Samlucky O

Full Member

Offline Offline

Activity: 266

Merit: 184

The great city of God 🔥

|

You are probably kind of correct in the assessment that there is a kind of consistency in the buying patterns of someone like Saylor, but your comparison to the gold/silver permabulls, bitcoin is still a new category of investment and a paradigm shifting discovery (invention), so there seems to be some kind of a lack of appreciation for the power of bitcoin when you compare bitcoin to gold/silver permabulls, when those older technologies have already been beaten the fuck in the market and even their physicality gives them some burdens that bitcoin does not have, and part of the reason that bitcoin is likely around 1,000x or greater value than gold is partly based on its lack of physicality which therefore translates into a more pure moneyness that goes above and beyond gold in a lot of ways, and surely I have been suggesting bitcoin to be around 1,000x better than gold for around 6-7 years, yet it seems that even Fidelity got into the mix of calling bitcoin 10,000x better than gold.. and I am not quite sure if I would go that far, and I have my reasons for choosing 1,000x better than gold based on the total addressable market currently being around $1 Quadrillion, and sure we might be able to double or triple that based on new innovations that bitcoin (and perhaps other inventions) is (are) likely going bring to the future in terms of the addressable market regarding places where monetary (rather than utility) value is currently being stored.

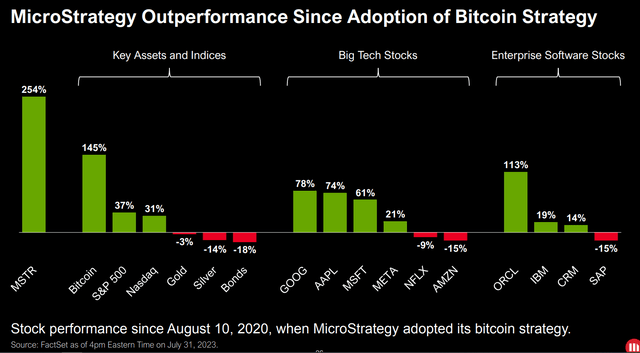

I think this image best describe the investment of Gold & silver vs Bitcoin, how massively bitcoin grew in microstrategy diagram.  [img Microstrategy invested in many assets but in all Bitcoin gave it 1000x compeard to silver & gold and even the existing asset. One of the funny things that the MSTR/Saylor haters continue to fail to figure out is that Saylor (and/or his team) is no dummy, and he is also a pretty good negotiator, including that MSTR/Saylor largely bought back their leveraged coins (and/or resolved their loan with Silvergate) for prices that were way bette than what any normal person could have had resolved

