fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 28, 2020, 11:13:02 AM

Last edit: June 03, 2021, 05:37:14 AM by fillippone |

|

In this thread I will collect various Research papers published by Wall Street Banks on Bitcoin.

Banking sectors have begun to cover Bitcoin in Various aspects. A few reports are quite remarkable, so will deserve their own thread. Some other are important for a minor reason, but maybe they are referenced on other news, or papers without proper reporting, and it is often difficult to read the original article.

I will use those to collate and reference into other thread, publishing graphs and paragraph linked to these research.

I won't always be able to post full documents to protect my sources, obviously, as often those materials come with a watermark.

All reported material will be quoted.

My comments will be out of quotes.

If you find some missing article, or want to read a particular one, just ask, I will unleash my hounds to fetch the missing pieces.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

|

|

Be very wary of relying on JavaScript for security on crypto sites. The site can change the JavaScript at any time unless you take unusual precautions, and browsers are not generally known for their airtight security.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 28, 2020, 11:13:17 AM

Last edit: May 16, 2023, 12:47:07 AM by fillippone Merited by hugeblack (2), JayJuanGee (1) |

|

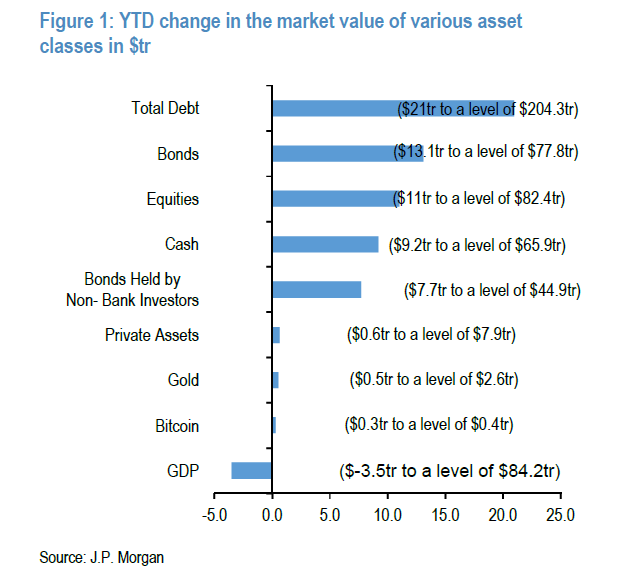

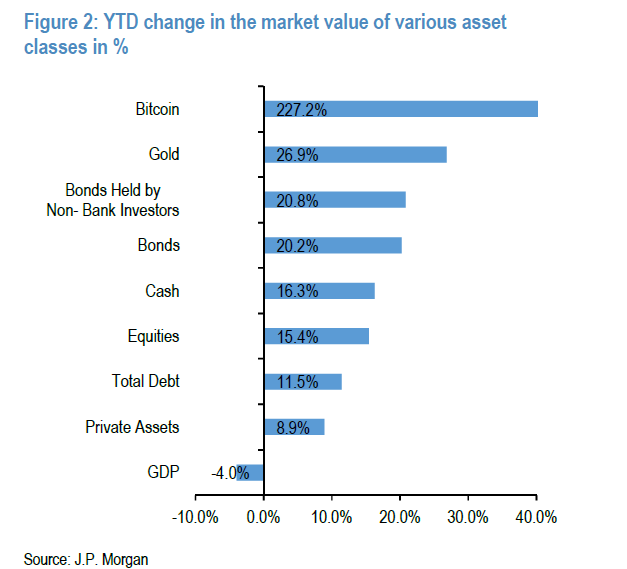

JP Morgan Flows & LiquidityHow has the investment landscape changed during 2020?21 December 2020Summary: - In percentage terms, the expansion of the equity universe has been smaller than that of the bond or cash universe.

- Private asset classes lagged the growth of public asset classes.

- Alternative “currencies” such as Gold and Bitcoin have been the main beneficiaries of the pandemic in relative terms.

- Within equities, the EM Asia universe grew the most, while Latam contracted.

- With credit, the strongest growth has been in Euro HY.

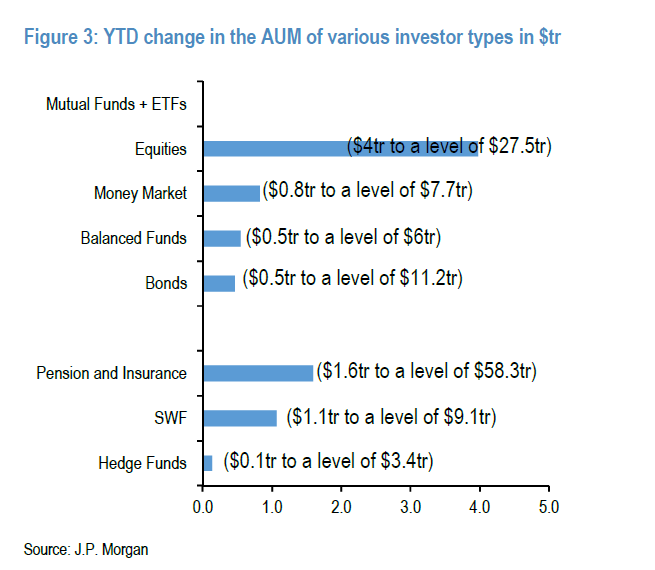

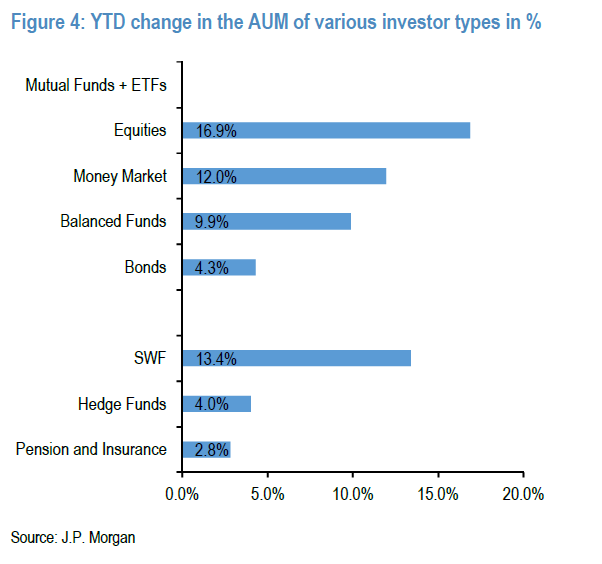

- Among investor types, retail funds such as Mutual Funds and ETFs and SWFs appear to have seen double-digit growth in their AUM this year, thus increasing their share in the total investor universe. HFs, as well as pension funds and insurance companies saw low single digit AUM growth instead.

- We find it difficult not to characterize bitcoin as overbought at the moment.

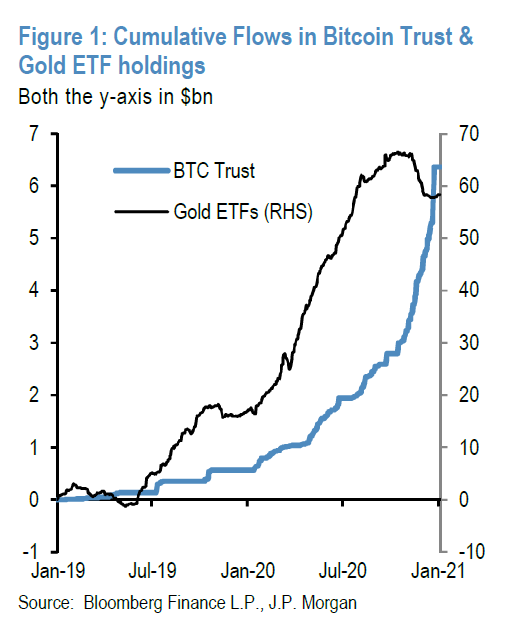

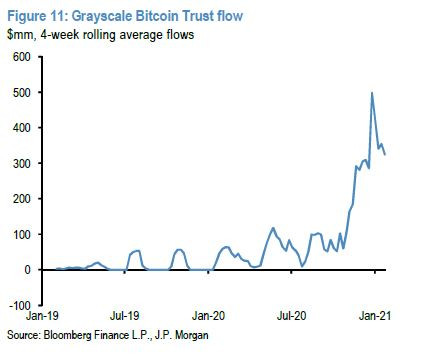

- At the same time, we acknowledge that the inflows into the Grayscale Bitcoin Trust, at $1bn per month currently, are too big to allow any position unwinding by momentum traders to create sustained negative price dynamics similar to the ones seen before in the second half of 2019.

