|

adam3us (OP)

|

|

November 14, 2013, 05:30:51 PM

Last edit: November 14, 2013, 05:56:48 PM by adam3us |

|

http://www.forbes.com/sites/kashmirhill/2013/11/13/sanitizing-bitcoin-coin-validation/Its based on significant misunderstanding about bitcoins value proposition - destroy its fungibility and the costs float up to meet credit cards and paypal. It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals. Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem. What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong. I am also incensed frankly that someone would step into the market with such a muddle-headed thinking, and attempt to sabotage or destroy the core bitcoin feature that gives its value, where the value has been created by Satoshi and a cast of millions of man-hours of contributions of the community and technical wizards developing it mostly on volunteer time. I am not someone prone to swearing, but this is astonishingly stupid and dangerous. Please stop now. In the article it is claimed they sought advice from the Winklevoss twins, if the twins value their estimated $30million bitcoin holding they should advise them to stop: if fungibility is destroyed bitcoins value as a transaction currency is impacted. I encourage anyone with technical skills to put their thinking caps on to find ways to increase fungibility in the short term like CoinJoin, coin control in wallets, helping less technical people migrate to better wallets, educating people about privacy practices that defend fungibility. And longer term privacy technologies like zero coin, homomorphic encrypted value and committed (hidden) transactions. I encourage all bitcoin businesses to shun Coin Validation unless we see some major U-turn or corrections. If your business depends on the success bitcoin, it depends on the fungibility of bitcoin, and Coin Validation seem to be set on destroying both. You can quote me on that. I welcome Coin Validations corrections of the claims in the Forbes article. Tell me you were misquoted. Adam ps For people who have no idea who http://cypherspace.org/adam/ I am https://bitcointalk.org/index.php?topic=225463.msg237167 , my small part in bitcoin is I invented distributed mining in 1997 https://en.bitcoin.it/wiki/Hashcash (you can find the reference in Satoshi's paper) and worked on opensource ecash & crypto currency research & implementation for about a decade alongside Wei Dai & Hal Finney & others.

|

hashcash, committed transactions, homomorphic values, blind kdf; researching decentralization, scalability and fungibility/anonymity

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

K1773R

Legendary

Offline Offline

Activity: 1792

Merit: 1008

/dev/null

|

|

November 14, 2013, 05:48:27 PM |

|

Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem.

thats why i give a damn about media. they never understand what they are talking about... |

[GPG Public Key]BTC/DVC/TRC/FRC: 1 K1773RbXRZVRQSSXe9N6N2MUFERvrdu6y ANC/XPM A K1773RTmRKtvbKBCrUu95UQg5iegrqyeA NMC: N K1773Rzv8b4ugmCgX789PbjewA9fL9Dy1 LTC: L Ki773RBuPepQH8E6Zb1ponoCvgbU7hHmd EMC: E K1773RxUes1HX1YAGMZ1xVYBBRUCqfDoF BQC: b K1773R1APJz4yTgRkmdKQhjhiMyQpJgfN

|

|

|

|

n8rwJeTt8TrrLKPa55eU

|

|

November 14, 2013, 06:45:26 PM |

|

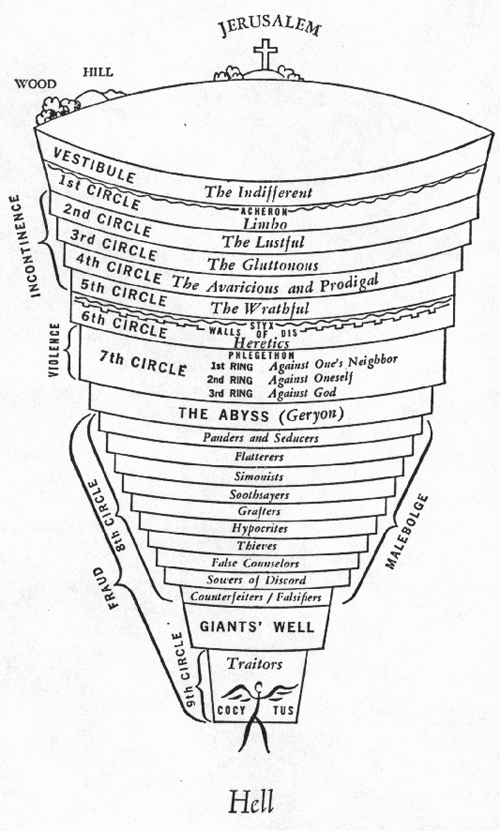

Great post Adam. In every superhero movie there's also a scumbag traitor who sabotages a noble cause for personal gain. These guys are it. They know perfectly well the full implications of what they propose. To assume they are just stupid or careless or misunderstanding, is to let them off lightly. They should be shunned and berated and boycotted to the point of never wanting to show their face again in any context related to Bitcoin. The many thieves and scammers in this community are an unpleasant reality, but these guys are an even lower life form. Traitors and collaborators were rightly assigned by Dante to the very deepest circle of hell.  |

|

|

|

|

powdabam

Newbie

Offline Offline

Activity: 52

Merit: 0

|

|

November 14, 2013, 06:58:17 PM |

|

Reality,

Boycotting won't stop them. We need to put our thinking caps on, as Adam said, and figure out a better solution. It seems the dark wallet and mixes is the best option. If we figure out now what will fix the problem, we can popularize it while the coin is still young.

|

|

|

|

|

ShadowOfHarbringer

Legendary

Offline Offline

Activity: 1470

Merit: 1005

Bringing Legendary Har® to you since 1952

|

|

November 14, 2013, 07:07:34 PM |

|

It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals.

Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem.

What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong.

Oh man, I'm sooooooo supporting you. |

|

|

|

solex

Legendary

Offline Offline

Activity: 1078

Merit: 1002

100 satoshis -> ISO code

|

|

November 14, 2013, 07:27:32 PM |

|

It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals.

Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem.

What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong.

Oh man, I'm sooooooo supporting you. 100% agree. This is the right approach. |

|

|

|

RichardForsyth

Newbie

Offline Offline

Activity: 15

Merit: 0

|

|

November 14, 2013, 07:37:39 PM |

|

I agree that this is the wrong approach to be taking cleaning bitcoin. But I do think it will have to be cleaned before it can become mainstream.

|

|

|

|

|

yayayo

Legendary

Offline Offline

Activity: 1806

Merit: 1024

|

|

November 14, 2013, 07:57:34 PM |

|

In every superhero movie there's also a scumbag traitor who sabotages a noble cause for personal gain. These guys are it. They know perfectly well the full implications of what they propose. To assume they are just stupid or careless or misunderstanding, is to let them off lightly. They should be shunned and berated and boycotted to the point of never wanting to show their face again in any context related to Bitcoin.

The many thieves and scammers in this community are an unpleasant reality, but these guys are an even lower life form. Traitors and collaborators were rightly assigned by Dante to the very deepest circle of hell.

This! Feel free to add information on these guys: https://bitcointalk.org/index.php?topic=332918.0ya.ya.yo! |

|

|

|

|

|

.