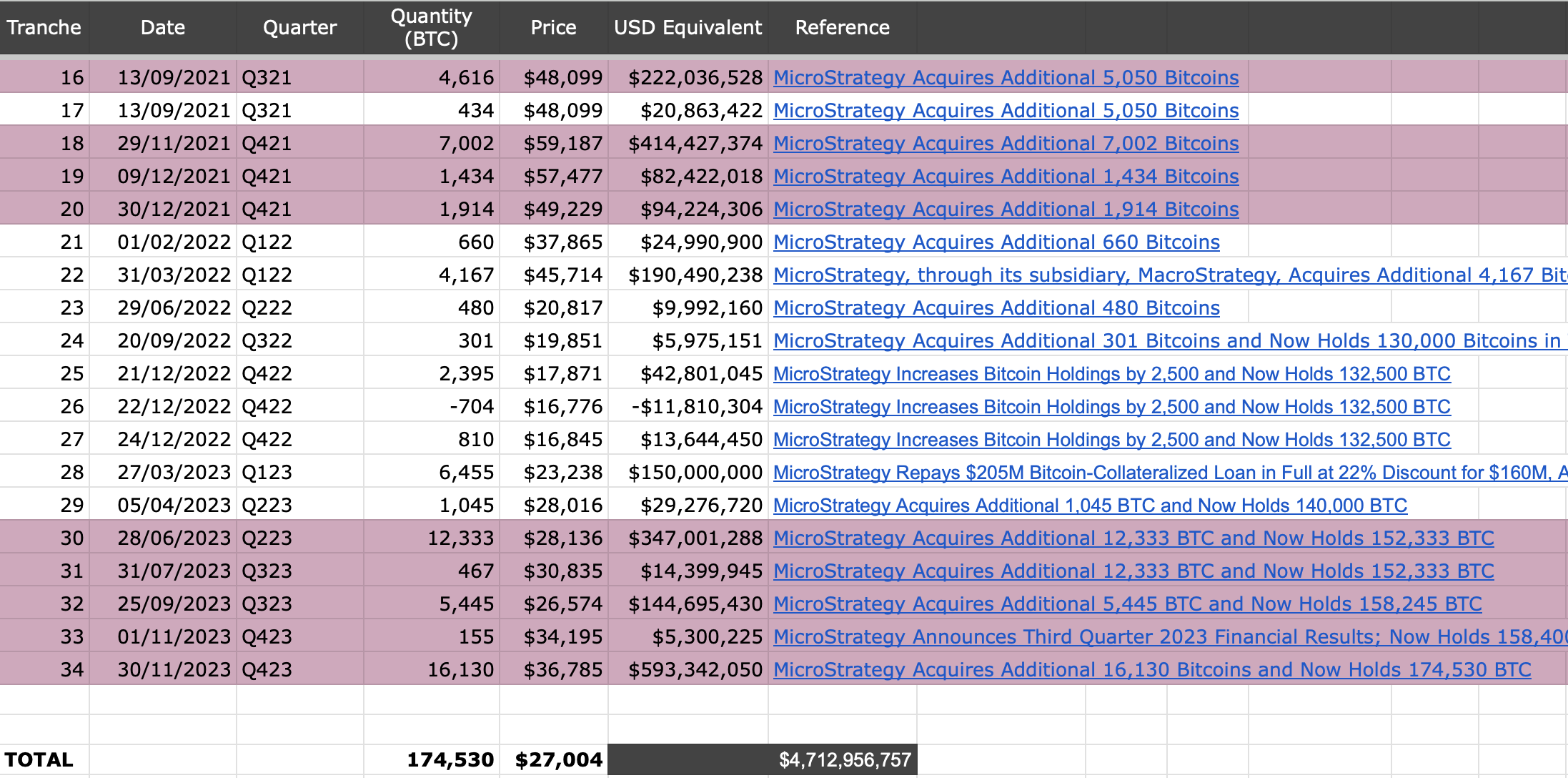

That's pretty cool deal. Can't still but wounder how a $205m worth of bitcoin was paid back to silver gate with a discount of %22 at $160 received cash back of 6,455btc such a hundreds of millions of dollars situation. MSTR/Saylor came out of their position pretty damned well, including that bitcoin related banking industries were seeming to be attacked during that time too.. so surely matters could have had turned out worse, but even the bitcoin price faired pretty well through so many attacks in 2022 and 2023 and several of the attacks are continuing, even though the BTC price is not going down as much as the attackers probably would like, which is most likely contributing to the attackers looking foolish, and maybe even that they are going to need to up their attack game, and still not sure if those attacks upon bitcoin are going to end up been effective.

Definitely there attacks on Bitcoin was not effective, perhaps Bitcoin has changed their thinking faculty to note that bitcoin is not a shit project, rather an overwhelming, fantastic and fabulous project. I also applaud MSTR/saylor for not liquidating the Bitcoin asset during the dip fall. Perhaps it paspctive has show that he's not a dummy after all. Today he's a topic of discussion. Sometimes we need to be strong in other to achieve our goals. An makes the fucking hatter's know we aren't playing in bitcoin investment. |

|

|

|

|

|

|

|

|

Bitcoin addresses contain a checksum, so it is very unlikely that mistyping an address will cause you to lose money.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Pi-network314159

|

|

November 11, 2023, 09:49:43 PM |

|

Do you really think if micro strategy would have made this statement about bitcoin? if he knew that bitcoin will still grow to the extent it did. I think Michael j saylor made a big mistake by saying bitcoin days are numbered because after he made that statement Bitcoin still didn't give up just like he expected, instead it grew above all odds. that is to say that Bitcoin is a coin never to underestimate and looked down on. Because after he made this statement he still continue to buy bitcoin again. |

|

|

|

gunhell16

Sr. Member

Offline Offline

Activity: 1680

Merit: 474

Crypto Swap Exchange

|

|

November 11, 2023, 10:23:43 PM |

|

I wonder who is handling the custody of this for them. That was probably the hardest part of the whole thing for them to work out.

