|

Mark_R (OP)

|

|

October 31, 2019, 02:04:45 PM |

|

The market looks inadequate these days. Returned to scalping and happy with that. Just catched the upwards impulse after the resistance breakout.  |

|

|

|

|

|

|

|

|

|

|

Bitcoin addresses contain a checksum, so it is very unlikely that mistyping an address will cause you to lose money.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

Mark_R (OP)

|

|

November 01, 2019, 08:52:15 AM |

|

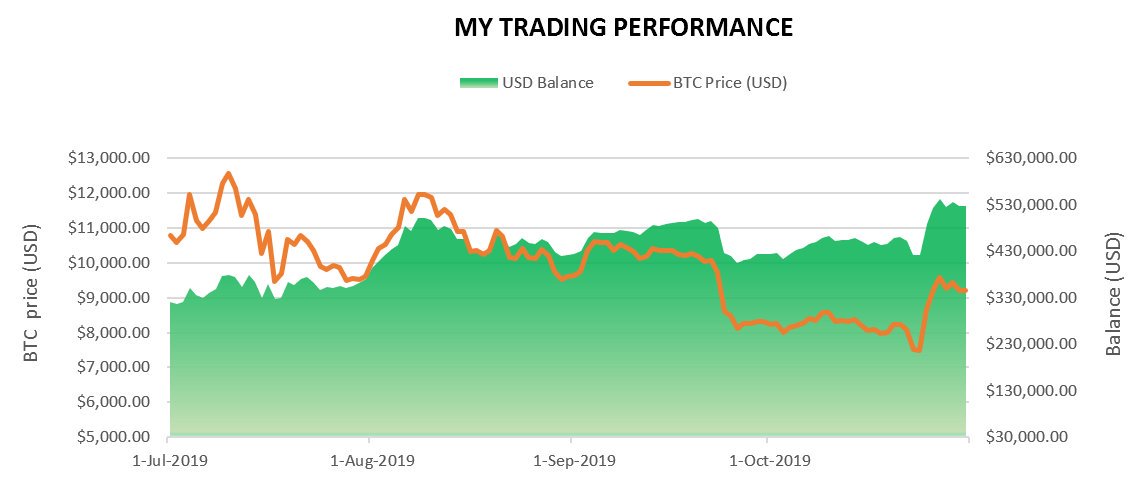

📊 OCTOBER TRADING RESULTS Here what we have for October More shorts again this month The trades are more risky this month, the profit is bigger Leverage stays the same   |

|

|

|

|

Mark_R (OP)

|

|

November 03, 2019, 11:34:20 AM |

|

XBTUSD price after the breakout is moving in the diapason of $9000-$9400. The price formed an upwards trend inside the range and broke it out after the upper border of the range rebound. I opened a short position at $9320 after a breakout and closed a half with 200 points gain. Waiting for further movements. The next targets are on the chart. What is your prediction? Any positions opened?  |

|

|

|

|

Mark_R (OP)

|

|

November 04, 2019, 08:34:13 PM |

|

After the upwards trend the ETH price entered the diapason of $180-190 and was fluctuating inside it. That gave lots of range trading and scalping opportunities. As for the further movements, 1) Bullish scenario: After reaching $190 level, the diapason below $200 is likely to be followed by the price. 2) Bearish scenario: Coming back to $180-190 range and then moving to a significant level of $170-160 approximately. Watching volumes carefully.  |

|

|

|

|

Mark_R (OP)

|

|

November 05, 2019, 09:07:29 AM |

|

While BTC and ETH are being in a boring diapason, BNB gives some long opportunities in and upwards range.  |

|

|

|

|

AUruHM

|

|

November 05, 2019, 05:24:03 PM |

|

Do you see what happens on the OKex? https://www.okex.com/derivatives/futures/full#usdt_110_4 $11600 for 1 BTC Is this some prediction for the nearest future?  Good speculation. My congratulations to traders with the quite big leverages. Watching volumes carefully.

Sorry, where do you analyze volumes? TigerTrade? ATAS? How to watch for volumes? Trend? Any dependencies? Something else? Sorry for noob questions |

|

|

|

|

|

Mark_R (OP)

|

|

November 06, 2019, 09:47:11 AM |

|

Ethereum is finally out of the neutral range. Opened the position after the second breakout and closed at the upper increasing range rebound. Bullush scenario: The level of $200 is the next target with the price moving supposedly in the green range. Bearish scenario: In case of the decreasing tendency the price is likely to cross the reutral range and then hit the $175 level.  |

|

|

|

|

Mark_R (OP)

|

|

November 06, 2019, 09:57:46 AM |

|

Lol. In (very) long term. Probably  Watching volumes carefully.

Sorry, where do you analyze volumes? TigerTrade? ATAS? How to watch for volumes? Trend? Any dependencies? Something else? Sorry for noob questions Rather prefer ATAS. Price action and supportive volumes. But this is not the only factor to rely on. Everything goes in complex. What I do not use for sure (or rarely) are indicators. As for volumes, probably this book will be interesting for you: Murphy, John J.: “Technical Analysis of the Futures Markets” |

|

|

|

|

Mark_R (OP)

|

|

November 07, 2019, 08:59:12 AM |

|

XBTUSD range: The resistance of $9480 approximately and an upwards support line. Shorted at the resistance rebound and closed tha position at the support line reaching with the 160 points gain. Currently looking for scalping opportunities.  |

|

|

|

|

Mark_R (OP)

|

|

November 08, 2019, 08:31:24 AM |

|

ETH price after following an upwards range from the 3rd of November approximately, broke its lower border and entered the opposite downwards trend. The short was opened at the retest of the former lower border of the diapason and closed above the second strong resistance level ($185 approximately). |

|

|

|

|

AUruHM

|

|

November 08, 2019, 10:00:08 PM |

|

Rather prefer ATAS. Price action and supportive volumes. But this is not the only factor to rely on. Everything goes in complex.

