JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10178

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 28, 2023, 08:56:21 PM |

|

Of course, everyone gets a little bit cocky and smug when their BTC holdings are in profits If I own that many btc, I'll probably be shaking my hands off when it gets below 10% of my buying price You still seem to thinking about the whole matter incorrectly. Of course, MSTR and Saylor have a pretty good sized amount of their networth in bitcoin, but they still made a purposeful play (or several purposeful) plays in terms of how much of their assets (reserve cash) they were going to allocate to bitcoin, and in the beginning they had decided a percentage.. but then increasingly started to increase their percentage and also to use leverage... and it's not clear if the money from this purchase mostly came from excess cashflow (and therefore reserves) or if they were leveraging in some kind of a way by using more debt (which Saylor and MSTR do not seem to have any opposition to using various kinds of debt - and even creative debt instruments). and even those kinds of multiple profits does not end up happening in the short-term

He is probably not going to sell any of his holding on the next bull run supercycle or something. I dont know what his 'grand scheme' with all that bitcoins is but one of the option would be leveraging it in the future for huge amount of capital but even then Im not sure what he is going to do with all those money that he had piled up from accumulating bitcoins Saylor has become one of the more openly transparent persons about his (and his company's) plans regarding bitcoin, so there is no need for you to blindly speculate, unless you might be taking from some thing that he has said on the topic, and mostly many of us know (or anyone who has listened to/seen Saylor in an interview), he is planning on hanging onto the bitcoin forever.. and even to keep building his bitcoin holdings, so his actions seem to be largely consistent with his words. Another thing is that it might be reasonable to believe that he might be exaggerating his plan a little bit because he is not locked into "holding his bitcoin forever," but it also still seems better to at least have some kind of a clue regarding what Saylor is saying rather than just speculating.. so maybe you should go listen to some Saylor talks or research into the matter a wee bit MOAR better, arallmuus. Saylor does not seem to be secretive in terms of his statements about having ongoing bitcoin stackening goals. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

No Gods or Kings. Only Bitcoin

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 28, 2023, 09:13:00 PM |

|

Be warned about the risky situation of Microstrategy.

Everyone is looking at Microstrategy as an "ETF proxy".

They are buying a lot of BTC, and investors have flocked to MSTR because of that.

In case of an ETF approval, Microstrategy would lose all those investors, as the ETF is such a more efficient way of holding BTC.

In case you want to bet on ETF approval: Long GBTC, short MSTR!

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10178

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 28, 2023, 09:31:58 PM

Last edit: June 28, 2023, 09:48:28 PM by JayJuanGee Merited by fillippone (3) |

|

Be warned about the risky situation of Microstrategy.

Everyone is looking at Microstrategy as an "ETF proxy".

They are buying a lot of BTC, and investors have flocked to MSTR because of that.

In case of an ETF approval, Microstrategy would lose all those investors, as the ETF is such a more efficient way of holding BTC.

In case you want to bet on ETF approval: Long GBTC, short MSTR!

Trading advice? Long bitcoin.. I don't know about those intermediary products.. handle at your own risk.. bitcoin is risky enough.. why get into shitcoins? Oh yeah, the topic of this thread happens to be MSTR related, and sure there is one thing to trade or buy stocks, and there is another thing to consider your own bitcoin allocation (and perhaps refrain from getting involved in those kinds of stocks) based on various information involving what some of the BIG players are doing (and maybe what they are saying?). But many of us were into bitcoin before these new entrant BIGGER players.. even though GBTC has been an offered product since about 2014.. Some people, institutions and kinds of funds cannot hold BTC directly, but as individuals we can hold BTC directly... which surely seems to be a bit of a better product than the various kinds of products that may or may not be playing loosey-goosey with the coins that they hold. If we are already able to get exposure to bitcoin by holding the underlying (and managing our holdings of the underlying), do we find any value to be playing around with various kinds of other ways to get price exposure to bitcoin (yes, some of the BIG players can ONLY get exposure like that, as fillippone describes) - so another level of complexity regarding whether any of us should be playing that kind of a stock stacking game..beyond directly stacking sats through our own various methods of DCA, buying on dip and lump sum purchases. No? Each of us is responsible for our own choices regarding how to go about these kinds of matters..and I am not even suggesting it is easy to hold your own coins or to manage your own keys and sometimes there can be some benefits in terms of having some exposure to more than just one way of holding bitcoin - careful, I am not referring to shitcoins here, because people will even go as far as going into shitcoins and considering that "diversification" into shitcoins is a good thing merely because other kinds of diversification might work, but does not necessarily mean that we should get into shitcoins, which may well be referred to as di-worsification, as some pundits have already labelled such a strategy... of how much spreading out of kinds of exposure is necessary/helpful rather than worse? hence the name, di-worsification. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

