fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 13, 2020, 09:38:38 AM

Last edit: April 13, 2020, 10:03:04 AM by fillippone |

|

Used my quarantine time and help from a fellow translator (thanks @gazetabitcoin ) to polish a few typos, minor edits and adding all the other translations of the original article.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

|

|

Make sure you back up your wallet regularly! Unlike a bank account, nobody can help you if you lose access to your BTC.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 23, 2020, 01:46:43 PM

Last edit: May 16, 2023, 02:05:30 AM by fillippone |

|

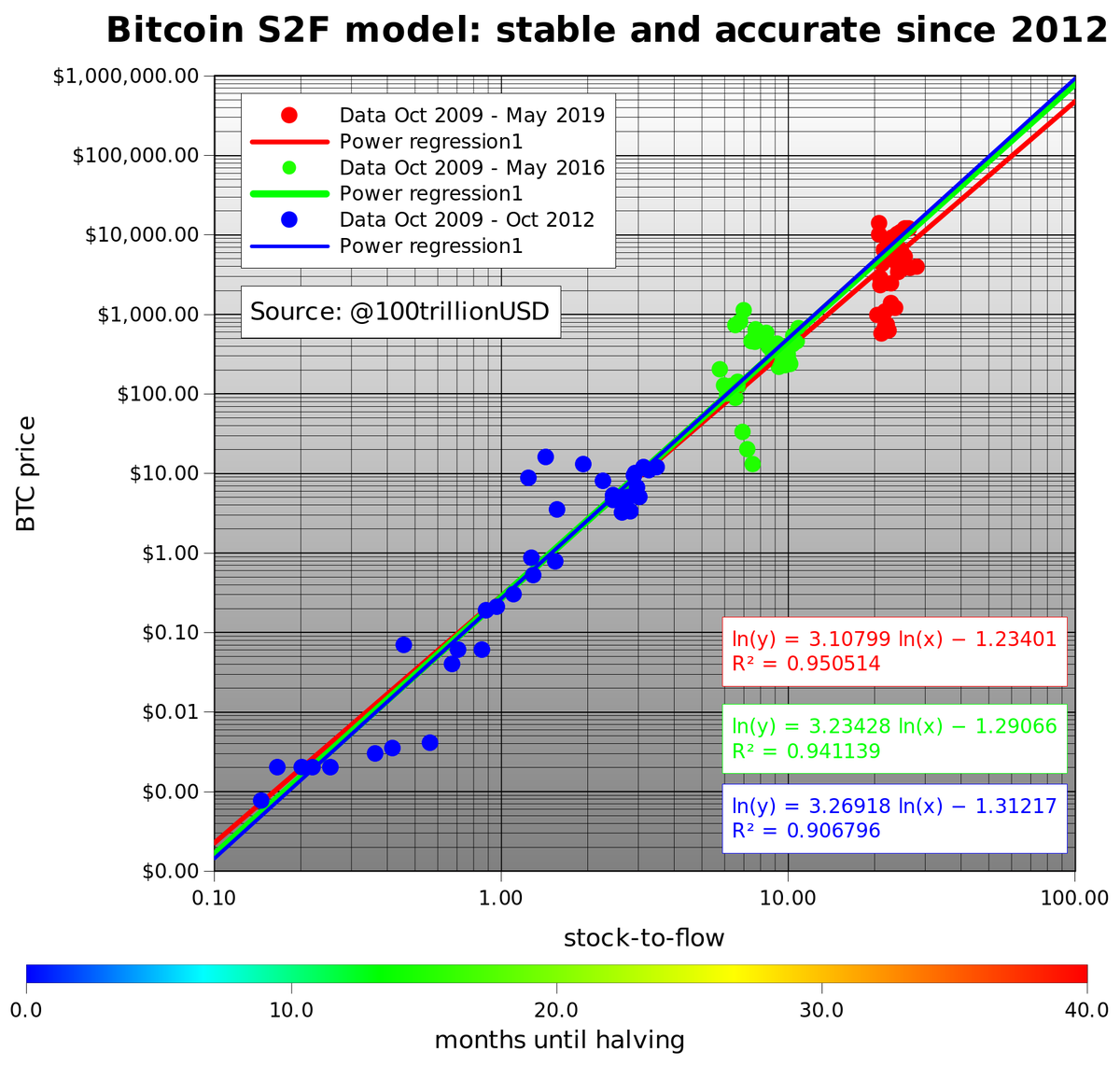

It is a different model from the full model that took in account I believe 111 monthly data points between 2009 and 2019 (r2 is also different).

Okay, then you have a good case about this model's ability to forecast. However, careful about "overfitting" and let's see about it in the next few years  Again, the author explored this possibility, and found some nice evidence: I am aware of the potential dangers of backward fitting and over fitting. However, the #bitcoin S2F model doesn't seem to have that problem.

https://twitter.com/100trillionUSD/status/1148255654051794944?s=20 https://twitter.com/100trillionUSD/status/1148255654051794944?s=20As you can see, taking different subset of sample points, doesn't change dramatically the model: hence overfitting hypothesis can be safely discarded. This is very important, imho, you were right pointing to this as a potential invalidating point for the model, but this can be safely dismissed. Little update on this. Plan B just tweeted this: #Bitcoin stock-to-flow model on 2010-2012 data still usable in today. It predicted post-2012-halving and post-2016-halving levels quite well. Will it hold again, after May 2020 halving?Crossed fingers

https://twitter.com/100trillionUSD/status/1253281280772407298?s=20 https://twitter.com/100trillionUSD/status/1253281280772407298?s=20So, one year has passed since the quoted image, and parameters aren't dramatically changed. This is why S2F is a robust model, whaile others are just line drawn over a chart. Like this one, for example: Diminishing returns on a log chart in 2014:  Diminishing returns on a log chart in 2020:  Source SourceYou see parameters aren't constant. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