..1xBit.com Super Six.. | ▄█████████████▄

████████████▀▀▀

█████████████▄

█████████▌▀████

██████████ ▀██

██████████▌ ▀

████████████▄▄

███████████████

███████████████

███████████████

███████████████

███████████████

▀██████████████ | ███████████████

█████████████▀

█████▀▀

███▀ ▄███ ▄

██▄▄████▌ ▄█

████████

████████▌

█████████ ▐█

██████████ ▐█

███████▀▀ ▄██

███▀ ▄▄▄█████

███ ▄██████████

███████████████ | ███████████████

███████████████

███████████████

███████████████

███████████████

███████████▀▀▀█

██████████

███████████▄▄▄█

███████████████

███████████████

███████████████

███████████████

███████████████ | ▄█████

▄██████

▄███████

▄████████

▄█████████

▄██████████

▄███████████

▄████████████

▄█████████████

▄██████████████

▀▀███████████

▀▀███████

▀▀██▀ | ▄▄██▌

▄▄███████

█████████▀

▄██▄▄▀▀██▀▀

▄██████ ▄▄▄

███████ ▄█▄ ▄

▀██████ █ ▀█

▀▀▀ ▄ ▀▄▄█▀

▄▄█████▄ ▀▀▀

▀████████

▀█████▀ ████

▀▀▀ █████

█████ | ▄ █▄▄ █ ▄

▀▄██▀▀▀▀▀▀▀▀

▀ ▄▄█████▄█▄▄

▄ ▄███▀ ▀▀ ▀▀▄

▄██▄███▄ ▀▀▀▀▄ ▄▄

▄████████▄▄▄▄▄█▄▄▄██

████████████▀▀ █ ▐█

██████████████▄ ▄▄▀██▄██

▐██████████████ ▄███

████▀████████████▄███▀

▀█▀ ▐█████████████▀

▐████████████▀

▀█████▀▀▀ █▀ | .

Premier League

LaLiga

Serie A | .

Bundesliga

Ligue 1

Primeira Liga | | .

..TAKE PART.. |

|

|

|

justusranvier

Legendary

Offline Offline

Activity: 1400

Merit: 1009

|

|

November 14, 2013, 08:02:38 PM |

|

Its based on significant misunderstanding about bitcoins value proposition - destroy its fungibility and the costs float up to meet credit cards and paypal. I don't think there's enough evidence to assume that it's based on a misunderstanding. Credit cards, PayPal, and many other existing players have a lot of investment at risk in the long term if Bitcoin manages to keep its value proposition. They have a very strong financial incentive to understand exactly how to bring Bitcoin down to their level. Reality,

Boycotting won't stop them. We need to put our thinking caps on, as Adam said, and figure out a better solution. It seems the dark wallet and mixes is the best option. If we figure out now what will fix the problem, we can popularize it while the coin is still young.

Give up on traditional business that have VC investors, physical offices, and bank accounts, and replace them with censorship-resistant organizations. |

|

|

|

|

Vycid

Sr. Member

Offline Offline

Activity: 336

Merit: 250

♫ the AM bear who cares ♫

|

|

November 14, 2013, 08:05:19 PM |

|

http://www.forbes.com/sites/kashmirhill/2013/11/13/sanitizing-bitcoin-coin-validation/Its based on significant misunderstanding about bitcoins value proposition - destroy its fungibility and the costs float up to meet credit cards and paypal. It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals. Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem. What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong. I am also incensed frankly that someone would step into the market with such a muddle-headed thinking, and attempt to sabotage or destroy the core bitcoin feature that gives its value, where the value has been created by Satoshi and a cast of millions of man-hours of contributions of the community and technical wizards developing it mostly on volunteer time. I am not someone prone to swearing, but this is astonishingly stupid and dangerous. Please stop now. In the article it is claimed they sought advice from the Winklevoss twins, if the twins value their estimated $30million bitcoin holding they should advise them to stop: if fungibility is destroyed bitcoins value as a transaction currency is impacted. I encourage anyone with technical skills to put their thinking caps on to find ways to increase fungibility in the short term like CoinJoin, coin control in wallets, helping less technical people migrate to better wallets, educating people about privacy practices that defend fungibility. And longer term privacy technologies like zero coin, homomorphic encrypted value and committed (hidden) transactions. I encourage all bitcoin businesses to shun Coin Validation unless we see some major U-turn or corrections. If your business depends on the success bitcoin, it depends on the fungibility of bitcoin, and Coin Validation seem to be set on destroying both. You can quote me on that. I welcome Coin Validations corrections of the claims in the Forbes article. Tell me you were misquoted. Adam ps For people who have no idea who http://cypherspace.org/adam/ I am https://bitcointalk.org/index.php?topic=225463.msg237167 , my small part in bitcoin is I invented distributed mining in 1997 https://en.bitcoin.it/wiki/Hashcash (you can find the reference in Satoshi's paper) and worked on opensource ecash & crypto currency research & implementation for about a decade alongside Wei Dai & Hal Finney & others. You're a good guy, Adam. We need level-headed leaders like you. If we are to organize meaningfully, we should be represented by people who understand how to compromise without destroying the essence of Bitcoin. |

|

|

|

crazy_rabbit

Legendary

Offline Offline

Activity: 1204

Merit: 1001

RUM AND CARROTS: A PIRATE LIFE FOR ME

|

|

November 14, 2013, 08:15:57 PM |

|

http://www.forbes.com/sites/kashmirhill/2013/11/13/sanitizing-bitcoin-coin-validation/Its based on significant misunderstanding about bitcoins value proposition - destroy its fungibility and the costs float up to meet credit cards and paypal. It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals. Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem. What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong. I am also incensed frankly that someone would step into the market with such a muddle-headed thinking, and attempt to sabotage or destroy the core bitcoin feature that gives its value, where the value has been created by Satoshi and a cast of millions of man-hours of contributions of the community and technical wizards developing it mostly on volunteer time. I am not someone prone to swearing, but this is astonishingly stupid and dangerous. Please stop now. In the article it is claimed they sought advice from the Winklevoss twins, if the twins value their estimated $30million bitcoin holding they should advise them to stop: if fungibility is destroyed bitcoins value as a transaction currency is impacted. I encourage anyone with technical skills to put their thinking caps on to find ways to increase fungibility in the short term like CoinJoin, coin control in wallets, helping less technical people migrate to better wallets, educating people about privacy practices that defend fungibility. And longer term privacy technologies like zero coin, homomorphic encrypted value and committed (hidden) transactions. I encourage all bitcoin businesses to shun Coin Validation unless we see some major U-turn or corrections. If your business depends on the success bitcoin, it depends on the fungibility of bitcoin, and Coin Validation seem to be set on destroying both. You can quote me on that. I welcome Coin Validations corrections of the claims in the Forbes article. Tell me you were misquoted. Adam ps For people who have no idea who http://cypherspace.org/adam/ I am https://bitcointalk.org/index.php?topic=225463.msg237167 , my small part in bitcoin is I invented distributed mining in 1997 https://en.bitcoin.it/wiki/Hashcash (you can find the reference in Satoshi's paper) and worked on opensource ecash & crypto currency research & implementation for about a decade alongside Wei Dai & Hal Finney & others. Brilliantly explained. |

more or less retired.

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

November 14, 2013, 08:20:34 PM |

|

it would do wonders for confidence if this the dev of the project would say something like " after hearing the communities concerns, we have decided to change are our plans for a black-list, thank you for you input."

something to that effect, please.

