|

|

|

|

|

|

|

|

|

|

|

Even in the event that an attacker gains more than 50% of the network's

computational power, only transactions sent by the attacker could be

reversed or double-spent. The network would not be destroyed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

dinofelis

|

|

June 04, 2017, 05:01:08 AM |

|

Crypto has the potential to cause the biggest financial catastrophe in history. Could it be possible for it to be the cause AND the cure also as well?

Crypto has introduced the idea to have scarce tokens that are not that easily manipulable without a trusted central authority ; at least, at first sight. On the other hand, this also means that everybody can invent a crypto ; and there's something that has not been tested a lot, but that seems to me to be unavoidable in the long run: successful crypto chains can be split, copied, copied with modifications, etc... Crypto has power games to it, that can lead to a small cartel of people to decide about the modifications of the rules of a crypto. So contrary to what it seems, crypto is NOT a single chain with rules graved in stone ; but the way these are modified, copied, morphed .... are obscure games we are still in the process of discovering. We don't know what the eco-system of many crypto, evolving, morphing, crossing over, being created, .... will look like (for the moment, we see what it looks like: a huge speculative market like the complex derivatives). The only thing such eco system provides, more and more, is a rather opaque means to get value from one place to another that may not see the daylight. As such, it is honouring somewhat its initial purpose of being an anarchist payment method where one can gain a form of economic freedom (for the better - dark markets, avoiding taxes and bribing deciders - or the worse - financing terrorism and ransoms), but the price to pay is that we have created a speculative bomb that will, like any speculative bomb, blow in our face. Will this complex eco system of different morphing crypto come to a kind of equilibrium that gives it a useful economic function apart from the economic freedom I mentioned above, or will it have brought a new form of economic instability one doesn't know how to master ? I don't see how a morphing boiling sea of speculative crypto can bring much good in the long term apart from the side application, which is economic freedom. But maybe this thing will find its own equilibrium and become something that moderates speculation but I don't see how. |

|

|

|

|

|

dinofelis

|

|

June 04, 2017, 05:06:18 AM |

|

2) Bitcoin is different than tulips because tulip trading died because people just couldn't trade it anymore. The government banned it. Bitcoin is invincible in this regard.

I don't know where you got that. The bubble burst because at a public auction of tulips in Haarlem, nobody showed up. The Dutch government would have been quite crazy to ban it, it was Holland's fourth largest export product. |

|

|

|

|

|

HabBear

|

|

June 04, 2017, 05:11:56 AM |

|

Your Subject and OP aren't the same.

To your Subject, I respectfully disagree with you - cryptocurrencies are stores of value, the blockchain is the network.

What does this have to do with bubbles? Everything. Stores of value have bubbles. Networks not so much.

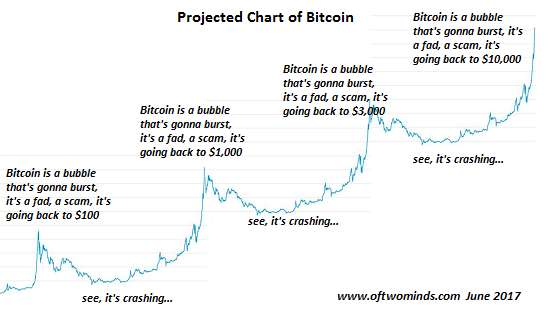

To your article, when I first saw this chart I actually thought it was real data. It would be nice to see the real data up to this point and then the projections. I realize you didn't create it. The key point of that chart (which I do agree with you on) is that thus far after every decline there's been a roaring return. It make take a year or more, but it's happened.

The best part for me is, what will happen next?

|

|

|

|

|

dothebeats

Legendary

Offline Offline

Activity: 3626

Merit: 1352

Cashback 15%

|

|

June 04, 2017, 05:14:48 AM |

|

The underlying assumption between every projection on cryptocurrencies is the rate of adoption. If adoption fails to take off, Bitcoin will die a slow death. Only when the adoption increases significantly does the network effect kick in.

