shahzadafzal

Copper Member

Legendary

Offline Offline

Activity: 1526

Merit: 2890

|

|

November 02, 2023, 01:44:12 PM |

|

Dump incoming.   Cute green dildos within minutes of his tweet. 155 BTC in October! and that too above average price of bitcoin for MicroStrategy!!! It’s true institutions will adopt bitcoin on large scale before individuals. Guess who will be the last? Who? Who? Who? governments? of course, a decent number of poor (and somewhat uneducated) people are going to get fucked with their lack of discretionary income and their difficulties in taking risk.. but they will still likely benefit from bitcoin being a much more fair system.. and it is more likely an indirect benefit rather than their getting into direct exposure and their getting in early. . so maybe they will get in last, even after their governments have already gotten in (on the sly). Exactly Governments will be the last ones to adopt bitcoin on large scale and reasons are obvious - No more bailouts for the Banks - No more stimulus checks |

|

|

|

|

|

|

|

|

|

TalkImg was created especially for hosting images on bitcointalk.org: try it next time you want to post an image

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1656

Verified Bitcoin Hodler

|

|

November 02, 2023, 01:58:52 PM Merited by JayJuanGee (1) |

|

Why the fuck is there so much drama in this place? It's like the toxic corner of bitcointalk. We should be celebrating the $35k.

