fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 06, 2020, 10:34:18 PM

Last edit: May 16, 2023, 01:51:51 AM by fillippone |

|

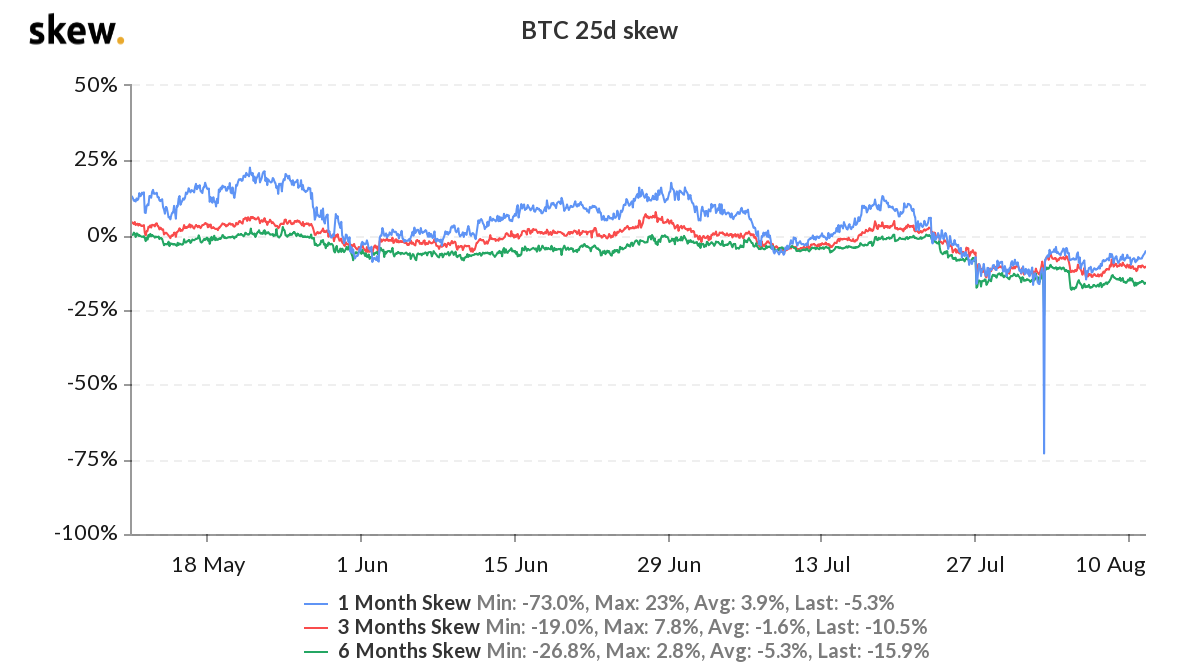

Option markets are living a period of extreme activity after the halving. If this is tied to some structural change in the option market itself, to the halving itself, or to the increased number of players, namely institutional, being active in the market is maybe too early to call, but definitely we have at least a couple of things to notice. First of all, it is not a news the overall market activity has increased, after the halving. In particular we observed a surge in volumes at the most prominent legacy exchange. The CME.  If you squint your eyes you can see the CME before the halving If you squint your eyes you can see the CME before the halving Same story for Open Interest, where CME has added a good weight. Can you see BAKKT? Same story for Open Interest, where CME has added a good weight. Can you see BAKKT?The fact that open interest has increased after the halving in every exchange, make me think it is some new player entering the market. And the fact that CME has gained so much compared to others, make me wonder that it is the institutional players starting paying with bitcoin options. This particular category of investors has the highest benefit using the CME platform, rather than a whale. Remember that CME options are traded for cash settlement, making it not the most obvious choice for he who want to have exposure to physical bitcoin, like, as we said, whales.  CME hovering around 20% on Open Interest is something that would have been unthinkable only a few months ago. Let's see if they are able to keep this momentum rolling. If we look at what actually happened on the market, after the halving, we se that, well, the activity on the spot was quite muted, we had some spike above 10,500 suddenly rejected, but nothing that triggered further sells. Market stabilising had his toll on realised volatilities:  Dead calm on market volatility Dead calm on market volatilityThis situation also dragged south also implied volatilities, that started following the move grinding lower. Of course short implied were discounting excessive movements from spot at the halving, those didn't materialise, so fell more markedly.  The result is the following, where implied trades at a huge discount compared to realised.  Implied Looks cheap! Implied Looks cheap!One might be tempted to buy implied vols, buy option, and dynamically hedge, cashing in the difference between the twos with the hedging activity profits. Let's zoom out a little bit:  Implied Looks cheaper! Implied Looks cheaper!Even if we can appreciate the discount of implied to realised, here it's immediately clearly why is that: while implied volatility is a forward looking indicator: is is an estimate of volatility level from today to option expiration, realised volatility is a backward looking indicator, being computed on the realised movement we have observed in the past. There you understand how important is the market crash of mid may, which has raised historical volatility, but it is not priced in to happen again. Probability of market crashes are often undervalued, actually this is the main reason why skew exists. One very interesting fact about this is how market wasn't pricing correctly market crashes, and how they reacted when it happened. We have seen how skew on BTC option was trading negative before the crash, this means call skew was higher than put options. Then the market crash happened, traders realised crash do happen and started buying protection against it, buying puts against calls. This continued until mid may when 25d skew (remember: difference in volatility between 25%delta puts - 25% delta calls) reached historic high around 20%.  Skew being priced flat again after being priced at 20% Skew being priced flat again after being priced at 20%This is the distribution of open interest per strike: we see the upside is very well populated, also for strikes very out-of-the-money, with tiny delta.  50K strike? Really? 50K strike? Really? The same information we had on skew is conveyed by the put/call ratio. When this ratio was high, meant puts were being bought, this raised their price and so their implied volatility. We now understand how an higher put/call ratio means higher skew. On the contrary, when this ratio began to fell, also the skew returned toward more "normal" levels.  Having a put/call ratio being not at extreme level, means interest are not exactly balanced, but they are not on an extreme distribution, meaning underlying movement. In the end I think the fall in this ratio has been due to the explosion in open interest at CME, where the ratio is actually very skewed on the upside:  1:51 are you kidding me? Aren't you supposed to be an institutional? 1:51 are you kidding me? Aren't you supposed to be an institutional? I am not saying the call buying on CME made the global put/call ratio to drop significantly, but for sure din't help it growing. Conclusion. We had some notable change in market structure in the last month. More institutional presence, more skew, even if lately the name of the game has been on the call side of the bet, as like before the market crash: is it possible the lesson was not learned by the traders? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