June 29, 2023, 07:20:59 AM

Last edit: June 29, 2023, 12:08:37 PM by bitebits Merited by JayJuanGee (1) |

|

Of course, everyone gets a little bit cocky and smug when their BTC holdings are in profits If I own that many btc, I'll probably be shaking my hands off when it gets below 10% of my buying price You still seem to thinking about the whole matter incorrectly. Of course, MSTR and Saylor have a pretty good sized amount of their networth in bitcoin, but they still made a purposeful play (or several purposeful) plays in terms of how much of their assets (reserve cash) they were going to allocate to bitcoin, and in the beginning they had decided a percentage.. but then increasingly started to increase their percentage and also to use leverage... and it's not clear if the money from this purchase mostly came from excess cashflow (and therefore reserves) or if they were leveraging in some kind of a way by using more debt (which Saylor and MSTR do not seem to have any opposition to using various kinds of debt - and even creative debt instruments). and even those kinds of multiple profits does not end up happening in the short-term

He is probably not going to sell any of his holding on the next bull run supercycle or something. I dont know what his 'grand scheme' with all that bitcoins is but one of the option would be leveraging it in the future for huge amount of capital but even then Im not sure what he is going to do with all those money that he had piled up from accumulating bitcoins Saylor has become one of the more openly transparent persons about his (and his company's) plans regarding bitcoin, so there is no need for you to blindly speculate, unless you might be taking from some thing that he has said on the topic, and mostly many of us know (or anyone who has listened to/seen Saylor in an interview), he is planning on hanging onto the bitcoin forever.. and even to keep building his bitcoin holdings, so his actions seem to be largely consistent with his words. Another thing is that it might be reasonable to believe that he might be exaggerating his plan a little bit because he is not locked into "holding his bitcoin forever," but it also still seems better to at least have some kind of a clue regarding what Saylor is saying rather than just speculating.. so maybe you should go listen to some Saylor talks or research into the matter a wee bit MOAR better, arallmuus. Saylor does not seem to be secretive in terms of his statements about having ongoing bitcoin stackening goals. It is clear from their form-8k: On June 28, 2023, MicroStrategy announced that, as of June 27, 2023, MicroStrategy had issued and sold an aggregate of 1,079,170 Shares under the Sales Agreement for aggregate net proceeds to MicroStrategy (less sales commissions and expenses) of approximately $333.7 million. The holding forever intend may be genuine. MicroStrategy does however sell underlying stock to investors. (even attempting to time the market? as they did in the previous bull market when MSTR > $1k per share) |

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

It is clear from their form-8k: On June 28, 2023, MicroStrategy announced that, as of June 27, 2023, MicroStrategy had issued and sold an aggregate of 1,079,170 Shares under the Sales Agreement for aggregate net proceeds to MicroStrategy (less sales commissions and expenses) of approximately $333.7 million. The holding forever intend my be genuine. MicroStrategy does however sell underlying stock to investors. (even attempting to time the market? as they did in the previous bull market when MSTR > $1k per share)Good spot. They also have roughly 95 million in cash equivalent. I suspect they will use those funds as well. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

Agbe

|

|

June 29, 2023, 04:48:51 PM

Last edit: June 29, 2023, 05:02:14 PM by Agbe |

|

This is a very good news from them. Michael Saylor's MicroStrategy Now Holds Over $4.6B Worth of BitcoinAs of April to June only Michael Saylor's MicroStrategy (MSTR) bought 12,333 bitcoin (BTC), for $347 million in cash, between April 29 and June 27, the company said on Wednesday. New buy!  From what I am seeing here, MicroStrategy will be one of the greatest Bitcoin giant firm in the world. I also discovered that they use lighting network to fast track their transactions. |

