goldkingcoiner

Legendary

Offline Offline

Activity: 2044

Merit: 1670

Verified Bitcoin Hodler

|

|

April 04, 2024, 08:21:33 PM |

|

Good that we are having a discussion about this. The community needs to put more pressure on devs, otherwise we will get nowhere. LN has been going stale and devs it seems have been running out of fresh ideas.

But Bitcoin is safe. Lightning was never a requirement for Bitcoin and even if it fails, something else will take it's place.

|

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|

|

|

|

|

Remember that Bitcoin is still beta software. Don't put all of your money into BTC!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

d5000

Legendary

Offline Offline

Activity: 3906

Merit: 6142

Decentralization Maximalist

|

I never believed that Lightning could be really the one and only scaling solution for Bitcoin. A Lightning payment has a completely different character than an on-chain payment - at both sides of each payment. Someone who uses Lightning mainly to "pay things" has to regularly top up the channel. And for those receiving LN there is not only the infrastructure, but also the monitoring requirement. Old channel updates are more dangerous for those who receive Bitcoin frequently (and of course, the intermediate nodes). It may be controversial what I'll write now, but I think the way to go forward is in this case (and only this one!): follow Ethereum! Ethereum has experienced some progress with Layer-Two solutions, above all with the rollup technology, which made tumble transaction fees. See Bitcoinrollups for a way to implement that in BTC. But there are also some other interesting L2 concepts like Nomic*. I could also imagine a " BTC stablecoin" based on a collateral/lend-based technology similar to Dai, which could be used on all EVM-compatible altcoins. Chain-based L2s have a crucial advantage to LN: they can be used like Bitcoin or any other altcoin basically -- no 24/7 requirement, no major monitoring costs. The only disadvantage to on-chain is that the security is a bit lower. I still think Lightning is a part of a larger scaling solution. Several times I compared it with a prepaid card. That's how Bitcoiners should think about it - as a specialized micro- to small-payments solution. Not as a layer which has to be run by every single Bitcoin user, but by those who use Bitcoin frequently to make online (or offline) purchases like buying books, VPS, and other relatively low-cost items. For small payments, the attacks described last year are not profitable, so they will most likely never occur. *The main problem I see for most of these technologies is that they are often using centralized tokens for some PoS/PBFT consensus. But these solutions are mostly open source so they can be forked, and a PoW token could be created for consensus. |

|

|

|

|

thecodebear

|

|

April 05, 2024, 12:18:06 AM |

|

Ideally we get a range of scaling solutions for Bitcoin. LN is a great one if you earn and spend in equal amounts on LN. Like say in the future you get paid 0.01 BTC per month from your job on LN, and you spend roughly that amount per month - spending what you make. Like if today we were at the point where you can readily spend Bitcoin, I'd happily have a LN wallet for spending, replenishing it when it gets low with crypto trading profits from an exchange sent over LN from exchange to my LN wallet, that would work great and is totally within the use cases of LN. But its not useful for people who are mostly going to have one-way payments, either receiving of paying.

And honestly the average person would probably use some LN service where they say pay a few bucks a month or whatever to get liquidity and rebalancing handled for them and they don't have to worry about it. I know there is already an industry of LN liquidity providers, though I have no idea if the costs are affordable enough to make it a viable option for the average person. Sure that is "centralized", but most people aren't going to care about that, they are just going to want to spend their bitcoin and not worry about the technicals and tradeoffs of LN, especially considering LN would act more like a checking account, while you still just hold long term savings in cold addresses.

But there should absolutely be other scaling solutions with different tradeoffs. I think the only real problem with LN is that it was touted as the ONLY scaling solution needed and so the community for the past 5+ years has sorta ignored the problem because LN will be ready by the time people want to start spending bitcoin en masse. And it will be, but also let's see what other scaling solutions can be designed. LN might work really well for some people, but it also might not work well for others. It's a great solution but doesn't work great for every use case. We need multiple scaling solutions to allow Bitcoin to be globally scalable for every use case.

|

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 05, 2024, 12:25:46 AM |

|

bitcoin scaling is about scaling bitcoin (any talk about needing people to leave bitcoin for other networks is not a scaling solution for bitcoin. its instead a abandon bitcoin and de-scale bitcoin solution)

subnetworks will become separate offerings of separate niche services, functions for different needs. but this is not to say the solution is to get people to stop using bitcoin and use other networks as "solutions" to bitcoin scaling

lightning is not a solution, its actually the excuse to not offer a bitcoin scaling solution. its the stall/stagnate/delay tactic

lightning wont even have a prosperous future because even LN devs admit it has flaws.

