johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 12:08:00 AM

Last edit: September 27, 2013, 10:43:11 AM by johnyj |

|

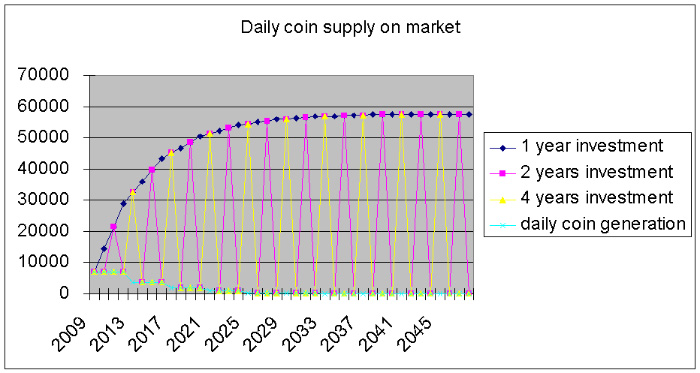

Joe had $1000, he bought 100 bitcoins at $10. After one year, he sold them for $1100 at $11. He spent $100 and reinvested the rest $1000 back into bitcoin Only 10 bitcoins were actually sold from him the second year, and 9 bitcoins will be sold from him the year after, etc... He will be able to spend $100 year after year, like a 10% interest earned forever So, if everyone sell 10% of their purchased coins per year, and the number of coins per day is decreasing by 16% per year (50% every 4 years), the coin supply will still derease by 6% per year This means, with a good cash out strategy (sell 10% of coins each year), people could keep making profit while maintain the deflation trend of bitcoin, thus price will appreciate continuously, at least 6% per year In above case, Joe only buy once and keep cashing out year after year, so averagely each year there should be 1.04x more people to buy bitcoins (if every one spend only $1000 like Joe), in order to keep the 10% price appreciation (together with a 6% decrease in supply) If the price appreciation speed is higher, say 100% per year, Joe can still keep this 10% cash out strategy, but the second year he will have much higher amount to spend, and that will also require 2x number of new joiner to support the higher bitcoin price What if Joe decided to purchase $1000 worth of coins each year until he retire after 30 years? Same, but price appreciation speed will be much higher during those 30 years because of constant buying support and no sell pressure from him. He would have accumulated so much coins during those 30 years, and when he start to spend 10% of them, he will cause a large increase in coin supply, but his profit will be bigger since he reinvested all the returns back into bitcoin during those years No matter one year or 30 years investment period, after Joe quit, if there is another Joe start to invest in bitcoin, the demand for bitcoin will not reduce, just like a pension fund, Joe's children and grand children will join it one after another, so long term wise this is sustainable With many different investors that holding from 1 year to 30 years, and different start time, the sell pressure will be more evenly distributed, if all of them hold a strategy of cashing out no more than 10% each year, then they will all benefit from the investment So, it is easy to see, even the underlying bitcoin economy does not grow at all, just because bitcoin's deflation nature, it will become a perfect medium for saving and investment If bitcoin's supply can be arbitrarily changed like fiat money, then all of these won't work at all (Edit: added the simulation of daily coin supply for 1, 2 and 4 years investing period)  |

|

|

|

|

|

|

|

|

|

|

|

|

The Bitcoin software, network, and concept is called "Bitcoin" with a capitalized "B". Bitcoin currency units are called "bitcoins" with a lowercase "b" -- this is often abbreviated BTC.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Priceslide

Full Member

Offline Offline

Activity: 220

Merit: 102

Hello

|

|

August 19, 2013, 05:14:48 AM |

|

What if an alt-coin reaches the same adoption level as Bitcoin? Wouldn't that be seen as effectively increasing the total number of available coins, therefore devaluing BTC?

|

reddit.com/r/kinfoundation

|

|

|

frankenmint

Legendary

Offline Offline

Activity: 1456

Merit: 1018

HoneybadgerOfMoney.com Weed4bitcoin.com

|

|

August 19, 2013, 05:31:44 AM |

|

amen brother. Makes things more interesting when you put in the fact that you could buy at the 52 week high price if youre smart about it. As I type this the ticker says 117 and put in my funds at 96 so it would make sense for me to dump it whenever I feel comfortable - safe bet would be now, but I'd like to be much more risky and wait until it gets back to 200 a peice and then Ill cash a little bit out.

Agree with alts. What makes things more interesting though is exchanges. I've found that with maybe 5 bitcoins (which is possible to appreciate very slowly over time) could allow adequate coverage across all alts to the point to where you can play the martingale strategy if desired. I've seen great positive swings in value on my alts despite having used a substantial portion on litecoin market alts. If the price of litecoin skyrockets, then in principle by proxy so do all those litecoin valuation dependent alts as well.

We need an open api that allows any alt to be transacted like a bar code with a built in message to be attached. mtgox and bitinstant (currently going through a website redesign) offer tools like these, but I'd prefer something open source along with the mobile wallet apps that could be used with standalone wallets...this would allow the ecosystem to takeoff!

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 10:19:27 AM |

|

What if an alt-coin reaches the same adoption level as Bitcoin? Wouldn't that be seen as effectively increasing the total number of available coins, therefore devaluing BTC?

Unless bitcoin had some major technical problem, alt-coins will remain a small part of the bitcoin market value. When it comes to money, you need only one type, because money's universal equivalent property. Bitcoin's first mover advantage is very clear, people need one type of digital currency that has limited total supply and no central authority, as long as bitcoin works, this demand is fulfilled |

|

|

|

|

xxjs

|

|

August 19, 2013, 10:38:36 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

|

|

|

|

|

|

J603

|

|

August 19, 2013, 02:48:02 PM |

|

Joe had $1000, he bought 100 bitcoins at $10. After one year, he sold them for $1100 at $11. He spent $100 and reinvested the rest $1000 back into bitcoin

Only 10 bitcoins were actually sold from him the second year, and 9 bitcoins will be sold from him the year after, etc... He will be able to spend $100 year after year, like a 10% interest earned forever

So, if everyone sell 10% of their purchased coins per year, and the number of coins per day is decreasing by 16% per year (50% every 4 years), the coin supply will still derease by 6% per year

This means, with a good cash out strategy (sell 10% of coins each year), people could keep making profit while maintain the deflation trend of bitcoin, thus price will appreciate continuously, at least 6% per year

In above case, Joe only buy once and keep cashing out year after year, so averagely each year there should be 1.04x more people to buy bitcoins (if every one spend only $1000 like Joe), in order to keep the 10% price appreciation (together with a 6% decrease in supply)

If the price appreciation speed is higher, say 100% per year, Joe can still keep this 10% cash out strategy, but the second year he will have much higher amount to spend, and that will also require 2x number of new joiner to support the higher bitcoin price

What if Joe decided to purchase $1000 worth of coins each year until he retire after 30 years? Same, but price appreciation speed will be much higher during those 30 years because of constant buying support and no sell pressure from him. He would have accumulated so much coins during those 30 years, and when he start to spend 10% of them, he will cause a large increase in coin supply, but his profit will be bigger since he reinvested all the returns back into bitcoin during those years

No matter one year or 30 years investment period, after Joe quit, if there is another Joe start to invest in bitcoin, the demand for bitcoin will not reduce, just like a pension fund, Joe's children and grand children will join it one after another, so long term wise this is sustainable

With many different investors that holding from 1 year to 30 years, and different start time, the sell pressure will be more evenly distributed, if all of them hold a strategy of cashing out no more than 10% each year, then they will all benefit from the investment

So, it is easy to see, even the underlying bitcoin economy does not grow at all, just because bitcoin's deflation nature, it will become a perfect medium for saving and investment

If bitcoin's supply can be arbitrarily changed like fiat money, then all of these won't work at all

I don't get this logic. Your evidence for bitcoins appreciating forever... is that they appreciate forever? Why did the price of bitcoins increase from 10 to 11 in the first few lines? In order for Joe to make money, someone has to be willing to buy bitcoins for more than what they used to be worth... Who would buy bitcoins at the highest they've ever been? |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 05:05:25 PM |

|

I don't get this logic. Your evidence for bitcoins appreciating forever... is that they appreciate forever? Why did the price of bitcoins increase from 10 to 11 in the first few lines? In order for Joe to make money, someone has to be willing to buy bitcoins for more than what they used to be worth... Who would buy bitcoins at the highest they've ever been?

