CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 21, 2012, 06:47:08 PM

Last edit: November 21, 2012, 07:12:01 PM by CoinHoarder |

|

Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do). Therefore people say they will be profitable for longer, which is true.

However, I'm not sure that this is as big a deal as people claim. I don't think that most people are taking into account 2nd generation ASICs.

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs.

If BFL puts a cutoff date on trade ins for 2nd generation ASICs (lets be honest, what company would not put a cut off date on such a thing?), like they have on the 1st generation, then all BFL customers will need to pay more capital to trade in their ASICs for the 2nd generation unless they want to quit mining, or be stuck with a previous generation ASIC.

The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade.

I'm just thinking aloud here... whats your opinion?

|

|

|

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

bitcoindaddy

|

|

November 21, 2012, 06:52:17 PM |

|

Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do). Therefore people say they will be profitable for longer, which is true.

However, I'm not sure that this is as big a deal as people claim. I'm not sure that most people are taking into account 2nd generation ASICs.

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs.

If BFL puts a cutoff date on trade ins for 2nd generation ASICs (lets be honest, what company would not put a cut off date on such a thing?), like they have on the 1st generation, then all BFL customers will need to pay more capital to trade in their ASICs for the 2nd generation unless they want to quit mining, or be stuck with a previous generation ASIC.

The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption.

I'm just thinking aloud here... whats your opinion?

I don't think the power improvements of later generations of ASIC kit will be as dramatic as the shift from GPU to ASIC. Probably on the order of 10-15 percent? In fact, I would be surprised if there was a second generation at all. |

|

|

|

|

|

firefop

|

|

November 21, 2012, 07:02:28 PM |

|

Really the only thing they'll be able to do second gen (or third gen) is use smaller gap silicon - which allows for a speed increase in the same heat/watt space. As such, I wouldn't expect many people to upgrade in general.

Now a smarter second gen product would be a same hash power, lesser power consumption unit (in a smaller more modular enclosure)... for a very minor price increase. say 5%. That might actually get people to buy them instead of first gen... but the company could continue to sell both. So then you've got the "refurbished generation 1s" going for 5% or 10% less than a new gen1, and a gen2 device going for 5% or 10% more.

I'd want to see upgrades in the form of better board design or innovative cooling instead of following the gpu model and going "faster, hotter, more power needed, in the same space". Space shouldn't really be a concern imo.

Now give me a rolling racked enclosure with slots for the gen2 singles where the enclosure uses a direct contact copper heatsink and I just plug it into a slot... some management metrics displayed on the outside of it... and I'd be all about upgrading to that.

|

|

|

|

CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 21, 2012, 07:38:31 PM |

|

Now give me a rolling racked enclosure with slots for the gen2 singles where the enclosure uses a direct contact copper heatsink and I just plug it into a slot... some management metrics displayed on the outside of it... and I'd be all about upgrading to that.

They are not stupid, they will release a product worth upgrading for IMO. That's what smart businesses do, they adapt, change, and upgrade their original big money making ventures to make more money. They will listen to customer complaints and wishes, and then develop a product that meets them to sell more units. (Example: Every product Apple sells... Ipod, Ipad, etc... What version Ipod are they on now?) |

|

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

November 21, 2012, 07:46:39 PM |

|

Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do). Therefore people say they will be profitable for longer, which is true.

However, I'm not sure that this is as big a deal as people claim. I don't think that most people are taking into account 2nd generation ASICs.

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs.

If BFL puts a cutoff date on trade ins for 2nd generation ASICs (lets be honest, what company would not put a cut off date on such a thing?), like they have on the 1st generation, then all BFL customers will need to pay more capital to trade in their ASICs for the 2nd generation unless they want to quit mining, or be stuck with a previous generation ASIC.

The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade.

I'm just thinking aloud here... whats your opinion?

My opinion is that electric usage under 100w is largely a moot point anyway. Even at $0.25/kwh, 100w would only cost $18/month to run. And if ASICs are only marginally profitable due to electric costs (i.e., it is profitable to operate a BFL @ $0.10/kwh but not at $0.20/kwh), then I don't think many people are going to be interested in running them anyway. If it is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit a 100w device could possibly be making is $7.20/month. Who wants to bother with maintaining a device to only make $7.20/month? Likewise, if a 400w device is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit it could be making is only $28.80/month. Again, hardly worth even maintaining the operation of it. So, in my opinion, electric costs aren't going to matter until ASICs drop steeply in price, to the point where someone could buy dozens of units for the same price as buying one of them today. When they have dozens of units consuming many kw, electricity costs will certainly make a much larger difference in profitability. |

|

|

|

|

|

firefop

|

|

November 21, 2012, 08:07:36 PM |

|

I also think then next step is alternate use for asics as a heating element.

Lets build a rig that vents its heat to dry clothes.

"Honey, I need you to do more laundry, we need that dryer be mining for us"

|

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

November 21, 2012, 08:10:26 PM |

|

I also think then next step is alternate use for asics as a heating element.

Lets build a rig that vents its heat to dry clothes.

"Honey, I need you to do more laundry, we need that dryer be mining for us"

I don't. ASICs are expensive and fragile. Heating elements are pennies and durable. Different items for different purposes. For warming a room, perhaps, if they get really cheap or for people who already own them. Not for drying clothes though! |

|

|

|

|

|

firefop

|

|

November 21, 2012, 08:22:05 PM |

|

I don't.

ASICs are expensive and fragile. Heating elements are pennies and durable. Different items for different purposes.

For warming a room, perhaps, if they get really cheap or for people who already own them. Not for drying clothes though!

Yes I can see your point. But that's where I see this going if bitcoin does become the giant I think it will. Why not integrate it into standard every-day application? Sure there are potential problelms, but why hardware has generations, to build more sensible and robust solutions. Anyone in a very cold winter region could for example, use a mining rig to heat a garage instead of paying thousands of dollars an embedded heater. While at the same time making back some of the operating costs of that unit. What about floorboard heating that uses asics to make the heat... basic electric baseboard heating, that's very cheap to run. |

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

November 21, 2012, 08:33:10 PM |

|

I don't.

ASICs are expensive and fragile. Heating elements are pennies and durable. Different items for different purposes.

For warming a room, perhaps, if they get really cheap or for people who already own them. Not for drying clothes though!

Yes I can see your point. But that's where I see this going if bitcoin does become the giant I think it will. Why not integrate it into standard every-day application? Sure there are potential problelms, but why hardware has generations, to build more sensible and robust solutions. Anyone in a very cold winter region could for example, use a mining rig to heat a garage instead of paying thousands of dollars an embedded heater. While at the same time making back some of the operating costs of that unit. What about floorboard heating that uses asics to make the heat... basic electric baseboard heating, that's very cheap to run. Time will tell, I guess. It is just much less complicated and less expensive to generate heat from simple $0.50 coils of metal than from an ASIC that requires an internet connection, setup, and maintenance (blowing out dust, etc). I don't see it ever being practical or desired by the "average joe". Embedded heaters are cheap. I could stick a 2000w in-wall heater in my garage for $60 if I wanted - a far cry from thousands of dollars. Not to mention that anyone concerned with saving money or energy efficiency would be looking at a heatpump, or perhaps natural gas, as a way to do it instead. |

|

|

|

|

dserrano5

Legendary

Offline Offline

Activity: 1974

Merit: 1029

|

|

November 21, 2012, 09:13:11 PM |

|

So, in my opinion, electric costs aren't going to matter until ASICs drop steeply in price

Or bitcoin value plummets to $1, which is not impossible. |

|

|

|

|

SolarSilver

Legendary

Offline Offline

Activity: 1112

Merit: 1000

|

|

November 21, 2012, 10:50:39 PM |

|

I'm just thinking aloud here... whats your opinion?

if the hardware is written off after 2 years (where it will eventually start to fail due to overheating issues), then the hardware cost per day is about $US 1.8. Energy if you have to pay for it in Europe is about EUR 0.7 / day at 100 Watts. If the power consumption halves in the next generation, the proportion of the hardware cost is still too significant to have much inpact on my total profitability. Unless the next generation drops half in price or better, which is a realistic scenario, due to competition (margins are huge, remember the performance jump from 30 to 60 GH/s?) We'll end up with the same power consumption per unit, but much higher performance probably. Power consumption is for most of us not much of an issue, as we already live with power hungry GPU setups. It will be an issue if you want to jam many machines into a small space, but if profit arguments means more old gen machines in a bigger room, I'll settle for that |

|

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 21, 2012, 11:11:34 PM |

|

Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do). Therefore people say they will be profitable for longer, which is true.

