crairezx20

Legendary

Offline Offline

Activity: 1638

Merit: 1046

|

|

November 30, 2016, 05:58:18 PM |

|

dam and price is up now problem was if i waited to much and price still more down , i had to mine 1-2 day more too have enough to cash out what i needed This is just a nature of bitcoin that the price will keep rising and i think we will see huge price increase again soon before christmass just like last year this is just my own speculation and experience.. and i hope that it will happen soon the same as last year.. .. |

|

|

|

|

|

|

|

|

|

"Bitcoin: mining our own business since 2009" -- Pieter Wuille

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

hacknoid (OP)

|

|

November 30, 2016, 06:12:23 PM |

|

dam and price is up now problem was if i waited to much and price still more down , i had to mine 1-2 day more too have enough to cash out what i needed This is just a nature of bitcoin that the price will keep rising and i think we will see huge price increase again soon before christmass just like last year this is just my own speculation and experience.. and i hope that it will happen soon the same as last year.. .. Short term, fluctuations of up to ~2%, plus or minus, in a day is normal and can always be expected (same goes for stocks). In Bitcoin, they are nearly impossible to reliably guess (too many factors, and too small a market cap/liquidity). It's not a game for the faint of heart, and is certainly not an investment strategy - Bitcoin is not a get rich quick scheme. It may not even be a get rich slow scheme; there are no guarantees. However, historically, the price has trended up over longer time periods - months and years. If you plan to invest and get out, I would say if you wait 6 months you will most likely be ahead in price of where you bought at (again, no guarantees). Pick an exit price that you're happy with and take it and be happy. Or hold as long as you comfortably can and enjoy the roller coaster. Either way, there will always be opportunity for regrets at some point (should have sold sooner, should have held longer, didn't buy enough, etc.), but try not to have them. |

|

|

|

|

BitcoinPC

|

|

December 06, 2016, 06:21:53 AM |

|

dam and price is up now problem was if i waited to much and price still more down , i had to mine 1-2 day more too have enough to cash out what i needed This is just a nature of bitcoin that the price will keep rising and i think we will see huge price increase again soon before christmass just like last year this is just my own speculation and experience.. and i hope that it will happen soon the same as last year.. .. So let see what is happening with bitcoin price in Christmas day, and also it is a last event of this year, so after it, still bitcoin remain $700 to $750, than i think in the year bitcoin couldn't be cross $800. And if we are talking about the next year, So should wait the Christmas day, after it we see the bitcoin price position. |

|

|

|

|

|

Taki

|

|

December 07, 2016, 11:21:56 AM |

|

The price cannot be predicted. Only the major adoption news of bitcoin will increase the price. Nothing else.

I think not the only this one can increase bitcoin's price. the demand to bitcoin can do it as well. The demand is growing now. Every day bitcoin attracts new users of any age of people. And demand is growing and the price is growing as well. |

|

|

|

|

|

geofflosophy

|

|

December 08, 2016, 01:04:04 AM |

|

Where we are, at around $750 today, reminds me a lot of where we were in October 2013 at around $120. An ATH of $3500-$6000 seems very possible within the next 2-3 months.

The higher market cap is making things move slower this time around IMO. No one sitting on a couple million extra USD is like "I need to convert this to BTC tomorrow." They're just sitting there soaking up the liquidity, occasionally dumping a bit to shake weak hands and buy back lower. This hasn't been the case with prior runups because the order of magnitude was lower, and I believe that it is effecting the time scale on your charts. That said, just because it has been slow to this point doesn't mean it can't pickup in a liquidity crunch.

I would be very interested to see this analysis done based on market cap rather than price of individual coins, and maybe using some kind of log(market cap) multiplier on the timescale to reflect the latency moving money out of the banking system into the market as the market cap increases.

