fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 15, 2019, 06:04:16 PM |

|

Do you remember the time where so many coins were created monthly? I think this period is starting again and is even worse... if I'm correct we got over 300 news altcoins within 6 months. No need to debate to say we agree 99.99% of them are just shit. Since it's shit, they fade and die and are forgotten. Mathematically BTC's dominance increases so. Not sure if it makes sense lol

If the market cap of a coin is zero, market dominance of Bitcoin is not affected. The problem is when a fake coin has pumped market capitalisation: then it can alter BTC dominance. But, yes, shit is shit and gravity will work for those useless coins. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

If you see garbage posts (off-topic, trolling, spam, no point, etc.), use the "report to moderator" links. All reports are investigated, though you will rarely be contacted about your reports.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

adaseb

Legendary

Offline Offline

Activity: 3738

Merit: 1708

|

|

July 16, 2019, 06:26:07 AM |

|

There were 2 major price hikes in the history of bitcoin. One was the 2013 year and another was the 2017 year. Ethereum plays a major role in today's alt market since most of the shit coins are created out of ethereum network. 2013 weren't much affected with the shit coin losses since Ethereum was created only in late 2013 - early 2014. So people who came to know of the cryptocurrency market followed bitcoin and updated themselves with the tech in the later time. But the real problem started with the development of Ethereum and the formation of EEA. This was probably the reason which triggered various companies to learn a little bit of solidity code and create their coins out of thin air.

The event reached its peak by end of 2017 and probably people who came to know of cryptocurrency jumped onto alts in the verge of catching an earlier train. This fueled various companies and scammers to start their own coin. Once some of these companies collapsed, the 2017 newbies started realizing the real potential of bitcoin. This paved way for major selling in these shitcoins and the transfer of all their money to bitcoin.

Alts have the potential unless the start-ups don't scam and run away with investors money and similarly Ethereum is a good platform for bringing business into the blockchain if they are utilized in a proper way. The speculation of alts being the next bitcoin should come to an end and if that happens we would see the real potential coins which can solve the real world problems through blockchain cherishing over the period of time. People should become more educated and must have the capability of distinguishing a product based alt with a payment processing coin like btc.

I completely agree with this statement and it deserves a merit. Basically the complete dump of BTCUSD to $9850 which happened yesterday was mostly due to ETH in my opinion. I was watching the charts and when ETHBTC started breaking yearly support areas, all hell started to break lose. Most likely due to over-leveraged longs waiting for "alt season" there were 2 massive spikes in ETHBTC, which caused a dump in ETHUSD which caused a flash crash and this most likely contributed to the selling of BTCUSD. Now it seems to have stabilized however there might be more dumps if ETHBTC breaks the 0.02 ratio. |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

July 16, 2019, 07:29:10 AM |

|

Basically the complete dump of BTCUSD to $9850 which happened yesterday was mostly due to ETH in my opinion. I was watching the charts and when ETHBTC started breaking yearly support areas, all hell started to break lose.

Most likely due to over-leveraged longs waiting for "alt season" there were 2 massive spikes in ETHBTC, which caused a dump in ETHUSD which caused a flash crash and this most likely contributed to the selling of BTCUSD.

Now it seems to have stabilized however there might be more dumps if ETHBTC breaks the 0.02 ratio.

Interesting theory. I hadn't been paying much attention to ETH at all. Pretty spectacular dumps! There's an alternative scenario where ETH/BTC keeps taking a beating. If BTC/USD exits this range to the upside, alts will probably taking another walloping across the board. |

|

|

|

Pursuer

Legendary

Offline Offline

Activity: 1638

Merit: 1163

Where is my ring of blades...

|

|

July 16, 2019, 09:21:50 AM |

|

There were 2 major price hikes in the history of bitcoin.

I just want to point out that you are wrong about this part, those two spikes are the most popular not the major ones. 2013 itself has 2 major spikes which is the rise from ~$10 to $250 in 4 first month of 2013 which is a 2400% rise and the 2017 rise in comparison looks like a small rise! we had other big rises like that too before in 2012 and 2011 such as the rise from $1.8 to $16.5 an interesting theory about ETH and the alt market effects though, I have talked about it before during certain drops last year that I saw the huge dumps in altcoin market that indicated exit of a lot of money that put a lot of pressure on bitcoin price. |

Only Bitcoin

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 16, 2019, 12:25:26 PM |

|

There were 2 major price hikes in the history of bitcoin. One was the 2013 year and another was the 2017 year. Ethereum plays a major role in today's alt market since most of the shit coins are created out of ethereum network. 2013 weren't much affected with the shit coin losses since Ethereum was created only in late 2013 - early 2014. So people who came to know of the cryptocurrency market followed bitcoin and updated themselves with the tech in the later time. But the real problem started with the development of Ethereum and the formation of EEA. This was probably the reason which triggered various companies to learn a little bit of solidity code and create their coins out of thin air.

