exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 20, 2020, 07:01:56 AM Merited by JayJuanGee (1) |

|

This was a good attempt to rally, but doesn't look like it has enough momentum and I think it will roll over now the same as it did October 19th. (looking at the weekly) You have to admit, the two rallies look very different. The late October move was a short squeeze that took place over a few days. Zero support was built on the way up. In comparison, we're 5+ weeks into the current rally, coming off a weekly W-bottom, and stair stepping (building support) the whole way up. We haven't seen bullish momentum on the weekly like this since March 2019. As long as we remain below that October pivot high, bears can rightfully keep repeating we're in a mid/long term downtrend. To me, however, it's becoming obvious that a change in market direction is occurring. |

|

|

|

|

|

|

|

|

|

|

|

|

"The nature of Bitcoin is such that once version 0.1 was released, the

core design was set in stone for the rest of its lifetime." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 20, 2020, 02:27:13 PM |

|

This was a good attempt to rally, but doesn't look like it has enough momentum and I think it will roll over now the same as it did October 19th. (looking at the weekly) You have to admit, the two rallies look very different. The late October move was a short squeeze that took place over a few days. Zero support was built on the way up. In comparison, we're 5+ weeks into the current rally, coming off a weekly W-bottom, and stair stepping (building support) the whole way up. We haven't seen bullish momentum on the weekly like this since March 2019. As long as we remain below that October pivot high, bears can rightfully keep repeating we're in a mid/long term downtrend. To me, however, it's becoming obvious that a change in market direction is occurring. I understand that bears say all kinds of things prematurely because they are trying to get the downward momentum to cause their proclamations to become true, and I fuck all admit that I am as much of a delayed indicator as anyone, so in our 2018 correction, I personally would not admit that we had entered into a bear market until the November 2018 intensive spike below $6k and approaching $3k.... Nonetheless, when we came out of the largely sub $4k prices on April 1, and mostly returned above $6k by mid-may, I had largely asserted, at that time that I had thought that we were no longer in a bear market, even though I can look at the charts and see from July 2019 to December 1919, we have had a quite a bit of prolonged correction, and I would NOT have asserted that correction (that we are currently still in) to have been either severe enough or prolonged enough to take us out of our about mid-May 2019 conversion into a bull market. In other words, we cannot be just flip flopping, and saying bull market, bear market, bull market.. after every little price move, so I still believe that we remain in out about mid-May conversion into a bull market with a interestingly long correction in the middle. Sure, maybe that does not really help for short to medium term assessments about what to do, but nonetheless, when part of the outcome action points (in my thinking) regarding assessing if you are in a bull market versus a bear market is whether the short-to-medium term odds of a break out weigh more in favor of up or down... not conclusive odds, but just a leaning in one direction versus the other direction. So in that regard, sgbett's proclamation that we are going down to $5,200-ish by February 10-ish, seems overly bearish not only in terms of direction but in terms of degree.. both time and amount. One plus side, of such proclamation is that we are not going to need to wait for very long to find out if he was correct. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

asus09

|

|

January 20, 2020, 03:35:25 PM |

|

Why do you look optimist bitcoin will back with higher price above $16,500 and what your way and how to keep believe with other investor to make bitcoin keep growing with higher price above $16,500. You must check with bitcoin price right now below $8,500 and keep stable always in lower price after last days have raise with higher price.

|

| | .

Gamdom | │ | 15% | .

CASHBACK

FOR THE FIRST

7 DAYS | | | ██████████

██

██

██

██

██

██

██

██

██

██

██

██████████ | █████████████████████████████████ .

█████████████████████████████████ | ██████████

██

██

██

██

██

██

██

██

██

██

██

██████████ | ▄██████████████████████████████▄

████████████████████████████████

█████▀▀████████▀▀████████▀▀█████ ▄▄▄▄

███ ▀▄▄▀ ████ ▀▄▄▀ ████ ▀▄▄▀ ███ ██████

████▀ ▀██████▀ ▀██████▀ ▀████ ▀████▀

████▄ ▄██████▄ ▄██████▄ ▄████ ██

████████████████████████████████ ██

████████████████████████████████ ██

██████████████████████████████████████▀

▀██████████████████████████████▀

██████████████████████

██████████████████████

████████████████████████████████ | .

