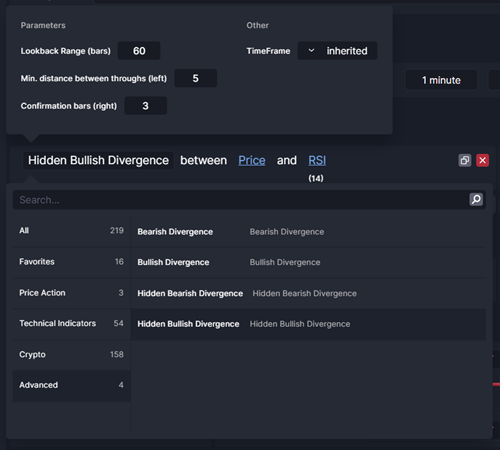

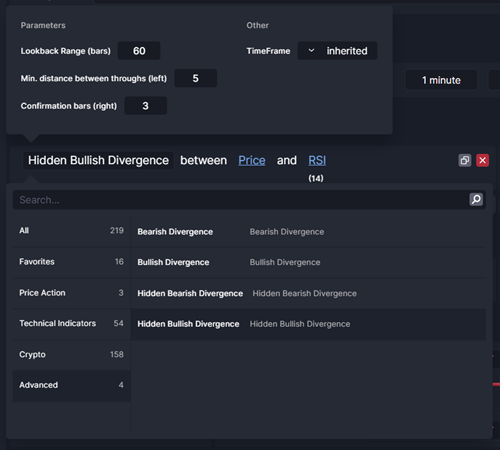

Hey guys, I summarized an article about the divergencies. What is divergenceies, what are the major types of divergiences and how should we use it along with our trading strategy: SOURCEWhat is Divergence?Divergence occurs when the direction of an asset’s price and the direction of a technical indicator move in opposite directions. Finding divergence between price and momentum indicators, such as the RSI and MACD, is a useful tool for identifying potential changes in the direction of an asset’s price and is therefore a cornerstone of many trading strategies.  Types of Divergencies?- Bullish Divergence Types of Divergencies?- Bullish DivergencePrice is printing lower low while the technical indicator shows higher lows. This signalizes a weakening momentum of a downtrend and a reversal to the upside can be expected to follow. Quick Notes: watching troughs in a downtrend, the indicator moves up first - Hidden Bullish DivergencePrice is making higher lows while the oscillator makes lower lows. A hidden bullish divergence can signalize that uptrend will continue and can be found at the tail end of a price throwback (retracement down). Quick Notes: watching troughs in an uptrend drawback, price moves up first - Bearish DivergencePrice is creating higher highs while the technical indicator shows lower highs. This signalizes that momentum to the upside is weakening and a reversal to the downside can be expected to follow. Quick Notes: watching peaks in an uptrend, the indicator moves down first - Hidden Bearish DivergencePrice is making lower highs while the oscillator makes higher highs. A hidden bearish divergence can signalize that downtrend will continue and can be found at the tail end of a price pullback (retracement up). Quick Notes: watching peaks in a downtrend drawback, price moves down first Regular divergencies – Provides a reversal signal.They indicate that the trend is strong but its momentum has weakened, providing an early warning of a potential change in direction. Hidden divergencies – Signals trend continuationThey indicate that the current trend is likely to continue after a pullback, and can be powerful entry triggers when confluence is present. You can find these all 4 divergencies on cleo.finance and compare those divergencies • Price with an oscillator indicator • An oscillator indicator with another oscillator indicator • Price of any asset with the price of any other asset. And customise the divergencies in terms of 4 different parameters: time frame, lookback range, min. distance between peaks/troughs, and confirmation bars.