mu_enrico

Copper Member

Legendary

Offline Offline

Activity: 2324

Merit: 2142

Slots Enthusiast & Expert

|

|

April 23, 2020, 02:03:34 PM |

|

^ You quote me, bro? Whatsup? Is the variance not widening (yet)? I see R2 changed to 0.698 for the blue one. Can you explain it? Thank you.

|

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | | | BK8? | | | .

..PLAY NOW.. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 23, 2020, 03:00:41 PM |

|

^ You quote me, bro? Whatsup? Is the variance not widening (yet)? I see R2 changed to 0.698 for the blue one. Can you explain it? Thank you.

Sotty mane, didn't realise I was quoting a message of yours. Blue correlation changed because they are actually different, as in the upper graph it is Oct 09 to Oct 12, while in the latter is Jul 10 to Nov 12. Why he did so it's not clear to me, and , sadly, made those to graph actually not comparable directly. Also note the legend is not correct, as also the Green period starts in Jul 10. So, Maybe this planB update was a little bit rushed! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 25, 2020, 02:16:11 PM |

|

Get ready. Monday I will publish my third article!

Title is "Bitcoin Stock-to-Flow Cross Asset Model".

Tweaking text, finishing calculations & charts, preparing for reviewCrossed fingers  https://twitter.com/100trillionUSD/status/1254042161647099905 https://twitter.com/100trillionUSD/status/1254042161647099905 |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 27, 2020, 11:07:31 PM |

|

Third PlanB's article Bitcoin Stock-to-Flow Cross Asset Model Introduction: In this article I solidify the basis of the current S2F model by removing time and adding other assets (silver and gold) to the model. I call this new model the BTC S2F cross asset (S2FX) model. S2FX model enables valuation of different assets like silver, gold and BTC with one formula.

First, I will describe the concept of phase transitions, because it introduces a new way of thinking about BTC and S2F. It explains why S2FX model is important.

Second, I will describe S2FX model, how it works and what the results mean.

