Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

March 28, 2024, 08:38:33 PM

Last edit: March 29, 2024, 05:34:20 PM by Biodom |

|

My take on price targets, etc..longer term view.

Previously I thought that we would likely peak at around 150-160K for this cycle.

However, the following occurred to me recently and presented a "new" pattern related to bitcoin market:

1. Bitcoin ETFs is the fastest growing ETF (even when counting just iBIT) EVER.

2. Before, say, 2020, only "true" hard core bitcoiners, including OGs (with more than, say, 8 years of experience or two full cycles) accumulated btc.

Most people used it as a speculation vehicle, although this has been progressively changing, maybe since 2020.

3. Fiat continues to be printed and easing would most likely commence relatively soon (worldwide). A simple reason is that governments cannot afford to keep paying large interest on their already large debt and pay for this with yet a new "layer" of debt. When people do this with credit cards, bankruptcy ensues relatively soon.

4. There are large cohorts of investors that learned to buy into ETFs, then contribute regularly, making an investment that is essentially automatic and DCA-like.

5. Gold appreciated about 5X in seven years after ETF, practically going straight up steadily, undeterred (mostly) even by the GFC in 2008.

All this suggest to me that it would be very difficult to predict an actual top as it is maybe 8 years or a decade away.

Well, a temporary top may, indeed, occur at 150-200K, but if the correction would be shallow by bitcoin's criteria, like 20-30%, then would it even be a "real" cycle going forward?

Instead, we might switch to a "utility cycle" or "adoption cycle" until at least $20 tril ($1 mil) plus minus 30% or even more, perhaps.

|

|

|

|

|

|

|

|

|

|

Whoever mines the block which ends up containing your transaction will get its fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

March 28, 2024, 08:50:00 PM |

|

Goodbye, Sam Bankman-Fried

Though I never knew you at all

You were a curly haired scamming cunt

While those around you had a ball

They crawled out of the woodwork

And like you, they all belong in jail

You only got 25 years behind bars

But I'm so glad that we got to see you fail

Lol, what a fkn joke. The establishment propped this guy up, gave him oodles of cash, and gave him all the rope in the world to hang himself. And he did. Just like they knew he would. What better way to produce the "rug pull" future event, than to allow it to create itself? Then when it all collapses, they can swoop in and clean it all up, all nice and tidy, and then send the signal to the normies that "It's all clear to invest now. No worries. This kind of thing won't happen again in the future." Sure it won't.    As funny as it is to see him fail, as always, I would have preferred to see the ones he donated to and clearly kept the charade going as long as no one found out, to be locked up. Ya know what one of the biggest kickers of this whole thing is? "Both Joseph Bankman and Barbara Fried, who are Stanford Law professors, were sitting in the first row of the courtroom gallery during the sentencing." Wow, top Standford Law profs, and they couldn't advise their son on how to stay out of fucking jail by avoiding massive financial fraud.  I mean, who was the CLO on his payroll? Daffy Duck? This whole thing reeks. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

