75% over 7 days  |

|

|

|

How Bitcoin Unlimited worksPlease review these examples of emergence first: http://www.pbs.org/wgbh/nova/sciencenow/3410/03-ever-nf.htmlAssume a BU majority network. Consensus occurs on the max block size over the whole Bitcoin network from low-level rules used by thousands of individual nodes. There is no voting.With Core and XT everyone needs the same maximum for block size. BU is different in that only the whole network possesses the attribute of a dynamic block limit, while each individual node has an approximation, or even a limit which is a lot smaller or larger. It doesn't matter, except that nodes with a too-small limit will frequently have the latest blocks "on probation" waiting for them to reach an acceptance depth. A node which sees a block which is excessive (over its limit) will not relay or process it until it is buried under enough confirmations. BU nodes always track the chain tip with the most PoW. A miner producing a block larger than emergent network consensus gets its block orphaned. As individual node owners update their settings after upgrading or getting new hardware, bandwidth etc, then the network consensus slowly changes, usually upwards although the exact value at any one time is an irrational number and unknowable. Individual node settings: - Excessive block limit (default 16MB)

- Acceptance depth, i.e. confirmations (default 4)

|

|

|

|

|

Bitcoin Unlimited is Bitcoin Core without BIP101.

It does have some new and advanced features which enable it to transcend the requirement for a universal (top-down) block size limit. Therefore a BU user can decide to have their node emulate Bitcoin Core 1MB or remain compatible with Bitcoin XT and BIP101.

|

|

|

|

For IBLTs to operate with O(1) efficiency, there needs to be some method to boost efficiency of keeping all miners' memory pools aligned.

The incentive is economic as Gavin mentioned earlier. RE: O(1) versus O(some-function-of-total-number-of-transactions):

Yes, it will depend on whether or not the number of differences goes up as the number of transactions goes up.

The incentives align so it is in everybody's best interest to make the differences as small as possible. I wouldn't be surprised if that causes innovations to drive the actual size to O(1) minus an increasing constant, as code gets better at predicting which transactions our peers do or don't have.

The gain actually achievable towards O(1) is not really important. What is important is seeing the implementation of some level of block propagation efficiency that is native to all nodes, i.e. not just elite miners on a sub-network. |

|

|

|

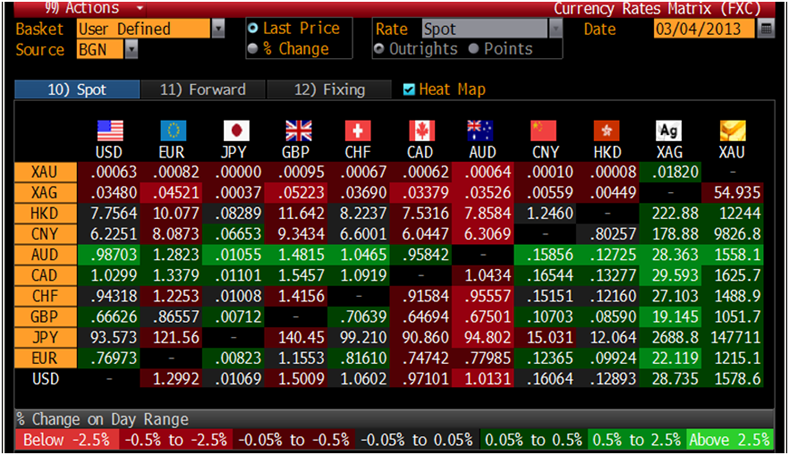

Some background Bitcoin adoption is achieving a critical mass for exponential growth. To maintain this growth Bitcoin needs to be supported on the world's FX systems and seen on data-feeds such as Bloomberg and Reuters. All the world's currencies have 3-letter ISO standard codes which are used to identify them in computer systems. http://en.wikipedia.org/wiki/ISO_4217The first two letters must match the ISO standard country code .e.g. USx codes are reserved for the United States, hence the dollar is known as USD on all FX systems. BTC is not available as it is reserved for the country of Bhutan.http://en.wikipedia.org/wiki/ISO_3166-1_alpha-2Transnational or world currencies begin with an X, for example XAU (gold) and XAG (silver) XBC has been taken by the European central bank, which leaves only XBT as the most suitable ISO code for Bitcoin. Below is the institution which needs to be lobbied to assign Bitcoin its currency code: ISO 4217:2008