Thanks for the question. I'm not 100% convinced of my logic, it is just a draft, but with your question, I can go a little bit deep into this topic Price appreciated from 10 to 11, simply because there are not enough coin and there are more participants. Suppose that first year there are 10,000 people, each of them buy 0.36 coins per day at $10, total 3600 coins were bought every day If second year there are 11000 people buying coins with same amount of dollar from each person ($3.6 per day), then there will not be enough coins, since 3600 coins per day is fixed in the protocol. They will get less coin for the same amount of dollar, so the exchange rate will rise Not all the people will buy the coins at the highest price they've ever been, they will select a proper timing based on their judgement. Maybe price first rised to 13 then dropped back to 9 and end up at 11 at year end. Anyway, supply is fixed, if the coin have some history of good performance, and there are more people joining the bitcoin economy, the supply will be insufficient, the average price over a year will rise The key point is: How to make sure that there are sustainable fiat money inflow into bitcoin (so it will not become a ponzi scheme or pyramid scheme), and what is the motivation behind those purchases If you have more question regarding this, I will be very interested to hear |

|

|

|

|

J603

|

|

August 19, 2013, 06:09:14 PM |

|

Thanks for the question. I'm not 100% convinced of my logic, it is just a draft, but with your question, I can go a little bit deep into this topic

Price appreciated from 10 to 11, simply because there are not enough coin and there are more participants. Suppose that first year there are 10,000 people, each of them buy 0.36 coins per day at $10, total 3600 coins were bought every day

If second year there are 11000 people buying coins with same amount of dollar from each person ($3.6 per day), then there will not be enough coins, since 3600 coins per day is fixed in the protocol. They will get less coin for the same amount of dollar, so the exchange rate will rise.

The problem with this is that only bitcoin's rate of supply is fixed. Technically, there can be "infinite" bitcoins if we use more decimal places. All 7 billion of the people on this Earth can share one btc if we really want to. Of course, this would mean that the price of 1 BTC will increase. However, only early adopters will benefit and that's assuming that they hoard and never sell all their bitcoins and then purchase more later. Not all the people will buy the coins at the highest price they've ever been, they will select a proper timing based on their judgement. Maybe price first rised to 13 then dropped back to 9 and end up at 11 at year end. Anyway, supply is fixed, if the coin have some history of good performance, and there are more people joining the bitcoin economy, the supply will be insufficient, the average price over a year will rise Again, there can't be an "insufficient" supply. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 11:22:21 PM

Last edit: August 22, 2013, 01:50:12 AM by johnyj |

|

The problem with this is that only bitcoin's rate of supply is fixed. Technically, there can be "infinite" bitcoins if we use more decimal places. All 7 billion of the people on this Earth can share one btc if we really want to.

Of course, this would mean that the price of 1 BTC will increase. However, only early adopters will benefit and that's assuming that they hoard and never sell all their bitcoins and then purchase more later.

If 3600 people purchase 3600 coins, each of them will receive 1 coin in average, if 7200 people purchase 3600 coins, each of them will get only 0.5 coin. If the amount of fiat money spent per person is the same, per coin cost will double Regarding the sustainability, my first post just tried to show: It does not matter if you are an early adopter or not, as long as there are another people similar to you purchase bitcoin the year after you, you only need to purchase once and then you are able to cash out 10% each year forever Imagine this: There are 10000 people purchased bitcoin in 2013, from 2014 they start to cash out and never buy any coin again. In order to maintain a price increase of 10% per year, you only need 11000 people to purchase bitcoin in 2014 (same amount of investment from each of them). And those 11000 people will also do the same, they never buy any coin after 2014, cash out 10% per year. And 2015 you need 12100 people to purchase bitcoin in order to maintain the price appreciation speed, and so on... Of course the real situation is a bit complex, because you will have those extra coin supply coming from those early buyers (they cash out 10% of their coins each year), that will make the coin supply increase at the beginning. But due to the coin supply will cut by half every 4 years, long term wise daily coin supply would still shrink I took some numbers and did a deeper analysis, Y axis showing the daily coin supply (Edit: this chart is wrong, see the later chart below)  You can see that 10% cash out strategy will not change bitcoin's deflative nature. The interesting thing is, even a 50% cash out strategy still won't change the long term projection, although the coin supply will increase more during the first 4 years, but after 11 years, its daily coin supply will drop below the level of the 10% cash out strategy This chart also indicated: It is always at the beginning of the decade you will face a big sell pressure from the early adopters. If they never reinvest, their sell pressure on the market will get less and less each year Now with this chart, the long term sustainability is even clearer Another question is: If every year more people need to buy the coins and they only buy coin once, for how long the earth population is enough to support the scenario My first thought: Every year there are many people joining the work force, and those people will have some extra money to purchase bitcoin. As long as those people put more money into bitcoin than previous year (due to rising income or rising population), and bitcoin supply is constantly shrinking (even include the cash out from early adopters), the price appreciation can be guaranteed forever. This is the same mechanism of a pension fund With a guaranteed income from bitcoin value increase, people will have the confidence to spend, and no matter what kind of cash out strategy they have, it will not hurt the long term appreciation trend of bitcoin. This means, a deflative currency still encourage people to spend because of their guaranteed future income! Isn't it amazing for such a genius design from Satoshi?  |

|

|

|

CoinChex

Newbie

Offline Offline

Activity: 38

Merit: 0

|

|

August 20, 2013, 12:56:26 AM |

|

Dude you need a disclosure at the bottom of this -

*Past performance is not indicative of future results. Nothing is guaranteed. The opinion of the author is his own and does not directly reflect the opinions of the bitcoin economy.

|

|

|

|

|

foggyb

Legendary

Offline Offline

Activity: 1666

Merit: 1006

|

|

August 20, 2013, 01:07:11 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

There are ALREADY altcoins out there that offer improvements on bitcoin. Everyone must be dumping their bitcoins for these better coins, right? Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup. The 3rd reason that I believe a 'better' altcoin won't usurp bitcoin is this: bitcoin protocol can be upgraded. Its not static. |

I just registered for the $PLOTS presale! Thank you @plotsfinance for allowing me to purchase tokens at the discounted valuation of only $0.015 per token, a special offer for anyone who participated in the airdrop. Tier II round is for the public at $0.025 per token. Allocation is very limited and you need to register first using the official Part III link found on their twitter. Register using my referral code CPB5 to receive 2,500 points.

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 01:10:50 AM |

|

Dude you need a disclosure at the bottom of this -

*Past performance is not indicative of future results. Nothing is guaranteed. The opinion of the author is his own and does not directly reflect the opinions of the bitcoin economy.