|

|

|

|

|

Gleb Gamow

In memoriam

VIP

Legendary

Offline Offline

Activity: 1428

Merit: 1145

|

|

December 12, 2016, 11:53:34 PM |

|

From the desk of Numerai Revisited:I actually read this article a day or two ago! It's a good read, but I'm not sure we're "there" yet. There's a lot more interesting smart contracts that will turn into "smart algorithms" or some-such until people are able to figure out how they work and trade against them. To me, it seems very very unlikely that someone creating a smart hedge fund will not eventually trade against it anonymously once people invest in it. Be careful of shysters who claim to be working in your best interest. If someone cannot clearly explain how they make you money, then YOU are the way THEY make money. Until we have blockchain-based smart contracts, take stories like this with a HUGE grain of salt.  Normally, encryption kind of messes up data to such an extent that you loose all predictive structure after you encrypt something. But Numerai has a very special form of encryption that enables it to actually pass data to the crowd and that's the big innovation of Numerai. With all due respect to Numerai [and Norman Packard], something doesn't smell right. e.g. ... <in the voice of the entity (I) who created/runs the "very special form of encryption thingy">: I love Kellogg cereal. Today, I will buy X amount of Kellogg shares knowing full well that within 48 hours its price is gonna rise thanks to the use of my "very special form of encryption thingy" blasting data to my special astute investors. <three days later> Fuck me in the ass! Like WTF, only 11.4% profit? Fuck Kellogg's! Today I'm going to buy X shares of World Wrestling Entertainment AND Premier Exhibitions, then tweak my "very special form of encryption thingy" just a tad prior to blasting the el pumpo to, again, my special astute investors. According to my calculations performed on my Casio calculator, I should have no prob recognizing no less than 18.1043% on the ROI meter.  "Numerai!" "Numerai!"

|

|

|

|

|

|

hacknoid (OP)