Codes for the representation of currencies and funds

Maintenance Agency

c/o SIX Interbank Clearing Ltd (acting on behalf of the Swiss Associa tion for Standardization)

P.O. Box

Hardturmstrasse 201

8021 Zurich

Switzerland

Tel: +41 58 399 4255

Fax: +41 58 499 4550

E-mail: office@currency-iso.org

Web: http://www.currency-iso.orgThe Bloomberg screen used by tens of thousands of people who continually buy and sell the major currencies...  Let's see Bitcoin elbow its way onto this screen! |

|

|

|

|

only 4% think the 200-300 range will hold?

Perhaps not, but is it that unlikely?

|

|

|

|

Question: is it possible for Bitcoin to enforce a rule that goes against the will of the market? How can we enforce rules that most of us disagree with?As an example, consider the block size limit. When it was put in place five years ago by Satoshi, it served as an anti-spam measure. It was actually 800x larger than Q* so the vertical line marked Qmax was actually 100 ft off the chart! Since the production quota was to the left of the free-market equilibrium point, it didn't affect the market dynamics. There was no economic pressure to change the limit.  However, Bitcoin has grown tremendously over the past five years and I believe the limit is now serving as a political measure instead. It is to the right of Q*, resulting in what economists call a "deadweight loss." This is the total economic activity lost as a direct result of the quota. It also represents the will of the market (people) clamouring for change.  If the market wants to be at Q*, but the production quota is forcing it to be at Qmax, what can a group do to continue to enforce the production quota against the will of the market? How can the invisible hand be restrained? I rechecked these charts, the "deadweight loss" part means that when there is a blocksize limit on the left of the Q*, some transactions will not be included in the block no matter how people adjust their fees But my view is that supply and demand curve is not fixed, they would move once the Qmax moved, so that a new Q* will always appear at the left of Qmax regardless of Qmax's position Imagine that Qmax moved to left of Q*, thus the tranaction capacity is not enough, so the natural reaction of normal user is to reduce diversify the transaction frequency, so demand curve will shift down alternative cryptocurrencies fill the demand gap, instead of the naive assumption that the supply curve will shift up: miners charge much more when the transaction capacity is less. So these two lines will cross at some where left of Qmax to make a new Q* Fixed it for ya. |

|

|

|

i have heard on good authority that the Core dev WILL be increasing the limit doing something like 2-4-8 soon. this is a "temporary fix" and have other ideas which will do far more for bitcoin scalability than simply increasing block size.

I really hope that you are right, because any temporary fix is better than sitting back and letting Bitcoin become the MySpace of cryptocurrency. |

|

|

|

I'm hopeful that we'll see 300-350 by the end of the year!

Indeed, the likely range. Next year should see a steady increase beyond that as the halving in July draws nearer. |

|

|

|

Dogecoin did something? Let's immediately implement whatever Dogecoin did, into Bitcoin! Sorry, but I just can't put much faith in a Dogecoin implementation run on the test net. It's just not at all a reliable indicator.

Do you even read? They didn't implement anything, they ran a stress test. The Dogecoin software is the same as Bitcoin with a few minor changes and a goofy name. Their test is a valid independent metric in the context of the 1MB debate. |

|

|

|

yes i know, stop yelling, 1MBPS allows for streaming a max of ~4,000 TPS

processing and storage is just as easy.

if you can't store 1MB of data pre second your HD sucks balls

if you can't process 1MB of TX pre second your GPU sucks balls.

point is a 1000$ computer with a home connection can deal with 4,000 TPS

did you expect bitcoin full nodes to run on embedded devices?

Meanwhile, the devs at Dogecoin conduct a stress test processing 5MB per 10 minutes and come up with flying colors: http://digiconomist.net/interview-ross-nicoll- Lastly, do you think Dogecoin might experience its own block size debate?

