JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 24, 2023, 03:32:30 PM

Last edit: December 17, 2023, 06:39:48 PM by JayJuanGee Merited by fillippone (13), vapourminer (12), bitmover (12), AlcoHoDL (3), Hueristic (1), batang_bitcoin (1), slaman29 (1), DdmrDdmr (1), goldkingcoiner (1), Poker Player (1), Don Pedro Dinero (1), Dave1 (1), Gachapin (1), Volgastallion (1), Catenaccio (1), True Myth (1), chigo (1) |

|

This thread serves as an extension to the maintenance and liquidation portion of my BTC Investment ideas thread since some of the various Opening posts in that thread were starting to get overly cluttered and potentially confusing. 1) This post: Introduction (Opening Post 1): 2) Opening Post 2: Creating monthly withdrawal limits - based on the then BTC Spot price's direction and distance from the 200-week moving average, and of course a withdrawal rate and quantity of coins in the account 3) Opening Post 3: Establishing price-based sell thresholds - including potential buy back options (yes seeming to border on trading - but really could be considered as ways to insure the BTC holdings from inevitable volatility 4) Opening Post 4: Reserved - still to be determined I am hoping that some of these ideas will be helpful to others, besides me and maybe helpful for institutions and/or governments too. Anyone have any suggestions, questions or similar ideas that they would like to share in this thread? Please do. Even though I made this as a self-moderated thread, I am open to attempts to critique the various ideas or investment frameworks herein, but at my discretion I may delete posts that I determine to devolve too much into personal attacks (without seeming to provide adequate substance), shitcoin pumpening, bitcoin naysaying (that largely appears to me to be backhanded ways to shill some kind of a shitcoin) trolling or shilling. I would like to NOT delete many if any posts, but let’s see how it goes. Last Edited: December 17, 2023 |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

In order to achieve higher forum ranks, you need both activity points and merit points.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 24, 2023, 03:33:04 PM

