|

261

|

Bitcoin / Press / [2018-11-23] Bitcoin Miners Ruined by Downturn, “Selling Hardware by the Pound”;

|

on: November 23, 2018, 11:46:58 PM

|

Bitcoin Miners Ruined by Downturn, “Selling Hardware by the Pound”; Giga Watt Files Bankruptcy Miners have been decimated by the market downturn. In response, miners have started decommissioning hardware, mothballing rigs, and even selling hardware by the pound. Bitcoin and cryptocurrency proof-of-work (PoW) mining is a controversial topic. Mining is a process where computers continuously solve a difficult algorithm in exchange for cryptocurrency. This exchange consumes a massive amount of electricity, but also secures and processes transactions on the Bitcoin network. This excessive consumption of electricity is intentional. Decision-making power in Bitcoin is based on the agreement and consensus of miners. By making it very expensive to gain majority control of the Bitcoin network, the coin is able to remain more decentralized and more secure from hacking. By the NumbersBased on estimates from the most sophisticated Bitcoin miner, the Antminer S9i, mining a single Bitcoin takes roughly 51,000 kWh, the equivalent of one day’s electricity consumption for 1700 residential homes. At a standard electricity rate of $0.12 per kWh, mining one Bitcoin costs $6100. That said, the recent drop in market prices is cause for concern. Lower Bitcoin prices make it less profitable to mine. Lower profitability results in less miners and the miners that remain are typically large-scale operations that can keep costs down. Reference: https://cryptoslate.com/bitcoin-miners-ruined-by-downturn-selling-hardware-by-the-pound-giga-watt-files-bankruptcy/

|

|

|

|

|

262

|

Economy / Speculation / Bitcoin Price Claws Back to $4,500 But Further Losses May Lie Ahead

|

on: November 21, 2018, 12:55:06 AM

|

The bitcoin price on Tuesday nursed extensive losses of over 12 percent against the US dollar, stabbing through $5,000 as it did. BTC/USD Intraday AnalysisThe BTC/USD index is currently trading at the 4513-fiat price level after a minor jump from its intraday low at 4035-fiat. The knee-jerk reaction after a massive sell-off does not confirm a substantial bias shift. It looks more like a bear pennant formation that is likely to extend the bearish action as it overreaches its downside targets.  BTC/USD 1H CHART | SOURCE: COINBASE, TRADINGVIEW.COM The little rise we are looking at could just be traders closing their short positions. It doesn’t guarantee any substantial accumulation. The BTC/USD rate, therefore, could consolidate for a while before forming another bearish flag, this time targeting new supports for a potential reversal. Indeed, the world’s leading digital currency is behaving like a reckless altcoin after weeks of stability. It doesn’t leave retail investors with any choice but to wait for things to settle down. Analysts are calling the bottom like they always do, but real accumulation could only appear when big-pocket bulls buy the dip. The events taking place in the bitcoin cash market are leaving investors no choice but to wait. Our intraday analysis, therefore, can only provide for day traders willing to catch the falling knife. Approach with caution. As BTC/USD forms a bearish pennant, we are testing its levels as a sign for out breakout/breakdown targets. That said, a jump above the upper trendline could have us enter a long position towards 4797-fiat. Similarly, slipping below the lower trendline could allow us to watch 4313-fiat as our short target. In both places, we are maintaining our stop losses tightly — just 2-pips opposite the direction of the price action would be enough to define our risk management perspective. Period. Reference: https://www.ccn.com/bitcoin-price-claws-back-to-4500-but-further-losses-may-lie-ahead/ |

|

|

|

|

263

|

Economy / Speculation / Crypto Hedge Funds are Going to Start Shutting Down: Morgan Creek

|

on: November 21, 2018, 12:52:33 AM

|

The depths of this year’s cryptocurrency bear market evidently show significant signs of further trouble. According to notable crypto figure and Morgan Creek Digital founder Anthony Pompliano, significant price drawdowns this year could lead to crypto hedge funds closing up shop soon.

Hedge FundsCCN reported today of Bitcoin dropping below $5,000 in price, the lowest price this year. Altcoins have also suffered significantly this year, seeing huge percentage losses. Pompliano, or Pomp for short, explained in his blog post today how this dramatic price drops cumulatively affect cryptocurrency businesses. Pomp specifically mentions crypto hedge funds and “high water mark issues”. Put simply, fund managers receive a commission based on their performance, in relation to associated crypto asset prices for each investment period. Last investment period ended in December 2017, concluding a very lucrative year for crypto assets as a whole. However, this year is a much different story. “We have seen 50-80% decreases in net asset values in some funds since then. This means these fund managers will not receive a performance fee in 2018, which drastically reduces the income of the individual manager”, Pomp explained. With reference to the numbers, earning these manager’s next commission’s will also be difficult. They will need to more than double their fund’s net asset value from present-day prices. Pomp explains many fund managers may simply close shop and return investor finances. They might then wait months or possibly a year to open a fresh fund with different parameters. Pomp posed a question on why these funds have not yet closed, concluding that – “[t]he most plausible answer is that many of the managers are young/inexperienced and they won’t realize the issue until they don’t receive their performance fee for 2018. If true, we could be less than 60 days away from many of the fund managers experiencing the pain of being ineligible for the bulk of their compensation”.