The event reached its peak by end of 2017 and probably people who came to know of cryptocurrency jumped onto alts in the verge of catching an earlier train. This fueled various companies and scammers to start their own coin. Once some of these companies collapsed, the 2017 newbies started realizing the real potential of bitcoin. This paved way for major selling in these shitcoins and the transfer of all their money to bitcoin.

Alts have the potential unless the start-ups don't scam and run away with investors money and similarly Ethereum is a good platform for bringing business into the blockchain if they are utilized in a proper way. The speculation of alts being the next bitcoin should come to an end and if that happens we would see the real potential coins which can solve the real world problems through blockchain cherishing over the period of time. People should become more educated and must have the capability of distinguishing a product based alt with a payment processing coin like btc.

I completely agree with this statement and it deserves a merit. Basically the complete dump of BTCUSD to $9850 which happened yesterday was mostly due to ETH in my opinion. I was watching the charts and when ETHBTC started breaking yearly support areas, all hell started to break lose. Most likely due to over-leveraged longs waiting for "alt season" there were 2 massive spikes in ETHBTC, which caused a dump in ETHUSD which caused a flash crash and this most likely contributed to the selling of BTCUSD. Now it seems to have stabilized however there might be more dumps if ETHBTC breaks the 0.02 ratio. I would say that flash crash was deliberately engineered on Bitstamp to force liquidation in 100x leverage positions on BitMex. This was a textbook case of agioage (manipulating one market to gain from positions on another market). It has been an illegal practice since 20 years in the traditional financial markets. But , you know, crypto si different. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

LeGaulois

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 4094

Top Crypto Casino

|

|

July 16, 2019, 12:39:52 PM |

|

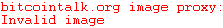

I stumbled upon this PDF from my local forum explaining Bitcoin has entered stealth phase of bull run A substantial Bitcoin's growth but a very little public awareness is associated with a stealth phase. The PDF explains much more but I just wanted to show this.  From historical data, Bitcoin dominance seems to inversely correlate with the public interest. In the peak public awareness period of every cycle, Bitcoin has always experienced the final and sharpest linear growth. This final sharp growth is also historically paired with the explosive growth of alt coins and violent decline in bitcoin dominance.

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 16, 2019, 12:53:56 PM

Last edit: May 16, 2023, 07:33:20 AM by fillippone |

|

I stumbled upon this PDF from my local forum explaining Bitcoin has entered stealth phase of bull run A substantial Bitcoin's growth but a very little public awareness is associated with a stealth phase. The PDF explains much more but I just wanted to show this.  From historical data, Bitcoin dominance seems to inversely correlate with the public interest. In the peak public awareness period of every cycle, Bitcoin has always experienced the final and sharpest linear growth. This final sharp growth is also historically paired with the explosive growth of alt coins and violent decline in bitcoin dominance.

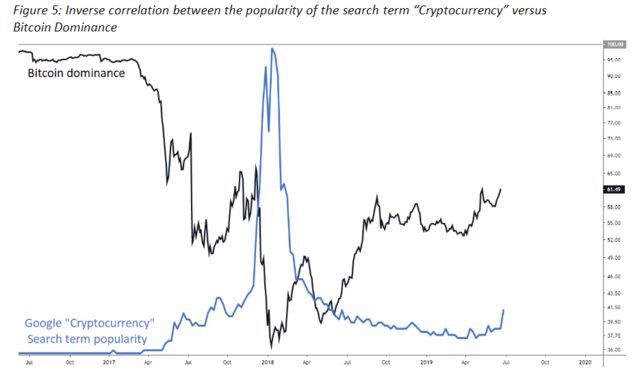

Looks like a case of spurious correlation. https://www.tylervigen.com/spurious-correlations |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

romero121

Legendary

Offline Offline

Activity: 3164

Merit: 1213

|

|

July 16, 2019, 04:24:17 PM |

|

Looks like people have lost their hope upon altcoins and the same is being getting moved to the bitcoin. This causes an inverse reaction in the market with growth on bitcoin and crash of altcoins market. Even the ethereum market keeps falling with more and more altcoins serving it as the base following the similar market movement.