Last edit: December 28, 2023, 10:20:49 PM by JayJuanGee |

|

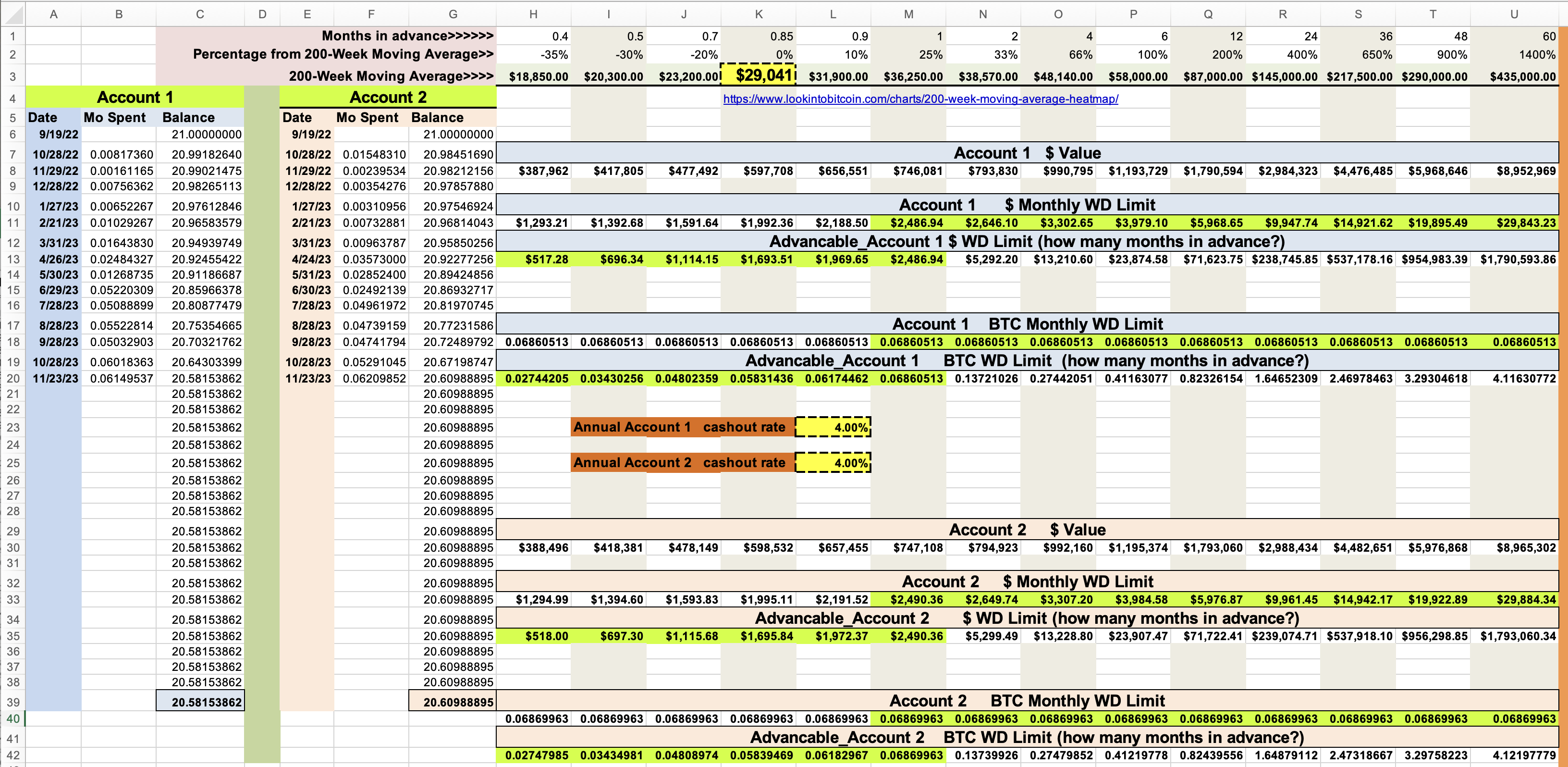

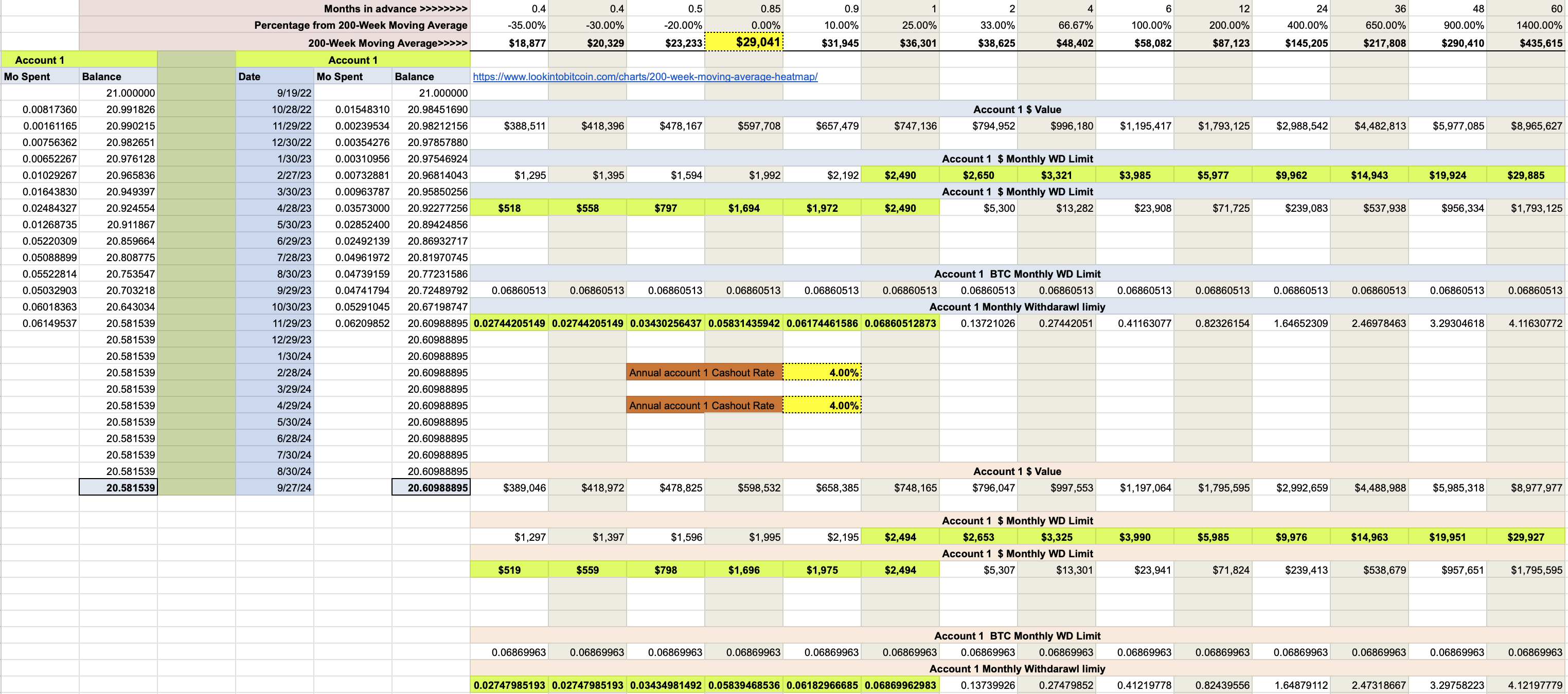

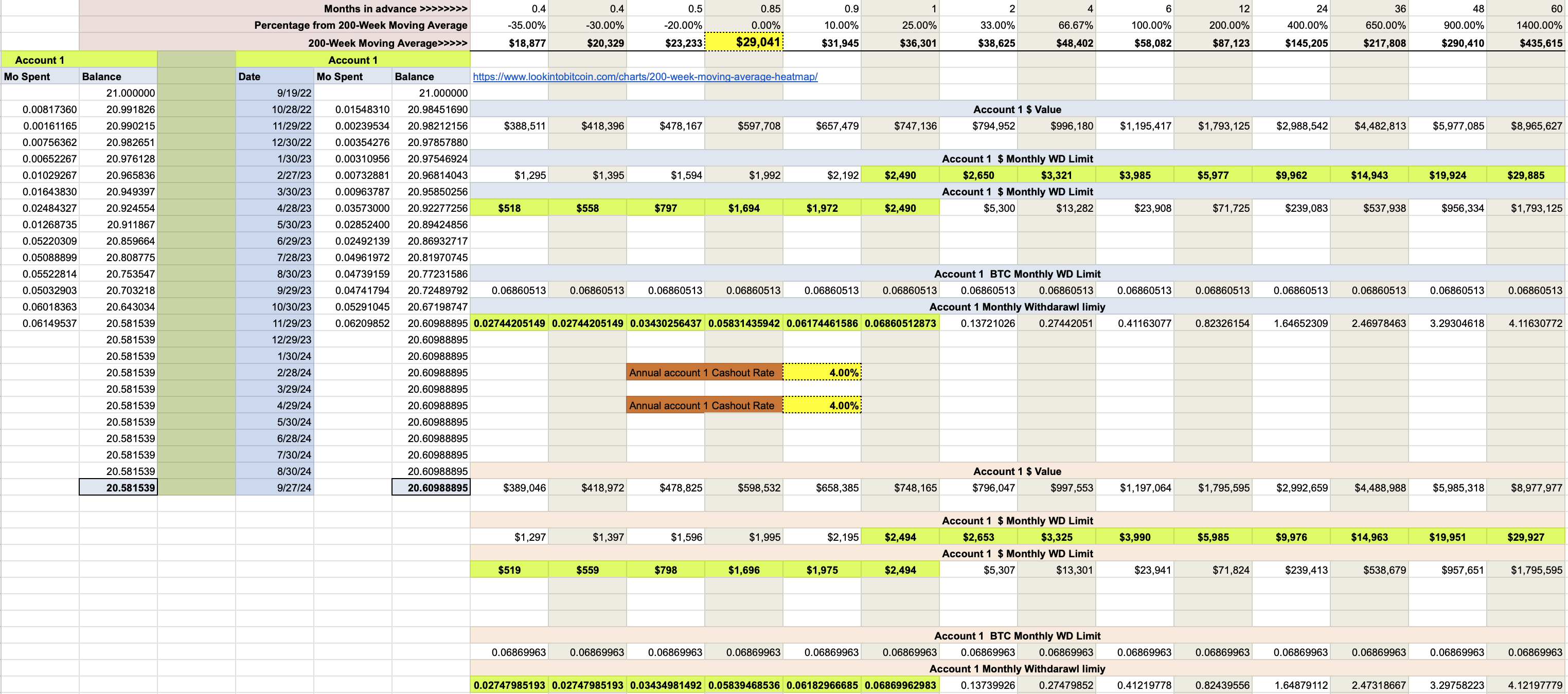

Opening Post 2: Creating monthly withdrawal limits - based on the then BTC Spot price's direction and distance from the 200-week moving average, and of course a withdrawal rate and quantity of coins in the account Ideas of sustainable withdrawal that attempts to measure monthly budget limits based BTC spot price relative to the 200-week moving average There has been a while that I have been talking about a chart/table that I had been working on that attempts to guide monthly budgets within the parameters of the 200-week moving average. Here's an example with two hypothetical accounts.. Account 1 and Account 2. ** **An amended and improved version of the above chart eliminates the second Account, and shows the ongoing BTC Spot Price and the 200-week moving Average in order to show how they compare with one another. **An amended and improved version of the above chart eliminates the second Account, and shows the ongoing BTC Spot Price and the 200-week moving Average in order to show how they compare with one another.From the above chart, you should be able to see that if there are two hypothetical accounts, and each of the accounts started out with 21 BTC in September 2022, and they have been experiencing withdrawals on a monthly basis. The amount withdrawn each month should be less than the limits of their monthly withdrawal limits based on the various formulas therein that also peg to the 200-week moving average and also the limits are based on then balance in the account. We can see that the actual 200-week moving average gets put into the spreadsheet in order to show the limits for the upcoming month. In this case, I have projected the 200-week moving average to be $29,041 (K,3) within the first day or so of December 2023. You can see the actual here. The spreadsheet autofills the various threshold BTC spot prices in row 3 in accordance with what percentage the BTC spot price is above or below the then 200-week moving average, as reflected in row 2. For example, to show the lowest Spot price on the chart (H,3 = $18,850), as long as the BTC price is above $18,850 but less than $20,300 (I, 3) (that is more than 30% below the 200-week moving average, but less than 35% below the 200-week moving average), then there is an authorization to ONLY spend 40% (H, 1 = 0.4) of the 200-week moving average monthly rate which based on the 4% per year, 1% per quarter or 0.33% per month which is also autofill calculated into the sheet (based on the 4% amount in L,3). So the monthly budget limit for that person would be 0.02744205 BTC (H, 20) (or $517.28 in H, 13). In my model, the BTC spot price has to be 25% (M, 2) higher than the 200-week moving average (which is estimated to be more than $36,250 (M,3) at the beginning of December) before account 1 would be authorized to withdraw the full (M,1) 0.33% per month allocation (as the percentage that is authorized is depicted in row 1), so that would be authorized to spend up to 0.06860513 BTC (M,18 and M,20) for the month and right at around $2,486.94 (M,11 and M,13). Another clarification that I should make is if the BTC price were to exceed the highest BTC spot price on the furthest left of Row 3 which would be $435, or higher (U,3), at the beginning of December, which is 1,400% higher ((U,2) than then 200-week moving average of $29,041 (K,3), then amount of authorization of BTC to withdraw is still the same (0.06860513 BTC for the month); however there is an authorization to withdraw and to cash out of BTC up to 60 months of the monthly limits in advance..which shows as 4.11630772 BTC (U,20) (U,13 = $1,790,593.86). Of course once the BTC price gets 0.33% or higher above the 200, week moving average, then gradually the number of months that can be withdrawn in advance increases at various thresholds as reflected in the increases in the percentages above the 200-week moving average in row 3 starting from column N and going through column U. And the number of months authorized to withdraw in advance are reflected in Row 1 and show greater than 1 month in advance starting from Column N at 2 months and Column U at 60 months. My tentative thoughts is that it would be a preferred practice to cash out several months of the monthly authorization in advance under such conditions of BTC prices many multiples and/or multitudes above the 200-week moving average in order to expect that some of the higher multitudes of being that high above the 200-week moving average are not really sustainable... and we have seen that non-sustainability high spot BTC prices historically, even though we cannot really know in advance how far UP, how fast the BTC spot price might go up and/or how long it will last at various higher price thresholds. I speculate that as the BTC price is going up and if it reaches higher multiples above the 200-week moving average, we might still get anxious about selling additional BTC (beyond the monthly sales authorization), and so we might still end up selling a number of months of our BTC authorization in advance at lower BTC price thresholds. It seems to me that even if the BTC price were to go 200% above the 200 week moving average as reflected in Column Q, we might end up selling 12 months of our monthly authorization in advance, so it might seem that we could be precluded from selling any BTC for the next 11 months; however, if a few months later, the BTC price were to reach the thresholds in Column S, then it may be quite reasonable to sell an additional 24 months to reach the authorization of being able to sell 36 months in advance (S,1), so we can make those kinds of calculations in order to stay within our limits but not necessarily being overly penalized for selling early even though we would have been able to sell more for higher but we are still able to do it within some reasonable limitations that are still quite generous in terms of the amounts that we are able to sell in advance, and the same is true for getting into the higher BTC spot prices of Column T or Column U. If the BTC price reaches higher thresholds, there would be new authorization to sell additional months in advance based on the higher BTC spot price movement, and at the same time, we can continue to plug into our formula based on how much we had already sold and based on the 200-week moving average continuing to move up while the BTC spot price is moving up and the higher the BTC spot price is out of line with the 200-week moving average (and for longer that the BTC spot price stays high) then it will cause the 200-week moving average to get drug up faster and faster than it had been previously (and can be measured daily or whatever is ball-parkedly reasonable numbers to use in K,3).. .It can be measured here, too. I understand that there is quite a bit of data in the charts and some of the ideas regarding the monthly spending limitations of the accounts are somewhat discretionary, but starting out by sticking with standard 4% per year withdrawal rates and even presume a kind of perpetual ability to withdraw BTC under this kind of system with a kind of underlying assumption that BTC prices (especially the 200-week moving average) will continue to go up at least 4% per year on average, so even if there are some down, years the account is not materially getting depleted in terms of its dollar values (or whatever other utility we might be measuring our cost of living). I also realize that account 1 and account 2 are not very materially different from each other in terms of the current balance of the accounts, so maybe i could have had come up with some differences in which one of the accounts might have hade been maxing out the monthly budget limit and the other one was spending minimal levels.. Maybe a future version I will change them around a bit? Any thoughts or feedback would be appreciated, or even some real life examples of trying to figure out these kinds of balances. I am focused on BTC in this example, but of course, there could be various other assets that comprise someone's investment portfolio and maybe even cashflow, so surely I am not against any kinds of Gresham Law types of considerations in which there would likely be spending from other assets prior to spending from BTC, so if the accounts are not spent to the max of their limits, then whatever BTC remains would just continue to sit in the accounts with probably a need to consider whether to maximize withdrawal or to sometimes even hold back on withdrawal or to maximize withdrawal which is also partially already guided by the parameters and assumptions contained in the chart/table. Last Edited: December 17, 2023 - and now a website to help to figure out these calculations and also a new thread by Bitmover.