"You Asked For Change, We Gave You Coins" -- casascius

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

darewaller

|

|

June 10, 2020, 05:10:15 PM |

|

I think I’m lost here  wait... Options, like you mean options trading, the same thing we can do with IqOption and Expertoption? Or is it a different something when it’s Bakkt and Deribit that we are talking about here  . I am quite confused because I can remember that IqOption is also called options trading and they have people trading bitcoin there for as low as $10. So, how comes are you saying that there are no other platforms where people can trade options apart from Deribit and that only whales do that? Unless Bitcoin option is completely different from what I know? Sorry, I’m quite confused, maybe cause I can’t comprehend the big article you wrote. If you don’t mind summarizing it an easy way. |

|

|

|

|

Vispilio

Legendary

Offline Offline

Activity: 2072

Merit: 1615

|

|

June 18, 2020, 07:13:46 PM

Last edit: June 18, 2020, 07:43:35 PM by Vispilio Merited by Bthd (2), fillippone (2), JayJuanGee (1) |

|

I think I’m lost here  wait... Options, like you mean options trading, the same thing we can do with IqOption and Expertoption? Or is it a different something when it’s Bakkt and Deribit that we are talking about here  . I am quite confused because I can remember that IqOption is also called options trading and they have people trading bitcoin there for as low as $10. So, how comes are you saying that there are no other platforms where people can trade options apart from Deribit and that only whales do that? Unless Bitcoin option is completely different from what I know? Sorry, I’m quite confused, maybe cause I can’t comprehend the big article you wrote. If you don’t mind summarizing it an easy way. It used to be the case that very few platforms offered Bitcoin options, now there are more names, although the greatest crypto option volume continues to be traded on Deribit (disregarding some OTC deals), here are 2 current charts from analytics.skew.com for more clarity:  |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 22, 2020, 05:44:55 PM

Last edit: May 16, 2023, 01:45:25 AM by fillippone Merited by JayJuanGee (1), Vispilio (1) |

|

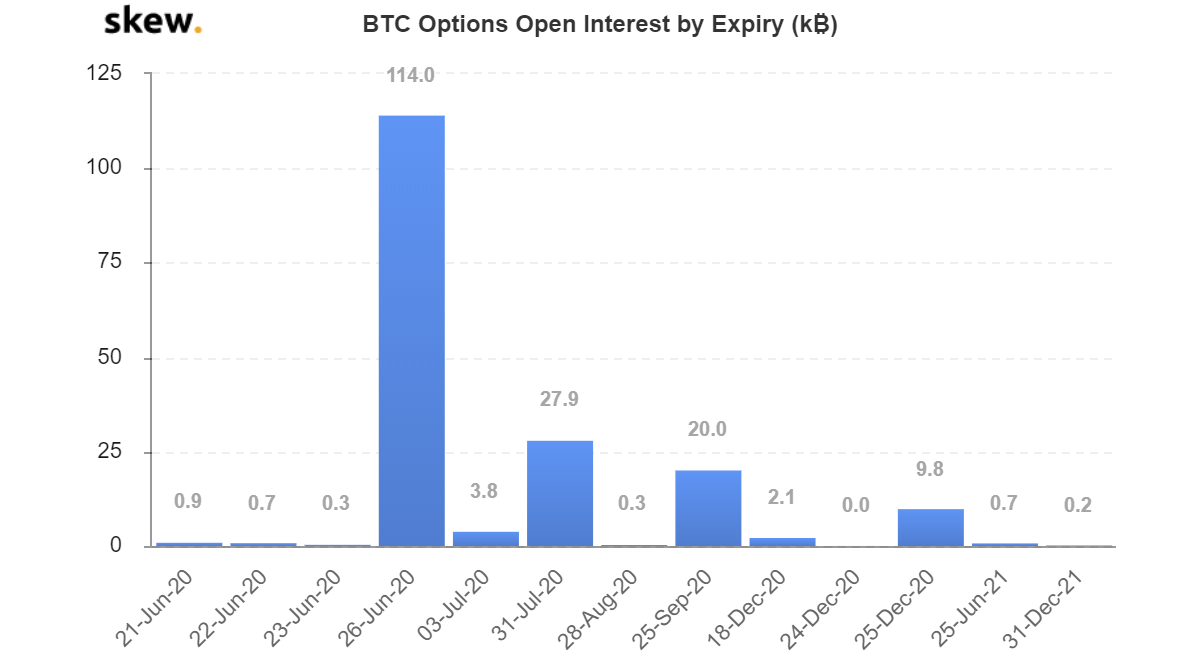

Just a little update from skew.com, as the next option expiry, on Jun 26 is going to be huge. Open interest is at historical high, nearly 1.8 billions, by far the highest in BTC options history. CME took a decent share of it: 25% is huge. To put that in relative terms, bear in mind that currently BTC options are roughly 1% of all BTC derivatives, while this percentage is almost 60% in traditional markets. |  |  | | Open Interest is at historical high. Care the vertical axis: deribit his bigger than it appears | CME at 25% seemed impossible until a few weeks ago |