Ha, this statement applies perfectly to fiat money, which no one knows how much more FED will print. For a fixed total supply money like bitcoin, such kind of statement is not needed. People get used to an uncertain future because once a while FED will come out and destroy all the people's projection with their OMO I'm not selling any financial products or services, just some research and a conservative hypothesis, not related to real world historical performance of bitcoin in anyway |

|

|

|

Cluster2k

Legendary

Offline Offline

Activity: 1692

Merit: 1018

|

|

August 20, 2013, 04:54:15 AM |

|

Bitcoin will only appreciate in value "forever" if people who want to own bitcoins are willing to pay ever higher prices for them. There is also always scope for something better, faster and easier to use to come along which can send bitcoin's value plummeting. Enjoy the ride and don't forget to cash out to cover all costs.

|

|

|

|

|

|

xxjs

|

|

August 20, 2013, 07:11:10 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

There are ALREADY altcoins out there that offer improvements on bitcoin. Everyone must be dumping their bitcoins for these better coins, right? Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup. The 3rd reason that I believe a 'better' altcoin won't usurp bitcoin is this: bitcoin protocol can be upgraded. Its not static. They have to be better all things considered, and not just a little bit better, because of the reputation that bitcoin now builds up. But a better coin is thinkable. It could also be an improvement of bitcoin itself. |

|

|

|

|

|

xxjs

|

|

August 20, 2013, 07:34:10 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Speculation tends to speed up the change and make us achieve the top of the S earlier.

Dramatic things can happen: War, general destruction of capital and productivity: higher prices (lower bitcoin value). A deadly epidemic disease, fewer users: higher prices(lower bitcoin value). Bitcoin goes out of fashion because all states of the world gradually transforms to totalitarianism: higher prices (lower bitcoin value).

|

|

|

|

|

|

shields

|

|

August 20, 2013, 08:58:16 AM |

|

Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup.

Great example, nothing will ever top VHS right? it has first mover advantage, meaning no superior video formats will ever replace it. |

If you liked this post -> 1KRYhandiYsjecZw7mtdLnoeuKUYoGRkH4

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 10:47:56 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

The value maybe never started at 0, since there is a cost, no matter how small it is. Running CPU mining on a computer still need some hardware investment and electricity and maintenance 2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Yes, an exponential increase in the user base will cause the price to rise quickly, but due to there are always new baby born each day, the new users that start to purchase bitcoin will stay relatively stable after a full saturation of existing potential users In such a situation, the price appreciation will purely depend on the population growth and productivity growth. Suppose that population growth is 0, e.g. every day same amount of new people start to purchase bitcoin, then productivity growth will decide the growth of the bitcoin value. Since there will never be liuquidity problem with bitcoin, the productivity growth will always be at their optimum speed |

|

|

|

|

xxjs

|

|

August 20, 2013, 11:31:14 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

The value maybe never started at 0, since there is a cost, no matter how small it is. Running CPU mining on a computer still need some hardware investment and electricity and maintenance Don't agree with this one, we don't support valuation base on cost around here, only subjective valuation from the market. 2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Yes, an exponential increase in the user base will cause the price to rise quickly, but due to there are always new baby born each day, the new users that start to purchase bitcoin will stay relatively stable after a full saturation of existing potential users In such a situation, the price appreciation will purely depend on the population growth and productivity growth. Suppose that population growth is 0, e.g. every day same amount of new people start to purchase bitcoin, then productivity growth will decide the growth of the bitcoin value. Since there will never be liuquidity problem with bitcoin, the productivity growth will always be at their optimum speed Mostly agree. You forgot the lost coins. The consequence of all this is, yes, bitcoins will appreciate forever, but hopefully eventually rather slowly so it does not disturb the day to day trade. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 11:37:21 AM |

|

Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup.

Great example, nothing will ever top VHS right? it has first mover advantage, meaning no superior video formats will ever replace it. Consumer products and money are very different Money must be able to carry value through decades, people put their value and trust in money, highest credibility and popularity is the key Most of the credibility of bitcoin come from its limited total supply. Alt-coins are inflation in the crypto currency world, this is against the idea of deflative currency, and dilute the wealth in crypto currency world. Even they are technically superior, they are politically wrong I have mined several different coins but most of them disappeared after 1 year, finally I realized that people here don't want their wealth to be stolen by inflation, be it a central bank or an alt-coin |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 21, 2013, 10:01:37 PM

Last edit: August 22, 2013, 01:42:12 AM by johnyj |

|

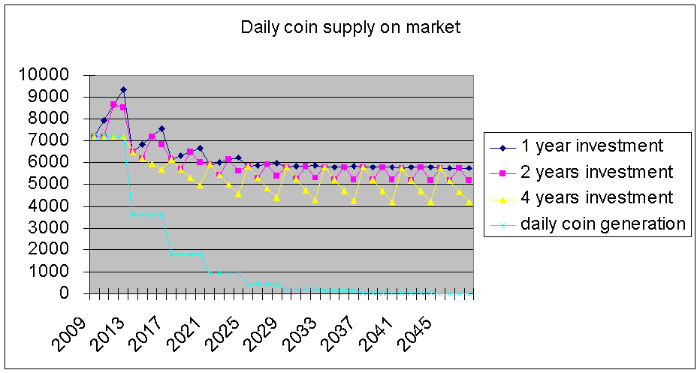

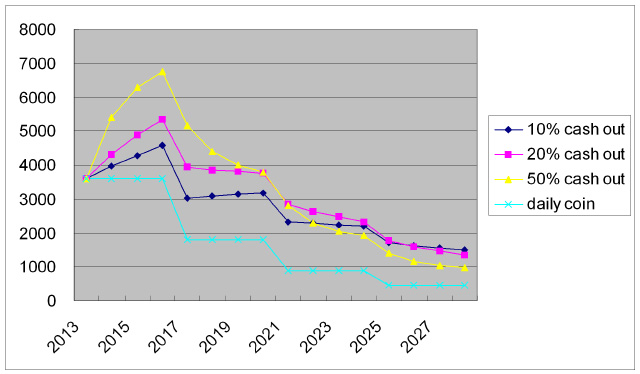

The motivation behind alt-coin is very clear: Many people missed the chance to be an early adopter of bitcoin, they saw the huge benefit of being an early adopter of bitcoin (much less difficulty and much more coins), and want to become an early adopter of an alt-coin But this is the same as time travel trading. When thousands of geeks were mining bitcoin with their CPUs and GPUs, the price of bitcoin were very low, they never knew that one bitcoin will worth $100 today, just like today's miner never know if one bitcoin will worth $10,000 some time in the future And, just as my analysis revealed, the early adopter's sell pressure will only be temporary during the first several years, it becomes less and less each year, for all the people joined after the first reward halving, they won't be affected too much I made the chart again from 2009 (Edit: corrected an error in previous calculation, those cashed out coins would be bought together with newly mined coins and they will increase the daily coin supply until each reward halving)  For 10% cash out strategy, the coin supply will be shrinking slowly. The 20% cash out strategy would keep the coin supply constant, and 50% cash out each year will cause the daily coin supply to increase very fast. A price appreciation can be projected if cash out less than 20% per year Looking back at 2011-2012, the coin supply actually increased a lot (over 10000 coin per day) due to the cash out pressure from early adopters, maybe that is the reason the last price crash is much more severe than this time (it crashed from 30 to 3) This chart is just a hypothesis, we all know that there are many coins never moved since they were mined, the actual cash out speed could be less than 5% per year |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

