|

Dump3er

|

|

April 16, 2024, 12:09:32 PM Merited by JayJuanGee (2) |

|

-

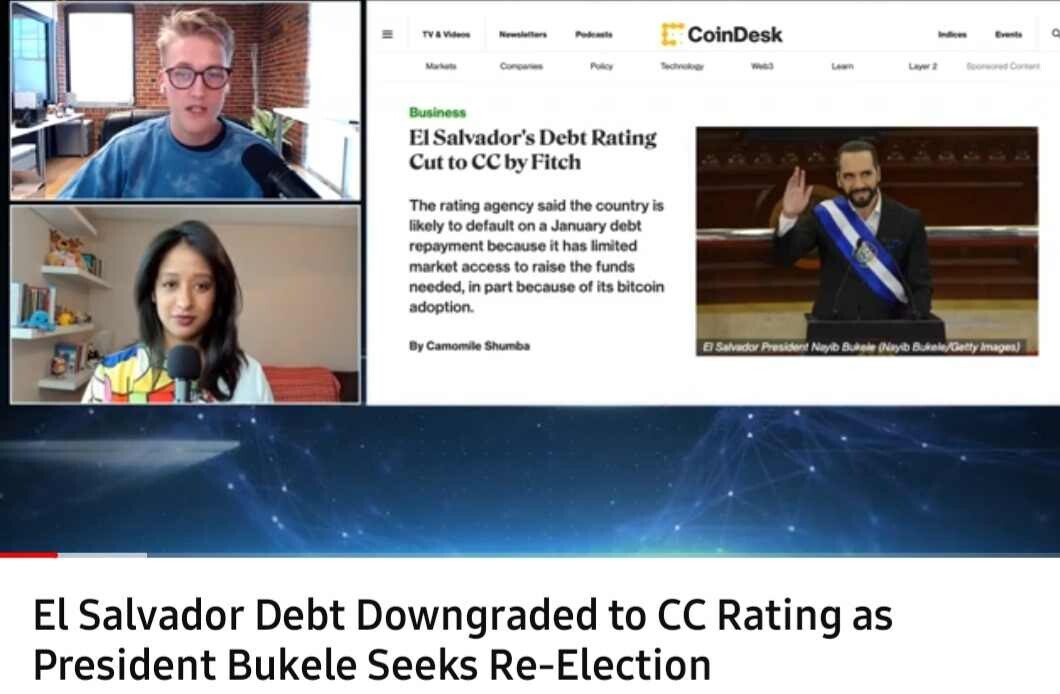

Our whole current monetary system revolves around debt. So it does not matter if we are talking about a country, an institution or an individual. If you are able to utilize debt without over extending yourself while able to service the debt for the purpose of investing rather than consumption, then that is a good use of debt. There is a difference between using debt for investing versus consumption or even if the investment is into something that has likely abilities to return more than it costs to service the debt versus if the thing that is invested into (or consumed) depreciates in value, so we likely need to figure out how the debt is being used in order to have some better sense regarding if it is a good debt or a bad debt. Terms of debt can also change, so in that regard, someone with good credit, good cashflow and various other highly valued assets (such as bitcoin) is going to be eligible to receive better terms for their abilities get into debt relationships. Not everyone is created equal and not all kinds of debt are created equal, and so it is quite likely that the building up of bitcoin as a held asset is going to put El Salvador in a better rather than a worse situation, even though right now, an overwhelming majority of status quo institutions don't necessarily recognize bitcoin as a good kind of an asset to hold.. but they are dumb in regards to bitcoin, and they are going to learn that bitcoin is the most pristine asset that exists, and that is where smart people, institutions and government are (and should be) putting their investments/savings/extra money. The place of bitcoin as a superior place to put money is asymmetric information that most people do not know or realize, and so the mere fact that other folks don't seem to know about bitcoin or to appreciate its power, does not mean that each of us, whether individuals, institutions or governments should not act upon our having had figured it out early.. and yeah, others are going to catch up, but it might take a while.. 20-50 years or more. Another interesting post of yours. You have mentioned many of the important aspects about debt, how debt isn't always the same. I have read articles where it was stated that during the interest rate hikes from 2022 until the end of 2023, some credit cards saw unbelievable raises in interest rates. That is why predictability is one important aspect to consider in terms of debt when it is used for investment and credit cards are probably the worst tools. There were rates that started just below 10% when interest was low in early 2022 and ended up well over 20% in 2023. The difference is massive and can get someone sneakily into trouble if attention isn't paid to the issue. even though right now, an overwhelming majority of status quo institutions don't necessarily recognize bitcoin as a good kind of an asset to hold. Do you think that this still holds true? Or is it possible that a lot of institutions don't necessarily admit in public that they are holding BTC or considering to acquire BTC? What status quo institutions are you mostly referring to here? The strategic relevance of BTC in global economics has been brought up a couple of times and it would be more than ignorant to not include BTC into a diversified portfolio strategy. Most people focus on what El Salvador has paid for their acquired BTC in total and what their holdings are worth now, but I think Bukelele was hoping for more cascade effects in terms of people and companies using favorable BTC conditions in the country. But the problem is that they are fighting so many other issues, like povery and a lack of food, which makes it close to impossible to mobilize positive sentiment for a country-wide experiment involving BTC. Sometimes I think it would have been even more interesting to see how a far more stable but still small country would have done. This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

