MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 01, 2012, 09:30:13 PM |

|

... is only outmatched by the myth that a fiat currency cannot return to a gold standard without economic upheaval. http://lewrockwell.com/case/case45.1.html |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

|

|

|

|

|

If you want to be a moderator, report many posts with accuracy. You will be noticed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

steelhouse

|

|

May 01, 2012, 10:14:59 PM |

|

The panic depressions were there. They were caused by fractional reserve lending. If banks were full reserve, none of the banks would have failed, only the investors who would have gotten back some of their money on the dollar.

|

|

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 01, 2012, 10:22:57 PM |

|

Yet, the common American didn't have any direct experience with those banks that failed. The Federal Reserve exists to protect the banks' investors and their funds, not the livelyhood of the public.

|

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

|

MarketNeutral

|

|

May 01, 2012, 10:33:27 PM |

|

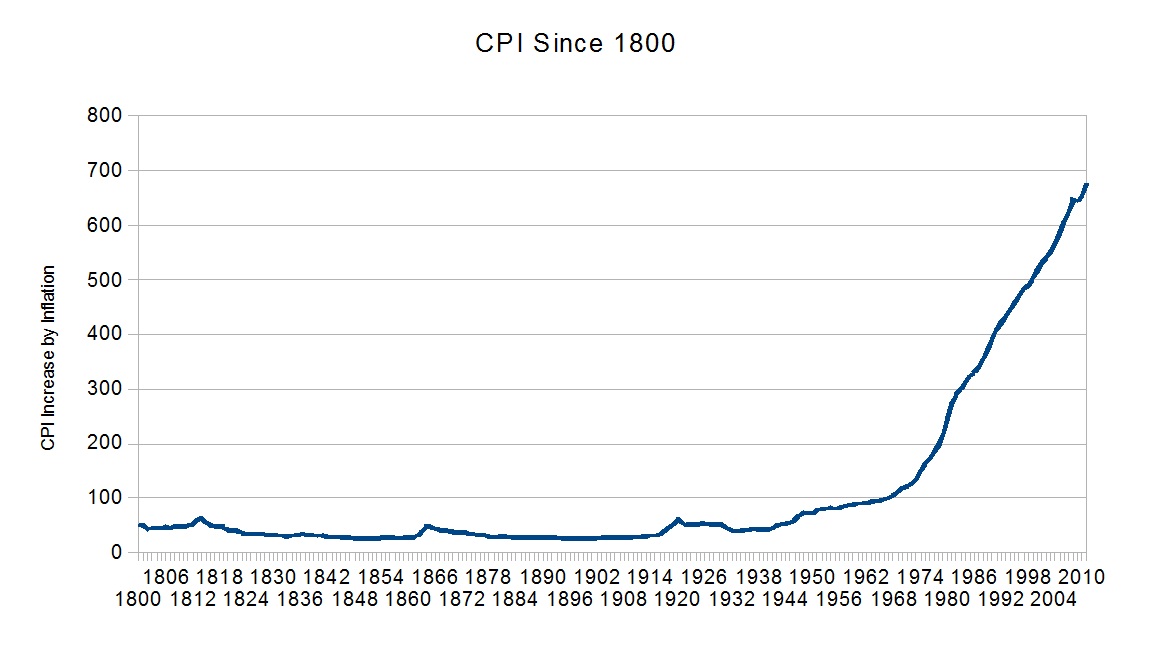

The gold window at least theoretically kept the Fed in check vis-a-vis international settlement. Look what's happened since it closed. |

|

|

|

|

notme

Legendary

Offline Offline

Activity: 1904

Merit: 1002

|

|

May 02, 2012, 04:08:09 AM |

|

Yet, the common American didn't have any direct experience with those banks that failed. The Federal Reserve exists to protect the banks' investors and their funds, not the livelyhood of the public.

+1 If the "bank bailout" had gone to pay down principle instead of paying off those who wound up with a mortgage in default, there would be a lot less defaults and a lot less people who lost access to credit at the same time they lost their house. Our economy would be in much better shape, but we're not their concern. Their concern is keeping the bankers happy since banks own the world's governments via debt. |

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 02, 2012, 04:23:55 AM |

|

Yet, the common American didn't have any direct experience with those banks that failed. The Federal Reserve exists to protect the banks' investors and their funds, not the livelyhood of the public.

+1 If the "bank bailout" had gone to pay down principle instead of paying off those who wound up with a mortgage in default, there would be a lot less defaults and a lot less people who lost access to credit at the same time they lost their house. Our economy would be in much better shape, but we're not their concern. Their concern is keeping the bankers happy since banks own the world's governments via debt. Bingo. A very wise person was once quoted by saying, "the borrower is slave to the lender." This is true enough at the personal level, and true enough at the national level as well. If the federal government is the borrower, who is the lender? It sure isn't me. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

Garr255

Legendary

Offline Offline

Activity: 938

Merit: 1000

What's a GPU?

|

|

May 02, 2012, 05:51:38 AM |

|

China.

|

“First they ignore you, then they laugh at you, then they fight you, then you win.” -- Mahatma Gandhi

Average time between signing on to bitcointalk: Two weeks. Please don't expect responses any faster than that!

