spazzdla (OP)

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

October 09, 2014, 04:00:09 PM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

|

|

|

|

|

|

|

|

"The nature of Bitcoin is such that once version 0.1 was released, the

core design was set in stone for the rest of its lifetime." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

RoadTrain

Legendary

Offline Offline

Activity: 1386

Merit: 1009

|

|

October 09, 2014, 04:08:47 PM |

|

Canada and Australia are the perfect examples of massive housing bubbles.

This crap is so expensive right now.

What is the yield your friends are getting now btw?

|

|

|

|

|

|

madken7777

|

|

October 09, 2014, 04:27:09 PM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

If they are getting high rental yield, it really doesn't matter if the housing market correct up to 50%. |

|

|

|

|

RoadTrain

Legendary

Offline Offline

Activity: 1386

Merit: 1009

|

|

October 09, 2014, 04:42:24 PM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

If they are getting high rental yield, it really doesn't matter if the housing market correct up to 50%. Yup, if you treat real estate market as somehow isolated from the rest of the economy. Even if prices correct 25% it will be a huge blow to the economy. And the rental yield won't help as it will plunge as well. Y'know crisis, unemployment... |

|

|

|

|

spazzdla (OP)

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

October 09, 2014, 05:05:07 PM |

|

Canada and Australia are the perfect examples of massive housing bubbles.

This crap is so expensive right now.

What is the yield your friends are getting now btw?

Gains of about 5-10% a year.. however they all still own.. sooo.... They view their own house as an investment tool :S.. "Who cares it will be worth 100% more in 20 years so I'll use my house to retire" Will you now... |

|

|

|

|

spazzdla (OP)

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

October 09, 2014, 05:08:17 PM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

If they are getting high rental yield, it really doesn't matter if the housing market correct up to 50%. Yup, if you treat real estate market as somehow isolated from the rest of the economy. Even if prices correct 25% it will be a huge blow to the economy. And the rental yield won't help as it will plunge as well. Y'know crisis, unemployment... I have a bad feeling if the prices dip more than 10% all of the forigen buyers will sell to stop their losses... the amount of houses not owned by Canadians is not known thx to Criminal Harper. |

|

|

|

|

JimboToronto

Legendary

Offline Offline

Activity: 4004

Merit: 4480

You're never too old to think young.

|

|

October 09, 2014, 05:08:53 PM |

|

Mortgage-free since 1995.

Just say no.

|

|

|

|

|

spazzdla (OP)

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

October 09, 2014, 05:10:31 PM |

|

Mortgage-free since 1995.

Just say no.

I am mortgage free but I also do not own a house.. |

|

|

|

|

JimboToronto

Legendary

Offline Offline

Activity: 4004

Merit: 4480

You're never too old to think young.

|

|

October 09, 2014, 05:10:54 PM |

|

the amount of houses not owned by Canadians is not known thx to Criminal Harper.

Edit: Oops, did I just Godwin this thread? |

|

|

|

|

RoadTrain

Legendary

Offline Offline

Activity: 1386

Merit: 1009

|

|

October 09, 2014, 05:44:44 PM |

|

I have a bad feeling if the prices dip more than 10% all of the forigen buyers will sell to stop their losses... the amount of houses not owned by Canadians is not known thx to Criminal Harper.

That's why I think that the investment use of real estate should be tightly regulated to avoid such disbalances. |

|

|

|

|

|

nsimmons

|

|

October 09, 2014, 07:11:51 PM |

|

My good friend paid 400k for a cookie cutter disposable condo in the vancouver lower mainland area. As long as interest rates never rise ever he should be fine.  |

|

|

|

spazzdla (OP)

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

October 09, 2014, 07:43:44 PM |

|

the amount of houses not owned by Canadians is not known thx to Criminal Harper.

