I typed 1\ when I want to send 1 merit and it works. To test it again, I typed 1/ and it works too. Tested it again with 1~, and it works too. Can these ones be considered as bugs with Merit button? Please check it theymos.  I guess the box should accept number only, not string. You know, one idea pops up in my head, and I want to hijack the merit system by using exponential but it does not work. It only allows me to send 2 merit, not 4.  |

|

|

|

When you spend more time in Bitcoin market, you will read more news about this market and Bitcoin. You will read many criticism or just hilarious and jealous comment that Bitcoin investors got profit because they were lucky. In this thread, I simply give you two charts of Bitcoin and Gold. Let me emphasize, it is not a comparison about Bitcoin and Gold, but my intention is to share a fact that intelligent investors got profit by their intelligent knowledge and decisions for investments, then good capital management. They did not get profit simply because of luckiness. Their profit did not come to them like airdrops without any knowledge and their own serious efforts with time. See two charts and discover a fact that intelligent investors bravely buy in bear markets, when most serious tests on their belief and mentality. Price did not hold if there are not strong believers and investors. It's not luckiness for Bitcoin, Gold and their investors to hold price in bear markets and tested in many bear markets in history. Their cycles can be longer or shorter but you can see how psychology of market cycle works. People say Bitcoin is too volatile but see the chart, and discover that Gold gets a correction about 40% and it needs about 10 years to have another bull run. Each market has its own cycle and discover powerful effects of holding your bitcoins as you can see there.

|

|

|

|

I read the announcement about latest adjustment on merit circulation. It affects my Merit score but there are bugs. If I click on my profile merit page, it gives me merit score with previous merit system. https://bitcointalk.org/index.php?action=merit;u=1292764If I visit the forum without login my account, read it as a Guest, I will see my merit score with previous merit system. There are at least two bugs, please fix it, theymos. |

|

|

|

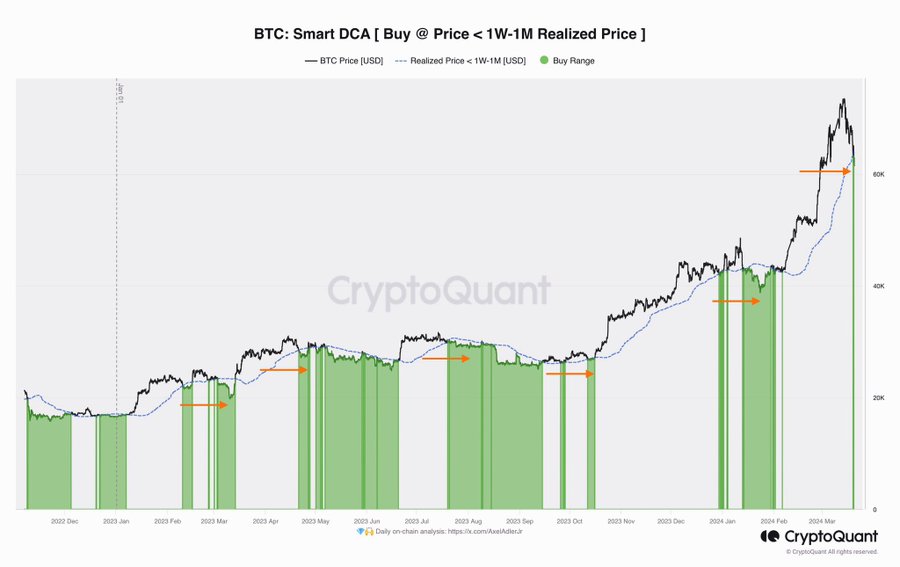

I believe many of us are familiar with Dollar Cost Averaging, DCA but how about Smart DCA. This thread is for discussion, and I am not concluding Smart DCA is actually Smart and better than DCA.  - Visit this dashboard on CryptoQuant

- It is built by @AxelAdlerJr on CryptoQuant and let's read his post about it on X.

I wanted to remind you about the concept of Smart DCA, purchasing BTC during corrections, when the price drops below the 1W-1M Realized Price.

This strategy works well during a bull rally and is much more effective than classic DCA.

A quick glance gives me that is a good strategy but if I look deeper, it is not actually smart. By using Smart DCA, simply glance at it, we see entries are below 1W-1M Realized Price but we will miss days, weeks before price drops behind the Realize price (blue line) and miss chances to buy when price is even lower than the Green areas that are entries given by Smart DCA indicator. Share your thinking about this strategy please. Personally I see a traditional DCA strategy is better. |

|

|

|

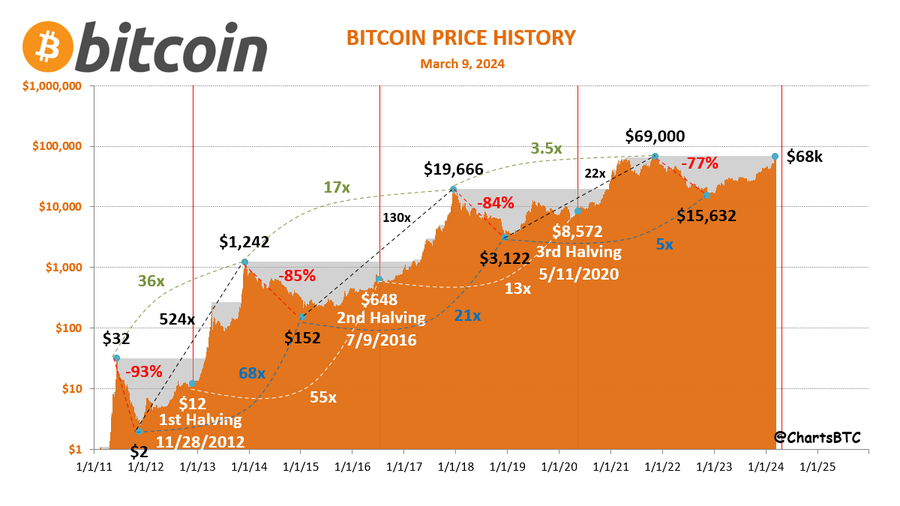

In finance and TradFi (Traditional Finance), we have saying like "This time will be different". That is true and untrue. True by nothing in life will repeat itself 100% accurately. Untrue by there are always things to be different, just in small or big scale. Let's see Bitcoin Price History with past bottoms and ATHs. You can do your own calculation with data from Coinmarketcap and run your own sheet or can simply look at this source.Details are in the graphical chart so I don't type it here. Let me know what you feel most meaningful for you and your future investment in Bitcoin? For me, it is % dip from ATHs, that are -93%, -85%, -84% and -77%.

Note:- I did not compare information in the chart with my calculation as I only made a first one for price change from $32 to $1242, it is 38x, not 32x, so probably there are some minor inaccuracies but let's skip them and see an overview picture.