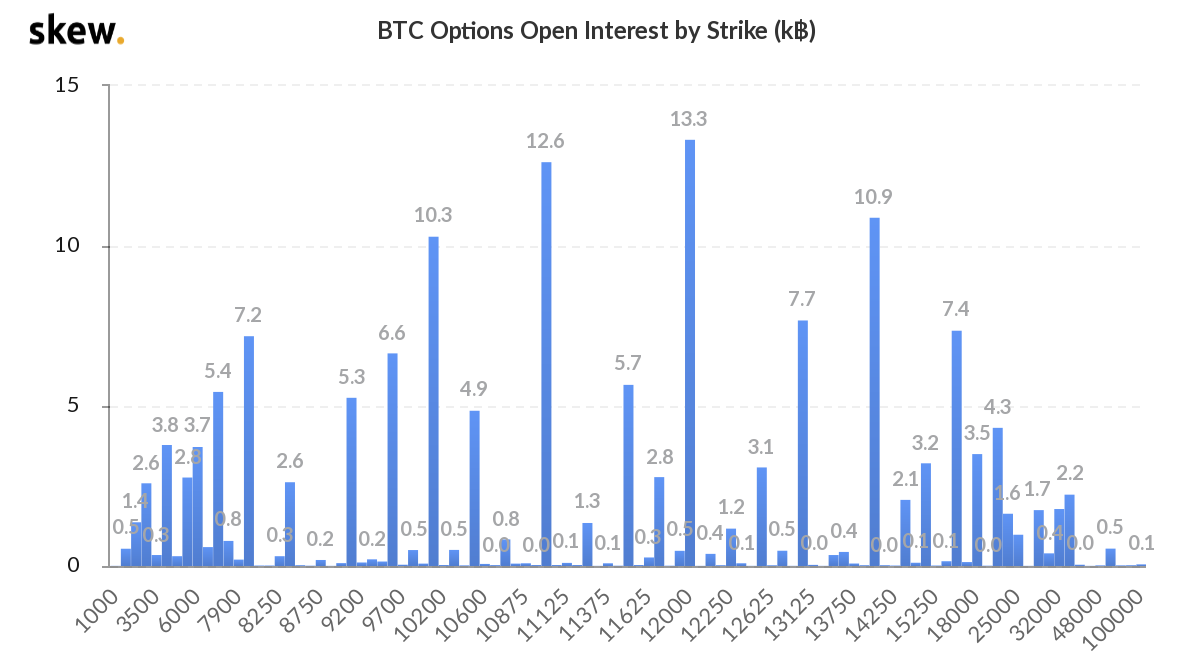

Most of the Open interest is in the front month, as usual, and the upside is playing the bigger part. There is no strike particularly dominant, and OI is well spread in the 11,000-16,000 region. |  |  | | As usual, most of the Open Interest is on the front month. Back months appear to be bigger than usual too. | Strike distribution is calling for an upside move |

One thing to notice is that open interest tells us that there is an open position in the market, but nothing on which side the position is open. A contract is open both if it is bought and if it is sold. So the Open Interest tells us where the "bulk of the contracts" is, but it doesn't tell us the direction, that is, if there have been more "buyers" or more sellers ". Well, but if one has bought the other has sold, you will say. Well, sure, but the two "sides" of the trade are often made up of two "players", with a totally different style of play. End users are interested in where the underlying expires, "win" if the option is in-the-money and "lose" if it is out-of-the-money, and therefore have an interest in "manipulating" the market to get them to the area where they profit. Instead, market makers are more interested in how the underlying expires: with what volatility, how it moved before, etc. They tend to have no interest in where the option closes, because they operate with a different logic and, so to speak, "neutral" with respect to the direction of the market. So depending on whether end users have "bought" or "sold" a particular strike, the behavior, especially near it, can be very different. In particular, it seems that many call spreads have been made, or call purchases, we assume the closest strikes, financed by selling calls with higher strikes. It is now too short to see too many strikes "go through" (even if, with BTC can never know), but if the former were bought and the others sold, then the behavior in those regions could be very different! So we will look at this expiry with great interest: options are a tool used by many different investors for a variety of reasons: fund managers, fast money traders or whale, for example, can use options to hedge, yield enhanchment or punting the market. As the market gain liquidity, these instruments will be more widely used, the gap to be closed with traditional market is huge, so the potential growth is enormous. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Vispilio

Legendary

Offline Offline

Activity: 2072

Merit: 1615

|

|

June 23, 2020, 02:34:54 AM Merited by fillippone (2) |

|

Just a little update from skew.com, as the next option expiry, on Jun 26 is going to be huge.

Open interest is at historical high, nearly 1.8 billions, by far the highest in BTC options history.

CME took a decent share of it: 25% is huge.

To put that in relative terms, bear in mind that currently BTC options are roughly 1% of all BTC derivatives, while this percentage is almost 60% in traditional markets.

...

One thing to notice is that open interest tells us that there is an open position in the market, but nothing on which side the position is open.

A contract is open both if it is bought and if it is sold.

So the Open Interest tells us where the "bulk of the contracts" is, but it doesn't tell us the direction, that is, if there have been more "buyers" or more sellers ".

Well, but if one has bought the other has sold, you will say.

Well, sure, but the two "sides" of the trade are often made up of two "players", with a totally different style of play.

...

Great update, if open interest is predominant in the 10-16k BTC price range, the traditional interpretation is to conclude that the market sentiment is slightly bullish. Most option contracts are traded out of the money, by virtue of the intrinsic philosophy of most options strategies, so 10-16k high open interest almost certainly means high concentration of OTM call options. Most of these, I guarantee, are either initiated as naked long call options (and delta long spreads), or Long BTC hedged by short call option premium (or various combo strategies derived from similar reasoning which we might get into later if there is more interest on this thread), thus the currently increasing volume in the BTC option markets is indicative of bullish sentiment. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 23, 2020, 06:46:10 AM

Last edit: May 16, 2023, 01:45:14 AM by fillippone |

|

Great update, if open interest is predominant in the 10-16k BTC price range, the traditional interpretation is to conclude that the market sentiment is slightly bullish.

<...>

Agree, you are right, slightly bullish is the best definition of current market sentiment. One thing that I would further highlight from your message is that long call spreads, which are for sure a great part of this total OI, aren't detected, as both options (one bought and one sold) are contributing increasing the OI. I am not sure a covered call writing (shorting a call to cash the premium, while hodling the underlying) is a bullish strategy, rather than one pointing to a stability in price (given the long delta, short vega exposure). But this is very technical, it really depends on which option you sold. Secondly, it is true that the option plays are bullish, but market makers learnt, after the March crash, how to price the puts. |  | | Skew is a measure of the difference, in volatility, of Puts - Calls |

We see the skew remains elevated, so there is a pressure to buy calls protecting from a downward leg. Thirdly, given the increase in positions from CME, probably more than a few market makers used Deribit to hedge their positions, "double counting" various structures between the two markets. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 23, 2020, 11:01:21 PM

Last edit: May 16, 2023, 01:39:05 AM by fillippone |

|

I wanted to update this thread for the last few days, but I procrastinated due to holiday seasons. But when I read this news I decided I couldn't stay silent: No One Has Traded Bitcoin Options on Bakkt for Over a Month: Deribit Continues to Dominate- Open interest for the exchange’s options market has suffered complete inactivity before, but the current 38-day streak dwarfs other periods.