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6800

Cashback 15%

|

Did I say I was never coming back to this thread? Can't remember (liar!), don't care. I'm bumpitty-bumping because I hadn't checked MSTR's stock price in a while but did so today. I've got them and some other bitcoin-related stocks on my brokerage watchlist, like MARA, RIOT, and Coinbase. And wow! Bitcoin's price has been kind of stagnant and yet all of those stocks are booming. Just for the record, here's an MSTR chart from May:  I guess bitcoin did jump starting in the middle of June, but for whatever reason my eyes nearly popped out of my head at the stock price gains. Part of that is because I was thinking about buying some shares of RIOT a while back and didn't. And I've been following MSTR for a long time now, and it looks like they own so much bitcoin that their stock has become a proxy for bitcoin--who needs a BTC ETF when you've got Microstrategy, right? Crazy. Edit: I apologize for the lack of markers on that graph. TD Ameritrade became Schwab, and their website sucks ass. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

ginsan

|

|

July 13, 2023, 09:52:12 PM |

|

MSTR is up a further 11% on the today. One thing that is likely to trigger the MSTR bullish movement is today's spike in BTC prices. Well Saylor is back at it and I'm glad to see that the BTC price rally is on the plus side in their treasury asset. Saylor made a Purchase of BTC in the last 2 weeks on June 28 to be exact and it was a perfect buy because on this day BTC touched $31.8k which is the highest price recorded this year after a big crash late last year. Seeing as the market conditions are more supportive or getting big advances today I think BTC will most likely reach $35k this week. Well a few tweets will shake his imagination even more after the embers are over  |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

July 14, 2023, 03:44:17 AM Merited by JayJuanGee (1) |

|

Did I say I was never coming back to this thread? Can't remember (liar!), don't care. I'm bumpitty-bumping because I hadn't checked MSTR's stock price in a while but did so today. I've got them and some other bitcoin-related stocks on my brokerage watchlist, like MARA, RIOT, and Coinbase. And wow! Bitcoin's price has been kind of stagnant and yet all of those stocks are booming. Just for the record, here's an MSTR chart from May:  I don't see that graph as very different from the Bitcoin graph. Since May 1, the Bitcoin price had a slight sustained decline until about June 15 where it started to rise. Maybe the end of the chart is a little different, being the MSTR one more pronounced upwards, but if we take into account the leverage it uses to buy Bitcoin, it is to be expected. And I've been following MSTR for a long time now, and it looks like they own so much bitcoin that their stock has become a proxy for bitcoin--who needs a BTC ETF when you've got Microstrategy, right?

An ETF will always be better than MSTR shares in terms of security, although in terms of potential return the shares can give you a better return because of the leverage. However, we must always bear in mind that leverage means risk and more leverage means more risk. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 28, 2023, 10:22:50 PM Merited by JayJuanGee (1) |

