icopress

Legendary

Offline Offline

Activity: 1638

Merit: 7825

light_warrior ... 🕯️

|

|

May 14, 2021, 08:13:08 PM |

|

Good thread, even though this isn't exactly Beginner material.

This guy literally reads my mind ... Frankly speaking, in order not to scatter attention, I would prefer that there was only one accessible and understandable thread about Futures, (with the transition from basic knowledge to information published in the OP). Below are a few questions that I would like to know the answers to if I were a beginner. - How theory differs from practice?

- The basics of hedging for beginners, (including strategies)

- How not to miss the bottom, (for example, is it worth placing a duplicate contract for price growth in an incomprehensible situation?)

- Action plan as an integral part, (where and when I should close the trade?)

- Security, (Trading against the trend, why my stop loss did not work, etc.)

- Test mode, (on which platforms can I get my first experience of futures trading without risking?)

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 15, 2021, 08:43:15 AM Merited by JayJuanGee (1) |

|

Good thread, even though this isn't exactly Beginner material.

This guy literally reads my mind ... Frankly speaking, in order not to scatter attention, I would prefer that there was only one accessible and understandable thread about Futures, (with the transition from basic knowledge to information published in the OP). Below are a few questions that I would like to know the answers to if I were a beginner. - How theory differs from practice?

- The basics of hedging for beginners, (including strategies)

- How not to miss the bottom, (for example, is it worth placing a duplicate contract for price growth in an incomprehensible situation?)

- Action plan as an integral part, (where and when I should close the trade?)

- Security, (Trading against the trend, why my stop loss did not work, etc.)

- Test mode, (on which platforms can I get my first experience of futures trading without risking?)

Tank you for the input. I will try to analyse a few of those questions in future update(pun intended). Please bear in mind that while a few question are good material for beginners (test platform one is quite good), other are the holy grail of trading (how not to miss a bottom? When closing a trade?): I don’t have this answer, as nobody has. And even if I had, for sure I wouldn’t share it, for free of for a paying fee, as this would severely undermine my competitive advantage in the trading. This mean: everyone selling magic recipes in trading is, basically, a scammer. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10230

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 15, 2021, 03:52:34 PM |

|

Good thread, even though this isn't exactly Beginner material.

This guy literally reads my mind ... Frankly speaking, in order not to scatter attention, I would prefer that there was only one accessible and understandable thread about Futures, (with the transition from basic knowledge to information published in the OP). Below are a few questions that I would like to know the answers to if I were a beginner. - How theory differs from practice?

- The basics of hedging for beginners, (including strategies)

- How not to miss the bottom, (for example, is it worth placing a duplicate contract for price growth in an incomprehensible situation?)

- Action plan as an integral part, (where and when I should close the trade?)

- Security, (Trading against the trend, why my stop loss did not work, etc.)

- Test mode, (on which platforms can I get my first experience of futures trading without risking?)

Tank you for the input. I will try to analyse a few of those questions in future update(pun intended). Please bear in mind that while a few question are good material for beginners (test platform one is quite good), other are the holy grail of trading (how not to miss a bottom? When closing a trade?): I don’t have this answer, as nobody has. And even if I had, for sure I wouldn’t share it, for free of for a paying fee, as this would severely undermine my competitive advantage in the trading. This mean: everyone selling magic recipes in trading is, basically, a scammer. Even though icopress seemed to have been presenting himself as a bit of a newbie in this category, I do believe that he could have attempted to provide some of the answers himself in order to help the subject along. I don't employ a variety of more sophisticated financial tools in my own tactics, even though I figure that there are ways to allow them to better hedge my positions or even to allow me more optionality, downside risk etc, yet, I also know that there are some folks that will give away some of their strategies for free, and some of those strategies may well be quite solid in terms of managing your own situation that are not necessarily any better than if you were to pay for advices. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

icopress

Legendary

Offline Offline

Activity: 1638

Merit: 7825

light_warrior ... 🕯️

|

|

May 15, 2021, 06:36:29 PM Merited by fillippone (2) |

|

My post was kind of just an impulse, so to speak, an example of questions that, in my opinion, a beginner should study immediately after he learned the meaning of the word "futures". I didn’t want to sound like an upstart, so I didn’t give answers to these questions, (although I found out the answers to most of the questions, simply making mistakes over and over again/losing money). Therefore, of course, if within the framework of this thread there is at least one person interested in futures trading who asks me about something, then I will be happy to answer. This mean: everyone selling magic recipes in trading is, basically, a scammer.