In order to achieve higher forum ranks, you need both activity points and merit points.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 16, 2024, 03:19:01 PM |

|

even though right now, an overwhelming majority of status quo institutions don't necessarily recognize bitcoin as a good kind of an asset to hold. Do you think that this still holds true? Or is it possible that a lot of institutions don't necessarily admit in public that they are holding BTC or considering to acquire BTC? What status quo institutions are you mostly referring to here? I don't have any specific pieces of data that I would like to quote or be able to quote, yet I get the sense that we are still in very early stages of adoption whether we are attempting to analyze individual adoption, institutional adoption and/or governmental adoption. Sure some of them are accumulating bitcoin on the side to the extent that they are able to do that. Some institutions and governments have reporting obligations, but it does not mean that they report what they are doing, unless the laws are very strict on that, such as in the publicly held company has even more strict reporting obligations. Even with the recent introduction of bitcoin spot ETFs. Sure, they provided some avenues for some individuals, institutions and governments to get into BTC (or at least price exposure) who would not have otherwise been ready, willing and/or able to get into BTC, but even that obviously successful opening of a investment product seems to be in very early days, and ONLY the earliest of folks had gotten into BTC through that vehicle.. and yeah some of those who had been early into the ETF might have been overly greedy because they are trying to front run the ones who are coming in later, but the mere showing of a lot of interest at the start does not likely signify that those early entrants to the ETF represent large segment of institutions (and they well might not even be institutions, but instead a bunch of scattered individuals). I am pretty sure that the ETF providers are going to have some reporting requirements in regards to the composition of folks buying into their ETFs. The strategic relevance of BTC in global economics has been brought up a couple of times and it would be more than ignorant to not include BTC into a diversified portfolio strategy.

The truth of the matter is that a lot of the population is still ignorant about BTC. For years, we have been hearing that "everyone knows about bitcoin now," and related kinds of claims that attempt to imply bitcoin is mature or is maturing or needs to be considered as a mature asset, which largely is a bunch of bullshit. Sure, more and more people are learning about bitcoin, and they are hearing the word bitcoin, and even some folks are choosing to get involved in bitcoin, in case it catches on, but still merely hearing the word bitcoin and being able to say a few descriptive things about it, does not mean that people really know what bitcoin is, except in some superficial and likely inaccurate sense.. including many times the most immediate thoughts are going to be "oh wow, look at that bitcoin thing. Price has gone up a lot over the years. Too bad that I did not get some. It's too late to get in now." And then after they come to these superficial assessments, they either get on with their day or they will tend to have the same response, every time they come across the term bitcoin.. and another thing is that they most likely don't know the difference between bitcoin and crypto, so anything that comes up in the news related to crypto (aka various shitcoins or other projects), they may also summarily include that into their general presumption that it relates to bitcoin (which surely is not an untrue assessment - because there is likely quite a bit of ongoing reluctance or even perceived inabilities to really investigate into figuring out some more accurate information sources to be able to better able to sort through how bitcoin fits into the picture more specifically - and more importantly the sound money and individual autonomy attributes of bitcoin). By the way, you seem to be making quite a bit of presumptions regarding what an average person looks like, which is that most people are not already diversified investors, so yeah they might have some stake in their personal residence, and they might have a 401k (or some other retirement account) that includes the holdings of stocks and bonds (index funds), yet there are likely an overwhelming majority of folks who don't have any kinds of meaningful investments... so how are they going to think about a "diversified portfolio" when they are not already at that stage. Sure, even the folks who already have investments and a "diversified portfolio" are largely not choosing to include bitcoin into their holdings, and so they are still likely ignorant about bitcoin. I am not sure who comes to bitcoin first? It would seem that the already investing folks might at least have some ideas about how to invest, versus a lot of folks new to investing are either going to learn about investing, but they might come to investing as a form of gambling and/or trading, so it could take them a bit of time and mistakes before they learn the difference between trading/gambling and investing. Most people focus on what El Salvador has paid for their acquired BTC in total and what their holdings are worth now, but I think Bukelele was hoping for more cascade effects in terms of people and companies using favorable BTC conditions in the country. But the problem is that they are fighting so many other issues, like povery and a lack of food, which makes it close to impossible to mobilize positive sentiment for a country-wide experiment involving BTC. Sometimes I think it would have been even more interesting to see how a far more stable but still small country would have done.

We are stuck with the history that we have, and in some sense we are lucky that El Salvador has been so smart about their approach to bitcoin. Of course, they have challenges of poverty, which likely contributes to their inabilities to invest more into bitcoin, and maybe it already seems that they are being overly aggressive in their bitcoin investment, yet from my attempts to do the numbers, they seem to have a pretty whimpy investment into bitcoin (less than $400 million holdings of bitcoin and $7 billion of annual revenues), even though it seems to be a lot.. but at the same time, even that relatively seemingly whimpy investment into bitcoin is showing quite a bit about how bitcoin can be used responsibly to buttress a country's budget. This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Troytech

|

|

April 16, 2024, 03:51:34 PM

Last edit: April 16, 2024, 04:22:49 PM by Troytech |

|

This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). Considering shitcoins might turn to be the bad idea for el salvador, shitcoins are unpredictable and risky to invest in. Wouldn't it be better they get more aggressive with their bitcoin accumulation, cause I know its not been up to 4 years since they started accumulating bitcoin, so I can say they are still early investors and Considering how much they are investing yearly out of their budget its quite whimpy and no one can tell why, but I think they could redirect this cash for whatever plan they have with shitcoins into bitcoin and that would give them a better end result. I believe they should have experts informing them, so no one can tell if this decision would cause them loss I gain and moreover I think here should be prepared for what ever comes with shitcoins and also have losses in mind. How TREK Tech Corp Helped Me Recover $189,000 in Lost Cryptocurrency I am writing this testimony to express my deepest gratitude to TREK Tech Corp for their exceptional service in helping me recover my lost cryptocurrency assets. In a world where digital assets are vulnerable to various threats, their expertise and professionalism were instrumental in retrieving what seemed lost forever. Several months ago, I found myself in a distressing situation when I discovered that $189,000 worth of cryptocurrency had vanished from my accounts due to a cyber attack. It was a devastating blow, both financially and emotionally. I tried various avenues to recover my assets but to no avail. That's when I came across TREK Tech Corp. From the moment I contacted them, I was impressed by their prompt response and willingness to assist. Their team of experts demonstrated a deep understanding of blockchain technology and cyber security, instilling confidence in their ability to tackle even the most challenging cases. They conducted a thorough investigation, utilizing advanced tools and techniques to trace the whereabouts of my lost funds. Throughout the process, TREK Tech Corp maintained clear and transparent communication, keeping me informed of their progress every step of the way. Their dedication and professionalism were truly commendable, and it was evident that they were committed to achieving a successful outcome. Thanks to the tireless efforts of the TREK Tech Corp team, I am thrilled to say that my lost cryptocurrency assets have been fully recovered. It's a testament to their expertise and unwavering commitment to their clients' success. I cannot thank them enough for their invaluable assistance during this challenging time. I wholeheartedly recommend TREK Tech Corp to anyone facing similar challenges with lost files, data, or assets. Their proven track record and dedication to client satisfaction make them the go-to choice for any digital recovery needs. Don't hesitate to reach out to them – they truly are the best in the business. Email: trektechcorp1@gmail.com / trektechcorp@consultant.com. A lot is damn fishy about you for a brand new account, many users would take a while to locate threads and start posting but you just created the account and you know what to do, no one cares about your Tech companies, our discussion here is for bitcoin alone and don't come spreading lies or misleading information here or promote any scam company. |

