Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3869

|

Btw these rallies are they more exciting for last cycle newcomers

Or for the more OG multiple cycle hodlers?

For example I see some cheering from people buying 20-30-40-50k coins but the feeling for true OG’s is little more life changing somehow?

Also been through some aweful bears, still being here, believing, knowing what we have in hand and ultimately being strongly rewarded etc

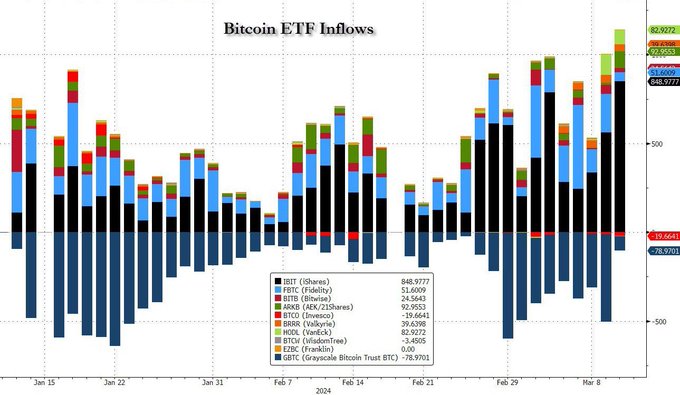

Success just needs stamina. GrayScale selling hopefully slowing down.

Only 560 BTC transferred today.

About -$40m. Yesterday: -$80m Monday: -$494m Only in the first two days of sport ETF trading Grayscale had less than three digit $m outflow (-$44m and -$22m, respectively). EDIT: source https://farside.co.uk/?p=997May be it is related to this news: It’s happening! @Grayscale just filed to launch the “Grayscale Bitcoin Mini Trust” expecting this to have a competitive fee. It will trade under the ticker $BTC and will come from a spinoff from $GBTC. This means $GBTC holders will get some % of holdings spun off into $BTC. https://twitter.com/JSeyff/status/1767531434258964630Here’s the language around the spinoff. There is no fee disclosed yet orrr what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost competitive product. https://twitter.com/JSeyff/status/1767531941060804830It mostly matters for taxable accounts. As I said before, GBTC was able to maintain a peg and was even at a slight premium on Mon, so I used that and divested 66% of GBTC in IRAs (into IBIT/FBTC 50:50), but kept a third in GBTC just in case if premium would rise. Feels good after at some point in 2022 being at a 49% discount. |

