There is a pretty strong libertarian movement going on in Oregon, and bitcoin has infected it. I just created a meetup.com group for it: http://www.meetup.com/Portland-Bitcoin-Group/Only three people are on the meetup group so far, but the meeting this sunday should have many more as it has been passed around a lot in email. Also, Intel is located in Oregon, and bitcoins are starting to get pretty popular on the intel campus. Finally "it is full of alternative minded people" is totally right on. |

|

|

|

I do not see these two competing systems co-existing together for the long term. Guess which one I am going long on? : )

What two competing systems? FRB will exist regardless of whether the asset is $, BTC, or metal. |

|

|

|

With 100% reserve bank, there would be no interest to earn. Because it would be a true bank, more likely you would pay fees for storing your bitcoins there. The benefit is that the bitcoins itself would no lose value, and would always appreciate in long run, thus keeping your savings safe.

What about loans? The point of FRB is that it can be used to lend money to individuals or businesses. Is bitcoin not suitable for lending? Ok, you don't need FRB to lend money, but it surely increases the amount that you can lend and therefore decreases the cost of lending. Otherwise lending will get much more expensive. Will it not? As for bank runs, they are a problem with the current banking system too. That's why Cyprus shut the banks for several days. If there is a bank run with FRB, people may lose their deposits, no matter if they were in euros or bitcoins. Is there going to be a cryptoloaning technology invented that does not require banks? I suppose this would be something like crowdfunding, but safer in terms of tracking where your loan goes and possibly getting part of it back, if necessary. People give and ask for loans frequently on the forums (I think there is a subforum for it). Dealing with credit and fraud protection in an anonymous system using a currency with no legal backing is troublesome. Whoever figures out how to do it well will be able to do quite well, but it definitely is a risky business. |

|

|

|

|

And so the newbie section will remain free to post. It will also be nice because it won't have any junk posts.

|

|

|

|

|

The bitcoin wiki makes it so that to edit content you pay a small fee in bitcoins. I think that would be a great way of confirming accounts. Just make it pay to play (but only a little amount).

This will make it so everyone on this forum has had actual bitcoins in their hands at one point and no one will be talking when they don't know anything. Plus the newbie section will no longer have junk posts.

The price can be something like $1 or $0.5 converted to bitcoins. This will easily support the hosting of the site.

An alternative would make it so it costs you $0.001 (in bitcoins of course) to buy a credit, and credits are spent to post to a thread (5 credits), vote up a thread (1 credits), or post a reply to a thread (2 credits).

|

|

|

|

|

This absolutely can work, and has happened (or at least I suspect it has).

mtgox keeps all of its bitcoins in its wallet and not tied to any particular users. It maintains user account balances in its database. It has been hacked before and I suspect lost a portion of its assets while maintaining user account balances. It also may have had occasional theft, accounting errors, and perhaps some investment spending using bitcoins. So if user account balances total 1000 bitcoins, it is totally possible that mtgox only has some fraction of those bitcoins (and USD) available to pay out. I suspect that many new investors in bitcoins don't even have a wallet outside of mtgox as they are just in the speculation game, so it makes it even easier for mtgox to maintain a only a fraction of the balances of the accounts in its reserves.

Now, this doesn't mean that they are really doing this, but I have no reason to believe that they are not, and they are not the bastion of transparency. Heck, if they sold off 50% of their stockpile into cash right now, they would have a lot of fiat to work with, and it would be likely that users would never be the wiser. Maybe they could play even riskier and keep only 10% of the bitcoins.

What makes this possible scenario interesting is that this actually inflates the money supply. If there were only 1000 bitcoins in existence, and 500 were in gox balances, and gox spent 400 of them keeping 100 in reserve, there would be in effect 1400 bitcoins in circulation, even though there are only 1000 real bitcoins.

As someone on the sidelines I eagerly wait until there is a run on mtgox and keep a stockpile of popcorn on hand. Only then will we see what is going on in their backrooms.

|

|

|

|

http://www.meetup.com/Portland-Bitcoin-Group/We will be having our next meeting this sunday at a cafe that you can pay for things using bitcoin. We have been having gatherings of 6-20 people every couple weeks, and I set this up to organize them better.

|

|

|

|

|

So I set up Abe and Bitcoind on a linux vps, but bitcoin either gets hung or consumes the whole machine in the course of a day (making it so I can't even ssh in).

