Show Posts Show Posts

|

|

Pages: [1] 2 »

|

|

1

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: March 07, 2022, 04:50:39 PM

|

Tested TickSpreader, here is my some of my critique.

Hi Clairvoyance, thank you for your feedback. Sorry for taking this long to answer, we now "resurrected" this thread. Please send us your address and we'll give you the promised payment for the testing. We made several changes over the last several months and I think most of your points have been fixed already! Website is totally different now, please check it out.  Edit: sent 0.5 mBTC! Edit: sent 0.5 mBTC! |

|

|

|

|

3

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: September 08, 2021, 04:35:35 PM

|

- Reordering panels is extremely choppy and 'grabbing' is way too sensitive when using mobile device.

- Users should be in control of how their balance is displayed. Eight decimal places to the right of one whole Bitcoin is my preference. Many find the mBTC display confusing.

- Any platform handling money of any kind should encourage users to employ two-factor authentication on their accounts from the very first time they sign in

- We would like the floating PnL to be reflected near it's respective range in the right-hand index of the candle chart, and updating in real time. There should also be static marker(s) there to note the open position(s)

- Using mobile device, the margin jumps away from intended position at the exact time of call/put.<<<<high priority

- If you could do one or both of the following: reduce confirmation requirements to one, or eliminate by implementation of lightning network, this would greatly improve UEX. ......edit ~20min laterBeyond 2 confirmations is super overkill. one is enough. Still waiting.

I'll return with a conclusion to this trial. I hope this information is finding you well with a demand for it. Salut! BTCThanks for the feedback! We will put those in the to-do list: - Improve reordering of panels in mobile

- Allow users selecting their preferred unit/precision

- Showing PnL and position on the right side of chart

We are working on improving security, and to make it easy to deposit. Agreed that several confirmations take too long. One thing I did *not* understand is the margin jump from intended position. Could you explain it a little more? Hi just used TickSpread today, noticed a couple of things that made it difficult for me to use. 1. When I tried to put a buy limit order the error message does not pop up long enough for me to see what changes needed to be made it's up for like 3 seconds if you could change this to something like 10 seconds would be so much better, see following image:  I am still learning about trading cryptocurrencies so once i learn more about whats going on I will give more feedback Email:harishhh_c@outlook.com Thanks for the image!! Agreed with increasing the popup time. Regarding this specific error, we can do even better and prevent users from typing invalid prices. Can I set a price to automatically close the contract?

You can with automatically close at a profit with a limit order. We are working on implementing a stop loss. |

|

|

|

|

5

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 20, 2021, 04:47:42 PM

|

The new updated site seems to great and much easier to use especially on mobile. I can now easily see and track my positions. Thanks for adding that option of easily placing a order without additional confirmation. Will keep on testing 👍

Hi Arthur! Thanks for testing! We just released a new version that shows the PnL of the position in real-time. Also, we are trying to make it easier to use on mobile. Please give us your feedback on what we can improve. I've just sent you 0.3 mBTC + 1 merit point for your help. Also you've now been promoted to Jr. Member, congratz!  |

|

|

|

|

6

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 09, 2021, 02:37:58 PM

|

I tried to close the position by simply clicking the close button this didn't work.

It piled up more orders in stead of just closing the damn position.

It also was not possible to close those, and now everything is gone.

Thank you for the screenshot. It really helps us find out what the problem is. We have three bugs right now that we are trying to solve: - The website is giving you a "Order Successful" popup whenever we receive your order (at the gateway level) even if we reject it later at the risk engine

- Whenever the rejection happens the user is getting no popup message. In your case, your orders were rejected because of lack of balance.

- Now finally the most important problem, you shouldn't need balance to close a position!

The way to make it possible to close positions without margin is to send orders with a "Reduce Only" flag. All major exchanges have it. These should be the ones used internally when you click on the button to close a position. However, we unfortunately are still working on this order flag, as there are some technical challeneges with implementing it. But be sure we'll increase the priority for that based on your feedback, but this might still take several weeks  . You successfully snatched all of my funds.

You ended up with a position that you couldn't close, and I guess you end up liquidated later. That is our bad, and it is really bad indeed. We'll never be launching with real bitcoin with problems like that, I can promise you. We'll be refunding your account with some more testnet bitcoin, please come and test more in the future, and you'll see improvements. Also sent you 0.3 mBTC for the testing and feedback.[/list] |

|

|

|

|

7

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 08, 2021, 09:44:36 PM

|

I have since made a withdrawal request and it hasn't come through yet. My withdrawal arrived 2 days ago. Since it's just for testing, that's okay. But on a live site with real Bitcoin, withdrawals should be automated and much faster (otherwise customers get real nervous). We'll absolutely implement automatic withdrawals before we launch! It will take some time as we have a lot of improvements on the to-do list, but we'll get there. Did your withRAW succeed ?  Typo is fixed, thanks for letting us know. Platform is lagging, can't see ongoing P&L, order pool tabs are confusing, no visual trigger entry/exit markers on the chart, does not store and reload settings, gives me the looks and feel of hitBTC the global scam experience.

Ongoing P&L is one of the next items in our to-do list. I think it might be done next week. How can the tabs be more intuitive? I see you had a bad time testing our exchange and you don't like it, but negative feedback is sometimes as useful as positive ones. Visual triggers in the chart are a great idea! We'll add to the to-do list. What do you mean by store and reload settings? Have you tried reordering components and they went back to default positions? I understand we don't have the best UX in the world right now but please understand that we are in testing mode. We are absolutely not ready for production, and we know that! Not my key's not my funds this is a disaster in the making.

We are actually working right now on a hybrid non-custodial model in which order matching is centralized but funds remain secure in a smart contract. It will in a way be very similar to a channel. Check out this post that I've made on the Ethereum Research forum: High-frequency trading and the MEV auction debate. Especially the inability to close a position that is in profit is one of the worst experiences a trader can have.

Total shit platform.

What happened when you tried to close your profitable position? If you found a bug when trying to close your position please let us know! Regardless of the fact that you really didn't like our platform, your feedback has been helpful, so please share your BTC address here and we'll sending you a tip. |

|

|

|

|

8

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 02, 2021, 10:12:10 PM

|

I've never seen a service that preemptively crashes when something goes wrong. I could imagine shutting it down, but crashing doesn't seem right as a solution.