|

|

|

|

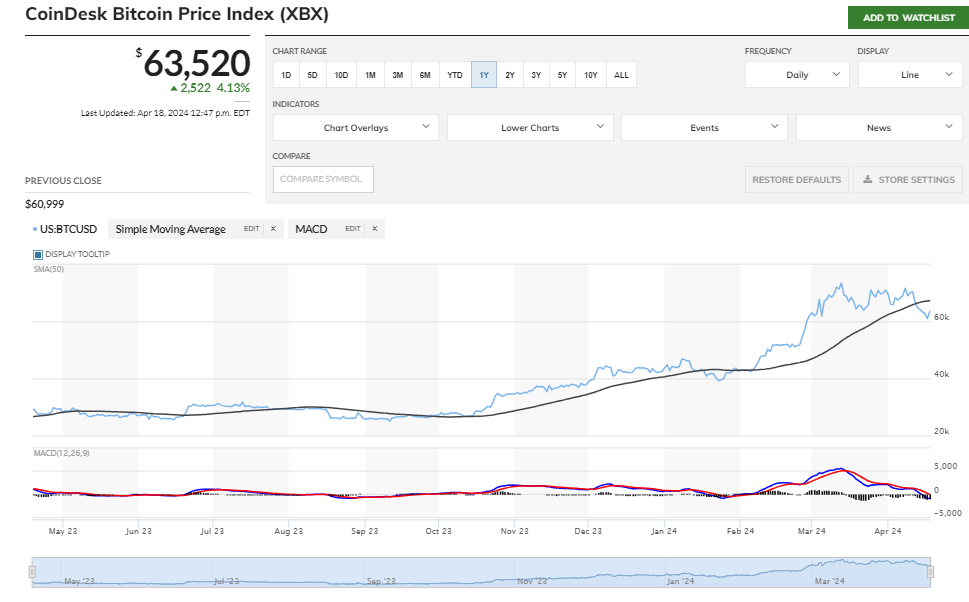

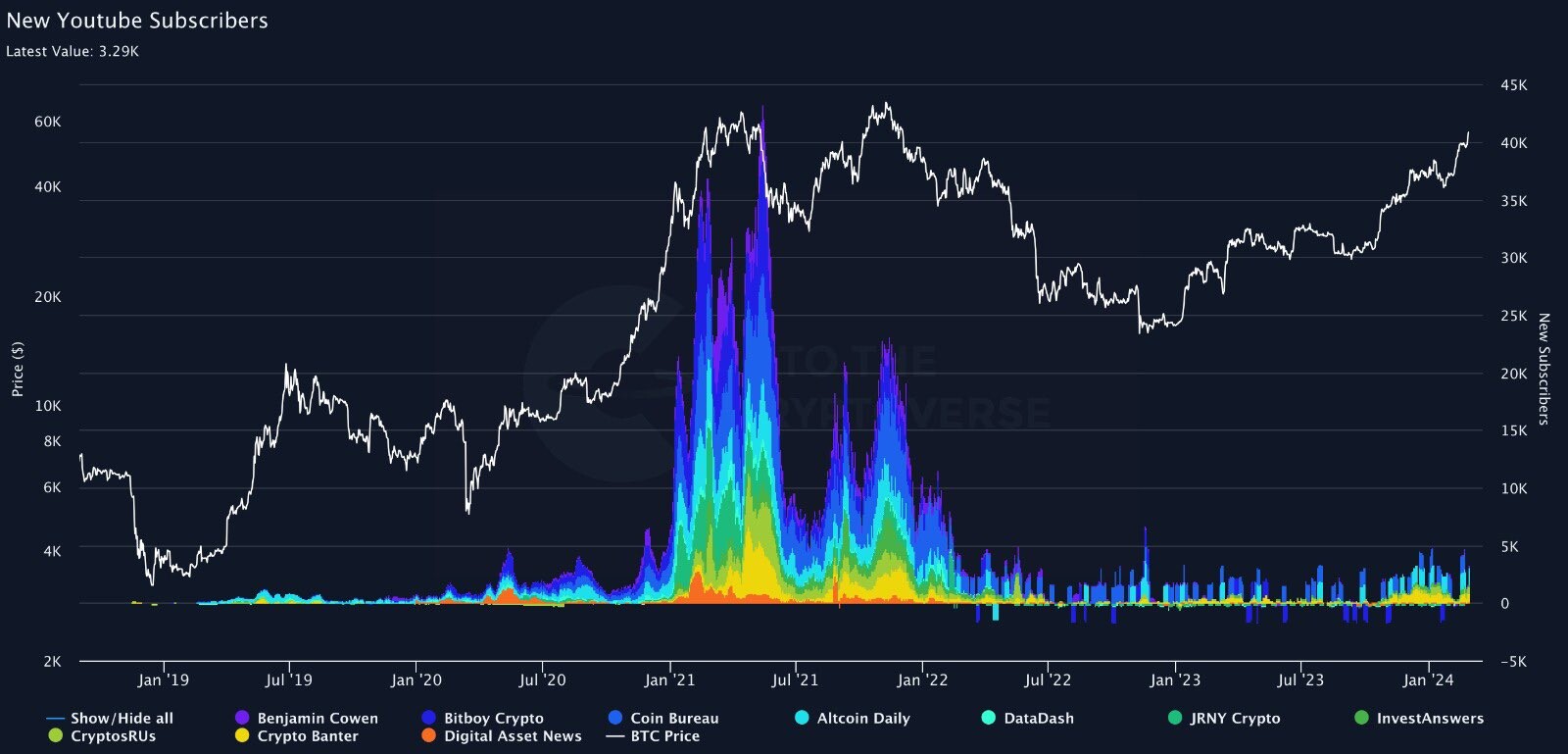

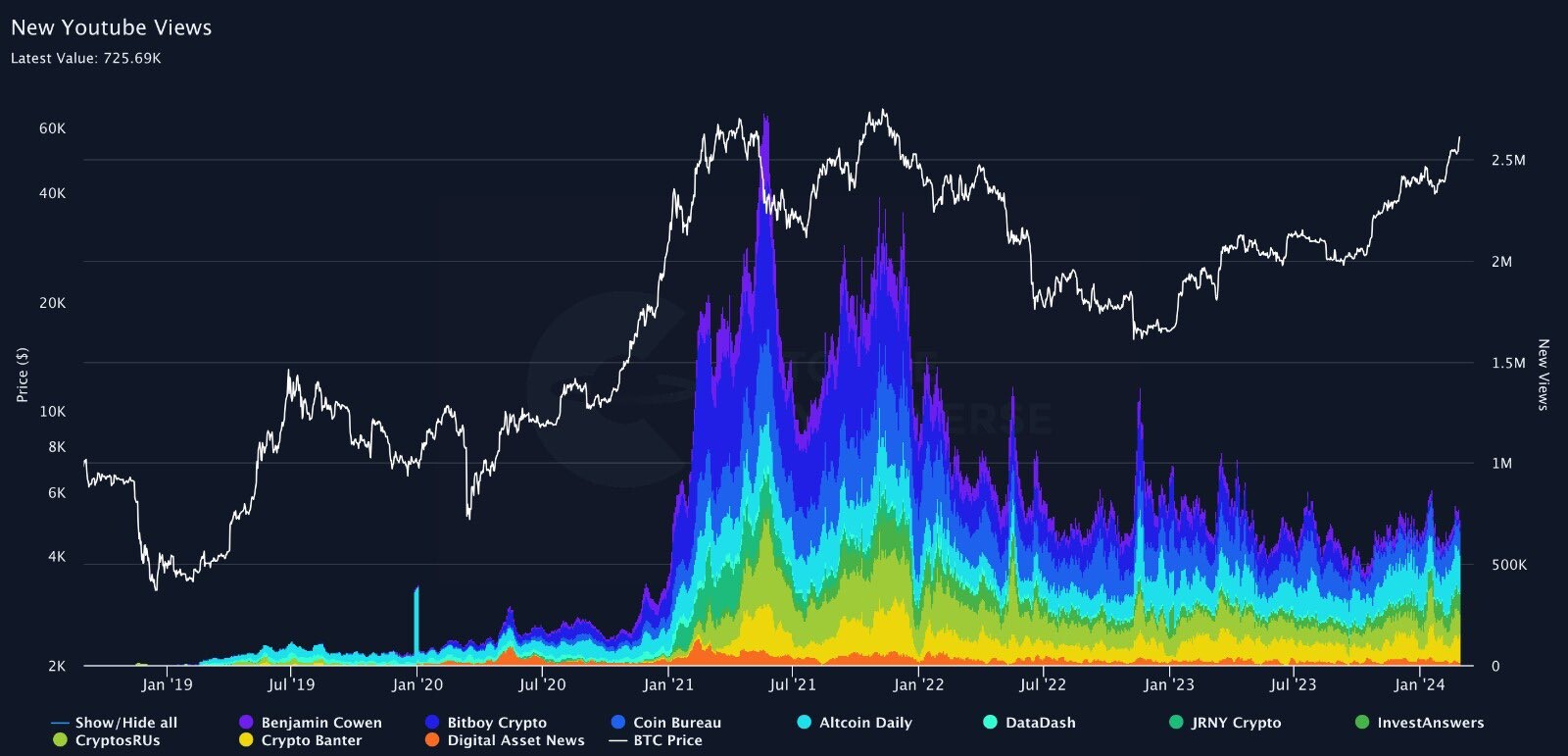

Institutional investors are whales who are game makers and manipulators but Bitcoin market hits its all time high with very last forces from retail investors. Bitcoin is up more than 44% last month (February) and makes many people feel like they missed the party. Fact is, it is still early. See some metrics above like - Google Trend