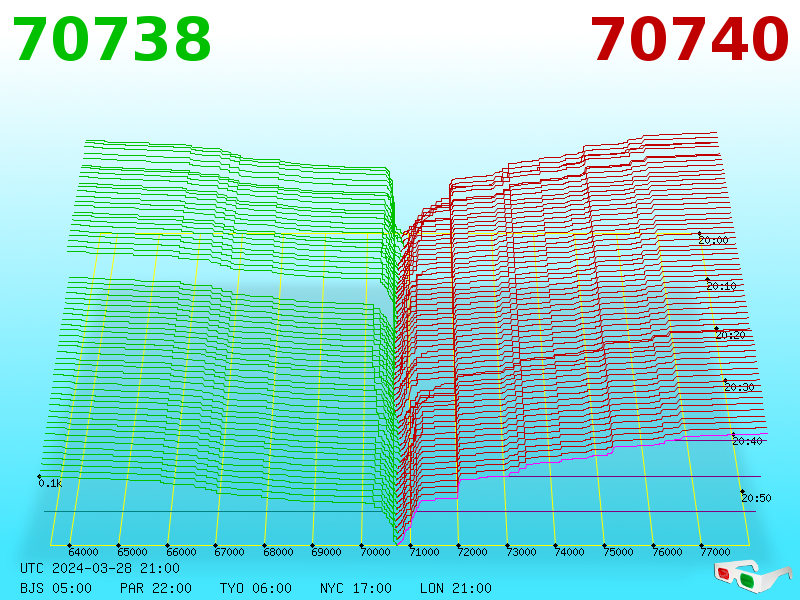

March 28, 2024, 09:01:15 PM |

|

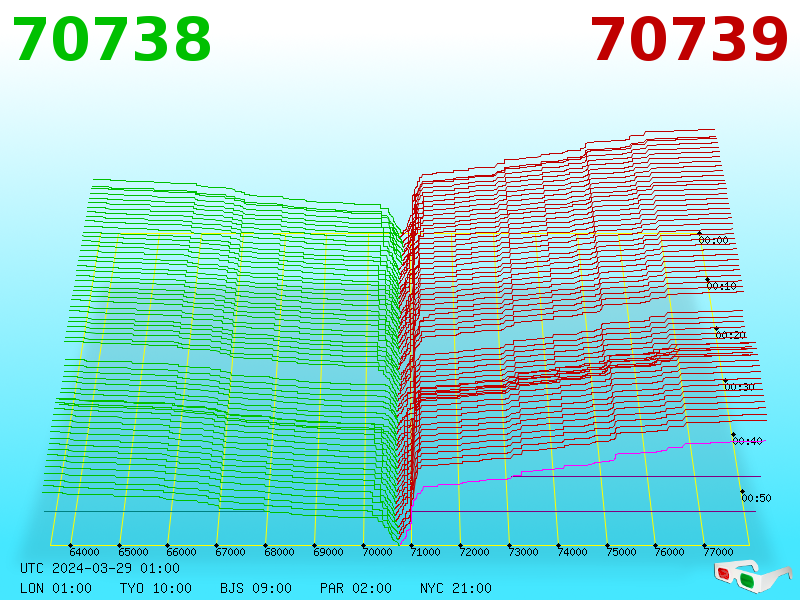

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

letteredhub

Full Member

Offline Offline

Activity: 504

Merit: 198

If bitcoin be for me...

|

|

March 28, 2024, 09:28:46 PM |

|

TL/DR

It may look like a peak when BTC and the noise around it is too heavily in the mainstream but one day that might just be Bitcoin itself becoming the mainstream, due to adoption like cars, electricity or the internet.

Comparison check as around a decade back I don't think I heard people talking about bitcoin on the street the way they do now, not even on the internet did it had the volume of discussion and engagements it does have now on all social platforms. Bitcoin to me is already a mainstream in the pipeline and unlike cars , electricity and the internet, the speed of bitcoin adoption is rapid than those even despite not having the government backing as the latter examples you had given. Within this circle able to break above a $100k price mark I am having that conviction that bitcoin will be gaining a 3x adoption that it's currently enjoying in another decade from now. |

|

|

|

|

|

Gachapin

|

|

March 28, 2024, 09:29:47 PM |

|

My take on price targets, etc..longer term view.

Previously I thought that we would likely peak at around 150-160K for this cycle.

However, the following occurred to me recently and presented a "new" pattern related to bitcoin market:

1. Bitcoin ETFs is the fastest growing ETF (even when counting just iBIT) EVER.

2. Before, say, 2020, only "true" hard core bitcoiners, including OGs (with more than, say, 8 years of experience or two full cycles) accumulated btc.

Most people used it as a speculation vehicle, although this has been progressively changing, maybe since 2020.

3. Fiat continues to be printed and easing would most likely commence relatively soon (worldwide). A simple reason is that governments cannot afford to keep paying large interest on their already large debt and pay for this with yet a new "layer" of debt. When people do this with credit cards, bankruptcy ensues relatively soon.

4. There are large cohorts of investors that learned by buy into ETFs, then contribute regularly, making an investment that is essentially automatic and DCA-like.

5. Gold appreciated about 5X in seven years after ETF, practically going straight up steadily, undeterred (mostly) even by the GFC in 2008.

All this suggest to me that it would be very difficult to predict an actual top as it maybe be 8 years or a decade away.

Well, a temporary top may, indeed, occur at 150-200K, but if the correction would be shallow by bitcoin's criteria, like 20-30%, then would it even be a "real" cycle going forward?

