TL;DR I develop a warning sign, to warn me about my Bitcoin price model is breaking towards the downside during a bear marketInput: Bitcoin price ( [valuation vs. trend] and [volatility multiple vs. S&P 500])

Output: Traffic light

● red = urgently check, if the Bitcoin price model is still valid

● yellow = keep attention on the traffic light,

● green = no problem with Bitcoin price model detected

Why do we use our traffic light? ●●● Risk management, time savings, control of emotions

A significant Bitcoin exposure as a % of net worth requires risk management tools. The tools should quickly indicate, if my Bitcoin portfolio allocation is developing according to expectations or I have to update my assumption, my model and possibly my allocation.

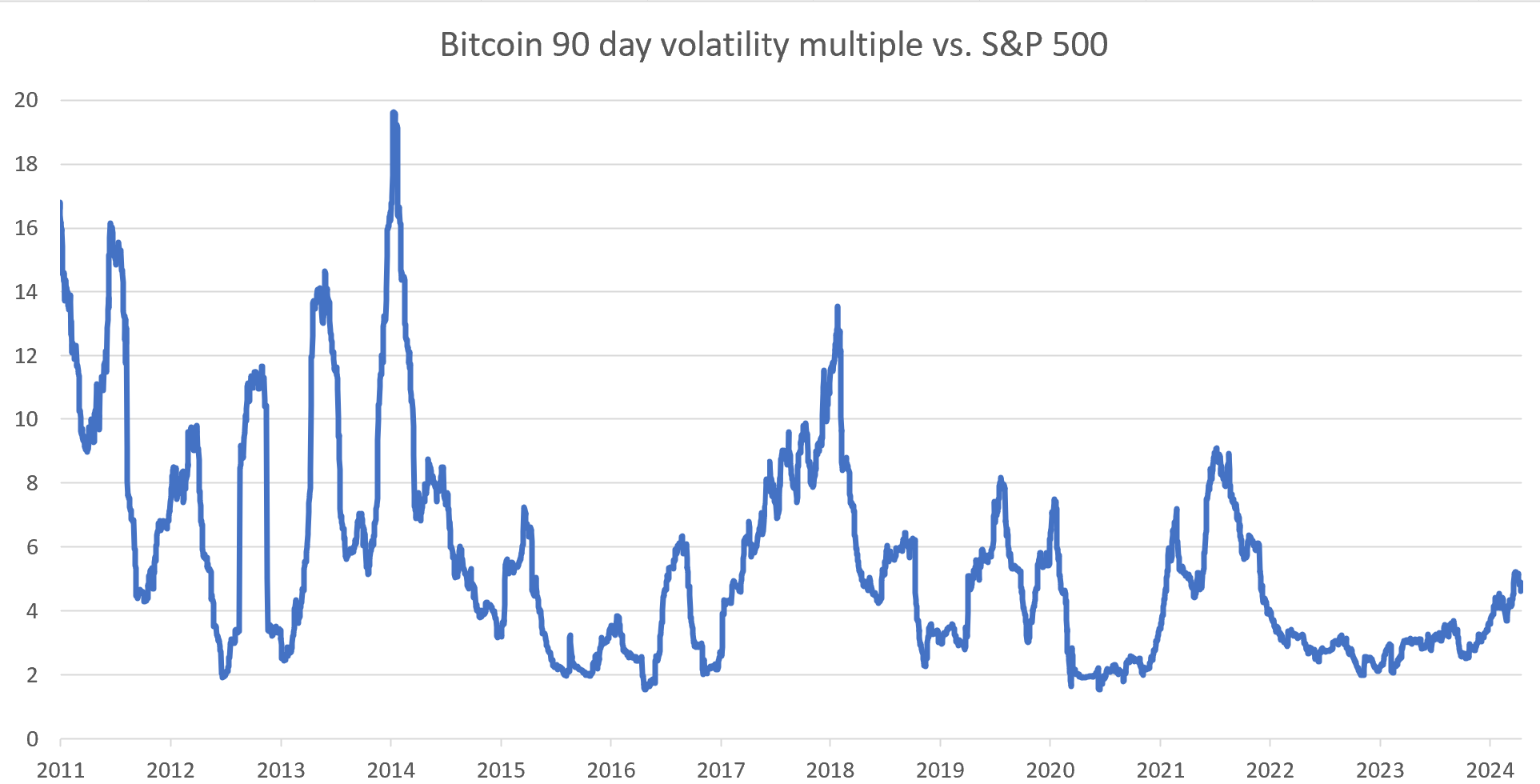

High volatility in Bitcoin in combination with low valuation could indicate mayor negative news. High Bitcoin volatility during times of high general market volatility (COVID 19) doesn't indicate Bitcoin specific problems. However if Bitcoin's is very volatile while other markets are calm, this could indicate problems influencing our Bitcoin price model. Therefore we calculate the multiple of Bitcoins volatility over the S&P 500 volatility (90 days).

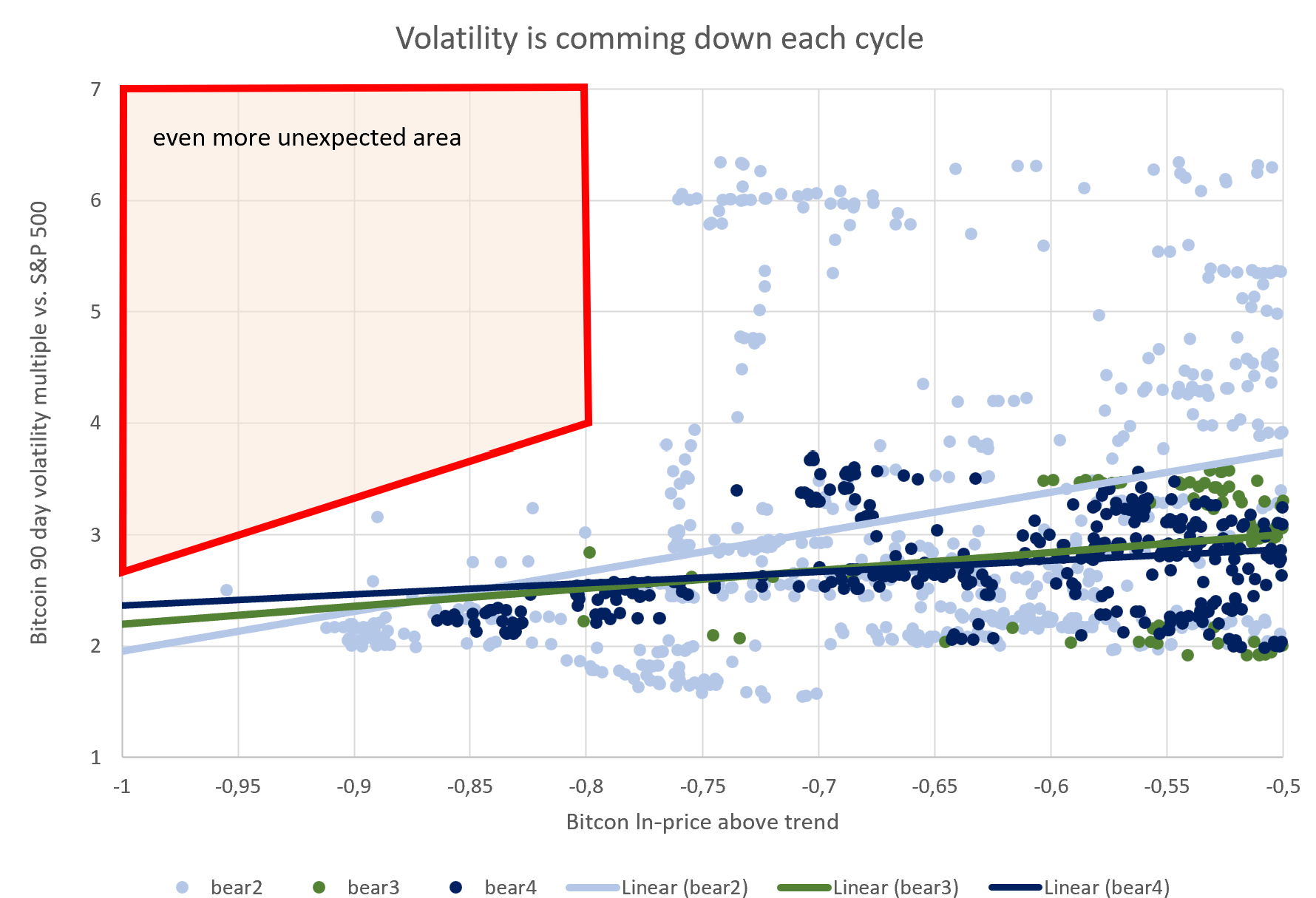

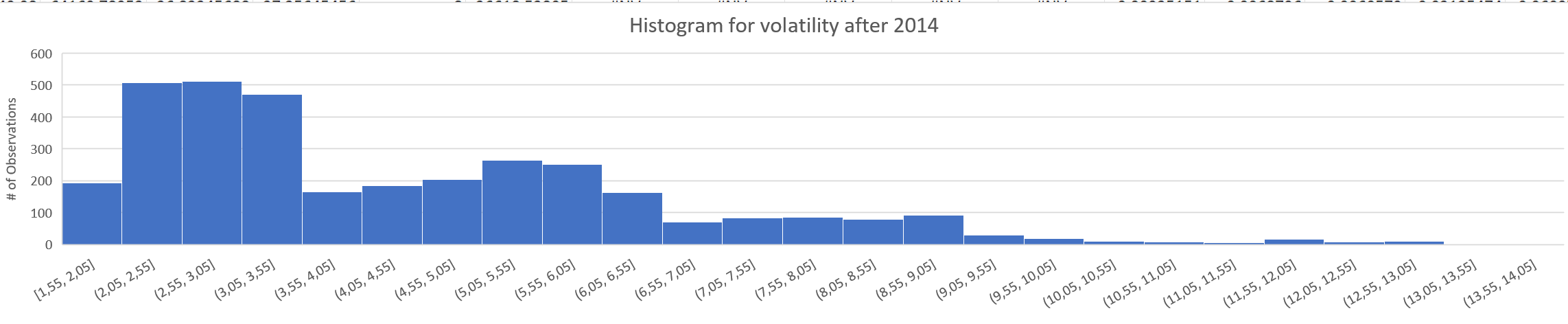

We can see Bitcoin's excess volatility is declining as time goes on.