|

|

December 19, 2016, 02:37:05 PM |

|

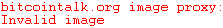

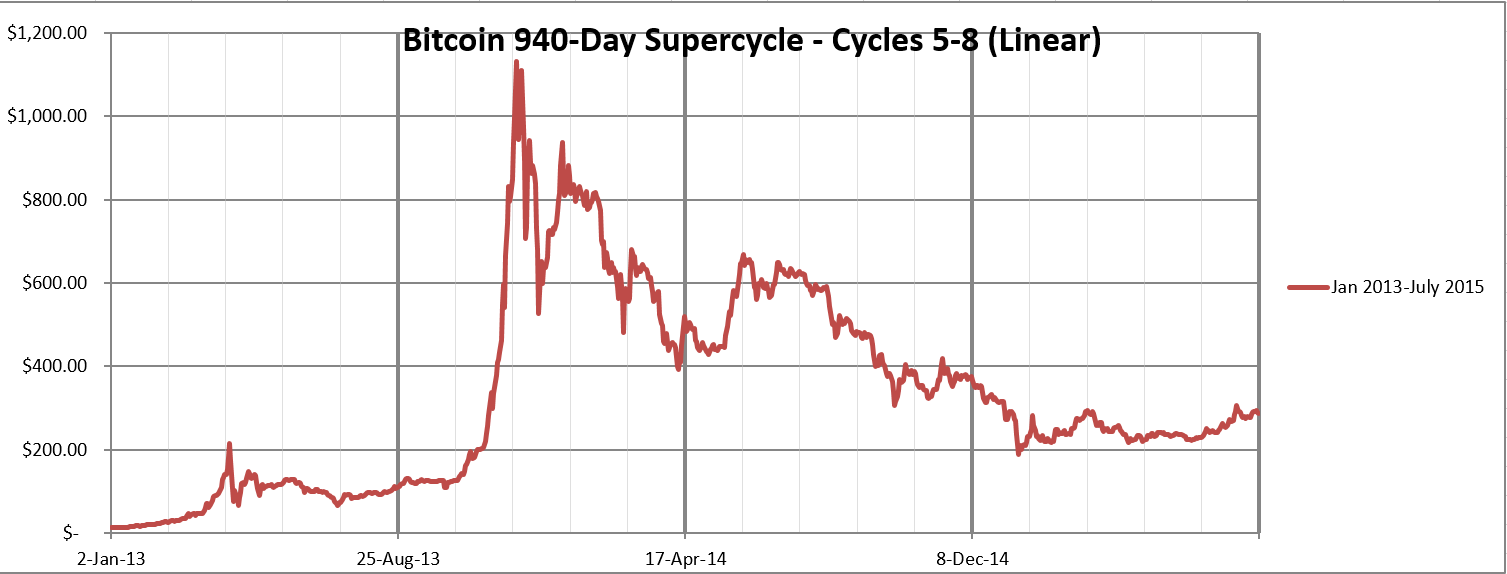

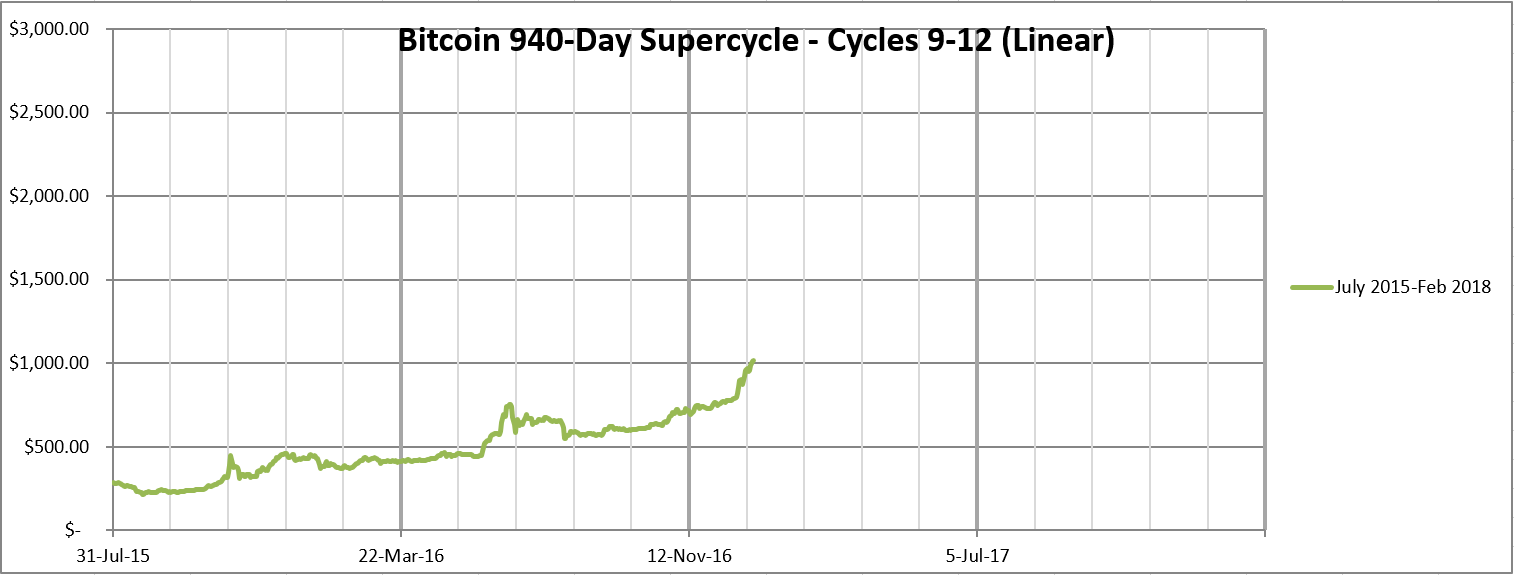

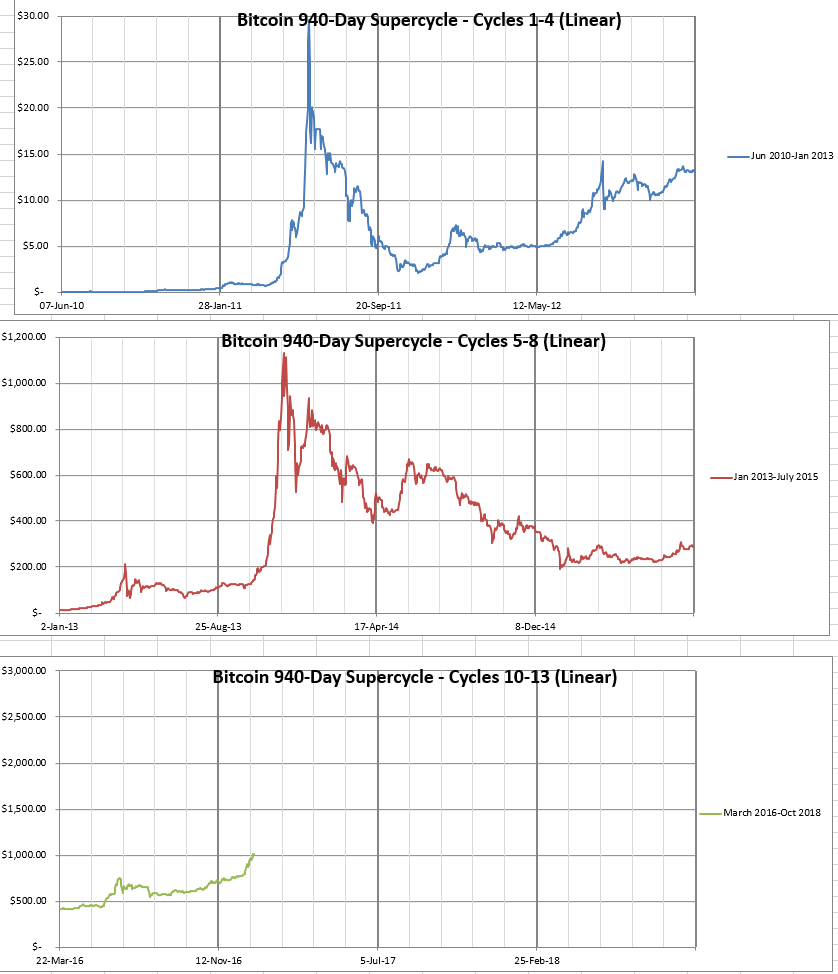

So... interesting; I came across this this morning in my twitter feed: https://www.tradingview.com/chart/BCHAIN/MKPRU/nvcHNfKD-The-235-Day-Cycle-somehow-is-Still-Not-Dead/Looking at it, there definitely seems to be something happening for at least a local maximum every 235 days or so... this comes pretty close to my 900-day cycle (which is strictly peak-to-peak), so I'm starting to look into maybe a 940-day super-cycle, divided into four 235 day phases or sub-cycles. This would still correspond to a new ATH reached each cycle (we again are in cycle 3 and have not yet reached this point), but would help to predict local maxima. It also falls away from the strict interpretation of where the peaks and valleys are, but keeps the concept of the cycle. I'll be looking into this more probably in a few weeks. Interestingly, my initial finding (in previous thread) of a 670 (later refined to 694) day cycle is very close to a multiple of 235 days (705 days), which is still in agreement in principle. In fact, changing from a 670 to 900 day cycle is a delta of 230 days, or almost exactly the length of one of these sub-cycles. BTW, for those asking about analysis based on market cap: I have done initial review, and the trending is not very different. The cycle trends stay the same, although the long-term graphs look a bit different. I'll finish up some work on those also, sometime soon, once Christmas is passed. |

|

|

|

|

|

Raize

Donator

Legendary

Offline Offline

Activity: 1419

Merit: 1015

|

|

January 02, 2017, 07:07:55 PM |

|

