Actually, I wasn't agreeing with his whole concept of just depending on headers and a hash of the UTXO set for a full node. I still think it's important for every new full node to download the entire block chain initially to build a valid UTXO set before discarding any blocks. But I do like the idea of adding a hash of the UTXO set into each block to ensure it's integrity.

You don't seem to quite get it. From who do you suppose you will "download" the entire block chain initially.? I don't care if you stick "validating" nodes on every USB key you can get your hands on. This does not improve the number of COMPLETE copies of the transaction log from which nodes can sync on the network. Did you bother reading the last link I posted? To quote Finally (for the purposes of this piece), there is the immutable transaction log. The log demonstrates incontrovertibly the complete heredity of each and every satoshi, from coinbase to unspent output. This globally-shared, append-only log cannot be disentangled from that which is Bitcoin. Nodes that run with "pruned" blockchains will still always depend on the existence of nodes with unpruned blockchains from which to sync. Perhaps in some idyllic (for the fiat shitgnomes) world, the entire Bitcoin network would switch over to this "headers first" synchronization method, bypassing the all-important verification of each transaction in each block. So much for inclusion and "nodes" propagation when only people who can afford petabytes of storage can run the only nodes that matters and that are foundation to the Bitcoin network You are taking the situation to its extremes. The reality is that in a decent sized Bitcoin economy there will be thousands of businesses who will always run full nodes. Individuals who want to use pruning *should* have the option of storing a percentage of the full blockchain. Even if it is 5% or 1%, as mentioned earlier, the whole blockchain can be rebuilt from segments held by many nodes with this variation of pruning. Also, storage is not really the problem, in 10 years time petabyte storage should be available to consumers, let alone to high-end users. 3D ( even 5D) glass storage has huge potential. Bandwidth is the real limiting factor, and fortunately there are major efficiencies to be had there. |

|

|

|

Did you see the latest commit on pruning? Allows you to specify max disk usage and it prunes old blocks.. validates by reindexing which downloads all chain then prunes. You check it out? I wonder what the point is if youhave todownload the full chain anyway why prune? The main bottleneck is the lenghty sync time not storage space.

I also noticed that it has logic to stop sending blocks requested that have been pruned. So there is assumption that there are full nodes out there to give you the block that others have pruned.

There's also a plan to let you keep certain block ranges and network protocol addition to advertise which parts a node has. That way, full block data can be kept in a distributed fashion while nodes can still run ( and contribute more meaningfully than just as a relay and utxo set provider) even with disk space limits. In fact with that it would be theoretically possible to run the network (fully trustable) without any node having storage space for the whole blockchain. Yes, keeping whole block ranges (randomly determined before pruning) is an important feature of pruning which will hopefully be included in due course. |

|

|

|

just brainstorming...

if we take a closer look at the last 2 yrs in log plots, and completely ignore the second gox bubble, usd tx volume has increased about 2.5-3x.

if we take a closer look at the last 2 yrs of the number of tx excl pop add., for the same range of time, txs have increased about 4x. its not crazy different. a lot of usd tx volume centered around gox and huge prices.

there could also just be more micro tx being used in the economy (more xcp tx, colored coins, etc)

Well, the USD has appreciated against many other currencies by 20% in the last 2 years. So that 2.5-3x can be increased by 10-15% to take account of that. |