September 27, 2013, 01:20:35 AM

Last edit: September 04, 2014, 02:46:00 PM by johnyj |

|

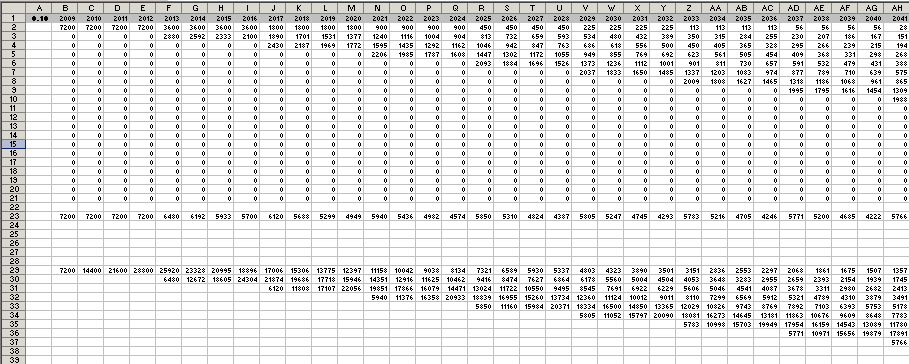

I went a little bit deeper into this analysis, here is a screen shot of my excel sheet: In the upper part of the chart, each row represent part of the coin supply, row 2 represent the number of coins coming from daily mining reward, row 3 through row 9 are number of coins sold by a corresponding row of investors in the lower part of the chart In the lower part of the chart, each row represent the number of coins that a group of investors hold Take Row 29 for example: This group of investors mine/purchase all the daily coin mined during the first 4 years period, the number of coins they hold rise year after year. From the 5th year, they stop buying and start to sell part of their holdings every year, at a rate that is defined in cell A1(10% in this chart), so their number of coins shrink continuously through F29, G29, etc... Row 30: From the 5th year, another group of investors enter the market, they have the same strategy: First save for 4 years and then spend 10% each year. Notice that they could only mine/purchase 6480 coins per day: F2 (daily coin generation) and F3 (cash out by the first group of investors) Row 31 means another group of investors from the 9th year enter the market, and they could only get 6120 coins per day due to a summarize of J2,J3 and J4 (J3 and J4 are spending from 1st and 2nd group investors) Row 23 is a summarize of all the coin supply from the upper part of the chart, e.g. the total daily coin supply on market  |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

September 27, 2013, 01:28:20 AM

Last edit: June 07, 2014, 12:22:55 PM by johnyj |

|

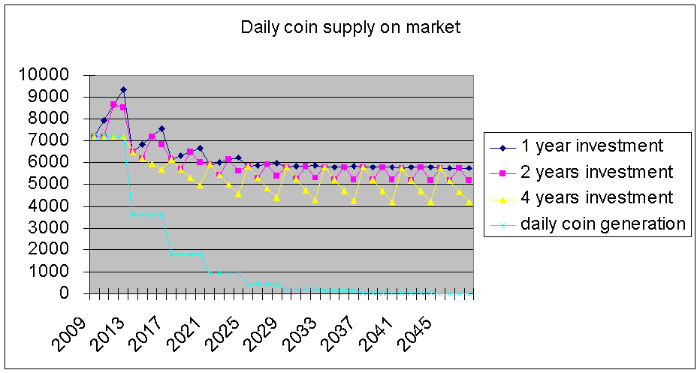

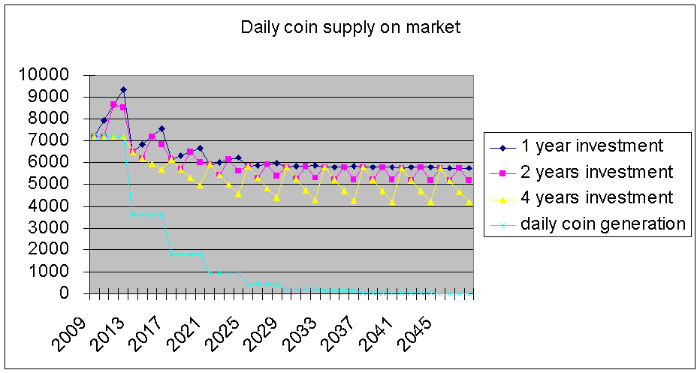

The recent polls ( https://bitcointalk.org/index.php?topic=296264 and https://bitcointalk.org/index.php?topic=295753) indicated that majority of the miners and traders will select a less than 10% per year spending strategy, so this chart shows the daily coin supply under such a spending strategy  The chart showed different daily coin supply under 3 different scenarios: Investing for 1,2 or 4 years, then spend 10% each year afterwards Under a 10% spending strategy, after about 16 years, the daily coin supply will be stabilized at a level around 5000-6000 bitcoins. The volatility for 2 and 4 year curve comes from the assumption that one group of investors only purchase during a 2 or 4 years period, in reality the curve should be much smoother, since there are investors starting anytime So it is clear to see, under a 10% spending strategy, the future daily coin supply will never get above 5000-6000 coins, and if the investment increase due to more population or higher productivity, the coin value will appreciate forever Even all the existing person have already fully invested in bitcoin, there are still 370,000 babies born every day. Suppose that each day same amount of person start to invest in bitcoin, and they are competing for those 5000 coins, they would averagely get 0.0135 coin per person  Suppose that each person need $ 1,350,000 for a comfortable retirement, and they put all those savings into bitcoin and get 0.0135 coin, e.g. 1,350,000 satoshi, this means 1 satoshi = 1 usd, 1 BTC will worth 100 million dollars, this might be the highest possible value bitcoin can achieve |

|

|

|

|

David Rabahy

|

|

October 11, 2013, 07:29:52 PM |

|

It is clear the OP is just beginning to understand the dynamics of this thing called Bitcoin (and many other things).

When I purchased my Bitcoins on an exchange, the coins came from someone (or perhaps multiple people) willing to sell them (the Bitcoins weren't created then and there new just for me). If I *ever* sell my Bitcoins on an exchange then they will go to someone et al willing to buy them; if there is no one then I won't be able to sell them at all, i.e. the effective exchange rate goes to zero. The number of Bitcoins doesn't go up or down per se during these exchanges.

The exchange rate (for example, USD/BTC) can vary (sometimes wildly) even when people brand new to Bitcoin are or are not purchasing their very first Bitcoins ever. The exchange rate is fundamentally a measure of relative confidence with the supply and demand dynamics impacting the confidence considerably. The Bitcoin exchange rate is very unlikely to increase steadily. Predicting when exactly to exchange out 10% each year is actually much harder than imagined. Worse, if you expect it to continue to rise then why exchange out at all? If you take too much into Bitcoin and need to exchange some out to make purchases available only in fiat then that was a risk (some might call it a mistake).

New people are born; old people die (for now). New people have little ability at first to purchase Bitcoins; they might be given some as gifts. Dying old people put their Bitcoins at risk of being lost if they don't take steps to make them available to their beneficiaries.

A wide variety of hopefully unlikely catastrophes can befall Bitcoin pushing confidence down; down even to zero.

|

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

October 11, 2013, 08:42:49 PM

Last edit: January 13, 2015, 09:18:40 PM by johnyj |

|

The exchange rate is fundamentally a measure of relative confidence with the supply and demand dynamics impacting the confidence considerably. The Bitcoin exchange rate is very unlikely to increase steadily. Predicting when exactly to exchange out 10% each year is actually much harder than imagined. Worse, if you expect it to continue to rise then why exchange out at all? If you take too much into Bitcoin and need to exchange some out to make purchases available only in fiat then that was a risk (some might call it a mistake).

