Looks like you have most of the forum behind you by the looks of the merits. I'll yield to the wisdom of the masses. |

|

|

|

Well, you get to see who had vaccines and who did not. Excellent data points. Dozens out of 50,000 doesn't sound like anything newsworthy. The vaccine provides little to no protection from COVID-19. In fact, it isn't really a vaccine at all. It may even sterilize or kill anyone who has taken it. Nobody really knows since it is experimental and did not go though the normal 5-10 year approval process. Collectively, the human race is putting all of it's faith in big pharma and the corrupt censor-happy media. What could possibly go wrong? https://coronavirus.jhu.edu/vaccines/timelineThe CDC is now running the PCR tests for vaccinated people at a lower number of cycles (28 vs 42) to ensure the reported number of infected people is lower among the vaccinated. https://www.cdc.gov/vaccines/covid-19/downloads/Information-for-laboratories-COVID-vaccine-breakthrough-case-investigation.pdfLook at how the media is pushing the vaccine so hard and not reporting the side effects or deaths from the vaccine. They say they don't want to report on the side effects because it will discourage people from getting the vaccine but shouldn't we make up our own minds with all available information? It is looking like there will be more deaths from the vaccine than COVID by the time this is done. Come on bitcoiners, we are supposed to be the ones who think for ourselves. Open your eyes once again and see what is really going on. |

|

|

|

Slap yourself if you bought BNB for more than $1. |

|

|

|

Can we apply this philosophy to Bitcoin Community .... UBUNTU - I am because we are.

No. We don't need that collectivist BS. It's an individual race to the top, not a group hug to the bottom. Only works with well behaved pre-pubescent boys. Once you throw in a little chaos (i.e. females), the game changes drastically. |

|

|

|

How does he leave the biggest shitcoins and their "CEOs" off the list though? Vitalik Buterin --> ETH Changpeng Zhao (CZ) --> Binance Coin Charles Hoskinson --> Cardano |

|

|

|

The problem is not the current 23.8% (3.8% added for Obamacare in 2013), it's the proposed increase to 43.8%.

On amounts over 1m-whatever slave wage you get paid in life, correct? What if you're not cashing out but just moving money from one investment to another? Doesn't seem as fair when you're not actually cashing out. Maybe there should be separate rates for cashing out or just shifting investments around/rebalancing your portfolio.

That's a very good point: My buying a new nano or whatever and moving my coins to it shouldn't result in a 43% hit. That does need to be corrected and is a consequence of the whole IRS decision way back when that treats bitcoins like gold bars or something. I'm mainly concerned about the capital gains on investments you didn't cash out. A million is more than anyone needs to live in a year. You don't pay for moving coins to a ledger anyway but not everyone will be 100% bitcoin when it goes above a million. Everyone in the US and on this forum may eventually get hit with the tax when bitcoin goes up combined with hyperinflation. Also, if the US goes to 43.8%, you can bet the EU will follow shortly. What happens when a million is equivalent to a current $100k because of inflation? Could happen in a few years at the current rate. If you want to shift investments around, you still get hit with the tax even if you didn't take that money out to use. The effect of the tax is it forces everyone to be a holder even if they are holding a bad investment. Good for bitcoin not so good for stocks or companies. It's better for the economy if people can move their investments from shit companies to good companies as their performance fluctuates rather than be locked in due to a 43.8% hit by the government. |

|

|

|

Well, hate to say it but if you only bought 20 bitcoins that's worth $1,000,000 today. Which means if you sell it all it's at the exact same tax rates (in the US) as it was last year. To the dime. The first 250k or so would be taxed at marginal rates up to 20% and the rest would be taxed at a straight 20%. That's kind of life. So if we simplified the math you get a net profit of $799,750, your initial $250 investment back. I mean yeah I guess that sucks, but compare that to someone who ignored bitcoin and has $0 and none of their avoided investment lost and didnt pay those evil taxes (the freeloaders!) Taxes are kind of a price to pay to live in a civilized society. In areas with low low tax rates and limited government they have other... issues and your protections against fraud and force are.... well less. Plus this is per year. So I can pick up 3 Lambos a year at the same tax rates as last year. I could also buy a 20m house, and pay it off at a rate of 800k a year for 30 or so years without hitting an additional penalty. Granted a 30m house is kinda lame but you know if you need bigger than that then maybe you can bitch about the Biden tax. So... meh? The problem is not the current 23.8% (3.8% added for Obamacare in 2013), it's the proposed increase to 43.8%. What if you're not cashing out but just moving money from one investment to another? Doesn't seem as fair when you're not actually cashing out. Maybe there should be separate rates for cashing out or just shifting investments around/rebalancing your portfolio. |

|

|

|

You mean the US won't stage a military coup to install a right-wing dictator friendly to US big business interests?