- Any signs of significant slowing in the flow trajectory for the Grayscale Bitcoin Trust would raise the risk of a bitcoin correction similar to the one seen in the second half of 2019.

Relevant Bitcoin Parts: - As the year comes to a close it is useful to look at how the investment landscape changed during 2020.

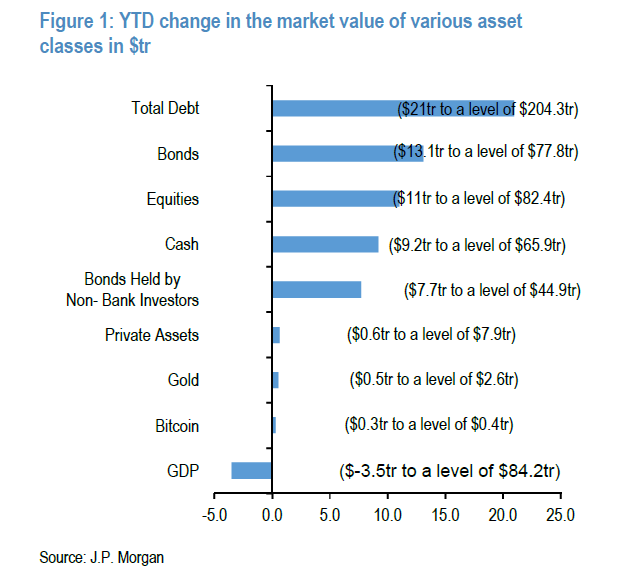

How have different asset classes and types of investors fared in terms of overall growth during a year dominated by the impact of the global pandemic and policy responses to it? Figure 1 and Figure 2 show the overall changes in broader asset classes in dollar terms as well as relative to their end-2019 levels, and includes the 4% contraction in global GDP for 2020 that our economists have in their forecast for context. The most striking increase has been in the total outstanding debt which in 1H20 had already increased by around $14tr, almost matching our previous projection for 2020 in total of $16tr 16tr (see F&L More debt, more liquidity, more asset reflation, Jul 6th). As a result, we now project total debt growth for 2020 of $21tr, reflecting continued strong bond issuance in particular. Of this total, the increase in bonds accounts for around $13tr reflecting a significant increase in government deficits as they sought to smooth the impact on incomes as well as record corporate bond issuance as companies sought to increase their cash buffers to weather the shock on cash flows. The remainder is a combination of bank loans, shorter-maturity paper such as bills, EM local debt and other non-marketable debt.

|  |  | | Fig.1 | Fig.2 |

- Moreover, this increase in debt is also reflected in a significant increase in cash, by $9tr in terms of M2 global money supply. Partly, this is a consequence of the increase in debt as bank loans directly create deposits. And while bond issuance does not create deposits directly in the same way bank lending does, when QE purchases by central banks absorb (mostly government) bonds from the portfolios of private non-bank investors, such as pension funds, asset managers and insurance companies, liquidity or money supply is being created.

- The universe of global equities has expanded by a similar order of magnitude to the expansion in bonds, i.e. by around $11tr. That is lower in dollar terms than the expansion in bonds, but larger than either cash or bonds held by non-bank investors. However in percentage terms the expansion in the equity universe has been smaller. This helps explain why equity weights in non-bank investor portfolios have only risen just above their post-Lehman averages despite global equity prices reaching new all-time highs.

- Private asset classes such as private equity, private debt, infrastructure, private real estate and natural resources, a $7.2tr universe at the end of 2019 according to Preqin, likely grew by around $640bn this year based on our estimates. This represents close to 9% growth, significantly below the 15%/17% growth for public equities/bonds. Alternative “currencies” such as Gold and Bitcoin have been the main beneficiaries of the pandemic in relative terms growing their assets (for investment purposes) by 27% and 227%, respectively.

- Looking across asset classes at a more granular level we find that just over half of the increase in the equity universe comes from US equities, with EM Asia another strong beneficiary. In percentage terms, however, EM Asia has seen a larger increase, likely in part reflecting the fact that China is one of the few countries globally where our economists forecast positive GDP growth for 2020, while Latam has seen a contraction in dollar terms. Within credit, unsurprisingly the largest increase in terms of market value has been USD HG, reflecting that nearly $1tr of net issuance. In percentage terms, however, the strongest growth has been by far in Euro HY, which is up by almost 50% over the past year.

- Across investor types retail funds such as Mutual Funds and ETFs (a $52tr universe currently) have seen the strongest percentage growth with Equity funds leading, followed by Money Market funds and Balanced/Hybrid funds, while Bond funds saw more muted growth (Figure 3 and Figure 4). SWFs, despite suffering liquidations in Q1, have benefited from their high exposure to public equities of 60%-70% and as a result they likely saw close to 13% growth (or $1tr) in their AUM this year, bringing their total assets to above $9tr currently. In contrast, hedge funds (a $3.4tr universe currently) and pension funds/insurance companies (a $58tr universe currently) saw more modest low single digit growth this year. In other words, among investor types, retail funds such as Mutual Funds and ETFs appear to have seen the strongest growth this year, thus increasing their share in the total investor universe.

|  |  | | Fig.3 | Fig.4 |

Now a really interesting part: Inflows the Grayscale Bitcoin Trust still too big to allow any position unwinding by momentum traders to create sustained negative price dynamics- We had argued in our F&L publication of Dec 11th that the previous week’s announcement by MassMutual life insurance company that has already invested $100mn in bitcoin for its general investment fund, represented another milestone in bitcoin adoption as it suggests that institutional investors’ adoption of bitcoin is spilling over from family offices/HNWI to more traditional real-money investors such as insurance companies and pension funds.

- That MassMutual announcement was followed this week by a wave of speculative bitcoin buying, likely reflecting a renewed impulse by speculative investors to front run real-money institutional investors.

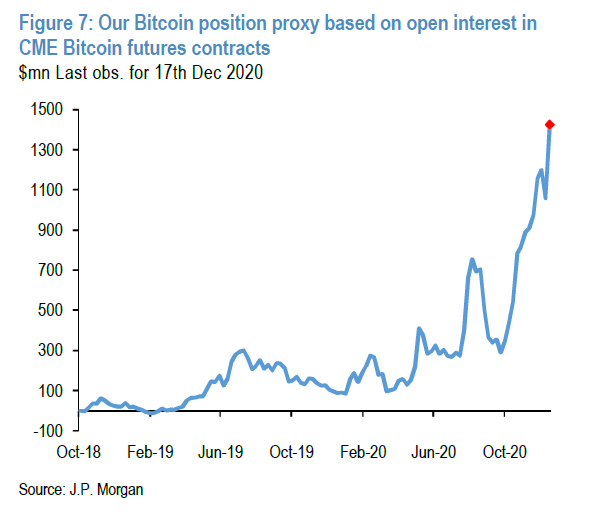

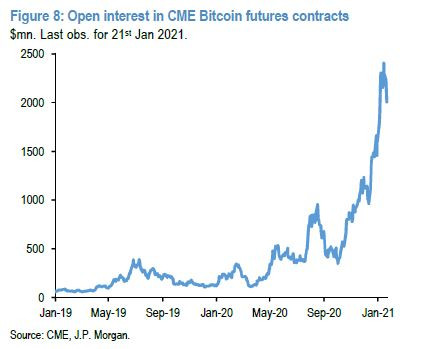

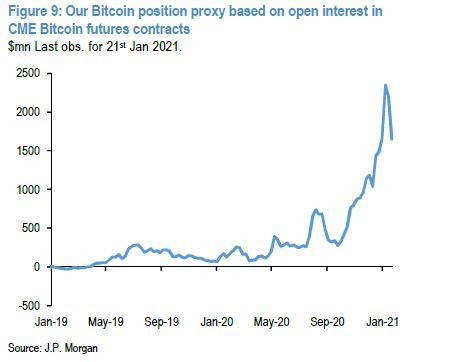

Indeed, bitcoin futures, the preferred vehicle of speculative investors, saw new record high volumes on Thursday this week (Figure 5), which combined with a sharp increase in open interest (Figure 6), points to intense buildup of futures positions. In fact Figure 6 shows that the open interest of CME bitcoin futures has increased by an astonishing 45% since last Friday, more than reversing the previous decline of Nov 25th and making a new record high of $1.4bn.