ConclusionDivergences can be an important tool for traders to add to their arsenal, but they should be used in a careful and strategic manner. By keeping these things in mind, traders can potentially use divergences to their advantage in making more informed trading decisions. It is always important to use divergences in conjunction with other forms of technical and fundamental analysis and to approach them with a disciplined and strategic mindset. |

|

|

|

Hey guys, here is an article summary about the security of API keys and how should a trading platform handle the API key security. You can find the source of the article here. One important aspect of a trading platform is how it handles your API keys, which are used to connect your trading platform to your exchange account. Is it safer to install the trading software on your PC or have it run in the cloud?Installing software on your PC at home and whitelisting the IP, is only as secure as your home network. Those, mind you, are being breached orders of magnitude more often than cloud servers networks. Not to mention the potential of downloading and installing malicious software right off the bat. So, the real question is how many and how strong “barriers” are between your API Key/Secret and a potential party with bad intentions?Cloud servers are typically more secure than home networks, as they are subject to regular security audits and updates. Additionally, cloud-based software is generally easier to keep up-to-date and secure, as updates are managed by the cloud provider. However, it’s still important to choose a reputable cloud provider and to use best practices for securing your API keys, regardless of whether the software is running on your home PC or in the cloud. How does cleo.finance(A trading platform) store API and Secret keys?• Main servers manipulating any sensitive data are not visible to the outside network at all • Your API key/secret is not stored in a single database but is stored in 3 different places, each with separate hardware and software security protections o The attacker would have to breach all 3 to get access to the Encrypted version of API key/secret – which wouldn’t help them all • Those sensitive data are encrypted with arguably the most modern and secure 256-bit encryption protocol o Brute-force decrypting of the data from a single database with current technology would take longer than the age of our universe. • cleo.finance cloud hardware is distributed and the software is up-to-date with the most recent security updates What can I do to increase the security of my funds if I want to use third-party software?1. Watch out for phishing schemesTo prevent and identify phishing scams, you should be cautious when clicking on links or opening attachments in emails, even if the email appears to be from a legitimate source. You should also be wary of providing personal information, such as passwords or credit card numbers, on unfamiliar websites. 2. Whitelisting IP addresses can help to increase the security of your funds when using any third-party software.

By limiting access to your exchange account only to known IP addresses, you can prevent a significant amount of unauthorized access attempts. However, for trading platforms serving thousands of users, such as cleo.finance, exposing the IP addresses of trading servers is a security and scalability issue on its own. 3. Allow only necessary access to your exchange account in the API key permission settingsYou can grant read + trading access, which allows the platform to view your account information and execute trades but not withdraw funds. It’s important to never allow withdrawals, as this can leave your funds vulnerable to unauthorized access.  4. Limit the number of third-party services you use and use a different API key for each of them. 4. Limit the number of third-party services you use and use a different API key for each of them.The more services you connect to your exchange account, the more potential vulnerabilities there are. By limiting the number of services you use, you can reduce the potential for unauthorized access to your account. Using different API keys for each of them can help figure out where the breach is coming from.

5. Regularly update your API keysBy deleting old API keys and creating new ones, you can ensure that your exchange account remains secure. This is particularly important if you suspect that one of your API keys has been compromised. By regularly updating your keys, you can prevent unauthorized access to your account and keep your funds safe. |

|

|

|

Hey Guys, for people who wonder about where to set the stop losses and stop loss types, here is an article summary. SOURCEIn the pursuit of long-term profitability, you need to become proactive in protecting your funds. Entering a position from the perspective of what you are risking, rather than what you stand to gain is the differentiator between the traders that “make it” and the rest. - Determining where to set a stop loss:

You are looking for an area, where your trade will be invalidated = where your trading idea is wrong. Popular options are:Price invalidation based on Support or Resistance levels – Identifying a price invalidation based on Support or Resistance levels Stop Loss based on ATR or another volatility indicator – It shows the average volatility for the past 14 bars. The idea behind using it: “I better put my Stop Loss outside the zone of normal volatility to avoid getting stopped by normal market moves”. Stop Loss based on the trend - There are many ways traders try to identify a trend and its strength. The easiest way to analyze them using Technical Analysis would be through moving averages (MAs). Whether you are looking at the slope of the moving average, its relationship to the price (being above or below the MA), price, or another moving average with different settings crossing it (fast and slow MA cross combinations) – all of these options can help you determine the trend direction. Fixed PnL Stop Loss - This is generally not a very efficient way to place a Stop Loss, because the market doesn’t care what % of your account you are willing to lose. If you’re for example always opening a position with the same size and using the same, say 2% stop loss, it will get placed on price levels with no regard to the previous market movements, volatility, or anything else but your balance. This can lead to you getting stopped out a lot, even though the underlying signal might be good. Trailing Stop Loss - This dynamic way of setting stop losses follows price. If you set a 5% trailing stop loss and the price keeps going up, the stop loss moves up with the price. It can be useful in trending markets or when the asset enters price discovery and traders don’t have known price levels to work with. Limit orders - set a specific price and can be executed only at that price.

PROS:In crypto: Limit orders tend to cost less than market orders as they are considered “market-making” (Maker Fee) It guarantees the execution price CONS:This stop loss can be set off only if there’s an equal or bigger buyer at that price. You risk not getting your full position closed. Market orders: set to trigger when a certain price is reached, but will execute until full position is closed – even if it means slippage (“eating through the order book”).

PROS:It will close your full position CONS:The actual execution price may vary (due to slippage = defined by volume and how thin is the order book). In crypto: Tend to cost more (Taker Fees) Stop Limit orders - There can be even more niche categorization of limit orders. |

|

|

|

...This time when you are not trading with stop loss, take for example your computer become faulty when you are in a volatile trade without stop lose? This you can lose all that would have been protected by stop loss...

Every trader currently has many different gadgets, thanks to which, in case of failure of one of them, you can continue to track the price change in the market. The only case when you really need to set a stop loss is when you are resting and cannot control the process of closing an order manually. Trading without a Stop Loss is the testimony of a lacking trading system. And I think using Stop Loss prevents you from adding to your losses and being emotionally attached to a trade. |

|

|

|

Is this some kind of company? And there are so many of them, it's hard to say for a specific one. I don't think it's any different than the others.

The article is from a trading platform's blog and the post is a summary of an article about position sizing. |

|

|

|

I have a question. Is it possible to set up a stop loss which works more like a trail stop loss order, mostly based on if the price reaches the target price or not.

For example, assuming I bought BTC at $20,000 and my target price is 10% for profit which is $22,000 (on a risk reward ratio of 1, my stop loss is around $18,0000). Once the trigger price hits $22,000, I would like a new stop order to be placed at $24,000 and stop loss at $20,000.if BTC price keeps going by 10%, and so does a new target and stop loss. Is this possible?

Yea, I understand. The feature you are asking for is something that has been worked on already. It is going to be added soon. |

|

|

|

I like the project overall. Looks pretty neat. The idea of creating conditions, setting multiple Stop losses and Take profits, and automating/backtesting sounds promising. I'll give it a try. How about trading templates, Do I have to pay for them? Is it some kind of marketplace thing?

Thanks! It is not a market place, there are just trading templates for different market conditions. They are meant to be a good starting point for creating your own trading strategy. |

|

|

|

There will definitely be losses in trading, but using the basics of risk management correctly, you can reduce the size of the loss. In this case, in order for our trade to bring us profit, it is necessary to compensate these unprofitable deals with profit from successful trading deals.

Precisely and also not all losses are equal. There are losses taken in accordance with your trading plan by setting stop losses and protecting your funds from further, larger losses. And then there are losses that are taken out of panic, fear, and a result of deviating from the trading plan. |

|

|

|

Before committing a trade it is ideal to have your trading plan always set the signals need and one of the most basic and common trade mistakes is getting greedy and not putting their stop loss and taking a profit. Always remember that if you work well in executing market trade, you know how to get disciplined in the price because getting greedy makes us more losses than taking a profit.