Well after January 2021 I wouldn't be so sure. The US might just end up invading itself if it feels itself becoming too socialist.

On that note, it sure would be nice if people knew what socialism means. Are the means of production owned by the workers? No? Not socialist then. Sorry,

The only way the workers can own the means of production is through public ownership by the government. When the government gets that much power, it never ends well. Plus, central planners can never keep up with the billions of price and markets signals that a free market does which leads to shortages, etc. Workers owning the means of production directly is a utopian fantasy. How would this work exactly? Also, what is stopping a group of enterprising individuals from creating a company right now where the workers own it and they directly control the means of production? Would the janitors get the same share as the software developers? What happens when a person moves to another company? What if some people are better at saving their money than others? Wouldn't we naturally return to some people having more than others and eventually the exact same wealth gap that we have now? Would you stop it from happening by making it illegal to save your money or live a frugal life? Would it be illegal to change jobs or would you lose your ownership when you changed jobs? Would a new employee just automatically get the same share as somebody working there for 20 years? What about a person who refuses to work at all. Would they still get a share? Surely there are some socialists out there with some good ideas that would work as a business. Surely there are some altruistic individuals who would forego their billions and split that up evenly with the janitors and accountants. If it was a superior way to run a businesses, wouldn't all businesses be run like that already? Why do you need the government to change something if the goal isn't to give the government central authority (i.e. Communism)? |

|

|

|

People who make these arguments have clearly never heard of Northern Europe Those countries are not socialist. This lie was started by Bernie Sanders and just won't die among the left extremists in the United States. Socialism is a dirty cuss word and nobody should be promoting it, least of all our own senators. https://www.nbcnews.com/think/opinion/bernie-sanders-wrong-democratic-socialism-sweden-everywhere-else-ncna1158636Contrary to the prevailing narrative, the success of Nordic countries like Sweden as measured by relatively high living standards accompanied by low poverty, with government-funded education through university, universal health coverage, generous parental-leave policies and long life spans precedes the contemporary welfare state. |

|

|

|

At this point a blind can see that this trend is not sustainable, i'm of the opinion that we have a runaway indicator. People that want to see this trend continue are the same ones that act dumbfounded when next students/occupy wall st/BLM civil unrest happens. Why are those plebs are not happy with their ever shrinking share of wealth, i tried showing them youngins (with college degrees still living with their parents because they can't afford to live on their own) rolling's statistics that show that they're better off in absolute dollars but they just ignored me and continued to sharpen their pitchforks. I'd rather not have to live in enclaves and hire private army to protect myself from them. Soviets provided cheap stimulus (vodka) to control their plebs, we can provide opioids but would need to take away their healthcare first.

It is very sustainable, someone else having wealth does not take anything away from you, the opposite is true. Nobody is dumbfounded that young people protest something they are too immature to understand fully, especially when you know how they were brainwashed throughout their years of education. There is a reason people tend to become more conservative as they get older, experience. The plebs are not happy because they listen to too much propaganda on liberal media and Twiiter and they've been lied to their whole lives about what they were entitled to. The youngins with college degrees who can't get a job were sold a lie. In the 1970s only 10% of people had degrees so it was a good way to secure a job. Now 35% of people have degrees and a large portion of those degrees are in fields without enough jobs for said degrees. Not many scientists or engineers are having trouble finding jobs. https://www.statista.com/statistics/184272/educational-attainment-of-college-diploma-or-higher-by-gender/Just because you are born, does not mean you are owed a "share" of anything. The wealth held by wealthy people is theirs and 0% of their wealth is or ever should be yours. There is not a limited wealth pie where it gets distributed amongst the population. There is unlimited wealth for those who create it and they owe none of it to those who did not create it. The wealthy do owe taxes and the top 50% pay 97% of the federal taxes already. Even if they pay 100% of the taxes, you are still not going to change the wealth gap and you are still entitled to 0% of their wealth. https://247wallst.com/economy/2018/10/15/top-0-001-bottom-50-of-us-taxpayers-pay-equal-shares-of-income-tax/ |

