Anduril

Member

Offline Offline

Activity: 92

Merit: 10

|

|

June 26, 2011, 03:18:01 AM |

|

bitcoin doesn't change any of this. the inflation of fiat currencies, and its effects, are very poorly understood on these forums in general.

the income from interest came from the participation of your savings accounts in the growth of the economy. the income from the hoped-for deflation of your bitcoins (based on bitcoin's future monetary policy, because of course bitcoins are right now substantially more inflationary than any fiat currencies, monetarily speaking, and they will remain so for some time) will come from exactly the same source. if the economy does not grow in real terms, there's no way that everyone can receive positive risk-free returns; there's nothing to do but shift the existing or dwindling wealth from person to person.

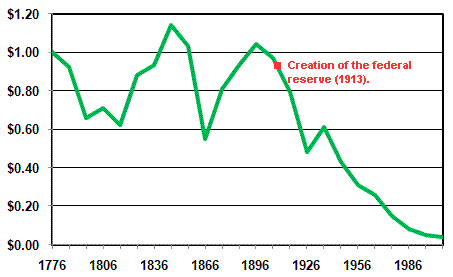

i still bristle when i see people in these forums angry at the inflation of fiat currencies. the comparison to bitcoins is misleading. nobody received a dollar in 1913 and expected it to have the same purchasing power in 1999. and during the inflation that the original poster's chart shows, the united states was, with a handful of exceptions, both prospering and increasing its prosperity; the inflation of the money supply did not stop that. moreover, as i've tried to explain before, monetary policy does not force inflation's effects on people; anyone could purchase other assets (though not with infinite flexibility, given the outlawing of private holding of gold, which is a more serious regulatory intrusion than monetary inflation) with their cash if they wanted to avoid the effects of inflation. other regulations, including tax laws, have imposed limits on people's abilities to invest arbitrarily, but that is not the fault of monetary policy. the anger at the 'inflation' of 'fiat currencies' is, for these reasons, rather bizarre, and honestly the frequency with which it's repeated here increases the amateurish and fringe feel of the community.

there are a lot of things to be angry at central banks for. that the dollar inflated throughout the 20th century is not one of them.

Just wanted to congratulate you on a very sound analysis. It is good to see someone who understands monetary policy beyond Tea Party soundbites. |

|

|

|

|

|

|

|

|

|

|

|

"This isn't the kind of software where we can leave so many unresolved bugs that we need a tracker for them." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

unk

Member

Offline Offline

Activity: 84

Merit: 10

|

|

June 26, 2011, 03:21:15 AM |

|

few people with significant wealth choose a portfolio more weighted toward cash in the long term, for obvious reasons. Exactly, and because these reasons discourage savings, and savings is a necessity for economic growth, the economy suffers. please try to explain the precise mechanism by which you think that happens. certainly taxes and transaction costs serve to slow various kinds of economic 'growth', though of course most people (perhaps not in this forum) think taxes have countervailing benefits. but you have not explained how you think monetary policy will 'discourage savings'; generally it does not, for the reasons i've already outlined. it simply makes one available 'savings' instrument less attractive, which eliminates nobody's choices. (other things, of course, might limit their choices.) if it helps, you might think of the dollar as a service provided by the united states government. you might not like the service, but nobody forces you to engage in it as a long-term holder subject to the sorts of inflationary pressures in your chart. you have to pay taxes in it if you owe income taxes, but that only helps you if it inflates and you need to convert to it on a certain date in the future. you have to accept it for payment of debts, though you can convert out of it immediately in that case. what's left are, again, various taxing issues that are not as significant, in practice, as people here think they are. note that i'm not relying on economic dogma here; i've explained the analysis i'm providing, both in this discussion and, in more detail, in others. i'm as critical of economic dogmas as anyone. i'm writing here just to try to correct an often-repeated misunderstanding in this forum. it's fairly unique to this forum and other fringe online communities; at least, i've never seen it elsewhere. my goal is actually to help people think more clearly about bitcoins, as i've been doing since i started posting. it is not in any way anti-bitcoin, in case that alleviates a concern that is possibly motivating your strident response to me. No matter how you try to paint it, the loss of real purchasing power does not benefit anyone but those who use it to their advantage (which in this case are politicians who use deficit spending to fund short-term projects to gain votes, and then encourage an inflationary policy to pay off past debt with devalued currency)

that's not quite true, but regardless, the point is that purchasing power is lost only by those who choose to continue to hold dollars long-term in the face of many alternatives. think of it this way: if you couldn't avoid deflation by holding commodities, securities, or other instruments instead, how could bitcoin help you avoid inflation? bitcoin doesn't add anything new if your goal is simply to avoid inflation; what it adds is, in principle, a convenient payments system, and it reduces the transaction costs (again, in theory) of moving funds into and out of that payments system. the rest of bitcoin is either (1) ill-founded marketing, though that's quite common in this forum or (2) speculation, which is as good or as bad as anyone ordinarily thinks speculation is. yet my scholarship is often cited, my businesses prosper, and my teaching is influential.

