Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

January 20, 2022, 12:26:01 PM |

|

Michael Saylor, in a conversation with Bloomberg, once again confirmed that he is not going to change his strategy for buying and holding bitcoin, and the price reduction by 40% of his ATH is not a cause for concern for him, but rather a consolation, given the current increase in inflation. What, in my opinion, is a great motivation for those who are constantly worried about the current decline in the value of bitcoin, especially on the example of a company whose investments in bitcoin have already exceeded the capitalization of MicroStrategy itself. |

|

|

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, which will follow the rules of the network no matter what miners do. Even if every miner decided to create 1000 bitcoins per block, full nodes would stick to the rules and reject those blocks.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 20, 2022, 04:47:12 PM |

|

Michael Saylor, in a conversation with Bloomberg, once again confirmed that he is not going to change his strategy for buying and holding bitcoin, and the price reduction by 40% of his ATH is not a cause for concern for him, but rather a consolation, given the current increase in inflation. What, in my opinion, is a great motivation for those who are constantly worried about the current decline in the value of bitcoin, especially on the example of a company whose investments in bitcoin have already exceeded the capitalization of MicroStrategy itself. Behind paywall |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

Michael Saylor, in a conversation with Bloomberg, once again confirmed that he is not going to change his strategy for buying and holding bitcoin, and the price reduction by 40% of his ATH is not a cause for concern for him, but rather a consolation, given the current increase in inflation. What, in my opinion, is a great motivation for those who are constantly worried about the current decline in the value of bitcoin, especially on the example of a company whose investments in bitcoin have already exceeded the capitalization of MicroStrategy itself. Behind paywall |

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 21, 2022, 03:08:09 PM |

|

Also, looks very very unlikely that Microstrategy holds all of their fund on a single signature address.

I first of all, a brief update on those two addresses. As of today, the two addresses hold more than 126,561 BTC, with an increase of 3,821 since last Dec 29. In second place actually being a single signature doesn’t mean too much. Many custodian don’t use multi signature for their customer's wallet. They rather use proprietary algorithms, to “split” the secret key, that is ultimately reconstructed on the fly at the time of the required signature and use to sign the transaction. So the onchain result is only a single signature transaction. This could explain how a multibillion account holds the stash on am single signature account. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6800

Cashback 15%

|

|

January 22, 2022, 09:32:08 AM |

|

Since I've been closely watching bitcoin's nosedive (with clenched teeth, even though I don't own enough to be sweating right now), MSTR has been on my mind. I've no doubt Michael Saylor will continue to justify his purchases and pump bitcoin, MSTR shareholders might be questioning whether it's worth holding their stock--I kind of have the feeling that at least some of them aren't familiar with how severe bitcoin's price swings can be or how much they can now affect MSTR's stock. Here's my periodic chart dump, this one a 10-day chart:  It's Saturday in the US, so the stock market is closed for the weekend. Since 4pm yesterday when the market closed, bitcoin has dropped over $2000 in value, and it was falling all throughout the trading day as well. If bitcoin doesn't show some sort of recovery by Monday morning, my guess is that there's probably going to be a flood of sell orders for MSTR stock. Yikes. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 22, 2022, 11:51:38 AM |

|

There's a reason why Microstrategy is falling like a rock: the GAAP accounting of their BTC stsh is going to hurt them on next earning report: MicroStrategy Plummets as SEC Rejects Its Bitcoin Accounting (3)MicroStrategy Inc. can’t strip out Bitcoin’s wild swings from the unofficial accounting measures it touts to investors, the SEC said.

Bad news for the MicroStrategy was compounded as the company’s shares fell as much as 20% Friday, the biggest intraday collapse since Feb. 23. Its stock closed at $375.89, down nearly 18%. Bitcoin also tumbled, and was down more than 7% around 4:15 p.m. in New York.

Why this underperformance? U.S. generally accepted accounting principles, or GAAP, offer no rules for reporting the value of digital assets. Nonbinding guidance from the American Institute of CPAs says companies should classify the currency as an intangible asset, as outlined in ASC 350. This means businesses that don’t qualify as investment firms would record cryptocurrency at historical cost and then only adjust it if the value declines. Once their holdings get written down, or impaired, companies can’t revise the value back up if the price recovers.