Conclusion: In this article I solidify the basis of the current S2F model by removing time and adding other assets (silver and gold) to the model. I call this new model the BTC S2F cross asset (S2FX) model. S2FX model enables valuation of different assets like silver, gold and BTC with one formula.

I have explained the concept of phase transitions. Phase transitions introduce a new way of thinking about BTC and S2F. It led me to the S2FX model.

S2FX model formula has a perfect fit to the data (99.7% R2).

S2FX model estimates a market value of the next BTC phase/cluster (BTC S2F will be 56 in 2020–2024) of $5.5T. This translates into a BTC price (given 19M BTC in 2020–2024) of $288K.

Solidifying known facts from the original S2F study, the S2FX model offers a new way of thinking about BTC transitioning into the fifth phase.

References

He basically use 2SF to interpolate between different asset classes. In the first article he extrapolated bitcoin prices regarding time, here interpolate across asset classes using S2F. Still have to think about it. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

April 28, 2020, 07:15:05 AM |

|

Plan B just tweeted this: #Bitcoin stock-to-flow model on 2010-2012 data still usable in today. It predicted post-2012-halving and post-2016-halving levels quite well. Will it hold again, after May 2020 halving?Crossed fingers

No offense intended, by from my vantage point anyone who takes years prior to 2015 (not even speaking of 2010-2012) and says that their model works good on them too actually discredits the approach they are taking. In reference to Bitcoin, for early years one should use models and frameworks describing stochastic processes like random walk as Bitcoin's dynamic back in the day was completely chaotic and random This is not to say that today's prices are not random for significant part, even though with more fundamental factors at play now |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 28, 2020, 07:45:05 AM |

|

Plan B just tweeted this: #Bitcoin stock-to-flow model on 2010-2012 data still usable in today. It predicted post-2012-halving and post-2016-halving levels quite well. Will it hold again, after May 2020 halving?Crossed fingers

No offense intended, by from my vantage point anyone who takes years prior to 2015 (not even speaking of 2010-2012) and says that their model works good on them too actually discredits the approach they are taking. In reference to Bitcoin, for early years one should use models and frameworks describing stochastic processes like random walk as Bitcoin's dynamic back in the day was completely chaotic and random This is not to say that today's prices are not random for significant part, even though with more fundamental factors at play now Why would they? The model is co-integrated. This means it is actually working, with those parameters, even if they are computed in such an early stage of bitcoin. This means short terms fluctuations of BTC price around S2F model are possible, but statistically not significant. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

April 28, 2020, 08:07:36 AM Merited by fillippone (2) |

|

Plan B just tweeted this: #Bitcoin stock-to-flow model on 2010-2012 data still usable in today. It predicted post-2012-halving and post-2016-halving levels quite well. Will it hold again, after May 2020 halving?Crossed fingers

No offense intended, by from my vantage point anyone who takes years prior to 2015 (not even speaking of 2010-2012) and says that their model works good on them too actually discredits the approach they are taking. In reference to Bitcoin, for early years one should use models and frameworks describing stochastic processes like random walk as Bitcoin's dynamic back in the day was completely chaotic and random This is not to say that today's prices are not random for significant part, even though with more fundamental factors at play now Why would they? Because prices were random in those years So anyone who tries to describe the early Bitcoin history using anything other than pure statistics and its methods, which are descriptive on their own and say nothing about the driving forces behind the raw data, is actually trying to derive a meaning from, or relate a meaning to, something which is, or was, meaningless (as a process) due to its random nature. If you ask me, this is not a good idea as it casts doubts on the plausibility of the entire approach In fact, I understand why people are doing this all the time (because they are looking for coherent explanations and plausible reasons for anything, even entirely random things), but any model, which is not statistical, either explicitly or implicitly, should separate the random part from the part which it tries to explain if it is to have any predictive power, i.e. an ability to generate verifiable predictions. But in case of early Bitcoin, there is simply nothing to winnow out |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 28, 2020, 08:12:51 AM |

|

Plan B just tweeted this: #Bitcoin stock-to-flow model on 2010-2012 data still usable in today. It predicted post-2012-halving and post-2016-halving levels quite well. Will it hold again, after May 2020 halving?Crossed fingers