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 08:26:34 PM

Last edit: November 14, 2013, 08:52:08 PM by Carlton Banks |

|

Yep, and Mike Hearn really does not understand all this, despite his capabilities as a software engineer and systems designer. Show yourself, Mike. It's trial by fire time, you're gonna have to get this out of the way.

This violates funds security (exceptionally ironic), privacy and fungibility.

We must institute some new behaviour of the block construction functions in the main client, such that miners can reject transactions from a list of their choosing. This is fraught with danger, as it could be used to enforce a blacklist instead of disparaging a whitelist. But I do not see how anonymising can help in the long term, it's characterisitics can be recognised in the anonymised transcations, and so there will be little point to trying to send these transaction to sanitised addresses. You will be banned from sanitary address schemes, and added to blacklist addresses, along with your anonymising buddies that make up the "suspicious" transactions.

|

Vires in numeris

|

|

|

justusranvier

Legendary

Offline Offline

Activity: 1400

Merit: 1009

|

|

November 14, 2013, 08:28:20 PM |

|

Yep, and Mike Hearn really does not understand all this, despite his capabilities as a software engineer and systems designer. Show yourself, Mike. It's trial by fire time, you're gonna have to get this out of the way.

He's hiding in the shadows of the private Bitcoin Foundation forums, where he doesn't need to answer inconvenient questions posed by the hoi polloi. |

|

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

November 14, 2013, 08:29:21 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

|

|

|

|

|

adamstgBit

Legendary

Offline Offline

Activity: 1904

Merit: 1037

Trusted Bitcoiner

|

|

November 14, 2013, 08:32:23 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

if sending coins to a new address makes them all clean again then this idea is beyond retarded and we need not care about anymore. |

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 08:36:28 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

if sending coins to a new address makes them all clean again then this idea is beyond retarded and we need not care about anymore. This assumes clean addresses will be the only list. Dirty addresses are being touted by Mike Hearn, when the real solution to theft and ransomware should be technical. And it's not like technical solutions don't exist, Mikes very own face and spiel are advertising the Trezor hardware wallet on it's front page. |

Vires in numeris

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

November 14, 2013, 08:38:39 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

if sending coins to a new address makes them all clean again then this idea is beyond retarded and we need not care about anymore. Reading the Forbes article I think it's pretty clear it's only what they are talking: a base of adresses link to a real world identity. So I don't see where is the huge problem, like you said sending coin to a new adress destroy the identity link. |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 08:49:06 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

if sending coins to a new address makes them all clean again then this idea is beyond retarded and we need not care about anymore. Reading the Forbes article I think it's pretty clear it's only what they are talking: a base of adresses link to a real world identity. So I don't see where is the huge problem, like you said sending coin to a new adress destroy the identity link. Read it again. They say that Avalon mining devices will not be available to people that don't use identified addresses. This is a way of destroying the concept of using multiple addresses at all, and it also compromises the security of the address. The more you re-use addresses, the easier some criminal will find it to synthesize a valid signature for that address, and steal any money sent to it. This is one of the reasons why address re-use is discouraged. |

Vires in numeris

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

November 14, 2013, 08:59:10 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

if sending coins to a new address makes them all clean again then this idea is beyond retarded and we need not care about anymore. Reading the Forbes article I think it's pretty clear it's only what they are talking: a base of adresses link to a real world identity. So I don't see where is the huge problem, like you said sending coin to a new adress destroy the identity link. Read it again. They say that Avalon mining devices will not be available to people that don't use identified addresses. This is a way of destroying the concept of using multiple addresses at all, and it also compromises the security of the address. The more you re-use addresses, the easier some criminal will find it to synthesize a valid signature for that address, and steal any money sent to it. This is one of the reasons why address re-use is discouraged. I understand how this is a privacy and security issues but I don't get why this is a fongibility issue ? |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 09:08:40 PM |

|

It attacks the property of one Bitcoin being as good as any other. If you can't understand why, well, I can't turn the cogs of logic in your head for myself.

|

Vires in numeris

|

|

|

|

adam3us (OP)

|

|

November 14, 2013, 09:17:15 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

All previous addresses that received the coin are listed on the public blockchain ledger. From what was said I believe Coin Validation plans to look at the history of the addresses associated with coins. If your coin was used 10 transactions ago by a silk road user, (eg seen entering the silk road address) then likely implications are you will not be able to spend your coin on any site using their system. They hope it will be viral, ie because you dont want to hold coins you cant spend, you may also refuse to accept coins they do not white list. Having them validate your coins will not be free and the uncertainty arising from not knowing if your coins will suddenly become less spendable will create fungibility problems. There are costs associated with the fraud tracing validation, blacklisting and payment revocation. eg its bad for merchants too, they cant rely on receiving money they can spend themselves. This is why credit cards are expensive for merchants (3-5% + 30c). This is one thing that makes bitcoin attractive for merchants and users - the fees are close to zero in comparison. Coin blacklist/whitelistng (just different names for the same trend) damage the underlying irrevocability which enables low cost transactions, and pulls bitcoins transaction cost up towards credit cards and paypal. The problem is when fungibility degrades because everyone is mutually scared of accepting blacklisted coins the utility of the coin goes down, the cost of using the currency goes up and so its price falls. It might literally collapse if the feedback loop picks up momentum as people sell non-white listed coins at steeper discounts in a race to the door. This makes as much sense as a $100 note in your pocket disabling itself because 10 previous holders ago, someone stole it from a convenience store. Someone posted on reddit about a 17th centur scottish court case (cant find the link now), where a bank was able to prevent legislation that would've had that implication - if you're left holding a stolen note, you lose it. The court rejected the case based on the argument that doing so would be unfair and also destroy the fungibility and value of the currency. Coin Validation want to reopen that 17th century mistaken (but defeated) court case. Adam |

hashcash, committed transactions, homomorphic values, blind kdf; researching decentralization, scalability and fungibility/anonymity

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 09:24:36 PM |

|

Even this uncertainty has made one decision for me.

I've been thinking over getting new mining equipment. This confirms to me that it's definitely, definitely too much risk. Until we have a clear way forward, I cannot commit to something that could be a dead loss in 6-12 months.

If a movement amongst miners started to use mining to ban clean addresses from the blockchain, I would step up and even swallow a loss, but only if it had a good chance to break the usability of the clean list.

|

Vires in numeris

|

|

|

solex

Legendary

Offline Offline

Activity: 1078

Merit: 1002

100 satoshis -> ISO code

|

|

November 14, 2013, 09:33:42 PM |

|

Even this uncertainty has made one decision for me.

I've been thinking over getting new mining equipment. This confirms to me that it's definitely, definitely too much risk. Until we have a clear way forward, I cannot commit to something that could be a dead loss in 6-12 months.

If a movement amongst miners started to use mining to ban clean addresses from the blockchain, I would step up and even swallow a loss, but only if it had a good chance to break the usability of the clean list.