I can imagine scenario when you could profit a lot with your trade but ''conveniently'' website crashes and you don't earn anything. This is not so hard to imagine because I think that both Bitmex and Binance had this ''glitches'' before. One problem with both exchanges mentioned is that, at least as far as I am aware of, your position can be auto-deleveraged at a price that is totally unrelated to the current orderbook. So the exchanges can have "glitches" and all the profit from a position are simply gone, and you may even lose money! I find that totally unacceptable, and this is not what happens in our exchange. If you have a long position, and the last price before the crash is $34,000, you may get your position auto-deleveraged, but we'll always close your position at a price higher than $34,000. While it may well be that prices rise to $40,000 and higher later on and you don't get the full profits you might expect, at the moment we crashed we could not have possibly known that, and so we cannot "conveniently" crash to deny profits to our users. In many other exchanges, if someone with a highly-leveraged position is lucky to close its position before the auto-deleverage triggers (maybe by having set a limit order previously), they can get away with their profits while the othere who are not so lucky get their profits stolen from them or even see their trades become negative. So I don't quite think the these two exchanges are hurting their users on purpose, I just think their system are not very well designed. And honestly I can totally understand them, as solving this problem requires having the liquidation/auto-deleverage process running synchronously with the matching engine, which is quite hard to do! It took months of effort for us to get it working, and we have carefully considered this problem from the beginning! I just returned interface to it's original state but I think it's better to remove deposit and withdrawal box and move it to top menu.

Balance could also be seen on top or tab instead of using the box, but you could make this change optional and users can choose what they like more.

I think you may be right. We'll be experimenting with having the balance on the top. This leaves more space in the position panel, and this may let us show the PnL of the position in real time! After i register i spent some time to see funcionality and tabs for trading, assets etc. From my point of view platform runs good. Visual is fine, functions runs without problems. Need more time to put detailed opinion, write what should mention you could change, make better, user friendly and so on. Not bad for first day usage.

Thanks for the positive feedback! Please come back and trade more  |

|

|

|

|

9

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 02, 2021, 04:18:00 PM

|

I really thought that my question was a stupid one. Another question I have is regarding this auto-deleveraging system, isn't that kind of interfering with the users decisions? Don't get me wrong, I see the point of doing that but I think the users who do do high-leverage knows what they are doing I guess.

No, your question is a great one! Auto-deleverage is bad, no questions about it, but it is also inevitable in leveraged trading. The best that we can do is make it very unlikely. Let me give you an example. Suppose we have two users, one buys 1BTC with 100x leverage (with 0.01 BTC as margin), and another sells 1BTC with 100 leverage (also with 0.01 BTC as margin). If there are no other users and BTC price rises 1%, the user with the short position will be liquidated, and we'll have to close the long position at this price. So the buyer will get 0.02 BTC, doubling his money, but won't get anything more than that, simply because there is no money available in the system! Of course, the exchange itself can pay up for the difference, and that is what an insurance fund is for, but even so the insurance fund may run out and an auto-deleverage may happen. So an insurance fund can at most make auto-deleverages less common. Is it also possible to have an option to instantly close the order than first having the pop up box and then confirming.

Good idea! Added to the TODO list. I've never seen a service that preemptively crashes when something goes wrong. I could imagine shutting it down, but crashing doesn't seem right as a solution.

You are right, we should shutdown gracefully if we have a bug (instead of crashing). We'll add that to our TODO list. When I close a Position, the popup shows: "order created successfully!.". And nothing changes.

We'll investigate this bug. Also, we have in our TODO list already to improve these popup messages. Currently this only means that we received your request, but your order may not have actually been created successfully. What happens if you try to close the position again? I placed 3 orders, each with different Leverage. Still a n00b here, but I would have expected them all to show up onder Positions. It seems they're added together, is that as intended?

Yes, this is intended. We only have one open position per market per user, so if you trade with different leverage the position adds up all the margin. Maybe we can do better than that. Would you prefer your positions to be handled (and potentially liquidated) separately? (This would not be easy to change, so I don't promise it will happen anytime soon). Update: I closed the browser tab and opened it again. Now the site is back to the previous layout (with my Assets on the left), and without the overview of open Positions. Are you updating things right now, or did something go wrong?

That is weird. Can you send us a picture? My (test) withdrawal is Approved, but not processed.

We'll process your withdraw today  @dkbit98, I'll write a detailed answer to your post and edit here later! |

|

|

|

|

10

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: July 01, 2021, 03:42:34 PM

|

You triggered an UI bug that crashed our system!  Lol, I did what?  I just tried to Place an Order, and once again got: Something went wrong! Please come back in a while or you can contact us for support! I hope it didn't crash again. My withdrawal amount is now Frozen. It could be I didn't click the final "Are you sure" after clicking the confirmation link in my email, I didn't expect that button and I had to scroll down to find it. Yes, it did crash again! We have a very conservative mindset regarding errors, and we'll crash preemptively whenever anything appears to be wrong. In this case, a validation check in the liquidation engine pointed to a bug when it was liquidating your position. You had a short position that was paying funding because of negative funding payments, and these payments should have gradually decreased your liquidation price, but these was a bug on this update, and your position was liquidated later than it should have been. We tested our liquidation system extensively, but infortunately the funding payments have clearly not been tested enough. It took several hours, but we finally got it working again. I'm sorry for the inconvenience! Please try again, we also have new features now!

I actually thought my account hadn't gone through until I had to check my mail ✉ box.

Hi Arthur! Thanks for the feedback! We'll work on that. It should let you know that we are waiting for the email confirmation  It is also great that you are experimenting on mobile. The mobile version has not been tested as much, so your feedback will be very important! Anyone noticed that something is now changed in TickSpread website interface or this is just happening to me?

I see that everything is modular and my window for open orders, my trades and my positions is now on the left side, and windows with balance, deposits and withdrawals moved to the right side of screen.

Maybe there are more changes but good thing is that I can change that, resize windows and make any window order I like.

Nice to see you noticed our changes, we are trying to make improve the user experience! If there is anything that you don't like, please let us know. Also, if you think you made a better panel by resizing and changing the order of the components, please share an image here with us! Please check our new features: we now have notifications icons on the Orders, Trades and Positions tabs. So for instance, whenever you make a new trade you will see a notification for the trade and the update in your position. I have a question, what if there's a whim of chance that someone hit the 100x in your leverage with the mBtc that you have provided, do you have enough bitcoin to cover the cost? Because as you have said in your thread, you are just a start up website.