Apparently this is correct. Though price appreciation over rate of adoption shows positive results as of now, we still can't be sure that this would be the case for the next coming months or years. Adoption is very critical for the growth of the network since the little minnows that support the reef is needed for the ecology to thrive. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

dinofelis

|

|

June 04, 2017, 05:15:47 AM |

|

There's still the question of adoption. More and more people are accepting crypto as currency. If the rate of this takes off, is it possible that the USD (or other world currencies) could collapse? Or would they simply create their own "USDCOIN" and convert to block chain technology?

Yes it's possible, but I'd say world reserve currencies will be kept afloat for a long time until a real collapse happens. The inflation will continue and what now costs $100 will be $200 in 10 years. You'll need a million to buy a house and new cheap cars will cost at least $20000, that's a near future. A 100 years ago people were working for $1 per hour, now they need at least $10, when we reach $100 per hour you'll know your fiat is hyperinflated and collapsing. In fact, not at all. The fact that the value is decreasing slowly, but in a foreseeable way (slightly inflationary), is exactly what makes these currencies good currencies, close to "Ideal Money". They are of course not good stores of value in the long term, but money is not supposed to be a store of value in the long term (investments are). Money has to be such that it has a *predictable* value (stable in the short term, slightly inflationary or deflationary in the longer term). Would you have dared to take a loan in bitcoin to buy a house ? Hell, I know people who are in deep shit because these idiots took a loan in Swiss Franc to buy a house and the Swiss Franc rose somewhat with respect to their income. If they would have taken a loan in bitcoin in 2015, they would be entirely broke now and could never pay their loan back. |

|

|

|

|

|

dinofelis

|

|

June 04, 2017, 05:16:52 AM |

|

The underlying assumption between every projection on cryptocurrencies is the rate of adoption. If adoption fails to take off, Bitcoin will die a slow death. Only when the adoption increases significantly does the network effect kick in.

Apparently this is correct. Though price appreciation over rate of adoption shows positive results as of now, we still can't be sure that this would be the case for the next coming months or years. Adoption is very critical for the growth of the network since the little minnows that support the reef is needed for the ecology to thrive. That sounds a lot like "we need fresh flesh, greater fools to come in (the minnows) to keep our early adopter wealth to grow". |

|

|

|

|

Amph

Legendary

Offline Offline

Activity: 3206

Merit: 1069

|

|

June 04, 2017, 05:26:06 AM |

|

the blockchain is the internet of money that carry the possibility to share information and storage, the real potential is the blockchain here that graph show the true, while there were dump the pump in the end always come victorious, the average increase per year is moving upward, the absolute trend is a bull run all those crash were done for acquiring more bitcoin, by the whales The underlying assumption between every projection on cryptocurrencies is the rate of adoption. If adoption fails to take off, Bitcoin will die a slow death. Only when the adoption increases significantly does the network effect kick in.

Apparently this is correct. Though price appreciation over rate of adoption shows positive results as of now, we still can't be sure that this would be the case for the next coming months or years. Adoption is very critical for the growth of the network since the little minnows that support the reef is needed for the ecology to thrive. That sounds a lot like "we need fresh flesh, greater fools to come in (the minnows) to keep our early adopter wealth to grow". eh i doubt it, because greater fools coming mean that early adopters sold their wealth, there is no farther adoption without better distribution |

|

|

|

|

|

dinofelis

|

|

June 04, 2017, 05:42:47 AM |

|

eh i doubt it, because greater fools coming mean that early adopters sold their wealth, there is no farther adoption without better distribution

The former greater fools are now the early adopters, as long as there is fresh flesh flowing in. |

|

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 04, 2017, 05:39:15 PM |

|

The constant change of value of bitcoin, makes it so hard to predict. Yes, if some took a loan for a house, they'd definitely be in a bad place now. Just the thought of someone doing that makes me laugh a little bit.

