|

141

|

Economy / Exchanges / Re: Bitfinex exchange owner admits to using inside information to trade on own platf

|

on: January 26, 2015, 03:15:45 PM

|

Yes I do understand how high frequency trading works. But this is still a classic definition of insider trading. Certain parties have access to information about select companies which is not yet publicly available through the SPI's of exchanges. With this information they can places trades which directly benefits them. Just because the timing is is milliseconds and not days/weeks does not alter the fact that this is a textbook definition of insider trading. I do know there is a massive debate on the issue, but any activity in which certain parties can benefit of knowledge gained before the public is insider trading.  P.S. I respect that you don't want to get drawn into a debate on the issue. Just giving my 2 cents. Bitcoin is not a stock and there is no inside information on the protocol itself because it is open source. I suppose perhaps someone could trade on early info about a hard fork before an announcement by Gavin Andreesen, or something of that nature... but that would be a stretch. |

|

|

|

|

142

|

Economy / Speculation / Re: Gold collapsing. Bitcoin UP.

|

on: January 24, 2015, 02:51:33 PM

|

Does it make sense to replace all Honda windshields with Lear style ones because they are 'more secure'.

It does make sense to do so if the Lear style windshield is not only more secure, but also less expensive than the Honda style. Better and cheaper. No brainer. I'm sure nobody would be able to make a transaction solution which is cheaper than real time flooding of the entire network with every transaction and keeping every transaction on every autonomous node in perpetuity...and every 'coin' (aka UTXO) in the currency system in memory. It sounds like you're trying to make the point that keeping LOTS AND LOTS of copies of an entry in a ledger (i.e, the blockchain) is expensive. Like, I buy a cup of coffee, and this single transaction gets recorded LIKE A ZILLION TIMES all over the globe. The average midsized town probably spends more on brick and mortar banking than the entire Bitcoin network costs to operate. Good luck finding a cheaper, more secure solution. |

|

|

|

|

146

|

Economy / Speculation / Re: If you are waiting for the "despair phase" to buy like in 2011 consider this

|

on: January 11, 2015, 04:10:36 PM

|

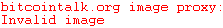

You know that speculative bubbles based on blind hype don't go up forever right?

You know that the more they go up the more difficult it becomes to keep the Pump&Dump pyramid scheme exponential trend going right?

Eventually THE bubble actually bursts and it doesn't matter anymore if price recovered from crashes and bear markets in the past.

Again. Why compare to 2011 and not show a chart of 2011? Trolls gotta troll. |

|

|

|

|

147

|

Economy / Speculation / Re: If you are waiting for the "despair phase" to buy like in 2011 consider this

|

on: January 11, 2015, 03:56:56 PM

|

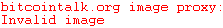

Some folks are feeling that everybody is becoming bearish, so they think that is the best time to buy right? "Be fearful when others are greedy, and be greedy when others are fearful"? They know price crashed in the past and it quickly recovered. Dear friends of the interwebs. You know that speculative bubbles based on blind hype don't go up forever right? You know that the more they go up the more difficult it becomes to keep the Pump&Dump pyramid scheme exponential trend going right? Eventually THE bubble actually bursts and it doesn't matter anymore if price recovered from crashes and bear markets in the past. I'm sure during the tulip bubble crash, some dudes thought it was a good idea to "be greedy" when others were "fearful" and to buy somewhere during the big crash because "they had already been there" (during the mini bubble that you can see a little bit before the big pump for example). They thought they were smart.   They went broke. I can't figure out why you would compare to 2011 and not show a chart of 2011. Trolls gotta troll I guess.  |

|

|

|

|

149

|

Economy / Speculation / Re: Bitstamp's stolen BTC on the move

|

on: January 07, 2015, 03:58:48 PM

|

Let's hope they will dump in btc-e and all my bids get filled. Or maybe bitstamp, have orders there too.  I doubt they will sell the coins on the same exchange they stole them from.  |

|

|

|

|

151

|

Economy / Speculation / Re: Gold collapsing. Bitcoin UP.

|

on: January 05, 2015, 05:37:33 PM

|

The Bitstamp hacking highlights the need for sidechains IMHO. Central bank's solution is to print money and bail out. Our solution should be sidechains. Bitshares could be forked onto a sidechain, potentially allowing all trade and storage to be done on protocol with bitcoin as the backing collateral... or perhaps the truthcoin model would work. Its time for this to happen.

no, not necessarily. your assumption is that SC's are more secure than current exchange models. the only way to achieve this is to obtain 100% MM cooperation from miners. there is no model for this and the best we have is about 55% for NMC. just given the fact that some miners won't be aware of SC existence if and when they do come to fruition means they won't be mining SC's which means there will be <100% for sure. theoretically, anything <100% MM'ing is vulnerable and i'm sure this can be mathematically modelled. plus, i'm not sure where all this desire comes from to "bailout" speculators on current exchanges. b/c that is what they are, imo. the reason i have never lost a coin is b/c i realize that Bitcoin is about increasing personal responsibility by becoming your own bank. i have never used an exchange as a trading mechanism and have just used them to buy and move coin to my privkeys. SC's are an attempt to bailout the individual speculator who wishes to leave their coin on some speculative trading platform. but even that doesn't work b/c of the MM'ing fallacies i've outlined above. Its not just speculators that use the exchanges. The sidechain model is not a bailout, it is a potentially more secure financial system where users have much less exposure to theft. While bitcoin is still in beta, I don't see any reason to not implement it. |

|

|

|

|

153

|

Economy / Speculation / Re: Gold collapsing. Bitcoin UP.