I totally agree with this expression, but I have another question. [Are you personally involved in futures trading?] I would even call this a rhetorical question, since I lead to the fact that disclosure would undermine your competitive advantage only if you were trading. But I'm also pretty sure that posting the intricacies of trading, regular updates, and answering questions will ultimately lead you to become a more disciplined, more knowledgeable trader.  |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10230

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 15, 2021, 09:07:06 PM

Last edit: May 16, 2021, 03:03:43 PM by JayJuanGee Merited by fillippone (2), icopress (1) |

|

My post was kind of just an impulse, so to speak, an example of questions that, in my opinion, a beginner should study immediately after he learned the meaning of the word "futures". I didn’t want to sound like an upstart, so I didn’t give answers to these questions, (although I found out the answers to most of the questions, simply making mistakes over and over again/losing money). Therefore, of course, if within the framework of this thread there is at least one person interested in futures trading who asks me about something, then I will be happy to answer. This mean: everyone selling magic recipes in trading is, basically, a scammer.

I totally agree with this expression, but I have another question. [Are you personally involved in futures trading?] I would even call this a rhetorical question, since I lead to the fact that disclosure would undermine your competitive advantage only if you were trading. But I'm also pretty sure that posting the intricacies of trading, regular updates, and answering questions will ultimately lead you to become a more disciplined, more knowledgeable trader.  Overall, I cannot really disagree with any of your points, icopress, and even though, like I suggested, I do not involve myself in various kinds of sophisticated financial instruments, I kind of was passive aggressively implying that none of them are really necessary for individuals in bitcoin - unless they really know how and why to employ such tactics - and they are also temptations of attempting to get rich quicker than what conventional basic mechanisms might achieve. In other words, bitcoin seems to remain as such a goddamned asymmetric bet that even someone who is brand new to bitcoin and investing (such as fresh out of highschool /college and freshly beginning to invest), and just employed basic techniques of buying and holding BTC, the other tools (such as futures, options, margin, leverage through exchanges, shorts, leveraging bitcoins for debt) would not be necessary in order to accelerate these newbies to fuck you status in about half the time (or even less) than traditional investment allocations would have accomplished. Accordingly, just engaging in various kinds of longing of bitcoin could cause a regular normie into fuck you status in 10 to 20 years rather than 30-40 years of the traditional systems - that are also far from guaranteed of reaching fuck you status in traditional systems. By the way, many of us likely know about regular peeps who had been prudent all of their life and invested and saved, and they still were forced to work into their 60s or longer because they just did not have enough money to pull the fuck you lever. I understand that my personal expansion of what I meant in my earlier posts causes this post to largely deviate from the topic, but I do mostly assert on a regular basis that newbies should be continuously working ways to slowly build their principle in conservative ways, and sure when they are young they can surely take some additional risks, so while they are attempting to invest more conservatively, they can continue to study the various investment options to figure out whether any of those more sophisticated investment options might work for them and their situation.. including that after 5 years investing in bitcoin, even at $100 per month (which would add up to $26k in 5 years), there could well be a very decent amount of investment capital that had accumulated through that time, such as half a million (as shown in this chart), and even if fuck you status had not been reached, the person is well on the way to possibly achieving fuck you status in a 10 to 15 year timeline - assuming that $2 million in today's dollars would be the bare beginning point to fuck you status and of course, with the passage of time - even 10-20 years from now, that $2 million in today's dollars may well need to double or more for a bare basic starting point for fuck you status, but if decent appreciations of BTC value continue to outpace other assets and investments (which seems quite likely), then there may well be abilities to really increase contributions too with the passage of time and to accelerate the capital invested into bitcoin and likely to be able to monitor and study the bitcoin space in such a way to know whether there might be some ways to compliment such bitcoin investments without getting sidetracked into shitcoins or even financial vehicles that might not be worth employing.. not saying that futures might not work but that it could take a few years for any newbie to study the matter (and maybe include consulting too) in order to figure out if it might be a good vehicle to complement individual investing beyond buying and hodling. Of course, the past abilities to accumulate in bitcoin and to witness price appreciation that outpaces almost any other asset or investment does not mean the same numbers of price appreciation are achievable in the future, but there is no real evidence that the investment thesis in bitcoin is getting any worse, so I still am suggesting that normies and newbies start out with similar tactics of solidifying their basics before employing more complicated tools that may or may not be necessary to reach fuck you status in a pretty reasonable time (such as half the time or less as investing in traditional assets.. which I would include a lot of the various bullshit out there currently to fall into that category, too). I ongoingly share my ideas and even helping to work through what are the basics that need to be considered for free in several public threads when the topic comes up. Accordingly, a lot of peeps do not even understand their particular basics that should include considerations of their cashflow, other investments, view of bitcoin compared with other investments, timeline, risk tolerance, and skills, time and abilities to study, learn, plan, strategies, employ various tools that might include trading, reallocating from time to time and/or other possible financial instruments (which would likely come after they had already made sure that they had a somewhat solid grasp on their basics). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 16, 2021, 10:48:07 AM

Last edit: May 17, 2021, 08:50:07 PM by fillippone Merited by JayJuanGee (1) |

|

This mean: everyone selling magic recipes in trading is, basically, a scammer.