- Youtube Subscribers

- Youtube Views

Like Youtube or not, we can not deny fact that it is one of most favorite homes of retail investors, newbies in Bitcoin market. It is where they get most exposure and information, to hype themselves in Bitcoin market. Three charts above show that we are far from peak hype of the past bull market. Also, let's check |

|

|

|

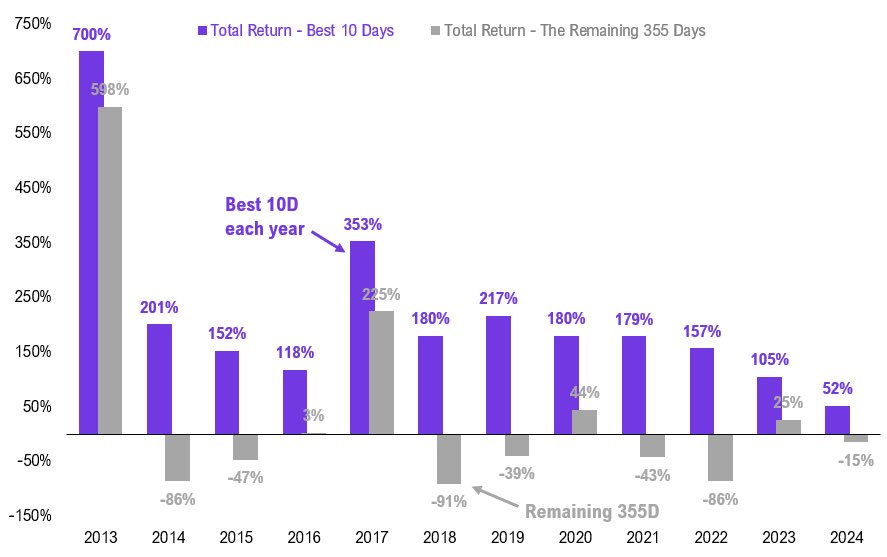

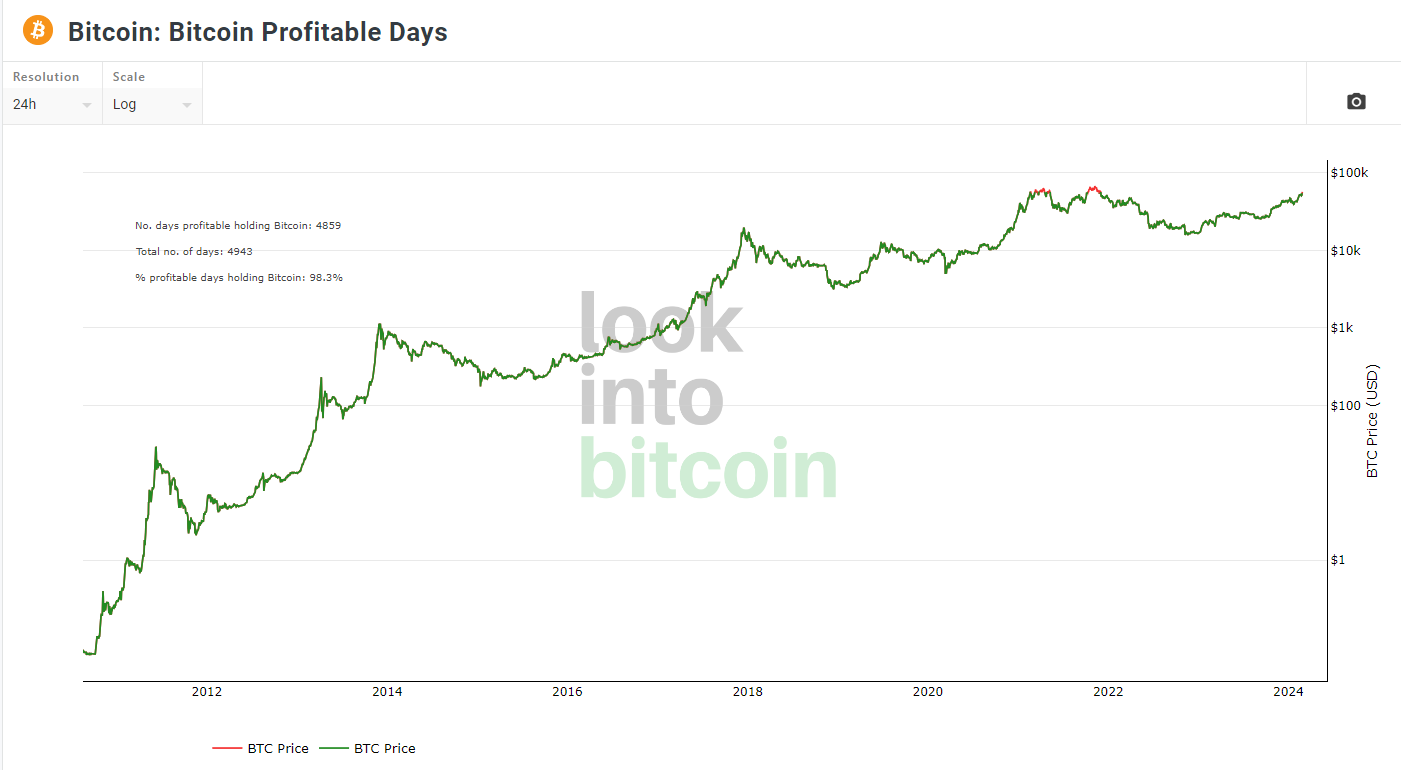

Source: https://twitter.com/HHorsley/status/1762660112915964385This point of view is interesting but my opinion is you should not bargain with the price too much and you should zoom out, think of something bigger than only one year, one market cycle. You can get good profit even you miss best ten days each year. See Bitcoin profitable days (98.3% as of writing) and its yearly candles chart (with only 3 Red Yearly candles in history). |

|

|

|

The table screenshot is taken from Bitwise's Crypto Market Review Q4 2023. You can click on the link to download the report. If you only need to read an abstract of it, read there. JPMorgan Chase is an institution which are participating in all categories: Crypto Trading and Custody, Private Crypto Funds, Crypto ETFs, Crypto-Enabled Payments, Tokenization. By pointing this out, I would like to show you how deep JP Morgan Chase engaged in cryptocurrency market so that you can see how their CEO Jamie Dimon told us something oppositely. He lies, the table shows that. |

|

|

|

My recommendations - Don't try to find All time high, you can not predict it correctly and you will only know ATH of a cycle after you are already in a bear market.

- Don't time the market. Let's the market runs and try to exit with market cycle length, that you can base on Bitcoin history.

- Each cycle is unique and it can be longer or shorter than previous cycles but if you make your strategy on average cycle length, you will not take profit too far from the ATH & more important you will be able to avoid stuck too deep in a bear market.

- If you don't want to exit the market by taking profit with all bitcoins you have, do DCA for profit taking, withdrawal like this strategy.

- Biggest common mistake of newbies is trying to find absolute bottom or ATH. Just don't!

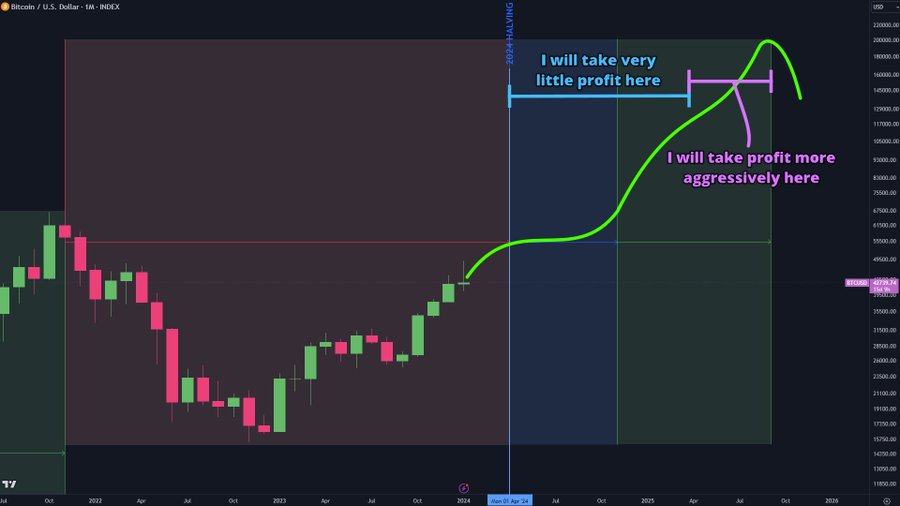

Now, let's use following flow of thinking and plan from LadyofCrypto1. I will keep her content originally as it is. My own thinking is above. ▶️ Some questions & predictions - When will Bitcoin break its ATH? November 2024