You new here?  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

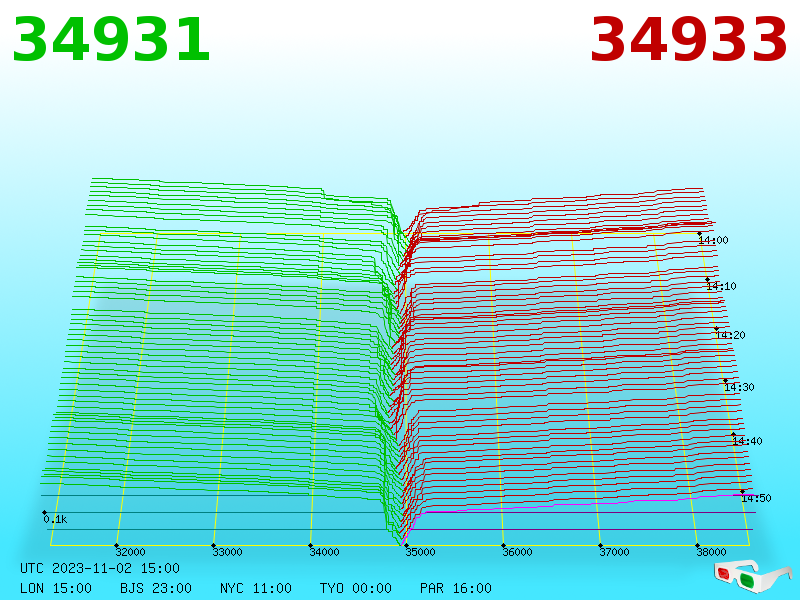

November 02, 2023, 02:03:24 PM |

|

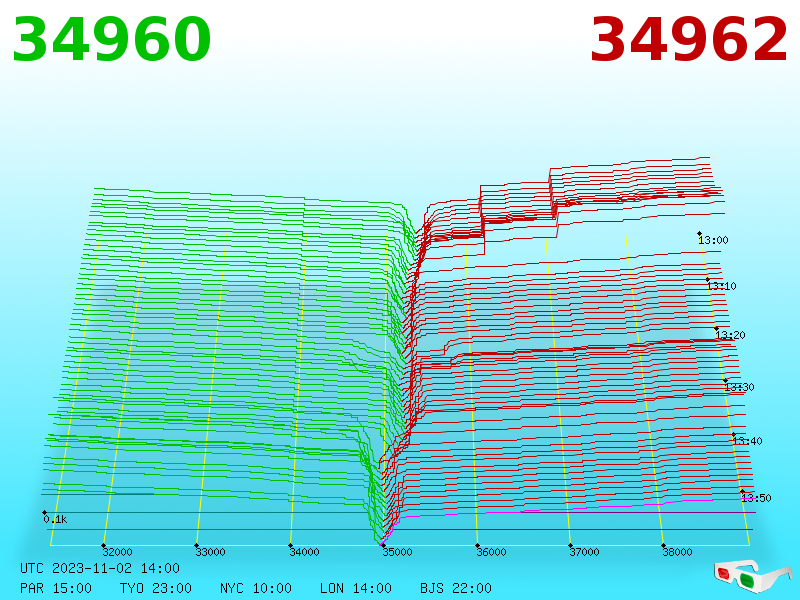

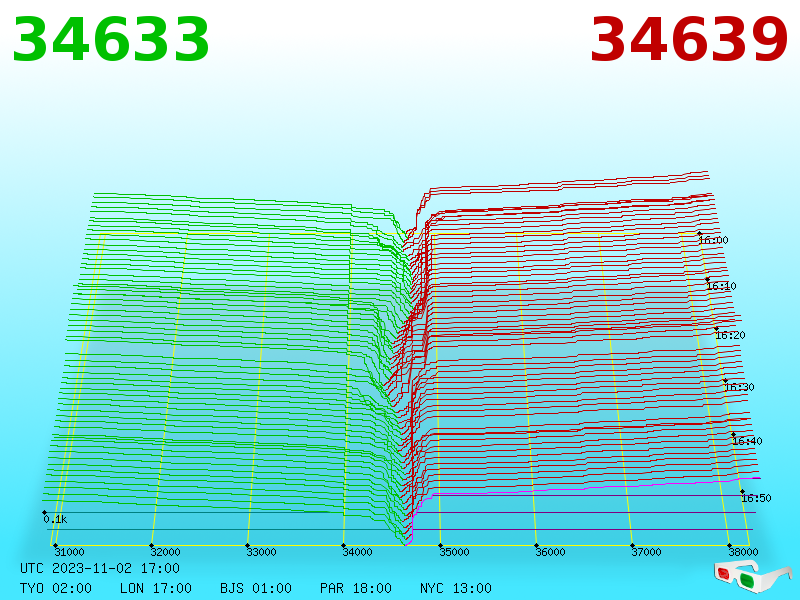

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

BlackHatCoiner

Legendary

Offline Offline

Activity: 1498

Merit: 7294

Farewell, Leo

|

|

November 02, 2023, 02:26:19 PM |

|

You new here? Hey hey hey! *Looks at your date of registration*Yeah... |

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

November 02, 2023, 02:30:38 PM Merited by El duderino_ (50), fillippone (20), Torque (5), hosseinimr93 (4), philipma1957 (3), JimboToronto (2), jojo69 (2), OutOfMemory (2), vapourminer (1), suchmoon (1), Paashaas (1), psycodad (1) |

|

even while we might not know the timeline for these progressions to play out since bitcoin is not so much a straight line like the 200-week moving average irons out to be a kind of straighter line than the actual BTC price.. it becomes a kind of stability within the unstable (the inevitably volatile, as I like to frequently proclaim).. and so many folks strive for proclaiming bitcoin as being stable, and they can go fuck off with that ideology that just does not exist in bitcoin current prices and/or the expectations of its future price performance, except perhaps when looking at something like the 200-week moving average, which sort of brings the "ought" to the "is".... and don't get me wrong.. it seems likely that bitcoin is going to become more and more stable and there won't be a choice since it is going to become harder and harder to move bitcoin's prices, but probably we are not going to get to such a state of BTC price stability until getting 5x to 10x or even higher than that of Gold's market cap (which would be bitcoin prices in the $2.5 milllion to $5 million) price arena. which could even happen in this cycle or the next cycle, but I am kind of thinking that it would take a bit longer than this or the next cycle.. but who really knows?