other subnetworks will start from scratch, learn from LN mistakes and offer other niche, utility, services for other features that are not part of bitcoins main function. but those subnetworks have yet to be built

bitcoin still needs to scale. emphasis BITCOIN

we have already learned from history that banking systems of bank notes did not scale the utility of gold assets. it actually done the opposite

we should learn from mistakes of the past. not repeat them

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3444

Merit: 10523

|

|

April 05, 2024, 06:26:14 AM |

|

I'm confused, because if indeed the community would support a hard fork into bigger blocks, then why does Bitcoin need to go through the Segwit soft fork? A hardfork would not only be an opportunity increase the transaction throughput, it would also be an opportunity to make Bitcoin's code cleaner/fix the transaction malleability issue, no?

That "other secret crap" that was behind 2X's proposal was to fork Bitcoin away from the Core Developers.

That's true, with a hard fork we can fix a lot of bugs weirdness in Bitcoin protocol that would actually increase the efficiency and capacity. The actual size cap increase would also increase the capacity. SegWit2x was flawed, some of which I knew back then a lot more of it I know now. But my point is that we are always going to need on-chain scaling and can not rely on other solutions like second layer to fix all scaling concerns. when fee's came down in 2024 after the 2022-23 bitcoin congestion(fee wars).. people actually closed lots of LN channels and removed their liquidity from LN..

