|

Here comes the sanity... at $400 already.

Like an LSD trip wearing off.

|

|

|

|

Of course it may pop at some point, then recover, but there wasn't even 4rd wave since 240. All this is the local 3rd.

Anyway, this is above my skillz. I waited this great 3, it comes suddenly. I quit. Bye guys. Analysis ended.

Hey luc, you're just done trying to forecast this *current* run, right? Because no one forecasted this... No one. If you meant to say youre quitting for much longer, let me try to persuade you to stay and share your analysis! This thread (your opinion) is highly regarded by a lot of people including myself. Would really suck if you went quiet (even for a short time)... Shit is about to get real fun  I've been following this thread for -- what is it -- 3 years now? This is the only thing worth reading on Bitcointalk. Seriously. |

|

|

|

|

Well I was wrong.

I have no idea how high this is going. To be fair, I don't think anyone does at this point.

I'm wondering though, we didn't have leveraged buying back 2013 right? At least not to the extent we have today... I wonder how large of a role that is playing here.

|

|

|

|

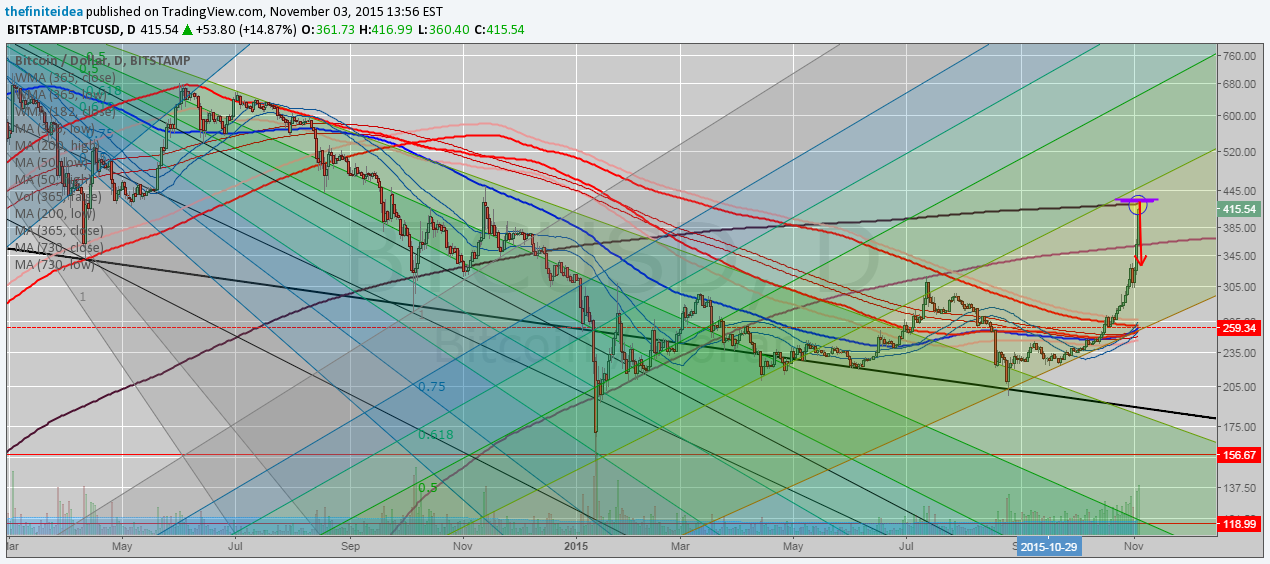

TECHNICALS! Alright, here's what I'm seeing guys...

Thats Not TECHNICALS, thats LSD I suppose I could've cleaned it up and simply shown you guys the relavent indicators... Oh well. Enjoy the trip. |

|

|

|

TECHNICALS! Alright, here's what I'm seeing guys...  |

|

|

|

|

Also, we still haven't resolved any part of the blocksize issue and the Fed is soon to raise interest rates (lifting the value of USD).

I am still hesitant, but am keeping an eye on as usual...

|

|

|

|

|

This is too fast to be sustainable for an all time high situation. We are going to back off after $425-$430, IMO.

|

|

|

|

Don't forget people that Bitcoin is backed by Greed

No, Bitcoin is backed by a belief that alternative currencies are healthy. Greed came in later. The important thing is stating Bitcoin is not about making money, it's about having a choice. That comes first. Making money off that fact is secondary. |

|

|

|

|

Strong support for S&P 500 at 1840. Bought a little coin here at 220.

|

|

|

|

Funny thing is, we haven't seen Bitcoin in a bear market yet.

I beg to disagree, unless you're talking about the monthly chart and very long timeframes. One could argue that the 2013 $266-$60 action was reaccumulation, but there is little doubt that heavy distribution occurred in Nov/Dec 2013 which unraveled nearly 100% of that bubble. I would call that a bear market  I don't think many fund managers even own Bitcoin nor is it on many institutional radars yet. If they don't have bitcoins to sell they probably won't all rush in to sell short during a bear market, especially after a year long downtrend and a weekly double bottom. For that reason digital currencies seem to me a bit detached from existing markets. On the other hand, worldwide economic fear is what has "driven" many of the past price increases in Bitcoin so a worldwide slump could bump up demand... and in a market dried up of selling after a year of it, that could launch a big trend. If USG steps in with some additional massive QE to prop up the failing markets this could lead to USD losing strength which in turn could lead to people looking for alternative safe heavens. I agree. I am waiting for another bout of QE (or something) as well. But I don't think that will happen for at least a year or two as the market needs to first -- massively fail. |

|

|

|

|

I actually meant Bitcoin existing in a global bear market environment (2000-2003, 2008-2009), as opposed to Bitcoin itself having a bear market.