However, I'm not sure that this is as big a deal as people claim. I don't think that most people are taking into account 2nd generation ASICs.

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs.

If BFL puts a cutoff date on trade ins for 2nd generation ASICs (lets be honest, what company would not put a cut off date on such a thing?), like they have on the 1st generation, then all BFL customers will need to pay more capital to trade in their ASICs for the 2nd generation unless they want to quit mining, or be stuck with a previous generation ASIC.

The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade.

I'm just thinking aloud here... whats your opinion?

That you are spot on. What you just described is basically a money pit. All the money goes out of your pocket and into the ground (the money pit). In order to recoup your loss you'd have to figure out a way to pass the loss on to someone else who is hopeful and naive. If you don't, then the only one making all the money in this is the vendor. The only way out of this is by the vendor selling second gen hardware that is several times more efficient than the first gen. At which point you can recoup the money. ----------------------- But... Then it becomes a Chicken and the Egg situation. Everytime they sell better hardware, they make the difficulty increase at a faster rate. So you will probably never beat this game. Only if there is exclusivity do you make back your money quickly and then profit. Exclusivity therefore is the major problem.... Difficulty is just a secondary problem. --------------------------------- Best you can hope for is that a vendor implodes and takes out a big chunk of the competition with it. Thereby increasing the exclusivity and lowering the difficulty. A manufacturing defect is good enough. Or bad vendor policy. Whichever comes first. |

|

|

|

|

|

makomk

|

|

November 21, 2012, 11:13:00 PM |

|

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs. Of course, another way - depending on what their margins are on ASICs - would be to drop the price. Remember that a huge proportion of the cost of ASICs is up-front NRE costs to design the things and get masks made; once they've paid off those costs they can probably reduce prices a fair amount and still make money. Then: So, in my opinion, electric costs aren't going to matter until ASICs drop steeply in price, to the point where someone could buy dozens of units for the same price as buying one of them today. When they have dozens of units consuming many kw, electricity costs will certainly make a much larger difference in profitability.

|

Quad XC6SLX150 Board: 860 MHash/s or so. SIGS ABOUT BUTTERFLY LABS ARE PAID ADS |

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 21, 2012, 11:18:12 PM |

|

My opinion is that electric usage under 100w is largely a moot point anyway. Even at $0.25/kwh, 100w would only cost $18/month to run. And if ASICs are only marginally profitable due to electric costs (i.e., it is profitable to operate a BFL @ $0.10/kwh but not at $0.20/kwh), then I don't think many people are going to be interested in running them anyway. If it is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit a 100w device could possibly be making is $7.20/month. Who wants to bother with maintaining a device to only make $7.20/month?

Finally! Someone who gets it....! Likewise, if a 400w device is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit it could be making is only $28.80/month. Again, hardly worth even maintaining the operation of it. Exactly. So, in my opinion, electric costs aren't going to matter until ASICs drop steeply in price, to the point where someone could buy dozens of units for the same price as buying one of them today. When they have dozens of units consuming many kw, electricity costs will certainly make a much larger difference in profitability.

The vendor who figures out a way to modularize their components and add (cheap) upgrade-ability will be the one to succeed. The upgrade path will have to exceed firmware and simple overlcocking changes. They should also diversify the support for various cyrptocurrencies. So you don't have all your eggs in one basket. |

|

|

|

|

|

bcpokey

|

|

November 22, 2012, 12:58:05 AM |

|

My opinion is that electric usage under 100w is largely a moot point anyway. Even at $0.25/kwh, 100w would only cost $18/month to run. And if ASICs are only marginally profitable due to electric costs (i.e., it is profitable to operate a BFL @ $0.10/kwh but not at $0.20/kwh), then I don't think many people are going to be interested in running them anyway. If it is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit a 100w device could possibly be making is $7.20/month. Who wants to bother with maintaining a device to only make $7.20/month?

Finally! Someone who gets it....! Even if his numbers are wrong, he does get the general idea, which is good.

Likewise, if a 400w device is profitable to operate at $0.10/kwh, but not at $0.20/kwh, then the maximum profit it could be making is only $28.80/month. Again, hardly worth even maintaining the operation of it.

Exactly. Again don't mean to be nitpicker, but it can't be "exactly" if the numbers are wrong, even if the idea is right. The vendor who figures out a way to modularize their components and add (cheap) upgrade-ability will be the one to succeed. The upgrade path will have to exceed firmware and simple overlcocking changes.

They should also diversify the support for various cyrptocurrencies. So you don't have all your eggs in one basket.

Here's where I begin to question. Modularizability sounds great and all, but it's not really the "game-changer" that you make it out to be. As far as I can tell, the BFL singles (only picture of an ASIC device we have currently) is essentially a box around a heatsink and a PCB+chips. In essence, it is almost as bare minimum as you can get. Aside from being able to buy some sort of massive copper-block with slots to insert boards into, you're not really going to get much more efficiency from some sort of modular design (and that's not very efficient really). As to the cryptocurrencies, there are already merged mining pools, so all the bitcoin forks do not need to covered by vendors, and the non doubleSHA256s can't work alongside bitcoin for ASICs as needs no explanation. |

|

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

November 22, 2012, 02:04:02 AM |

|

My numbers are correct bcpokey. If you believe them to be wrong, then please show the math.

|

|

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 22, 2012, 02:38:33 AM

Last edit: November 22, 2012, 02:53:54 AM by PuertoLibre |

|

Here's where I begin to question. Modularizability sounds great and all, but it's not really the "game-changer" that you make it out to be. As far as I can tell, the BFL singles (only picture of an ASIC device we have currently) is essentially a box around a heatsink and a PCB+chips. In essence, it is almost as bare minimum as you can get. Aside from being able to buy some sort of massive copper-block with slots to insert boards into, you're not really going to get much more efficiency from some sort of modular design (and that's not very efficient really).

