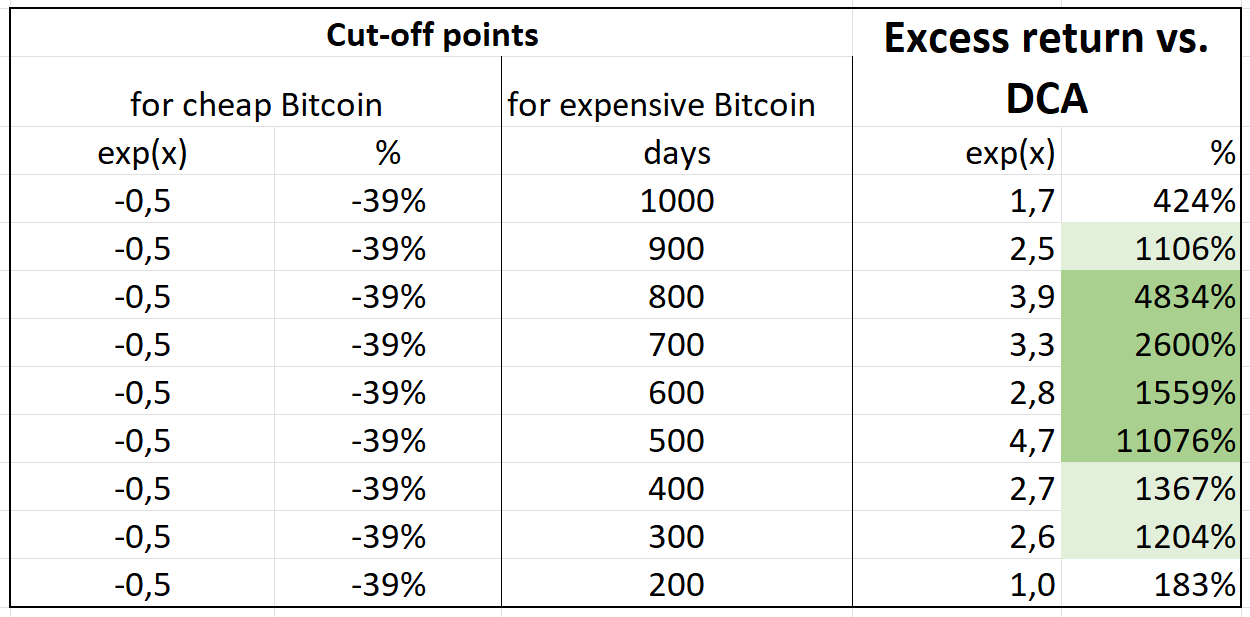

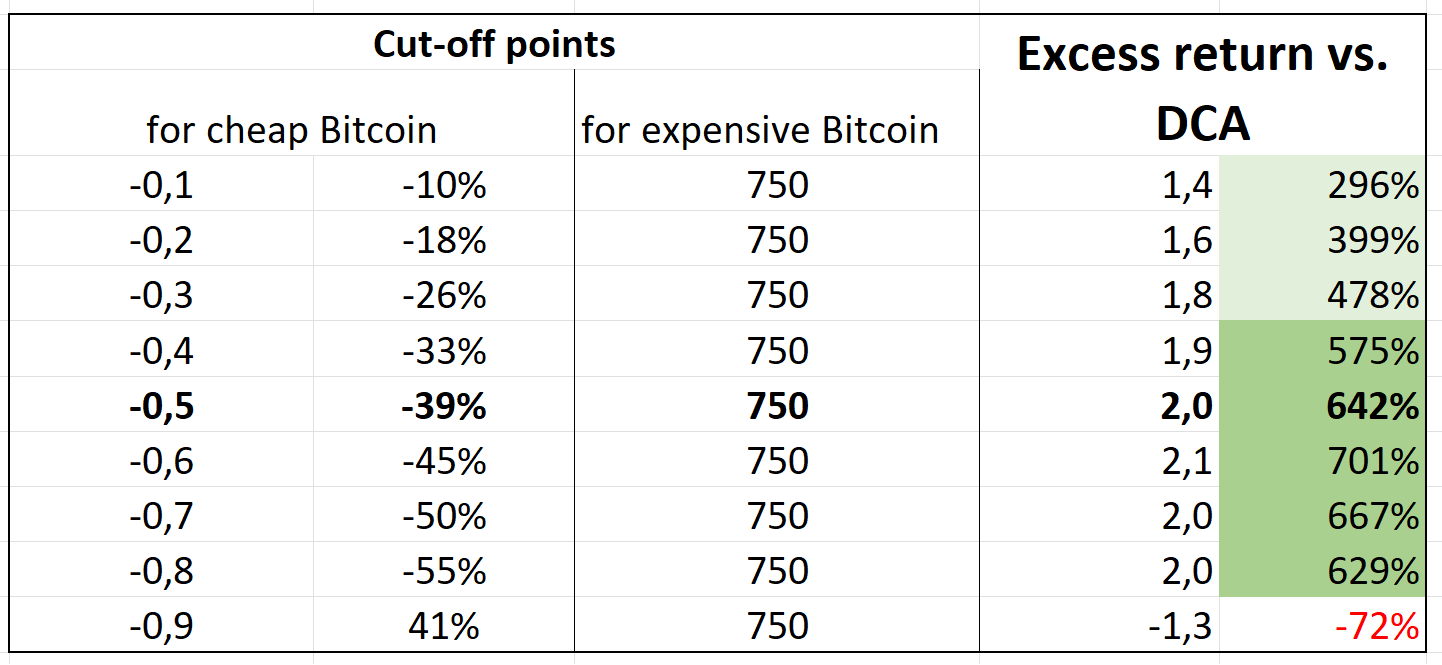

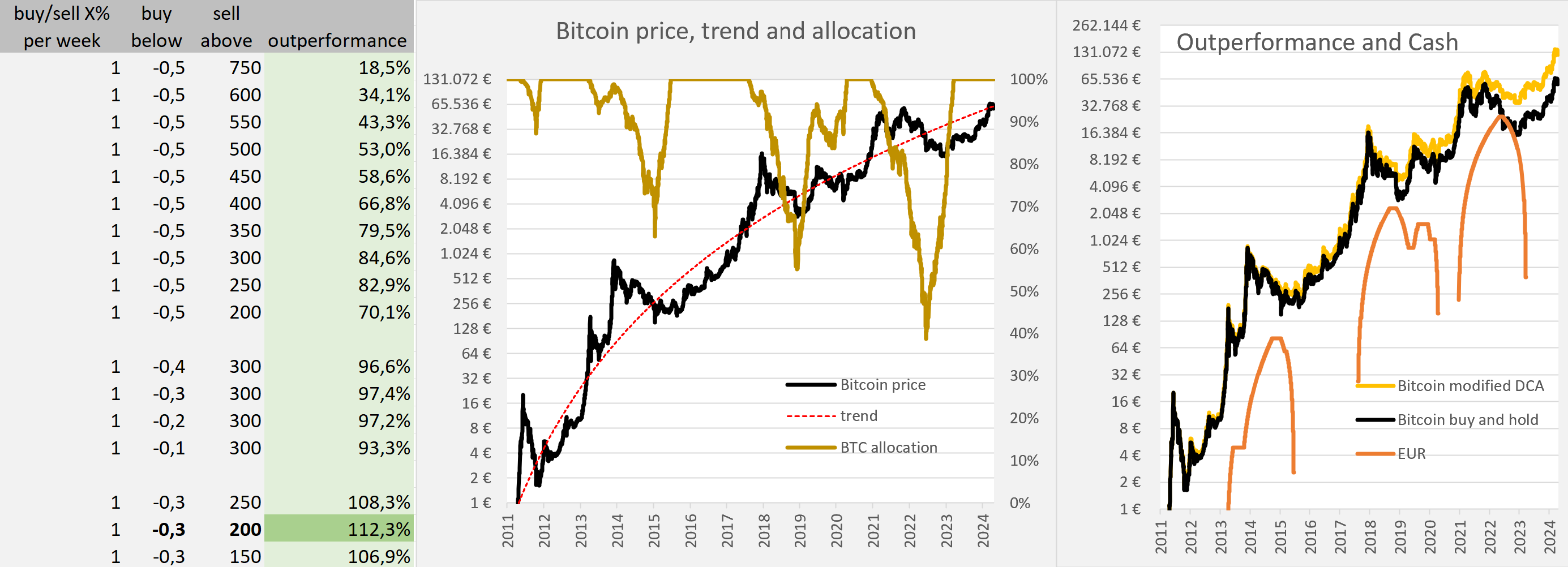

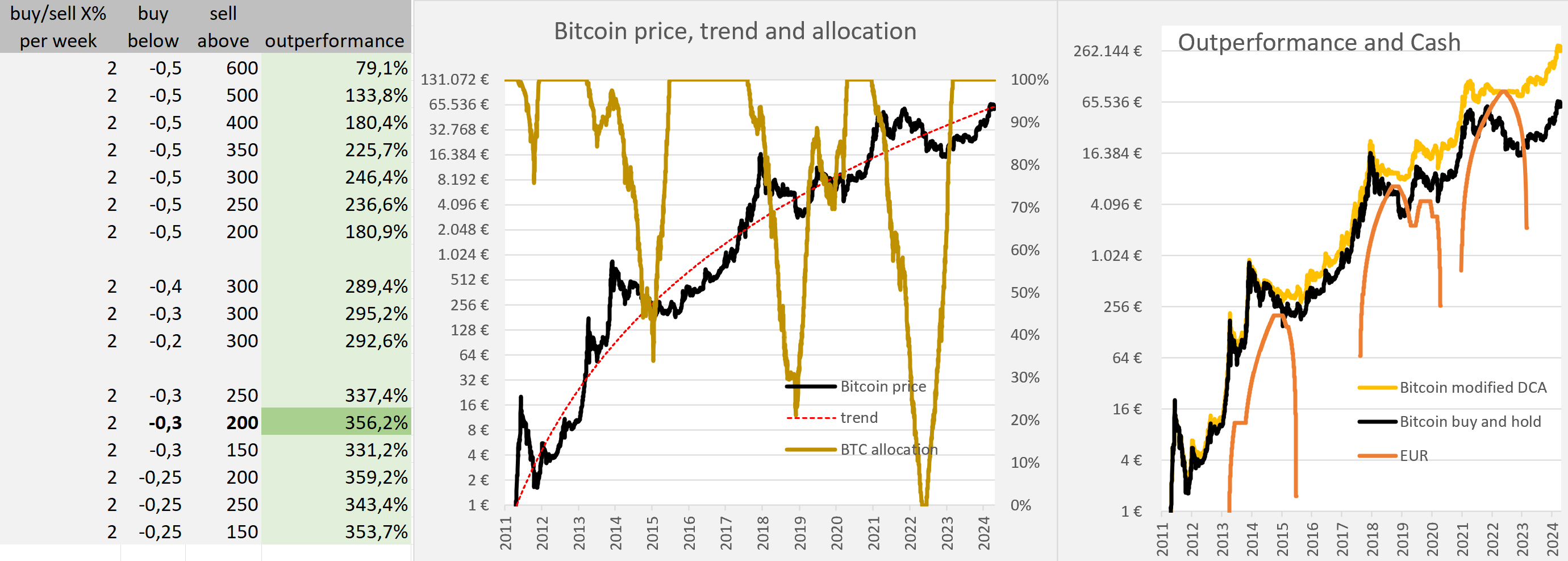

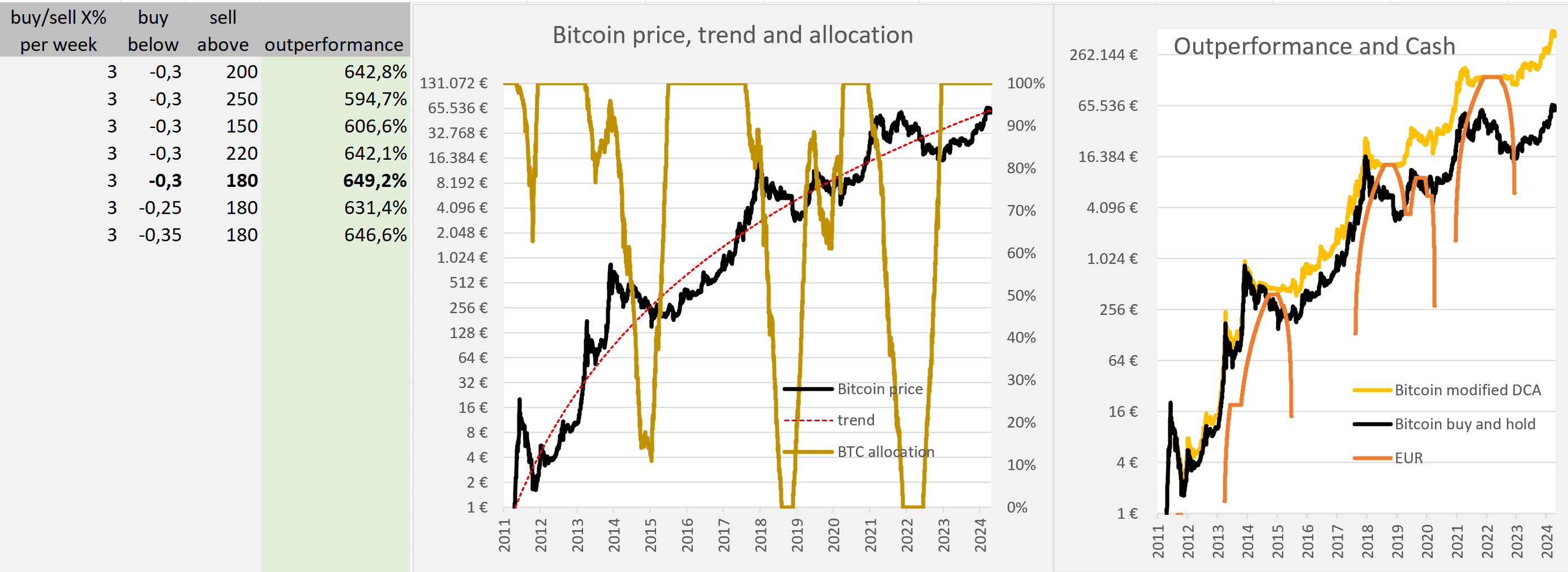

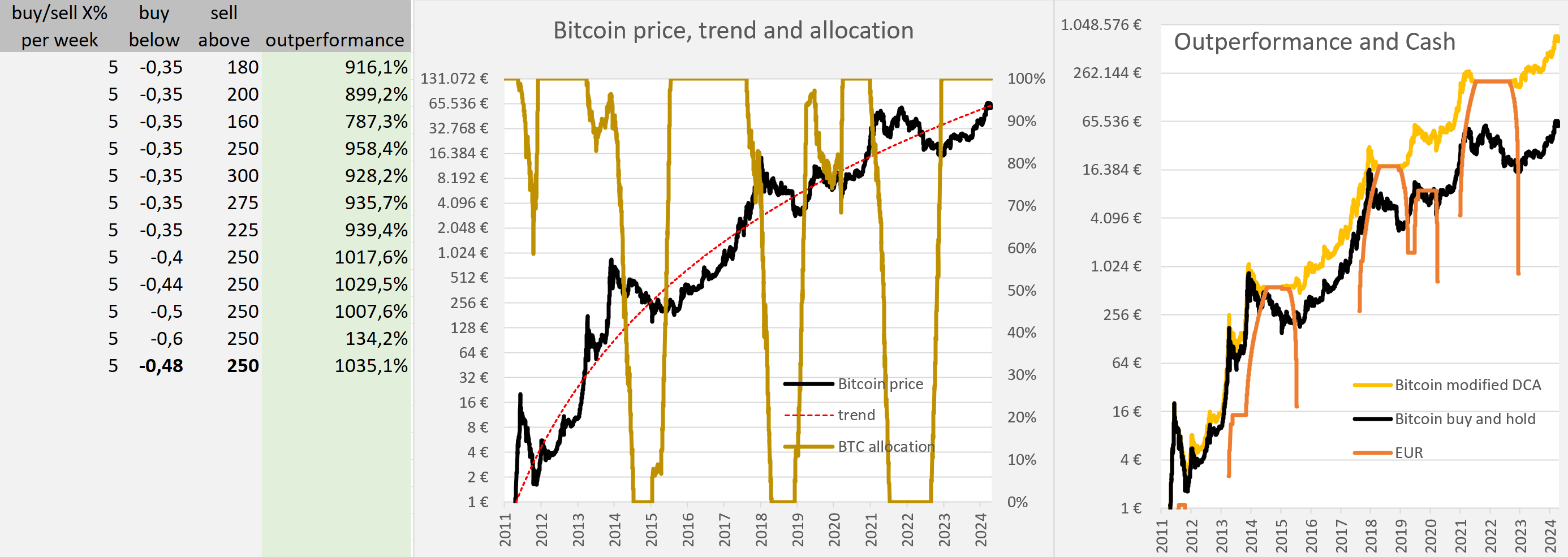

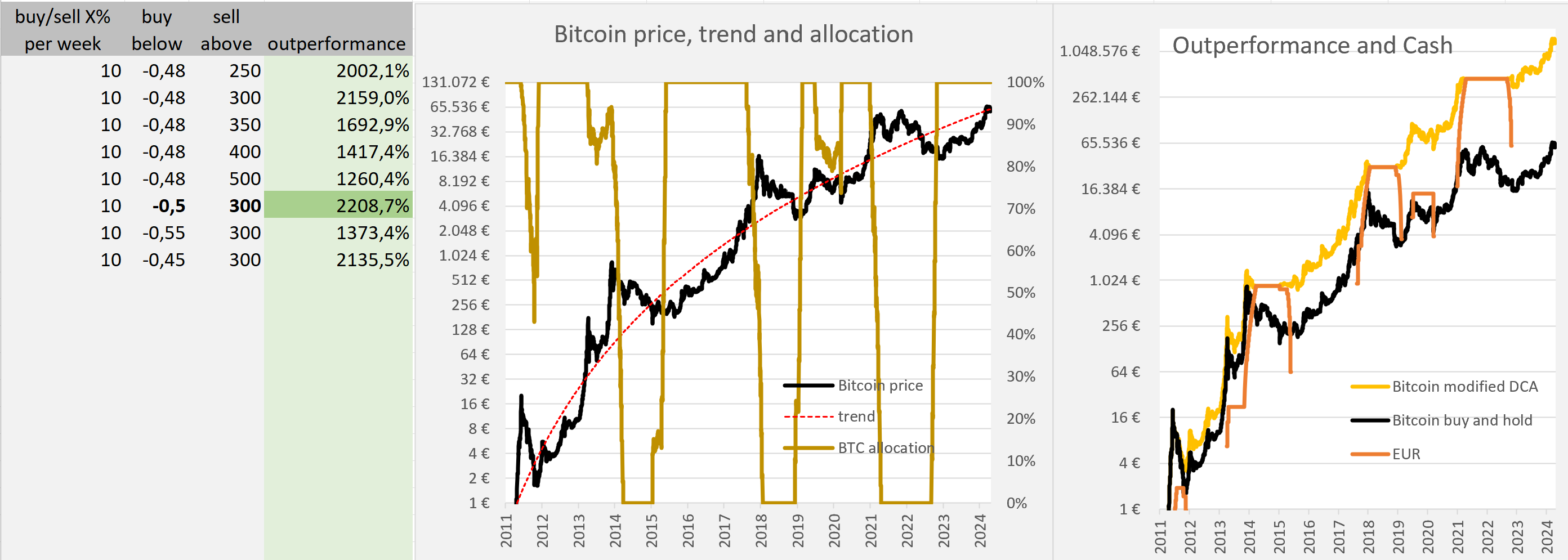

Putting our strategy to the test.We invest 1000€ each month. We can either DCA or try to buy low and sell high. If bitcoin is too expensive, we sell our bitcoin for gold. If bitcoin is too cheap, we sell our gold for bitcoin. If bitcoin is neither cheap nor expensive, we DCA into bitcoin and maintain our gold position. How much do we outperform a DCA strategy depending on our definition of cheap and expensive? Backtest 1:Cheap Bitcoin means Bitcoin is 18% (e^-0.2) to 59% (e^-0.9) below trend. Expensive Bitcoin means that Bitcoin is 500 days ahead of the trend.  What do we learn?1.) In most scenarios we can significantly outperform DCA by up to 11076%. What do we learn?1.) In most scenarios we can significantly outperform DCA by up to 11076%.

2.) If we are too greedy and wait for Bitcoin 0.9 or 59% below trend, we will miss the re-entry into Bitcoin and thus underperform. 3.) It is worse to be a little too greedy than a little too cautious. Waiting to buy bitcoin 18% below trend instead of 39% below trend will cost you 2x performance. Waiting to buy bitcoin 59% below trend instead of 55% below trend will cost you 12x performance. 3.) It is worse to be a little too greedy than a little too cautious. Waiting to buy bitcoin 18% below trend instead of 39% below trend will cost you 2x performance. Waiting to buy bitcoin 59% below trend instead of 55% below trend will cost you 12x performance.Sorry for the typo, the chart title should be: Sell Gold, if Bitcoin is 39% below trend. Buy Gold if Bitcoin is 500 days ahead of trend. Otherwise keep your Gold position and DCA into Bitcoin. -> A re-entry into bitcoin at 0.5% or 39% below the trend looks best to me. Backtest 2:Ceap Bitcoin means Bitcoin is 39% (e^-0.5) below trend. Expensive Bitcoin means Bitcoin is between 200 and 1000 days above trend.  What do we learn?1.) Again, we can significantly outperform DCA by up to 11076%. What do we learn?1.) Again, we can significantly outperform DCA by up to 11076%.

