I don't believe a word that any Russian official says about crypto. They all talk shit and contradict each other. Ditto. They have waffled on proposed cryptocurrency rules more times than I can remember. And that's all we're discussing here -- changes to a proposed bill, which may never get passed. And the only bit of crypto where Russia leads is scamming anyway. It never has been a significant market. If it goes it's unfortunate for Russians but the rest of the market will pay little attention. It's certainly not like the US or China in terms of adoption, but Russia's OTC market is flourishing. Cross-border remittance is also becoming a significant market. |

|

|

|

2 different things, that's why.

What do you mean "that is why" ? I was buying cryptos for the past year using those cards... Your credit card issuer doesn't care about charges for hosting fees, SSL, or Fiverr -- those may be crypto-related to you, but they aren't to your bank. Your bank just sees them as web services, freelancing, etc. When they see you charging credit to buy bitcoins through Simplex, that's a very different type of activity, which is prohibited by the bank. |

|

|

|

I AM LOL!

I sent 0.1 BTZ to the address of this mixer !

BECAUSE THE SITE: bestbitcoinmixers.com IS A SCAM! SAME As coinmixer.es - SCAM!

I sent coins to the address: 2020-02-28 00:10

I have not received my coins. (coins are still at your address)

Or can my coins be returned to me? I have all the evidence + PGP SIGNATURE

You've been defrauded. The top mixers listed on bestbitcoinmixers.com are fake clone sites. They just steal your bitcoins. Coinmixer.es is one such clone. The original real mixer was Coinmixer.se -- they shut down in 2018. There is a list of similar scam sites posted here. For a regularly updated list of legitimate mixers, see here. |

|

|

|

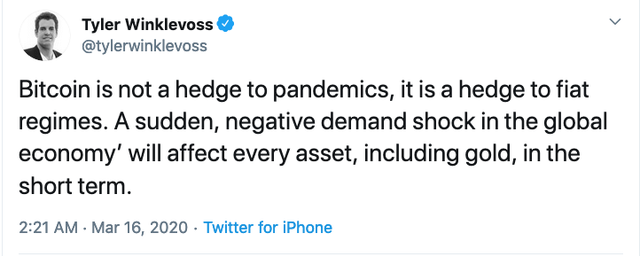

Yes. The markets are expecting the pandemic to hinder growth and cause recession. That creates unfavorable investment conditions for stocks, commodities, and other investment assets. Investors are reducing market exposure and looking to government bonds and cash as a hedge. That will always be the case, until there is a significant loss of confidence within fiat money systems. If major fiat currencies began to default and collapse, that would drive people en masse towards alternative forms of money that hedge against that risk. Gold or Bitcoin could be viable alternatives in that situation. In conventional economic crises, that won't happen. |

|

|

|

There's Coinbase too but I think they make merchants handle their own seeds now which is why their processing business has collapsed, probably intentionally.

I remember that, but they seem to have made a resurgence recently: Likewise, a Coinbase spokesperson said Coinbase Commerce processed $135 million worth of cryptocurrency payments for thousands of merchants in 2019, which represents a 600 percent increase in the number of unique transactions via Coinbase Commerce since 2018. Apparently, they don't even charge merchants to use Coinbase Commerce. It's sort of a convenience. I'm sure most of their merchants send the cryptocurrency straight to Coinbase to cash out, which is why they offer the service. |

|

|

|

First the dominant narrative was that Bitcoin brings a financial revolution and soon the whole world will abandon fiat and use it instead. Then, the problems with scaling started to arise the narrative shifted to store of value and digital gold. Now Bitcoin had its first test as those things and it failed it miserably with 50% crash.

So, how will we justify its value in the future? Those are just projections and marketing narratives. We need to drop the expectations and just let Bitcoin be. People will either treat it as money -- currency, store of value, unit of account -- or they won't. In time, I believe they will. Even if we're going to place those expectations on Bitcoin, it would never happen in 10 or 11 years. Establishing a new asset class worthy of replacing gold or fiat money won't happen overnight. People are understandably skeptical, and Bitcoin still has a lot of technological and UI concerns to overcome. This will take decades to play out. |

|

|

|

BUT with the Bitcoin blockchain as the secure, censorship-resistant, base layer.

