there is competition from altcoins to consider. If we leave 99% of the market on the table because of ultraconservatism about blocksize, we let an altcoin have all that, and Bitcoin gets swept by the wayside. And guess which one ends up more decentralized.

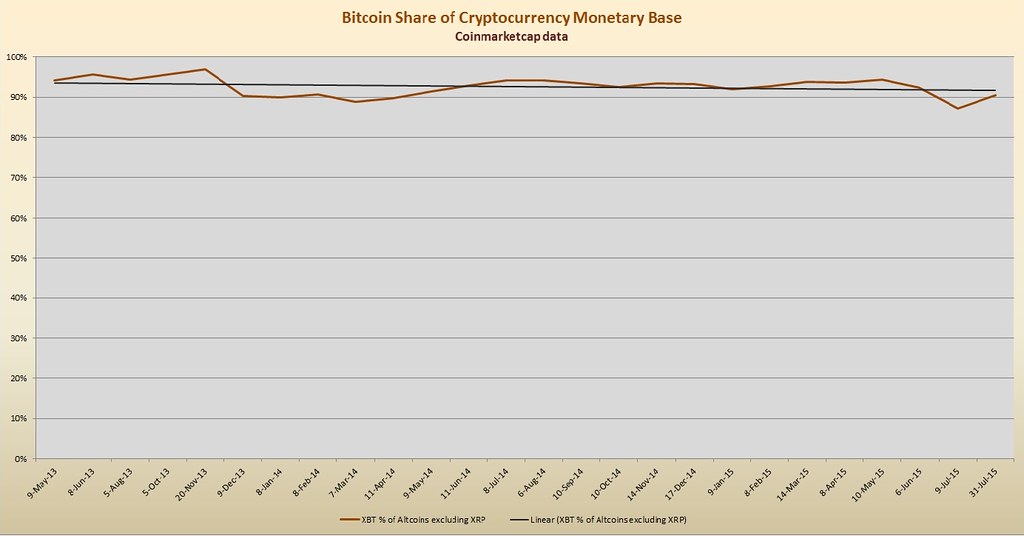

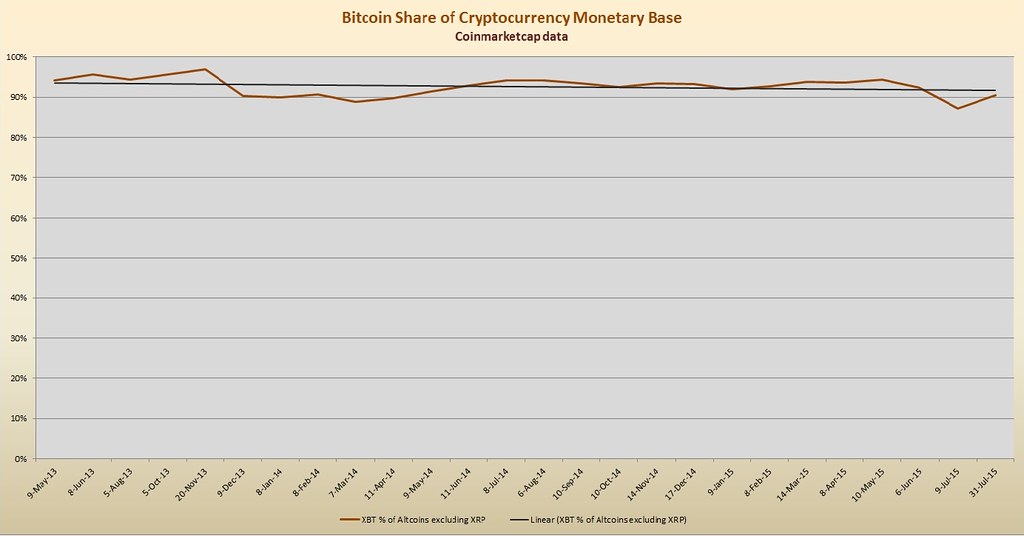

This important comment made me think that it's a good time to review just how Bitcoin has fared against the altcoins since a useful comparison has been made possible by coinmarketcap. Using the Wayback machine I got one data-point (aggregate values in USD) for each month as close to the 9th (first one) as possible. The chart below shows Bitcoin's monetary base (or market cap) as a percentage of all cryptocurrency excluding Ripple.  There is a very slight trend down (black), exacerbated by the recent LTC ramp, probably pre-halving noise as smooth says. I have shown the y-axis from 0% to avoid the scarier looking trend when base-lined at 80%. This chart is interesting because it shows that despite the acrimonious 1MB debate it is not yet having a serious effect on price, and similarly the 1MB is not yet crippling user volumes and driving up usage (and therefore enhanced value) of alternative crypto. Yesterday, we had a BIP [77? 103?] from Pieter, which is extremely welcome and the first official solution from the 1MBers in Core Dev. Unfortunately, this BIP pursues minimal change, with 2MB blocks only in 2021 and 10MB blocks (effectively the same capacity as Dogecoin today), in 2030. Personally, I think this will leave a severe bottleneck in Bitcoin throughput by about Q2/Q3 2016 and the major risk of a sharp change down in trend in the chart above. |

|

|

|

Yeah I think we can handle 2 MB or maybe even a hike to 4 MB, if it was held there for at least 3-4 years.

Doubling every 4 years, i.e. at rate of upload bandwidth limit growth, makes sense for the next 5-10 years ... and then who knows.

Marcus, what you say is very reasonable. Although I have been supporting "increase the limit" all the while I wanted to see a counter-proposal from core dev which was something other than keep 1MB and see what happens. They did not even show much enthusiasm for Jeff's BIP 102, or even reworking it in some way. |

|

|

|

by running a full node you're helping to prop your investment in the coin and you should be using it to secure your own tx's; which should be a security measure you're willing to pay for. as the user base grows, if we let it, then merchant base grows with it and they will be more than willing from a security and fiduciary standpoint to increase the availability of full nodes across the network.