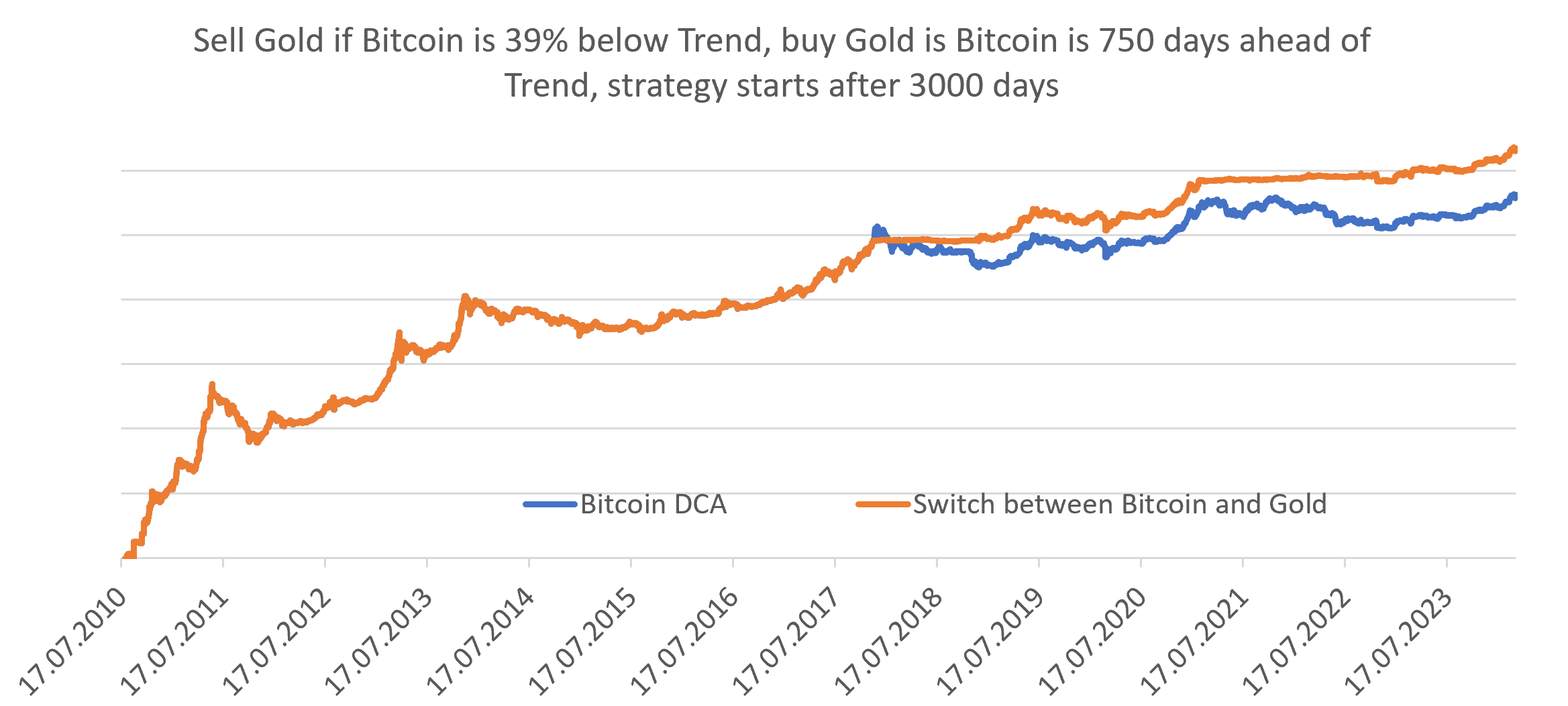

2.) We have two peaks at 4834% outperformance and 11076% outperformance. In between we have lower outperformance. There seem to be several local maxima that we can only hit with the benefit of hindsight. As my default position is in bitcoin and not gold, I would only sell my bitcoin when it is 700-800 days expensive. Backtest 3: Backtest 3:To determine whether bitcoin is cheap relative to our trend function, we must first estimate the function. Therefore, we could not have started measuring Bitcoin vs. Trend from day 1. Currently we are about 5600 days from the Genesis block. Therefore, I assume that we can only start selling expensive bitcoin and buying cheap bitcoin 3000 days after the genesis block, as only then will we have a stable trend function. Will we still outperform from day 3001 to day 5550? Cheap bitcoin means bitcoin is 18% (e^-0.2) to 59% (e^-0.9) below trend. Expensive Bitcoin means that Bitcoin is 750 days ahead of the trend.   What do we learn?We can confirm past results. In recent history, the strategy still offers significant outperformance. We should be cautious when trading bitcoin and not wait for too big a drawdown. What do we learn?We can confirm past results. In recent history, the strategy still offers significant outperformance. We should be cautious when trading bitcoin and not wait for too big a drawdown.Selling late (750 days high) is also better than selling early (500 days high).

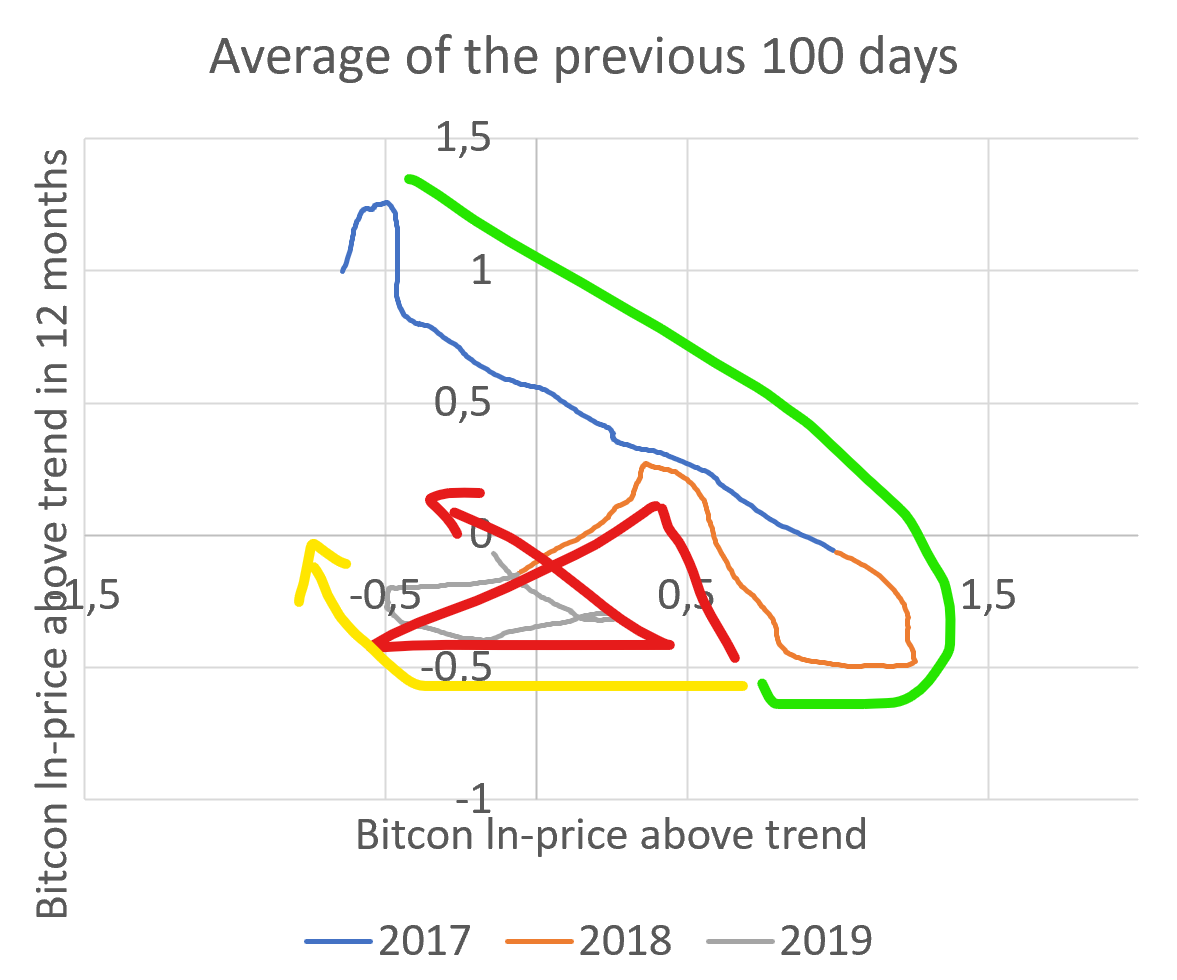

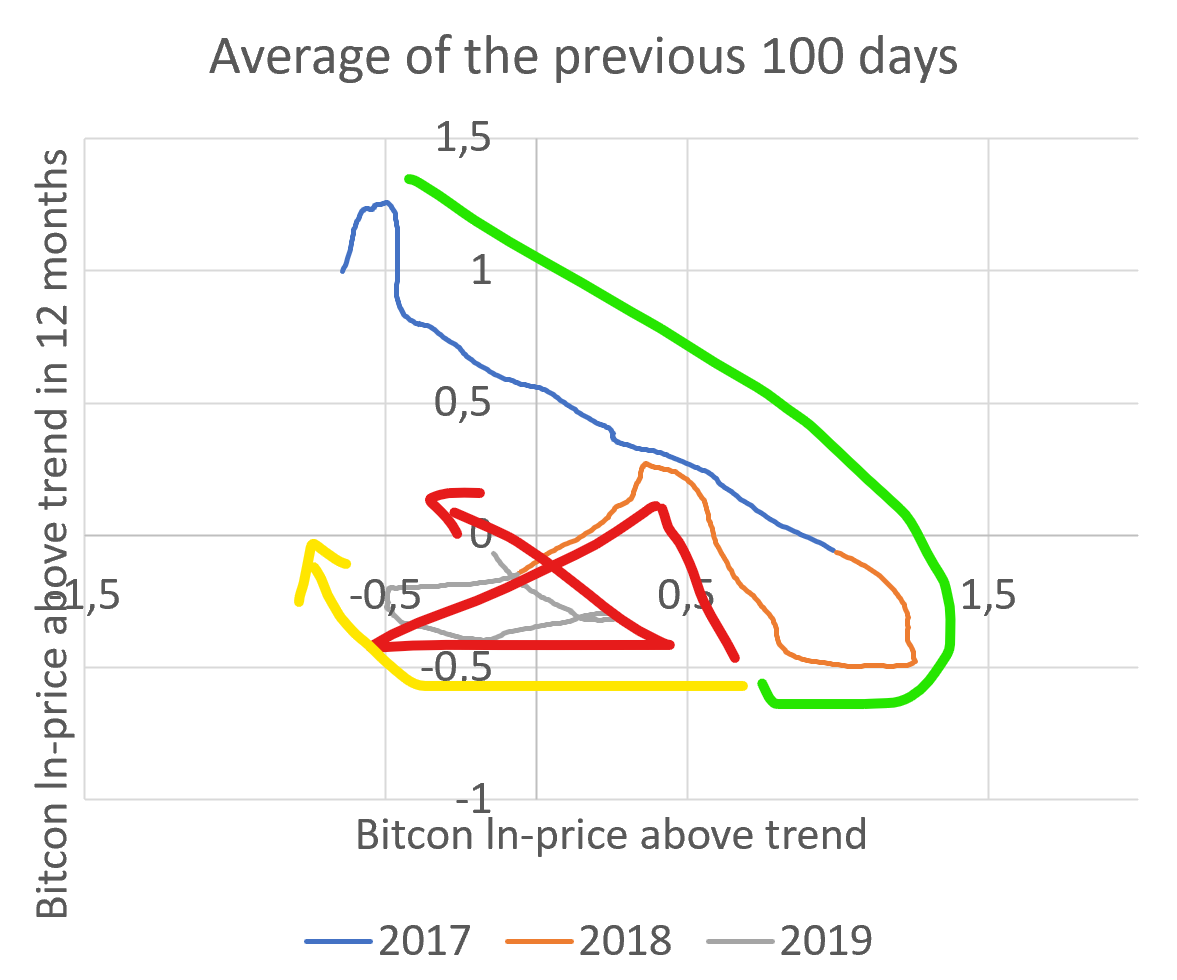

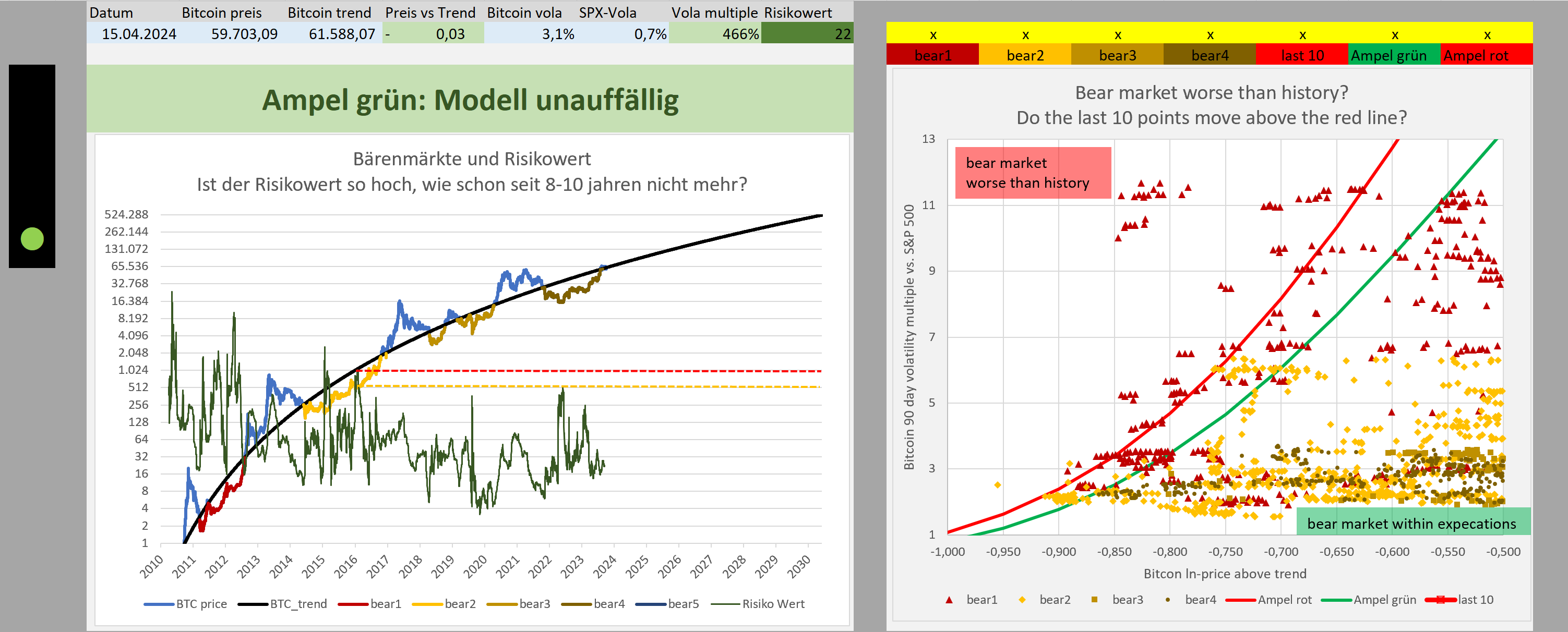

Crating a simple decision chart for day to day useThe analysis in this post helped us to understand the Bitcoin trend, the Bitcoin cycle and optimum entry and exit points within the cycle. For daily usage I will visualize the relevant information in an simple chart.