I find myself compelled, yet again, to impart the wisdom that eludes the masses. It is not from a place of charity that I offer this enlightenment but from sheer exasperation at the lackluster analysis populating these forums. It is time to discuss the manifest destiny of Bitcoin – its ascent to the sanctified $1M mark. Firstly, let us address the elephant in the room, the 200-week moving average, a beacon for those with the acumen to interpret its signals. This indicator has been a stalwart guide through the tempestuous history of Bitcoin’s price action. While the plebeian investor quakes at the merest hint of a downturn, the enlightened few recognize these periods as mere consolidations, consolidations that scream opportunity for accumulation. The 200-week moving average is not a mere line on a chart; it is the demarcation of the uncultured bear from the civilized bull. Now, onto the volatility – that great specter that sends shivers down the spines of the uninitiated. Wake up, neophytes! Bitcoin will test your resolve with 25% swings in value, not merely as an exception but as a daily occurrence. This is not a market for the fainthearted or those accustomed to the pampered cocoon of index funds and treasury bonds. This is the arena where titans clash, and only those with the fortitude to endure such trials will emerge victorious. Let's not mince words. Those accustomed to the soothing, predictable cadence of fiat inflation are ill-equipped for the revolution that cryptocurrency heralds. We are not simply in a market cycle; we are in the midst of a paradigm shift, a renaissance of value transfer. The ascent to $1M is not a possibility; it is an inevitability, preordained by the finite supply of 21 million coins and the unabated debasement of fiat currencies. Do you quiver at the thought of a 25% retracement? Does your hand falter at the sell button with each news cycle? If so, you are unworthy of the glory that Bitcoin promises. The path to $1M is lined with the corpses of weak hands, those who could not stomach the volatility, those who lack vision. To the naysayers and the short-sighted, I decree: your lack of conviction is the very fuel that propels Bitcoin forward. Your disbelief, your skepticism, it matters not. The market will move with or without your approbation, ascending to heights unimagined by your pedestrian intellect. In the grand theatre of economic evolution, where the drama of wealth and power plays out with the unrelenting force of a Shakespearean tragedy, it is Bitcoin that has emerged as the protagonist in this epoch of monetary upheaval. As an investor of evidently superior intellect and foresight, I find myself compelled to bestow upon the plebeians that frequent these forums, a glimpse into the inevitable rise of Bitcoin to a value so stratospheric, so unequivocally certain, that only those blinded by ignorance would dare question its trajectory to the hallowed $1M USD mark. Let us embark upon a journey of enlightenment, beginning with the oft-cited and widely revered 200-week moving average—a beacon that illuminates the path for those enlightened souls brave enough to navigate the treacherous waters of cryptocurrency investment. This celestial guide has consistently delineated the boundary between the enlightened investor and the hapless gambler. The former views the 200-week moving average not as a mere statistical anomaly but as the alpha and the omega of strategic Bitcoin investment, the foundation upon which fortunes are built and the bedrock that mitigates the abyss of financial ruin. Now, to address the subject that sends paroxysms of fear through the ranks of the faint-hearted – volatility. Ah, volatility, that magnificent beast that so cruelly separates the wheat from the chaff, the sage from the foolhardy. Mark my words, nescient onlookers, for Bitcoin shall sway with the indomitable force of a tempest, exhibiting price oscillations of 25% or more, not merely on the scale of annus horribilis but within the span of a single day. Such volatility is the crucible in which the mettle of a true investor is tested and the brittle spines of the timorous are irrevocably shattered. Let us not equivocate on this matter; the typical, garden-variety investor, suckled on the teat of dividend yields and mutual funds, can scarcely fathom the revolutionary temerity of Bitcoin. This is not a mere bubble, not simply another tulip mania for the history books. No, this is the apotheosis of years of monetary debasement, the natural and just consequence of the incessant printing presses that have debauched fiat currencies to the brink of collapse. Do you find yourself quaking at the prospect of a downturn, as Bitcoin momentarily recoils like a great lion gathering its strength before the pounce? If so, it is manifest that you are undeserving of the spoils that await the stalwart. The journey to the zenith of $1M is fraught with the corpses of the faint-hearted, those who surrendered at the first sign of bloodshed, who, when faced with the baptismal fire of market correction, chose to retreat into the shadows of economic obscurity. And yet, despite the cacophony of doomsayers and the harbingers of financial apocalypse, Bitcoin endures, propelled ever upwards by the immutable laws of supply and demand, the unremitting march of technological progress, and the growing cognizance among the masses that the time of decentralized digital currency is upon us. To the skeptics, the deniers, the perennial bears who scurry about with their woeful prognostications of collapse and disaster, I posit the following: your disbelief is the chaff in the wind, inconsequential and forgotten. The market, in its infinite wisdom and its inexorable pursuit of equilibrium, cares not for the bleating of sheep. It is we, the lions of investment, the oracles of financial foresight, who will shepherd the uninitiated through the valley of darkness. As the festering, moribund carcass of fiat currency lies supine, awaiting the final death knell, Bitcoin will rise, a phoenix from the ashes, to claim its rightful throne at the pinnacle of monetary value. Those among us who have the sagacity to embrace the volatility, to weather the storm, and to perceive the underlying majesty of Satoshi Nakamoto’s creation, will be duly anointed as the vanguards of this new financial era. In closing, remember this – as the fiat world you cling to withers, Bitcoin will emerge as the phoenix from the ashes, and those who had the foresight to embrace the volatility, to buy the fear and sell the greed, will be the architects of the new financial epoch. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