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 02, 2012, 05:54:06 AM |

|

China.

Partially true, mostly not. The single largest creditor of the US Federal Government is The Federal Reserve and member banks. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

Garr255

Legendary

Offline Offline

Activity: 938

Merit: 1000

What's a GPU?

|

|

May 02, 2012, 06:04:59 AM |

|

I wonder where the optimal amount of inflationary currency issued is. Then, we (as a country) would have much fewer future problems!

But this is the same ideology as freedom and order. The balance will never be found. Well, at least for humans by humans, because nothing is intelligent enough to interpret its own workings.

|

“First they ignore you, then they laugh at you, then they fight you, then you win.” -- Mahatma Gandhi

Average time between signing on to bitcointalk: Two weeks. Please don't expect responses any faster than that!

|

|

|

|

realnowhereman

|

|

May 02, 2012, 09:25:34 AM |

|

I wonder where the optimal amount of inflationary currency issued is. Then, we (as a country) would have much fewer future problems!

But this is the same ideology as freedom and order. The balance will never be found. Well, at least for humans by humans, because nothing is intelligent enough to interpret its own workings.

There is no literal "optimal amount". The optimal result is "leave it the hell alone". As long as the economy can rely on the fact that the $X in circulation won't be $(X+10^9) tomorrow, then everything can be correctly priced, wages can be correctly paid and there is no inherent advantage to either the saver or the borrower. There is even nothing inherently wrong with no "gold standard"; floating exchange rates represent "price finding" action for relative success of a country with respect to its import and export imbalances. It's only wrong when governments break that price-finding mechanism by utterly smashing any stability to the meaning of 1 USD. You have to start thinking of 1 USD at twenty three minutes past ten on May second 2012. You're right the balance will never be found; but that's only because someone keeps coming along and kicking the scales over. |

1AAZ4xBHbiCr96nsZJ8jtPkSzsg1CqhwDa

|

|

|

|

Etlase2

|

|

May 02, 2012, 12:31:53 PM |

|

Partially true, mostly not. The single largest creditor of the US Federal Government is The Federal Reserve and member banks.

The Fed may be the largest creditor, but any profit the Fed makes goes to the treasury, so this is always a silly point. The real problem is whom the politicians are indebted to. The problem beyond that is this cycle of inflation that makes saving money absolutely pointless so that one cannot hedge their bets against economic collapse. If savings were actually rewarded by having increased purchasing power in down economies, one would not be forced into 401ks and IRAs and their ilk and thus at the whim of the economy. But then the middle class would have a lot more clout, and that simply isn't good if you're wealthy. |

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 02, 2012, 01:34:26 PM |

|

Partially true, mostly not. The single largest creditor of the US Federal Government is The Federal Reserve and member banks.

The Fed may be the largest creditor, but any profit the Fed makes goes to the treasury, so this is always a silly point. ORLY? Who pays for the Fed's employee pensions, then? How is the US monetary system paid for? You know that it costs money, right? |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

|

Etlase2

|

|

May 02, 2012, 02:52:27 PM |

|

OHNO THE FED PAYS ITS OWN SALARIES, THAT MEANS THEY HAVE THE US GOVT BY THE BALLS

HEARD IT HERE FIRST!

Note that I said profit.

|

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 02, 2012, 05:42:26 PM |

|

OHNO THE FED PAYS ITS OWN SALARIES, THAT MEANS THEY HAVE THE US GOVT BY THE BALLS

HEARD IT HERE FIRST!

Note that I said profit.

No, you pay the fed's salaries, via the inflation tax. There must be profit before there can be a salary. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

|

Etlase2

|

|

May 02, 2012, 05:48:16 PM |

|

An astute observation, my dear MoonShadow, quite unlike your implication that the Fed has some control over the federal government because it is its biggest lender.

|

|

|

|

MoonShadow (OP)

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

May 02, 2012, 07:18:07 PM |

|

An astute observation, my dear MoonShadow, quite unlike your implication that the Fed has some control over the federal government because it is its biggest lender.

It does, indirectly. But it's kind of a circular loop, since the fed chairman is appointed by the president. Of course, the fed chairmen can only be appointed from a very short list provided by the board members of the federal reserve, whom are themselves appointed by the largest member banks. Granted, the federal reserve board is very limited in it's practical influence upon the actions of Congress, but that is not to say that they don't have any. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

cypherdoc

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

May 03, 2012, 10:54:58 PM |

|

IIRC, the entire mortgage debt in this country back in the depths of the GFC in 2007-9 was around 11 trillion USD's. the entire backstop to the banks totalled approx. 29 trillion USD's the highest number i've heard. Neil Barofsky's study put the backstop around 21 trillion USD.

so yes, the American ppl could have been easily bailed out which would have solved the real problem. instead we're still saddled with that 11 trillion plus the 29 trillion to back stop those pricks.