But aside from all the crypto exchange casinos, and all of the pump and dump altcoin scams, the real potential is in blockchain. That is something that will never go away.

|

|

|

|

|

Bit_Happy

Legendary

Offline Offline

Activity: 2100

Merit: 1040

A Great Time to Start Something!

|

|

June 04, 2017, 05:45:48 PM |

|

....

Now that we're finally out of that 2013-2015 slump people are rushing to get bitcoins again. We're just back on track to where we should have been in 2014. More people are adopting bitcoins, more places are accepting it, more countries are declaring it legal currency. It's not a fad or whatever. This is the real value of bitcoins. Get on the bus or or watch it drive away.

This bus has two flat tires and charges way too much for a slow ride when compared to competing bus companies. We must fix Bitcoin soon, or you will watch several other buses driving away. |

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 04, 2017, 09:52:57 PM |

|

....

Now that we're finally out of that 2013-2015 slump people are rushing to get bitcoins again. We're just back on track to where we should have been in 2014. More people are adopting bitcoins, more places are accepting it, more countries are declaring it legal currency. It's not a fad or whatever. This is the real value of bitcoins. Get on the bus or or watch it drive away.

This bus has two flat tires and charges way too much for a slow ride when compared to competing bus companies. We must fix Bitcoin soon, or you will watch several other buses driving away. Are you referring to some of the many other altcoins that exist? Do you predict any of them being more successful? |

|

|

|

|

Bit_Happy

Legendary

Offline Offline

Activity: 2100

Merit: 1040

A Great Time to Start Something!

|

|

June 04, 2017, 10:22:17 PM |

|

....

Now that we're finally out of that 2013-2015 slump people are rushing to get bitcoins again. We're just back on track to where we should have been in 2014. More people are adopting bitcoins, more places are accepting it, more countries are declaring it legal currency. It's not a fad or whatever. This is the real value of bitcoins. Get on the bus or or watch it drive away.

This bus has two flat tires and charges way too much for a slow ride when compared to competing bus companies. We must fix Bitcoin soon, or you will watch several other buses driving away. Are you referring to some of the many other altcoins that exist? Do you predict any of them being more successful? = Yes More successful than BTC = Several years ago the official Bitcoin Wiki labeled Litecoin as an example of a "Ponzi scheme" (does anyone know if that ever got edited/revised?) I never took alts too seriously, they were fun to trade when everyone else was constantly panic selling. Bitcoin still has a chance to remain dominant, but the trend towards "rich people only" is very disturbing. We had a chance to set common people free, and instead we are (in many ways) locked in a sick repeat of much of Human history. This place used to be fun! |

|

|

|

nuela

Full Member

Offline Offline

Activity: 145

Merit: 100

Blocklancer - Freelance on the Blockchain

|

|

June 05, 2017, 02:38:10 AM |

|

Then more and more people will accept crypto as currency, Or will they create their own "USDCOIN" and change it or create it into a technology block chain

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6095

Decentralization Maximalist

|

|

June 05, 2017, 04:00:28 AM |

|

This bus has two flat tires and charges way too much for a slow ride when compared to competing bus companies.

We must fix Bitcoin soon, or you will watch several other buses driving away.

[...]

Bitcoin still has a chance to remain dominant, but the trend towards "rich people only" is very disturbing. We had a chance to set common people free, and instead we are (in many ways) locked in a sick repeat of much of Human history.

That is also worrying me. If all "poor users" can do is use a not-entirely-trustless off-chain mechanism like Lightning Network when they want to use Bitcoin, then BTC loses advantages to the fiat system. But more worrying - for Bitcoin Maximalists - is that this path isn't mandatory and there are other blockchain projects trying to fix it in a more sustainable way, e.g. with "sharding", "sidechain" or "child chain" concepts, where the "on-chain transaction paradigm" isn't preserved only for the rich. If one of these competing approaches get really traction and it is cheaper and faster to do a transaction with them than with Bitcoin, network effect will slowly fade away and the chart the OP posted transforms simply into a wet dream. (tl;dr: Bitcoin should introduce decentralized sidechains! There is only a **** opcode missing ...) To your Subject, I respectfully disagree with you - cryptocurrencies are stores of value, the blockchain is the network.