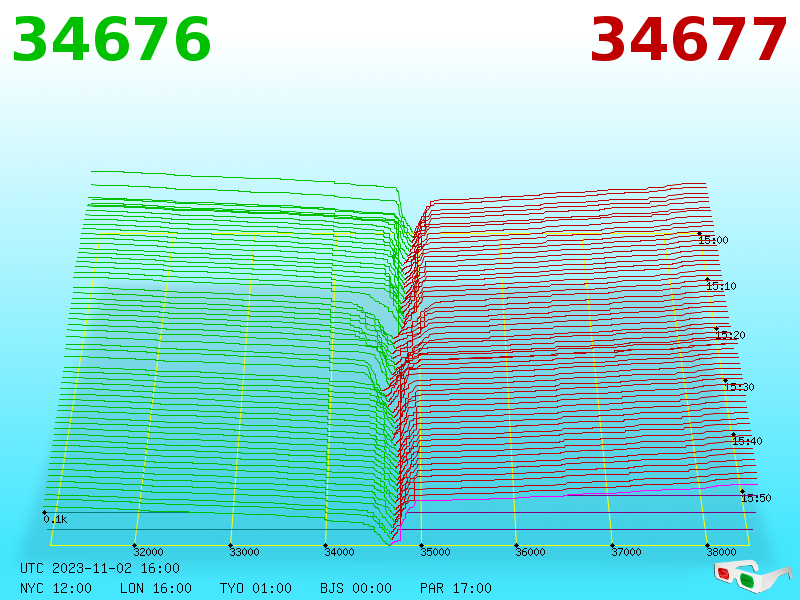

November 02, 2023, 03:01:19 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

November 02, 2023, 03:28:17 PM |

|

even while we might not know the timeline for these progressions to play out since bitcoin is not so much a straight line like the 200-week moving average irons out to be a kind of straighter line than the actual BTC price.. it becomes a kind of stability within the unstable (the inevitably volatile, as I like to frequently proclaim).. and so many folks strive for proclaiming bitcoin as being stable, and they can go fuck off with that ideology that just does not exist in bitcoin current prices and/or the expectations of its future price performance, except perhaps when looking at something like the 200-week moving average, which sort of brings the "ought" to the "is".... and don't get me wrong.. it seems likely that bitcoin is going to become more and more stable and there won't be a choice since it is going to become harder and harder to move bitcoin's prices, but probably we are not going to get to such a state of BTC price stability until getting 5x to 10x or even higher than that of Gold's market cap (which would be bitcoin prices in the $2.5 milllion to $5 million) price arena. which could even happen in this cycle or the next cycle, but I am kind of thinking that it would take a bit longer than this or the next cycle.. but who really knows?