I noticed we've had some crazy increases recently and just wanted to say that the two algorithms of my own here that I posted earlier in this thread have been thoroughly trashed now due to these recent price increases. Unless the market is heavily overbought, I have no way to use them or anything I've worked on to justify the present price. It's not uncommon to see some drastic volatility in Bitcoin, but even my estimates would have never predicted we'd see $1k or more this early. The scale of the increases is just too high for Bitcoin to be closing in on its all-time high this soon. Even my most accelerated version had us not hitting parity till after April of 2017. Unless there's a huge sell off or stagnation in price for the next four months, I'm not sure my algorithm will be anything close to legit.

That could be a good thing, maybe it means the price is going much higher much sooner, and it could mean hacknoid's 900 day cycles could be more accurate, even if they did kind of lag early on.

|

|

|

|

|

|

njcarlos

|

|

January 02, 2017, 07:12:46 PM |

|

I noticed we've had some crazy increases recently and just wanted to say that the two algorithms of my own here that I posted earlier in this thread have been thoroughly trashed now due to these recent price increases. Unless the market is heavily overbought, I have no way to use them or anything I've worked on to justify the present price. It's not uncommon to see some drastic volatility in Bitcoin, but even my estimates would have never predicted we'd see $1k or more this early. The scale of the increases is just too high for Bitcoin to be closing in on its all-time high this soon. Even my most accelerated version had us not hitting parity till after April of 2017. Unless there's a huge sell off or stagnation in price for the next four months, I'm not sure my algorithm will be anything close to legit.