Precisely, most of the traders end up with losses for being too greedy for more profits and deviating from their trading plan. Practice patience and focus on executing your system is what most of us missing I think. |

|

|

|

Before committing a trade it is ideal to have your trading plan always set the signals need and one of the most basic and common trade mistakes is getting greedy and not putting their stop loss and taking a profit. Always remember that if you work well in executing market trade, you know how to get disciplined in the price because getting greedy makes us more losses than taking a profit.

You said it! Most people are either taking it as a gamble or they are not taking it seriously. Trading is a process that requires time and discipline. It is important to have the mindset that your trading strategy will not work all the time but over time in the long term. Having a long-term trading approach is what matters for your trading success. |

|

|

|

Manually: Watching the price and manually clicking when the level is reached. Good if you are an intraday trader, and don’t leave open positions overnight. It is not good when price moves violently, especially in crypto, often you will not have time to react. I find this interesting and it looks like an advise never to leave running market over to the next trading day, this is dangerous. Every trading day has it own challenges so never expect total continuation of the previous day. So close your running trade if on profit or you put stop loss if you are losing before the night falls. Every day is new, prepare a fresh set up and see direction of the market because if you leave a running to the next day, you will be emotionally confused to take accurate trading decision. I definitely agree, you have a point. I do automation in order to avoid from emotional factor when trading. |

|

|

|

How about going on the old and traditional way of writing down your trading?

So that at least you can go back and see how everything went wrong, regardless of you winning or losing? And then adjust your strategy as you go along? I'm no longer very active in trading, but years ago when I was starting in this journey I used to do this simply strategy. I know it might cost sometime but at least you can still go back and look at your own personal logs and see what you really do during your active trading days.

I did that for a while but then I started to use this tool for going back and keep improving myself by finding out my mistakes and understanding my trading flaws. PnL, my size, what triggered, how it triggered, which of my trading conditions are fulfilled and how they were fulfilled, my RRR levels, and so forth. I have pretty much all the insights I need.  |

|

|

|

Herkese Merhaba, Ben ve arkadaslarim, kodlamaya gerek duymadan kendi krip botunuzu ileri seyive risk yonetimi araclari ile olusturup, geriye donuk test edip(backtesting), gecmis pozisyonlarini chart uzerinde izleyebileyeceginiz bir platform gelistirdik. Buradaki yatiricimlarinda fikir ve dusuncelerini merak ediyoruz. Simdiden tesekkurler. Cleo.finance, kripto yatirimcilarinin ticaret süreçlerini otomatikleştirebilecekleri yenilikçi bir kripto yatirim platformudur. Platform, kripto yatirimcilarina genis veri setleri, gelişmiş risk yönetimi, kodsuz anında otomasyon, geriye dönük test, kapsamlı istatistikler ve kripto yatirimcilarinin her pozisyonlarını tekrar tekrar chart uzerinde izleyebildikleri benzersiz bir analiz aracı ile kendi özel pozisyon acma ve kapama kurallari oluşturmalarını sağlar. Kullanicilar, OKX veya Binance hesaplarını API aracılığıyla bağlayarak kolayca başlayabilir. Onemli not: Cleo.finance'in fonlarınıza erişimi yoktur ve fonlarınızı çekemez. API bağlantısı yalnızca pozisyon acma ve kapama için kullanılabilir ve istediğiniz zaman iptal edebilirsiniz. Zaten platformda para çekme izinleriyle API bağlantısını kabul edilmemektedir.  - Her kullanici kendine ozel kripto yatirim botlarini sadece yazarak, kodlamaya gerek duymadan olusturabilirler. BTCUSDT fiyati EMA(200) uzun uzerine ciktiginda al gibi.

- Hizli ve kapsamli geri donuk test araci(Backtesting) - Daha gercekci test sonuclari icin borsa komisyon ve islem ucretlerini de ekleyebilirsiniz

- Typing your entry and exit conditions with up to 55 technical indicators, including VWAP, MACD, RSI, candlestick patterns or price action.