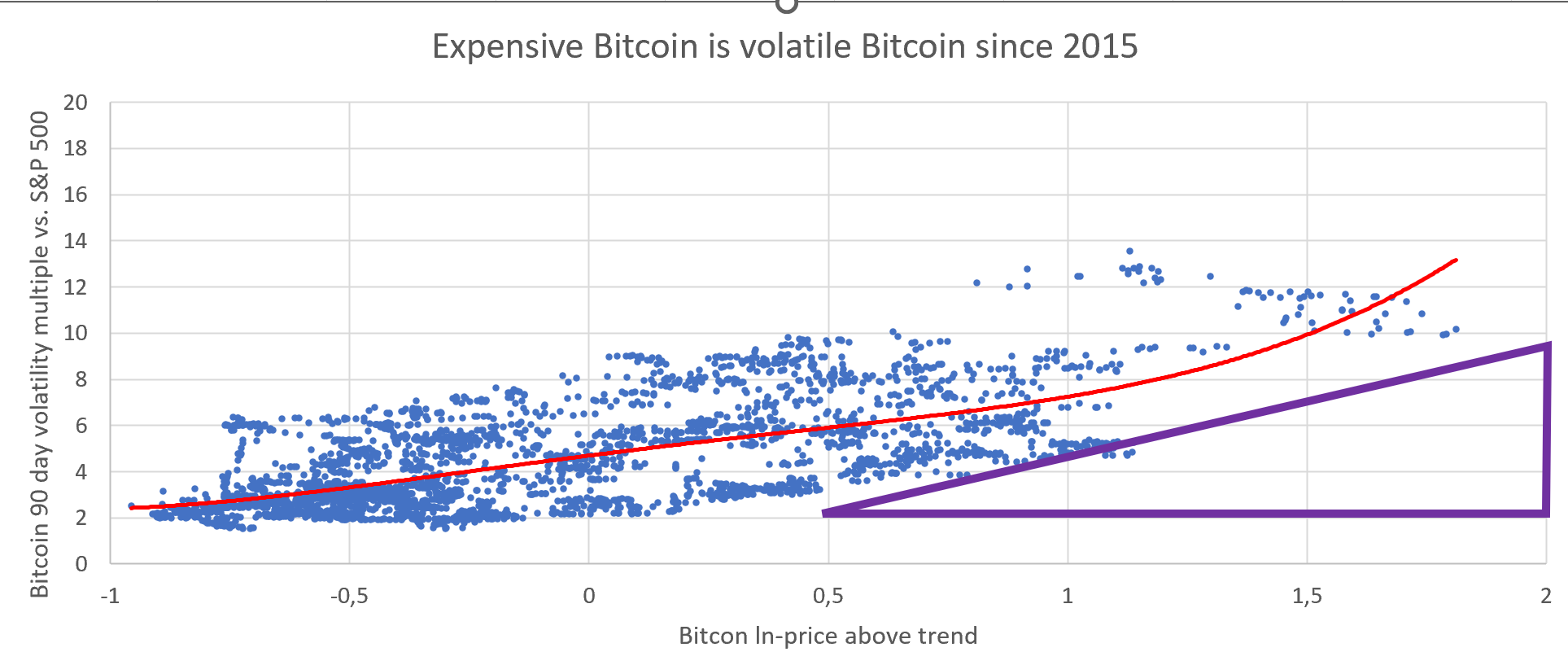

If we plot Bitcoin's [excess volatility vs. stocks] vs. [Bitcoin's valuation vs. trend] ...

... we notice that high Bitcoin valuations are associated with higher volatility, while low Bitcoin valuations are often associated with low volatility. This trend relationship is even clearer, if we only plot data after 2014:

The higher Bitcoin's valuation the higher the volatility. The positive relationship between valuation and volatility is uncommon for other asset classes. Usually low valuations are associated with higher volatility (bond spreads or shares).

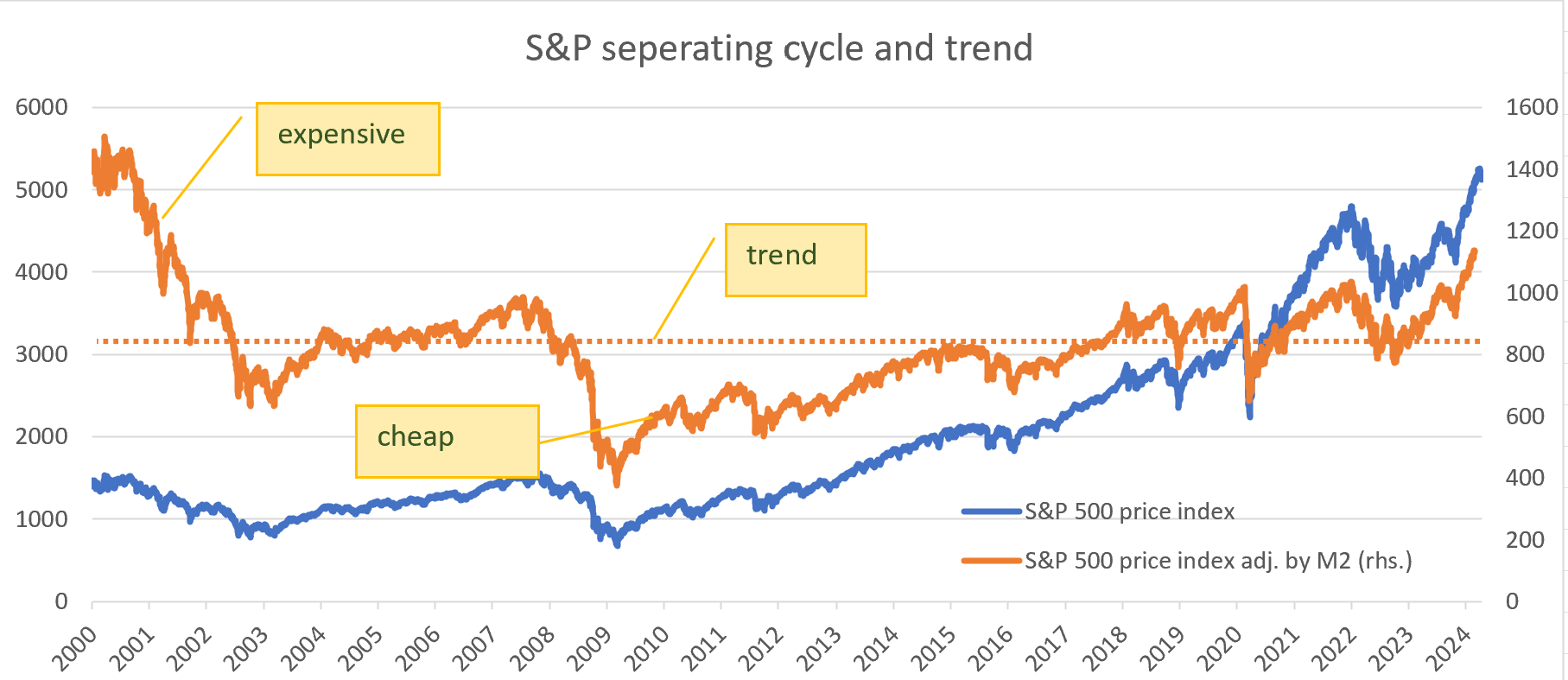

If we look at the S&P 500 (blue line), and adjust the S&P 500 by M2-money inflation (orange line), we can separate the cyclical S&P performance (orange line minus orange dotted line) from the trend performance (orange dotted line).