ICOsPomp also mentions ICOs, referencing their exuberant funding successes over the past year or so. ICOs are now facing significantly more scrutiny from regulators. Previous ICOs could face fines, as well as requirements to refund investor funds at original ICO price, in original USD value. The hitch here is the fact that most ICOs raised funds via cryptocurrencies. With prices down as much as they are currently, these ICOs could owe investors more money in USD than they currently own. In short, ICOs may not have the money to pay back investors, due to holding assets that have plummeted in price. These ICOs may need to file bankruptcy, leading to fund managers potentially seeing further losses. Reference: https://www.ccn.com/crypto-hedge-funds-are-going-to-start-shutting-down-morgan-creek/ |

|

|

|

|

264

|

Bitcoin / Press / Re: [2018-11-20] Crypto Investors Who Bought Bitcoin at $1,000 are Now Starting to

|

on: November 21, 2018, 12:30:34 AM

|

What the fuck is wrong with these people? They sat all the way through a bubble and did nothing and are dumping just as the real scraping starts to warm up? I thought deep pockets were sharp pockets. Evidently not. This is a poor show.

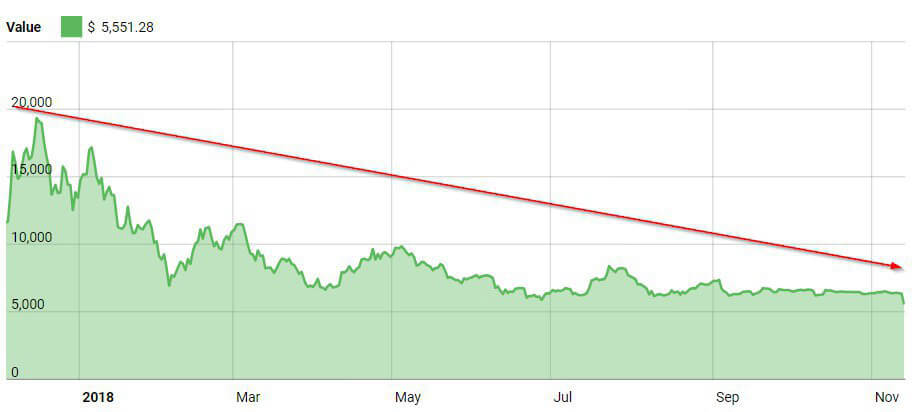

lol, been thinking the same thing. why on earth are they selling their bitcoins now? are they waiting for bitcoin price to fall down to $4000 before they sell or what? the bitcoin price reached its peak at around $19,500 since then the price is falling. the question is what are they waiting for since? i think they should at least sell their bitcoins during the time when the price was $15,000 not even $10,000. |

|

|

|

|

265

|

Economy / Speculation / Tom Lee Maintains $15,000 Year-End BTC Prediction Despite Market Crash