|

|

|

|

|

|

arpon11

|

|

July 16, 2019, 04:43:11 PM |

|

Do you remember the time where so many coins were created monthly? I think this period is starting again and is even worse... if I'm correct we got over 300 news altcoins within 6 months. No need to debate to say we agree 99.99% of them are just shit. Since it's shit, they fade and die and are forgotten. Mathematically BTC's dominance increases so. Not sure if it makes sense lol

Many new and similarity coins are been introduced daily not even monthly again and we have several tokens that are entering the market daily. It is good we are having everything been narrow down to few coins and bitcoin is killing most of the coins that has been abandoned by the developers as many holders see no need of holding them but converting them to Bitcoin and that increase Bitcoin dominant. Maybe in some years to come it might be above 80% dominant as even the Almighty ethereum is also part of the coins that are falling hard against Bitcoin. |

|

|

|

|

LeGaulois

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 4094

Top Crypto Casino

|

|

July 16, 2019, 04:49:03 PM |

|

...

That was funny, but actually, the pdf has more graphs, I just posted the one referring to BTC dominance, and the pdf makes sense. |

|

|

|

Heisenberg_Hunter

Legendary

Offline Offline

Activity: 1583

Merit: 1276

Heisenberg Design Services

|

|

July 17, 2019, 06:43:37 AM |

|

Basically the complete dump of BTCUSD to $9850 which happened yesterday was mostly due to ETH in my opinion. I was watching the charts and when ETHBTC started breaking yearly support areas, all hell started to break lose.

Most likely due to over-leveraged longs waiting for "alt season" there were 2 massive spikes in ETHBTC, which caused a dump in ETHUSD which caused a flash crash and this most likely contributed to the selling of BTCUSD.

Now it seems to have stabilized however there might be more dumps if ETHBTC breaks the 0.02 ratio.

The dominance is rising strongly and the Alt market is tanking to the prices equivalent to what they were during 2016. ETH/BTC were at 0.02 only during March 2017 and when the alt market gained momentum we haven't been seeing any slow downs in the alt season since then. Not just the ETH, but other good coins like XMR and DASH have reached the state as they were during the 2016 year. After August 2016 pump in XMR, I have never seen the prices of XMR/BTC trading reaching a low of 0.007 BTC per XMR. Similarly DASH had never been 0.01 BTC since July 2016. Apart from Bitcoin, I am a believer of ETH (more importantly the technology behind it) and Monero. Ethereum and Solidity collaboratively will surely help the businesses to take a new innovative way of using the blockchain and solve major real world problems. Similarly Monero's secure transactions and fungibility help us to be anonymous and gives us full control over the privacy. I just want to point out that you are wrong about this part, those two spikes are the most popular not the major ones. 2013 itself has 2 major spikes which is the rise from ~$10 to $250 in 4 first month of 2013 which is a 2400% rise and the 2017 rise in comparison looks like a small rise! we had other big rises like that too before in 2012 and 2011 such as the rise from $1.8 to $16.5

an interesting theory about ETH and the alt market effects though, I have talked about it before during certain drops last year that I saw the huge dumps in altcoin market that indicated exit of a lot of money that put a lot of pressure on bitcoin price.

Yes that's quite true and I agree with that. The 2013-14 price crashes can be due to the Mt.Gox hack and steadily people got past of it after the halving period. |

|

|

|

|

|

kronos123

|

|

July 18, 2019, 02:04:42 PM Merited by fillippone (1) |

|

- Technology has progressed, people studied and has understood better how cryptos work, so they came to the right conclusion shitcoins are indeed...shitcoins. Shitcoins value proposition has since faced and now they are clearly revealed for what they have always been: (kind of elaborate) exit scams by fraudster to transfer your bitcoin in their wallets.