This hardly seems like the path to a stable server that could be relied on. What do people do to make bitcoind more stable? Why is it so demanding?

|

|

|

|

|

Does anyone have a monthly chart of the USD value of NMC for the last two years? I am curious to see how well it is trending.

|

|

|

|

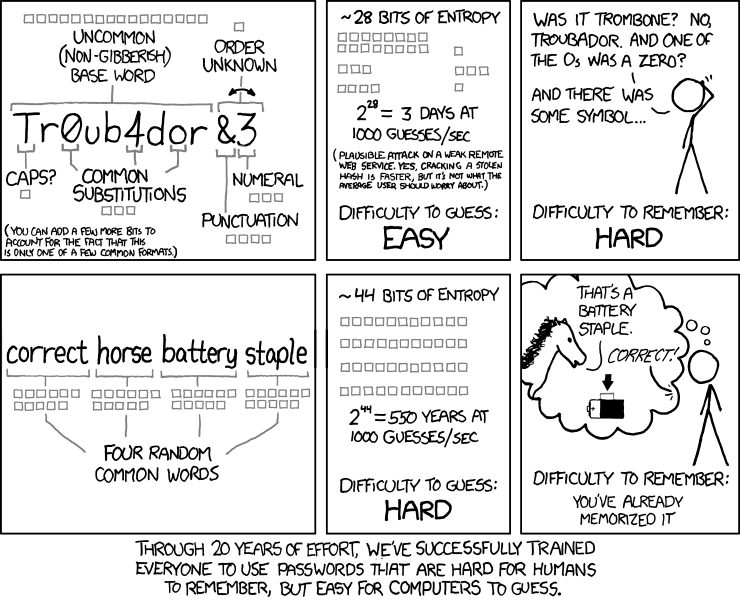

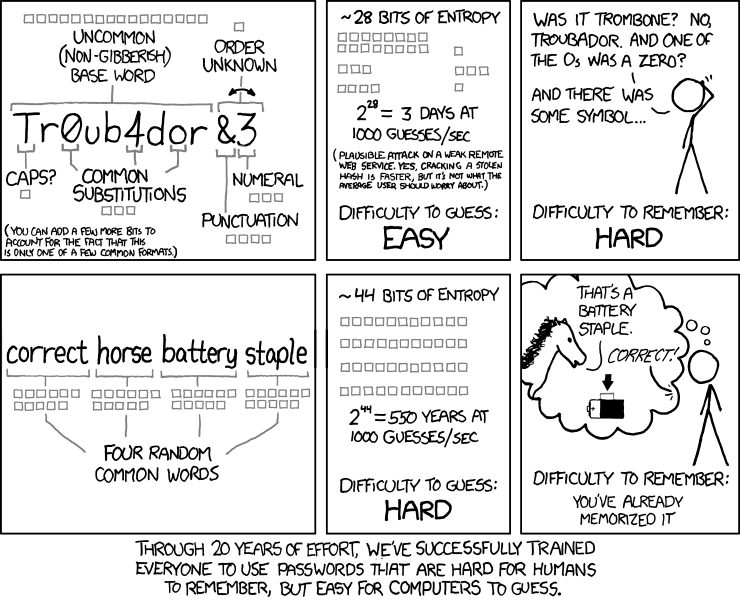

So I am looking into what would be required for a simple brain wallet passphrase generator that produced simple to remember passphrases, but ones that would not be able to be feasibly cracked within one's lifetime. This comic was the starting point for me:  and someone created a generator here: http://preshing.com/20110811/xkcd-password-generatorLooking at this thread: https://bitcointalk.org/index.php?topic=68930.0it is considered that the number of possible bitcoin addresses is 2^96 or 8e28 (8x10^28). This passphrase generator does 1949^4 = 1.4e13. If a gigahash is 10^9 hashes per second, than 1 gigahash should be able to generate every possible hash of this in 1.4e4 seconds (or roughly 4 hours). If I use something like this: http://www.infochimps.com/datasets/word-list-100000-official-crossword-words-excel-readableit comes to about 3171 years for a machine producing 1 gigahash per second. (This would have 10^20 different 4 word combinations) Assumptions made: * Checking the blockchain for an address match takes no time (good indexing required to make this fast) * The hashing hardware that is used to solve bitcoin blocks will generate priv/pub keypairs just as fast (This second one I am very unsure of) So to me it seems that using a really basic dictionary of about 2000 words does not produce the security required for this type of environment assuming a 4 word passphrase. A ~100000 word dictionary does produce the needed complexity using today's hardware. Anyone with a better grasp of this stuff want to take a look and see if I am wildly off? |

|

|

|

|

Well we give such large blocks to miners, they might as well fill them with small paying transactions. It is better than leaving them mostly empty.

The max block size should be smaller to have actual price competion for block space, than we won't need to worry about setting fee rates.

As a miner why not just accept every nonzero since you don't lose anything by adding them.

|

|

|

|

Bitcoin's blockchain db has been switched to leveldb. Does it still work with this?

The blockchain isn't a database, it's raw data so it will work. Is that a problem? Is the transaction index required?

No, since everything is rebuilt SQL side. Fantastic. Thank you very much. |

|

|

|

So it reads the bitcoin main client's db and dumps it into a database. Bitcoin's blockchain db has been switched to leveldb. Does it still work with this? Also, 0.8 release has this in its notes This release no longer maintains a full index of historical transaction ids

by default, so looking up an arbitrary transaction using the getrawtransaction

RPC call will not work. If you need that functionality, you must run once

with -txindex=1 -reindex=1 to rebuild block-chain indices (see below for more

details).