Instead, we might switch to a "utility cycle" or "adoption cycle" until at least $20 tril ($1 mil) plus minus 30% or even more, perhaps.

this explains pretty much how I feel. thanks. |

|

|

|

|

|

Gachapin

|

|

March 28, 2024, 09:32:09 PM |

|

Goodbye, Sam Bankman-Fried

Though I never knew you at all

You were a curly haired scamming cunt

While those around you had a ball

They crawled out of the woodwork

And like you, they all belong in jail

You only got 25 years behind bars

But I'm so glad that we got to see you fail

Lol, what a fkn joke. The establishment propped this guy up, gave him oodles of cash, and gave him all the rope in the world to hang himself. And he did. Just like they knew he would. What better way to produce the "rug pull" future event, than to allow it to create itself? Then when it all collapses, they can swoop in and clean it all up, all nice and tidy, and then send the signal to the normies that "It's all clear to invest now. No worries. This kind of thing won't happen again in the future." Sure it won't.    As funny as it is to see him fail, as always, I would have preferred to see the ones he donated to and clearly kept the charade going as long as no one found out, to be locked up. Ya know what one of the biggest kickers of this whole thing is? "Both Joseph Bankman and Barbara Fried, who are Stanford Law professors, were sitting in the first row of the courtroom gallery during the sentencing." Wow, top Standford Law profs, and they couldn't advise their son on how to stay out of fucking jail by avoiding massive financial fraud.  I mean, who was the CLO on his payroll? Daffy Duck? This whole thing reeks. haha good point. he will not have killed himself  |

|

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

March 28, 2024, 09:45:36 PM |

|

"Ultra Bullish: 250k" ?? I don't think you know what the badger is capable of

Haha I probably dont, I'm entering this cycle as my 2nd cycle. You could classify me as a bit conservative and I get that, but I'm also trying to be realistic too. Honestly if Ultra Bullish PT will be 400K+ then dont you worry: My exuberance with BTC @ 400k > My anguish at being wrong   |

|

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

March 28, 2024, 09:56:27 PM |

|

My take on price targets, etc..longer term view.

.

.

snip

..

4. There are large cohorts of investors that learned by buy into ETFs, then contribute regularly, making an investment that is essentially automatic and DCA-like.

This one point is definitely important to make, will it smooth some of the rough edges of current cycle. I'm still much more aligned to the 4 year cycle, and its probably going to take a change in that to at first make me consider that there is change in it. It would certainly increase the % acceptance that the cycle has changed and will continue to change. Some of the things that have changed, or at least different is all this movement pre halving. I expected a little bit of it but the prices is about 25-30% higher than I thought it would this early. That ETF volume is a monster, when Fink said earlier that "we see this kind of retail demand". Is retail the bulk of the buying? Have the institutions not really started yet. That was interesting way to say it, or does Fink consider everyone to be retail? If that the truth, we are in for wild ride of uppity. https://www.youtube.com/watch?v=_LssQegEHMg |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

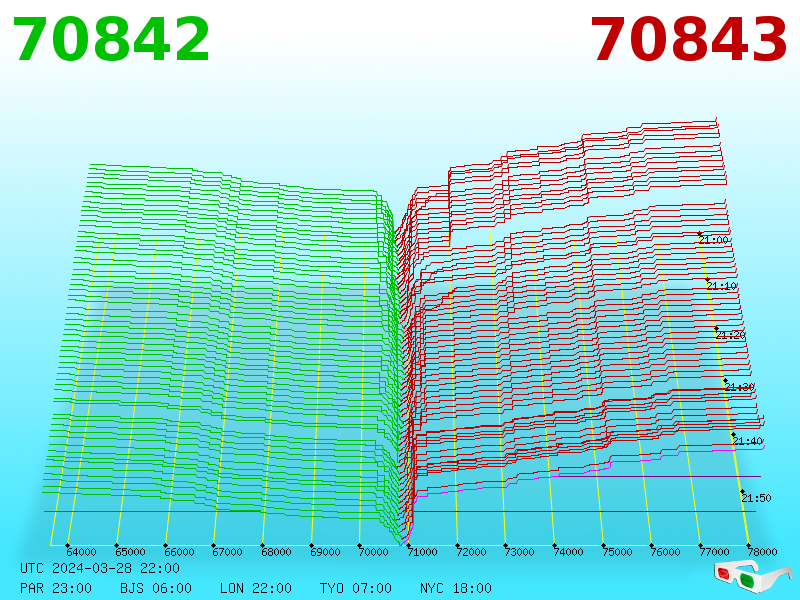

March 28, 2024, 10:01:13 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 28, 2024, 10:01:23 PM |

|

We’re only 2 months in, imagine what price we will be at in 12 months from now, after the block reward halving. I really believe $250,000 is possible, if not likely thus cycle.