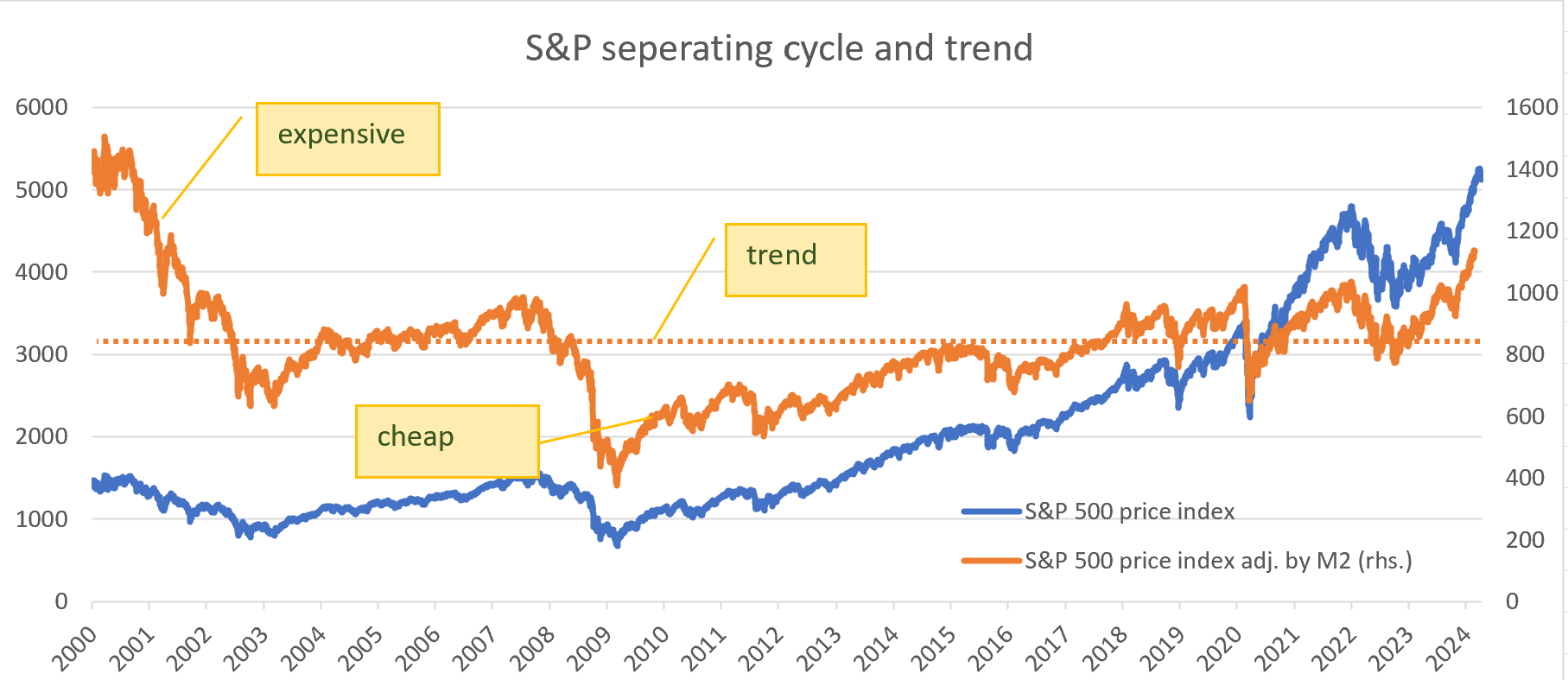

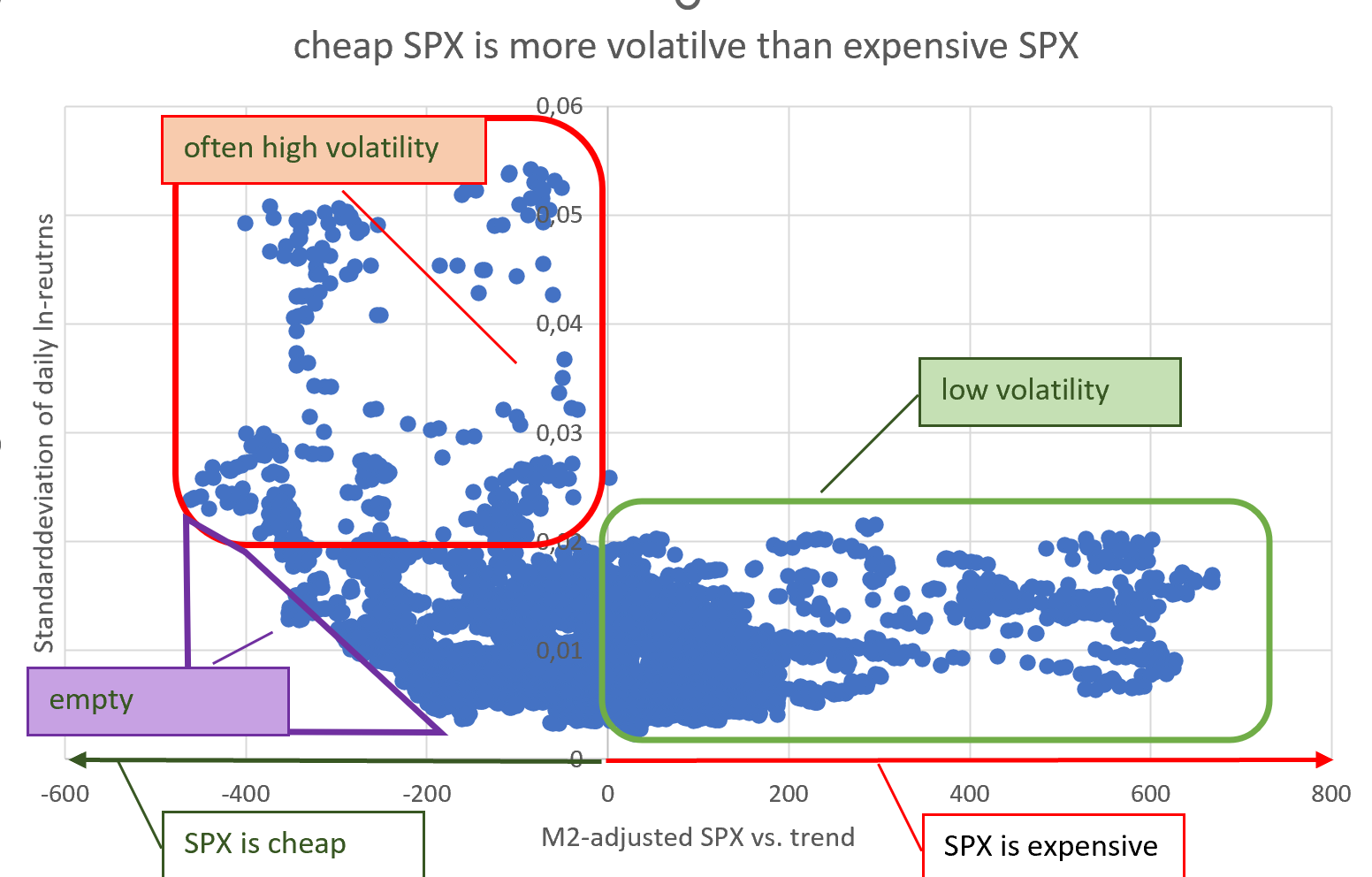

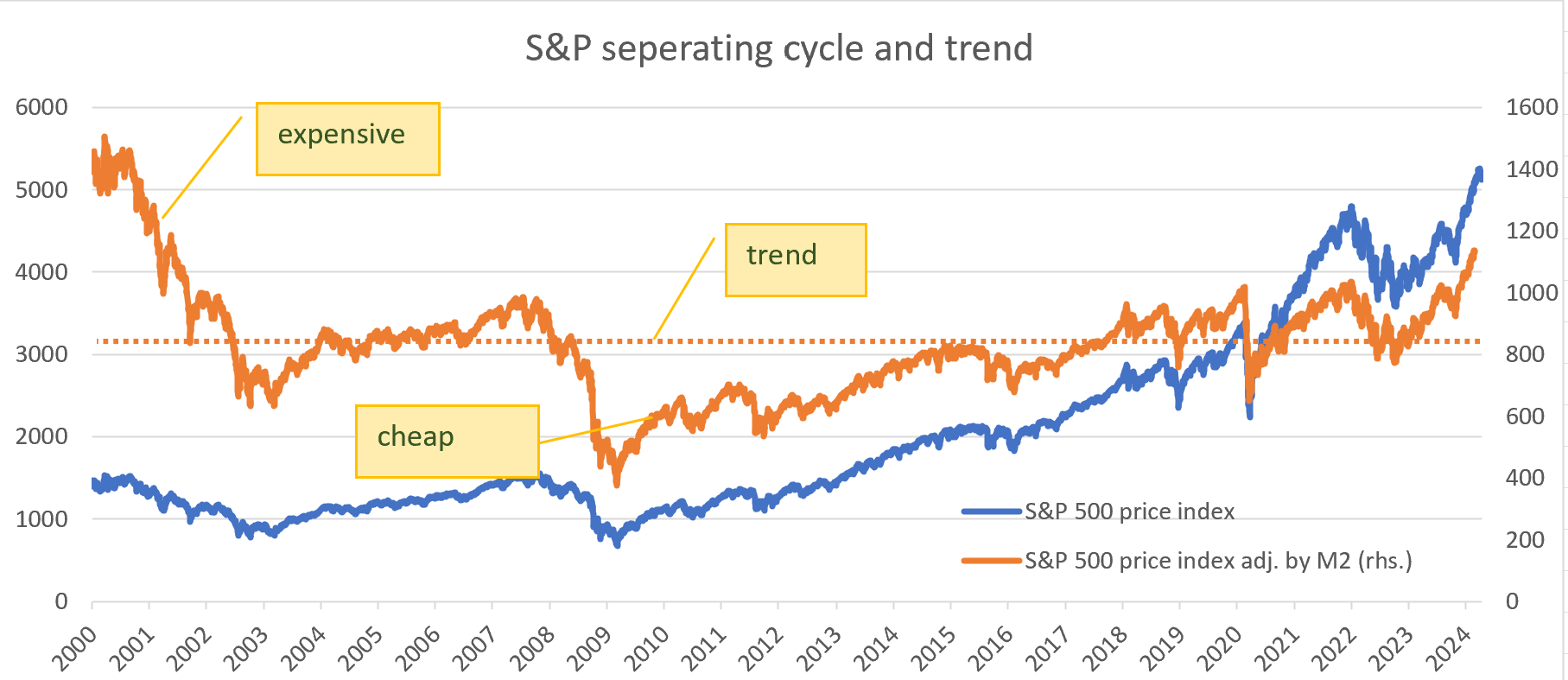

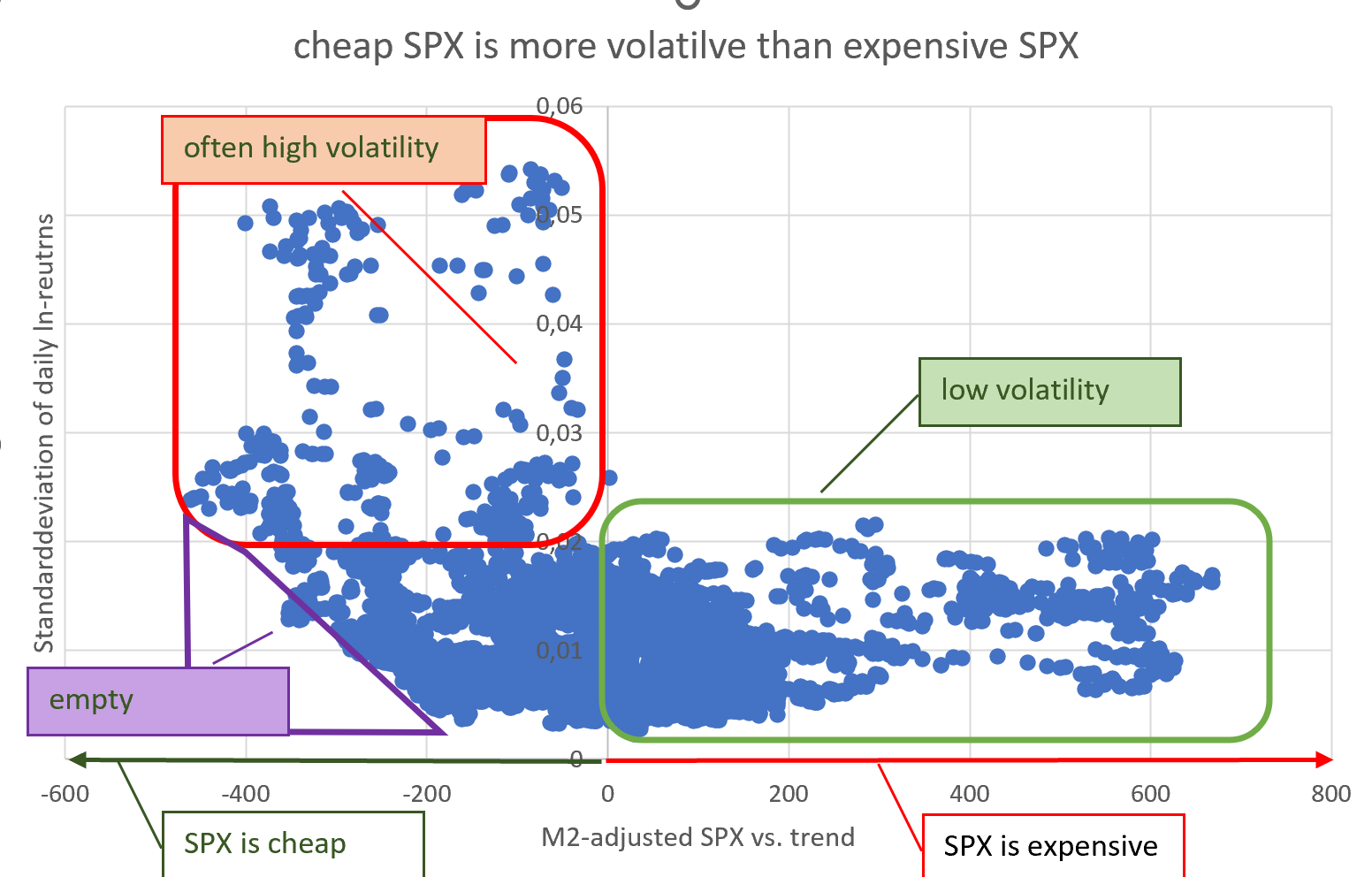

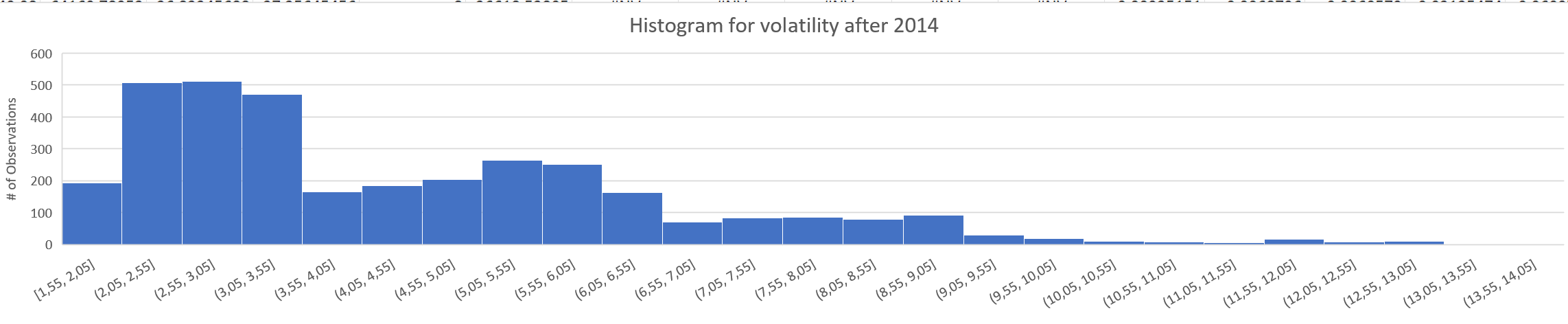

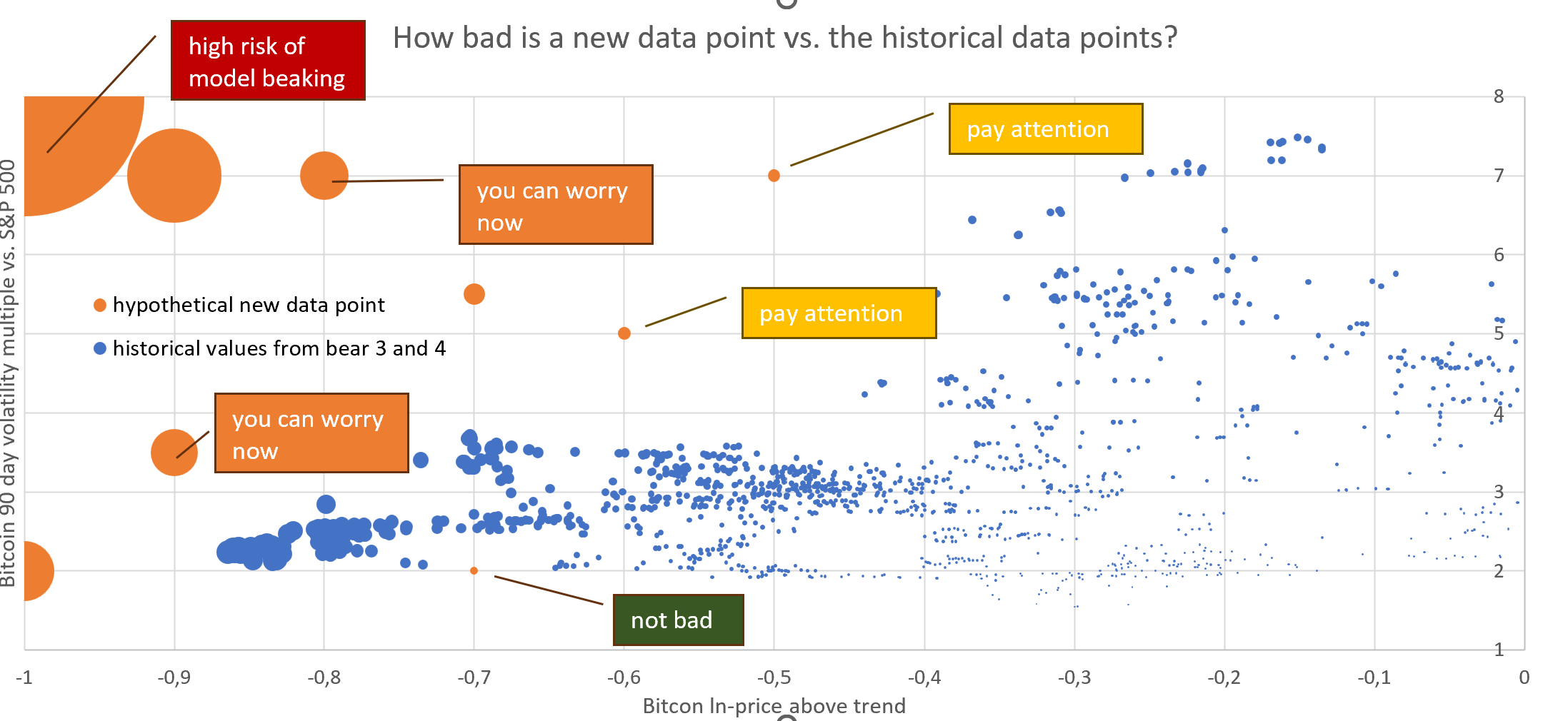

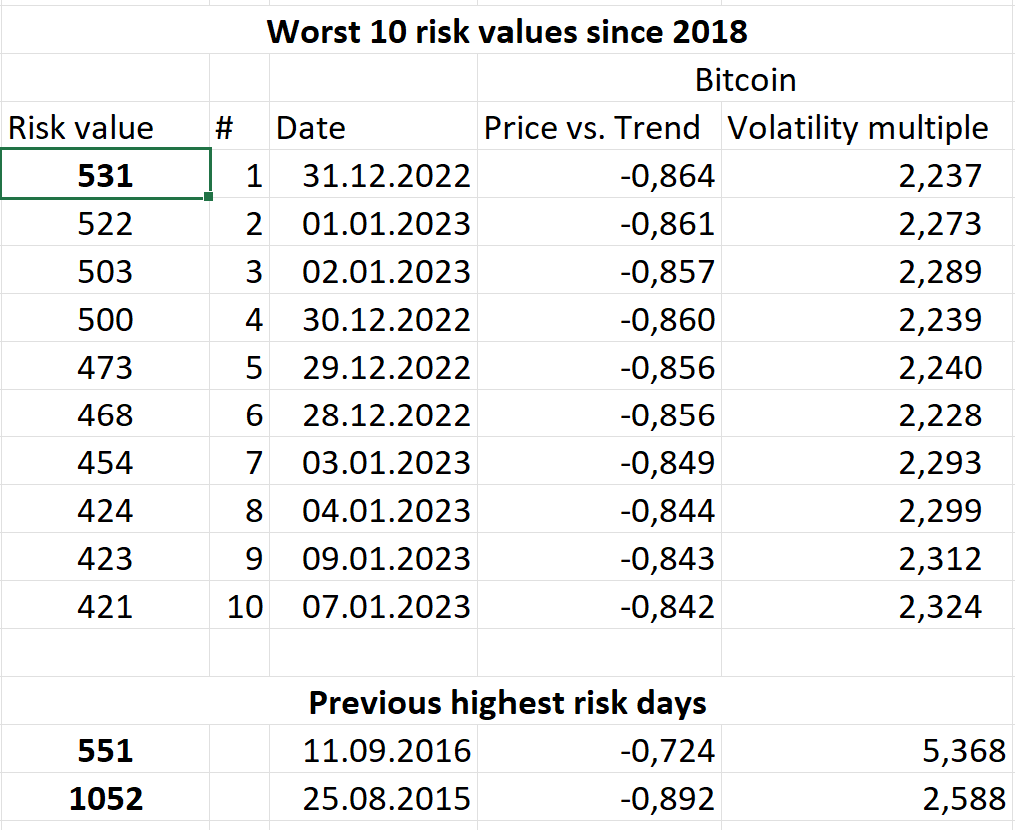

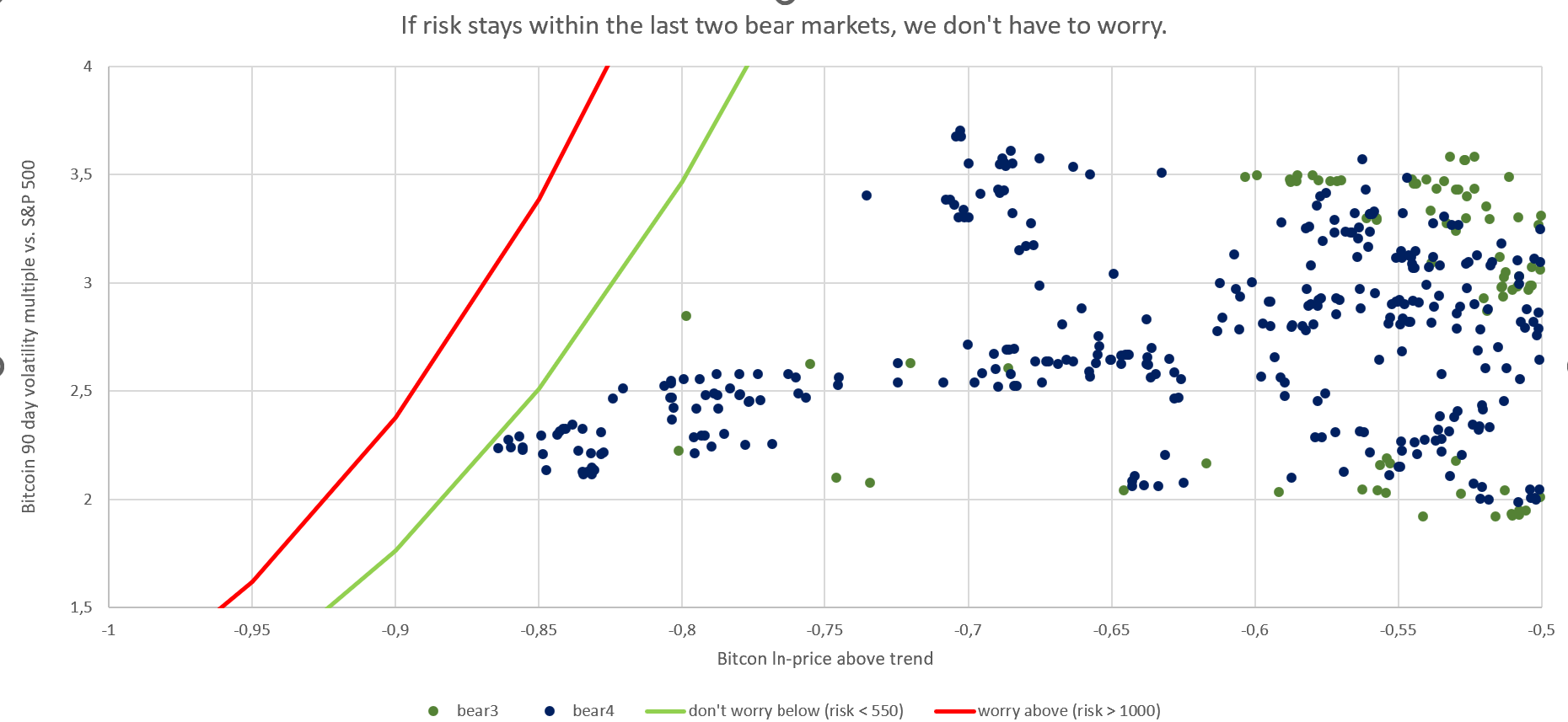

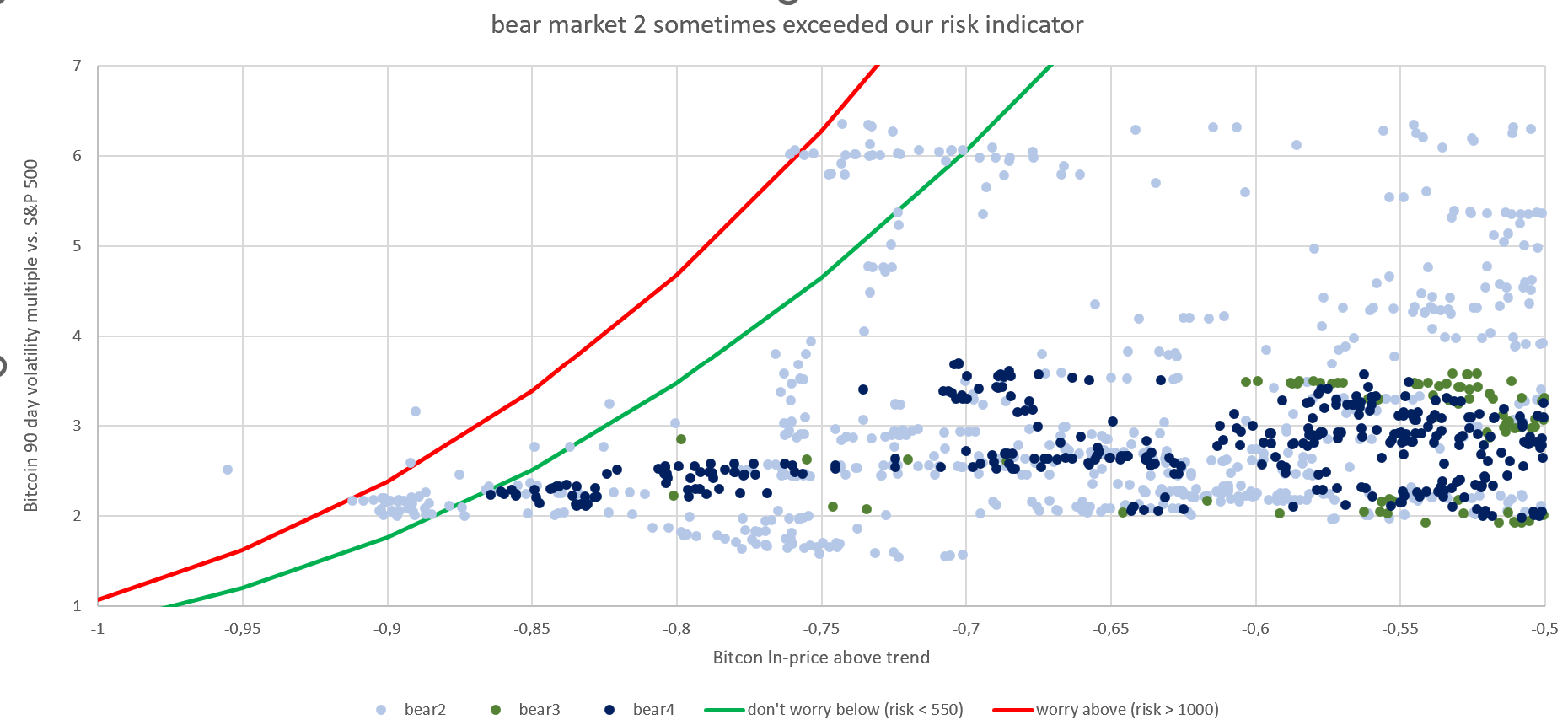

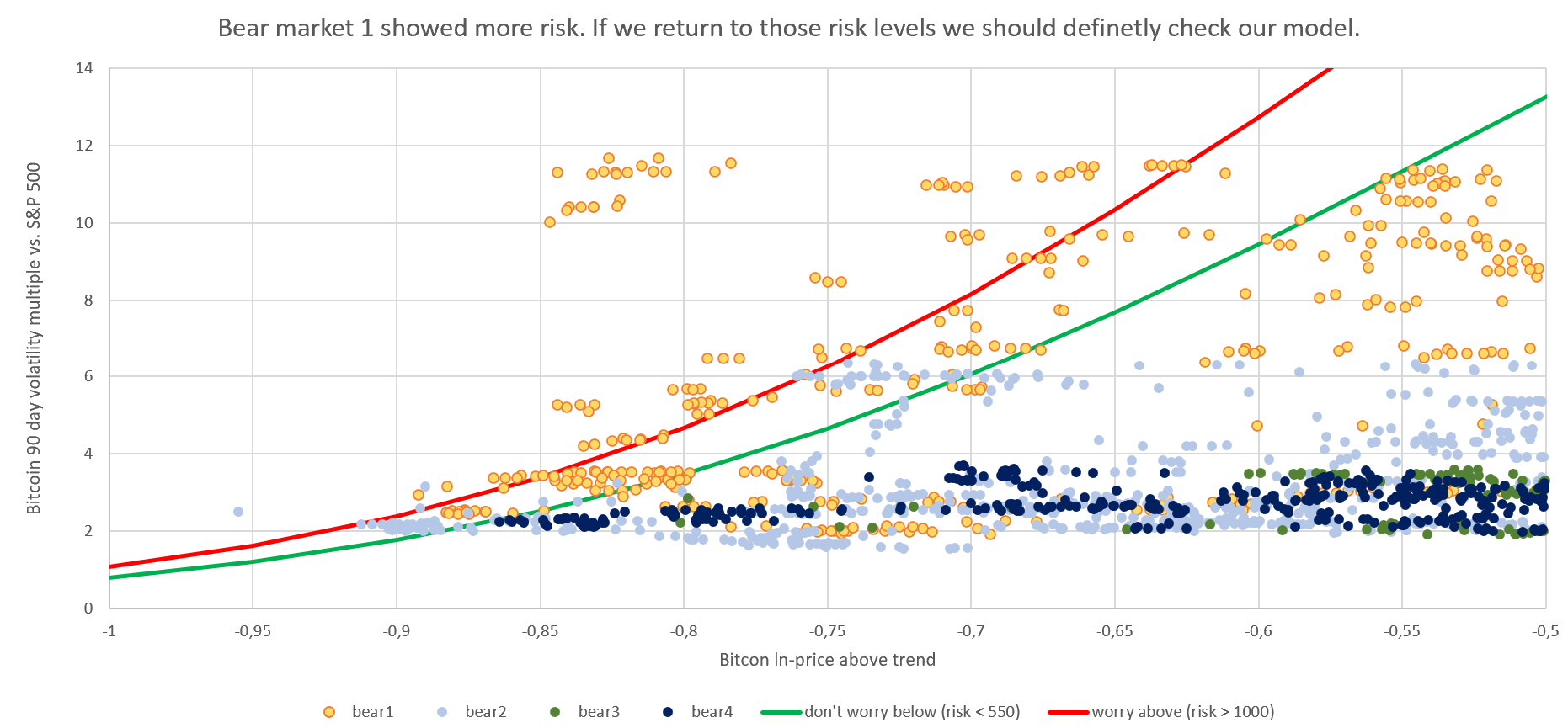

Checking the model for weaknessesChecking the stability of the bitcoin trend lineRisk: We believe that bitcoin is cyclically cheap, but the bitcoin price trend just went down. We need to measure the bitcoin price trend correctly in order to extract the cyclical price component correctly. Otherwise, we wouldn't know where we are in the cycle and would make inefficient decisions when buying and selling bitcoin. However, the early days of bitcoin's adoption dominate the data set, masking possible recent changes in the trend. I would like to see a stable trend in the past. A stable trend in the past gives us more confidence in extrapolating that trend than an unstable trend in the past.   Stable: Stable: If we divide our data set into the first two major tops (16/10/2010 - 01/05/2016) and the second two major tops (02/05/2016 - 21/03/2024), we get a trend of almost 5.7 in both periods. More or less stable: If we divide the data set into 3 sets from cycle bottom to cycle bottom, we get a slope of 6.7, 9.6, 6.7. If we divide the data set into 3 sets from cycle top to cycle top, we get a slope of 5.8, 3.5, 5.5. The trend looks reasonably stable at around 6. One day in the future, the price of Bitcoin could change its behaviour and break our current model (when Bitcion is cheap or expensive). This model will need to be revised if the bitcoin price falls significantly more than 63% (e^-1 = -63%) below trend. This model will also need to be revised if the slope of our function changes significantly. This could be the case due to significant regulatory changes in the US or due to the introduction of Mayor. This could also happen if bitcoin adoption runs out of steam. In the long run, financial assets (cash, bonds, loans, gold, part of the value of real estate, most of the value of art) can't grow faster than the amount of goods and services. The bitcoin trend looks stable so far and we can reasonably expect this trend to continue for some years into the future. However, we should be aware that one day our model will break. -> The model is stable so far Introduction of M2 inflation for USD and EUR not necessary at presentWe measure the value of bitcoin against fiat. However, money printing devalues fiat and could affect our results. Adjusting for inflation reduces our slope from 5.8 to 5.2, but so far has not had a major impact on the model's results. This would change if the pace of inflation or monetary expansion in the US or the eurozone were to increase significantly. A much stronger monetary expansion in the future would increase the slope of our trend function. This could lead to a premature switch from bitcoin to gold, which would then also rise due to inflation, making this mistake less costly. -> I use a bitcoin price that is not adjusted for M2 because bitcoin price data is more recent than M2 data and to keep the model simple. However, one should keep an eye on the monetary expansion of the major central banks. TaxationSwitching between gold and bitcoin has an additional tax burden on realised taxes. As a rule of thumb, it is more efficient to let your wealth compound and pay your legal taxes later than earlier. In my country there is no capital gains tax on gold or bitcoin after 12 months, but your tax situation may be different. PrivacyTrading in and out of bitcoin leaves data with exchanges, banks, etc. You may value your privacy more than additional financial wealth and therefore refrain from trading. Even if privacy and tax concerns limit your trading decisions, you can still choose to postpone your regular DCA close to a top. If you are planning to sell some of your bitcoin anyway, you could choose the top. If bitcoin is significantly undervalued, you can buy additional bitcoin.

How do I apply this knowledge to my investment decisions?In general, I have two constraints on my bitcoin investments: 1. Liquidity constraint: I need a liquidity buffer for (i) expected negative future cash flows and (ii) unexpected liquidity needs, for which I assume 2 annual salaries. This liquidity buffer is invested in cash (for short term needs) and a minimum drawdown portfolio of equities/gold (for medium term needs). I make a cash flow projection for the next 8 years (salary plus other income minus food minus mortgage) and calculate my minimum excess liquidity during these 8 years. This excess liquidity is earmarked for buying bitcoin. 2. Single position risk constant: I'm willing to invest 2/3 of my current and expected future net worth in bitcoin. After 2/3, I can only buy bitcoin in the bear market if I sold bitcoin during the bull market. I divide my excess liquidity into 3 equal buckets:1. bucket will be invested when we reach e^-1 undervaluation. 2. bucket will be invested when we reach fair value. 3. bucket will be partially invested each month as long as bitcoin does not exceed 150 days of overvaluation. Unfortunately the current bitcoin price is lightly above trend. Therefore I can only deploy bucket nr. 3. I should have invested earlier, but I'm still in the process of formulating my strategy.

I hope my post offered some value to some of you. I personally got some insights out of my calculations. However since I'm relatively new to the Bitcoin space, it is possible that my thoughts are not new for some members here. Therefore I would like to get some feedback, if I made some mistakes to how to improve my model. Do you think, it is possible to outperform investing into Bitcoin taking the cycle into account instead of just dollar cost averaging into Bitcoin?

Did you find any mistakes in my thought process?

|

Sicherheit für deine Familie, dich und deine BTC, dank der fundierten Sicherheits-Tipps der KryptoArche. Wir kaufen Bitcoin zum Vermögensaufbau oder zur Krisenvorsorge. Wir kaufen Bitcoin dezentral als Schutz vor Räubern, mit guter Historie und verwahren unsere Bitcoin sicher vor Verlust, Räubern und Dieben sowie versteckt Wir nutzen sichere Passwörter, Betriebssysteme, Software und sufen sicher. Sicher dir deinen kostenlosen Platz auf der KryptoArche! Die Zeit läuft ab! Steig ein, bevor es zu spät ist! Gemeinsam bleiben wir immer über Wasser!

|

|

|

|

|

|

|

|

|

|

It is a common myth that Bitcoin is ruled by a majority of miners. This is not true. Bitcoin miners "vote" on the ordering of transactions, but that's all they do. They can't vote to change the network rules.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Solosanz

|

|

March 28, 2024, 02:44:39 PM |

|

Long thread, but it's really informative.

The only suggestion I can give is you might need to resize your image a bit smaller, probably like "[img width=700" or less, because it's too big IMO.

Selling Bitcoin for gold or vice versa isn't easy because the seller won't accept Bitcoin or gold as currency, so you're need to sell your Bitcoin to fiat then buy gold, it would cost additional fees.

The thing that I learn, despite Bitcoin keep break new ATH for every four years, but actually the trend tops are getting smaller and smaller, probably in the next two halving events, the tops and bottom are close, which make Bitcoin become more stable...

|

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

thecodebear

|

|

March 28, 2024, 03:44:21 PM

Last edit: March 28, 2024, 04:06:57 PM by thecodebear Merited by virginorange (1) |

|

Can we time the Bitcoin cycle?

The case for Dollar Cost Averaging (DCA)

Most people discover Bitcoin during a bull market, invest money, get discouraged during the bear market and sell. As a result, they can lose in USD terms even though they have invested in an asset with a huge average trend growth. Investing the same amount in Bitcoin every month is an easy rule to follow. It saves you the mental load of thinking about when and how much to invest and prevents you from buying at the euphoric top and selling at the depressed bottom.

The case for countercyclical buying

However, if we could be reasonably sure that Bitcoin were near the top or near the bottom, we could invest accordingly. For example, we could stop DCA during the euphoria and double DCA during the bear market. Or we could sell some of our bitcoin close to the top and buy back close to the bottom. This would be a simple DCA strategy.