- When will the bull run end? September 2025

- When will most of the new 100x alts be released? Jan-July 2024

Why do I think this? I'll show you below 👇 ▶️ This Time Is NOT DifferentAll I've heard for the past 2 years is "This time is different". They said the bear would be longer because of FTX and recession... They said the BTC would break its ATH sooner because of ETFs... Yet, things have been exactly the same 👇 ▶️ Market TopsIn 2017 the bull market peaked exactly 29 months before the halving. In 2021 it did the exact same thing. Alright, I know, it might just be a coincidence. But what if I told you... ▶️ Bear Market LengthBoth the 2018 and 2022 bear markets lasted exactly 12 months. This is crazy when you consider how many people were saying this bear market would be way longer and deeper. But was it deeper? No, it wasn't. In the 2018 market, Bitcoin retraced 84%. In the 2022 one there was only a 77% retrace. So all the drama around the bear market and it ended up being the exact same length as the previous one and percentage-wise... better. ▶️ All Time HighIn the last two cycles, Bitcoin broke its all-time high 7 and then 8 months after the halving. The ETF has so far not propelled BTC to 100k overnight as many assumed. I think that like the last two time, it will be 7-8 months, so, November 2024! ▶️ Bull RunThe last three bull runs lasted 9, 9 and 11 months respectively. This one could be longer but I think 9-11 months is a good target to keep in mind. I think the next run peaks around September 2025 give or take a month. Let's talk profit-taking. ▶️ Taking Profit I'll take partial profit slowly the whole run up. I believe that if you're up big you should 5%-10% out to secure profit. A lot of people say "Don't sell strength"... meh. In crypto things can go from strong to dead in hours. I'll take a small amount of profit on alts that pump hard but as we get closer to Sep 2025 I'll ramp up profit taking. This is a loose plan and could change! Some profit will be moved out of crypto and the rest reinvested in new projects with more upside potential 🚀 |

|

|

|

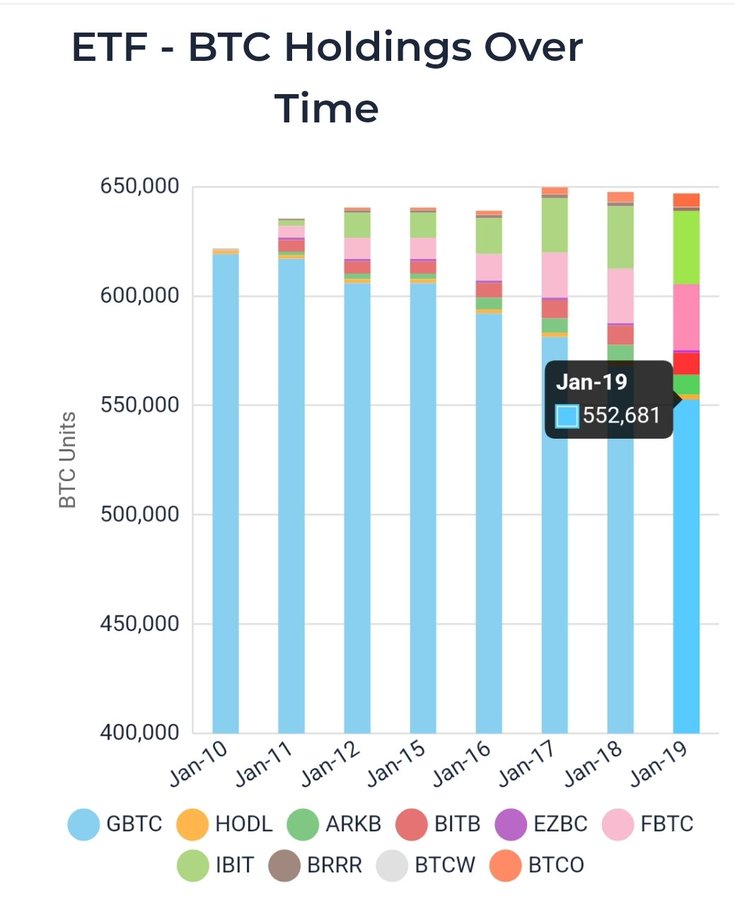

Bitcoin Spot ETF approval is a very big milestone for Bitcoin market. It makes Bitcoin more 'legal' and attract bigger capital to this market. A website to track Bitcoin Spot ETFs' holdings. If you use Twitter, you can follow We will not see instant effects from Bitcoin Spot ETFs on Bitcoin Spot market because those companies are buying Bitcoin through OTC market. Soon they will knock the Bitcoin Spot market and let's use your imagination to see how price will react.

Bitcoin Spot ETF Trackers | | | | | | | | | | | | | | | | | | | | | | | | | Link | | | Notes | | | | | | Heyapollo.com | | | ETF details (fee), charts exclusively animated | | | | | | Bitcoin Strategy | | | Chart, Newsletter | | | | | | Blockworks.co | | | ETF details (fee, status, AUM ..) | | | | | | Coinglass.com | | | ETF details (fee, status, AUM ..) | | | | | | ETFdb.com | | | Bitcoin ETFs List (factsheet, ...) | | | | | | Farside.co.uk | | | Bitcoin ETF Flow (table, cumulative flow chart) | | | | | | Bitcointreasuries.net | | | Bitcoin ETF overview, stats, balance sheet history | | | | | | Daily Bitcoin Spot ETF volumes on Trading View | | | A script on Trading view. | | |

|

|

|

|

This Bitcoin bubble index can be a good extra tool for you to watch the Bitcoin market and be alerted of time when people are starting and probably most FOMO in this market. It can not tell you when Bitcoin hits its all time high or a peak of bull run but can signal you about time to seriously consider of market exit. It is from Coinglass. We are like warming up but still calm before a storm too all time high. |

|

|

|

Above is the chart from Glassnode for Bitcoin trend accumulation score by cohorts. The market is in a most shaking period after some months. If you are holding Bitcoin and missed chance to take profit nearly $50,000, don't feel bad. Because - Halving is only three months ahead

- Big whales have been accumulating bitcoin for their games.

The point of this thread is the 10+k Cohort just started their accumulation. See the top blue row in the chart and now we have three top rows (whales) are accumulating Bitcoin after long time of distribution. Accumulating more bitcoins like whales or if you can not do accumulation, just hold and wait for a bull run. |

|

|

|

In Bitcoin Wiki, there is Unfortunately, it is no longer a Bitcoin Block explorer, as you can see how it looks today. My proposal is to change this specific information in Bitcoin Wiki by adding some latest information about that site. A note that it was taken over by Lira Siri and now is no longer a Bitcoin block explorer. Is it possible? |

|

|

|

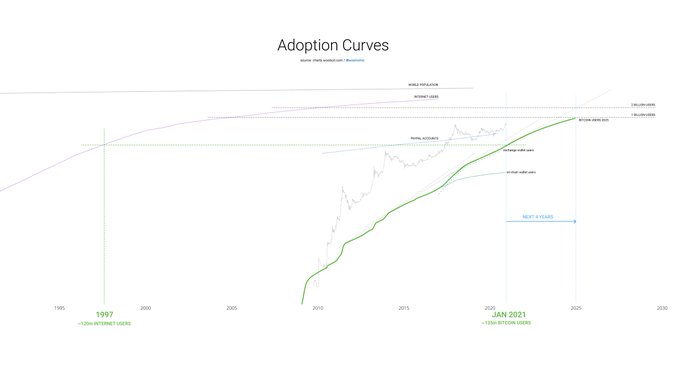

First, let's watch this short video. In the interview, Bill Gates was trolled about Internet capacity to handle a podcast, just a podcast, not a video, movies or livestream like we have nowadays. In the first six years of the WWW (1990-1996), less than 1% of the world used the internet.

The internet’s adoption curve was marked by a really slow beginning when it was only interesting to tech experts. This is similar to the early days of Bitcoin. We can observe the growth of Bitcoin through its value as the number of holders increases the currency’s worth. Sixteen months after Bitcoin was created, its value was still at only $0.004.