|

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 24, 2023, 03:33:22 PM

Last edit: March 13, 2024, 06:50:30 AM by JayJuanGee |

|

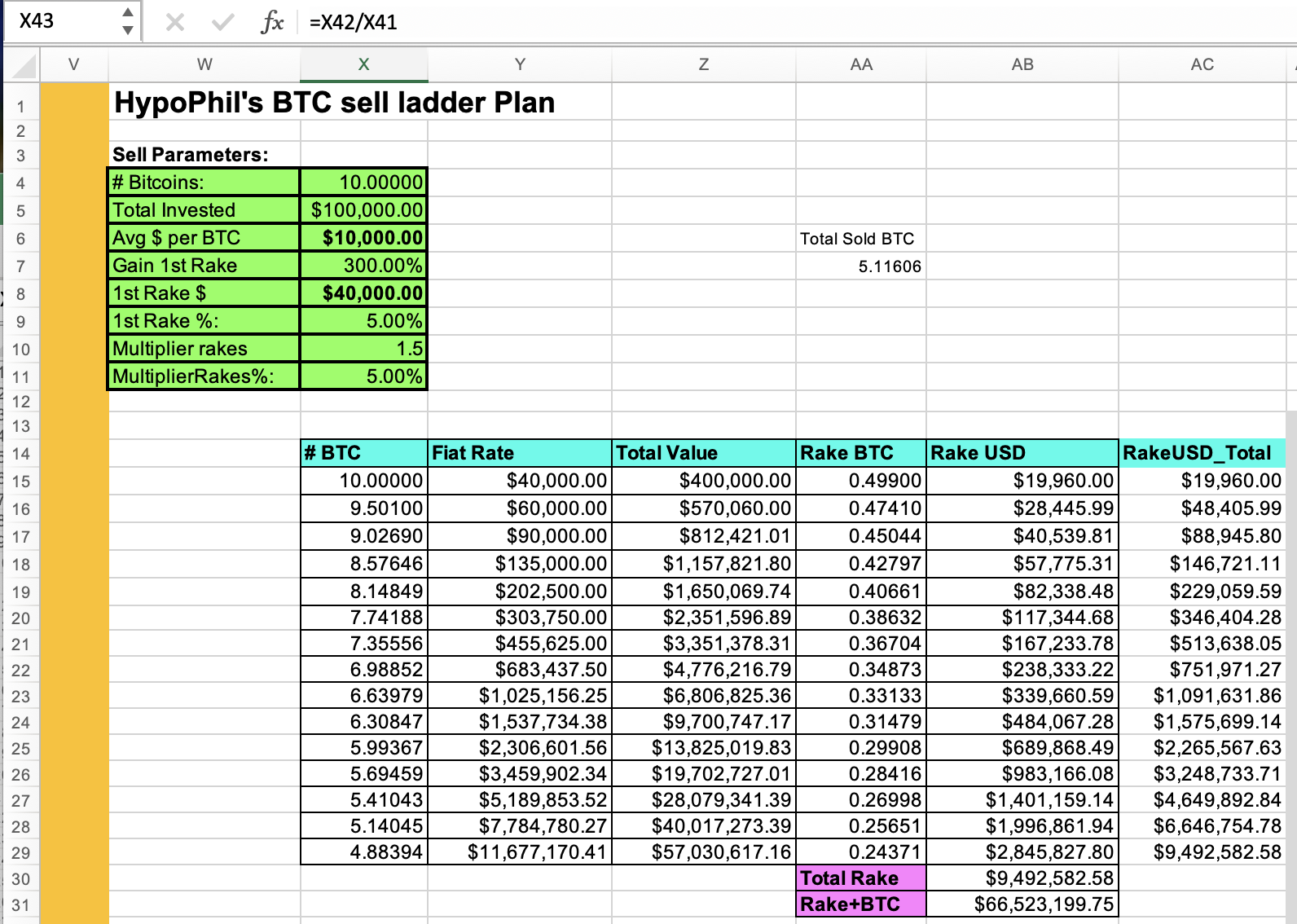

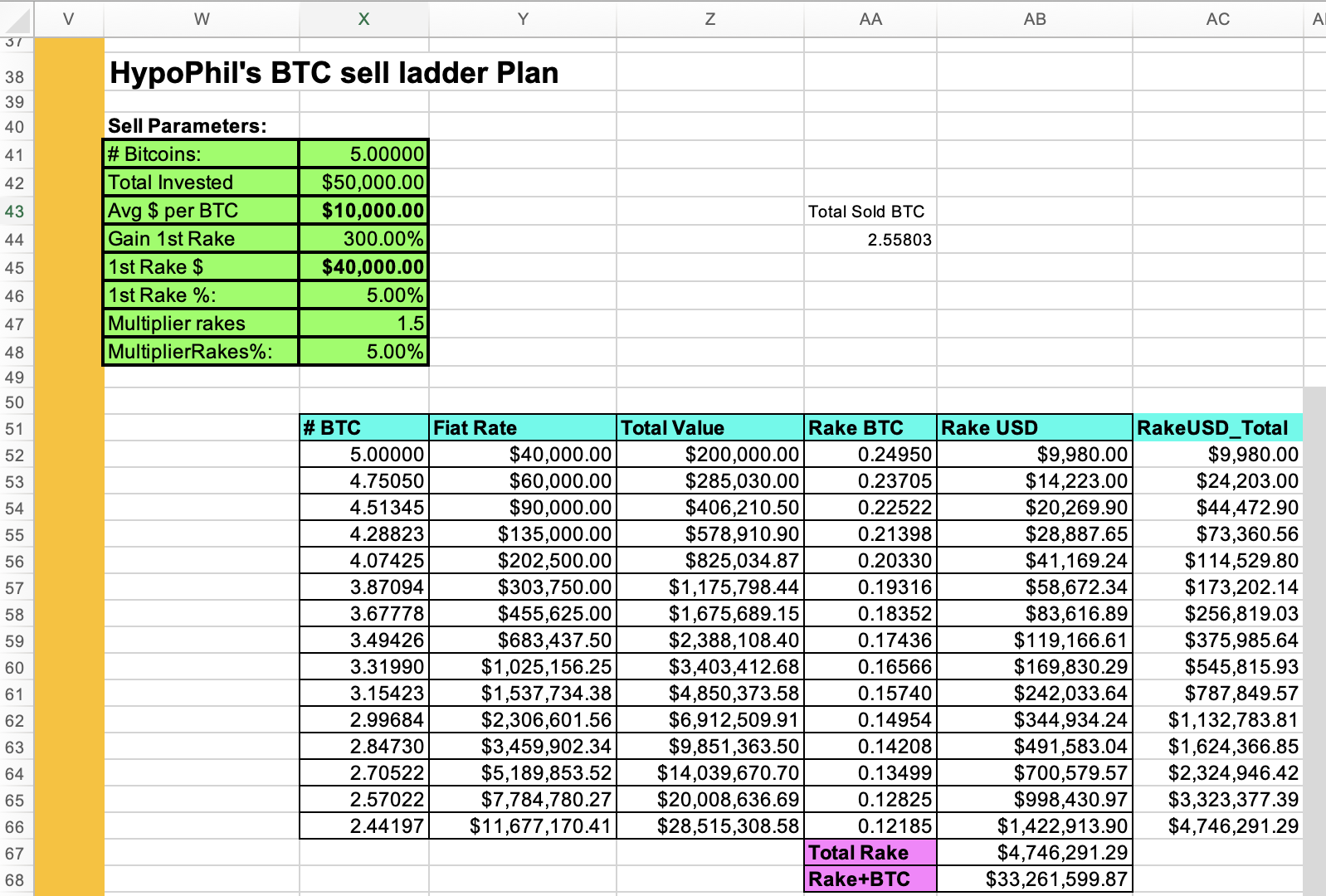

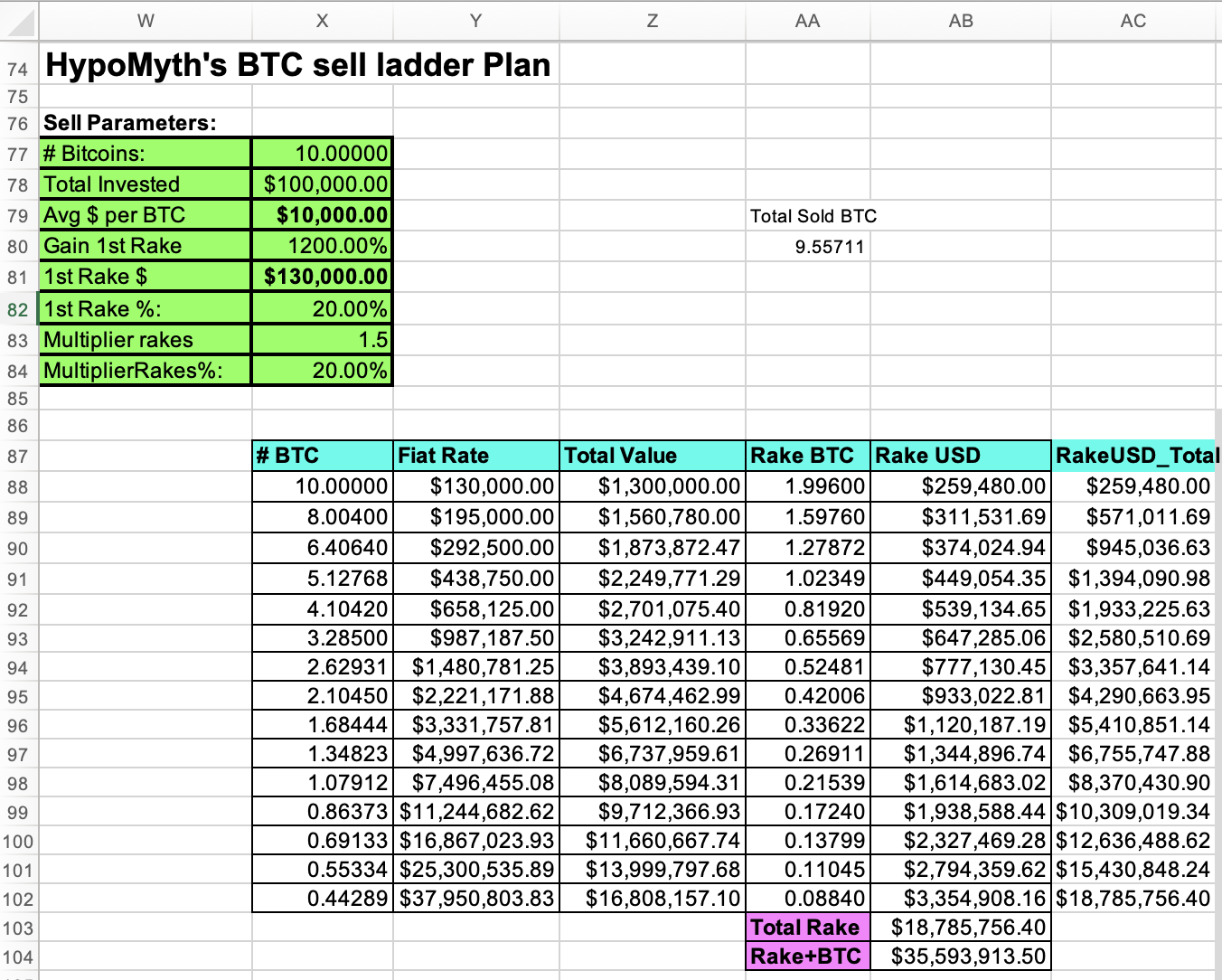

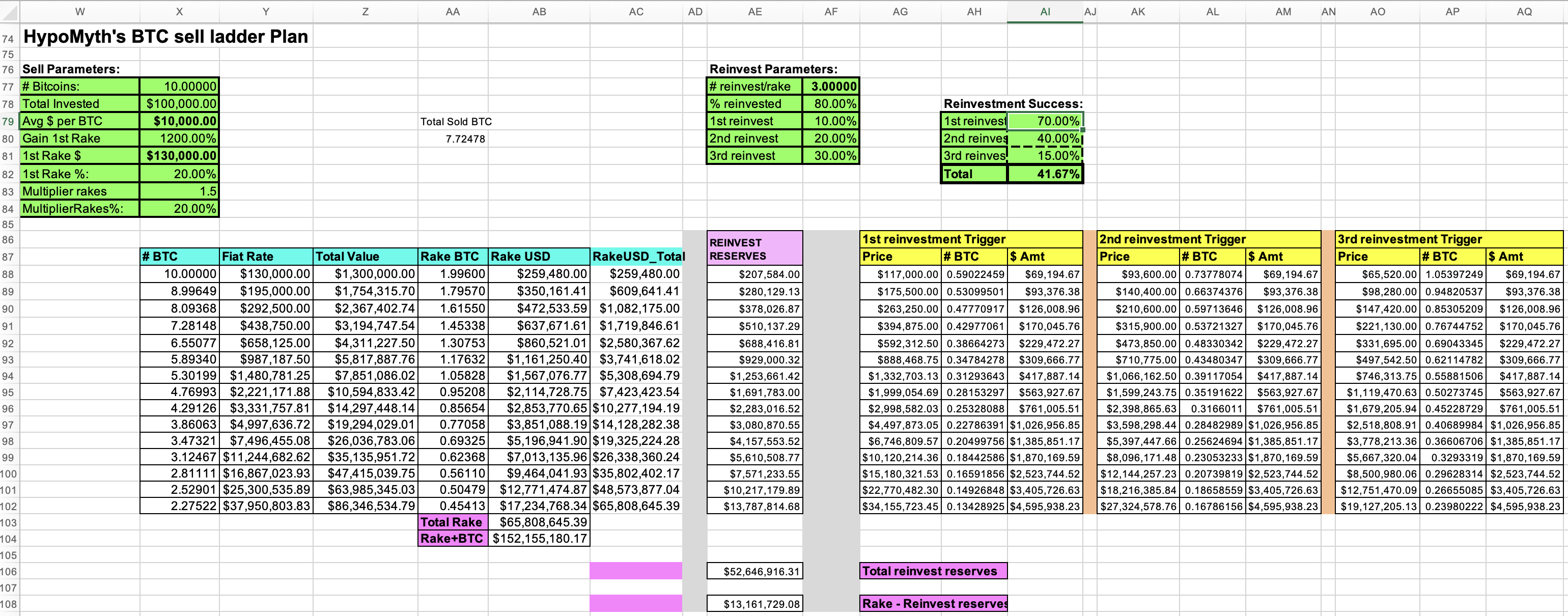

Opening Post 3: Establishing price-based sell thresholds (also referred to as a raking system/tool) - including potential buy back options (yes seeming to border on trading - but really could be considered as ways to insure the BTC holdings from inevitable volatility As I have mentioned in various other places, my first year and a half in bitcoin from late 2013 to mid-2015, I was almost exclusively in BTC accumulation, so whenever I sold any amounts of BTC, I would immediately replace whatever I sold. Even though I had largely concluded that I had reached my overall BTC accumulation goal by late 2014 (which was to invest an amount that equalled 10% of my investment portfolio into BTC), I continued to accumulate some BTC in 2015 (the BTC price was quite low through the whole year, but also my additional cash was not really very much), and so by the middle to end of 2015 I was getting to be around 13.5% accumulation into BTC into my quasi-liquid investment portfolio, so I started to consider that I had gotten into a state of 0ver-accumulation - or a conclusion that I had too much BTC, so I was not really sure about how to deal with my over-accumulation status, except to create a plan to be able to sell BTC on the way up, some variation of Risto's SSS plan. The more pure versions of Risto's plan would be to sell on the way up at something like 10% for every doubling of the BTC price, while discretionarily figuring out a starting point for the BTC sales, and then sticking to such a selling on the way up plan with no expectations to buy back any of the sold BTC. My own variation included both possibilities, which was considering the possibility that the BTC price would go up and there would be no corrections and/or abilities to figure out when or if to buy back, and there might not be any advantages in actually buying back. Accordingly, over the years since around mid-2015, I have both put into place and practiced variations of the model of selling on the way up, while at the same time some various structures of buying back the BTC with the proceeds of the sales. Over the past 8 years or so, several times, I have presented variations of my ideas of selling on the way up and buying back on the way down, and many times, prior to my most recent December 14, 2023 creation of HypoMyth, I would not present charts in regards to the buying back of BTC ideas because sometimes those ideas would get too confusing and/or convoluted. Here's a couple of charts that summarizes the HypoPhil matter. ** **You can go to the original post to find further explanation and context for the charts. [........&......]

Subsequently, we found out from the real Phil himself that he does not have hardly any intention to be restricted by such charts, because his own way of playing his bitcoin stash includes the needs and/or preferences to draw some profits from his bitcoin on an annual basis, so surely there might be some years in which some compounding benefits could be achieved, yet instead it is quite more likely that the needs (and/or preferences) to draw income from BTC every year ends up stifling the amount of profits that anyone could be expecting to receive from his BTC stash.

In that sense, maybe we just give up on HypoPhil because he is not even close to wanting to follow such a more strict system.