Forking a drivechain into Bitcoin's consensus makes it part of the base layer. That's the issue. Game-theory. Why would a miner try to "win" the competition by destroying their source of income? Plus, isn't that the situation in most altcoins? What's stopping them?

Altcoins get 51% attacked all the time, and that's just to perform limited double spending attacks. Why don't we fully trust SPV wallets? Because they trust miners to be honest. The same logic applies in this case, since Bitcoin nodes only SPV validate drivechains. Such an attack would only destroy faith in drivechains, not Bitcoin, so the "Miners won't 51% attack because of long term incentives" argument doesn't apply. Presumably, transaction activity would not only return to Bitcoin, but at even higher fee rates. A 51% attack on Bitcoin only allows miners to double spend. On a drivechain, they can just steal everything.

It has been said ever and ever, still a very misleading and wrong assertion. Paul Sztorc admits it is true here. I didn't realize that he later addressed this by increasing the withdrawal requirement to 13,150 ACKs. That's one way of sidestepping the whole problem -- nobody will be interested in using this sidechain since it takes 3-6 months to withdraw your bitcoins! Therefore, there will never be enough value to on the drivechain for any of this to matter.  Thus, mis-withdrawals are possible – they just take 3-6 months to go through (as do valid-withdrawals). A hypothetical collusion by miners against a sidechain in the future, will make my above argument void as it proves the mere existence of a 51% that exposes bitcoin to double-spend and censorship threats. Sidechain theft is much easier than targeted double spend attacks. That's something you aren't accounting for. Suggesting such hypothetical miner-collusions as "a security hole" or "something concerning" for sidechains is absurd too as it is applicable to every single two-way-pegged solution, the most distinguished one being LN. e.g. they could selectively censor/nullify anti-cheat punishment transactions in favor of their own fraudulent behaviors in the network and our superhero full nodes would have absolutely no clue about the existence of the problem, forget about being helpful. The rules for sidechain withdrawals aren't enforced by Bitcoin full nodes. That's the difference. Miners can collude to steal all drivechain funds; it's simply a matter of waiting. This situation does not apply to Bitcoin or LN. What you're suggesting is just attempted censorship and is probably virtually impossible already. It's completely impossible once we're transacting with LN via Taproot. |

|

|

|

Maybe this particular decision will stand but we've seen what the Indian government is willing to do to its people in the name of driving them towards their economic goals. Bitcoin does not align with those goals so if I were Indian I'd be buying with the expectation of future meddling.

No argument there, but it's at least clear now that the RBI and India's executive branch do not have unchecked power to stop Bitcoin and VASPs with blanket bans. They can craft regulations within the existing legal paradigm, but effective meddling like the RBI ban will probably require the passage of new laws by the Indian Parliament. I don't know how likely the passage of a bill like this is, but that's my biggest concern now. |

|

|

|

If you had a choice between a block size increase (soft or hard fork) and a drivechain, which would you choose? Why?

On the block size increase, none for now, and on Drivechain, clearly you know my answer is "I don't know", I'm still learning about it the hard way. By debating/playing devil's advocate. Let me ask that question a different way. What do you hope to achieve by forking a drivechain into the consensus? Offloading transaction throughput from the mainchain, cheaper fees? Altcoin interoperability? I think economically important drivechains may skew Bitcoin's mining incentives. I'm not sure. I'd like to see more convincing game theory suggesting drivechains are a good idea before considering enforcing them at the consensus level, that much is certain.

Why? Mining on the base layer could be worth more because it supports all side-chains. Plus if a side-chain has value, wouldn't the game-theory/incentive-structure be the same as in Bitcoin? I was thinking about this a bit more. Consider this situation presented by Adam Back, except let's take it to the logical extreme. Say we're a couple decades down the road, the block subsidy is tiny and fees provide almost all block rewards. Mining has a 5% profit margin and drivechains provide 75% of total revenue. This implies a super majority of transaction activity -- and probably a majority of bitcoin-denominated value -- is on drivechains. Meanwhile, a majority of miners can steal all funds held on drivechains at any time. There is nothing Bitcoin full nodes can do to stop them. Is the incentive structure still the same as now? |

|

|

|

An interesting move and I'm surprised it hasn't occurred to other exchanges. It's a natural extension.

Since Kraken seems a little casual about its regulation compared to other operations I wonder whether this will bring more heat on them. Does it require more explicit regulation if it's pure fiat?