- Bakkt's options volume has also dropped to $0 since April 23, according to Skew.

- Bakkt declined to comment when contacted by CoinDesk.

In the article there are sad picture like those: |  |  | | BAKKT Open Interest | BAKKT Volume Tracker |

Going to the source I haven't been able to exactly reproduce the graph, but the Open Interest one is quite similar:  One could think context is not exactly the best to open new positions on options given the low volatility that is affecting every asset class: buying options in such a context would imply burning the time value and see the P&L bleeding every day. For example this is the volatility for Bitcoin, SPX and XAU recently observed:  Skew confirm that picture: we see 1M historical volatility hovering around 30%, and feeling the gravity as BTC is lacking movement.  Also Implied have been dragging south, even if they look resilient to me:  Of course shorter expires are getting sold more aggressively, but intermediate expires look quite resilient to me. But can this narrative be confirmed by other exchanges? In fact, contrary to what happens looking at Bakkt, OI and Volumes look quite solid: |  |  | | Open Interest across various exchanges | Reported Volume at various exchanges |

I think market might bee too complacent with current regime, and could move on either direction. For sure currently markets are pricing a move into the downside less likely, as collars are again on the cheap side:  Please remember that in March, at the time of the market crash, collar were paid negatives, this means that the downside protection was a very neglected purchase. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 12, 2020, 03:21:42 PM

Last edit: May 16, 2023, 01:34:09 AM by fillippone |

|

Interesting times in the Options space after the PUMP. Price moved up sharply in the last weeks, and this had some impact in the Options World. First a recognition of Open Interest and Volume across the exchanges: |  |  | | Open Interest. Please Note Axis starts at 500 $ mios: the red part is way greater than appears. | Trading Volume. |

As soon as the underlying moved and broke to significative resistances, both open interest and volumes moved also up. Open interest has been consistently grinding up during the last months, this is a very important sign of maturation for BTC markets, where a more established derivatives market can help the underlying price discovery activity. Also means options market are efficient enough to help market participants taking positions. This is very bullish long term: more efficient and "complete" markets tend to reduce volatility, and erratic price movement, as in more developed markets there are more than one category of investors involved, with a variety of objectives and time-horizons. CME, the main "legacy" market, still has a decent percentage of Open Interest, sign of more traditional investors taking positions in these instruments. Volume had record values on July 27, also because there was an option expiry on that date, so a lot of players had to "roll" their exposures on the new front contract, closing expiring options to open new ones on the first contract (for this reason there isn't a corresponding spike on the open interest graph). Now, looking at the strikes, how the upmove affected the strike involved in trading? |  |  | | Open Interest distribution over the various strikes. | Put/Call Ratio. Note the time scale:longer to make visible the cycles. |

The stike mapping is quite well distributed, with not excessive imbalances that could cause quick movements when approached due to the hedging activity of market makers (this being highly dependent on their long or short position). Regarding Put/Call ratio we can differentiate a bit: the volume Put/Call ratio is stable at 0.86. This is an highly volatile numbers, but we do observe a constant mean. This implies that for trading options scalpers actually prefer using Calls to speculate instead of Puts. Of course this means also they close the day hedged without open positions and hence without registering the open interest. On the contrary, Put/call Ratio on the open Interest, takes into account the more "structural" positioning of players with longer time horizons. Here we see the Put/Call ratio spiking toward high levels of 0.7 This means the community is actively buying puts, like they did just after the March Market crash. So they are probably going trying to hedge themselves against a correction of the price, maybe investing some of their profits(no proofs on this). What it strikes me is the constant failure for the market to positively price the put side: the market is so skewed to the upside, the buyers cannot lift the put side skew to the premium usually associated with such a volatile asset: |  | | Skew fails to stay positively priced. |

Probably if price fails to break this levels, we could see more aggressive put buying, but I always wonder why these kind of movements are never anticipated by rational investors, who should price in a spot/vol relationship. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

September 20, 2020, 06:40:23 AM Merited by fillippone (2) |

|

Bitcoin price volatility expected as 47% of BTC options expire next Friday Bitcoin price volatility expected as 47% of BTC options expire next FridayThe open interest on Bitcoin (BTC) options is just 5% short of their all-time high, but nearly half of this amount will be terminated in the upcoming September expiry.

Although the current $1.9 billion worth of options signal that the market is healthy, it’s still unusual to see such heavy concentration on short-term options.

By itself, the current figures should not be deemed bullish nor bearish but a decently sized options open interest and liquidity is needed to allow larger players to participate in such markets. https://cointelegraph.com/news/bitcoin-price-volatility-expected-as-47-of-btc-options-expire-next-fridayLet's see how BTC works out the move throughout the week. |

1PCm7LqVkhj4xRpKNyyEeekwhc1mzK52cT

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 20, 2020, 05:52:16 PM Merited by fillippone (2) |

|

Bitcoin price volatility expected as 47% of BTC options expire next Friday Bitcoin price volatility expected as 47% of BTC options expire next FridayThe open interest on Bitcoin (BTC) options is just 5% short of their all-time high, but nearly half of this amount will be terminated in the upcoming September expiry.

Although the current $1.9 billion worth of options signal that the market is healthy, it’s still unusual to see such heavy concentration on short-term options.