|

|

|

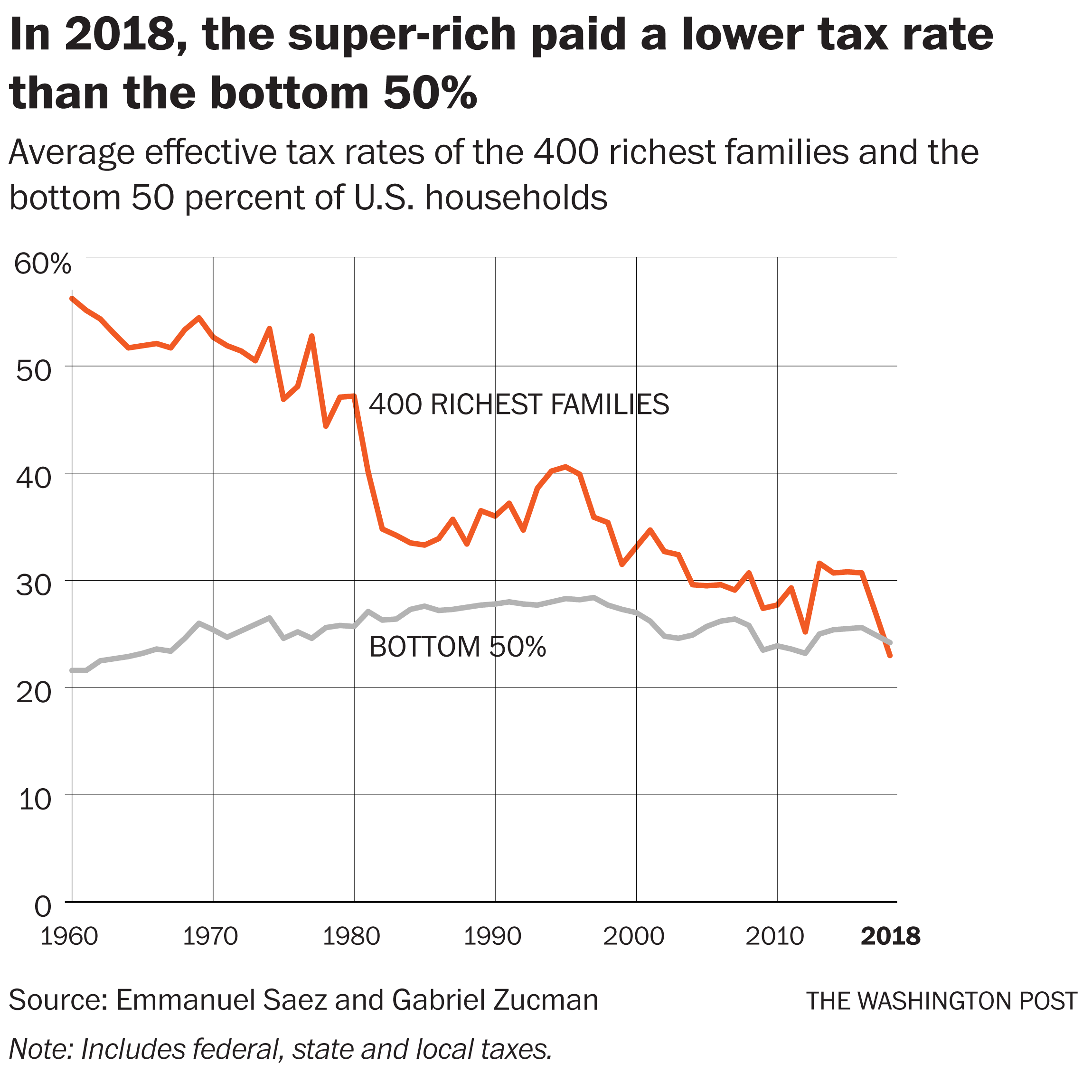

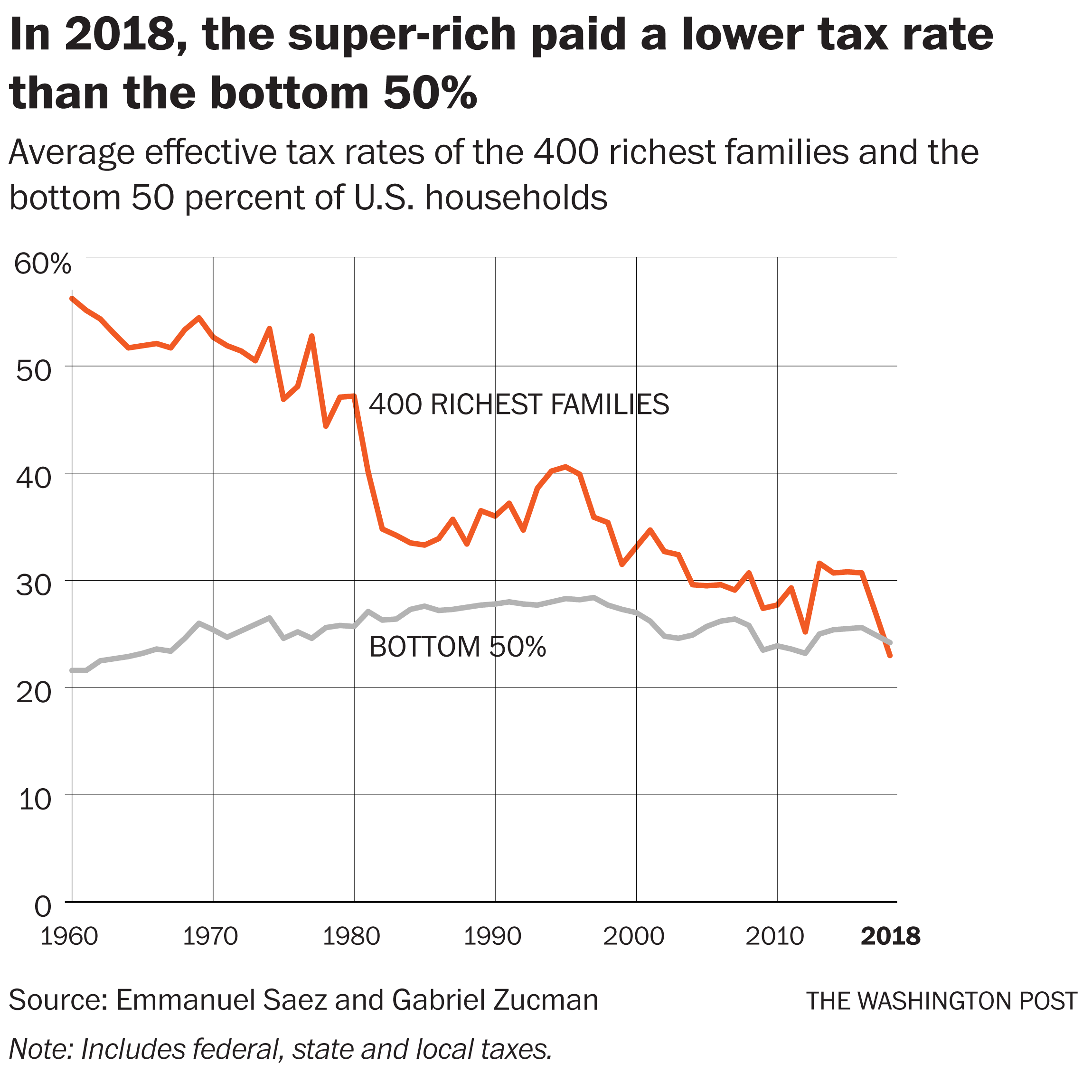

A lower tax "rate" doesn't mean they paid less. The rich are paying more than their fair share, the poor are paying nothing

Wrong, again. My guess is you think federal income tax is the only tax. https://itep.org/whopays/The nationwide average effective state and local tax rate is 11.4 percent for the lowest-income 20 percent of individuals and families.