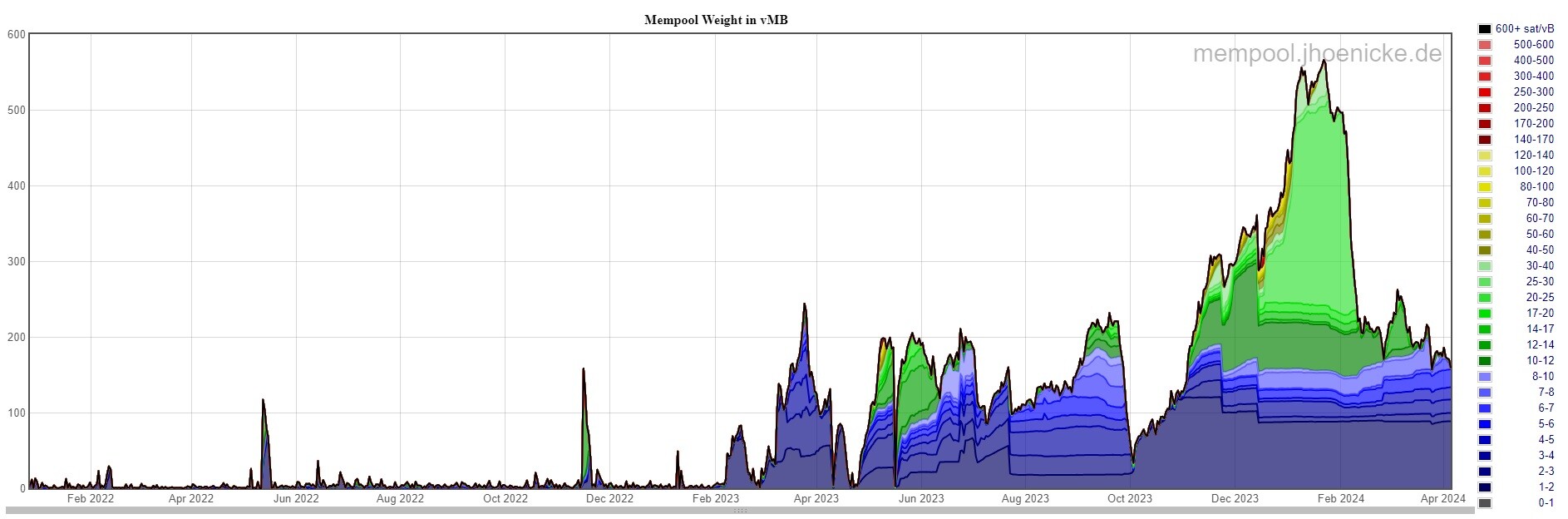

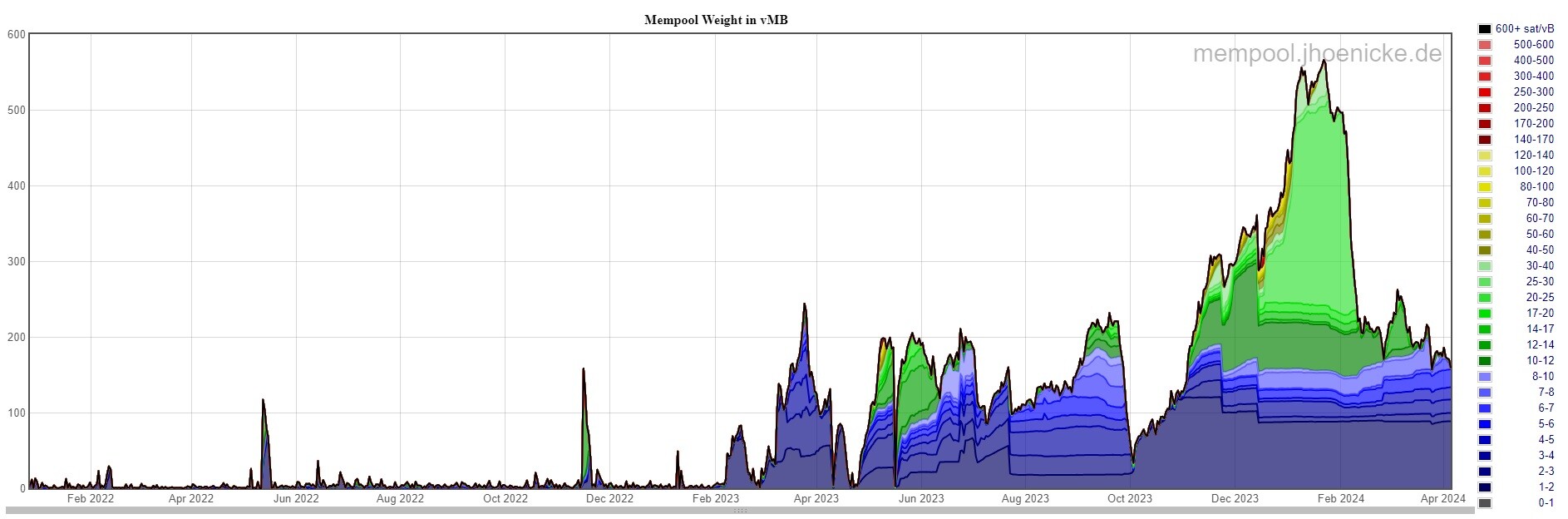

Your speculation isn't backed by data. The spam attack on Bitcoin under the codename Ordinals got severe mid 2023 (not 2022) and the peak was at the end of 2023 and start of 2024. (click for larger image) This shows the mempool from January 2022 till today:  It is clear when the fee is the highest! The following shows the number of LN channels in the same period (the green square shows the same section where the fee is peaking)  Source: https://bitcoinvisuals.com/ln-channelsFrom these two charts it is clear that when the Ordinals Attack got worse and caused the biggest fee spike at the end of 2023 and start of 2024, we had the biggest drop in number of LN channels. Before the attack in 2022 when the fees are almost always low, the number of LN channels is also pretty much a plateau. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

God bless u

Full Member

Offline Offline

Activity: 322

Merit: 109

Eloncoin.org - Mars, here we come!

|

|

April 05, 2024, 02:58:03 PM |

|

If I'm not wrong people were talking about the same thing almost a year ago and what's new? Lightning Network can't solve Bitcoin scaling issues because if it could it would have been implemented. This is just a positive step towards solving the scaling issue but in my opinion it's now worth it.

Bitcoin has done pretty well and now again halving is near and people are discussing this type of shit so that they can prevent the growth of BTC but it won't be possible and it's just a waste of time. People know that by establishing side chains BTC will solve scaling issue it's not dependent on LN networks.

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 05, 2024, 04:37:16 PM

Last edit: April 05, 2024, 05:11:37 PM by franky1 |

|

when fee's came down in 2024 after the 2022-23 bitcoin congestion(fee wars).. people actually closed lots of LN channels and removed their liquidity from LN..