HIGH QUALITY CASINO

WITH MULTIPLE GAMES | | | ████████

██

██

██

██

██

██

██

██

██

██

██

████████ | | ████████

██

██

██

██

██

██

██

██

██

██

██

████████ |

|

|

|

tmfp

Legendary

Offline Offline

Activity: 1932

Merit: 1737

"Common rogue from Russia with a bare ass."

|

|

January 20, 2020, 03:50:46 PM |

|

Why do you look optimist bitcoin will back with higher price above $16,500 and what your way and how to keep believe with other investor to make bitcoin keep growing with higher price above $16,500. You must check with bitcoin price right now below $8,500 and keep stable always in lower price after last days have raise with higher price.

This PSA brought to you by courtesy of that fine upstanding organization known as Yobit. |

Extraordinary Claims require Extraordinary Evidence |

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 20, 2020, 03:58:24 PM |

|

Why do you look optimist bitcoin will back with higher price above $16,500 and what your way and how to keep believe with other investor to make bitcoin keep growing with higher price above $16,500. You must check with bitcoin price right now below $8,500 and keep stable always in lower price after last days have raise with higher price.

You might not be asking me, asus09, but my personal financial strategy (or mindset) does not require bitcoin to go above $16.5k in any kind of short-to-medium term time-frame in order for me to feel that I am in a good investment. Of course, some kind of stagnation in bitcoin's price for a couple more years would likely bring some concerns about whether certain price models are valid, such as the stock to flow model or the 4-year fractal or even the various Metcalfe law / networking effects/adoption models, but that might just mean that the models need to be tweaked rather than their being wrong, necessarily. I think that a perspective of already being good with bitcoin, even if price dynamics might remain somewhat flat in the coming years, comes from already having had been in bitcoin for more than 6 years and experienced considerable profits already. Of course, another possibility could be more in-line with bear scenarios in which bitcoin bleeds value for the next 4-6 years.. which could be quite shocking to a lot of people, but also seems like a scenario that is quite pie-in-the-sky unlikely too, because historically, we have not really seen bitcoin price dynamics to be happening with any kind of meaningful gradualism, so whether BTC's price is going down, up or somewhat flat, the more likely scenarios seem likely to continue to include a lot of volatility along the way - even if we were to end up at the same price as we are now in 4-6 years. Sure, currently, each person is in a different place in terms of whether s/he has been accumulating bitcoin over the years or merely trading it and attempting to accumulate dollars through such trades, so in that regard, each person is going to have a different approach to bitcoin, even if there is a bit of a presumption that members participating in this forum are somewhat inclined to be informing themselves about bitcoin and presumably striving to accumulate (at least some) to put in their portfolio (to the extent that they might not be getting too distracted into the various noise of the space including over allocating into various shitcoins - which remains a real, tempting and ongoing balancing dynamic of the space). Even if institutions might not yet be dominating the bitcoin space, we cannot discount that institutions continue to contemplate entering bitcoin, what tools are available and what kind of approach they are going to take in regard to bitcoin. The way institutions make decisions might have some similarities and differences from how individuals decide, yet bitcoin can work for both (individuals and institutions), so sometimes it can be important to consider how others are thinking about the space in order to decide one's own perspective regarding how to approach BTC's anticipated future price performances. Why do you look optimist bitcoin will back with higher price above $16,500 and what your way and how to keep believe with other investor to make bitcoin keep growing with higher price above $16,500. You must check with bitcoin price right now below $8,500 and keep stable always in lower price after last days have raise with higher price.