Your appeal to authority, on the other hand, is not influential. you seem to have neglected the flow of the conversation here. you suggested my 'feelings' were irrelevant; i claimed they aren't. nothing else i've said depends on my 'authority', my stature, or indeed on anything else about me. westkybitcoins: you're missing my point, i'm afraid. i'm not saying that central banks aren't responsible for inflation. i'm saying that nobody is forced to experience that inflation long-term, contrary to the sentiments that i so commonly see in this forum. let me ask you: do you hold us dollars in your long-term investment accounts? if so, why? what's preventing you from avoiding them if you are so concerned about inflation? the answer is nothing, except again, in the marginal case, perhaps capital-gains taxes that you could likely avoid if you put your mind to it. |

|

|

|

|

foggyb

Legendary

Offline Offline

Activity: 1652

Merit: 1006

|

|

June 26, 2011, 03:46:26 AM

Last edit: June 26, 2011, 06:02:37 AM by foggyb |

|

nobody received a dollar in 1913 and expected it to have the same purchasing power in 1999.

The expectation of the day was CERTAINLY NOT that the dollars they were accepting in 1913 would be lose more than 90% of their value in less than 90 years. |

|

|

|

|

bitcoin0918 (OP)

Newbie

Offline Offline

Activity: 70

Merit: 0

|

|

June 26, 2011, 03:47:57 AM |

|

few people with significant wealth choose a portfolio more weighted toward cash in the long term, for obvious reasons. Exactly, and because these reasons discourage savings, and savings is a necessity for economic growth, the economy suffers. please try to explain the precise mechanism by which you think that happens. I believe you stated it for me. People with wealth do not keep it in cash, due to long-term devaluation. This reduces the amount of savings available to be loaned out by banks to grow the economy. but you have not explained how you think monetary policy will 'discourage savings'; Besides what I have said above, I am curious how you conclude that the Fed's monetary policy of keeping interest rates artificially low, thus reducing the interest rate paid toward savings, does not discourage savings. the point is that purchasing power is lost only by those who choose to continue to hold dollars long-term in the face of many alternatives I am forced to pay into social security - money which I will supposedly get back at retirement in a highly diluted state. Are you saying I have a choice not to give up that purchasing power? nothing else i've said depends on my 'authority', my stature, or indeed on anything else about me. Then why the necessity to reference your credentials? What did you hope to gain by citing them? |

|

|

|

|

westkybitcoins

Legendary

Offline Offline

Activity: 980

Merit: 1004

Firstbits: Compromised. Thanks, Android!

|

|

June 26, 2011, 03:49:14 AM |

|

westkybitcoins: you're missing my point, i'm afraid. i'm not saying that central banks aren't responsible for inflation. i'm saying that nobody is forced to experience that inflation long-term, contrary to the sentiments that i so commonly see on that board. let me ask you: do you hold us dollars in your long-term investment accounts? if so, why? what's preventing you from avoiding them if you are so concerned about inflation? the answer is nothing, except again, in the marginal case, perhaps capital-gains taxes that you could likely avoid if you put your mind to it.