|

|

|

|

jossiel

|

|

April 16, 2024, 04:29:44 PM Merited by JayJuanGee (1) |

|

This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). I have a bad feeling about this tokenization that Bitfinex is introducing to El Salvador. There have been projects that are into this debt tokenization in the past IIRC that most of them didn't do well. Or let's just start with those lending/borrowing platforms that not all of them thrived and some did even filed for bankruptcy. While this is a RWA type of project, I'm not optimistic about it if that's going have good result with it but good luck with the construction. |

Signature for rent

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 16, 2024, 06:10:01 PM |

|

This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). Considering shitcoins might turn to be the bad idea for el salvador, shitcoins are unpredictable and risky to invest in. Wouldn't it be better they get more aggressive with their bitcoin accumulation, cause I know its not been up to 4 years since they started accumulating bitcoin, so I can say they are still early investors and Considering how much they are investing yearly out of their budget its quite whimpy and no one can tell why, but I think they could redirect this cash for whatever plan they have with shitcoins into bitcoin and that would give them a better end result. Countries have complicated set ups and relationships and infrastructures that they have to support, build and incentivize, so they are not really in a position to just sit back and invest without putting capital to work and/or putting their own status to work in terms of generating business in their countries and at the same time making sure that citizens are supported and incentivized to build and be productive. And, in regards to shitcoins, there are so many different ways that they can get involved in that, and some of those ways could be closer pegged to bitcoin, yet some of the ways could deviate from the ideas of bitcoin, if they fall down the rabbit hole of overly issuing debt (and/or tokens) which could bring them back into various fiat traps - so I am not even proclaiming that there might not be responsible ways to both maintain their bitcoin focus, while at the same time attempting to be creative in terms of various kinds of innovations that will still help to build their country and to facilitate the right kinds of sound money and responsible incentives. I believe they should have experts informing them,

They already have experts helping them. How do you think that they got as far as they have so far? Maybe we could quibble that they don't have the right experts or they are going down the wrong paths, but no government can be just run by a few people, so there are various ongoing reliances on people who are experts and some of the "experts" may well be learning along the way too, especially since there may well be new ways of innovating, even while there also might be traditional financial instruments that are also included in the mix of prioritizng, technical set ups and execution of plans. so no one can tell if this decision would cause them loss I gain and moreover I think here should be prepared for what ever comes with shitcoins and also have losses in mind.

There has always been some balancing of shitcoins in El Salvador, since they did not make shitcoins illegal, and even some of the past "technological initiatives" that El Salvador had passed could have had been considered to be shitcoin friendly, since they were not hostile to shitcoins... and sometimes it is not always clear about how much a shitcoin might be distracting from aspects of El Salvador's mission. [edited out]

A lot is damn fishy about you for a brand new account, many users would take a while to locate threads and start posting but you just created the account and you know what to do, no one cares about your Tech companies, our discussion here is for bitcoin alone and don't come spreading lies or misleading information here or promote any scam company. There is no reason to quote obvious shilling/scamming accounts. You can just hit the "report to moderator" link so that the moderator will be made aware sooner rather than later.. and probably, Troytech, you should delete your re-quoting of that richardcarter20221 information in your post - other wise you could get accused of promoting such.. or maybe your post will also get deleted from the thread (which richardcarter20221 is probably soon going to end up as a banned account). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Obulis

Jr. Member

Offline Offline

Activity: 83

Merit: 3

|

|

April 18, 2024, 07:37:40 AM |

|

Some new data on the situation with the migration of the population of El Salvador to neighboring countries in order to get good and well-paid jobs in these countries. And then send part of the money you earn to El Salvador to your family, parents or other close relatives. This process has been going on for quite some time, and in particular, with the introduction of BTC into legal circulation in El Salvador, the Bukele government planned to reduce by transferring money in BTC the cost of commissions for cross-border payments, which in the case of payments in $ with the participation of international financial corporations were very large. Sometimes these fees exceed 25% of the $ amount transferred. However, Salvadorans still make very few cross-border transfers using BTC conversion. But let’s hope that the percentage of such transfers in BTC will gradually increase. Since this is a good option not to lose your earned money on cross-border transfer fees. In the summarized data of the public organization opposition to the Bukele government “Association of Human Rights “Maria Julia Hernandez” noted, that in the period 2019-2023: 93.0% of remittances came to El Salvador from the United States, or $7,606 million. From Canada, Salvadorans sent $79.4 million to the country; From Spain with $48.7 million. From Italy with $45 million. From the UK with $13 million. The report also notes that the Salvadoran economy is more dependent on generating foreign exchange for household remittances than on direct exports of goods or services. Remittances total more than $1.2 billion in the last two months. The experts who wrote the repot note that the increase in the flow of remittances also indicates an increase in the number of Salvadorans who are forced to migrate. “The most logical explanation is that more and more migrants are sending money to their families,” they wrote. From your update here, it implies that Salvadorans has an economic plan they are working on of which making BTC a legal tender is part of it. |