I am thinking that if there is such a desire to sell on the way up with an expectation of buying on the way back down, and maybe even a willingness to ride bigger BTC price waves, then we might be able to create a HypoMyth out of this deal, and we could start with a similar portfolios of HypoPhil of 10 BTC and then to show some sell scenarios that spread out the sells a bit further (and more aggressively when they happen) while at the same time showing how it might look to build some buy back scenarios into the whole model. So we can start out with the same cost basis of $10k per BTC, and so maybe there are assumptions of mistakes along the way, but also assumptions of not having enough BTC, so wanting to sell and buy back.

I think that with HypoMyth, we still could throw in some fairly aggressive presumptions, including that HypoMyth is not going to sell any BTC until the price reaches at least 1,200% of his investment costs, so in this case the first sell would be at $130k-ish.. and we can go with a fairly aggressive sale of 20%. Furthermore, we can go with fairly aggressive sales of 20% of the holdings each time the BTC price goes up 50%.

So under this first scenario of no buying back, if there is no buy back of the BTC, then the 10 BTC will get depleted down to 1 BTC by the time the BTC price reaches $7.5 million. Not really a bad place to be. The second scenario of having some set buy back plans is more complicated because there are several discretionary variables; however, if we project out an account, we can attempt to account for the various discretionary scenarios and to even create some structure that shows probabilities of success in our buying back at certain rates. The second scenario of having some set buy back plans is more complicated because there are several discretionary variables; however, if we project out an account, we can attempt to account for the various discretionary scenarios and to even create some structure that shows probabilities of success in our buying back at certain rates.

The chart looks like this: You can probably see why I am so excited to be able to go over something like this. You can probably see why I am so excited to be able to go over something like this.

So under the reinvestment parameters we can see that I divided the reinvestment into 3 parts that draw from the reinvest reserves 1/3 for each of the downward buy back prices that are 10%, 20% and 30% below the sell price, and we are using 80% of the amount that we sold for our buy backs. The likelihood of successful buy back is calculated as 70%, 40% and 15% respectively, and we are able to average those out to 41.67% (because they have equal proportionality to each other. Of course, if we had put different amounts into each of the buy back amounts, rather than 1/3 each, then we would have to change the formula for our total reinvestment success in order to calculate in accordance with the probability of each of the buy backs and the ratio (the amount) in each of the categories.

So a ball park figure shows that if the buy back success ends up being 41.67%, then the amount of bitcoin at $7.5 million would be about 3x greater at 3.12467 BTC rather than just over 1 BTC.

Of course, some people want to presume greater reinvestment success, especially if they sell, they kind of give high chances that they will be able to buy back at lower prices, so it is just a matter of how much lower, so there is a kind of presumption that selling BTC is going to increase their stash rather than decrease it.. .which I surely consider to be a BIG presumption, even if selling is not necessarily a bad thing to do, especially if we are not taking it for granted that we are going to be able to buy back cheaper, even if we are selling at price points that we consider to be exponential price rises (or potential blow off tops).