If the ASIC vendors can make smaller daughterboards that are alike and can be hosted on an internal bus or something like a mini-PCIe board, then that would cut costs in manufacturing the device. http://en.wikipedia.org/wiki/PCI_Express#PCI_Express_Mini_CardConsider for example the BFL Single. Like you said, it is a square box with a PCB board with a heatsink. Imagine if you only had to produce 1 motherboard and had vertical mounts (like the old BTCFPGA design). This would make it a bit cheaper to produce quantities of add-on boards. With fabs, with quantity there are discounts. There are also less processes to go through to put one together than say a BFL single which should have a higher overhead because it brings lots of components like the case and power supply.. The metal box is one piece and it has to be created n number of times how many boxes you want. With add-on daughter card(s) it should be simpler, cheaper and easier to populate a rig with identical daughter cards (as needed). If I am not mistaken, the BFL mini-rigs are modules but they are separate by connective cabling. They have to be professionally assembled as opposed to an end-user just popping the case open and adding more processing power into one of many east to install slots. As to the cryptocurrencies, there are already merged mining pools, so all the bitcoin forks do not need to covered by vendors, and the non doubleSHA256s can't work alongside bitcoin for ASICs as needs no explanation. [/quote] |

|

|

|

|

|

bitcoindaddy

|

|

November 22, 2012, 12:46:15 PM |

|

Here's where I begin to question. Modularizability sounds great and all, but it's not really the "game-changer" that you make it out to be. As far as I can tell, the BFL singles (only picture of an ASIC device we have currently) is essentially a box around a heatsink and a PCB+chips. In essence, it is almost as bare minimum as you can get. Aside from being able to buy some sort of massive copper-block with slots to insert boards into, you're not really going to get much more efficiency from some sort of modular design (and that's not very efficient really).

If the ASIC vendors can make smaller daughterboards that are alike and can be hosted on an internal bus or something like a mini-PCIe board, then that would cut costs in manufacturing the device. http://en.wikipedia.org/wiki/PCI_Express#PCI_Express_Mini_CardConsider for example the BFL Single. Like you said, it is a square box with a PCB board with a heatsink. Imagine if you only had to produce 1 motherboard and had vertical mounts (like the old BTCFPGA design). This would make it a bit cheaper to produce quantities of add-on boards. With fabs, with quantity there are discounts. There are also less processes to go through to put one together than say a BFL single which should have a higher overhead because it brings lots of components like the case and power supply.. The metal box is one piece and it has to be created n number of times how many boxes you want. With add-on daughter card(s) it should be simpler, cheaper and easier to populate a rig with identical daughter cards (as needed). If I am not mistaken, the BFL mini-rigs are modules but they are separate by connective cabling. They have to be professionally assembled as opposed to an end-user just popping the case open and adding more processing power into one of many east to install slots. As to the cryptocurrencies, there are already merged mining pools, so all the bitcoin forks do not need to covered by vendors, and the non doubleSHA256s can't work alongside bitcoin for ASICs as needs no explanation. [/quote] This has been discussed before. Using PCI instead of USB would make the boards more complicated and harder to design. |

|

|

|

|

|

bcpokey

|

|

November 22, 2012, 02:24:03 PM |

|

My numbers are correct bcpokey. If you believe them to be wrong, then please show the math.

Apologies, I was thinking along different lines, your numbers are indeed correct.

Here's where I begin to question. Modularizability sounds great and all, but it's not really the "game-changer" that you make it out to be. As far as I can tell, the BFL singles (only picture of an ASIC device we have currently) is essentially a box around a heatsink and a PCB+chips. In essence, it is almost as bare minimum as you can get. Aside from being able to buy some sort of massive copper-block with slots to insert boards into, you're not really going to get much more efficiency from some sort of modular design (and that's not very efficient really).

If the ASIC vendors can make smaller daughterboards that are alike and can be hosted on an internal bus or something like a mini-PCIe board, then that would cut costs in manufacturing the device. http://en.wikipedia.org/wiki/PCI_Express#PCI_Express_Mini_CardConsider for example the BFL Single. Like you said, it is a square box with a PCB board with a heatsink. Imagine if you only had to produce 1 motherboard and had vertical mounts (like the old BTCFPGA design). This would make it a bit cheaper to produce quantities of add-on boards. With fabs, with quantity there are discounts. There are also less processes to go through to put one together than say a BFL single which should have a higher overhead because it brings lots of components like the case and power supply.. The metal box is one piece and it has to be created n number of times how many boxes you want. With add-on daughter card(s) it should be simpler, cheaper and easier to populate a rig with identical daughter cards (as needed). If I am not mistaken, the BFL mini-rigs are modules but they are separate by connective cabling. They have to be professionally assembled as opposed to an end-user just popping the case open and adding more processing power into one of many east to install slots. As to the cryptocurrencies, there are already merged mining pools, so all the bitcoin forks do not need to covered by vendors, and the non doubleSHA256s can't work alongside bitcoin for ASICs as needs no explanation. [/quote] I see, you meant an entire revamp to the whole design, rather than a simple modification to the existing design. As to what the specifics would be PCI vs. USB vs. ?? I would not want to get into, but I still question the efficiency gained by this method. As I understand the mini-rigs are going to be something along the lines of the size of a large trash can? This obviously would be unattractive for the average consumer. A smaller design such as the FPGA would be more attractive, but lose some of the savings you imagine, by being larger/bulkier to ship, requiring extra superfluous parts (1 board with spaces for daughter boards, power connector slots, etc.), increased cooling solutions for the near-housing of units, and still needing to make a large number of housing units (say 5 daughter boards per housing?). I'm not saying there would be NO savings, but simply that I don't know that it would be game changing enough to make a company that went this direction the sole survivor in the competitive ASIC market. |

|

|

|

|

SolarSilver

Legendary

Offline Offline

Activity: 1112

Merit: 1000

|

|

November 22, 2012, 02:43:12 PM |

|

This has been discussed before. Using PCI instead of USB would make the boards more complicated and harder to design.

You could create a PCI express card that has a USB hub on it and link that direct to the USB port of the existing card design. The power for the card can be drawn from a 6 or 8 pin PCIe power cord. (this is the same principle to hide the complexity of ADSL firmwares in PCI ADSL cards where they show up as a simple realtek network device) A little bit more complicated then a stand alone USB card but not much. And much easier to 'house' into existing servers. The only problem is the form factor, the current card from bASIC for example is 4" x 9" (10 cm x 23 cm) and with the heatsink on the side, it's probably to bulky to fit into a PCI slot |

|

|

|

|

|

hardcore-fs

|

|

November 23, 2012, 04:29:49 AM |

|

Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do). Therefore people say they will be profitable for longer, which is true.

However, I'm not sure that this is as big a deal as people claim. I don't think that most people are taking into account 2nd generation ASICs.

BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013. They will be looking for a way to increase or maintain profit. One of the most obvious ways of doing this will be to release 2nd generation ASICs.

If BFL puts a cutoff date on trade ins for 2nd generation ASICs (lets be honest, what company would not put a cut off date on such a thing?), like they have on the 1st generation, then all BFL customers will need to pay more capital to trade in their ASICs for the 2nd generation unless they want to quit mining, or be stuck with a previous generation ASIC.

The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade.

I'm just thinking aloud here... whats your opinion?

1.Sorry who is this "everyone"....? I don't know such a thing , because I have not seen the spec, manufacturer OR internal design of their product. Please consider: "Many people know the hearsay that BFL has more power efficient ASICs than their competitors ". 2. An ASIC design is ONLY as good as its internal design, so you may well have the shit-hottest process in the WORLD!!! Consider that Xilinx FPGA's are manufactured on 22nm/32nm/45nm and yet we see in the case of the XUPV5 that it is only capable of about 120MH/s (ok I'm at 210MH/s but thats another story) This tells us that it is the ROUTING and resource allocation within the design that can have a FAR MORE CRITICAL impact that physical size of the die/process. 3. "BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013." Analysis, based on what, quote/site references? 4. "The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade." Sorry.... again there are some very creative ways to save power and get it for FREE LEGALLY, making such discussions moot. Instead of arguing "fallacies" with such weakly made points you could make perhaps better use of your time... |

BTC:1PCTzvkZUFuUF7DA6aMEVjBUUp35wN5JtF

|

|

|

CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 23, 2012, 05:38:18 AM

Last edit: November 23, 2012, 06:08:16 AM by CoinHoarder |

|

1.Sorry who is this "everyone"....?