- Her bir indicator kendi icinde ozellestirebilir. Ornegin RSI indikatoru icin parametre ayarlarini, kripto para cifllerini, yada zaman ayarini degistirebilirsiniz./size]

- 7 period secme – 1 dakikaliktan 1 gune kadar

- Hazir ve ucretsiz trading sablonlari

- 4 Stop Loss ve 4 Take Profit emirleri

- and ve cok daha fazlasi.

Automated Loop Strategy istatistikleri Automated Loop Strategy istatistikleri Position Replayer araci Position Replayer araci  Asset Management Araci - Asset Management Araci -  |

|

|

|

Create your trading plan, work on it and stick to your plan - Achieving consistency and disciplineIt is fascinating to see it start to pay off once you patiently work on it! And I wanted to share some of the rules I strictly followed here. It might help other traders and might add some value to the community here: - Systemizing the learning process

- Thinking on effective ways of learning.

- Build through small wins, not the biggest, but where's the easiest money for me to test and implement what I have learned

- I learned that I mostly lost profits and even ended up with losses for being too greedy for more profits and deviating from my trading plan.

- Set your take profit, and stop loss along with the right position sizing. Have a clear plan for what you want to achieve. (To learn how to set up your stop losses and effective position sizing, you can find it here.)

- Don't let emotional elements affect your trading decision and harm your long-term profitability. (Automated trading helped me greatly with this and also with my trading discipline)

- Set a risk limit for each trade, but also for a day/week/month.

- Determine the right position size and start small

- Increase the size of trades slowly if your account grows

- Lower size or switch back to paper trading if your account doesn’t.

|

|

|

|

Hey Guys, I have an article about how to set your stop losses. Here is a quick summary: Full Article is here:- What is a Stop Loss (SL)?

Stop Loss is an order designed to limit an investor’s loss on a trading position. Every time you enter a trade, you expose yourself to the risk of losing your capital. If you don’t use a stop loss order, you are exposing your entire portfolio to a loss every time you trade. Stop loss defines the risk you are taking for that particular trading opportunity. - Determining where to set a stop loss:

You are looking for an area, where your trade will be invalidated = where your trading idea is wrong. Popular options are:Price invalidation based on Support or Resistance levels – Identifying a price invalidation based on Support or Resistance levels Stop Loss based on ATR or another volatility indicator – It shows the average volatility for the past 14 bars. The idea behind using it: “I better put my Stop Loss outside the zone of normal volatility to avoid getting stopped by normal market moves”. Stop Loss based on the trend - There are many ways traders try to identify a trend and its strength. The easiest way to analyze them using Technical Analysis would be through moving averages (MAs). Whether you are looking at the slope of the moving average, its relationship to the price (being above or below the MA), price, or another moving average with different settings crossing it (fast and slow MA cross combinations) – all of these options can help you determine the trend direction. Fixed PnL Stop Loss - This is generally not a very efficient way to place a Stop Loss, because the market doesn’t care what % of your account you are willing to lose. If you’re for example always opening a position with the same size and using the same, say 2% stop loss, it will get placed on price levels with no regard to the previous market movements, volatility, or anything else but your balance. This can lead to you getting stopped out a lot, even though the underlying signal might be good. Trailing Stop Loss - This dynamic way of setting stop losses follows price. If you set a 5% trailing stop loss and the price keeps going up, the stop loss moves up with the price. It can be useful in trending markets or when the asset enters price discovery and traders don’t have known price levels to work with. Limit orders - set a specific price and can be executed only at that price.

PROS:In crypto: Limit orders tend to cost less than market orders as they are considered “market-making” (Maker Fee) It guarantees the execution price CONS:This stop loss can be set off only if there’s an equal or bigger buyer at that price. You risk not getting your full position closed. Market orders: set to trigger when a certain price is reached, but will execute until full position is closed – even if it means slippage (“eating through the order book”).