|

on: November 20, 2018, 11:47:20 PM

|

Despite the present market crash, major Wall Street crypto bull Tom Lee has reiterated his recently reduced year-end price prediction for Bitcoin (BTC) at $15,000 in an interview with CNBC’s Squawk Box on Tuesday, Nov. 20. In the recent statement, the head of research at Fundstrat Global Advisors pointed out two major types of crypto players — those who are “using it and have wallets in crypto,” and those who belong to a speculative side of the market. According to Lee, those two sides of the crypto community should find a way for “sort of interacting with each other” for crypto investors not to get burnt by crashes like this. While reiterating his crypto-rebound prediction, Lee still admitted that the markets have “certainly” seen a “negative development,” which signals a “downside of the momentum.” However, Lee stressed that institutional cryptocurrency investors are “not necessarily getting hurt” by the recent market downturn, even as Bitcoin’s price dropped sharply to as low as $4,237 today. In this regard, the investor emphasized the crucial role of institutional participation in the industry, claiming that specifically this part of the market will pull the “next wave of the adoption.” According to Lee, there are two key factors that will soon bring more institutional interest to the markets. First, it will be the upcoming launch of the digital assets platform Bakkt by the operator of major global exchange New York Stock Exchange (NYSE), Intercontinental Exchange (ICE). Announced in August this year, Bakkt recently confirmed a “target” launch date for Jan. 24, 2019. Second, institutions will get more involved in the market as the industry receives more regulatory clarity, which is partly “under way now,” Lee said, adding: “Once we have that [regulatory clarity], I think, institutions will feel more comfortable in making bets.” In this regard, the crypto analyst noted that Bitcoin is “not necessarily a value asset,” claiming that it is “probably best viewed as a commodity,” and is “really an opportunity for an emerging asset class.” Tom Lee had reduced his year-end Bitcoin price prediction from $25,000 to $15,000 last week, Nov. 16, following a massive decline on the markets that started on Nov. 14, with Bitcoin hitting yearly lows. Previously, the crypto bull had, several times, predicted that Bitcoin’s price would rise above $20,000 for the year’s end. Lee announced his first prediction in January this year, advising “aggressive buying,” while considering the $9,000 price point as “the biggest buying opportunity in 2018.” Recently, Netherlands-based “Big Four” auditor KPMG has released another bullish stance on crypto, claiming that the industry needs institutional investors’ participation in order to “realize its potential.” Earlier last week, CoinShares CSO Meltem Demirors claimed that the the recent collapse of the markets is caused by institutions“taking money off the table” due to Bitcoin Cash’s (BCH) hard fork. Source: https://cointelegraph.com/news/tom-lee-maintains-15-000-year-end-btc-prediction-despite-market-crash |

|

|

|

|

266

|

Bitcoin / Press / [2018-11-20] Crypto Investors Who Bought Bitcoin at $1,000 are Now Starting to

|

on: November 20, 2018, 11:28:17 PM

|

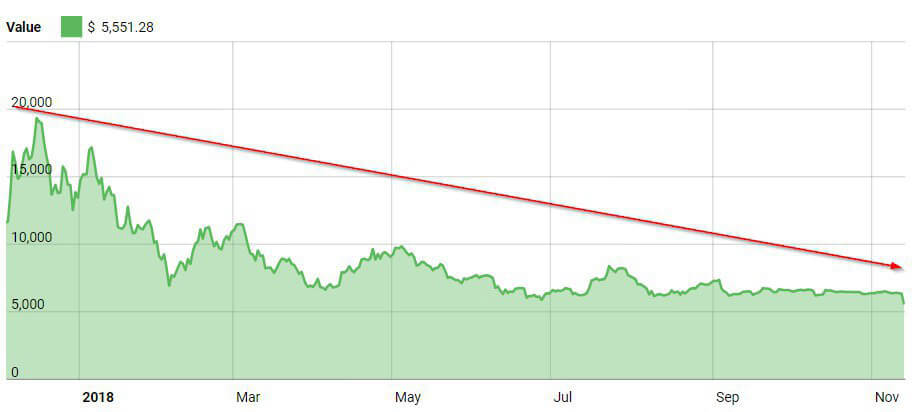

Crypto Investors Who Bought Bitcoin at $1,000 are Now Starting to Sell According to Michael Moro, the CEO of a major over-the-counter (OTC) crypto trading firm, investors that bought Bitcoin in early 2017 are now starting to sell. Speaking to The Block, Genesis Global Trading CEO Michael Moro, who provides institutional investors access to block size liquidity to purchase or sell cryptocurrencies like Bitcoin, Ethereum, and Bitcoin Cash, said that large investors have started to move funds garnered when the price of Bitcoin was just about $1,000. “We are seeing the folks who bought in early 2017 sell for the first time today,” Moro told Frank Chapparo, adding that the majority of Bitcoin investors that bought into the market in the first quarter of 2017 have started to see near to zero return on investment off of their cryptocurrency investment. Bitcoin at $4,200On November 20, CCN reported that the price of Bitcoin reached a new yearly low once again for the second time in a week, falling below the $4,200 mark to $4,170 on fiat-to-cryptocurrency exchanges like Coinbase and Kraken. The price of Bitcoin on cryptocurrency-only exchanges did not drop below $4,400 due to the premium on the Tether-to-BTC pair created by a decline in the price of the US dollar-backed stablecoin. “The bears aren’t even pushing, BTC is just free-falling. Very weak dump, imagine what it looks like when the volume comes in. A short-term reversal could happen at any moment – shorting with high leverage is a terrible idea. However, if you are trying to knife catch, be patient. No one should be in a rush to long this,” one technical analyst said. However, over the past 12 hours, the volume of BTC has increased from around $5 billion to $8 billion, by more than 60 percent, suggesting that BTC could establish a bottom-like trend in the low region of $4 billion. Throughout the past two days, the volume of BTC remained relatively low despite its steep decline from $5,500 to $4,300, leading investors to be concerned about the short-term trend of the digital asset. Gloomy Period For BTCIn consideration of poor market conditions and the intensity of the drop of BTC in the past five days, investors, even those that bought BTC at $1,000 to $2,000, are expected to sell a significant chunk of their holdings fearing a further drop below major support levels. Investors from the first quarter of 2017 are still up 50 to 100 percent on their investments. But, the cryptocurrency market has not seen a correction of this scale since 2014, when the value of BTC dropped by more than 85 percent. BTC is yet to achieve an 85 percent drop from its all-time high at $19,500. An 85 percent drop from $19,500 is $2,950, and the dominant cryptocurrency would have to drop by more than 32 percent from $4,400 to dip below $3,000. If investors from nearly two years ago are starting to clean up their portfolio, the vast majority of investors who entered the space in mid to late 2017 have likely existed from the market. The next mid-term rally of BTC and other major cryptocurrencies would require a new wave of investors, which could result in a months-long consolidation period. Reference: https://www.ccn.com/crypto-investors-who-bought-bitcoin-at-1000-are-now-starting-to-sell/