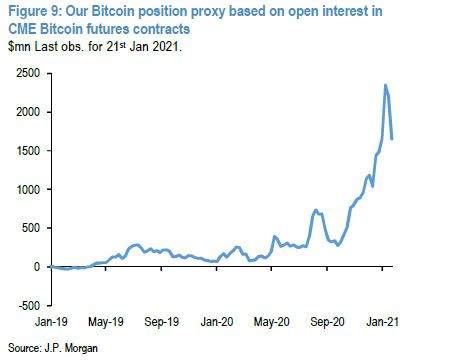

This is also true with our more carefully calculated bitcoin futures position proxy shown in Figure 7 which experienced a similarly steep ascent this week to unprecedented territory. As a reminder to our readers to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa. When there is a price decrease, the net long position of spec investors decreases also with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest). Looking at Figure 6 and Figure 7 it is difficult to not become concerned about a buildup of speculative long futures positions in bitcoin. At the same time, any previous attempts to call for mean

reversion in these two indicators proved futile.

- What about momentum traders? There is little doubt that momentum traders, such as CTAs and quantitative crypto funds, amplified this week’s surge. How much of vulnerability do these momentum traders pose for bitcoin at the moment?

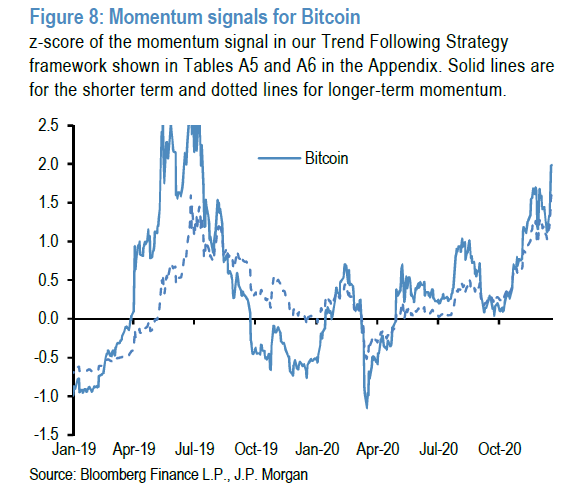

We had argued in previous weeks that the near term outlook for bitcoin was skewed to the downside due to a potential decay of its momentum signals into January, unless the bitcoin resumed its uptrend by rising above $20k. Clearly, this week’s surge to above $23k has not only cancelled our previous momentum-signal-decay thesis, but it has reversed it by shifting these momentum signals to even higher territory. This is shown in Figure 8 which depicts our short and long lookback period momentum signals for bitcoin. Figure 8 shows that the short lookback period momentum signal rose this week to 2.0 stdevs and the long lookback period to 1.6 stdevs. Both are above our 1.5stdev threshold typically associated with overbought conditions and a high risk of mean reversion. According to Figure 8 the last time momentum traders were so long bitcoin was in June 2019.

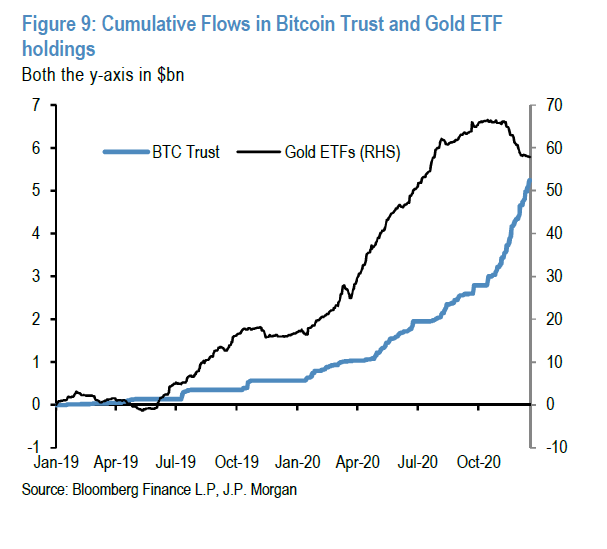

Taking Figure 6, Figure 7 and Figure 8 together, we find it difficult not to characterize bitcoin as overbought at the moment. At the same time we acknowledge that the inflows into the Grayscale Bitcoin Trust, at $1bn per month currently (Figure 9), are too big to allow any position unwinding by momentum traders to create sustained negative price dynamics similar to the ones seen before in the second half of 2019. In other words, monitoring on a high frequency basis the flow trajectory for the Grayscale Bitcoin Trust remains very important. Any signs of significant slowing in the flow trajectory for the Grayscale Bitcoin Trust in Figure 9 would raise the risk of a bitcoin correction similar to the one seen in the second half of 2019.

|  |  | | Fig.8 | Fig.9 |

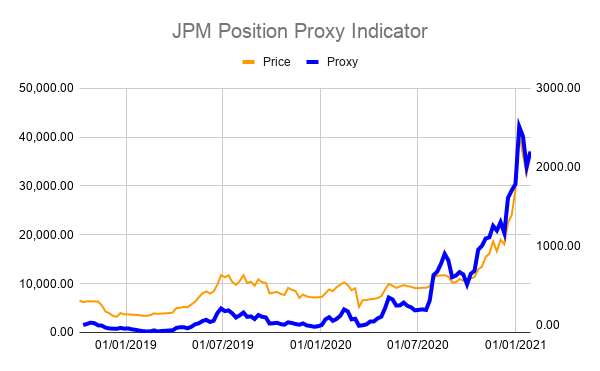

Apart every speculation about Grayscale, I think I have addressed in my thread, I think the interesting part is the proxy positioning based on Open Interest. An Indicator I will try to reproduce in TradingView. EDIT: Zerohedge referenced to this article, with various comments Bitcoin At $650,000? One Stunning Chart, And Why JPMorgan Thinks Nothing Can Stop It Now

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 28, 2020, 10:41:50 PM

Last edit: May 16, 2023, 12:46:30 AM by fillippone |

|

There is an interesting bit here:

As a reminder to our readers to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week.

The result is the following graph: |  | | Fig.7 |

Is anyone able to reproduce it in Tradingview? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6800

Cashback 15%

|

|

December 28, 2020, 10:51:37 PM Merited by fillippone (2) |

|

Cool idea for a thread, OP. It's kind of amazing to me how mainstream bitcoin has become in terms of its coverage in the financial news compared to when I started getting interested in it about six years ago. There was some coverage back then, but it was almost as if bitcoin was a freak-show asset that was performing like a carnival act. Now there's just straight reporting on it as if it were just another investment class. This caught my eye:  I would not have expected stock values to lag that far behind bitcoin, considering stocks have been in a prolonged bull market for over a decade now--but nonetheless the bitcoin growth numbers are incredible! There's certainly been huge demand for it, particularly by all those companies that bought it as an alternative to cash (like MicroStrategy). Whew. It's been one hell of a year in many ways, but at least one positive that came out of 2020 is that bitcoin reached a new ATH. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 28, 2020, 11:04:49 PM

Last edit: May 16, 2023, 12:46:25 AM by fillippone |

|

Well, the explanation is in the previous graph: |  | | Fig.1 |

Bitcoin is barely visible. Bitcoin is tiny, so a minuscule amount of money can send it to the sky. Of course once BTC will prove itself as a viable SoV, it will begin sucking value from all other asset classes, as at least some percentage of those are held because...SoV. Anyway, the Gold amount doesn’t seems correct to me, as Gold capitalisation looks more 10 trln to me (they might be referring only to privately held Gold) equivalent to a Bitcoin priced at 485,000 USD. EDIT: Zerohedge referenced to this article, with various comments and a slightly different Gold Estimate! Bitcoin At $650,000? One Stunning Chart, And Why JPMorgan Thinks Nothing Can Stop It Now |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 05, 2021, 04:12:27 PM

Last edit: May 16, 2023, 12:42:39 AM by fillippone Merited by Paolo.Demidov (4) |

|

JP Morgan Flows & LiquidityHas bitcoin equalised with gold already?04 January 2021Summary: - We believe that the valuation and position backdrop has become a lot more challenging for bitcoin at the beginning of the New Year.