I don't know such a thing , because I have not seen the spec, manufacturer OR internal design of their product.

Please consider:

"Many people know the hearsay that BFL has more power efficient ASICs than their competitors ".

Ok.. whatever... here you are nitpicking my wording trying to make a point. It's cute but just because you believe we never landed on the moon, doesn't mean we didn't. Anyways, I adressed your concerns at the end of that sentence, if you would have read the whole thing: "Everyone knows by now that BFL has more power efficient ASICs than their competitors (or at least, they think they do)."  2. An ASIC design is ONLY as good as its internal design, so you may well have the shit-hottest process in the WORLD!!!

Consider that Xilinx FPGA's are manufactured on 22nm/32nm/45nm and yet we see in the case of the XUPV5 that it is only capable of about 120MH/s (ok I'm at 210MH/s but thats another story)

This tells us that it is the ROUTING and resource allocation within the design that can have a FAR MORE CRITICAL impact that physical size of the die/process.

This has nothing to do with my OP 3. "BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013."

Analysis, based on what, quote/site references?

Common sense... let me spell it out since you're a couple clowns short of a circus: 1. People order ASICs 2. Difficulty goes up because people order ASICs 3. Less people buy ASICs because they are less profitable 4. ASIC manufacturers sales decrease 5. ASIC manufacturers improve their products and release 2nd generation to maintain/increase profit. It's not rocket science... 4. "The sooner they announce/preorder/deliver 2nd generations ASICs, the less important 1st generation power consumption rates will be because you will have less time to reap the benefits of the lower power consumption and you will need to spend more money to upgrade."

Sorry.... again there are some very creative ways to save power and get it for FREE LEGALLY, making such discussions moot.

That was my whole purpose of the OP... power consumption is a moot point. What the hell are you smoking? Not for the reasons you state though, because I guarantee you most people on here pay for power. It is a moot point because 2nd generation ASICs will be here sooner than most people would like, and you will need to upgrade or be left with an older model. Instead of arguing "fallacies" with such weakly made points you could make perhaps better use of your time...

Instead of failing to write a proper rebuttal, making tin foil hats, and making yourself like an idiot, maybe you can go jump off a cliff? |

|

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 23, 2012, 06:51:20 AM

Last edit: November 23, 2012, 07:08:34 AM by PuertoLibre |

|

3. "BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013."

Analysis, based on what, quote/site references?

Common sense... let me spell it out since you're a couple clowns short of a circus: 1. People order ASICs 2. Difficulty goes up because people order ASICs 3. Less people buy ASICs because they are less profitable 4. ASIC manufacturers sales decrease 5. ASIC manufacturers improve their products and release 2nd generation to maintain/increase profit. It's not rocket science... [DISCLAIMER: This post is nothing but pure speculation on what may happen in the ASIC market] I don't want to get in between your spat but this is how I see it.  If you look at the basic graphic above, these are all number I pulled out of thin air. But they should approximate the gradually decreasing returns. (This is why it may take up to 2 years for ROI, or less if you use a higher end rig.) Lets say you earn $100 in January. The longer you keep the rig, the more profits you make. What most people realize so far is that they gradually reap less benefits from the device each additional month (due to increasing difficulty). Short of some miraculous events, this is pretty normal and predictable. Each month that a person owns a rig, they make back some of their invested cash. It isn't until they come out even (made back all the cash that they spent) that they will begin to draw out profits from the device. Lets go through a few simple scenarios: A) Lets say a vendor wishes to introduce a "GEN 2 ASIC" in September 2013.* Problem of the Vendor: They have to lower their [GEN 1 ASIC] price in order to sell it. Otherwise, they must sell Gen 2 at an even higher price. (possible but unlikely) This is problematic for current owners of GEN 1 equipment. While their equipment(s) value is logically going down the longer they own and use it. Their resale value is also going down. Prospective buyers in the gray market (Bitcointalk.org for example) are not going to be willing to pay 100% of the purchase price. Logically, prospective are going to want to pay 90% for a $1299 mining rig in January. Lets say 75% in March. 55% in June. 40% in August. The valuation of an ASIC GEN 1 mining rig will (extremely likely) not be $1299 in September Probably less than $500 or less if an owner is unlucky.. It will probably have devalued enough that the only people who will want to buy it form current owner are the ones who are willing to sell their rigs at dirt cheap prices. (Keep in mind, a rig in september 2013 is producing alot less $$ than a rig in Janurary 2013 due to difficulty and hashing power on the BTC network. So its value is much lower by then.) So people who want their cash back fast and don't want to wait another year while the investment pays off will have to Sell it to someone else very cheaply. --------------------------- What happens though if some Vendor cuts their price on their current GEN 1 stock? Example? : https://forums.butterflylabs.com/pre-sales-questions/354-bfl-price-guarantee-4.htmlWell, that forces the hands of current owners of ASIC GEN 1 equipment. Say the price is cut from $1299 to $499. They (individual sellers) will have to sell at an even lower price than they originally intended in the Gray Market. They won't make back their investment. They will actually lose money in the process. Note: Why would a Gray Market buyer...buy used equipment at near retail price from an individual seller trying to offload their rig? (They won't) If they want to buy Gen 2. They will have to take the loss and pull even more cash out of their pocket to pay for the GEN 2 rig. (Assuming it is priced at $1299....) So CoinHoarder is making a pretty (as he said) obvious point. It is not rocket science. The only people who will make positive returns are the people in the Gray Market who short change the average seller whom will want to get rid of their (marginal profit) rigs. As they pick them up cheaply, they can hoard rigs and scale it to make a profit at a steep discount. (these folks will effectively resolve "the price problem" of ASICs.) |

|

|

|

|

Unacceptable

Legendary

Offline Offline

Activity: 2212

Merit: 1001

|

|

November 23, 2012, 07:09:22 AM |

|

3. "BFL, and other ASIC manufacturers, are going to see sales diminishing as difficulty rises throughout the year 2013."

Analysis, based on what, quote/site references?

Common sense... let me spell it out since you're a couple clowns short of a circus: 1. People order ASICs 2. Difficulty goes up because people order ASICs 3. Less people buy ASICs because they are less profitable 4. ASIC manufacturers sales decrease 5. ASIC manufacturers improve their products and release 2nd generation to maintain/increase profit. It's not rocket science... I don't want to get in between your spat but this is how I see it.  If you look at the basic graphic above, these are all number I pulled out of thin air. But they should approximate the gradually decreasing returns. (This is why it may take up to 2 years for ROI, or less if you use a higher end rig.) Lets say you earn $100 in January. The longer you keep the rig, the more profits you make. What most people realize so far is that they gradually reap less benefits from the device each additional month (due to increasing difficulty). Short of some miraculous events, this is pretty normal and predictable. Each month that a person owns a rig, they make back some of their invested cash. It isn't until they come out even (made back all the cash that they spent) that they will begin to draw out profits from the device. Lets go through a few simple scenarios: A) Lets say a vendor wishes to introduce a "GEN 2 ASIC" in September 2013.* Problem of the Vendor: They have to lower their [GEN 1 ASIC] price in order to sell it. Otherwise, they must sell Gen 2 at an even higher price. (possible but unlikely) This is problematic for current owners of GEN 1 equipment. While their equipment(s) value is logically going down the longer they own and use it. Their resale value is also going down. Prospective buyers in the gray market (Bitcointalk.org for example) are not going to be willing to pay 100% of the purchase price. Logically, prospective are going to want to pay 90% for a $1299 mining rig in January. Lets say 75% in March. 55% in June. 40% in August. The valuation of an ASIC GEN 1 mining rig will (extremely likely) not be $1299 in September Probably less than $500 or less if an owner is unlucky.. It will probably have devalued enough that the only people who will want to buy it form current owner are the ones who are willing to sell their rigs at dirt cheap prices. (Keep in mind, a rig in september 2013 is producing alot less $$ than a rig in Janurary 2013 due to difficulty and hashing power on the BTC network. So its value is much lower by then.) So people who want their cash back fast and don't want to wait another year while the investment pays off will have to Sell it to someone else very cheaply. --------------------------- What happens though if some Vendor cuts their price on their current GEN 1 stock? Example? : https://forums.butterflylabs.com/pre-sales-questions/354-bfl-price-guarantee-4.htmlWell, that forces the hands of current owners of ASIC GEN 1 equipment. Say $1299 to $499. They will have to sell at an even lower price than they originally intended in the Gray Market. They won't make back their investment. They will actually lose money in the process. If they want to buy Gen 2. They will have to take the loss and pull even more cash out of their pocket to pay for the GEN 2 rig. (Assuming it is priced at $1299....) So CoinHoarder is making a pretty (as he said) obvious point. It is not rocket science. The only people who will make positive returns are the people in the Gray Market who short change the average seller whom will want to get rid of their (marginal profit) rigs. As they pick them up cheaply, they can hoard rigs and scale it to make a profit at a steep discount. (these folks will effectively resolve "the price problem" of ASICs. ,you & CoinHoarder are spot on !!! Please keep posting your thoughts,hopefully everyone will get the point & stop buying into this ASIC/mining game  I think if you look back when GPU's were starting to hit the mining scene,the same mantra was being brought up  |