What I do not use for sure (or rarely) are indicators.

As for volumes, probably this book will be interesting for you:

Murphy, John J.:

“Technical Analysis of the Futures Markets”

Oh, thanks for advise. Now I learn Steve Nison 'Japanese Candlestick'. Next will be Murthy. Trading without indicators has own features. Is it mean that you don't use such a definition as 'divergence'? What about a wide-known 'gap with CME'? |

|

|

|

|

|

Mark_R (OP)

|

|

November 11, 2019, 09:11:20 AM |

|

Rather prefer ATAS. Price action and supportive volumes. But this is not the only factor to rely on. Everything goes in complex.

What I do not use for sure (or rarely) are indicators.

As for volumes, probably this book will be interesting for you:

Murphy, John J.:

“Technical Analysis of the Futures Markets”

Oh, thanks for advise. Now I learn Steve Nison 'Japanese Candlestick'. Next will be Murthy. Trading without indicators has own features. Is it mean that you don't use such a definition as 'divergence'? What about a wide-known 'gap with CME'? Consider it to be quite useful and powerful, just not my cup of tea. Sometimes practice, may apply in strategies, but not a fan. You? |

|

|

|

|

Mark_R (OP)

|

|

November 11, 2019, 09:20:46 AM |

|

Ethereum price for now entered a third diapason, an upwards one. The strong levels that may trigger price consolidation and reversal trend are $190-195 - upper border (range) $180-175 - lower border (range) Currently, the price reached the lower border of the diapason. Waiting for breakout or rebound, supposedly, to open a trade. What are your projections? |

|

|

|

|

Mark_R (OP)

|

|

November 12, 2019, 09:13:01 AM |

|

Recently, the price of BTC experienced an array of impulces, along with the low of the month. Managed to take an advantage of the latest price movement with the short trade afterthe strong level rebound ($9100). Opened short at the confirmation movement and closed at the price consolidation. Overall, 250 points gain. At the chart there are the major price tragets are indicated, according to the sifnificant levels and price action analysis. Currently, looking for breakout or rebound from the nearest resistance level (lower white line).  |

|

|

|

|

Mark_R (OP)

|

|

November 13, 2019, 11:45:55 AM |

|

Probably sth interesting will happen at $ETH chart. Keeping abreast to open a trade! The price consolutdated more and more that is a sign of possible impulse. Currently, there is a local downwards trend and low volumes, however, the global tendency is still unknown. Thus, looking for thr channel breakout with the nearest targets - $195 for bulls and $175 for bears.  |

|

|

|

|

Mark_R (OP)

|

|

November 15, 2019, 08:32:28 AM |

|

TC price experienced a decline during a week approximately. Many consider the dynamics rather pessimistic after theis week. Personally I am not convinced in strong bearish rally, would better wait for any border breakout, anyway... Possible targets are still accessable by both bulls and bears.  |

|

|

|

|

Mark_R (OP)

|

|

November 16, 2019, 10:46:52 AM |

|

While the market continues its strange behavior, I continue not caring. Sometimes this strategy makes you more efficient. The guys below help me not to care a lot 👌😁  |

|

|

|

|

Lionel

|

|

November 16, 2019, 01:47:42 PM |

|

Hi @Mark

How do you think the ETH price will be affected by the upcoming fork?

AFAIK there are 2 cases: if the fork is perceived as potentially dangerous to the network/blockchain integrity, people sells en masse during the few days before the fork.

They wait to see what happens after the fork. If it goes well then everybody buy back.

Conversely, if the fork is perceived as beneficial and safe, people buy more as the fork approaches.

|

|

|

|

|

|

Mark_R (OP)

|

|

November 18, 2019, 08:31:34 AM |

|

Hi @Mark

How do you think the ETH price will be affected by the upcoming fork?

AFAIK there are 2 cases: if the fork is perceived as potentially dangerous to the network/blockchain integrity, people sells en masse during the few days before the fork.

They wait to see what happens after the fork. If it goes well then everybody buy back.

Conversely, if the fork is perceived as beneficial and safe, people buy more as the fork approaches.

Hello Lionel! These are some thoughts on Ethereum price movements As for the fork, the targets imo are staying the same (will renew the chart), no huge impulses are projected. Ethereum price experienced an upwards trend in a triangle since the end of October. On 14th of November the bottom line of the pattern was broken with the price crossing the level of $180. This weekend the price again was back to the former support and formed the retest pattern so far. The price scenarios are 175 lvl eventually in case of bearish pressure. For now the volumes are low, but personally I do not expect strong bear rally. Rather expect some consolidation in the current area. In case of the bullish pressure. $195 would be the target.  |

|

|

|

|

Mark_R (OP)

|

|

November 19, 2019, 10:19:49 AM |

|

RETEST TRADE RETEST TRADE Look at that nice retest. The projection came true, +3.5R gain. |

|

|

|

|