I agree with this reason, and I think this is maybe one of the most important reason why bitcoin dominance is so high, and altcoins do not follow king of crypto as was the case in the past. Many investors are burn too much money with altcoins, and they see that only bitcoin is crypto with purpose. There is a saying “Fool me once, shame on you, fool me twice, shame on me.” Merit for you Fillippone who, as always, provides excellent arguments for reflection, even if this time I am only partially in agreement. Besides Bitcoin there are not only shitcoin, or rather there is to separate shitcoin and shitcoin; in the marketcap there are over 4000 and altcoin passes and most probably many will disappear, maybe .... or maybe not! In essence, and by analyzing the data better, who really cares about 4000 Coins? The numbers today tell us that the entire crypto market is worth about $ 260 billion, with only Bitcoin worth $ 170 billion (around 65%), which means that 4000 Coins share the remaining $ 90 billion; analyzing these numbers even better we can see that of these $ 90 billion, the first 10 Coins, after Bitcoin, "are worth" about $ 60 billion, or 66% of the entire cake; the next 10 coins (from 11 to 20) are worth $ 10.5 billion, from position 21 to 30 there are $ 4.5 billion, from 31 to 40 there are $ 2.5 billion, from 41 to 50 there they are $ 1.5 billion, from $ 51 to $ 60, there are $ 1 billion, there are $ 1 billion, from $ 71 to $ 80, $ 81 to $ 80, and from 91 to 100 there are $ 620 million. Basically the other 99 crypto after Bitcoin capitalize as many as 85 of the $ 90 billion currently on the market, that is over 90% of the rest, that is, about 95% of all the capitalization of the crypto is concentrated in the first 100 Coins !!!So the question is: what do we care about the other 4000 coins / shitcoins? of the scams associated with them? of the money they burn on them? about pump & dump of the various coins? They are part of the system and "inevitable", and they are insignificant numbers, background noise, used for different purposes and purposes, today by governments, yesterday by miners and speculators, tomorrow by associations and funds.

Even if institutional money is leading with Bitcoin there's a whole world of saps out there who'll swallow the 'next Bitcoin' narrative no matter what's actually screaming in their face.

Correct, but in the end it is not a question of discovering the new Bitcoin but of being able to find that new Coin that can be functional and useful in the everyday real world; the new and unexpressed use of Blockchain technology is immense and it cannot be reduced "only" to the exchange of money or to the reserve of value (what appears to be Bitcoin today), but there are many applications and fields still unexplored, in where an avalanche of money will be ready to flow when the opportunity arises. The truth is simple - altcoins were in a bubble, much bigger bubble than Bitcoin was, realistically there's no way more than a dozen of coins can co-exist - the point of money is to be universal, so just like the US dollar is welcomed everywhere in the world, Bitcoin is the king of crypto. Tons of altcoins were claiming that they will dethrone Bitcoin, but when investors started realizing that it was a lie, those coins started losing their value.