I figure it could be Greyscale, or one of the exchanges (Gemini? Kraken? Coinbase?). Could be Bakkt? Of course they could do it themselves, but that is a fairly serious security undertaking when $250MM is the amount of value.

Looking at the news I do not see that detail.

Yes, and whoever holds the amount that they bought a large amount of Bitcoin is for sure a huge responsibility for him. And even I didn't see any news or any article news about the thing you are asking about. Because the only thing we often read is how much they bought, which is the big value of bitcoin for their company. Well, anyway, let's not worry about that matter, as long as I'm the only one who thinks that Bitcoin is just like a coin to them when they buy it, while for others, it's very difficult to accumulate at least one bitcoin. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 11, 2023, 11:57:33 PM |

|

Do you really think if micro strategy would have made this statement about bitcoin? if he knew that bitcoin will still grow to the extent it did. I think Michael j saylor made a big mistake by saying bitcoin days are numbered because after he made that statement Bitcoin still didn't give up just like he expected, instead it grew above all odds. that is to say that Bitcoin is a coin never to underestimate and looked down on. Because after he made this statement he still continue to buy bitcoin again. A lot of people change their mind about bitcoin, and I doubt that there is any real need to dig deeply into Saylor's case because sure he was negative about bitcoin in 2013, and his story is that he did not realize the use case for bitcoin until some time around and after the March 2020 events with money printing and some of the crazy monetary policy actions going on around that time. .. so if you listen to what Saylor has been saying since around August 2020 and even many points after that (believe it or not he has been in BTC for three years now), and he has given a plausible enough story as to why he considered bitcoin to be a good investment and he has built his conviction since his first investments in late 2020.. and sure some folks are a bit skeptical of him, but he seems to be mostly legitimately pushing for the ideas of bitcoin, even though he is surely much more regulation friendly and maybe some individuals consider that bitcoin needs to stay more peer to peer, and even if we have these various competing ideas in bitcoin, bitcoin is not very easy to change, so various bitcoin supporters can have different and even opposing ideas in regards to purposes of bitcoin, how it should be used and how it should be regulated (if at all?). I wonder who is handling the custody of this for them. That was probably the hardest part of the whole thing for them to work out.

I figure it could be Greyscale, or one of the exchanges (Gemini? Kraken? Coinbase?). Could be Bakkt? Of course they could do it themselves, but that is a fairly serious security undertaking when $250MM is the amount of value.

Looking at the news I do not see that detail.

Yes, and whoever holds the amount that they bought a large amount of Bitcoin is for sure a huge responsibility for him. And even I didn't see any news or any article news about the thing you are asking about. Because the only thing we often read is how much they bought, which is the big value of bitcoin for their company. Well, anyway, let's not worry about that matter, as long as I'm the only one who thinks that Bitcoin is just like a coin to them when they buy it, while for others, it's very difficult to accumulate at least one bitcoin. Public companies have disclosure requirements, and sure for security purposes they might not disclose all of their custodians, but I am pretty sure that they have to use qualified custodians, and I am pretty sure that the topic of the custody of MSTR's coins has come up from time to time over the last 3 years, and how many specifics that they gave may be contained in their quarterly reports and I am sure that they are giving as much as they need to give legally.. but sure the questions of their adequately securing their coins could become a question of concern, even though they did seem to survive the 2022 situation in which several custodians were shown to have been irresponsible with their coins. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

Public companies have disclosure requirements, and sure for security purposes they might not disclose all of their custodians, but I am pretty sure that they have to use qualified custodians, and I am pretty sure that the topic of the custody of MSTR's coins has come up from time to time over the last 3 years, and how many specifics that they gave may be contained in their quarterly reports and I am sure that they are giving as much as they need to give legally.. but sure the questions of their adequately securing their coins could become a question of concern, even though they did seem to survive the 2022 situation in which several custodians were shown to have been irresponsible with their coins.