- While we cannot exclude the possibility that the current speculative mania will propagate further, pushing the bitcoin price up towards the consensus region of between $50k-$100k, we believe that such price levels would prove unsustainable.

- Risk markets look vulnerable ahead of this week’s Georgia runoffs..

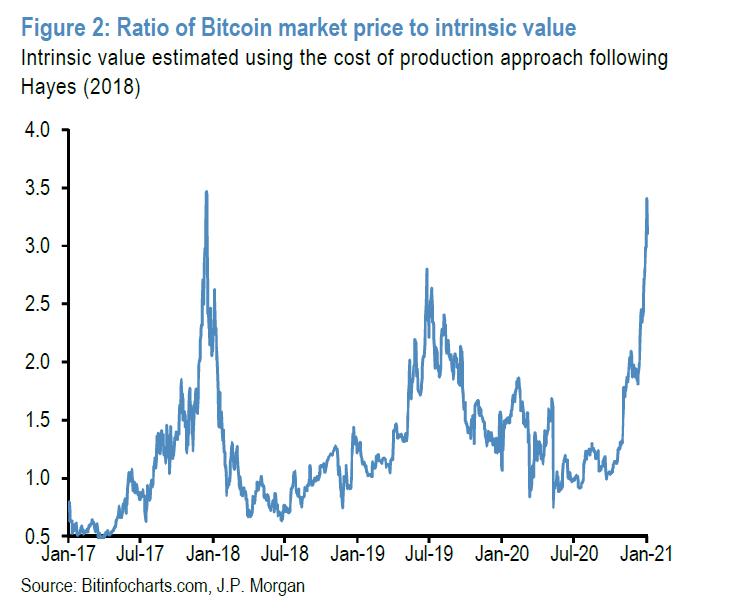

Relevant Bitcoin Parts: - We note that the spectacular bitcoin rally of the past few weeks has moved bitcoin into more challenging territory not only in terms of its positioning backdrop, but also in terms of its valuation. We had previously used two valuation metrics for bitcoin, one based on its comparison to gold and one based on its mining cost or intrinsic value.

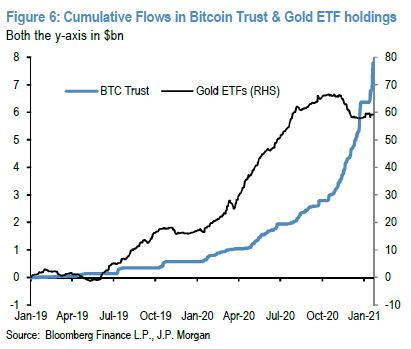

- Bitcoin's competition with gold has already started in our mind as evidenced by the more than $3bn of inflows into the Grayscale Bitcoin Trust and the more than $7bn of outflows from Gold ETFs since mid-October (Figure 1). There is little doubt that this competition with gold as an "alternative" currency will continue over the coming years given that millennials will become over time a more important component of investors' universe and given their preference for "digital gold" over traditional gold. Considering how big the financial investment into gold is, a crowding out of gold as an "alternative" currency implies big upside for bitcoin over the long term. As we had mentioned previously in the Oct 23rd F&L, "Bitcoin's competition with gold," private gold wealth is mostly stored via gold bars and coins the stock of which, excluding those held by central banks, amounts to 42,600 tonnes or $2.7tr including gold ETFs. Mechanically, the market cap of bitcoin at $575bn currently would have to rise by x4.6 from here, implying a theoretical bitcoin price of $146k, to match the total private sector investment in gold via ETFs or bars and coins.

- But this long term upside based on an equalization of the market cap of bitcoin to that of gold for investment purposes is conditional on the volatility of bitcoin converging to that of gold over the long term. The reason is that, for most institutional investors, the volatility of each class matters in terms of portfolio risk management and the higher the volatility of an asset class, the higher the risk capital consumed by this asset class. It is thus unrealistic to expect that the allocations to bitcoin by institutional investors will match those of gold without a convergence in volatilities. A convergence in volatilities between bitcoin and gold is unlikely to happen quickly and is in our mind a multi-year process. This implies that the above $146k theoretical bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year.

|  | | Fig.1 |

- In fact, an argument can be made that, in terms of risk capital, bitcoin has largely equalized with gold already. To see this, one could compare the volatilities of bitcoin and gold or the volatilities of the biggest bitcoin and gold funds given many institutional investors are only allowed or prefer to invest in fund format. The 3m realized vol for bitcoin currently stands at 57% vs. 17% for gold. In other words, the ratio of the two vols suggests that bitcoin currently consumes x3.4 more risk capital than gold. This ratio rises further if one looks at the biggest bitcoin and gold funds. The 3m realized vol for the Grayscale Bitcoin Trust stands at 87% vs. 17% for GLD, the largest gold ETF by AUM. I.e., the ratio of the two vols suggests that the Grayscale Bitcoin Trust currently consumes x5.1 more risk capital than gold.

Taking the average of the x3.4 and x5.1 ratios, suggests that bitcoin and its biggest fund on average consume x4.3 more risk capital than gold and its biggest fund, which is very much close to the x4.6 ratio needed to equalize the market cap of bitcoin to that of gold for investment purposes. In other words, bitcoin has already almost equalized gold in risk capital terms. In our opinion this challenges the consensus idea that a price in the region of $50k-$100k region is a sustainable bitcoin target for 2021 in the absence of a significant decline in bitcoin volatility.

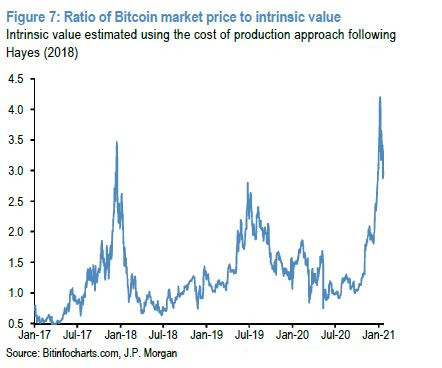

- Our second valuation metric is based on the mining cost or intrinsic value of bitcoin. The ratio of the bitcoin market price to its intrinsic value is shown in Figure 2. The current ratio is higher than its previous mid-2019 peak and matches its end-2017 peak, again raising concerns about valuations. This is not say that the mining cost is driving the market value. The opposite is likely true. In the early years, bitcoin’s production cost had naturally stronger influence on the price because new coin generation was a higher percentage of existing stock or supply. Now that more than 18m bitcoins have been mined already (vs. max supply of 21m) and new coin generation is a smaller percentage of the existing supply, the influence of the production cost on the price has likely diminished. Thus, in the current conjuncture, the market price is likely driving the production cost rather than the other way round. However, this causality does not mean that the bitcoin price would be diverging from its mining cost on a sustained basis. Similar to gold, when the bitcoin market price is well above the production cost, mining activity and mining difficulty should increase pushing the cost of production up towards the market price, thus inducing some convergence. But similar to previous episodes, some of that convergence could happen with an adjustment in the market price also. We thus view the acute divergence of Figure 2 as another valuation challenge for bitcoin.

|  | | Fig.2 |

- What about positioning? There is little doubt that the institutional flow impulse into bitcoin is what distinguishes 2020 from 2017. And there is no better metric to capture this institutional impulse than the flow trajectory of the Grayscale Bitcoin Trust in Figure 1. This is because many institutional investors are only allowed or prefer to invest in bitcoin in fund format for regulatory or other reasons. In fact, many of them are not even allowed to hold restricted shares of the Grayscale Bitcoin Trust via private placements given the 6-month lock up period, and are thus forced to pay a premium by buying these shares in the secondary market.