"If you run into an asshole in the morning, you ran into an asshole. If you run into assholes all day long, you are the asshole." -Raylan Givens Got GOXXED ?? https://www.youtube.com/watch?v=9KiqRpPiJAU&feature=youtu.be"An ASIC being late is perfectly normal, predictable, and legal..."Hashfast & BFL slogan  |

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 23, 2012, 07:12:30 AM

Last edit: November 23, 2012, 07:27:22 AM by PuertoLibre |

|

That was like a year ago, whats up with the GPU rigs today?

I see alot of people commenting that they aren't going to be buying any [more GPU's] considering they can't make back their investment....in 90 days? (And this is without ASICs in the BTC network)

Now we have spokespeople for one vendor who says some devices may not make it back in 2 years....(that is not insane??)

How do you square that away?

---------------------------

What is a rough estimate for a 55 to 60Gh/s unit? Around 1 year? (2014?)

|

|

|

|

|

Unacceptable

Legendary

Offline Offline

Activity: 2212

Merit: 1001

|

|

November 23, 2012, 08:57:34 AM |

|

That was like a year ago, whats up with the GPU rigs today?

I see alot of people commenting that they aren't going to be buying any [more GPU's] considering they can't make back their investment....in 90 days? (And this is without ASICs in the BTC network)

Now we have spokespeople for one vendor who says some devices may not make it back in 2 years....(that is not insane??)

How do you square that away?

---------------------------

What is a rough estimate for a 55 to 60Gh/s unit? Around 1 year? (2014?)

GPU's still make money,it depends on how much your power is........opps,I let that slip didn't I.Those with low power consumption/prices make more,opps there it goes again,dang it  If ASIC's WEREN'T coming,I'd be buying more vid cards & FPGA's,well more FPGA's because of the LOWER power consumption.But would still keep my vid cards running. Who said 2 year ROI  he's an idiot...............maybe with a Jalapeno,but with 60 GH,I figure 2-4 months MAX  Unless thier power consumption is like 2-5 or more watts per GH. Yes,by late next year,with the network at full bore (400-500 TH),ROI may very well take 2 years,but that's your fault for not being an "EARLY ADOPTER"  BTW,in most financial markets/buissness's,ROI is as long as 10 years  So 2 years still isn't bad.................. Awesome,BFL advert on the calc site,oooo,that'll tweak em some more  http://www.alloscomp.com/bitcoin/calculator http://www.alloscomp.com/bitcoin/calculator |

"If you run into an asshole in the morning, you ran into an asshole. If you run into assholes all day long, you are the asshole." -Raylan Givens Got GOXXED ?? https://www.youtube.com/watch?v=9KiqRpPiJAU&feature=youtu.be"An ASIC being late is perfectly normal, predictable, and legal..."Hashfast & BFL slogan  |

|

|

|

SLok

|

|

November 23, 2012, 09:32:32 AM |

|

That was like a year ago, whats up with the GPU rigs today?

I see alot of people commenting that they aren't going to be buying any [more GPU's] considering they can't make back their investment....in 90 days? (And this is without ASICs in the BTC network)

Now we have spokespeople for one vendor who says some devices may not make it back in 2 years....(that is not insane??)

How do you square that away?

---------------------------

What is a rough estimate for a 55 to 60Gh/s unit? Around 1 year? (2014?)

It's not even about making back their investments in any period, it is loosing money soon (@3x today's difficulty) even running them! Even a jalapeno will give a roi in 4-6 months, with a 10x difficulty increase and 25btc reward/block at a $/btc ratio as today's. 2 vidcard $800 - 1600 Mh/s - 600W incl.host pc = $60 power Coins Dollars per Day ฿0.48 $5.61 per Week ฿3.34 $39.29 per Month ฿14.52 $170.64 7.5 month roi after power, no roi/loss running @3x difficulty jalapeno $149 - 4500Mh/s - 120W incl.host pc = $12 power Coins Dollars per Day ฿1.34 $15.79 per Week ฿9.40 $110.51 per Month ฿40.84 $479.91 10 days roi after power, no roi/loss running @40x difficulty. Single $1299 - 60000Mh/s -180W incl.host pc = $18 power Coins Dollars per Day ฿17.91 $218.37 per Week ฿125.40 $1,528.62 per Month ฿544.59 $6,638.57 6 days roi, profit even running @200x difficulty Mmm, did I miscalculate somewhere, or should I order some more Singles? |

WARNING! Don't trade BTC with Bruno Kucinskas aka Gleb Gamow, Phinnaeus Gage, etc Laundering BTC from anonymous sellers, avoid! https://bitcointalk.org/index.php?topic=649176.msg7279994#msg7279994 #TELLFBI #TELLKSAG #TELLIRS WARNING! Darin M. Bicknell, a proclaimed atheist, teaching at the Jakarta CanadianMontessori School. Drop your kids there at your own risk! WARNING! Christian Otzipka - Hildesheim is a known group-buy scammer, avoid! WARNING! Frizz Supertramp, faker with dozens of accounts here! WARNING! Christian "2 coins to see SLOk's" Antkow, still playing his little microphone... WARNING! Slobodan "Stolen Valor" Bogovac, faking being a Professor WARNING!Marion Sydney Lynn, google him, errr her, errr.. and lol

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 23, 2012, 09:48:05 AM |

|

I will get back to your in a bit.

So far it looks like we have two emerging camps. One states that we will be filthy rich on ASIC in no time.

The other states that difficulty will climb and you will be saddled with debt in the form of an ASIC.

Two opposing camps. One is good news (everyone can use that) and the other is pretty grim news.

-----

Place your bets folks, if you fall into the great news camp, put your money down, in a short time you will make tons of BTC or cash.

Others with a more critical eye of the situation, sorry for the bad news.

When I see people getting their invested money in three months...then I will hop the fence into the Good news camp. Either way, it's bad. You can't have both good and bad news at the same time in this situation.