One interesting aspect is that, as far as I know, they are giving their Bitcoin to a single custodian (I will let you discover in the thread which one I am talking about). On the contrary, I know other companies have made the exact opposite choice. The rationale is that, yes, spreading the custody over multiple custodians actually increases the risk of being hacked but diminishes the expected value of the loss, and this allows the enterprise to survive in such an event. No matter how tiny the chance of a hack to a single custodian, it puts the firm's existence at risk because a single point of failure is a no-go. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 13, 2023, 04:43:55 PM |

|

Public companies have disclosure requirements, and sure for security purposes they might not disclose all of their custodians, but I am pretty sure that they have to use qualified custodians, and I am pretty sure that the topic of the custody of MSTR's coins has come up from time to time over the last 3 years, and how many specifics that they gave may be contained in their quarterly reports and I am sure that they are giving as much as they need to give legally.. but sure the questions of their adequately securing their coins could become a question of concern, even though they did seem to survive the 2022 situation in which several custodians were shown to have been irresponsible with their coins.

One interesting aspect is that, as far as I know, they are giving their Bitcoin to a single custodian (I will let you discover in the thread which one I am talking about). I believe that I had already read about the conjectures about the single custodian and who it is, yet I am pretty sure that I had heard Saylor mention that companies have options regarding their custodians, which I had understood to imply that it would not be a very good practice to ONLY use one custodian.. but sure, you can tell from the way that I am talking about the topic that I have not either figured out specifics or investigated much in that direction. On the contrary, I know other companies have made the exact opposite choice. The rationale is that, yes, spreading the custody over multiple custodians actually increases the risk of being hacked but diminishes the expected value of the loss, and this allows the enterprise to survive in such an event. No matter how tiny the chance of a hack to a single custodian, it puts the firm's existence at risk because a single point of failure is a no-go.

Surely, we are likely of very similar thinking on the topic, and I am pretty sure that may bitcoin pundits have suggested that MSTR should have enough technical expertise and even abilities to consult with counsel in ways that they should be able to figure out ways to self-custody at least some of their own coins but yeah, even with a company that seems to have been as open as MSTR (and Saylor), I cannot recall Saylor getting into a lot of detailed discussions regarding what their deliberations might be in that direction, including the trade-offs that might come from some of the self-custody and/or multi-sig options that might be available and usable for a public company, such as MSTR. Another thing is that Saylor talks so much about a variety of topics, I could not imagine that he has not at least somewhat danced around talking about the various tradeoffs in regards to various custodial options that are available to them. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Mayor of ogba

Full Member

Online Online

Activity: 280

Merit: 158

★Bitvest.io★ Play Plinko or Invest!

|

|

November 20, 2023, 08:57:03 AM Merited by JayJuanGee (1) |

|

I think Microstrategy is seeing what we aren't seeing in this space, the way they keep increaisng their Bitcoin holdings is worthy of notable concern. Imagine a company pumping in millions of dollars in acquisition of Bitcoin constantly for more than two years and they seem not to be slowing down even in bear market, I hope we don't wake up one day to see them as the highest hodlers of Bitcoin after Satoshi himself.

With the latest buy of $5.3m worth of Bitcoin, I can confidently say, that crypto is still at its early stage, more investors will soon join the trend soon.

The reason why MicroStrategy and Saylor are investing heavily in Bitcoin is that they believe it is better to invest in Bitcoin than to keep money in the bank since what you save in the bank will be what you get back when you want to withdraw it, and the money will lose it purchasing power due to inflation. The Bitcoin investment is working for them because, from JJG calculation when the Bitcoin price is at $34k, MicroStrategy and Saylor are already on $800m profit, I see them hodling their Bitcoin till another ATH. I doubt that it is accurate to suggest that MSTR is buying on the dip.