That could be a good thing, maybe it means the price is going much higher much sooner, and it could mean hacknoid's 900 day cycles could be more accurate, even if they did kind of lag early on.

Good read: http://www.zerohedge.com/news/2017-01-02/bitcoin-surges-above-1000-china-unveils-new-capital-controls |

|

|

|

|

|

hacknoid (OP)

|

|

January 04, 2017, 12:34:33 AM |

|

So... interesting; I came across this this morning in my twitter feed: https://www.tradingview.com/chart/BCHAIN/MKPRU/nvcHNfKD-The-235-Day-Cycle-somehow-is-Still-Not-Dead/Looking at it, there definitely seems to be something happening for at least a local maximum every 235 days or so... this comes pretty close to my 900-day cycle (which is strictly peak-to-peak), so I'm starting to look into maybe a 940-day super-cycle, divided into four 235 day phases or sub-cycles. This would still correspond to a new ATH reached each cycle (we again are in cycle 3 and have not yet reached this point), but would help to predict local maxima. It also falls away from the strict interpretation of where the peaks and valleys are, but keeps the concept of the cycle. I'll be looking into this more probably in a few weeks. Interestingly, my initial finding (in previous thread) of a 670 (later refined to 694) day cycle is very close to a multiple of 235 days (705 days), which is still in agreement in principle. In fact, changing from a 670 to 900 day cycle is a delta of 230 days, or almost exactly the length of one of these sub-cycles. BTW, for those asking about analysis based on market cap: I have done initial review, and the trending is not very different. The cycle trends stay the same, although the long-term graphs look a bit different. I'll finish up some work on those also, sometime soon, once Christmas is passed. So I have done some more analysis, based on this article on TradingView; if I extend each cycle into 940 days, and make the phases 235 days, they look like this (from this point, I am taking to calling each 235-day grouping a "cycle" and the larger ones "supercycles")    Now what I see here definitely corresponds to a supercycle in cycles 1-4 and again in 5-8, but things have changed in 9-12. Why? Well, looks like it could be the change to a strong bear market following the China crackdown/Mt. Gox debacle at the start of 2014 (cycles 7-8). I think what that did is break the supercycle trend and it had to start all over again once the market sentiment changed bullish again (starting at the end of cycle  . So, keeping the same 235-day cycles and omitting cycle 9, the third supercycle now looks like:  Now note that the start and end of each cycle is completely arbitrary at this point, but that doesn't matter when it comes to comparing cycles and supercycles (the length is what matters, and that stays the same). Using this formulation and comparing just the supercycles, it looks like this:  So there you go. I think the cycles still exist. I'll look into playing with the ending points of cycles and seeing what more I can glean, but looks good for now. |

|

|

|

|

Shiroslullaby

|

|

January 04, 2017, 01:21:44 AM |

|

Thank you hacknoid, that is some very good analysis and the charts are great.

If I'm reading this right, we are in the middle of a strong peak which might actually fall to the $700 to $800 range in the next couple of months?

That would actually be perfect. I would be able to cash some out for fiat or trade for alt-coins and then re-buy when everyone sells their Bitcoin a few hundred dollars cheaper than they are right now.

Or am I reading this all wrong?

|

|

|

|

|

hacknoid (OP)

|

|

January 04, 2017, 01:30:57 PM |

|

Thank you hacknoid, that is some very good analysis and the charts are great.

If I'm reading this right, we are in the middle of a strong peak which might actually fall to the $700 to $800 range in the next couple of months?

That would actually be perfect. I would be able to cash some out for fiat or trade for alt-coins and then re-buy when everyone sells their Bitcoin a few hundred dollars cheaper than they are right now.

Or am I reading this all wrong?

Well, first let me give the usual disclaimer - past results are not a guarantee of future performance! As much as the price seems to follow cycles, don't bet on anything; anyone that is predicting the price is purely speculating, so we just have to wait and see. Now, that being said, my look of things seems to indicate we are on the uptrend of a strong peak; following the 235-day cycle theory, there should be a local peak around February 16th, 2017. Now, that could mean that we drop down before that then go up again (possibly not as high as we already are), or that we continue the trend up and up past the previous ATH and the Valentine's Day peak will be even higher. Following the theory that we are in a supercycle, then that would be the likely outcome. But I'll also point out a few other things: - One of the most prescient observer's that I have seen in a long time, Vinny Lingham, has indicated in his latest post that Bitcoin could reach $3000 before the end of 2017; he's been an excellent reader of the market and Bitcoin, and has been remarkably correct for 2016, so I would put faith in his prediction.