^This^ is key to the preservation of Bitcoin as a growing decentralised network. Yes, miners earn rewards directly and have a estimated ROI, but the majority of full nodes are non-mining, their owners are looking at the long-game, ecosystem growth, and the current situation of be-your-own-bank, escape from CB fiat, fast economical permissionless money transfers. Constraining volume with a block limit which does not at least increase in line with improving technology will seriously erode the confidence of non-mining node owners, who will switch off, or switch to an alternative coin. This is the real threat to decentralisation. If average blocks were to increase to 3,5, or 10MB and at some level cause problems for the network then full node owners would rally with Core Dev to put in place a lower temporary limit, or help fund obvious scaling improvements. Bitcoin the network constrained by technical limits will bring people to work together to maintain the $4 Billion enterprise. Bitcoin constrained by an artificial limit which is not wanted by the majority of mining power and user-base will achieve the opposite and destroy co-operation, destroy the enthusiasm to work together, and increase centralisation by reducing node counts. Edit, of relevance here too: Raystonn nails shut the coffin of the plan to force a "settlement layer"Much like anywhere else where liquidity moves within a

system, value will move to the network of least friction. The reality right

now is it's very easy to move value from Bitcoin to another blockchain with

less friction. Because of this, there will never be a high value settlement

network created by an artificially imposed limit on transaction rate. The

value will simply bleed out of Bitcoin to alternative blockchains offering

lower fees if this is attempted. This is basic economics.

|

|

|

|

This may be true in general, but for the particular hosting company where I run my VPS, disk is the limiting factor in the decision when I have to upgrade to a more expensive plan. With pruning, you can not fully support the network and you have to be careful with your wallet handling, as rescanning is not possible. That's actually what I do on one of the VPS exactly because the blockchain is already too big for the plan I use there, but I would have preferred to run an unpruned full node if I could. Increasing the block size makes this issue larger by orders of magnitude.

Furthermore, as stated above already, block relay optimisations also help only "little" with bandwidth. (At best a factor of two in comparison to a much bigger increase in block size being discussed.)

Yes. Your situation re disk is different, and the pruning has known improvements to come. Block relay optimization is more than "just" a factor of two gain, because unconfirmed tx are relatively uniform over a 10 minute window (so the network has an impressive capacity to handle these, as seen by how fast the mempool can grow), whereas blocks need to be sent at once, so ~600x data / second. Also, up-link is invariably slower than down-link which is a big concern for miners publishing blocks. |

|

|

|

Lightning network and sidechains are not magical things, they're orthorgonal and not alternatives to relay improvements. But since you bring them up: They're both at a _futher_ level of development than IBLT at the moment; though given the orthogonality it's irrelevant except to note how misdirected your argument is...