|

|

|

|

delfastTions

Legendary

Offline Offline

Activity: 2716

Merit: 1471

|

|

April 19, 2024, 04:42:22 AM Merited by JayJuanGee (1) |

|

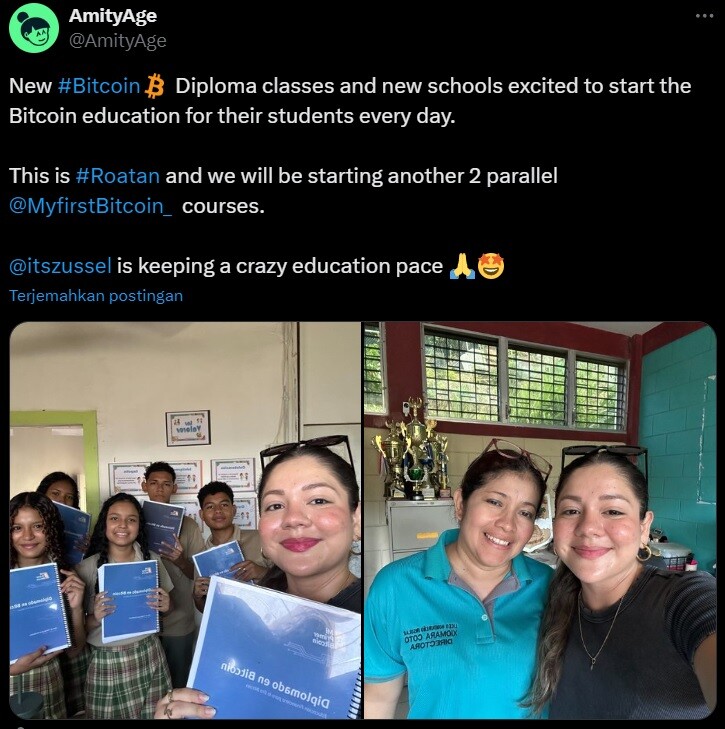

~snip ~

From your update here, it implies that Salvadorans has an economic plan they are working on of which making BTC a legal tender is part of it. Here, perhaps, some clarification should be given on the issue of cross-border payments to El Salvador, as I found out earlier mainly from the USA (93% of all cross-border payments to El Salvador are from the US). So: One of the main goals of the legalization of BTC in El Salvador in September 2021 was the hope of the country's government that cross-border payments from the USA to El Salvador would increasingly be carried out in bitcoins. At the same time, the fee for transferring money across the country’s borders was very significantly reduced, almost exclusively by spending on the commission for the transaction. And international money transfer companies such as Western Union or PayPal charged excessive fees for transfers of dollars, which are El Salvador's legal currency. El Salvador actually has only two legal currency units - US$ and BTC. Since 2004, the country's own currency, “Colon,” ceased to exist. However: It turned out that in the total mass of transfers from the USA to El Salvador, the share of transfers in Bitcoin began to be about 2.5%, then this share decreased to about 1.5%. This, I think, is due to the difficulties when Salvadorans working in the US purchase bitcoins on legal exchanges or otherwise. There are probably additional dollar costs when purchasing BTC in the US itself. In addition, not all Salvadorans who work in the US and their family members in El Salvador are able to master payments in BTC. That is why the percentage of cross-border transfers to BTC is so small. But we can hope that the percentage of Salvadorans using cross-border transfers to BTC will gradually increase. This is due to the increasing literacy of the population in the use of cryptocurrencies and the fact that the new generation of Salvadorans already understands blockchain technology well, since they take appropriate training courses at school. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|

Dump3er

|

|

April 20, 2024, 02:59:18 PM Merited by JayJuanGee (1) |

|

even though right now, an overwhelming majority of status quo institutions don't necessarily recognize bitcoin as a good kind of an asset to hold. Do you think that this still holds true? Or is it possible that a lot of institutions don't necessarily admit in public that they are holding BTC or considering to acquire BTC? What status quo institutions are you mostly referring to here? I don't have any specific pieces of data that I would like to quote or be able to quote, yet I get the sense that we are still in very early stages of adoption whether we are attempting to analyze individual adoption, institutional adoption and/or governmental adoption. Sure some of them are accumulating bitcoin on the side to the extent that they are able to do that. Some institutions and governments have reporting obligations, but it does not mean that they report what they are doing, unless the laws are very strict on that, such as in the publicly held company has even more strict reporting obligations. Even with the recent introduction of bitcoin spot ETFs. Sure, they provided some avenues for some individuals, institutions and governments to get into BTC (or at least price exposure) who would not have otherwise been ready, willing and/or able to get into BTC, but even that obviously successful opening of a investment product seems to be in very early days, and ONLY the earliest of folks had gotten into BTC through that vehicle.. and yeah some of those who had been early into the ETF might have been overly greedy because they are trying to front run the ones who are coming in later, but the mere showing of a lot of interest at the start does not likely signify that those early entrants to the ETF represent large segment of institutions (and they well might not even be institutions, but instead a bunch of scattered individuals). I am pretty sure that the ETF providers are going to have some reporting requirements in regards to the composition of folks buying into their ETFs. Yes, there are reporting requirements, but there are a thousand ways to let asset or liability positions run under names in the balance sheet that will never reflect a "true and fair statement". Now, of course it could be true and fair. But there is scope and in most cases these things only go wrong if the bet doesn't pay off. Otherwise, nobody asks questions. BTC is a very interesting bet to everyone around the world and those who can take some volatility without sweating during the night, will probably take that volatility either with or without the highest reporting standards. If they have to, ok. But seriously, there is a way for anyone wealthy and important enough in this world to accumulate some asset without any other parties knowing at least in the short term. i could blow up at some point, but not necessarily in the short term. I know this is very speculative, but yeah. The strategic relevance of BTC in global economics has been brought up a couple of times and it would be more than ignorant to not include BTC into a diversified portfolio strategy.