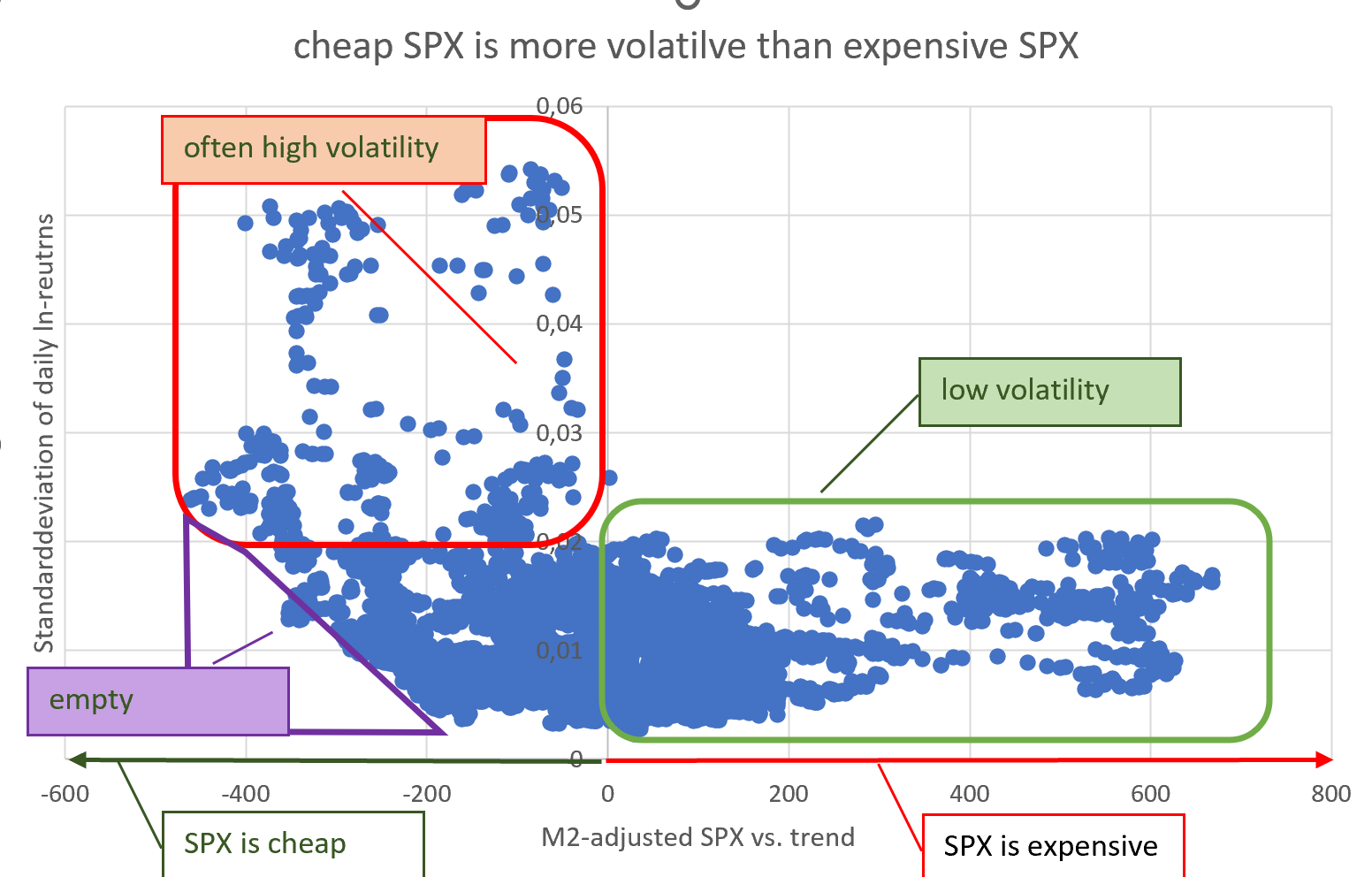

Interestingly the S&P has 0 trend growth exceeding M2-inflation. The S&P was expensive 2000-2002 and cheap 2009 - 2014. If we plot S&Ps volatility ...

... we notice expensive S&P is associated with low volatility (green box) and cheap S&P is often associated with high volatility (red box). Very cheap S&P almost never comes with low volatility (purple triangle).

So lets get back to Bitcoin.