Of course, guys can create their own spreadsheets like this in order to figure out their own circumstances and to plug in their own numbers and their own projections. I am pretty sure that fillippone had created an earlier version of the HypoPhil spreadsheet (but I am not even sure any more), but I am pretty sure this is my debut of the buy back parameters.... so those formulas are a bit more complicated but they are still extractable and I have also laid out some format for trying to consider it.. and if anyone has some better suggestion of format, I am all ears. fillippone created an update to the above chart in an interactive GoogleSpreadsheet in which guys can input their own data (such as BTC stash size, increments for withdrawal and % amounts of withdrawal) in order to see their own results. Guys do frequently like to talk about selling BTC at various points on the way up and buying back on the way down, so I think that my chart helps guys to plot out those kinds of matters, and even though many guys seem to have ideas in their head about trying to be able to identify the top and to be able to execute sales at or near the top, and then being able to figure out various locations to buy back based on BTC price dynamics that they will be able to identify in the market at the time that they choose to execute.. I personally believe that it is a bit of a fantasy to try to figure out abilities to time tops and/or bottoms, and I believe it is preferable to pre-set your sell points and your buy back points. Of course since you are in charge of your own destiny, you can change pre-set plans at any time that you like, even while at the same time I posture that it is better to have the pre-set plans in place rather than not, even if you might end up changing them at various points. And, also in my own experiences, I have found it better to NOT be changing pre-set plans too frequently, and I have also found that if the plan is already set up pretty solidly in terms of personal circumstances, then it most likely won't even need to be changed... and if it needs to be changed, going through such change likely signifies that it was not very well coordinated with personal circumstances (those 9-factors pointed out in another of my posts).

|

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 24, 2023, 03:33:49 PM

Last edit: December 17, 2023, 07:09:40 PM by JayJuanGee |

|

Opening Post 4: Reserved - still to be determined

|

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Aanuoluwatofunmi

|

Any thoughts or feedback would be appreciated, or even some real life examples of trying to figure out these kinds of balances. I am focused on BTC in this example, but of course, there could be various other assets that comprise someone's investment portfolio and maybe even cashflow, so surely I am not against any kinds of Gresham Law types of considerations in which there would likely be spending from other assets prior to spending from BTC, so if the accounts are not spent to the max of their limits, then whatever BTC remains would just continue to sit in the accounts with probably a need to consider whether to maximize withdrawal or to sometimes even hold back on withdrawal or to maximize withdrawal which is also partially already guided by the parameters and assumptions contained in the chart/table.

Indeed I've been following up with some of your threads that talked about having something like this coming up and i must commend you well for taking your time in making the precise breakdown on making withdrawals and how we can also have an sustainable investment, you've also talked alot about bitcoin holding, DCA and many other relevant aspects relatively having similarities with this. It's something interesting to make an investment and it's another thing to have that tenacity to wait patiently without making withdrawal of our investment due to some other reasons beyond the ordinary, if we are making an investment, then we should know that it's something that we should do out of the passion for holding it over a long period of time, because we cannot release and make withdrawals when it is not yet time to do so but there are other needs that are extremely pushing us for making withdrawals, we should plan well right before we start. |

|

|

|

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 27, 2023, 01:19:24 PM |

|

Any thoughts or feedback would be appreciated, or even some real life examples of trying to figure out these kinds of balances. I am focused on BTC in this example, but of course, there could be various other assets that comprise someone's investment portfolio and maybe even cashflow, so surely I am not against any kinds of Gresham Law types of considerations in which there would likely be spending from other assets prior to spending from BTC, so if the accounts are not spent to the max of their limits, then whatever BTC remains would just continue to sit in the accounts with probably a need to consider whether to maximize withdrawal or to sometimes even hold back on withdrawal or to maximize withdrawal which is also partially already guided by the parameters and assumptions contained in the chart/table.

Indeed I've been following up with some of your threads that talked about having something like this coming up and i must commend you well for taking your time in making the precise breakdown on making withdrawals and how we can also have an sustainable investment, you've also talked alot about bitcoin holding, DCA and many other relevant aspects relatively having similarities with this. It's something interesting to make an investment and it's another thing to have that tenacity to wait patiently without making withdrawal of our investment due to some other reasons beyond the ordinary, if we are making an investment, then we should know that it's something that we should do out of the passion for holding it over a long period of time, because we cannot release and make withdrawals when it is not yet time to do so but there are other needs that are extremely pushing us for making withdrawals, we should plan well right before we start. I had been thinking about these kinds of budgeting ideas and even the ideas of having a kind of guided passive income from a stack of BTC for the last year and a half or so, and I had some posts with other forum members around the May 2022 and June 2022 major BTC price drops, in which I was talking about the possibility of funding a developer with a couple of bitcoin funds and maybe even using 21 BTC as the amount with each of the funds. One possibility could be that one of the funds would be to fund a developer (or perhaps more than one developer as the fund's value might grow from BTC's probable future appreciation) and the second fund might be to pay for the administration costs. Of course, there are a variety of reasons that someone might create a fund, and might even do so in order to fund their own expenses... to establish budgeting limits regarding how much to be able to cash out on a monthly basis. The chart is not about establishing an investment position, and it is also not about my particular investment, since they are hypothetical accounts, but instead about ways to consider spending within budget limits that refer to the balance of the account, the BTC price position in reverence to the 200-week moving average and the rate of withdrawal (in this case I use 4% per year). In regards to the accumulation of BTC and other related ideas, I have more extensive investment ideas in my other related thread that I mentioned at the beginning of the post. I had been considering adding these ideas of Sustainable withdrawal and/or BTC portfolio maintenance to my BTC Investment ideas thread, but the various Opening posts in that thread were starting to get overly cluttered and potentially confusing. Regarding your links, I frequently have cite dcabtc.com and also the SSS thread... but I had not previously seen the costavg.com website or your thread about it, so in the coming days, I will take a look at your thread that you referenced. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

slaman29

Legendary

Offline Offline

Activity: 2632

Merit: 1212

Livecasino, 20% cashback, no fuss payouts.

|

|

November 27, 2023, 04:08:21 PM Merited by JayJuanGee (1) |

|

Thank you for this thread, I'm ashamed that I never bothered to make this kind of calculation. I practice DCA too but I don't have the discipline to do 2 things. First, to make actual dates and calculations. Secondly, not to touch it.

So over the past years especially from 2019, I only know the growth in coins, because I add DCA to my personal wallet and see it grow.

BUT I take out sometimes to fund small habits + expenses, to try to return it to origiinal levels asap. I think therefore there is an idea of "sustainable withdrawal" like this to ensure you keep enjoying the benefits while still maintaining a portfolio.

The thing is the time to watch the 200-week trend line, I guess with automated indicator easier but I know I would fail at this "discipline".

|

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 27, 2023, 08:10:42 PM |

|

Thank you for this thread, I'm ashamed that I never bothered to make this kind of calculation. I practice DCA too but I don't have the discipline to do 2 things. First, to make actual dates and calculations. Secondly, not to touch it.

Of course, the ideas underlying this particular chart do not have very much at all to do with DCA and/or the various ways that BTC HODLers may end up accumulating their bitcoin, and even though we could perform these same kinds of budget limits within whatever amount of BTC that we had accumulated and were able to put into the overall account value, it still might not be very practical to start to engage in these kinds of sustainable withdrawals until the size of the account have built up to an amount in which the withdrawals are meaningful. Actually, I am not sure if I am going to change the OP, but I am thinking that I need to come up with another chart that shows the dollar values for each of the months, and so maybe I can just take an estimated average BTC price for that particular month... but that seems to be something that I could probably do in order to attempt to make the monthly withdrawal amounts more relatable to be able to see both the BTC value and the then dollar value.. Essentially, it takes efforts to continue to hold and to aim for a certain quantity of BTC in order to attempt to consider the withdrawal amounts as meaningful. For example in the current chart, we see that as long as the BTC price is above $26,250 (M,3) then the monthly amount that can be spent is nearly $2,500 (M,11) (M,13) and also .06860513 (M,18) (M,20). Even if your account balance were to be half as much ($1,250 instead of $2,500), it still might be an o.k. withdrawal rate if it is merely supplementing other kinds of income. I do expect that the withdrawal rate (of 4%)(L,23) is way more than sustainable, and probably we could have a higher withdrawal rate - however, maintaining the lower withdrawal rate right now likely allows for more growth of the value and a kind of deferred gratification - even though it is not guaranteed to continue to go up greater than 4% per year.. even though historically we have not really every had yearly rates that have been less than 20%. You can see those actual rates that the 200-week moving average had gone up in the 4th column of my fuck-you status chart (each of the percentages therein represents 6 months). So over the past years especially from 2019, I only know the growth in coins, because I add DCA to my personal wallet and see it grow.

I have come to conclude that the power of bitcoin's compounding surely comes from experiencing several doublings of the value of the BTC in the account, and so sometimes we get caught upon periods in which we might wonder about the rate of growth, but it could take a couple of full cycles to really experience bitcoin's compounding effects, and since bitcoin's investment thesis does not seem to be getting weaker, it seems better to just allow it to continue to compound, and to exercise some self-restraints in the withdrawal rates - which also would include withdrawing (in accordance with Gresham's law practices) from other sources (money of less value) prior to withdrawing from bitcoin. BUT I take out sometimes to fund small habits + expenses, to try to return it to origiinal levels asap.

I have historically done quite a bit of spend and replace in order to keep the BTC at the original levels and maybe even to take the opportunity of the spend and replace to replace with more BTC than I had spent.. which surely is important during the BTC portfolio building years.. but then in my above chart and the topic of this thread would be that you already have reached your goals, so no need to spend and replace from this one as long as you have reached your goals and you are spending within the limits..even though I could also see that someone might be spending monthly from his/her 21 bitcoin, and then all of a sudden if the BTC price dropped by 30% to 50% there might be some desires to buy more BTC and to put it into a fund like this in order to increase the balance (I probably should include a column for adding value to the accounts, too). I think therefore there is an idea of "sustainable withdrawal" like this to ensure you keep enjoying the benefits while still maintaining a portfolio.