No offense intended, by from my vantage point anyone who takes years prior to 2015 (not even speaking of 2010-2012) and says that their model works good on them too actually discredits the approach they are taking. In reference to Bitcoin, for early years one should use models and frameworks describing stochastic processes like random walk as Bitcoin's dynamic back in the day was completely chaotic and random This is not to say that today's prices are not random for significant part, even though with more fundamental factors at play now Why would they? Because prices were random in those years So anyone who tries to describe the early Bitcoin history using anything other than pure statistics and its methods, which are descriptive on their own and say nothing about the driving forces behind the raw data, is actually trying to derive a meaning from, or relate a meaning to, something which is, or was, meaningless (as a process) due to its random nature. If you ask me, this is not a good idea as it casts doubts on the plausibility of the entire approach In fact, I understand why people are doing this all the time (because they are looking for coherent explanations and plausible reasons for anything, even entirely random things), but any model, which is not statistical, either explicitly or implicitly, should separate the random part from the part which it tries to explain if it is to have any predictive power, i.e. an ability to generate verifiable predictions. But in case of early Bitcoin, there is simply nothing to winnow out That is the point. It wasn't random, because there is a 95% R^2. This means 95% of the price is explained by this model. All the other factor are explaining 5%. And this is not a spurious correlation (like high correlation between people drown in a pool and Nicholas Cage movies) because this model is also cointegrated. A fact that rejects this hypothesis. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

April 28, 2020, 11:09:45 AM |

|

It wasn't random, because there is a 95% R^2. This means 95% of the price is explained by this model. All the other factor are explaining 5% The numbers don't tell anything by themselves For instance, you can take an arbitrary set of random data and build a model (say, a polynomial function of high enough order) that would technically give you a 100% accuracy, at least as far as only the sample data points are considered. Then, on this account, you could go on to claim that the distribution is not random (following your logic here). But it would be a far cry from actually explaining anything in a meaningful way, let alone having any predictive power (the analogy of a random number generator seems appropriate here) This is probably a borderline if not outright extreme example but it is still illustrative enough to show that numbers can be misleading as well as deceiving, and thus shouldn't be taken in isolation for drawing deductions and making inferences. You can arrive at very bizarre conclusions if you don't assess and keep in mind the nature of the subject matter. Put differently, statistical metrics are sufficient and unreservedly valid only in reference to truly random populations. With everything else, we should rather be concerned with looking for the underlying principles, forces, and causes, i.e. the actual mechanics of some phenomenon or process, and how things work internally Mistaking correlation for causation has already become a cliché of sorts, but it is only a tip of the iceberg of the whole gamut of possible judgment errors we have to deal with and be aware of |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 28, 2020, 11:17:44 AM |

|

It wasn't random, because there is a 95% R^2. This means 95% of the price is explained by this model. All the other factor are explaining 5% The numbers don't tell anything by themselves For instance, you can take an arbitrary set of random data and build a model (say, a polynomial function of high enough order) that would technically give you a 100% accuracy, at least as far as only the sample data points are considered. Then, on this account, you could go on to claim that the distribution is not random (following your logic here). But it would be a far cry from actually explaining anything in a meaningful way, let alone having any predictive power (the analogy of a random number generator seems appropriate here) This is probably a borderline if not outright extreme example but it is still illustrative enough to show that numbers can be misleading as well as deceiving, and thus shouldn't be taken in isolation for drawing deductions and making inferences. You can arrive at very bizarre conclusions if you don't assess and keep in mind the nature of the subject matter. Put differently, statistical metrics are sufficient and unreservedly valid only in reference to truly random populations. With everything else, we should rather be concerned with looking for the underlying principles, drivers and forces, i.e. the actual mechanics of some phenomenon or process, and how things work internally Mistaking correlation for causation has already become a cliché of sorts, but it is only a tip of the iceberg of the whole gamut of possible judgment errors we have to deal with and be aware of I totally get your point. But i guess the original S2F model has already well demonstrated it is not a well articulated fit of a random data point, as it it cointegrated (this is a statistical test) and parameters are well stable over time (running S2F over different data sets, taken from different halving cycles for example, yields to almost identical parameters and price predictions). A lot of your points have been actually been raised in the past and discussed in the above thread. I think it is useful to approach the topic with a grain of salt and in a "challenging" way, as you are doing (we already have religion where you need faith to believe, models are different). So I am happy to discuss your questions, as answering might me help me find the flaw in this model. I would like to find it, as I find disturbing to have a BTC valuation in the millions in a couple of halving....this means something (the USD) has to break to be true. Otherwise it is the BTC that is going to break. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 30, 2020, 11:00:41 AM |