This PSA brought to you by courtesy of that fine upstanding organization known as Yobit. hahahahaha You mean that asus09 was not asking a serious question? I agree the question seemed a bit lame and unspecific, but there tends to be quite a bit of that going on in the forum, anyhow (in sum, I have been trolled into a "taking it seriously" response....   ) |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 20, 2020, 06:39:22 PM |

|

In other words, we cannot be just flip flopping, and saying bull market, bear market, bull market.. after every little price move, so I still believe that we remain in out about mid-May conversion into a bull market with a interestingly long correction in the middle. When I say "bull market" and "bear market" I'm really talking about mid-term uptrends and downtrends that play out over several months. I don't restrict usage of those terms to Bitcoin's long term multi-year cycles. The 350% rally of early 2019 was an undeniable bull market. The 70% retracement since the $13,000s and the chain of lower highs and lower lows (which has still not been broken) is/was an undeniable bear market. At the monthly time frame, there is no obvious break of that trend yet. That's what I mean by saying "bears can rightfully keep repeating we're in a mid/long term downtrend." Until the October and November pivots are engulfed to the upside, they are technically right. I believe you are correct that December 2018 was the beginning of another cycle like 2015-2017. The charts have yet to prove it though. For me, we need to break the 2019 highs before becoming too confident in that assessment. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 20, 2020, 07:22:24 PM |

|

In other words, we cannot be just flip flopping, and saying bull market, bear market, bull market.. after every little price move, so I still believe that we remain in out about mid-May conversion into a bull market with a interestingly long correction in the middle. When I say "bull market" and "bear market" I'm really talking about mid-term uptrends and downtrends that play out over several months. I don't restrict usage of those terms to Bitcoin's long term multi-year cycles. The 350% rally of early 2019 was an undeniable bull market. Yeah, but I am not even really saying that the 350% increase was a bull market, but instead that it seemed to be a pretty strong sign that we had exited the bear market and that the bull market had begun. We would not really know if that assessment was correct until some passage of time, and I am still leaning on those facts in my consideration regarding where we are at and whether we had either gotten knocked back into the bear market or that we never had transitioned into the bull market in the first place. I am merely saying that there is insufficient evidence, so far, that our current correction that has brought BTC prices all the way back down to $6,425 has reverted us to the previous bear market or that we have been knocked out of the bull market. Of course, all of these assessments and evidence remains tentative because subsequent movements in price can cause a previous market movement to be considered in another light and have to be relabelled.. and that relabelling was no fucking way known in advance, but the subsequent movement ended up necessitating such relabelling. The 70% retracement since the $13,000s and the chain of lower highs and lower lows (which has still not been broken) is/was an undeniable bear market.

I am not going there... but hey you might be correct, but that surely is not my assessment. Currently, I consider it as a mere correction in a tentative bull market. Surely, I do not consider the matter conclusive, but I still am NOT going to go so far as agreeing with assessments that such price movement is a "bear market" or that we should be creating our expectations of future BTC price movement based on such an assessment of a bear market.. Yeah, I might be wrong, but I give two shits about whether it is right or wrong.. and surely each person comes to his/her own decisions regarding what factors are relevant to considering these kinds of labels and to make assessments regarding BTC price direction probabilities. At the monthly time frame, there is no obvious break of that trend yet. That's what I mean by saying "bears can rightfully keep repeating we're in a mid/long term downtrend." Until the October and November pivots are engulfed to the upside, they are technically right.

You can give weight to whatever timeline that you want in order to conclude what is "technically" correct or not. My presumptions seem to be based on a bit of a longer time frame than what you seem to be "technically" using to arrive at your conclusions regarding the purported proper label for where we are at, currently. I believe you are correct that December 2018 was the beginning of another cycle like 2015-2017. The charts have yet to prove it though. For me, we need to break the 2019 highs before becoming too confident in that assessment.