By itself, the current figures should not be deemed bullish nor bearish but a decently sized options open interest and liquidity is needed to allow larger players to participate in such markets. https://cointelegraph.com/news/bitcoin-price-volatility-expected-as-47-of-btc-options-expire-next-fridayLet's see how BTC works out the move throughout the week. The little snip that you provided, VB1001, mentions that the options largely provide a means for BIGGER players to get into BTC, but from the underlying, neither a bullish nor bearish determination can be assessed. You, VB1001, seem also to be guarded in terms of trying to figure out if there might be a direction one way or another that might be incentivized by the end of the week expiration of the outstanding options. I suppose that there might be some BIGGER players that might want to attempt to play the BTC market and use options as one of their tools to attempt to play the market, but even the recent statement from Michael Slayor and his purchase of more than 38k BTC in the past several weeks, his assessment was that he was surprised that even his relatively large purchase of $425million in BTC in a relatively short period of time was able to be accomplished without a lot of BTC price slippage.... which surely is a sign that BTC prices are likely requiring more and more commitment of capital in order to even attempt to manipulate the prices whether we are referring to attempts to take advantage of options bets or some other tool that some BIGGER players might attempt to deploy to make money based on BTC volatility or possible abilities to cause BTC to be more volatile than some traditional (longer history) asset classes. I am not really attempting to proclaim any kind of knowledge either regarding how option expiration dates might play into possible BTC price movements, but surely it should not hurt to have knowledge of this kind of data for those nerds, like yours truly, who spend a decent amount of time each day looking at whether BTC prices have gone up or down - over various snapshot periods of time.  |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

September 20, 2020, 06:11:52 PM |

|

I suppose that there might be some BIGGER players that might want to attempt to play the BTC market and use options as one of their tools to attempt to play the market, but even the recent statement from Michael Slayor and his purchase of more than 38k BTC in the past several weeks, his assessment was that he was surprised that even his relatively large purchase of $425million in BTC in a relatively short period of time was able to be accomplished without a lot of BTC price slippage.... which surely is a sign that BTC prices are likely requiring more and more commitment of capital in order to even attempt to manipulate the prices I think the way Saylor made the purchase helped the market not to make any sudden movements in the price. To acquire 16,796 BTC (disclosed 9/14/20), we traded continuously 74 hours, executing 88,617 trades ~0.19 BTC each 3 seconds. ~$39,414 in BTC per minute, but at all times we were ready to purchase $30-50 million in a few seconds if we got lucky with a 1-2% downward spike. https://twitter.com/michael_saylor/status/1306940165160656897 |

1PCm7LqVkhj4xRpKNyyEeekwhc1mzK52cT

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 20, 2020, 07:21:38 PM |

|

I suppose that there might be some BIGGER players that might want to attempt to play the BTC market and use options as one of their tools to attempt to play the market, but even the recent statement from Michael Slayor and his purchase of more than 38k BTC in the past several weeks, his assessment was that he was surprised that even his relatively large purchase of $425million in BTC in a relatively short period of time was able to be accomplished without a lot of BTC price slippage.... which surely is a sign that BTC prices are likely requiring more and more commitment of capital in order to even attempt to manipulate the prices I think the way Saylor made the purchase helped the market not to make any sudden movements in the price. To acquire 16,796 BTC (disclosed 9/14/20), we traded continuously 74 hours, executing 88,617 trades ~0.19 BTC each 3 seconds. ~$39,414 in BTC per minute, but at all times we were ready to purchase $30-50 million in a few seconds if we got lucky with a 1-2% downward spike. https://twitter.com/michael_saylor/status/1306940165160656897Of course, anyone who intended to buy on various exchanges (rather than OTC), as far as we know, would want to buy in such a way to attempt to both minimize upward price slippage and also to take advantage of any BTC price dips that might be inclined to take place during their BTC buying period. Some might also argue that any large entity adding that quantity of BTC to their investment portfolio would be serving as a kind of BTC price support - which sort of implies that the BTC price may have fallen a bit more, absent such additional buying support. Surely, the price support theory is considerably speculative since we have difficulties, in the real world, to really compare the difference between what would have happened to the BTC price absent the more than 38k BTC accumulation that Microstrategy employed. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

September 20, 2020, 09:15:27 PM

Last edit: May 16, 2023, 01:22:37 AM by fillippone |

|

Bitcoin price volatility expected as 47% of BTC options expire next Friday Bitcoin price volatility expected as 47% of BTC options expire next FridayThe open interest on Bitcoin (BTC) options is just 5% short of their all-time high, but nearly half of this amount will be terminated in the upcoming September expiry.

Although the current $1.9 billion worth of options signal that the market is healthy, it’s still unusual to see such heavy concentration on short-term options.

By itself, the current figures should not be deemed bullish nor bearish but a decently sized options open interest and liquidity is needed to allow larger players to participate in such markets. https://cointelegraph.com/news/bitcoin-price-volatility-expected-as-47-of-btc-options-expire-next-fridayLet's see how BTC works out the move throughout the week. The little snip that you provided, VB1001, mentions that the options largely provide a means for BIGGER players to get into BTC, but from the underlying, neither a bullish nor bearish determination can be assessed. <...> Reading the supposed market direction from Metrics like Open interest, or strike distribution or some other “static” data from options market has always been an art well beyond my understanding of such market. There is such a variety of players, trading styles or trade rationale that could produce exactly the same outcome on such metrics, that I always giggle when someone try to sell you a “recipe” to navigate trough option expiry. As @VB1001 and @JayJuanGee pointed out, skepticism is a must in these cases, as junping to conclusion coul put on the wrong side of the market on expiration day. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

In the past days, Greg Maxwell has been interviewed on the forum. You can read the full interview here , it is really an interesting interview, perhaps the most interesting read so far, I strongly recommend reading the whole of it. As far as this thread is concerned, there is a special passage that is relevant: I trade options on Bitcoin at LedgerX with a portion of my stash. Most of my trading could be characterised as selling moon insurance (deep out of the money calls) and crash insurance (deep out of the money puts). For the most part, the activity hedges my substantial Bitcoin exposure-- and it more than covers all of my living expenses which gives me peace of mind. I've averaged a ~20%/yr return on investment (not including Bitcoin's gain in value, of course) since I opened the account in December 2017.

I think more people trading Bitcoin should be interested in options: They can be used to better reflect the kinds of opinions people have about Bitcoin's price and can be shaped to better match people's risk tolerance. For people who want more risk options (esp physically delivered ones like LedgerX) can be a lot safer than the leveraged Bitcoin products traded elsewhere. They can also be more tax efficient.