I totally agree with this expression, but I have another question. [Are you personally involved in futures trading?] I would even call this a rhetorical question, since I lead to the fact that disclosure would undermine your competitive advantage only if you were trading. But I'm also pretty sure that posting the intricacies of trading, regular updates, and answering questions will ultimately lead you to become a more disciplined, more knowledgeable trader.  Let me answer to this. I disclosed a lot of knowledge about the trading future, and options. I explained the basic stuff, vocabulary, and basic strategies. I never told anyone how to trade their stash, when opening a position, and when closing it. I never commented on other people's analysis or trading strategies (with only one notable exception). So, I might or might not be involved in future, but I never tried to "sell" any trading strategy. Even more, I have too much respect for each one risk and time preferences, personal constraints knowledge or history, or other facts that might determine their trading style, to comment on other people actions, besides correcting factual errors. EDIT: fixed a quoting error. I am not talking alone , this time. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10230

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 16, 2021, 03:02:18 PM Merited by fillippone (3) |

|

This mean: everyone selling magic recipes in trading is, basically, a scammer.

I totally agree with this expression, but I have another question. [Are you personally involved in futures trading?] I would even call this a rhetorical question, since I lead to the fact that disclosure would undermine your competitive advantage only if you were trading. But I'm also pretty sure that posting the intricacies of trading, regular updates, and answering questions will ultimately lead you to become a more disciplined, more knowledgeable trader.  Let me answer to this. I disclosed a lot of knowledge about the trading future, and options. I explained the basic stuff, vocabulary, and basic strategies. I never told anyone how to trade their stash, when opening a position, and when closing it. I never commented on other people's analysis or trading strategies (with only one notable exception). So, I might or might not be involved in future, but I never tried to "sell" any trading strategy. Even more, I have too much respect for each one risk and time preferences, personal constraints knowledge or history, or other facts that might determine their trading style, to comment on other people actions, besides correcting factual errors. It surely seems to be a bit of a dilemma fillippone, especially for someone who either does not have an outside cashflow already established to be able to attempt to spend a lot of time on bitcoin related matters and other stuff and not be wanting to attempt to monetize their time spent to some extent. I tend to recommend a variety of self-help mechanisms, and I also tend to be weary about purported experts - even when I am forced to consult with them - and not even saying that they are not necessarily very knowledgeable in their field if they do it full time, but there might also be a variety of vehicles that they employ to keep their clients dependent upon them rather than providing self-help kinds of knowledge. I understand also that there are some clients that might just say fuck it. The fee is cheap enough (whether it is .5% per annum or up to 2%) that they might feel that it is well worth the fee - even though the higher the fee, the more difficult it will be to justify continuing with the use of such services, in the event that the advisor is custodying or the consulting is for one-shot time frames and perhaps flat fees? Financial managers likely need to employ a variety of complicated financial instruments to establish to their clients that they are "doing something" even if some clients might realize that in the whole scheme of thing (including after the fees) their portfolio may well not be doing better than if they self directed into an index fund, and surely bitcoin should be providing further justifications that such complicated instruments are not necessary because on average bitcoin even outperforms the best of the prior investments (index funds), and so whether I personally am correct or not, I do not give too many shits, but many times when peeps are talking about a variety of sophisticated instruments, I still continue to assert one of the best places to start (especially in bitcoin) is to get your basics down, and in the longer term - (such as 4 years or longer - might take 10 years perhaps), your financial portfolio will quite likely outperform your having had employed a variety of other financial instruments into such investments. So for me, getting the basics straight is a starting point, but it is NOT necessarily exclusive, especially if some peeps might feel that they have more time, then they might experiment with other financial instruments to attempt to complement their approach once they have assured that they got their basics straight, whether that is the use of futures, options, leverage, margin, shorts, etc.. some of them are easier to learn about and to figure out how to use than others... And, yeah it seems to me that each financial instrument that is employed, there is a possibility that the investor is magnifying the risk, even though the instrument is meant to allow for the lessening of risk, if it is used properly... and another trade off could be that the employment of some of the financial instruments ends up taking away some of the upside profit potential because it ends up betting in both directions - which may or may not be needed in my thinking, so for example, when I got into bitcoin, I already had a significant amount of investment already into a variety of traditional investments that were largely dollar based. So, I had already figured that my bitcoin investment was already a hedge against that, and so even if I ended up accumulating a relatively decent amount of value in bitcoin, it still was not as large as my various dollar based investments - even though through the years - because of bitcoin's value appreciation relative to the dollar became so much larger and larger portions of my overall value and even outgrew the dollar-related appropriated investments, which at that point justified that I should attempt to take some measures within my BTC holdings to attempt to ameliorate some of the downside risk within the BTC portion (because its value became so great). Of course, if someone is coming into investment, and they have no other investments besides bitcoin, then it could be prudent to actually consider hedging mechanisms right from the start... I doubt that I am really good at speaking to that.. but I do understand that the various mechanisms that I already discussed, including considerations of futures, might thereby become more relevant to a person in such a financial/psychological circumstance. Hopefully I am not derailing your thread too much when it comes to attempting to consider basics before even considering whether futures might be a good thing for normies to attempt to employ...which seems to be part of the point that I am trying to make .. in a kind of long-winded way. By the way.. in my response above, I fixed the quotes in fillippone's post to clarify which comments were from icopress - otherwise it may well appear that fillippone is merely talking to himself.. which might happen from time to time, but not in this particular case.. hahahahaha |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 07, 2021, 09:24:49 PM