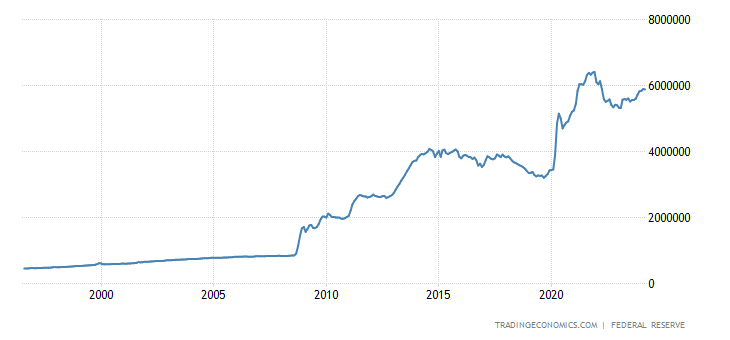

The biggest confidence of bitcoin comes from the limited/fixed supply and unlimited demand. It can not be inflated by central banks, nor inflated by added gold producers. You can spend 10% per year by evenly distribute the spending throughout the year. You start to cash out or spending when you have already accumulated enough coins, and if you cash out carefully, you won't affect the constantly shrinking supply trend. (Actually, even with a 100% cash out strategy (everyone sold all of their coin after one year), the daily coin supply will still stablize after 10 years, and it will only be 1 magnitude higher than a 10% cash out scenario, like 60,000 coins per day) And of course those 370,000 babies per day will not buy the coin when they were born, but when they grew up 20 years later. Currently you have more than 500,000 grown ups entering the bitcoin world everyday due to higher birth rate 20 years ago, and no old people die with bitcoin savings yet Daily coin supply for 100% cash out strategy after a certain investment period  I think at current price level, those who have already accumulated >10k bitcoins are the major spenders in bitcoin economy. In fact, lots of bitcoin promoters today are those early adopters who accumulated enough coins and have the motivation to drive this ecosystem further |

|

|

|

|

zachcope

|

|

October 11, 2013, 10:21:26 PM |

|

You need to consider the difference between the fiat price of bitcoin vs the purchasing power in goods and services of a bitcoin.

The fiat price will go up faster than the purchasing power so that the 100 dollar cash out becomes worth less and less over time.

This is due to fiat inflation vs increased utility of bitcoin as a store of value and way to transfer value over time.

|

|

|

|

Shallow

Sr. Member

Offline Offline

Activity: 938

Merit: 255

SmartFi - EARN, LEND & TRADE

|

|

October 12, 2013, 06:40:54 AM |

|

These charts don't really make much sense. Bitcoin could drop significantly at any time and there is a possibility (albeit a small one) of an altcoin usurping bitcoin.

|

|

|

|

|

cowandtea

|

|

October 12, 2013, 07:00:35 AM |

|

Not if the Bitcoin market continue to get harass by US government. At this rate, every Bitcoin related market would be closed down and Bitcoin would had no value  |

|

|

|

hashman

Legendary

Offline Offline

Activity: 1264

Merit: 1008

|

|

October 12, 2013, 08:29:11 AM |

|

Not if the Bitcoin market continue to get harass by US government. At this rate, every Bitcoin related market would be closed down and Bitcoin would had no value  Yeah, like remember all those other things folks claiming to be goverment officials claimed the right to confiscate? They really dropped in value didn't they. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

October 12, 2013, 07:12:56 PM

Last edit: October 12, 2013, 08:20:45 PM by johnyj |

|

You need to consider the difference between the fiat price of bitcoin vs the purchasing power in goods and services of a bitcoin.

The fiat price will go up faster than the purchasing power so that the 100 dollar cash out becomes worth less and less over time.

This is due to fiat inflation vs increased utility of bitcoin as a store of value and way to transfer value over time.

The cash out strategy is based on a percentage of bitcoin holding, nothing to do with exchange rate. You should also consider that not only fiat money can exchange bitcoin, but also anything else with a value (goods/services/gold/securities, etc...), they will further reduce the daily coin supply on the exchanges |

|

|

|

Johnny Bitcoinseed

Full Member

Offline Offline

Activity: 154

Merit: 100

Johnny Bitcoinseed

|

|

October 12, 2013, 09:35:28 PM |

|

I'm thinking that eventually bitcoin will stand on its own. That is, you don't so much trade bitcoin for dollars and then dollars for bitcoin. Rather you earn bitcoin through your job or business and then spend them for the stuff you need and want - the people on the receiving end then spend the bitcoins and round and round it goes, no dollars needed.

As the bitcoin economy grows, each bitcoin will buy an increasing amount of stuff - its value is increasing because of its limited nature. But you never run out because bitcoins can be divided into tens of thousands of units. Perhaps one day 1/1000th of a bitcoin could purchase what one full bitcoin does today.

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

October 12, 2013, 11:46:41 PM

Last edit: October 13, 2013, 12:06:46 AM by Erdogan |

|

I'm thinking that eventually bitcoin will stand on its own. That is, you don't so much trade bitcoin for dollars and then dollars for bitcoin. Rather you earn bitcoin through your job or business and then spend them for the stuff you need and want - the people on the receiving end then spend the bitcoins and round and round it goes, no dollars needed.

As the bitcoin economy grows, each bitcoin will buy an increasing amount of stuff - its value is increasing because of its limited nature. But you never run out because bitcoins can be divided into tens of thousands of units. Perhaps one day 1/1000th of a bitcoin could purchase what one full bitcoin does today.

Bitcoin stands on its own. It can be traded for other currencies and goods and services. Currently it is most practical to value it in USD, but for users of the other major currencies Yen, Pound, Euro and Renminbi, those currencies could be used for valuation. The valuation used is normally the good/money or money/money pair that has the thickest market. If necessary the users can change that in no time. See "thick market" on investopedia. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

October 14, 2013, 11:11:05 AM

Last edit: December 06, 2013, 01:37:01 AM by johnyj |

|

Actually the "less than 10% cash out strategy" is a typical practice in today's fiat money system. For example, most of the QE money went into commercial banks' pocket by purchasing bad loans from them but they save all that money at FED and receive a 2% interest for those money, only those interest were spent. A typical pension scheme is also trying to spend the interest

Since bitcoin does not generate any interest (No one will use bitcoin to invest since itself is already the most profitable investment), the only way to benefit from bitcoin is to spend coins. But that is very positive, since it re-distribute the coin to other people and so on, not like today's system, rich people only spend the interest and their fiat money get more and more, thus the wealth distribution is extremely unbalanced after several generation

|

|

|

|

|

morphtrust

|

|

April 02, 2014, 07:41:07 PM |

|

I'm thinking that eventually bitcoin will stand on its own. That is, you don't so much trade bitcoin for dollars and then dollars for bitcoin. Rather you earn bitcoin through your job or business and then spend them for the stuff you need and want - the people on the receiving end then spend the bitcoins and round and round it goes, no dollars needed.

As the bitcoin economy grows, each bitcoin will buy an increasing amount of stuff - its value is increasing because of its limited nature. But you never run out because bitcoins can be divided into tens of thousands of units. Perhaps one day 1/1000th of a bitcoin could purchase what one full bitcoin does today.

this is kinda what I am angling for by working on getting a community of people making something tangible that they have little to no money invested in making, just labor so we can start building a community that stands on crypto currency only. possibilities are endless from making common lye used for making bio diesel to a number of other things like paper, to ferric chloride, both from table salt, using cheap ugly but still new and powerful solarcells that can cost as little as 14 cents per watt they output. I have found a way to extend the useful life of a solar cell too for anyone interested so you can either expand how long you can use them up to 5 times longer, or concentrate more light (reflectors made of anything but I plan on using MDF and aluminum foil) so you get 5 times more power RIGHT NOW but the lifespan is only as long as they are normally with out protection, thus you can get that value out of them faster rather than having to wait to get it. There are tons of other things out there too that we can make at home easily if we only knew how to, so it is all down to figuring that out, and developing the skill set to allow the production and investing our spare time to do it for bitcoin or some other alt currency, instead of dollars or yuan  would be nice to figure out what our hourly time is actually work in a sort of community like that and use that to base our value on the bitcoin we collect for our work, and we can be more flexible too by charging bitcoin for the products, and dollars (if you are in the USA) for shipping or something, till we have some people join the community that can and are willing to provide shipping for bitcoin. |

"Violence, is the last refuge of the incompetent."