I agree with you at JJG, because MicroStrategy and Saylor bought most of their Bitcoin when the Bitcoin price was at $29k. And I think MicroStrategy and Saylor will buy Bitcoin at any price when they have extra money to invest in Bitcoin. |

|

|

|

|

Orpichukwu

|

|

November 20, 2023, 02:21:38 PM |

|

I think Microstrategy is seeing what we aren't seeing in this space, the way they keep increaisng their Bitcoin holdings is worthy of notable concern. Imagine a company pumping in millions of dollars in acquisition of Bitcoin constantly for more than two years and they seem not to be slowing down even in bear market, I hope we don't wake up one day to see them as the highest hodlers of Bitcoin after Satoshi himself.

With the latest buy of $5.3m worth of Bitcoin, I can confidently say, that crypto is still at its early stage, more investors will soon join the trend soon.

Based on my calculations, they are currently holding about 0.76% of the 21,000,000 bitcoin total supply, which doesn't look like a small holding to me. 158,400 BTC is 0.76% of 21,000,000 BTC . I used the formula:(158,400 / 21,000,000) x 100 = 0.76%. And from the look of things, if they continue buying as time goes on, they might be able to accumulate up to 1% or above of the total supply, which I believe will be their target, as Micro Strategy has been known to be among the top firms that have so much faith in bitcoin like the rest of us, and they have predicted the price to be above $100k in the coming years. And for private institutions, which have so much financial power with great hope and deal with the currency, we should not expect anything less from them. Selling also won't be in their favour, although they have sold a little in the past, which I believe was a result of escaping tax because they bought back what they sold almost immediately after a few days or a week. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 30, 2023, 02:00:12 PM

Last edit: November 30, 2023, 11:06:45 PM by fillippone Merited by JayJuanGee (1) |

|

Earlier Version of the tweet:  I will update you with full details later. Purchase detail:  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 27, 2023, 01:33:34 PM Merited by JayJuanGee (1) |

|

Microstrategy bought another clip:  No matter if the are in profit or in loss, they are DCA-ing their purchases at a constant pace. Probably they want to front load next year when they will change their accounting rules. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

a298b112

Member

Offline Offline

Activity: 139

Merit: 36

|

|

December 27, 2023, 02:55:19 PM |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 27, 2023, 06:28:54 PM Merited by fillippone (2) |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

I don't mean to evade your question - because I don't know about the actual proof - however, a public company lying in their making those levels of detailed disclosures, would be in pretty deep shit, including the various principle officers may well end up with criminal charges.. and pretty severe penalties... so even though I don't have any problems about being doubtful and/or a skeptic, but certain kinds of proclamations are supposed to be able to rely upon them.. so public statements in official quarterly release documents by companies are the kinds of documents we should be able to mostly rely upon... yeah of course, public companies lie sometimes.. but I doubt that lying is taking place with Saylor/MSTR in regards to these acquisition of BTC kinds of matters.. Even though there are a lot of MSTR/Saylor haters, bitcoin naysayers, shitcoin pumpeners and perhaps some others who would just love these kinds of false claims or fraud to be present in this particular case.. To me it seems to me that your own asking of those kinds of questions may well mean that you are part of one of those hater camps or you are reading talking points of some of those hater camps.. even your question is not very fleshed out to show that you have studied into the matter beyond merely asking the seemingly pretty lame question. Sceptical Chymist? Is that you?       |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

I don't mean to evade your question - because I don't know about the actual proof - however, a public company lying in their making those levels of detailed disclosures, would be in pretty deep shit, including the various principle officers may well end up with criminal charges.. and pretty severe penalties... so even though I don't have any problems about being doubtful and/or a skeptic, but certain kinds of proclamations are supposed to be able to rely upon them.. so public statements in official quarterly release documents by companies are the kinds of documents we should be able to mostly rely upon... In addition to these very correct statements, please remember there are auditors of public companies, who should assess the quality of the information on the balance sheets. So it wouldn't only be MicroStrategy making up numbers, but also KPMG would need to be involved. This would be quite a plot twist. As they are doing self-custody of their coins, instead of resorting to a custodian, we haven't a separate, direct assessment of their holding, but I anyway think that the information should be quite reliable. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Mayor of ogba