I find myself compelled, yet again, to impart the wisdom that eludes the masses. It is not from a place of charity that I offer this enlightenment but from sheer exasperation at the lackluster analysis populating these forums. It is time to discuss the manifest destiny of Bitcoin – its ascent to the sanctified $1M mark. Firstly, let us address the elephant in the room, the 200-week moving average, a beacon for those with the acumen to interpret its signals. This indicator has been a stalwart guide through the tempestuous history of Bitcoin’s price action. While the plebeian investor quakes at the merest hint of a downturn, the enlightened few recognize these periods as mere consolidations, consolidations that scream opportunity for accumulation. The 200-week moving average is not a mere line on a chart; it is the demarcation of the uncultured bear from the civilized bull. Now, onto the volatility – that great specter that sends shivers down the spines of the uninitiated. Wake up, neophytes! Bitcoin will test your resolve with 25% swings in value, not merely as an exception but as a daily occurrence. This is not a market for the fainthearted or those accustomed to the pampered cocoon of index funds and treasury bonds. This is the arena where titans clash, and only those with the fortitude to endure such trials will emerge victorious. Let's not mince words. Those accustomed to the soothing, predictable cadence of fiat inflation are ill-equipped for the revolution that cryptocurrency heralds. We are not simply in a market cycle; we are in the midst of a paradigm shift, a renaissance of value transfer. The ascent to $1M is not a possibility; it is an inevitability, preordained by the finite supply of 21 million coins and the unabated debasement of fiat currencies. Do you quiver at the thought of a 25% retracement? Does your hand falter at the sell button with each news cycle? If so, you are unworthy of the glory that Bitcoin promises. The path to $1M is lined with the corpses of weak hands, those who could not stomach the volatility, those who lack vision. To the naysayers and the short-sighted, I decree: your lack of conviction is the very fuel that propels Bitcoin forward. Your disbelief, your skepticism, it matters not. The market will move with or without your approbation, ascending to heights unimagined by your pedestrian intellect. In the grand theatre of economic evolution, where the drama of wealth and power plays out with the unrelenting force of a Shakespearean tragedy, it is Bitcoin that has emerged as the protagonist in this epoch of monetary upheaval. As an investor of evidently superior intellect and foresight, I find myself compelled to bestow upon the plebeians that frequent these forums, a glimpse into the inevitable rise of Bitcoin to a value so stratospheric, so unequivocally certain, that only those blinded by ignorance would dare question its trajectory to the hallowed $1M USD mark. Let us embark upon a journey of enlightenment, beginning with the oft-cited and widely revered 200-week moving average—a beacon that illuminates the path for those enlightened souls brave enough to navigate the treacherous waters of cryptocurrency investment. This celestial guide has consistently delineated the boundary between the enlightened investor and the hapless gambler. The former views the 200-week moving average not as a mere statistical anomaly but as the alpha and the omega of strategic Bitcoin investment, the foundation upon which fortunes are built and the bedrock that mitigates the abyss of financial ruin. Now, to address the subject that sends paroxysms of fear through the ranks of the faint-hearted – volatility. Ah, volatility, that magnificent beast that so cruelly separates the wheat from the chaff, the sage from the foolhardy. Mark my words, nescient onlookers, for Bitcoin shall sway with the indomitable force of a tempest, exhibiting price oscillations of 25% or more, not merely on the scale of annus horribilis but within the span of a single day. Such volatility is the crucible in which the mettle of a true investor is tested and the brittle spines of the timorous are irrevocably shattered. Let us not equivocate on this matter; the typical, garden-variety investor, suckled on the teat of dividend yields and mutual funds, can scarcely fathom the revolutionary temerity of Bitcoin. This is not a mere bubble, not simply another tulip mania for the history books. No, this is the apotheosis of years of monetary debasement, the natural and just consequence of the incessant printing presses that have debauched fiat currencies to the brink of collapse. Do you find yourself quaking at the prospect of a downturn, as Bitcoin momentarily recoils like a great lion gathering its strength before the pounce? If so, it is manifest that you are undeserving of the spoils that await the stalwart. The journey to the zenith of $1M is fraught with the corpses of the faint-hearted, those who surrendered at the first sign of bloodshed, who, when faced with the baptismal fire of market correction, chose to retreat into the shadows of economic obscurity. And yet, despite the cacophony of doomsayers and the harbingers of financial apocalypse, Bitcoin endures, propelled ever upwards by the immutable laws of supply and demand, the unremitting march of technological progress, and the growing cognizance among the masses that the time of decentralized digital currency is upon us. To the skeptics, the deniers, the perennial bears who scurry about with their woeful prognostications of collapse and disaster, I posit the following: your disbelief is the chaff in the wind, inconsequential and forgotten. The market, in its infinite wisdom and its inexorable pursuit of equilibrium, cares not for the bleating of sheep. It is we, the lions of investment, the oracles of financial foresight, who will shepherd the uninitiated through the valley of darkness. As the festering, moribund carcass of fiat currency lies supine, awaiting the final death knell, Bitcoin will rise, a phoenix from the ashes, to claim its rightful throne at the pinnacle of monetary value. Those among us who have the sagacity to embrace the volatility, to weather the storm, and to perceive the underlying majesty of Satoshi Nakamoto’s creation, will be duly anointed as the vanguards of this new financial era. In closing, remember this – as the fiat world you cling to withers, Bitcoin will emerge as the phoenix from the ashes, and those who had the foresight to embrace the volatility, to buy the fear and sell the greed, will be the architects of the new financial epoch. I have an opinion and since I carefully use wipes my opinions like my asshole do not stink. @no homoThe 2019-2020-2021 rally with a double top was an aberration. Toss it out and ignore it. Look at the 2015-2016-2017 rally so far we are matching up to it well. Very nice Sept and Oct gains just like 2015. If we continue to match it we reach 42k on dec 1 and 48k on Jan 1 give or take a few bucks and days. the really interesting shit is when we match Jan 2016 to Dec 2017 in that 2 time we did 368 usd to 19,900 usd a factor of 54 to 1 which would be in 2023 to 2025 42k dec 1 2023 48k jan 1 2024 40k feb 1 2024 2163k dec 31 2025 so unfortunately Bob is too low in his 1 million mark. So a 40trillion cap by dec 31 2025 is in the cards. |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4309