The whole discussion is about Biden's plan to raise the capital gains tax at the "federal" level. |

|

|

|

Really? lower 50% now own more land/resources than ever before? Cause this is a bitcoin forum and surely you wouldn't try to deceive by measuring "wealth" of lower 50% in absolute 2021 US dollars now would you? Well, then why have brackets for everything else and leave 20% cap gain static for ultra wealthy, what makes it such a perfectly balanced number? Why was it fine at 35% in the 70s but now only a dirty commie would suggest bumping it to 21%? Following your logic on how filthy rich are more efficient than poor, then it'll be logical to raise taxes on poor and middle class (there's 0 chance they'll get us to Mars) and lower it for ultra rich? Then just hope really really hard that out of hundreds of billionaires that spend their money on hookers and blow and writing their names to be seen from space (as their rightfully should, it's their damn money  , new idea for Bob?) the next one hopefully turns out like Musk and decides to find cure for cancer? This is just the US but the whole world is on a similar trajectory as long as we don't ruin it by some shortsighted socialist policies. https://fred.stlouisfed.org/series/WFRBLB50107Well, then why have brackets for everything else and leave 20% cap gain static for ultra wealthy, what makes it such a perfectly balanced number? Because investment money is what allows businesses to be created, expanded, and to create jobs. Jobs aren't magical things that appear on their own. More taxes on investment money means less investment. You're not going to fix any of the wealth gap by increasing taxes anyway. They will not pay the taxes. They will just reduce investment or move to a more tax friendly country. Even when the rates were high in the past, they did not collect more taxes as a percentage of income. The wealthy will just change their behavior to avoid the taxes. It's game theory. If you want to change the wealth gap for real and not as part of a socialist agenda, stop shopping at Amazon and using products or services from huge companies. We can go back to mom and pop shops and the wealth will be more evenly distributed. Again, taxation will never change "wealth inequality" short of full on socialism/communism where the companies are taken away from the owners. The US tax system is already one of the most progressive in the world so stop complaining and enjoy what your ancestors built for you. |

|

|

|

10 friends go out every day for dinner. The bill would be SEK 1,000. The bill was divided in the same way that taxes are paid. The first four - (the poorest) pay nothing; - the 5th pays SEK 10 - the 6th pays SEK 30 - the 7th SEK 70 - the 8th SEK 120 - the 9th SEK 180 - The 10th person (the richest) pays SEK 590.

The ten friends ate dinner at the restaurant every day, happy with the deal. Until one day, when the owner of the restaurant gave them a discount. You are such good customers. I give you SEK 200 off your dinners. Dinner for 10 people now costs SEK 800.

They still wanted to pay for the dinner the way taxes are paid in Sweden. The first four people were not affected. They were allowed to continue eating for free. But what would the other 6 do - those who paid? How would they divide the discount of SEK 200 so that everyone would get their share? They realized that SEK 200 divided by 6 would be SEK 33.33. But if they deducted it from each person's share, the 5th and 6th person would be paid to eat. The restaurant owner suggested that it would be fair to reduce each person's bill proportionately. He calculated the amounts each person would pay:

The result was that the 5th person also got to eat for free - the 6th had to pay SEK 20 - the 7th paid SEK 50 - the 8th SEK 90 - the 9th SEK 120 - the 10th person paid SEK 520 instead of the previous SEK 590. Everyone got a lower price than before and now the first five could eat for free. Outside the restaurant, they began to compare what they had saved. "I only earned a tenth of the discount!", The 6th person began. He pointed to the 10th person, "

but he earned 70 kroner !!!" - "Exactly, I also only saved ten", said the 5th person. "It's unfair that he got seven times as much as I did!"

"It's true!" Shouted the 7th person. Why should he get SEK 70 back when I only got SEK 20? The rich always gets the most! - Wait a minute , shouted the first four, We got nothing! This system exploits us poor!

The nine people scolded the 10th and called him a cold-hearted egoist, a capitalist pig, a bloodsucker who kicks those who lie down. The next night, the 10th person didn't come to dinner. The other nine said " how nice", sat down and ate. When the bill came, they discovered something. They couldn't pay it. SEK 520 was missing.