- In each of the cycles I outlined, when we are in a bullish trend the cycle ends higher than it started (though this would be affected by choice of start "dates" of a cycle). Indicates to me that we will likely not drop back below $900 probably

- Each uptrend in Bitcoin's history has followed what I refer to as the "Bitcoin heartbeat", where after the peak is reached, we correct to a midpoint that reaches (as low as) halfway from the starting price to the peak price; in this current beat, the starting price was around $800, meaning the current corrected price might reach $950 (possibly dipping below that, very temporarily); the higher the peak is, the higher the corrected price would also be

- We are just re-entering mainstream media coverage, meaning there could be more demand coming in soon from new buyers. We will see.

- I believe we are only now seeing the result of the latest halving coming into play; I believe many people held onto coins from well before the last halving in the expectation of higher prices, and have since started to liquidate them during the latest price rise. However that supply is rapidly running out (maybe already has), meaning demand is exceeding supply even more as time goes on.

At this point there is no way in hell that I personally would want to be in alts; there may be potential upside much greater than Bitcoin, but you would either have to be a top trader or else manipulate those small markets in order to expect to see those gains - or else be incredibly lucky. But it seems to me Bitcoin gains would be much more likely to achieve, even if it wasn't on the order of 5x-10x like alts could give. That's my current take; we are rapidly approaching uncharted territory with new ATHs and prices not seen in years. So nobody knows what happens, but personally I still feel very bullish. |

|

|

|

|

hacknoid (OP)

|

|

January 05, 2017, 03:47:10 PM |

|

- Each uptrend in Bitcoin's history has followed what I refer to as the "Bitcoin heartbeat", where after the peak is reached, we correct to a midpoint that reaches (as low as) halfway from the starting price to the peak price; in this current beat, the starting price was around $800, meaning the current corrected price might reach $950 (possibly dipping below that, very temporarily); the higher the peak is, the higher the corrected price would also be

|

|

|

|

|

hacknoid (OP)

|

|

February 02, 2017, 01:13:25 PM |

|

Now, that being said, my look of things seems to indicate we are on the uptrend of a strong peak; following the 235-day cycle theory, there should be a local peak around February 16th, 2017. Now, that could mean that we drop down before that then go up again (possibly not as high as we already are), or that we continue the trend up and up past the previous ATH and the Valentine's Day peak will be even higher. Following the theory that we are in a supercycle, then that would be the likely outcome. But I'll also point out a few other things:

Well, the trend indicated we could hit a local maximum around Valentine's Day, and here we are trending up again as we are 2 weeks out. With all the financial and political instability now, looks like we could be heading to a peak again right around that time!  |

|

|

|

xIIImaL

Legendary

Offline Offline

Activity: 1372

Merit: 1005

|

|

February 02, 2017, 01:45:04 PM |

|

Now, that being said, my look of things seems to indicate we are on the uptrend of a strong peak; following the 235-day cycle theory, there should be a local peak around February 16th, 2017. Now, that could mean that we drop down before that then go up again (possibly not as high as we already are), or that we continue the trend up and up past the previous ATH and the Valentine's Day peak will be even higher. Following the theory that we are in a supercycle, then that would be the likely outcome. But I'll also point out a few other things:

Well, the trend indicated we could hit a local maximum around Valentine's Day, and here we are trending up again as we are 2 weeks out. With all the financial and political instability now, looks like we could be heading to a peak again right around that time!  I do not think it is because of valentine's day. You can check the price chart, it will show like bitcoin value is increasing in the month of November, December and first part of January. Then we can see the price pump in the month of April. Dips we cannot identify it due to btc price volatility. |

|

|

|

|

Raize

Donator

Legendary

Offline Offline

Activity: 1419

Merit: 1015

|

|

February 02, 2017, 04:39:11 PM |

|

I still hold that March/April (and maybe a bit into May) is going to be a key period as well. There's also reason to see this politically as it's becoming more likely that Brexit is going to be "official" with Article 50 around then, Netherlands vote on exit, France's elections. Then by August we'll have Germany's elections, too, so it's important to note that several of the polls aren't really in EU's favor right now and will likely be very much not in their favor considering all these elections by April.