"Never let your sense of morals prevent you from doing what is right."

|

|

|

|

Possum577

|

|

August 14, 2014, 06:03:49 PM |

|

Any updates on this theory given the recent and significant sell off this week or based on the new retailers that have entered the market place accepting Bitcoin?

Clearly the price stability or appreciation is important to us all and there's not much thorough research on the topic.

|

|

|

|

nizamcc

Legendary

Offline Offline

Activity: 1218

Merit: 1007

|

|

August 14, 2014, 06:09:09 PM |

|

this is a bullshit theory  |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 15, 2014, 04:25:24 PM |

|

Any updates on this theory given the recent and significant sell off this week or based on the new retailers that have entered the market place accepting Bitcoin?

Clearly the price stability or appreciation is important to us all and there's not much thorough research on the topic.

I saw a poll recently showing that about 80% of people are holding their coins, so the basic behavior has not changed much. But you can see from the chart, if everyone is investing for one year and then start to spend, the daily coin supply will actually rise year after year until the next reward halving The natural appreciation tendency is caused by reward halving every 4 years, that will give a 19% appreciation each year when money inflow does not grow However, even we had a huge boost in user adoption, that won't make a 10 fold increase in money inflow in one year. Money inflow can be several times higher than last year, resulting an exchange rate of several hundred dollars Usually the technology shift causes lots of miners to lose the ability to mine and forced them to buy on exchanges, thus creating a rally. Now technology shift is over and daily coin supply will still be about 5000 coins. Since many new established large mining farms in china only sell the mined coins, the coin supply can be bigger than the time when ASIC first arrived. It is a test for how much money inflow the market really has Anyway, a 19% increase in price during a time frame of one year is almost guaranteed, anything beyond that can be regarded as a bonus due to expoential increase in adoption and money inflow To keep exchange rate at $500, for 5000 coins you need $2.5 million net inflow every day, that is about one apartment in big capital cities |

|

|

|

juliogf

Newbie

Offline Offline

Activity: 4

Merit: 0

|

|

August 03, 2015, 09:54:52 PM |

|

What happened?

|

|

|

|

|

|

neurotypical

|

|

August 04, 2015, 12:28:51 AM |

|

What happened?

Bitcoin went up forever happened:  Now it's time for a slow uptrend since it will not go under the mean. This is math. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 04, 2015, 12:04:46 PM |

|

A little summarize about the development during past year: First, increased usage will reduce the daily coin supply on market thus raise its value, An easy way to make bitcoin worth millions of dollarsHowever, the effect is not as large as long term hodling: If you constantly spend 10 coins every month, then only 10 coins will disappear from exchange, but if you hold 10 coins, they will also disappear from exchanges, for a long time With more established exchanges, the usage as remittance medium just become more user friendly. Now I'm doing all my international transactions using bitcoin, if the receiver is in a country that have good bitcoin exchange. It is much cheaper and faster than traditional way There are still limited spaces to spend bitcoin, but that means majority of merchant still have to learn how to use bitcoin by themselves, instead of relying on payment processor like bitpay. And that require a thorough understanding of bitcoin security, it will take some time. It is not recommended to rely on any third party to take care of your bitcoin, while majority of people are not geeks, this is still the major obstacle towards mass adoption Mining difficulty does not drop, this indicated that the demand is still strong. If the demand drops, the mining difficulty will drop, because majority of the demand is fulfilled by mining (lowest possible cost to get coin) So far, we have not seen hyperinflation following the huge scale of fiat money printing. Just like stock market bubble, as long as fiat money hold its value, big institutions would still ride the wave for a while. But those institutions are fully aware of the overvalued situation of fiat money, now it is a fiat money bubble, they will get rid of their fiat money positions as soon as they see the sign of a crash, we just don't know how and when it will happen |

|

|

|

|

lahm-44

|

|

August 04, 2015, 01:17:27 PM |

|

bitcoin will be appreciated forever due to its advance technology and awesome thinking the satoshi has made most of the possible system of future In short I can say he has showed us the way to develop our future a lott cooler that it was we guys has access to markets so now we can design our own future

|

|

|

|

|

ummina

Member

Offline Offline

Activity: 70

Merit: 10

★777Coin.com★ Fun BTC Casino!

|

|

August 04, 2015, 04:18:53 PM |

|

well... i think bitcoin like a magnet shipon visitor, and interest to join it.

very interesting for me, we can make money from here...

and if we can use easily and continue, this is very funny, and like a chat. just like that.

the money we can make very much if we get the positions up like Legendary "oh my god" the payment may be very much...

but if like me still little. just make it make it and make it,,, never no.... fight to try and try never give up.

you can get happynes in the end.

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 04, 2015, 06:34:31 PM |

|

There are two problems:

1. Price depends on supply and demand, and you cannot predict what might happen to the price without knowing what will happen to both supply and demand. Furthermore, you can't assume that demand will rise constantly. It is possible for demand to fall even as adoption rises.

2. You are confused about the meanings of the word "supply". "Supply" as in "money supply" is not the same as "supply" as in "supply and demand". The money supply is the total number of bitcoins in existence. It effects the supply (as in supply and demand) in the market, but is not the same thing. Furthermore, supply and demand are curves, not numbers. The price is at their intersection.

It does not matter what is the definition of supply, there are 5000 coins net sell every day on market, that is calculated after considering several facts getting from poll. There is larger transaction volume daily, but those are day traders and short term speculators, basically the buying and selling volume cancel each other, only the net sell amount matters In fact the total money supply in bitcoin is irrelevant, because many of them does not exist in circulation. It's the money in circulation matters. FED printed 5x USD but the money in circulation remains the same, that's the reason the USD did not crash in value by 5x As analyzed, if the demand falls, the first thing we will notice is that the mining difficulty will go down. Because mining is the lowest cost to get bitcoin constantly, serious investors will always first seek large mining operation, if they can not get coin through mining, they will consider buying on open market. That is the reason when ASIC arrives, suddenly many investors lost the ability to get coin from mining, thus they all went to market to purchase, and made the price rise 10 fold So far the mining difficulty is still rising, means the demand is still strong. If difficulty jumps up, then it means the demand is extremely strong |

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

August 04, 2015, 11:10:36 PM |

|

There are two problems:

1. Price depends on supply and demand, and you cannot predict what might happen to the price without knowing what will happen to both supply and demand. Furthermore, you can't assume that demand will rise constantly. It is possible for demand to fall even as adoption rises.

2. You are confused about the meanings of the word "supply". "Supply" as in "money supply" is not the same as "supply" as in "supply and demand". The money supply is the total number of bitcoins in existence. It effects the supply (as in supply and demand) in the market, but is not the same thing. Furthermore, supply and demand are curves, not numbers. The price is at their intersection.

This is correct, and the vision that bitcoin will appreciate forever, also depends on that market actors (everybody) regard bitcoin as the best money. Otherwise, it will not happen. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 05, 2015, 04:05:26 AM |

|

There are two problems:

1. Price depends on supply and demand, and you cannot predict what might happen to the price without knowing what will happen to both supply and demand. Furthermore, you can't assume that demand will rise constantly. It is possible for demand to fall even as adoption rises.

2. You are confused about the meanings of the word "supply". "Supply" as in "money supply" is not the same as "supply" as in "supply and demand". The money supply is the total number of bitcoins in existence. It effects the supply (as in supply and demand) in the market, but is not the same thing. Furthermore, supply and demand are curves, not numbers. The price is at their intersection.