Yeah since Bitcoin has a very well known 4 year market cycle and clear bull runs and bear markets in the four year cycle, it is easy to DCA extra during the lower part of the cycle and then save up fiat during the high part in order to DCA extra when the low part of the cycle comes back. That's my strategy from here on out. It's still DCA, but using the most basic knowledge about Bitcoin's market cycles to get a much improved DCA over a typical steady buying DCA strategy. For example, I've been DCA'ing recently in the $60,000s and low $70,000s, but probably won't do any more from this point onward this bull run. I'll wait until prices get back under $80k next bear market to resume DCA around bottom of the next bear market, and then I'll continue doing it until price passes whatever the high ends up being this cycle. There really is no reason to DCA during the main part of the bull markets, you're just buying higher than you would be buying if you waited for the bear market. This better strategic DCA of course only works with Bitcoin (and things that follow Bitcoin), as opposed to the stock market where a consistent DCA is best because there is no way to guess when asset prices will be higher or lower than today. Bitcoin following an regular market cycle allows us to easily beat out the typical consistent DCA with a strategic DCA only buying on the lower half of the market cycle. In terms of selling at the top, you COULD do that as well, but then you have the risk of missing the top by a lot and maybe after taxes it wouldn't even be worth it, I dunno thats for each person to decide for themselves. I personally would prefer the super low risk strategy of strategically only DCA during low part of the market cycle and save during the high part of the cycle, while holding everything long term. |

|

|

|

|

Ascended_Intellect

Newbie

Offline Offline

Activity: 12

Merit: 0

|

|

March 28, 2024, 03:46:46 PM |

|

Fantastic breakdown!

Your analytical approach may prove to be accurate but time will answer this.

Some may complain about the "complicated nature" of the breakdown but when the average person is consumed by short form entertainment it's a given.

Personal standpoint for this current cycle is that we are below the ATH by a good margin, my guess is that BTC will top out at 67-70K GBP.

My theory even though the market is unpredictable is that we cannot possibly have a downtrend in price back to base level due to the recent bear market we just had, I've seen assumptions that this bull run will last into 2025 but November 2024 seems like a more reasonable guess.

|

|

|

|

|

|

348Judah

|

|

March 28, 2024, 04:13:24 PM |

|

If you think the use of DCA is what you can afford to go with, then the best thing is to embrace using such purchasing pattern for your bitcoin accumulation and you could easily get going well with your investment over a long term, this method has been seen as part of the most simplest means everyone can afford to use in making an investment, you have done well in bringing all these together OP, there is more we can also learn extensively using these same pattern from this link. https://dcabtc.com/ |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

Turbartuluk

|

|

March 28, 2024, 04:38:00 PM

Last edit: April 09, 2024, 01:44:48 PM by Turbartuluk Merited by virginorange (1) |

|

Very impressive, it is a pleasure to see your brain working.

Indeed it was occasionally hard to understand your process, due to the deepness of analysis. I guess it takes me about 90min to read and understand everything, but it was worth every second.

In the end everything was plausible to me and i was not able to find mistakes in your thought process.

Just one suggestion for improvement: Instead of switching to gold you could switch to a "betting against beta" portfolio. Choosing Altcoins with lower performance than BTC in the bull and betting against them via Altcoin short BTC long could help you to minimize risks and peak out the bull market.

It might also be an approach for entry in the bear market to eliminate the risk of BTC going to zero, but obviously the risk of marketwide altcoinrun is much highter when entering Alts short / BTC long in the Bear market.

|

|

|

|

|

|

Queentoshi

|

Very long read, but I managed to follow through till I could really make meaning of it. Do you think, it is possible to outperform investing into Bitcoin taking the cycle into account instead of just dollar cost averaging into Bitcoin?

Your strategy of Dollar cost averaging according to the circles will be effective for a smart investor with a good knowledge of bitcoins and understanding of the market, a newer investor in bitcoins may not be able to monitor the market properly to know when they should DCA more and pause DCA, so we advise them to just first develop the habit of investing by regular DCA, before they are mature enough to now do DCA more smartly like with this your strategy. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | | | [ | 1,000x

LEVERAGE | ] | [ | .

COMPETITIVE

FEES | ] | [ | INSTANT

EXECUTION | ] | | | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ | ████████████████████████████████████████████████████████

.

TRADE NOW

.

████████████████████████████████████████████████████████ | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ |

|

|

|

|

virginorange (OP)

|

|

March 28, 2024, 07:55:34 PM

Last edit: March 28, 2024, 08:08:37 PM by virginorange Merited by hugeblack (10) |

|

Very long read, but I managed to follow through till I could really make meaning of it.

Thanks for you feedback. I added a TL;DR summary. TL;DR: A smart and disciplined investor can outperform a simple dollar cost average strategy, by buying Bitcoin depending to its price cycle. If Bitcoin is cheap (40% below trend), I would take a full position. If Bitcoin's price is expensive (more than 750 days ahead of trend), I would not add to my position and possibly even trim my position. If Bitcoin is neither cheap nor expensive I would dollar cost average into Bitcoin.

I also agree with you, that DCA is better for most investors. The bulk of my Bitcoin buys were end 2021, which only recently turned green. So I personally unperformed a simple DCA strategy. However during the bear market I continued studying Bitcoin, kept my money off changes, didn't sell and continued to add slightly to my position. For the next cycle I try to improve my setup.

Thanks for your compliments, I always enjoy you high quality feedback. Indeed it was occasionally hard to understand your process, ... I guess it takes me about 90min to read and understand everything, but it was worth every second.

If I you would like me dig deeper into a particular point or make my explanation easier to follow, let me know. Choosing Altcoins with lower performance than BTC in the bull and betting against them via Altcoin short BTC long could help you to minimize risks and peak out the bull market.

How would you short? Via a centralized exchange or on Defi-projects in Etherium with Wrapped BTC. I think this would be quite a challenge managing all the margin requirements. Also shorting is difficult. You can loose 100% going long, but you can loose 500% or 1000% going short. So either you short with a stopp loss, forcing you to buy back even higher or you leave enough liquidity to survive the exuberance. Enough spare liquidity means low position size and low potential return. I tried shorting stocks, which ultimately went to zero, but with many spikes in between. |

Sicherheit für deine Familie, dich und deine BTC, dank der fundierten Sicherheits-Tipps der KryptoArche. Wir kaufen Bitcoin zum Vermögensaufbau oder zur Krisenvorsorge. Wir kaufen Bitcoin dezentral als Schutz vor Räubern, mit guter Historie und verwahren unsere Bitcoin sicher vor Verlust, Räubern und Dieben sowie versteckt Wir nutzen sichere Passwörter, Betriebssysteme, Software und sufen sicher. Sicher dir deinen kostenlosen Platz auf der KryptoArche! Die Zeit läuft ab! Steig ein, bevor es zu spät ist! Gemeinsam bleiben wir immer über Wasser!

|

|

|

coolcoinz

Legendary

Offline Offline

Activity: 2604

Merit: 1103

|

|

March 28, 2024, 08:32:13 PM |

|

I to answer the question if we can do better, yes we can, by performing a lump sum buy when bitcoin is in a correction. I used to start buying bitcoin in bear markets which I identified as -50% from the top. Everything below 50% was cheap in my view and worth buying and because of this I've managed to get my hands on $20k bitcoin last year. Sure, I could have done better by waiting and buying the bottom, but at that point nobody knew what the bottom was.

Going to gold and back is only for people who are willing to risk paying exchange fees, network fees, taxes on their gains. If I were to switch back and forth, every $1k transaction would mean paying $10 in exchange fees and another $20 in network fees, holding my bitcoin on exchanges and exposing myself as a holder... I prefer anonymity of a physical bitcoin exchange, where I do no KYC, pay with cash, don't have to report any gains and the only fee I pay is to the network.

|

|

|

|

btc78

Full Member

Offline Offline

Activity: 2478

Merit: 212

Eloncoin.org - Mars, here we come!

|

|

March 29, 2024, 05:12:12 AM |

|

Really impressive breakdown. I am sure this took you days or maybe even weeks to have completed.

Many think that those who invest understand all the complexities and technological nature of investing but that is simply not true. Many actually do not know how to analyze the market and only buys when it seems to be going up and sell when it seems to be going down. This really could help a lot of people myself included. Props and keep up the good work!

|

|

|

|

|

Turbartuluk

|

|

March 29, 2024, 09:43:00 AM

Last edit: March 29, 2024, 09:54:23 AM by Turbartuluk |

|

Thanks for your compliments, I always enjoy you high quality feedback. Indeed it was occasionally hard to understand your process, ... I guess it takes me about 90min to read and understand everything, but it was worth every second.

If I you would like me dig deeper into a particular point or make my explanation easier to follow, let me know. Choosing Altcoins with lower performance than BTC in the bull and betting against them via Altcoin short BTC long could help you to minimize risks and peak out the bull market.