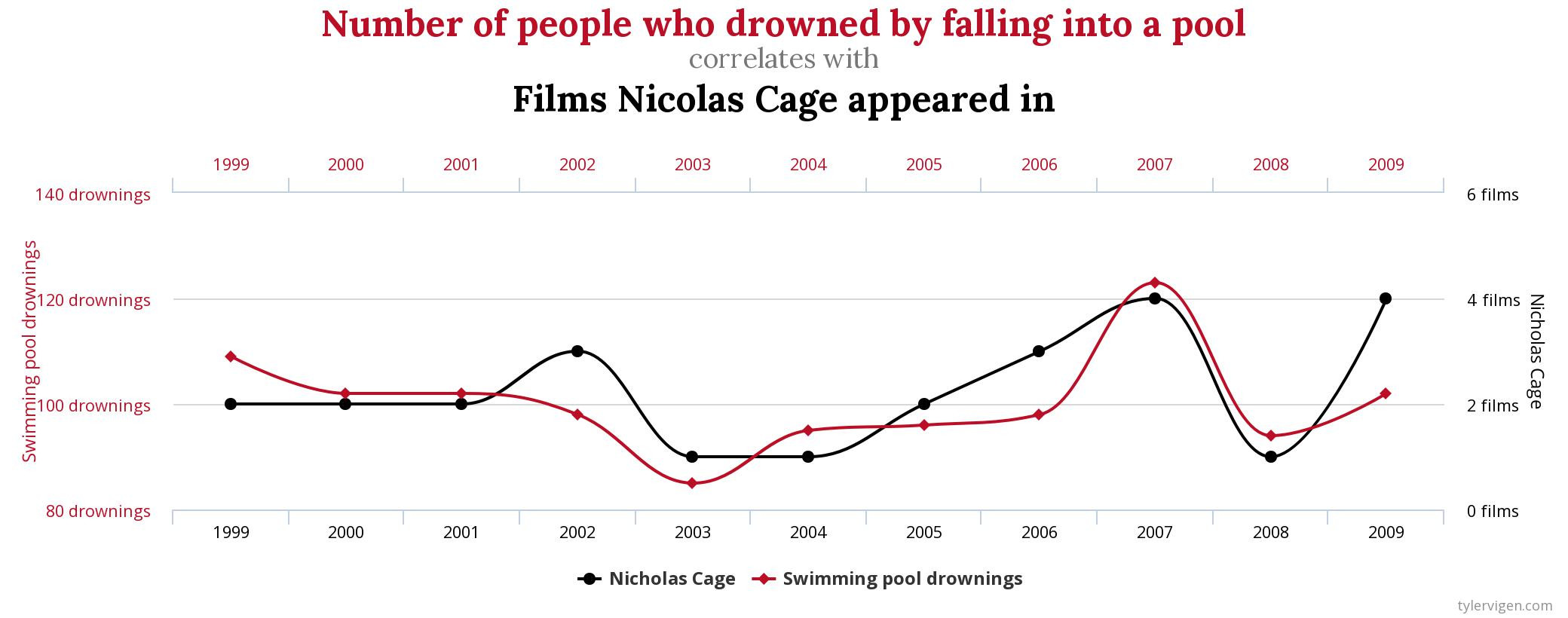

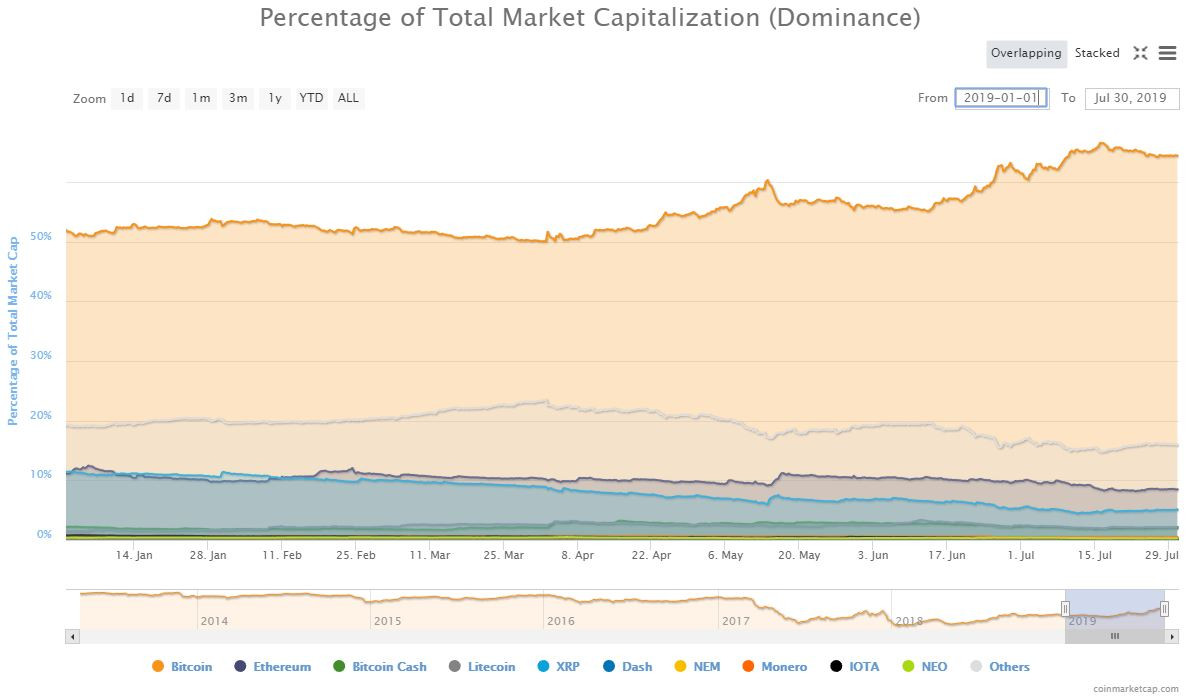

Realistically, much more than a dozen coins can coexist for me, and much more than today's 4000, but in essence they will be of no use, as they are today, and will have a quotation that will reflect their value and potential, namely NOTHING! Everything is functional to the market and, as repeated by several users "Money got separated by stupids. This is a natural and unstoppable process. Hopefully it is for the Good." Finally a final consideration: the dominance of Bitcoin today is at 65% but in fact it fluctuates and varies like all the indices or the same coins, touching points of resistance and points of support; in fact it has gone from 100%, when there was just Bitcoin, to about 32% last January 2018. I'm not good at drawing graphics, resistances and supports, but I just observe and evaluate the work of others, so I show you the work of a user, found on twitter https://twitter.com/paddystash/status/1150141415399276545/video/1 |

|

|

|

|

|

timerland

|

|

July 18, 2019, 09:16:33 PM |

|

Market dominance is a shitty indicator, we all know why: it is based on market prices. After Bitwise report, where we learnt that many exchanges faked volumes, and ultimately prices themselves, we cannot ignore anymore those flaws.

Still dominance can point in the right directions to intresting thoughts about markets in a broader way.