Your speculation isn't backed by data. The spam attack on Bitcoin under the codename Ordinals got severe mid 2023 (not 2022) and the peak was at the end of 2023 and start of 2024. (click for larger image) This shows the mempool from January 2022 till today:  It is clear when the fee is the highest! The following shows the number of LN channels in the same period (the green square shows the same section where the fee is peaking)  Source: https://bitcoinvisuals.com/ln-channelsFrom these two charts it is clear that when the Ordinals Attack got worse and caused the biggest fee spike at the end of 2023 and start of 2024, we had the biggest drop in number of LN channels. Before the attack in 2022 when the fees are almost always low, the number of LN channels is also pretty much a plateau. read the quote you quoted of me, then read what you responded i never said severe but anyways let me guide you word for word "when fee's came down in 2024" you too admit and confirm the PEAK(your word severity) was december 16th 2023.. thus "when the fees came down in 2024" aka come down from peak(severity) people were not taking the opportunity to move TO LN instead they took the opportunity to LEAVE LN at a faster channel decline than 2022-2023 look at the numbers.. the 2022-2023 number of LN channels were in an area of 80k-73k but then dipped at a quicker rate down to near ~55k in RECENT MONTHS also if you check your own charts you will see that the september 2023 dip in fees's seen a dip in channels again(73k-68k) people were taking the low fee opportunity of sept-oct to LEAVE LN then the next surge of congestion and fee. which peaked .. december 2023 also 2021-2022 where you and i say "before the attack in 2022" (we both know people started at the start of 2022 noticing ordinals was more then a petty thing, so you agree the starting point of congestion was mainly from 2022) here is where you try to disagree but the chart agree's with my stance the amount of channels "before the attack in 2022" the channels were not "pretty much a plateau" before the attack you can see that 2021-2022 was LN channel growth from ~50k channels to ~80k channels (look below the channel chart at the part where you can scroll the chart with the scrollbar (| 2020 | 2021 | <| 2022 | 2023 | 2024 |>) ~33k ~80k ~80k 73k~65k 55k [ = ] 2021 seen a growth of 33k-~80k before the attack .. so not a plateau before the attack then as the attack began.. 2022-oct 2023 was 80k-73k (a nearish plateau of small change(slow decline)) YOU mentioned the world plateau so im correcting where you see the "platuea" era you want to suggest.. actually happened the plateau(your theory of 'plateau', i did not even mention) BEGAN after the 2022 start of congestion not before the 2022 date which also proves that when bitcoin got congested/annoying. people still did not want to move over to LN as "a solution" after the congestion began the channels BEFORE the attack(2022) seen 2021 go from 33k-80k based on your image of the chart so there was no plateau before the attack the plateau started as the attack started and channel declines when people could take the opportunity after some surge and dip in fee's when fee's took a fall people took opportunities to LEAVE LN not join even during the longer congestion people were not joining LN to escape the congestion |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4732

Merit: 4239

Leading Crypto Sports Betting & Casino Platform

|

|

April 05, 2024, 05:25:43 PM |

|

If I'm not wrong people were talking about the same thing almost a year ago and what's new? Lightning Network can't solve Bitcoin scaling issues because if it could it would have been implemented. This is just a positive step towards solving the scaling issue but in my opinion it's now worth it.

Bitcoin has done pretty well and now again halving is near and people are discussing this type of shit so that they can prevent the growth of BTC but it won't be possible and it's just a waste of time. People know that by establishing side chains BTC will solve scaling issue it's not dependent on LN networks.

Ordinals drove the point home that Lightning Network is not going to solve anything and will create new problems for users. Not to mention the whole thing basically requires you to use a 3rd party which made it dead on arrival as an idea. It is nice to hear someone mention side chains (merged mined chains) as a solution. I think people overlook that satoshi literally gave us an answer to the scaling problem as well as the internet censorship issue with merged mining and Namecoin. If this was built upon to include merged mining chains for lower cost and faster solutions, NFT storage, data storage, smart contracts, etc. we would have seen Bitcoin mining explode in profitability while developers continued working with Bitcoin and not against it. Unfortunately, Blockstream had a "scaling solution" they wanted to push and that made it so instead of everything being merged mined and working with Bitcoin, altcoins exploded and took away vital resources and talent from Bitcoin while causing a lot of drama and mistrust that still echoes in the community today. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 05, 2024, 05:33:08 PM

Last edit: April 05, 2024, 05:55:53 PM by franky1 |

|

Unfortunately, Blockstream had a "scaling solution" they wanted to push and that made it so instead of everything being merged mined and working with Bitcoin, altcoins exploded and took away vital resources and talent from Bitcoin while causing a lot of drama and mistrust that still echoes in the community today.