I am not confident in anything regarding where we are going. I am just attempting to suggest where we are at and that the odds seem to weigh slightly in favor of UP rather than down.... Does not mean that we won't go down, but if I am saying 51/49 for up rather than 49/51 for up, there is a difference that might not make a large swaying about how to bet, if I were betting in one direction or another or picking various time lines in order to make such assertions regarding where we are going to be at at certain points into the future, whether talking about 2.5 weeks (like sgbett), referring to the time of the halvening (May 9), the end of 2020 or some other potentially relevant time frame. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 21, 2020, 06:42:39 PM |

|

Yeah, but I am not even really saying that the 350% increase was a bull market, but instead that it seemed to be a pretty strong sign that we had exited the bear market and that the bull market had begun. You're just limiting your definition of "bull market" to Bitcoin's multi-year bullish cycle. I was merely clarifying that I (and other traders) don't necessarily limit our usage of the term that way. 2015-2017 was a bull market. So was the first half of 2019. These bull markets occur at different time frames. I don't believe it's useful to restrict "bull" and "bear" to multi-year cycles. As a trader, I need much more granularity in my analysis to successfully navigate intermittent trends. If it pleases you, you can mentally replace every instance of "bear market" with "downtrend" or "bearish correction." It's not something worth arguing over. This is an unimportant, purely semantic issue that you are focusing on. I am merely saying that there is insufficient evidence, so far, that our current correction that has brought BTC prices all the way back down to $6,425 has reverted us to the previous bear market or that we have been knocked out of the bull market. I never suggested anything like that. It's only your arbitrary definitions that lead you to think when I say "bear" it means "the 2018 bear market hasn't ended yet." Nothing could be further from the truth. The 70% retracement since the $13,000s and the chain of lower highs and lower lows (which has still not been broken) is/was an undeniable bear market.

I am not going there... but hey you might be correct, but that surely is not my assessment. Currently, I consider it as a mere correction in a tentative bull market. That's exactly what I've already speculated: https://bitcointalk.org/index.php?topic=5218374.msg53633657#msg53633657Nothing I've said about the latter 2019 downtrend contradicts that theory. I do believe we are in a multi-year bull market. That unfortunately tells us nothing about what will happen in the next few months (or what happened in the last few months), hence my consistent attempts to further speculate on shorter term movements: https://bitcointalk.org/index.php?topic=5196072.80At the monthly time frame, there is no obvious break of that trend yet. That's what I mean by saying "bears can rightfully keep repeating we're in a mid/long term downtrend." Until the October and November pivots are engulfed to the upside, they are technically right.

You can give weight to whatever timeline that you want in order to conclude what is "technically" correct or not. You're just speaking in vague terms and going with your gut feeling. That's fine but I can't operate that way as a trader. I'm simply applying a rigorous and accepted definition of "uptrend" and "downtrend" based on Dow theory, because being on the right side of the mid-term trend is vital to surviving the market: A reversal in the primary trend is signaled when the market is unable to create another successive peak and trough in the direction of the primary trend. For an uptrend, a reversal would be signaled by an inability to reach a new high followed by the inability to reach a higher low. In this situation, the market has gone from a period of successively higher highs and lows to successively lower highs and lows, which are the components of a downward primary trend.

The reversal of a downward primary trend occurs when the market no longer falls to lower lows and highs. This happens when the market establishes a peak that is higher than the previous peak, followed by a trough that is higher than the previous trough, which are the components of an upward trend. Until the October pivot high is broken, the market has not yet printed a higher high that would confirm a bullish reversal. Objectively we cannot say the June-January downtrend is over yet. I am speculating we will break the downtrend, but objectively we have not yet. My presumptions seem to be based on a bit of a longer time frame than what you seem to be "technically" using to arrive at your conclusions regarding the purported proper label for where we are at, currently. Correction: you are only considering one time frame, one trend. For some strange reason, you repeatedly ignore my speculation (which 100% agrees with you) that we have already been in a multi-year bull market since December 2018. I am considering trends within trends. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 22, 2020, 01:00:02 AM |