Edit: Oops, did I just Godwin this thread? I might post this picture on facebook it's so epic LOL |

|

|

|

|

piramida

Legendary

Offline Offline

Activity: 1176

Merit: 1010

Borsche

|

|

October 09, 2014, 08:15:21 PM |

|

Yesterday's speech from Antonopulous to canadian senate is really amazing and deep. Senators, suprisingly, seem to understand much more than most trolls here. https://www.youtube.com/watch?v=xUNGFZDO8mM |

i am satoshi

|

|

|

jubalix

Legendary

Offline Offline

Activity: 2618

Merit: 1022

|

|

October 10, 2014, 01:03:10 AM

Last edit: October 10, 2014, 01:43:20 AM by jubalix |

|

Australia has a multi tiered system to support house prices unlike anything else in the world asfaik

eg at least in canada housing wentt down or was level or just 4% the last few years. Sydney went 12~15% again last year.

One of the most ubranised counties in the world. There is nothing outside the 5 major cities.

>Negative gearing, tax breaks on your income if you own an investment property and it makes a loss.

>100% tax free when sell on profit if you lived in the house

>0% land tax if you live in the house.

>social security underwrites the entire lower end of the market, eg tax supported.

>No public housing for people to move to

>people who are in the country moveing to cities.

>popular with overseas immigrants and investors, and they have only really heard of Sydney.

>banks won't loan to you if you buy in many rural areas.

>Politicians have substantial property interests

>Banks are forced by gov to make a deal if too many people go to the wall. Last time this happened was in the 80's when interest rates went to 13~16%. Gov stated banks would not forclose but let people of until they could pay.

>crap transport do you cannot live out of the central near cbd areas, beyond 15km its impossible.

>finally limited land supply in Sydney, makes Sydney even worse.

To give you and idea of how urbanized Australia is

population of western Australia 2,517,200 (4th)

population of Perth, the capital city, `1,972,358

No other country I know of has any where near this mix of prop property.

It shows to in the GFC Australian prices hardly fell (1%), were stable or went up. Whereas UK, and US fell alot

Thus its much safer to have a large home loan than not, as it put you in the important class of people to the gov and you get all the tax breaks.

|

|

|

|

|

fa

|

|

October 10, 2014, 01:41:17 AM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

Hopfully. But Canadian Housing is only based on Canada, while bitcoin is global. |

|

|

|

|

gogxmagog

Legendary

Offline Offline

Activity: 1456

Merit: 1009

Ad maiora!

|

|

October 10, 2014, 02:11:13 AM |

|

I have a large amount invested in a canadian private mortgage company. It has proven to be a really good value. I get returns of around 7 to 10% annually, which is pretty good, but during the last recession it returned 10-14% which is amazing for a traditional investment product. right now my dividends pay my rent and bills, so I am not complaining, but a crash in the market will earn me rent, bills, and a healthy flow of disposable income as well.

The logic seems to be when economy suffers BTC rises, but I dont really think that is guranteed. It is BTC afterall. It will defy expectations. I really hope that a crumbling economy will pump up the BTC value, though, for obvious reasons (I'm a hodler)

I've been sitting here all year cursing the improving economy, waiting, hoping for the big collapse. Bring it on!!!!!

|

|

|

|

|

byronbb

Legendary

Offline Offline

Activity: 1414

Merit: 1000

HODL OR DIE

|

|

October 10, 2014, 04:17:37 AM |

|

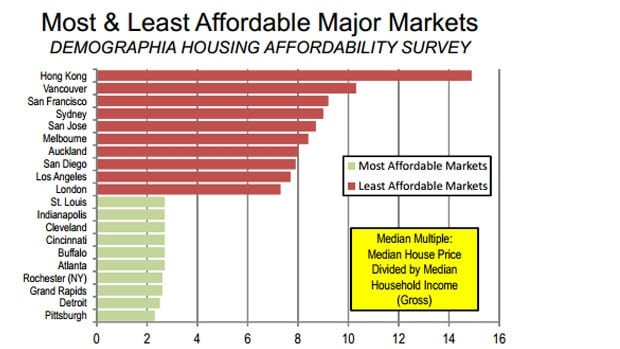

My good friend paid 400k for a cookie cutter disposable condo in the vancouver lower mainland area. As long as interest rates never rise ever he should be fine.  Always a safe play to buy into 2nd most unaffordable market in the world.  |

|

|

|

|

scryptasicminer

|

|

October 10, 2014, 08:26:40 AM |

|

Almost all of my friends are 100% or 99% invested in real estate.....

Almost every chart I look at implies Canadian housing is in a MASSIVE MASSIVE bubble.. our ecom is real estate..