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

March 13, 2024, 03:47:19 PM Merited by JayJuanGee (1) |

|

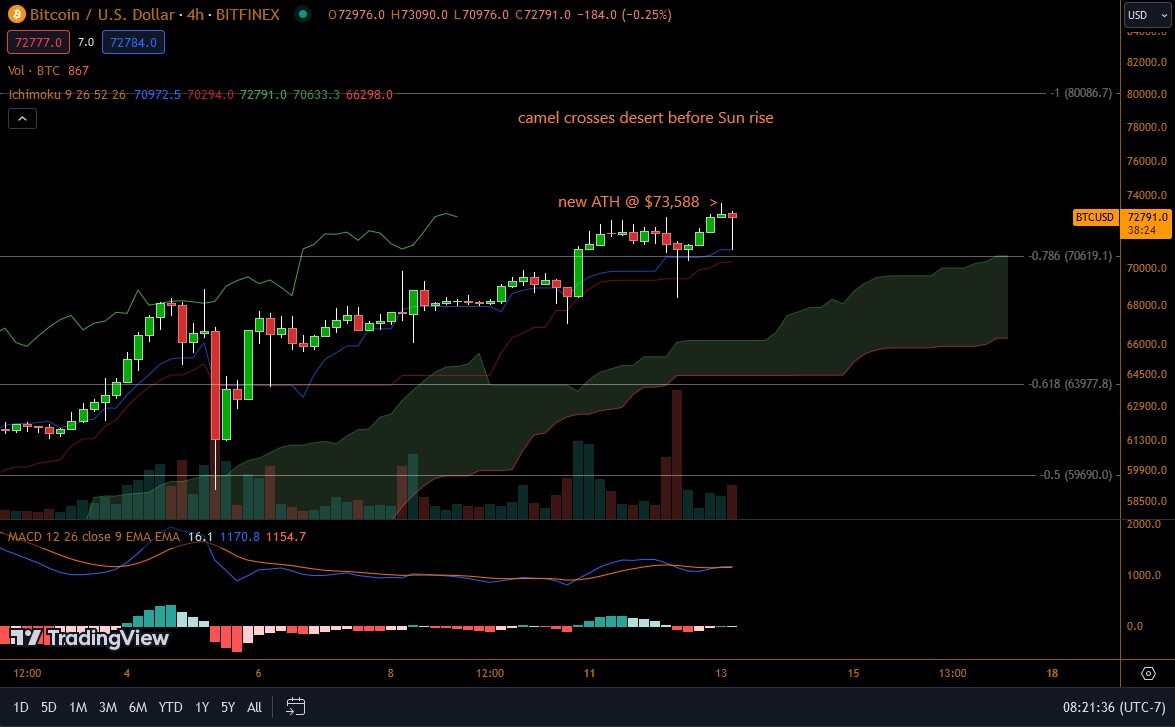

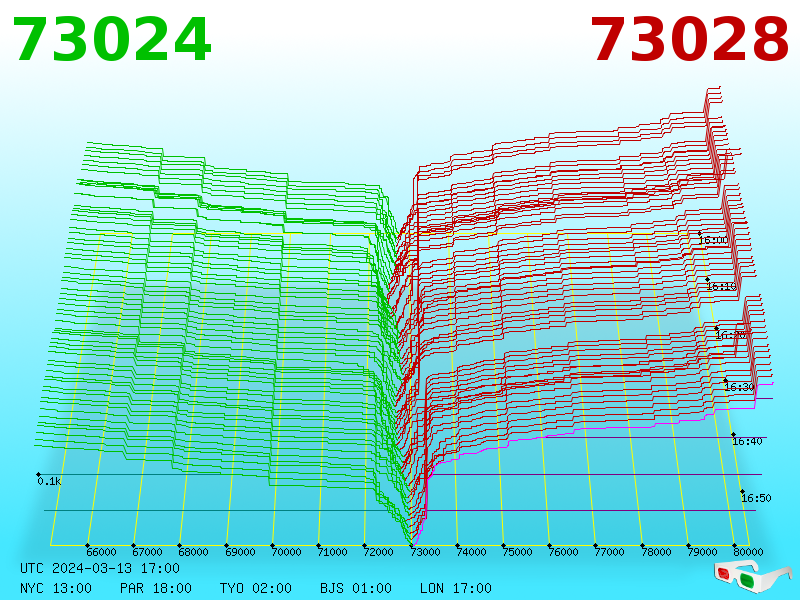

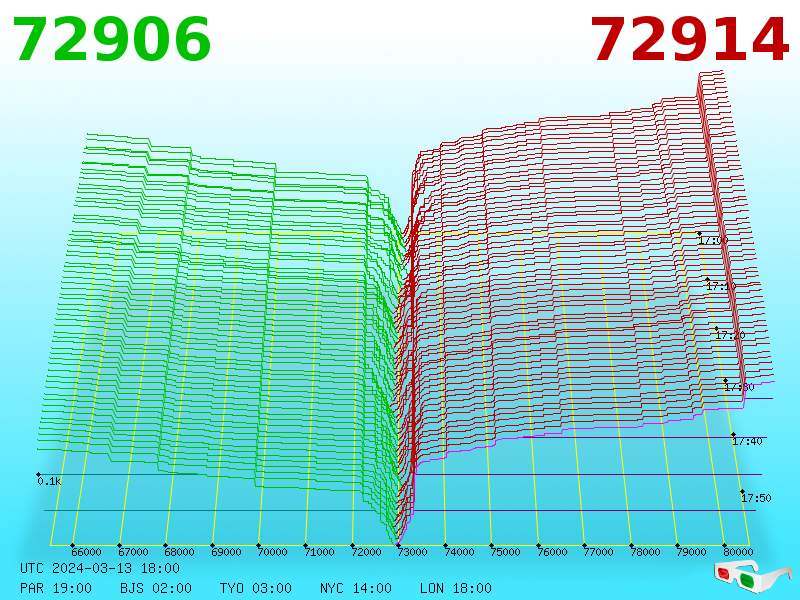

https://twitter.com/DylanLeClair_/status/1767892483470406034 https://twitter.com/DylanLeClair_/status/1767892483470406034'ACCELERATE' +1 WOsMerit ------- gm increasing trade volume continued through the night with bitcoin posting another ATH @ $73,679 closing arguments continue in the COPA vs. faketoshi trial today....be nice to start closure on that fraud steady on dyor 4h  D  stronghands |