|

A nice surprise:  https://twitter.com/100trillionusd/status/1255805636555739138?s=21 https://twitter.com/100trillionusd/status/1255805636555739138?s=21This is a Great interview. A lot of information about the article and what is next. Of course a few months have passed, so you have to put this in context, but the ideas are still there! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 06, 2020, 08:04:00 AM |

|

A really nice Webcast by Stephan Livera on Stock to Flow with Saifedean Ammous, author of the Bitcoin Standard and first proponent of Stock to Flow model in Bitcoin, and PlanB on his new Stock to Flow article, model development, haling and many more.  Definetly worth listening to. I will try to extract the most interesting parts here. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 13, 2020, 02:32:33 AM Merited by fillippone (2) |

|

In Episode 392 of the Bitcoin Audible (rebranded from cryptoconomy), Guy Swann read Dominik Stroukal's critique of the stock to flow model, and really it seemed that Stroukal had made a really strong, persuasive argument critiquing the stock to flow model in terms of asserting that in economics, any model should account for both supply and demand, and proclaiming that the stock to flow model is pure speculation and wishful thinking because it ONLY focuses on supply. More or less Guy Swann's rebuttal tears Stroukal a new asshole... hahahahaaha... What I am suggesting is that it is a good podcast, with both a good read of a provocative article and a great rebuttal, too. Here it is: Bitcoin Audible (previously the cryptoconomy): Read_392 - Economics of the Bitcoin Halving [Dominik Stroukal] |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 13, 2020, 02:58:59 AM |

|

<...>in economics, any model should account for both supply and demand, and proclaiming that the stock to flow model is pure speculation and wishful thinking because it ONLY focuses on supply.

Is he serious? If that were true Just tell me where demand (or supply) is considered in Dividend Discount Model for stocks, or Black&Scholes Model for derivatives |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

bkbirge

|

|

May 13, 2020, 03:10:21 AM |

|

In Episode 392 of the Bitcoin Audible (rebranded from cryptoconomy), Guy Swann read Dominik Stroukal's critique of the stock to flow model, and really it seemed that Stroukal had made a really strong, persuasive argument critiquing the stock to flow model in terms of asserting that in economics, any model should account for both supply and demand, and proclaiming that the stock to flow model is pure speculation and wishful thinking because it ONLY focuses on supply. More or less Guy Swann's rebuttal tears Stroukal a new asshole... hahahahaaha... What I am suggesting is that it is a good podcast, with both a good read of a provocative article and a great rebuttal, too. Here it is: Bitcoin Audible (previously the cryptoconomy): Read_392 - Economics of the Bitcoin Halving [Dominik Stroukal]Thanks for sharing! Listening now. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 13, 2020, 03:38:09 AM |

|

<...>in economics, any model should account for both supply and demand, and proclaiming that the stock to flow model is pure speculation and wishful thinking because it ONLY focuses on supply.