|

Yeah, but I am not even really saying that the 350% increase was a bull market, but instead that it seemed to be a pretty strong sign that we had exited the bear market and that the bull market had begun. You're just limiting your definition of "bull market" to Bitcoin's multi-year bullish cycle. I was merely clarifying that I (and other traders) don't necessarily limit our usage of the term that way. 2015-2017 was a bull market. So was the first half of 2019. These bull markets occur at different time frames. I don't believe it's useful to restrict "bull" and "bear" to multi-year cycles. As a trader, I need much more granularity in my analysis to successfully navigate intermittent trends. If it pleases you, you can mentally replace every instance of "bear market" with "downtrend" or "bearish correction." It's not something worth arguing over. This is an unimportant, purely semantic issue that you are focusing on. I am merely saying that there is insufficient evidence, so far, that our current correction that has brought BTC prices all the way back down to $6,425 has reverted us to the previous bear market or that we have been knocked out of the bull market. I never suggested anything like that. It's only your arbitrary definitions that lead you to think when I say "bear" it means "the 2018 bear market hasn't ended yet." Nothing could be further from the truth. The 70% retracement since the $13,000s and the chain of lower highs and lower lows (which has still not been broken) is/was an undeniable bear market.

I am not going there... but hey you might be correct, but that surely is not my assessment. Currently, I consider it as a mere correction in a tentative bull market. That's exactly what I've already speculated: https://bitcointalk.org/index.php?topic=5218374.msg53633657#msg53633657Nothing I've said about the latter 2019 downtrend contradicts that theory. I do believe we are in a multi-year bull market. That unfortunately tells us nothing about what will happen in the next few months (or what happened in the last few months), hence my consistent attempts to further speculate on shorter term movements: https://bitcointalk.org/index.php?topic=5196072.80At the monthly time frame, there is no obvious break of that trend yet. That's what I mean by saying "bears can rightfully keep repeating we're in a mid/long term downtrend." Until the October and November pivots are engulfed to the upside, they are technically right.

You can give weight to whatever timeline that you want in order to conclude what is "technically" correct or not. You're just speaking in vague terms and going with your gut feeling. That's fine but I can't operate that way as a trader. I'm simply applying a rigorous and accepted definition of "uptrend" and "downtrend" based on Dow theory, because being on the right side of the mid-term trend is vital to surviving the market: A reversal in the primary trend is signaled when the market is unable to create another successive peak and trough in the direction of the primary trend. For an uptrend, a reversal would be signaled by an inability to reach a new high followed by the inability to reach a higher low. In this situation, the market has gone from a period of successively higher highs and lows to successively lower highs and lows, which are the components of a downward primary trend.

The reversal of a downward primary trend occurs when the market no longer falls to lower lows and highs. This happens when the market establishes a peak that is higher than the previous peak, followed by a trough that is higher than the previous trough, which are the components of an upward trend. Until the October pivot high is broken, the market has not yet printed a higher high that would confirm a bullish reversal. Objectively we cannot say the June-January downtrend is over yet. I am speculating we will break the downtrend, but objectively we have not yet. My presumptions seem to be based on a bit of a longer time frame than what you seem to be "technically" using to arrive at your conclusions regarding the purported proper label for where we are at, currently. Correction: you are only considering one time frame, one trend. For some strange reason, you repeatedly ignore my speculation (which 100% agrees with you) that we have already been in a multi-year bull market since December 2018. I am considering trends within trends.I said my part, and you said your part. Could be somewhat semantical, and surely I am not attempting to call BTC price moves in shorter time frames, but I do frequently engage in rebuttal attempts towards members who seem to be assigning what I consider to be too high of probability value towards one direction or another, especially when it comes to short-term predictions. Seems to me that sgbett's post had sparked my post in that direction, rather than your post, unless you are agreeing with Sgbett's $5,200 prediction for February 10th-ish? In other words, I am not really attempting to call anything, except that I was attempting to assert that sgbett's prediction of $5,200 by February 10 was way too pie in the sky bearish based on what seems to be current circumstances.. which is way the fuck more than just semantical insignificance. I also attempted to explain why I want to use such terms and what they mean to me. No need for me to repeat what I already said. Sure, I understand that you feel that you need to attempt to make assessments for shorter time frames and you want to use terms that attempt to describe what you are saying on a shorter time frame, and y disagreement with those terms seems to go a bit beyond semantics since it seems to go towards the assignment of probabilities to short term price directions, too, as I already attempted to explain my framework. We might just be repeating ourselves, unnecessarily, at this point. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

sgbett (OP)

Legendary

Offline Offline

Activity: 2576

Merit: 1087

|

|

January 28, 2020, 03:55:32 PM |

|

Well damn, you are all going to think I'm absolutely off my rocker, but then it wouldn't be the first time  Before I continue, I spotted this... ...I understand that bears say all kinds of things prematurely because they are trying to get the downward momentum to cause their proclamations to become true...