I think there’s a risk of it, yes, but so far no-one seems to be leading an anti-increase group, so I’d not anticipate problems. We use 1MB blocks, but every minute instead of 10 minutes, giving us effectively 10 times the throughput of Bitcoin, which reduces pressure for a change to be made soon. The recent stress test of Dogecoin on the testnet up to around 500kB blocks (so 5MB equivalent for Bitcoin) went far better than expected, which is extremely encouraging about our ability to scale. I’m going to write up a proposal once Dogecoin Core 1.10 is out, and that will most likely involve moving to parity with the BIP 101 block size increments. If Dogecoin can do it then why is Bitcoin #FUKT? |

|

|

|

Solex,

can you expand on why main chain is so important?

Does off chain imply certain limitations?

Yes, indeed. Main-chain is so important because this is the proven technology. Satoshi's PoW model has functioned extremely well for 6.5 years. This is why when we talk about scaling main-chain volume handling we are talking about extending the capabilites of what is known. And the quote from the Developers all refers to work which they have done to improve on Satoshi's original implemetation. All other ideas are unknowns: Side-chains, Tree-chains, Lightning Network. None of them are going to have a 6.5 year proven real-world live-usage track record in the face of the world's most determined hackers and spammers until 2022 at the earliest. LN is a great idea, I like it a lot, but basic questions exist like "How safe is its version of BTC addresses?" LN allows for several hops between sender and receiver. So if you are sending BTC to "Joe Bloggs" then how secure it, when some MITM attack may route your payment to "Joe Bloggz" in Russia instead? LN will have a federated model with far fewer nodes. Does this mean it is more vulnerable to white-listing, black-listing or tracking? Any other 3rd party solution will always have risks, just like leaving fiat in a bank or BTC on MtGox. Side-chains have huge promise where fundamentals can be varied, 2-minute blocks?, no problem. But how guaranteed can it be that BTC on a side-chain might not get locked permanently when a side-chain has a catastrophic failure? SC are not even considered a true scaling option. Tree-chains have been in draft for 2 or 3 years now. They need to be in the wild for 2 or 3 years to be a viable scaling option. There is a long road until any of them can do better than using the existing blockchain. Remember the recent meme in the mainstream about "Blockchain tech without Bitcoin"? Well how about a new dev meme "Bitcoin without the blockchain". Is that any better? The comment below captures the essence of my concern: Shmullus_ZimmermanHad to sign up for Reddit as a total newb (after lurking for years) just to post this:

Isn't the biggest concern in the 'Open Letter' (a) the fact the letter does NOT contain term "blockchain" when (b) combined with the the following language: " We’re committed to ensuring the largest possible number of users benefit from Bitcoin, without eroding these fundamental values."

What does that mean? The phrase "benefit from Bitcoin" does not convey a commitment for the maximum number of users to have access to the BLOCKCHAIN! They talk about "Bitcoin" as an amorphous concept. They talk about the "Bitcoin network" without mentioning the single-most crucial bedrock component, the block chain. The letter contains zero commitment to "scaling" involving the block chain itself.

I've dealt with lawyer-speak my entire adult career. I've seen what it looks like when folks with an agenda are trying carefully to dance around an 'elephant in the corner of the room.'

My Seat of the Pants Prediction: The workshops will turn out to focus to a troubling extent on off-chain solutions (which is to say: private for-profit enterprises building ecommerce banks off the blockchain). Implicit in off-chain solutions, so far as I can tell, will be a strong bias toward keeping the block size fixed so that you have to go to the off chain solution if you want something to occur fast. If things keep going this way, eventually talk will turn to limiting the blockchain to only transactions of "X or more" Bitcoin, with all smaller transactions kicked into the proprietary sidechains and clearing houses.