The truth of the matter is that a lot of the population is still ignorant about BTC. For years, we have been hearing that "everyone knows about bitcoin now," and related kinds of claims that attempt to imply bitcoin is mature or is maturing or needs to be considered as a mature asset, which largely is a bunch of bullshit. Sure, more and more people are learning about bitcoin, and they are hearing the word bitcoin, and even some folks are choosing to get involved in bitcoin, in case it catches on, but still merely hearing the word bitcoin and being able to say a few descriptive things about it, does not mean that people really know what bitcoin is, except in some superficial and likely inaccurate sense.. including many times the most immediate thoughts are going to be "oh wow, look at that bitcoin thing. Price has gone up a lot over the years. Too bad that I did not get some. It's too late to get in now." And then after they come to these superficial assessments, they either get on with their day or they will tend to have the same response, every time they come across the term bitcoin.. and another thing is that they most likely don't know the difference between bitcoin and crypto, so anything that comes up in the news related to crypto (aka various shitcoins or other projects), they may also summarily include that into their general presumption that it relates to bitcoin (which surely is not an untrue assessment - because there is likely quite a bit of ongoing reluctance or even perceived inabilities to really investigate into figuring out some more accurate information sources to be able to better able to sort through how bitcoin fits into the picture more specifically - and more importantly the sound money and individual autonomy attributes of bitcoin). I have nothing more to say about this. Truth is truth. In some way some people might argue we claim to know what the truth is, but well, let them argue against it.  By the way, you seem to be making quite a bit of presumptions regarding what an average person looks like, which is that most people are not already diversified investors, so yeah they might have some stake in their personal residence, and they might have a 401k (or some other retirement account) that includes the holdings of stocks and bonds (index funds), yet there are likely an overwhelming majority of folks who don't have any kinds of meaningful investments... so how are they going to think about a "diversified portfolio" when they are not already at that stage. Sure, even the folks who already have investments and a "diversified portfolio" are largely not choosing to include bitcoin into their holdings, and so they are still likely ignorant about bitcoin.

I am not sure who comes to bitcoin first? It would seem that the already investing folks might at least have some ideas about how to invest, versus a lot of folks new to investing are either going to learn about investing, but they might come to investing as a form of gambling and/or trading, so it could take them a bit of time and mistakes before they learn the difference between trading/gambling and investing. You got me wrong here I think. I said that the big actors in the game should know what a diversified portfolio is supposed to include and ignoring BTC 100% can only be 100% wrong. Most of them should know as their investment departments hopefully do not only consist of blind idiots. There is an elasticity factor at work. Some actors believe to know that 1%exposure means 10% risk more to them. Some have some other ratio. But I'd be shocked if the majority would still refuse to look at BTC as a must have. I am not talking about rations, just about the consideration to understand that BTC can't be ignored. Most people focus on what El Salvador has paid for their acquired BTC in total and what their holdings are worth now, but I think Bukelele was hoping for more cascade effects in terms of people and companies using favorable BTC conditions in the country. But the problem is that they are fighting so many other issues, like povery and a lack of food, which makes it close to impossible to mobilize positive sentiment for a country-wide experiment involving BTC. Sometimes I think it would have been even more interesting to see how a far more stable but still small country would have done.

We are stuck with the history that we have, and in some sense we are lucky that El Salvador has been so smart about their approach to bitcoin. Of course, they have challenges of poverty, which likely contributes to their inabilities to invest more into bitcoin, and maybe it already seems that they are being overly aggressive in their bitcoin investment, yet from my attempts to do the numbers, they seem to have a pretty whimpy investment into bitcoin (less than $400 million holdings of bitcoin and $7 billion of annual revenues), even though it seems to be a lot.. but at the same time, even that relatively seemingly whimpy investment into bitcoin is showing quite a bit about how bitcoin can be used responsibly to buttress a country's budget. This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). I am a friend and an enemy of experiments at the same time. Sometimes I ask myself whether that is fair. I think people trying new things can never hurt because it either contributes to BTC's manifestation as the only rock solid innovation, or they prove a case. But there should be room for experimentation. I was part of a project a decade ago and I enjoyed it so much. I didn't make money from it because even though my name is dump3er, I didn't dump anything. But I enjoyed projects. This is where I would like to ask you about your position: don't you think it is good to have people experiment around? The fuck ups are something I take into account. I took part or supported a project I found really cool a decade ago. Today I know it never had a chance. But back at the time it was never a bad intention to scam someone. Engaging in projects is never wrong I think. I did it because I love the tech. I did all the things, mining, setting up my own wallets, making them safer over time, learning from the community and so on and so forth. It was fun. Indeed, I have become a BTC semi-maximalist over time. But I would still want people to try to come up with something better. Never easy to keep up with you. Waiting for your next challenge to answer. Damn, how do you do this... |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 20, 2024, 10:08:32 PM |

|

By the way, you seem to be making quite a bit of presumptions regarding what an average person looks like, which is that most people are not already diversified investors, so yeah they might have some stake in their personal residence, and they might have a 401k (or some other retirement account) that includes the holdings of stocks and bonds (index funds), yet there are likely an overwhelming majority of folks who don't have any kinds of meaningful investments... so how are they going to think about a "diversified portfolio" when they are not already at that stage. Sure, even the folks who already have investments and a "diversified portfolio" are largely not choosing to include bitcoin into their holdings, and so they are still likely ignorant about bitcoin.