I appreciate the further detail that you describe regarding the relay situation. So it seems that you are not optimistic that block propagation efficiency can have a major benefit for all full-nodes in the near future. Yet block propagation overhead is probably the single biggest argument for retaining the 1MB as long as possible. To cap volume growth to a certain extent. I'm not sure about that. My opinion is that the biggest argument for retaining the cap (or, at least, not introducing a 20x plus exponential increase or something like that) is the burden on full nodes due to (cumulated) bandwidth, processing power and, last but not least, disk space required. Of course, for miners the situation may be different - but from my own point of view (running multiple full nodes for various things but not mining) the block relay issue is not so important. As gmaxwell pointed out, except for reducing latency when a block is found it does only "little" by, at best, halving the total bandwidth required. Compare this to the proposed 20x or 8x increase in the block size. Bandwidth is always a much bigger concern than blockchain usage on disk. TB disks are very cheap, v0.11 has pruning. |

|

|

|

Lightning network and sidechains are not magical things, they're orthorgonal and not alternatives to relay improvements. But since you bring them up: They're both at a _futher_ level of development than IBLT at the moment; though given the orthogonality it's irrelevant except to note how misdirected your argument is...

I appreciate the further detail that you describe regarding the relay situation. So it seems that you are not optimistic that block propagation efficiency can have a major benefit for all full-nodes in the near future. Yet block propagation overhead is probably the single biggest argument for retaining the 1MB as long as possible. To cap volume growth to a certain extent. I know that Lightning network and sidechains are orthogonal and not alternatives to relay improvements. However, I did not bring them up as a solution to dealing with the 1MB. Mentioning LN just now was prompted by Icebreaker's opinion that the prospect of LN is part of the reason why the 1MB should be left in place for some more years. For the record. I like LN, I like its potential and I hope it succeeds. what's your position on block size limit, never change it or change (in the way you like the most) in the future?

I agree with Satoshi, change it "eventually" sometime in the next ~5 years (after optimization by sidechains/LN and fee markets mature). "Eventually" will be when we see actual congestion (competitive fees no longer prioritizing tx) or the network otherwise being harmed by the Holy 1MB crapflood regulator. Accommodating more 'cosmic background spam' with a permanent home in the Mother Chain is the worst reason ever for increasing blocksize. BTW. Well done implementing BIP 66 the way you did. |

|

|

|

Your mistake here is assuming the Gavinistas have any interest in, much less the ability to, participate in an honest debate, whereby they apply the same criticisms and expectations they put upon Team Core to themselves and their own goal of larger blocks.

They have yet to demonstrate any such interest, nor the ability in terms of intellectual consistency required to develop one.

This is a blatant rewrite of history. Misrepresenting opposing positions is your speciality. Gavin did a series of blog posts about why on-chain scaling is necessary, and the pros and cons of the change to make this feasible. Satoshi made it perfectly clear in several posts that he wanted VISA-scale volumes on-chain, and the limit was temporary. Jeff has written a blog post to go with BIP 100 explaining his perspective. Rusty Russell and David Hudson have also made it clear how scaling is needed and why. It is Core Dev who take the position that it is premature, too risky, want to force higher fees (too bad for ordinary users) etc etc. They offer no alternative which is viable before the 1MB causes major problems to the ecosystem growth. LN is complex and too late, and unanswered questions remain about how decentralised its servers will be. 1MB will cripple Bitcoin. The Chinese miners know this and that is why we have >50% of the hashing power behind an open letter saying blocks up to 8MB are OK. The 1MBers stick their heads into the sand by pretending that a problem of the near future does not exist. It is also hypocritical to pump Monero based on it able to scale by supporting blocks >1MB. And it is irrelevant what year someone learned about Bitcoin to their being able to execute a trade on the knowledge of one coin potentially having crippled volumes and another not. IBLT is a known change which can help a lot with decentralised scaling.

IBLT is still somewhere between whitepaper and prototype, and won't really help scale until blocks are ~100s of MB. According to Gavin, the relay network already plucked the low-hanging fruit for the short and medium term future: Gavin says "Network usage should get cut in half as soon as we stop doing the simplest thing and re-broadcasting transactions twice." http://gavintech.blogspot.co.nz/?view=classicHe means using IBLT, and IBLT is so powerful that it can squeeze a 100MB new block announcement into 1MB, the size in use today. It is also less work overall than LN or SC. i.e. simplest. It does need prototyping, testing and benchmarking, and the breakeven point is unknown. But like JR's node services payment channels, it is a Cinderella of software where the focus of attention is mostly elsewhere. |

|

|

|

No, I've already said I'm in favor of an immediate modest increase to 2-3 MB (and generally only keeping up with hardware technology unless there are other changes to the software that improve its ability to scale decentralized, which so far there have not been)