Don't get depressed by events such as coin validation / redlist censorship proposals. This is all part of the Gandhi ignore/laugh/fight/you-win paradigm. The solution is a formal community funded bounty for CoinJoin and Zerocoin enhancements to the btc protocol. Most bitcoiners are against address censorship. Software solutions are the defense and need to be built. |

|

|

|

BldSwtTrs

Legendary

Offline Offline

Activity: 861

Merit: 1010

|

|

November 14, 2013, 09:41:35 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

All previous addresses that received the coin are listed on the public blockchain ledger. From what was said I believe Coin Validation plans to look at the history of the addresses associated with coins. If your coin was used 10 transactions ago by a silk road user, (eg seen entering the silk road address) then likely implications are you will not be able to spend your coin on any site using their system. They hope it will be viral, ie because you dont want to hold coins you cant spend, you may also refuse to accept coins they do not white list. Having them validate your coins will not be free and the uncertainty arising from not knowing if your coins will suddenly become less spendable will create fungibility problems. There are costs associated with the fraud tracing validation, blacklisting and payment revocation. eg its bad for merchants too, they cant rely on receiving money they can spend themselves. This is why credit cards are expensive for merchants (3-5% + 30c). This is one thing that makes bitcoin attractive for merchants and users - the fees are close to zero in comparison. Coin blacklist/whitelistng (just different names for the same trend) damage the underlying irrevocability which enables low cost transactions, and pulls bitcoins transaction cost up towards credit cards and paypal. The problem is when fungibility degrades because everyone is mutually scared of accepting blacklisted coins the utility of the coin goes down, the cost of using the currency goes up and so its price falls. It might literally collapse if the feedback loop picks up momentum as people sell non-white listed coins at steeper discounts in a race to the door. This makes as much sense as a $100 note in your pocket disabling itself because 10 previous holders ago, someone stole it from a convenience store. Someone posted on reddit about a 17th centur scottish court case (cant find the link now), where a bank was able to prevent legislation that would've had that implication - if you're left holding a stolen note, you lose it. The court rejected the case based on the argument that doing so would be unfair and also destroy the fungibility and value of the currency. Coin Validation want to reopen that 17th century mistaken (but defeated) court case. Adam Thanks. Now I understand why it's such a huge deal, it's so huge that it will probably destroy Bitcoin. It's so big that I wonder how these guys can have such a retarded idea. Are you sure they plan to track all the history of previous adresses and don't plan to only validate the adress that send bitcoins to the merchants? |

|

|

|

|

|

Pente

|

|

November 14, 2013, 09:43:22 PM |

|

Reusing an address allows for a possible security breach in the ECDSA algorithm. Many random number generators are not truly random. If the same number is used twice while sending money from an address, then the private key can be calculated as per this paragraph from the wikipedia article on ECDSA: When computing s, the string z resulting from \textrm{HASH}(m) shall be converted to an integer. Note that z can be greater than n but not longer.

As the standard notes, it is crucial to select different k for different signatures, otherwise the equation in step 6 can be solved for d_A, the private key: Given two signatures (r,s) and (r,s'), employing the same unknown k for different known messages m and m', an attacker can calculate z and z', and since s-s' = k^{-1}(z-z') (all operations in this paragraph are done modulo n) the attacker can find k = \frac{z-z'}{s-s'}. Since s = k^{-1}(z + r d_A), the attacker can now calculate the private key d_A = \frac{s k - z}{r}. This implementation failure was used, for example, to extract the signing key used in the PlayStation 3 gaming console. The odds of using the same random number from a faulty RNG goes up as y=x!/2 (as long as x>1, otherwise y=0), where x is the number of transactions sent from the address. I feel safe reusing an address after swiping it once, even though it is only protected by the strength of irreversibility of the ECDSA algorithm. However, I will not reuse an address after pulling funds out of it a second time. For people who trust their RNG algorithm, this may seem to be mute issue. But I am sure that people using the SecureRandom() call in Java on their Android phones felt pretty safe. As we all know, they weren't. |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 09:49:12 PM |

|

Even this uncertainty has made one decision for me.

I've been thinking over getting new mining equipment. This confirms to me that it's definitely, definitely too much risk. Until we have a clear way forward, I cannot commit to something that could be a dead loss in 6-12 months.

If a movement amongst miners started to use mining to ban clean addresses from the blockchain, I would step up and even swallow a loss, but only if it had a good chance to break the usability of the clean list.

Don't get depressed by events such as coin validation / redlist censorship proposals. This is all part of the Gandhi ignore/laugh/fight/you-win paradigm. The solution is a formal community funded bounty for CoinJoin and Zerocoin enhancements to the btc protocol. Most bitcoiners are against address censorship. Software solutions are the defense and need to be built. I have plenty of time for optimistic plans and determined action. But I don't think CoinJoin and ZeroCoin come without their problems. CoinJoin use with clean addresses can get you kicked out of the scheme, your addresses and your CoinJoin anonymous buddies may end up on Mike Hearn's red/black list. ZeroCoin isn't implemented, and therefore untested. And has a problem in that the Genesis Block requires trust that the progenitor does not record the value of the accumulator, and use that to steal or track funds. WE CAN FIGHT THIS, though. With the miners. Miners must be encouraged to reject clean addresses from the blockchain, it's the only way to kill this. |

Vires in numeris

|

|

|

|

EhVedadoOAnonimato

|

|

November 14, 2013, 09:52:16 PM |

|

Coin blacklist/whitelistng (just different names for the same trend)

Oh but they're not quite the same. Blacklists are easier to work-around. Mix your coins enough and there will be no meaningful taint anymore. Whitelists, OTOH, are an entirely different matter. Authoritarian governments may force every business in their jurisdiction to only accept money from the whitelist. Everything not whitelisted should be taxed or even seized. That's the real danger. Since I'm replying to the bright mind behind Zerocoin, I'll use the opportunity to ask: does it make sense to talk about whitelisting Zerocoin transactions/addresses? I confess I tried to understand how your system works, but I'm just too dumb to actually get it. WE CAN FIGHT THIS, though. With the miners. Miners must be encouraged to reject clean addresses from the blockchain, it's the only way to kill this.

Whitelists do not need to be public. |

|

|

|

|

gmaxwell

Staff

Legendary

Offline Offline

Activity: 4158

Merit: 8382

|

|

November 14, 2013, 09:55:32 PM |

|

Oh but they're not quite the same. Blacklists are easier to work-around. Mix your coins enough and there will be no meaningful taint anymore.

Thats not so, blacklisting increases the probability that you receive back blacklisted coins— even if you didn't have blacklisted ones going in. This increases the "cost" to you of using this approach, so only outlaws will think it worth the cost, and so you'll only receive outlawed coins while using such a system. It's self-fulfilling once it takes off. I don't think that things that have cost and take effort and which only a tiny fraction of (more likely than usual to be troublesome) users can really move the needle against efforts like this, or at least we shouldn't count on them to. |

|

|

|

|

ColinTulloch

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

November 14, 2013, 10:00:48 PM

Last edit: November 14, 2013, 10:16:29 PM by ColinTulloch |

|

I think there's a misunderstanding around the use of the term fungible here...

To me fungibility describes the ability of a good to be divided and recombined to the same value... With varying degrees of divisibility and recombine-ability but same term...

This thread somehow confuses governmental violent coercion through white-lists with fungibility... Violent coercion, that is using violent force to get what you want is obviously going to end bad for the person who isn't going to get what they want, or the person who is going to be a victim of violence/jail/etc... In this case the groups utilizing violence to force others into using their products, their coin outputs etc, are obviously going to benefit from that ability...

I should also mention that it doesn't seem like Coin Validation is asking for government force to backup their white-list at this point, but there's an assumption that it won't be long before they likely will.