How would you short? Via a centralized exchange or on Defi-projects in Etherium with Wrapped BTC. I think this would be quite a challenge managing all the margin requirements. Also shorting is difficult. You can loose 100% going long, but you can loose 500% or 1000% going short. So either you short with a stopp loss, forcing you to buy back even higher or you leave enough liquidity to survive the exuberance. Enough spare liquidity means low position size and low potential return. I tried shorting stocks, which ultimately went to zero, but with many spikes in between. Let's start with some idea's for possible improvements: 1. Formula y = 5,8323x - 39,296-> I guess you have done some kind of logarithmic Regression like Trolololo did it once-> therefore i guess the formula will be outdated with the years going and it would be helpful to reference the way of calculations 2. "Cyclical Component of Bitcoin price" graphics -> due to logarithmic timeline it's somehow difficult to assign the peaks/years -> maybe vertical halving-lines or labeling the peaks with year count could help as a guideline 3. Entry Price vs. Trend graphic-> regarding the cloud of blue dots it might be possible to separate dataset into 3-4 parts (coresponding full cycles) and use different colours for the dots and regression lines -> maybe some trend will show up (regarding hight or incline) 4. Finding the Tops-> while i understand the days ahead model itself i find it somehow difficult to switch between two different models for Highs and Lows -> maybe you could use an approach like: y = (5,8323 -1 )x - 39,296 +9,5 for the Highs (numbers roughly estimated, mistaken thinking is very likely)

Regarding a switch to an Altcoins/BTC short portfolio it is meant to be a kind of hedge. I guess i would use Kraken CFDs as i am familiar with them. There are about 50+ pairs for margin trading. I would sort out all those Altcoins with a better performance than BTC during the Bull (regarding sharpe or sortino ratio). I would also sort out Alcoins with extreme volatility like Memecoins. Lets say there are 40 Altcoins left which build the portfolio. During the rest of the Bull (and regarding ETFs which only push BTC) it should be likely that these Altcoins do not excessive outperform BTC even in an Altcoin-Run (which could lead to margin call). On the other hand the crash for those Altcoins after the Peak should be much harder in comparison to BTC so you could profit from the crash. Obviously you need collateral on CEX so you are affectet by Counterparty Risk. Also there might be drawbacks regarding privacy and taxes. |

|

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

March 29, 2024, 11:06:10 AM |

|

Since Dollar cost averaging is a strategy for beginners, and without going into details, beginners will prefers to follow the approach of buying an amount every week or month, and after gaining sufficient experience, will moves on to more complex strategies, so why not create a simple site called advanced DCA that has a simple recommendation indicator for beginners, where the indicator is suggested to either increase the amount of your investments or reduce them, something like the Fear & Greed Index, but it is for advanced DCA, through which there are points on the index that indicate whether you are investing in large amounts or not. Then the strategy will be better because it is intended for beginners, and beginners may not be able to understand the charts you mentioned above.  |

|

|

|

SilverCryptoBullet

Member

Offline Offline

Activity: 82

Merit: 38

|

|

March 30, 2024, 11:55:40 AM |

|

With ROI, very high, it is attractive enough to DCA Bitcoin. https://casebitcoin.com/I appreciated your work that is complex and I don't understand all of your charts and math but you did good works to convince newbies that Bitcoin is a good investment choice for them. https://dcabtc.com/ |

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6140

Decentralization Maximalist

|

Very good thread I would have missed if there wasn't a post in a well known German thread. I should frequent this subforum more  In general terms I agree with most of your points, and I think even newbies can come to the simple conclusion that you can almost safely "catch the falling knife" (in an intelligent way, like the described DCA-based strategy, not going all-in at once!) if the price has fallen low enough from the last top. This is always what baffles me: Many people wait way too long to buy when the bear market reaches its end, waiting for even lower and lower lows, but then they return when the bull market is already fully in force (this was the case when $32.000 was passed in late 2023 - those going in at this point missed more than 100% profit!) . Such strategies becoming more popular would also increase the stability and confidence in Bitcoin in general, the bear markets would be less deep and progressively cause less fear which is a virtuous cycle.

I have only one thing to add: One could perhaps improve the model trying to spot anomalies caused by external effects. This is based on the theory that the long-term price trend is generally based on an "adoption" curve and has thus "fundamental" reasons, but there can be some temporary effects in place, which seem to change the trend but in reality are only temporary increases of either demand or supply. The best example was the crash in March 2020 due to the Coronavirus crisis. But there are of course also more gradual and longer-lasting effects, like the influence of the interest rate in major markets like the US and Europe. I believe that for example in 2019-2021 the bull market could have started earlier in full force and have been stronger if the Corona crisis didn't materialize, and the May 2021 top possibly was "lower than normal" for the effect caused by the China mining ban, late Coronavirus crisis effects and the start of the inflation increase in the US and Europe. On the other hand, the El Salvador Bitcoin law could have led to an anomalous second top in late 2021, which was not seen in most other coins. If the market had developed like in previous cycles, without this "positive black swan", then the late 2021 top would perhaps only be at 60% of the May 2021 top. How to include that into a mathematical model? One could add a kind of "positive/negative general market sentiment bonus" to the figures. This bonus would take into account the situation in high-risk markets (mainly stock markets in US, Europe, India and other relevant countries) but also very relevant Bitcoin- or crypto-specific news and add or subtract this number from the expected tops or bottoms. |

|

|

|

|

Turbartuluk

|

|

March 31, 2024, 05:45:34 AM |

|

How to include that into a mathematical model? One could add a kind of "positive/negative general market sentiment bonus" to the figures. This bonus would take into account the situation in high-risk markets (mainly stock markets in US, Europe, India and other relevant countries) but also very relevant Bitcoin- or crypto-specific news and add or subtract this number from the expected tops or bottoms.

Interesting approach. What kind of sentiment analysis you have in mind? Do you know some good "pure sentiment" indicators? The first sentiment indicator i had in mind was the fear and greed Index, but as it has a lot TA in it (volatility, momentum, volume, dominance) i am not sure if it is suitable, it could depend more on chart history than predicting it. |

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6140

Decentralization Maximalist

|

|

March 31, 2024, 04:49:15 PM |

|

Interesting approach. What kind of sentiment analysis you have in mind? Do you know some good "pure sentiment" indicators?

First, I don't know if "sentiment" is the correct word, because "sentiment"-based indices like Greed & Fear are partly based on the price evolution itself. Perhaps one could call this indicator "general market situation". Or simply "External effects influence". I'd thought about a simple "bucket list" of items you can assign a value and apply it to the general "trend index". For example: - Interest rates in a significant part of the most markets (North America, Europe, India, China) more than 1.5 percentual points above the 20-year average --> -10% - " " more than 1.5 percentual points below the 20-year average --> +10% - same for world economic growth rate (this would explain the Covid anomaly) - Regulatory/political event affecting demand negatively in a significant part of the Bitcoin market (e.g. trading/mining ban in China) -> -5% to -20% depending on the size of the market affected and so on. - Regulatory/polical event of high impact in a smaller market, but first of its kind (example: El Salvador's acceptance as legal tender) +/- 10% The good thing is that such indicators are hard enough be tested with past market data. I would limit them to important events. For example, El Salvador's Bitcoin law would be an item I'd include, but the Central African Republic's short-lived Bitcoin law not as it wasn't the first of its kind and its impact was also low. It would be of course object of debate which "hard" indicators determine what to include, but that's a challenge for any of such indices. |

|

|

|

|

Turbartuluk

|

|

March 31, 2024, 06:54:15 PM |

|

~

Hmm. While I agree, that those items mentioned have major impact, i am not a friend of that "bucket list" idea. As it is easy to add items it is likely that you get an overfitted model in the end. And when that model does not fit the future prices anymore it is likewise easy to say, that is because another item that is not on the list and has to be added. Even if you had something different in mind, i dont have a clue how you want to prevent that risk?! On the other hand you could also argue, that all those items mentioned (an much more major and minor impacts) were already priced in and therefore part of chart history. Additionally you don't have to discuss weighting of the list items, as market has already decided for you. In the end you come back to a (mathematical) model based on chart history as it keeps things more simple. To my mind it is fine if you keep flexibility and don't get a 100% fit with past price history. Such a high fit is often only possible with a very small number of target points (e.g. only highs or lows instead of 1D closing prices) and would suggest an accuracy which is unrealistic for future "prediction". |

|

|

|

|

|

Etranger

|

|

March 31, 2024, 07:00:26 PM |

|

To my mind it is fine if you keep flexibility and don't get a 100% fit with past price history. Such a high fit is often only possible with a very small number of target points (e.g. only highs or lows instead of 1D closing prices) and would suggest an accuracy which is unrealistic for future "prediction".

I agree that historical analysis cannot be considered a sufficient basis for building future forecasts, but still it is necessary to rely on it, because retrospective image gives an idea of what was already possible for the crypto market, and therefore - can be possible again. It also makes it real to draw analogies with those new events that have taken place and what their impact on the price may be. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6140

Decentralization Maximalist

|

|

March 31, 2024, 09:33:37 PM |

|

Hmm. While I agree, that those items mentioned have major impact, i am not a friend of that "bucket list" idea. As it is easy to add items it is likely that you get an overfitted model in the end. And when that model does not fit the future prices anymore it is likewise easy to say, that is because another item that is not on the list and has to be added. Even if you had something different in mind, i dont have a clue how you want to prevent that risk?! Obviously an exact price prediction is impossible. What virginorange instead pretends (if I interpret correctly) is to find general guidelines for retail investors to know when it's a good time to increase the position in Bitcoin, and when it's better to decrease it, not an exact moment when to buy or sell (which would be impossible). The idea is basically to not ignore these "external" factors. Everybody interested in this model can vary his own bucket list and add or remove items - different traders will always process information differently (at least if they're not using the same trading bot or so  ) and thus concede some factors more and others less weight. It would be interesting to create a software tool to be able to contrast such variables with the past price data, being able to adjust the weights of each factor. This tool could then be used in combination with virginorange's general model. On the other hand you could also argue, that all those items mentioned (an much more major and minor impacts) were already priced in and therefore part of chart history. Additionally you don't have to discuss weighting of the list items, as market has already decided for you. In the end you come back to a (mathematical) model based on chart history as it keeps things more simple. The problem is that if you base a model on a chart history which was partly influenced by external factors, you may get a distorted model. The most significant example would be the "underperforming" 2021 bull run. In my opinion without Covid and the begin of inflation growth later that year, the bull run could have been stronger and already reached or approached $100.000 in that year. That was expected by many Bitcoiners that time. The theory about an "underperformance" of course is only an assumption, like everything we discuss in these sections. But this "underperforming" bull run could lead that in the current bull run (and the next ones, if there are any left  ) you may sell too early because the model considered 2021's "underperforming" run part of a general trend where highs tend to be lower. I don't dispute here that the volatility to the upside is probably decreasing, but from my impression particularly the last stretch of 2021 bull (November high was less than 10% above the May high) was quite weak compared with earlier bulls. To my mind it is fine if you keep flexibility and don't get a 100% fit with past price history. Such a high fit is often only possible with a very small number of target points (e.g. only highs or lows instead of 1D closing prices) and would suggest an accuracy which is unrealistic for future "prediction".

Fully agree here. |

|

|

|

laijsica

Member

Online Online

Activity: 70

Merit: 10

|

|

April 01, 2024, 09:51:59 AM

Last edit: April 02, 2024, 03:40:46 PM by laijsica |

|

The case for countercyclical buying

However, if we could be reasonably sure that Bitcoin were near the top or near the bottom, we could invest accordingly. For example, we could stop DCA during the euphoria and double DCA during the bear market. Or we could sell some of our bitcoin close to the top and buy back close to the bottom. This would be a simple DCA strategy.

Your opinion about DCA strategies is very reasonable and a good example of investment. DCAing in the bear market is limited and the tendency to increase in the upper market is promising. Bubbles are constantly entering the market, even in a bull market. I've covered long-term moving averages in the past on DCAing. But I didn't think like you. As this analytical thinking opens new windows for market trending |

|

|

|

|

|

Turbartuluk

|

The problem is that if you base a model on a chart history which was partly influenced by external factors, you may get a distorted model.

I am not sure about that. Obviously there are external factors which influence the chart history, but the approach to exclude those factors from the model is not helpful to my mind, as those factors will also exist in the future and cant be forecasted. Let us assume that i agree to the theory of "underperforming" 2021 bull run due to corona pandamic. With an "adopted peak" of 100k€ the price would have been ~1,5 above trend instead of ~1. It would than perfectly fit the trend line of previous peaks.  But what is the message out of it for future peaks? The "peak line" now pretends to predict the next peak more precisly, but that is just not true, as the "model" is still based on very few (=4) target points and other black swan events in both directions could occure at any time. Therefore it would be kind of missleading to my mind. If there is one weakness in the analysis of @virginorange than it is including some sort of peak or bottom area instead of letting trend line speak for itself. While the trend line is build from thousands of data points (1D close prices) there are only a few peaks or bottoms and therefore much less statistical evidence for envelope lines. But obviously everbody wants to buy the bottom and sell the peak so that the readers focus is on those bottom and peak areas instead of trend line itself.

@virginorange: this might also be a mistake in the thought process regarding the cut-off points as the backtests for buy and sell might be dominated by a few bottoms / peaks. Regarding your Backtest 2 that could exemplary mean: 1000 Days ahead -> sell 1 Peak 900 Days ahead -> sell 2 Peaks 800 Day ahead -> sell 4 Peaks -> 1st maximum 700/600 Days ahead -> sell 4 Peaks (less effective) 500 Days ahead -> sell 6 Peaks -> 2nd maximum in conclusion the prediction power of results would be very limited due to small amount of peaks.... |

|

|

|

|

clone4502

Newbie

Offline Offline

Activity: 1

Merit: 0

|

|

April 02, 2024, 03:27:19 PM |

|

Excellent post. Thanks!

Have you ever compared dollar-cost averaging with value-averaging?

Value average appears to work better for volatile assets like crypto.

I used the strategy to accumulate XMR with surprising results.

It is a disciplined strategy that takes the guessing out of where asset prices are trending and has you buying more as asset prices decrease and less as asset prices rise.

|

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6140

Decentralization Maximalist

|

But what is the message out of it for future peaks? The "peak line" now pretends to predict the next peak more precisly, but that is just not true, as the "model" is still based on very few (=4) target points and other black swan events in both directions could occure at any time. Therefore it would be kind of missleading to my mind.

Thank you for your calculations, I think you have a valid point here. And in general I think to simply outperform DCA for the next few years @virginorange's model in its pure form would work even if it was slightly distorted. Taking external factors into account would mainly be useful for longer timeframes, but also could yield a slightly better performance in the mid term. But the longer a model seems to work although it is distorted, the bigger the risks that its predictions will be totally off for the next cycle. We have already an example where a model which was based on the past price history and "seemed to work fine" for years but then failed because it was distorted: Stock to Flow. People who adopted risky strategies based on the original model which predicted a 2021 peak of well over 100.000$ will very likely have suffered big losses in the 2021-2022 bear. Virginorange's model is much, much better than S2F, but the "problem" that it is only based on price history remains. The big question is of course: Is there a fundamental reason for the long term Bitcoin trend? If we assume the answer is "yes", like I wrote before assuming that the "grade of adoption" is the main factor here, then it would be useful to "isolate" this trend curve in some way. And then there is room to improve the model with such an "external effect factor". If however your answer is "no", which is also a valid assumption, then I'd go for the "pure" price history based model. Many traders/investors would disagree about this question, and that's totally fine. |

|

|

|

SilverCryptoBullet

Member

Offline Offline

Activity: 82

Merit: 38

|

|

April 03, 2024, 02:09:07 AM |

|

S2F model, DCA, Bitcoin Power Law and try to find bottom of market. If we apply all of these, we will be very confusing with the market and no longer be able to apply DCA well. Models are for every senior investors who have enough experience but with new investors, I can not understand models and DCA is my strategy. |

|

|

|

|

|

Turbartuluk

|

|

April 03, 2024, 12:06:31 PM |

|

Virginorange's model is much, much better than S2F, but the "problem" that it is only based on price history remains.

Taking external factors into account would not solve this "problem", because you have to quantify those factors based on historical experience. This approach in 2019 would not have had a pandamic on the bucket list, or at least not within the Top10 external factors. In 2020/21 it would have been Top1, but even if you are able to quantify it's influence for 2020/21, the next black swan event will not be a pandemic and the next pandemic will be different from the last one. The big question is of course: Is there a fundamental reason for the long term Bitcoin trend?

To my mind that is not the question. Regarding that trendline, the likelihood that the relationship between Price and Date is caused by chance is close to zero. In other words: there must be some fundamental reasons. The question is what are those reasons and how to quantify them? Is it possible at all to quantify those external factors as some of them an single events with major impact? Building a model on price history is far from perfect, but at least it is a simplification we could reasonable prove right or wrong with "scientific" methodes. For me those models are like driving on the street, you need to take into account the latest data to adjust direction and stay on track. But even then a truck from the side street could slingshot you to a complete different direction. |

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6140

Decentralization Maximalist

|

|

April 03, 2024, 08:34:37 PM |

|

The big question is of course: Is there a fundamental reason for the long term Bitcoin trend?

To my mind that is not the question. Regarding that trendline, the likelihood that the relationship between Price and Date is caused by chance is close to zero. In other words: there must be some fundamental reasons. I think I should have written: Is there a fundamental reason outside the price history itself?The alternative would not be "chance", but that the growth's reason is related to the past price history. The price growth itself could have led to an increasing interest and thus cause a prolongation of the increasing trend (the "Bitcoin: I can get rich quick!" theory). But also the "I see there are bull-bear cycles of 4 years, thus I ride the waves" theory is such a "investment principle" without external influence which could have caused the long term trend. On the other ("a fundamental reason exists outside of price history") side, aside from the simple "adoption" theory there could be also something like "static demand surplus combined with increasingly lower supply growth" like in S2F. About more specific details of such a model I'll open a dedicated thread (as said per PM). The important thing for me is that you should be able to try several independent variables and test them empirically with a software tool. But such a model could not find the reason for every price movement, this would be too complex/next to imposssible. It's only meant to fine-tune a more general, price-history based model like virginorange's. |

|

|

|

el kaka22

Legendary

Offline Offline

Activity: 3500

Merit: 1162

www.Crypto.Games: Multiple coins, multiple games

|

|

April 03, 2024, 11:45:03 PM |

|

We practically can't. People failing at DCA as it is, they see it go down and instead of buying more they end up selling, hence makes it go down even more than that too, and it would not be something that could take a long time neither, should be alright. I believe that we need to learn to do DCA better and should be considering that as a normal thing as we can.

This is the most important thing, and as long as we keep doing this, it shouldn't really be living in a different kinds of world of it. I know that it is going to take a while, but we are going to get better at it with time as well, without a doubt. I hope that price will go up so that people wouldn't really end up with anything that will require any learning of it.

|

|

|

|

|

OcTradism

|

|

April 04, 2024, 02:41:29 AM |

|

We practically can't. People failing at DCA as it is, they see it go down and instead of buying more they end up selling, hence makes it go down even more than that too, and it would not be something that could take a long time neither, should be alright. I believe that we need to learn to do DCA better and should be considering that as a normal thing as we can.

DCA is a famous investment strategy and it's more easily to talk about it than actually practice it with our money. It's more easier to say that "I am planning to do DCA with Bitcoin" than actually spending money regularly to purchase Bitcoin. First barrier is our failure to assign our money for DCA. Second barrier is our failure to maintain our belief in Bitcoin and control our emotion and psychology in the volatile market. DCA strategy is helpful to avoid effects from emotion and psychology but in practice, not all people can avoid fear when market is bad and do their DCA plan. People who are fearful will need to look at Michael Saylor and MicroStrategy as example of DCA. They have been doing DCA since 2020 and they are winning big. |

| | | .

.Duelbits. | | | █▀▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄▄ | TRY OUR

NEW UNIQUE

GAMES! | | .

..DICE... | ███████████████████████████████

███▀▀ ▀▀███

███ ▄▄▄▄ ▄▄▄▄ ███

███ ██████ ██████ ███

███ ▀████▀ ▀████▀ ███

███ ███

███ ███

███ ███

███ ▄████▄ ▄████▄ ███

███ ██████ ██████ ███

███ ▀▀▀▀ ▀▀▀▀ ███

███▄▄ ▄▄███

███████████████████████████████ | .

.MINES. | ███████████████████████████████

████████████████████████▄▀▄████

██████████████▀▄▄▄▀█████▄▀▄████

████████████▀ █████▄▀████ █████

██████████ █████▄▀▀▄██████

███████▀ ▀████████████

█████▀ ▀██████████

█████ ██████████

████▌ ▐█████████

█████ ██████████

██████▄ ▄███████████

████████▄▄ ▄▄█████████████

███████████████████████████████ | .