10th friend owns all 9 houses his friend live in and collects rent from them. He has more total wealth than his other 9 friends combined. On top of that every year 10th friend amasses more and more % of over all wealth, as the other nine own less and less. So the other 9 friends get together and say remember how things were more even with the tax rate 30yrs ago? Yeah lets make sure not come back to that as current trend is totally sustainable, instead let's just blame the friend who's poorer then you. 10th friend doesn't do anything and just buys more land Plot twist, back in high school, 9 friends screwed around smoking weed all day and gave the 10th friend wedgies for always doing his homework on time. Now they are all grown up and they want to go back to how things were 30 years ago when they weren't such losers. They want to fuck around and make their hard working friend pay for it. Taking stuff away from successful people to give it to less successful people is called socialism. Just because you can beat someone up and take their money doesn't mean it's a good way to run a society. It's immoral and has never worked in any country that has tried it. It doesn't help the poor people, it just hurts the rich people. Poor people will always be poor because they don't know how to be rich or are just unmotivated. You seem to be missing my argument so let me spell it out. I'm saying that, we have a runaway unsustainable indicator, wealth distribution is flashing red, we're at historical levels we've never been before, and trend continues in the wrong direction. 1st level resposes- It's not an issue, despite the fact that overall population is more educated then ever before, poor people are just lazy druggies, lets push the pedal to the metal. Anyone proposing solution to freeze distribution disparity at current levels or god forbid attempt to bring it back in line with what it was in the 70s is a dirty red commie bastard, and better be dead than red. <-- this is the group you seem to fall into 2nd level-yes it's an issue but we still have some wiggle room and the situation is not as dire as you make it out to be. We believe in solution X and are willing to keep the current trend hostage, keep the trend going until 1% owns Y% of total wealth or our solution is adopted ...or maybe those are very narrow and short sighted categorizations that very few people fit into. The issue is more complicated. I think you know that and are just playing dumb to justify the socialist talking points. The bottom 50% of humans currently have more wealth that any other time in history. The ones with a socialist agenda are using "wealth inequality" as a rallying cry to push their agenda which will tear down what the world has achieved. They use other rallying cries such as racism, sexism, hatred, etc. The goal is the same. Tear down our current system and build a new system (socialism) where everyone is "equal in outcome" despite their individual talents or efforts. This is not a new thing. Societies have tried socialism over and over throughout history because it seems like the "fair" thing to do and it has always failed miserably. It's pure evil and you should be ashamed to be a part of it. A wildly successful economy will have some wildly successful people and that should be celebrated rather than attacked. Nobody is building citadels. Most of that wealth sits in the companies everyone works for and benefits from. The agenda you're pushing will not achieve what you think it will. The more likely outcome is collapse of the system that everyone is benefiting from. It's not your fault you think like you do. I'm sure some well intentioned people thought they were doing you a favor by teaching you what they did, but it's a deeply flawed ideology. At some point you have to start thinking for yourself instead of just regurgitating the socialist talking points without any other analysis or insight. |

|

|

|

Taking stuff away from successful people to give it to less successful people is called socialism. Just because you can beat someone up and take their money doesn't mean it's a good way to run a society. It's immoral and has never worked in any country that has tried it. It doesn't help the poor people, it just hurts the rich people. Poor people will always be poor because they don't know how to be rich or are just unmotivated.

And what about generational wealth, you cool with putting a tax on "dead" money (when someone uber rich dies)? Or is successful a term that applies to anyone you are associated with, no matter what they did to generate that success? If the person inheriting a fortune doesn't learn how to manage the money and be successful then the money goes back into society through mismanagement anyway. Sure they got a head start but that's no guarantee of success. But wouldn't that be socialism then? If taking from successful people and giving it to less successful ones? I just wanted to know when it applies and when it doesn't in your view. Who is doing the taking in this scenario? Someone is willfully giving wealth to their heir. If the heir is indeed unsuccessful then they will lose the money that was given to them. |

|

|

|

Taking stuff away from successful people to give it to less successful people is called socialism. Just because you can beat someone up and take their money doesn't mean it's a good way to run a society. It's immoral and has never worked in any country that has tried it.