true but for clarity core devs that 'founded' blockstream (who then invented sister companies like chaincodelabs/brink to appear less centralised(pfft) were coerced by money funding/sponsors to perceive and develop sandbox tests for CBDC via hyperledger involvement its funny how CBDC is modelled after a central reserve chain just for the central/commercial bank transfers(reserves network).. with smart contract channel/federations subnetwork for the customers of the commercial banks(not a coincidence) if they didnt mandate a bitcoin change before november 2017 they would have lost a funding target/goal. and not get paid.. so forced it in august 2017 to be set by november 2017 so that it would unlock their next tranche of income to continue getting paid to work if they didnt suck up and say how certain features were the future they wouldnt get ongoing R&D funding from sponsors if they didnt pretend these subnetwork sandboxes were perfect they wouldnt get ongoing funding.. (you can tell they rushed to push segwit. because core node didnt even have the feature of "sign message" in the node GUI for segwit.. and didnt finish it after activation as all they cared about was activating if for their payday target) they however are now seeing funding dry up now central/commercial banks are doing their own beta tests of CBDC and not needing core devs so now you start to see all the previously sponsored devs and businesses involved of promoting the sandbox tests, start announcing publicly the flaws and admit the faults are bigger then they previously wanted to admit |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1825

|

|

April 06, 2024, 07:46:10 AM |

|

Don't get me wrong — I hope Lightning does succeed, but if Lightning amounts to nothing in the end, do we actually have an alternative solution for scalability? It seems that Bitcoiners are betting all their cards on Lightning. Not a fan of halving the future of bitcoin payments in one company.

This is why ever since 2017 I've been saying we will always need on-chain scaling alongside everything else we do. This is also why I was a fan of the 2x part of the SegWit2x thing regardless of the other crap that surrounded the proposal. I'm confused, because if indeed the community would support a hard fork into bigger blocks, then why does Bitcoin need to go through the Segwit soft fork? A hardfork would not only be an opportunity increase the transaction throughput, it would also be an opportunity to make Bitcoin's code cleaner/fix the transaction malleability issue, no? That "other secret crap" that was behind 2X's proposal was to fork Bitcoin away from the Core Developers. windfury you are soo wrong yet again you cant even be bothered to read the NYA or the proposals or code, or anything to back up your mentors narrative you copy and recite like a drone zombie the reality and fact is(which is backed up by the NYA own words and code and versionbits in the immutible blockchain, is that X2 was a FAKE/empty promise to eventually give the community (at some un-dated future vapour time) 2mb base block IF they first agree to the mandate flag of normal segwit first. and yep after segwit happened the talk of the 2mb did not continue.. core+NYA got their way so 2mb blocks talk ended as soon as segwit activated x2 was not a deviation away from core, it was made by core sponsors(nya) to bait and switch the community into complying with segwit via empty promises, basically core+nya came up with a faked second option to make it feel like a choice but all paths lead back to giving core and their sponsors what they wanted, try reading things for once. look at who funded and wrote the NYA of the segwit+2mb(x2) try learning for once frankandbeans says anyone debating him is "wrong" and he wants you to learn, BUT the "correct information" that he has posted is a conspiracy theory made inside his own mind that even big blocker Deadalnix himself would find very VERY foolish and laughable.  This gaslighting-4D Chess of yours will not work frankandbeans. Newbies, it was the UASF that activated Segwit, https://bitcointalk.org/index.php?topic=1805060.0Study Bitcoin history. Study BIP-148. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3444

Merit: 10523

|

|

April 06, 2024, 11:04:51 AM |

|

"when fee's came down in 2024"

you too admit and confirm the PEAK(your word severity) was december 16th 2023.. thus "when the fees came down in 2024"

aka come down from peak(severity)

Fees coming down, in my book, is when fee enters 1 digit rate. So they haven't actually come down, it is just not as terrible as it once were. Otherwise the average fee since February is 20-ish sat/vb. And the decline in the number of channels intensified as we set the ATH in fee rate then continued as they remained high. Ordinals drove the point home that Lightning Network is not going to solve anything and will create new problems for users. Not to mention the whole thing basically requires you to use a 3rd party which made it dead on arrival as an idea.

You can run a LN node just like you can run a Bitcoin node and connect to the network to send/receive transactions. There is no need for a third party. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 06, 2024, 12:20:17 PM |

|

You can run a LN node just like you can run a Bitcoin node and connect to the network to send/receive transactions. There is no need for a third party.

the whole LN network runs on third party.. its the entire business model of LN (using other parties to hot potato/pass the parcel of borrowed value) learn payment hops learn routing learn channel partners even if you lock your value into a bitcoin utxo on the bitcoin network and then reference it to set up a channel on the lightning network with someone else(channel partner). you only adjust your unsettled contract of IOU with/to go to your channel partner and then using onion agreements ask them to then use their balance of unsettled iou contract with their other partner, and so on and so on until the destination. LN does not set the destination in the contract and then relay the contract(TX) around the network to settle... LN is nothing like how bitcoin pays a destination come on its LN 101, basic stuff |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 06, 2024, 12:28:06 PM

