Regarding two things listed in the above posts:

...

PPS mining pools

WARNING

Be careful of low fee PPS-only pools that do not explain how they will afford to pay miners when the pool has a downturn in luck.

...

and

I'd like to quote some of Meni's statistical analysis and update with current Bitcoin information regarding PPS pools.

There are common misunderstandings regarding PPS pools and rewards.

This example below will help all those mathematically challenged PPS pool operators to use the information provided by Meni to attempt to work out if they can afford to run a PPS pool

Firstly, a 100% reward PPS pool means that the pool is keeping transaction fees.

Transactions fees vary quite a lot over time, for example they are currently a little below 2% but at the beginning of 2018 were around 30%

The PPS pools don't state their fees in terms of what they actually earn, they usually state it related to 100% PPS.

But secondly, of most importance, is that a PPS pool is required to charge quite high fees in order to not go broke, and also hold a large sum of BTC in the pool's wallet to ensure they don't go broke.

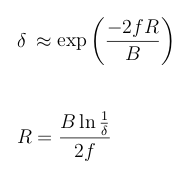

Meni's report points out two equations related to this on page 38:

where

δ = the chance of going bankrupt

R = the amount of BTC a PPS pool must keep in reserve in it's pool wallet

B = the block BTC reward (currently 12.5 BTC)

f = the pool fee

So for a current bitcoin PPS pool with a (high) 5% fee, the amount R they must keep in the pool wallet (with a 0.1% chance of going bankrupt)

R = B x (ln (1/δ)) / (2 x f) = 12.5 x 6.9078 / (2 x 0.05) =

863.5 BTCand using a US$ conversion rate (today) of 1BTC = $4,000 that's about $3.5 million

If instead they say charge a 2% fee, then this becomes:

12.5 x 6.9078 / (2 x 0.02) =

2158.7 BTCand using a US$ conversion rate (today) of 1BTC = $4,000 that's about $8.6 million

If they reduce the fee or the R amount they must keep in the wallet then the chance of going bankrupt increases.

So e.g. a 2% PPS fee pool with only 250 BTC (about $1 million)

has a exp((-2 x f x R) / B) = exp(-2 x 0.02 x 250 / 12.5) = 0.449 i.e. about

45% chance of going broke

Edit: and phil, please go argue this with Meni, since it is your claim Meni is wrong