I understand you're trying to suggest that inflation shouldn't be a problem, because it's avoidable. But I believe you've missed my point. Do you think the average person throughout the 20th century managed their finances with an eye toward inflation? If you do, may I suggest you have a rather generous view of "the average person throughout the 20th century?" Think of the people who were present during the transition in 1913. They were used to a monetary system that was totally fixed to precious metals. Do you think most of them knew, and really understood, that first their paper dollars were going to be devalued in 1933, and then continually devalued from then on, all due to the deliberate actions of men, rather than natural market forces? Think of poorer people who didn't have access to a lot of wealth, and hence much of the wisdom regarding it's proper handling. Think of grandpa stuffing money under the mattress because he didn't trust banks. Think of the poor family who diligently saved their coins (and even the occasional bill!) in a large jar as an emergency fund for when times got bad, trying to improve their condition. Think of people NOW who may not have a 401k or a stock broker, but have a money market savings account, and think that they're doing well because of it. These people all got--and are getting--screwed.If your attitude is that they're just not educated, then you're forgetting that education isn't free ("free" public education is the worst) and that even then there's much pressure to miseducate. Many people of modest means know they need to save to get ahead. But the Keynesian crap pushed in the classroom doesn't give them the tools to realize just saving dollars isn't enough, and that one of the best ways to save and avoid inflation is through that "relic" called gold. If your attitude is that, well, some folks are just less intelligent, and can't be helped, then we have a problem. Fifty percent of any given society is going to be of less than average intelligence. What sort of man-made system requires us to take 50% of the population and just accept they're going to get robbed annually by their central bank? Especially considering this 50% is frequently the less-well-off? That's my main beef with an centralized, inflationary monetary system. It's bad enough that it steals, moreso from the poorer and less educated. It's that at its core it's a fundamentally dishonest system, and one that to some extent (thanks to legal tender laws) is forced onto the society. It's just plain wrong, regardless of whether I can personally figure out how to beat it. |

Bitcoin is the ultimate freedom test. It tells you who is giving lip service and who genuinely believes in it.

... ... In the future, books that summarize the history of money will have a line that says, “and then came bitcoin.” It is the economic singularity. And we are living in it now. - Ryan Dickherber... ... ATTENTION BFL MINING NEWBS: Just got your Jalapenos in? Wondering how to get the most value for the least hassle? Give BitMinter a try! It's a smaller pool with a fair & low-fee payment method, lots of statistical feedback, and it's easier than EasyMiner! (Yes, we want your hashing power, but seriously, it IS the easiest pool to use! Sign up in seconds to try it!)... ... The idea that deflation causes hoarding (to any problematic degree) is a lie used to justify theft of value from your savings.

|

|

|

bitcoin0918 (OP)

Newbie

Offline Offline

Activity: 70

Merit: 0

|

|

June 26, 2011, 03:55:05 AM |

|

nobody received a dollar in 1913 and expected it to have the same purchasing power in 1999.

That's extraordinarily disingenuous of you. The expectation of the day was CERTAINLY NOT that the dollars they were accepting in 1913 would be lose more than 90% of their value in less than 90 years. But don't you see - it is their own fault for not having a crystal ball and knowing to move their savings out of cash. Nobody forced them to stay in the dollar. They should have known that it would have been better to hire a full-time broker to manage their (and their children's) funds.  |

|

|

|

|

bitcoin0918 (OP)

Newbie

Offline Offline

Activity: 70

Merit: 0

|

|

June 26, 2011, 04:07:46 AM |

|

westkybitcoins: excellent post!

|

|

|

|

|

unk

Member

Offline Offline

Activity: 84

Merit: 10

|

|

June 26, 2011, 04:14:21 AM |

|

That's extraordinarily disingenuous of you. The expectation of the day was CERTAINLY NOT that the dollars they were accepting in 1913 would be lose more than 90% of their value in less than 90 years.

they could have simply asked their grandparents, as a similar phenomenon described the previous ninety years. inflation in the united states is generally recognised to have been greater from 1913 to 1999, but not by as much as the often-disputed '90%' figure would have you believe. (probably it was about twice as great in the 20th century as the 19th century, though i'm saying that offhand without looking at the best data.) more to the point, very few people held dollars outside of interest-bearing accounts, particularly after the federal deposit guarantees that followed the great depression in the united states. as ribuck pointed out, most people matched or beat inflation in practice, with those interest-bearing accounts. my point is that to focus on the inflation of the currency, out of context, is itself 'extraordinarily disingenuous'. i want to avoid the inline quoting in the rest of the responses, so i'll just address your points in freeform. first, social security has nothing to do with what we're talking about. if you want to say that social security isn't sufficiently adjusted for inflation, that's fine, but again, that is not an indictment of monetary policy. if social security were properly adjusted for inflation, your concern here would fall away. (please, though, let's not have a general debate about social security. i recognise the american tea party calls it a 'ponzi scheme' and that those views are common in this forum. it's a profoundly and tragically misguided understanding of the system, but i don't want to debate that in detail here.) second, i referenced my 'credentials' (not really; i just made a claim that i knew what i was talking about) only because you suggested that i ought to be ignored, incorrectly terming my analysis 'feelings' that ought to be easily dismissed. i'd never have brought anything personal about myself up if you'd responded to my analysis instead of dismissing it as coming from someone inappropriately emotional, which is of course far from the truth. third, and probably most importantly, interest rates do affect riskfree savings, but their effect is largely to shift riskfree savings to 'investments'. in practice, empirically, they do not substantially decrease 'savings' as opposed to 'spending'. if all they do is shift around what 'saved' money does, then we're back to the point i've been making all along: nobody is forced to experience the inflation of the dollar, and their choice of other instruments (such as commodities) does not significantly distort the economy. note also that you're criticising low interest rates, which ordinarily do not coincide with inflation. you may be upset at a particular feature of the monetary landscape over the last few years, and other actions of the central banks of major industrialised countries, that have little to do with inflation. as i have said from the start, i'm not telling you that you should not oppose all central banks' decision. i'm just telling you that you're opposing the wrong ones. westkybitcoins: for much of the period you're describing, the group of 'middle class' americans to which you're referring held extremely little cash, and they held essentially none outside interest-bearing accounts with which they matched or even beat inflation. furthermore, many such families 'saved' in non-cash assets, such as a family house. to be clear, however, i'm not disputing that inflation takes from some people and gives from others. that's true of anything, however; it's true, of deflation too, for example. who benefits and who suffers is a detailed empirical question that requires nuanced analysis to answer, just like questions about the true incidence of a new tax. for instance, if we all used bitcoins, the eventual presumed deflation would affect salaried laborers versus investors in very complicated ways that are hard to predict based merely on the notion of 'deflation', for they would depend on many other macroeconomic and psychological factors. (for example, how sticky are wages? how are pensions computed?) to answer these questions with ideological generalities will almost always lead to wrong answers and bad decisions. |