Full Member

Online Online

Activity: 280

Merit: 158

★Bitvest.io★ Play Plinko or Invest!

|

|

December 28, 2023, 09:22:03 AM Merited by JayJuanGee (1) |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

It is left for you to believe if MicroStrategy actually bought all the Bitcoins they are hodling now. And it is not advisable to show your BTC wallet address online where you are holding your Bitcoin because you might put yourself at risk and scammers will be sending a phishing link to you just to get access to hack your Bitcoin wallet. Never show your assets online for any reason. Secondly, I don't think MicroStrategy will lie about the Bitcoin they have bought because people will not like to associate with the MicroStrategy company if they know they have lied about purchasing Bitcoin. They will see the MicroStrategy company as people who can possibly scam because they lied about purchasing 189,150 BTC. |

|

|

|

|

Hewlet

|

|

December 29, 2023, 08:41:09 AM |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

do they owe you any responsibility of showing details to support such claim? Would you even want to give out your holding just for a public show and in the long run put yourself at a serious disadvantage where hackers will do anything possible to get your wallet hacked. Maybe you should understand that if you believe it or not doesn't make any difference and your opinion is just unpopular and doesn't make what is true become false. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 29, 2023, 02:25:16 PM |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

do they owe you any responsibility of showing details to support such claim? Public companies must make these kinds of disclosures on a quarterly basis, but they most likely don't have to show the actual proof - except if they were to get audited by the SEC or whatever agencies could be involved in such monitoring.. as fillippone had mentioned such accountability in their disclosures. Would you even want to give out your holding just for a public show and in the long run put yourself at a serious disadvantage where hackers will do anything possible to get your wallet hacked.

Yep.. very true.. which also relates to some of the various governmental initiatives in which some of the control-freak legislators are striving to push forth efforts to not allow us to have such privacies...or to severely infringe upon such privacies. This topic of showing proof frequently comes up with El Salvador, too... and their so far lack of disclosures (that are even less than the specifics that Saylor/MSTR has been providing) causes some folks to question how they are holding whatever coins that they supposedly bought and even if they have really bought the coins that they claim to have bought... just as a298b112 is questioning here. Maybe you should understand that if you believe it or not doesn't make any difference and your opinion is just unpopular and doesn't make what is true become false.

a298b112 might end up causing himself to NOT have confidence in BTC, and perhaps his kinds of claims could also cause others to not have confidence in BTC, and really that is the choice of each of us to figure out how much, if any, confidence we have to invest in bitcoin, and historically the bitcoin naysayers and fearmongers have not tended to do as well as those folks who largely hunkered down and bought bitcoin and continued to buy bitcoin and even the longer and the more aggressive that people have been (without overdoing the aggressiveness of course) have tended to do better than those who were either whimpy in their bitcoin investment or who chose to completely stay out of investing in bitcoin. There is no real sign that bitcoin's investment thesis is getting any less strong, and actually with the passage of time, it seems that bitcoin's investment thesis may well continuing to get stronger and stronger, and so if there are folks who are continuing to find imaginary reasons to be scared to invest in bitcoin, then that is on them to suffer from their lack of conviction to either buy and/or accumulate bitcoin sooner rather than later and to stay with such ongoing persistent and consistent BTC accumulation until they have enough BTC.. which surely are individual decisions regarding where to start, perhaps 1% to 25% allocation of a quasi-liquid investment portfolio into bitcoin would be a good start to consider where any newbie to bitcoin might fall and then go from their in terms of their own determinations.. and realizing at the same time that there are no guarantees that bitcoin will continue to perform as well as it has done historically, even though anyone studying bitcoin likely realizes that it continues to have a pretty decently strong investment thesis. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Zlantann

Legendary

Offline Offline

Activity: 840

Merit: 1004

|

|

December 29, 2023, 02:54:28 PM Merited by JayJuanGee (1) |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