Great question. Yes, we will always have enough bitcoins to pay any profits! However, like most other futures exchanges, we do have an auto-deleverage system. This means that, if you open a 100x long position and price rises too much too fast, causing short positions to be liquidated, and if there is not enough liquidity on the book to close short positions, long positions with highest leverage may be forced to close their positions. During auto-deleverage, our positions are always closed at a price between the bid/ask. Some other exchanges have badly designed auto-deleverage mechanisms that close positions are a price unrelated to the current orderbook -- this is sometimes called a 'clawback'. We don't do anything like that. So positions will be usually closed at fair prices (or even better than usual prices if the liquidating positions caused some slippage). If prices move suddenly, though, or if prices move during an exchange outage, highly-leveraged positions may see smaller profits than what one might expect. For example if you buy bitcoin with high-leverage at $35,000, current price is $36,000 and price start going up really fast and there is no liquidity to liquidate short position, at some point (maybe if it hits $40,000) you may see your position closed automatically at a profit. It price keeps rising after that, you may be disappointed later that your position was closed. But if the prices falls back after that, so you may even be glad we closed your position for you! Even so, we'll have an insurance fund in the future to prevent auto-deleverage events from happening. |

|

|

|

|

11

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 28, 2021, 07:28:52 PM

|

New market orders are working fine for me and I received my pending withdrawal that was probably manually done, so the question is would withdrawals in future with real Bitcoin also be manual or automatic?

And what happens in situation if you don't have enough Bitcoin for withdrawal? Maybe there should be some proof of funds with reserve addresses or something similar.

If you don't have enough bitcoin the withdraw will fail after you confirm in your email. In the future withdraws will be mostly automatic (except for very large ones or if our small hot wallet runs out of money). I Market Order, and when I try to close the Position I get: Something went wrong! Please come back in a while or you can contact us for support! A few minutes later I got a Server Error. You triggered an UI bug that crashed our system!  Of course we should never crash no matter what messages the user sends us. Both the UI bug and the system crashing because of it are now fixed. We had downtime of about two hours unfortunately and any open ordens you might had were cancelled. I'm able to reproduce the market order server error. Also, it might be contains more bugs.

On my side, sometimes, my active/filled order doesn't automatically listed on the My Position, it only gets added after I'm refreshing the page.

Another thing is when I just successfully make an order, then immediately close my position, It doesn't close my position instead whenever I clicking the button it just makes a new order.

Furthermore, I notice on the withdrawal page if I hover the date on the withdrawal history, it shows the timedate of the withdrawal right? The problem is if I hover it, the whole text table position is adjusted, it might be good if you just adjust the withdrawal time text instead of the whole table.

Also, when I switch to the Limit order, the price input is empty. I tried to click the price on the order book, but the price doesn't automatically inputted. The price I click only showing if I switch to market layout then reswitching to the limit order again.

Fixed some of the bugs: you can now click in the orderbook to set limit price. Also closing the position with the button should be working fine now. Other bugs are in the todo list that I'm updating in the original post, thanks for the feedback! Sent you 0.3 mBTC  |

|

|

|

|

12

|

Other / Meta / Re: Where to post about a new futures exchange

|

on: June 27, 2021, 06:27:28 AM

|

|

Thank you for all the helpful replies! Sorry for taking several days to reply here.

Yes, I think we'll wait to move the topic to the Exchanges board once we launch for real. But maybe Project Development is also not the right place, as right now I'm looking for users to test the exchange, not developers to help me with issues. Maybe the Service Annoucements board is a good one for now.

I really like the idea of running a signature campaign once we launch! Thanks for the suggestion. One thing I wonder is how to approach trusted an experienced users for such a campaign. Obviously everyone carrying our signatures would have to put a lot of trust in us, and as you've mentioned, it is hard to join or recommend an exchange without an established founder, and I'll have to work hard to become one.

How can I approach experienced managers for help related to a signature campaign? I'd love to explain the project in detail, giving as much information as needed, so that some trusted members in this community can verify that we have a serious project.

|

|

|

|

|

13

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 27, 2021, 06:04:06 AM

|

Currently I can't enter a Price for the order, so I can't test anything. Clearing cookies didn't help.

The feeld looks "unavailable":

We added the option to create market orders. What this means is that you do not have to set the price. You just select the amount and you click either the buy or sell buttons. This will generate a price at whathever the current market price is. If you want to select the price of your order, you need to switch to Limit:  What's still unclear to me (and not intuitive) is what's going to happen when I start a trade. I understand the amount, the leverage, and the liquidation, but I have no idea when a trade will take profit.

Earlier it didn't say "Market" and "Limit", that has been added now. That helps, but I'm still unsure: with Market, I assume the price I enter will be to close the order, is that correct? So if I'm buying now, I should enter a price higher than the current price, and if it reaches that before liquidating, I turn a profit. If that's the case, it may be more intuitive to split the Order field into 2 parts: one to buy, and one to sell. The one to buy shows the Price is to sell, and the order field in which you click sell shows the Price is to buy. (am I making any sense?)

You can see the trades you made at the My Trades, right next to the Open Orders.  If you buy first and then sell at a higher price, you made a profit and your total balance will increase. Also if you sell first and then buy at a lower price. Clearly this is not as intuitive as we wanted, but that's what the feedbacks are for! One thing we learned already is that open positions need to be much more salient. Once you click the buy button (with Market order), you will make a trade, and your position will change as a result. We want everyone to see that immediately. Probably we'll make it bigger, maybe we can make it flash once it changes. Also, when you close your position, we can make your balance flash green or red depending on whether you realized a profit or a loss. Maybe we could show your real time profits or losses on open positions! Yeah, we are going to do that  Also we may add some "notifications" to the My Trades panel so that you know you can click there to see the last trades you made (including exactly the price you executed at), and same thing on the Open Orders when you place a limit order and it appears on the book. I don't really understand your suggestion regarding splitting the order fields. Are you talking about "Take Profit" prices? Like, if you are going to buy right now (say at 33,000) do you want to define the price (say at 33,050) at which you will close your position at a profit? If so, we are planning such an interface for the future. Right now, however, the price you set is the limit price for your order (how much you are willing to buy for right now). If you put this price higher than current price, you will just buy immediately at the market price (not the higher price you set!). Again, you can only set prices on your orders if you are in the "Limit" mode. We'd like to encourage you to try out the "Market" mode: just click the buy button whenever you think the price will go up and once you want to take profit or stop losses you can click the sell button. You need to keep a watch on your current position. If it is positive you need to sell to close your position, and if it is negative you need to buy to close it. We are also working on an "Open Position" line with a "Close Position" button. You can see your position on the amount field here:  My new test-withdrawal shows up as Pending, and the amount doesn't get Frozen.