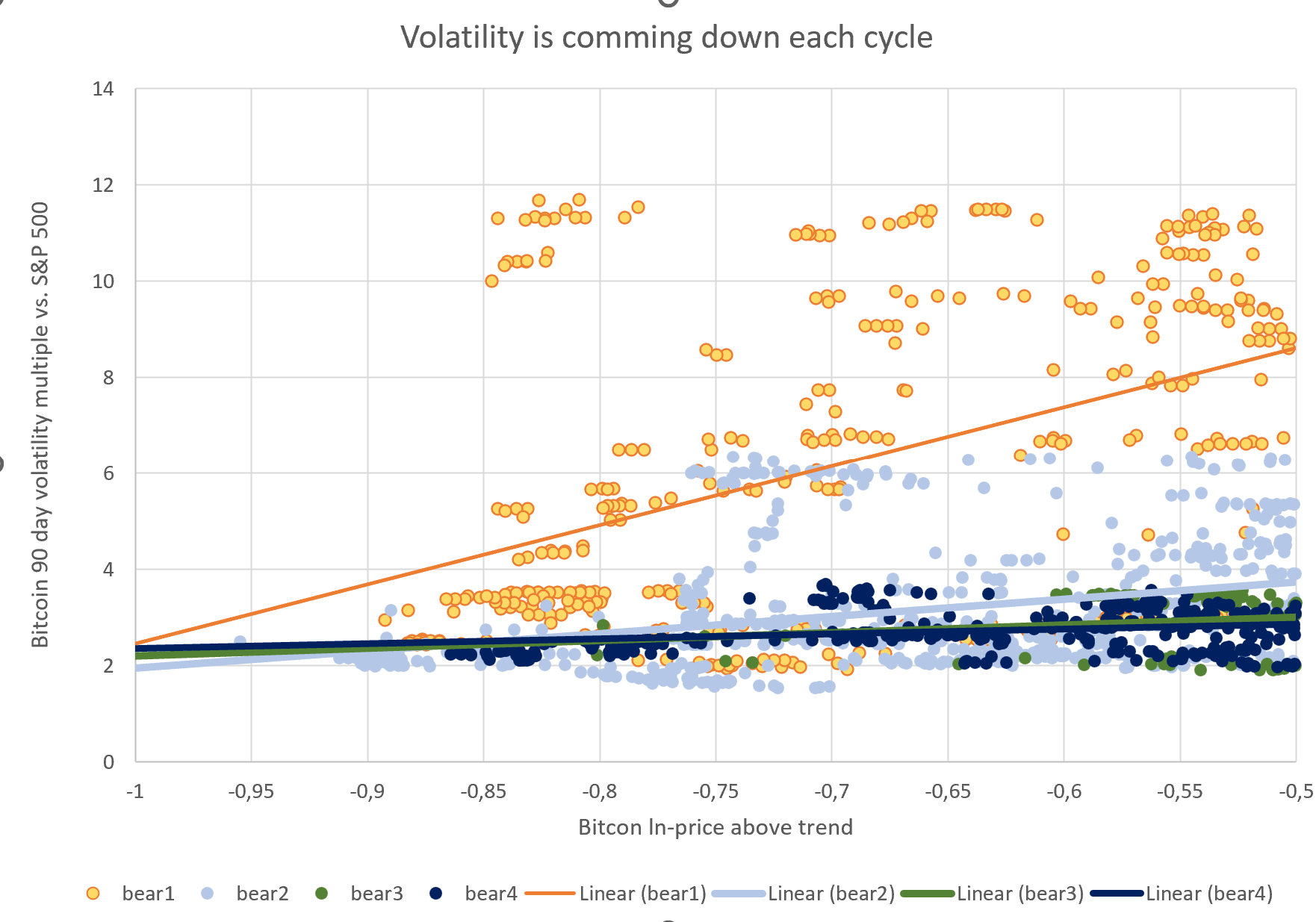

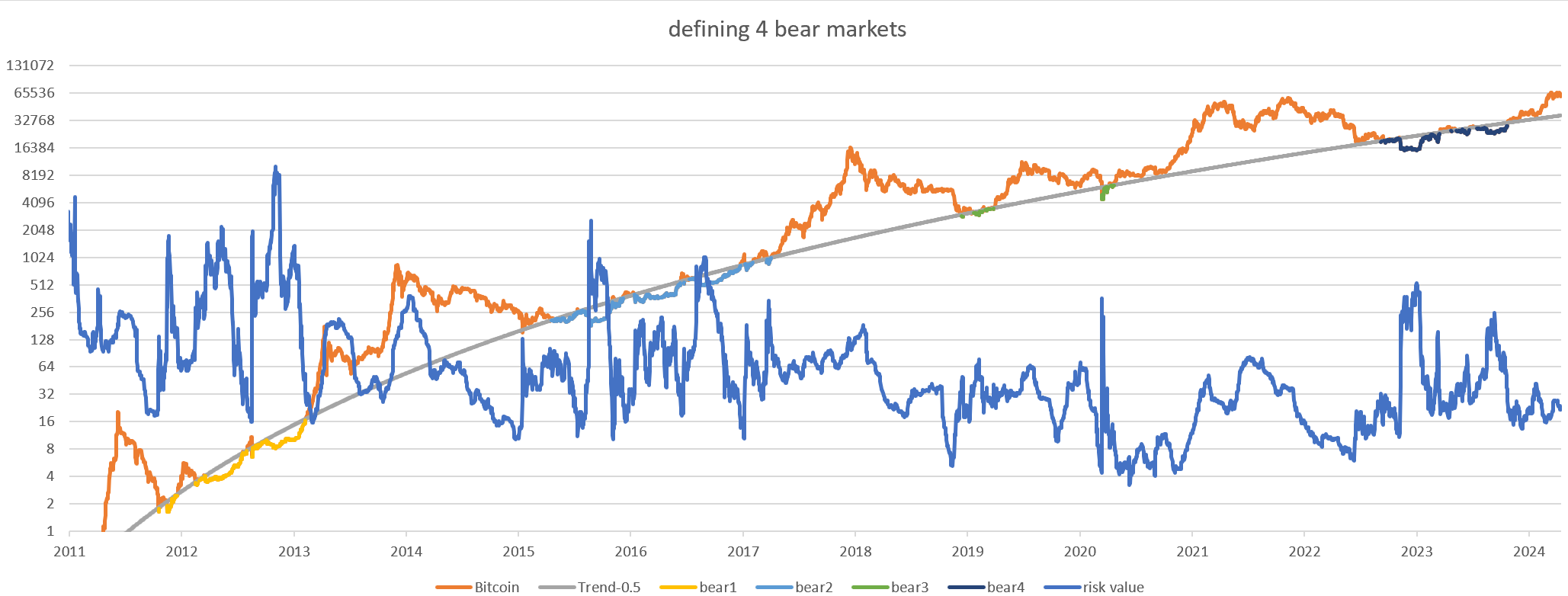

Since Bitcoin has declining volatility, we have to separate early bear markets from later bear markets. A bear market is Bitcoin price falling e^-0.5 below trend. We separate those bear market in 4 separate bear markets (bear 1, bear 2, bear 3 and bear 4) for each 4 year Bitcoin cycle.

We can now take a look at the relationship between Bitcoin valuation and volatility for our 4 bear markets.

We can observe that the first bear market was the most volatile with subsequent bear markets becoming less volatile. We can also see from the linear trend lines that lower valuation is weakly associated with lower volatility.

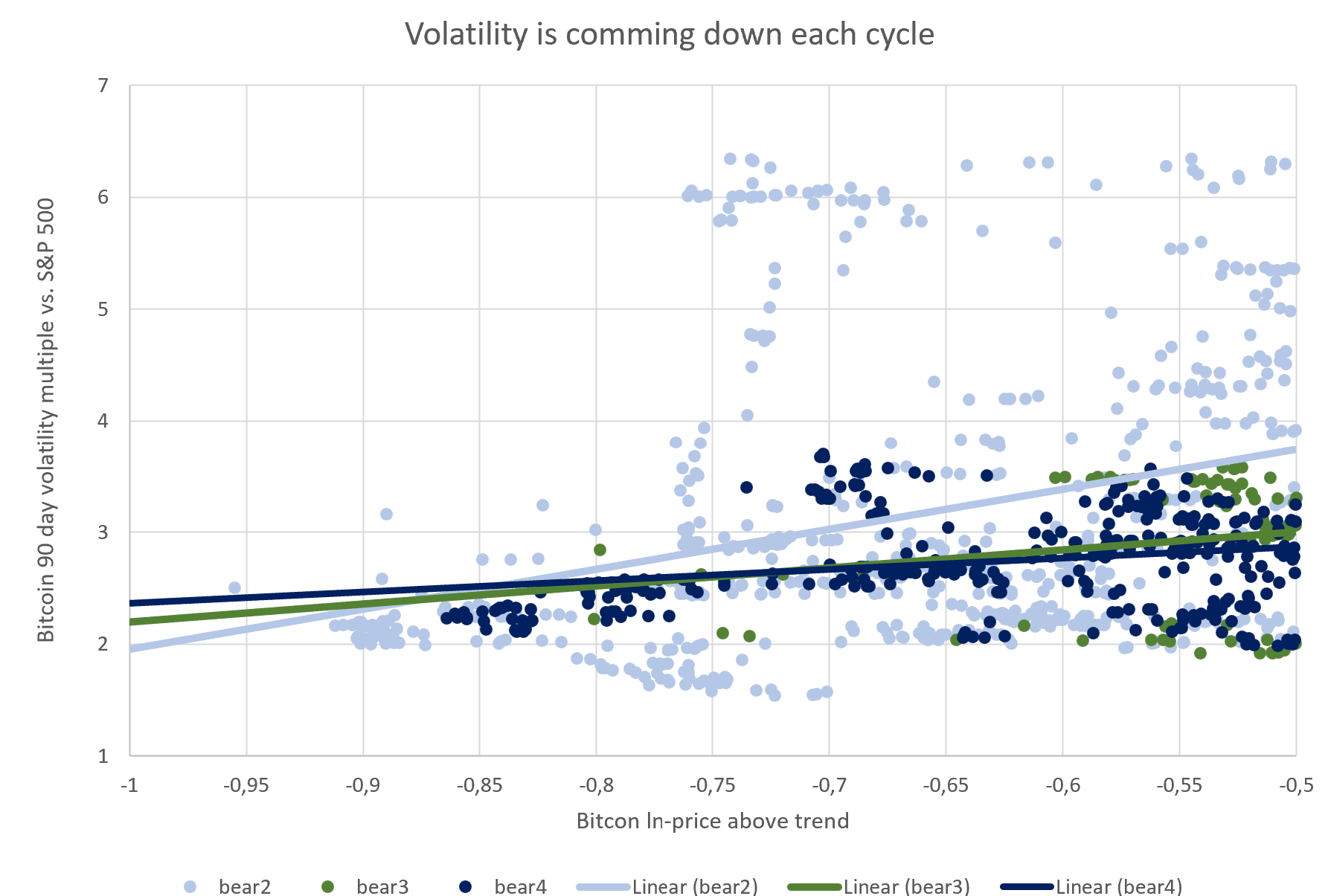

To get a better picture I make a chart with only the most recent 3 bear markets:

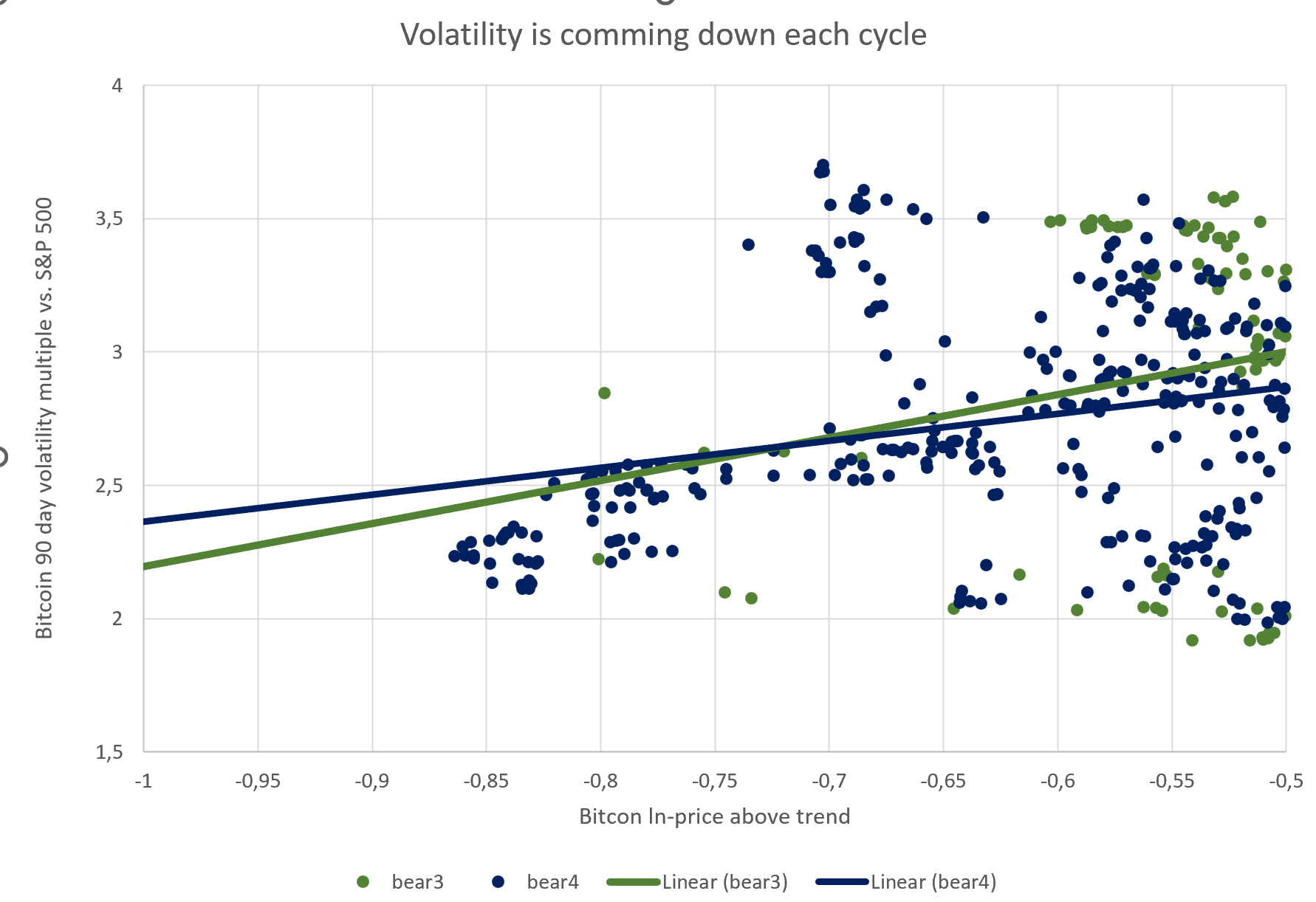

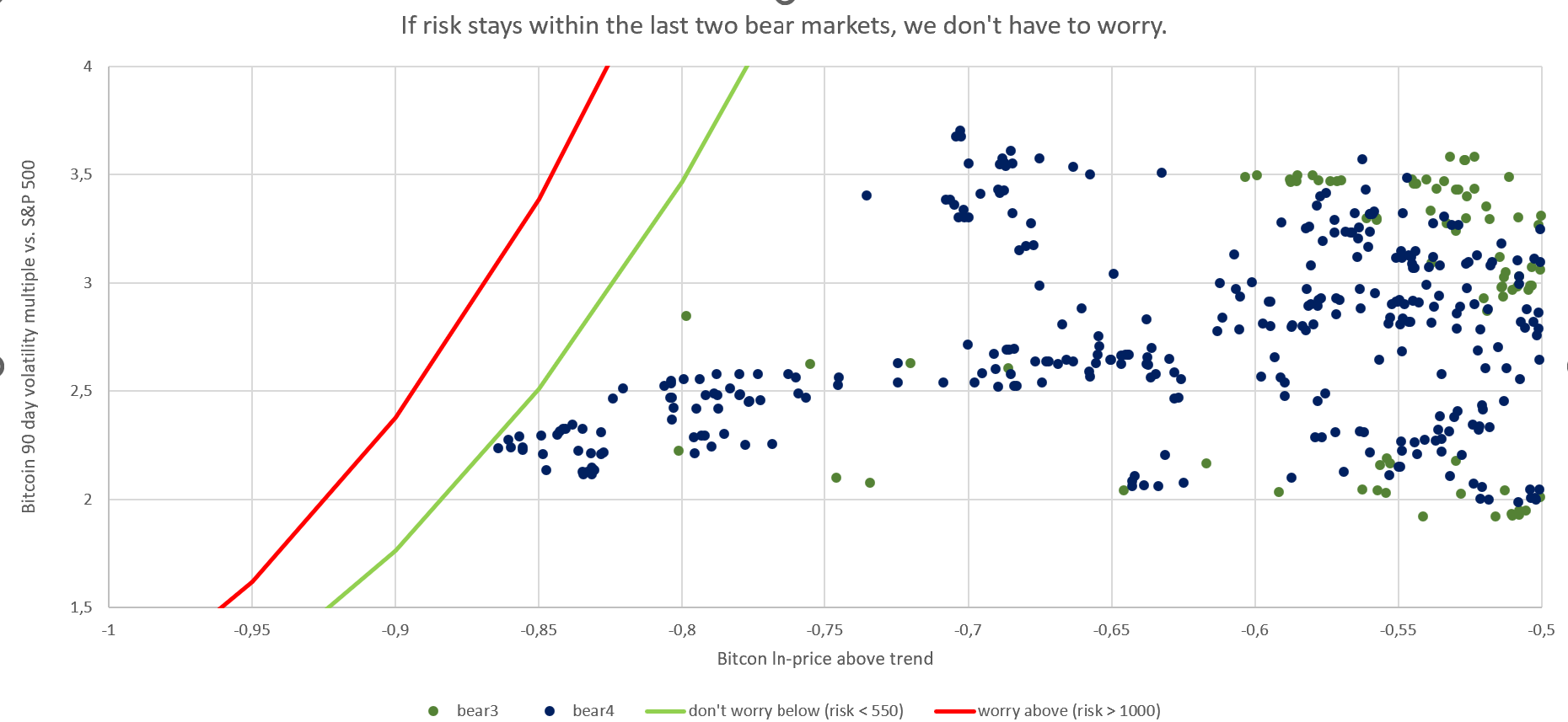

And I made a chart with only the most recent 2 bear markets as well:

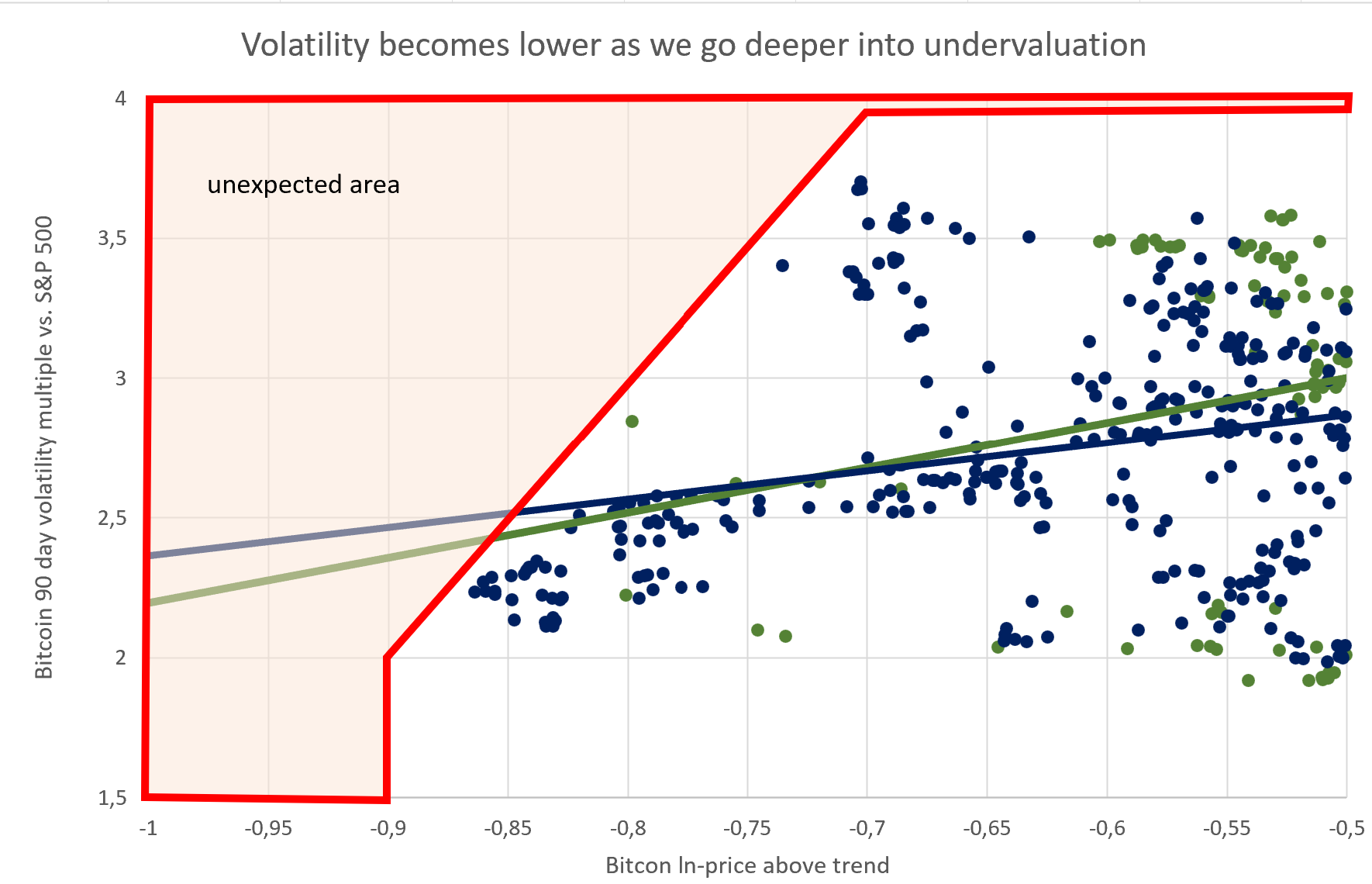

We can observe below average volatility in a severe bear markets (-0,75 and lower). The combination of low valuation AND high volatiltiy was especially unlikely in the past, and I would not expect dots in the "unexpected are" in the future either.

The two red boxes "unexpected area" and "even more unexpected area" are drawn via hand. An alternative visualization would be to mark all points, which were not exceeded during previous 4 bear markets.