Last edit: June 17, 2021, 11:18:05 PM by fillippone |

|

One month into bitcoin futures CME is doing a recap of the situation. Micro Bitcoin futures: one-month trading recap

Micro-sized bitcoin, major possibilitiesIn the first month of trading, Micro Bitcoin futures (MBT) volume has reached 653,373 total contracts traded across seven expirations, indicating strong customer interest and growing liquidity in the new smaller-sized contract. Sized at 1/10 of one bitcoin or 1/50 of the larger Bitcoin futures contract, Micro Bitcoin futures offer greater access for traders of all sizes to scale bitcoin exposure with greater precision and enjoy the price discovery of transparent futures. Month one trading highlights: - 28,408 average daily volume

- 20,926 average daily open interest

- 36% of overall volume came from outside the United States

- Over 54% of the trades were executed during non-US trading hours with quoting available nearly 24 hours a day

- ~3,700 unique, active accounts trading

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 17, 2021, 11:24:53 PM

Last edit: May 15, 2023, 11:41:18 PM by fillippone |

|

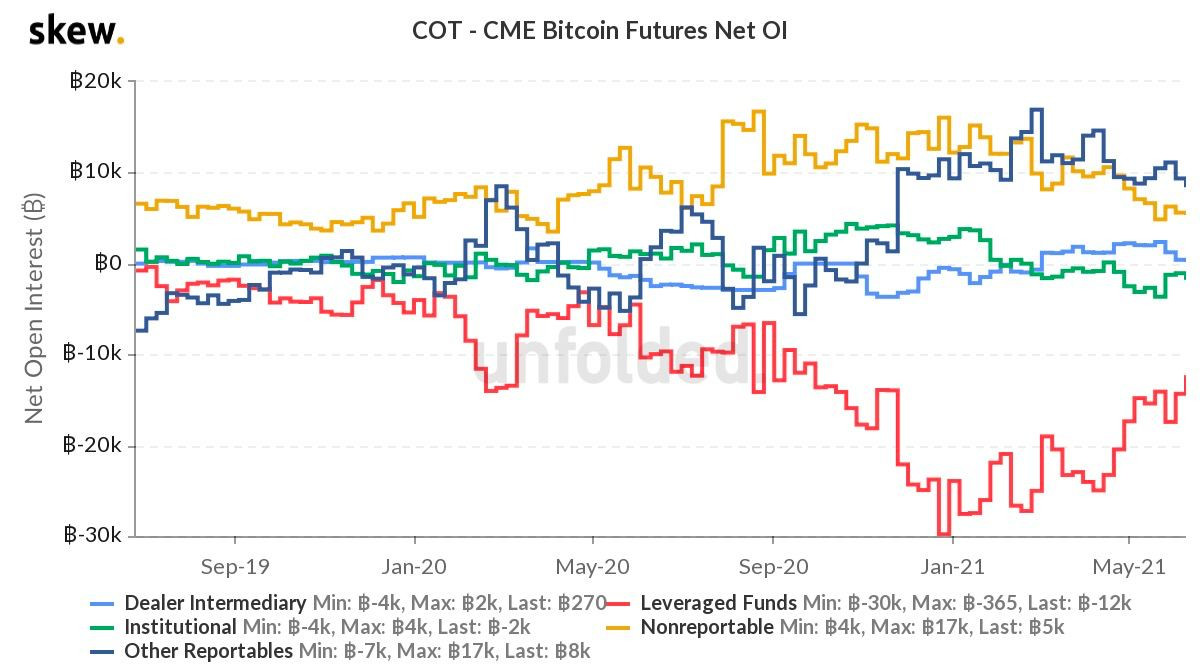

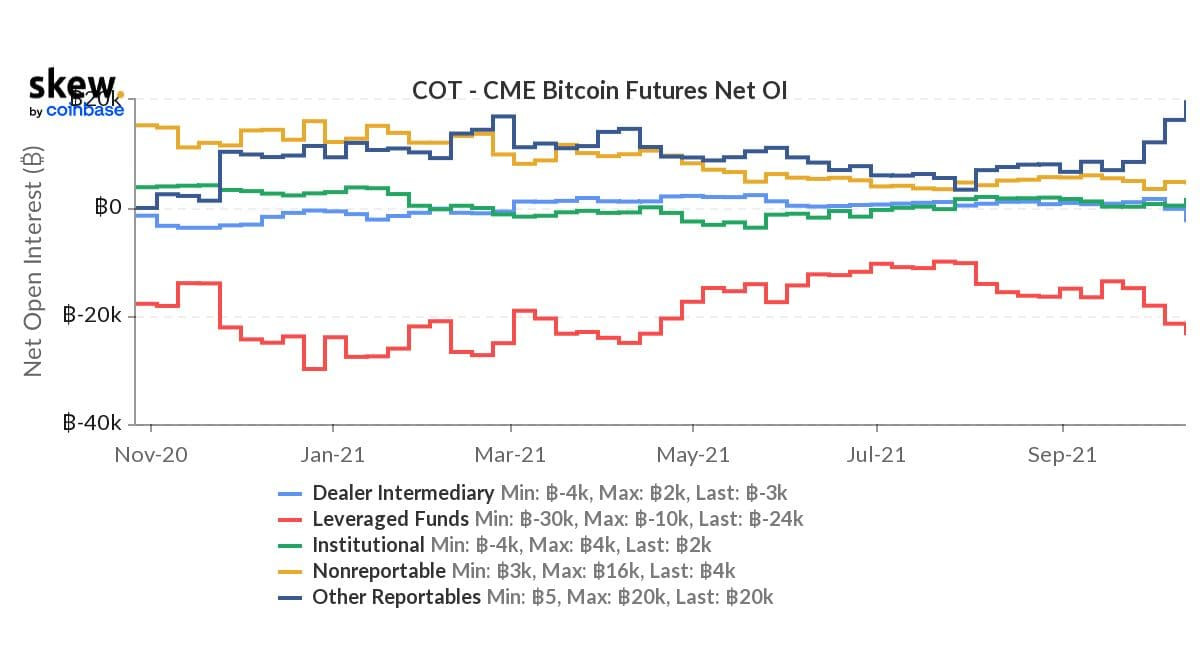

A quick update on contango: for a variety of reason we have explored in the previous posts, the steep contango that was characterising the BTC future curve, has now gone, for the desperation of all cash&carry traders. If we look at the weekly CoT documents by the CME:  We see that leveraged accounts have been recently buying back their shorts as there is less profitability to sell the future against buying the underlying. Hence many of those positions got closed. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 22, 2021, 03:27:43 PM