Last edit: April 06, 2024, 01:04:11 PM by franky1 |

|

wrong again.. you are stuck in doomad nonsense scripts of 2018 here i showed you and him(many times and many topics) a nice colourful image of the versionbit and user agents of the era..(you can verify it with blockdata and other stats)  blueline reaching its threshold, triggered the redline to then go from natural wiggles of 45% to unnatural /-\ 100% as you can see UASF didnt even get 20% popularity!! now go do your research even doomad occasionally realises he gets debunked and then comes to his senses and realises it was not UASF the closest thing to an abbreviated term would be a ENAHF(economic node assisted hard fork) however most commonly referred to it as the NYA agreement due to how the NYA made old blocks get rejected so only new versionbit segwit flagging blocks got seen (the unnatural /-\ rise to unnatural 100%) NYA done its job by fake promising a later 2mb base, as long as everyon fell into line against their mandated blackmail of rejecting old blocks if people didnt fall into line... and as soon as segwit activated by the NYC scheme. the talk of a later 2mb base ended and the promise got broken go read the code, go learn the NYA agreement and go verify the blockdata. if you realy want to beleive one of your mentors clearer days of sounding as close to the truth as possible where he shows a bit of bravery to admit he was wrong and shown he could do some research Your definitions aren't accurate.

BIP148 and BIP149 are virtually identical except that BIP149 activates 6-12 months later in order to reduce turbulence. Distinguishing BIP148 as a "UASF" and BIP149 as "timed" is misleading: they're both UASFs, and both timed with the possibility of early activation in case of miner cooperation.

There are many very different "Segwit2x" proposals, but BIP91 is absolutely not one of them. It doesn't involve any max block size increase except for SegWit. BIP91 is a way of activating the original BIP141/BIP9 deployment at an 80% mining threshold rather than the original 95% threshold.

There is no single "Segwit2x" proposal that you can clearly point to.

OP tweaked again to rectify. I think the latest plan to activate SegWit2x is to utilise the signalling bits from BIP91, which is where I got mixed up. (...)SegWit2x readiness would be signaled using another piece of activation data: “bit 4” instead of “bit 1.”

This makes SegWit2x largely incompatible with BIP141, and especially with BIP148: Different nodes would be looking at different activation bits, meaning they could activate SegWit under different circumstances and at different times; and that would mess up SegWit-specific block relay policy between nodes, potentially fracturing the network.

BIP91

Now, it seems BIP91 has provided the solution.

BIP91 is a proposal by Bitmain Warranty (not to be confused with Bitmain) engineer James Hilliard which was specifically designed to prevent a coin-split by making SegWit2x and BIP148 compatible.

The proposal resembles BIP148 to some extent. Upon activation of BIP91, all BIP91 nodes will reject any blocks that do not signal support for SegWit through bit 1. As such, if a majority of miners (by hash power) run BIP91, the longest valid Bitcoin chain will consist of SegWit-signaling blocks only, and all regular BIP141 SegWit nodes will activate the protocol upgrade.

Where BIP91 differs from BIP148 is that it doesn’t have a set activation date, but is instead triggered by hash power. BIP91 nodes will reject any non-SegWit signalling blocks if, and only if, 80 percent of blocks first indicate within two days that’s what they’ll do.

This indication is done with bit 4. As such, the Silbert Accord can technically be upheld — 80 percent hash power activation with bit 4 — while at the same time activating the existing SegWit proposal. And if this is done before August 1st, it’s also compatible with BIP148, since BIP148 nodes would reject non-bit 1 blocks just the same.

This proposal gives miners a little over six weeks to avoid a coin-split, under their own agreed-upon terms. With a SegWit2x launch date planned for July 21st, that should not be a problem… assuming that the miners actually follow through. So obviously miners are jumping on board with this. //EDIT: -ck sums it up more succinctly in this thread. //DOUBLE EDIT: Look at the last 1000 blocks. This looks like a pretty momentous shift. |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1825