Your repetition of such bearish numbers is causing me depression.  #justsaying #justsayingAre you preoared, anon?

I suspect that you had meant to say "pee pared?" ChartBuddy's Daily Wall Observation recap All Credit to ChartBuddySo does this mean that in the past few days, you started to time the ChartBuddy recap to run from midnight UTC until the following midnight? That seems good, so that we would know that the first ones in the run would be early in the day and the last ones in the run would be at the end of the day, in terms of UTC.. Maybe you could add some kind of a description of that, so that it is easier to understand how it runs? I personally have been tending to look more at the recaps rather than the actual ChartBuddys, since that provides a lot of juxtaposition of each of the hourly reports and if one or more of them stand out, then that could motivate going back and looking at the one or two that stand out. That does feel good, if successful, to have it run on the UTC day. Been a few minutes late. I changed the name from 24 hour recap to Daily recap accordingly. Perhaps Daily UTC recap? I will give my opinion, though I am not exactly attached to any of it.. so if a guy gives some better name or explanation, then that would be fine since any of those names seem o.k... So whatever the name, there could be an explanation that start time for the recap is 01:00 UTC, and end time is 00:00 UTC.. Just to make it clear.. regarding the start and end time... and even though based on nomenclature, it would seem logical that start time should be 00:00 rather than 01:00.. yet I can see that reasonably, you consider 00:00 to be like 24:00 rather than 00:00.. which is a reasonable interpretation.. |

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

Well, as everyone here knows, I'm still a newbie (BTC since 2021)

Anyway, this still unexplored price region (ATH) also depends a lot on human behavior, I don't know about you, but currently when I see the price of bitcoin below 65...66k USD my conscience says that it's a cheap price to buy, that's strange, because a few weeks ago we could say that the price at 66 was already very high....

I believe this should happen to most people who follow the price of BTC... does that make sense? Or does this just ONLY happen to me?

This is very typical and repeats a lot. You are either in the "dang" 60k is expensive or "dang" 60k is cheap. If you want to elevate out of these perspectives you need to think less about the price in the moment and come at it from a price target perspective. e.g is the current price cheaper than my target price. My target price's for this cycle are Very Conservative: 110k Conservative: 138k Bullish: 170k Ultra Bullish: 250k If we go up past or close to 110k will start to reprice the high target to next level, so I always have the perspective in this cycle that "dang" XXXk is cheap. Keep stacking :-) Target for this year: 170K. Because of, reasons. |

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1656

Verified Bitcoin Hodler

|

|

March 28, 2024, 10:52:48 PM |

|

Well, as everyone here knows, I'm still a newbie (BTC since 2021)

Anyway, this still unexplored price region (ATH) also depends a lot on human behavior, I don't know about you, but currently when I see the price of bitcoin below 65...66k USD my conscience says that it's a cheap price to buy, that's strange, because a few weeks ago we could say that the price at 66 was already very high....

I believe this should happen to most people who follow the price of BTC... does that make sense? Or does this just ONLY happen to me?

This is very typical and repeats a lot. You are either in the "dang" 60k is expensive or "dang" 60k is cheap. If you want to elevate out of these perspectives you need to think less about the price in the moment and come at it from a price target perspective. e.g is the current price cheaper than my target price. My target price's for this cycle are Very Conservative: 110k Conservative: 138k Bullish: 170k Ultra Bullish: 250k If we go up past or close to 110k will start to reprice the high target to next level, so I always have the perspective in this cycle that "dang" XXXk is cheap. Keep stacking :-) Target for this year: 170K. Because of, reasons. I absolutely like those reasons. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 28, 2024, 10:54:07 PM |

|

Well, as everyone here knows, I'm still a newbie (BTC since 2021)

Anyway, this still unexplored price region (ATH) also depends a lot on human behavior, I don't know about you, but currently when I see the price of bitcoin below 65...66k USD my conscience says that it's a cheap price to buy, that's strange, because a few weeks ago we could say that the price at 66 was already very high....