When it fails I am wondering if others think BTC and PMs will lift off.

If they are getting high rental yield, it really doesn't matter if the housing market correct up to 50%. Yup, if you treat real estate market as somehow isolated from the rest of the economy. Even if prices correct 25% it will be a huge blow to the economy. And the rental yield won't help as it will plunge as well. Y'know crisis, unemployment... From investor perspective, rental yield going down alone is not the primary factor of concern. Let's say you buy a rental property, and get 6% yield a year. After 5 years, you already getting back 30% of the capital. A 30% price correction will only set you back to square one and you are still getting return back every year in the form of rental. 10 more years and you will most likely be ahead of the game in term of profitability. |

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2384

Viva Ut Vivas

|

|

October 10, 2014, 08:49:37 AM |

|

As someone in the US who just went through the housing bubble 5 years ago here is what happened.

The interest rate was so low that when calculating how much you can afford for a house per month you were more willing to pay more for a house because the monthly bill would not be as much. Also all of the housing prices were rising so you figured that if you paid a little bit more you could get your dream house and sell it down the road for double making a buttload, more than you could working. All of the prices were going way up, people were buying several homes figuring that if they could have a few houses they could rent them out and get the income while also being able to sell at a huge profit. As they bought one home and the value went up they would finance from the equity in that home as the price went up...this created more demand and higher prices. The prices went up the most in cities where new construction was not possible, in cities that could expand the rate did not climb as much because new home companies were popping up houses to try to meet demand.

Then the bubble popped. Triggered by the AIG, bank crash.

The people that were in the process of acquiring new properties were usually stretched very thin money wise because they were putting everything they had into the next house. That next house would not sell/rent so they would be stuck on a property that was losing them money. They would try to dump that house but nobody would buy. Housing prices started dropping quickly. People who were renting started seeing these cheap houses that they could not afford previously and started breaking their leases and bought cheaper houses. People who were into real estate would have a bunch of empty homes with no income, they would end up being mortgaged up to their eyeballs and needed to drop their homes so they would sell on a short sale. There were an increasing amount of foreclosures on the market making people who were buying homes look for extremely cheap deals (I was talking to a guy in my town that bought a nice house on the Gulf or Mexico for $60,000).

For me personally, I bought a house in San Antonio as the bubble was building for $130k but the prices weren't as high in San Antonio because there was room to expand housing and new homes were going up all over. Then the bubble hit, I moved to Florida because of my job and rented a house there. I tried to sell my house but could not find a buyer so I put it up for rent and was fortunate to get a renter to cover the mortgage. After a few months in Florida seeing the housing prices dropping I found a great house on the Gulf for $290k, it had been appraised for $600k two years before. So we broke our lease (had to pay a few thousand to get out of the lease) and bought the house. I was finally able to sell my house in San Antonio for $118k, fortunate to be down only $12k compared to other people. The guy that sold me the Florida house had houses all over the place, he went bankrupt and ended up getting a divorce and moving in with his grandmother. He had a million dollar home with several other nice homes as well, none of them sold, one the bank just tore down and turned into an empty lot, another still sits there an empty shell because he could not finish the interior. He had a really nice yacht, everything...it all came tumbling down. Shortly after I bought for $290k the zillow price eventually wound down to about $170 at its lowest point. Not it is back up to around $230k. I will likely sell in a few years, hopefully close to what I paid for it.

|

First seastead company actually selling sea homes: Ocean Builders https://ocean.builders Of course we accept bitcoin. |

|

|

RoadTrain

Legendary

Offline Offline

Activity: 1386

Merit: 1009

|

|

October 10, 2014, 12:25:37 PM |

|

From investor perspective, rental yield going down alone is not the primary factor of concern.

Let's say you buy a rental property, and get 6% yield a year. After 5 years, you already getting back 30% of the capital.

A 30% price correction will only set you back to square one and you are still getting return back every year in the form of rental. 10 more years and you will most likely be ahead of the game in term of profitability.

It's might be a good investment until it isn't. So it wipes out all of your rental earnings of the past 5 years. When you see the prices being that high I don't think it's wise to invest any more. In fact, I'd be divesting instead. Because when it pops I might not be able to sell fast. |

|

|

|

|

|