|

|

|

|

bitcoin0918 (OP)

Newbie

Offline Offline

Activity: 70

Merit: 0

|

|

June 26, 2011, 04:39:22 AM |

|

Unk: There is no free lunch. You cannot inflate a currency without consequence. Even if every citizen was capable of minimizing the loss of purchasing power, that purchasing power would still be seized from the rest of the world through treasury bills. As the rest of the world realizes that the US is increasingly printing money and issuing new debt just to pay the interest on past debt, the US will lose its reserve currency status, and nobody will want our debt. Then all of the government programs we have come to rely on will fail, and we (the private sector) will have to create and fund those programs ourselves, reducing our standard of living. You can say that the specific inflationary policy alone does not cause all of this grief, but that policy was not enacted in a vacuum, and is what allows all of these problems to become possible. you suggested that i ought to be ignored, incorrectly terming my analysis 'feelings' that ought to be easily dismissed. I only suggested that your claim that the community is feeling more "amateurish" and "fringe" be ignored. |

|

|

|

|

iya

Member

Offline Offline

Activity: 81

Merit: 10

|

|

June 26, 2011, 05:04:40 AM |

|

What is the chart actually showing? Dollar in $ makes no sense to me. @unk I agree with you theoretically, and I always recommend holding only as much currency as needed for monthly expenses. If most people would do that, the central bank had less influence. But I don't think it's as easy as you make it out to be. We get bubble after bubble in things that seem to be good assets, but actually aren't. Gold is the only "hands-off" store of wealth, and in many countries it's legally impossible or expensive to acquire. In case of emergency it will likely get confiscated. The main problem with central banks, fiat money and government debt is the illusion of wealth they create. When the economic distortions can no longer be hidden/ignored, people always blame scapegoats. For example the Greeks are angry at the prospect of becoming poorer, while, in fact, they were never as rich as they believed to be. Would you argue that there is no "debt supercycle", and that for example the US deficit is no big deal? |

|

|

|

|

marcus_of_augustus

Legendary

Offline Offline

Activity: 3920

Merit: 2348

Eadem mutata resurgo

|

|

June 26, 2011, 05:13:39 AM |

|

i still bristle when i see people in these forums angry at the inflation of fiat currencies. the comparison to bitcoins is misleading. nobody received a dollar in 1913 and expected it to have the same purchasing power in 1999. and during the inflation that the original poster's chart shows, the united states was, with a handful of exceptions, both prospering and increasing its prosperity; the inflation of the money supply did not stop that. moreover, as i've tried to explain before, monetary policy does not force inflation's effects on people; anyone could purchase other assets (though not with infinite flexibility, given the outlawing of private holding of gold, which is a more serious regulatory intrusion than monetary inflation) with their cash if they wanted to avoid the effects of inflation. other regulations, including tax laws, have imposed limits on people's abilities to invest arbitrarily, but that is not the fault of monetary policy. the anger at the 'inflation' of 'fiat currencies' is, for these reasons, rather bizarre, and honestly the frequency with which it's repeated here increases the amateurish and fringe feel of the community.