I am not sure who comes to bitcoin first? It would seem that the already investing folks might at least have some ideas about how to invest, versus a lot of folks new to investing are either going to learn about investing, but they might come to investing as a form of gambling and/or trading, so it could take them a bit of time and mistakes before they learn the difference between trading/gambling and investing. You got me wrong here I think. I said that the big actors in the game should know what a diversified portfolio is supposed to include and ignoring BTC 100% can only be 100% wrong. Most of them should know as their investment departments hopefully do not only consist of blind idiots. There is an elasticity factor at work. Some actors believe to know that 1%exposure means 10% risk more to them. Some have some other ratio. But I'd be shocked if the majority would still refuse to look at BTC as a must have. I am not talking about rations, just about the consideration to understand that BTC can't be ignored. We might be talking over each other a bit, and maybe I am the one who is deviating from points in this thread, which is about what a country is doing in regards to their investments into bitcoin, including their encouraging and creating incentive systems for the involvement of individuals and institutions to invest into bitcoin - yet surely when it comes to larger players, such as governments, institutions and even richer folks, then, as you say, they likely should be considering ways to diversify their investment and to make sure that they get off of zero.. .. and so yeah, I agree that zero is the wrong answer - yet still I stand by my other points regarding smaller players might not even be in the habit of investing, and perhaps that also goes into governments too, since the IMF, world bank and other outside institutions seem to love to push various governments into living off of debt, they really are not so likely to even encouraging either self-sustainability and/or strong investments from countries.. but instead seem tor frequently want to put countries into pickles and even dependency relationships so that they cannot exercise self-sovereignty or systems that are sustainable and growable for their own countries... which likely goes back to why international institutions are continuing to act so hostly regarding El Salvador's investment into itself through its investment into bitcoin. Most people focus on what El Salvador has paid for their acquired BTC in total and what their holdings are worth now, but I think Bukelele was hoping for more cascade effects in terms of people and companies using favorable BTC conditions in the country. But the problem is that they are fighting so many other issues, like povery and a lack of food, which makes it close to impossible to mobilize positive sentiment for a country-wide experiment involving BTC. Sometimes I think it would have been even more interesting to see how a far more stable but still small country would have done.

We are stuck with the history that we have, and in some sense we are lucky that El Salvador has been so smart about their approach to bitcoin. Of course, they have challenges of poverty, which likely contributes to their inabilities to invest more into bitcoin, and maybe it already seems that they are being overly aggressive in their bitcoin investment, yet from my attempts to do the numbers, they seem to have a pretty whimpy investment into bitcoin (less than $400 million holdings of bitcoin and $7 billion of annual revenues), even though it seems to be a lot.. but at the same time, even that relatively seemingly whimpy investment into bitcoin is showing quite a bit about how bitcoin can be used responsibly to buttress a country's budget. This is another experiment that could bring interesting results over the course of the next few years. El Salvador is trying while other countries are holding back without good reason. It surely can be dangerous if El Salvador tries to overly fuck around with shitcoins, and so it could end up having some slippery-slope effects if they are not able to keep some of there debt issuance (token creation) or whatever are the details in check, and so within any of their bitcoin adoption, they are still needing to dance around real world dynamics, and hopefully they do not end up losing their way or becoming hypocrites in their actual real world practices. With any of these discretionary matters, there sometimes might need to be some practicalities, and I am not going to presume that they are going overboard in whatever shitcoins they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes). I am a friend and an enemy of experiments at the same time. Sometimes I ask myself whether that is fair. I think people trying new things can never hurt because it either contributes to BTC's manifestation as the only rock solid innovation, or they prove a case. But there should be room for experimentation. I was part of a project a decade ago and I enjoyed it so much. I didn't make money from it because even though my name is dump3er, I didn't dump anything. But I enjoyed projects. This is where I would like to ask you about your position: don't you think it is good to have people experiment around? People can do what they like, and surely a bitcoin first strategy is likely going to help to guide value - and if people are experimenting for the mere sake of experimenting and cannot identify where the value is, then they likely are going to get sucked into nonsense.. it can be a slippery slope when someone might fall off of the ability to distinguish what is valuable from what is not valuable. they are allowing to seep into various aspects of their budgeting matters (or various projects that might seem ambiguous in regards to going down shitcoin routes).

They might have ways to make sure that they are emphasizing the right things. Of course, in some ways the obligations of governments tend to be different from individuals in terms of their need to attempt to play neutrals, act in the public interest and create balanced incentives. The fuck ups are something I take into account. I took part or supported a project I found really cool a decade ago. Today I know it never had a chance. But back at the time it was never a bad intention to scam someone. Engaging in projects is never wrong I think.

We cannot always know if we are being scammed, and some projects they raise money before they have done anything, so there likely needs to be some balancing in terms of the project getting paid for delivering rather than getting paid in advance and not delivering, even if they say (and the facts seem to support) that they had good intentions to carry out their end of the bargain. I did it because I love the tech. I did all the things, mining, setting up my own wallets, making them safer over time, learning from the community and so on and so forth. It was fun. Indeed, I have become a BTC semi-maximalist over time. But I would still want people to try to come up with something better.

For sure, people can learn more when they have ways to interact rather than being passive... so getting involved in various activities can be a learning experience, yet no one likes being duped into something that was different from what they had thought it was going to be. Never easy to keep up with you. Waiting for your next challenge to answer. Damn, how do you do this...

I try to just do one post at a time, and sometimes quoting my other posts (or some other content) in order to make it easier for me to try NOT to repeat myself too much in ways that would be overly boring. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

FinePoine0

Full Member

Offline Offline

Activity: 392

Merit: 122

★Bitvest.io★ Play Plinko or Invest!