This is correct, and the vision that bitcoin will appreciate forever, also depends on that market actors (everybody) regard bitcoin as the best money. Otherwise, it will not happen. Only English people using Pound is enough to support its value, similarly, only IT interested/Libertarian/Austrian economists giving bitcoin strong support can maintain its value. For merchants, it is so easy to accept international payment with bitcoin, just download an app. It has not gained enough traction because of its volatility, it takes time for people to get rid of their fear towards new things |

|

|

|

|

luciann

|

|

August 05, 2015, 04:25:14 AM |

|

There are two problems:

1. Price depends on supply and demand, and you cannot predict what might happen to the price without knowing what will happen to both supply and demand. Furthermore, you can't assume that demand will rise constantly. It is possible for demand to fall even as adoption rises.

2. You are confused about the meanings of the word "supply". "Supply" as in "money supply" is not the same as "supply" as in "supply and demand". The money supply is the total number of bitcoins in existence. It effects the supply (as in supply and demand) in the market, but is not the same thing. Furthermore, supply and demand are curves, not numbers. The price is at their intersection.

This is correct, and the vision that bitcoin will appreciate forever, also depends on that market actors (everybody) regard bitcoin as the best money. Otherwise, it will not happen. Only English people using Pound is enough to support its value, similarly, only IT interested/Libertarian/Austrian economists giving bitcoin strong support can maintain its value. For merchants, it is so easy to accept international payment with bitcoin, just download an app. It has not gained enough traction because of its volatility, it takes time for people to get rid of their fear towards new things when you speak of not attracting new users based on volatility.. are you expecting minimum like 1k like we did see fake value with mt.gox i know I got in it cause there was no option of making money and another form to get cash. |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 05, 2015, 04:38:59 AM |

|

As analyzed, if the demand falls, the first thing we will notice is that the mining difficulty will go down. Because mining is the lowest cost to get bitcoin constantly, serious investors will always first seek large mining operation, if they can not get coin through mining, they will consider buying on open market. That is the reason when ASIC arrives, suddenly many investors lost the ability to get coin from mining, thus they all went to market to purchase, and made the price rise 10 fold

So far the mining difficulty is still rising, means the demand is still strong. If difficulty jumps up, then it means the demand is extremely strong

The difficulty depends on the price (w.r.t the cost of mining). The price depends on both supply and demand. Therefore, demand can be lower when the difficulty rises and vice versa. Higher price will raise the difficulty since it created speculative mining demand - make a quick buck with mining, that is also a demand. Speculation demand is always part of the bitcoin demand, but it changes with price, not like other demands. Currently we are in a low volatility period, thus speculative demand is at its minimum. If the speculative demand is dropping while difficulty is rising, then you know there are some other type of demand quietly driving the difficulty up. Because the supply of bitcoin on market is very easy to estimate, that makes the demand the only variable that can affect price, and demand is very easy to spot through difficulty, which makes it extremely simple to model the future valuation By the way, money's value is decided by a consensus, supply and demand theory never works on money, because money can be regarded as having infinite demand, thus any change in supply will not affect money's value. This seems start to apply to bitcoin too: Bitcoin's demand can be very very high, but its value is not really decided by supply and demand, but by a consensus, around the mining cost, similar to gold |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 05, 2015, 04:47:27 AM |

|

There are two problems:

1. Price depends on supply and demand, and you cannot predict what might happen to the price without knowing what will happen to both supply and demand. Furthermore, you can't assume that demand will rise constantly. It is possible for demand to fall even as adoption rises.

2. You are confused about the meanings of the word "supply". "Supply" as in "money supply" is not the same as "supply" as in "supply and demand". The money supply is the total number of bitcoins in existence. It effects the supply (as in supply and demand) in the market, but is not the same thing. Furthermore, supply and demand are curves, not numbers. The price is at their intersection.

This is correct, and the vision that bitcoin will appreciate forever, also depends on that market actors (everybody) regard bitcoin as the best money. Otherwise, it will not happen. Only English people using Pound is enough to support its value, similarly, only IT interested/Libertarian/Austrian economists giving bitcoin strong support can maintain its value. For merchants, it is so easy to accept international payment with bitcoin, just download an app. It has not gained enough traction because of its volatility, it takes time for people to get rid of their fear towards new things when you speak of not attracting new users based on volatility.. are you expecting minimum like 1k like we did see fake value with mt.gox i know I got in it cause there was no option of making money and another form to get cash. 1k was an overshoot of the speculative bubble top. Long term wise, the coin value should be close to its mining cost, which should rise over time if there is no major disaster in bitcoin ecosystem |

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

August 05, 2015, 10:47:40 AM |

|

As analyzed, if the demand falls, the first thing we will notice is that the mining difficulty will go down. Because mining is the lowest cost to get bitcoin constantly, serious investors will always first seek large mining operation, if they can not get coin through mining, they will consider buying on open market. That is the reason when ASIC arrives, suddenly many investors lost the ability to get coin from mining, thus they all went to market to purchase, and made the price rise 10 fold

So far the mining difficulty is still rising, means the demand is still strong. If difficulty jumps up, then it means the demand is extremely strong

The difficulty depends on the price (w.r.t the cost of mining). The price depends on both supply and demand. Therefore, demand can be lower when the difficulty rises and vice versa. Higher price will raise the difficulty since it created speculative mining demand - make a quick buck with mining, that is also a demand. Speculation demand is always part of the bitcoin demand, but it changes with price, not like other demands. Currently we are in a low volatility period, thus speculative demand is at its minimum. If the speculative demand is dropping while difficulty is rising, then you know there are some other type of demand quietly driving the difficulty up. Because the supply of bitcoin on market is very easy to estimate, that makes the demand the only variable that can affect price, and demand is very easy to spot through difficulty, which makes it extremely simple to model the future valuation By the way, money's value is decided by a consensus, supply and demand theory never works on money, because money can be regarded as having infinite demand, thus any change in supply will not affect money's value. This seems start to apply to bitcoin too: Bitcoin's demand can be very very high, but its value is not really decided by supply and demand, but by a consensus, around the mining cost, similar to gold No no. Since there is no production (in principle) and no consumption (the money just moves from one owner to another ad infinitum), the demand is only demand to hold the money in the reserve. (For consumable commodities, think of reserve demand as a large heap of iron ore in front of a steel factory, the reserve is grown when the ore seems cheap to the steel-maker, and reduced when he envisions a lower price in the future). The demand to hold money in reserve is the only reason to hold money, and the supply is other people running down their reserves for any reason. By trading against something else, price pairs are discovered. The reasons behind the supply and demand, respectively, is basically the same, only inversed. The actual amount each market actor wants to hold, depends on everything, and changes continually. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 05, 2015, 12:09:04 PM |

|

No no. Since there is no production (in principle) and no consumption (the money just moves from one owner to another ad infinitum), the demand is only demand to hold the money in the reserve. (For consumable commodities, think of reserve demand as a large heap of iron ore in front of a steel factory, the reserve is grown when the ore seems cheap to the steel-maker, and reduced when he envisions a lower price in the future).

The demand to hold money in reserve is the only reason to hold money, and the supply is other people running down their reserves for any reason. By trading against something else, price pairs are discovered. The reasons behind the supply and demand, respectively, is basically the same, only inversed. The actual amount each market actor wants to hold, depends on everything, and changes continually.

you can't exchange iron ore for anything else except money, but with money you can exchange anything, the liquidity preference is different. If you produce 5x more iron ore, most likely the price will crash to 1/5, but FED has proved that printing 5x more USD will not affect its value The demand for money can be driven by many psychological cause, most notably purchasing of high valued goods and building a safety net for future. Nothing prevent everyone from accumulating 1 billion dollar and do nothing with those money: A large amount of reserve just increase the feeling of safety dramatically and positively affect their mental status, even most of the consumptions in today's life is already enough good and cheap |

|

|

|

funkenstein

Legendary

Offline Offline

Activity: 1066

Merit: 1050

Khazad ai-menu!

|

|

August 07, 2015, 04:55:54 PM |

|

you can't exchange iron ore for anything else except money,

Who is going to stop me? We trade what we like, that is a fact.

but with money you can exchange anything,

However there is no -guarantee- of a willing exchanger for any good, no matter whether you choose to call that good money or not. How is this not obvious?

the liquidity preference is different. If you produce 5x more iron ore, most likely the price will crash to 1/5, but FED has proved that printing 5x more USD will not affect its value

?? I'm not sure I follow you here. We don't know how much USD has been issued, nobody does. All we know is since the FED took over the value of a USD has dropped to well under 1% of its previous value vs. gold or oil or housing or food or clothing.