PROS:It will close your full position CONS:The actual execution price may vary (due to slippage = defined by volume and how thin is the order book). In crypto: Tend to cost more (Taker Fees) Stop Limit orders - There can be even more niche categorization of limit orders.Manually: Watching the price and manually clicking when the level is reached. Good if you are an intraday trader, and don’t leave open positions overnight. It is not good when price moves violently, especially in crypto, often you will not have time to react. Automatic stop loss:This is the more conventional way these safeties are implemented. In trading platforms cleo.finance you can set several simultaneous take profit orders and stop loss orders, close positions based on indicators or price movements, and set position sizes with a lot of flexibility. Closing thoughtsStop Loss defines your risk. The use of stop loss will ensure their longevity in the markets. Hope you find this helpful. |

|

|

|

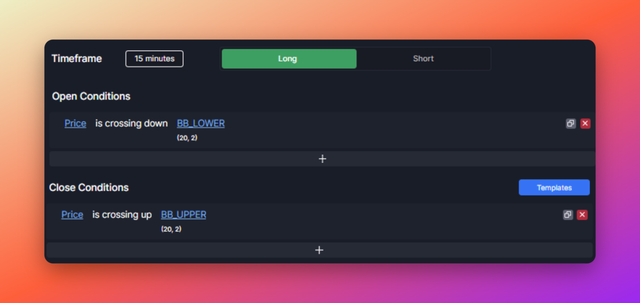

I just want to contribute that trading with bollinger band, you don't have to do it alone because it will not really show you much. You have to add MA to it and more importantly is candlestick. You long to also have a good understanding of this candlestick , like the short and long you put in template can be redirected by the type of candlestick price closing with.

Yes, I definitely agree. These templates should not be used by themselves all alone right away. This is like starting point for traders to start honing and developing their own trading setups. To show how technicals works |

|

|

|

Cleo.finance partnered with OKX via their API broker program. Within this program, cleo.finance receives part of the trading commission as a reward for the trading volume for managing to bring to OKX. Ok, so you're somewhat an intermediary who brings users and OKX together, and once you do, you get some proportion from this registration. Sort of reselling. No, we are not an intermediary or any kind of reselling. Cleo Finance is a financial technology provider. Taking the complex and fragmented financial tools, removing complexity, and making them available in one trading platform to all individual traders. Traders can create their own custom trading conditions with advanced risk management, backtesting their strategies, automating them with no-code, comprehensive performance statistics, and a unique analysis tool where they can replay their every position in detail right in the chart. Research, analyze, and execute. But, you didn't answer my question: Do you, as Cleo.finance, use the data that you receive from traders that use your software, to gain advantage over the market? Data such as total money supplied, sell/buy orders, perhaps personal data of these users etc.

I haven't read your privacy policy, because apparently I don't have the time. I just want you to make this clear for me.

Not at all. We are a technology provider, not a market maker/prop trading firm. We do not resell your data in any shape or form and you retain ownership of your trading ideas. As for personal data - we do not collect any. If you choose to sign up using google/facebook account, the basic data (email, name, last name) are stored securely on Auth0 - our authentication platform. When connecting to your exchange account we use solely the API key credentials needed. Cleo does not request and neither of the exchanges supported provide any data as to who owns the exchange account. |

|

|

|

What do you know from the traders' activity? I presume you don't make money from the "Trader" and "Trader Pro" pricing plans only. You're likely making something from that free version there, because as far as I can see, there are few benefits on upgrading to a pricing plan.

Do you act as a broker, and therefore earn from traders' data as well?

That is a great question. The free plan is only for OKX users. Cleo.finance partnered with OKX via their API broker program. Within this program, cleo.finance receives part of the trading commission as a reward for the trading volume for managing to bring to OKX. And we also decided to share that reward with our users via the cashback program - traders can earn up to $6000 per month by just trading through cleo.finance. And the cashbacks are deposited directly to traders' OKX accounts. How much is cleo.finance giving away? Sharing anywhere between 25% - 40% of the trading commissions we receive from OKX with the users. The rest is used to improve and run the platform. Here is more information about this program. |

|

|

|

Hey everyone,

Cleo.finance - an automated no-code trading platform - have some new updates. I wonder about the opinions and thoughts of this community about the platform. Any feedback and opinons are most welcome. Here is the site for more info

Cleo.finance is an innovative crypto trading platform where crypto traders can automate their trading process. The trading platform offers crypto traders to create their own custom trading conditions with ever-expanding data sets, advanced risk management, instant automation with no-code, backtesting, comprehensive statistics, and a unique analysis tool where crypto traders can replay their every position in detail right in the chart candle by candle.

