|

brg444

|

|

October 27, 2014, 03:35:54 AM |

|

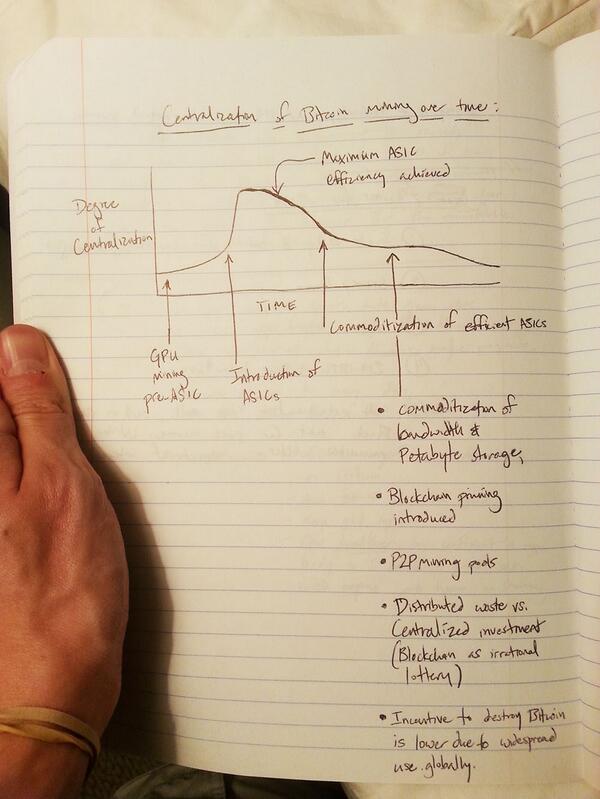

Big players making farms. Sure. Everyone can see that. Specialized silicon that would lead to 1 or 2 large players controlling bitcoin. No.

The intent was a decentralized peer-to-peer system. Failing to adapt the core to that end put bitcoin on a path of greater and greater consolidation that will eventually make it vulnerable to a number things and non-viable. It will be replaced by a version 2.0 that is peer-to-peer decentralized and probably has other fundamental innovations.

Remember there is an economic incentive for players not to collude and respect decentralization of the system. Moreover you are also underestimating the prospects of commoditized ASICs and development of p2p mining pools.  |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

EternalWingsofGod

|

|

October 27, 2014, 04:24:56 AM |

|

Well if the mining farms do put a lot of their Bitcoin on the market it means that there will be a depressing effect on the bitcoin price for a while, this combined with increasing merchant adoption with conversions to fiat using bitpay means a price drop

The question is when the stabalizing effect and market upside begin to return to offset these factors.

|

|

|

|

sublime5447

Legendary

Offline Offline

Activity: 966

Merit: 1000

|

|

October 27, 2014, 06:29:10 AM |

|

This is how bitcoin slowly dies from here. What started as a chance for everyone to generate their own bitcoins and participate in the economy now turns to a few data centers producing bitcoins thus forcing new users to purchase new bitcoins from them. We've traded fiat currency controlled by a few central banks to bitcoin controlled by a few data centers.

Meet the new 1%. Slightly different to the old 1%, but they're still there.

Holy shit I thought I was the only one that noticed that. Nice to meet you I have been saying that for 10 months.  |

|

|

|

|

labsbitforum

Member

Offline Offline

Activity: 99

Merit: 10

|

|

October 27, 2014, 01:58:06 PM

Last edit: October 27, 2014, 02:16:55 PM by labsbitforum |

|

Big players making farms. Sure. Everyone can see that. Specialized silicon that would lead to 1 or 2 large players controlling bitcoin. No.

The intent was a decentralized peer-to-peer system. Failing to adapt the core to that end put bitcoin on a path of greater and greater consolidation that will eventually make it vulnerable to a number things and non-viable. It will be replaced by a version 2.0 that is peer-to-peer decentralized and probably has other fundamental innovations.

Remember there is an economic incentive for players not to collude and respect decentralization of the system. Moreover you are also underestimating the prospects of commoditized ASICs and development of p2p mining pools. Good diagram. Really helps to clearly understand your perspective and whats guiding it. Couple thoughts that I think may materially impact the degree of centralization differently than what you drew. 1. Why would a company making the best (most efficient cost per hash) sell that for less than what they would make mining themselves? The trend so far has been get public support to raise start up capital. If successful phase out public to maximize profits. 2. Assuming the best hardware is commoditzed and sold to the public; mining would still centralize around cheap power and cooling. Anyone paying $0.15+ in a hot climate is not going to be viable against someone paying $0.05 or even lower if subsidized like it is in some countries. http://en.wikipedia.org/wiki/Electricity_pricing |

|

|

|

|

sublime5447

Legendary

Offline Offline

Activity: 966

Merit: 1000

|

|

October 27, 2014, 03:30:02 PM |

|

|

|

|

|

|

|

MrBig (OP)

|

|

October 27, 2014, 06:37:33 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

|

|

|

|

|

|

brg444

|

|

October 27, 2014, 08:10:03 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

ElectricMucus

Legendary

Offline Offline

Activity: 1666

Merit: 1057

Marketing manager - GO MP

|

|

October 27, 2014, 10:09:22 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream Right there are totally no gold mines on the stock exchange. Cryptocurrency miners on the other hand...... |

|

|

|

|

ivanovasmd

Newbie

Offline Offline

Activity: 43

Merit: 0

|

|

October 27, 2014, 10:19:53 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

Im not sure as I dont have he data but I think mantaining a gold mine business is way more expensive than maintaining a btc mining business, so they are forced to buy to pay a lot of expenses anyway. |