I believe this should happen to most people who follow the price of BTC... does that make sense? Or does this just ONLY happen to me?

ONLY you. Goodbye, Sam Bankman-Fried

Though I never knew you at all

You were a curly haired scamming cunt

While those around you had a ball

They crawled out of the woodwork

And like you, they all belong in jail

You only got 25 years behind bars

But I'm so glad that we got to see you fail

Lol, what a fkn joke. The establishment propped this guy up, gave him oodles of cash, and gave him all the rope in the world to hang himself. And he did. Just like they knew he would. What better way to produce the "rug pull" future event, than to allow it to create itself? Then when it all collapses, they can swoop in and clean it all up, all nice and tidy, and then send the signal to the normies that "It's all clear to invest now. No worries. This kind of thing won't happen again in the future." Sure it won't.    Yesterday, I posted on the topic of Sam and the strangeness of the whole situation in another thread, which I think bears reposting here. So.. yeah we are looking forward to tomorrow and the sentencing of Sam.. and so quite a bit of curiosities regarding what ends up being the sentence. Don't get me wrong, but I don't really like Sam, and I think that he is pretty damned close to a total fraud, yet I think that Professor Jonathan Lipson makes a lot of very good points about how Sam's law firm (Sullivan & Cromwell and Quinn Emanuel Urquhart & Sullivan) (and perhaps John J. Ray, too?) pretty much threw Sam under the bus and engaged in a lot of problematic behaviors when they both took over the FTX and also failed/refused to allow for an examiner, until recently.. and so now that an examiner is going to be assigned to FTX, that same lawfirm is likely going to continue to cover up the extent to which they were responsible for some of the problems with FTX.. and they ended up engaging in a cover-up... What a bunch of bullshit that there are so many injustices in the world, and sure probably Sam is quite culpable, but there may well be several of the lawfirm folks and perhaps the trustee who are also criminally responsible too. You can listen to Jonathan Lipson discuss these matters for about 45 minutes in Michael Lewis's Judging Sam podcast. Well, as everyone here knows, I'm still a newbie (BTC since 2021)

Anyway, this still unexplored price region (ATH) also depends a lot on human behavior, I don't know about you, but currently when I see the price of bitcoin below 65...66k USD my conscience says that it's a cheap price to buy, that's strange, because a few weeks ago we could say that the price at 66 was already very high....

I believe this should happen to most people who follow the price of BTC... does that make sense? Or does this just ONLY happen to me?