So basically as the BTC must be accounted according to the formula: GAAP PRICE=min(purchase price;observed price after purchase) The only possible adjustment is downward, but the price shoots, there is no way to impact positively the valuation until there is a sell. And as Micheal Saylor told us they are never going to sell his bitcoin, the benefit will be.. never registered on the balance sheets. Next thing to do: compute the GAAP adjustment for the next quarter. Accounting test for me. Given the low 34,000 USD print it is going to be big. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 22, 2022, 08:58:37 PM |

|

There's a reason why Microstrategy is falling like a rock: the GAAP accounting of their BTC stsh is going to hurt them on next earning report: MicroStrategy Plummets as SEC Rejects Its Bitcoin Accounting (3)MicroStrategy Inc. can’t strip out Bitcoin’s wild swings from the unofficial accounting measures it touts to investors, the SEC said.

Bad news for the MicroStrategy was compounded as the company’s shares fell as much as 20% Friday, the biggest intraday collapse since Feb. 23. Its stock closed at $375.89, down nearly 18%. Bitcoin also tumbled, and was down more than 7% around 4:15 p.m. in New York.

Why this underperformance? U.S. generally accepted accounting principles, or GAAP, offer no rules for reporting the value of digital assets. Nonbinding guidance from the American Institute of CPAs says companies should classify the currency as an intangible asset, as outlined in ASC 350. This means businesses that don’t qualify as investment firms would record cryptocurrency at historical cost and then only adjust it if the value declines. Once their holdings get written down, or impaired, companies can’t revise the value back up if the price recovers.

So basically as the BTC must be accounted according to the formula: GAAP PRICE=min(purchase price;observed price after purchase) The only possible adjustment is downward, but the price shoots, there is no way to impact positively the valuation until there is a sell. And as Micheal Saylor told us they are never going to sell his bitcoin, the benefit will be.. never registered on the balance sheets. Next thing to do: compute the GAAP adjustment for the next quarter. Accounting test for me. Given the low 34,000 USD print it is going to be big. Does MSTR have to pick the lowest BTC price for the quarter for the GAAP accounting? or do they pick the BTC price on a certain day of the quarter, such as the last day or some day that is within a parameter such as so long as it is a day in the last week of the quarter? |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

royalfestus

|

|

January 22, 2022, 09:05:32 PM |

|

Michael Saylor, in a conversation with Bloomberg, once again confirmed that he is not going to change his strategy for buying and holding bitcoin, and the price reduction by 40% of his ATH is not a cause for concern for him, but rather a consolation, given the current increase in inflation.

What, in my opinion, is a great motivation for those who are constantly worried about the current decline in the value of bitcoin, especially on the example of a company whose investments in bitcoin have already exceeded the capitalization of MicroStrategy itself.

Who has any information on the wallet? It was in the news that 2 of the institutional owners of bitcoin were active in the market in the last 24 hrs. There are no further detail on the institution though. I also want to remind that the sale of Elon bitcoin was meant to be secret of the year review before it goes public. Institutions are not reliable in this market and that why we might still, need larger numbers of retail investors. |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 22, 2022, 10:03:44 PM Merited by JayJuanGee (1) |

|

Does MSTR have to pick the lowest BTC price for the quarter for the GAAP accounting? or do they pick the BTC price on a certain day of the quarter, such as the last day or some day that is within a parameter such as so long as it is a day in the last week of the quarter?

They simply have to value their stash at the lowest price observed during their holding period. Each day count. I guess it’s not lowest intraday price, but observing closing prices only. I wanted to double mech this, so I am looking at the historic OHLC serie on Coinbase, but for the moment I can’t find this information. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 23, 2022, 05:10:07 AM |

|

Does MSTR have to pick the lowest BTC price for the quarter for the GAAP accounting? or do they pick the BTC price on a certain day of the quarter, such as the last day or some day that is within a parameter such as so long as it is a day in the last week of the quarter?

They simply have to value their stash at the lowest price observed during their holding period. Each day count. I guess it’s not lowest intraday price, but observing closing prices only. I wanted to double mech this, so I am looking at the historic OHLC serie on Coinbase, but for the moment I can’t find this information. There probably could be ways to work this kind of weird accounting to your advantage.. .. and probably smart investors are going to recognize that certain companies are undervalued merely because of both the carrying of certain kinds of assets on their balance sheets (bitcoin in this case) and the appreciation that some normies are not going to appreciate such a unlisted value I will note that for a few days I have been maxed out on my 50 per month with you.. so I have a few of your posts building up until I get back below the 50 max... Yikes.