Wake up, dude. It's working now, in every single modern country. The problem is the ultrarich not paying their fair share. The ultrarich are paying lower tax rates than the poor.  A lower tax "rate" doesn't mean they paid less. The rich are paying more than their fair share, the poor are paying nothing, and the middle class is paying way too much. You fix it by lowering taxes on the middle class, not raising them on anyone else. |

|

|

|

Taking stuff away from successful people to give it to less successful people is called socialism. Just because you can beat someone up and take their money doesn't mean it's a good way to run a society. It's immoral and has never worked in any country that has tried it. It doesn't help the poor people, it just hurts the rich people. Poor people will always be poor because they don't know how to be rich or are just unmotivated.

And what about generational wealth, you cool with putting a tax on "dead" money (when someone uber rich dies)? Or is successful a term that applies to anyone you are associated with, no matter what they did to generate that success? If the person inheriting a fortune doesn't learn how to manage the money and be successful then the money goes back into society through mismanagement anyway. Sure they got a head start but that's no guarantee of success. |

|

|

|

10 friends go out every day for dinner. The bill would be SEK 1,000. The bill was divided in the same way that taxes are paid. The first four - (the poorest) pay nothing; - the 5th pays SEK 10 - the 6th pays SEK 30 - the 7th SEK 70 - the 8th SEK 120 - the 9th SEK 180 - The 10th person (the richest) pays SEK 590.

The ten friends ate dinner at the restaurant every day, happy with the deal. Until one day, when the owner of the restaurant gave them a discount. You are such good customers. I give you SEK 200 off your dinners. Dinner for 10 people now costs SEK 800.

They still wanted to pay for the dinner the way taxes are paid in Sweden. The first four people were not affected. They were allowed to continue eating for free. But what would the other 6 do - those who paid? How would they divide the discount of SEK 200 so that everyone would get their share? They realized that SEK 200 divided by 6 would be SEK 33.33. But if they deducted it from each person's share, the 5th and 6th person would be paid to eat. The restaurant owner suggested that it would be fair to reduce each person's bill proportionately. He calculated the amounts each person would pay:

The result was that the 5th person also got to eat for free - the 6th had to pay SEK 20 - the 7th paid SEK 50 - the 8th SEK 90 - the 9th SEK 120 - the 10th person paid SEK 520 instead of the previous SEK 590. Everyone got a lower price than before and now the first five could eat for free. Outside the restaurant, they began to compare what they had saved. "I only earned a tenth of the discount!", The 6th person began. He pointed to the 10th person, "

but he earned 70 kroner !!!" - "Exactly, I also only saved ten", said the 5th person. "It's unfair that he got seven times as much as I did!"

"It's true!" Shouted the 7th person. Why should he get SEK 70 back when I only got SEK 20? The rich always gets the most! - Wait a minute , shouted the first four, We got nothing! This system exploits us poor!

The nine people scolded the 10th and called him a cold-hearted egoist, a capitalist pig, a bloodsucker who kicks those who lie down. The next night, the 10th person didn't come to dinner. The other nine said " how nice", sat down and ate. When the bill came, they discovered something. They couldn't pay it. SEK 520 was missing.

10th friend owns all 9 houses his friend live in and collects rent from them. He has more total wealth than his other 9 friends combined. On top of that every year 10th friend amasses more and more % of over all wealth, as the other nine own less and less. So the other 9 friends get together and say remember how things were more even with the tax rate 30yrs ago? Yeah lets make sure not come back to that as current trend is totally sustainable, instead let's just blame the friend who's poorer then you. 10th friend doesn't do anything and just buys more land Plot twist, back in high school, 9 friends screwed around smoking weed all day and gave the 10th friend wedgies for always doing his homework on time. Now they are all grown up and they want to go back to how things were 30 years ago when they weren't such losers. They want to fuck around and make their hard working friend pay for it. Taking stuff away from successful people to give it to less successful people is called socialism. Just because you can beat someone up and take their money doesn't mean it's a good way to run a society. It's immoral and has never worked in any country that has tried it. It doesn't help the poor people, it just hurts the rich people. Poor people will always be poor because they don't know how to be rich or are just unmotivated. |

|

|

|

Anyone advocating for more taxes has been watching too much MSNBC. It's not about feeling sympathy for people who have billions, it's about people thinking the government is their daddy.