diamond-handed zealot

|

|

November 02, 2023, 03:49:16 PM |

|

...

|

|

|

|

|

suchmoon

Legendary

Offline Offline

Activity: 3654

Merit: 8909

https://bpip.org

|

|

November 02, 2023, 03:51:57 PM |

|

~

Did you feed JJG's post as a prompt to ChatGPT?  |

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3484

born once atheist

|

|

November 02, 2023, 03:54:37 PM |

|

OT alert... Any Beatles fans in here? The "new" release (couple of hours ago), featuring Lennon vocals, cleaned up and brought to life from an ancient cassette recording is pretty amazing. https://www.youtube.com/watch?v=AW55J2zE3N4 |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 02, 2023, 04:03:23 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3484

born once atheist

|

~

Did you feed JJG's post as a prompt to ChatGPT?  Wordyman contest. |

|

|

|

|

|

Bananington

|

|

November 02, 2023, 04:16:42 PM |

|

Why the fuck is there so much drama in this place? It's like the toxic corner of bitcointalk.

I actually enjoy the drama and reading the conversations here  I will not say it is toxic, just very organic and real. |

|

|

|

|

|

SamReomo

|

|

November 02, 2023, 04:36:31 PM |

|

Why the fuck is there so much drama in this place? It's like the toxic corner of bitcointalk. We should be celebrating the $35k.

I wouldn't call it toxic but addicting instead. This is the thread where members are frank with each other and can share their opinions without much thinking. Actually, a few of the best members of the forum mostly post here and they enjoy posting on this thread because they can share their ideas, opinions, knowledge, information, and some rumor without any worries. Ah, it's one of the best corners of the forum for some people and they really love this place bro! |

|

|

|

|

|

WatChe

|

|

November 02, 2023, 04:46:54 PM |

|

Aim big. Aim for 40k.