|

|

|

|

JimboToronto

Legendary

Offline Offline

Activity: 4004

Merit: 4482

You're never too old to think young.

|

|

March 13, 2024, 03:59:42 PM |

|

Good morning Bitcoinland.

Another day another ATH.

Let's get back up over $73k and then over $74k.

We need a new chopper.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 13, 2024, 04:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 04:10:25 PM |

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoin |

|

|

|

|

MERlT

Member

Offline Offline

Activity: 162

Merit: 32

|

|

March 13, 2024, 04:13:49 PM |

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoinJamie Diamond is the FED, don't you know that yet? |

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoinJamie Diamond is the FED, don't you know that yet? Really thanks for the information comarade.. now I see the reason why he is dancing that tune been a wholesomely confused....🤣🤣🤣🤣🤣 |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7862

'The right to privacy matters'

|

|

March 13, 2024, 04:30:08 PM |

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoinJamie Diamond is the FED, don't you know that yet? Really thanks for the information comarade.. now I see the reason why he is dancing that tune been a wholesomely confused....🤣🤣🤣🤣🤣 Ah this is good enough to get a merit |

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

March 13, 2024, 04:41:49 PM |

|

|

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 04:43:11 PM |

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoinJamie Diamond is the FED, don't you know that yet? Really thanks for the information comarade.. now I see the reason why he is dancing that tune been a wholesomely confused....🤣🤣🤣🤣🤣 Ah this is good enough to get a merit Ah Baba thanks alot for the merit you sent to me I so much appreciate |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1456

Merit: 2494

|

|

March 13, 2024, 04:49:17 PM |

|

Didn't Jamie Dimon say he would never mention Bitcoin ever again?

|

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 04:50:49 PM |

|

Pro basketball player Darius Garland spotted wearing a Satoshi shirt before a game........ Bitcoin has already come to stay everybody is campaigning for bitcoin in various areas they could.... It is a thing of great joy to have some bitcoin in my wallet also to witness how bitcoin is changing people's lives unexpectedly in this recent years I never regret being part of this bitcoin forum because I have become more educated that all my friends want to ask me everything about bitcoin the pros and cons of this bitcoin every given day even THE GRAET DARIUS GARLAND IS SPOTTED WEARING STATOSHI |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 13, 2024, 05:01:14 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 05:18:57 PM |

|

Didn't Jamie Dimon say he would never mention Bitcoin ever again?

He has no choice because bitcoin is already taken all over the atmosphere till the extent that he can't even resist it any longer he can't just help himself from not to mention it at all...... |

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 05:28:34 PM |

|

I was actually making my research and I came across this post it actually baffles me how bitcoin is taking over the atomsphere and it habitant this is happening in EL Salvador........................

PRESS RELEASE

New Report Reveals Media Sentiment on El Salvador's Bitcoin Adoption

Bitcoin Perception |

San Salvador, February 20th, 2024 – Media research firm Bitcoin Perception today announced the release of its first long-form research report, titled "Bitcoin as Legal Tender: El Salvador's Groundbreaking Decision and the Salvadorian Mainstream Media's Reaction."

The report, authored by Luis David Esparragoza and Fernando Nikolić, offers an unprecedented analysis of the local mainstream media's coverage of Bitcoin since El Salvador made history by adopting Bitcoin as legal tender in 2021.

This comprehensive study scrutinizes 1440 articles from five major local news outlets from January 1, 2021, to December 31, 2023, providing a nuanced understanding of the media's stance toward this groundbreaking financial move by President Nayib Bukele's government.

The analysis delves into the sentiment expressed by the Salvadorian media and discusses the broader implications of such coverage on public perception and understanding of Bitcoin within the country.