|

|

|

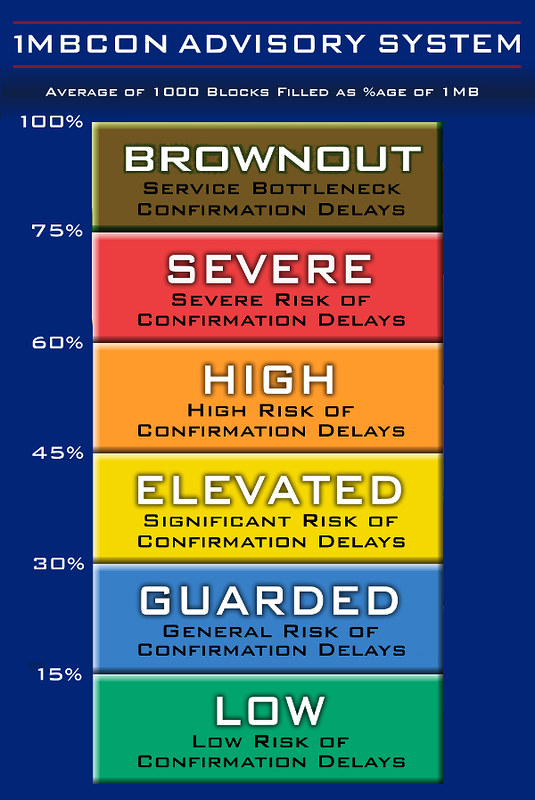

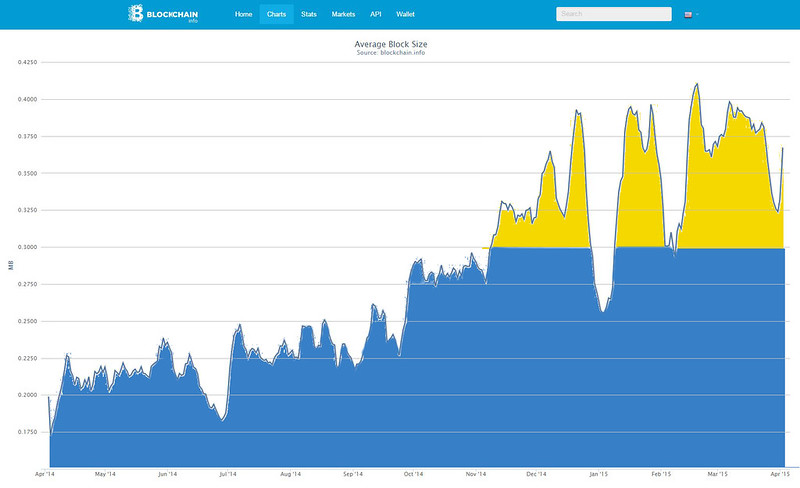

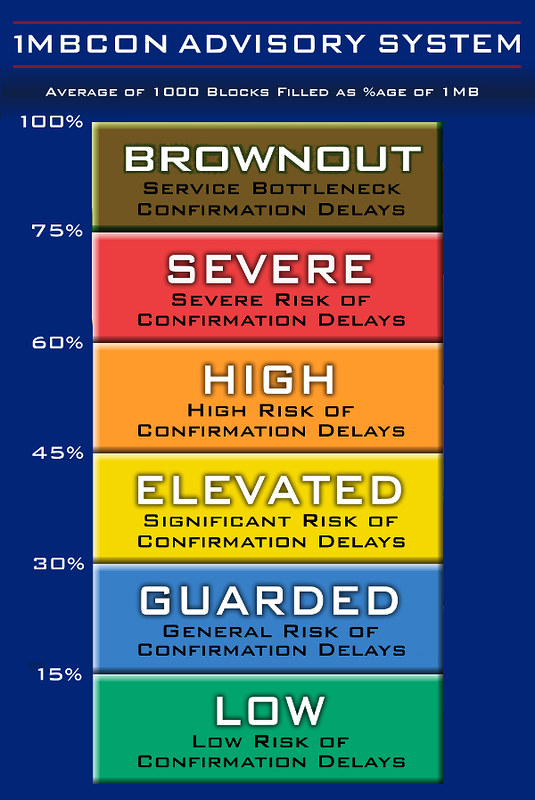

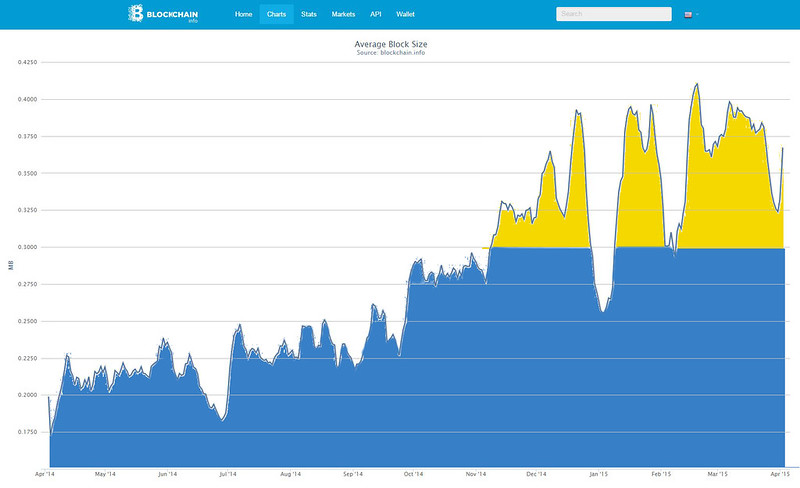

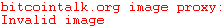

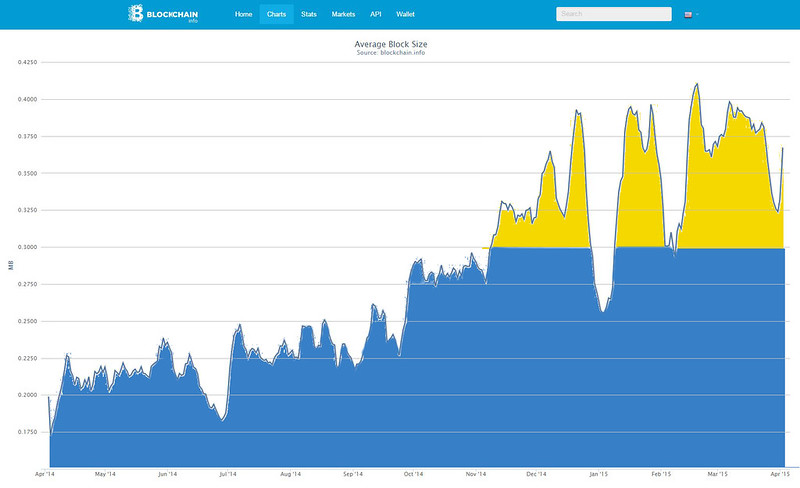

Apropos of Cypherdoc's poll, I am posting a copy of my recent OP on the subject. This software problem has been my No.1 worry about Bitcoin's future for over 2 years now...  Introducing the 1MBCON Advisory System which gives a quick overview of the risk conditions against timely transaction confirmations into the blockchain. The debate has been thorough and extensive. Now the status of the risk needs to be tracked: average size of 1000 blocks (7 days) as a percentage of 1MBEnd of Q1, 2015

|

|

|

|

Rather then actually fix the problem (say by requiring a 5 minute minimum time for placed orders) they simply make money on the traders and then when the market goes down find a scapegoat to arrest for doing what their system explicitly allowed. A two second minimum life-span for orders on all exchanges would be the simplest and most effective action regulators could take to stabilize markets. That UK trader should get a medal for highlighting how broken the HFT-abused markets are. |

|

|

|

It seems obvious that reversible computing is the future for Bitcoin mining ASICs, and could be the first major commercial application of the technology. From the Reddit page you linked: "No. Hashing by definition is irreversible and results in loss of information and therefore increased entropy." It's irreversible because the normal circuit for SHA256d discards information (and thus requires an energy input to move in the forward direction). For example, we hash the 640 bit blockheader to get a 256 bit digest; there's no way to work backwards with only 256 bits to reconstruct the 640 bit input (the output contains less information than the input). But I don't see why there wouldn't be another circuit that performs the hash function in a reversible way, by tracking all the information that is normally discarded. This circuit would output the hash value PLUS enough of other information that one could work backwards to reconstruct the inputs. Yes, that's what I was thinking. The final hash is irreversible, but not if the results of each step are known. The efficiency is gained by recycling logic gate inputs as they occur. Certainly a challenging design problem though. |

|

|

|

If the US calculated unemployment the same way as Spain does, the US would be well above 25% unemployment today.

The US unemployment calculation has been modified and manipulated to show good numbers over the past 50 years. The headline number today is the U3 rate, but we used to show the U6 number which included underemployed as well. On top of this none of these numbers include people who dropped out of the workforce and are now on entitlements (which is unemployed). You add this all up and we are well past 25%. If the government ever runs out of entitlement money people are going to see just how bad the employment situation really is.