Last edit: May 15, 2023, 11:37:34 PM by fillippone Merited by JayJuanGee (1) |

|

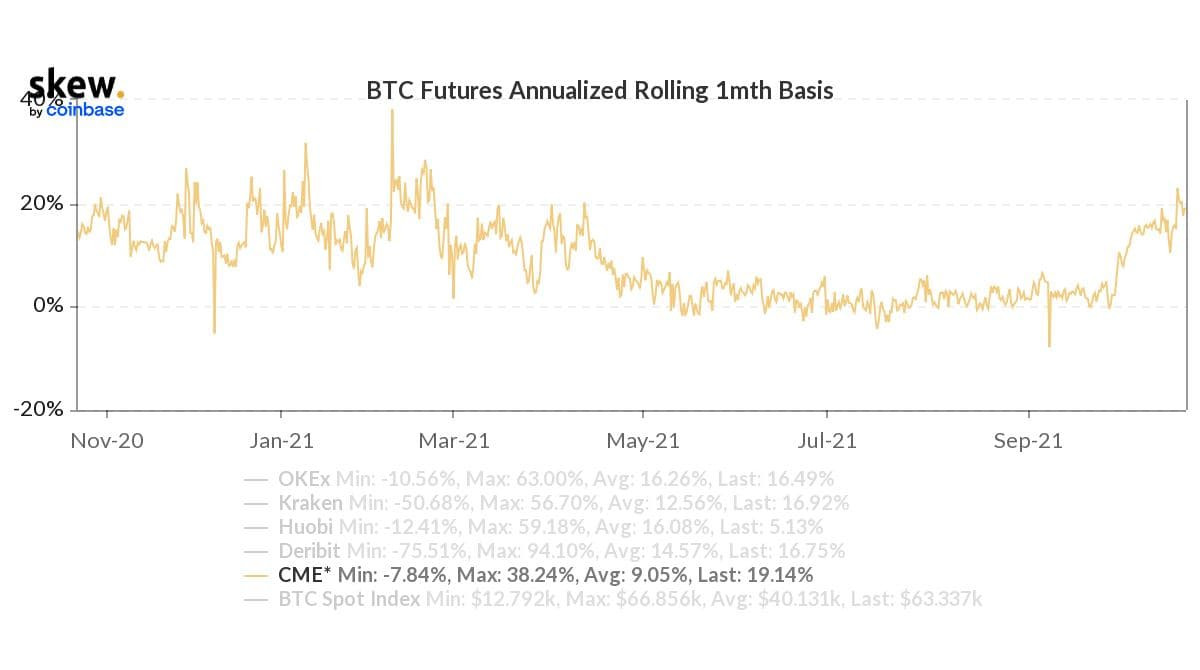

Finally I found a graph or the reason behind the closing of position I mentioned in the previous post:  Here you can see the contango of the bitcoin futures curve has disappeared completely, and it actually now has a backwardation shape. If you recall the OP correctly , backwardation means that future prices are lower than current one (spot price). In the graph above backwardation happens when the basis line crosses below zero. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 25, 2021, 10:27:08 PM Merited by JayJuanGee (1) |

|

An interesting article on carry trade by Coindesk: How One Fund Used the Carry Trade to Beat Bitcoin

How the carry trade works

Carry trading, or cash and carry arbitrage, is a market-neutral strategy that exploits inefficiencies in the spot and the futures market. It combines a long position in the spot market and a short position in futures when the market is in contango – a condition where the future prices of an underlying asset are higher than the current spot price. As expiration nears, the premium evaporates; on the day of the settlement the futures price converges with the spot market price, generating relatively riskless returns.

Yes, this is the basic idea I have been mentioning in the last posts here. The closing paragrap is quite distrubing to me: Instead, some may look to take on another bet: selling options, which can be quite risky as the maximum return is limited to the extent of premium paid, while losses can be significant.

“The carry trade has no premium anymore,” Tang noted. “Option implied volatilities are still high, so there’s still yield to be harvested there by selling calls and puts, or strangles, if we think the market is going to consolidate around these levels.”

This is a totally different trade: carry trade is basically an arbitrage: a riskless (or with limited risks) position while shorting options is one of the riskiest positions I can think of. Really, mixing apples and pears. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 07, 2021, 12:41:19 PM