I remember the time when we used to say "everything under $1000 is cheap", then that saying changed only a little when the price reached $10 000 - and today we can say "everything under $100k is cheap". If by any chance you ever bought BTC at a price of a few hundred $, what would you think today about how expensive it actually is to buy BTC? I've thought about this a few times, how much the dynamics of the moment can change our perception of price, whether it's expensive or cheap... The best price I could buy BTC was 16,000 USD, but I also bought it at higher prices and found it cheap in a way... The way things are right now we can consider a price below 100k (or 70k) can still be considered cheap... I think the ideas of cheap or expensive change from price region to price region... this change in price mentality. For sure, perceptions of cheapness may also depend upon whether you have any BTC at all and/or if you might be a low coiner, and so sure, guys who have been accumulating BTC for a while have a certain amount of luxury to sit back and suggest that BTC is no longer cheap, yet guys who are either just coming to BTC or maybe they had been less aggressive than they should have been or could have been at earlier dates, then they might be feeling that they need to catch up and they cannot turn back the clock, so they are somewhat forced into a perception of relative "cheapness." Many of us likely realize that it can take a whole fucking long time to build up an investment portfolio, even if we might consider ourselves to be attempting to reach an appropriate amount of aggressiveness balancing in regards to our BTC accumulation, but then maybe later down the road, we end up realizing that we were way too whimpy in our BTC accumulation approach, and it is not like we can go back in time, so we therefore have to reframe our perceptions of BTC as cheap even though it is currently breaking through previous ATHs and doing such breaking throughs in a way that seems to be even more bullish than a lot of folks had expected.. but then in retrospect, we can also figure out various legitimate reason for why the seemingly earlier than expected break out (and touching upon new ATHs and price exploration) is happening right now. Some folks also become enlightened at a later date, and sure maybe such enlightenment is not going to happen with gold bugs like Peter Schiff or some other seemingly smart people who we might consider should come to recognize and appreciate the bullish case for bitcoin, yet some of those guys might end up being forced to come around or otherwise have fun staying poor or otherwise just end up being too much on the losing side of the greatest wealth transfer known to man.. which surely may cause some of them to consider to wrongly continue to believe that they are too late, rather than recognizing and appreciating the value of getting into bitcoin now (even though they feel late) rather than continuing to wait for price corrections that may well end up not happening. Ego and pride problems too.. and sometimes it is better to just bite the bullet and get the fuck started rather than staying a stubborn person who continues to fail/refuse to sufficiently/adequately pee pare his lil selfie for UPpity. I think it would be the same if I had bought it for 100 USD or 1000 USD... it all depends on the moment, right? Change in perception happens all the time I don't know it if it is the same.. Surely some of us got lucky to be in the right spot (and the right mental framework) at the right time, so a certain level of comfort can later come from earlier employments of front-loading and/or aggressiveness, so some of that could be a bit of luck, including even just having some disposable income to be able to put into it.. which surely can be a challenge for a lot of folks, and I think that there are plenty of recent studies that show that even folks with decently large sizes of disposable income, around half of them do not have shit when it comes to savings and/or investments, and maybe they cannot be completely to blame for such lack of preparedness... so sometimes there can be a certain amount of luck that comes from ending up being a person who both figures out that some level of savings and/or investment is a good thing to work towards and then on the other part they also figure out that bitcoin is a good place to put some of that investment, even if they might feel skeptical about bitcoin, so then it can be understandable that sometimes investors/savers (that have gotten over the first hump of actually saving/investing) will shy away from some kinds of investments that they don't consider to be sufficiently safe places to put even a small amount of their investment/savings allocation (which yeah it could take some looking into the bitcoin matter before starting to build a sufficient amount of confidence to invest in it). human behavior is an inexplicable thing

Sure we are individuals, yet there are a lot of schools of thought that try to explain human behavior, even if they might be claiming to do other things... maybe even the bitcoin school of hard knocks attempts to explain human behavior by the incentives that are structured at various points within it.. and the balances that had been struck (and perhaps amended from time to time) through its code. Well, as everyone here knows, I'm still a newbie (BTC since 2021)

Anyway, this still unexplored price region (ATH) also depends a lot on human behavior, I don't know about you, but currently when I see the price of bitcoin below 65...66k USD my conscience says that it's a cheap price to buy, that's strange, because a few weeks ago we could say that the price at 66 was already very high....

I believe this should happen to most people who follow the price of BTC... does that make sense? Or does this just ONLY happen to me?

This is very typical and repeats a lot. You are either in the "dang" 60k is expensive or "dang" 60k is cheap. If you want to elevate out of these perspectives you need to think less about the price in the moment and come at it from a price target perspective. e.g is the current price cheaper than my target price. My target price's for this cycle are Very Conservative: 110k Conservative: 138k Bullish: 170k Ultra Bullish: 250k If we go up past or close to 110k will start to reprice the high target to next level, so I always have the perspective in this cycle that "dang" XXXk is cheap. Keep stacking :-) "Ultra Bullish: 250k" ?? I don't think you know what the badger is capable of Yeah.. last cycle I had my highest range starting from $1.5 million and higher (with around 0.5% odds), so this cycle has gotta be higher than that, unless I happened to have been wrong the last time around with my assignment of possibilities.. I am not going t concede the assignment to have had been wrong, even though surely the outcome showed that such prices would not even come close to being met within the terms that I had outlined... yet still I would suggest ultra bullish for this particular cycle has to at least get close to $1 million .. or perhaps sub $1 million and higher (such as $800k plus).. would also be acceptable in order to really attempt to recognize and appreciate some of the underlying dynamics that push upon my lil precious prices.. so in that regards to $250k as a "ultra-bullish price target" would maybe be on the relative conservative or perhaps mid-range side of bullish. even though sure there is ONLY around a 3.2x-ish difference between $250k versus $800k plus. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