But we live in the era of twitter politics that generate headlines such as "Unemployment dropped to 5.6% under Obama", never mind the fact that Obama changed the calculation a bit to hit that number, and the number is complete bullshit.

Yes, the numbers are so distorted they have lost historical significance. 100 years ago government workers were counted as unemployed as they were funded from taxation, not the productive economy. Not only does the debt-based financial system need a reset button, so do economic statistics. I know we are in liberterian territory on this forum, but that's a bit much. Whether a service is provided by a private firm or the government doesn't really matter as long as the service is being provided (and at the same or a similar cost). Obviously, it can be argued that the private sector allocates capital more efficiently, and that government structure leads to squandering, but considering every job that is paid by the government as non-existent is a clear error (inb4 every government job does harm). Absolutely. I certainly don't think that government jobs "don't matter", and agree that some/many are essential to a stable society. It is a matter of how the employment statistics are increasingly tortured to make the case that unemployment is under control, and part of this is the millions of extra non-jobs created in the government sector in recent decades. Which then has the twin downsides of being unaffordable (perpetual deficits) and interventionist (cradle-to-grave nanny-state). Really? That's awesome, I didn't know that. Any references? Not that it mattered to the calculation anyway since government workers only comprised an insignificant fraction of the working population.

No direct references to hand, I just recall reading it a few times. Probably more of an interpretation from data, such as the census below, when GW was indeed a smaller percentage of the total. Example: the US 1940 censusThe instructions to enumerators for column 30 give five codes for "Class of Worker":

PW—a person who worked for a wage under the direction of an employer

E—an employer, who employed one or more helpers

GW—government worker

OA—own account, such as a lawyer with no hired help

NP—unpaid family member whose work contributed to the family income, such as in a family store

The census clearly separates GW from other types of employment, then it is up to the user of the stats to interpret what is full or productive employment. |

|

|

|

If the US calculated unemployment the same way as Spain does, the US would be well above 25% unemployment today.

The US unemployment calculation has been modified and manipulated to show good numbers over the past 50 years. The headline number today is the U3 rate, but we used to show the U6 number which included underemployed as well. On top of this none of these numbers include people who dropped out of the workforce and are now on entitlements (which is unemployed). You add this all up and we are well past 25%. If the government ever runs out of entitlement money people are going to see just how bad the employment situation really is.

But we live in the era of twitter politics that generate headlines such as "Unemployment dropped to 5.6% under Obama", never mind the fact that Obama changed the calculation a bit to hit that number, and the number is complete bullshit.

Yes, the numbers are so distorted they have lost historical significance. 100 years ago government workers were counted as unemployed as they were funded from taxation, not the productive economy. Not only does the debt-based financial system need a reset button, so do economic statistics. |

|

|

|

to me, there are just 2 remaining levels at which this prolonged 1.5 yr bear mkt will stop; here at final support, or, at a double bottom down near 160. it's a coin toss but it's possible we've just had the bottom:  Hmm. Wondering whether a complete meltdown at OKCoin would be enough to flash-crash a 2nd bear market bottom. |

|

|

|

On another note, what does everyone think of the chances of BTC putting a double bottom in at ~$180 and then beginning a rally?

It's becoming quite the ubiquitous mindset around here that I bet many have buy orders in around that level which will shoot the price back up should it reach this area. Likely, others are stacking orders all the way down to the low 1xx. I imagine this would be a brief unfolding and then the market should be clean of selling pressure, I hope. The market will never be clean of selling pressure. The protocol is designed to award 3600 new coins per day and some of them will be sold. Market participants are incapable of pricing this in, so they get burned over and over. 1800 coins a day in just over a year from now. The market will have this somewhat priced in, but continued ecosystem growth will make the reduced number keenly felt. |

|

|

|

As for node incentivization, what do you think of Justus's idea? Larger blocks (after the limit is raised) kept in check by something I roughly understand to be nodes agreeing to give priority to certain miners for pay. I like the concept, and the thinking behind the potential different node services which could be priced in a networked market. Whatever crypto is dominant in 5 or 10 years time will need to have a functional implementation of this to maintain its no.1 position. I hope it is Bitcoin. However, time is too short to see the coding done, and a node services market develop, before the existing block size limit has major negative effects. |

|

|

|

This alert system may apply if fee bidding market dynamics haven't been fully implemented.