It should be able to go on forever without losing value if the average of the rate of growth is higher than the withdrawal rate... even if there might be some years in which BTC might not perform as well, yet so far the 200-week moving average has not gone down, even though it is not out of the question that the 200-week moving average might not continue to go up.. but we can cross that bridge if we get there. The thing is the time to watch the 200-week trend line, I guess with automated indicator easier but I know I would fail at this "discipline".

Yep.. if you want to try to be accurate, then every month or whenever you might be considering how much you are able to spend within your monthly budget limit, the 200-week moving average should be plugged into K,3. I think that anyone can learn to exercise discipline in these regards, even though surely so many folks want to live off of the principle and the interest rather than just the interest, and so if you can limit your budget to living off of the interest only, then that would be a good thing - even though I can see why you might be tempted to go "over -budget" and then you end up depleting your principle and no longer following a sustainable system, even if it might still end up working out for you. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

slaman29

Legendary

Offline Offline

Activity: 2632

Merit: 1212

Livecasino, 20% cashback, no fuss payouts.

|

|

November 28, 2023, 11:41:57 AM Merited by JayJuanGee (1) |

|

Thank you for the meaningful reply, I find that there are very few careful calculations done, thereby most "strategies" and discussions don't have the data to back them up. The key summary for me is proof of what I've always believed. That an accumulation strategy that lets you reap continuous benefits is still much more beneficial than pure stacking. I always see my holding as something that must not allow "normal" spending as detrimental even psychologiclly (especially when missing out the highs). Actually, I am not sure if I am going to change the OP, but I am thinking that I need to come up with another chart that shows the dollar values for each of the months, and so maybe I can just take an estimated average BTC price for that particular month... but that seems to be something that I could probably do in order to attempt to make the monthly withdrawal amounts more relatable to be able to see both the BTC value and the then dollar value..

<>

Even if your account balance were to be half as much ($1,250 instead of $2,500), it still might be an o.k. withdrawal rate if it is merely supplementing other kinds of income.

Yep, and for me, I need to even add my local currency price to my own data if I ever want to do so. Because USD wise, withdrawals already show a supplementary figure that encourages holding over long term, but because since 2018 when I started seriously DCA, dollar vs my currency is also breaking ATHs. Just by holding BTC I not only avoided my local inflation but overcame it (a double benefit of BTC/USD value! |

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

Thank you for the meaningful reply, I find that there are very few careful calculations done, thereby most "strategies" and discussions don't have the data to back them up.

The key summary for me is proof of what I've always believed. That an accumulation strategy that lets you reap continuous benefits is still much more beneficial than pure stacking. I always see my holding as something that must not allow "normal" spending as detrimental even psychologiclly (especially when missing out the highs).

There surely are a variety of ways to attempt to divide your BTC stack up that will allow you to potentially aspire to keep building it, but at the same time potentially have some amounts that you are able to spend, especially if your overall stash is in sufficient profits - and surely it is up to you to decide how much you believe would be sufficient profits, whether that is 2x, 5x, 10x, 20x or some other amount that you deem to be the threshold that thereby allows you to start to spend from that portion of your BTC stash. I can recall that you and I have had some back and forths before, but I cannot remember much about your particulars in order to try to come up with an example that might be somewhat fitting for what could be your situation.. and then also to try to make it relatable.. so if we go by your forum registration date, and your admission that you made several mistakes along the way and likely ONLY became more serious about stacking bitcoin in 2019, then we do not necessarily have a lot of time to work with, and one of the bigger advantages of bitcoin (or any investment) is building it over time, but also getting some of the compounding effects, and surely 2013 and 2017 were a bit better in term of their compounding effects as compared with 2021, even though 2021 was nothing really to sneeze at either. Even someone with 21 BTC right now merely has $609k in realistic "bottom" value if we use the 200-week moving average (of $29k) as the measure, even though BTC spot price is around $785k worth of value ($37,300). In recent times, I like to use $2 million as the fuck you status entry level, even though I know that people can get by with a lot less based on their own present and future expected costs of living... and part of the rationale for that is that I was using $1million from 2013 to 2020, but things in the world seemed to have gone so crazy in 2020 that it no longer made sense to potentially incrementally boost up the entry-level fuck you status, and a doubling seemed reasonable, prudent and potentially broadly applicable. Another thing about entry-level fuck you status is that it should be around 20 to 30x of your annual income (or your annual expected expenses) in order to justify entering into a 4% perpetual withdrawal rate. Let's say that your goal is to get to 21 BTC, but you are not sure how long that will take to get there because maybe you have barely reached 12 BTC even during times that BTC prices were way cheaper relative to current BTC prices, and so if there are quite a few expectations that the BTC prices are going to continue to rise, you want to attempt to be realistic with yourself about how many BTC you need and by when do you need them in order to reach entry-level fuck you status, whether you fit within the default entry-level fuck you status as I describe or if you have your own version of it. But even my recently revised (and continuing to get more and more conservative in its predictions) chart show that by early 2029, 21 BTC will cross into entry-level fuck you status, and surely the amount of BTC that you need for entry-level fuck you status goes down if you are ready, willing and able to wait longer prior to starting to employ any of your withdrawal system... even 12 BTC would qualify for entry-level fuck you status by mid-to-late 2032. So if you are really tempted to enter into some kind of a withdrawal system, but you are still in the process of growing your BTC stash, you might feel that you are spinning your wheels becaue you are selling with one portion of your stash and buying with another portion, and perhaps you would have just been better off to just continue to buy, especially if the net goal is to try to increase your BTC stash, and in my hypothetical of you, even if you might not be able to reach 21 BTC by early 2029, you are already at 12 BTC currently, and you can already see from the chart that there are pretty good odds that 12 BTC will be enough for late 2032, and so any additional BTC that you are able to stack between now and then is likely going to bring down the year that you end up entering into entry-level fuck you status. Surely there are other ways to frame goals, but I was trying to figure out a way to show how there could be trade-offs in terms of beginning to cash out too early, but if you have some kind of thing that you want to fund and you could create a separate budget for that, maybe using 1/2 of your BTC stash, such as 6 BTC, but that surely could cause you to feel that you are either spinning your wheels and it even if your BTC stash is not building as fast, it may well end up not building as fast, and surely a kind of hidden presumption that seems to be underlying your desires to cash out some BTC when the prices are going up is because not only do you want to be able to benefit from the fruits of your BTC accumulation, but you may also be wanting to use some of those proceeds to buy BTC back at a lower price.. which is understandable because we know that BTC prices do not go up in a straight line and there can be some advantages to incremental cashing out as compared with selling large lump sums of BTC and maybe ending up over-doing the amount sold. Actually, I am not sure if I am going to change the OP, but I am thinking that I need to come up with another chart that shows the dollar values for each of the months, and so maybe I can just take an estimated average BTC price for that particular month... but that seems to be something that I could probably do in order to attempt to make the monthly withdrawal amounts more relatable to be able to see both the BTC value and the then dollar value..

<>

Even if your account balance were to be half as much ($1,250 instead of $2,500), it still might be an o.k. withdrawal rate if it is merely supplementing other kinds of income.

Yep, and for me, I need to even add my local currency price to my own data if I ever want to do so. Because USD wise, withdrawals already show a supplementary figure that encourages holding over long term, but because since 2018 when I started seriously DCA, dollar vs my currency is also breaking ATHs. Just by holding BTC I not only avoided my local inflation but overcame it (a double benefit of BTC/USD value! Brings some extra complications, but yes most local currencies continue to lose against the dollar too.. so you have some extra balancing that you have to consider since you probably need to make sure that you maintain a certain amount of value in your local currency in order to be able to pay expenses and even possible emergencies that might ONLY be payable in your local currency.. but then, surely there can be questions about how many dollars to hold (and then if they are stable coins, how much extra risk might be going on with which stable coin you choose to keep your value), so it does seem practical that at minimum you would be ongoingly making sure that you have whatever new investments that you make into BTC (or even what you cash out) to be measured in terms of the other places that you are holding value, namely in dollars and in your local currency. I think that you need to be careful about overdoing your BTC allotment in terms of holding short term expenses in BTC, but surely if you are not a complete beginner than at least you have had 4-7 years to have had been building your wealth. .if we go by your 2016 forum registration date and the 2019 year you said that you became more serious about focusing on BTC as your preferred investment. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

This thread is food for thought.

It's nice to have it here, but I will try not to interact with it too much.

It's nice to see someone thinking about cashing out in a sensible way, but for the moment, I am too focused on increasing my stash, not to deplete it.

I will read it in the distant future, I hope. I reckon this is a luxury I do hope to maintain.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 28, 2023, 10:20:27 PM |

|

This thread is food for thought.

It's nice to have it here, but I will try not to interact with it too much.

It's nice to see someone thinking about cashing out in a sensible way, but for the moment, I am too focused on increasing my stash, not to deplete it.

I will read it in the distant future, I hope. I reckon this is a luxury I do hope to maintain.