"El Salvador's adoption of Bitcoin has not only been a bold financial experiment but also a case study in how media coverage can shape public opinion on such a global scale," said Bitcoin Perception founder and one of the report's authors Fernando Nikolić.

Co-author Luis David Esparragoza added, "Our work seeks to identify the causes that shape the perception of Bitcoin in the media in El Salvador, and provide suggestions on how to improve journalistic coverage of Bitcoin, in aspects such as adoption, regulation and significance of its technology."

"Bitcoin as Legal Tender: El Salvador's Groundbreaking Decision and the Salvadorian Mainstream Media's Reaction" is now available and offers a unique lens through which to view the interaction between Bitcoin adoption and media influence.

It is an essential read for policymakers, journalists, and anyone interested in the evolving narrative of Bitcoin.

About Bitcoin Perception

Bitcoin Perception is a media research initiative focused on analyzing and understanding the public and media narratives surrounding Bitcoin. Through comprehensive studies and reports, Bitcoin Perception aims to contribute to a more informed and balanced discussion about Bitcoin's role in global finance and society................

I just stumbled this post and I came to observe that some government like El Salvador has actually believed in bitcoin to the extent of adopting BITCOIN as their legal tenders wow that actually amazing to know that some countries has been soich advance to understand that bitcoin is future digital currency that will never fail they have been accepting bitcoin as the legal tenders for over 6 years now ans still counting now imagine that kind of profit they have made so far.......

Let be wise to make a wise decision......

|

|

|

|

|

|

aesma

|

More than 24 hours above 70K that's nice.

Observing 73000$ and 66666€.

|

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 13, 2024, 06:00:28 PM |

|

Jamie Dimon, the CEO of JPMorgan Chase and a known Bitcoin skeptic, remains unconvinced of the asset’s merits. Speaking at the Australian Financial Review business summit in Sydney via video link, Dimon expressed his reservations about the asset amidst broader discussions on topics ranging from upcoming elections to federal economic policies. During the call, Dimon criticized Bitcoin, particularly focusing on its volatility and the potential for its use in illegal activities, including money laundering and fraud. He suggested that the rapid increase in Bitcoin's value might indicate a speculative bubble, cautioning investors about the risks involved. Despite his criticisms, Dimon stated that he would defend the right of individuals to purchase Bitcoin, likening it to personal choices such as smoking cigarettes. "I defend your right to smoke a cigarette, [and] I’ll defend your right to buy a Bitcoin." Said by Dimon...... ~You see no matter how they want to criticise bitcoin thesame mouth will still defend I will only say that Dimon is totally confused right here ~ Bitcoin still remains the king and aways become the kings of all coins https://www.btctimes.com/news/jpmorgan-chase-ceo-says-he-will-defend-peoples-right-to-buy-bitcoinJamie Diamond is the FED, don't you know that yet? Really thanks for the information comarade.. now I see the reason why he is dancing that tune been a wholesomely confused....🤣🤣🤣🤣🤣 Ah this is good enough to get a merit Ah Baba thanks alot for the merit you sent to me I so much appreciate Even BlackRock's CEO vindicated Bitcoin as a tool to protect oneself from governments 🙌 I don't actually know what they want but I am.happy statoshi no dey even respond to all this commentaries |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 13, 2024, 06:01:18 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2091

Merit: 1461

We choose to go to the moon

|

|

March 13, 2024, 06:17:07 PM |

|

In March 2020 we crashed to $5000... what a difference in only 4 years.

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10225

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 13, 2024, 06:33:39 PM |

|

I got a raise today.

3,33%

Needless to say I wasn't impressed.