|

|

April 07, 2024, 06:56:21 AM |

|

wrong again.. you are stuck in doomad nonsense scripts of 2018 here i showed you and him(many times and many topics) a nice colourful image of the versionbit and user agents of the era..(you can verify it with blockdata and other stats)  blueline reaching its threshold, triggered the redline to then go from natural wiggles of 45% to unnatural /-\ 100% as you can see UASF didnt even get 20% popularity!! Of course you would show that image to everyone in the forum without context and without the source.  This is the source, it's from Reddit /r/btc, the home of the big blockers, https://www.reddit.com/r/btc/comments/8golyn/what_caused_the_miners_to_activate_segwit_threat/¯\_(ツ)_/¯ And for the context, that image illustrates that actual point that Jihan Wu and the miners cabal are working together with the signatories of the New York Agreement. In fact, they were also signatories of the agreement. The formation of the NYA also proved that desperation among them was starting because the UASF was not going to concede. It was actually starting to win some of the Core Developer's support, like Eric Lombrozo. Newbies, study history, https://learn.saylor.org/mod/book/view.php?id=30784 |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

slaman29

Legendary

Offline Offline

Activity: 2632

Merit: 1212

Livecasino, 20% cashback, no fuss payouts.

|

|

April 07, 2024, 09:25:21 AM |

|

Man I don't think Liightning has failed at all. Sure if you look at L2 you got tons of Ethereum and altcoin networks doing billions in volume BUT that's mainly defi and memecoin games etc that's not really real utility, anybody including devs can admit that internally.

At least Lightning volume is all actual transactions actual utility.

We all know that's what's important in the end for Bitcoin.

|

|

|

|

DooMAD

Legendary

Offline Offline

Activity: 3766

Merit: 3103

Leave no FUD unchallenged

|

|

April 07, 2024, 09:18:44 PM

Last edit: April 08, 2024, 06:37:10 AM by DooMAD |

|

wrong again.. you are stuck in doomad nonsense scripts of 2018 I'm of the view that BIP91 is what broke the deadlock, so it I guess I don't agree with either of you. UASF was a dumpster fire from start to fizzled out. Looks like franky1 is so paranoid about conspiracies and cultists, he's too blind to recognise when individuals have different opinions (purely because no one shares franky1's moronic and delusional opinions). |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

d5000

Legendary

Offline Offline

Activity: 3906

Merit: 6142

Decentralization Maximalist

|

|

April 07, 2024, 10:50:50 PM

Last edit: April 07, 2024, 11:38:10 PM by d5000 |

|

Adding a thought about the "subnetwork" controversy.

Yes, I agree actually with franky1 that "subnetworks" are not exactly the same than the Bitcoin network. Transactions that are shared only by a subset of the nodes do not have the same security than on-chain Bitcoin transaction, be it LN or sidechains.

But we have to distinguish between Bitcoin as a currency and Bitcoin as a core technology (i.e. limiting this technology to "on-chain Bitcoin transactions" or "Layer 1").

The Bitcoin currency can circulate on all kinds of different technological platforms and solutions. Just like fiat can do that too: We can have physical cash (coins/banknotes), credit cards, bank accounts, prepaid solutions and maybe other exotic means of payment an storage. All of these have different characteristics, some have risks associated that others don't have. Same with Bitcoin: if you chose to only use a subnetwork, then you have some tradeoffs, but you are using the same currency.

But we would never say that a US dollar payment is not an USD payment because it was made with a credit card.

I would even argue that Lightning shares more with the "core Bitcoin technology" than what a credit card-based technology (censorable, depending on a centralized payment provider) shares with fiat coins and banknotes (difficult to censor, private). Lightning is also uncensorable, for example - while you could censor a route inside the network, you can't prevent the censored user to simply close the channel. So all what can be done by a malicious third party is to lock another party out of a particular channel, but not to block the funds (like banks can do). Centralized wallets are much more similar to the "credit card"/"bank-based" model than LN, even if the users can use them to transact on-chain.

Also, while Lightning depends on third parties in some way, it gives total liberty to choose your third party. With credit cards, you have only three major international providers, and even if you count each bank separately, there aren't that many options. On LN you have thousands of nodes you can open a channel with, and many of them are not even for-profit entities. And if you aren't satisfied with the existing providers you can set up one on your own.

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

April 07, 2024, 11:23:39 PM

Last edit: April 07, 2024, 11:47:24 PM by franky1 |

|

Adding a thought about the "subnetwork" controversy.

Yes, I agree actually with franky1 that "subnetworks" are not exactly the same than the Bitcoin network. Transactions that are shared only by a subset of the nodes do not have the same security than on-chain Bitcoin transaction, be it LN or sidechains.