Thanks. That seems to be exactly a correct way of thinking about the matter. None of us should be getting too distracted by various BTC selling techniques and/or sustainable withdrawal of our BTC unless we have reached a point in which we are able to dedicate a certain amount of our stash to this (whether it is all or a portion); however, if we were to be just sustainably withdrawing BTC for personal reasons (whether needs or wants), then we may well end up feeling like we are spinning our wheels because we are buying with hand and selling with the other, when maybe our overall goal is buying, so then we would wonder why are we even selling in the first place - unless maybe we were in a situation in which we were to create a separate fund, trust or business that we might be willing to inject a certain amount of BTC into that (entity) and the amount of BTC injected would be meaningful to the cause or whatever we might be wanting to achieve by providing such a sustainable income to such fund, trust or business. There were a few times, in the context of making this sheet, and then playing around with it in Google spreadsheets that I was considering contacting you to figure out if there might be a better way of presenting the information, but then I was starting to consider that I would NOT even be able to explain it to you very well until I put it into a context of a post, and that is why I ended up using talk.img instead of google spreadsheet - and surely since I am kind of an open source kind of believer, I am not really opposed to sharing the various formulas - even though surely anyone who really studies the image should be able to reverse engineer in order to get to my various formulas... especially since I have already attempted to explain them or to list them in the chart.. .so in the end, I am not sure how much extra value would come from making sure the formulas are in a Google spreadsheet - and when I copy and paste from Excel to Google Spreadsheet the formulas do not paste into Google Spreadsheets. Another thing was when I was finalizing this chart, I realized that I needed to update my entry-fuck you status chart, and you seemed to have noticed that post because you merited that update. But one of the things from using the template that you had provided to me, I noticed that depending on how much data that had on the page, there seems to be a limit in how large I can have my charts, because I was actually going to go to 2157, even though the forum page seemed to only allow me to go up to 2078.. otherwise I would get a BBcode error. In the end, I am not sure how much consulting you would be willing to do in regards to these matters, but we could maybe take it to PM, if there might be something that you might see in terms of presentation.. and surely, I understand that going all the way to 2078 seems a bit much for the entry-level fuck you status chart, because another problem potentially comes if I want to update the 200-week moving average in that chart every 6 months to the extent that the actual 200-week moving average might deviate from my projected 200-week moving average, and if it ONLY deviates a little then probably no BIG deal, I probably don't need to update the chart, but if it deviates a lot (which was around 10% for this time around), then I would probably have to make sure that the whole future is updated based on the correct starting values... and another thing is that I think that I made the numbers overly conservative, .. but let's see how it plays out.. I am a bit embarrassed that I had already updated my 200-week moving average projections more conservatively earlier in the year (to make my slope gradually curve to be less and less rather than being too much of a straight-line), and I still ended up overshooting by 10% for a mere 6-month period. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15403

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 29, 2023, 01:06:52 AM |

|

In case you find it easy to share:  I did my best to replicate your sheet's genuinely horrible colour scheme. I had some ideas to improve the sheet, but I abstained from modifying cells or "workflow" of the sheets. Please let me know if I missed something. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

I understand that there is quite a bit of data in the charts and some of the ideas regarding the monthly spending limitations of the accounts are somewhat discretionary, but starting out by sticking with standard 4% per year withdrawal rates and even presume a kind of perpetual ability to withdraw BTC under this kind of system with a kind of underlying assumption that BTC prices (especially the 200-week moving average) will continue to go up at least 4% per year on average, so even if there are some down, years the account is not materially getting depleted in terms of its dollar values (or whatever other utility we might be measuring our cost of living).

It seems like a safe assumption at 4%, which would be the classic rule because at least in the next few cycles it is normal for Bitcoin to continue to give a much higher return than that, although I for one would expect the returns in percentage terms to gradually decrease as the cycles progress. I am focused on BTC in this example, but of course, there could be various other assets that comprise someone's investment portfolio and maybe even cashflow, so surely I am not against any kinds of Gresham Law types of considerations in which there would likely be spending from other assets prior to spending from BTC, so if the accounts are not spent to the max of their limits, then whatever BTC remains would just continue to sit in the accounts with probably a need to consider whether to maximize withdrawal or to sometimes even hold back on withdrawal or to maximize withdrawal which is also partially already guided by the parameters and assumptions contained in the chart/table.

Well, in my case, and I think I am by far not the only one, Bitcoin is part of my wealth building plan which also has other assets, but I think it is better to focus here on sustainable ways of withdrawing Bitcoin as I am sure that in the forum there is too much heterogeneity in terms of wealth building and having this plan one can get an idea and adapt it to his personal situation. For example, let's suppose that in a market downturn, apart from Bitcoin we also have money in an S&P 500 index fund or pension plan that we can withdraw. Surely we will be more interested in withdrawing from the S&P 500 because it is normal that when the market rises again the Bitcoin will give us more returns than the S&P. Then in a bullish market we may be more interested in withdrawing from the Bitcoin portfolio to diversify the risk and not have too high a percentage of our net worth concentrated in Bitcoin. I know that there are people in the forum who have 100% in Bitcoin or a very important part of their net worth but in my case I prefer to play safer even at the cost of sacrificing a little profitability. Here I am only considering the case in which both Bitcoin and the S&P rise and fall in unison, but if this does not happen, and we have a fall in the S&P and the portfolio in Bitcoin rises in price, or conversely, the decision of where to withdraw it's clear. I too, like Fillippone, am more focused on increasing my stash, or rather my global wealth, but I am interested in the topic as information for the future and because I am interested in financial strategies in general |

|

|

|

|

yudi09

|

|

November 29, 2023, 11:29:15 AM Merited by JayJuanGee (1) |

|

Hi JayJuanGee. This topic is a good idea of your investment ideas. I have read it to the end. But I will read it again on different days.

Today is the fourth day that I have returned to this thread to read your thoughts on attracting and maintaining a portfolio and wanted to convey this as a workplan sheet which is very useful if bookmark.

Thank You.

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

Volgastallion

Sr. Member

Offline Offline

Activity: 462

Merit: 263

CONTEST ORGANIZER

|

|

November 29, 2023, 02:50:50 PM |

|

Very nice post/thread, one of the missed stone in this road is that, when and how to cashout some btc to anything,whether it's to live or for an emergency or a travel ,etc.

The same happens with every portfolio of people when they start to think to live from their investments, is not so easy and sustainable without a lot of discipline and a ton of knowledge.

|

|

|

|

JayJuanGee (OP)

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 29, 2023, 07:20:49 PM

Last edit: November 29, 2023, 07:34:50 PM by JayJuanGee |

|

In case you find it easy to share:  I did my best to replicate your sheet's genuinely horrible colour scheme. I had some ideas to improve the sheet, but I abstained from modifying cells or "workflow" of the sheets. Please let me know if I missed something. That is nice.. especially when I click on it and I can see the formulas. I generally like the idea of having it much easier for anyone who logs into this thread to be able to just take the spreadsheet and the formulas contained therein, and to just plug in their own numbers.. but yeah.. there might need to be better clarity in regards to which are the cells that are input cells (to plug in your own data - or to update such as (k,3) with the 200-week moving average) and which cells are reference cells. Regarding missing anything: 1) I suppose it might be o.k. to round out the dollar values to not show decimals. My version had shown two decimals. 2) I had used the florescent green in rows 19 and 40 in order to highlight one month's budget, and sure even I am a bit confused about how to present one month's budget with clarity because what I conceive to happen once the BTC spot price becomes 33% or higher above the 200-week moving average, then there develops authorization to spend more than one month at a time, and since those would be discretionary determinations, I ONLY put the monthly amounts of rows 19 and 40 into florescent green. In regards to ideas to improve the sheet - 1) I think that it is better to start with what is there, first.. which you seem to have accomplished pretty well.. and I still am having so many problems with GoogleSpreadsheet formulas colors and other kinds of formatting... and for example, if I have a spreadsheet that I am working on in Excel, then if I copy and paste into Chrome, then all of the colors and formatting seem to show up - but they do not show up in Safari... Neither copies the formulas... at least from my ways of attempting to do it so far. 2) One change that I have recently been pondering over is to add the dollar spot value for each month so then it would both show how much dollar value was transacted in each account for each month but then it would also end up showing what the account value is for that month too.. So it might not necessarily end up showing the spot price on that day of the month but maybe the average price that the withdrawals were made for the month 3) Surely we could talk about any ways to improve the chart.. especially if it helps to present the information better without necessarily taking away from any of the substance.. and surely there are some of the matters that are a bit discretionary (and perhaps even a bit random). .regarding how much to authorize to withdraw based on how far above or how far below the BTC spot price is from the 200-week moving average. 4) Regarding colors. I am not exactly attached to the colors that I use, but sometimes, I purposefully use colors so that I can easily distinguish this spreadsheet from some other spreadsheet that I use.. so there might be some ways to change the colors to make them more pleasing.. but of course there are needs for readability, too. I am probably going to send you a PM. I understand that there is quite a bit of data in the charts and some of the ideas regarding the monthly spending limitations of the accounts are somewhat discretionary, but starting out by sticking with standard 4% per year withdrawal rates and even presume a kind of perpetual ability to withdraw BTC under this kind of system with a kind of underlying assumption that BTC prices (especially the 200-week moving average) will continue to go up at least 4% per year on average, so even if there are some down, years the account is not materially getting depleted in terms of its dollar values (or whatever other utility we might be measuring our cost of living).

It seems like a safe assumption at 4%, which would be the classic rule because at least in the next few cycles it is normal for Bitcoin to continue to give a much higher return than that, although I for one would expect the returns in percentage terms to gradually decrease as the cycles progress. Based on BTC's historical returns, we could have easily gotten away with 15% and still would have had been fine. You can see from my entry-level fuck you status chart that this last year and a half have been the worst 6-month increases in the 200-week moving average of ONLY a little more than 10% for each of the 6-month increments. So even in my newest version of the entry-level fuck you status, I tried to make the numbers slope downwardly, while attempting to account for the continuation of some aspects of the 4-year cycle merging together, and surely I might have ended up going to conservative with those estimates, but it seems better to error more on the conservative side.. but without overdoing that either.. some folks go so conservative that they completely eliminate that bitcoin is still in such a buddingly new asset class at seemingly very early stages of its adoption curve. I am focused on BTC in this example, but of course, there could be various other assets that comprise someone's investment portfolio and maybe even cashflow, so surely I am not against any kinds of Gresham Law types of considerations in which there would likely be spending from other assets prior to spending from BTC, so if the accounts are not spent to the max of their limits, then whatever BTC remains would just continue to sit in the accounts with probably a need to consider whether to maximize withdrawal or to sometimes even hold back on withdrawal or to maximize withdrawal which is also partially already guided by the parameters and assumptions contained in the chart/table.