(World Bank, Wells Fargo)

Born in doubt, the Internet changed the world entirely and I see some similaries and potentiallities of the Internet and Bitcoin. Now, let's read some more resources Bitcoin has potential to make bigger impacts than the Internet. Coming days will be very chaotic with SEC. and Bitcoin Spot ETFs but if you have bitcoins, spend time to read above and hold your bitcoin. Best has yet come, even without Bitcoin Spot ETF approvals, best has yet come, I repeat! |

|

|

|

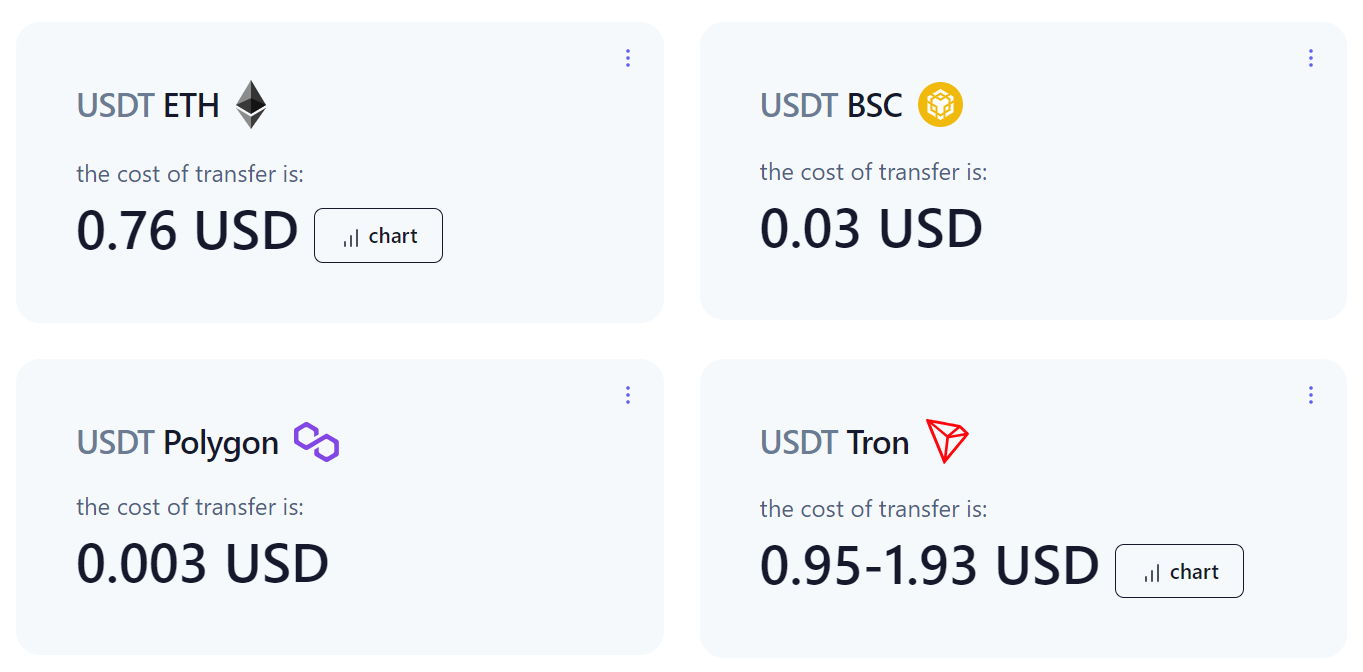

You want to withdraw/ make a transaction with Tether USDT, what are fess now? - The above website gives you USDT fees across 4 chains

- ETH ERC20

- Binance Smart Chain BSC

- TRON TRC20

- Polygon

Everyone knows ERC20 transfers are expensive, but how exactly expensive, and what is the best alternative? This page was built so I don't need to jump over Metamask Networks to estimate gas fees in different networks for a simple USDT transfer.

What about BUSD and USDC?

Other stablecoins gas fees are very similar across the same blockchains, so you can safely assume that BUSD(BEP20) transfer on BSC blockchain will cost the same as USDT(BEP20) transfer on the same BSC blockchain.

Quick observations

As of Aug 2022, all blockchains except native ETH (Ethereum) are pretty stable in terms of fees during the day. But Ethereum USDT transfer gas fee is very volatile: it fluctuates from 0.5 USD to 7 USD! And Polygon is the cheapest network to transfer USDT.