But if they have, there should never be delayed transactions, just a rise in transaction fee versus speed. I think that is much less severe and much less urgent concern.

Even a third-party centralized website where users and miners could quickly check the recent fee rates for a given desired confirmation time would work, if the clients took an API from it. In fact, something like this will almost certainly pop up if blocks start getting full and the clients haven't figured out fee markets yet, or the blocksize hasn't been raised yet.

For that matter, get nodes and miners working out payment deals as well so we can remove the blocksize limit once and for all and rely on market dynamics. But I guess this will happen naturally as we approach those critical levels, as an antifragile response.

Transaction fees are already the major factor keeping the block size under control, and so is the consensus dust threshold. Without improvements in this area the 1MB would have been maxed out in 2013 based upon the growth of traffic from SatoshiDice (and similar sites). I fully agree that market dynamics is most important, but the market is not as efficient as it could be because non-mining nodes are not directly rewarded for their overhead (only indirectly, by the value appreciation of BTC savings). There is a serious concern with limited block sizes even when they are not full. The probability of tx confirmation within a given time period decays rapidly once they are usually half-full.  http://hashingit.com/analysis/34-bitcoin-traffic-bulletin http://hashingit.com/analysis/34-bitcoin-traffic-bulletinProbably the first thing to realize here is that the traces for 0.1%, 10% and 20% are so similar that the 20% line hides the other two. The 30% line is only slightly different. This tells us that up to now we've not really seen any real effects as a result of transaction rate. At 30% loading we'll still see half of all transactions confirmed within 434 seconds, as opposed to 415 for 0.1%. That gap really starts to widen at 40%, however, where it now takes 466 seconds and at 80% we're up at 1109 seconds (18.5 minutes)! At 100% we're up at a huge 7744 seconds (more than 2 hours)! If the network were ever to reach this 100% level, though, the problems would be much worse as 10% of all transactions would still not have received a confirmation after 22800 seconds (6.3 hours).

I find this worrying, because Bitcoin's strong network effect could be seriously damaged through long tx delays resulting in bad publicity, collapsing price, then persistently falling hash rate. If people who want to use Bitcoin are priced away from it and forced to use alternatives then it is the beginning of a long decline. |

|

|

|

yes jorge take it to the technical discussion section you coward.

[ noise] ok, so you found the fatal flaw in bitcoin ... go, make yourself rich exploiting it, let us know how your academic exercises pay off. This is the problem: exploiting an idea means work, actually doing something, which is the antithesis of ivory tower academia where the only "work" done is relentlessly attacking the work of other people. |

|

|

|

At first I was tempted to go with "guarded", but after looking more closely I'd agree with "elevated". There have only been a few brief occasions in the last 60 days when we've been below 0.3MB, so on this scale we are indeed in the yellow. Also this is something that could escalate quickly and at short notice, so I'm pleased people are taking note of this. Perhaps the wording of the scale might need tweaking, though. At 30%-45%, I don't know if I'd call that a significant risk of delay.

Maybe bump them all up one and add a new category above 90%, so:

0-15% = Very low risk

15-30% = Limited risk

30-45% = Some general risk

45-60% = Significant risk

60-75% = High risk

75-90% = Severe risk

90%+ = Bottleneck

Fair points, but I really don't think 75%+ presents simply just a "risk". At that level there will be clear and present time periods of delays because not all miners will fill blocks even when unconfirmed, fee paying, tx are backing up by the thousands. Near-empty blocks are churned out at random intervals by many different miners. Also, as soon as a pool solves a block new work requests are often met with an empty block template. So 90%+ is unlikely to be seen, yet the bottleneck will be happening. The risk of a flooding attack also grows as the cost of executing one drops as the average block size increases. It becomes very cheap in the end. |

|

|

|

Introducing the 1MBCON Advisory System which gives a quick overview of the risk conditions against timely transaction confirmations into the blockchain. The debate has been thorough and extensive. Now the status of the risk needs to be tracked: average size of 1000 blocks (7 days) as a percentage of 1MBEnd of Q1, 2015

|

|

|

|

I am not sure, but i think you do not understand how the bitcoin network works. Every day we have several "hard forks" in the form of orphaned blocks. You simply do not understand the consensus mechanism, if you insist that A and B blockchains can coexists - with the same mining power behind them!- for more than say 2 consecutive blocks (on avg 20 minutes), and that they both individually represents bitcoin as per se. No, they do not.