|

on: January 05, 2015, 04:07:13 PM

|

nice quote Marc Andreessen Paraphrasing (Bitcoin's value is it's blockchain not the BTC) My fundamental issue with SC is they don't secure the value just the BTC. SC offer economic hackers a way to steal that value. It's economic ignorance to believe the value in the blockchain is inherent. I thought the blockchain and the currency couldn't be separated. Can a blockchain exist without having a token to secure it? (or have I misinterpreted the entire thing - long day) No. The currency and the blockchain cannot be separated. A blockchain without a currency has no security. |

|

|

|

|

154

|

Economy / Speculation / Re: Gold collapsing. Bitcoin UP.

|

on: January 05, 2015, 04:05:34 PM

|

|

The Bitstamp hacking highlights the need for sidechains IMHO. Central bank's solution is to print money and bail out. Our solution should be sidechains. Bitshares could be forked onto a sidechain, potentially allowing all trade and storage to be done on protocol with bitcoin as the backing collateral... or perhaps the truthcoin model would work. Its time for this to happen.

|

|

|

|

|

155

|

Economy / Speculation / Re: sidechains discussion

|

on: January 05, 2015, 02:32:29 PM

|

He thinks he can get to 100k TPS. What's the problem with doing 100k TPS on the main chain? (other than non-answers like "it's hard to do") I said what on the thread that you trimmed  security... I really dont think you want that on the main chain because its weaker, and he cut down a lot of bitcoin features to get it. But its useful.

I am talking about the specific sharding approach. Its not easy sharding a block chain, and he made security tradeoffs to do it. Nothing against someone doing it if they can do it securely (ie without impacting the security of the rest of the coins on the chain) or without making the centralisation very bad. Adam Seems he does not understand what is "100k TPS". 100,000 transactions * 260 bytes * 60 seconds * 60 minutes * 24 hours = 2 246 400 000 000 bytes per day = 2.25 TB / day Guys, 100k TPS would equate to 8.64 billion transactions per day. There are only 7 billion people on earth. That is theoretical upper upper upper limit... probably never be reached. |

|

|

|

|

157

|

Economy / Speculation / Re: 300 is broken, to never see again

|

on: January 04, 2015, 07:09:45 PM

|

You can thank the paycoin groupies that are pushing this 1000s BTC scam that I bet is being dumped into Fiat as we speak.

It's ironic how the guy that represents PayCoin is named Josh, just as it was the case with Butterfly Labs. And guess what, both broke their promises. When I suddenly recognized the weird similarity between GAW and BFL I insta-dumped my speculative paycoins I can afford to lose. Seeing BTC falling under 300 I insta-dumped a good portion of my hot wallet. However, I'm not holding any fiat, I bought nubits instead. NuBits is an excellent hedge against the collective downtrend of all other cryptos. Thank god I invested heavily into NuShares when they first came out, it has covered all my losses I'm having in BTC, PPC and now XPY. NuBits is like a dream come true. Nubits is too centralized and relies on third party custodians to manage the supply, not to mention centralized exchange risk. Bitusd from bitshares is the only legit decentralized solution with on-chain collateral. |

|

|

|

|

158

|

Economy / Speculation / Re: sidechains discussion

|

on: December 31, 2014, 04:37:21 PM

|

i view Bitcoin as digital gold which is the principle behind this long thread. but better. no one can transmute gold atoms into SCgold.

Here is food for thought... What if the dollar had somehow been pegged at an elemental level to gold from the beginning? Would the dollar still be sound money today? Obviously, a very fragile and subjective peg maintained by central banks did not work. Gold lost is dominance as the world's reserve currency because of lack of utility but if that utility could have been preserved by scaling gold's utility at a fundamental level vs scaling at such a weak level (USD), then it may have worked. I believe this is the crux of the whole issue and you are right, there is no precedent for it. Unfortunately, the only way I see to figure out if a protocol level peg will be strong enough is by trial and error in a live environment. Theoretically, this should be the last major untested change to the main chain as all other major changes can be done on side chains before being implemented on the main chain, if ever. |

|

|

|

|

160

|

Economy / Speculation / Re: Russia seems like to adopt bitcoin

|

on: December 28, 2014, 05:59:26 PM

|

|

It will probably wind up like China... smoke and mirrors, disorder and disarray when it comes to an official stance and regulation on bitcoin. People will still use it if they want.

|

|

|

|

|

security...

security...