In the following post I will try to analyse Greg's strategy from a technical point of view. For the moment I will abstain from the "tax efficient part" as it has a lot to do about very specific details of Greg's position I don' know and I can't guess about. Maxwell's strategy is called "short strangle": that is the sale ("go short" means to sell something) of a "strangle" that is an option strategy composed of a put option and a a call option with the same maturity on the same underlying. Example: Short a 20% delta Six months Strangle I tried to create this strategy using Deribit Options, as he referenced them on the thread. He never mentioned 20% delta or six months time horizon, these are just working hypothesis. So, trying to find out the options as close as possibile to the desired delta level I found those two: Sell 1 44,000 CALL Strike K=44,000 expiry 25 Jun 2021 for 0.0594 BTC Sell 1 14,000 PUT Strike K=14,000 expiry 25 Jun 2021 for 0.0681 BTC This means cashing in 0.1276 between 14,000 and 44,000 being exposed to unlimited losses on the extreme movements. Bear in mind that currently the BTC Jun futures trades at 20,290 The position details are the following: |  | | Pic.1 Details of the two options in Greg Portfolio with details of the position's greeks. |

Looking at the summary we see, from left to right the description of the options, then the "short" label means we sold both of them, in 1 unit each. Bear in mind that usually strangle strategy implies selling the call and the put in the same amount. Selling more than one options would have changed the absolute size of the final payoff, but it wouldn't have changed the level of "discontinuities" in the payoff (the strikes) and of the breakeven points (that are functions of the cashed in premiums) . This is very important. Going further to the right we see the IV column, this represents the "Implied Volatility" of the options, or the level we have to put in the model to obtain the current market price. This is the breakeven volatility: if the realised volatility, at the end of the trade, will be lower than that, then the trade will be in the profit, while if the realised volatility will be higher, the trade will end up in a loss [1]. Next column we have the delta of the options. I choose those two options to have a delta as more close to 20% as possible (being on a listed market, the choice for strikes is limited). The put has a negative delta, i.e. the price of the put increases when BTC price falls, while the call has a positive delta, i.e. the price of the call increases when the price of BTC goes up. If we sum up the two deltas we see the result is a tiny negative number: this means that our strategy is, for the moment, quite neutral about the direction of the price. Another way of looking at this is the green line in the Table 2. That is the value of the strategy today: we see that close to the current market level the P&L is quite flat around zero (the positive premium cashed in is equal to the negative value of the options we sold). The last three columns are other greeks of the strategy: - Gamma: the rate of change of delta in case of underlying movements. Note that both of them are negative because we sold both options)

- Theta : the sensitivity of the price of the options to the time. We sold both options, so Theta is positive: every day we cat closer to the option expiry, so it is more difficult to the underlying to move in any directions. This means the "time value" of the options decreases and the residual value of the option is the intrinsic value.

- Vega: the sensitivity of the price of the options to change in implied volatility. Again both of them are negative because we sold both options. If implied volatility rises then both options premium rises trough an increase in the "time value" part of the option. Thus the value of the sold options increases, but the cashed premium stays the same, putting the strategy P&L at risk.

|  | | Pic.2 The payoff of the strategy at the end of the trade (red Line) and the P&L at inception (green line). During the life of the trade the green line morphs into the red line trough the collapse in the time value of the strategy. |

If we look at the graph of the options we see that at the expiry Greg collects the full 0.1276 premium if BTC is between the two strikes. If BTC moves away from the strike on the outside, the strategy stats losing money, initially the P&L erodes the collected premium (the final P&L is still positive), but as BTC moves away from the strike, the payoff gradually worsens, at the breakeven points gets zero, then it becomes more and more negative. On the left the loss is limited to the fact that BTC price is floored at Zero, but on the upside the maximum loss is technically infinite, as BTC can go to the moon. The astute reader could argue: if we sold one option per side, why is the strategy not symmetrical, and the slopes of the p&L are so different on the two sides? Well the point is that the payoff of the options is in BTC, but the graph is in dollars. So if we had the possibility to look at that graph in Bitcoin (both the x-axis and the P&L axis) the two side of the plot would be symmetrical, but as we are looking at the dollar value of that BTC we see that graph tilted to take into account the different BTCUSD exchange rate. Trying not to get too technical, in practice Greg sells options that are far from being "activated" and collects the prize. On average, nothing happens, and so he collects this sum and nothing happens. On average Greg's strategy produce a small gain, but it occasionally will produce big losses. Greg is exposed, consciously, I guess, to big swing in the underlying movement. If the price rises a lot, his calls end up in the money, so exercise, and Greg is forced to sell bitcoin at a price lower than that of the market at that moment. Alternatively, if the price drops a lot, his puts end up in-the-money, so get exercised, and Greg is forced to buy bitcoin at a price higher than that of the market at that moment. Obviously, in a strangle, only one of the two options will necessarily be exercised, while the other will necessarily be abandoned. Greg knows N. Taleb as he read "Fooled by randomness" by N.Taleb (I spotted that book on his bookshelf, can you find it? Solution: last right bookcase, third shelf from the bottom, fourth book from the right), so he knows he's betting against the "black swans". I guess he took this approach consciously, as probably he's not covering all his coins stash with options, and he needs some regular cash flows to pay his expenses. If he gets exercised on the upside, he's actually losing money in the single trade, but he's probably also making huge money on the whole of his position.

Personally I do not like this strategy, because a certain maximum result (the sum and the premiums collected) is contrasted by an unlimited maximum loss in case the price goes to the moon or crashes to zero. Obviously while we see he could stand quite well a loss when price moons, I guess the same is not true on the downside. When price get to zero, he's suffering not only for the reduction on the value of his main stash, but also he's losing money the derivatives side of the trade, where Greg inflicts himself an additional punishment of going to buy Bitcoin at a higher price than the market). What I would do, being a risk adverse, is buying the put, instead of selling if, maybe a little bit further OTM, just to reduce the premium. Of course the gain in "normal times" would be reduced, but at least I would have a downside protection during adverse times. It would be a poor hedge, as we said this trade don't cover all the stash, but at least I wouldn't be adding pain to the bleeding. Or more simply I would only sell the call. Just a couple of final remarks: - Deribit options are European Options. This means they can be exercised only at the maturity of the options. This doesn't mean they need to be held until maturity. Usually exercising an option before the maturity (in case of American style exercise) is sub optimal, as you give up the whole time value, a the exercise locks in only the intrinsic value. So a better way is just selling the options in the markets, which allows you to cash-in also the time value.