Just keeping up with official inflation, or slightly above in euro zone. I have been on committees which negotiate salaries: their argument when inflation is 2-3% is always...see, inflation is low, no need to exceed it, but when the inflation is 8-10%, they reverse the argument and start whining that they don't have the budget to go above, say, 5%. A complete silence about inflation and what it does to employees in this case. I got 7% last year so I'm keeping up with average inflation (not necessarily my expenses inflation) however compared to seeing ones corn adding hundreds of thousands at a time, it's not much... Even though in bitcoin, we might still measure some kind of a strict short-term increase in interest, but largely if we have been mostly building and holding our coins for 6-10 years, then as some point, we have so many doublings and compounding upon itself, so that even a few percentage increase in BTC prices, might even be months worth of our historical wages, and so at some point it no longer makes sense to continue working.... It seems that my BTC holdings had crossed over into such territories in early 2017, and if you think about it, in early 2017, we had merely had just gotten over $1,250 or so, and just a little over a year earlier we had been bouncing around $250 for so much time, so yeah going from $250 to $1,250 is a 5x, but we all know that the BTC price did not stop there, so even if we ended correcting back down into the $3ks after going to $19,666 in late 2017, the upper $3ks would have been 3x higher than the 5x that we had already experienced in early 2015, so largely we are already 15x up at that point, even at the bottom of the worst times in 2018 that did end having one more dip in early 2020... and even though we really did not know that $3ks were going to be the bottom for that period, at some point it came to be that we likely could rest assured that sub $3k would likely never be reached again, which was still 15x higher than the $250-ish BTC prices through much of 2015. So, yeah if you did not stack your bitcoin until later, then you likely have higher numbers that you have to work from, and I still do not even like to use $250 as my number rather than using $1k as my number in order to attempt to be somewhat more conservatively realistic in regards to my own profits and various losses that I made along the way that likely end up taking out a few of my earliest doublings, since I am needing to start with $1k as my doubling number rather than starting with $250. There surely are some guys (or there should be some guys) in these here parts that might be able to use sub $10k as their starting out number.. but they may well feel better to be a bit more conservative in their calculations, and so therefore they choose to use $10k as their costs per BTC, and so they still might be just amazed to have had ONLY been around 50% in profits in late 2022, but now they ar fining themselves to be more than 7x in profits... or at least have 7x their initial starting amount... so the value that they put in is compounding at seemingly stupendous rates.. and at some point it might start to make sense to just start to live off of their BTC.. and they might be able to figure out some kind of calculation for that. I think that my latest formula is going to account for the fact that the BTC price is generally not even touching the 200-WMA, so it is likely that fuck you status in bitcoin could actually start around 25% lower than fuck you status within traditional (non-bitcoin) asset classes.. which also means that the withdrawal rate could be sustained at 6% to 10% rather than 4% in traditional asset classes. But guys still have to do the work of both calculating what their fuck you status might be and then making sure that they either get their bitcoin holdings up to 75% of their fuck you status.. or some combination of traditional formulas that combine with their bitcoin holdings in order to get them over the fuck you status threshold... .. but from my point of view, we still should not be using BTC spot price to be making these kinds of calculations, even though if we shave off some BTC, we will be doing it at spot price, so it is not completely irrelevant in terms of various kinds of rakings that we might make if we conclude that it is in our interest to make some rakings rather than merely continuing to let our BTC holdings ride or continue to accumulate to our BTC holdings if we might be thinking that we don't have enough of dee cornz, yet. Btw these rallies are they more exciting for last cycle newcomers

Or for the more OG multiple cycle hodlers?

For example I see some cheering from people buying 20-30-40-50k coins but the feeling for true OG’s is little more life changing somehow?

Also been through some aweful bears, still being here, believing, knowing what we have in hand and ultimately being strongly rewarded etc

That is part of the funniness because even though the later comers are in multitides of profits, there does seem to be a difference in the exponential nature, and so we likely have difficulties considering anyone with costs in the $20ks to $30ks as OGs, but maybe if our costs are in the $10k or less then maybe that might be considered more likely to be OG... because there needs to be a kind of cushion, and so the lower that you go in the costs per BTC help, but then over the years you could stack way more BTC, so even if you costs are around $20k rather than under $10k, but if you have 5x more BTC, then you are likely way better off, even if you cost per corn is higher. Otherwise, I agree with the idea of being able to relax and the relaxing is not necessarily ONLY about our costs per BTC, but also a bit of time in the market too. Bitcoin ETFs are 58% of the way to flipping Gold ETFs for total assets.

$58.7b for $BTC

$98b for Gold

That's just after just 8 weeks... At this rate, Bitcoin will flip Gold ETFs in a few month!   "Technically" speaking that is 59.87% - so almost 60%. I get that answer by dividing = $58.77/$98.17. |

|

|

|

|

|

Poll

Poll