The demand for money can be driven by many psychological cause, most notably purchasing of high valued goods and building a safety net for future. Nothing prevent everyone from accumulating 1 billion dollar and do nothing with those money: A large amount of reserve just increase the feeling of safety dramatically and positively affect their mental status, even most of the consumptions in today's life is already enough good and cheap

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 08, 2015, 12:51:20 AM |

|

but with money you can exchange anything,

However there is no -guarantee- of a willing exchanger for any good, no matter whether you choose to call that good money or not. How is this not obvious? Each fiat money is a guarantee of exchanging any good in that specific country, I would like to see the future where people refuse to accept their domestic fiat money because it is created out of nothing, but that is not the case right now, 99% of people (including many famous entrepreneurs) have zero knowledge about fiat money, they are all playing the bank's fiat money game without understanding how the game is designed

the liquidity preference is different. If you produce 5x more iron ore, most likely the price will crash to 1/5, but FED has proved that printing 5x more USD will not affect its value

?? I'm not sure I follow you here. We don't know how much USD has been issued, nobody does. All we know is since the FED took over the value of a USD has dropped to well under 1% of its previous value vs. gold or oil or housing or food or clothing. Yes, USD has dropped 99% of its value since 100 years ago, but the USD supply has increased much more than 1000 times, so the value does not drop enough fast with the supply. 99% of people are short sighted, if a currency drops in value by even 5% per year, most of the people just don't care, as long as their income is enough to deal with the living expense. They maybe complain the rising living cost, but they won't take any action. Only Zimbabwe-like hyperinflation that increase the money supply by 10 fold in a month will cause a currency to fail |

|

|

|

AlexGR

Legendary

Offline Offline

Activity: 1708

Merit: 1049

|

|

August 08, 2015, 02:32:47 AM |

|

Why bitcoin will appreciate forever

1. Fiat supply (debt-backed money) is required to be inflated to infinity to support itself, otherwise the system will crumble. If there is 100 trillion debt, 100 trillion money and 5% interest, you need another 5% of the money supply (5 trillion extra) to repay the debt = new money needs to be created to keep the debt serviced. Compound interest effect has a "compound" effect in the fiat money supply. The ratio of fiat supply:btc supply is ensuring the long-term appreciation of BTC, but it'll take a while longer in order for BTC's inflation to slow down a bit. 2. Gold/silver output is also getting inflated by new mining output. While it may be better compared to fiat, it still has uncertainties in its inflation model like "what if a large gold deposit is found that is a game changer" or what happens if new mining techniques increase the output dramatically. In light of the above two, I believe it's hardly relevant whether people cash out or not as the existing maximum supply is fixed for BTC. Sure, if someone cashes out a million coins it can have a bearish effect on price, but in the long run it won't matter that much. |

|

|

|

|

eternalgloom

Legendary

Offline Offline

Activity: 1792

Merit: 1283

|

|

August 08, 2015, 06:52:30 AM |

|

I was wondering if there actually is a good source to 'measure' Bitcoin popularity and to figure out at what kind of rate new users are coming in approximately?

Have not yet seen any figures that I would trust.

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

August 08, 2015, 09:38:57 AM |

|

I was wondering if there actually is a good source to 'measure' Bitcoin popularity and to figure out at what kind of rate new users are coming in approximately?

Have not yet seen any figures that I would trust.

There are some hard statistics from the blockchain, like number of transactions and the number of unspent outputs. Currently unspent outputs is at 32 million. That could mean the number of users are somewhere between 1 and 10 million. But it turns out that some people never redraw coins from the exchange where they bought them. Maybe it is too difficult or risky, or they just don't know it is possible, living with a fiat/stockbroker mindset. |

|

|

|

|

funkenstein

Legendary

Offline Offline

Activity: 1066

Merit: 1050

Khazad ai-menu!

|

|

August 08, 2015, 10:45:41 AM |

|

but with money you can exchange anything,

However there is no -guarantee- of a willing exchanger for any good, no matter whether you choose to call that good money or not. How is this not obvious? Each fiat money is a guarantee of exchanging any good in that specific country, I would like to see the future where people refuse to accept their domestic fiat money because it is created out of nothing, but that is not the case right now, 99% of people (including many famous entrepreneurs) have zero knowledge about fiat money, they are all playing the bank's fiat money game without understanding how the game is designed Thanks for your reply. OK then, 20$ for your daughter. Guaranteed you said. JK of course. First of all whether the cost of production of the currency is zero (definition of fiat) or not doesn't matter. There is NEVER a guarantee that anybody will trade you anything for anything else. Even legal tender laws only disincentivise folks to accept a given tender as repayment of debts, not as trade for whatever thing you might be interested in.

the liquidity preference is different. If you produce 5x more iron ore, most likely the price will crash to 1/5, but FED has proved that printing 5x more USD will not affect its value

?? I'm not sure I follow you here. We don't know how much USD has been issued, nobody does. All we know is since the FED took over the value of a USD has dropped to well under 1% of its previous value vs. gold or oil or housing or food or clothing. Yes, USD has dropped 99% of its value since 100 years ago, but the USD supply has increased much more than 1000 times, so the value does not drop enough fast with the supply. 99% of people are short sighted, if a currency drops in value by even 5% per year, most of the people just don't care, as long as their income is enough to deal with the living expense. They maybe complain the rising living cost, but they won't take any action. Only Zimbabwe-like hyperinflation that increase the money supply by 10 fold in a month will cause a currency to fail I'm curious why you are so confident that the USD supply has increased so much more than it's market value would imply. For me, I have no information about the USD supply other than what markets tell me. Yes I am aware that markets are delayed in their reaction to printing events, so in general your hypothesis is in the right direction, but as to the factor concerned - I am ignorant. |

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

August 08, 2015, 11:33:32 AM |

|

[...]

Yes, USD has dropped 99% of its value since 100 years ago, but the USD supply has increased much more than 1000 times,

[...]

(I had to crop the quote, I wanted to address only this point) I have no idea if your numbers are correct, but if they are: We know that the consequence of increasing the money quantity has effect on prices, more money means higher prices, but there is a delay. When money is printed and are still in the basement of the central bank, and it is unknown to the public, there is no price rise, but when the money is distributed, it will rise prices, first on the products that are bought by the state, then the products that are bought by the vendors to the state and so on, until they are evenly spread out, which can take ten years or more. So when he money quantity have risen 1000 times, but prices only 100 times (your numbers), the prices may rise in the future, eventually up to 1000 times, or 10 times more than today, don't you think? How long time will it take, will it be quicker? Money printing is still going on, not? |

|

|

|

|

|

HarHarHar9965

|

|

August 09, 2015, 01:06:45 AM |

|

I was wondering if there actually is a good source to 'measure' Bitcoin popularity and to figure out at what kind of rate new users are coming in approximately?

Have not yet seen any figures that I would trust.

Determining such a number is not yet so easy, limiting us to work with very few options. Even with the help of statistics, its accuracy is still something which we need to figure out from every individual. The best way to know how many people are using bitcoins is having at he mass survey, or ask them personally about a vote-down, etc. So what is your final choice anyway? |

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

August 09, 2015, 02:46:55 AM |

|