Market dominance just broke the peak during Dec '17 (price) ATH, and at 65,2% it is now at the highest levels since April 2017. Conventional wisdom would have told you that as the bull market progresses, you would see bitcoin dominance decrease due to the fact that people like to take risks while markets are bullish. I think that the two main reasons that this is not happening as follows. 1. As you mentioned, institutional money. They are more inclined towards investing in BTC because it is the most stable, most long term proven crypto. Anything else for them with a smaller market cap would simply be too little liquidity. Market anticipation of this kind of institutional interest occurring is probably a self fulfilling prophecy in of itself. 2. The fact that this is the start of a bull market, and we are nowhere near euphoria yet. People are still very risk averse, and given that fact, they default to investing in BTC which they deem as the safest crypto asset (sort of like T-bills in the bond market). Also, from a fundamental standpoint, perhaps the implementation of LN had something to do with it as well. Scalability was a huge reason why people were inclined to use alts, but with that issue somewhat tackled, the demand for these alternatives isn't there as much. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 18, 2019, 09:42:28 PM |

|

Market dominance is a shitty indicator, we all know why: it is based on market prices. After Bitwise report, where we learnt that many exchanges faked volumes, and ultimately prices themselves, we cannot ignore anymore those flaws.

Still dominance can point in the right directions to intresting thoughts about markets in a broader way.

Market dominance just broke the peak during Dec '17 (price) ATH, and at 65,2% it is now at the highest levels since April 2017. Conventional wisdom would have told you that as the bull market progresses, you would see bitcoin dominance decrease due to the fact that people like to take risks while markets are bullish. I think that the two main reasons that this is not happening as follows. 1. As you mentioned, institutional money. They are more inclined towards investing in BTC because it is the most stable, most long term proven crypto. Anything else for them with a smaller market cap would simply be too little liquidity. Market anticipation of this kind of institutional interest occurring is probably a self fulfilling prophecy in of itself. 2. The fact that this is the start of a bull market, and we are nowhere near euphoria yet. People are still very risk averse, and given that fact, they default to investing in BTC which they deem as the safest crypto asset (sort of like T-bills in the bond market). Also, from a fundamental standpoint, perhaps the implementation of LN had something to do with it as well. Scalability was a huge reason why people were inclined to use alts, but with that issue somewhat tackled, the demand for these alternatives isn't there as much. Nice point on the impact of LN and second layer on BTC dominance. Sadly I'm out of sMerits! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

July 19, 2019, 08:22:27 PM |

|

The fact that this is the start of a bull market, and we are nowhere near euphoria yet. People are still very risk averse, and given that fact, they default to investing in BTC which they deem as the safest crypto asset (sort of like T-bills in the bond market). This is a big part of it. In the 2013 and 2017 bull markets, altcoins rallied massively during the final 2-3 weeks of Bitcoin's bubble. That's when euphoria is occurring. No one is selling their BTC for dollars anymore, and everyone is pouring it into riskier investments. The altcoin markets will probably wait at least until BTC reaches a new ATH to start getting interesting. That's when the Ethereum/ICO bubble started in early 2017, after Bitcoin reached a new ATH and corrected. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 22, 2019, 01:18:25 PM

Last edit: May 16, 2023, 07:31:14 AM by fillippone |

|

Just a small update: Bitcoin dominance still high, after having hit a top at 66.20%.  A recap of the two most interesting comments since last update: Also, from a fundamental standpoint, perhaps the implementation of LN had something to do with it as well. Scalability was a huge reason why people were inclined to use alts, but with that issue somewhat tackled, the demand for these alternatives isn't there as much.

In the 2013 and 2017 bull markets, altcoins rallied massively during the final 2-3 weeks of Bitcoin's bubble. That's when euphoria is occurring. No one is selling their BTC for dollars anymore, and everyone is pouring it into riskier investments.

The altcoin markets will probably wait at least until BTC reaches a new ATH to start getting interesting. That's when the Ethereum/ICO bubble started in early 2017, after Bitcoin reached a new ATH and corrected.

So , basically the first suggest bitcoin dominance is not going down further on, while the others suggests, bitcoin might go down again, as long as we progress toward the next, inevitable, ATH, we are too early in the bull cycle, basically. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2171

Professional Community manager

|

|

July 22, 2019, 05:06:40 PM |

|

The most recent bear market exposed a lot of ICOs and alternative e currencies. I know of a number of reputable ICO/STO managers who pulled out due to lack of credible projects. Only the projects with actual products and use case survived.

This action caused most to lose faith in most altcoins and shift to Bitcoin and the few alts that actually have product value, hence the rise in BTC dominance.