I want to just point out how absurd it is to still think that it possible that some crappy chart on a bitcoin talk thread (least of all one from a "BSV Shill" like me) can have *any* effect on price. It was bad enough in 2012, now... I think its probably time to put that idea to bed  Anyway, you didn't come here for that, you came here for ridiculous speculation and I've got that in spades. I was gazing at the 1month chart, looking at my long term forecast, thinking how it was OK but it didn't seem to be quite right, then suddenly this hit me. The Elliot-wave downtrend "ABC" is a 3-wave... so plotting that on post gox and then goxfractalstrapoliting it up gave me this. Furthermore, we all know that markets (not just BTC) love to go back and retest highs, it did post gox - no reason to think it wouldn't this time, so I figured the target region would be the wick at the ATH. With that I give you the nightmare horror story that is a ~$1150 bottom:  So please, fire away & rip it to shreds. I'm used to it by now  |

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution" - Satoshi Nakamoto*my posts are not investment advice*

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 28, 2020, 04:23:08 PM |

|

Well damn, you are all going to think I'm absolutely off my rocker, but then it wouldn't be the first time  Before I continue, I spotted this... ...I understand that bears say all kinds of things prematurely because they are trying to get the downward momentum to cause their proclamations to become true...

I want to just point out how absurd it is to still think that it possible that some crappy chart on a bitcoin talk thread (least of all one from a "BSV Shill" like me) can have *any* effect on price. It was bad enough in 2012, now... I think its probably time to put that idea to bed  Anyway, you didn't come here for that, you came here for ridiculous speculation and I've got that in spades. I was gazing at the 1month chart, looking at my long term forecast, thinking how it was OK but it didn't seem to be quite right, then suddenly this hit me.The Elliot-wave downtrend "ABC" is a 3-wave... so plotting that on post gox and then goxfractalstrapoliting it up gave me this. Furthermore, we all know that markets (not just BTC) love to go back and retest highs, it did post gox - no reason to think it wouldn't this time, so I figured the target region would be the wick at the ATH. With that I give you the nightmare horror story that is a ~$1150 bottom:  So please, fire away & rip it to shreds. I'm used to it by now  You are so knowingly bonkers that you cannot even take yourself seriously enough to make a straight-faced prediction... and that is usually what makes better humor into GREAT humor.... hahahahaha ... that's why you have so many qualification framings in your phraseologies... (nearly the whole thing is like one BIG qualifier... that I have bolded some of your chosen hilarious parts), merely to prepare us for your level of ridiculous that you don't even believe to be anywhere close to being possible.  |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

fabiorem

|

|

January 28, 2020, 05:00:16 PM |

|

This prediction by sgbett miss one thing: the big green candle at the start of the first wave.

Instead you have some smaller green candles, which means the ATH was not as manipulated as it were in 2013.

The A wave in the second group is also at a higher point than in the first.

You see, even bears believe in the four-year cycle. But after StF got busted, repetition is not certain.

|

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 28, 2020, 08:54:39 PM |

|

Well damn, you are all going to think I'm absolutely off my rocker, but then it wouldn't be the first time  Before I continue, I spotted this... ...I understand that bears say all kinds of things prematurely because they are trying to get the downward momentum to cause their proclamations to become true...

Just want to point out that I was misquoted here. JayJuanGee wrote that in response to me: https://bitcointalk.org/index.php?topic=2541338.msg53656118#msg53656118That C wave looks awfully exaggerated in magnitude. I also don't see how it fits into the higher degree wave count. I won't say it's impossible but it doesn't seem like the most likely scenario. You see, even bears believe in the four-year cycle. But after StF got busted, repetition is not certain.

Stock to flow, busted? Why? |

|

|

|

|

fabiorem

|

|

January 29, 2020, 12:44:25 PM |

|

Stock to flow, busted? Why?

