This is similar to central bank's intervene, it is happening on the FOREX exchange all the time, central banks around the world use this and other method to keep their currency's exchange rate stable

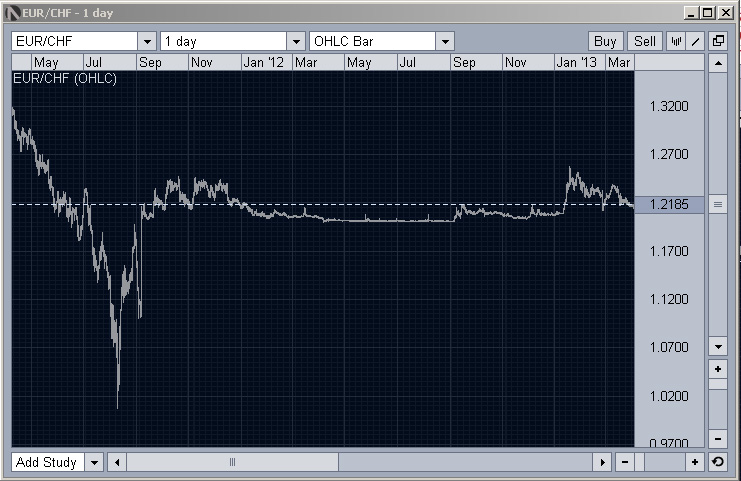

A good example is the exchange rate between Swiss franc and euro, it stayed in a very narrow range during summer 2012 because of this kind of action

Bitcoiners advocate free market, but if one large entity have enough fiat money reserve, he essentially can manipulate the price and cause large price swing, like we saw last year in china (Chinese have a huge fiat money reserve). Because majority of the coins were hoarded, the number of coins circulating on exchanges are much lower and vulnerable to price manipulation

So, some kind of price stabilizing mechanism can be established to reduce volatility. Due to bitcoin's networked nature, it should be as efficient as central bank, because all the bitcoiners will be informed online instantly and take action accordingly

I was thinking about the same thing and have done some practice and research on my trades, some observations:

1. You can limit the downward price movement, but you can never limit the upside movement, because you can have large fiat money reserve but impossible to have large bitcoin reserve, so the large price swing to the upside would still happen

2. If you put all the orders around one price and make one huge wall, and that wall is eaten at once, then you are left with no reserve. So these walls must be flexible and setup at multiple price pivot and be able to adjust itself depends on the current wall's thickness, this is basic market making dynamics

3. The arbitraging from other exchanges will affect the wall, so it is better to setup the wall at several large exchanges so that arbitraging from other small exchanges won't affect too much

If we could get enough amount of bitcoiners reach such an agreement with enough fiat money reserve, then we can defend the lower bound for bitcoin's price. People has always been asking the question about who is backing bitcoin, now we can give them the answer: The bitcoiners back bitcoin. Today we have bitcoin foundation to coordinate the technical aspect of development, we could also have a bitcoiner's association to back bitcoin's value. Bitcoin is advocated to be people's money, so people should back it, not central banks or governments

Currently there are only 12 million or so coins out there, and maximum only 10% of that is in circulation, about 1 million coins. If there is one million bitcoiners back it, each one promise to put in $1000 to the buy wall, then the price will never get below $1000.

Usually the required fiat money reserve is much less, since the price is decided by the daily coin supply, which is around 5000 to 20000 coins, and the daily purchase of 5-20 million USD will keep a price of $1000, requiring only 5-20 USD per day from each bitcoiner, if there are one million of them

You cant quote eurchf or usdjpy because its going to have negative consquences... already did with usdjpy... it hit lows even after intervention.. and eurchf will fall below the floor because there are too many stop losses luring banks and funds into it.

Market controls NEVER work, get it NEVER... its only a temp fix. JPY will now devalue on the other end of the spectrum. Forex is completely different, BRIC currencies have been devalued vs USD and consequently EUR because of the plaza accord signed around mid 1980s that basically signed an agreement that the US will let themselves devalue USD while raising the value of their currencies... ofcourse with no foresight these countries agreed but now see the ramifications of those actions today. The 25 year cycle is up and now something has to change or we enter a severe global depression (something alot of people consider already happening).

In the end only liquidity will stabilize bitcoin price and that means once there is sufficient liquidity between intervals of price it will naturally gravitate within those increments. Think of a pip in forex being 1mBTC in bitcoin or something... as more money is exchanged every day the price stabalizes because more people are willing to buy/sell and mor emarket makers are making the price... the 1%-2% dips are then seen as severe price corrections instead of 10%-50%.