- We looked at those strategies and we analysed trough an "expiry trade". This means that we didn't take into consideration any corrective actions by Greg during the life of the trade. Setting up this strategy, forgetting about it for six months, and then hitting F9 at expiry to see the outcome is not the best way to do so. There are an infinite combination of possibilities between "continuous" hedging (the one put in place by market makers") and "static hedging" ("buy and hold"). Greg potentially can take a variety of action in case some "adverse" scenario is going to materialise: he could hedge the direction of the market using the underlying BTC futures, he can roll up the strike of the strangle, buying back the options and selling a further out of the money strike, or he could even roll to a calendar spread buying his options and selling a same strike with longer maturity one, or any combination of those.

- The hedging possibilities are endless, there is not a "better" or "worse" strategy, as it really depends on personal risk appetite, time horizon, global portfolio analysis, tax/legal/accounting constraints etc. This post was made out for pure intellectual curiosity and as an academic exercise, of course it is not any kind of investment recommendation.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

December 08, 2020, 02:34:43 PM |

|

I wish I could understand this better but I am a total fool within this field and I would not even know where to start! I will try to re-read gmaxwell's interview and re-read again your post because I feel so stupid that I can't get anywhere around it. Thank you very much for this detailed post, you must have dedicated quite some time to it.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15459

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 08, 2020, 02:45:42 PM |

|

I wish I could understand this better but I am a total fool within this field and I would not even know where to start! I will try to re-read gmaxwell's interview and re-read again your post because I feel so stupid that I can't get anywhere around it. Thank you very much for this detailed post, you must have dedicated quite some time to it.

It is not about being stupid or intelligent. It’s about studying certain topics. I dedicated many years of my life to these topics, and now I think I can manage those instruments quite well. It took many years, so don’t think you are stupid because you don’t understand this at the first read. Actually, a stupid person would think they have learned “all they wanted to know about option” from this thread! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

gmaxwell

Staff

Legendary

Offline Offline

Activity: 4158

Merit: 8382

|

|

December 08, 2020, 10:39:42 PM

Last edit: December 08, 2020, 11:17:40 PM by gmaxwell Merited by fillippone (10), Hueristic (1), aesma (1) |

|

I think your post might make a better case against using deribit.  I use LedgerX -- I don't use deribit because it's not physically delivered, doesn't allow US customers, etc. If he gets exercised on the upside, he's actually losing money in the single trade, but he's probably also making huge money on the whole of his position. This highlights why its not very useful to consider a position without its hedges or what its hedging. E.g. the isolated analysis has you characterize the loss as unlimited-- but for covered positions (which are the only kind of short you can get into on LedgerX) the worst case loss is the value of the collateral minus the premiums you received, which is a very different story. If you were going to hold the collateral for the duration regardless then no loss is possible. The positions I take are a bit wider than you assume-- $7.5k, 5k, or 2k strikes on the put side (which I try to get a premium comparable to a 15-20%/yr on the collateral, depending on the strike/date), and I'm getting more on the call side than you expected: E.g. recent trades have me receiving $2,699/BTC for JUN2021 50k, $6,985/BTC for DEC2021 35k, and $4920/BTC for DEC2021 50K, to give some examples. So lets look at the value at expiration of a position consisting of {2 BTC, -1BTC 35k DEC2021 call, -1BTC 5k DEC2021 put} using some recent trade prices, and compare that to just hodl the same 2 BTC:  In exchange for diminished returns over a BTC price of $42,866, the position gets increased value at all lower prices. Another way to look at is is in terms of ratios of dollar values:  So under a hypothetical crash to $2,866 the position is twice as valuable in dollar terms compared to hodl. If Bitcoin crashed to nothing the position would be worth $2867. Back when I acquired most of my Bitcoin $1,433/BTC would have been considered a fantasy moon price, its a price below the ATH up until May 2017. At the ATH price of (say) $21,000/BTC, the position is 18% better off than hodl and even at $36,953/BTC the position is a respectable 8% ahead of hodl. True, at a super-moon price of $500k/BTC the position is only worth 54% of HODL, but it's still worth 14.28 times its current value at that price. Of course, in the crash situation I'd be better off selling now but we don't know the future. I think crashes and supermoons are certainly possible, but I also don't consider either to be extremely likely in the next year. It's also worth considering in BTC terms:  These trades help avoid regret: If the BTC price crashes the seller (me) at least locked in some income (or, alternatively, gets a lot more BTC), while if the price stays flat-ish this position gets a ~20%/yr return and the seller doesn't need to regret not selling BTC and investing the funds elsewhere. In the moon case the trade limits the returns but there are only so many lambos a person can need (in my case I need exactly zero lambos, but you get the point). I'm pretty bullish on the future Bitcoin price, but I'm also not in dire need of astronomical amounts of wealth. I find it generally more valuable to me to mitigate risk. Even under the most aggressive model of mid term future prices that I find vaguely justifiable-- assuming the future price is a random walk with the same distribution as the returns since 2013 that 35k call is <50% likely to get assigned. Under a more conservative model -- using the derivative of delta at the options premium to get the assignment odds under black-scholes - , the 35k call 1yr call is about 12.5% likely to get assigned. Assuming the price is flat, this trade just yields a extremely respectable 20%/yr from selling volatility (I say extremely because half the btc isn't even 'at risk' when reasoning from the perspective of a hyperbitconized world).