I almost feel like responding to your ongoing panic regarding the seeming gambling tendencies of MSTR and your ongoing desires to want to say "I told you so," and surely the fact of the matter is this is a long BTC play in which guys like you are going to look foolish with the passage of time, including only a few years down the road (if not sooner) for not recognizing and appreciating the likely low risk payoff for such a play of aggressively allocating into BTC.. You have been registered on the forum for almost as long as me, and actually came to BTC at a much better time than me in terms of being able to get in at the bottom of a trend for pretty much the whole of 2015 (except for parts in the end of 2015), and you even admitted that you do not hold very many BTC... so seems that you are having some of the same troubles in your own personal lack of BTC holdings... and likely sucks to be you that you have missed out on quite a few pretty BIG BTC upwards price moves in which you are likely not going to be able to buy BTC at such various low prices in terms of your continuing to be wrong and your likely ongoing continuing to be wrong in terms of considering that our current BTC dip that is merely about 50% from the November 9 top as if we are in a loss period.. and you are failing/refusing to recognize outloud and appreciate the facts of the matter for where we really are up 3.5x-ish from September 2020.. and also.. if we go back a wee bit further, it is pretty easily formulated that we are good 35x up... so looking at bitcoin as if it were down fails/refuses to appreciate where we are at.. how we got here and where we are likely going in the coming 4-10 years (if not sooner). And through your ongoing comments about MSTR and seeming failure/refusal to appreciate the play(s) that it is making, you are likely ongoingly going to be failing/refusing to appropriately allocate yourself a bit more aggressively into BTC.. so let's see how your lack of aggressiveness in your mentality (and your likely lack of financial follow through) pays off for you.. and by the way, bitcoin is such an asymmetric bet, it does not take a whole hell of a lot of aggressiveness to pay of quite handsomely.,. BTC history has shown that, and our likely future - especially 4-10 years into the future (if not sooner) is going to continue to show that. Too bad when someone involved in the forum so long (maybe distracted by meta nonsense rather than being here for actual bitcoin information) cannot seem to understand the value of ongoing aggressiveness (or would it be assertiveness?) in terms of bitcoin investing. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6800

Cashback 15%

|

|

January 23, 2022, 07:26:01 AM |

|

The only possible adjustment is downward, but the price shoots, there is no way to impact positively the valuation until there is a sell.

And as Micheal Saylor told us they are never going to sell his bitcoin, the benefit will be.. never registered on the balance sheets.

I don't understand what you said in the above statement, and one reason for my confusion is that what Michael Saylor says about what he's going to do with anything MSTR owns (bitcoin included) has nothing to do with accounting principles. The only thing that matters is whether any bitcoin is sold and profits/losses are realized, i.e., what MSTR does and not what it or Saylor says. And if mark-to-market accounting has to be used, it doesn't even matter if bitcoin is sold or not. It'll be treated as an appreciating or depreciating asset based on what the market dictates. normies

Can you define that term in the context of this discussion? I'm really curious. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 23, 2022, 08:50:03 AM |

|

The only possible adjustment is downward, but the price shoots, there is no way to impact positively the valuation until there is a sell.

And as Micheal Saylor told us they are never going to sell his bitcoin, the benefit will be.. never registered on the balance sheets.

I don't understand what you said in the above statement, and one reason for my confusion is that what Michael Saylor says about what he's going to do with anything MSTR owns (bitcoin included) has nothing to do with accounting principles. The only thing that matters is whether any bitcoin is sold and profits/losses are realized, i.e., what MSTR does and not what it or Saylor says. And if mark-to-market accounting has to be used, it doesn't even matter if bitcoin is sold or not. It'll be treated as an appreciating or depreciating asset based on what the market dictates. normies

Can you define that term in the context of this discussion? I'm really curious. As far as I could see, I had only used the term "normie" in the context of my comment on the accounting, so in that regard, I am suggesting that more sophisticated persons are going to likely recognize that an asset such as BTC is marked way down.. and then perpetually stuck in such marked down status, but regular people are not likely going to understand that.. I was referring to normies as regular people who are less sophisticated, and I supposed if you are reading a 10k or any kind of prospectus, you might already be outside of the category of "normie," perhaps? I though that you would be more concerned about my comment that was more directed at you, and I see that I started out the post without really having much of an intent to say very much, but then I could not really stop myself once I got going..;. so I will admit that I said quite a bit more than I had originally intended to say.. ... and gosh I suppose in these kinds of considerable correction times, there can be a lot of concern about when the correction is going to stop... not saying that I have any kind of answer to that.. even though for sure, many of us deal with the situation differently in terms of buying, holding or selling. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6800