What does this have to do with bubbles? Everything. Stores of value have bubbles. Networks not so much.

Good observation, I agree. Bubbles occur when the network (blockchain ecosystem) is smaller the "store of value" makes believe some people. And I think that is actually the case with Bitcoin, even if we may go higher in this bubble. |

|

|

|

|

dinofelis

|

|

June 05, 2017, 06:14:33 AM |

|

The constant change of value of bitcoin, makes it so hard to predict. Yes, if some took a loan for a house, they'd definitely be in a bad place now. Just the thought of someone doing that makes me laugh a little bit.

And that is exactly why bitcoin (or most other alts) cannot be a true currency. One of the main functions of a true currency is to be a "unit of account" which has a *predictable* value (not necessarily a *stable* value). This is why Nash defines ideal money as one that has stable value, and an asymptotic ideal money, as one that has a predictable inflation/deflation ; so even if it is not stable in itself, one can account (in time-dependent contracts such as a loan) for the change. And the origin of that instability is that bitcoin (and most other alts) have a combination of two aspects: - high initial seigniorage (that is, early adopters can get coins for low value) - high inelasticity (falling debasement curve) or worse, a collectible (like bitcoin: maximum number of coins EVER). That makes for a very, very speculative asset, and hence for a very, very bad currency (and even a bad store of value in the very long term, because it bubbles too much). This is also why bitcoin and altcoins won't go away so easily: there's a lot of demand for speculative assets ! After all, that's what most of the financial world lives off. But the problem is that pure speculation is actually economically a bad thing. Speculation as a way to trade risk for gains is economically positive. But *pure* speculation is a side effect that has only negative consequences, and the irony is that bitcoin was invented after the banking crash because of too much pure speculation by financial institutions (the banking crisis of 2007 had NOTHING to do with fiat but everything with uncontrolled speculation, blowing bubbles, and getting it blow in your face), and invented, itself, an even worse form of speculation that are PURE bubbles. If ever big finance gets into crypto - and I don't see how they couldn't: if this stuff can multiply fortunes by serious factors, how could professional finance stay out of it ? - this will cause a far, far more severe financial crisis than we've ever seen before, simply because its bubble capacity is unlimited, and the floor is ZERO. There's no economical "backing" of anything in crypto, so there is no floor. But aside from all the crypto exchange casinos, and all of the pump and dump altcoin scams, the real potential is in blockchain. That is something that will never go away.

True, but that's nothing else but a cryptographic invention. Like "public key crypto", or like "hash functions". It is not necessarily related to some "token". It is a kind of cryptographically certified database. One of its applications is "token transfers". |

|

|

|

|

|

dinofelis

|

|

June 05, 2017, 06:30:56 AM |

|

Good observation, I agree. Bubbles occur when the network (blockchain ecosystem) is smaller the "store of value" makes believe some people. And I think that is actually the case with Bitcoin, even if we may go higher in this bubble.

Well, unless of course you see the actual price as a market prediction for the future "fundamental" value. However, bitcoin is probably by far the most "useful" thing as a currency, and if we make a quick estimation, its coin value (its "fundamental" as a currency) should be of the order of a few tens of dollars. How can we know ? If we take bitpay as an indicator for "merchant currency usage", we are (end of 2016) at a volume of less than 300 million per month, which brings us to about 3 billion per year. Let us say that bitpay has 1/5 of the market share of "merchant usage", that would bring us to a volume of 15 billion a year. Now, a normal fiat currency M1 has a velocity of the order of 10, but things like bitcoin circulate normally more quickly, because they are bought and sold more quickly. So let us give it a velocity of 50. The market cap of bitcoin should then be 15 billion / 50 = 300 million dollars. That's the "fundamental" of bitcoin at this moment, as a "merchant currency". It would put the price of a coin around $20-$30. This is the true economic value of bitcoin, its true merchant value. |