"Aim for the moon. If you miss, you may hit a star." -W. Clement Stone

40K is big...he he he? jk..I know that you only talked about a couple of days  It was like "Goldberg's , you're next!" After 30k, 40k you are next !!! I don't consider $40k to be very BIG

Its a subjective thing that what price is BIG. 40k might be a big price for anyone who bought Bitcoin when it was down at 16k but same price might not be big for someone who bought it at 30k. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 02, 2023, 05:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3484

born once atheist

|

Why the fuck is there so much drama in this place? It's like the toxic corner of bitcointalk. We should be celebrating the $35k.

Compared to the "good old days" on this forum, this place is like Disneyland. |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

Why the fuck is there so much drama in this place? It's like the toxic corner of bitcointalk.

I actually enjoy the drama and reading the conversations here  I will not say it is toxic, just very organic and real. A small fraction of posts here are toxic, mainly by two kinds of members: 1. toxic people ("sad fucks" based on a recent quote by --- i can't remember) 2. non toxic people that have a bad time, or got upset because of reasons. The latter are creating some toxic posts, but only temporarily. In the end, most of us here are like a big, colorful family. IMO EDIT: I forgot 3. Honored contributors using toxic humor to state their point of view in a quite intelligent way. Good people, in essence. This thread is all about being a Bitcoiner. Everybody else is kindly asked to fuck off  |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

November 02, 2023, 05:53:45 PM |

|

even while we might not know the timeline for these progressions to play out since bitcoin is not so much a straight line like the 200-week moving average irons out to be a kind of straighter line than the actual BTC price.. it becomes a kind of stability within the unstable (the inevitably volatile, as I like to frequently proclaim).. and so many folks strive for proclaiming bitcoin as being stable, and they can go fuck off with that ideology that just does not exist in bitcoin current prices and/or the expectations of its future price performance, except perhaps when looking at something like the 200-week moving average, which sort of brings the "ought" to the "is".... and don't get me wrong.. it seems likely that bitcoin is going to become more and more stable and there won't be a choice since it is going to become harder and harder to move bitcoin's prices, but probably we are not going to get to such a state of BTC price stability until getting 5x to 10x or even higher than that of Gold's market cap (which would be bitcoin prices in the $2.5 milllion to $5 million) price arena. which could even happen in this cycle or the next cycle, but I am kind of thinking that it would take a bit longer than this or the next cycle.. but who really knows?