- It is, however, wrong to view all these institutional flows of last year as entirely driven by long-term investors. We believe that a significant component of last year’s institutional flows into bitcoin reflect speculative investors seeking to front run other more real-money institutional investors. The frothy positioning in CME bitcoin futures is one manifestation of this speculative institutional flow which encompasses momentum traders such as CTAs and quantitative crypto funds. Indeed, bitcoin futures, the preferred vehicle of speculative investors, saw a sharp increase in open interest in recent weeks (Figure 3), pointing to intense buildup of futures positions. This is also true with our more carefully calculated bitcoin futures position proxy shown in Figure 4, which experienced a similarly steep ascent in recent weeks to unprecedented territory. As a reminder to our readers, to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa. When there is a price decrease, the net long position of spec investors decreases also, with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest). Looking at Figure 3 and Figure 4 it is difficult to not be concerned about a buildup of institutional speculative long futures positions in bitcoin.

- What about momentum traders? There is little doubt that momentum traders, such as CTAs and quantitative crypto funds, amplified the past weeks’ surge. How much vulnerability do these momentum traders pose for bitcoin at the moment? Clearly, the past weeks’ price surge to above $30k has shifted our bitcoin momentum signals to even higher territory. This is shown in Figure 5 which depicts our short and long lookback period momentum signals for bitcoin. Figure 5 shows that the short lookback period momentum signal rose this week to 3.0 stdevs, and the long lookback period to 2.3 stdevs, i.e. to even higher levels than the previous peaks of mid-2019. Both are well above our 1.5stdev threshold typically associated with overbought conditions and a high risk of mean reversion.

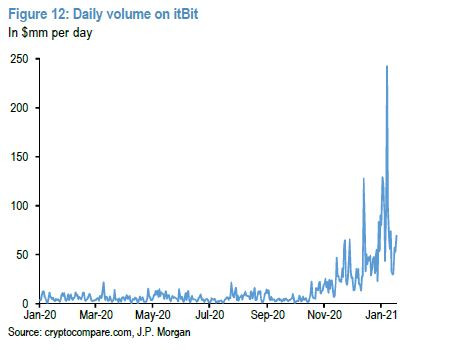

- What about retail investors? The speculative mania by retail investors characterized the bitcoin surge during 2017. Unfortunately, there are some signs that retail interest has also increased sharply. For example, as we had argued previously the broadening of corporate support for bitcoin, e.g. via Paypal and Square, has been facilitating and enhancing over time the usage of bitcoin by Millennials. And while we do not yet have data for 4Q volumes, one way to gauge the impact from retail purchases via Paypal is to look at volumes on itBit. These volumes have increased markedly since Oct 21st when Paypal announced the launch of services to enable trading and holding of cryptocurrencies.

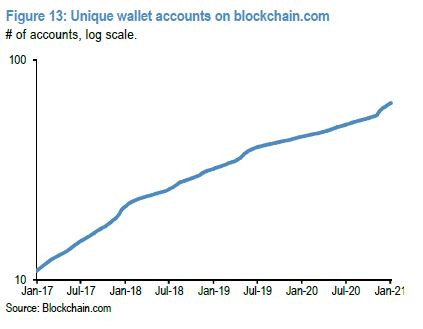

- Another proxy suggesting increased retail participation is new account openings on ‘traditional’ cryptocurrency exchanges. Figure 7 below shows unique cryptocurrency wallet accounts on blockchain.com. While the number of accounts clearly has an increasing trend over time, there are sharp pickups in new wallet accounts during the retail-driven price spikes in end-2017 as well as mid-2019. Since the start of November 2020, there has been a proportionally similar rise in new wallet accounts to those two previous episodes.

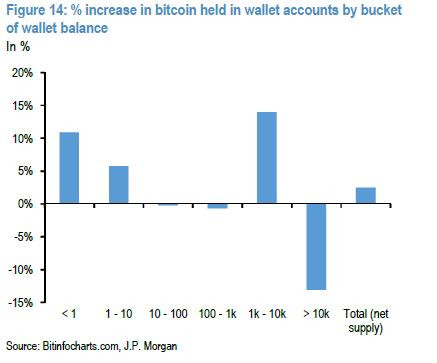

- Moreover, data on the distribution of bitcoin balances held in wallet accounts is also suggestive of retail participation. Figure 8 shows percentage change in total bitcoin held in wallet accounts by bucket of bitcoin balance, e.g. < 1 shows the % change in bitcoin held in wallet accounts with a balance of less than one bitcoin. It shows that between the start of 2020 and 2021 accounts with less than one bitcoin or between one and ten bitcoin have seen a marked increase in holdings that is more likely to be retail driven. Similarly, there has been a significant increase in balances held in accounts between 1,000 and 10,000 bitcoin, which is more likely to be institutionally driven. By contrast, balances held in accounts with more than 10,000 bitcoin have declined significantly, suggesting early investors and miners have been selling bitcoin to facilitate the increase of new entrants.

- Taking all the above together, we believe that the valuation and position backdrop has become a lot more challenging for bitcoin at the beginning of the New Year. While we cannot exclude the possibility that the current speculative mania will propagate further pushing the bitcoin price up towards the consensus region of between $50k-$100k, we believe that such price levels would prove unsustainable.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Upgrade00

Legendary

Online Online

Activity: 2016

Merit: 2171

Professional Community manager

|

|

January 05, 2021, 06:49:59 PM Merited by fillippone (2) |

|

Those are pretty impressive figures. $3 billion inflows into Bitcoin is quite significant and when you consider it's only being charted from Grayscale investments, it gives the idea that there is a global paradigm shift in investment destination as individuals and companies alike are trusting Bitcoin to preserve the value of their funds and speculatively give them profits.

What's your comment on the suggestion that mining cost represents intrinsic value for Bitcoin?

Mining cost varies depending on location and some other factors and would you consider it to be the metric that gives Bitcoin its value and as such any price spike above that could be considered to be purely speculative?

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 05, 2021, 10:31:11 PM

Last edit: January 06, 2021, 11:03:52 AM by fillippone |

|

What's your comment on the suggestion that mining cost represents intrinsic value for Bitcoin?

Mining cost varies depending on location and some other factors and would you consider it to be the metric that gives Bitcoin its value and as such any price spike above that could be considered to be purely speculative?

As the article itself stated mining costs are becoming less and less relevant determining the value of bitcoin. My point here is the following: "Why bother trying to infer the price of Bitcoin from mining costs when the Stock to Flow model already correctly captures the 95% of the value of Bitcoin? I am not that worried about that 5%" |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 06, 2021, 10:49:10 AM Merited by fillippone (2) |

|

My point here is the following: "Why bother trying ti infer the price of Bitcoin from mining costs, when the Stock to Flow model already correctly captures the 95% of the value of Bitcoin? I am not that worried with that 5%"

Based on a very small sample. How long that plays out into the future, we shall see. I think stock-to-flow comes off as voodoo to many. It's just so out of touch with traditional fundamental analysis. But this long term upside based on an equalization of the market cap of bitcoin to that of gold for investment purposes is conditional on the volatility of bitcoin converging to that of gold over the long term.