Do you think billionaires are swimming around in a pool of gold coins or pallets of $100s? Nearly all of the wealth that people are complaining about is on paper. Jeff Bezos owns a bunch of Amazon shares. If you raise the capital gains tax, he'll just never sell those shares. If the capital gains tax was lowered however, he might sell those shares and invest that money in some other endeavor which could create millions of new jobs. I'm betting the guy who created Amazon is a lot smarter than anyone in the government.

Nearly all the wealth in the world is invested in companies and profits are reinvested in other companies to create more and more jobs. Taxes stifle growth. All taxes are a deterrent to economic activity.

The Government is not your baby daddy and the more money the government takes, the less economic activity, jobs etc.

Anyone advocating too little taxes on extreme wealth is a puppet for extremely wealthy people. I mean seriously. Look at the common good. Be a patriot. Care for your fellow countrymen. Also this trickle down shit has been debunked for ages. I didn't say anything about trickle down. I'm saying taxes are already outrageous and higher taxes will only hurt the economy and help nobody. If we want to help people we should be cutting everyone's taxes. The common good is a smaller nanny state where you have to work for what you get. I do care, it's tough love though. People need to stand up for what made the world as amazing as it is. It wasn't big government or social "justice". It was hard work. |

|

|

|

Exactly, the higher the taxes, the more avoidance. Also, a wealth taxes is outright confiscation and is against everything free democratic societies stand for. I don't know where you live but I'm guessing there are not a lot of rich people there.

Welcome to The Netherlands  It has it's benefits though: if your investment goes from almost nothing to a lot in a short amount of time, you barely pay any taxes on those gains. But if it's the other way around, you still pay taxes. The Netherlands has been f*cked over for decades, I used to live there. The same car I bought in the UK in 2016 new for £28,000 would have cost 90,000 at the time. BPM, emission tax, whatever else nonsense they could come up with and there is the road taxation based on car weight. They literally sold 4 of those cars. No idea how that foreign brand can stay afloat doing business with its small operation in The Netherlands. When I saw pictures of an imbecile dancing on a table because of a gain in the election whilst businesses are still forced to close DuE tO A dAnGeRoUs pAnDeMiC and the no confidence stuff of trying to get rid of Pinocchio Mark Rutte straight after an election, debating till 2am whilst there is curfew for ordinary citizens but he just stays in the end anyway I almost had to vomit. Also the tax system is incredibly complex with its mortgage subtraction stuff. People are insane to constantly vote for the same 50% tax supporting imbeciles. The country and its people are lovely but I cannot afford to live there with the lifestyle and freedom of car transport (have owned 2-3 cars at various times, nicely kept - garaged and used on different days) that I can have in the UK. Taxes are higher here yes, but in return we have a much better infrastructure than the UK, it is a good deal to me. Energy transition is not a free lunch. We have one of the best tapwater that also cost money which i believe is also a good deal. There are more but my point is all those higher taxes invested results that our country is ranked high at global indexes in tems of happiness, infrastucture, healthcare, education, children, quality of life. Moral of the story; the grass is not always greener on the other side. The only way any of that is possible is because The Netherlands is one of the biggest tax havens in the world for mega corporations. Your country skims a little off the top of the taxes that would otherwise be due in every other country in the world. If The Netherlands had to stand on it's own with your tax policies, it would look like soviet era eastern Europe. |

|

|

|

I've seen several articles showing the "trickle-down" economy doesn't work.

There is no trickle down. There is just a choice of who you want to manage the money. The rich can manage the money or the corrupt politicians can manage the money. In either case, nobody is sitting on a pile of unproductive money. It is going to be used for one purpose or another by someone. In the case of a private person, it will be used to make more money which normally means more jobs. In the case of the government, they will probably give it away. Forget about what you feel is unfair. In nearly all cases, the billionaires are better at managing resources, which is how they became billionaires in the first place. Sure they could pay taxes and still make billions but human nature will stop them from doing that. They will just hold what they have instead of making the world a better place. Taxes cause them to make that decision. In the absence of taxes, the billionaires are free to sell anytime and move on to other opportunities. With taxes, they will just hold rather than give away money and the whole economy suffers as a result. This is the impact to economic activity I'm talking about. |

|

|

|

|

).

).

, new idea for Bob?) the next one hopefully turns out like Musk and decides to find cure for cancer?

, new idea for Bob?) the next one hopefully turns out like Musk and decides to find cure for cancer?