|

|

|

|

|

267

|

Bitcoin / Press / [2018-11-20] Bitcoin Price Hits New Yearly Low at $4,280; Market Needs Quick Reb

|

on: November 20, 2018, 11:25:40 PM

|

Bitcoin Price Hits New Yearly Low at $4,280; Market Needs Quick ReboundOver the past 24 hours, the price of Bitcoin fell from $4,900 to $4,280, by more than 12.5 percent amidst an unforeseen short-term price drop.  On fiat-to-crypto exchanges like Coinbase and Kraken, which demonstrate a more accurate representation of the Bitcoin price given the premium on the Tether-to-BTC pair, the price of BTC dropped below the $4,300 mark for the first time in 2018. $4,280: Where is the Bottom?On November 19, a cryptocurrency trader and analyst known as The Crypto Dog stated that $4,800, despite being down from 6,300, is not a bottom for Bitcoin. “$4800 was not a bottom by any means – my arbitrary line in the sand was the wrong arbitrary line. Judging by volume, we are still quite far from a bottom. So far this sell off has been relatively weak (volume wise). BTC / USD longs are rising, while shorts are barely touched. This dump has been straightforward spot selling, and no one is interested in buying.” Previously, CCN reported that the low volume of BTC in a period of an intense sell-off and free fall suggests a further decline to the low $4,000 region is likely, especially if the volume of BTC begins to increase in the days to come. The Crypto Dog reaffirmed that a spike in volume on Bitcoin could lead to a decline to a low range at $4,000. Since then, the price of BTC has fallen from $4,800 to $4,250. “The bears aren’t even pushing, $BTC is just free-falling. Very weak dump, imagine what it looks like when the volume comes in. A short-term reversal could happen at any moment – shorting with high leverage is a terrible idea. However, if you are trying to knife catch, be patient. No one should be in a rush to long this.” Within the past three days, BTC recorded a 32 percent drop in price without immense sell pressure and large sell orders from the bears in the market. In the short-term, there exists a possibility for a quick turnaround, but investors also have to respect the possibility of a further decline to $4,000 and a test of the $4,000 support level. Given the intensity of the drop of BTC in the last 24 hours, a minor corrective rally is expected, as long as the sell volume of BTC remains low. Reference: https://www.ccn.com/bitcoin-price-hits-new-yearly-low-at-4280-market-needs-quick-rebound/

|

|

|

|

|

268

|

Bitcoin / Press / [2018-11-20] Another $25 Billion Wiped Out: Crypto Market Suffers From Large Sel

|

on: November 20, 2018, 03:23:39 PM

|

Another $25 Billion Wiped Out: Crypto Market Suffers From Large Sell-Off Over the past 24 hours, another $25 billion has been wiped out of the crypto market as major digital assets fell sharply in value. Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and Stellar (XLM) recorded a loss of 14 percent, 14.5 percent, 45 percent, and 10 percent respectively, demonstrating a large decline in both volume and momentum. Bitcoin Cash Dropping More Than Any AssetAs expected, Bitcoin Cash SV, a hard forked cryptocurrency created by the Craig Wright, Coingeek, and Calvin Ayre camp, fell from $170 to $60 within a three-day span. As SV fell, the combined value of SV and Bitcoin Cash (ABC) fell from around $450 to $270, by nearly half. Due to the contentious hard fork and the hash power battle between SV and BCH on November 15, the price of BCH dropped from $450 to $270, with BCHABC suffering significantly from the conflict. As Roger Ver, a renowned cryptocurrency investor and Bitcoin.com CEO said, “no one wins a war. Some just lose less than others.” Based on current market conditions and the intensity of the drop over the last 24 to 48 hours, Bitcoin Cash and other major cryptocurrencies are expected to drop further in price, with BCHABC eyeing a test of $180 for the first time in its 15-month history. Other large market cap digital assets like Monero (XMR), Tron (TRX), Dash (DASH), IOTA (IOTA), and Binance Coin (BNB) have recorded an average daily drop of around 16 percent. The steep decline in the price of BNB is especially surprising in consideration of the fact that BNB remains the best performing cryptocurrency in all of 2018 ahead of Bitcoin. From its all-time high, Binance Coin is down about 74 percent. In contrast, Bitcoin is down 76.5 percent and Ethereum is down 87 percent. Reference: https://www.ccn.com/another-25-billion-wiped-out-crypto-market-suffers-from-large-sell-off/amp/