If as you say, even with a jally you can make 3 times it's price in no time, then people should listen to you. Cause it means I can make back the cost of a 66Gh/s ASIC in even less time than that.

|

|

|

|

|

|

creativex

|

|

November 23, 2012, 09:53:19 AM |

|

Can't it be a bit of both? Surely if I had an ASIC or two just now I'd be reeling in some major BTC. Even after block halving those that get their ASICs first will make bank.

|

|

|

|

Unacceptable

Legendary

Offline Offline

Activity: 2212

Merit: 1001

|

|

November 23, 2012, 10:09:37 AM |

|

|

"If you run into an asshole in the morning, you ran into an asshole. If you run into assholes all day long, you are the asshole." -Raylan Givens Got GOXXED ?? https://www.youtube.com/watch?v=9KiqRpPiJAU&feature=youtu.be"An ASIC being late is perfectly normal, predictable, and legal..."Hashfast & BFL slogan  |

|

|

organofcorti

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

November 23, 2012, 10:30:54 AM |

|

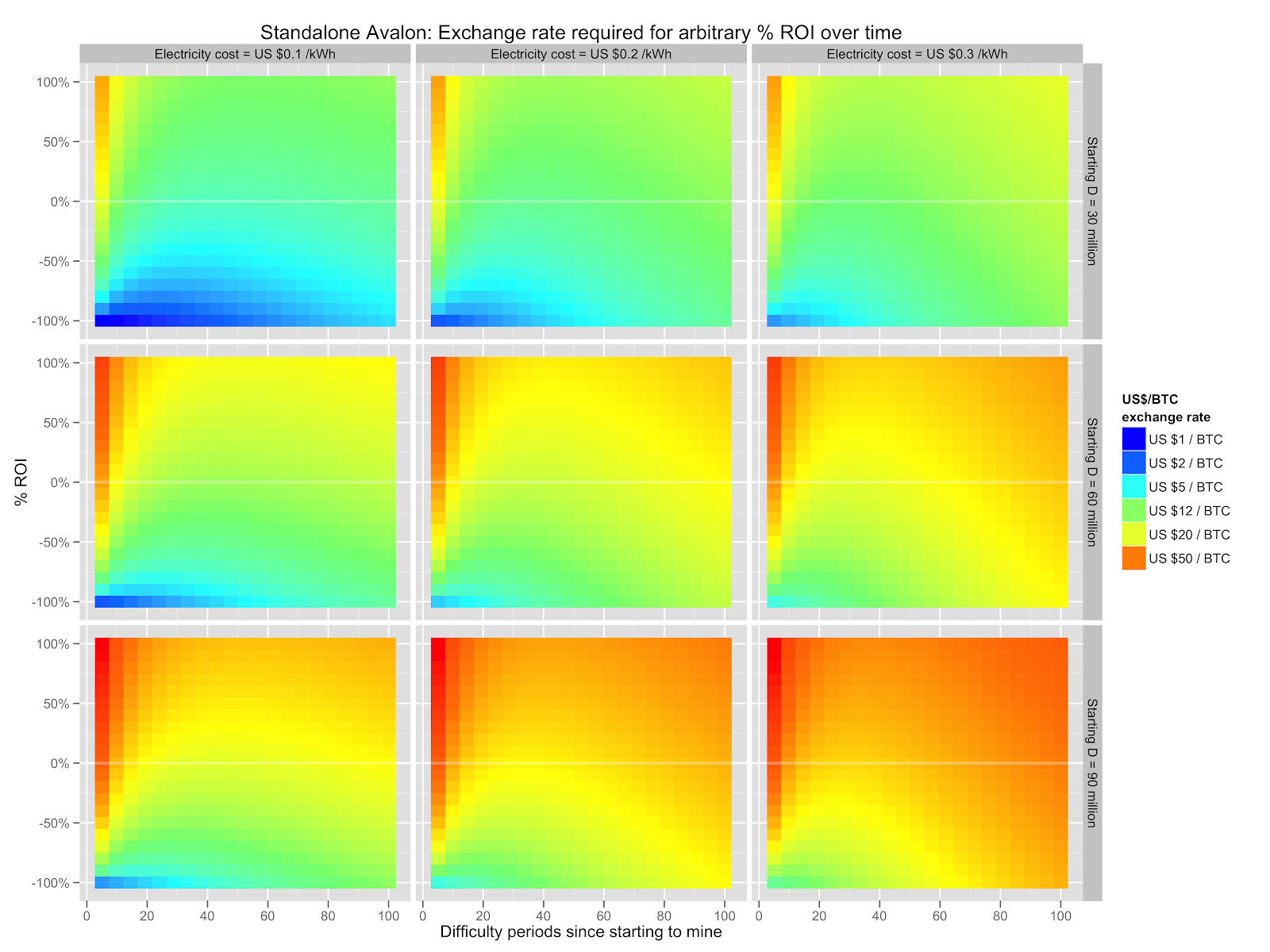

Power consumption is crucial in places where the cost of electricity is high. It can be the difference between breaking even and not. If you're not paying for electricity, then it won't matter. If you're paying US$0.1 for kWh it probably still wont matter a great deal. But if you're paying US$0.3 or even 0.2 per kWh then it matters greatly. I wrote a couple of posts on this which I won't rehash here. I'll just link to them, and show you some pretty charts. Please read the posts if you're going to reply. http://organofcorti.blogspot.com/2012/11/91-asic-choices.htmlhttp://organofcorti.blogspot.com/2012/11/92-asic-choices-update-2nd-november.htmlhttp://organofcorti.blogspot.com/2012/11/93-more-on-asic-choices.htmlChart 1: In order to read this group of charts, find the intersection of a percentage ROI and number of difficulty periods (eg. % ROI after one year is at ~ 26 difficulty periods). The colour of the tile is an indicator of the exchange rate required to meet this %ROI after the given number of difficulty periods. The faint white line along the middle of each plot indicates the break even point. Click on a chart for enlargement.  Chart 2: Profitable mining limits as a function of exchange rate and mining Difficulty.

The chart below shows the profitable mining limit for four ASIC devices for which I was able to obtain hashrate and power consumption estimates. It can be used to find the maximum difficulty at which an ASIC device can profitably mine. For example, at an electricity cost of USD$0.20 per kWh and an exchange rate of USD$20 / btc, the BFL Single SC plus a 100 W computer will be still profitable at a difficulty of 750 million, but not at a difficulty of 1 billion.

Chart 3: Profitable mining duration as a function of exchange rate and time since purchase.

The chart below shows a comparison between the four devices listed (an additional 100 W added for the attached computer). The chart facets are groups according to assumed D when mining on the device started and the electricity cost. Pick a column closest to your local electricity cost, a row closest you the D at which you think you'll be mining, then if you agree that the average percentage increase in D per difficulty period is 5% you can determine for how long the devices are likely to be profitable.  |

|

|

|

Cablez

Legendary

Offline Offline

Activity: 1400

Merit: 1000

I owe my soul to the Bitcoin code...

|

|

November 23, 2012, 02:21:14 PM |

|

Can't it be a bit of both? Surely if I had an ASIC or two just now I'd be reeling in some major BTC. Even after block halving those that get their ASICs first will make bank.

This is the fallacy that is going around by the hopeful. There may be bigger returns by early investors in ASIC but it is only going to last a few days before more shipments reach their destination and that difficulty shoots up 4X at a time for a while. Mining was never envisioned as anything more than a marginal profit business. Those that do well are doing so at the expense of others (The BTC pie idea). |

Tired of substandard power distribution in your ASIC setup??? Chris' Custom Cablez will get you sorted out right! No job too hard so PM me for a quote

Check my products or ask a question here: https://bitcointalk.org/index.php?topic=74397.0

|

|

|

|

creativex

|

|

November 23, 2012, 02:33:15 PM |

|

Seems like you called it a fallacy and then agreed with me.  Just a few days at anything near current difficulty would just about cut ROI in half, and as you said it will scale. |

|

|

|

molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

November 23, 2012, 02:54:25 PM |

|

just one comment: If difficulty rises exponentially (let's say it doubles every 2 weeks) a mining rig will make 50% if its lifetime profits within the first 2 weeks.