Cashback 15%

|

|

January 24, 2022, 04:27:00 PM |

|

I almost feel like responding to your ongoing panic regarding the seeming gambling tendencies of MSTR and your ongoing desires to want to say "I told you so," and surely the fact of the matter is this is a long BTC play in which guys like you are going to look foolish with the passage of time, including only a few years down the road (if not sooner) for not recognizing and appreciating the likely low risk payoff for such a play of aggressively allocating into BTC..

I think you're misinterpreting what I've written in this thread, because I don't mean to tell anyone here "I told you so", nor am I panicking about anything. I love bitcoin and everything it stands for, and I hate to see it get slaughtered like it has in the past few weeks. Long game or not, we're talking about a corporation in this thread, and the brutal fact is that while Michael Saylor may not plan to ever sell the bitcoin he's bought for MSTR, the company's stock is taking a beating because of those purchases. MSTR shareholders might not share his zeal for bitcoin and may not have the patience to wait for either bitcoin or MSTR's stock price to recover--and if enough of them end up selling, it could tank even worse than bitcoin (assuming btc keeps sliding downward) because of market forces alone. I share passions for the stock market and bitcoin, which is why I've posted so many times in this thread--not because I'm rooting for MSTR's demise or because I don't like Michael Saylor or anything he's said or done. I've been keeping an eye on a few other bitcoin-related stocks as well, such as MARA, RIOT, and Coinbase. They just don't happen to be relevant to this thread. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 24, 2022, 10:10:27 PM

Last edit: January 24, 2022, 10:22:44 PM by JayJuanGee |

|

I almost feel like responding to your ongoing panic regarding the seeming gambling tendencies of MSTR and your ongoing desires to want to say "I told you so," and surely the fact of the matter is this is a long BTC play in which guys like you are going to look foolish with the passage of time, including only a few years down the road (if not sooner) for not recognizing and appreciating the likely low risk payoff for such a play of aggressively allocating into BTC..

I think you're misinterpreting what I've written in this thread, because I don't mean to tell anyone here "I told you so", nor am I panicking about anything. I love bitcoin and everything it stands for, and I hate to see it get slaughtered like it has in the past few weeks. For sure, I am not attempting to make any of my comments personally directed against you, even though I concede that I have been ongoingly noticing and asserting that your mindset in regards to bitcoin seems to show that you are missing some ways of thinking about the whole bitcoin matter - that's increasingly my assessment based on some of the ways that you post about how you think about bitcoin - and it is likely reflected in your personal investments into bitcoin to.. You have said that you do not own very much bitcoin, even though you have been registered on this forum nearly as long as me (sure a one-year difference in registration time, but that one year is not very much time, especially if we were to look at and appreciate at where the BTC prices were when you registered onto this forum as compared to where they were when I registered on the forum). So yeah, our ways of thinking about matters and our ways of framing our discussion points are likely somehow connected with our own historical experiences, perceptions and approaches to our investments into bitcoin, too. i am not blaming you for your perspective but attempting to incorporate what I seem to see about your perspective (and it is not ONLY what you say, but what you say that you have done, too) into my speculations regarding why you might sometimes be making some of your assertions about bitcoin in the ways that you are making them. For example, take your last phraseology in the above sentence that I have bolded. You seem to believe that currently/recently bitcoin is "getting slaughtered," and that is quite far removed from how I am thinking about what is going on in bitcoinlandia, currently. Sure we have been having some pretty severe BTC price corrections in recent times, and even we are witnessing quite a bit of panic from certain HODLers in the space - but I would hardly characterize what has been happening in recent times anything close to "getting slaughtered" - even though you are sharing the same language that is used by other folks in a lot of places, whether we are talking about mainstream media (superficial assessements), and especially folks who don't seem to understand bitcoin very well or to be able to appreciate a larger vision where bitcoin is, from where bitcoin came and where it might be going - even looking at 4-year cycles or just zooming back at history - where were we at in September 2020.. for example..? Of course, you could look at various other jumping off BTC price points too... and frequently, the ones who are getting quite screwed up in their framing of where bitcoin is are seemingly overly focused on short-term timeframes and also are putting way too much weight to the various short-term doom and gloom scenarios.. and even seeming to overly reading into the ramifications of such short-term doom and gloom scenarios if they were to happen.. For sure, you seem to fall into such a camp of doomer/gloomers and who easily seem inclined to see that bitcoin could fail (or die) at any moment, and continuously causes me to wonder how well you either understand or appreciate fundamental aspects of bitcoin. Long game or not, we're talking about a corporation in this thread,