White-lists might have real market value in specific cases - Market value is determined by a free market though. - A market ceases to be free when a government, or a few individuals who control or manipulate government, use it to force a markets participants to act a certain way.

So this no doubt bad because it looks like Coin Validation is only building towards government backed white-lists - but it shouldn't be called a fungibility issue.

I haven't looked into the details of Coin Validation, but is there some kind of *whole coin* limit, where they want to limit people to use whole coins behind addresses and not any smaller amounts? In this case you can call this a fungibility problem - but I don't think this is the case...

White-listing != fungibility

|

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4470

|

|

November 14, 2013, 10:01:56 PM |

|

after reading the forbes news report and then investigating coinvalidation themselves.. i have come to this conclusion

never take whats written on the news as gospel.. (a lesson i learned way back, but recently got reminded)

secondly, there is alot of hysteria without much investigation by people.

so here it is short ans sweet.

coinvalidation are not government. they cannot freeze, seize funds

coinvalidation are just business advisors with a data base.

coinvalidation cannot make it a requirement to use their service. they are a business. people are free to choose to use it or not.

now lets talk about this database.

this database will not store every public key and eventually link it to users.

it will however list pubkeys of businesses that are fully fincen compliant and also seek out to list blackmarket addresses, again i highlight businesses not personal keys.

think of it like a santas "naughty or nice list" for BUSINESSES not individuals.

coinvalidation is not seeking to get every USERS identification , much like the government does not request everyone to write their name and zipcode on every bank note they spend. all its for is to increase the ability to see the source of funds. much like banks look at serial numbers of bank notes to see if they come up with flags that funds once got blacklisted/marked as part of a drugs cartel blackmarket

EG have funds come from a compliant exchange, or a blackmarket recently.

how will businesses use coinvalidation services.

(a) alpaca socks shop wont need to check TXID for its origins as they only accept small amounts, meaning low risk and no need for the AMLKYC stuff

(b) real estate agent will check every TXID for its origins due to higher value transactions. and if within 3 hops they notice a legitimate bitstamp address, great no risk. if its silkroad with 3 hops *, then the real estate agency will assess the risks of money laundering and do all the fincen checks required of them and report to fincen if serious crime criteria is met.

parts of finCEN require compliant members to:

do AMLKYC on customers transactig over $10k

monitor for serious crimes.

now a serious crime is NOT selling a dimebag of weed for $20 of bitcoin. a serious crime is a druglord with over $10k of funds for instance. or a murderer for hire, etc etc

so for businesses to monitor serious crimes they need to look out for large amounts of money that come pretty much directly * from drug websites for instance. small amounts like $20-$100 or even $1000 can be weighed up by the business as a low medium or high risk themselves.

*businesses will decide how many hops are deemed high/low risk for validation checks as part of their own policy handbooks

now then

all of this only applies to businesses that have to deal with FIAT exchanging for customers and its purely about sniffing out large transacting serious crimes and tax evaders. so all those businesses that dont do customer FIAT-bitcoin transactions dont need compliance. but businesses that do handle FIAT on behalf of customers do.

so chill out on the hysteria. bitcoin anonymity wont change, infact the FINCEN regulations wot/havnt changed in decades. the only difference is that coinvalidation will make it easier for bitstamp to recognise a 1-2-3-4-or 5 hop TXID as coming from a notorious website to then assess the requirement to report it to fincen.

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

|

DeeSome

|

|

November 14, 2013, 10:08:50 PM |

|

Even this uncertainty has made one decision for me.

I've been thinking over getting new mining equipment. This confirms to me that it's definitely, definitely too much risk. Until we have a clear way forward, I cannot commit to something that could be a dead loss in 6-12 months.

If a movement amongst miners started to use mining to ban clean addresses from the blockchain, I would step up and even swallow a loss, but only if it had a good chance to break the usability of the clean list.

I like your idea Carlton, get the miners to stop it in it's tracks. I bet Xperian and Equifax are salivating at Mike Hearn's suggestion. |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 10:26:51 PM |

|

Even this uncertainty has made one decision for me.

I've been thinking over getting new mining equipment. This confirms to me that it's definitely, definitely too much risk. Until we have a clear way forward, I cannot commit to something that could be a dead loss in 6-12 months.

If a movement amongst miners started to use mining to ban clean addresses from the blockchain, I would step up and even swallow a loss, but only if it had a good chance to break the usability of the clean list.

I like your idea Carlton, get the miners to stop it in it's tracks. I bet Xperian and Equifax are salivating at Mike Hearn's suggestion. I'm not sure that this is possible in the way I'm presenting it without a change to the current mining protocol. There are sensible reasons to prevent it, as it creates a market for miners to accept personal vendettas against certain addresses, which is precisely the mechanism I'm arguing for. But in the name of only targeting the clean list. Perhaps it might be possible to query all public Bitcoin nodes to see which addresses they are blacklisting. Then at least you can identify who is blocking you. The truth is that all solutions to this problem are a compromise, we're working with an information system here, and for it to be in any way useful, it must permit misuse as well. Storing non transaction information in the blockchain being just one example of misusing the innovation, people always worked around any attempt to stop it, so Gavin Andresen moved to standardise it instead. |

Vires in numeris

|

|

|

cypherdoc

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

November 14, 2013, 10:32:58 PM |

|

But isn't the purpose of CoinValidation to label adresses and not coins?

I don't get why the fungibility of coins is destroyed if only adresses are impacted?

All previous addresses that received the coin are listed on the public blockchain ledger. From what was said I believe Coin Validation plans to look at the history of the addresses associated with coins. If your coin was used 10 transactions ago by a silk road user, (eg seen entering the silk road address) then likely implications are you will not be able to spend your coin on any site using their system. They hope it will be viral, ie because you dont want to hold coins you cant spend, you may also refuse to accept coins they do not white list. Having them validate your coins will not be free and the uncertainty arising from not knowing if your coins will suddenly become less spendable will create fungibility problems. There are costs associated with the fraud tracing validation, blacklisting and payment revocation. eg its bad for merchants too, they cant rely on receiving money they can spend themselves. This is why credit cards are expensive for merchants (3-5% + 30c). This is one thing that makes bitcoin attractive for merchants and users - the fees are close to zero in comparison. Coin blacklist/whitelistng (just different names for the same trend) damage the underlying irrevocability which enables low cost transactions, and pulls bitcoins transaction cost up towards credit cards and paypal. The problem is when fungibility degrades because everyone is mutually scared of accepting blacklisted coins the utility of the coin goes down, the cost of using the currency goes up and so its price falls. It might literally collapse if the feedback loop picks up momentum as people sell non-white listed coins at steeper discounts in a race to the door. This makes as much sense as a $100 note in your pocket disabling itself because 10 previous holders ago, someone stole it from a convenience store. Someone posted on reddit about a 17th centur scottish court case (cant find the link now), where a bank was able to prevent legislation that would've had that implication - if you're left holding a stolen note, you lose it. The court rejected the case based on the argument that doing so would be unfair and also destroy the fungibility and value of the currency. Coin Validation want to reopen that 17th century mistaken (but defeated) court case. Adam +1 |

|

|

|

|

|

EhVedadoOAnonimato

|

|

November 14, 2013, 10:39:17 PM |

|

Thats not so, blacklisting increases the probability that you receive back blacklisted coins— even if you didn't have blacklisted ones going in. This increases the "cost" to you of using this approach, so only outlaws will think it worth the cost, and so you'll only receive outlawed coins while using such a system. It's self-fulfilling once it takes off. I don't think that things that have cost and take effort and which only a tiny fraction of (more likely than usual to be troublesome) users can really move the needle against efforts like this, or at least we shouldn't count on them to.