|

|

|

|

|

269

|

Bitcoin / Press / [2018-11-20] Bitcoin Bloodbath Continues: Price Hits $5000, Market Loses $45 Bil

|

on: November 20, 2018, 03:15:23 PM

|

Bitcoin Bloodbath Continues: Price Hits $5000, Market Loses $45 BillionThe market continues on a downward spiral; $45 billion evaporates from aggregate cryptocurrency market capitalization. Bitcoin hits a year-long all-time low of $5000. All cryptocurrencies deep in the red, with XRP as an outlier. Over the last two months, the market has been relatively peaceful, with primarily sideways movement with Bitcoin hovering at $6300-$6600. This week, there have been two major cliffs. One on Nov. 14 and another on Nov. 18, bringing the price down from $6300 to a year all-time-low of $5000. There have been rumors on Reddit and Twitter that these sudden drops could be indicative of a whale or other large token holder participating in price manipulation. It has been mentioned that this may be done with the intention to later “scoop up cheap Bitcoin.” Over the last seven days, Bitcoin has dropped from $6400 to $5000, a decrease of 22 percent. Overall, the market has fallen from an aggregate market capitalization of $213 billion to $167 billion. Following the downward trend of BTC, most major cryptos including Ethereum (ETH), Bitcoin Cash (BCH), Stellar (XLM), EOS (EOS), and Litecoin (LTC) have experienced losses between 15-35 percent. Reference: https://cryptoslate.com/bitcoin-bloodbath-continues-price-hits-5000-market-loses-45-billion/

|

|

|

|

|

271

|

Economy / Speculation / Market Crash 2018: It's History Baby!

|

on: November 20, 2018, 10:28:47 AM

|

The year 2018 is going to be recorded as one of the years with the worst cryptocurrency market crash ever. But hey, this is not the first time for the market crash (remember 2013) and it is not the end of a line for the cryptocurrency. For me, all I see is another big opportunity to buy more bitcoins. Heck, the bitcoin cash looks awesome too  plus some good looking altcoins.  |

|

|

|

|

272

|

Alternate cryptocurrencies / Altcoin Discussion / When is RavenCoin coming to hardware wallets?

|

on: November 18, 2018, 07:59:08 AM

|

|

I don't feel safe or secure HODLing my coins on the cryptocurrency exchanges as they get hacked everyday or HODLing on my laptop because I crashed it over 10 times, and sometimes malwares, keyloggers and so on. In fact, anything can happen that is why I don't trust both.

The cryptocurrency is still in the infancy stage with lots of new coins with huge potentials that are worth holding for like the next 10 years and I think the RVC is one of those.

But the problem is you can't store RVC on a Hardware wallet e.g. Ledger nano, or Trezor. only on your PC or crypto exchange such as Binance, which none of them is safe. What are you suggesting then?

|

|

|

|

|

273

|

Bitcoin / Press / [2018-11-15] Bitcoin’s Breakdown Will Take ‘Weeks, If Not Months’ to Rebound