But we have to distinguish between Bitcoin as a currency and Bitcoin as a core technology (i.e. limiting this technology to "on-chain Bitcoin transactions" or "Layer 1"). bitcoin BTC never leaves the bitcoin network.. fact we for years been trying to educate people about things like #not-your-key-not-your-coin when LN is now admitting its flaws technically and economically (where people are now using custodians as work arounds).. realise that was the game plan all along.. its how the sponsors of devs get their ROI. by becoming middlemen scraping LN fee's/rents(loans) from users. as they know they cant play middleman on the bitcoin network. so want to make bitcoin a hazard, hindrance and headache to use, to push people into the LN promotion games LN msat is a pegged unit of subunits of sats. they are pegged/unsettled credit iou balance of a decimal of a sat much like how wrapped and pegged units of other subnetworks are not the actual asset.. rBTC wBTC L-BTC are not actual btc LN payments are not bitcoin/sat payments.. the format is in msat of a onionized payment/invoice.. bitcoin does not understand msats analogy: having credit on a credit card does not mean you have bank account savings.. you have debt. a dollar amount in a debit card is not the same as a dollar amount on a credit card.. and looking at the lack of fiat education shows why people see a big national debt of 34trilltion dollars and how the fiat economy has so many problems.. lack of education we should not repeat the same silly fool games of playing idiot and pretending that credit/debt is the same as asset ownership the whole point of bitcoin was to be something different to the uneducated fiat system of admiring credit/debt as something to aim for while selling off assets to accumilate debt (get a credit score to get a mortgage, instead of save up and buy a house in full) people foolishly (due to bad education at school/lack of education at school, dont know about how money/assets work) people who have a mortgage think they have ownership rights of a house.. wrong. the bank makes the decisions. if you dont pay the bank they evict you. you are only a few payments away from being evicted if you dont pay the bank. they wont let you stay, its not your home you cant just choose you have the ilusion of being called a home owner as they dont want the liability of maintaining the home, but funny part is they usually have terms that they want you (they set the demands) on the upgrades you need to do to give equity to the home, they tell you they want you to insure it to protect them fiat has many economic bait and switch schemes pretending credit cards are better then debit cards, when you learn how fiat economy is messed up you start to see the errors of other systems that play the same games learn the differences of how things work. learn economics, and learn all the schemes played against people.. and this learning process will enlighten your mind about other things.. it will help you know the difference between bitcoin and LN both technically and economically you need to learn alot about economics and how the real world works outside of the silly idiot games people play to try to syphon value from you when you fall into their traps.. and LN is the same trap as credit cards

LN fails many times as a technology, but also economically. its not the same asset model as bitcoin.. its a debt/unsettled(unconfirmed) IOU model like credit card. analogy dont be fooled when visa credit cards say they "work ontop bank wire-transfer networks" credit cards are beneath assets and real savings/investments. we should not hold debt to a higher standard or hierarchy or present debt as something people should prefer or think is better then debit cards/actual savings/investments |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1825

|

|

April 08, 2024, 07:41:47 PM |

|

wrong again.. you are stuck in doomad nonsense scripts of 2018 I'm of the view that BIP91 is what broke the deadlock, so it I guess I don't agree with either of you. UASF was a dumpster fire from start to fizzled out. Looks like franky1 is so paranoid about conspiracies and cultists, he's too blind to recognise when individuals have different opinions (purely because no one shares franky1's moronic and delusional opinions). Although it was the minority, obviously it wasn't merely a "dumpster fire". It was starting to make the community see that SegWit will activate with or without the miners support, and it was also starting to gain open support from some of the developers. I believe deep inside, the majority of the Core Developers supported the UASF from a community perspective, but they'll never admit it openly. Without the UASF, I'm very confident that Jihan Wu and Roger Ver would never have made the move to hard fork to an altcoin. - Barry Silbert would never have made the move to call the leading Bitcoin companies and miners to form the NYA. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

d5000

Legendary

Offline Offline

Activity: 3906

Merit: 6142

Decentralization Maximalist

|

|

April 08, 2024, 08:00:18 PM |

|

@franky1: No, I don't agree with the "LN is debt" analogy. You can always close the channel, and a channel closing does not depend on trust. You only lose the advantage to be able to transact instantly and for low fees, but only until you open a new channel.

You may lose some msats because that's the only part not "backed" on the blockchain all the time, but I don't see msats as a crucial part of LN. LN can work without any problem without msats. In fact, I question severely that the LN projects introduced msats as they probably will be never needed. Of course you can use a smaller unit for the fee rate but IMO this should be rounded up to whole satoshis when calculating the real fee. On the other hand, losing less than 1 sat when closing a channel will also probably never be an issue, you'll probably always pay thousands or more times this amount in transaction fees.

|

|

|

|

|