If your withdraw shows up as Pending, you need to confirm it on your email. After you confirm it will freeze balance (if balance is available) and will appear as Approved. You then need to wait for us to process it manully (in the future we'll have a hot wallet and you won't have to wait in most withdraws). Made an account and reading through the documentation to understand what this is about. I am not really into trading so this is going to be a learning experience from me.

Reading about the profit calculation, is this website going to be about returning the profits in terms of BTC and not stablecoins per se? If it is so, I think its a great idea. It'd be great if you can include small tutorials about how to use the website. This would be good to onboard newbies like me because the idea of "batch auctions" isn't something we hear about everyday.

If you can provide a bit of hand-holding, people like us will be open to exploring more.

Thanks for trying out! Yes, all your profits will be in bitcoin. So yes, it is kind of a funny trade because you can 'buy' and 'sell' bitcoins and you get more bitcoins as profit. For now, of course, and until we are confident enough to launch with real money, your profits will be in testnet bitcoins. We'll have a tutorial eventually, but first we need to understand much better what the challenges for new users are, otherwise we won't be able to create a helpful tutorial. Nice to see you are reading through the documentation! Please let me know if there is anything that is unclear or confusing. Our exchange has several unique features, from the logarithmic contract to the fee structure to the auction mechanism. This is quite a lot to explain, and we want to make the explanation acessible. Our batch auction mechanism should not be something a new trader has to worry about. Rather, the experience should be very much like that of other futures exchanges. Certainly there is quite a lot that is very confusing right now. Believe me: if you feel confused, that's our fault, not yours! If you can give us feedback regarding what your impressions are as a novice trader, that would be awesome. If it is your first time at a futures exchange, that is great as well: futures exchanges are known to be confusing for new users, and we'd like to change that. |

|

|

|

|

14

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 25, 2021, 07:12:02 PM

|

I can confirm that @LoyceV problem also occurred to me. But a couple of hours later, at the time, I was able to normally log on.

This was indeed a bug. The error message had a wrong description. Problem fixed now! I'm retesting the site now and seems a couple of things already being worked on, that seem promising.

Nice to hear! I'm editing the original post to list all the suggestions / bug reports and their current state, and also new features that we are adding. Anyway, I noticed there is a reset layout button on the settings icon at the navbar. I wonder what does its functionality? Does it mean you plan to add more trade layout views?

You can resize and move the components around in the trading panel, and this button lets you reset components to their default sizes and positions. By the way, please share your BTC address! My (test) withdrawal is still pending (after 5 days). Not sure if that's just not implemented yet.

What's weird though: it shows Amount: 0.00000.

The withdraw had a bug on it and the amount was set to zero. We'll abort this one, and you'll have to make a new one. I'm sorry for that. It's still bad: if I trade something with someone, they'll know some of my Bitcoin addresses. If I then use that address to deposit to your site, they'll easily know I use your site (but they could probably figure that out through WalletExplorer.com too). What's worse, is if they can trace all my other transactions to and from your site too, after which they can know many more of my addresses. Not only that, they'll also know exactly how much I've deposited and withdrawn for as long as I've used the site. Exchanges don't do that either. Let's compare it with a bank: it's okay for the bank to see who I pay, but it's not okay to sell/publish/use this data.

Maybe publishing all transactions is a bad idea indeed. We'll try to find a better solution. Either way, we'll always be very transparent regarding what our privacy policy is. For proof of funds, I'd stick to the cold storage with a signed message. Hot wallets shouldn't hold a large portion of total funds, and there's no need to proof every last satoshi.

Problem with that is that you don't know how much deposits the exchnage has. I can sign a message with cold storage address containing 100 BTC, but what if the users actually have 200 BTC in their accounts? If we can publish account hashes and balances, one can see that the balances sum up to the amount at our cold storage address. However, I just had an idea here! We can publish just the root of a merkle tree containing hashes of balances, and just let the user know the derivation path. This way we can have proof of funds without jeopardizing user privacy.  My (test) withdrawal is still pending (after 5 days). Not sure if that's just not implemented yet.

What's weird though: it shows Amount: 0.00000.

I can confirm this also, after I clicked to withdraw my tBTC I received an email to confirm that action and status on my account is now confirmed , however I didn't receive anything in my wallet and balance on my account is still the same. Maybe withdrawals are not working yet, but it would be weird that only deposits work and not withdrawals. I can confirm this also, after I clicked to withdraw my tBTC I received an email to confirm that action and status on my account is now confirmed , however I didn't receive anything in my wallet and balance on my account is still the same. Maybe withdrawals are not working yet, but it would be weird that only deposits work and not withdrawals. We are having a problem in the withdraws, we'll have it solved ASAP. I couldn't log in for a while but I'm back on now.

I was able to place multiple orders without closing previous trades with the 0.1 tmbtc test provided.

And so I’m guessing it's safe to assume that the extra funds are provided as margin? If that's the case, shouldn’t there be some kind of warning for users that, they are trading assets with borrowed funds? This could lead to serious problems and debt if not checked.

I can’t find any data in my open orders tray.

The P&L never updates

I still don’t understand the concept behind frozen funds and how it would benefit users

You’ve done a good job explaining it here, but not many users will check on here. You should have a tutorial made, and even at that expect to be bombarded with many questions.

My account logs out automatically, even when I’m still active.

My general feeling is confusion, but then I am not a pro trader. I have only dabbled in it a few times, but someone well versed in trading may feel otherwise.

I'm sorry to hear that you feel confused. Margin trading is really complicated. Our top priority is getting it as intuitive as possible, so that we don't have to explain as much. But yes, we'll have a tutorial eventually as well. Problem with account logging out should be fixed now! EDIT: All withdraws processed! Bugs fixed. |

|

|

|

|

15

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 24, 2021, 06:34:31 PM

|

I also noticed that when I log in after some time my dark them is all messed up and it is half light and half dark.

Like I said before, many people don't have a clue what they are doing with futures trading so making good tutorial and instructions is must have feature for your website.

I think we indeed have a bug related to half light and half dark themes, we'll investigate. Thanks! And yes, we are working right now on making it simpler. We'll do a tutorial eventually, but for now we just want to make it easier and more intuitive. That makes it less likely for P3 or P4 to strike a deal, but makes it more risky to recover the funds when needed. Say P1 dies. Now P2 needs both P3 and P4, while P3 only trusts P1.