Because the price didn't recover. According to those charts, we should be above 10k right now. Unless we see some big green candle in the upcoming weeks, the model will be put into question. Stretching the lines will not help, since its a mathematical model. And by big green candle, I mean a rocket launching bitcoin from the current price to 25-30k. This would burn the bears and start the real bull run. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10211

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 29, 2020, 04:00:21 PM |

|

Stock to flow, busted? Why?

Because the price didn't recover. According to those charts, we should be above 10k right now. Unless we see some big green candle in the upcoming weeks, the model will be put into question. Stretching the lines will not help, since its a mathematical model. And by big green candle, I mean a rocket launching bitcoin from the current price to 25-30k. This would burn the bears and start the real bull run. That's ridiculous. You seem to be trying to paint some kind of impossible bullish picture for bitcoin in order for the stock to flow model to be correct, or to make it easier to be proven wrong. The price could be 50% off of the model for short periods of time and the stock to flow model could still end up being correct. The fact of the matter is that bears, bitcoin naysayers (including bitcoin attackers) and alt coin pumpeners would like to employ resources to either cause the stock to flow model to seem to be wrong or to actually cause bitcoin price dynamics that would actually break the model.. good luck with that, you are going to need it. Let's say for example, bears et al are able to manipulate BTC prices down for several years into the future to both cause the BTC prices to be way below stock to flow model or even to be out of line with the four-year fractal model. Absent some kind of bitcoin blackswan situation, they are likely only going to be able to achieve such success of keeping BTC prices down for so long before such prices end up violently bouncing back. We have already witnessed these kind of dynamics in bitcoin history on a large number of occasions, and there is almost no reason to believe that such dynamics do not continue. In other words, bears et al are motivated to push btc prices down for as long as they can and for as low as they can through whatever means that they can achieve it whether physically dumping bitcoin or employment of new financial instruments to attempt to dump by using fractal reserve instruments or to spread FUD (and sometimes even FUD that have some stronger basis in reality). Of course, NON of this is really inevitable, but it is going to be scary if you bear wannabes are preparing ur lil selfies too much for down, and there just are NOT enough resources available to continue to fight and win against the ongoing underlying powers of king daddy. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Torque

Legendary

Offline Offline

Activity: 3556

Merit: 5041

|

|

January 29, 2020, 07:16:30 PM |

|

Sgbett: spending all of his time/effort on telling you how low Bitcoin will go, but none of his time predicting how high it will go. The very definition of a troll.  |

|

|

|

|

Febo

Legendary

Offline Offline

Activity: 2730

Merit: 1288

|

|

January 29, 2020, 07:32:26 PM |

|

With that I give you the nightmare horror story that is a ~$1150 bottom:

So instead of $2483 bottom 19 Feb 2021, we have now $1150. When will this one happen? 2022, maybe later? EDIT: Uh, I see from the chart. Autumn 2021. Well I can give you a news, that unless there will be huge recession at that time, which is actually possible, that will not be the case. |