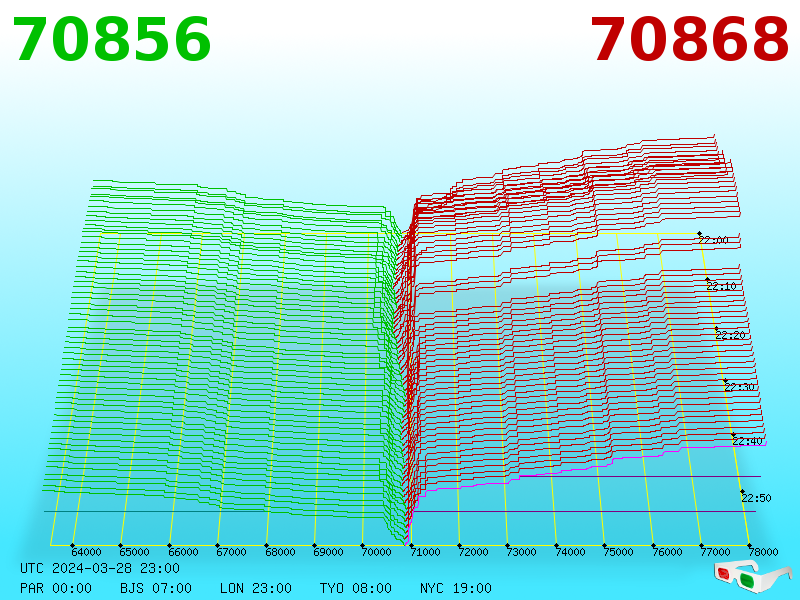

March 28, 2024, 11:01:14 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2352

Merit: 4138

Addicted to HoDLing!

|

|

March 28, 2024, 11:15:07 PM |

|

Sensing a new ATH in the next 24 hours.

Because...reasons.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

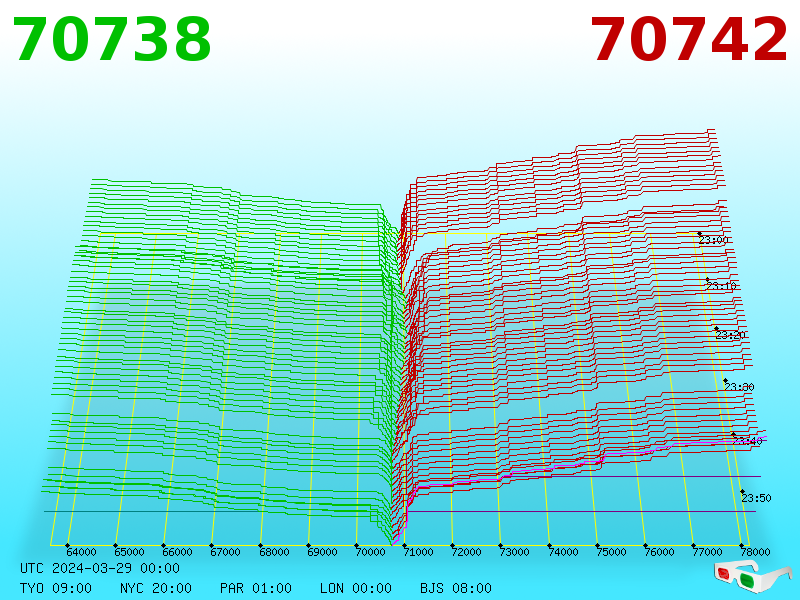

March 29, 2024, 12:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

March 29, 2024, 12:27:29 AM

Last edit: March 29, 2024, 12:42:54 AM by BobLawblaw |

|

Damnit... Another 55 acres of grazing land came up for sale directly south abutting of our homestead... Guess I should do something with this corn... Can't spend it when I'm dead...

Submitted a counter offer earlier today. Cross your fingers for me, gentlemen! |

|

|

|

|

DirtyKeyboard

Sr. Member

Online Online

Activity: 252

Merit: 448

Fly free sweet Mango.

|

|

March 29, 2024, 12:52:51 AM |

|

ChartBuddy's Daily Wall Observation recap . . .All Credit to ChartBuddy |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 29, 2024, 01:01:13 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

March 29, 2024, 01:34:25 AM |

|

Sensing a new ATH in the next 24 hours.

Because...reasons.

peeps are too 'cute' with those unnamed 'reasons'  EDIT: why kitchen remodels are so expensive these days? darn it. |

|

|

|

|

|

Poll

Poll