I think we can use the scripting language to achieve the same effect without having one person holding multiple keys. So funds might be moved with the following combinations: P1 + P2 P1 + P3 + P4 P2 + P3 + P4 Also P3 and P4 can have encrypted key backups so that funds are not lost in case P1+P3 or P2+P4 die at the same time. It seems really unlikely that P1 and P2 will die simultaneously, and it also seems really unlikely that the backups for both P3 and P4 are compromised simultaneously, and even so one of P1 and P2 would need to sign such a transaction. That would be very, very bad! I've never seen any website that publishes all transaction data, and within EU it could even be a GDPR violation.

I assume any exchange keeps trade and transaction data forever, and if they ever need to provide it, they can dig it up.

TL;DR: don't do it. You'll scare away your customers.

Thanks for the candid feedback. Just to make things clear, we would never publish personal information (emails, etc). What we would do is use email + some random salt to generate a hash for each user and then, for each incoming deposit or withdraw, we would publish this hash. So no personal data involved! (and no GDPR violation for sure) That would be somewhat equivalent to you geting your withdraws from the same address you used to deposit. Maybe you are right and this is really a bad idea, but I don't really understand why someone would be scared by that. One reason I thought this was OK is because in the long-term I want to make our exchange work with decentralized custody. Fully decentralized exchanges have a lot of problems with latency, front-running and large fees (or spreads) that are really hard to solve. So I think we can get the best out of both worlds with centralized order matching + decentralized custody and setlement. In this model, traders would make deposits and receive withdraws from smart contracts, and everybody would be able to easily link deposits and withdraws, so that I why I thought this lack of privacy would not be a big issue for most users. After this explanation, do you still feel that this is a bad idea? If so, can you elaborate on what exactly do you think is bad or will scare users away? It will be a centrally controlled database, meaning you can put anything you want in there, so anyone accused of anything could just deny it and government won't have conclusive evidence. Or you could be bribed to change something.

We would publish that daily (and maybe even save the hash in the blockchain) so we would have no power to change history. Also, we if wanted to publish daily balances we could have a full proof of funds! Everyone would be able to check that we have as much funds as the sum of all balances because everyone would be to see the their own balance associated with their own user hash in a public ledger, and they would be able to see that our cold storage address contains at least the sum of all balances listed there. But again, there are privacy considerations here, so this may turn out to be a very bad idea. We'll not do that if the overall feedback from the community is negative, and of course we would be very transparent regarding what privacy we can offer. I wanted to test it, but I now get this:

Login Error: We cannot find a valid account with this credentials

Are you sure you didn't forgot your password? We only store a hash of your password, so we have a limited ability to debug that. We are being able to access our own accounts just fine. Can you try the "Forgot password? Reset" link and see if it works? This should send you a link in your email to set a new password.  |

|

|

|

|

16

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 20, 2021, 06:34:24 PM

|

Also, we saw several withdraw requests, was it you?

Yep, I tried the withdrawal feature. But doesn't seem it works. I did receive the withdrawal request confirmation, but when I click it, it just shows your login page. When I log on, the withdrawal status doesn't change. At first, I thought you didn't activate the withdrawing feature on this test mode, checking out the network log, it shows me an API 500 Internal Server Error. Turns out I'm requesting below the minimum required amount(<1mBtc). Maybe you could show a warning to the user if they requested below the minimum amount, I notice if I put 0, the site gives an error the amount not accepted. You are right, we should show a warning whenever your request is below the minimum, just like happens when you put 0. We'll investigate what is going wrong with the withdraw confirmation link, thanks for letting us know! While trying, I got an error:  When I click "Contact us", it shortly shows a contact form, then jumps back to the error page. I don't think that's supposed to happen. Oh no our exchange went down from 8:40 to 13:55 UTC. Even worse, our monitor bot that should have waked us up in this scenario didn't. It is up and running again, and we fixed the monitor, so we hope we won't have such downtimes again. We'll also fix the "Contact us" link. I'm still not sure what I'm doing, for people new to this it's not very obvious what "buy" and "sell" does in relation with the margin and current price.