|

|

|

|

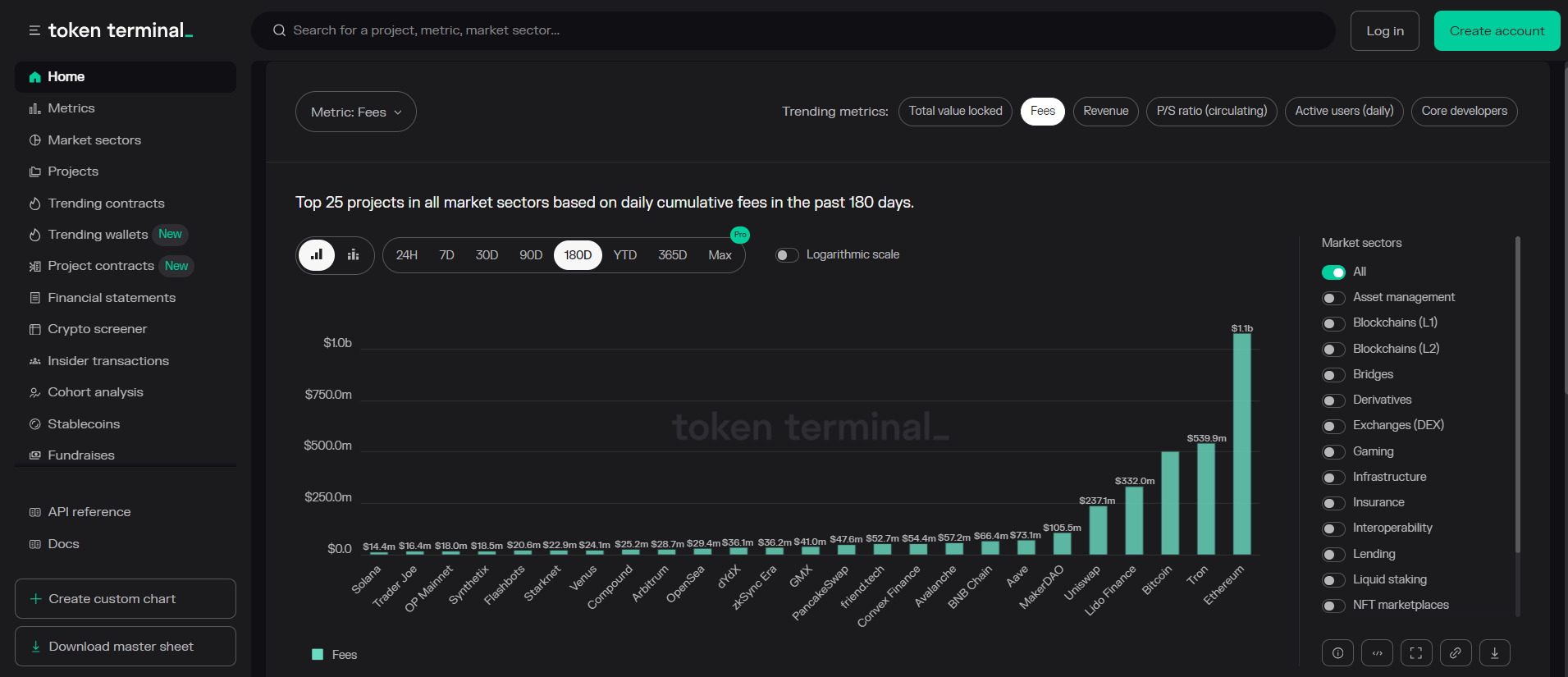

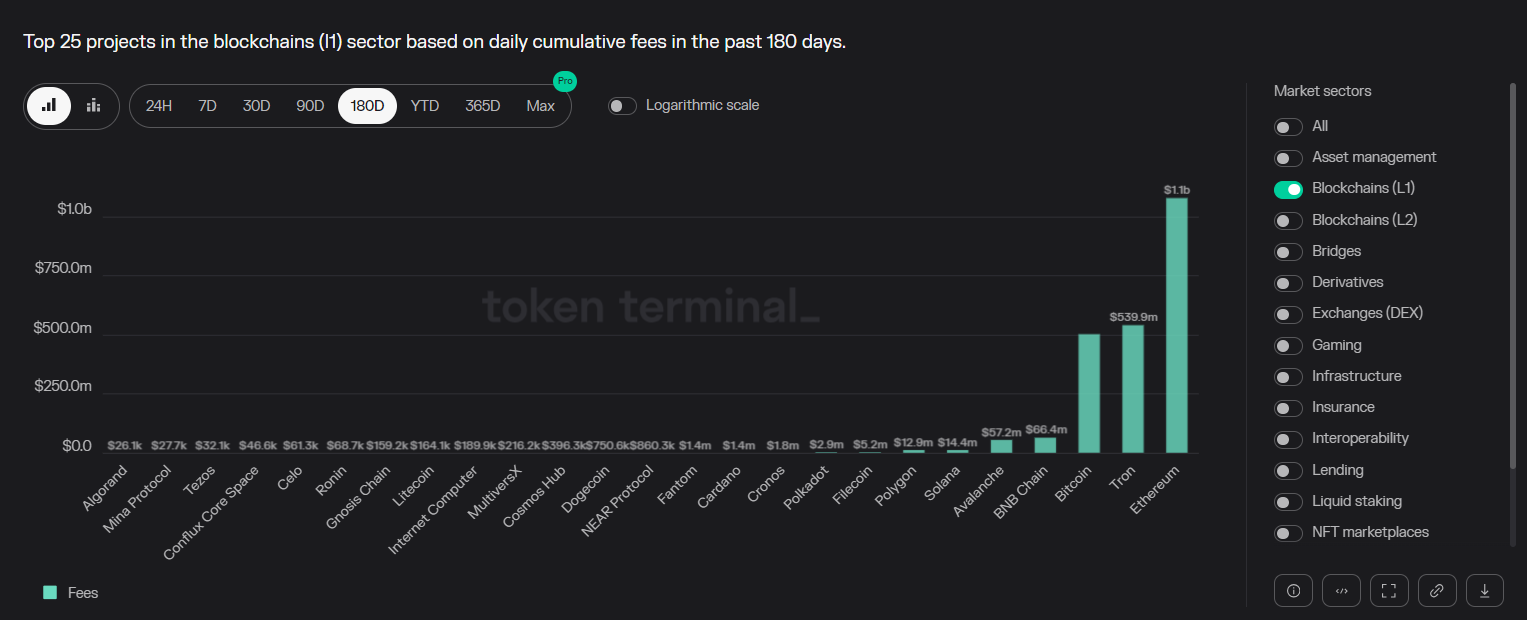

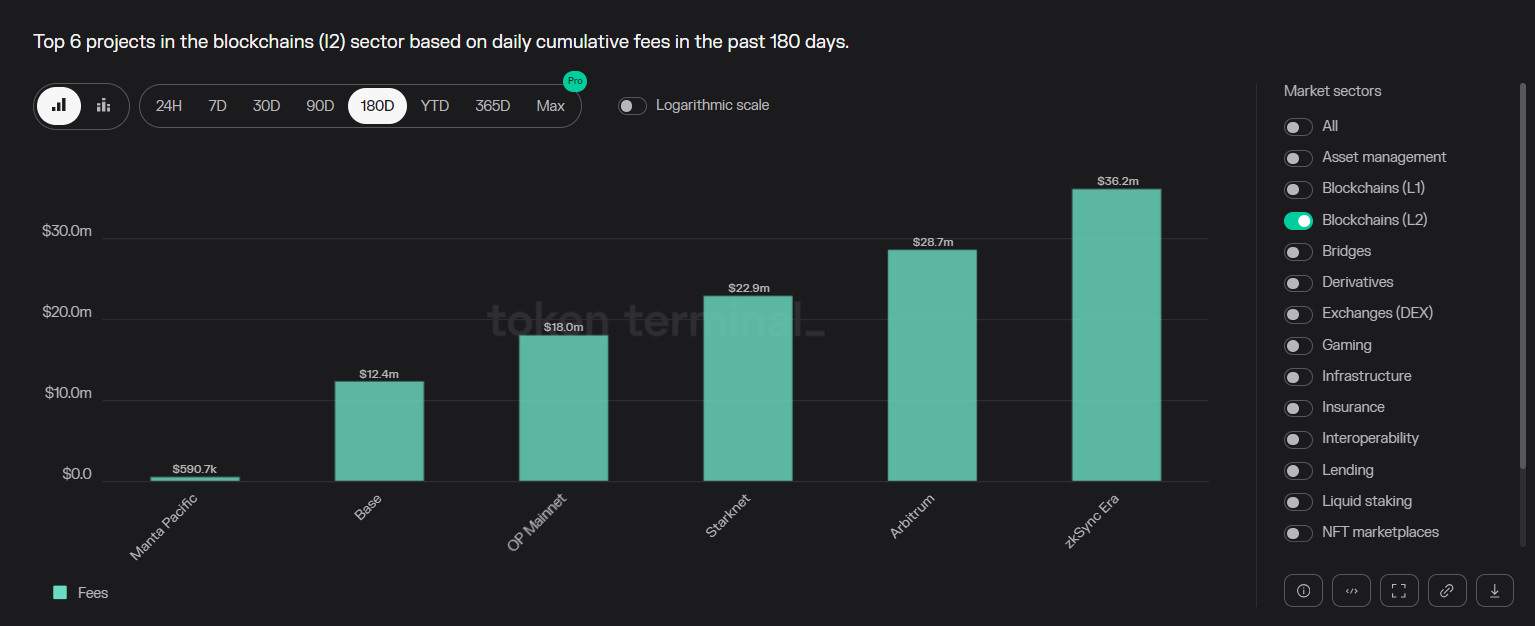

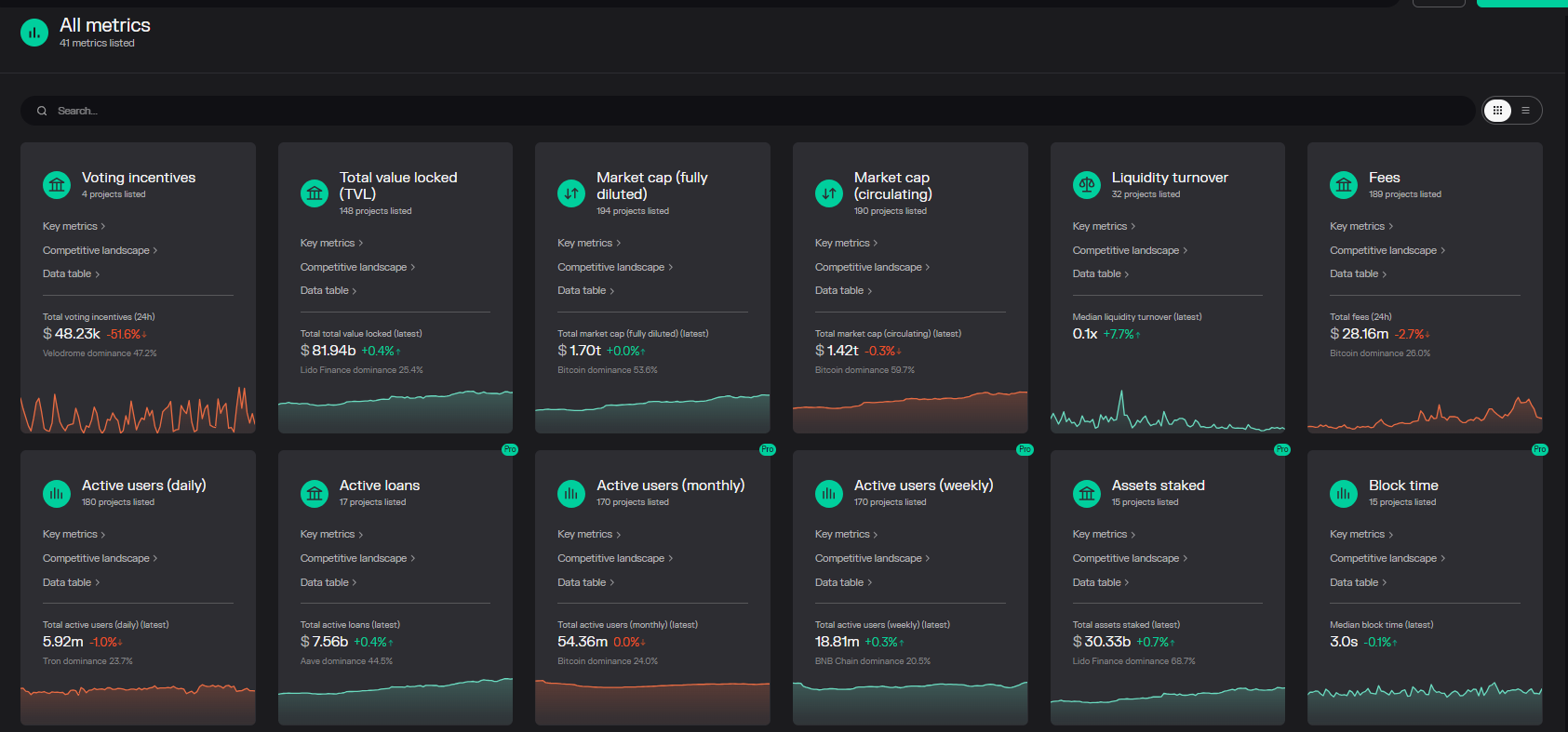

DeFi is risky so make sure you are aware about risk and can afford loss if you touch coins, tokens and any product on DeFi. Here is information about an interesting site that has some tools for Free users to use and filter over blockchains, layers, DEX. They have 41 metrics, some are free and some for Pro users. They