This implies that the above $146k theoretical bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year. I think these are weak conclusions. Too much emphasis on the need for a decline in gold to fuel a rise in Bitcoin. I don't think they fully understand Bitcoin's scarcity dynamics, and how few consistently circulating BTC there really are. As for $146K being unattainable this year.....maybe, maybe not. Related to the above, I don't trust their ability to recognize the prospects for a speculative blow-off top. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 06, 2021, 11:07:30 AM |

|

I think these are weak conclusions. Too much emphasis on the need for a decline in gold to fuel a rise in Bitcoin. I don't think they fully understand Bitcoin's scarcity dynamics, and how few consistently circulating BTC there really are.

You have to understand where they come from. Jp Morgan is (one of the best) investment banks in traditional finance. Hence their mindset is all about the difference between yielding and not yielding bearing assets. Scarcity is not a feature they are really understanding, as they are applying the traditional way of thinking in those investments. I am pretty satisfied, as it's a nice U-turn since the infamous Jamie Dimon statements a few years back. Just give them a few more years to complete their transformation. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 28, 2021, 06:16:47 PM |

|

JP Morgan Flows & Liquidity Retail investors’ euphoria returns08 January 2021 Why the approval of a bitcoin ETF in the US would be negative for bitcoin in the near term? - Optimism around the prospect of the SEC approving a bitcoin ETF in the US this year has risen in anticipation of SEC leadership changes. While the introduction of a bitcoin ETF in the US would be positive for bitcoin over the longer term, in the near term it could have a negative impact. The reason is a potential decline in the Grayscale Bitcoin Trust (GBTC) premium to NAV from the introduction of bitcoin ETF in the US, which would unwind a big portion of GBTC investments currently placed for monetizing this premium.

- An important support for the large premium to NAV in GBTC arises from the fact that many institutional investors are only allowed or prefer to invest in bitcoin in fund format for regulatory or other reasons. In fact, many of them are not even allowed to hold restricted shares of the Grayscale Bitcoin Trust via private placements given the 6-month lock up period, and are thus forced to pay a premium by buying these shares in the secondary market.

- The typical GBTC premium monetization trade involves borrowing bitcoin (typical cost of 5-7% per annum), placing these bitcoins to GBTC at NAV via private placement for in-kind shares locked up for 6 months, and hedge the exposure during the lockup period by borrowing GBTC shares (typical cost of 7- 10% per annum) and selling them short. Alternatively one could hedge via shorting CME futures, but this entails some basis and rollover risk. The cost of this GBTC premium monetization trade is around 10-15% per annum and this is why it has been difficult so far for the GBTC premium to NAV to fall below this threshold.

- Some institutional investors likely subscribed to GBTC (at NAV) during the second half of last year with the intention of selling after the 6m unlock period to monetize the premium (selling price minus subscription at NAV). Gauging by the amount of GBTC shares on Loan (around 8% of outstanding stock) and by the short base in CME bitcoin futures, we believe that the GBTC premium monetization trade could account for around 15% of outstanding GBTC stock. As the 6m unlock period expires, some of these institutional investors might sell GBTC during the first half of 2021 to monetize the premium. If it materialises, this selling pressure would put downward pressure on GBTC premiums.

- This unwinding of the GBTC premium monetization trade could become more violent if a bitcoin ETF is approved in the US. The introduction of a bitcoin ETF would erode GBTC’s effective monopoly status and cause a cascade of GBTC outflows and a collapse of its premium. ETFs allow for daily creation and redemption of shares and thus a more efficient arbitrage of the premium to NAV. A cascade of GBTC outflows and a collapse of its premium would likely have negative near-term implications for bitcoin given the flow and signaling important of GBTC.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 29, 2021, 02:31:10 PM

Last edit: May 16, 2023, 12:34:02 AM by fillippone |

|

JP Morgan Flows & LiquidityPolicy Shift22 January 2021- With bitcoin failing to break out above $40k, the balance of risks is still skewed to the downside over the near term.

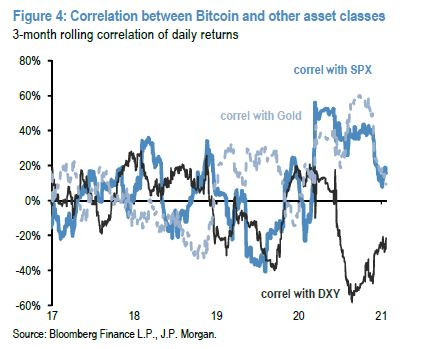

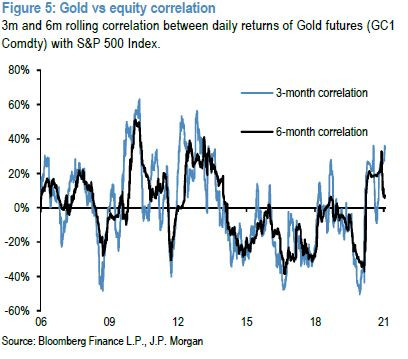

A review of the past year for bitcoin- The virus crisis by boosting money supply as well as demand for an “alternative” currency supported both gold and bitcoin over the past year. The older cohorts preferred gold, while the younger cohorts preferred bitcoin as an “alternative” currency. Both gold and bitcoin investment vehicles have experienced strong inflows over the past year, as both cohorts saw the case for an “alternative” currency. This simultaneous flow support has caused a change in the correlation pattern between bitcoin and other asset classes, with a more positive correlation between bitcoin and gold but also between bitcoin and the dollar (Figure 4). In addition, the simultaneous buying of US equities and Bitcoin by Millennials has increased the correlation between bitcoin and S&P500 since last March, so it is more appropriate to characterise bitcoin as a “risk” asset rather than “safe” asset also, given its still very high 70% realized volatility. To some extent, this is also true with gold. Gold’s correlation with the S&P500 has been predominantly positive over the past year and its volatility at close to 20% is more similar to that of equities than to currencies or bonds (Figure 5). In other words, both bitcoin and gold could be more characterised as “risk” rather than “safe” assets based on their behavior over the past year and investors’ preference for them is likely more of a reflection of a need for an “alternative” currency rather than a need for a “safe” asset or “hedge”.

|  |  | | Figure 4 | Figure 5 |

- In the second half of 2020, bitcoin started receiving more support via corporate adoption, initially with Square and MicroStrategy and last October with Paypal. Paypal’s adoption of bitcoin was a big step toward corporate support for bitcoin, which in turn appears to have triggered demand for bitcoin by institutional investors such as family offices, hedge funds and even insurance companies such as MassMutual. Some of that institutional impulse into bitcoin likely came at the expense of gold based on the more than $4bn of inflows into the Grayscale Bitcoin Trust and the more than $7bn of outflows from Gold ETFs since mid-October (Figure 6). There is little doubt that this competition with gold as an “alternative” currency will continue over the coming years given that millennials will become over time a more important component of investors’ universe and given their preference for “digital gold” over traditional gold. Considering how big the financial investment into gold is, any such crowding out of gold as an “alternative” currency implies big upside for bitcoin over the long term. As we had mentioned previously in the Oct 23rd F&L, “Bitcoin’s competition with gold”, private gold wealth is mostly stored via gold bars and coins the stock of which, excluding those held by central banks, amounts to 42,600 tonnes or $2.7tr including gold ETFs. Mechanically, the market cap of bitcoin at $600bn currently would have to rise by almost x4.5 from here, implying a theoretical bitcoin price of $146k, to match the total private sector investment in gold via ETFs or bars and coins.

|  | | Figure 6 |

- But we mentioned previously this long-term potential upside based on an equalization of the market cap of bitcoin to that of gold for investment purposes is conditional on the volatility of bitcoin converging to that of gold over the long term. The reason is that, for most institutional investors, the volatility of each class matters in terms of portfolio risk management and the higher the volatility of an asset class, the higher the risk capital consumed by this asset class. It is thus unrealistic to expect that the allocations to bitcoin by institutional investors will match those of gold without a convergence in volatilities. A convergence in volatilities between bitcoin and gold is unlikely to happen quickly and is in our mind a multi-year process. This implies that the above $146k theoretical bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year.