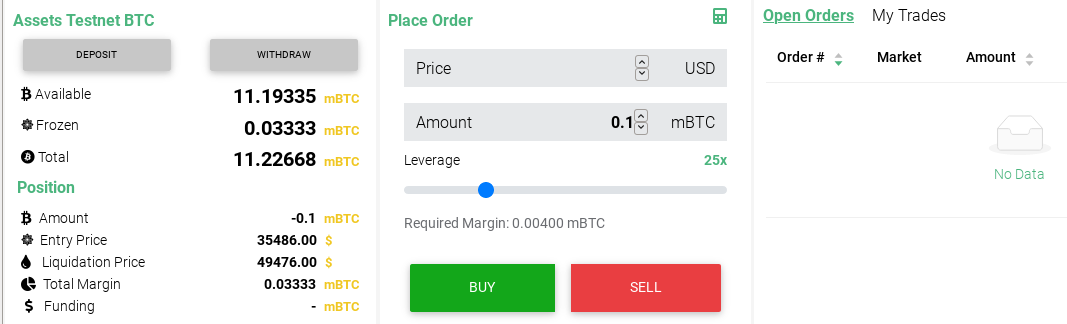

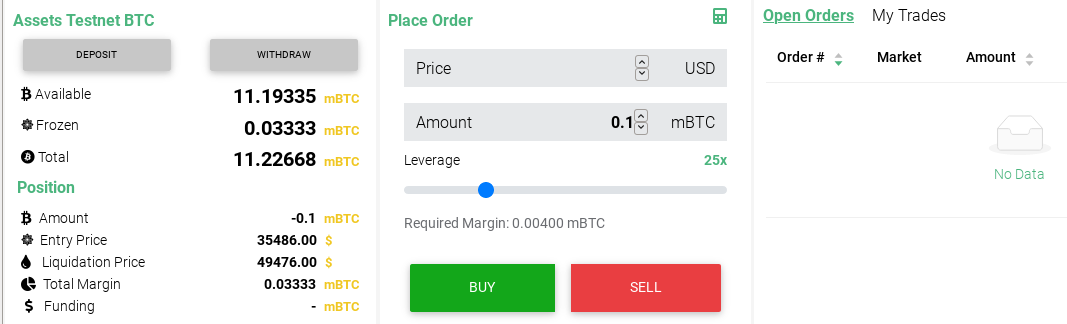

Margin trading is known to be confusing for many people and I'm sure that many other people would have a similar experience. It is really important for us to figure out a way to make margin trading easier and more intuitive. What happens is that whenever you open an order, some of your balance is frozen as margin for that order, depending on how much leverage you select. For example, if you use 5x leverage to open an order with size 10 mBTC, we'll freeze 2 mBTC from your balance. That's the most you can lose by opening this order.  If you instead use 100x leverage, we'll only freeze 0.1 mBTC for the same order. This is the margin associated with this order.  When your order gets executed, the margin associated with the order becomes associated with the position instead:  This is the size of your position, and how much margin is associated with it:   The same value that appears on the "Total Margin" above remains frozen in your balance, until you close the position. When you close the position, you will get more than what was frozen if you made a profit on your trade, or less than what was frozen otherwise. Again, you'll never lose more money than what was frozen: the worst that can happen is you get liquidated and the amount frozen is lost. The "Entry Price" tells you what is the reference price. So if you have a long position, you need to sell higher than this price to make a profit, and if you have a short position, you need to buy back lower than this price to make a profit. If price moves against and reaches the "Liquidation Price" you may get liquidated and lose the amount frozen.  Do you this explanation helps? Please let me know whether there is anything else that is still confusing to you, as anything confusing you is likely to confuse to many other people too! So which one do you prefer: losing funds in a $5 wrench attack, or losing your life? Both options aren't desirable.

Paradoxically, the less the other key holders care about my own personal well-being, the more secure I am, as long as everybody knows about it (for any high-level criminals reading this old post from the future, be warned that you won't be able to get away with anything unless you can pull off a simultaneous operation in multiple countries!). Did you mean "decryption keys" instead of "encryption keys"? If so: it looks to me like the opposite is true: P1 and the person holding backup key B together have all the information to decrypt the backup key, which gives them all they need to steal the funds. If P1 dies, the person trusted by P1 holding the backup for key A will approach P2 and ask for the encryption key, and vice versa. Allow me to edit this statement: If P1 doesn't die, the person trusted by P1 can approach P2 and ask for the encryption key. If P2 agrees, they split the money. And you wouldn't even know if it was P1 or his "trusted" person who made the deal with P2, they'd both have plausible deniability! At least with a 2-of-4 multisig where the person trusted by P1 holds a different (encrypted) key, you'd know for sure who signed the transaction stealing funds. Yes, I meant decryption keys. Let us define P3 to be the person trusted by P1 who holds the encrypted copy of key A, and P4 to be the person trusted by P2 who holds the encrypted copy of key B. You are absolutely right about the plausible deniability problem. If P3 teams up with P2, that is indistinguishable from P1 teaming up with P2. Being P1, I don't worry much about this scenario. At least in my perspective, I have people that I can trust very much, and the problem is finding someone I can trust that won't be giving the funds as ransom to save me from danger. But if this arrangement makes people feel unconfortable to deposit their funds, we can find another solution. One possibility might be to have a 4-out-of-6 multisig with P1 and P2 holding 2 keys each, and P3 and P4 holding 1 key each. What do you think of this idea? No four keys are in a single continent, and we can know for sure who signed a transaction. Maybe it's worth looking into how exchanges handle this. They've lost many Bitcoins in the past, but seem to have improved their setups nowadays.

That would be great to know, but I can't find enough information about it. Shouldn't those open positions show up under Open Orders? If not: where can I find back the details to those open positions?

You can find all information about the position here:  So that explains my confusion: if "positions" are different from "orders", they should show up in the list under "Open Orders".

Yes, agreed, we'll work on that! On what exchanges are you planning to list your token? I guess if this token would have some real utility on your website than it would be ok, but most of the tokens we see in market are totally useless so I am always a bit skeptical about them, but thanks for sending some btc  We'll be giving a lot more information about our future TICK tokens whenever we start preparations for our ICO. But we can tall you now that we'll be using some percentage of the net revenue to buy back tokens, traders will be incentivized to hold tokens in proportion to the volume they make to get fee discounts, and holding tokens will also be needed to get maximum referral bonuses. Hopefully we'll be able to give investors confidence in our project and in the team to make it attractive as an investment. We plan on competing heads-on against major exchanges like FTX and Binance, so raising money will help us grow in future. I must say however that growth and fundraising is not top priority right now. Rather, the most important thing is getting our product to work well, making it easy and intuitive for users, achieving product-market fit, validating market hypothesis, etc. We'll move to full-speed growth mode once we are sure that users really like our product and once we can establish that the expected value of new users is consistently higher than the acquisition costs. I just deposited around 13.7 testnet mBTC in my account, and my suggestion is to add optional generating of new addresses each time I am sending new deposit.

It is much better for privacy, instead of reusing same address but I am not sure how complicated implementation of this feature is going to be for you.

Think about adding Lightning Network or other options when fees are high on Bitcoin mainnet.

Nice! Multiple addresses is in our to-do list, as is LN and other channels. In the future we'll also try to establish channels with other exchanges so that margin can be transfered immediately in between exchanges. This would help arbitrators quite a lot, because they hedge positions in different exchanges, and today they are often overcollateralized. They fear getting liquidated in one exchange even while making profits at another. But it remains to be seen how open big exchanges are to this idea. In the long-term we also want to move to a hybrid model in which we allow decentralized custody in smart contracts while maintaining centralized orderbook and matching. We think this may provide most of the benefits of decentralized exchanges while allowing much more liquidity. This may also allow US citizens to trade with us without legal problems on our side, as according to US legal interpretation we only have to be regulated as futures exchange if we are holding the users' margin as guarantee for trading. I'm afraid we may let you down with our privacy commitments, though. While ideologically we are totally in favor of private transactions, for several reasons we don't want people to use our exchange to mix bitcoins. We may actually do the very opposite and publish all transaction data allowing anyone to link withdraw and deposit transactions, so that in some sense your account is just like a set of public addresses in the blockchain. By doing so we can counter the argument used by governments that exchanges either have to require KYC identification from all users or else they are complicit in money laundering. Of course, users will be able to mix their incoming and outgoing transactions if they want! I see some exchanges (like Binance) harassing their users for depositing from or withdrawing to a mixer. That is totally unacceptable in my opinion. It's working fine now, but I also had automatic logging-off from website like other members reported earielr.

Fixing that is top priority right now. It may take a few days but I'll let you all know once it is done. Before placing BUY or SELL order we should be able to manually enter liquidation price, and order should stay in open orders until it's closed, and I would also add Profit and Loss section in left side.

You can see Profit and Loss in the "My Trades" tab. Users selecting their liquidation price (and therefore leverage being chose automatically) seems like a very good idea. We are designing a new interface to let users define more easily how much money they want to risk, at what price they want to close their positions and take profits, and so on. This may take quite a while, though. We have a very small team right now. One more suggestion I have is to add 2FA to improve account security.