|

|

April 21, 2024, 05:50:46 AM |

|

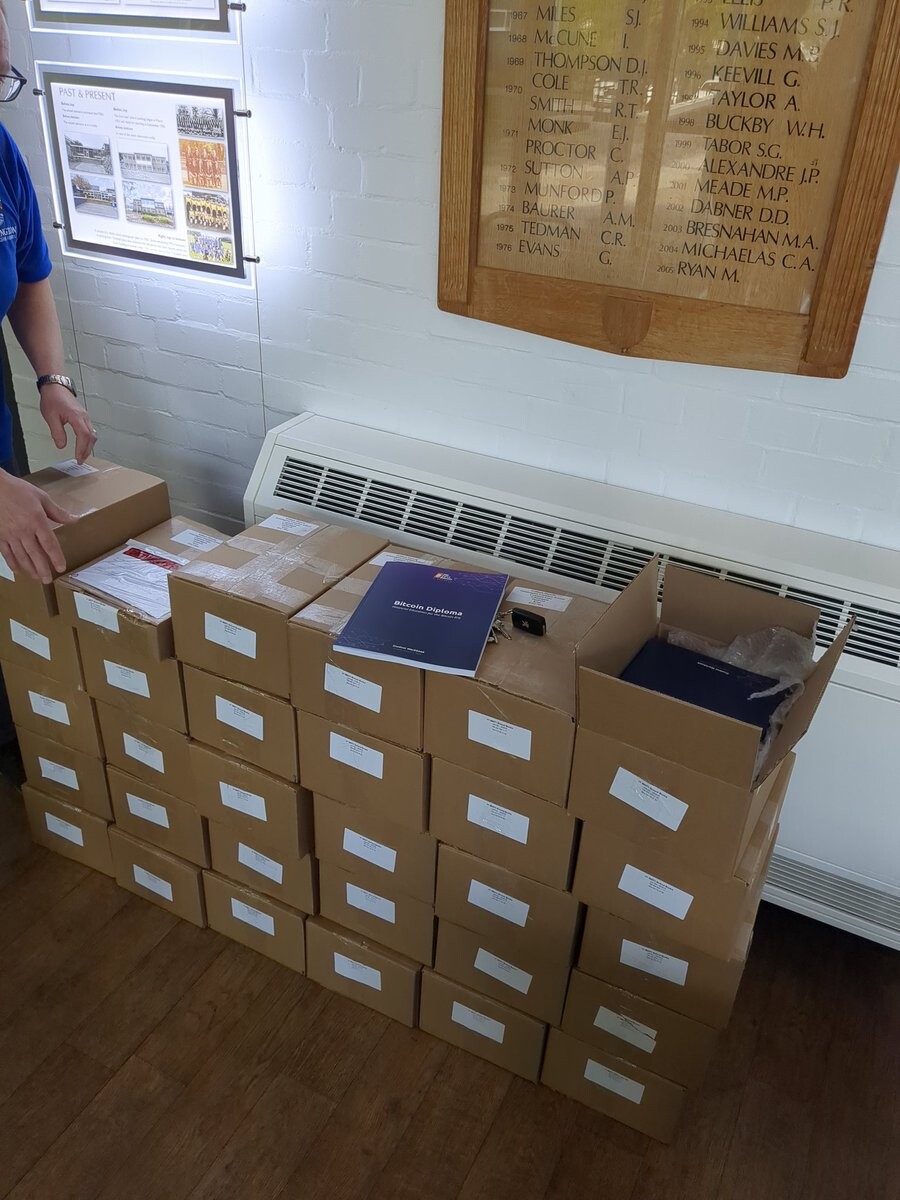

NEW: #Bitcoin education is spreading from 🇸🇻 El Salvador to the 🇬🇧 UK 👀 Source Link Below are 500 copies of the My First Bitcoin Student Workbook to be distributed across Great Britain 🙌 El Salvador's Bitcoin education has created such a stir in the outside world that many developed countries have also expressed interest in adopting Bitcoin. And the education being taught in El Salvador has praised everyone about Bitcoin, thanks only to the President of El Salvador, Nayeb Buquel, who has taken steps to teach Bitcoin to the people of his country. Just praise for that. |

|

|

|

|

Popkon6

|

|

April 24, 2024, 10:27:30 AM Merited by JayJuanGee (1) |

|

Bitfinex Securities Introduces El Salvador’s First Tokenized Debt to Fund New Hilton Hotel  YouTube Video Link: https://youtu.be/4AzrtViez8M?si=69E9gFXCJW06BhbiBitfinex Securities, El Salvador’s first registered and licensed digital asset provider, has said it is introducing a tokenized debt issue to construct and develop a Hampton by Hilton hotel complex at the country’s international airport. The token will be issued under the ticket HILSV and will be traded against the U.S. dollar and tether (USDT). HILSV will be issued on the Liquid Network, a bitcoin sidechain, according to a press release. The issuance comes as tokenization continues to ramp up, with new offerings cropping up every month, providing new tools for investors and traders. Debt tokenization is the process whereby traditional debt instruments, such as bonds or loans, are converted into digital tokens on blockchains. Source Link: https://www.coindesk.com/business/2024/04/11/bitfinex-securities-introduces-el-salvadors-first-tokenized-debt-to-fund-new-hilton-hotel/ |