"Fast!" "Convenient!" "Backed by (but not on) the Block Chain!" I can just see it now.

|

|

|

|

Bitcoin is based on notions of scarcity. Making room for every transactions in the world makes it worthless. I agree. Once I found out that there were millions of miles of open roads in the world, I threw out my Ferrari. Me too, but I can't even walk the pavements now because there are so many miles of pavements which are not cram-packed with people. |

|

|

|

The Developers have written an open letter to the community about Bitcoin scalability. https://bitcointalk.org/index.php?topic=1168393.0They have done a lot of work and describe it here: Much work has already been done in this area, from substantial improvements in CPU bottlenecks, memory usage, network efficiency, and initial block download times, to algorithmic scaling in general. However, a number of key challenges still remain, each with many significant considerations and tradeoffs to evaluate. We have worked on Bitcoin scaling for years while safeguarding the network’s core features of decentralization, security, and permissionless innovation. We’re committed to ensuring the largest possible number of users benefit from Bitcoin, without eroding these fundamental values.However, the real question for them is: Will they make a commitment to the principle of main-chain scaling?Will they support volume handling on the main-chain as a preference to off-chain solutions? 1). Bitcoin should be scaled so that transactions are handled on its main-chain, as a first and guiding principle. 2). Bitcoin's main-chain capacity should be allowed to scale at a rate broadly in line with the general improvement in global computing technology. How hard is it for them to publicly support 1&2 above? Unless they don't agree....? |

|

|

|

sure it's likely that the 25% that don't agree with will fall into line, but can we really call 75% a successful agreement

lets all vote 90%

75% voting majority plus a 2-week grace period should see a wave of laggards move across and the total becomes more like 90% anyway before the change takes effect. |

|

|

|

The mods at /r/bitcoin are now deleting every post that mentions the existence of the "other" implementation of bitcoin, whatever the contents. Dozens of posts that had hundreds of upvotes and hundreds of comments. And banning users who defend it, too.

So much for the great age of freedom and stuff that bitcoin was going to bring.

Oh, and the bitcoin "news" webshites, like CoinDesk, have been as silent on the topic as any statist newsmedia would be.

This makes me think that it is very possible that a lot of these individuals are selling their BTC out of frustration and being fed up with being silenced. Yeah. CoinDesk is just like any one-party political paper seen in 3rd world countries, by maintaining silence on a Bitcoin story far more important than their usual offerings. |

|

|

|

$254.90 on Stamp. The bears are out in force by the looks of it, I'm feeling pretty negative at the moment, still going to HODL as usual obviously, I understand bitcoin is a long term investment but this XT bull shit with Hearn & Gavin is causing the price to tank imo. Weak hands are panicking & getting out  This price dip is nothing compared to the crash that would happen sometime next year when Core Dev allows the 1MB to cripple legitimate user tx throughput. |

|

|

|

Got to correct you there cypher. -------------------- This whole debate hinges on what is acceptable main-chain scaling. Core Dev (especially BS) are gloomy about Satoshi's original VISA-scale main-chain volume projections. To an extent they have a point because it is only subsequent dev work which has made Satoshi's original code 100x more robust and more efficient, and it would have failed under today's volumes without all that improvement. So they are focussed on 2nd-level solutions, and maybe the chance for profit has shifted that focus too far. There is no good reason why main-chain scaling cannot keep up with improvements in technology, which is what Gavin has effectively put a ceiling on with BIP 101. I suspect that another BIP will get adopted by both Core and XT which is more like Jeff's BIP 100 and works within the constraint of BIP 101. Gavin has said that he likes the idea of a belt-and-braces block size limit, i.e. a high, but steadily increasing hard-limit, and a lower dynamic limit. That dynamic limit could reflect incentives to reduce UTXOs. When Gavin raised BIP 101 he made the promise not to commit it to Core using his own access without consensus. IMHO this constitutes a pact. It means that Core cannot commit a different BIP (like Pieter's) which has minimal main-chain scaling i.e. just 1.17MB by Jan 1st 2018. So Core are duty bound to only commit a BIP that has Gavin's approval as well as Jeff's. So, as Core's node count diminishes, and miners shift UP, I expect a sensible dynamic BIP proposal from Core which works within BIP 101 and both BIPs get committed to Core and XT. The risk for Core is that the longer they delay with a sensible BIP allowing main-chain scaling the more likely that BIP 101 will stand alone and that it will get 90+% of the ecosystem, nodes and miners. |

|

|

|

|