Good. I am fine with that as well as that is a perfectly sensible position. It is also a compromise, which is why it is so dismaying to see Core Dev all but ignore Jeff's bare-minimum BIP 102. This is a problem, they are not offering any alternative themselves. As mentioned before too: IBLT is a known change which can help a lot with decentralised scaling. |

|

|

|

If anything, we should get the blocksize to the largest rationally supportable size

This is exactly where reasonable people differ. That is a key word right there "reasonable". I certainly haven't had any great epiphany as to how to choose the correct size or how to make it a reliably updated thing. Predictability and anything that removes human consensus making from an ongoing process is what I would favor. (MP argument). That is btw pretty much Wladimir's view. He's not going to back any change that doesn't have human consensus. So you either have human consensus or, removing it from the process, no changes at all. Is this your position too? Because the way Bitcoin is today with a protocol level transaction cap so small it is too crippled to ever become a significant part of the world economy. A cap too small even for LN to provide much scaling because LN needs the capability to close a lot of payment channels simultaneously. SC is not a scaling solution unless Pieter is wrong. Which then leaves Monero as a lifeboat where I recall some recent post about it having massive scaling capacity, no 1MB rubbish for them! Icebreaker is transparent like an ice-cube when it comes to campaigning for a crippled Bitcoin, clearly so he can execute a massive Monero put during a time of Bitcoin crisis and Monero pump, hoping to catch the reverse trade when the 1MB is finally fixed and quadruple his coinage accordingly. |

|

|

|

"After 5 years is the 1MB hard-limit the best anti-DoS mechanism that Bitcoin dev can come up with?"

Answer no, because the real anti-DoS protection comes from the consensus dust-limit and fee policy. False. The dust limit and fee policy are not part of the consensus code (which the 1 MB limit is). So the answer is in fact yes: There is no other anti-DoS mechanism in the consensus code after 5 years. Proposing to add one is one possibility. Have at it. consensus dust-limit and fee policy.

Policy which is observed by a super-majority of nodes is effectively a consensus. Also the message size limit is anti-DoS |

|

|

|

So they are trying to solve the ever increasing burden of running a full node for a non miner indirectly, through the mean of a side effect of an anti-DoS mechanism.

Am I right?

if I'm correct, It seems to me a rather convoluted way of thinking, why not just say that instead of use the fee pressure rhetoric?

why not embrace JR's free market idea for full node services?

Yes, absolutely. That's what I think is the central plank of the informed pro-1MB opinion. This question can be turned around: "After 5 years is the 1MB hard-limit the best anti-DoS mechanism that Bitcoin dev can come up with?" Answer no, because the real anti-DoS protection comes from the consensus dust-limit and fee policy. This is what has kept the average block size to something reflecting real market demand, otherwise blocks would have been constantly bumping the 1MB since 2011/12 where real ecosystem traffic would have to crowd out spam with fee pressure alone, as a "normal" state of affairs. Effectively, this is 5 years of proof that a hard block limit is not needed, with the 32.5MB message size limit still remaining as a sanity check. The market for node services will certainly be a major feature of successful cryptocurrency in the years ahead, but again, requires more time to develop, and co-ordination than can quickly be expected. Also, I suspect that work on SC and LN has potentially more scope for individual profit than work on a real free market for node services. TBH, that is OK, it is human nature to work on what has the most scope for individual gain, especially for long periods of time. The solution to accelerating work on node services payment channels is indirect incentives for the developers of it. Monetizing it. |

|

|

|

Looks like we have a rate rise by the fed on tap this year. Should start to get priced in on monday

Yeah, no. QE4? Yep. I'm expecting both, with unlimited Keynesian hubris on the side. This is a confidence game, so with sufficiently disorganized alternatives, the Fed may be bold and anyway they are not afraid of Bitcoin... at all. Indeed. And for those that are still counting it will be QE5 next. http://useconomy.about.com/od/glossary/g/Quantitative-Easing.htmQE4 was a re-bailout of the Treasury market for new issuance plus a much needed cash infusion for the primary dealers (banks) QE3 was a re-bailout of the MBS investors (re-bailout of Fannie & Freddie) and banks QE2 was a bailout of the Treasury market, FDIC, plus domestic and foreign banks QE1 was a bailout of the MBS investors (bailout of Fannie & Freddie) and the banks TARP was a bailout of the merchant banks (Citi, Squid etc) plus AIG, car-makers and (why not?) foreign banks |

|

|

|

the thing that I can't grok at all about arguments contrary to max blk size increase is the "fee-pressure" one.

isn't the fixed and over time decreasing tokens emission already supposed to take care of it?

why do we need to anticipate the time when miners should sustain theirs activity through fees?