There are some forex-specific regulations on US-based firms that presumably apply now. For example, capital requirements: Under Dodd-Frank rules, enforced by the CFTC, firms offering retail forex trading in the United States must maintain minimum capital of at least $20 million, plus 5 percent of the amount by which liabilities to retail forex customers exceed $10 million.

By comparison, the minimum capital requirement in Cyprus, where many FX brokers have moved, range from 40,000 euros ($42,680) to one million euros ($1.067 million). I assume Kraken meets those. However, US-based forex brokers are supposed to register with the CFTC and NFA, yet I can't seem to find Kraken's registration in the NFA's registry. Kraken has always occurred to me as rather bold and unruly for a US-based company, operating on the margins regarding money transmission and CFTC margin regulations, not to mention that middle finger they gave to the state of New York. Maybe they plan on skirting the law in this area too. |

|

|

|

It's odd to see something like this happening today since Bitcoin is a decentralized cryptocurrency. This should make it "immune" from real-world events whatsoever.

Where does this belief come from? It's commonly held among Bitcoin investors, but it makes no sense to me. Why would any investment be immune to real world events? Bitcoin investors are real people and real institutions. They are affected by market panics and economic downturns just like stock and commodity investors are. At best, we could hope that bitcoins hold value better than stocks do during an economic crash. Gold seems to fit that niche, but it certainly isn't "immune" to the world economy. I don't like commodities as safe haven assets. In a crash, demand for, and consumption of commodities tends to fall. Perhaps their prices fall less than stocks in this situation, but stable fiat currencies seem like a much safer financial hedge. |

|

|

|

The last time I saw this on an exchange was several years ago on BTC-e. They used to have multiple fiat vs. fiat trading pairs. I always assumed it was to bridge the USD markets with their RUR and EUR-based payment processors. I suppose this could come in handy during these turbulent economic times? Cryptocurrency traders who want to hedge the fiat value of their coins can now hedge against GPB, EUR, etc. devaluation too. Do you know the reason why the display precision for JPY-based pairs is 3 decimal points while it's 5 for others?

I assume it's because of the JPY's weakness against all the other currencies. The Yen is more equivalent to a penny than a dollar. Two less decimal places evens out that disparity. |

|

|

|

Beware if you have not done your 2019 tax return yet. The IRS has planted a land mine in the Schedule One. They directly ask you "At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?". Answering No to this direct question will result in them having a clear case in prosecution for people that are discovered to hidden their assets.

We've been discussing that landmine since last year.  I assume at the very least that the IRS plans to cross-check 1099-Ks received from Coinbase, Kraken, et al. against taxpayer Form 1040 Schedule 1. Be careful answering no to this question if you've ever given your SSN or EIN to an exchange and transacted there, especially if you have received a 1099-K. That will probably put you on a fast track to getting one of these nasty non-compliance letters from the IRS. |

|

|

|

I'm not particularly comfortable with the precedent of miners forking in sidechains, on which users blindly trust those miners.

But full nodes secure the network, not miners. Bitcoin nodes only SPV validate the drivechain. That's the security model. Full nodes may enforce the drivechain rules at the Bitcoin consensus level, but that can't stop miners from stealing drivechain funds. 51% of miners can always steal all drivechain funds, no matter what. The only thing Bitcoin nodes can do to stop them is a UASF after the fact that reverses the theft. Mining on the base layer could be worth more because it supports all side-chains. Drivechains, extension blocks, and similar mechanisms are block size increases by another name. They offload transaction throughput, bringing cheaper fee costs to users. Would the base layer actually be worth more to miners? That depends if overall combined throughput increases enough to account for the cheaper fees. We simply don't know, and it's dangerous to rely on that. This is the block size and fee market debate all over again. If you had a choice between a block size increase (soft or hard fork) and a drivechain, which would you choose? Why? |

|

|

|

This is a very interesting attack. It reverses Meltdown-style attacks, defeating all of the associated mitigations. https://lviattack.eu/LVI turns previous data extraction attacks around, like Meltdown, Foreshadow, ZombieLoad, RIDL and Fallout, and defeats all existing mitigations. Instead of directly leaking data from the victim to the attacker, we proceed in the opposite direction: we smuggle — "inject" — the attacker's data through hidden processor buffers into a victim program and hijack transient execution to acquire sensitive information, such as the victim’s fingerprints or passwords.