Is he serious? If that were true Just tell me where demand (or supply) is considered in Dividend Discount Model for stocks, or Black&Scholes Model for derivatives I may not have been summarizing the Stroukal arguments very well. I just listened to it while I was doing some other things, and overall it sounded like Stroukal was making some decent arguments to me, until I listened to Guy Swann's various rebuttals. One of the difficulties seems to be to assert that if you create a model that only emphasizes supply that demand is NOT also sufficiently embedded in the model by accounting for supply, such as holding demand constant or allowing for demand to be embedded in the historical data that is plotted on the line in order to create a trajectory based on where BTC prices had already been and where the prices had clustered. So, even though demand might NOT be explicitly discussed within the model, it may be adequately accounted for by plotting the starting / historical prices which implies demand as a kind of constant (and perhaps within a range). just Of course, stock to flow can be read as allowing for a lot of variance in where BTC price might go above and below the projected price points, and that tolerance for variance seems to allow for variance in the demand that may cause the price projections to deviate from where they might more likely thought to be on the model, too... so even though Stroukal's arguments presented the lack of demand within the model idea persuasively, I still question whether the model does not adequately account for demand by largely plotting empirical price data points and then kind of assuming a range of ongoing demand as a kind of constant or range and including that scarcity of supply likely motivates demand within a projected range of ongoing expectations that are reasonably predictive of future BTC prices, too. [edited out]

Thanks for sharing! Listening now. Great. Let us know if you have some further insight regarding the topic. I personally do not like to listen to the same thing more than once, unless there has been some considerable passage of time or I am feeling motivated to listen again for some other compelling reason. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 15, 2020, 07:01:51 AM

Last edit: May 16, 2023, 02:00:03 AM by fillippone |

|

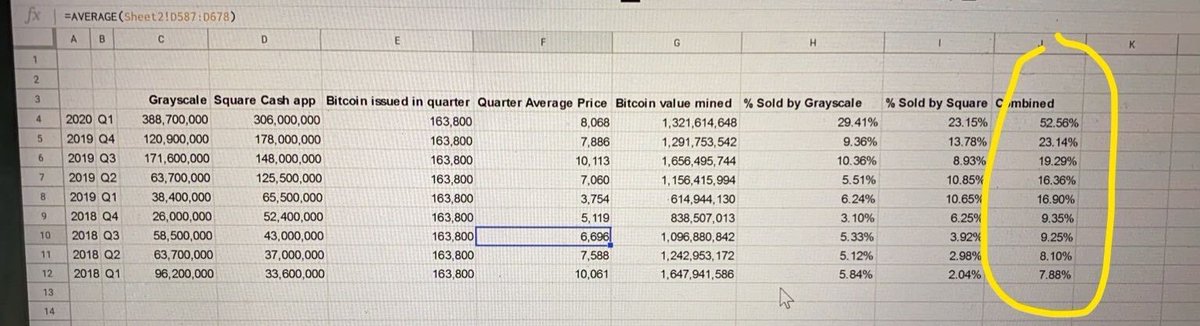

I saw a very intrresting picture on Twitter. That was a back-of.the envelope calculation i did many time here on BTC Talk (cit. needed), so I tought to make my onw version to share with you guys: CashApp and Grayscale consumed over 50% of all new issuance in Q1.

Take a bow

@hodl_american

we assume most of the

@CashApp

action is you

#BitcoinBTC

https://twitter.com/listedreserve/status/1258268244319694848?s=20 https://twitter.com/listedreserve/status/1258268244319694848?s=20So, here it is my version to play with. I am going to update it with reference of every price and numbers from reliable sources.  https://docs.google.com/spreadsheets/d/1weRaV1wuOM8XlsbvRGX7YkJ9-EbT2SuA_-x3irHRd-g/edit?usp=sharing https://docs.google.com/spreadsheets/d/1weRaV1wuOM8XlsbvRGX7YkJ9-EbT2SuA_-x3irHRd-g/edit?usp=sharingThis is the biggest reason why S2F matters. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

May 15, 2020, 09:12:15 AM |

|

^ Nice fillippone. Are those Grayscale/CashApp numbers net buys?

|

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

|