When Satoshi designed Bitcoin he expected most users of it to be able to mine using their own full nodes, receiving block rewards, for a lot longer than actually happened, ASIC farms and mining pools hijacked the reward emission to a certain extent. So people who run full nodes are often not mining and not compensated for handling ever larger blocks. So the idea of higher and higher fees is to force tx volumes lower than what the market and ecosystem would like, purely in the theory that it helps the non-mining nodes with less overhead. The real solution to this is a combination of several things: node services payment channels (like JR has written about), blockchain pruning, Lightning Network type off-chain services, and IBLT which reduces the block propagation bandwidth requirements. If all these changes were happening then there would be no pressure to try forcing a (misguided) centrally planned fees-market. |

|

|

|

I cannot wait until we fork this problem away.

Yep. interesting reddit post that sums up the fork in the road debate nicely. https://www.reddit.com/r/Bitcoin/comments/3ef6h1/bitcoin_ideology_do_you_vote_for_a_or_b/Multiple Choice Question:

Do you see bitcoin in the future as:

A) a scaling peer to peer network with ultra cheap transactions, for anyone globally to use, with bitcoin functioning as internet cash, avoiding financial intermediaries or banks.

B) a settlement layer for banks, fin tech companies and early adopters, with a low volume expensive to transact upon blockchain

The root of the issue is that option "B" Bitcoin as a high-fee high-value settlement layer, without "A" scaling and widespread growing ecosystem usage happening first, is economic illiteracy of the first order. "B" by itself is simply a wet-dream of Blockchain Economics central planner fanbois. If the 1MB is allowed to crowd out regular user tx, not just spam, then fees will plateau and inexorably decline amid an ongoing PR disaster. Fortunately rescue from the 1MB4EVR idiocy seems likely. Gavin is fixing the cpu-intensive bloat-tx attack threat, and then it looks like the change to an 8MB block limit will be offered to the community. I hope that Gavin and Jeff team up for this. When I first learned about Bitcoin it was Satoshi, Gavin, Jeff and Sipa who were commit access Core Dev (though Satoshi was already the Silent One). If it takes just two of them to get Bitcoin back on the track to success - then all power to them! |

|

|

|

How would the block be accepted by nodes and other miners if the block was validated using different policies than the attacking miner? IE the size policy would invalidate that block on the rest of the nodes.

Isn't that the point? To introduce extra validation that eventually all the nodes will use (once super-majority threshold reached). |

|

|

|

Gavin is already on the case with negating excessively cpu-intensive "bloat tx" which are a concern. http://lists.linuxfoundation.org/pipermail/bitcoin-dev/2015-July/009494.htmlMitigate a potential CPU exhaustion denial-of-service attack by limiting the maximum size of a transaction included in a block. ==Motivation== Sergio Demian Lerner reported that a maliciously constructed block could take several minutes to validate, due to the way signature hashes are computed for OP_CHECKSIG/OP_CHECKMULTISIG ([[ https://bitcointalk.org/?topic=140078|CVE-2013-2292]]). Each signature validation can require hashing most of the transaction's bytes, resulting in O(s*b) scaling (where n is the number of signature operations and m is the number of bytes in the transaction, excluding signatures). If there are no limits on n or m the result is O(n^2) scaling. This potential attack was mitigated by changing the default relay and mining policies so transactions larger than 100,000 bytes were not relayed across the network or included in blocks. However, a miner not following the default policy could choose to include a transaction that filled the entire one-megaybte block and took a long time to validate. |

|

|

|

What goes up must come down? or Damned lies and statistics? (squish the x-axis and truncate the y for dramatic effect) |

|

|

|

|

Jeez. No trip to the stars without yet one more check of basement?

|

|

|

|

Everytime I see a Western Union death thread, it fails to point out that WU has been experiencing record growth and profits over the past few years, so Bitcoin hasn't been making any sort of dent in it.

Western Union share price for 5 years, massively underperforming the S&P 500 (red line). Note that the drop at the end of oct 2013 coincides exactly with the first Bitcoin BTM at Vancouver which was a huge media event and preceded the $1150 run-up. WU claimed their share price was hit by "cost overhead from increased money transmission regulations" though it suffered in Oct 2012 too (more regulations then as well?) |

|

|

|

|