Also on the to-do list! We'll get that one done before we launch with real bitcoin. When withdrawing, can you add the withdrawal address to the confirmation email? That's always a good check.

After clicking the confirmation link, I'm asked to login again (I don't think that step is necessary). My withdrawal is Pending now, so it seems to work. But the Pending amount isn't added to the Frozen amount (I think it should!).

When I open "Trading rules" on the bottom of the page in a new window, I'm again asked to login.

Great idea, we'll be sending withdraw address in the confirmation email. Logging in again is indeed not necessary. Your balance should be frozen for the withdraw. I'll see what the problem is! Edit 1: We found the withdraw problem, and we are working on it. Edit 2: Our market making bot is currently having an issue. You may not see the prices updating as you would expect. I'm trying to get it fixed. |

|

|

|

|

17

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Test for free our new futures exchange, and get paid bitcoin!

|

on: June 20, 2021, 05:02:33 AM

|

Things I noticed: When I click Account, I see this: Last login time 2021-02-15 07:00:26IP: 49.***.*.200

Email: test@****mail.com

Created at: 2020-01-20 12:23:20 Does that mean I'm seeing someone else's email address (and even IP address) (censored to post it here)? This is just placeholder account information for a page that is not yet ready. Sorry for that, we updated to remove this page while we get it working. Related to the image links you posted: Did you know a Copper Membership (around $20) allows you to post embedded images as a Newbie (otherwise you'd have to be at least Jr. Member). Also: please check the forum rules: you should edit your last post if you're the last one who posted in a topic instead of making 2 posts in a row. Thanks for the suggestion! Purchased it already, just waiting for the confirmation. Sorry for the two posts in a row, won't do that again. We'll probably use a 2-out-of-2 multisig, with one of the keys with me here in Brazil and the other with our employee in North America, and both keys with encrypted copies somewhere else in case one of us dies This sounds risky: who gets access to the encrypted copies, and doesn't that negate the use of multisig? Have you considered 2-out-of-3 multisig instead? One in Brazil, one in North America, and the last key wherever you're currently keeping the 2 encrypted copies? That is an interesting discussion, I might open a new topic eventually to get more feedback on the relative merits of the two solutions. Yes, 2-out-of-3 is the standard solution, but we don't have three trusted people in three geographically different regions. For instance, I do have a co-founder who lives nearby, but we can't hold one key each because we see each other nearly every day, or else someone might track us down and kidnap both of us at once. Other trusted people living further away are close friends and would not commit to keeping the funds safe in case me or my family is in danger. So this is quite a complicated problem if you think about it. We know it will probably take quite some time before we are entrusted with significant assets, but we take the responsibility of holding other people's money very seriously. In the 2-out-of-2 multisig proposal that we are considering, the backup keys can be cross-encrypted. So we have: P1 holding key A + encryption keys for backup of key B P2 holding key B + encryption keys for backup of key A So the person holding the backup key A can't team up with the person holding backup key B to steal the funds. If P1 dies, the person trusted by P1 holding the backup for key A will approach P2 and ask for the encryption key, and vice versa. Moreover, kidnapping P1's loved ones is useless because, although P1 and P2 trust each other, neither P2 nor P2's backup holder have personal ties to P1. We can verify that the backup holders have not lost their keys by giving them several other files encrypted with several other keys and asking them regularly to provide proof that they can open them. But yes, we agree this is a nonstandard solution, and we are going to ask the community for feedback on this approach before we make a decision. What's annoying, is that I was logged out after a while, without warning. I wasn't even unactive, I had just closed some trades.

Thanks for the feedback, this has happened to me as well, we are trying to investigate what is causing this issue. We'll let you know once it is fixed. I can confim the Frozen funds:  It doesn't look right to have funds Frozen/Margin without open orders (but again: I feel like a total n00b in this). Or maybe it just takes a while to update the value? You are the second person to report being confused about the frozen funds, so that is something we definitively need to improve. What is happening here is that, while you do not have open orders, you do have open positions, and these freeze your balance as well! The amount frozen is the most you can lose if the price goes against you and you get liquidated. You can see that the amount frozen is exacly what is in the "Total Margin" field of the position. Still, given that everybody is getting confused about that, we need to find a way to make it more intuitive! One idea I am considering is having a small information icon next to the frozen balance, so that when the user hovers the mouse over it, a popup baloon appears explaining the breakdown of what is causing the balance to be frozen (how much due to open orders, how much due to open position, how much due to other stuff like pending withdraws). Another idea is adding a line for an open position next to the open orders, along with a button for the user to close it, just like Binance and other exchanges have. This may help making it more clear that you do have a position open. Any other ideas? We have a totally new matching engine that generates dozens of auctions per second. Could it be the bots weren't on a bit earlier? Now the entire site gets quite unresponsive because of the quick movements everywhere. It might be because I'm using Tor (and my laptop is quite old), but it takes several seconds for a new order to be added. Our servers are running in AWS at the Tokyo region, so there may be some network ping for the orders to get there and ping back. Latency will get worse when using Tor, but the website should not get unresponsible because of that. May we reach up to you later to investigate this issue? Thanks for the very helpful feedback. You also made the first tBTC deposit and several trades. You even made a big high-leverage position and got liquidated! Just sent 0.6 mBTC, thanks! https://www.blockchain.com/btc/tx/e7134e05efe43cb58142883bf5b5666833bfaf1e7fa12eb3dc8dcf7498c1b030

Gonna give a few inputs about the UI/UX.

I think it's better to match the order book tick size to the whole site theme. Displaying the default select box might look not too good. I also notice on the feedback page, the "Submit a Feedback" section, there is some text that overlaying the image on the smaller screen size.

Upon clicking the calculator(?) icon on the "Place Order" section, Did you intended to put the arrow left-facing? if the icon is intended to close the window, personally, it's better to make the arrow facing right, or maybe just change it to the exit icon. Also, it would be good if it is able to close the window when clicking outside the "Profit Calculator" window.

I also notice the dollar sign icon on the Position section alignment looks off compared to the others icon. The last thing is, I agree if you make a tutorial instruction on the Trade page.