Sure we are... yet there are also ways that individuals and governments can model their behaviors in similar ways as some of the stuff we discuss here - but for sure some of the tools that are available to corporations can differ too, depending upon how it is structured - which surely causes Microstrategies to have some unique characteristics in the corporate world. and the brutal fact is that while Michael Saylor may not plan to ever sell the bitcoin he's bought for MSTR, the company's stock is taking a beating because of those purchases. MSTR shareholders might not share his zeal for bitcoin and may not have the patience to wait for either bitcoin or MSTR's stock price to recover--and if enough of them end up selling, it could tank even worse than bitcoin (assuming btc keeps sliding downward) because of market forces alone.

Sure.. all of that stuff could happen. Let's see if it does happen. I share passions for the stock market and bitcoin, which is why I've posted so many times in this thread--not because I'm rooting for MSTR's demise or because I don't like Michael Saylor or anything he's said or done. I've been keeping an eye on a few other bitcoin-related stocks as well, such as MARA, RIOT, and Coinbase. They just don't happen to be relevant to this thread.

For sure, MSTR does seem to have an approach that is different from those other companies that you listed, and sometimes it might be relevant to make comparisons, but of course, there are aspects that are specific to MSTR that needs to be accounted to the extent that any of us understands, and surely, Saylor continues to be very public regarding what he is doing and whether any of his thoughts or strategies are changing in the short-term.. which is also nice to see.. A couple of days ago, I did watch one of Saylor's recent interviews.. linked below.... and he just continues to be a very interesting person to watch who is ongoingly grappling with ideas in this space and continues to have great ongoingly bullish bitcoin conversations. I watched it.. .. fair enough recent reiteration of his position. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 24, 2022, 11:09:42 PM