there are a lot of things to be angry at central banks for. that the dollar inflated throughout the 20th century is not one of them.

yet again unk proves he wrong, wrong, more wrong and full of wind ... bristling or otherwise ... tax laws and monetary policy are bound at the hip by the same people creaming it off the top ... supporting a failed system must leave one feeling dirty and guilty at some point ... surely? |

|

|

|

|

airdata

|

|

June 26, 2011, 05:32:26 AM |

|

ROFL. Well played sir  5 star thread !!! |

|

|

|

westkybitcoins

Legendary

Offline Offline

Activity: 980

Merit: 1004

Firstbits: Compromised. Thanks, Android!

|

|

June 26, 2011, 05:41:50 AM |

|

westkybitcoins: for much of the period you're describing, the group of 'middle class' americans to which you're referring held extremely little cash, and they held essentially none outside interest-bearing accounts with which they matched or even beat inflation. furthermore, many such families 'saved' in non-cash assets, such as a family house.

to be clear, however, i'm not disputing that inflation takes from some people and gives from others. OK. Fair enough that you don't dispute it. Let's just focus on that then. that's true of anything, however; it's true, of deflation too, for example. who benefits and who suffers is a detailed empirical question that requires nuanced analysis to answer, just like questions about the true incidence of a new tax. for instance, if we all used bitcoins, the eventual presumed deflation would affect salaried laborers versus investors in very complicated ways that are hard to predict based merely on the notion of 'deflation', for they would depend on many other macroeconomic and psychological factors. (for example, how sticky are wages? how are pensions computed?) to answer these questions with ideological generalities will almost always lead to wrong answers and bad decisions.

Three points. First, let's look at "who benefits and who suffers." In a centralized, inflationary monetary system, this is pretty clear. The primary beneficiary is the one who gets to create more money (or I suppose more accurately, those immediately able to use the new money in exchange for goods and services at full value. This could be the central bank itself. This could be the entities bailed out via newly minted cash.) The primary suffering are those forced to hold the money, those holding it out of ignorance, and those holding it out of necessity--the system as it is requires us all to use dollars for our everyday needs. There will always be some of these people. In fact, for the monetary system to actually function, the money MUST be in someone's hands. And those someones get screwed. What about with bitcoins? Well, remember that the bitcoin network doesn't go and periodically destroy bitcoins. There's simply a cap on the number of them that will ever exist. So the primary beneficiaries of any deflation are ALL the voluntary holders of bitcoins. So far, no problem there, is there? And the primary suffering in this case? Those who lose their bitcoins. Please take a second and think about how ingenious that is. Some people will irretrievably lose their money in ALL monetary systems. Under inflation, these people lose 100% of their lost money, and will also lose some % of their remaining money due to their central bank. Under a non-inflationary money, these people still lose 100% of their lost money, but they gain some % of that value back in their remaining money. Even if they have no remaining money, then they've just broken even with the inflationary system... they certainly didn't fare any worse for it. This reduces the group of sufferers to the ideal, most fair group... those who would have lost purchasing power anyway. They are demonstrably never worse off than they would be under an inflationary system, and periodically are better off. This arrangement seems far, far superior to one where the politically connected profit at the expense of the poor, the uneducated and the coerced. Second, there's a big difference in how any transfer of wealth occurs under an inflationary and a non-inflationary system. In a non-inflationary system, any wealth transfer can only be initiated by the person who would lose their purchasing power... for example, those who lose their bitcoins. Call such a situation what you will, but at best, their loss of purchasing power is an accident, at worst, it's just their own fault. Under an inflationary system, the wealth transfer can be initiated pretty much at will by those who would gain the purchasing power. Which is so ripe for abuse it stinks. Moreover, that purchasing power comes AT THE EXPENSE of the suffering. And remember: for the monetary system to even work, SOMEONE has to be holding the money, so there is NECESSARILY a patsy. Before we started redefining terms in western society, we used to call that sort of a wealth transfer theft. And considering it's a system forced onto some segment of the society or another, I prefer to just call it getting screwed. Third, there's something far more fundamental we're overlooking. Our opinions on the issue don't matter. The fact is: people choose non-inflationary systems. You can call that stupidity, ignorance, cowardice, whatever. People do. They do it over and over, every time. They choose non-inflation over inflation. This is proved by the fact that governments have to resort to legal tender laws and having tax payments required to be in their own currency. Gresham's law ceases to exist in the absence of coercion. Thought experiment: go to a nation, any nation. Give them a choice: they can transact in a non-inflationary fiat money, or some other inflationary fiat money, or even both, with all contracts and debts honored equally. They can pay taxes in either form of money they wish. Of course, they still can have access to all the other means of asset protection; just ensure there will be no penalties or punishments given to them for choosing one fiat money over the other in regular use. Oh, and don't bar anyone from informing others about the true natures and consequences of each. Which of the fiat monies do you think people will choose? Seriously, is there even any question? So say what we will, people have spoken. They don't want inflationary monies. THE MASSES DISAGREE WITH YOUR ASSESSMENT OF THE ILLS OF A NON-INFLATING CURRENCY. They only deal with it because it's forced down their throat by people who feel the need to save them from themselves. But considering that (a) they're the ones who have to use it, and (b) the whole issue is supposedly about what's in their best interests... I'd say the people themselves are best suited to determining what is best for them. |