have some categories for Market, Projects (free to use with some filters) and more (Pro users). I like this one because it has friendly chart for fee information, which I can not have at other sites like Defilama. |

|

|

|

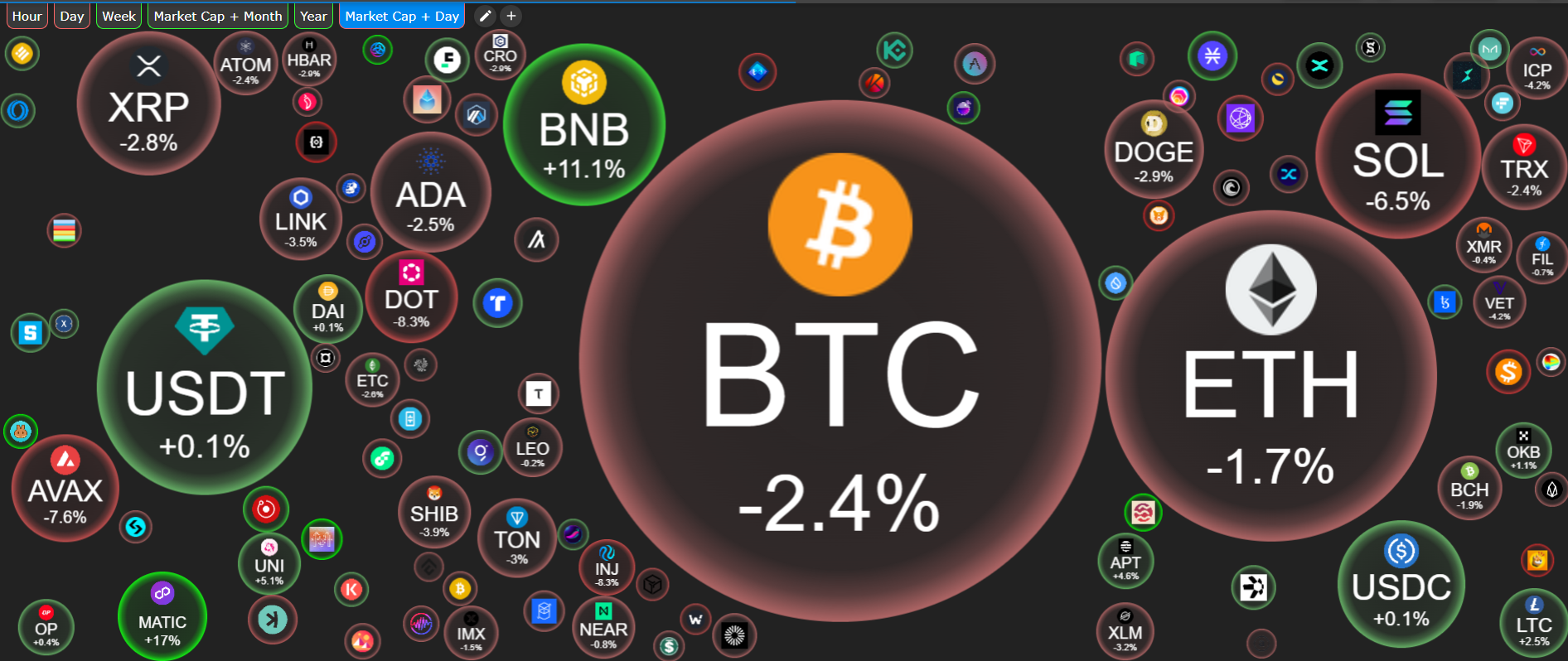

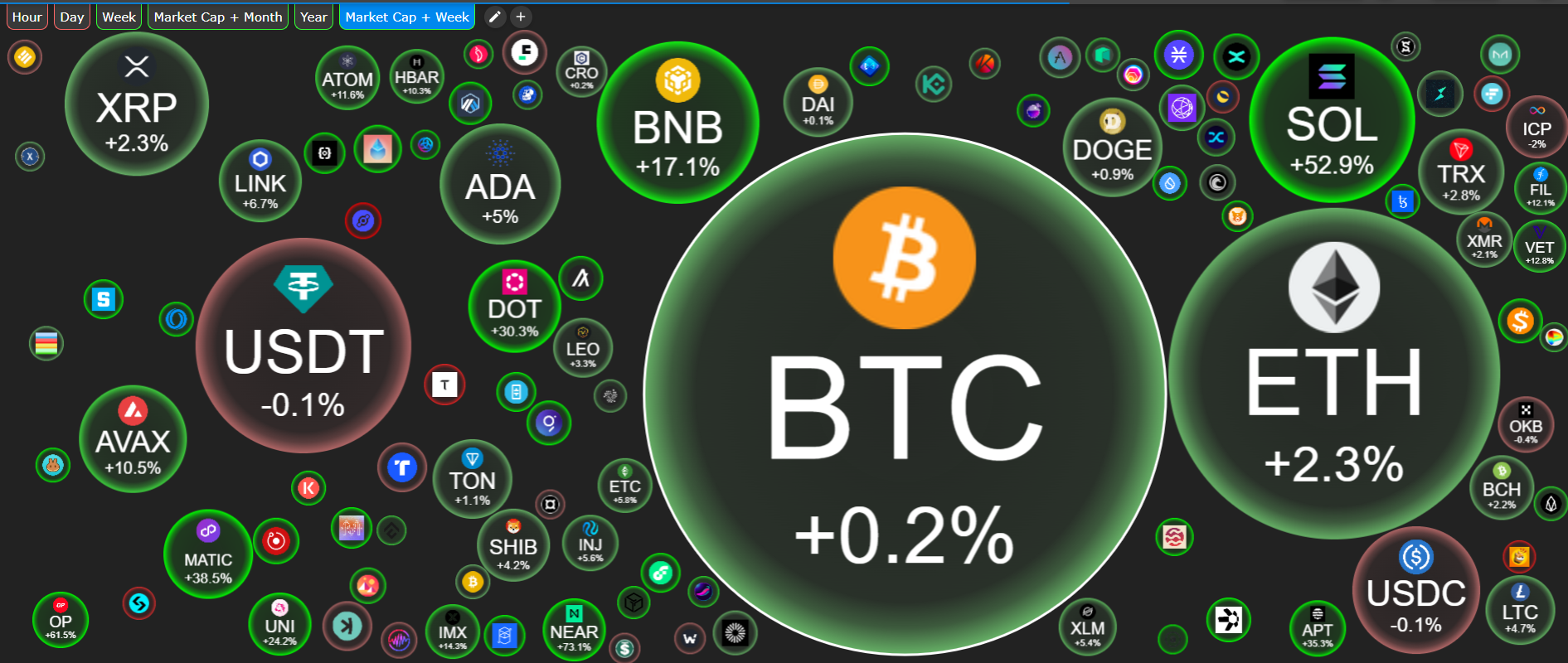

Cryptobubbles.net introduces themselves as Independent visualization tool and data aggregator for the cryptocurrency market. Available for free and without ads as website or app.