It used to be like that (sometime around Mai/June/July 2011) and I think it might be like that again.

|

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

|

abeaulieu

|

|

November 23, 2012, 03:45:26 PM |

|

just one comment: If difficulty rises exponentially (let's say it doubles every 2 weeks) a mining rig will make 50% if its lifetime profits within the first 2 weeks.

It used to be like that (sometime around Mai/June/July 2011) and I think it might be like that again.

I think an exponential trend can only be sustained for finite period of time. (Unless the price per BTC goes up with a compelling trend as well). |

|

|

|

|

CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 23, 2012, 05:35:10 PM |

|

Ah... finishing my cup of Joe for the morning. My apologies for being so hostile last night hardcore-fs. However, you must understand when you speak to people like this: Instead of arguing "fallacies" with such weakly made points you could make perhaps better use of your time...

That it will not bring out the best in them.  I'm up for a debate, but lets play nice. |

|

|

|

|

CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 23, 2012, 05:40:07 PM |

|

organofcorti makes some good arguments for the pro power efficiency crowd.

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

I guess I am spoiled paying .08, and that is where part of my opinion on this matter stems from.

|

|

|

|

|

molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

November 23, 2012, 06:11:12 PM |

|

just one comment: If difficulty rises exponentially (let's say it doubles every 2 weeks) a mining rig will make 50% if its lifetime profits within the first 2 weeks.

It used to be like that (sometime around Mai/June/July 2011) and I think it might be like that again.

I think an exponential trend can only be sustained for finite period of time. (Unless the price per BTC goes up with a compelling trend as well). True, a finite period of time... but (kind-of by definition) that will be a time when a lot of people buy their rigs, so it's relevant to many. Just wanted to drop this in here anyway. |

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

punningclan

Sr. Member

Offline Offline

Activity: 283

Merit: 250

Making a better tomorrow, tomorrow.

|

|

November 23, 2012, 06:48:24 PM

Last edit: November 23, 2012, 07:25:38 PM by punningclan |

|

Who would lose if Bitcoin went to $100 today? Why nickel and dime the miners who are the machine or detract from the immense power and possible impact of this protocol and system. Perhaps miners will have to wait until a government crackdown before they can reach anything like the profitability of the early adopters since their increased risk will mandate higher prices? Many miners are selling at near cost into an ecosystem that's using them to propel impossible industries, this must be a godsend for the up and coming Bit Barons. Hopefully the miners selling out will wise up. If mining is a marginal industry then Bitcoin is, and always will be, marginal.  |

It was a cunning plan to have the funny man be the money fan of the punning clan.

1J13NBTKiV8xrAo2dwaD4LhWs3zPobhh5S

|

|

|

MrTeal

Legendary

Offline Offline

Activity: 1274

Merit: 1004

|

|

November 23, 2012, 07:04:32 PM |

|

Who would lose if Bitcoin went to $100 today?

Why nickel and dime the miners who are the machine?

Early people who preordered mining hardware would be screwed if BTC jumped to $100, unless they paid with fiat. People who just recently purchased pre-order hardware would be doubly screwed. |

|

|

|

|

molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

November 23, 2012, 10:10:03 PM |

|

Who would lose if Bitcoin went to $100 today?

Why nickel and dime the miners who are the machine?

Early people who preordered mining hardware would be screwed if BTC jumped to $100, unless they paid with fiat. People who just recently purchased pre-order hardware would be doubly screwed. when I did the jalapeno->"little single whatever" upgrade, BFL wanted FIAT via paypal only. The jalapeno was payed in bitcoin, true, but when I buy things using bitcoin, I replenish the supply by buying more using FIAT. |

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

|

abeaulieu

|

|

November 23, 2012, 11:58:51 PM |

|

If mining is a marginal industry then Bitcoin is, and always will be, marginal.  Bitcoin Mining is just a subset of Bitcoin. Just because mining is marginal does not make the currency itself marginal. |

|

|

|

|

|

firefop

|

|

November 24, 2012, 06:24:12 AM |

|

If mining is a marginal industry then Bitcoin is, and always will be, marginal.  Bitcoin Mining is just a subset of Bitcoin. Just because mining is marginal does not make the currency itself marginal. Correct - also, mining isn't marginal - it's the core design... without miners there isn't a bitcoin network. That being said - Everyone needs to just stop freaking out about ASICs. a single will make what a single makes, and a rig will make what a rig makes... You'll still be struggling for some percentage of the entire network. We need to start focusing on growing bitcoin as a network, instead of just profit taking. Lets get those transactions fees high enough to replace the block reward entirely. Yes? Great... |

|

|

|

molecular

Donator

Legendary

Offline Offline

Activity: 2772

Merit: 1019

|

|

November 24, 2012, 09:38:37 AM |

|

If mining is a marginal industry then Bitcoin is, and always will be, marginal.  Bitcoin Mining is just a subset of Bitcoin. Just because mining is marginal does not make the currency itself marginal. Correct - also, mining isn't marginal - it's the core design... without miners there isn't a bitcoin network. That being said - Everyone needs to just stop freaking out about ASICs. a single will make what a single makes, and a rig will make what a rig makes... You'll still be struggling for some percentage of the entire network. We need to start focusing on growing bitcoin as a network, instead of just profit taking. Lets get those transactions fees high enough to replace the block reward entirely. Yes? Great... If you mean: keep the fees low but increase the number of transactions, then I'm all for it. Let's see how bitcoin scales. |

PGP key molecular F9B70769 fingerprint 9CDD C0D3 20F8 279F 6BE0 3F39 FC49 2362 F9B7 0769

|

|

|

|

abeaulieu

|

|

November 24, 2012, 03:56:35 PM |

|

If mining is a marginal industry then Bitcoin is, and always will be, marginal.  Bitcoin Mining is just a subset of Bitcoin. Just because mining is marginal does not make the currency itself marginal. Correct - also, mining isn't marginal - it's the core design... without miners there isn't a bitcoin network. That being said - Everyone needs to just stop freaking out about ASICs. a single will make what a single makes, and a rig will make what a rig makes... You'll still be struggling for some percentage of the entire network. We need to start focusing on growing bitcoin as a network, instead of just profit taking. Lets get those transactions fees high enough to replace the block reward entirely. Yes? Great... Agreed. Everyone benefits from growing the network. At the very least there will be much more stability. If it grows enough then the price per BTC should increase as well. And yes more transactions could make the transaction fees earned by miners actually worth it. |

|

|

|

|

punningclan

Sr. Member

Offline Offline

Activity: 283

Merit: 250

Making a better tomorrow, tomorrow.

|

|

November 24, 2012, 11:23:08 PM |

|

To clarify, the miner's take all the capital risk of the Bitcoin protocol.

|

It was a cunning plan to have the funny man be the money fan of the punning clan.

1J13NBTKiV8xrAo2dwaD4LhWs3zPobhh5S

|

|

|

|

bitboyben

|

|

November 25, 2012, 05:24:03 AM |

|

OMG WTFBBQ.

Power will be crucial.

I'm with Organofcorti on this one. The math doesn't lie.

As for gen two? You will not be required to upgrade. 65->45nm wont be enough of an improvement to shut miners out. Also your 60w device is good to about 600TH network hash rate with 1 yr ROI! If the price climbs more you can still hash at higher difficulties.