Also the current mini bull run started with Bitcoin while other currencies were slow at growing, FOMO drove investors to BTC as well.

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

July 22, 2019, 07:40:05 PM |

|

The most recent bear market exposed a lot of ICOs and alternative e currencies. I know of a number of reputable ICO/STO managers who pulled out due to lack of credible projects. Only the projects with actual products and use case survived. That's what bear markets do best. There's an old saying about it: "You only find out who is swimming naked when the tide goes out." Everything looks rosy during the bull market when investment capital is flowing and operations can be funded on a portion of capital gains alone. This washing out of unsustainable projects (and money flowing back into Bitcoin) is all part of the market cycle. If you like to ride altcoin investments during bull markets, keep your eyes peeled for the next big thing. Because by the time the next altcoin season finally arrives (could be many months out still), ICOs and IEOs and STOs probably won't look as interesting as the new kid on the block. You've got to stay ahead of the hype! |

|

|

|

|

Harlot

|

|

July 22, 2019, 07:49:10 PM |

|

Doesn't the reasons you have given all points out to the cryptocurrencies dominating the market and not only Bitcoin? Not if you are only talking about how Bitcoin will maintain market dominance because of it. With all the developments and progress we have in the crypto industry all cryptocurrencies are affected and because Bitcoin being the market leader it gives us assurance that the rest of the cryptos will be influence by it not against it. I know the current situation now where most of the cryptos are bleeding but its not always like that, its just because majority of the money now is with the big mover and that is Bitcoin.