|

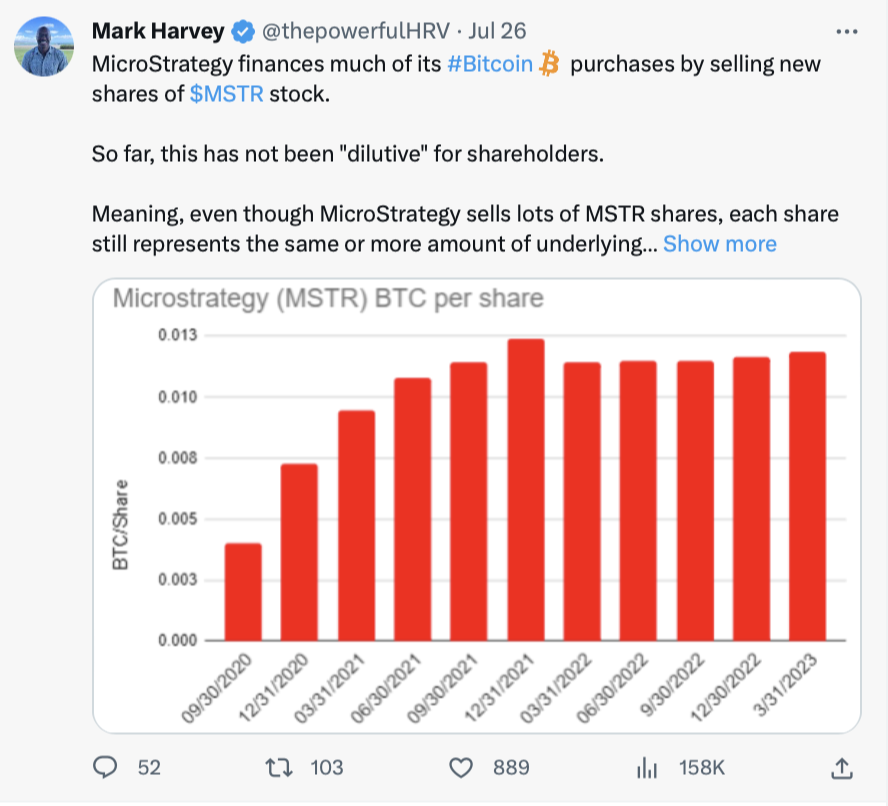

Even if Microstrategy has been relentlessly buying BTC, they have been doing so by keeping the BTC per share quite constant:  This is interesting in the narrative of MSTR being an ETF-proxy instrument: if the BTC per share remain constant, then the price will be directly comparable with underlying asset performance: something very useful if you want to market yourself as the de facto Bitcoin ETF |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

Selling more shares and the price rises represents quite alot of demand then, I agree its likely an ETF proxy. People should be wary if thats the case as the share price can fall just as much but unlike an ETF he cannot alter the float as easily I presume. They cannot buy back the shares when required like funds will do to regulate themselves, that would mean the share price could be erratic.

Probably best to chart MSTR for its market capital and also include a check on any debt instruments or liabilities they have also.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 28, 2023, 10:44:47 PM |

|

Probably best to chart MSTR for its market capital and also include a check on any debt instruments or liabilities they have also.

A very common way of looking at MSTR is considering the "enterprise value", which is the sum ok equity market cap and outstanding debt less the cash. In this way, you can understand how much is valued over the BTC they hold on their balance sheet. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

July 29, 2023, 11:34:48 AM |

|

Probably best to chart MSTR for its market capital and also include a check on any debt instruments or liabilities they have also.

A very common way of looking at MSTR is considering the "enterprise value", which is the sum ok equity market cap and outstanding debt less the cash. In this way, you can understand how much is valued over the BTC they hold on their balance sheet. Since many of the bitcoins MSTR owns are financed with debt, isn't the stock/business currently overvalued? I would think you can't just take the number of bitcoins MicroStrategy owns and multiply it with the current bitcoin price. However that is exactly what seems to be the case, even with a hefty premium at the moment. Not trying to talk the stock down, I own some. But the pricing does not seem to be right unless I am missing something, other than there are currently few onramps for legacy finance adding bitcoin to their portfolio. |

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 03, 2023, 01:32:50 PM |

|

In the below recent recording Saylor explains a question likely many investors have: what separates MSTR from other options owning

<…>

This is bullshit. There is no reason to hold MSTR after an ETF is approved. This is an inferior vehicle to get exposure ti bitcoin price, no matter how much Micheal Saylor try to persuade us. As I said, if you want to bet on an ETF approval you might want to short MSTR and long Grayscale. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 04, 2023, 02:13:43 PM Merited by JayJuanGee (1) |

|

In the below recent recording Saylor explains a question likely many investors have: what separates MSTR from other options owning

<…>

This is bullshit. There is no reason to hold MSTR after an ETF is approved. This is an inferior vehicle to get exposure ti bitcoin price, no matter how much Micheal Saylor try to persuade us. As I said, if you want to bet on an ETF approval you might want to short MSTR and long Grayscale. Ser, are you sure? What an irresponsible advice to suggest. Because even if there's an ETF approval for many asset managers, it doesn't change the fact that MicroStrategy still HODLs 152,800 Bitcoin in their balance sheet. If that surges in value, then their balance sheet will have a BIG PLUS sign in it, which will definitely be very good for MSTR's market value. But I'm the stupid pleb, I could be wrong. ¯\_(ツ)_/¯ |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

In the below recent recording Saylor explains a question likely many investors have: what separates MSTR from other options owning