Well, in my case, and I think I am by far not the only one, Bitcoin is part of my wealth building plan which also has other assets, but I think it is better to focus here on sustainable ways of withdrawing Bitcoin as I am sure that in the forum there is too much heterogeneity in terms of wealth building and having this plan one can get an idea and adapt it to his personal situation. For example, let's suppose that in a market downturn, apart from Bitcoin we also have money in an S&P 500 index fund or pension plan that we can withdraw. Surely we will be more interested in withdrawing from the S&P 500 because it is normal that when the market rises again the Bitcoin will give us more returns than the S&P. Then in a bullish market we may be more interested in withdrawing from the Bitcoin portfolio to diversify the risk and not have too high a percentage of our net worth concentrated in Bitcoin. Yes. I think that you are hitting upon the same kinds of Gresham's law type considerations that I was trying to describe, even though you also seem to be trying to play the market too.. .which surely there may or may not be necessities to overly complicate matters. Because let's say that you have three or four main things.. and I am going to suggest some values for the ones that you consider to be the main things. I am also going to add the consideration of other items that you might have .. and even to suggest that you have already exceeded fuck-you status (let's say by 25%.. so fuck you status is $2 million and you have reached $2.5 million.. .. and of course you can adjust these numbers to what you consider to be your own entry-level fuck you status).. which may or may not end up being the case (of having to meet entry-level fuck you status) once someone starts withdrawing.. but I am going to conclude that most of your cashflow from work has dried up.. and you don't really want to pursue cashflow from work. I have a little bit of a problem to extrapolate exactly, but I think that any of us who might stay in bitcoin for a while, then we may well end up getting to a position in which the growth of our bitcoin ends up exceeding the value of our other investments, so then questions likely develop about whether we let the bitcoin portion ride (let the winners ride) or do we reallocate the winners into the losers.. those are personal choices, and I don't have any problem putting some value into the various losers because it is good to have value in areas other than just bitcoin, especially during drawdown periods... and there can be other purposes too in regards to having options of places to spend from. So if I presume by the time that you get to your bitcoin withdrawal stage, then you have more value in bitcoin than you do any other asset, and maybe even all of the others combined. Here's a potentially realistic scenario that is either at or near entry-level fuck you status (of course, the numbers can be changed in accordance with what you consider to be your entry-level fuck you status)1) some index funds - $550k 2) pension - $550k - this pays out at a fixed rate and generally you have few options regarding the amount of pay (except maybe when you first start to withdraw they might give you the option between monthly payments and lump sum, but I am not even sure if they are able to do that) - unless you were also referring to a 401k 3) 401k - you said zero... some people have these and some don't .. these have options to rebalance within the fund and options regarding withdrawal rates. 4) property - .. not very liquid and not easy to count unless you just have some possible equity... or if you might be renting out part of it. 5) commodities - $25k 6) bonds - $50k 7) cash and cash equivalents - $25k 8 ) various personal property, cars, other vehicles, tools, equipment, computers/phones, electronics, furniture, appliances, collectors items, jewelry, clothes - not very liquid .. even though you could cash out of some of it.. for supplemental cash .. maybe even a few months of living 9) Bitcoin - $1.3 million Total: $2.5 Million. Just from the $2.5 million, then we can presume a passive withdrawal rate from all of these at 4% per year which would be $100k per year or $25k per quarter or $8,333 per month. I am not sure what advantage you are going to get from trying to fuck around with any of them in terms of trying to play the waves of the market, except if you have a set withdrawal rate for each one of them, and then based on what is happening at the time, then you might choose to spend mostly from one rather than spending from the other or not to withdraw from one (or to withdraw more or less from one or another), and then hopefully whatever you do choose to withdraw ends up covering your expenses during the months that you are in that state of preference (prioritizing). Like I mentioned, my chart only is about the bitcoin portion of your withdrawing, and my chart already attempts to make adjustments in regards to where the BTC spot price is in reference to the 200-week moving average in order to show you your limitations for each of the months. I think you would be potentially getting distracted if you are attempting to deviate too much from the motives of the chart and try to figure out other macro-factors that may or may not end up affecting BTC prices... even though if the BTC price gets several multiples higher than the 200-week moving average, then you would likely need to consider cashing out months in advance like is suggested to be authorized in the chart, rather than just merely cashing out one month at a time, and so if you miss out cashing extra during those peaks and you only cash out one month at a time, then you might end up short-falling yourself in the future regarding some extra cash that you could have had gotten on hand (without even hurting your portfolio) for later down the road when the BTC price might end up going to way lower levels of withdrawal authorizations. and then once the BTC spot price falls back down then you are back to ONLY being able to cash out one month at a time.. at least in terms of the guidelines of the chart, and since it is your money, you are not even restricted by the guidelines of the chart.. you can completely abandon the chart.. and then likely be stuck in even a worse state, especially since the limitations of the chart is meant to empower you rather than to really restrict you. Of course, if you were to be a trustee of a fund and you are mandated to be following these kinds of guidelines, then that would be another story.. but as an individual, you can do whatever you like. I know that there are people in the forum who have 100% in Bitcoin or a very important part of their net worth but in my case I prefer to play safer even at the cost of sacrificing a little profitability.

I doubt that 100% in works for very many people, and from my perspective it puts you in a worse position in terms of potentially drawing red flags.. and sure it might work for guys who have figured out how to earn in bitcoin and spend in bitcoin.. but many folks, and especially if we are referring to normies, we are going to have feet in both worlds, even if we might have 70% to 90% of our wealth in bitcoin, we also might have various kinds of fiat related funds, expenses and ways of transacting. I suppose even someone who has everything in bitcoin, they still could use some kind of a chart like mine in terms of figuring out if the amount of their BTC is being spent in a sustainable way.. and surely if they have an income in bitcoin and they are spending less than they earn, then the extra would presumably be going into some kind of a fund (or cold storage), and if the income ever dries up, then there would still some guidelines to spend in a sustainable way instead of depleting the principle.. Even with my chart, there may be some attempts to follow the guidelines in perpetuity.. but then if we suddenly die then do we have a plan for whatever is left in the fund at that time? Do we have an administrator who can take over the fund? Or if we have notice of our impeding death, do we either want to spend the money more rapidly or to donate the money or to just die with the BTC in our wallets in order to give back to the then remaining BTC HODLers. Here I am only considering the case in which both Bitcoin and the S&P rise and fall in unison, but if this does not happen, and we have a fall in the S&P and the portfolio in Bitcoin rises in price, or conversely, the decision of where to withdraw it's clear.

I think that my chart already attempts to give guidance on that in terms of where the BTC spot price is in regards to the 200-week moving average, and whether the S&P and various other macro-factors are overinflated or underinflated, then surely that could affect your decision on the margins, but I think that part of the reason that I have been thinking about these kind of ideas for so long and have been trying to work on a chart in regards to how to think about the BTC price is in order to not have to try to factor in so many unknowables.... but just have a plan that is more based on what is known - which is how far away from the 200-week moving average is the BTC spot price, and does that authorize me to spend more or not, and if so how much. At some point we might consider is the 200-week moving average a good indicator (it is based on the average weekly price over 4 years), or should be be using the 300-week moving average (which would be the 6-year weekly average) in order to attempt to be more long term in the way that we manage our spending within our bitcoin holdings. I too, like Fillippone, am more focused on increasing my stash, or rather my global wealth, but I am interested in the topic as information for the future and because I am interested in financial strategies in general

Well my entry-level fuck you status chart should help to give you some ideas regarding how many BTC that you feel that you need by what year, and if you ONLY have 8 BTC, but you want to get to the default entry-level fuck you status of 10 BTC within 10 years, then maybe you still need to be buying or earning around $300 to $400 per week in bitcoin in order to increase your stash by more 2 BTC in 10 years... and according to my entry-level fuck you status chart, 10 BTC would be enough to be at entry-level fuck you status by early 2034... and of course, until your stash of coins crosses over into entry level fuck you status, you are not necessarily going to know that the 200-week moving average will continue to go up as projected.. so if you end up overly preparing and you end up getting 10 BTC by 2026 and then 12 BTC by 2030 and then 13 BTC by 2032.. and then maybe somewhere along the preparations the lines will cross in which you might start to feel that you have either accumulated enough BTC or maybe even that you accumulated more than enough.. or on the other hand, if your accumulation does not end up going as well, then 8 BTC might still end up being enough to enter into entry-level fuck you status by 2035. We kind of have to be prepared to do our best and hope that our preparations continue to pay off, and even if you have ONLY been in BTC as long as your forum registration date, then you have not quite been in a full cycle, and maybe you do need another full cycle of BTC accumulation before you start to get more tangibly closer to a position in which you might end up changing away from an accumulation status. Hi JayJuanGee. This topic is a good idea of your investment ideas. I have read it to the end. But I will read it again on different days.

Today is the fourth day that I have returned to this thread to read your thoughts on attracting and maintaining a portfolio and wanted to convey this as a workplan sheet which is very useful if bookmark.

Thank You.

Of course, this chart is meant to be something that supplements my other investment ideas in regards to getting your whole portfolio up to a size in which you can reference the whole thing and then start some kind of a sustainable withdrawal (to the extent that you might feel that you are out of the investing and accumulating stage), or of course, you could just divide part of your BTC investment portfolio into a spendable amount if you would rather allow your other portion to continue to grow.. or just stay in cold storage. I cannot recall if you ever said where you are at in your bitcoin accumulation journey and if you feel that you are getting close to being done with accumulation? and moving into maintenance and perhaps some variation of liquidation. .which this could help with those kinds of ideas/practices. Very nice post/thread, one of the missed stone in this road is that, when and how to cashout some btc to anything,whether it's to live or for an emergency or a travel ,etc.

The same happens with every portfolio of people when they start to think to live from their investments, is not so easy and sustainable without a lot of discipline and a ton of knowledge.