A blacklist need to have a threshold, otherwise it's meaningless (you could distribute taint to people you don't like, if you happen to have tainted coins). If the percentage of taint is below a certain level, you can't really consider that input as linked to the originally tainted output. And concerning the fact that most mixers would contain mostly tainted coins, even if that becomes the case, they would still be able to cover tracks. Let's say a non-violent, honest individual does something perfectly ethical but which governments tend to punish, like, say, not paying taxes, selling cocaine or whatever. If governments manage to identify a particular address as participant in a particular "made-up crime", they'll taint it for that reason. If the said individual mixes his coins enough, even if in the end he gets lots of tainted coins still, the original reason his coins got tainted for is practically lost. Yes, there may still be lots of tainting in his coins, for many different reasons, what indicates with a decent probability that he did something the government does not approve. But you can't really know what. Legally, they can't hold anything on him, other than the fact that he probably tried to cover his money tracks. Yeah, perhaps they can criminalize that with some scary wording like "money laundering". But, well, if wallets do it automatically on the background once in a while, it would be hard to criminalize it. Also, there would probably be multiple different blacklists. Victims of one particular blacklist have an interest in working together with victims of other blacklists in order to mix their coins. Assuming the place you want to spend your coins block coins from blacklist A but not blacklist B, exchanging your taint from A to B would make you clean. Further on, from an tyrannical surveillance POV, blacklists don't easily allow a government to know everything you do with your money. Whitelists allow them to track each little spending of yours. When they control your money, they control you. Anyways, I'm not trying to say that blacklists offer no danger and that people should not try to fight them, quite on the contrary. I'm just trying to point the fact that it's easier to work around them, when compared to whitelists. Mandatory whitelists could render the Bitcoin payment network almost as awful as credit cards. We'd still have an inflation-proof currency, what's great, but the payment network value would considerably decrease. |

|

|

|

|

|

Luckybit

|

|

November 14, 2013, 11:07:07 PM |

|

http://www.forbes.com/sites/kashmirhill/2013/11/13/sanitizing-bitcoin-coin-validation/Its based on significant misunderstanding about bitcoins value proposition - destroy its fungibility and the costs float up to meet credit cards and paypal. It is also a ridiculous approach. If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins. The certificates should be non-transitive they attest to the identity of the user, not the coins. They should be optionally sent - if the recipient does not request it, it is privacy destructive and a security risk to send identifying information to unregulated businesses and individuals. Their technical representatives of Coin Validation should be ashamed. How can someone who doesnt understand a concept as basic as fungibility and its relation to transaction costs, and the difference between identity and coins hope to exist in this ecosystem. What they are proposing so far at least as explained by the Forbes article is stupid, dangerous and just wrong. I am also incensed frankly that someone would step into the market with such a muddle-headed thinking, and attempt to sabotage or destroy the core bitcoin feature that gives its value, where the value has been created by Satoshi and a cast of millions of man-hours of contributions of the community and technical wizards developing it mostly on volunteer time. I am not someone prone to swearing, but this is astonishingly stupid and dangerous. Please stop now. In the article it is claimed they sought advice from the Winklevoss twins, if the twins value their estimated $30million bitcoin holding they should advise them to stop: if fungibility is destroyed bitcoins value as a transaction currency is impacted. I encourage anyone with technical skills to put their thinking caps on to find ways to increase fungibility in the short term like CoinJoin, coin control in wallets, helping less technical people migrate to better wallets, educating people about privacy practices that defend fungibility. And longer term privacy technologies like zero coin, homomorphic encrypted value and committed (hidden) transactions. I encourage all bitcoin businesses to shun Coin Validation unless we see some major U-turn or corrections. If your business depends on the success bitcoin, it depends on the fungibility of bitcoin, and Coin Validation seem to be set on destroying both. You can quote me on that. I welcome Coin Validations corrections of the claims in the Forbes article. Tell me you were misquoted. Adam ps For people who have no idea who http://cypherspace.org/adam/ I am https://bitcointalk.org/index.php?topic=225463.msg237167 , my small part in bitcoin is I invented distributed mining in 1997 https://en.bitcoin.it/wiki/Hashcash (you can find the reference in Satoshi's paper) and worked on opensource ecash & crypto currency research & implementation for about a decade alongside Wei Dai & Hal Finney & others. I agree with a lot of what you have to say but how can we have transparency with privacy? For instance if I want to claim my transactions under a pseudo-nym as being transactions I have made then this would be possible with a digital signature and public key. It is also possible that I could have that digital signature verified by Coinbase. My personal identifiable information does not need to be shared with anyone other than Coinbase and then Coinbase could verify me and all of my transactions would be connected to a real world identity. My public key could be uploaded to a decentralized blockchain/database along with a verified digital signature. I don't really like the idea of tainting coins but no one is offering a better alternative either. So what is an alternative idea which does not involve tainting coins which can preserve privacy, pseudo-anonymity and fungibility while also removing bank secrecy and providing transparency? I think in order to have democracy we cannot have bank secrecy and must have transparency. In order to combat institutionalized corruption we must have the ability to follow the money trail and this means transparency. So I don't want to remove the ability of the community to use the tactic of sousveillance to investigate itself and I do not want to remove the ability of law enforcement to investigate (with the cooperation of the global Bitcoin community). I want the ability to be able to claim my transactions under a pseudo-anonymous but verified identity so that I can be cleared if there is an investigation. Is it possible to do this? |

|

|

|

|

|

Luckybit

|

|

November 14, 2013, 11:19:28 PM |

|

Reality,

Boycotting won't stop them. We need to put our thinking caps on, as Adam said, and figure out a better solution. It seems the dark wallet and mixes is the best option. If we figure out now what will fix the problem, we can popularize it while the coin is still young.

All of these sorts of reactions only will make the situation worse. Darkwallet is not a solution, it's a patch. We have a legitimate requirement for transparency and the ability to investigate the blockchain. Whether it's journalists trying to uncover corruption, or law enforcement, or members of a community trying to determine whether or not to vote for certain politicians. If we do not focus on solving the problem of institutional corruption then Darkwallet will be used by the corrupt institutions to maintain their corruption. The same technology you build for anonymity to be used by you could also be used by the people in power to control you through corrupting your community with bribes and other tactics. So no I don't think Darkwallet will fix anything. It does produce greater privacy but it also removes the ability to follow the money trail which enables and helps the corrupt individuals already in power. If a law enforcement officer is corrupt and taking bribes behind the scenes I'm sure Darkwallet will be what they'd use. We need the ability to apply sousveillance to follow the money trail to the corrupt police officer so I'm on the side of transparency. But I'm also on the side of privacy. I don't think every coin should be subject to scrutiny. I don't think every transaction should be carefully analyzed by law enforcement to determine whether or not a crime took place. The reason is that if you allow that then whoever has enough power to hire private investigators can simply watch their political enemies until they commit a crime and then the private investigator can pass the evidence to law enforcement. So we must care about privacy to protect the community from fishing expeditions but we also have to care about transparency to protect the community from institutionalized corruption, hackers, scams, etc. We need a balanced approach which attempts to solve the problem while upholding both of these critical ideals. Darkwallet is good for hackers, for corrupt politicians, cops, and perhaps some paranoid individuals, but it can also be abused if taken too far. Balance is necessary. |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 11:29:19 PM |

|

how can we have transparency with privacy?