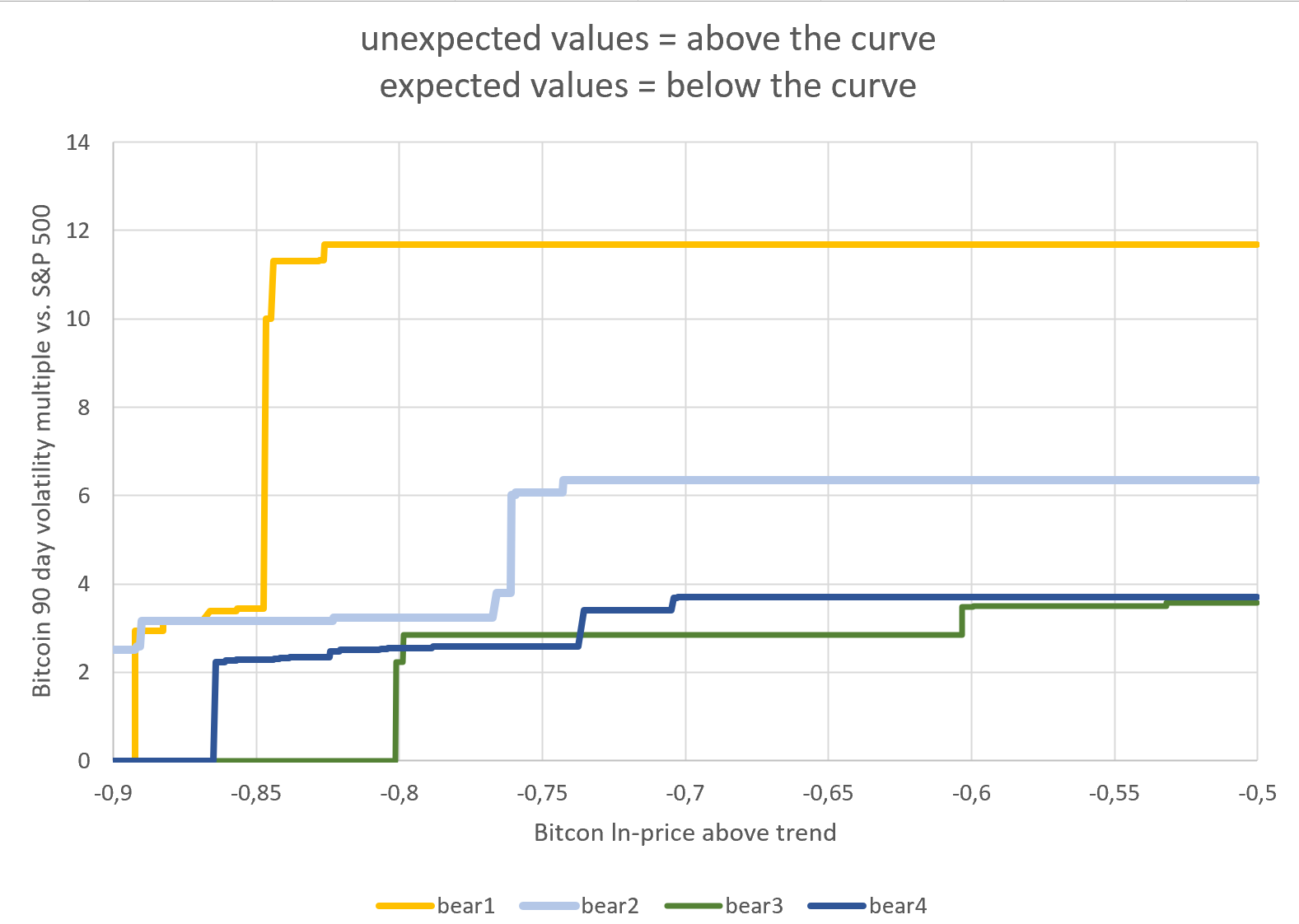

The yellow line marks the frontier data points in the first bear market. All the points above the yellow line, we have no observation of higher volatility given a certain level of undervaluation. So all observed data points, even the worst data points are below the curve. The 3 other lines (bear 2, bear 3, bear 4) show the worst observed combinations of drawdown and volatility during the respective bear market.

From bear1 to bear2 to bear3 we can see a clear reduction in volatility. The worst data points for bear3 and bear4 however look pretty similar, so I will lump them together in future charts. These frontiers only give us a binary indicator. If our newly observed data point is outside of the frontier (above the curve), our observation is worse than historical data points. If our newly observed data point is inside of the frontier, our observation is within historical observations. To quantify "Know how bad is it?" we have to rank our data points somehow.

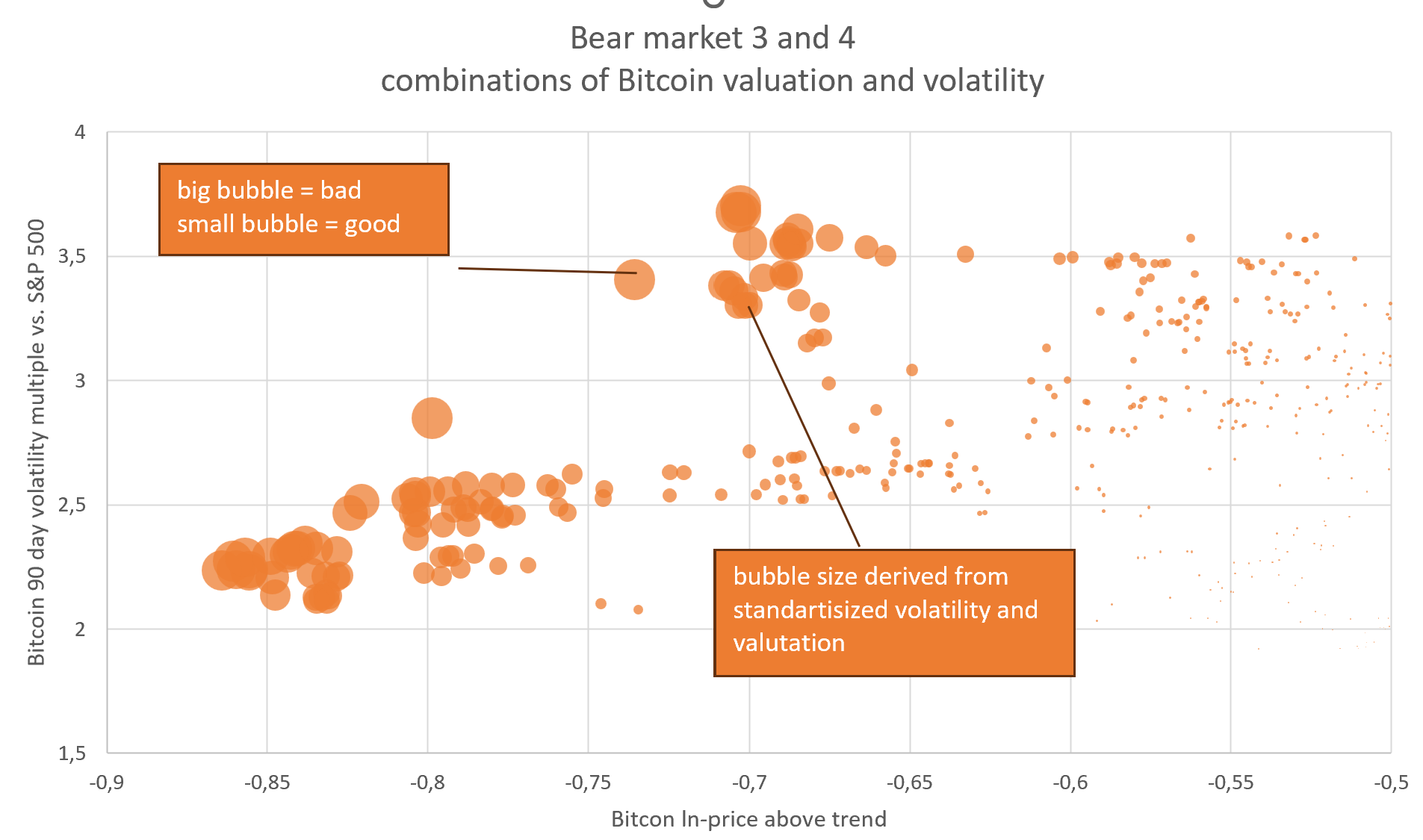

We want to create a metric, which shows (i) high volatility is bad, (ii) low valuation is bad, (iii) a valuation decline from -0,5 to -0,7 much ist less bad than a valuation decline from -0,85 to 1,05 and (iv) a combination of high volatility AND low valuation is worse than any one of both.

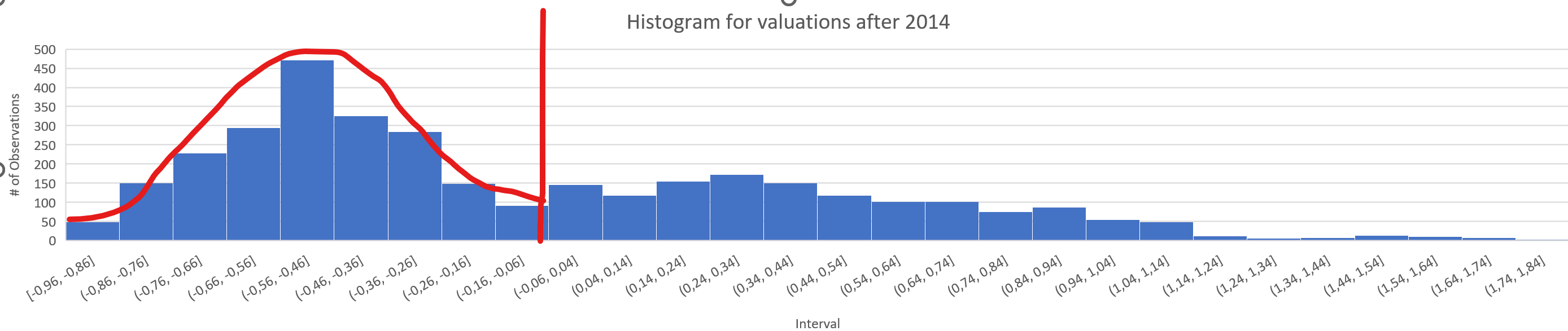

The valuations during bear market (Bitcoin price below trend) shows many observations of average bear market and fewer observations as the bear market become more extreme. Describing the valuation data in a bear market with a normal distribution seems fitting to me.