|

on: November 15, 2018, 10:38:34 PM

|

Bitcoin’s Breakdown Will Take ‘Weeks, If Not Months’ to Rebound, Says Fundstrat Analyst  lt will take “weeks, if not months” to repair the “technical damage” caused by the recent collapse of Bitcoin (BTC), according to a Fundstrat Global Advisors analyst, Bloomberg reports today, Nov. 15. In a note to clients yesterday, cited by Bloomberg, Fundstrat’s Rob Sluymer predicted that Bitcoin’s collapse yesterday has pushed crypto markets into a “deeply oversold” area, while “longer-term technical indicators aren’t so favorable.” Sluymer concluded that Bitcoin will be able to support a “multi-month rally,” but only after the “significant” damage done this week has been overcome: “This week’s breakdown produced significant technical damage that will likely take weeks, if not months, to repair to create a durable enough price ‘structure’ to support a multi-month rally.” Yesterday, the largest cryptocurrency Bitcoin dipped below the $5,600 price point for the first time since October 2017, breaking longstanding recent support around $6,000 and hitting multi-month records of volatility. A trader at eWarrant Japan Securities K.K. in Tokyo, Soichiro Tsutsumi, told Bloomberg today that the loss of $6,000 support looks like a “dangerous sign” for industry players, especially the ones with “business models reliant on a client pool.” The recent crypto market slump has also reportedly caused a decline in the shares of crypto-connected companies, including Japanese SBI Holdings and Monex Group. Both Monex Group, owner of crypto exchange Coincheck, and SBI Holdings suffered a slump of more than 2 percent to close at two-week lows in Tokyo, Bloomberg reported.  Impact of Bitcoin’s slump on Asia Crypto Stocks. Source: Bloomberg Fundstrat’s analysts has subsequently commented that the year-end market trend is “stressed, but not broken,” according to a tweet of CNBC journalist Carl Quintanilla. According to Quintanilla, Fundstrat claimed that they expect the “sectors hit the hardest to lead into YE,” which will lead to growth of stocks. Earlier in summer, Fundstrat’s head of research Tom Lee reiterated his prediction that Bitcoin will trade between $22,000 to $25,000 by the year’s end. Most recently, Lee expressed content with the recent stability of Bitcoin, claiming that he expected its volatility to be much higher. In early November, Galaxy Digital CEO Michael Novogratz claimed that Bitcoin has to “take out $6,800” in order to hit $8,800-9,000 by the end of the year. He also predicted that the biggest coin could hit “$20,000 or more” in 2019. Ref: https://cointelegraph.com/news/bitcoins-breakdown-will-take-weeks-if-not-months-to-rebound-says-fundstrat-analyst

|

|

|

|

|

274

|

Bitcoin / Press / [2018-11-15] Bitcoin Lightning Network Reaches All-Time High Capacity

|

on: November 15, 2018, 10:34:30 PM

|

Efforts to improve the scalability of Bitcoin appear to be bearing fruit as the Lightning Network, a second layer off-chain scalability solution on the network designed to handle vast transaction throughputs without resulting in high prices has recorded an important milestone. According to data from 1ML, the Lightning Network now has a total of 4,039 nodes at press time, of which a total of 2,914 have public IP addresses.

Boom Time for Lightning NetworkThis marks the first time that the Lightning Network has exceeded 4,000 nodes, at a time when its total network capacity now stands at an all-time high of 134.42 BTC (about $760,454), barely two months after the network capacity figure crossed 100 BTC for the first time ever. Following a September summit held in Melbourne, Australia, Lightning Labs developer Alex Bosworth revealed on Nov. 12, 2018, that a total of thirty changes would be implemented in the next version of the Lightning Network including multi-path payments, dual-funded channels, and hidden destinations, among other features. It will be recalled that earlier this week, Lightning Labs co-founder Olaoluwa Osuntokun was featured on the latest Forbes 30-Under-30 list after the startup successfully raised more than $2.5 million for its commercial implementation of the Lightning Network to make bitcoin a more viable means of carrying out microtransactions in the manner of Venmo or Cash App. Ref: https://cryptoslate.com/bitcoin-lightning-network-reaches-all-time-high-capacity/ |

|

|

|

|

275

|

Bitcoin / Press / [2018-11-15] Bitcoin Plunges to $5400: 12 Month Low, Market Sheds $25 Billion

|

on: November 15, 2018, 09:21:21 AM

|

Bitcoin Bitcoin hits a historic 12 month low of $5400; The pre-eminent cryptocurrency has cratered 11 percent just within the last four hours. The enormous drop in price appears to be driven by major Bitcoin and derivatives exchange BitMEX, representing 34 percent of 24-hour market volume. The bear market continues. Following the hysteria experienced during the peak of trading in prices in January, Bitcoin, Ethereum, and many other major coins are quickly shedding market capitalization. The across the board price drops are following the plunge in Bitcoin’s price. The duration of the current bear market is unprecedented for 2015-2018, spanning five continuous months since the rebound in May. That said, the market has made some major recoveries during this year. In February and May, the market rebounded to a total market capitalization of $500 billion and $450 billion and then experienced a minor rebound in late July at $300 billion. However, None of these rebounds are even close to the market’s all-time high of $850 billion. Bubble or Temporary Dip?Is this year-long decline in the market temporary, or a lasting correction? The Bitcoin hysteria experienced 2017 through early 2018 could be coming to an end. One source revealed that majority of ICOs and projects are scams or simply unable to live up to what they claim. Perhaps the market is learning that the next project to “revolutionize” or “up-end” existing services is likely to fall flat, so this correction could be a better indicator of the value of the underlying technology.  Year-Long Downtrend Punishes HODLers To put things in perspective, this isn’t the first nor the worst bear market in Bitcoin’s history. In December of 2013, the market reached an all-time high of $13 billion, growing 8x (from $1.7 billion) in the span of two months. The market was then devastated over the next 10 months, shrinking below $3 billion and losing 77 percent percent of its value from all-time highs. For those looking hedge against the volatility of the market, exchanging crypto for a stable coin such as TrueUSD, USD Coin, or Tether can mitigate further losses. Once the market stabilizes it is then possible to repurchase crypto holdings.