Last edit: May 15, 2023, 11:22:17 PM by fillippone Merited by JayJuanGee (1) |

|

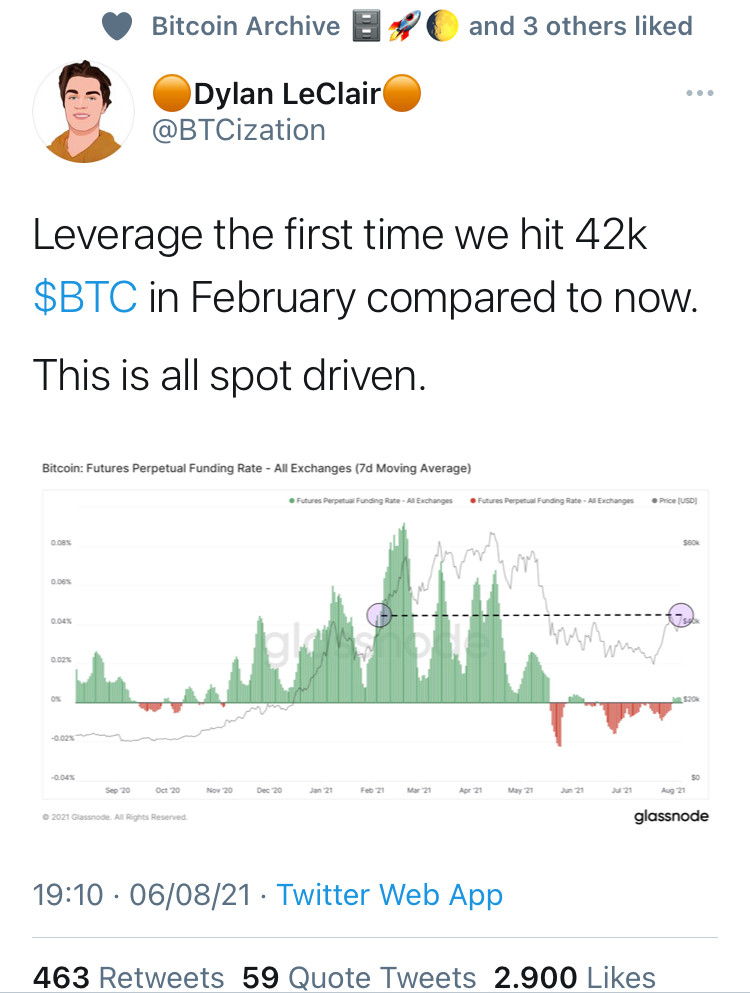

A very interesting tweet today:  https://twitter.com/btcization/status/1423692870771425290?s=21 https://twitter.com/btcization/status/1423692870771425290?s=21What does it mean? When the funding rate is high, means that future long open interest is high, so future holders pay an high price to maintain their longs. The fact that funding rate is so low now, means that this move is not a derivatives driven squeeze, rather it is a spot driven move. This means that there are less stops to be triggered, and rally is much more solid. Very nice. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 14, 2021, 09:44:11 PM

Last edit: May 15, 2023, 10:50:24 PM by fillippone |

|

Some very interesting development in the futures market. There are many tweets and article out there with the same content. I will try to provide a summary of them in the most complete way. There is a big push in CME futures markets. There are a few sign of it: |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9552

#1 VIP Crypto Casino

|

Next week could be explosive……   |

|

|

|

Quickseller

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 2300

|

There is a big push in CME futures markets.

Where does this observation lead?

What cause such an excitement in the market?

CME futures are cash settled. This means it is more difficult for trader to arbitrage price discrepancies. Say for example, interest rates, the cost of holding, and the cost of borrowing bitcon are all zero (for simplicity sake). With a "physical" delivery futures contract, the cost of an arbitrage trade would be trading commissions, and slippage when trading both the futures contract and when trading bitcoin. However when a futures contract is settled via cash, an arbitrage trader will need to close his position in bitcoin when the contract expires, which includes the cost of price slippage when he closes his trade. It is unknown how deep orderbooks will be when the futures contract expires, so a trader will have to guess the cost of slippage when closing the bitcoin portion of the trade, and he will likely need to assume there will be an increased slippage cost in his model to protect himself against losses. A "physical" delivery futures contract is much easier to arbitrage. If the futures price is above the spot price, he can simply buy spot bitcoin, short the futures contract, pay the trading fees, incur slippage, then transfer his bitcoin from his exchange account to his futures account, and wait for the contract to expire. Or he could buy the futures contract, short bitcoin, transfer the delivered bitcoin from his futures account at expiration to his exchange account to cover his short position, if the futures price is below the spot price. Obviously, the cost to borrow bitcoin is not zero, and as such, the futures price compared to the spot price will change in part by changes in the cost to borrow bitcoin. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 14, 2021, 10:25:14 PM

Last edit: May 15, 2023, 10:50:02 PM by fillippone Merited by JayJuanGee (1) |

|

Oh, you spoiled my "suprise". But it's not surprise as it is well known.  https://twitter.com/EricBalchunas/status/1448738997543612418?s=20 https://twitter.com/EricBalchunas/status/1448738997543612418?s=20Complete ETF list:  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

impulse709

|

|

October 19, 2021, 10:44:37 PM Merited by fillippone (1) |

|

This is a pretty good topic to my interest., I've been in the crypto market for a while now and my interest in long-term investing has always been something I'm interested in right now. , i have done a lot of research on futures contracts contracts of many projects including Chng finance this is my project on futures contracts and your topic is very helpful for those who want to learn more about operation and details everything about futures contract.

|

|

|

|

|

johnyj

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

October 20, 2021, 02:43:44 AM

Last edit: October 20, 2021, 02:57:00 AM by johnyj |

|

OMG, im shocked, really its walls of text to explain one way of investing? I mean why there is need to create such complex ways of investing in Bitcoin world?

Buying is best investment, why complicate things? Often its to confuse less bright or people less beign able to manage their funds, to make them make wrong decisions and loose money.

I really don't like complicated instruments of investment, banks love to create them to steal money from customers over and over. Its really sad how many people falling for that.