Whereas the the volatility does not suggest a normal distribution. The higher the volatility the lower the probability, with a volatility floor slightly below 2.

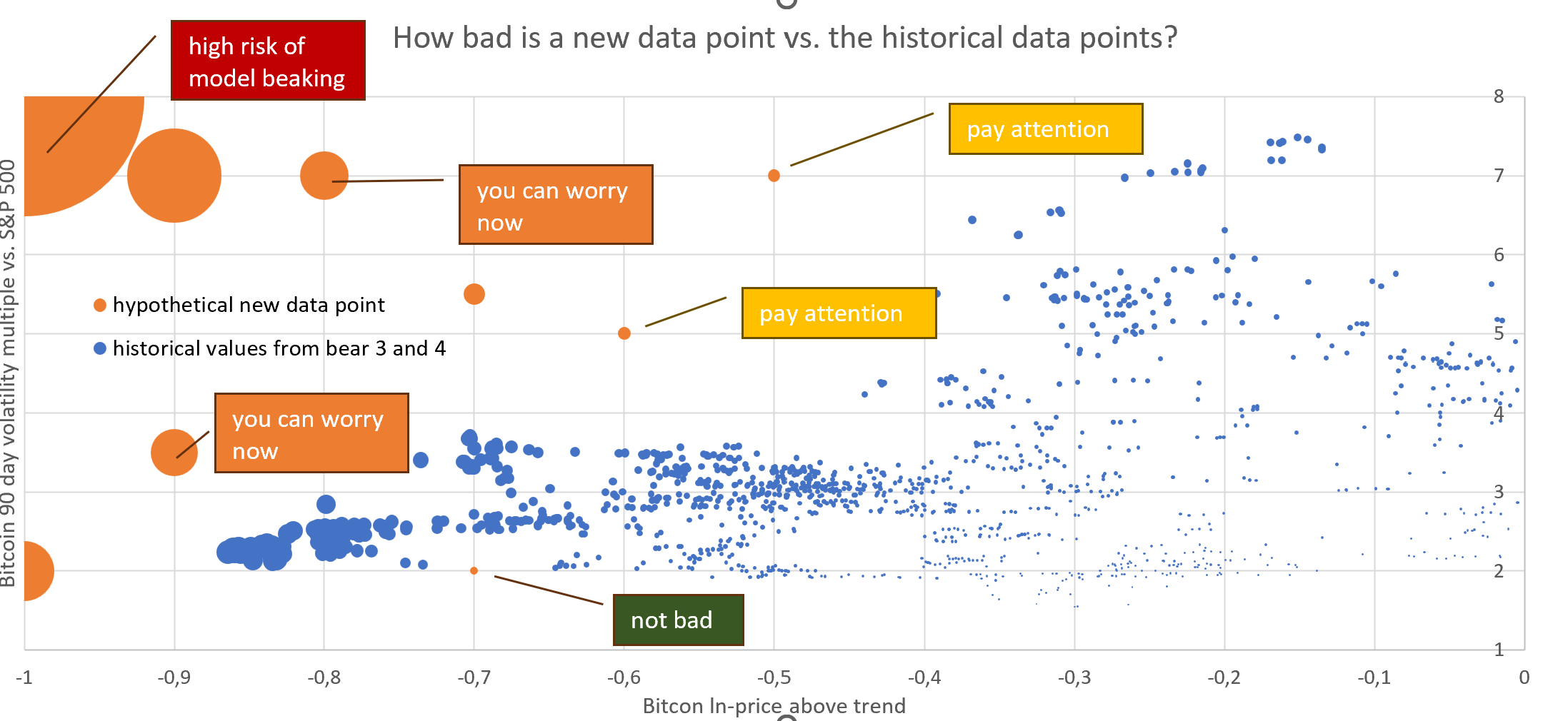

With this information I create a formula for calculating risk scores, which seems fitting to me. The risk score measures the risk of a sudden break in my model to the downside. Each blue dot represents a day in the bear market bear3 or bear4. The size of the dot represents how risky a break down of the model to the downside was for each day.

The orange points are hypothetical new data points in the future to show how much risk each data point would have:

- A Bitcoin price at trend*e^-0.7 with a volatility of 2, would be low risk, since we have historical data points with am even lower Bitcoin price with higher volatility. This data point would be a green traffic light.

- A day of (-0.6, 5) or (-0.5, 7) would be slightly elevated risk. The combination of Bitcoin price and volatility seems a bit high compared to the last 2 bear markets. However Bitcoin was cheaper or more volatile in the past, so we have to pay attention. This data point would be a yellow traffic light.

- A hypothetical day of (-1, 2) or (-0.9, 3.5) or (-0.8, 7) would indicate elevated risk of a model break down, since drawdown and volatility exceeds historical data from the last two bear markets. This data point would be a orange traffic light.

- A hypothetical day of (-1, 8 ) would indicate a high risk of our model breaking, since the historically Bitcoin price didn't sink so far below trend and the high level of volatility is also very unusual.

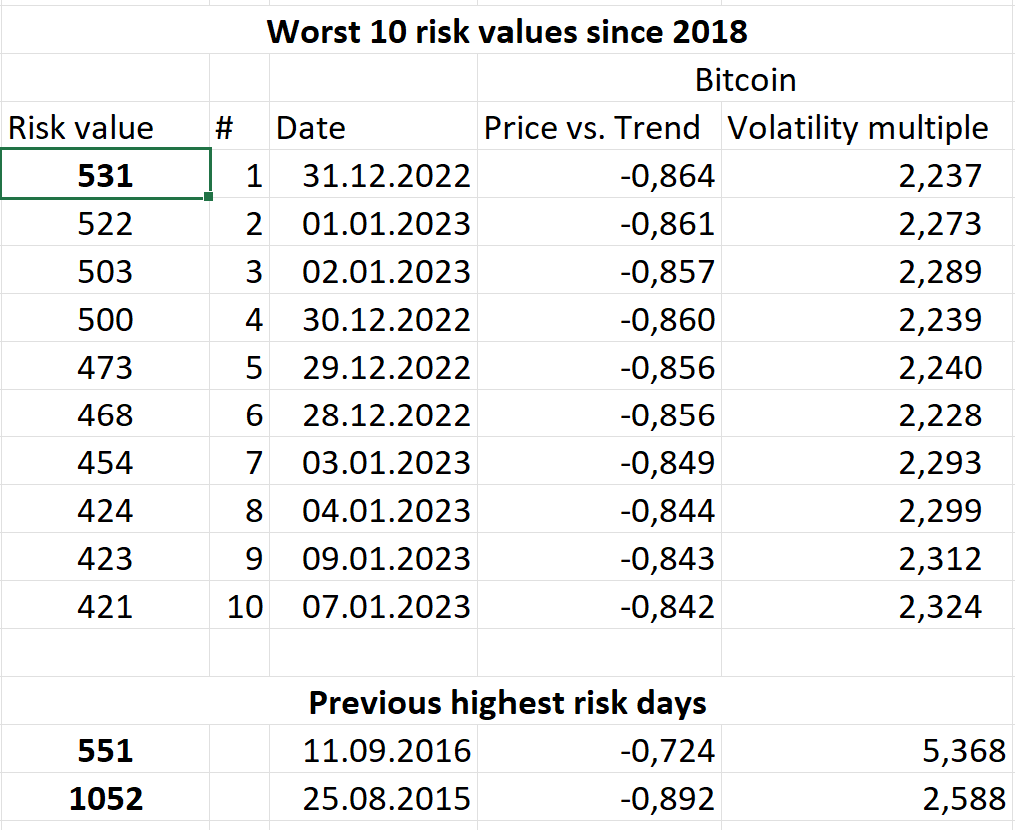

The 10 days with the highest risk value were end of 2022 / beginning of 2023, with high drawdown, but only moderate volatility. I added a graph for the risk values since 2011 (blue line).

We couldn't have calculated the blue line in real time. However I still plottet the line to get a feeling how the risk value moved during Bitcoin's history.

The highes recent risk value was 531 at Dec. 31th of 2022. This was the highest risk value since 551 on Sep. 11th 2016, which was 6.3 years earlier. The absolute risk value has not important meaning for our interpretation. However our risk value in comparison to previous risk values is important for our interpretation.