Is that a problem? Is the transaction index required? |

|

|

|

|

I am looking to develop some sites that would end up relying on the APIs provided on blockexplorer.com or blockchain.info.

Specifically, I will need access to their services to get transactions related to specific addresses.

Rather than relying on their services though, I would like to have my own internal site that does the same - or just a version of bitcoind that has indexed all addresses and will allow me to query for the raw transactions for any address stored in the blockchain.

Does anyone know how these sites set up a system to arbitrarily query different addresses? Does anyone know of an open source build of something that I can use to reach what I am looking for?

Heck, a tool that would be able to scan the blk data files of bitcoind and dump results into mysql would even work.

|

|

|

|

This is meant as a simple message to send to merchants to introduce the concept of bitcoins to them and provide information on how to get setup. If you see any ways to improve this message, feel free to edit it here: https://en.bitcoin.it/wiki/Email_pitch_to_merchantsThis was originally written to convince a person who sells alternative medicine, and I left that text in as an example. It should be modified to suit your target audience. ------ You might want to consider Bitcoin as a payment option for your website. It is a decentralized digital currency. The video here helps explain how it works: http://www.weusecoins.com/If you chose to accept bitcoins on your site, you can use this as a payment processor: https://bitpay.com/and they automatically convert bitcoins into USD and deposit in your bank account. There are other payment processors on this page: http://www.weusecoins.com/merchant-tools.phpThe benefit to your business is that there are a lot of people with bitcoins that like to support businesses that use bitcoins. This means basically tapping into a niche market of people that are into a fringe alternate currency that might also be open to alternative medical products. [NOTE: modify the message here to relate to whatever the business is] If you do start accepting them, let me know, and provide me a little press release. I will make sure it ends up on the bitcoin forums. If you have any questions, feel free to ask. And in case you are wondering, I am not tied to any of the businesses or services listed above. I am just an advocate of bitcoin, and I like to see businesses accepting them. |

|

|

|

Well, the first one paid 0.018 in fees for the privilege (almost $0.60) and the second one was about the same. In the end, who cares what the values of the outputs are. The only thing that matters is the space transactions take up in the block chain, and if fees are based upon that, then this nonsense resolves itself. This person spent a good portion of the bitcoins that make up the transactions in fees. |

|

|

|

|

$1 today according to CPI is equivalent to $0.04 in 1900 (yep, I know CPI is far from perfect). That means that $1 today would have bought $25 in old money. Coincidentally, BTCs are worth $25 in mtgox as of today, so you are really using the equivalent of your ancestor's dollars, and they worked just fine for them, and they didn't even make half penny coins at that point.

Much of bitcoin's value is currently propped up by speculation and not true economic activity. Since it is speculation, the general consensus is that the future value of bitcoin will continue to be $25, otherwise if people believed it would be worth $30, than it would be worth $30 today. My belief is that once it becomes a more common currency for real economic flows, it will drop in value as velocity is a major factor in money value, and any drop will cause a massive devaluation.

In other words, don't worry about bitcoins being valued so highly that we have to sit there counting decimal places by 5 or 6 digits. It is unlikely to ever be a problem, though it would be a problem we would all like to have.

|

|

|

|

Before I left for vacation, I submitted a pull request that makes the default policy for miners "more fees == more likely to get into a block." That will be in the 0.7 release (the policy before was mostly "higher priority == more likely to get into a block"), and I've been encouraging the big mining pool operators to implement something similar if they have their own transaction-selection code. When I get back from vacation I plan on writing code to watch the transactions that do or do not make it into blocks to derive an estimate of the average miners' fee policy, and use that to recommend a reasonable fee to the user. Those changes will let fees float naturally-- users and miners will form a market and fees will rise or fall based on what users are willing to pay and what miners are willing to accept. I don't like the arbitrary, centralized setting of fees that we've had up until now. That is great to hear, the set fee seems way too arbitrary. I was thinking a good way to calculate it is to take the minimum fee per KB of the last 10 blocks. If you want to get your transaction accepted by 20% of the mined blocks, you just need to beat the minimum of 2 of the last 10 blocks. Your client won't need to be totally up to date, and the 10 most recently known blocks should be good enough. Admittedly this is rather simplistic, but it is more useful than a set number. It might also be meaningful to factor in ignored transactions as that would be helpful in the calculation. If the maximum ignored transaction had .0005 as the fee, and the minimum accepted fee was 0.001, then you know the breaking point was somewhere in between. This would require looking at all transactions passing through a node for both validity storing the fees per kb in a db, so this might be not worth the effort. This all gets more complicated if you try to use coin age or include other factors in the calculation, but I don't see why anything else would be useful. When you create a transaction you are paying for space in the blockchain, and that space is measured in bytes. |

|

|

|

|