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 30, 2019, 09:26:52 PM

Last edit: May 16, 2023, 07:28:40 AM by fillippone |

|

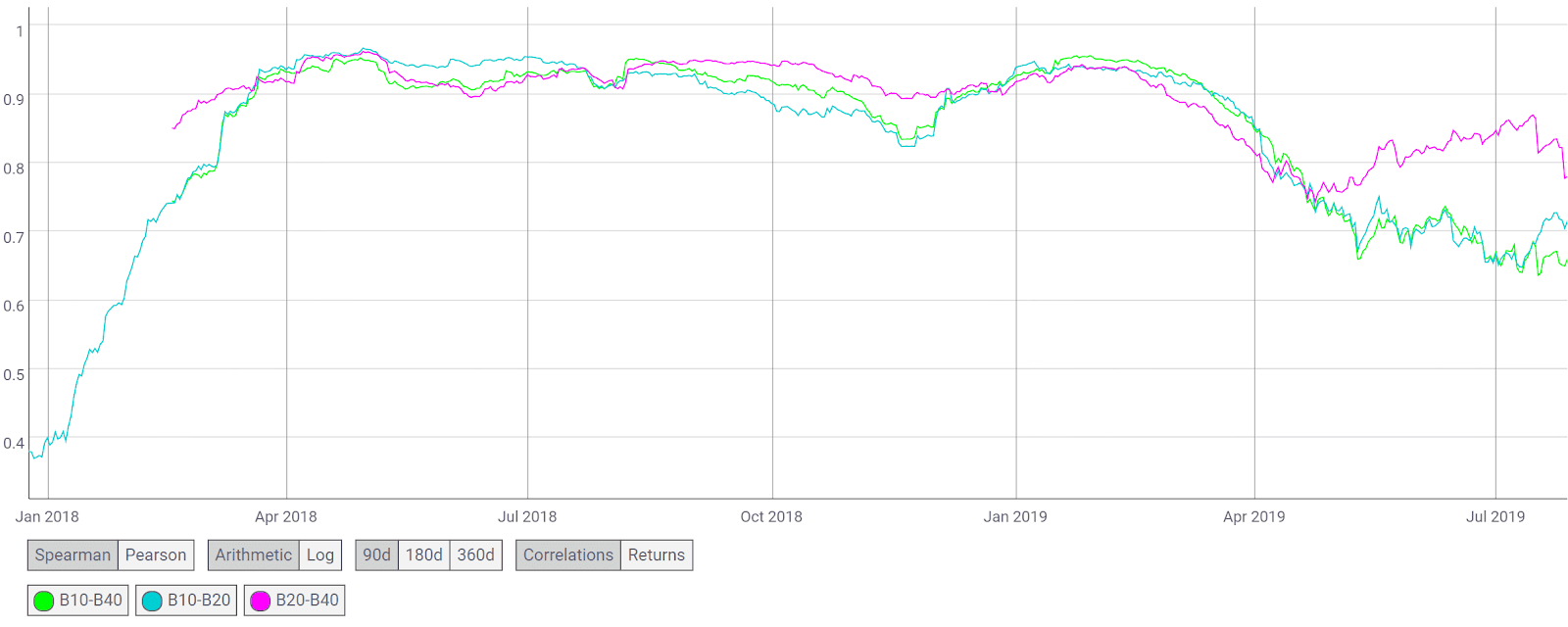

Reading from Coinometrics State of the Network weekly newsletter Issue 10 we have a confirmation of what we empirically observed: CM Bletchley Indexes (CMBI) Insights Correlation charts can provide interesting insight into the expected price relationship between assets. A correlation of 1 or -1 implies a perfect positive or negative relationship between two assets. Through assessing the correlation of Bletchley assets we can derive insight into how the market has been behaving. During the bear market of 2018, generally speaking, much of crypto was correlated with Bletchley Indexes all having a correlation score >0.9 (i.e. If any of the Indexes increased, the most likely scenario was that the others increased as well, the same can be said for a decrease). However, since the beginning of the year Bitcoin has continually outperformed most of its peers. Since the Bletchley 10 is comprised ~70% of Bitcoin, the performance of the Bletchley 10 has outperformed the Bletchley 20 and Bletchley 40. Additionally, the level of correlation between them has reduced to around 0.7. This demonstrates a lower relationship between the price movement of the Bletchley 10 with the Bletchley 20 and Bletchley 40. However, more recently there is a flattening and even a slight increase in correlation, potentially signalling an improvement in short term strength for mid and low market cap assets.  Dominance has been high lately: after the local maximum at 66.45, it is slightly down at 64.72 at the time of writing. Again, I wouldn't read too much in tiny fluctuation, when the important thing is the long term dynamic.  In the last issue the same newsletter tried to explain why Bitcoin is rising against all other crypto. I think we nailed down all the best explaination. Bitcoin Outperformance Driven by Regulatory, Geopolitical, and Macroeconomic Factors

Several narratives explain the strong relative outperformance in bitcoin over this period:

Although there have been few public announcements by U.S. regulators, the body of evidence that U.S. regulators are exerting more pressure on market participants continues to grow. Earlier this year, Poloniex, Bittrex, and Binance all took steps to restrict U.S. traders from participating in certain markets. In June, the SEC filed a lawsuit in connection with Kin’s token offering in a clear indication that the SEC will be unyielding in its interpretation of existing securities law. The CFTC has also begun an investigation into BitMEX and whether it has allowed U.S. investors to trade on its platform.

U.S. Treasury Secretary Mnuchin recently stated in a White House press briefing that he had “very serious concerns” about cryptocurrencies and stated that crypto businesses must comply with the Bank Secrecy Act and register with the Financial Crimes Enforcement Network. And Facebook’s launch of Libra has sparked congressional scrutiny with two separate Senate committees holding hearings about Libra and cryptocurrencies.

The net impact of these events is to drive crypto capital towards Bitcoin, which thus far has the most regulatory clarity.

Additionally, heightened geopolitical tensions and a growing acceptance that Bitcoin serves as a digital store of value and hedge in uncertain times has provided support. The recent increase in geopolitical risk has been driven primarily by the U.S.-China trade dispute, but also by the increased threat of disruption of global oil supplies in the Middle East, the resurgence of Eurozone fragmentation risk (particularly increased risk that Italy may leave), and growing tensions in Hong Kong.

The correlation between Bitcoin and gold has been particularly strong over the recent past as investors increasingly seek haven assets. Gold recently has exceeded key technical price levels and reached a six-year high.

Lastly, the macroeconomic environment has decisively shifted over the past several months in the direction of more monetary easing. Specifically, real interest rates (inflation-adjusted interest rates) have come down across the board in major developed world countries and across most durations. Pockets of weakness in forward-looking macroeconomic indicators have increased market participants’ expectations of a recession and combined with the dramatic shift in forward guidance by major central banks, interest rates have sharply declined. It now seems nearly certain that the four major central banks of the world (the Federal Reserve, the European Central Bank, the Bank of Japan, and the People’s Bank of China) are on the cusp of another monetary easing cycle. As real interest rates decline, the opportunity cost of holding non-yield producing assets like Bitcoin declines. Moreover, since many short-term interest rates around the world are close to the effective lower bound, central banks will once again have to consider the use of quantitative easing and other unconventional monetary tools that risk long-term instability.

Although the empirical evidence around Bitcoin’s reaction function to changes in future monetary policy and expectations in growth and inflation is mixed, on balance, this factor should provide further long-term support to Bitcoin prices.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|