Traders can get started easily by connecting their OKX or Binance exchange account via API. And for the records: Cleo.finance does not have access to your funds and cannot withdraw your funds. The API connection can only be used for trading, and you can revoke it at any time. The platform does not accept the API connection with withdrawal permissions.

- Custom crypto bot creation in minutes. No coding is required.

- Fast and extensive backtesting tools with fees and transaction costs are included

- Typing your entry and exit conditions with up to 55 technical indicators, including VWAP, MACD, RSI, candlestick patterns or price action.

- Each indicator is fully customizable and independent. You can change parameters, assets or the timeframe it evaluates.

- 7 execution timeframes – from 1 minute to 1 day

- Fast execution speed with avg. execution delay is less than 300ms

- Trading templates

- Up to 4 Stop Loss and 4 Take Profit orders with full flexibility

- and more features.

Create your own crypto trading bot through simple typing  Automated Loop Strategy Statistics Automated Loop Strategy Statistics Position Replayer Tool - Traders can replay their position history and position progress candle by candle Position Replayer Tool - Traders can replay their position history and position progress candle by candle Asset Management Tool - Where traders can set multiple stop losses and take profit and they can also preview their trading setups on the integrated tradingview chart before placing their trades. Asset Management Tool - Where traders can set multiple stop losses and take profit and they can also preview their trading setups on the integrated tradingview chart before placing their trades.  There are also programs where traders can earn additional cash while trading on cleo.finance! With the affiliate program: Traders can earn 30% revenue from each purchase (forever) of their referees plus $100 for every Qualified user. With the Cashback Program, traders can get paid up to $6,000 per month for trading with cleo.finance. Looking forward for your feedback, thank you all!

|

|

|

|

Hey guys, here is an article about 10 trading templates using technical analysis. I will put the summary here. If you like to read the full review, you can find it here: and you can find those templates for free on cleo.finance and you can also modify them further according to your own trading needs.

The way to achieve long-term profitability is through putting a bit of work upfront, understanding the markets, and honing your trading plan accordingly. Nevertheless, most traders tend to avoid constructing a trading strategy until the market turns on them.

Trading setups – aka picking the spot where you enter and exit the market – tend to get all the focus online, while proper risk management is overlooked and understudied. So, these are trading setups but without the proper risk management and position sizing, it won't take us anywhere but to constant losses.

Important note: Each of these templates is meant to be a starting point in your trading journey and together are the most used basic setups involving technical indicators. Those templates should not be used on their own in a vacuum. In general, trading using technical indicators as a sole entry or exit signal is not the best approach. You should observe the current market structure before using these setups! But, they can be a good starting point for developing your own trading setup.

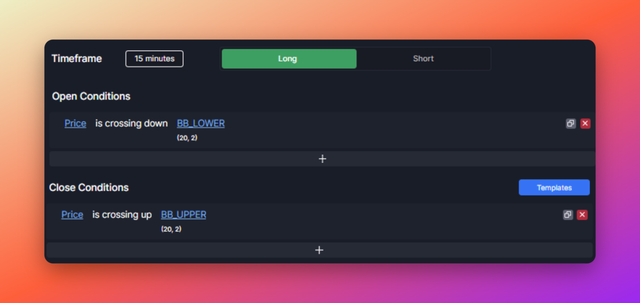

1. Lower Bollinger Band® cross – LONG

This setup opens a long (buy) position when the price closes below the lower band of the Bollinger Band® and exits when the price closes above the upper band. Bollinger Bands® is set at 2 standard deviations from the 20-day SMA.

