US real estate prices are looking frothy, according to central bank researchers. The US Federal Reserve (the Fed) recently updated its exuberance index for Q2 2021. The little-known index exists to identify housing bubbles early, to minimize damage. For the first time since 2007, that indicator is now warning that US real estate prices are in a bubble. Did the Fed even notice?

The US Federal Reserve Exuberance IndexExuberance might sound like a good thing, but when economists say it — lookout. If asset buyers are said to be exuberant, they’re excitedly paying emotional premiums. These premiums are above fundamentals, paid because people think prices will always rise. If buyers are exuberant for an extended period, the whole market can become exuberant. Exuberant buyers no longer stand out in contrast to rational buyers. It’s been happening just long enough that people think it’s the new market normal.

After the US housing bubble nearly took down the global economy, housing became a focus. Previously, experts thought real estate was local. Now they’ve come to learn that exuberant homebuyers can take down a whole economy if left unchecked. Consequently, researchers set out to design this exuberance indicator, to help identify bubbles.

The exuberance index works by identifying explosive growth in home prices. Explosive growth is just another way of saying growth above fundamentals. The longer a market strays from fundamentals, the greater the odds it needs a correction. If the whole market shows persistent exuberance, it will require a correction to make it efficient. The central bank can minimize the economic fallout by identifying these issues early.

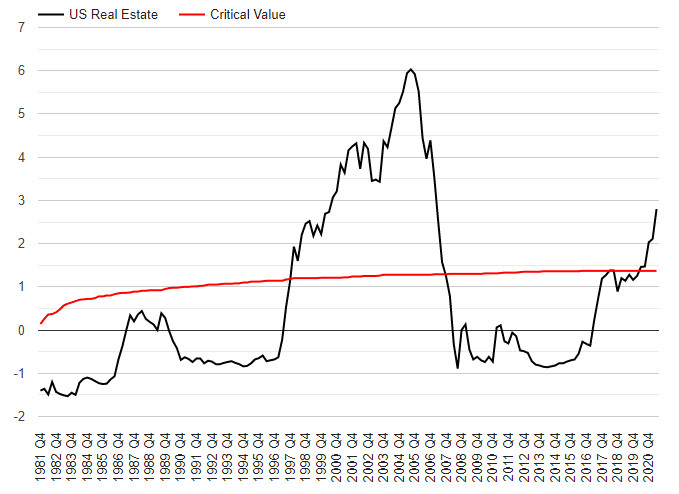

How To Read The Exuberance IndexThe Dallas Fed did all of the hard work, and analysts just have to learn how to read a straightforward data set. We’ve graphed two values — the exuberance indicator and critical threshold. If the exuberance rises above the critical threshold, buyers are exuberant. If the market prints five consecutive exuberant quarters, the whole market is exuberant. An exuberant real estate market is better known as a real estate bubble.

US Real Estate Has Entered Its First Bubble Since 2005American real estate buyers are displaying obvious signs of exuberance. The exuberance index read 2.8 in Q2 2021, more than double the 1.37 threshold needed to seem bubbly. The most recent quarter was the fifth above the threshold, making it officially a bubble. Home prices across the US have been on the rise for a few years now, but they’ve only just begun to show exuberant growth. American housing is in its first national bubble since 2007.

US Real Estate Exuberance IndexThe US Federal Reserve Exuberance Index for American real estate, and critical value threshold. A market that is above the threshold for 5 consecutive quarters is considered to be exuberant.

Source: US Federal Reserve; Better Dwelling.

The last time this indicator showed bubble-like behavior was back in 2007. That run first produced a warning from Q1 1998 until finally falling below the threshold in Q3 2007. That’s 39 quarters or 9.75 years for you weirdos that don’t count your kid’s birthdays in dividend payments. Nearly a decade of exuberance caused a bubble big enough to take down the economy in a correction. The most recent five quarters of exuberance look tiny in contrast, don’t they?

Declaring a bubble after just five quarters might seem early, but that’s the point. The indicators help central banks and policymakers identify them early. By alerting policy makers early, they can act and contain the issue before it gets out of control. The current bubble will be the first time in history that the US has a system in place for an early warning.

The question is, will they ignore the warning sign? Central banks have become increasingly political, dismissing even their own research. It wouldn’t be surprising to see them gloss over existing warning systems as they did with inflation. Though the “transitory” narrative was retired shortly after they would have seen this data.

https://betterdwelling.com/us-real-estate-enters-a-bubble-for-the-first-time-since-2007-us-federal-reserve/....

It wouldn't be a legit economic or financial discussion, without a daily prediction of future doom and gloom.

It is interesting to me that we have metrics for identifying housing bubbles in advance. I can't recall this topic having been brought up before.

A common urban myth in finance is the concept of bitcoin being a bubble. Could it be possible to devise a system of metrics which might identify the degree to which cryptocurrencies were actual bubbles? There doesn't appear to have been much of an attempt to quantify such claims made by Jamie Dimon and others.

If it were possible to devise metrics for identifying potential bubbles in crypto, what would they look like?