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

January 29, 2020, 07:54:01 PM Merited by JayJuanGee (1) |

|

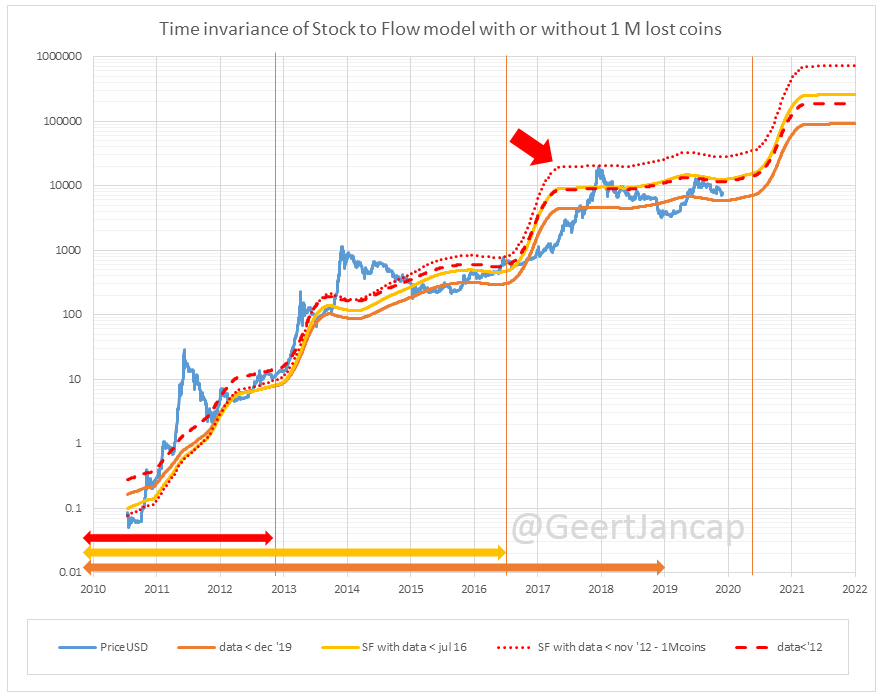

Stock to flow, busted? Why?

Because the price didn't recover. According to those charts, we should be above 10k right now. That's not how stock-to-flow works. The price doesn't stay glued to it. The market can easily front run or lag behind it. Look at how long price remained below SF in 2015, and how the 2017 bubble lagged behind the halving-driven SF increase in 2016:  So instead of $2483 bottom 19 Feb 2021, we have now $1150. Sort of like when a gambler doubles down on his losses.  |

|

|

|

STT

Legendary

Offline Offline

Activity: 3906

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

|

January 29, 2020, 10:58:24 PM |

|

but none of his time predicting how high it will go.

I always think of BTC volatility like a Richter graph which is very sharp but in both directions. It could easily still be called out as a criticism to say BTC is volatile but its rising very fast, that is a form of instability even if people like the sharply rising prices. So yea, seems to be with some bias to leave out the positives people might like but are still part of the details of a negative argument against BTC. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

sgbett (OP)

Legendary

Offline Offline

Activity: 2576

Merit: 1087

|

|

February 10, 2020, 11:15:22 AM |

|

So the support around 6500 held very strong at the end of last year and seems to be a solid foundation for this reversal in the downtrend of Q3-4 of 2019. The move over 10k didn't stick but resistance in that area built up in mid 2019 would explain that. So what, you are saying sgbett.... that maybe the bear market is over!? I dunno lets take a look, for sure, from the chart its getting to the point where I would have to conceded that downward momentum has been arrested.  So what I am seeing is how ~6400-10,300 could act as a bit of consolidation range whilst the market figures out which direction it wants to go. I can also see what could be a bullish pennant, which would mark continuation of the 200-20k upwards move, with around a $350k target! Would I buy back into BTC? hell no! "fundamentals". See "Bitcoin: A Peer-to-Peer Electronic Cash System", sorry (not sorry). Am I trolling, ask yourself who keeps posting image macros and desperate ad-hom in order to assuage their fears. Same old story. I've been on spec subform years and have a long history of both bullish and bearish price calls. This thread is no different (e.g the part where in the overall picture I said it would go from 6 to 16k then from 5 to 10k, that's not exactly bearish price action!). So knowing that it is a fact I call Bothe ways, suggestions that I only ever consider "how low bitcoin can go" ( lolwut?) highlights the ever present menace of people that do not know their history, and/or refuse to learn from it. Those people post an awful lot... who is trying to the influencing here? What they fail to realise, is that my economic incentives are in check (Yes I am all in BSV, yes I still have a BTC hedge position via an ETF which I have mentioned several times in this thread) which I think makes for much more honest commentary. My ability to think is not clouded by the prospect of significant financial loss should an opposing thesis turn out to be correct, nor is my vision blocked by the peak of a cap. If you are trading BTC good luck, i'm sure there is money to be made (and lost). If you are buying/holding as a long term investment you sure as hell better understand what exactly it is you own. |

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution" - Satoshi Nakamoto*my posts are not investment advice*

|

|

|

|