Risk RewardMany crypto die-hards appear unphased by the drop in prices. For many, this is just another lull in the grand scheme of things. Many on Reddit and Twitter are doubling down on HODL, quoting that to “experience the highs of crypto it is necessary to endure the lows.” Meanwhile, there are those in the broader community have been skeptical of Bitcoin’s adoption, with some claiming that the phenomenon is a bubble. The continuous price drops may be indicative of such claims. Whatever happens, the market shall decide who’s right. Ref: https://cryptoslate.com/bitcoin-plunges-to-5400-12-month-low-market-sheds-25-billion/ |

|

|

|

|

276

|

Bitcoin / Press / [2018-11-15]Top Crypto Exchange Binance Adds Circle’s USD Coin in Latest Stable

|

on: November 15, 2018, 09:14:35 AM

|

Top Crypto Exchange Binance Adds Circle’s USD Coin in Latest Stablecoin Support Move Major cryptocurrency exchange Binance announced it would list Circle’s USD-pegged stablecoin USD Coin (USDC) in a blog post Nov. 15, with deposits opening immediately. USDC, which the financial services company announced in May this year and released in September, is one of an increasing number of cryptocurrencies notionally tied 1:1 with a major fiat currency. Binance is not the first major platform to list USDC, U.S. exchange Coinbase supporting the asset since the end of last month. “For increased transparency, USDC has engaged a top-ranking auditing firm to release monthly balance attestations of the corresponding USDC and USD balances held/issued,” Binance adds in its statement today. The exchange also noted that trading for USDC/BNB and USDC/BTC trading pairs will begin Nov. 17. Exchanges across the world have stepped up efforts to support fiat-backed stablecoins as more and more are issued, Cointelegraph reporting on how the currently world’s largest crypto exchange OKEx as well as major competitor Huobi recently opted to list four USD stablecoins at once. Binance has not been shy about its enthusiasm for stablecoins, CEO Changpeng Zhao saying he “hoped more” would surface when the exchange added Paxos’ USD-pegged asset in September. “Regulated stable coins [sic] serve as a middle ground where regulators maintain control, but the token also offers far more freedom than traditional fiat for users,” he wrote on Twitter at the time, adding: “Hope more will copy/follow/improve, and for other fiat currencies too.” Binance is currently the world’s second largest cryptocurrency exchange by 24-hour trade volumes, seeing over $1.5 billion in trades on the day to press time. Ref: https://cointelegraph.com/news/coinshares-cso-demirors-urges-calm-among-bitcoin-investors-as-prices-slide-12-percent

|

|

|

|

|

277

|

Economy / Economics / Markets See Massive Sell-Off, Bitcoin Dips Below $5,600 for the First Time 2018

|

on: November 14, 2018, 09:17:21 PM

|

Nov. 14: Crypto markets have suffered sharp losses over the past several hours. The major market drop off took place between 10:30 a.m. (UTC -5) and 12:00 p.m., with some of the top 20 cryptocurrencies dropping by as much as 18 percent at press time, according to data from CoinMarketCap. According to data from Bitcointicker, after 11:00 a.m. (UTC -5) Bitcoin dropped below the $5,600 price point for the first time in 2018, sinking further to as low as $5,506 at around 2:00PM. Bitcoin is now down around 11 percent on the day, trading at $5,612 at press time. The recent movement of the market was predicted by a number of industry experts, who also suggest that the bear market would last beyond this year. Technical expert Willy Woo, founder of data webstie Woobull, has recently predicted that the bear market end may end “around Q2 2019,” based on “putting together the blockchain view:” “After that we start the true accumulation band, only after that, do we start a long grind upwards.” Earlier this year, crypto investor and founder of Galaxy Investment Partners Mike Novogratz predicted that Bitcoin will not manage to break $10,000 by the end of 2018, claiming that reverse of the trend will take place by Q2 in 2019, when the industry will get more institutional involvement. Reference: https://cointelegraph.com/news/markets-see-massive-selloff-bitcoin-dips-below-5-600-for-the-first-time-in-2018 |

|

|

|

|

278

|

Bitcoin / Press / [2018-11-14] IMF Chief Lagarde: Central Banks Should ‘Consider’ Issuing crypto