|

|

|

|

|

BrightAnarchist

Donator

Legendary

Offline Offline

Activity: 853

Merit: 1000

|

|

May 04, 2012, 12:02:38 AM |

|

This explains the problem fairly well regarding central banking and bailout policies... http://online.wsj.com/article/SB10001424052970204903804577082533052728286.htmlChristmas Trees and the Logic of Growth The ubiquitous greenery of the season has me thinking conifers and stock market crashes. There is much to be learned from the coned evergreen trees that form vast forests across the Northern Hemisphere. As the oldest trees on the planet, the mighty conifers have survived threats of catastrophic extinction since the time of the hungry herbivorous dinosaurs. The conifer's secret to longevity lies in a paradox: Their conquest has been largely the result of episodes of massive forest destruction. When virtually all else is gone, conifers show their strength and prowess as nature's opportunists. How? They have adapted to evade competitors by out-surviving them and then occupying their real estate after catastrophic fires. First, the conifer takes root where no one else will go (think cold, short growing seasons and rocky, nutrient-poor soil). Here, they find the time, space and much-needed sunlight to thrive early on and build their defenses (such as height, canopy and thick bark). When fire hits, those hardy few conifers that survive can throw their seeds onto newly cleared, sunlit and nutrient-released space. For them, fire is not foe but friend. In fact, the seed-loaded cones of many conifers open only in extreme heat. This is nature's model: overgrowth, followed by destruction of the overgrowth, and then the subsequent new growth of the healthiest and most robust, which ultimately leaves the forest and the entire ecosystem better off than they were before. Pondering these trees, it is not too much of a stretch to consider the financial forests of our own making, where excess credit and malinvestment thrive for a time, only to be destroyed—and then the releasing of capital into markets where competition has been wiped out. The Austrian school economists understood this well, basing a whole theory around this investment cycle. After the purge, great investment opportunities are created, from which prolific periods of growth emanate—provided that sufficient capital remains to reinvest into the fertile and now-open landscape. Suppressing fire, creating the illusion of fire protection, leads to the wrong kind of growth, which then invites greater destruction. About 100 years ago, the U.S. Forest Service took a zero-tolerance approach to forest fires, stamping them out at the first blaze. Fast forward to 1988 when a massive wildfire at Yellowstone National Park wiped out more than 30 times the acreage of any previously recorded fire. What obviously occurred was that the most fire-susceptible plants had been given repeated reprieves (bailouts, in a sense), and they naturally accumulated, along with the old, deadwood of the forests. This made for a highly flammable fuel load because when fires are suppressed the density of foliage is raised, particularly the most fire-prone foliage. The way this foliage connects the grid of the forest, as it were, has come to be known as the "Yellowstone Effect." A far better way to prevent massively destructive fires is by letting the fires burn. Human intervention in nature's cycles by suppressing fires destroys the system's natural homeostatic forces. Strangely parallel to the Yellowstone catastrophe was the start of the federal government's other fire-suppression policy with the 1984 Continental Illinois "too big to fail" bank bailout. This was followed by Alan Greenspan's pronouncement immediately after the 1987 stock market crash that the Federal Reserve stood by with "readiness to serve as a source of liquidity to support the economy and financial system," which heralded the birth of the "Greenspan put." The Fed would no longer tolerate fires of any size. From a forestry point of view, the lessons were learned. In 1995, the Federal Wildland Fire Management Policy stated, "Science has changed the way we think about wildland fire and the way we manage it. Wildland fire, as a critical natural process, must be reintroduced into the ecosystem." Herein are pearls of great wisdom for central bankers today. Central banks are creating a tinderbox by keeping alive many very bad investments, fertilizing them with everything from artificially low interest rates to preferential liquidity to outright securities purchases. As these institutions and instruments overrun the financial landscape, they hamper the economic ecosystem and perpetuate the environment of low growth and high unemployment in which we currently find ourselves. Seeing periodic, naturally occurring catastrophes as part of the growth cycle requires thinking more than one step ahead, not only longer term but, more specifically, intertemporally. This is perhaps an insurmountable cognitive challenge, both to investors and central bankers in today's news-flash world. When contemplating the forest, we may intuitively understand nature's logic of growth. Yet when we look at the seeds of destruction we have sown through current monetary policy, it is clear we are lost in the trees. Mr. Spitznagel is the founder and chief investment officer of the hedge fund Universa Investments L.P., based in Santa Monica, Calif. |

|

|

|

|

|

blablahblah

|

|

May 04, 2012, 08:21:06 AM |

|

Christmas Trees and the Logic of Growth

What about the conundrum of the Fed "charging interest" even though it's impossible to repay in full? I thought that that system was already supposed to maintain equilibrium, e.g.: - the Fed would supply a stable amount of fertile ground,

- interest can only be repaid by trees/forests that are growing in proportion to the total amount of ground,

- "forest fires" represent bankruptcy and the destruction of bad debt.

Except that in Spitznagel's example it's implied that the banking hierarchy and large corporations are nobly represented by conifer trees. Mistletoe and eucalyptus are probably more accurate depictions, respectively. |

|

|

|

|

|