|

|

|

|

|

MrBig (OP)

|

|

October 29, 2014, 02:27:43 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream So basically the BTC mining companies take the money from their other revenue streams and throw it into a bottomless pit, right? |

|

|

|

|

|

brg444

|

|

October 29, 2014, 02:46:51 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream So basically the BTC mining companies take the money from their other revenue streams and throw it into a bottomless pit, right? Bottomless pit? Not sure what you're referring too. They're using the money to build large scale industrial farms that can mine BTCs at significantly lower prices than even current market price. I'd say that inventory need not to be sold unless the market price goes down to that production cost level. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

brg444

|

|

October 29, 2014, 03:02:11 PM |

|

Big players making farms. Sure. Everyone can see that. Specialized silicon that would lead to 1 or 2 large players controlling bitcoin. No.

The intent was a decentralized peer-to-peer system. Failing to adapt the core to that end put bitcoin on a path of greater and greater consolidation that will eventually make it vulnerable to a number things and non-viable. It will be replaced by a version 2.0 that is peer-to-peer decentralized and probably has other fundamental innovations.

Remember there is an economic incentive for players not to collude and respect decentralization of the system. Moreover you are also underestimating the prospects of commoditized ASICs and development of p2p mining pools. Good diagram. Really helps to clearly understand your perspective and whats guiding it. Couple thoughts that I think may materially impact the degree of centralization differently than what you drew. 1. Why would a company making the best (most efficient cost per hash) sell that for less than what they would make mining themselves? The trend so far has been get public support to raise start up capital. If successful phase out public to maximize profits. 2. Assuming the best hardware is commoditzed and sold to the public; mining would still centralize around cheap power and cooling. Anyone paying $0.15+ in a hot climate is not going to be viable against someone paying $0.05 or even lower if subsidized like it is in some countries. http://en.wikipedia.org/wiki/Electricity_pricingto be fair this is not my diagram. I have no answer for your first question, only time will tell how all of this unfold. As for your second question, my vision of commoditized ASICS is that they would essentially be integrated to regular house appliances and personal computers in a way that they are essentially everywhere and run at no significant premium cost for the user. Of course if their propagation is marginal it might have no significant impact but imagine a world where every personal computer is sold with an ASIC running inside. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

|

|

brg444

|

|

October 29, 2014, 05:30:21 PM |

|

consolidation of small fries != centralization they probably amount to less than 10-15% of the network hashing power so I don't see the problem try again, troll

|

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

MrBig (OP)

|

|

October 29, 2014, 05:45:32 PM |

|

consolidation of small fries != centralization they probably amount to less than 10-15% of the network hashing power so I don't see the problem try again, troll If a small fry controls 15% of the network hashing power, I wonder how much a big fry will control. |

|

|

|

|

labsbitforum

Member

Offline Offline

Activity: 99

Merit: 10

|

|

October 29, 2014, 05:49:35 PM |

|

And simple greed. Make as much as you can as quickly as you can. You cant really blame them. They are fighting tooth and nail with other ASIC/rig makers. Its not like they have been in business for a hundred years or looking to go another hundred. The root of the problem is bitcoin core development failed to evolve and keep it P2P and the consequences will be centralization and open the doors to the many downfalls that p2p decentralization solves. Those who argue that we are not headed to increased centralization sound more and more like denialist. http://en.wikipedia.org/wiki/Denialism |

|

|

|

|

|

MrBig (OP)

|

|

October 29, 2014, 06:49:42 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream Gold mining companies don't sell equipment to their competitors. Why would a giant mining farm sell equipment to users to compete with them and take a cut of their profits? That makes no sense. Until you realize that they sell last-gen hardware to clueless prospectors. |

|

|

|

|

|

brg444

|

|

October 29, 2014, 07:04:38 PM |

|

I wonder what would happen to the gold mining companies if they tried 'hodling' their gold until it went to the moon...

gold mining companies do not have other revenue stream Gold mining companies don't sell equipment to their competitors. Why would a giant mining farm sell equipment to users to compete with them and take a cut of their profits? That makes no sense. Until you realize that they sell last-gen hardware to clueless prospectors. Are you kidding me? What exactly is your point here, you just arguing for the sake of it? I know they don't sell mining equipment to their competitors, that's why you cannot compare it with Bitcoin mining company who, in a way, do, hence why your original comparison is asinine and holds no ground. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|

MrBig (OP)

|

|

October 29, 2014, 07:29:56 PM |

|

My point is that it doesn't make sense for a company to enable others to compete with them. The main point that mining is becoming centralized still stands, as evidenced by the link that notlambchop posted. Thanks for bringing this to my attention. This is further proof that mining will be controlled by a handful of big players in the future. |

|

|

|

|

|

brg444

|

|

October 29, 2014, 07:47:58 PM |

|

My point is that it doesn't make sense for a company to enable others to compete with them. The main point that mining is becoming centralized still stands, as evidenced by the link that notlambchop posted. Thanks for bringing this to my attention. This is further proof that mining will be controlled by a handful of big players in the future.  You do know that likely the biggest mining company out there, BitFury, sells industrial mining gears to other miners. I would say this qualifies as "enabling others to compete with them". They actually offer the service of building data centers and supplying mining equipment for mining operations i.e. other Bitcoin miners. In fact, every mining companies in the ecosystem probably mine Bitcoins themselves AND sell mining gear. So your point really doesn't make any sense, at all. |

"I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash." Hal Finney, Dec. 2010

|

|

|

|