Genrally Bitcoin's risk is declining. If on one day we exceed the risk of multiple prior years, we can for sure say is a sign of elevated risk.

Our historical data enables us to set cutoff points for acceptable risk. I think a risk value 550 does not indicate a break down of our model, since we reached this neighborhood 2016, 2022, 2023 and 2020.

A risk level of more then 1000 would indicate possible model breakdown, since we would reach the risk neighborhood of 2015 or even 2013. This would be surprising, since we would exceed the risk values of the previous decade and breaking the trend of decreasing risk in Bitcoin.

Since now we have our risk levels (<550 for

● green light, >1000 for

● red light and

● yellow light for 550-1000) we can draw them into our plotter chart.

All datapoints for bear3 and bear4 are below the green line, which means we can sleep well and trust in our model (Bitcoin trend price growth and moving around cycle). While everybody is scared, we sleep like a baby. We have no data points above the red line, therefore on no days we had to question our model.

Since we calibrated our at bear3 and bear4 this result is not surprising.

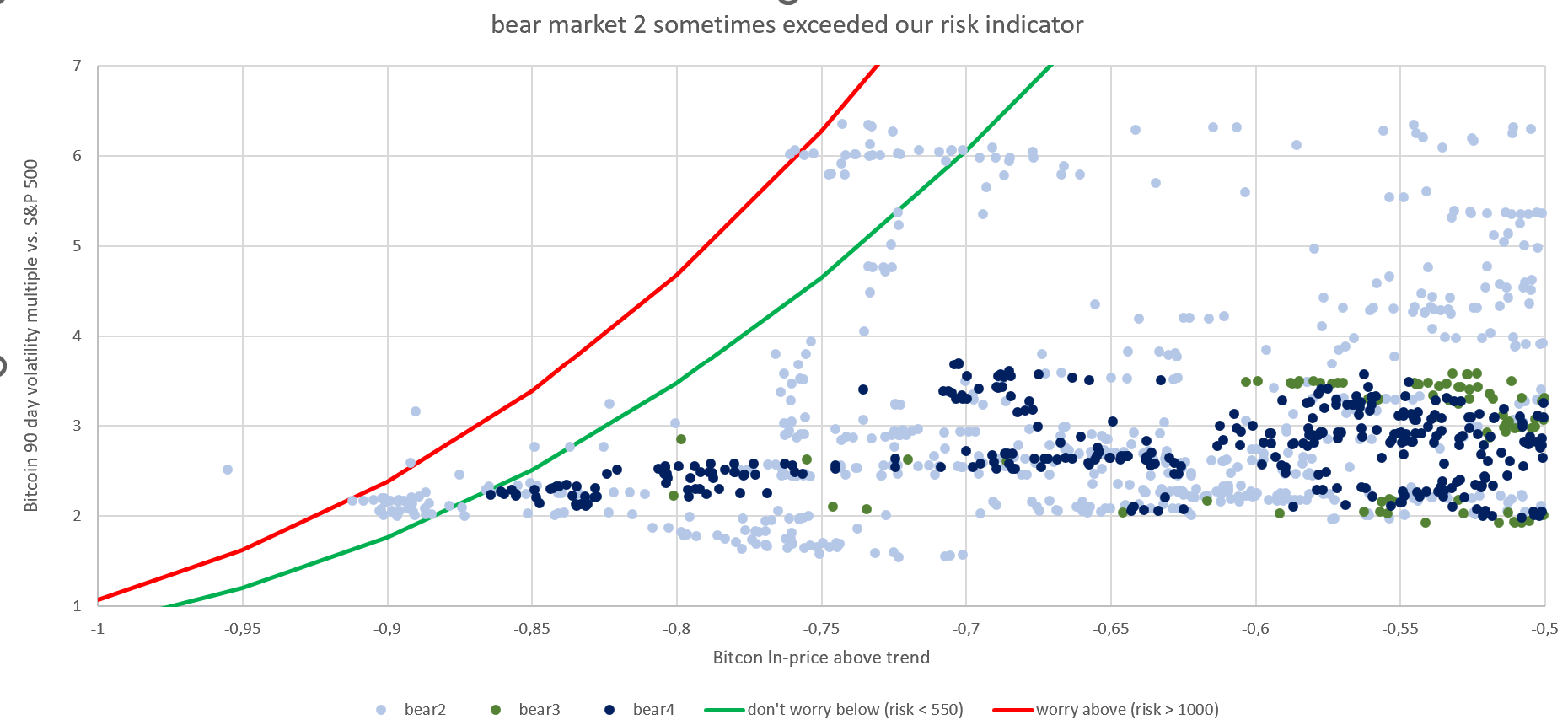

If we add bear2, we can see some dots get a yellow traffic light from us (those dots are between the green and the red line). A few dots are are even north of the red line meaning on those days we should check our model for possible break down. I think this calibration is reasonable, because getting risk values during bear market 5, which were last seen in bear3, should make us cautious.

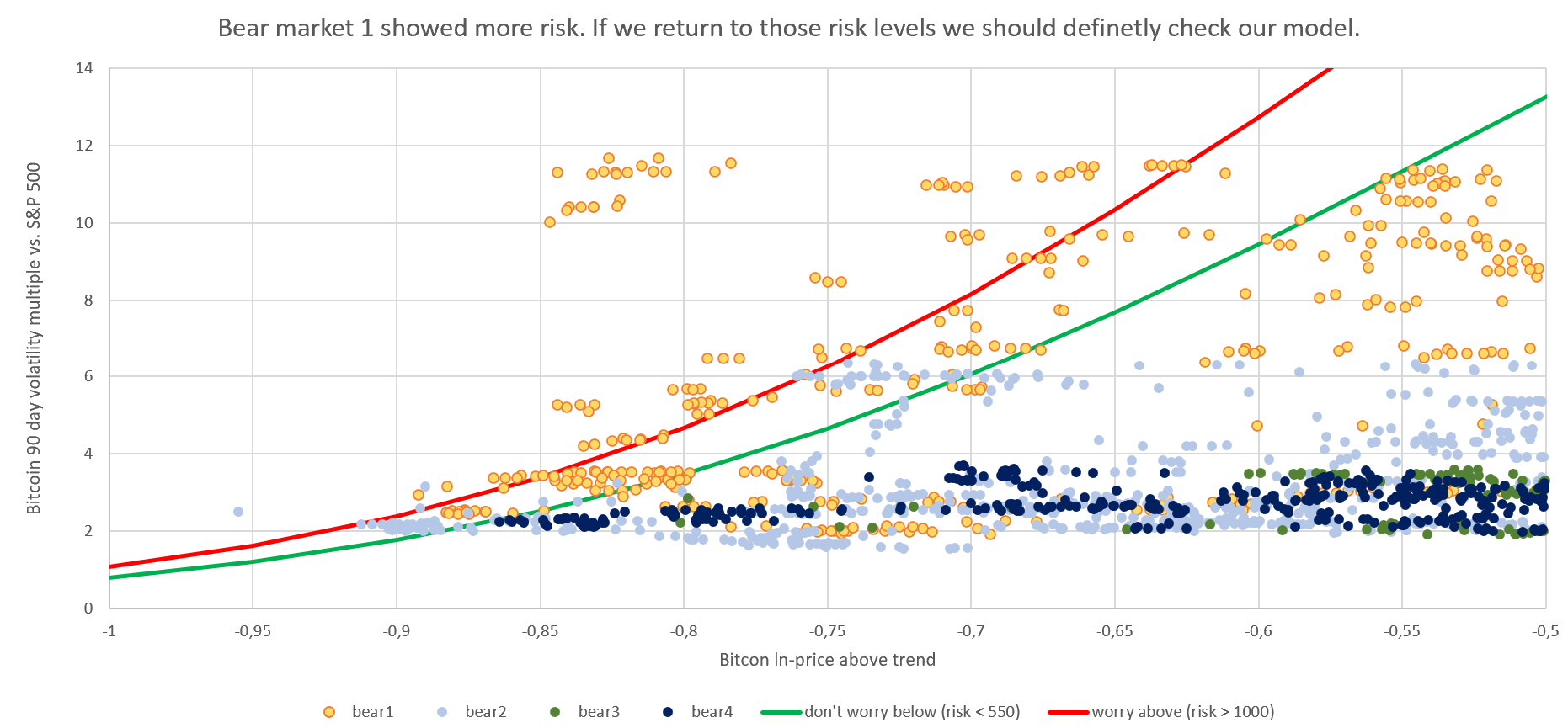

We add bear1, now we see multiple values exceeding our red line.

Traffic light is ...

-

● red, if Risk_value > 1000

-

● green, if Risk_value < 550

-

● yellow otherwise

risk_value = risk_value_below_trend * risk_value_volatility

risk_value_below_trend = 1 / NORMSDIST(z)

z = (Bitcoin_vs_trend - Bitcoin_vs_trend_average) / Standarddeviation(all Bitcoin_vs_trend from bear3 and bear4)

Bitcoin_vs_trend = ln(Bitcoin_price) - ln(Bitcoin_price_trend)

risk_value_volatility = (Standarddeviation(daily Bitcoin price returns from previous 90 days) / Standarddeviation(daily S%P 500 price returns from previous 90 days)^2