.PLINKO. | ███████████████████████████████

█████████▀▀▀ ▀▀▀█████████

██████▀ ▄▄███ ███ ▀██████

█████ ▄▀▀ █████

████ ▀ ████

███ ███

███ ███

███ ███

████ ████

█████ █████

██████▄ ▄██████

█████████▄▄▄ ▄▄▄█████████

███████████████████████████████ | 10,000x

MULTIPLIER | │ | NEARLY UP TO

.50%. REWARDS | | | ▀▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄▄█ |

|

|

|

|

virginorange (OP)

|

|

April 08, 2024, 03:03:24 PM

Last edit: April 08, 2024, 05:07:58 PM by virginorange Merited by Turbartuluk (10) |

|

[3. Entry Price vs. Trend graphic

-> regarding the cloud of blue dots it might be possible to separate dataset into 3-4 parts (coresponding full cycles) and use different colours for the dots and regression lines

-> maybe some trend will show up (regarding hight or incline)

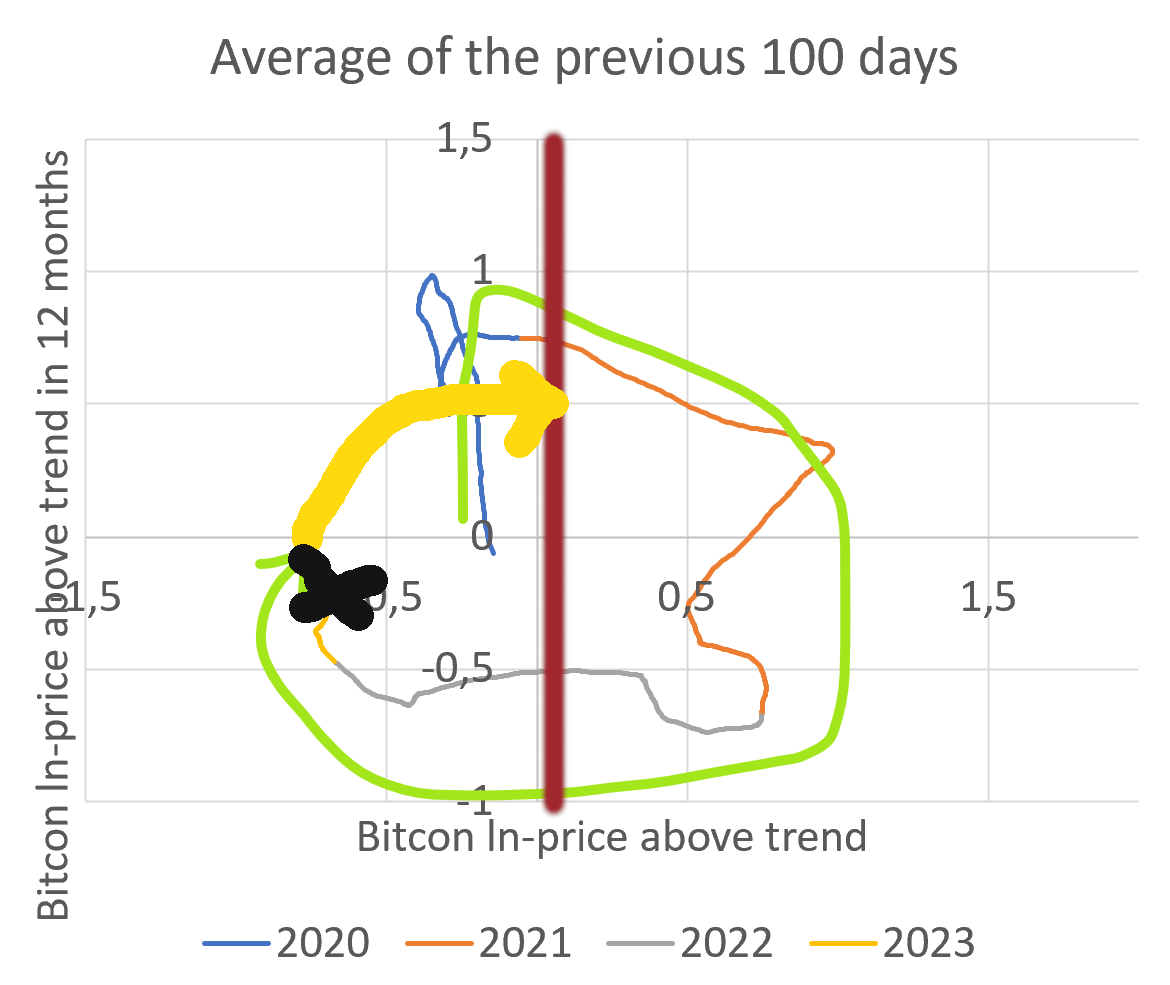

Thanks for your improvement proposals Tubabuluk, I will start with #3 and shine a bit more light on the cloud of blue dots. TL;DR: Bitcoin is slightly overvalued, but it is still a good time to buy Bitcoin.