Last edit: May 15, 2023, 05:39:36 PM by fillippone |

|

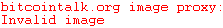

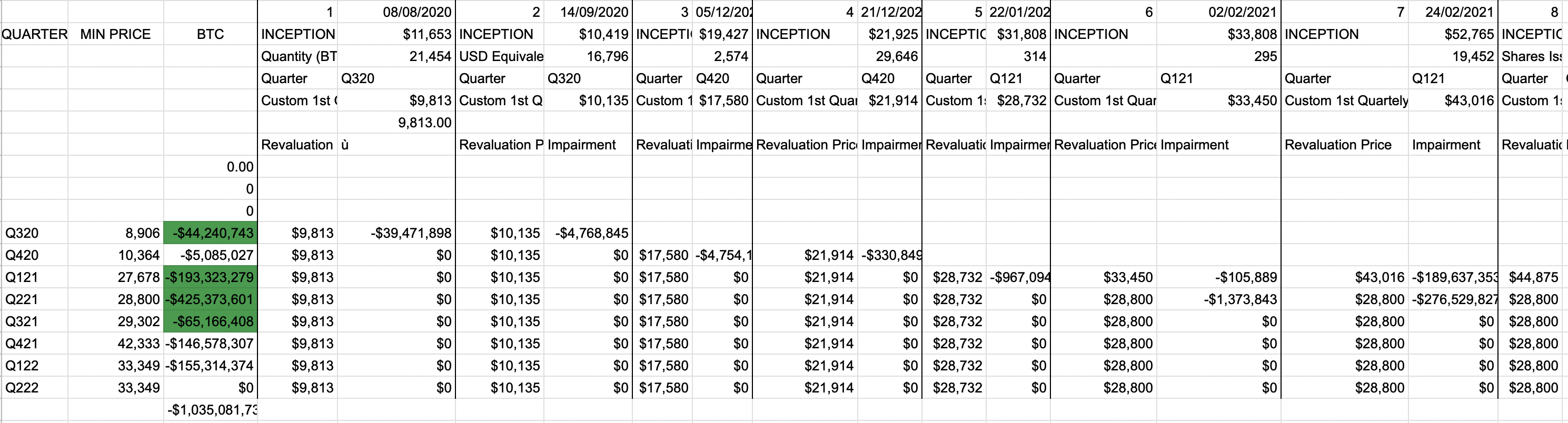

So, I had my try at the accounting exam. First iRead what's written everywhere on Microstrategy's balance sheet: MicroStrategy determines the fair value of its bitcoin based on quoted (unadjusted) prices on the active exchange that MicroStrategy has determined is its principal market for bitcoin. MicroStrategy considers the lowest price of one bitcoin quoted on the active exchange at any time since acquiring the specific bitcoin. If the carrying value of a bitcoin exceeds that lowest price, an impairment loss has occurred with respect to that bitcoin in the amount equal to the difference between its carrying value and such lowest price. Impairment losses are recognized as “Digital asset impairment losses” in MicroStrategy’s Consolidated Statements of Operations.

So pi corocceded in the following way: - I downloaded the Historical Coinbase (which I presume is the "relevant Market") time series, and focused only on the daily the low price.

- I Checked such low price, every quarter with the initial price.

- I valued each tranche with the following revaluation price:

revaluation price(t)=min(initial price, minimum observed price in quarter(t), revaluation price (t-1))

- I computed the eventual impairment in case of diminishing revaluation price

What I got is available here:  What I got is pretty similar to Microstrategy's report:  The only (big) difference is in Q420, where I get an impairment of 5 millions only, while Microstrategy accounts for a total of 26.5 millions. Here you can see, that with the current minimum, in Q122 they will take another 155 mins impairment, to be added to the 146 bios to be reported into Q421. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

January 26, 2022, 11:52:57 AM Merited by JayJuanGee (1) |

|

The financial director of MicroStrategy, Fong Le, also supports the position of CEO Michael Saylor (well, it would be strange if he had a different opinion) and says that MicroStrategy plans to continue to only buy bitcoin, despite its price drop and claims from regulators, but not to sell it. A very optimistic attitude certainly causes respect and hope for the future, by the way, there is a mention in the article that even with the existing price, MicroStrategy has already earned more than $750 million on its investments in bitcoins. https://www.wsj.com/articles/microstrategy-to-continue-buying-bitcoin-despite-market-tumble-cfo-says-11643106608 |

|

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

January 27, 2022, 07:05:19 AM |

|

Just a quick comment to say that I had some MSTR shares, and I sold them close to last year's top. Lol. I had some expenses to make, and I sold the shares of this and other companies. I made the expenses and the money that was left over I squandered. At that time I thought about whether I had done wrong, because if you are a good investor, when you have money in the asset column you should never leave that column. In any case you can sell to buy other assets. Seeing how MSTR shares and the market in general have been doing, I don't regret it at all. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 27, 2022, 07:29:53 AM |

|

The financial director of MicroStrategy, Fong Le, also supports the position of CEO Michael Saylor (well, it would be strange if he had a different opinion) and says that MicroStrategy plans to continue to only buy bitcoin, despite its price drop and claims from regulators, but not to sell it.

The point is that these absurd rules would make a compelling case to sell those bitcoins and realise a profit. This could be made to “window dress” balance sheets. For example, in a quarter with bad results Microstrategy could buy say buy 1,000 BTC and sell 900 BTC (just to say they actually increased their BTC stash). This would mean a huge profit on the sold BTC (by definition they are accounted at lower values), thus increasing quarterly revenues. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

oHnK

|

|

January 27, 2022, 03:36:22 PM |

|

The financial director of MicroStrategy, Fong Le, also supports the position of CEO Michael Saylor (well, it would be strange if he had a different opinion) and says that MicroStrategy plans to continue to only buy bitcoin, despite its price drop and claims from regulators, but not to sell it. A very optimistic attitude certainly causes respect and hope for the future, by the way, there is a mention in the article that even with the existing price, MicroStrategy has already earned more than $750 million on its investments in bitcoins. https://www.wsj.com/articles/microstrategy-to-continue-buying-bitcoin-despite-market-tumble-cfo-says-11643106608I became very interested in how the investment analysis was carried out before actually entering the crypto world. Especially when the price increased a few weeks ago, and now it has fallen and almost touched its low point yesterday, but he still decided to hold their assets. Even with the drop in prices, Saylor didn't really care. Considering the heating conditions in the regions of Russia and Ukraine, it was enough for the market to hit prices down, even though they were fit to sell and take profits as they did. |

|

|

|

|

|