|

|

|

|

|

|

Bitcoinsummoner

|

|

February 02, 2017, 04:59:53 PM |

|

So... interesting; I came across this this morning in my twitter feed: https://www.tradingview.com/chart/BCHAIN/MKPRU/nvcHNfKD-The-235-Day-Cycle-somehow-is-Still-Not-Dead/Looking at it, there definitely seems to be something happening for at least a local maximum every 235 days or so... this comes pretty close to my 900-day cycle (which is strictly peak-to-peak), so I'm starting to look into maybe a 940-day super-cycle, divided into four 235 day phases or sub-cycles. This would still correspond to a new ATH reached each cycle (we again are in cycle 3 and have not yet reached this point), but would help to predict local maxima. It also falls away from the strict interpretation of where the peaks and valleys are, but keeps the concept of the cycle. I'll be looking into this more probably in a few weeks. Interestingly, my initial finding (in previous thread) of a 670 (later refined to 694) day cycle is very close to a multiple of 235 days (705 days), which is still in agreement in principle. In fact, changing from a 670 to 900 day cycle is a delta of 230 days, or almost exactly the length of one of these sub-cycles. BTW, for those asking about analysis based on market cap: I have done initial review, and the trending is not very different. The cycle trends stay the same, although the long-term graphs look a bit different. I'll finish up some work on those also, sometime soon, once Christmas is passed. So I have done some more analysis, based on this article on TradingView; if I extend each cycle into 940 days, and make the phases 235 days, they look like this (from this point, I am taking to calling each 235-day grouping a "cycle" and the larger ones "supercycles")    Now what I see here definitely corresponds to a supercycle in cycles 1-4 and again in 5-8, but things have changed in 9-12. Why? Well, looks like it could be the change to a strong bear market following the China crackdown/Mt. Gox debacle at the start of 2014 (cycles 7-8). I think what that did is break the supercycle trend and it had to start all over again once the market sentiment changed bullish again (starting at the end of cycle  . So, keeping the same 235-day cycles and omitting cycle 9, the third supercycle now looks like:  Now note that the start and end of each cycle is completely arbitrary at this point, but that doesn't matter when it comes to comparing cycles and supercycles (the length is what matters, and that stays the same). Using this formulation and comparing just the supercycles, it looks like this:  So there you go. I think the cycles still exist. I'll look into playing with the ending points of cycles and seeing what more I can glean, but looks good for now. Your great on analyzing but you think it could be happen again.. since almost movement of bitcoin price are same movement but in different price . Well we there is no exact time that the price could be the same spikes but theres no problem for trying it and set own margin and make some profit.. This is what happen right the price are gradually increasing just like before.. the spike still same but the date are not.. Lets hope that we can make a good result this coming months.. |

|

|

|

|

Kimpoiluiseta

|

|

February 03, 2017, 11:14:27 AM |

|

I still hold that March/April (and maybe a bit into May) is going to be a key period as well. There's also reason to see this politically as it's becoming more likely that Brexit is going to be "official" with Article 50 around then, Netherlands vote on exit, France's elections. Then by August we'll have Germany's elections, too, so it's important to note that several of the polls aren't really in EU's favor right now and will likely be very much not in their favor considering all these elections by April.

I think this now is right time and good time to selling in bitcoin if last month, you buy in level bitcoin price under 800 dollar, this now every one bitcoin can get profit over 200 dollar |

|

|

|

|

ASHLIUSZ

|

|

February 03, 2017, 11:37:59 AM |

|

I still hold that March/April (and maybe a bit into May) is going to be a key period as well. There's also reason to see this politically as it's becoming more likely that Brexit is going to be "official" with Article 50 around then, Netherlands vote on exit, France's elections. Then by August we'll have Germany's elections, too, so it's important to note that several of the polls aren't really in EU's favor right now and will likely be very much not in their favor considering all these elections by April.

I think this now is right time and good time to selling in bitcoin if last month, you buy in level bitcoin price under 800 dollar, this now every one bitcoin can get profit over 200 dollar Even if its a 20$ that's a good profit as the price increase happens without any work. So people who have been holding long for a increase in price can sell and cash it out to buy when the price falls back to a lower price than the current price. |

|

|

|

|

|