There are a lot of people who seek to profit off volatility in other ways, e.g. day trading the bitcoin spot market. But the fees and taxes from doing that can be considerable and the risk is substantial. Of course there is also custodial risk, though this position only needs to expose half its Bitcoin to third party custody. I've also ignored the tax implications. But I think whatever your tolerance for risk and/or ideas about the future values of Bitcoin say, there is usually a way to use options to get an outcome that better meets your needs. - And yes, Talib would point out that black-scholes assumption of normal returns doesn't have fat tails-- while market history including Bitcoin history does (Bitcoin historical returns are heavily skewed and have mac-truck sized tails).

so he knows he's betting against the "black swans". The way I see it, owning Bitcoin on an ongoing basis is a massive bet for and against a collection of black swans: Owning Bitcoin is a bet for BTC becoming a world currency, fiat hyperinflation, widespread distrust in institutions/monetary policy, and massive globalization of economies (with concordant lack of functional legal process across borders, making irreversible and machine arbitrated transactions more valuable). Owning Bitcoin is also a bet against technical/economic fault destroying Bitcoin's viability, effective adverse regulation denying people access to Bitcoin, Bitcoin businesses being so corrupt or incompetent that they scare everyone away, the collapse of technological society, or Bitcoin not being the solution to the prior list of pro-bitcoin black swans that people adopt. I believe that the current price substantially reflects a balance between these considerations. In general I share the view that these black swans-- both the positive and negative ones-- are credible but at the same time I also believe many people over-estimate their likelihood especially in the short to mid term. So by owning Bitcoin (as well as non-cryptocurrency assets) and selling the BTC/USD return tails I seek to turn the the difference between my beliefs and more extreme beliefs into profit, along with locking in some of those black swan gains now when they can do me some good rather than in some hypothetical future that I might not even live to see. Simultaneously, I believe the marginal value of additional wealth isn't constant-- and so I think there is the potential for mutually beneficial trade even with someone who shares a similar perspective on the distribution of future prices but just has a different risk preference than I do. Aside, I did some image processing magic and managed to make a 'flatter' projection of my bookshelves. |

|

|

|

|

|

GeorgeJohn

|

|

December 09, 2020, 01:28:04 AM |

|

These particular post really boost the level of my IQ, everything discussing here just look's like film, I don't really know that someone can spend time in preparing such ambiguous and interesting topic that attract attention, how I wish I can be like op via research and construction of topic i won't complain again, infant in recapitulation I so much love these topic because i noticed that is very educating even when you lost attention towards it.

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4894

Doomed to see the future and unable to prevent it

|

|

December 09, 2020, 02:12:40 AM Merited by fillippone (2) |

|

...I don't use deribit because it's not physically delivered,...

People disregard this as if it means nothing when in fact it means everything! |

“Bad men need nothing more to compass their ends, than that good men should look on and do nothing.”

|

|

|

gmaxwell

Staff

Legendary

Offline Offline

Activity: 4158

Merit: 8382

|

|

December 09, 2020, 10:08:15 PM |

|

...I don't use deribit because it's not physically delivered,...

People disregard this as if it means nothing when in fact it means everything! I agree, this deserves more elaboration. Options exist in "physically delivered" and "cash settled" form. Physically delivered works basically like what you would imagine an option to work: To write a call on a Bitcoin someone posts a Bitcoin and writes a contract. At maturity, whomever owns the contract can opt to pay the strike and get the Bitcoin. (Same thing for selling calls, but they'd post dollars and if it gets assigned the contract holder pays the bitcoin and gets the dollars). With cash settlement, the covered Bitcoin may not actually exist, and at expiration if the option is in the money the seller will pay the buyer the difference between the strike and the price. Physically delivered avoids a lot of complexity and risk. Cash settled is essentially a side bet on the price of Bitcoin. With cash settlement you need a "the price", which means you need an index. As a seller of a cash settled option you can potentially get screwed if the index prices aren't reliable-- e.g. someone could buy an OTM option right before expiration, then at moderate cost manipulate the index and force you to pay them a bunch. As a buyer of cash settled options the assets to make good on them may simply not exist in the event of a black swan that turns your position extremely valuable-- potentially resulting in a cascading failure of the exchange. To protect against that risk any exchange engaging in cash settlement will need to have extensive exposure management-- this will automatically force traders to post additional balance if their positions get out of wack. They'll also need to auto-liquidate positions-- potentially profitable ones too. Kind of ironic that when your predictions are right and are moving in your favor you might be liquidated to protect the platform exposure. Platform risk management to users is inherently fairly opaque, traders should be accounting for it in their prices but it's not clear how they can do so rationally without a great deal more information. Any kind of auto-liquidation also disrupts the potential value proposition of options, since part of that value is that you can make a trade once then ride out volatility along the way to the expiration date. So why would anyone ever want to touch cash settled? There are a couple reasons: One is that the settlement process of a physically delivered asset can be inefficient. Say you are super bullish bitcoin-- you bought a bunch of calls, and they're about to expire ITM. Great, but now you need to get a bunch of USD to fund their execution, but you don't have any because you're super bullish on Bitcoin! You can, instead, trade out of the position but the market may not be liquid enough to do this at a good price. In mature markets this is mostly a solved problem: For a modest fee retail brokers will loan you the cash you need for whatever milliseconds it takes to receive the shares and sell them on the spot market. But this is not solved for the Bitcoin options market yet. Another is that regulatory complications make it harder for exchanges to handle USD at all. In a cash-settled options market you can use BTC as your cash, so you can make a platform that is 100% all Bitcoin, no USD (It can even be 100% all bitcoin even when it has options on altcoin/btc). This is also a convenience for customers that don't want USD exposure. Another reason is that since cash settled platforms are inherently having people trade on margin there is no fundamental problem with customers keeping custody of the coins covering their positions in their own wallets. But the flip side of this is that the platform can't guarantee delivery. Cryptocurrency markets and options based on them are already volatile enough that I'm dubious of the belief that market efficiency requires a lot of leverage on these positions. Unfortunately, by their very nature these side bet markets easily generate a lot more volume than physically delivered markets, so to some extent they also may be denying air to the more robust alternatives. Personally, I think cash settled is fraught with long tail systemic risk -- I suppose it has a place in mature and highly liquid markets, but cryptocurrency markets aren't that. I think the risks while clearly large are also not particularly simple or easy to understand-- in theory there is some price where I should be willing to trade at a cash settled market, but I don't believe I could calculate that price. |

|

|

|

|

|