But if you want, the hardware would have trade in value at bfl, 50% or so has been what the fpgas are worth at upgrade time. reduced capital expenses, reduced power consumption.

RPi host ftw.

You're welcome.

(man I'm in a pissy mod or what?)

|

Why did I sell at $5! Come back to me my old bitcoin! 1GjeBGS4KrxKAeEVt8d1fTnuKgpKpMmL6S

If you don't like the price of BTC come back in 8 hours.

|

|

|

|

firefop

|

|

November 25, 2012, 05:42:32 AM |

|

If you mean: keep the fees low but increase the number of transactions, then I'm all for it. Let's see how bitcoin scales.

Yes of course. Grow the potential gain from mining by having more transactions leaving the fees at current rates. To be honest, once the average fees per block surpass 50btc - I'd expect that the next logical step make blocks happen faster. With the eventual goal being a block every 2 mins. This would be the final step in making the network robust enough to actually compete with traditional point of sale networks. Now we could wait for that growth of mining rewards to happen naturally - but there might be a chance that this gets done early, assuming that the network gets into the 2000+ transaction per second range. |

|

|

|

organofcorti

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

November 25, 2012, 06:35:06 AM |

|

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

Sorry, I hadn't realised this was a "US only" thread  There are lots of miners paying US$0.20 - US$0.30 per kWh. Of course, I don't know exactly how many. Maybe the US miners vastly outnumber the non-US miners, and power consumption won't matter. Or maybe all miners will relocate their machines to US data centres in states with cheap electricity (that'd be my preferred option). But without data on how many miners pay a certain amount for electricity, you really can't know if there's going to be a "chilling effect" on the network hashrate any time soon. |

|

|

|

CoinHoarder (OP)

Legendary

Offline Offline

Activity: 1484

Merit: 1026

In Cryptocoins I Trust

|

|

November 25, 2012, 06:45:27 AM |

|

Sorry, I hadn't realised this was a "US only" thread  No no, my apologies, it is not a US only thread  . I see your point. I would be much more concerned about power consumption if I was paying .20c or .30c per KWh |

|

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 25, 2012, 06:48:12 AM |

|

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

{snip...]Or maybe all miners will relocate their machines to US data centres in states with cheap electricity (that'd be my preferred option). But without data on how many miners pay a certain amount for electricity, you really can't know if there's going to be a "chilling effect" on the network hashrate any time soon. How much does this cost? Is it affordable to do this? If so, how does someone go about doing what you described? (collocating I think it is called.) |

|

|

|

|

organofcorti

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

November 25, 2012, 07:18:25 AM |

|

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

{snip...]Or maybe all miners will relocate their machines to US data centres in states with cheap electricity (that'd be my preferred option). But without data on how many miners pay a certain amount for electricity, you really can't know if there's going to be a "chilling effect" on the network hashrate any time soon. How much does this cost? I don't know yet. Is it affordable to do this? I don't know yet. If so, how does someone go about doing what you described? (collocating I think it is called.)

I don't know yet. What I would do is start by posting your request on a board in this forum. Find some well known long time and respected members who run or work at a data centre are willing to do what you're asking, and find out how much they'd charge per month. If you don't want to SSH in to manage your miners, find out if they'll manage them for you, and if so how much extra that will cost. Then, once you have all the data, collate it into a table, and then pm me with it. Then I'll be able to edit my post and supply you with the details you're after  It's not that I'm lazy, I just haven't put an ASIC order in yet. |

|

|

|

|

firefop

|

|

November 25, 2012, 07:20:04 AM |

|

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

{snip...]Or maybe all miners will relocate their machines to US data centres in states with cheap electricity (that'd be my preferred option). But without data on how many miners pay a certain amount for electricity, you really can't know if there's going to be a "chilling effect" on the network hashrate any time soon. How much does this cost? Is it affordable to do this? If so, how does someone go about doing what you described? (collocating I think it is called.) It would simply involve shipping your hardware to the datacenter location - and then paying a housing fee (think electricty + bandwidth costs + a small margin for profit). Personally, I'd be happy to house your mining equipment - you can manage it via remote session and I'm sure we could work out a percentage based on what your current power costs are. For us to find a starting point, what are your current power draw and cost? |

|

|

|

organofcorti

Donator

Legendary

Offline Offline

Activity: 2058

Merit: 1007

Poor impulse control.

|

|

November 25, 2012, 07:29:01 AM |

|

It would simply involve shipping your hardware to the datacenter location - and then paying a housing fee (think electricty + bandwidth costs + a small margin for profit). Personally, I'd be happy to house your mining equipment - you can manage it via remote session and I'm sure we could work out a percentage based on what your current power costs are.

For us to find a starting point, what are your current power draw and cost?

Well, PuertoLibre, it turns out that you could just ask firepfop. How much do you pay for electricity? Would you be housing equipment at home or do you have/work at a datacentre? |

|

|

|

PuertoLibre

Legendary

Offline Offline

Activity: 1834

Merit: 1003

|

|

November 25, 2012, 08:32:01 AM

Last edit: November 25, 2012, 08:45:22 AM by PuertoLibre |

|

I could see how power consumption could be a big deal for someone paying .2 or .3, but I don't think that most people pay that much, especially in the US.

{snip...]Or maybe all miners will relocate their machines to US data centres in states with cheap electricity (that'd be my preferred option). But without data on how many miners pay a certain amount for electricity, you really can't know if there's going to be a "chilling effect" on the network hashrate any time soon. How much does this cost? Is it affordable to do this? If so, how does someone go about doing what you described? (collocating I think it is called.) It would simply involve shipping your hardware to the datacenter location - and then paying a housing fee (think electricty + bandwidth costs + a small margin for profit). Personally, I'd be happy to house your mining equipment - you can manage it via remote session and I'm sure we could work out a percentage based on what your current power costs are. For us to find a starting point, what are your current power draw and cost? If I am not mistaken it is around 0.095 cents per kwh. (It fluctuates as the electrical company here changes the rates every few months.) Edit: I have heard that Datacenters pay the cheaper wholesale rate of .045 -> .01 per kwh. I also asked because I have just purchased my first [used] blade server and would consider collocation. I don't mine so my current costs are zero in that vein. |

|

|

|

|

mrb

Legendary

Offline Offline

Activity: 1512

Merit: 1027

|

|

November 25, 2012, 08:59:36 AM |

|

For us to find a starting point, what are your current power draw and cost?

If I am not mistaken it is around 0.095 cents per kwh. (It fluctuates as the electrical company here changes the rates every few months.) You are mistaken  You mean 9.5 cents or $0.095 per kWh. |

|

|

|

|

|

abeaulieu

|

|

November 26, 2012, 12:07:52 AM |

|

For us to find a starting point, what are your current power draw and cost?

If I am not mistaken it is around 0.095 cents per kwh. (It fluctuates as the electrical company here changes the rates every few months.) You are mistaken  You mean 9.5 cents or $0.095 per kWh. why does everyone seem to struggle with dollars vs. cents. |

|

|

|

|

|

hardcore-fs

|

|

November 26, 2012, 12:22:32 AM |

|

For us to find a starting point, what are your current power draw and cost?

If I am not mistaken it is around 0.095 cents per kwh. (It fluctuates as the electrical company here changes the rates every few months.) You are mistaken  You mean 9.5 cents or $0.095 per kWh. why does everyone seem to struggle with dollars vs. cents. I wish I could use 10Kwh of electricity for less than a cent, but this does highlight WHY so many people think they can buy a Rolls Royce after mining bitcoins for a week. |

BTC:1PCTzvkZUFuUF7DA6aMEVjBUUp35wN5JtF

|

|

|

|