This setup does not work well in trending markets, but profits in ranging markets. Therefore, you should implement a trend filter before you consider using this template. For higher hit rate substitute the exit conditions of an Upper Bollinger band® cross for SMA(20) – the middle line.

2. Upper Bollinger Band® cross – SHORT

This setup is the reversed setup of the previous Long template. It opens a short (sell) position when the price closes above the upper band of the Bollinger Band® and exits when the price closes below the lower band. Bollinger Bands® is set at 2 standard deviations from the 20-day SMA.

Just like the previous setup, this also does not work well in trending markets, but profits in ranging markets.

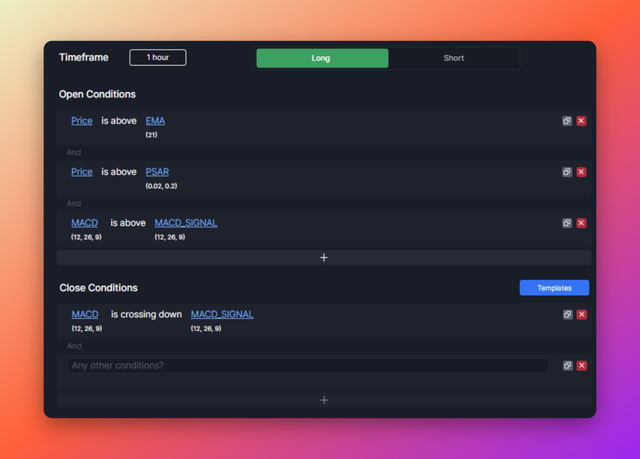

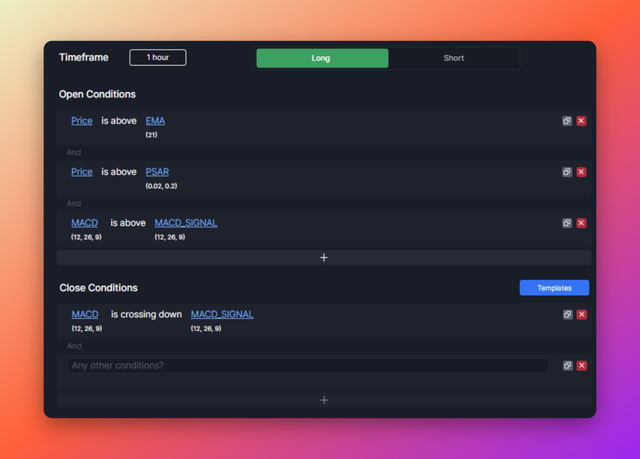

3. Uptrend with EMA, PSAR, MACD – LONG

This setup opens a long (buy) position when the price is above EMA(21), Parabolic SAR, and when the MACD line is above the Signal line all on a 1-hour timeframe. Parabolic SAR and MACD indicators both have default settings.

This setup tends to profit in uptrending market conditions and should be avoided in ranging markets. You can change the timeframe to fit your preferences.

4. Downtrend with EMA, PSAR, MACD – SHORT

This setup opens a short (sell) position when the price is below EMA(21), Parabolic SAR, and when the MACD line is below the Signal line all on a 1-hour timeframe. Parabolic SAR and MACD indicators both have default settings.

This setup tends to profit in downtrending market conditions and should be avoided in ranging markets. You can change the timeframe to fit your preferences.

You can find the rest of the review of the article on blog.cleo.finance.

5. Moving average Golden Cross – LONG

6. Moving average Death Cross – SHORT

7. Upturn in momentum with RSI, SMA – LONG

8. Downturn in momentum with RSI, SMA – SHORT

9. Upward Momentum – LONG

10. Downward Momentum – SHORT

Don’t forget – You can find all these conditions on cleo.finance and they are all free to use. You can modify the conditions, periods of the indicators, their timeframe or even the asset they are evaluated on, add other conditions, and generally play around within the platform to find out something you want to use in your trading.

|

|

|

|

|