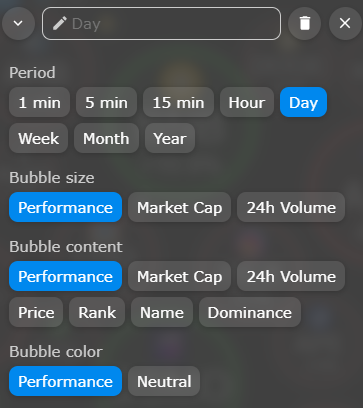

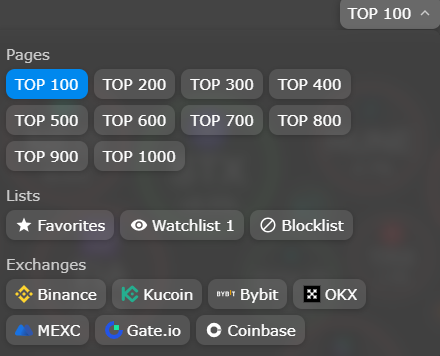

You can choose to see different bubbles map with Day, Month, Year plus with other indicators like Marketcap, 24h Volume for bubble size or some different options for Bubble content. To filter bubbles, Marketcap and 24h volume are important and you must use those indicators after quickly look at their default bubbles map. You can customize the map to Top 100, 200 ... till top 1000 and can create your Watch list as well. Below are some screenshots with different settings. Below are some places on the website for customize settings They also have a summary table and you can sort each column descending or ascending. |

|

|

|

With massive rallies of DeFi and Farming on more Layer-1, Layer-2 projects as well as chances to get airdrops, people will take Opportunity Cost and easily to ignore risk of Impermanent Loss when they stake their altcoins in Liquidity Pools. There are some Calculator tools to calculate Impermanent Loss and imagine some scenarios for it, think of your strategies, what to do with each scenarios before you start staking (farming) with AMM's Liquidity Pools. If you don't understand what is Impermanent Loss, please read Some calculator tools. |

|

|

|

It seems a next bull market for altcoins will be very hot with Layer-2 projects. I would like to emphasize that this thread is not created to shill any Layer-1 or Layer-2 projects, it's simply for information. With those statistics tables over chains and layers, you can have overview on what's happening on those chains and layers. To invest, you will have to make more due diligent research before spending money. Crypto feesMoney printerLayer-1 and Layer-2 fees |

|

|

|

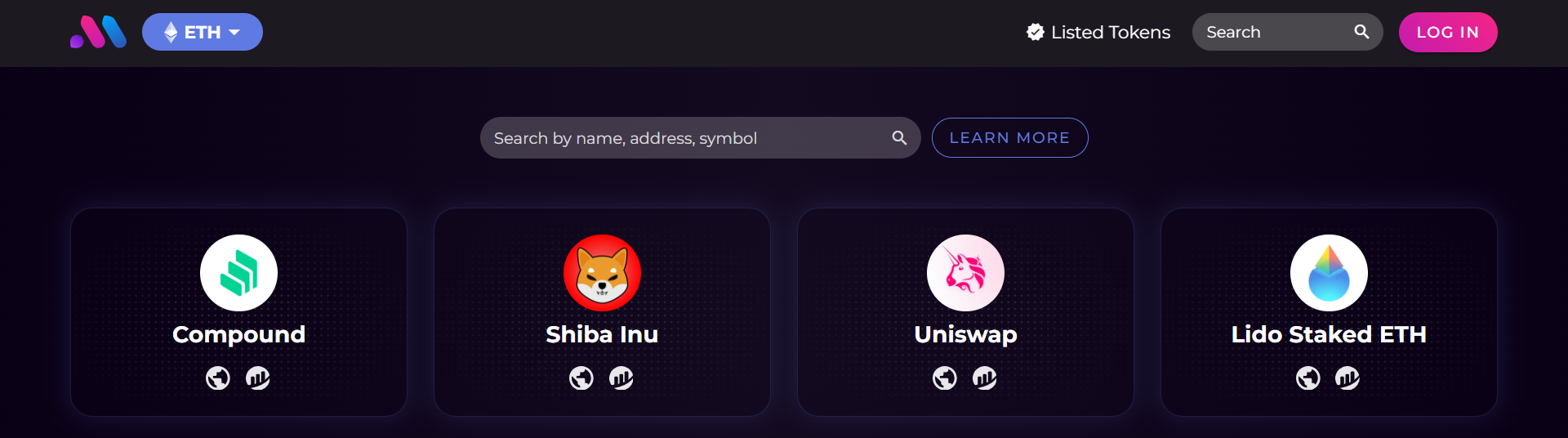

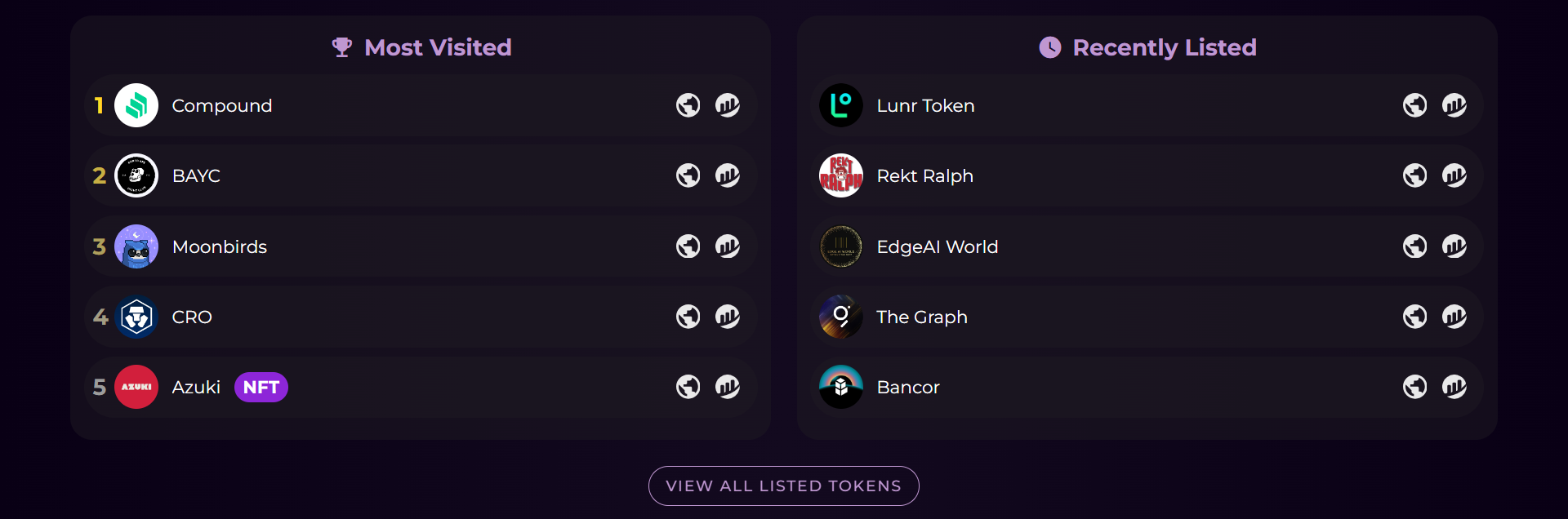

This bubble map which is interactive, informative and for token enthusiasts. Those guys want to find hidden gems and I wish them best of luckiness. Because tokens are very risky and scam, if they don't have ability to check token distributions especially top wallets, they can choose scam projects that will have rug pulls later. Now, let's dig in a website that can help them to minimize risk. - Website: https://bubblemaps.io/

- Application link: https://app.bubblemaps.io/

- It has some chains like ETH, BSC, AVAX, CRO, FTM, POLY, ARBI

- You can have some features like Explore Wallets; Reveal Connections; Manage your Map; Travel in Time

- Some features are limited for Premium account but with free account, you can get basic information to avoid rug pull.

|

|

|

|

|