They're the logical opposite of one another. The likely answer is, not with this design. |

Vires in numeris

|

|

|

TraderTimm

Legendary

Offline Offline

Activity: 2408

Merit: 1121

|

|

November 14, 2013, 11:41:33 PM |

|

adam3us - I know you'll be flooded with replies, but I just wanted to say THANK YOU. You have perfectly encapsulated why Coin Verification is a bad idea, and I'll do my best to protest this and boycott the individuals and their associated businesses.

Mike Hearn, Yifu, etc.. you should be ashamed of yourselves for trying to undermine the core tenet of Bitcoin - FREEDOM.

|

fortitudinem multis - catenum regit omnia

|

|

|

|

jedunnigan

|

|

November 14, 2013, 11:44:31 PM |

|

All previous addresses that received the coin are listed on the public blockchain ledger. From what was said I believe Coin Validation plans to look at the history of the addresses associated with coins. If your coin was used 10 transactions ago by a silk road user, (eg seen entering the silk road address) then likely implications are you will not be able to spend your coin on any site using their system.

They hope it will be viral, ie because you dont want to hold coins you cant spend, you may also refuse to accept coins they do not white list. Having them validate your coins will not be free and the uncertainty arising from not knowing if your coins will suddenly become less spendable will create fungibility problems.

This is what I thought too, but now I am looking closer and it appears that Forbes may have misrepresented the tech. Read Alex's reddit posts from the previous day: http://www.reddit.com/user/alex_waters : we're not planning on tracking coins... so go ahead and send coins to those coins  As mentioned above, if there were "clean coins" and "unclean coins" - we would quickly run out of clean coins. That is a ridiculous model that we have worried about for some time, and its advent is likely impossible.

It is very easy to taint "clean coins" with the current protocol - so that would be a fruitless endeavor to pursue.

Please stop confusing "clean coins" with KYC'd Bitcoin addresses.

I agree, KYC Bitcoin addresses != blacklist.

I think the quote you are referring to, and the one that has people upset is somewhat out of context. We are not looking to create a distinction for clean / unclean coins or even clean / unclean addresses for that matter. It is simple as you stated, creating a list of known addresses. This is something that has been thought about and worked on for years. BIP 15 https://en.bitcoin.it/wiki/BIP_0015 is an example of how much this has been thought about. In fact, Satoshi himself originally thought about using IP addresses as an alternative to Bitcoin addresses, and it existed in the client for some time. There was even some work done by some prominent core devs to explore using DNS or email addresses in conjunction with or as an alternative. Ultimately the new payment protocol was developed: https://bitcointalk.org/index.php?topic=300809.msg3225143#msg3225143"Is this just about creating known addresses?" Yes "Let's say I buy some coins on an exchange, and a couple hops ago they passed through some illicit site's wallet. Does your system track that?" No "Am I going to be able to spend my coins with a company using your system?" Yes, I hope so "Do I just have to send them to my personal known registered address first?" Probably, depending on how strict the company receiving them is about receiving coins from KYC'd addresses. It is beginning to sound a bit more like what you proposed Adam. |

|

|

|

|

|

adam3us (OP)

|

|

November 14, 2013, 11:45:52 PM

Last edit: November 15, 2013, 12:37:22 AM by adam3us |

|

all its for is to increase the ability to see the source of funds. much like banks look at serial numbers of bank notes to see if they come up with flags that funds once got blacklisted/marked as part of a drugs cartel blackmarket

This is not about crime, nor identifying perpetrators, its about fungibility, they are (perhaps surprisingly) orthogonal payment system properties. An electronic cash system, must have irrevocability, which as we discussed here is how bitcoin can achieve low cost and efficiency relative to credit cards & paypal. Coin anonymity is necessary for fungibility, but that is strictly about fungibility, identity level privacy is separate. Bitcoin makes attempts to achieve irrevocability via blockchain hardening (so it is expensive to undo or change the transaction) and also via using fresh addresses to add coin-level anonymity. CoinJoin and mixes are technical solutions to improve on just using fresh addresses. However that does not mean the user is anonymous. The user is identified because they have an identity, they interact with multiple coins and identify themselves to businesses. Police investigators can ask normal businesses they interact with to identify them. And users identify themselves via street address for delivery, IP address (unless using Tor), username/password on web site, and email address for receipt, bank account for exchange, AML/KYC identities at the exchanges, geo-location of their smart phone, IP address log of their DSL connection, and (without CoinJoin) because their payments link different addresses when a transaction is made using multiple coins, and change is given. The bitcoin user is far from anonymous. The full transaction log is public. (Bitcoin really is not that private nor anonymous: if someone offered to make your bank account or credit card statement as public as bitcoin does we would be angry about it.) As I said in the original post: If they want to certify users, they should do that as optional KYC, AML certificates that regulated merchants in respective jurisdictions can request, which could be attached to wallets/identities, not to fully fungible coins.

Now in an ideal world how it is supposed to work is the fungibility/anonymity is secure like zerocoin. And identity is managed between people sending and receiving bitcoin. Many variants are possible: 1. public (everyone can see amount, and sender/recipient addresses - current bitcoin) 2. private (encrypted so only recipients see value and address information) 3. private but identified (encrypted between recipients, but recipient and/or sender is identified) I prefer user choice of 2 or 3. We use SSL for web commerce for a reason, confidentiality of the transaction, and bitcoin does not encrypt transactions. It means only parties to the communication see the value and decide what level of identification they want if any. This supports buying ebooks without a dossier of what books you read. Its no ones business. And it supports AML/KYC for large for regulated businesses. And identifying the customer account so the business can account eg with repeat customers. And it supports criminal investigation also. The police go subpoena information from businesses the criminal interacted with to track him down. Same as in real life. (This is what committed transactions try to do, though it so far has inefficiencies for SPV, and has imperfect privacy as people on the transaction see previous transactions; however it is much more efficient than zerocoin.) The problem with Coin Validation arises because bitcoins coin-level fungibility/anonymity is imperfect, so it is somewhat possible to correlate users via coins. It depends if the user follows technical advice, what wallet they use, and if they use coin privcacy enhancing tools like coinjoin. There are two approaches: cryptography like zerocoin/committed tx; and stirring coins together like coinjoin and mixes - so their whitelist attempts see a jumble of spagetti and reject all transactions and so are ignored. CoinJoin works now the others are future projects. Bitcoin identification is also adhoc. However any regulated bitcoin processor asks for AML. Most business sites will have an address for delivery, an email for a receipt, an IP address from the web, cookies linking to other sites. Hence my suggestion to them: issue AML certs in their jurisdiction that the user can show when requested its the sane way to do it within the architecture of an ecash system without destroying its fungibility and hence destroying the currency itself. (btw fungibility to the other reader, has a second standard meaning: that each coin should be considered equal value). the only difference is that coinvalidation will make it easier for bitstamp to recognise a 1-2-3-4-or 5 hop TXID as coming from a notorious website to then assess the requirement to report it to fincen.