- In fact, an argument can be made that, in terms of risk capital, bitcoin has largely equalized with gold already (see Jan 4th F&L “Has bitcoin equalised with gold already?”). To see this, one could compare the volatilities of bitcoin and gold or the volatilities of the biggest bitcoin and gold funds given many institutional investors are only allowed or prefer to invest in fund format. The 3m realized vol for bitcoin currently stands at 72% vs. 19% for gold. In other words, the ratio of the two vols suggests that bitcoin currently consumes x3.8 more risk capital than gold. This ratio rises further if one looks at the biggest bitcoin and gold funds. The 3m realized vol for the Grayscale Bitcoin Trust stands at 103% vs. 19% for GLD, the largest gold ETF by AUM. i.e., the ratio of the two vols suggests that the Grayscale Bitcoin Trust currently consumes x5.4 more risk capital than gold. Taking the average of the x3.8 and x5.4 ratios, suggests that bitcoin and its biggest fund on average consume x4.6 more risk capital than gold and its biggest fund, almost equal to the x4.5 ratio needed to equalize the market cap of bitcoin to that of gold for investment purposes. In other words, bitcoin, at current market prices, has already almost equalized with gold in risk capital terms. In our opinion, unless bitcoin volatility subsides quickly from here, a price level of close to $35k should be considered as an upper bound of its fair value range at current levels of volatility. This challenges the idea that a price in the region of $50k-$100k region is a sustainable bitcoin target for 2021 in the absence of a significant decline in bitcoin volatility.

- What about the lower bound of its fair value range? In our opinion one way of thinking about the lower bound of its fair value is based on the mining cost or intrinsic value of bitcoin. The ratio of the bitcoin market price to its intrinsic value is shown in Figure 7. The current ratio is higher than its previous mid- 2019 peak and matches its end-2017 peak, again raising concerns about valuations. This is not say that the mining cost is driving the market value. The opposite is likely true. In the early years, bitcoin’s production cost had naturally stronger influence on the price because new coin generation was a higher percentage of existing stock or supply. Now that more than 18.6m bitcoins have been mined already (vs. max supply of 21m) and new coin generation is a smaller percentage of the existing supply, the influence of the production cost on the price has likely diminished. Thus, in the current conjuncture, the market price is likely driving the production cost rather than the other way round. However, this causality does not mean that the bitcoin price would be diverging from its mining cost on a sustained basis. Similar to gold, when the bitcoin market price is well above the production cost, mining activity and mining difficulty should increase pushing the cost of production up towards the market price, thus inducing some convergence. But similar to previous episodes, some of that convergence could happen with an adjustment in the market price also. We thus view the acute divergence of Figure 7 as another valuation challenge for bitcoin and the current mining cost of $11k as a lower bound of its fair value range.

|  | | Figure 7 |

- What about positioning? There is little doubt that the institutional flow impulse into bitcoin is what distinguishes 2020 from 2017. And there is no better metric to capture this institutional impulse than the flow trajectory of the Grayscale Bitcoin Trust in Figure 6. This is because many institutional investors are only allowed or prefer to invest in bitcoin in fund format for regulatory or other reasons. In fact, many of them are not even allowed to hold restricted shares of the Grayscale Bitcoin Trust via private placements given the 6-month lock up period, and are thus forced to pay a premium by buying these shares in the secondary market.

- It is, however, wrong to view all these institutional flows of last year as entirely driven by long-term investors. We believe that a significant component of last year’s institutional flows into bitcoin reflect speculative investors seeking to front run other more real-money institutional investors. The frothy positioning in CME bitcoin futures is one manifestation of this speculative institutional flow which encompasses momentum traders such as CTAs and quantitative crypto funds. Indeed, bitcoin futures, the preferred vehicle of speculative investors, saw a sharp increase in open interest in recent months (Figure

pointing to intense buildup of futures positions. This is also true with our more carefully calculated bitcoin futures position proxy shown in Figure 9, which experienced a similarly steep ascent in recent months to unprecedented territory. As a reminder to our readers, to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa. When there is a price decrease, the net long position of spec investors decreases also, with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest). Looking at Figure 8 and Figure 9 it is difficult to not have been concerned about a buildup of institutional speculative long futures positions in bitcoin up until the beginning of this year. pointing to intense buildup of futures positions. This is also true with our more carefully calculated bitcoin futures position proxy shown in Figure 9, which experienced a similarly steep ascent in recent months to unprecedented territory. As a reminder to our readers, to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa. When there is a price decrease, the net long position of spec investors decreases also, with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest). Looking at Figure 8 and Figure 9 it is difficult to not have been concerned about a buildup of institutional speculative long futures positions in bitcoin up until the beginning of this year.

|  |  | | Figure 8 | Figure 9 |

- How much vulnerability do these momentum traders pose for bitcoin at the moment? Clearly, the price surge to above $40k had shifted our bitcoin momentum signals to even higher territory. This is shown in Figure 10 which depicts our short and long lookback period momentum signals for bitcoin. Figure 10 shows that the short lookback period momentum signal rose above 3.5 stdevs in early January, and the long lookback period to above 2.5 stdevs, i.e. to even higher levels than the previous peaks of mid-2019. Both are well above our 1.5stdev threshold typically associated with overbought conditions and a high risk of mean reversion. As we mentioned in our publication last week, the current challenge for bitcoin is that, if its price fails to break out above $40k soon, the momentum signals would keep decaying till the end of March, given a lookback period of around 2-3 months for our short lookback period momentum signal. Bitcoin faced a similar challenge at the end of November when its price was hovering just below $20k. At the time, we had argued that if the bitcoin price had failed to break out above $20k, the momentum signals would have naturally decayed until the end of January creating negative dynamics for bitcoin. Luckily, at the time the institutional flow impulse behind the Grayscale Bitcoin Trust was so strong that bitcoin managed to break out above $20k inducing further position build up rather than position unwinding by momentum traders in December. At the moment, the institutional flow impulse behind the Grayscale Bitcoin Trust is not strong enough for bitcoin to break out above $40k as the 4-week pace of the flow into GBTC (Figure 11) appears to have peaked. Thus the risk is that momentum traders will continue to unwind bitcoin futures positions even after the large almost 30% decline in our position proxy of Figure 9 since its peak on January 7th.

|  |  | | Figure 10 | Figure 11 |

- What about retail investors? The speculative mania by retail investors characterized the bitcoin surge during 2017. Unfortunately, there are some signs that retail interest has also increased sharply in recent months. For example, as we had argued previously the broadening of corporate support for bitcoin, e.g. via Paypal and Square, has been facilitating and enhancing over time the usage of bitcoin by Millennials. And while we do not yet have data for 4Q volumes, one way to gauge the impact from retail purchases via Paypal is to look at volumes on itBit. These volumes (Figure 12) had increased markedly since Oct 21st when Paypal announced the launch of services to enable trading and holding of cryptocurrencies. Admittedly volumes have slowed over the past two weeks pointing to some slowing in the retail impulse via Paypal.

|  | | Figure 12 |

- Another proxy suggesting increased retail participation is new account openings on ‘traditional’ cryptocurrency exchanges. Figure 13 below shows unique cryptocurrency wallet accounts on blockchain.com. While the number of accounts clearly has an increasing trend over time, there are sharp pickups in new wallet accounts during the retail-driven price spikes in end-2017 as well as mid- 2019. Since the start of November 2020, there has been a proportionally similar rise in new wallet accounts to those two previous episodes.

|  | | Figure 13 |

- Moreover, data on the distribution of bitcoin balances held in wallet accounts is also suggestive of retail participation. Figure 14 shows percentage change in total bitcoin held in wallet accounts by bucket of bitcoin balance, e.g. < 1 shows the % change in bitcoin held in wallet accounts with a balance of less than one bitcoin. It shows that between the start of 2020 and 2021 accounts with less than one bitcoin or between one and ten bitcoin have seen a marked increase in holdings that is more likely to be retail driven. Similarly, there has been a significant increase in balances held in accounts between 1,000 and 10,000 bitcoin, which is more likely to be institutionally driven. By contrast, balances held in accounts with more than 10,000 bitcoin have declined significantly, suggesting early investors and miners have been selling bitcoin to facilitate the increase of new entrants.

|  | | Figure 14 |

- In all, while bitcoin is currently trading within our fair value range of between $11k and $35k (at current levels of bitcoin volatility), the apparent peaking of the flow pace into the Grayscale Bitcoin Trust and a mechanically decay of our momentum signal till the end of March, both imply that the near term balance of risks is still skewed to the downside. In the long term, our theoretical price target of $146k is conditional on bitcoin vol converging to that of gold, which is not only likely to be multi-year process but would also depend on bitcoin ownership becoming more institutional and less retail over the coming years.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5629

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

January 29, 2021, 03:24:19 PM Merited by fillippone (2) |

|

Interesting reading, especially if we take into account that it was written by JPM, which still has a very high place in the world of finance. The report focuses in large part on comparisons of gold and Bitcoin, and interestingly, the Bitcoin market cap should grow by about x4.5 to reach the value of all private investment in gold, which includes gold ETFs. According to JPM, millennials will play a big role in this in the coming years because they prefer digital then physical gold.