Bitcoin is the ultimate freedom test. It tells you who is giving lip service and who genuinely believes in it.

... ... In the future, books that summarize the history of money will have a line that says, “and then came bitcoin.” It is the economic singularity. And we are living in it now. - Ryan Dickherber... ... ATTENTION BFL MINING NEWBS: Just got your Jalapenos in? Wondering how to get the most value for the least hassle? Give BitMinter a try! It's a smaller pool with a fair & low-fee payment method, lots of statistical feedback, and it's easier than EasyMiner! (Yes, we want your hashing power, but seriously, it IS the easiest pool to use! Sign up in seconds to try it!)... ... The idea that deflation causes hoarding (to any problematic degree) is a lie used to justify theft of value from your savings.

|

|

|

unk

Member

Offline Offline

Activity: 84

Merit: 10

|

|

June 26, 2011, 05:47:28 AM |

|

yet again unk proves he wrong, wrong, more wrong and full of wind ... bristling or otherwise ... tax laws and monetary policy are bound at the hip by the same people creaming it off the top ... supporting a failed system must leave one feeling dirty and guilty at some point ... surely?

i don't understand the point of comments like this; surely this is what people call a 'troll'? if not, it's just ignorant nonsense, almost glorying in its intentional, anti-intellectual ignorance. there are many ways to read up on the substantive and procedural differences between tax laws and monetary policy, in the united states and elsewhere. to criticise someone for separating them analytically reflects exactly the kind of tragically simpleminded worldview i'm faulting. iya: the chart compares the changing functional value of a dollar against its calculated value in 1776. i didn't previously take issue with the details of how inflation is calculated because the details are complex and contentious ('inflation' is not a singular phenomenon but a distributed one that can be measured in a variety of ways), but it may be worth pointing out that the particular chart is far from universally accepted. that said, nobody disputes that there has been dollar-inflation in the last 235 years. bitcoin0918: it's hard to disentangle the various points you're making; they don't relate to each other analytically. as far as i can tell, you're making a series of very specific but unsupported empirical predictions, and the only place i've seen those particular predictions is on various websites populated by amateur, self-styled economists. if you would be willing to specify the claims into concrete, testable predictions, i likely would be willing to bet substantial money against you, as would anyone who has studied the matter in more substantive detail than the various websites that foam at the mouth about the united states's impending doom after its currency fails to maintain its status as the functional global 'reserve'. if you think you can predict the specific actions of most national governments over the next twenty years in response to economic conditions that have not yet manifested themselves, you're probably wrong, or else you're a better economist than everyone who's worked in detail on related matters. in case the perspective helps, very few people (or perhaps no one) with a deeper understanding of global trade make the same strong predictions as the foam-at-the-mouth amateurs that you can find on various blogs. the only consistent response i've seen in this forum is that all those analysts must be 'brainwashed' because they 'suckle the teat of the state'. if that is a convincing argument to you, then we probably have nothing further to discuss. |

|

|

|

|

unk

Member

Offline Offline

Activity: 84

Merit: 10

|

|

June 26, 2011, 06:05:01 AM |

|

First, let's look at "who benefits and who suffers." In a centralized, inflationary monetary system, this is pretty clear. The primary beneficiary is the one who gets to create more money (or I suppose more accurately, those immediately able to use the new money in exchange for goods and services at full value. This could be the central bank itself. This could be the entities bailed out via newly minted cash.)

just as an example, bailouts of banks are an extremely recent phenomenon and have little to do with historical inflation. i've never criticised anyone who opposed bailing out the banks. i simply insist that people who criticise the very existence of central banks at least try to learn, in detail, how newly created funds enter the monetary system. almost nobody here seems to manifest that understanding, but that doesn't stop them from criticising the system they don't understand. What about with bitcoins? Well, remember that the bitcoin network doesn't go and periodically destroy bitcoins. There's simply a cap on the number of them that will ever exist. So the primary beneficiaries of any deflation are ALL the voluntary holders of bitcoins. So far, no problem there, is there? And the primary suffering in this case? Those who lose their bitcoins.