Totally agree! Although there is a need for hedging price risk for a future delivery of commodities/goods, such kind of risk does not exist for bitcoin, since it is always delivered instantly in an hour Futures and options for bitcoin seems to be merely a complicated way of gambling using leverage |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15481

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 22, 2021, 03:43:56 PM

Last edit: May 15, 2023, 10:45:43 PM by fillippone Merited by JayJuanGee (2) |

|

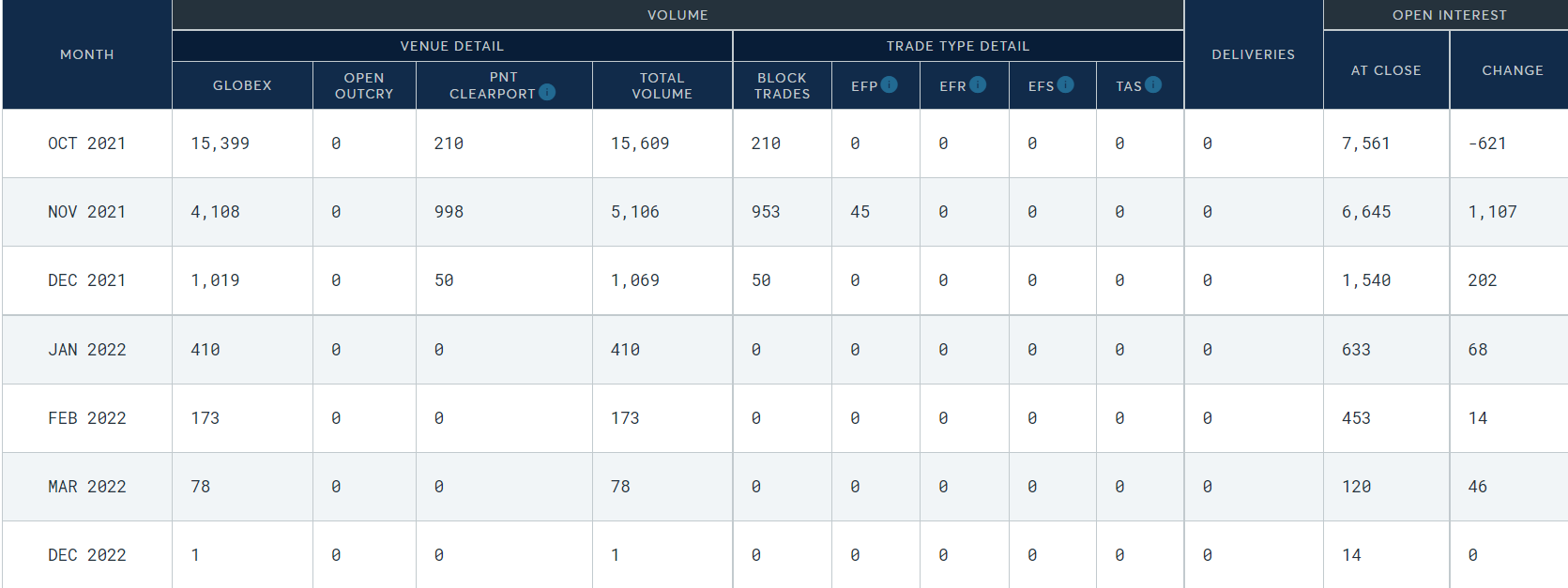

After two days of trading, BITO has a little more than 1.2 Billion of AUM. As of COB of 21 Oct 2021, these were the fund Holdings:  they bought an aggregated of 3,812 contracts. As each of them controls 5 Bitcoin, the market value of such a position is right around 1,221,000. So this position, as expected, almost exactly covers the AUM of the fund. On the CME website, we discover they hold a large percentage of the Open Interest (essentially, the position held open overnight) of the whole contract:  Bear in mind that each account has a position limit of 4,000 contracts (due to be reduced to 2,000 in the last three trading days). Actually, BITO is the only player in the future market at the CME, and they are forced to buy. This is reflecting on the measures. First of all, all this buying sent the curve in contango again. Annualized future basis went crazy again, and cash and carry trades (selling future vs buying spot) are profitable again.  This is certified by the COT documents, which tells us that "Leveraged Funds" accounts are again turning short and shorter in the future  You see there is a correlation between leveraged accounts short and basis, and the causality flows from the first picture to the second: when the basis is high, those accounts try to profit from it, selling the future and buying the cash. As they sell, the basis compresses, and once they get to their target, they exit the position, closing their short and returning toward a neutral position. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Quickseller

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 2300

|

|

October 22, 2021, 04:11:19 PM |

|

After two days of trading, BITO has a little more than 1.2 Billion of AUM.

It is much easier for an institutional fund, such as a pension fund or an endowment to account for buying an ETH verses buying a "non-traditional" investment such as a hedge fund (or bitcoin). My guess is there are some investment managers who want bitcoin exposure that cannot account for holding bitcoin directly. |

|

|

|

|

|