|

|

|

|

wmaurik

|

|

April 27, 2024, 05:17:05 AM |

|

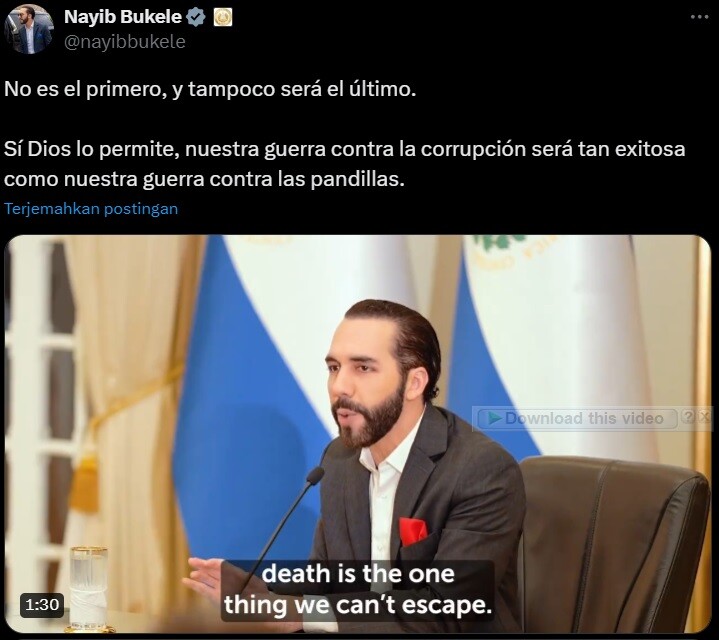

Yesterday the president of El Salvador made a statement in his meeting that they would be successful in fighting corruption like they have been successful in fighting gangs so far and Nayib Bukele said via his X account that it would not be the first and not the last either. This means that Nayib Bukele will continue to fight things that have a bad impact on the country and its citizens in order to be able to succeed in several good programs that he has wanted all this time, especially at the level of learning and adopting Bitcoin for all his citizens. Additionally, new Bitcoin Diploma Classes and new schools are eager to start Bitcoin education for their students every day. And this will be carried out by the school through @MyfirstBitcoin_ by starting on 2 parallel paths. This was revealed by @AmityAge via his X account two days ago and I think this is part of a new development that is starting to spread to every school.   |

|

|

|

|

Luzin

|

|

April 28, 2024, 10:05:43 AM Merited by JayJuanGee (1) |

|

I wrote this in a local thread as well. Regarding the Chivo Wallet VPN data breach used by El Salvador. They are CiberInteligenciaSV. CiberInteligenciaSV has hacked and leaked the source code and VPN access credentials of the Chivo Wallet ATM network plus the personal data of 5.1 million user El Salvador. I have not yet heard how El Salvador's official statement. Source: 1. https://cointelegraph.com/news/el-salvador-hacks-leak-state-bitcoin-wallet2. https://www.bitdegree.org/crypto/news/hackers-leak-source-code-of-el-salvadors-bitcoin-wallet |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

Popkon6

|

|

April 28, 2024, 02:15:25 PM |

|

Leaked Personal Info of Over 5 Million Salvadorans Apparently Linked to Chivo Wallet A database with the personal information of over 5 million Salvadorans was recently leaked in a data breach forum. The database, which has been around since August and has recently been linked to Chivo, El Salvador’s national cryptocurrency wallet, has 144GB of data, including the full name, unique identity number, date of birth, address, and an HD pic of every user. 5 Million Salvadorans’ Personal Data Leak Recently Linked to Chivo Wallet A data hack that exposed the personal information of over 5 million Salvadorians has been linked to Chivo, the Salvadoran cryptocurrency wallet, in social media. The database, available for purchase through different channels since August, was leaked for free recently, allowing criminals to use it illegally. The file, which has over 144GB of data, includes the full name, unique identity number, date of birth, address, telephone, email, and a picture of every citizen included in it. Source Link: https://news.bitcoin.com/leaked-personal-info-of-over-5-million-salvadorans-apparently-linked-to-chivo-wallet/#google_vignette |

|

|

|

|

Aanuoluwatofunmi

|

|

May 01, 2024, 01:11:25 PM |

|

https://twitter.com/LibertyCappy/status/1785142799018467610?t=jSxwoI22mn1RFSUMhFbphQ&s=19 https://twitter.com/LibertyCappy/status/1785142799018467610?t=jSxwoI22mn1RFSUMhFbphQ&s=19Considering one of the things to learn and impact from Bitcoin adoption is the equal opportunity it has rendered for everyone to have access for it's adoption, likewise the government will always keep to maintain and try it's possible best in seing that everyone has the same mentality of this equality of human rights to live up to their desired expectations. This make the government led by the Nayib Bukele Administration to emphasize on this that gender ideology be banned in El-Salvador and it's corresponding public schools among pupils, with this, we already know and have it in mind that transformation in El-Salvador is without boarders and has also been an unending lifetime memorable achievements ever since after Bitcoin adoption. |

|

|

|

|

legiteum

|

|

May 01, 2024, 02:58:01 PM |

|

Leaked Personal Info of Over 5 Million Salvadorans Apparently Linked to Chivo Wallet

A database with the personal information of over 5 million Salvadorans was recently leaked in a data breach forum. The database, which has been around since August and has recently been linked to Chivo, El Salvador’s national cryptocurrency wallet, has 144GB of data, including the full name, unique identity number, date of birth, address, and an HD pic of every user.

So citizens in El Salvador don't actually use Bitcoin in a decentralized way--they might as well be using a government-run central bank. Good to know. So while everybody here is excited about anything that promotes their investment in Bitcoin no matter what it is, it's worth noting that this is just one more installment of the government boondoggle that has been El Salvador's (unsuccessful) forcing of Bitcoin upon its citizens. I've said in many other threads that asking for Bitcoin to be dubbed "legal tender" by the government, thereby forcing Bitcoin on citizens whether they want it or not, is immoral, impractical and foolish. This is just one example of what happens. |

|

|

|

delfastTions

Legendary

Offline Offline

Activity: 2716

Merit: 1471

|

|

Today at 07:24:52 AM

Last edit: Today at 07:38:41 AM by delfastTions Merited by JayJuanGee (1) |

|

With great interest, I found out that it turns out that a plant producing chips (also known as fixed electronic capacitors) has been operating in El Salvador for a long time. The plant has long been considered in the El Salvadoran economy as a “star product of the industry”, since it is the exclusive plant of the Japanese company Kyocera AVX. The plant is located in the free zone of San Bartolo, Ilopango, which began operations back in 1977. Salvadoran supplies from this enterprise to the world market amounted to $40.9 million in the first quarter of 2024. However, this is still at least $12.2 million less than the $53 million for the same period in 2023. By the way, in 2002, apparently after the Covid epidemic and also due to the deterioration of international relations, the export of electronic capacitors exceeded $259.9 million and became the fourth best-selling product exported from El Salvador in terms of financial volume according to statistics from the Central Reserve Bank (BCR). True, now this product occupies sixth position in exports with a share of 2.65% in total exports. But this is also a lot. But also the only product belonging to the section of high-tech products. And it should be especially noted that this product is produced only in El Salvador. Electronic capacitors are in great demand in various industries such as automobiles, telecommunications, mobile phones and space satellites. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|