<…>

This is bullshit. There is no reason to hold MSTR after an ETF is approved. This is an inferior vehicle to get exposure ti bitcoin price, no matter how much Micheal Saylor try to persuade us. As I said, if you want to bet on an ETF approval you might want to short MSTR and long Grayscale. Ser, are you sure? What an irresponsible advice to suggest. Because even if there's an ETF approval for many asset managers, it doesn't change the fact that MicroStrategy still HODLs 152,800 Bitcoin in their balance sheet. If that surges in value, then their balance sheet will have a BIG PLUS sign in it, which will definitely be very good for MSTR's market value. But I'm the stupid pleb, I could be wrong. ¯\_(ツ)_/¯ A lot of people hold Microstrategy because there is no better way to gain exposure to bitcoin price for an US professional investor than Microstrategy. When an ETF is approved, then there will be a selling pressure on Microstrategy (stock) to buy the ETF. The ETF has many advantages tracking bitcoin price over MSTR. It is true that they hold BTC on their balance sheet, buttthey also have other industrial activities that can impact shareholders value. In addition to that, Micheal Salylor could decide to dump all the BTC and nobody could argue with it. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10178

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 04, 2023, 08:08:25 PM

Last edit: August 04, 2023, 08:20:37 PM by JayJuanGee |

|

But I'm the stupid pleb, I could be wrong.

¯\_(ツ)_/¯

That's true.       In addition to that, Micheal Salylor could decide to dump all the BTC and nobody could argue with it.

Technically true, but it does not seem too likely. By the way, it seems that I already commented on this topic when fillippone mentioned it earlier (and he said something like long Grayscale, short MSTR or were you talking about another topic fillippone?... anyhow, gosh the topics are blending their lil selfies.. and I am not going to take any of that advice since I buy my lil cornz directamente... and HODL them for dear life too.. or whatever it is that it seems that I might be doing with my cornz.. ), and it seems that I largely agree with Wind_FURY.. but hey whatever, fillippone does have a pretty decent theory - especially in terms of an actual ETF being a superior product in contrast to MSTR serving as a kind of substitute ETF (that's really not an ETF) for any of the large players/financial institutions trying to get bitcoin exposure, and it could end up playing out in fillippones direction.. ....but in terms of the holders of cornz.. WHO CAReS!!!!!! play with your stocks and your various forms of 3rd party holdings to your own content (play silly games and win silly prizes).. and when BTC is inclined to make money, you may or may not end up making money with whatever roulette table you are playing while the directamente cornz HODLers, including but not limited to yours truly will laugh our lil selfies all the way to the bitcoin node.... |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

In the below recent recording Saylor explains a question likely many investors have: what separates MSTR from other options owning

<…>

This is bullshit. There is no reason to hold MSTR after an ETF is approved. This is an inferior vehicle to get exposure ti bitcoin price, no matter how much Micheal Saylor try to persuade us. As I said, if you want to bet on an ETF approval you might want to short MSTR and long Grayscale. Ser, are you sure? What an irresponsible advice to suggest. Because even if there's an ETF approval for many asset managers, it doesn't change the fact that MicroStrategy still HODLs 152,800 Bitcoin in their balance sheet. If that surges in value, then their balance sheet will have a BIG PLUS sign in it, which will definitely be very good for MSTR's market value. But I'm the stupid pleb, I could be wrong. ¯\_(ツ)_/¯ A lot of people hold Microstrategy because there is no better way to gain exposure to bitcoin price for an US professional investor than Microstrategy. When an ETF is approved, then there will be a selling pressure on Microstrategy (stock) to buy the ETF. The ETF has many advantages tracking bitcoin price over MSTR. But the point is if an ETF is approved, Bitcoin will surge then expand the value of MicroStrategy's balance sheet, therefore making the actual value of MSTR go up. But if MSTR is sold because "reasons" and its price crashes down, THEN the stock is undervalued because of MicroStrategy's surging Bitcoin in the company's vaults. It will be a golden investment opportunity.

It is true that they hold BTC on their balance sheet, buttthey also have other industrial activities that can impact shareholders value. In addition to that, Micheal Salylor could decide to dump all the BTC and nobody could argue with it.

That's a strawman and outside the context of the debate. Because those other industrial activites could add value to the company too, and Chad Saylor could also decide to buy more Bitcoin from company profits. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|