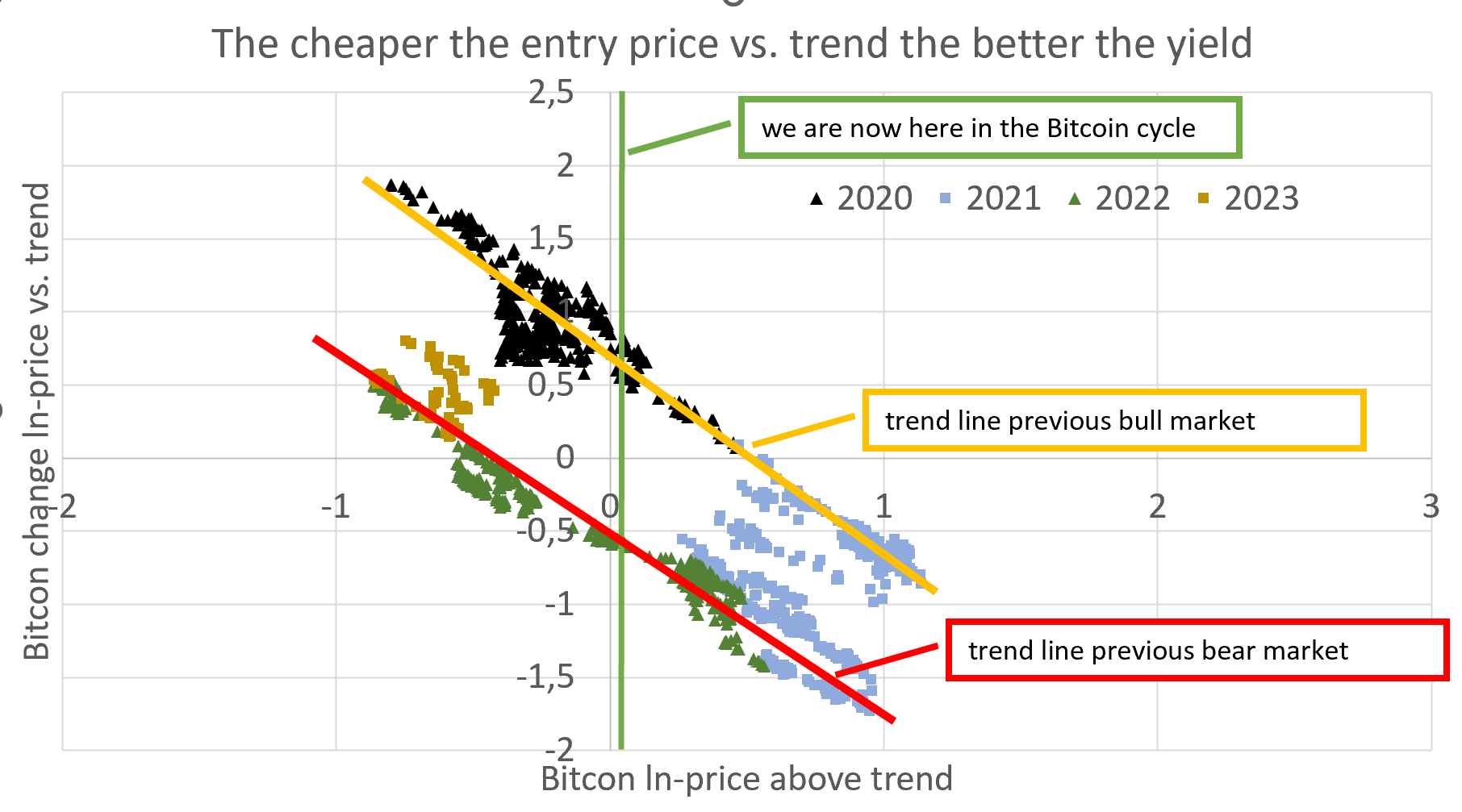

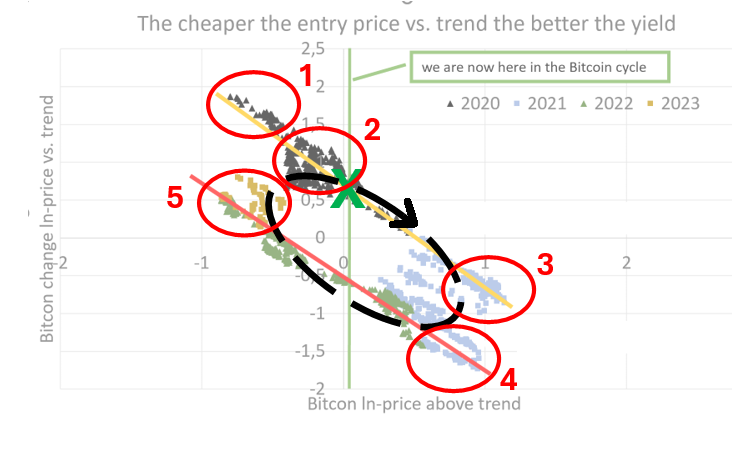

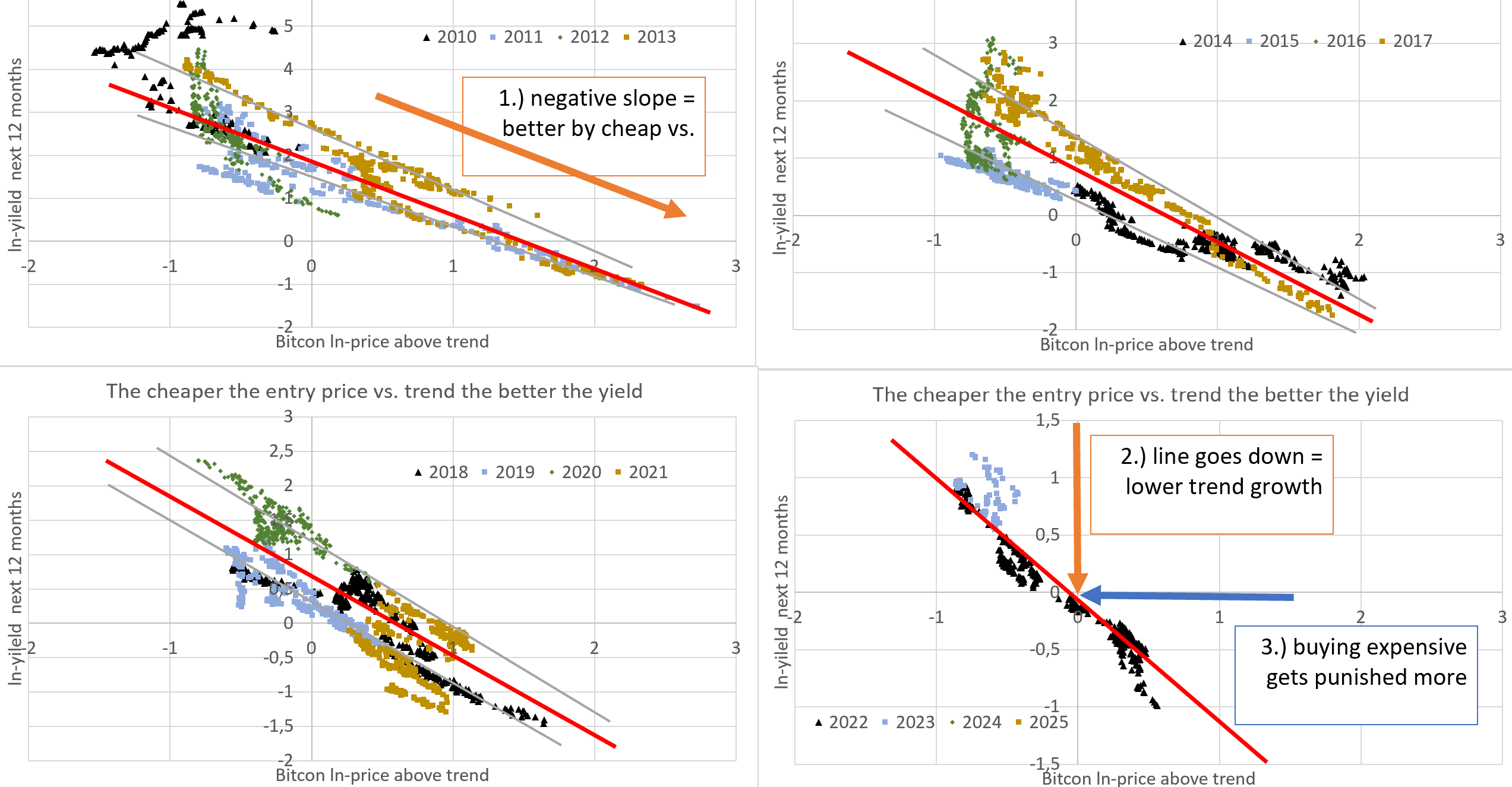

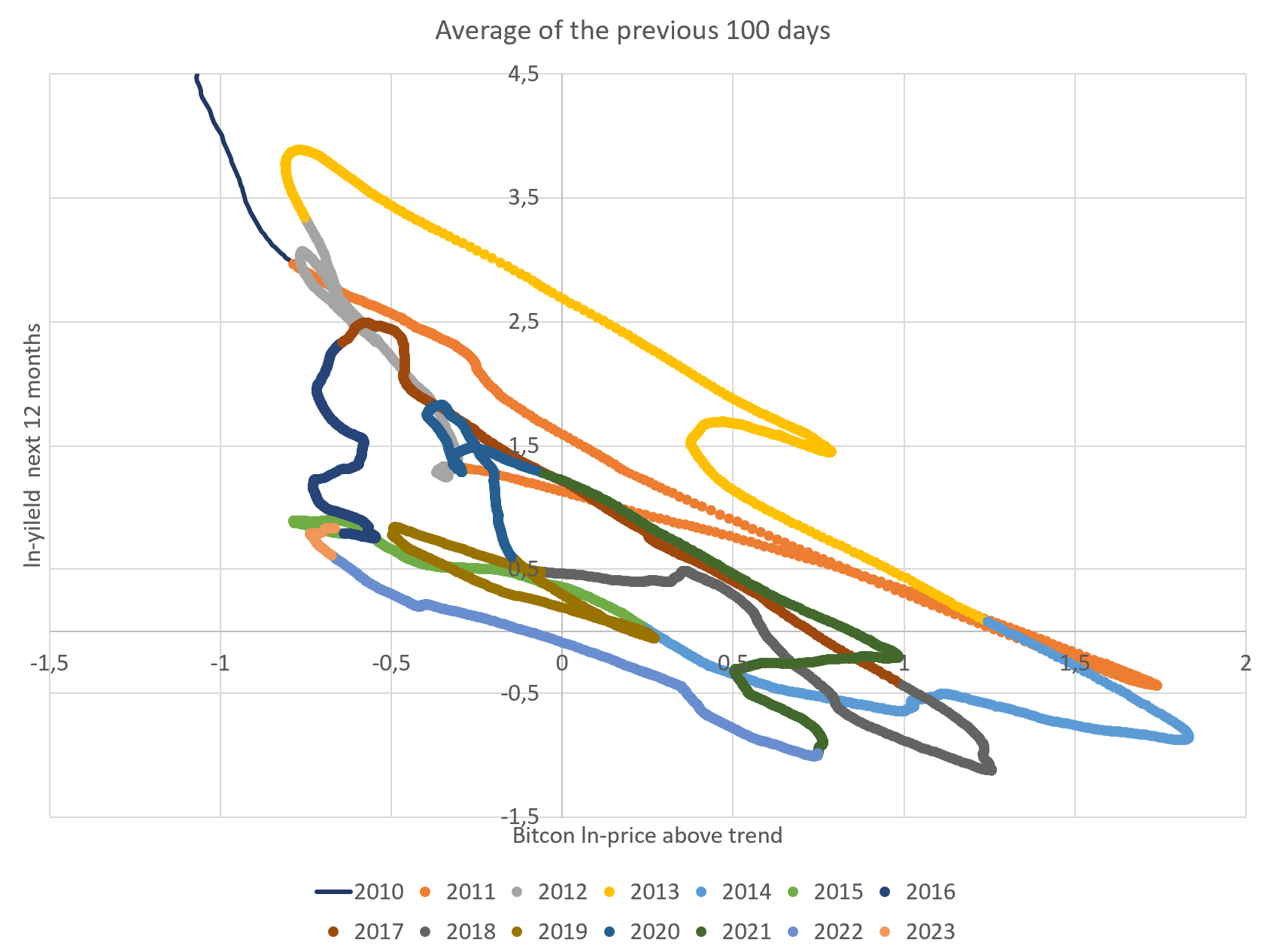

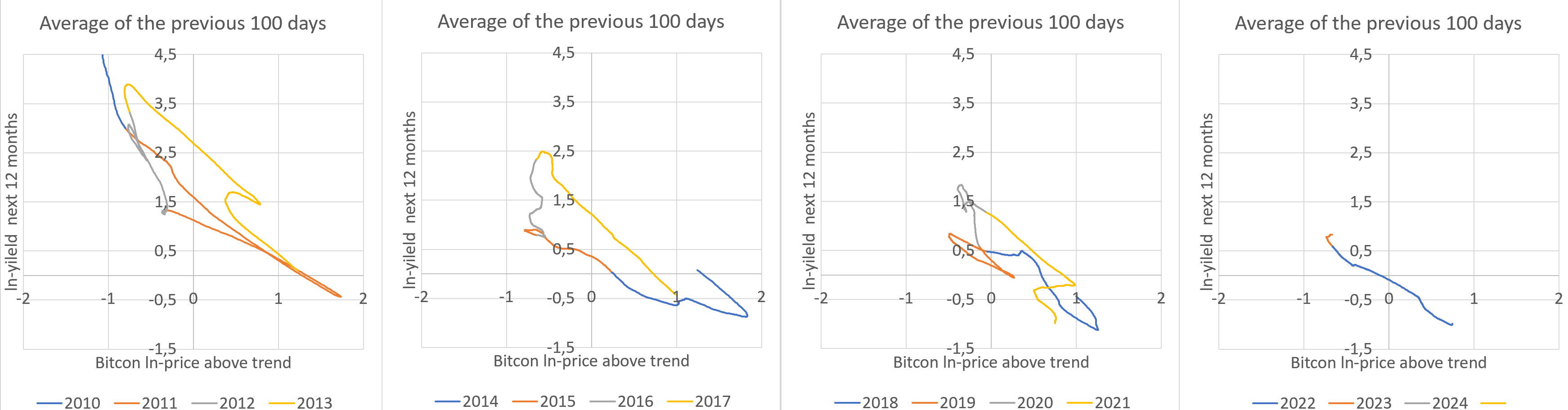

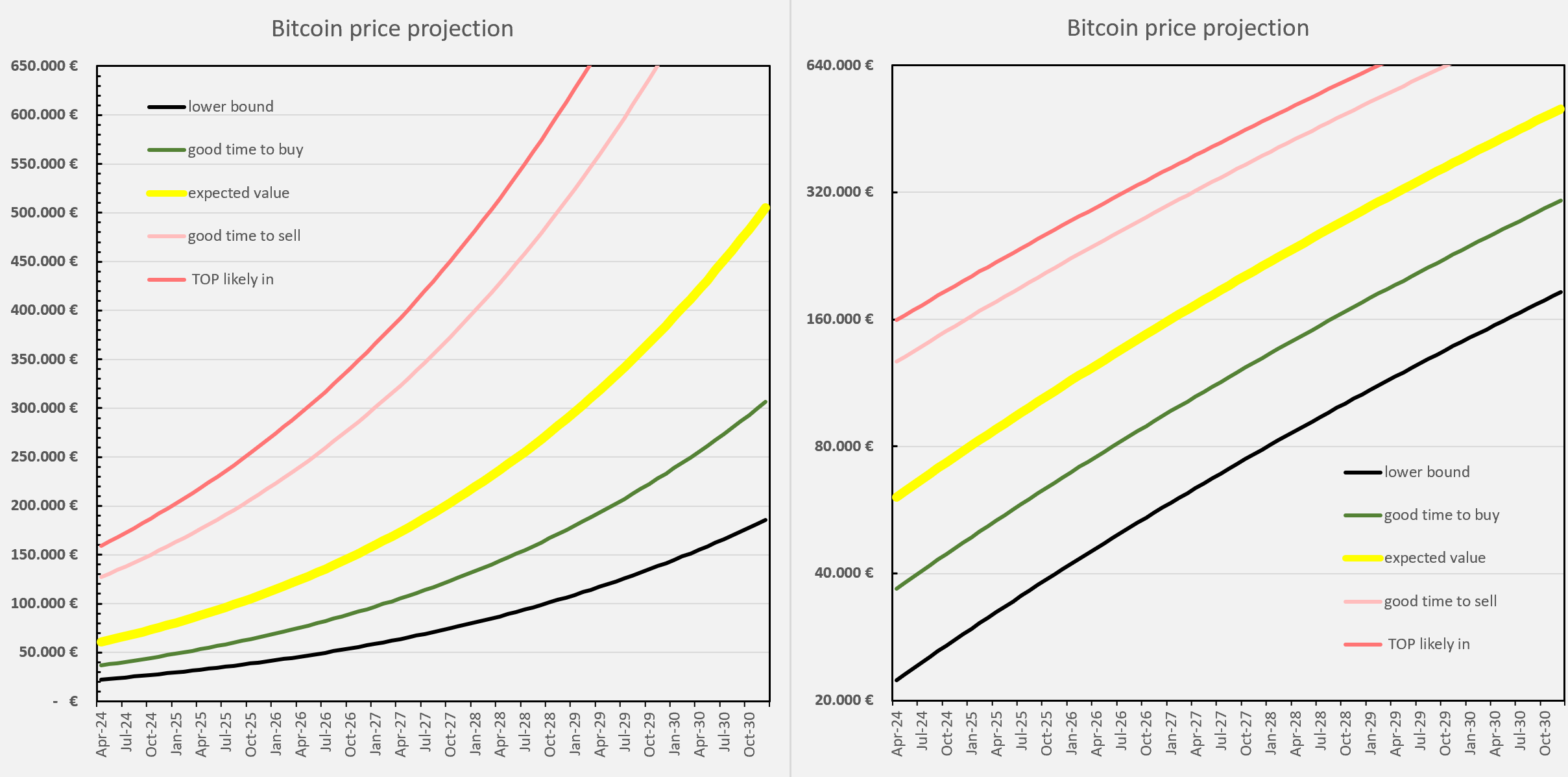

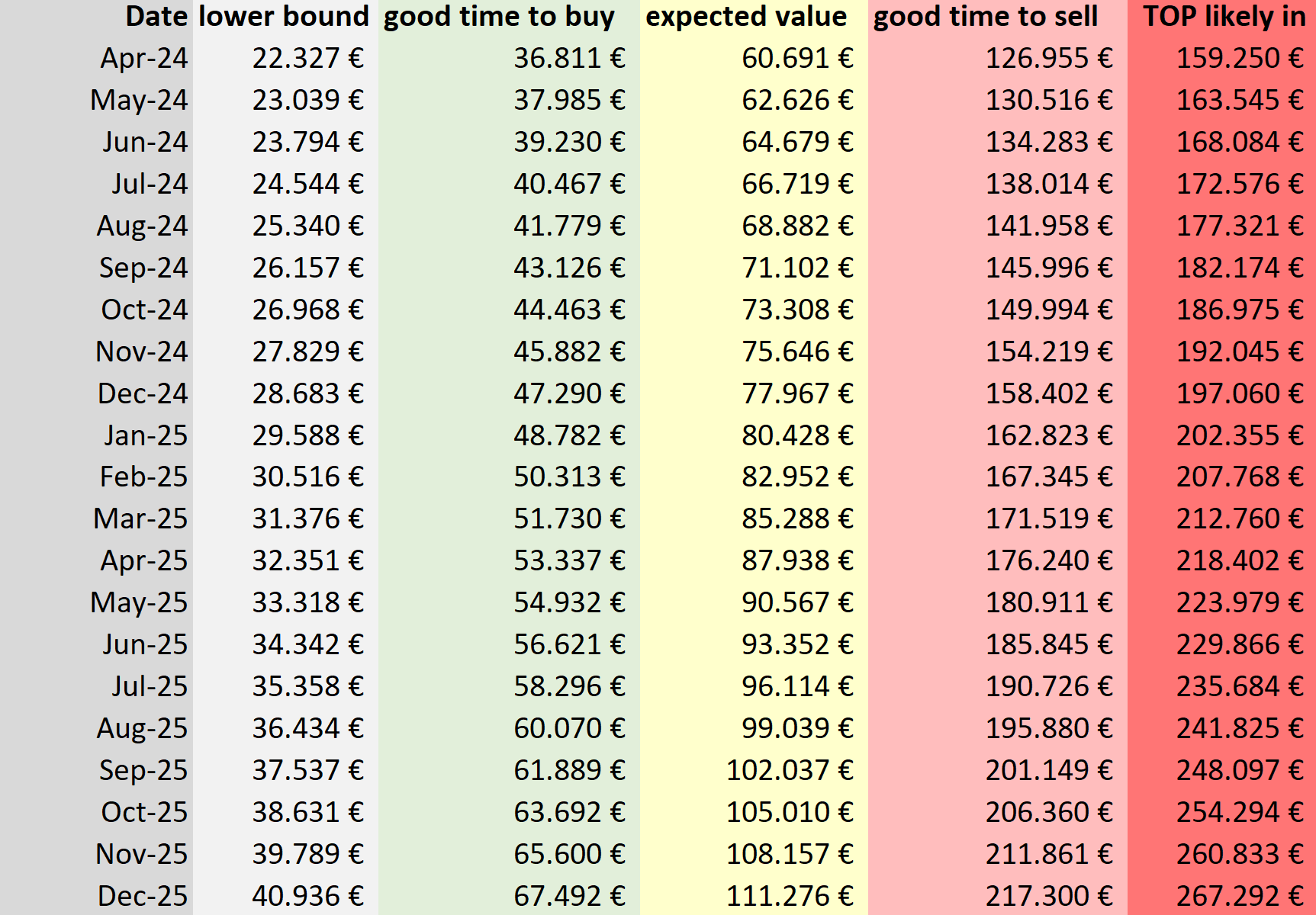

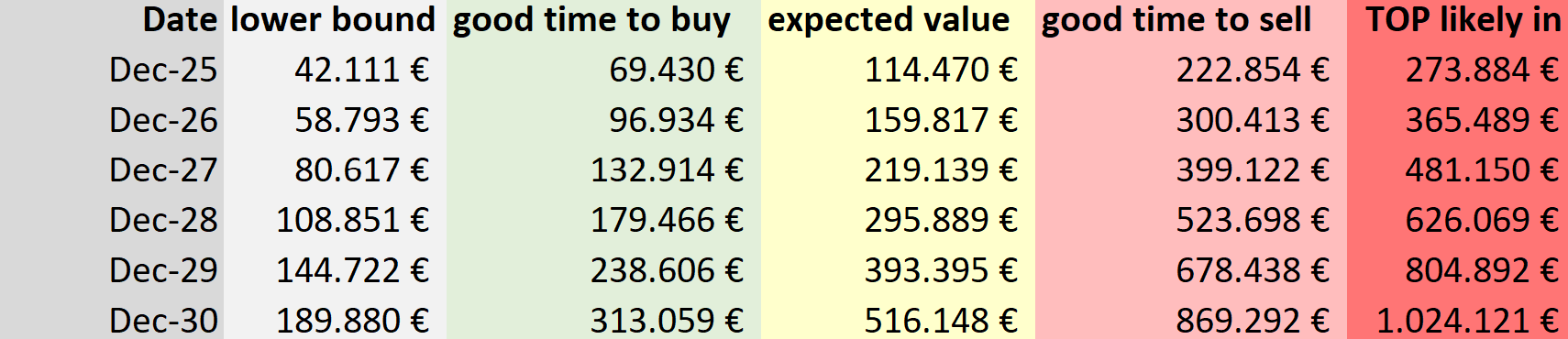

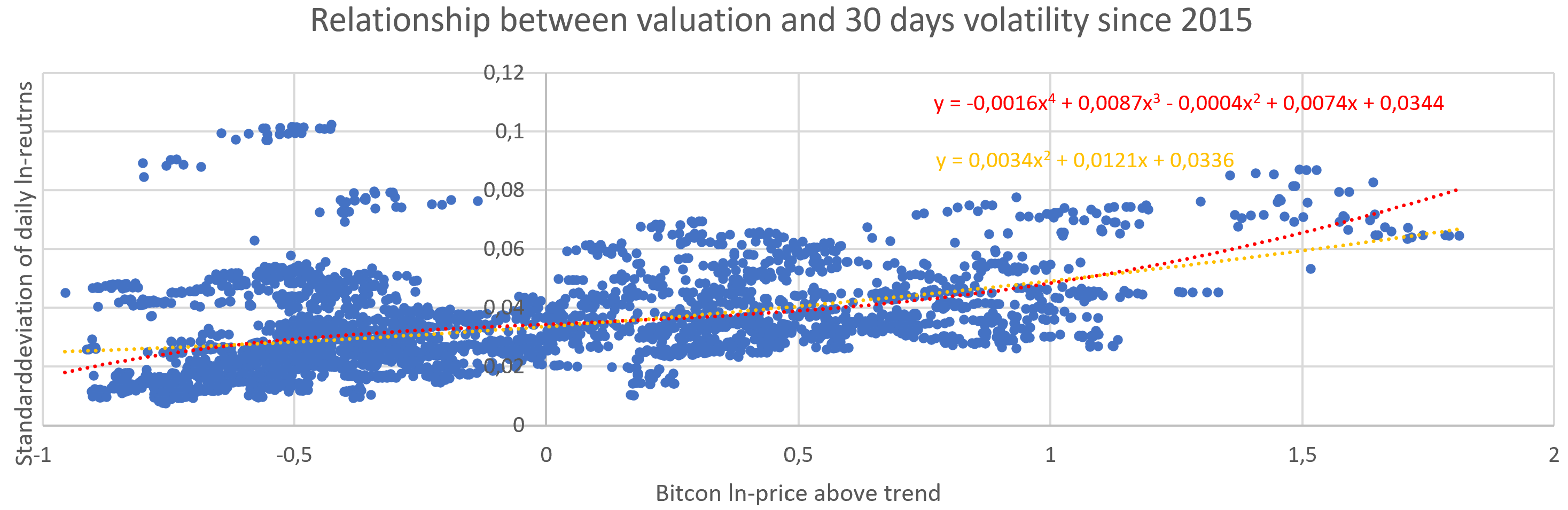

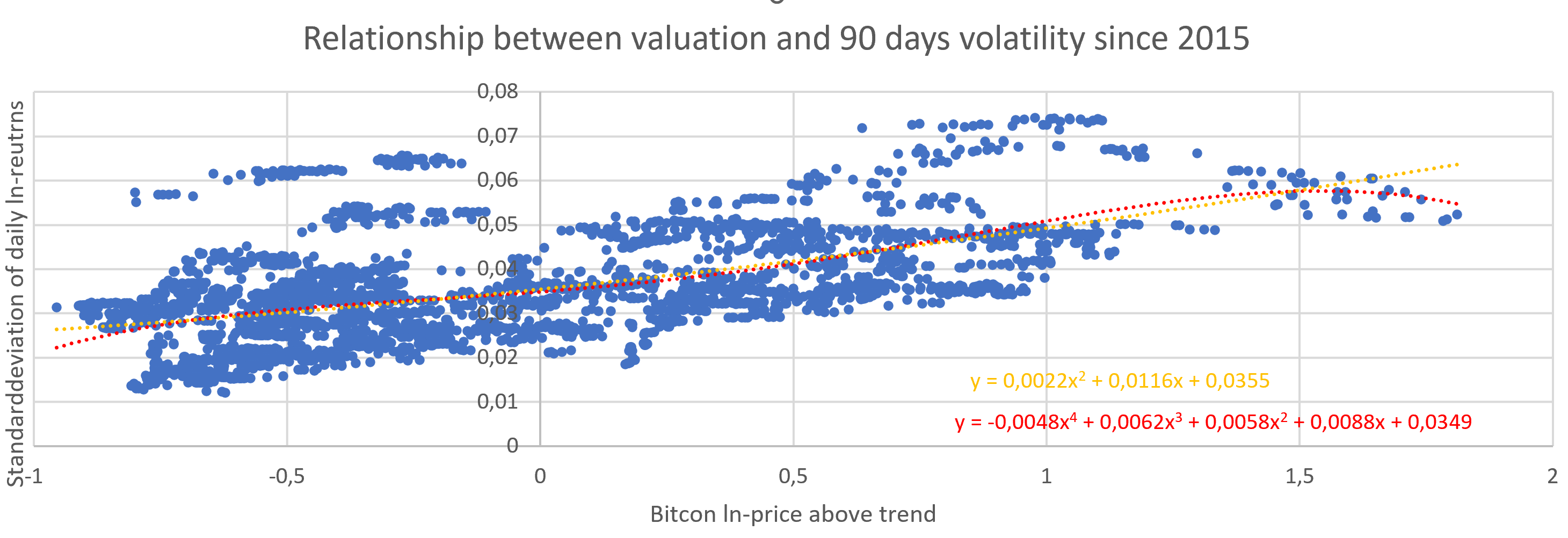

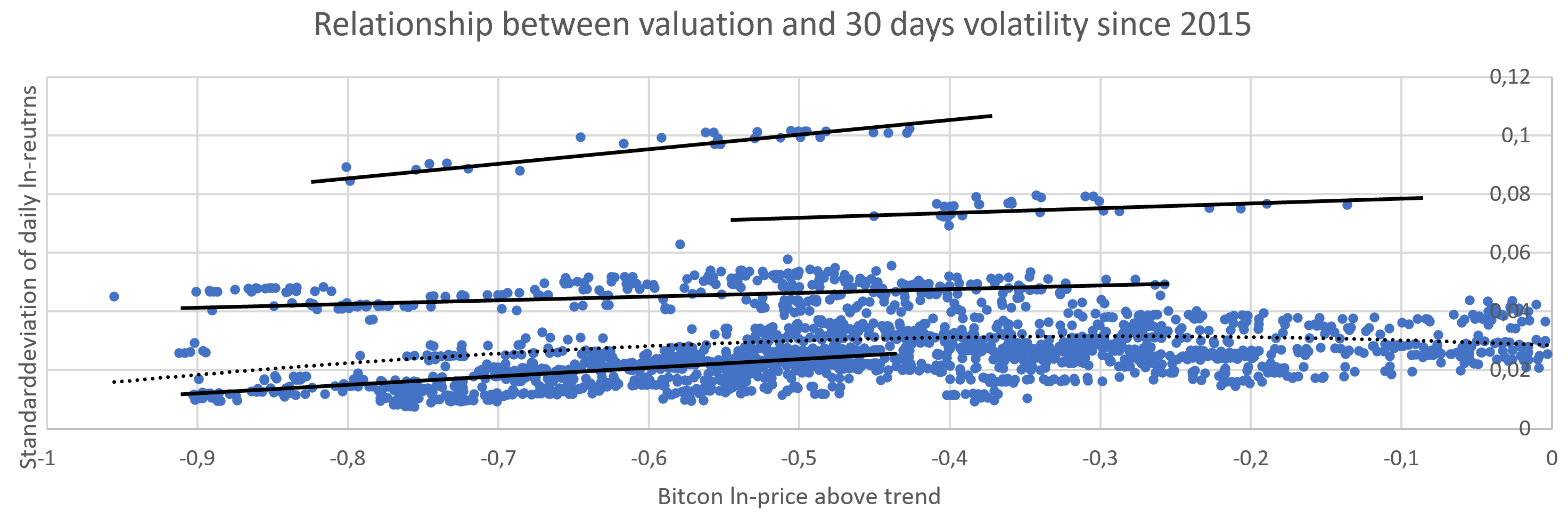

Predicting [1 year Bitcoin yield] depending on [the current cycle (measured in % overvaluation)]x-axsis shows how much the historical Bitcoin price exceeded its trend (right = expensive, left = cheap). y-axsis shows how the yield the following 12 months (high = Bitcoin gains vs. EUR, low = Bitcoin looses vs. EUR)  What do we learn? What do we learn?1.) We can see that the red lines have a declining slope. You get better 1-year forward returns by buying bitcoin cheaply. This makes sense as the mean of the cycle reverses around the trend. It is still interesting to see this result on a time horizon of only 12 months, not 2 or 4 years. 1st orange arrow2.) We can see that the red line (2010-2013) is the highest, the red line (2014-2017) is lower, the red line (2018-2021) is even slightly lower and the last line (2022-March 2023) is even lower. As time goes on, you can expect less return on your bitcoin investment for the same level of overvaluation relative to the trend. This makes sense as the price trend of bitcoin flattens out. 2nd orange arrow3.) We can see the red lines crossing the x-axis at lower and lower values. 2nd orange arrow 2010-2013 we cross at 1.5, 2014-2021 at 0.6 and recently at 0. Buying relatively expensive bitcoin (trend +0 to trend +1.5) in 2010-2013 still gave you positive returns, recently buying only slightly expensive bitcoin gave you negative returns. 3rd blue arrow4.) In our four charts we see 2 grey lines. We can see 2 different trend lines for each 4y cycle. One trend is on the way to the top. The second trend is on the way from the top to the bottom. Obviously you can get a better return the way up vs. on the way down. Unfortunately, it is only partly tradable:  Falling from the green peaks, we could assume that we are on the way down. Excessive overvaluation can be traded. At the yellow tops, however, we could have assume in real time that we were still climbing to a green top. Only in hindsight we would have realized we missed the yellow top. Since we can't tell the yellow tops in real time moderate overvaluation is not tradable. Looking at our most recent dot plot, we can see that the red line crosses 0/0. Does only the cycle matter now? Bitcoin price trend growth is declining. Maybe it is declining much quicker than the cycle? Is trading the Bitcoin cycle more important than holding Bitcoin? The answer is no.  It is true that the yield from owning Bitcoin (red arrow) declines faster (from 1200% to 300%) than the yield from trading the cycle (blue arrow, 350% to 200% to 100%) and therefore the cycle matters relatively more. However the return from just holding Bitcoin is still much higher than the yield from timing the Bitcoin cycle. The main take away is: trading the cycle can juice your returns, but the most imposant decision is buying Bitcoin at all. The red line crosses 0/0, not because the cycle dominates the returns, but because it represents a bear market. Therefore the line is naturally lower than a bull market line (see: what can we learn #4, the two grey lines).

Predicting [1 year change in Bitcoin cycle] depending on [the current cycle (measured in % overvaluation)]x-axsis shows how much the historical Bitcoin price exceeded its trend (right = expensive, left = cheap). y-axsis shows how the yield the following 12 months (positive = Bitcoin price growth exceeds trend, negative = Bitcoin price growth is slower than trend)  What do we learn? What do we learn?1.) We see a clear mean reversion in the Bitcoin trend with the dot-plots now sitting crossing 0/0 on average. Cyclically cheap Bitcoin becomes more expensive after 12 months. Cyclically expensive Bitcoin becomes cheaper after 12 months. 2.) I marked the area of 1 below trend (e-1 = 0,37*trend = 63% below trend) in orange. The last time we touched the orange area was in 2010 (red box). This information is slightly usefull to project future returns and future drawdowns. What does the dotplot tell us about the current Bitcoin market? Bitcoin (currently at 64.500€) vs. trend (currently at 60.500€) is slightly overvalued. The slight overvaluation is represented by the green line at x>0. We didn't go below -1 (currently at 22.250€) since 2010. So a drawdown to less than 22.500€ is reasonably unlikely (<8%). If we get a severe drawdown, I would expect a price of -0.8 (currently at 27.000€). What kind of valuation would be realistic 12 months from now? The orange trend line shows for a given historical bitcoin valuation: "How did the Bitcoin price change after 12 months during the last bull market?" The red trend line shows, for a given historical bitcoin valuation: "How did the bitcoin price change after 12 months during the last bear market?" The green line shows the current valuation of bitcoin. Price projection for a bull market (probability = 50%):The intersection of orange and green is +0,6. Bitcoin is now at trend+0,065. So during a bull market, I would expect Bitocoin to go to trend+0,665. Trend in one year will rise to 87.700€. Trend+0,665 will be at 170.000€. This would be roughly in line with our previous result for taking profits at trend+750 days (175.000€). Price projection for a bear market (probability = 42%):The intersection of orange and green is -0,6. Bitcoin is now at trend+0,065. So during a bear market, I would expect Bitocoin to go to trend-0,535. Trend in one year will rise to 87.700€. Trend-0,535 will be at 51.000€. This would be roughly in line with our previous result for going all in trend-0,5 (53.000€). Price projection for model break (probability = 8%):If my model breaks, I would assume Bitcoin to be at trend-2 (12.000€). Expected value of Bitcoin in one year = 8%*12k + 42%*53k + 50%*174k = 110k. Sounds too good to be true. The relationship between bitcoin's overvaluation and the expected return (orange line) from the past bull market is probably a bit optimistic, as the trend and cycle flatten over time. However, as long as bitcoin continues to get adopted, the strong growth in the trend price makes investing in bitcoin still very attractive. However, we should not take it for granted that we are now in a bull market:  Maybe we are on the way to a new green top. Maybe we just get a yellow top and a big contraction until we get to the next green top. Don't invest more than you can stomach during a drawdown.