Please take a second and think about how ingenious that is.

ah, the near-religious faith in the 'ingenious' design of bitcoin. as i've demonstrated many times before, i've studied the code in detail and have commented on its strengths and weaknesses; i don't need to sit and reflect on its ingenuity. nothing about bitcoin depends on a shift of wealth from those who lose funds to those who keep them. indeed, bitcoin would probably be stronger, rather than weaker, if there were a convenient way to recover funds that were lost, as some developers have proposed via a 'keepalive'-like system or a variety of other mechanisms. (strictly speaking, 'deflation' is a bit imprecise when applied to a system where the money supply stays constant, and 'non-inflation' would be a more precise term, but i'm using 'deflation' the way most people do in this forum - that is, in a way, that does not at all depend on funds being lost by people who corrupt their wallets.) the wealth transfers i was talking about are more complex than what i think you have in mind. for example, in a non-inflationary system, wages will need to fall as prices fall, and wealth will be transferred based on the relative rates at which they fall. note that the relative rates cannot be derived theoretically, because in the real world they depend on complex macroeconomic and psychological factors. if you propose a world with no transaction costs and perfectly competitive markets, you propose an ideal world that doesn't exist, and the economic conclusions you reach won't be particularly useful in our world. Third, there's something far more fundamental we're overlooking. Our opinions on the issue don't matter. The fact is: people choose non-inflationary systems. You can call that stupidity, ignorance, cowardice, whatever. People do. They do it over and over, every time. They choose non-inflation over inflation. This is proved by the fact that governments have to resort to legal tender laws and having tax payments required to be in their own currency.

it's absolutely not proved by that; many other things explain legal-tender laws, both historically and conceptually. if you adopt this sort of reasoning, you just assume your conclusion. the point i've made many times in this forum, in much greater detail, is that the inflation or deflation of a monetary instrument doesn't matter at all for investment decisions unless you take into account contextual factors, because if you're occupying an ideal theoretical realm, the inflation or deflation of competing instruments can be priced into the instruments. in the 'real world', of course, that pricing is imperfect, but that doesn't mean that inflation or deflation magically 'wins', and there's absolutely no historical evidence to bear out the kind of phenomenon you're describing (the systematic preference by large populations for deflationary currency instruments). Gresham's law ceases to exist in the absence of coercion. Thought experiment: go to a nation, any nation. Give them a choice: they can transact in a non-inflationary fiat money, or some other inflationary fiat money, or even both, with all contracts and debts honored equally. They can pay taxes in either form of money they wish. Of course, they still can have access to all the other means of asset protection; just ensure there will be no penalties or punishments given to them for choosing one fiat money over the other in regular use. Oh, and don't bar anyone from informing others about the true natures and consequences of each.

Which of the fiat monies do you think people will choose? Seriously, is there even any question?

you're forgetting that the exchange rate between the two will matter, as well as the relatively riskfree interest available in both. you can't compute the merits of the competing instruments without considering those factors. So say what we will, people have spoken. They don't want inflationary monies. THE MASSES DISAGREE WITH YOUR ASSESSMENT OF THE ILLS OF A NON-INFLATING CURRENCY. They only deal with it because it's forced down their throat by people who feel the need to save them from themselves.

i think you're just repeating this point over and over, but which masses? where? if your economic understanding of the foreign-currency markets is coming from the wikipedia page on gresham's law, note that at present it's simply an unjustified tirade against legal-tender laws, as many people in the 'talk' page of the article have pointed out. |

|

|

|

|

MoonShadow

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

June 26, 2011, 06:07:26 AM |

|

That's extraordinarily disingenuous of you. The expectation of the day was CERTAINLY NOT that the dollars they were accepting in 1913 would be lose more than 90% of their value in less than 90 years.