I hope contrarily that to quote John Gilmore the internet views Coin Validation as censorship and routes around it. Meaning the coin graph is stirred to a blur via coinjoin integration in all major clients, or Matthew Green & Ian Miers figure out a faster zerocoin or something else figures something else out. Please do not feed the "oh but the criminals" meme. We're not encouraging or facilitating crime. Before it was shutdown silk road accounted for < 1% of transaction volume/month and falling. Paper cash has worse statistics and is less traceable. HSBC laundered $880m of dirty money for drug cartels and worse, and walked away with a fine, no sanctions. http://www.reuters.com/article/2012/12/11/us-hsbc-probe-idUSBRE8BA05M20121211 We just want an efficient fungible payment system that works without the reputation (equifax etc) costs and revocability (credit card charge backs, paypal freezes etc) that come with credit cards and paypal. Do NOT invite currency destruction via fungibility attacks it WILL pull the costs up to credit cards and paypal levels. Adam |

hashcash, committed transactions, homomorphic values, blind kdf; researching decentralization, scalability and fungibility/anonymity

|

|

|

|

Luckybit

|

|

November 14, 2013, 11:48:31 PM

Last edit: November 15, 2013, 12:03:36 AM by Luckybit |

|

how can we have transparency with privacy?

They're the logical opposite of one another. The likely answer is, not with this design. No they are not logical opposites. Secrecy is the opposite of transparency. Privacy is not the same as secrecy. Transactions should be private but not secret. If an investigation takes place it should be possible to follow a money trail. If there is secrecy in a system such as then then the secret money would have to show up somewhere. So if politicians start dressing nice and driving in brand new cars, living beyond their means, then of course it's reasonable to consider the possibility that they could be taking a bribe. If you were a journalist trying to uncover all this then secrecy wouldn't help you. If information is private but not secret then it can be uncovered if you interview the right people or ask the right questions, but as a considerable enough cost that it couldn't be a situation where everyone is investigated by a machine. At the same time most of us don't want to be associated with corrupt social networks, but that has nothing to do with fungibility. If Bitcoin is not fungible then you have dirty and clean Bitcoins and that cannot work. If Bitcoin is fungible then it means we don't have to care where our Bitcoins come from and this is a necessary requirement for Bitcoin. |

|

|

|

|

Carlton Banks

Legendary

Offline Offline

Activity: 3430

Merit: 3071

|

|

November 14, 2013, 11:59:42 PM |

|

how can we have transparency with privacy?

They're the logical opposite of one another. The likely answer is, not with this design. No they are not logical opposites. Secrecy is the opposite of transparency. Privacy is not the same as secrecy. Um, whatever you want to believe, then. |

Vires in numeris

|

|

|

|

Luckybit

|

|

November 15, 2013, 12:10:31 AM |

|

how can we have transparency with privacy?

They're the logical opposite of one another. The likely answer is, not with this design. No they are not logical opposites. Secrecy is the opposite of transparency. Privacy is not the same as secrecy. Um, whatever you want to believe, then. It's semantic pedantry but it's still fact. Private information is your name, address, social security number, or whatever you don't want everyone to know. Secret information is a level higher than that. People will kill each other to protect secret information because the level of seriousness is higher. Usually when you have networks of people in authority keeping secrets you have corruption of whatever that institution is. That is because you cannot vet anyone without a background check and you cannot trust anyone who has secrets. If a human being is in a position of authority then secrecy is risk. While we don't need to know exactly what was transacted it's a good thing that we can see the movement of money. If a lot of people give money to a particular address that is something which should be known to anyone. We don't have to know who they all are to know that. Personal information is your identity. Public information is a lot of people who use Bitcoins like to buy books. Private information is the particular books that you chose to buy. If you don't want the world to see what you chose to buy then you need pseudo-anonymity to mask your email address, personal information, etc. It is still important for a society to know that certain books are popular without knowing which individuals are buying the books. |

|

|

|

|

|

adam3us (OP)

|

|

November 15, 2013, 12:25:49 AM |

|

I don't really like the idea of tainting coins but no one is offering a better alternative either. So what is an alternative idea which does not involve tainting coins which can preserve privacy, pseudo-anonymity and fungibility while also removing bank secrecy and providing transparency?

Its a subtle point but there should ideally be two layers. A. Coin layer, the coin is anonymous and fungible (like zerocoin if they can get the CPU & storage efficiency and another issue fixed). B. User layer: the users send each other encrypted transactions for commercial sensitivity and user privacy, within the encryption the users identify to the degree they choose, if any. If the recipient is a regulated, it asks for AML/KYC level identification. Bitcoin is not so far able to meet this normal ecash design. Bitcoin is cutting edge, the blockchain design is an elegant all-new design to handle double-spend protection for distributed ecash. But it lost some crypto ecash features of fungibility via cryptographic blinding (Chaum) because they are harder to do in a distributed system. As close as we have so far is the ZeroCoin proposal of Matthew Green & Ian Miers which improves on a 1999 paper by Sanders & Ta-Shma. It is very complex to improve bitcoin features, to do it with practical efficiently, and to get them implemented securely, tested as rigorously as a jumbo jet autopilot, and deployed. There are hard cryptography problems. People are working on it as hard and as fast as they can, most of them volunteers but enthralled by the new possibilities bitcoin enables for society, with smart-contracts, user self-determination etc. I think in order to have democracy we cannot have bank secrecy and must have transparency.

I think you have been reading too much David Brin  While corruption is bad, as Assange says, there should be transparency for the powerful, and privacy for the weak. Current financial systems have the reverse. In fact a further future, smart-contracts (that bitcoin includes an early version of) should allow rules to be apriori enforced. This is because smart-contracts act like a scrupulously honest virtual AI that always follows the rules and cant be influenced. Technically its just that all recipients of proceeds of contracts, and he network itself validate the transactions before they rely on the money. But its a very powerful effect. Mike Hearn made a presentation on smart contracts www.youtube.com/watch?v=mD4L7xDNCmAI do think in principle we could build a future with less systemic risk, less scope for fraud with more sophisticated smart-contracts apriori enforcing rules. It is better to prevent a crime than occasionally catch these people, and mostly they are smart-enough and connected-enough to avoid sanctions anyway. In order to combat institutionalized corruption we must have the ability to follow the money trail and this means transparency.

Or strong legal protections and government funded support for whistle-blowers. Whistle-blowers of corporate and government crimes should be lauded as heroes. Take Snowden: should be nominated for Nobel prize, not grounded in Russia. So I don't want to remove the ability of the community to use the tactic of sousveillance to investigate itself and I do not want to remove the ability of law enforcement to investigate (with the cooperation of the global Bitcoin community).

I think investigation should work as at present. Subpoena people and businesses the criminal interacted with to track down. I want the ability to be able to claim my transactions under a pseudo-anonymous but verified identity so that I can be cleared if there is an investigation. Is it possible to do this?

Typically the user can keep receipts and present them afterwards in event of dispute or to prove what happened. Adam |

hashcash, committed transactions, homomorphic values, blind kdf; researching decentralization, scalability and fungibility/anonymity

|

|

|

|

adam3us (OP)

|

|

November 15, 2013, 01:21:33 AM |

|