The fact that Bitcoin has equalized gold in terms of risk capital says a lot, especially if we take into account the fact that gold ETFs have recorded an outflow of $7 billion in the last few months. If the trend of institutional investment continues, with the evident growth of investment from retail investors, JPM predicts that in 2021 it is realistic to expect the price of BTC from $50k - $100k.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 05, 2021, 10:00:43 AM

Last edit: May 16, 2023, 12:31:52 AM by fillippone |

|

Hello. I have been finally able to reproduce JPM Position proxy. They described it as: to infer positioning in bitcoin futures, we use our open interest position proxy methodology that we also apply to other futures contracts, where we look at the cumulative weekly absolute changes in the open interest multiplied by the sign of the futures price change every week. The rationale behind this position proxy is that when there is a price increase, the net long position of spec investors increases also with the magnitude of the increase determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can increase either via fresh longs (increase in open interest) or a reduction of previous shorts (reduction in open interest). And vice versa. When there is a price decrease, the net long position of spec investors decreases also, with the magnitude of the decrease determined by the absolute change in the open interest. It does not matter whether the open interest rises or falls, as the net long position can decrease either via fresh shorts (increase in open interest) or reduction of previous longs (reduction in open interest)

This the latest image:  This is what I got (added price for convenience):  This is the Spreadsheet I used for. Position Proxy IndicatorSadly, I haven't been able to find a publicly available source for aggregated open interest positions, maybe I have to dig a little bit more on tradingView. Also yes, it would be interesting if someone could reproduce this indicator in trading view! Stay tuned! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

beerlover

Legendary

Offline Offline

Activity: 2856

Merit: 1156

|

|

February 05, 2021, 05:23:35 PM Merited by JayJuanGee (1) |

|

It is awesome that JP Morgan type of companies are finally seeing what we have seen for a decade now. Bitcoin has always been a great investment if you could make it at a good level but these companies never really understood or seen that for a long time. We are finally seeing these companies making a change and they are really doing it for smart reasons as well basically validating what we have been doing so far.

Five years ago or so if you invested 100k into bitcoin all-in and you said it is going to go up people would say that you were gambling your money away and you would be losing a lot of money from that investment, today people are investing tens of billions of dollars into bitcoin from huge corporations, that 5 year change from 100k being risky to tens of billions of dollars is basically a way of saying people who bought bitcoin were smart people and not idiots like people claimed back then.

|

| | .

.Duelbits│SPORTS. | | | ▄▄▄███████▄▄▄

▄▄█████████████████▄▄

▄███████████████████████▄

███████████████████████████

█████████████████████████████

███████████████████████████████

███████████████████████████████

███████████████████████████████

█████████████████████████████

███████████████████████████

▀████████████████████████

▀▀███████████████████

██████████████████████████████ | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | ███▄██▄███▄█▄▄▄▄██▄▄▄██

███▄██▀▄█▄▀███▄██████▄█

█▀███▀██▀████▀████▀▀▀██

██▀ ▀██████████████████

███▄███████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

▀█████████████████████▀

▀▀███████████████▀▀

▀▀▀▀█▀▀▀▀ | | OFFICIAL EUROPEAN

BETTING PARTNER OF

ASTON VILLA FC | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | 10% CASHBACK

100% MULTICHARGER | │ | | │ |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 05, 2021, 11:07:22 PM |

|

It is awesome that JP Morgan type of companies are finally seeing what we have seen for a decade now. Bitcoin has always been a great investment if you could make it at a good level but these companies never really understood or seen that for a long time. We are finally seeing these companies making a change and they are really doing it for smart reasons as well basically validating what we have been doing so far.

Five years ago or so if you invested 100k into bitcoin all-in and you said it is going to go up people would say that you were gambling your money away and you would be losing a lot of money from that investment, today people are investing tens of billions of dollars into bitcoin from huge corporations, that 5 year change from 100k being risky to tens of billions of dollars is basically a way of saying people who bought bitcoin were smart people and not idiots like people claimed back then.

What puzzles me the most is how the banking sector, that has traditionally poached the best mind across all sectors, due to the financial power they had (for years salaries in the banking sector have been well above average), completely oversaw this opportunity. I can understand if we were talking about central bankers, the real target of the bitcoin revolution. But all other banks could well thrive in a new bitcoin standard, nevertheless, they decided to keep the eyes shut until the phenomenon was too big to ignore, and then they decided to ride it... |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

February 06, 2021, 06:41:27 AM |

|

I would not have expected stock values to lag that far behind bitcoin, considering stocks have been in a prolonged bull market for over a decade now--but nonetheless the bitcoin growth numbers are incredible! There's certainly been huge demand for it, particularly by all those companies that bought it as an alternative to cash (like MicroStrategy). Whew. It's been one hell of a year in many ways, but at least one positive that came out of 2020 is that bitcoin reached a new ATH.

Stocks typically return 8-10% annually in aggregate, so 15% is quite robust. You have to remember that this is an the entire asset class of all stocks, and it's weighed down by a significant number of under performers. You would see the same weighted down effect if you looked at the entire crypto asset class instead of just bitcoin, and crypto as a whole would be significantly weighed down by the vast majority of under achievers. There are plenty of individual stocks that have outperformed bitcoin in the time period shown in the graph, however the graph only shows a single asset versus a broad asset class, so it is misleading in that it's not a like comparison. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 06, 2021, 09:55:44 AM |

|

<...> There are plenty of individual stocks that have outperformed bitcoin in the time period shown in the graph, however the graph only shows a single asset versus a broad asset class, so it is misleading in that it's not a like comparison.

I do agree. Think of Tesla. The stock had a better return than Bitcoin this year. Not only, TSLA had a greater volatility than bitcoin during such period. This is something that I usually oppose to someone telling me "bitcoin is a toxic, volatile asset". |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

TheGreatPython

|

|

February 07, 2021, 03:32:46 PM |

|

This is a good thread and I noticed that other stocks/assets has been seriously lagging behind Bitcoin which has been seeing some huge increases in price. I am happy about that, and as we are now starting to have a lot of institutions that are becoming part of this great community I believe there will still be more to it, so I look forward to that. Stocks typically return 8-10% annually in aggregate, so 15% is quite robust.

Yep, I also noticed that, 15% is an improvement. Although in the case of bitcoin, I think it’s because it is still new and when it grows huge it might stop being as volatile, and the up and down wouldn’t be as much as it is now. |

|

|

|

|

aesma

|

|

February 07, 2021, 10:53:13 PM |

|

fillippone : good finds. I wouldn't use Tesla as a benchmark as it is overvalued as a company, and it's not that special, it's still a car company, with some technology that doesn't really work yet (self-driving).

Bitcoin on the other hand is its own beast, and it is special for a couple reasons, one being the limited supply, the other being the mother/father of crypto.

I'll keep that in mind : "current mining cost of $11k" and set up a buy order at that price...wait, I already did some time ago, I guess we think alike with JPM...

|

|

|

|

|

|