|

|

|

|

|

Yuuto

|

|

June 05, 2017, 06:43:03 AM |

|

Source : http://www.zerohedge.com/news/2017-06-02/projecting-price-bitcoinThe true potential value of cryptocurrencies will not become visible until the global economy experiences a catastrophic collapse of debt and/or a major fiat currency. These events are already baked into the future, in my view; nothing can possibly alter the eventual collapse of the current debt/credit bubble and the fiat currencies that are being issued to inflate those bubbles.

The skeptics will continue declaring bitcoin a bubble that's bound to pop at $3,000, $5,000, $10,000 and beyond. When the skeptics fall silent, the potential for a bubble will be in place.  Agreed fully. I think that bitcoin's true value will never be discovered until fiats around the world collapses. Fiats will eventually collapse, there is absolutely no doubt about it. There has never been a surviving fiat currency even from 200 years ago. The thing is that bitcoin is going to thrive when there is a financial crisis - unlike the other investment tools like stocks and property. Property prices are in a frenzy, everyone is taking out loans to finance their new home. When fiat becomes worthless, the best alternative will be btc. |

|

|

|

|

|

pearlmen

|

|

June 05, 2017, 06:52:33 AM |

|

A perfect understanding of bitcoin shows that its not only a form of currency or an asset to be stored but also an infrastructure and that is why the news we are reading that banks are adopting bitcoin does not necessarily means adopting bitcoin as a currency but blockchain technology for their process. The same thing for Etherum to the best of my understanding which is combination of several computers or softwares that can be developed for several uses.

|

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6095

Decentralization Maximalist

|

|

June 05, 2017, 07:34:26 AM |

|

Well, unless of course you see the actual price as a market prediction for the future "fundamental" value. However, bitcoin is probably by far the most "useful" thing as a currency, and if we make a quick estimation, its coin value (its "fundamental" as a currency) should be of the order of a few tens of dollars. How can we know ? I agree. But the price - and so the "estimation of future fundamental value" - has changed in 2017 heavily to the upside, while the fundamentals (e.g. transaction count/volume) have not changed significantly since the end of 2016, when Bitcoin's price was 30%-40% of today's price ($2500). It's true that it's somewhat "capped" because of the 1MB blocksize limit, but if you take the pure number of transaction added to the mempool the growth since December 2016 seems not to justify the price increase. And there are some negative fundamental news, too, like the possibility for a chain split or a "flippening" (=losing the leadership as most valued - not most used! - cryptocurrency). For me, that is a "bubblish" (sounds like bullish but is actually bearish) sign, not an indicator of a growing network. There seems to be much newbie speculation in countries like Japan, Bolivia and Nigeria, for example. If we take bitpay as an indicator for "merchant currency usage", we are (end of 2016) at a volume of less than 300 million per month, which brings us to about 3 billion per year. Let us say that bitpay has 1/5 of the market share of "merchant usage", that would bring us to a volume of 15 billion a year.

Now, a normal fiat currency M1 has a velocity of the order of 10, but things like bitcoin circulate normally more quickly, because they are bought and sold more quickly. So let us give it a velocity of 50.

The market cap of bitcoin should then be 15 billion / 50 = 300 million dollars.

That's the "fundamental" of bitcoin at this moment, as a "merchant currency". It would put the price of a coin around $20-$30.

This is the true economic value of bitcoin, its true merchant value.

I doubt a bit if you should multiply velocity by five respect to fiat currencies. But even if you take a "normal" velocity of 10 then the "fair price" would be below $200, so BTC would be at least 10x overvalued. |

|

|

|

|