Crucially, LVI is much harder to mitigate than previous attacks, as it can affect virtually any access to memory. "Attacks are not expected to target consumer computers" seems to be somewhat reassuring, although I'd not be so sure about this. An attack does seem difficult to mount, at least presently: Due to the numerous complex requirements that must be satisfied to successfully carry out, Intel does not believe LVI is a practical method in real world environments where the OS and VMM are trusted. New mitigation guidance and tools for LVI are available now and work in conjunction with previously released mitigations to substantively reduce the overall attack surface. The difficulty in carrying out LVI attacks isn’t the only limitation. The data the attacks can acquire is also restricted to that stored at the time the malicious code is executed. That makes exploits either a game of luck or further adds to the rigorous requirements for exploitation. For those reasons, many researchers say they’re unsure exploits will ever be used in active malicious attacks. |

|

|

|

Just 5 people in attendance, bitcoin is still in its infancy that time, but makes me wonder how those 5 are doing today? probably millionaires, or some sort of whales by today.  Perhaps, or maybe they all ended up like this guy:  I got into Bitcoin in 2013 myself. I regrettably did not manage to hold onto most of my bitcoins from those days. Almost everyone from earlier years has a story like that -- spending, gambling, trading, or otherwise losing much of their bitcoin stash -- so don't feel too bad.  |

|

|

|

With drivechains, Bitcoin users can't opt out. That's the difference. Drivechains are soft forked into the consensus by miners.

With consensus reached, what would be bad about that? Segwit was soft forked into consensus with the backing of full nodes behnd it. I can see the analogy you're making, but it's not entirely accurate. Segwit didn't fork a separate protocol into the consensus. I have doubts that Core would merge something like that, especially given the security trade-offs of a drivechain. Segwit was much less contentious than that. I'm not particularly comfortable with the precedent of miners forking in sidechains, on which users blindly trust those miners. I think economically important drivechains may skew Bitcoin's mining incentives. I'm not sure. I'd like to see more convincing game theory suggesting drivechains are a good idea before considering enforcing them at the consensus level, that much is certain. |

|

|

|

I'm a little concerned about the network security of Incognito. My bitcoins would be secured by the "Bond smart contract" which is secured by Incognito network validators. Who comprises these validators? Is this like a Binance Chain or Ripple situation where the developers actually control most of the validators -- giving you ultimate control of all the cryptocurrency secured by the network? Even if the project is legitimate, it sounds like an attacker controlling ⅔ of the network can probably steal everything: A burn proof on Incognito is a cryptographic proof. When signed by more than ⅔ of Incognito validators, it proves that the privacy coins have been burned on the Incognito network.

The user then submits the burn proof to the Bond smart contract, which verifies the burn proof and instructs a custodian to release the public coins that back those privacy coins at a 1:1 ratio. What prevents that from happening? |

|

|

|

It is a wasting because it could be done with staking, that way the could shouldn't need miners.

Yes, but it could end up making Bitcoin centralized. Think about it. Imagine being a huge exchange with a lot of PoS coins in custody? Solely from being a whale, you automatically have a significant influence over the network. In contrast to PoW whereas you'd actually have to dedicate money to buy hardware. No need to imagine, it's already been done -- at least with Delegated POS. https://twitter.com/VitalikButerin/status/1234522463129800709Poloniex, Binance and Huobi were caught staking customer STEEM and using it to attack the existing DPOS consensus. They've done a pretty good job of brushing the attack under the rug, but the evidence is rather damning. POS hasn't been solved yet. It may never be. POW is the best we have, for now and the foreseeable future. |

|

|

|

I'm very curious, especially after Adam Back mentioned "trade-offs" of using Lightning, or Liquid. I believe using Drivechains might also just be a matter of accepting the trade-offs. https://twitter.com/adam3us/status/1217845788438601733lightning makes security tradeoffs, liquid makes different security tradeoffs

These are two very different situations. Lightning and Liquid can be thought of as off-chain or out-of-band. They have no effect on Bitcoin's consensus. The security trade-offs -- like needing to keep private keys online in LN, or trusting Liquid validators not to steal funds -- only affect LN users or Liquid users, respectively. Bitcoin users are unaffected no matter what. With drivechains, Bitcoin users can't opt out. That's the difference. Drivechains are soft forked into the consensus by miners. |

|

|

|

|