they could have simply asked their grandparents, as a similar phenomenon described the previous ninety years. inflation in the united states is generally recognised to have been greater from 1913 to 1999, but not by as much as the often-disputed '90%' figure would have you believe. (probably it was about twice as great in the 20th century as the 19th century, though i'm saying that offhand without looking at the best data.) You're saying this without access to any factual data. It's simply not true. The US Dollar prior to 1913 did have it's ups and downs, but the general trend over the prior century was deflationary, if only very mildly. It would be tricky to have an inflating currency that wasn't just on a bi-metal standard, the currency was actually the metal. Try and imagine the world before 1913, for the most part paper money didn't really exist. All those old Westerns showing thieves robbing banks and getting away with paper money were wrong. A dollar was (and legally still is, look it up) a defined weight in gold, while coins were made of the silver itself. Paper money was rare. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

MoonShadow

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

June 26, 2011, 06:10:43 AM |

|

First, let's look at "who benefits and who suffers." In a centralized, inflationary monetary system, this is pretty clear. The primary beneficiary is the one who gets to create more money (or I suppose more accurately, those immediately able to use the new money in exchange for goods and services at full value. This could be the central bank itself. This could be the entities bailed out via newly minted cash.)

just as an example, bailouts of banks are an extremely recent phenomenon and have little to do with historical inflation. i've never criticised anyone who opposed bailing out the banks. i simply insist that people who criticise the very existence of central banks at least try to learn, in detail, how newly created funds enter the monetary system. almost nobody here seems to manifest that understanding, but that doesn't stop them from criticising the system they don't understand. That's quite an assumption to make about your detractors. I consider it more likely that you don't understand a system that you advocate. You might know bitcoin inside and out, but you still don't understand that which you speak. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

unk

Member

Offline Offline

Activity: 84

Merit: 10

|

|

June 26, 2011, 06:21:00 AM |

|

That's quite an assumption to make about your detractors. I consider it more likely that you don't understand a system that you advocate. You might know bitcoin inside and out, but you still don't understand that which you speak.

it's not an assumption; as i said, it's an observation based on what's manifested. perhaps people here are just poor at communicating their understanding, but i see no indications of a detailed understanding of the operation of central banks. you may be right about the particulars of deflation in 1800s america; the united states is not my home or my speciality. if so, i retract that particular point, but very little depends on it. my larger point is still that very few actually suffered substantially from inflation from 1913 onward, because most people who had a bank account were able to match or outpace inflation. the more general point is that the amateur economists in this forum seem implicitly to be comparing (1) bitcoins with (2) dollars held under a mattress. the more accurate comparison, however, is with (3) dollars held in a bank account, earning interest. the chart for most 'savers', even those who never opened a brokerage account, would not be close to the original poster's once interest were taken into account. it is only recently that it was hard to match inflation in a bank account, and the reason for that has more to do with the unique failures of central banks over the last few years than the generalised problems that people here want to assign to all central banks everywhere, throughout time. of course, that's a classic mistake that many anti-government extremists make ('i can point to a bad thing that a government did, therefore governments should not exist'). perhaps i shouldn't draw myself into another debate with a horde of anti-governmental extremists, however. i realise that i am in the minority in this forum by not belonging to that group. |

|

|

|

|

foggyb

Legendary

Offline Offline

Activity: 1652

Merit: 1006

|

|

June 26, 2011, 06:22:25 AM |

|

they could have simply asked their grandparents, as a similar phenomenon described the previous ninety years. inflation in the united states is generally recognised to have been greater from 1913 to 1999, but not by as much as the often-disputed '90%' figure would have you believe. (probably it was about twice as great in the 20th century as the 19th century, though i'm saying that offhand without looking at the best data.

Thanks for helping my case.  more to the point, very few people held dollars outside of interest-bearing accounts.

Nearly everyone's good fortunes rest on the stability of the US dollar, today.That's the point. |

|

|

|

|

MoonShadow

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

June 26, 2011, 06:33:40 AM |

|

it is only recently that it was hard to match inflation in a bank account, and the reason for that has more to do with the unique failures of central banks over the last few years than the generalised problems that people here want to assign to all central banks everywhere, throughout time.

Well, that's just it. The recent failures of central banking over the last few years were not only not unique, they were entirely predictable from the moment the central banks shed the discipline of the gold standard and thus gained the power to inflate. That is what happens to all fiat currencies. It always has. Just because we are finally starting to see the fatal imbalances in the system accumulate to a visible level, doesn't mean that those imbalances were not there from the start. They were, and I believe that you are smart enough to understand that. The cognative dissonance that you are experiencing within this forum is not a unique affliction. Most people very much desire to believe that the society that they live within is a predominately honest one, and that the image that it presents to us is not fraudulent. I'm sorry to be the one to tell you this, but what you have been told since you were a child, what your parents believed, and what you believe about the best intentions of those who command these vast monetary systems is a lie. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

|