I find myself compelled, yet again, to impart the wisdom that eludes the masses. It is not from a place of charity that I offer this enlightenment but from sheer exasperation at the lackluster analysis populating these forums. It is time to discuss the manifest destiny of Bitcoin – its ascent to the sanctified $1M mark. Firstly, let us address the elephant in the room, the 200-week moving average, a beacon for those with the acumen to interpret its signals. This indicator has been a stalwart guide through the tempestuous history of Bitcoin’s price action. While the plebeian investor quakes at the merest hint of a downturn, the enlightened few recognize these periods as mere consolidations, consolidations that scream opportunity for accumulation. The 200-week moving average is not a mere line on a chart; it is the demarcation of the uncultured bear from the civilized bull. Now, onto the volatility – that great specter that sends shivers down the spines of the uninitiated. Wake up, neophytes! Bitcoin will test your resolve with 25% swings in value, not merely as an exception but as a daily occurrence. This is not a market for the fainthearted or those accustomed to the pampered cocoon of index funds and treasury bonds. This is the arena where titans clash, and only those with the fortitude to endure such trials will emerge victorious. Let's not mince words. Those accustomed to the soothing, predictable cadence of fiat inflation are ill-equipped for the revolution that cryptocurrency heralds. We are not simply in a market cycle; we are in the midst of a paradigm shift, a renaissance of value transfer. The ascent to $1M is not a possibility; it is an inevitability, preordained by the finite supply of 21 million coins and the unabated debasement of fiat currencies. Do you quiver at the thought of a 25% retracement? Does your hand falter at the sell button with each news cycle? If so, you are unworthy of the glory that Bitcoin promises. The path to $1M is lined with the corpses of weak hands, those who could not stomach the volatility, those who lack vision. To the naysayers and the short-sighted, I decree: your lack of conviction is the very fuel that propels Bitcoin forward. Your disbelief, your skepticism, it matters not. The market will move with or without your approbation, ascending to heights unimagined by your pedestrian intellect. In the grand theatre of economic evolution, where the drama of wealth and power plays out with the unrelenting force of a Shakespearean tragedy, it is Bitcoin that has emerged as the protagonist in this epoch of monetary upheaval. As an investor of evidently superior intellect and foresight, I find myself compelled to bestow upon the plebeians that frequent these forums, a glimpse into the inevitable rise of Bitcoin to a value so stratospheric, so unequivocally certain, that only those blinded by ignorance would dare question its trajectory to the hallowed $1M USD mark. Let us embark upon a journey of enlightenment, beginning with the oft-cited and widely revered 200-week moving average—a beacon that illuminates the path for those enlightened souls brave enough to navigate the treacherous waters of cryptocurrency investment. This celestial guide has consistently delineated the boundary between the enlightened investor and the hapless gambler. The former views the 200-week moving average not as a mere statistical anomaly but as the alpha and the omega of strategic Bitcoin investment, the foundation upon which fortunes are built and the bedrock that mitigates the abyss of financial ruin. Now, to address the subject that sends paroxysms of fear through the ranks of the faint-hearted – volatility. Ah, volatility, that magnificent beast that so cruelly separates the wheat from the chaff, the sage from the foolhardy. Mark my words, nescient onlookers, for Bitcoin shall sway with the indomitable force of a tempest, exhibiting price oscillations of 25% or more, not merely on the scale of annus horribilis but within the span of a single day. Such volatility is the crucible in which the mettle of a true investor is tested and the brittle spines of the timorous are irrevocably shattered. Let us not equivocate on this matter; the typical, garden-variety investor, suckled on the teat of dividend yields and mutual funds, can scarcely fathom the revolutionary temerity of Bitcoin. This is not a mere bubble, not simply another tulip mania for the history books. No, this is the apotheosis of years of monetary debasement, the natural and just consequence of the incessant printing presses that have debauched fiat currencies to the brink of collapse. Do you find yourself quaking at the prospect of a downturn, as Bitcoin momentarily recoils like a great lion gathering its strength before the pounce? If so, it is manifest that you are undeserving of the spoils that await the stalwart. The journey to the zenith of $1M is fraught with the corpses of the faint-hearted, those who surrendered at the first sign of bloodshed, who, when faced with the baptismal fire of market correction, chose to retreat into the shadows of economic obscurity. And yet, despite the cacophony of doomsayers and the harbingers of financial apocalypse, Bitcoin endures, propelled ever upwards by the immutable laws of supply and demand, the unremitting march of technological progress, and the growing cognizance among the masses that the time of decentralized digital currency is upon us. To the skeptics, the deniers, the perennial bears who scurry about with their woeful prognostications of collapse and disaster, I posit the following: your disbelief is the chaff in the wind, inconsequential and forgotten. The market, in its infinite wisdom and its inexorable pursuit of equilibrium, cares not for the bleating of sheep. It is we, the lions of investment, the oracles of financial foresight, who will shepherd the uninitiated through the valley of darkness. As the festering, moribund carcass of fiat currency lies supine, awaiting the final death knell, Bitcoin will rise, a phoenix from the ashes, to claim its rightful throne at the pinnacle of monetary value. Those among us who have the sagacity to embrace the volatility, to weather the storm, and to perceive the underlying majesty of Satoshi Nakamoto’s creation, will be duly anointed as the vanguards of this new financial era. In closing, remember this – as the fiat world you cling to withers, Bitcoin will emerge as the phoenix from the ashes, and those who had the foresight to embrace the volatility, to buy the fear and sell the greed, will be the architects of the new financial epoch. Soooo...bitcoin go up, or...? |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

November 02, 2023, 05:54:50 PM |

|

Soooo...bitcoin go up, or...?

Of course, Laura  This was also one of the greatest pamphlets to Bitcoin naysayers, imho. |

|

|

|

|

|

Poll

Poll