Thanks for the feedback, we'll be fixing all these issues! I feel we need to learn more about what is causing friction before we can create a good tutorial, though. Also, we saw several withdraw requests, was it you? Thank you all! Kelvin |

|

|

|

|

18

|

Local / Português (Portuguese) / Re: Bolsa de futuros para competir com a Binance e a FTX, venham testar!

|

on: June 19, 2021, 05:56:27 PM

|

É legal o site, tem até o gráfico de 1s do tradingview, doidera  Também é possível reorganizar os elementos da tela e o design é responsivo, isso é o que as outras exchanges não tem. Mas vai uma dica para já implementar no produto: uma API. Pois muitos que fazem day trade utilizam apps próprios para implementar suas estratégias. Obrigado pelos comentários positivos! Mas temos muuuita coisa pra melhorar, entra lá e faça alguns trades pra ajudar a gente a testar! Tem muita coisa pra melhorar, mas já temos uma API funcionando! Olhem aí, e implementem alguns bots! https://documenter.getpostman.com/view/14373735/TzRa63u9Vamos trabalhar pra deixar ela compatívem com CCXT e outras plataformas. O objetivo é ousado... "competir com a Binance e a FTX"  Porém não venho criticar, muito pelo contrário... desde que seja um projeto sério, desejo sucesso e prosperidade no empreendimento. Eu larguei o trade faz um tempo e não creio que haja aqui na comunidade local muitas pessoas que ainda o façam, ainda mais o DayTrade que é uma modalidade mais ariscada, mas talvéz eu brinque um pouco durante a testnet. Sei que pode parecer difícil acreditar, mas estamos sérios nisso! O objetivo não é tentar ganhar 1% do market share não! Temos um matching engine totalmente novo, que ao invés de processar as ordens sequencialmente, ele roda dezenas de leilões por segundo. Isso faz com que bots possam competir entre si para serem takers, oferecendo um preço melhor. Então na nossa bolsa, você pode colocar uma ordem no book para comprar por $100, e depois ver que a ordem na verdade executou por $99! Isso ajuda os market makers a não perder dinheiro na hora em que o mercado mexe rápido. Com isso o objetivo é ser a única bolsa do mundo que consegue ter spreads bem baixos (<0.01%) sem ter que pagar rebate (taxa negativa) para os makers. Se a gente conseguir isso, vamos conseguir oferecer taxas pra taker melhor do que qualquer outra bolsa do mundo também. Vou fazer um post depois contando melhor pra vocês! E depois vamos divulgar nosso whitepaper, claro. Um projeto interessente, e parabéns por todo esse trabalho. Eu por acaso, apesar de estar um pouco parado e com falta de tempo, até gosto de as vezes fazer day trade. Um dia destes sou bem capaz de experimentar a vossa plataforma. Nós os founders somos brasileiros, mas a bolsa é internacional (e o site está em inglês).

Mas, eu acho que vocês deviam melhorar isto. Se o projeto é brasileiro, o site também devia estar em PT. Isso é uma coisa que costumo criticar aqui em Portugal, é projetos portugueses com o conteúdo do site só em Inglês! Eu entendo que é para abraçar o mercado internacional, e acho bem isso. Mas tem de ter o idioma do país de origem. A menos que não queira o mercado nacional. Para mim isso não faz sentido. Porque depois, vem defender a língua Portuguesa... Não estou com isto dizer, que vocês fizeram mal em ter o site em inglês, mas pensem em ter em português também. Acho que seria bom. Fica a dica.  Vamos ter o site em português sim! Estamos trabalhando nisso ainda, porque dá um certo trabalho ter mais de um idioma. Quando puder, entre lá e faça alguns trades para experimentar! |

|

|

|

|

20

|

Alternate cryptocurrencies / Marketplace (Altcoins) / Re: Try out our new Futures Exchange! (margin in testnet BTC)

|

on: June 19, 2021, 05:28:03 PM

|

I can't sell something I don't have because I went to cancel open order and I think you should improve interface and make it more intuitive.

Maybe adding some tutorial page with instructions would help with this.

Thank you for the feedback. What do you see in your balance + position panel?  Here you can see that my position is -8.5 mBTC. In your case, it should be something like +0.2 mBTC? If so, you can send a sell order to close the position. If it says your position is zero, and you have no open orders, and your balance is still frozen, then this is a bug and we need to investigate! Can you share a screenshot of what you see in this panel? And yes, we absolutely need to improve the interface to make it more intuitive. It totally sucks right now! But we'll be improving it little by little thanks to feedback like yours. Very much appreciated! Regarding making it more intuitive, what did you expect for the position? For instance, Binance has this:  Would something like this make more sense to you? I would prefer to get a real Bitcoin as a gift, instead of some new speculative token that may never get listed on any exchanges.

I think you are right! No one cares about our potential tokens right now. But I must say that our tokens have actually nearly a 100% chance of being listed, because we are going to list it ourselves even if no one else will! Nevertheless, changed it already, we'll pay 0.1 mBTC to 3.0 mBTC for helpful feedback! You deserve some already, sent 0.3 mBTC. Not much, but please keep testing it for us! https://www.blockchain.com/btc/tx/2d15ec661ebae90881f528c567d2da261feec53518ae4670d0c372434a9fca13

You can withdraw those coins to your own testnet BTC wallet, you can also deposit, and it's obviously done for testing, nobody is crazy enough to test something like this with real Bitcoin.

Yeah, we are only going to accept real bitcoin once things are running for quite a while with no problems. Also, we'll be using testnet bitcoins to test our safety protocols. Current we have an HD wallet in which only the master public key is in the servers to generate addresses to deposit, but we are working on making the HD wallet a hot wallet so that it can move funds in real time to our multisig cold storage. We'll also be developing and following safety protocols before signing the offline transactions, even while we are still using testnet bitcoins, so that we have enough practice with them. We'll probably use a 2-out-of-2 multisig, with one of the keys with me here in Brazil and the other with our employee in North America, and both keys with encrypted copies somewhere else in case one of us dies Personally, I do not encourage the use of leverage and risky trading like that, as even repetition and practice will not make you a professional.

Regarding leverage, yes it can be used irresponsably, especially if the user is putting a substantial part of its money at risk. But if you only risk a small amount of money in each trade, you can do short-term trades responsably, whether you are trading based on price signals, news, or just for entertainment. We encourage that by segregating margin per order and position. So you never lose more than what you define explicitly. Also, leverage has several other legitimate uses: - By making the same trades with less margin, you need to leave less of money in centralized exchanges, and so less custody risk. So users can own the keys for most of their money.

- You can do some trades without having to wait for a deposit to be credited, which might make you lose opportunities.

- Market makers use leverage to provide more liquidity, and this benefits all traders, whether they use leverage or not.

|

|

|

|

|

.

.