The whole point of the consensus mechanism is to only and ever follow the longest chain of blocks in the long run, a.k.a. deciding which chain of blocks (A vs B) represents reality, and totally disregard transactions happened in the less long chain of blocks once a the n+1 block found. Hence your theoretical "B" chain would be instantly will be abandoned by the majority of miners (mining is automated by algorithm, not a press a button every ~10 min if you accept or not), resulting in that all the nodes will continue downloading and propagating the longer A chain, essentially destroying the B chain by the time the next block found. That B chain n-1 block became an orphaned block.

Yes, you can mine your own forked "B" copy of the blockchain at your laptop - offline! - until you start synchronise with the network, your B chain gets instantly overwritten by the majority A chain.

Also, your B chain will not ever propagate because: the moment you fork, you also inherit the difficulty of the A chain. That difficulty is so high, that your laptop will practically never finds the next block (which by the way will be without any transactions, since you are offline from the main A chain nodes), and without no new block, your offline node/mining copy will never reach enough blocks (aprx 2600) to reduce difficulty. This means that B chain will be hopelessly shorter than the A chain -> rejected by all miners/nodes on A chain.

TLDR.: Your idea will never work -not even in theory, since you missing the point in the first place- because the whole point of the PoW census is to have only ONE representation of the true about transactions (unspent BTCs sitting on addresses). By the way any full node wallet has the whole copy of the blockchain, every time you go offline more than 1 block, your copy is forked from A chain to B chain (n-1 long blockchain)....

EDIT: if you think that the state of the blockchain is a political decision, you are seriously should STOP posting bullshit here please. You do not understand the very basic idea: consensus through mathematical proof independent of central authority ( which is politics...)

Well Said! The sad truth is that not only does Jorge fail to comprehend how PoW consensus works, but he also fails to understand why Bitcoin is sound money. He has spent a year on here, most of that time totally wasted, including the time of many of us here in this forum who are willing to learn from others. |

|

|

|

What are the problems with bitcoin??

Some problems: * Centralization of mining seems inevitable. As mining matures it is becoming decentralized. organofcorti stats shows this clearly. * There is no mechanism to stabilize the value.

Yes there is: more widespread adoption, the plateau of market penetration at the top of the S-curve. It's value will be very stable then, more so than the DXY which has screamed from 80 to 100 in a short time and that measures multi-trillion$ of value. * Limited supply leads to expectations of high value which leads to hoarding instead of use.

Hearding is good, investing is good, saving is good. Only inflationistas dream otherwise. * Block reward leads to a hyperdeveloped mining industry supported by investors rather than by users.

As before, investors are good. How many people mine their own raw materials for products they use? * For most people, irreversibility is a serious defect, not a feature.

Cash and gold is irreversible. This is a good feature of sound money. * Risk of theft is too high for people who are not computer experts.

Early days in a new technology. Wallet software has improved massively, still a way to go, but in 10 years, very safe to own bitcoins. I am sure that millions of people don't think like you do.

Or you. You are doing your students a disservice by not teaching them about Bitcoin in the way MIT, Princeton and Nicosia do. Perhaps a million people have a reasonable understanding of bitcoin and believe in its eventual succeess. Probably millions of people also have a reasonable understanding of bitcoin but do not believe in its eventual success. The other 7000 million either haven't heard of it, or have heard of it but don't care to know more, or know just enough to dismiss it.

Handwaving. Only a few people understand the software in detail. The rest have to just see that it works: like smartphones, like quantum mechanics, like stem-cell treatment, like meteorology, etc etc etc. In case you haven't noticed a major feature of modern civilization is extreme specialization. No one person can understand more than a fraction of everything. |

|

|

|

|