Predicting [1 year Bitcoin yield] depending on [the current cycle (measured in days overvaluation)]x-axsis shows how much the historical Bitcoin price exceeded its trend measured in days (right = expensive, left = cheap). y-axsis shows how the yield the following 12 months (high = Bitcoin gains vs. EUR, low = Bitcoin looses vs. EUR)  I think 2020 ( black line) is too optimisitc, since we were heading out of Corona with a massive monetary stimulus and the trend line tends to go down anyway each cycle. I think 2022 ( yellow line) is too pessimistic. Maybe 2019 is reasonable ( red line). Here we would expect a yield of e^0,2 which is 22%. This price prediction +22% (days overvaluation and 2019 scenario) is less optimistic than my previous prediction >+50% (expected value, % overvaluation). In both calculations however it pays out to buy Bitcoin now, since the expected return of Bitcoin exceeds my cost of capital (around 6-10%). It is not too late to buy Bitcoin yet.When would the expected return on Bitcoin over the next 12 months fall below my cost of capital?When the Bitcoin price exceeds trend+106 days (currently $68k, at 10% cost of capital) or trend+127 days (currently $70k, at 6% cost of capital), buying Bitcoin on a 12-month time horizon would no longer make sense. However, it could still make sense to buy Bitcoin on a shorter time horizon (selling into the bubble) or on a longer time horizon (riding the adoption trend). In general, I would stick to my overvaluation threshold of trend+750 days. However, I would scale back by buying at trend+150 days to buy more Bitcoin at e^-1*trend. |

Sicherheit für deine Familie, dich und deine BTC, dank der fundierten Sicherheits-Tipps der KryptoArche. Wir kaufen Bitcoin zum Vermögensaufbau oder zur Krisenvorsorge. Wir kaufen Bitcoin dezentral als Schutz vor Räubern, mit guter Historie und verwahren unsere Bitcoin sicher vor Verlust, Räubern und Dieben sowie versteckt Wir nutzen sichere Passwörter, Betriebssysteme, Software und sufen sicher. Sicher dir deinen kostenlosen Platz auf der KryptoArche! Die Zeit läuft ab! Steig ein, bevor es zu spät ist! Gemeinsam bleiben wir immer über Wasser!

|

|

|

|

virginorange (OP)

|

|

April 08, 2024, 06:50:27 PM

Last edit: April 09, 2024, 01:14:59 PM by virginorange |

|

1. Formula y = 5,8323x - 39,296-> I guess you have done some kind of logarithmic Regression like Trolololo did it once-> therefore i guess the formula will be outdated with the years going and it would be helpful to reference the way of calculations You are correct, as new data points arrive the formula will see minor changes. The formula is created with a simple least squares linear regression in excel. y = ln(Bitcoinprice_in_EUR) and x = ln(number of days since the Bitcoin genesis block) = ln(Date - 03 Jan 2009). We will see a new change in trend quite late, since most of the old data still supports the trend. Therefore we have to check the trend for the new data only, which I did in " Checking the stability of the bitcoin trend line" in my initial post. Ultimately we will see a weaker trend as adoption finalises 2. "Cyclical Component of Bitcoin price" graphics

-> due to logarithmic timeline it's somehow difficult to assign the peaks/years

-> maybe vertical halving-lines or labeling the peaks with year count could help as a guideline

Thanks for your feedback. I added one more chart to my initial post to translate our ln-values into values we can understand. Making the graphs easier to followA Bitcoin price in ln(EUR) and a Bitcoin age in ln(days) is easy to draw, but difficult to understand. Therefore I added the Bitcoin price in EUR and the calendar year.  |

Sicherheit für deine Familie, dich und deine BTC, dank der fundierten Sicherheits-Tipps der KryptoArche. Wir kaufen Bitcoin zum Vermögensaufbau oder zur Krisenvorsorge. Wir kaufen Bitcoin dezentral als Schutz vor Räubern, mit guter Historie und verwahren unsere Bitcoin sicher vor Verlust, Räubern und Dieben sowie versteckt Wir nutzen sichere Passwörter, Betriebssysteme, Software und sufen sicher. Sicher dir deinen kostenlosen Platz auf der KryptoArche! Die Zeit läuft ab! Steig ein, bevor es zu spät ist! Gemeinsam bleiben wir immer über Wasser!

|

|

|

|

Turbartuluk

|

|

April 09, 2024, 10:17:04 AM

Last edit: April 09, 2024, 01:51:58 PM by Turbartuluk Merited by virginorange (7), d5000 (2) |

|

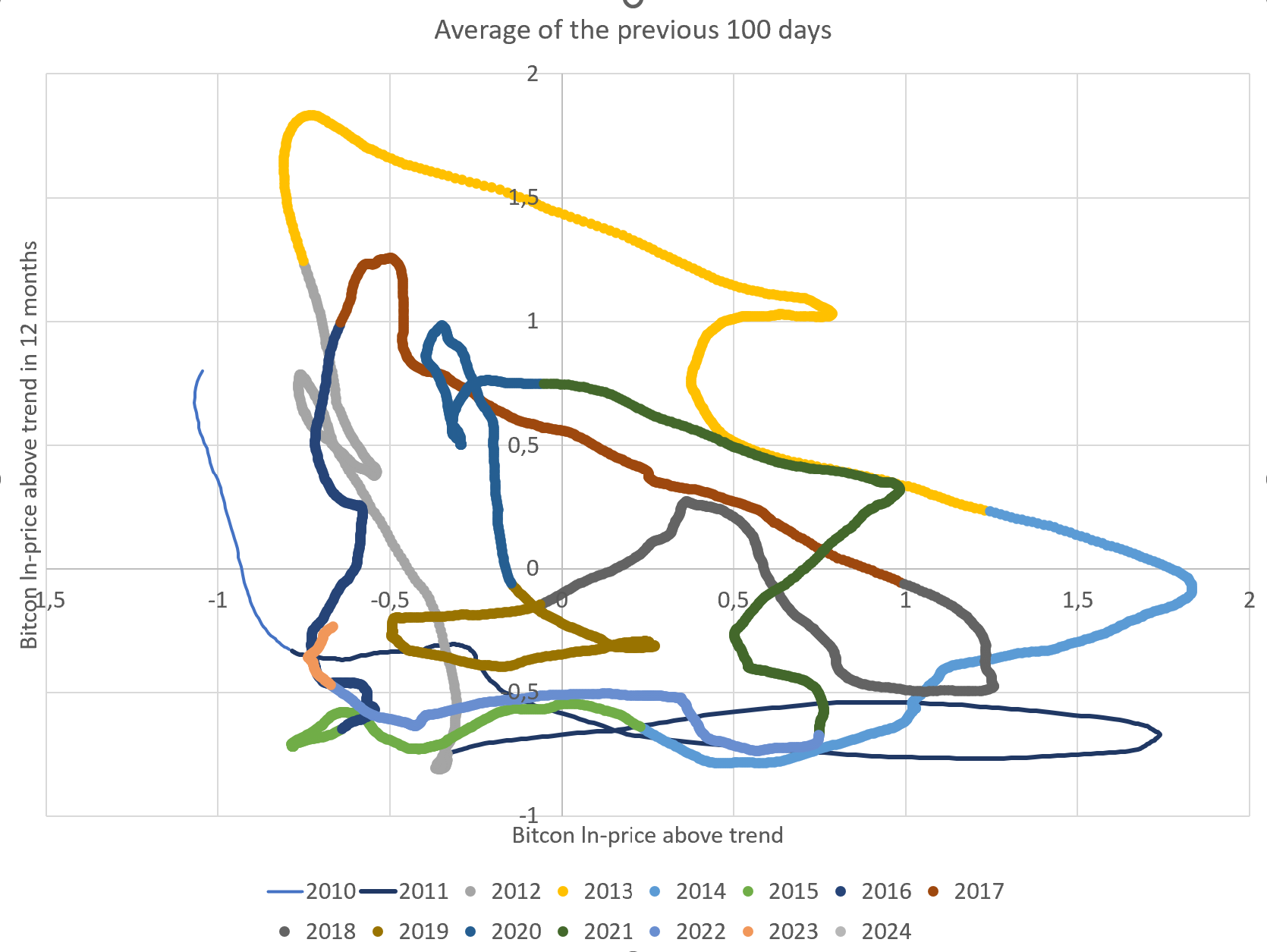

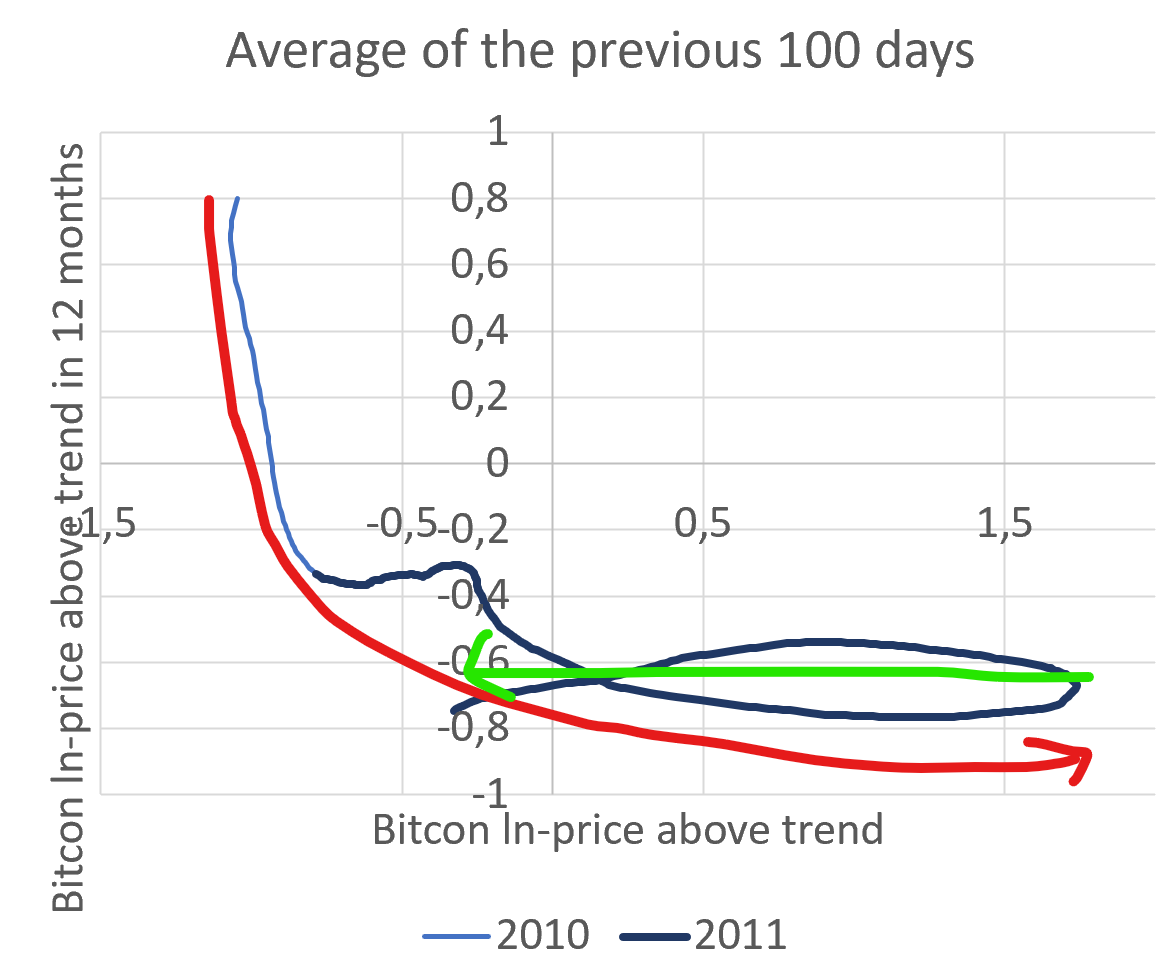

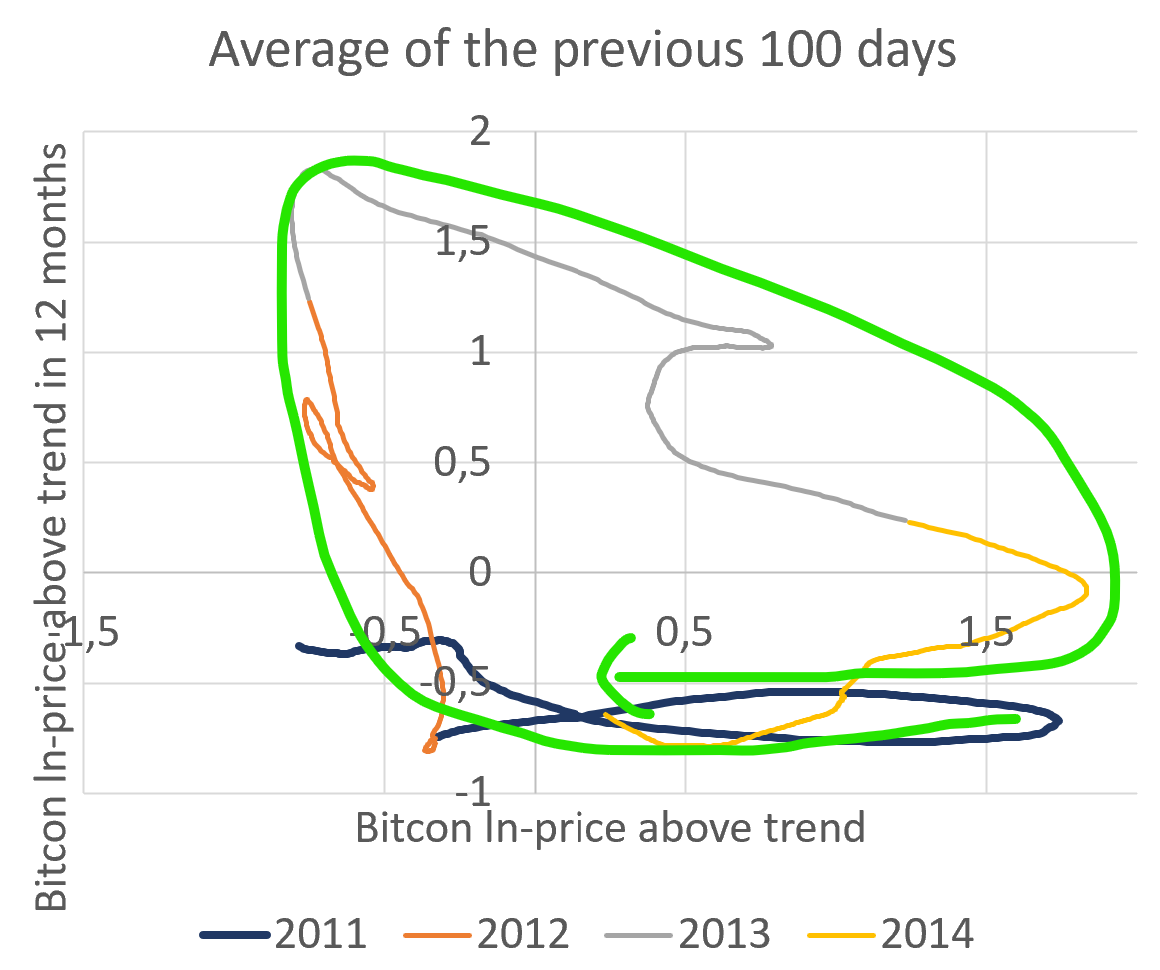

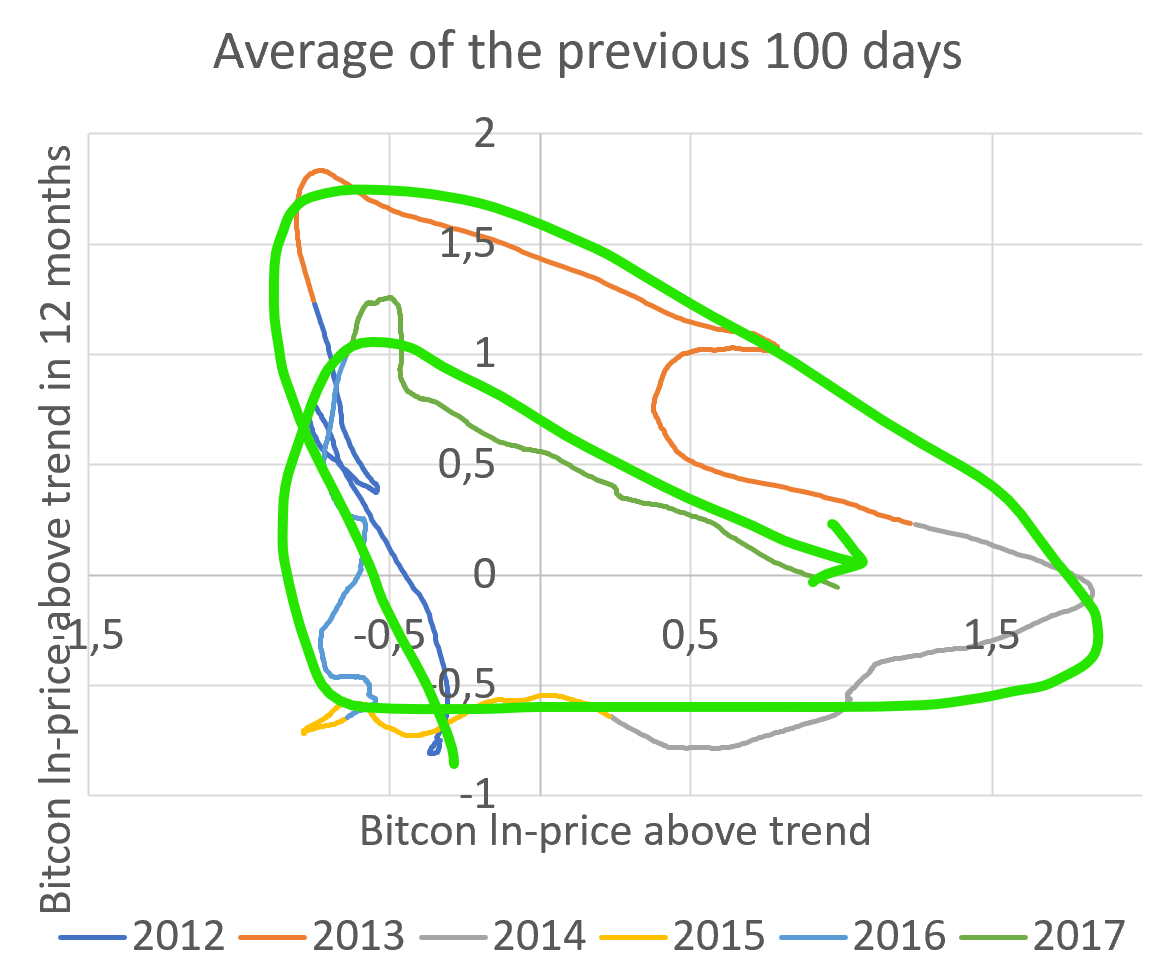

Thank you very much for digging even deeper. It takes me some time to assume the scope of results. As i have a slightly different interpretation of past data, i will share what i do see on those pictures starting with the latest data (last 4 years):  Black line: First of all you can see clearly some sort of cycle within the last 4 years, with the direction shown in the graphic Red 1: Bought in Corona Dip 2020, sold in 1st Peak 2021, i expect this area to be outliers which will not repeat Red 2: Bought after Bottom 10k+, sold in 2nd Peak 2021 Red 3: Bought in 1st Peak 2021, sold 1 year after Red 4: Bought in 2nd Peak 2021, sold 1 year after Red 5: Bought 1y+ before now, latest data Green X: possible cycle position right now, 1y ahead of latest dots If cycle repeats (big if) and Green X is assumed correctly you could draw following conclusions from that: - there are only shown buying points 1y+ in the past, with time passing new dark yellow dots will occure, they might occure in direction from Red 5 to Red 1. This would mean, that BTC bought <1y in the past from now will show hightest increase -> Peak can be assumed within the next year.

- BTC bought today and sold 1y from now could be slightly after the peak, not optimal but still in good profit

- starting DCA BTC for the next 6-12 month and selling 1y after (18-24M from now) seems to be a bad idea, in conclusion it could be a good idea to execute a withdrawal plan during that time, but be aware of ln-price scale -> choose a backloaded layout for DCA

- roughly ln-price +0,5 above price trend (i guess we will see that in a few months from now) you enter bubble territory, buying BTC and selling 1y after could result in massive losses, you could use that prediction for hedge or short strategies

- for identifiing peak you could use 2 different indicators: BTC change ln-price +1 (~250% within 1year) which equals red 2 or ln-price +0,5-1 above trend which equals red 3/4

Now here is why i don't believe Green X to be assumed correcly:Predicting [1 year Bitcoin yield] depending on [the current cycle (measured in % overvaluation)]x-axsis shows how much the historical Bitcoin price exceeded its trend (right = expensive, left = cheap). y-axsis shows how the yield the following 12 months (high = Bitcoin gains vs. EUR, low = Bitcoin looses vs. EUR)  If you focus on the red lines on those 4 pictures described by y=a*x+b you can see a decreasing trend for incline a and offset b. Additionaly the clouds of dots are more and more concentrated in the center. Regarding all 3 trends together i would rather not expect a "clear" elliptic cycle but more some sort of twisted elliptical spiral, slipped from the center.  Idea: Idea: We could plot all years from 2010-2023 into 1 high resolution graphic, while having 1 colour each year. For each year the center of gravity could be calculated, to draw a spline through those coordinates. (You could calculate coordinates with excel, i could draw spline with CAD tools) I would be curious if this spline results in a picture like the Bitcoin Spiral  Maybe this could be even used somehow for cut-offs?!  PS: please lets stay with ln price model instead of days ahead model, i guess it will make things easier to compare bull and bear in the same graphic. |

|

|

|

|

|

bettercrypto

|

|

April 09, 2024, 02:00:46 PM |

|

Now all of us who believe in Bitcoin or cryptocurrency know that it will make a great contribution to our investors who believe in Bitcoin or cryptocurrency. And even now,

there are many communities that use and believe in the DCA method; that's just, honestly speaking.

So thank you very much to Op, and he made that matter to be shared here in this forum section for the awareness of all the members here on this platform.

|

|

|

|

|

virginorange (OP)

|

TL;DR: With a time horizon of 9-12 months I expect Bitcoin's trend price growth to continue (95% probability) plus a cyclical price expansion on top (80% probability). If you want to buy Bitcoin anyway, my model would suggest you don't wait. If you want to sell Bitcoin anyway, my model would suggest you to wait at least a couple of months.* Please consider models can be wrong. *Obviously not finical advise. Only a profession certified advisor can judge your personal situation. He might find a long term bank deposit yielding treasury yield - 200 basis points more suitable to you. Especially considering the excellent long term fiscal situation in the US.Question: Why did Bitcoin perform so well in summer 2019?Idea: We could plot all years from 2010-2023 into 1 high resolution graphic, while having 1 colour each year.