|

on: November 14, 2018, 08:51:09 PM

|

IMF Chief Lagarde: Central Banks Should ‘Consider’ Issuing Digital Currency The Managing Director and Chairperson of the International Monetary Fund (IMF), Christine Lagarde, has called on central banks around the world to consider issuing digital currencies. According to Lagarde, the state has a role to play in injecting money to the digital economy and it was, therefore, necessary to ‘consider the possibility to issue digital currency’. Initially reported by the BBC, the IMF head outlined the various benefits that would emerge from such a move in a speech delivered in Singapore. “The advantage is clear. Your payment would be immediate, safe, cheap and potentially semi-anonymous… And central banks would retain a sure footing in payments,” said Lagarde. Citing the example of reserve banks in countries such as Sweden and Canada where central bank digital currencies (CBDCs) were under serious consideration, Lagarde added that such a move would not only make transactions safer but also more common and consequently cheaper. Enhanced SecurityPer Lagarde, the fact that CBDCs would be the state’s liability as opposed to the existing cryptocurrencies would make such digital currencies more secure. This is because governments will have no choice but to go to the fullest extent possible to ensure their security. “Private firms may under-invest in security to the extent they do not measure the full cost to society of a payment failure,” Lagarde warned in reference to the existing cryptocurrencies. Lagarde’s call is interesting given that the financial institution she heads recently expressed misgivings over a plan by the Marshall Islands to issue a national cryptocurrency. As reported by CCN, the IMF argued that the planned state-backed cryptocurrency to be known simply as the Sovereign (SOV) would raise the financial integrity and macroeconomic risks of the Pacific island.

Change of HeartWhile she was initially skeptical of cryptocurrencies, Lagarde has since warmed up to the nascent technology. Earlier this year as CCN reported, the IMF head noted that cryptocurrencies were reducing the cost of making financial transactions and thus posed a threat to the traditional financial system. “The ways in which new technologies are lowering the cost to make financial transactions more accessible, even in very small numbers…I think it’s already massively disruptive,” Lagarde said at the time. With regards to the negative perception that cryptocurrencies have earned in some quarters due to their anonymous nature, Lagarde has also proved to be level-headed. While acknowledging that there was a need for a degree of regulation in the sector, the IMF head has been careful to warn that this need not go overboard. In a blog post about seven months ago, Lagarde called for cryptocurrency regulations that would minimize risk while encouraging innovation. Source: https://www.ccn.com/imf-chief-lagarde-central-banks-should-consider-issuing-digital-currency/

|

|

|

|

|

280

|

Bitcoin / Press / [2018-11-14] BitMEX CEO Denies Allegations of Trading Against Customers

|

on: November 14, 2018, 07:56:05 PM

|

Last month an independent crypto researcher who goes by the name, Hasu, posted an article exploring some of the most prevalent concerns users have with crypto exchange behemoth BitMEX, one of which is that the exchange trades against its customers to make a profit. BitMEX CEO Arthur Hayes publicly came out against the allegations on Monday in an interview with Yahoo Finance. Foul play at BitMEX? Exploring the biggest concerns https://t.co/yG6sspN1Vg — Hasu (@hasufl) October 22, 2018 Hasu brought up three shady practices in his article that he claims the people he spoke with – on condition of anonymity, had concerns about. While there is no hard evidence to support them, he still views them as valid in consideration of the incentive BitMEX has through them to make money. 1. BitMEX trades against its customers. 2. The exchange “weaponizes” server problems. 3. BitMEX monetizes customer liquidations via its insurance fund. The DeskBitMEX has its own trading desk that acts, according to BitMEX’s website, as a market-maker posting bid and sell orders to bring liquidity to the market. They fill an exchange order book, and others match those orders. Any money made by a market-maker is gained through the spread of pricing, not through trades. This is exactly what Hayes claims BitMEX’s trading desk does, stating in the interview with Yahoo that no one is granted exclusive or special access to the desk’s information: “They have the same trading rights as any other regular trader, they can’t see the liquidation prices of any of our customers. We don’t trade against our customers. It’s actually pretty bad business model and introduces a lot of risk into what is right now a riskless business model, BitMEX. We match trades, that’s it, we have no risk. Trading against our clients is nonsensical.” Hayes also states on BitMEX’s official blog that “no front office personnel are shared between the trading business and [BitMEX],” and “that the trading business operates from a separate physical location, and…does not have access to any platform order flow, execution, customer or other information on terms that are not otherwise available to any other platform user.” In his post, Hasu alleges that the exchange kept its trading desk a secret, and even insinuates that that may have lost their legal counsel after making it known to the public. He asserts most of BitMEX’s customers “don’t believe” that their trading desk breaks even, and cites a lack of an external audit of their business practices as the source of customer concern. Continue: https://cryptoslate.com/bitmex-ceo-denies-allegations-of-trading-against-customers/ |

|

|

|

|

plus some good looking altcoins.

plus some good looking altcoins.