Sorry about that.

|

|

|

|

I do believe the larger markets influence Bitcoin's price. Keep an eye out.

Do you believe its an inverse correlation or they generally move in the same direction? Funny thing is, we haven't seen Bitcoin in a bear market yet. Bitcoin was developed right at the start of our current bull market. So if we're about to enter a bear market, I guess we'll see what happens... IMO, I can't imagine it will be an inverse correlation. Large capital likes to flow together like a large river; wealth managers all have the same ideas usually. Flow into what though, US Dollar, Gold? It would be so explosive if even some of that capital considered Bitcoin a safe heaven. The usual: Cash (US Dollar), Gov Bonds, Corporate Bonds, Buyouts, Real Estate, Commodities, etc... a lot of the wealth has already moved over in the past year, take a look at a DXY chart or the cost of real estate... partly why I think Bitcoin has done so poorly in the past year and a half, and why I think there will be a bit more shifting to come. I think most of them consider Bitcoin to be a high-risk investment still so... probably not. I think a lot of people will convert their Bitcoin to USD actually... just makes the most sense to me risk-wise in that sort of environment. |

|

|

|

I do believe the larger markets influence Bitcoin's price. Keep an eye out.

Do you believe its an inverse correlation or they generally move in the same direction? Funny thing is, we haven't seen Bitcoin in a bear market yet. Bitcoin was developed right at the start of our current bull market (2009). So if we're about to enter a bear market, I guess we'll see what happens... IMO, I can't imagine it will be an inverse correlation (as it's been positive since 2009-2015, UP). Large capital likes to flow together like a large river; wealth managers all have the same ideas usually. |

|

|

|

S&P 500 dipped under level 1 support today, futures currently at 2025. Last strong support at 1985-2000 (yearly EMA). If (more like when) trading pushes past that support, things will be ugly. I do believe the larger markets influence Bitcoin's price (if they haven't already). Keep an eye out.  |

|

|

|

Bitcoin has been fairly cycle-ish and range-bound since the beginning of the year.  IMHO we are at an inflection point. The above is more likely in my opinion. However, these two crash fractals look eerily similar:  The fork fears are overblown IMO. I predict we will see >1mb blocks quietly begin to appear in January. If the currently month-long+ downtrend breaks over the next week or so, we could head higher. +1 really liked this analysis, mate! |

|

|

|

|

We're at $255 now... If we break $245 then we're going to $220... then $200 by September, etc...

I don't like the technicals or the fundamentals, not just Bitcoin, but the overall global market.

I don't think we can focus on just how Bitcoin is going to do over the next few months, because I think the outside market will place more pressures on BTC price, like safety to dollar, than the internal pressures of Bitcoin, like this maxblocksize, XT debate.

|

|

|

|

With the prospect of a hard fork and this lack of consensus around MBS, I think it's safe to say that we will see a lot of negative price pressure from people going to safety... at least until there's a clear winner. I for one do not want to be heavily invested while this goes on, but the volatility could make for good trading.

With this in mind, the current support at $255 doesn't seem so strong to me. Even the support at $200 seems weak under the circumstances.

These squabbles and the uncertainty have likely already been priced in for a while. I'm not so sure about that... I think there's more movement from this to come as developer's plans become clearer. This fight isn't nearly close to being over yet. |

|

|

|

|

With the prospect of a hard fork and this lack of consensus around MBS, I think it's safe to say that we will see a lot of negative price pressure from people going to safety... at least until there's a clear winner. I for one do not want to be heavily invested while this goes on, but the volatility could make for good trading.

With this in mind, the current support at $255 doesn't seem so strong to me. Even the support at $200 seems weak under the circumstances.

|

|

|

|

SMA200 not broken, long term log trend not broken.

Just got emergency alert from my FX broker. 29 June greece will likely to default, extreme EURUSD and other pairs volatility and lack of liquidity expected.

I seat and think what it may mean to bitcoin. It is on verge of trendline. Will it break it up or will it collapse?

EUR will probably break up and DXY down... Bitcoin? I dont think much will happen. |

|

|

|

I've seen a lot of talk on the rise of USD and US stocks and suggestions of an expected bear turn (at some point, not sure when?). TBH, i don't keep up with USD trends or US financial markets. What i've picked up from all i've come across, is an impending poof! USD, US stocks and possibly other central bank fueled artificial valuations. Can anyone here confirm how true this is? And possibly some guesstimates on when this poof! might occur? Can the US really go back into another recession? resembling 2007 magnitude? I am really out of sync. Also, USD vs local currency rates in East, SOuth and West AFrica - KES, TZ, UG, Naira, Rand, CEdi are all losing value partly due to the dollar appreciates. SO, i have even more reasons to keep track of this possibility.  I know things look bad on USD terms, and while I believe there is impending doom in US financial markets, I don't see and end of USD any time soon. The USG won't relinquish that power yet. They are a huge part of the over inflation on stocks. Once they let up, stocks will plummet and all will be well. At least for a bear like me.  Based on known sentiment and voting patterns, we will have a dovish FOMC well into 2016. I can't really see any bear market until 2017, 2018 because of that fact... but that's just me. It really all depends on unemployment figures, though. But even the way economies rely on labor incomes is radically changing, so it's hard to say with as much certainty anymore when the bull ends and bear begins (sounds like a good Radiohead song). http://www.wsj.com/articles/fed-minutes-june-rate-hike-doubtful-1432144801http://www.cnbc.com/id/102569651More on the voting members of the Fed:http://chandlerasset.com/blog/2014/09/rotation-at-the-fed-what-does-it-mean-for-policy-in-2015/https://www.briefing.com/investor/our-view/the-big-picture/meet-your-new-fomc.htm |

|

|

|

|