I don't mean to evade your question - because I don't know about the actual proof - however, a public company lying in their making those levels of detailed disclosures, would be in pretty deep shit, including the various principle officers may well end up with criminal charges.. and pretty severe penalties... so even though I don't have any problems about being doubtful and/or a skeptic, but certain kinds of proclamations are supposed to be able to rely upon them.. so public statements in official quarterly release documents by companies are the kinds of documents we should be able to mostly rely upon... yeah of course, public companies lie sometimes.. but I doubt that lying is taking place with Saylor/MSTR in regards to these acquisition of BTC kinds of matters.. Companies cannot lie with such important financial information because their financial report is in the public space. They need to report to tax agencies and this information must be included in the financial returns. I don't doubt that MicroStrategy bought these Bitcoins and I don't also need any proof. Even though there are a lot of MSTR/Saylor haters, bitcoin naysayers, shitcoin pumpeners and perhaps some others who would just love these kinds of false claims or fraud to be present in this particular case.. Some people generally want Bitcoin to fail and these set of persons try to talk down on positive news while they publicise any challenge Bitcoin faces. Most of them promote failed projects that they presented as alternatives to Bitcoin. Many of them failed to stand the test of time, so they are now filled with envy because of the success of Bitcoin and MicroStrategy. Haters will keep hating and Bitcoin will keep flourishing. They have predicted the death of Bitcoin many times, yet Bitcoin has outlived some of them. Congratulations to MicroStrategy for believing in Bitcoin, they are creating a prosperous future. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

erep

|

|

December 29, 2023, 03:14:53 PM Merited by JayJuanGee (1) |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

do they owe you any responsibility of showing details to support such claim? Public companies must make these kinds of disclosures on a quarterly basis, but they most likely don't have to show the actual proof - except if they were to get audited by the SEC or whatever agencies could be involved in such monitoring.. as fillippone had mentioned such accountability in their disclosures. You are right, MicroStrategy company publishes DCA strategies to the public and they should be responsible for providing proof of bitcoin purchase by providing bitcoin ownership instructions although they don't have to show every bitcoin asset held in multiple addresses, at least publish their portfolio for basic proof for those who doubt the statement they. However, MicroStrategy has not yet appeared with the SEC for a specific audit of its bitcoin acquisitions, but I am sure MicroStrategy complies with every financial and other relevant regulation, I am sure they will not provide false information claims of any bitcoin purchases. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 29, 2023, 04:20:57 PM |

|

I mean is there any proof that they are actually buying? It will be good to see even some indirect evidence

do they owe you any responsibility of showing details to support such claim? Public companies must make these kinds of disclosures on a quarterly basis, but they most likely don't have to show the actual proof - except if they were to get audited by the SEC or whatever agencies could be involved in such monitoring.. as fillippone had mentioned such accountability in their disclosures. You are right, MicroStrategy company publishes DCA strategies to the public and they should be responsible for providing proof of bitcoin purchase by providing bitcoin ownership instructions although they don't have to show every bitcoin asset held in multiple addresses, at least publish their portfolio for basic proof for those who doubt the statement they. However, MicroStrategy has not yet appeared with the SEC for a specific audit of its bitcoin acquisitions, but I am sure MicroStrategy complies with every financial and other relevant regulation, I am sure they will not provide false information claims of any bitcoin purchases. I am not sure exactly what kinds of behaviors or parameters would trigger an audit, and I am not even sure if the SEC has authority to issue such an audit randomly or sua sponte... In other words, it could well be the case that some kind of an official charge or proceeding might need to happen before they are even able to issue an audit. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

0t3p0t

|

|

December 31, 2023, 05:02:37 AM |

|

Do you really think if micro strategy would have made this statement about bitcoin? if he knew that bitcoin will still grow to the extent it did. I think Michael j saylor made a big mistake by saying bitcoin days are numbered because after he made that statement Bitcoin still didn't give up just like he expected, instead it grew above all odds. that is to say that Bitcoin is a coin never to underestimate and looked down on. Because after he made this statement he still continue to buy bitcoin again. Manipulation is common most specially whales so let us just expect them to say something that creates fud so they can accumulate more and more Bitcoins. We all know that crypto is whales favorite playground they sometimes play the role of making markets turns green and red. They trusted Bitcoin and it's technology other than centralized investments that is quiet slow and stable compared to Bitcoin. |

|

|

|

|